Distributional Predictability and Quantile Connectedness of New Energy, Steam Coal, and High-Tech in China

Abstract

1. Introduction

2. Literature Review

3. Methodology

3.1. Nonparametric Quantile Causality Testing

3.2. Quantile Connectedness

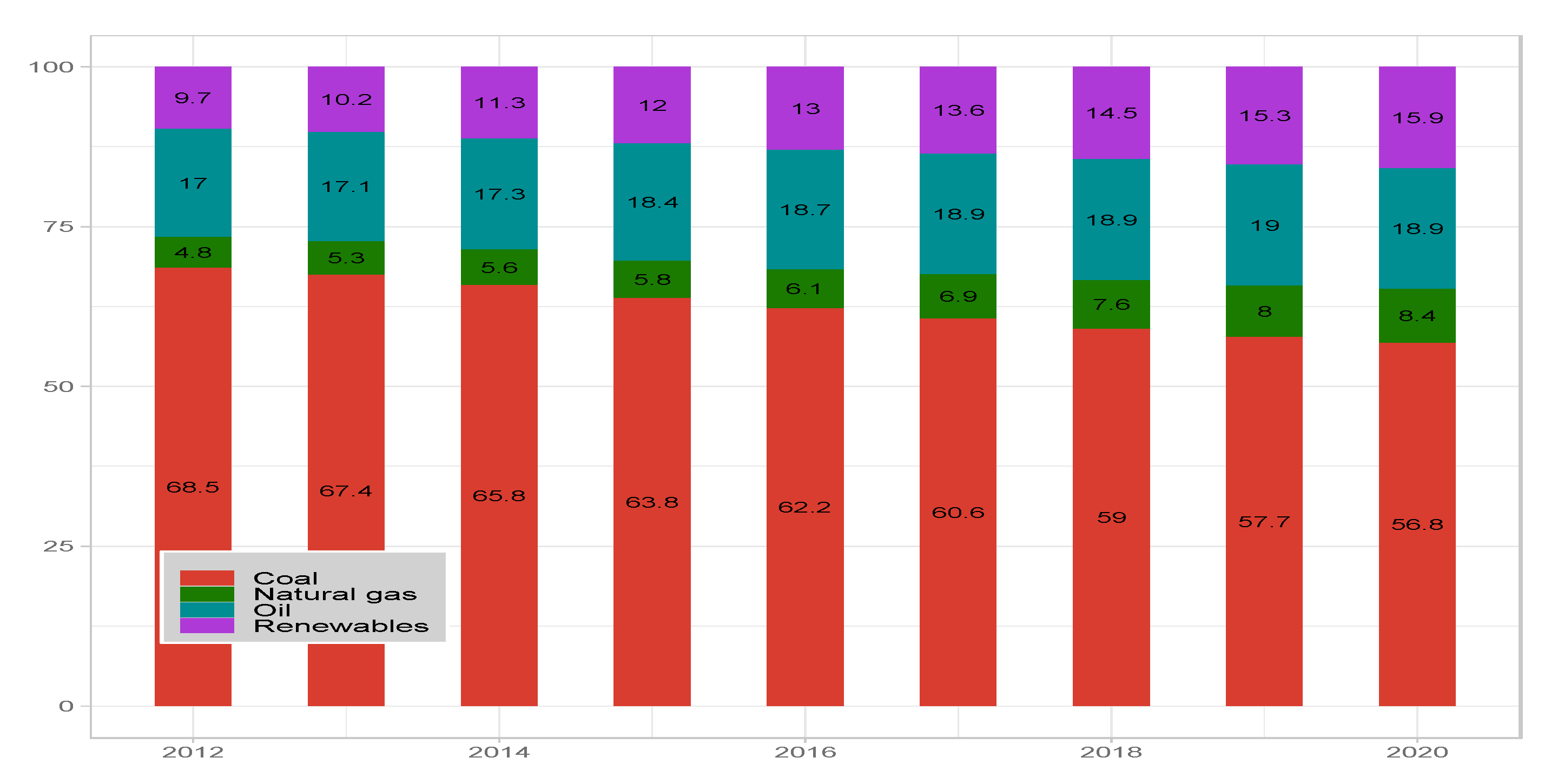

4. Data and Descriptive Analysis

5. Empirical Results and Discussion

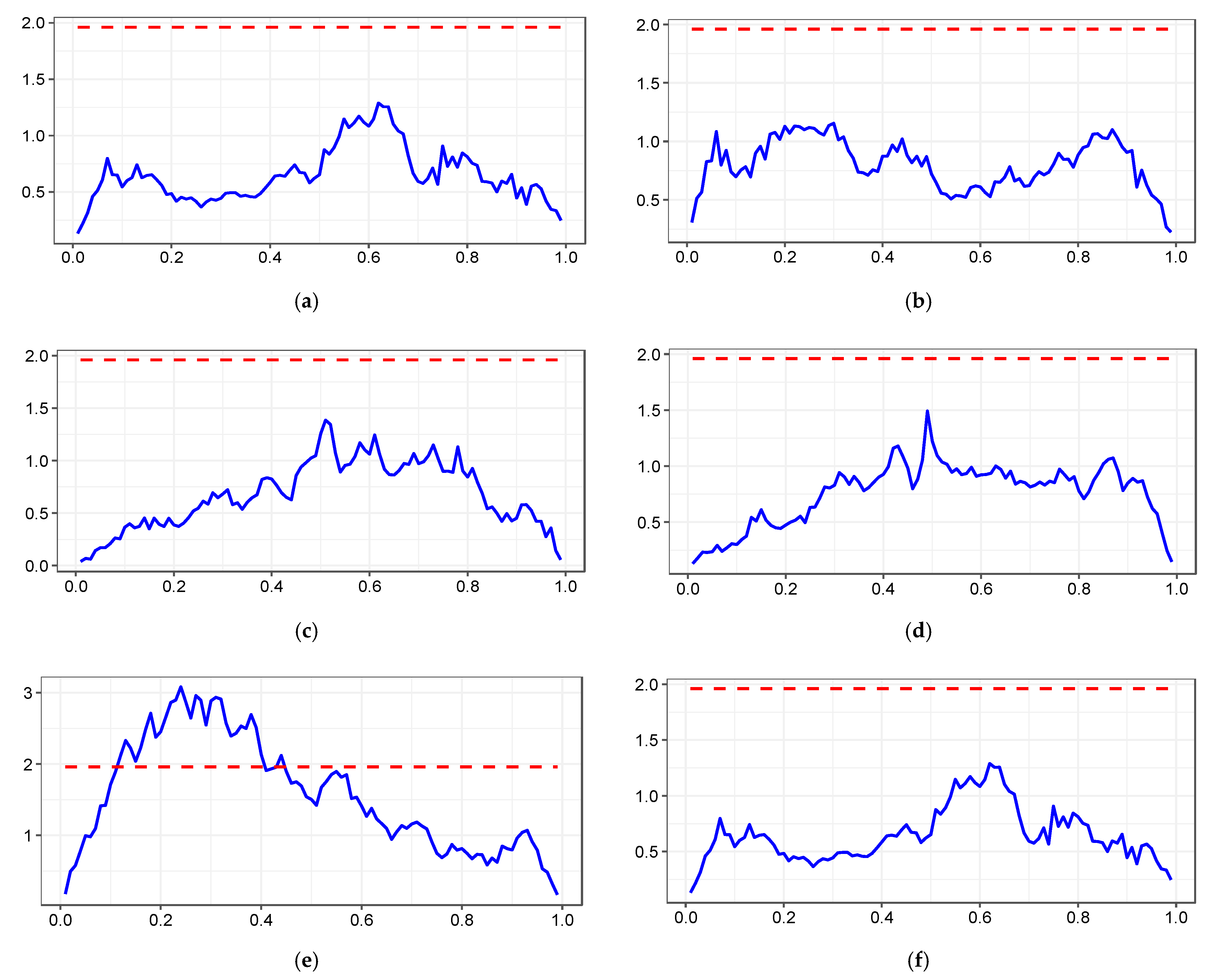

