Inter-Firm ESG Rivalry: A Competitive Dynamics View

Abstract

1. Introduction

2. Literature Review and Overarching Theory

Competitive Dynamics

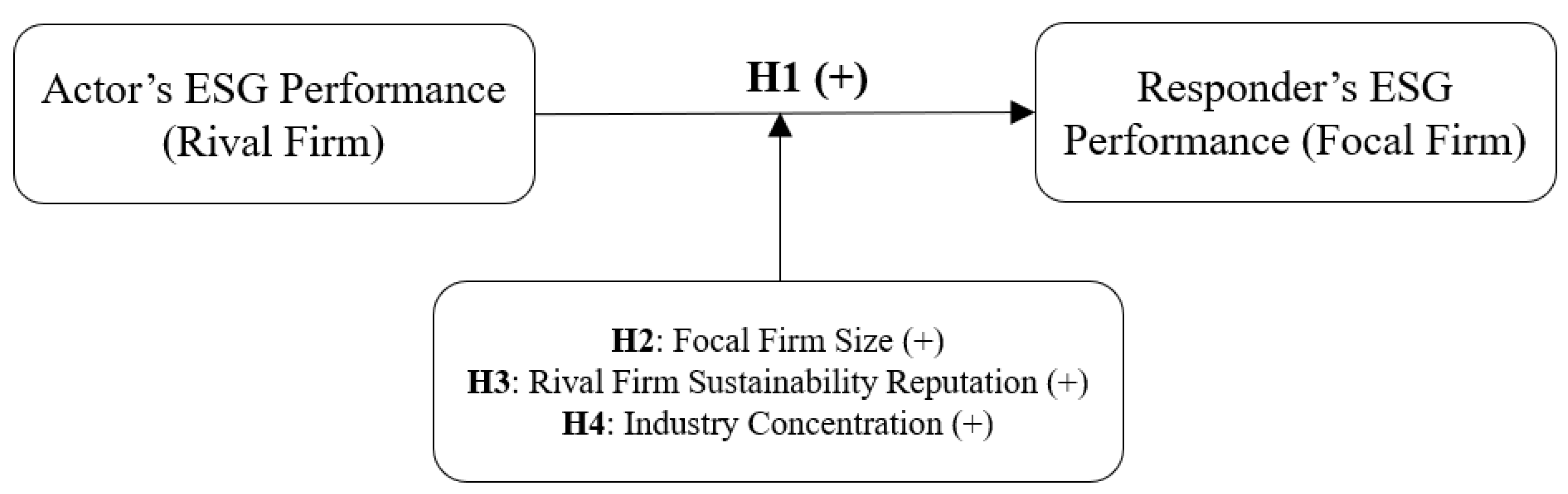

3. Hypotheses

3.1. Inter-Firm Competitive Rivalry

3.2. Focal Firm Size

3.3. Rival Firm’s Sustainability Reputation

3.4. Industry Competitive Environment (Industry Concentration)

4. Methods

4.1. Data and Sample

4.2. Dependent Variable

4.3. Independent and Moderating Variables

4.4. Control Variables

4.5. Model Specification and Results

5. Discussion

5.1. Theoretical Implications

5.2. Practical Implications

6. Conclusions

Limitations and Future Research

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Perez, L.; Vivian Hunt, D.; Smandari, H.; Nuttall, R.; Biniek, K. Does ESG Really Matter—And Why? 2022. Available online: https://www.mckinsey.com/business-functions/sustainability/our-insights/does-esg-really-matter-and-why (accessed on 2 September 2022).

- Apple Inc. Environmental Progress Report. 2022. Available online: https://www.apple.com/environment/pdf/Apple_Environmental_Progress_Report_2022.pdf (accessed on 2 September 2022).

