Abstract

The scientific literature and practical studies show that one of the main challenges facing the ongoing development of sustainable real estate markets is the understanding of the specifics of real estate as an object of increasing importance in the global economy. Misinterpretation of the principles of modern valuation models causes conflict between opponents and proponents of their use. To reconcile the two sides, the authors of this study propose the possibility of extending the methodology with new solutions—hybrid automated valuation models—and introducing a new value called the rough value. The study mostly draws on monographic and deductive reasoning methods, which includes an analysis of the basic principles of real estate appraisal (as described by internationally recognized professional standards) and valuation methods. The introduction of proposed solutions to valuation practice should be preceded by the development of unified standards and the principles of their application.

1. Introduction

Property is one of the most valuable assets in the global economy, which is why knowledge of their value often constitutes as key information in many investment decisions. Value is widely recognized as a universal category found and used in all scientific disciplines, including technical disciplines, humanities, natural sciences, and social sciences. The wide presence of this category in social and economic life means that it combines the scientific complexity established from the results of multidirectional research with the pragmatics of everyday experiences [1,2]. An analysis of the scientific literature and applied, practical studies shows that one of the main challenges facing modern economies [3], including especially real estate economics, is a broader understanding of the essence of real estate as an object in an increasingly global real estate market. This is due to the fact that, in this era of frequent changes in the market environment, assessment of market phenomena is becoming increasingly difficult [4,5,6,7]. The appearance and development of various types of value have been driven by the needs of (real estate) industry, as well as by the conclusions drawn from actual valuation practiced by (real estate) professionals [8]. The evolution of the value category indicates its complexity determined by the various factors shaping it. Therefore, the following thesis was formulated: misinterpretation of the principles of modern valuation models causes a conflict between opponents and proponents of their use, hindering the development of real estate valuation methodology, which should be adapted to the current needs of real estate market entities.

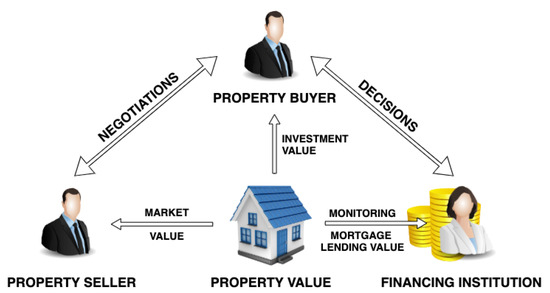

Modern land management requires, inter alia, spatial sustainable development and quick investment decision making. Additionally, the increasing number of multidirectional relationships between market entities causes, among other things, expectations with regard to how their property will be valued, depending on their needs (Figure 1).

Figure 1.

Examples of entities on the real estate market and the multidirectional relationships between them (source: author’s elaboration).

Consequently, real estate industry professions (property valuers, real estate brokers) are indispensable entities in creating proper and just relations, as presented in Figure 1. Depending on the role assigned to the value in real estate decision making, the client needs a specific type of value, often determined by applying special assumptions. At the same time, the wide use of valuation results determines the basic directions and scope of theoretical and methodological investigations into the base of value itself, and the methods/procedures for its determination. The basis of value may influence or directly dictate the type of data required, the method of collection, and in some cases, the assignment of suitable assumptions by the property valuer and the choice of the valuation method. Academic researchers have increasingly emphasized that the methodology of property valuation is currently undergoing a technological transformation, pointing to innovations and disruptions. This also includes studies on innovative GIS-based territorial information tools, analysis of the interdependencies of the real-estate market with zonal and socio-economic variables, and data-driven techniques for mass appraisal [9,10] that will impact property valuation around the world in the coming years [11,12]. These include evolving client requirements, new market entrants, big data collected by modern technology, intelligent valuation platforms, and automated technologies, including automated valuation models [13,14]. The emergence of new technological (PropTech) and financial (FinTech) solutions supporting the real estate market further encourages modification of the valuation methodology, which not only uses new technologies, but also adapts to the ever-changing reality. The real estate value can be obtained with the use of modern automatic and semi-automatic valuation models, including hybrid systems that can meet the requirements of many parties. The authors of the article note the need to analyze the concept of real estate market value, as well as the principles governing other kinds of value determination. The conclusions from the analysis constitute an important starting point for indicating the similarities and possible differences between the value obtained with the use of commonly accepted valuation methods and those obtained via methodological solutions using modern means of collecting, processing, and analyzing data provided by hybrid solutions—hybrid AVMs (HAVMs). This is an ongoing research problem, since formal acceptance of new methods in real estate valuation is the subject of (often heated) debates between scientists, practitioners, and entities responsible for creating valuation standards at the international, European, and national levels [6,15,16,17,18]. The importance of these studies is also amplified by the fact that some countries have highly institutionalized systems of property valuation, which means that the choice of valuation methodology by property appraisers in these countries is limited by provisions of law or standards, as is the case in Poland [19], Lithuania [20], and other countries. There is a persistent problem of whether modern technologies can be treated as an instrument supporting real estate market entities and the development of valuation methodology. The key to solving this problem may lie in the answers to three basic questions:

Is the incorporation of the proposed hybrid AVM (HAVM) into real estate valuation methodology sufficiently justified?

Does acceptance of the HAVM as a valuation model require that the current concept of market value be modified?

Does the value determined with the use of the HAVM under specific assumptions (ones which would meet the needs of specific user groups) require a new definition of value base?

The present attempt to answer the questions relies mostly on monographic and deductive reasoning, which included an analysis of the basic concept of real estate appraisal as embodied by internationally recognized professional standards and valuation methods implemented in many countries.

The article is structured as follows: Section 1 presents considerations on the issue of valuation quality, including the strengths and weaknesses of traditional and automated valuation models; Section 2 concerns the principles of using modern technologies as parts of the property appraisal toolbox, which are key to the quality of valuations; Section 3 concerns modern technologies as tools in the hands of a property appraiser; Section 4 introduces the concepts of the different bases of property valuation against the background of the ‘market value’ concept; and Section 5 discusses the need to introduce a new type of property value. The last chapter summarizing the research contains the conclusions, as well as recommendations for further research.

2. The Problem of the Quality of the Real Estate Valuation

One of the major challenges of the modern real estate market is the need to quickly provide the client with reliable information about the value of real estate useful for a specific purpose. For a property appraiser, collecting, processing, and interpreting market data and characteristics of the valuation property in a timely fashion is usually problematic. Some commentators categorize the veracity and reliability of comparison data by referring to it in grades of “hard” and “soft” information. Hard information is the data on the comparable sale of a similar property where all information is available to the valuer and trusted by him. Soft information is where the valuer needs to rely more upon the reports and commentary of a third party without being able to verify the facts [21,22,23,24,25]. This creates the need to apply an effective valuation procedure while maintaining the desired quality/accuracy of the result. Crosby, French, and Matysiak [26] stated that “the accuracy of any valuation is defined as how close the valuation is to the exchange price in the marketplace.” The inherent element of subjectivity in a valuation leads to a margin of variation between valuations given by different appraisers, or between the valuation and the final market exchange price. The primary goal in valuation procedures is to keep this margin as low as possible.

2.1. The Main Factors Determining the Quality of the Valuation

In valuation procedures, real estate appraisers mainly use data sources that pertain to the subject being valued and record market transactions regarding the sale or rental of real estate. The appraisers collect data and, on their basis, generate new ones, carrying out the following activities as part of the valuation process:

- collection of data on the property being appraised,

- collection of market data on properties that were the subject of the transaction and adjustment thereof to the requirements of the given valuation method/technique,

- data connection, comparison, and processing,

- provision of new synthetic information, or the “property value”, which is transferred to another person, institution, or system (this information is then converted into a price, compensation, or basis for determining the real estate fees or tax).

Due to the improvement of technology and easier access to more complete market evidence, many stages of the valuation process can be and are performed using computer models. French [21] classifies data acquired with AVMs as soft information from a private subscription service. This refers to property pricing that is provided online, where the property value is calculated by an automated valuation model. Whether each subsequent stage of the valuation is correctly applied depends on the quality of the results obtained in the previous stage. The higher the quantity and quality of the necessary data collected, the more objective the valuation process becomes, and risk of making a valuation error is lowered. Incomplete/incorrect physical, economic, and legal data regarding the real estate itself and real estate market factors can jeopardize the accuracy of the process.