5.1. Causality-Quantile Results

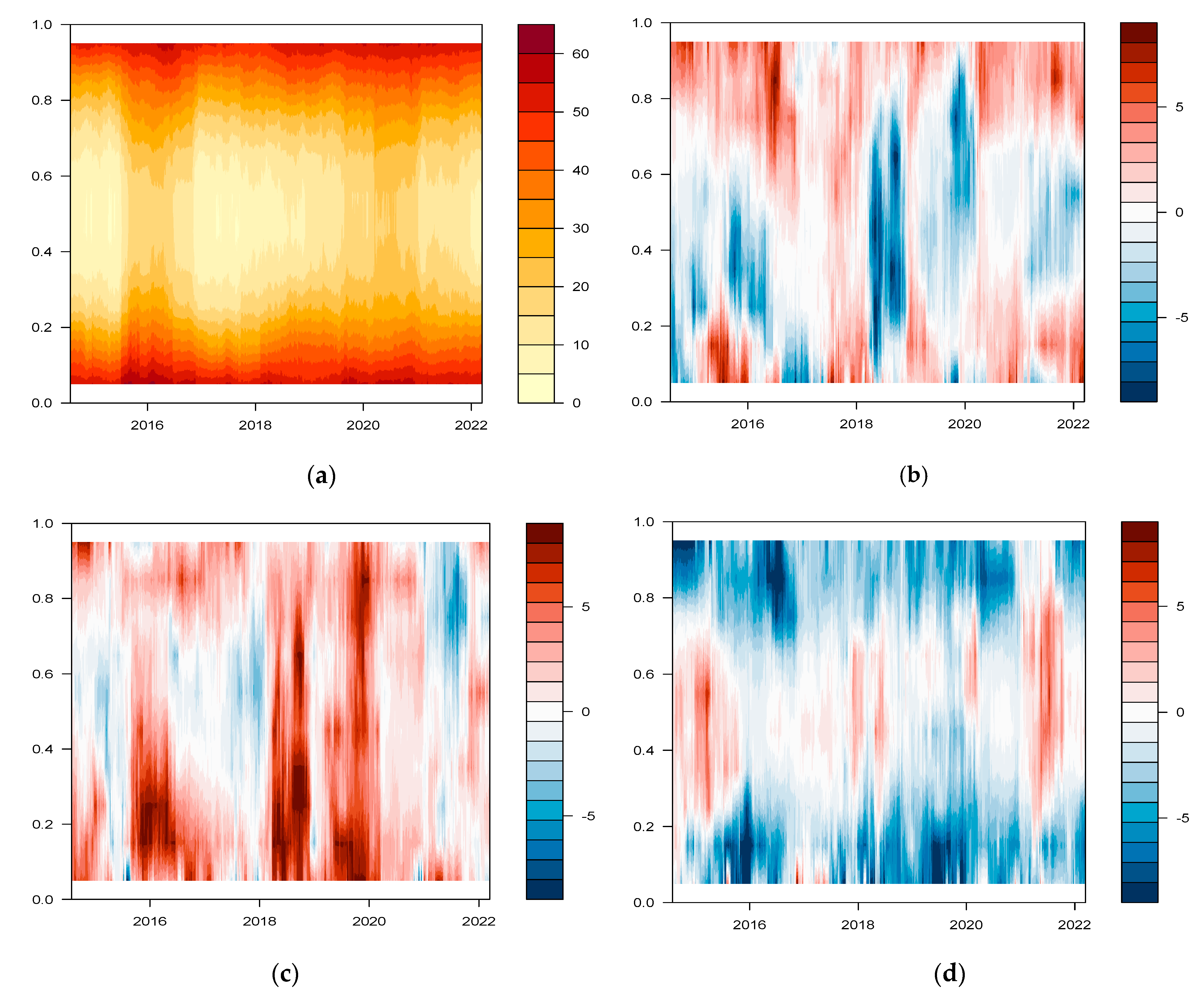

5.2. Quantile Connectedness Results

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Saeed, T.; Bouri, E.; Alsulami, H. Extreme return connectedness and its determinants between clean/green and dirty energy investments. Energy Econ. 2021, 96, 105017. [Google Scholar] [CrossRef]

- Umar, M.; Farid, S.; Naeem, M.A. Time-frequency connectedness among clean-energy stocks and fossil fuel markets: Comparison between financial, oil and pandemic crisis. Energy 2022, 240, 122702. [Google Scholar] [CrossRef]

- China Daily. Nation Leads Way with Renewable Energy. Available online: https://global.chinadaily.com.cn/a/202210/17/WS634c9118a310fd2b29e7ccee.html (accessed on 17 October 2022).