- Ajwang, S.O.; Nambiro, A.W. Climate change adaptation and mitigation using information and communication technology. Int. J. Comput. Sci. Res. 2022, 6, 1046–1063. [Google Scholar]

- World Commission on Environment and Development. Our Common Future; Oxford University Press: Oxford, UK, 1987. [Google Scholar]

- Faber, N.; Jorna, R.; Van Engelen, J.O. The sustainability of “sustainability”—A study into the conceptual foundations of the notion of “sustainability”. In Tools, Techniques and Approaches for Sustainability: Collected Writings in Environmental Assessment Policy and Management; World Scientific: Singapore, 2010; pp. 337–369. [Google Scholar]

- Maynard, D.D.C.; Vidigal, M.D.; Farage, P.; Zandonadi, R.P.; Nakano, E.Y.; Botelho, R.B.A. Environmental, social and economic sustainability indicators applied to food services: A systematic review. Sustainability 2020, 12, 1804. [Google Scholar] [CrossRef]

- Hull, C.E.; Rothenberg, S. Firm performance: The interactions of corporate social performance with innovation and industry differentiation. Strateg. Manag. J. 2008, 29, 781–789. [Google Scholar] [CrossRef]

- Du, S.; Bhattacharya, C.B.; Sen, S. Corporate social responsibility and competitive advantage: Overcoming the trust barrier. Manag. Sci. 2011, 57, 1528–1545. [Google Scholar] [CrossRef]

- Erhun, F.; Kraft, T.; Wijnsma, S. Sustainable triple-A supply chains. Prod. Oper. Manag. 2021, 30, 644–655. [Google Scholar] [CrossRef]

- Broadstock, D.C.; Matousek, R.; Meyer, M.; Tzeremes, N.G. Does corporate social responsibility impact firms’ innovation capacity? The indirect link between environmental & social governance implementation and innovation performance. J. Bus. Res. 2020, 119, 99–110. [Google Scholar]

- Koh, H.K.; Burnasheva, R.; Suh, Y.G. Perceived ESG (environmental, social, governance) and consumers’ responses: The mediating role of brand credibility, brand image, and perceived quality. Sustainability 2022, 14, 4515. [Google Scholar] [CrossRef]

- Hofer, C.; Cantor, D.E.; Dai, J. The competitive determinants of a firm’s environmental management activities: Evidence from US manufacturing industries. J. Oper. Manag. 2012, 30, 69–84. [Google Scholar] [CrossRef]

- Tate, W.L.; Ellram, L.M.; Kirchoff, J.F. Corporate social responsibility reports: A thematic analysis related to supply chain management. J. Supply Chain. Manag. 2010, 46, 19–44. [Google Scholar] [CrossRef]

- Weston, P.; Nnadi, M. Evaluation of strategic and financial variables of corporate sustainability and ESG policies on corporate finance performance. J. Sustain. Financ. Investig. 2021, 1–17. [Google Scholar] [CrossRef]

- Huang, D.Z. Environmental, social and governance (ESG) activity and firm performance: A review and consolidation. Account. Financ. 2021, 61, 335–360. [Google Scholar] [CrossRef]

- Benlemlih, M.; Bitar, M. Corporate social responsibility and investment efficiency. J. Bus. Ethics 2018, 148, 647–671. [Google Scholar] [CrossRef]

- Kumar, A.; Cantor, D.E.; Grimm, C.M.; Hofer, C. Environmental management rivalry and firm performance. J. Strategy Manag. 2017, 10, 227–247. [Google Scholar] [CrossRef]

- Martins, H.C. Competition and ESG practices in emerging markets: Evidence from a difference-in-differences model. Financ. Res. Lett. 2022, 46, 102371. [Google Scholar] [CrossRef]

- Bagnoli, M.; Watts, S.G. Selling to socially responsible consumers: Competition and the private provision of public goods. J. Econ. Manag. Strategy 2003, 12, 419–445. [Google Scholar] [CrossRef]

- Galbreath, J. ESG in focus: The Australian evidence. J. Bus. Ethics 2013, 118, 529–541. [Google Scholar] [CrossRef]

- Baker, E.D.; Boulton, T.J.; Braga-Alves, M.V.; Morey, M.R. ESG government risk and international IPO underpricing. J. Corp. Financ. 2021, 67, 101913. [Google Scholar] [CrossRef]

- Ge, B.; Yang, Y.; Jiang, D.; Gao, Y.; Du, X.; Zhou, T. An empirical study on green innovation strategy and sustainable competitive advantages: Path and boundary. Sustainability 2018, 10, 3631. [Google Scholar] [CrossRef]

- He, R.; Chen, X.; Chen, C.; Zhai, J.; Cui, L. Environmental, Social, and Governance Incidents and Bank Loan Contracts. Sustainability 2021, 13, 1885. [Google Scholar] [CrossRef]