Valuation practice is the conciliation of a paradox: it involves deriving value from hard evidence while also identifying market phenomena with a lasting impact on value [6]. The reason for this can be sought, among others, in:

- -

- complex methods of data description (differences in the attribute description scale), the same attribute can be described in many ways using different rating scales,

- -

- lack of complete information (due to the lack of unified systems for collecting real estate data),

- -

- frequently inadequate awareness of the dependencies that exist between real estate attributes and market actors or the property price,

- -

- discontinuities in transactions, whereas space, location, and describing factors are continuous,

- -

- inaccuracies and “fuzzy” data on real estate (caused by stochastic factors that reflect random processes which elude the widely recognized market cause-and-effect relationship),

- -

- highly emotional decisions made on the real estate market and behavioral factors that are very difficult to quantify.

In cases where the market data is insufficient or incomplete, the property valuer is forced to refer to his subjective experiences and assessments, which often leads to an increase in estimation error. The presence of behavioral elements in the valuation practice is not without significance [27,28]. It can arise, among others, at the stage of subjective assessment of property attribute significance or selection of comparable sales. Heuristics introduce a bias in the valuation process and lead to the inferior value of normative models. Time pressure, caused by the increased number of appraisals as the real estate market experienced a strong resurgence, and the volatility of real estate prices, have spurred a shift away from the normative valuation model. Appraisers simplify some elements of this model (e.g., market analysis), relying on their own experience and using simplified methods of data processing and selection of comparable sales. Experienced appraisers tend to consider less data for comparison than novices, only focusing on key attributes such as location, which can lead to erroneous estimates. Research in the US and UK found that valuers who valued the same property repeatedly were prone to “anchoring” to the previously estimated value, leading to biased values deviating from those derived solely from market data. Detachment from market data, as well as excessive trust in one’s own experiences, undermine the rationality of behavior in the valuation process [13]. Unforeseen circumstances (e.g., the COVID-19 pandemic) can also speak to the need for property appraisers to have additional skills to cope with specific conditions [13,29,30,31,32]. The basic types of risk factors that may affect the quality of valuation are presented on Figure 2.

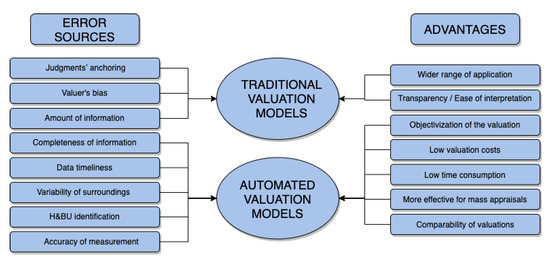

Figure 2.

Potential risk factors for valuation quality (source: author’s elaboration).

However, the needs of the recipient should also be taken into account when assessing the collected data and, consequently, the correctness of the valuation result. The data adopted for valuation and the use of analytical and calculation procedures can be deemed suitable if they meet the formal requirements applicable in the given country, if they conform to the recognized principles of the adopted valuation methodology, and if the users (recipients) of the value are satisfied. In this context, the next section presents a comparison of two basic groups—the so-called traditional and modern methods of real estate appraisal.