- Wang, Y.; Zhang, D.; Ji, Q.; Shi, X. Regional renewable energy development in China: A multidimensional assessment. Renew. Sust. Energy Rev. 2020, 124, 109797. [Google Scholar] [CrossRef]

- Xia, T.; Ji, Q.; Zhang, D.; Han, J. Asymmetric and extreme influence of energy price changes on renewable energy stock perfor-mance. J. Clean. Prod. 2019, 241, 118338. [Google Scholar] [CrossRef]

- Nasreen, S.; Tiwari, A.K.; Eizaguirre, J.C.; Wohar, M.E. Dynamic connectedness between oil prices and stock returns of clean energy and technology companies. J. Clean. Prod. 2020, 260, 121015. [Google Scholar] [CrossRef]

- Sadorsky, P. Correlations and volatility spillovers between oil prices and the stock prices of clean energy and technology companies. Energy Econ. 2012, 34, 248–255. [Google Scholar] [CrossRef]

- Zhang, G.; Du, Z. Co-movements among the stock prices of new energy, high-technology and fossil fuel companies in China. Energy 2017, 135, 249–256. [Google Scholar] [CrossRef]

- Sun, C.; Ding, D.; Fang, X.; Zhang, H.; Li, J. How do fossil energy prices affect the stock prices of new energy companies? Evi-dence from Divisia energy price index in China’s market. Energy 2019, 169, 637–645. [Google Scholar] [CrossRef]

- Kassouri, Y.; Kacou, K.Y.T.; Alola, A.A. Are oil-clean energy and high technology stock prices in the same straits? Bubbles speculation and time-varying perspectives. Energy 2021, 232, 121021. [Google Scholar] [CrossRef]

- Lin, B.; Chen, Y. Dynamic linkages and spillover effects between CET market, coal market and stock market of new energy companies: A case of Beijing CET market in China. Energy 2019, 172, 1198–1210. [Google Scholar] [CrossRef]

- Gu, F.; Wang, J.; Guo, J.; Fan, Y. How the supply and demand of steam coal affect the investment in clean energy industry? Evidence from China. Resour. Policy 2020, 69, 101788. [Google Scholar] [CrossRef]

- Li, J.; Xie, C.; Long, H. The roles of inter-fuel substitution and inter-market contagion in driving energy prices: Evidences from China’s coal market. Energy Econ. 2019, 84, 104525. [Google Scholar] [CrossRef]

- Batten, J.A.; Brzeszczynski, J.; Ciner, C.; Lau, M.C.K.; Lucey, B.; Yarovaya, L. Price and volatility spillovers across the international steam coal market. Energy Econ. 2019, 77, 119–138. [Google Scholar] [CrossRef]

- Li, H.; An, H. How Does the Coal Stock Market, Carbon Market and Coal Price Co-movement with Each other in China: A Co-movement Matrix Transmission Network Perspective. Energy Procedia 2017, 105, 3479–3484. [Google Scholar] [CrossRef]

- Janda, K.; Kristoufek, L.; Zhang, B. Return and volatility spillovers between Chinese and U.S. clean energy related stocks. Energy Econ. 2022, 108, 105911. [Google Scholar] [CrossRef]

- Ando, T.; Greenwood-Nimmo, M.; Shin, Y. Quantile connectedness: Modelling Tail Behaviour in the Topology of Financial Net-Works. 2018. Available online: https://doi.org/10.2139/ssrn.3164772 (accessed on 25 March 2021).

- Chen, J.; Liang, Z.; Ding, Q.; Liu, Z. Extreme spillovers among fossil energy, clean energy, and metals markets: Evidence from a quantile-based analysis. Energy Econ. 2022, 107, 105880. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Mokni, K.; Ben-Salha, O.; Ajmi, A.N. Distributional predictability between oil prices and renewable energy stocks: Is there a role for the COVID-19 pandemic? Energy Econ. 2021, 103, 105512. [Google Scholar] [CrossRef]

- Yahya, M.; Kanjilal, K.; Dutta, A.; Uddin, G.S.; Ghosh, S. Can clean energy stock price rule oil price? New evidences from a re-gime-switching model at first and second moments. Energy Econ. 2021, 95, 105116. [Google Scholar] [CrossRef]

- Tan, X.; Geng, Y.; Vivian, A.; Wang, X. Measuring risk spillovers between oil and clean energy stocks: Evidence from a systematic framework. Resour Policy 2021, 74, 102406. [Google Scholar] [CrossRef]

- Geng, J.B.; Liu, C.; Ji, Q.; Zhang, D. Do oil price changes really matter for clean energy returns? Renew. Sustain. Energy Rev. 2021, 150, 111429. [Google Scholar] [CrossRef]