- Gopal, P.R.C.; Thakkar, J. Analysing critical success factors to implement sustainable supply chain practices in Indian automobile industry: A case study. Prod. Plan. Control 2016, 27, 1005–1018. [Google Scholar] [CrossRef]

- Esfahbodi, A.; Zhang, Y.; Watson, G. Sustainable supply chain management in emerging economies: Trade-offs between environmental and cost performance. Int. J. Prod. Econ. 2016, 181, 350–366. [Google Scholar] [CrossRef]

- Smith, K.G.; Grimm, C.M.; Gannon, M.J. Dynamics of Competitive Strategy; Sage Publications, Inc.: Thousand Oaks, CA, USA, 1992. [Google Scholar]

- Chen, M.J.; Miller, D. Competitive dynamics: Themes, trends, and a prospective research platform. Acad. Manag. Ann. 2012, 6, 135–210. [Google Scholar] [CrossRef]

- Young, G.; Smith, K.G.; Grimm, C.M. “Austrian” and industrial organization perspectives on firm-level competitive activity and performance. Organ. Sci. 1996, 7, 243–254. [Google Scholar] [CrossRef]

- Grimm, C.M.; Smith, K.G. Strategy as Action; South-Western College Publishing: Cincinnati, OH, USA, 1997. [Google Scholar]

- Gresov, C.; Haveman, H.A.; Oliva, T.A. Organizational design, inertia and the dynamics of competitive response. Organ. Sci. 1993, 4, 181–208. [Google Scholar] [CrossRef]

- Smith, K.G.; Ferrier, W.J.; Ndofor, H. Competitive dynamics research: Critique and future directions. In The Blackwell Handbook of Strategic Management; Blackwell Publishers Ltd.: Hoboken, NJ, USA, 2005; pp. 309–354. [Google Scholar]

- Baum, J.A.; Korn, H.J. Competitive dynamics of interfirm rivalry. Acad. Manag. J. 1996, 39, 255–291. [Google Scholar] [CrossRef]

- Marcel, J.J.; Barr, P.S.; Duhaime, I.M. The influence of executive cognition on competitive dynamics. Strateg. Manag. J. 2011, 32, 115–138. [Google Scholar] [CrossRef]

- Smith, K.G.; Grimm, C.M. A communication-information model of competitive response timing. J. Manag. 1991, 17, 5–23. [Google Scholar] [CrossRef]

- Smith, K.G.; Grimm, C.M.; Gannon, M.J.; Chen, M.J. Organizational information processing, competitive responses, and performance in the US domestic airline industry. Acad. Manag. J. 1991, 34, 60–85. [Google Scholar] [CrossRef]

- Slater, S.F.; Narver, J.C. Does competitive environment moderate the market orientation-performance relationship? J. Mark. 1994, 58, 46–55. [Google Scholar] [CrossRef]

- Chen, M.J.; Su, K.H.; Tsai, W. Competitive tension: The awareness-motivation-capability perspective. Acad. Manag. J. 2007, 50, 101–118. [Google Scholar] [CrossRef]

- Porter, M.E. Industry structure and competitive strategy: Keys to profitability. Financ. Anal. J. 1980, 36, 30–41. [Google Scholar] [CrossRef]

- Harrigan, K.R. Barriers to entry and competitive strategies. Strateg. Manag. J. 1981, 2, 395–412. [Google Scholar] [CrossRef]

- Soberman, D.; Gatignon, H. Research issues at the boundary of competitive dynamics and market evolution. Mark. Sci. 2005, 24, 165–174. [Google Scholar] [CrossRef]

- Jacobson, R. The “Austrian” school of strategy. Acad. Manag. Rev. 1992, 17, 782–807. [Google Scholar] [CrossRef]

- Ferrier, W.J.; Smith, K.G.; Grimm, C.M. The role of competitive action in market share erosion and industry dethronement: A study of industry leaders and challengers. Acad. Manag. J. 1999, 42, 372–388. [Google Scholar] [CrossRef]

- Arend, R.J.; Bromiley, P. Assessing the dynamic capabilities view: Spare change, everyone? Strateg. Organ. 2009, 7, 75–90. [Google Scholar] [CrossRef]