- Wen, X.; Guo, Y.; Wei, Y.; Huang, D. How do the stock prices of new energy and fossil fuel companies correlate? Evidence from China. Energy Econ. 2014, 41, 63–75. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Ugolini, A. The impact of energy prices on clean energy stock prices. A multivariate quantile dependence ap-proach. Energy Econ. 2018, 76, 136–152. [Google Scholar] [CrossRef]

- Henriques, I.; Sadorsky, P. Oil prices and the stock prices of alternative energy companies. Energy Econ. 2008, 30, 998–1010. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Nasreen, S.; Hammoudeh, S.; Selmi, R. Dynamic dependence of oil, clean energy and the role of technology com-panies: New evidence from copulas with regime switching. Energy 2021, 220, 119590. [Google Scholar] [CrossRef]

- Managi, S.; Okimoto, T. Does the price of oil interact with clean energy prices in the stock market? Jpn. World Econ. 2013, 27, 1–9. [Google Scholar] [CrossRef]

- Bondia, R.; Ghosh, S.; Kanjilal, K. International crude oil prices and the stock prices of clean energy and technology companies: Evidence from non-linear cointegration tests with unknown structural breaks. Energy 2016, 101, 558–565. [Google Scholar] [CrossRef]

- Fahmy, H. The rise in investors’ awareness of climate risks after the Paris Agreement and the clean energy-oil-technology prices nexus. Energy Econ. 2022, 106, 105738. [Google Scholar] [CrossRef]

- Maghyereh, A.I.; Awartani, B.; Abdoh, H. The co-movement between oil and clean energy stocks: A wavelet-based analysis of horizon associations. Energy 2019, 169, 895–913. [Google Scholar] [CrossRef]

- Zhang, H.; Cai, G.; Yang, D. The impact of oil price shocks on clean energy stocks: Fresh evidence from multi-scale perspective. Energy 2020, 196, 117099. [Google Scholar] [CrossRef]

- Shahbaz, M.; Trabelsi, N.; Tiwari, A.K.; Abakah, E.J.A.; Jiao, Z. Relationship between green investments, energy markets, and stock markets in the aftermath of the global financial crisis. Energy Econ. 2021, 104, 105655. [Google Scholar] [CrossRef]

- Qu, F.; Chen, Y.; Zheng, B. Is new energy driven by crude oil, high-tech sector or low-carbon notion? New evidence from high-frequency data. Energy 2021, 230, 120770. [Google Scholar] [CrossRef]

- Balcilar, M.; Bekiros, S.; Gupta, R. The role of news-based uncertainty indices in predicting oil markets: A hybrid nonparametric quantile causality method. Empir. Econ. 2017, 53, 879–889. [Google Scholar] [CrossRef]

- Nishiyama, Y.; Hitomi, K.; Kawasaki, Y.; Jeong, K. A consistent nonparametric test for nonlinear causality: Specification in time series regression. J. Econom. 2011, 165, 112–127. [Google Scholar] [CrossRef]

- Jeong, K.; Härdle, W.K.; Song, S. A consistent nonparametric test for causality in quantile. Econom. Theory 2012, 28, 861–887. [Google Scholar] [CrossRef]

- Koop, G.; Pesaran, M.H.; Potter, S.M. Impulse response analysis in nonlinear multivariate models. J. Econom. 1996, 74, 119–147. [Google Scholar] [CrossRef]

- Pesaran, H.H.; Shin, Y. Generalized impulse response analysis in linear multivariate models. Econ. Lett. 1998, 58, 17–29. [Google Scholar] [CrossRef]

- Cui, J.; Goh, M.; Zou, H. Information spillovers and dynamic dependence between China’s energy and regional CET markets with portfolio implications: New evidence from multi-scale analysis. J. Clean. Prod. 2021, 289, 125625. [Google Scholar] [CrossRef]

- Kilian, L. Not all oil price shocks are alike: Disentangling demand and supply shocks in the crude oil market. Am. Econ. Rev. 2009, 99, 1053–1069. [Google Scholar] [CrossRef]

- Koenker, R.; Xiao, Z. Unit root quantile autoregression inference. J. Am. Stat. Assoc. 2004, 99, 775–787. [Google Scholar] [CrossRef]

- Galvao, A.F. Unit root quantile autoregression testing using covariates. J. Econom. 2009, 152, 165–178. [Google Scholar] [CrossRef]

- IEA. 5 ways Big Tech Could Have Big Impacts on Clean Energy Transitions. Available online: https://www.iea.org/commentaries/5-ways-big-tech-could-have-big-impacts-on-clean-energy-transitions (accessed on 25 March 2021).