- Schumpeter, J.A. Capitalism, Socialism and Democracy; Harper & Row: New York, NY, USA, 1942; Volume 36, pp. 132–145. [Google Scholar]

- Koufteros, X.A.; Cheng, T.E.; Lai, K.H. “Black-box” and “gray-box” supplier integration in product development: Antecedents, consequences and the moderating role of firm size. J. Oper. Manag. 2007, 25, 847–870. [Google Scholar] [CrossRef]

- Guntuka, L.; Corsi, T.M.; Grimm, C.M.; Cantor, D.E. US motor-carrier exit: Prevalence and determinants. Transp. J. 2019, 58, 79–100. [Google Scholar] [CrossRef]

- Björk, J.; Magnusson, M. Where do good innovation ideas come from? Exploring the influence of network connectivity on innovation idea quality. J. Prod. Innov. Manag. 2009, 26, 662–670. [Google Scholar] [CrossRef]

- Davis, G.F.; Cobb, J.A. Resource dependence theory: Past and future. In Stanford’s Organization Theory Renaissance, 1970–2000; Emerald Group Publishing Limited: Bingley, UK, 2010; Volume 28, pp. 21–42. [Google Scholar]

- Meyer, A.D. Adapting to environmental jolts. Adm. Sci. Q. 1982, 27, 515–537. [Google Scholar] [CrossRef]

- Shi, W.; Connelly, B.L.; Hoskisson, R.E.; Ketchen, D.J.J. Portfolio spillover of institutional investor activism: An awareness—Motivation—Capability perspective. Acad. Manag. J. 2020, 63, 1865–1892. [Google Scholar] [CrossRef]

- Souri, A.; Hosseini, R. A state-of-the-art survey of malware detection approaches using data mining techniques. Hum.-Cent. Comput. Inf. Sci. 2018, 8, 3. [Google Scholar] [CrossRef]

- Gao, P.; Meng, F.; Mata, M.; Martins, J.; Iqbal, S.; Correia, A.; Dantas, R.; Waheed, A.; Rita, J.X.; Farrukh, M. Trends and future research in electronic marketing: A bibliometric analysis of twenty years. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 1667–1679. [Google Scholar] [CrossRef]

- Rosario, R.A.; Roshini, R.; Pillai, V. A study on digital marketing and its types: A deep review of pros and cons. Integr. J. Res. Arts Humanit. 2022, 2, 140–145. [Google Scholar] [CrossRef]

- Fan, D.; Xiao, C.; Zhang, X.; Guo, Y. Gaining customer satisfaction through sustainable supplier development: The role of firm reputation and marketing communication. Transp. Res. Part E Logist. Transp. Rev. 2021, 154, 102453. [Google Scholar] [CrossRef]

- Wolter, J.S.; Donavan, D.T.; Giebelhausen, M. The corporate reputation and consumer-company identification link as a sensemaking process: A cross-level interaction analysis. J. Bus. Res. 2021, 132, 289–300. [Google Scholar] [CrossRef]

- Chen, M.J.; Michel, J.G.; Lin, W. Worlds apart? Connecting competitive dynamics and the resource-based view of the firm. J. Manag. 2021, 47, 1820–1840. [Google Scholar]

- Siyal, S.; Ahmad, R.; Riaz, S.; Xin, C.; Fangcheng, T. The impact of corporate culture on corporate social responsibility: Role of reputation and corporate sustainability. Sustainability 2022, 14, 10105. [Google Scholar] [CrossRef]

- Dai, J.; Cantor, D.E.; Montabon, F.L. How environmental management competitive pressure affects a focal firm’s environmental innovation activities: A green supply chain perspective. J. Bus. Logist. 2015, 36, 242–259. [Google Scholar] [CrossRef]

- Modi, S.B.; Mishra, S. What drives financial performance—Resource efficiency or resource slack?: Evidence from US based manufacturing firms from 1991 to 2006. J. Oper. Manag. 2011, 29, 254–273. [Google Scholar] [CrossRef]

- Chatterjee, S. Gains in vertical acquisitions and market power: Theory and evidence. Acad. Manag. J. 1991, 34, 436–448. [Google Scholar] [CrossRef]