- Bouri, E.; Saeed, T.; Vo, X.V.; Roubaud, D. Quantile connectedness in the cryptocurrency market. J. Int. Financ. Mark. Inst. Money 2021, 71, 101302. [Google Scholar] [CrossRef]

- Chatziantoniou, I.; Gabauer, D.; Stenfors, A. Interest rate swaps and the transmission mechanism of monetary policy: A quantile connectedness approach. Econ. Lett. 2021, 204, 109891. [Google Scholar] [CrossRef]

- Ji, Q.; Zhang, D. How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? Energy Policy 2019, 128, 114–124. [Google Scholar] [CrossRef]

- Dean, W.G.; Faff, R.W.; Loudon, G.F. Asymmetry in return and volatility spillover between equity and bond markets in Australia. Pac.-Basin Financ. J. 2010, 18, 272–289. [Google Scholar] [CrossRef]

- Det Norske Veritas (DNV). Energy Transition Outlook 2022, Greater China Regional Extract. Available online: https://www.dnv.com/energy-transition-outlook/index (accessed on 20 October 2022).

- Chatziantoniou, I.; Abakah, E.J.A.; Gabauer, D.; Tiwari, A.K. Quantile time–frequency price connectedness between green bond, green equity, sustainable investments and clean energy markets. J. Clean. Prod. 2022, 361, 132088. [Google Scholar] [CrossRef]

- Zheng, B.; Zhang, Y.W.; Qu, F.; Geng, Y.; Yu, H. Do rare earths drive volatility spillover in crude oil, renewable energy, and high-technology markets?—A wavelet-based BEKK-GARCH-X approach. Energy 2022, 251, 123951. [Google Scholar] [CrossRef]

| Author(s) | Period | Variables | Modeling | The Main Results |

|---|---|---|---|---|

| Umar et al., 2022 [2] | Jan 1, 2004 to Dec 31, 2020 (Daily) | Clean energy, oil, natural gas, gas oil, and fuel oil | Baruník and Krehlík | Weak volatility connections among clean energy stocks and fossil fuel markets, contagion effects between the energy markets increase in the crisis periods. |

| Xia et al., 2019 [5] | Apr 2008 to Jul 2019 (Daily) | Renewable energy, oil, natural gas, electricity, coal, and carbon | VaR network | The electricity market behaves as the major contributor to the changes of renewable energy returns in the return connectedness network, while oil and coal contribute most to the changes of renewable energy returns in the VaR connectedness network. |

| Nasreen et al., 2020 [6] | Dec 2000 to Jun 2017 | Clean energy, technology, and crude oil | Wavelet coherency, Baruník and Krehlík, DCC | Returns of technology stocks appear to be the main source of volatility transmission. |

| Sadorsky, 2012 [7] | Jan 2001 to Dec 2010 (daily) | Clean energy, technology, and crude oil | Multivariate GARCH | The stock prices of clean energy companies correlate more highly with technology stock prices than with oil prices. |

| Zhang and Du, 2017 [8] | Jul 2011 to Dec 2015 | New energy, technology, and coal and oil index | TVP-SV-VAR | New energy correlate more highly with high technology stock than with coal and oil stock prices. |

| Sun et al., 2019 [9] | Jul 2010 to Dec 2016 (monthly) | Technology, carbon futures, China’s new energy, and Divisia index (oil, coal and natural gas) | VAR, Divisia price synthesis | Compared with Divisia fossil energy price index, the dynamic relationship between technology index and new energy stock prices is more significant. |

| Lin and Chen, 2019 [11] | Nov 2013 to Jul 2017 (daily) | Beijing carbon emission allowance, new energy, and coal | DCC, BEKK | The coal market and the new energy market have higher volatility persistence and bi-directional spillover effects. |

| Gu et al., 2020 [12] | Jan 2008 to Feb 2019 | Coal, stock, environmental protection, and five clean energy sectors | VAR-DCC-GARCH | Significant bi-directional volatility spillover between the steam coal market and the clean energy stocks. |

| Janda et al., 2022 [16] | May 2012, to Jul 2021 (Daily) | Oil, Chinese and U.S. clean energy and technology | CCC, DCC and ADCC | China technology is the best asset to hedge Chinese clean energy stocks. |