- Scherer, F.M.; Ross, D. Industrial Market Structure and Economic Performance; University of Illinois at Urbana-Champaign’s Academy for Entrepreneurial Leadership Historical Research Reference in Entrepreneurship: Champaign, IL, USA, 1990. [Google Scholar]

- John, K.; Lang, L.H.; Netter, J. The voluntary restructuring of large firms in response to performance decline. J. Financ. 1992, 47, 891–917. [Google Scholar] [CrossRef]

- Fornell, C.; Robinson, W.T. Industrial organization and consumer satisfaction/dissatisfaction. J. Consum. Res. 1983, 9, 403–412. [Google Scholar] [CrossRef]

- Turner, S.F.; Mitchell, W.; Bettis, R.A. Responding to rivals and complements: How market concentration shapes generational product innovation strategy. Organ. Sci. 2010, 21, 854–872. [Google Scholar] [CrossRef]

- Jarvenpaa, S.L.; Todd, P.A. Consumer reactions to electronic shopping on the world wide web. Int. J. Electron. Commer. 1996, 1, 59–88. [Google Scholar] [CrossRef]

- Pullman, M.; Wikoff, R. Institutional sustainable purchasing priorities: Stakeholder perceptions vs environmental reality. Int. J. Oper. Prod. Manag. 2017, 37, 162–181. [Google Scholar] [CrossRef]

- Zarabi, Y. Yasmin Zarabi on Four Key Factors for 2022 Manufacturing ESG. 2022. Available online: https://sustainabilitymag.com/sustainability/four-driving-factors-of-esg-in-manufacturing-in-2022-sustainability-digital-platforms-parsable-yasmin-zarabi (accessed on 2 September 2022).

- Securities and Exchange Commission (SEC). SEC Announces Enforcement Task Force Focused on Climate and ESG Issues. 2021. Available online: https://www.sec.gov/news/press-release/2021-42 (accessed on 2 September 2022).

- Calantone, R.; Vickery, S.K. Special topic forum on using archival and secondary data sources in supply chain management research. J. Supply Chain. Manag. 2009, 45, 68–70. [Google Scholar] [CrossRef]

- Ellinger, A.; Shin, H.; Northington, W.M.; Adams, F.G.; Hofman, D.; O’Marah, K. The influence of supply chain management competency on customer satisfaction and shareholder value. Supply Chain. Manag. Int. J. 2011, 17, 249–262. [Google Scholar] [CrossRef]

- Murphy, J.B. Introducing the North American industry classification system. Mon. Lab. Rev. 1998, 121, 43. [Google Scholar]

- Sayler, S.K.; Roberts, B.J.; Manning, M.A.; Sun, K.; Neitzel, R.L. Patterns and trends in OSHA occupational noise exposure measurements from 1979 to 2013. Occup. Environ. Med. 2019, 76, 118–124. [Google Scholar] [CrossRef]

- RepRisk. ESG with a Risk Lens and Transparency. RepRisk. 2022. Available online: https://www.reprisk.com/approach (accessed on 2 September 2022).

- Kotsantonis, S.; Serafeim, G. Four things no one will tell you about ESG data. J. Appl. Corp. Financ. 2019, 31, 50–58. [Google Scholar] [CrossRef]

- Spitzer, S.W.; Mandyck, J. What Boards Need to Know About Sustainability Ratings. Harvard Business Review. 2019. Available online: https://hbr.org/2019/05/what-boards-need-to-know-about-sustainability-ratings (accessed on 2 September 2022).

- Li, J.; Wu, D. Do corporate social responsibility engagements lead to real environmental, social, and governance impact? Manag. Sci. 2020, 66, 2564–2588. [Google Scholar] [CrossRef]

- Cui, J.; Jo, H.; Na, H. Does corporate social responsibility affect information asymmetry? J. Bus. Ethics 2018, 148, 549–572. [Google Scholar] [CrossRef]

- Gartner. Gartner Announces Rankings of the 2020 Supply Chain Top 25. 2020. Available online: https://www.gartner.com/en/newsroom/press-releases/2020-05-20-gartner-announces-rankings-of-the-2020-supplychain-top-25 (accessed on 2 September 2022).