| Hammoudeh et al., 2021 [19] | Oct 2010 to Sep 2020 (Daily) | Oil, and renewable energy (five sub-sectors) | Nonparametric causality | Oil returns cause the renewable returns during normal market conditions. Renewable energy sectoral stock returns have no predictive power of oil returns. |

| Geng et al., 2021 [22] | Sep 2009 to Jun 2019 (weekly) | Oil, and eight European clean energy companies | DCC, Asymmetric Connectedness | Information interdependence for crude oil returns and clean energy companies’ returns remains at a relatively high level, bad news on information connectedness is greater than that of good news. |

| Wen et al., 2014 [23] | Aug 2006 to Sep 2012 | China’s new energy, and coal and oil index | Asymmetric BEKK | The dynamics of new energy/fossil fuel stock spillover are found to be significant and asymmetric. |

| Tiwari et al., 2021 [26] | Dec 2000 to Jun 2017 (daily) | Clean energy, technology, and crude oil | Dependence-switching copula | Asymmetric dependence structure under the positive correlation regimes, while a symmetric dependence under negative correlation regimes. |

| Managi and Okimoto, 2013 [27] | Jan 2001 to Feb 2010 (weekly) | Clean energy, technology, crude oil, and interest rate | Markov-switching VAR | There was a structural change in late 2007, a positive relationship between oil prices and clean energy prices after structural breaks. |

| Bondia et al., 2016 [28] | Jan 2003 to Jun 2015 (weekly) | Clean energy, technology, crude oil, and interest rate | Threshold cointegration tests | The stock prices of alternative energy companies are impacted by technology stock prices, oil prices and interest rates in the short run, there is no causality running towards prices of alternative energy stock prices in the long run. |

| Fahmy, 2022 [29] | Jan 2009 and Dec 2019 | Clean energy, technology, and crude oil | Exogenous STR model | Oil price has a stronger asymmetric persistence on the cycle of clean energy assets pre-Paris Agreement. In the period post Paris Agreement, Technology stock prices are the best regime drivers for clean energy assets with strong nonlinear asymmetric persistence. |

| Maghyereh et al., 2019 [30] | Jan 2001 to Feb 2018 (Daily) | Oil, clean energy, and clean energy technology | Wavelet, DCC-GARCH | Significant bidirectional return and risk transfer from oil and technology to the clean energy market in the long term. |

| Zhang et al., 2020 [31] | Jan 2006 to Dec 2018 (monthly) | Oil, clean energy, and clean energy technology | Wavelet-based quantile-on-quantile, Causality-in-quantiles | Strong predictability of the oil price shocks for the stocks in the long run. |

| Shahbaz et al., 2021 [32] | Mar 2005 to May 2021 (Daily) | Clean energy, technology, light crude oil, and stock | Granger causality, Quantile regression | Clean energy markets react to crude oil and stock markets depending on the market regime. |

| Qu et al., 2021 [33] | Jan 2011 to Mar 2016 (5-min) | New energy, high-tech, low-carbon notion, andcrude oil | Diebold and Yilmaz | High-tech and low-carbon are main contributors to the volatility spillover of new energy. |

| Meaning | Index and Calculation |

|---|---|

| Measuring the connectedness across all markets | Total ( ) |

| Measuring the total connectedness from others | Directional ( ) |

| Measuring the total connectedness to others | ) |

| Measuring the net connectedness from market i to others | Net ( |

| Measuring the net connectedness between i and j | Net pairwise () |

| Mean | Max | Min | Std.Dev. | Skewness | Kurtosis | Jarque-Bera | ADF | |

|---|---|---|---|---|---|---|---|---|

| Coal | 0.021 | 11.44 | −18.629 | 1.914 | −1.292 * | 17.804 * | 19365.0 * | −6.623 * |

| New energy | 0.059 | 7.168 | −9.828 | 1.975 | −0.654 * | 6.259 * | 1057.6 * | −12.887 * |

| High-tech | 0.014 | 9.203 | −11.6 | 1.802 | −0.358 * | 6.179 * | 910.6 * | −12.935 * |