- Lin, H.C.; Shih, C.T. How executive SHRM system links to firm performance: The perspectives of upper echelon and competitive dynamics. J. Manag. 2008, 34, 853–881. [Google Scholar] [CrossRef]

- Pham, H.S.T.; Tran, H.T. CSR disclosure and firm performance: The mediating role of corporate reputation and moderating role of CEO integrity. J. Bus. Res. 2020, 120, 127–136. [Google Scholar] [CrossRef]

- Dowling, G.; Moran, P. Corporate reputations: Built in or bolted on? Calif. Manag. Rev. 2012, 54, 25–42. [Google Scholar] [CrossRef]

- Koumanakos, D.P. The effect of inventory management on firm performance. Int. J. Product. Perform. Manag. 2008, 57, 355–369. [Google Scholar] [CrossRef]

- Moheb-Alizadeh, H.; Handfield, R. The impact of raw materials price volatility on cost of goods sold (COGS) for product manufacturing. IEEE Trans. Eng. Manag. 2018, 65, 460–473. [Google Scholar] [CrossRef]

- Amit, R.; Wernerfelt, B. Why do firms reduce business risk? Acad. Manag. J. 1990, 33, 520–533. [Google Scholar] [CrossRef]

- Merkert, R.; Hensher, D.A. The impact of strategic management and fleet planning on airline efficiency—A random effects tobit model based on DEA efficiency scores. Transp. Res. Part A Policy Pract. 2011, 45, 686–695. [Google Scholar] [CrossRef]

- Walmart. Environmental, Social & Governance Reporting. 2022. Available online: https://corporate.walmart.com/esgreport/ (accessed on 2 September 2022).

- ExxonMobil. Sustainability across Our Operations. 2022. Available online: https://corporate.exxonmobil.com/Sustainability/Sustainability-Report (accessed on 2 September 2022).

- Lambert, F. Tesla Confirms Several Acquisitions Worth $96 Million. Electrek. 2019. Available online: https://electrek.co/2019/10/29/tesla-acquisitions-worth-96-million/ (accessed on 2 September 2022).

- IBISWorld. Top 10 Highly Concentrated Industries. 2012. Available online: https://news.cision.com/ibisworld/r/top-10-highly-concentrated-industries,c9219248 (accessed on 2 September 2022).

- Walker, A. First There was Diet Rite, Then Tab and Diet Pepsi. In 1982, Diet Coke Arrived on the Scene. Now, with Coke Zero, the Latest Entry on the Market, It’s a Real. Baltimore Sun. 2005. Available online: https://www.baltimoresun.com/news/bs-xpm-2005-07-07-0507070035-story.html (accessed on 2 September 2022).

- Lenox, M.J.; Toffel, M.W. Diffusing environmental management practices within the firm: The role of information provision. Sustainability 2022, 14, 5911. [Google Scholar] [CrossRef]

- Pyles, M.K. Examining portfolios created by bloomberg ESG scores: Is disclosure an alpha factor? J. Impact ESG Investig. 2020, 1, jesg.2020. [Google Scholar] [CrossRef]

- Akey, P.; Lewellen, S.; Liskovich, I.; Schiller, C. Hacking Corporate Reputations; Working Paper No. 3143740; Rotman School of Management: Toronto, ON, Canada, 2021. [Google Scholar]

| Variable | Description | Source | Mean | Std. Dev. |

|---|---|---|---|---|

| Focal firm ESG performance (Focal_ESG) | Reciprocal of RepRisk index of the focal firm | RepRisk | 0.68 | 0.39 |

| Rival firm ESG performance (Rival_ESG) | Reciprocal of RepRisk index of the rival firm | RepRisk | 0.61 | 0.41 |

| Focal firm size (Focal_size) | Log of total assets of the focal firm | Compustat | 9.96 | 1.62 |

| Rival firm sustainability reputation (Rival_reputation) | Binary variable coded as 1 if the rival firm is present in Gartner’s supply chain rankings | Gartner | 0.34 | 0.47 |

| Industry concentration (HHI) | Sum of squared shares of firm’s market shares in an industry | Compustat | 0.29 | 0.24 |

| Focal firm performance (Focal_ROA) | Net income divided by total assets of the focal firm | Compustat | 0.10 | 0.14 |

| Focal firm sustainability reputation (Focal_reputation) | Binary variable coded as 1 if the focal firm is present in Gartner’s supply chain rankings | Gartner | 0.15 | 0.35 |

| Inventory turnover (Inventory_turnover) | Net sales divided by average inventory at selling price | Compustat | 12.63 | 38.31 |

| Cost of goods sold (COGS) | Costs directly related to products sold (log) | Compustat | 8.96 | 1.67 |

| TobinQ | Firm’s total market value divided by total assets | Compustat | 1.82 | 1.20 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

|---|---|---|---|---|---|---|---|---|---|

| Rival firm ESG performance (1) | 1 | ||||||||

| Focal firm size (2) | −0.09 *** | 1 | |||||||

| Rival firm sustainability reputation (3) | −0.48 *** | 0.01 | 1 | ||||||

| Industry concentration (4) | 0.04 *** | 0.02 ** | −0.20 *** | 1 | |||||

| Focal firm performance (5) | −0.09 *** | 0.40 *** | 0.04 *** | 0.07 *** | 1 | ||||

| Focal firm sustainability reputation (6) | −0.17 *** | 0.32 *** | 0.26 *** | 0.04 *** | 0.13 *** | 1 | |||

| Inventory turnover (7) | 0.03 *** | 0.04 *** | −0.03 *** | −0.01 | 0.01 | −0.01 * | 1 | ||

| Cost of goods sold (8) | −0.14 *** | 0.52 *** | 0.02 * | 0.14 *** | 0.20 *** | 0.37 *** | 0.0008 | 1 | |

| TobinQ (9) | 0.04 *** | −0.17 *** | 0.01 | −0.14 *** | −0.18 *** | 0.04 *** | −0.01 | −0.05 *** | 1 |

| D.V.: Focal_ESGt | Model 1: Control Variables | Model 2: Direct Effects | Model 3: Interaction Effects |

|---|---|---|---|

| Focal_sizet−1 | −0.19 *** (0.02) | −0.17 *** (0.02) | −0.16 *** (0.02) |

| Rival_reputationt−1 | 0.19 *** (0.04) | 0.34 *** (0.04) | 0.34 *** (0.04) |

| HHIt−1 | −0.11 (0.07) | −0.06 ** (0.06) | −0.46 *** (0.11) |

| Focal_ROAt−1 | 0.24 (0.15) | 0.35 ** (0.14) | 0.43 *** (0.14) |

| Focal_reputationt−1 | −0.49 *** (0.04) | −0.48 *** (0.04) | −0.47 *** (0.04) |

| Inventory_turnovert−1 | −0.001 (0.001) | −0.001 (0.001) | −0.001 (0.001) |

| COGSt−1 | −0.06 *** (0.02) | −0.06 *** (0.02) | −0.05 ** (0.02) |

| TobinQt−1 | −0.10 *** (0.01) | −0.08 *** (0.01) | −0.08 *** (0.01) |

| Rival_ESGt−1 | 0.41 *** (0.05) | 0.14 *** (0.05) | |

| Rival_ESGt−1 * Focal_sizet−1 | 0.01 ** (0.006) | ||

| Rival_ESGt−1 * Rival_reputationt−1 | 0.05 (0.09) | ||

| Rival_ESGt−1 * HHIt−1 | 0.83 *** (0.16) | ||

| Year fixed effects | Included | Included | Included |

| Industry fixed effects | Included | Included | Included |

| Constant | 3.34 *** (0.17) | 2.64 *** (0.17) | 2.53 *** (0.16) |

| Log-likelihood | −1040.93 | −996.86 | −948.54 |

| Pseudo R-squared | 0.40 | 0.43 | 0.46 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guntuka, L. Inter-Firm ESG Rivalry: A Competitive Dynamics View. Sustainability 2022, 14, 13665. https://doi.org/10.3390/su142013665

Guntuka L. Inter-Firm ESG Rivalry: A Competitive Dynamics View. Sustainability. 2022; 14(20):13665. https://doi.org/10.3390/su142013665

Chicago/Turabian StyleGuntuka, Laharish. 2022. "Inter-Firm ESG Rivalry: A Competitive Dynamics View" Sustainability 14, no. 20: 13665. https://doi.org/10.3390/su142013665

APA StyleGuntuka, L. (2022). Inter-Firm ESG Rivalry: A Competitive Dynamics View. Sustainability, 14(20), 13665. https://doi.org/10.3390/su142013665