| τ | Coal | New Energy | High-Tech | |||

|---|---|---|---|---|---|---|

| α(τ) | T-Stat | α(τ) | T-Stat | α(τ) | T-Stat | |

| 0.05 | 0.086 | −8.462 | 0.212 | −7.475 | 0.227 | −12.551 |

| 0.10 | 0.082 | −15.935 | 0.134 | −15.629 | 0.203 | −16.889 |

| 0.15 | 0.046 | −29.073 | 0.115 | −22.746 | 0.146 | −19.127 |

| 0.20 | 0.025 | −39.420 | 0.097 | −29.200 | 0.076 | −25.608 |

| 0.25 | 0.020 | −48.665 | 0.048 | −36.549 | 0.048 | −31.648 |

| 0.30 | 0.004 | −55.148 | 0.018 | −40.423 | 0.042 | −36.087 |

| 0.35 | −0.004 | −63.372 | −0.004 | −47.970 | 0.020 | −40.186 |

| 0.40 | 0.009 | −66.118 | −0.007 | −50.903 | −0.003 | −49.137 |

| 0.45 | 0.003 | −68.948 | 0.002 | −51.778 | −0.010 | −46.189 |

| 0.50 | 0.003 | −68.053 | −0.011 | −53.763 | −0.003 | −47.259 |

| 0.55 | 0.003 | −67.890 | −0.004 | −52.082 | −0.025 | −46.413 |

| 0.60 | 0.001 | −64.674 | −0.014 | −48.765 | −0.009 | −45.048 |

| 0.65 | −0.005 | −58.725 | −0.036 | −45.933 | 0.013 | −38.796 |

| 0.70 | −0.013 | −54.399 | −0.039 | −41.464 | 0.005 | −38.366 |

| 0.75 | 0.003 | −45.676 | −0.056 | −37.131 | −0.014 | −35.884 |

| 0.80 | 0.014 | −35.805 | −0.029 | −32.376 | −0.006 | −33.076 |

| 0.85 | 0.028 | −25.387 | −0.022 | −29.464 | −0.001 | −29.649 |

| 0.90 | −0.013 | −22.414 | −0.013 | −22.795 | −0.026 | −25.764 |

| 0.95 | −0.039 | −14.557 | −0.064 | −15.816 | −0.100 | −19.923 |

| 0.5 | Coal | New Energy | High-Tech | FROM Others |

|---|---|---|---|---|

| Coal | 97.84 | 0.98 | 1.18 | 2.16 |

| New energy | 1.23 | 83.52 | 15.26 | 16.48 |

| High-tech | 1.52 | 14.07 | 84.4 | 15.6 |

| TO others | 2.75 | 15.05 | 16.44 | TCI |

| NET | 0.59 | −1.43 | 0.84 | 11.41 |

| 0.05 | ||||

| Coal | 47.28 | 26.45 | 26.27 | 52.72 |

| New energy | 24.12 | 43.42 | 32.45 | 56.58 |

| High-tech | 24.71 | 30.73 | 44.55 | 55.45 |

| TO others | 48.84 | 57.19 | 58.72 | TCI |

| NET | −3.88 | 0.61 | 3.27 | 54.91 |

| 0.95 | ||||

| Coal | 48.97 | 25.97 | 25.06 | 51.03 |

| New energy | 23.19 | 45.77 | 31.04 | 54.23 |

| High-tech | 23.42 | 31.04 | 45.53 | 54.47 |

| TO others | 46.61 | 57.01 | 56.11 | TCI |

| NET | −4.42 | 2.78 | 1.64 | 53.24 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qi, X.; Zhang, G.; Wang, Y. Distributional Predictability and Quantile Connectedness of New Energy, Steam Coal, and High-Tech in China. Sustainability 2022, 14, 14176. https://doi.org/10.3390/su142114176

Qi X, Zhang G, Wang Y. Distributional Predictability and Quantile Connectedness of New Energy, Steam Coal, and High-Tech in China. Sustainability. 2022; 14(21):14176. https://doi.org/10.3390/su142114176

Chicago/Turabian StyleQi, Xiaohong, Guofu Zhang, and Yuqi Wang. 2022. "Distributional Predictability and Quantile Connectedness of New Energy, Steam Coal, and High-Tech in China" Sustainability 14, no. 21: 14176. https://doi.org/10.3390/su142114176

APA StyleQi, X., Zhang, G., & Wang, Y. (2022). Distributional Predictability and Quantile Connectedness of New Energy, Steam Coal, and High-Tech in China. Sustainability, 14(21), 14176. https://doi.org/10.3390/su142114176