2.2. Traditional and Automatic Valuation Procedures and Problems with Their Application

At its core, valuation methodology is based on the workings of a free market economy. All valuation methods need to reflect the economic fundamentals of the real world. The rules governing the valuation methods/procedures applied vary across different countries. These differences stem from variations in the institutional framework of the market, including the legal framework resulting also from political goals and from the execution of economic/social goals. However, the methodology of valuation is primarily influenced by the availability and quality of data from the real estate market. The analysis of the literature on the subject, as well as professional publications, shows that the valuation methodology may apply a number of analytical tools or techniques. Although there are certain differences in their application, there are only three basic approaches for valuing land and buildings: the market (or comparative) approach, the income approach, and the cost approach [4,5,6,7,21]. In practice, the most common approach is the market-based one, where the value is obtained by comparing the estimated property with evidence obtained from market transactions for similar properties. The specific procedure, based on one or more valuation approaches used by the valuer to arrive at an estimate of value, is referred to as the valuation method. The valuation method used depends on many factors, including: the legal regulations, the state of the market and real estate appraisal practice operating in a given country, the type of real estate, available data, and the purpose of the appraisal. The preferred method of determining market values is a comparative method based on actual market transactions. A specific technique of data treatment conducted within a valuation method is referred to as the valuation model [6]. One set of methods are grouped as the so-called traditional pricing models. These include: the classical comparative method, the investment method, the contractor’s method, the residual method, and the profit method (receipts and expenditure) [30,33]. However, there has been increased adoption of modern technologies utilizing advanced methods, such as artificial neural networks, hedonic pricing, spatial analysis, fuzzy logic, and autoregressive integrated moving average [34,35,36,37,38], as well as multiple criteria methods [39,40,41,42,43,44,45]. As a rule, the choice of the appropriate approach, method, and model is left to the professional judgment of the valuer. However, it should be noted that the more advanced the valuation method, the higher the level of caution necessary to ensure that there is no internal inconsistency (e.g., with the assumptions made) [46]. High analytical and statistical competence of the appraiser in that case is unquestionably crucial. Figure 3 presents a comparison of traditional valuation models with automated valuation models according to selected comparative criteria relevant to the subject of this article.

Figure 3.

Examples of susceptibility of models (automated/traditional) to the risk of lowering the quality of the valuation, as well as their advantages (source: author’s elaboration).

Figure 3 shows that each group of models has advantages and disadvantages in terms of vulnerability to error sources (left side of the figure), as well as the benefits they offer to valuers and property appraisers (right side of the figure). The main weakness of the popular AVMs, as currently used, is the risk of feeding incomplete essential transaction data into the analysis. On the other hand, traditional valuation models may also produce incorrect value determinations, if the assessment of the facts is subjective (biased) and/or the expert interferes with the assumed numerical values (which is possible at many stages of the analysis). Furthermore, the valuers’ ability to arbitrarily adopt a particular level of detail and choose how to present the calculation process may lead to difficulties in interpreting the valuation report by its recipient. The fact that each field inspection undertaken to collect real estate data extends the time and costs of the valuation, but may not increase its usefulness to the given recipient, also needs to be considered. In special situations (e.g., the COVID-19 pandemic), it may also be dangerous for the inspector of the property. The use of AVMs can solve these disadvantages or at least eliminate/mitigate their negative impact on the quality of the valuation, especially if they are modified to take into account the full involvement of the valuer across the entire valuation process. However, it should be noted that if a real estate (with a specific use) is appraised, or if the value is to constitute the basis for determining the amount of expenditure incurred, it will be more appropriate to use traditional models that can take into account the real estate potential, a more accurate selection of specialist real estate features, and comparative market data. In light of the presented arguments for and against the two groups of models, there is a real need to open a constructive discussion on the use of new, improved techniques of market analysis and real estate valuation. In this context, the valuer community view of AVM as a threat to the quality of valuations and the harbinger of their gradual elimination from the valuation market, seems incomprehensible and borders on ostracism. However, it is important to stress that the progressively more automatic valuation models, used openly on internet platforms, provide instant property value “estimations” to users with general/limited knowledge of the real estate market [47,48]. This leads to many negative effects, including: the development of this type of tool by laypersons not familiar with real estate valuation, non-disclosure of the use of AVM by incompetent persons (and the resultant lack of control over it), and the outflow of clients and/or unverified investment decisions by professionals with a high risk of error. An additional problem is that the meaning of AVM is usually misinterpreted, and it has a wider spectrum of application than just mass appraisal (MA) [49]. Automated valuation models (AVMs) can be applied in numerous aspects of property analysis, both in large and small databases, including the valuation of individual properties. AVMs are computer applications that use real estate information to calculate value for a particular purpose in real estate analysis. Further questions pertain to whether mass appraisal should be considered equal to or synonymous with AVM. Unlike MA, the application of AVM is not limited to the valuation of groups of properties. Thus, AVM has a broader meaning than MA. Furthermore, whilst mass appraisal is generated for a governmentally defined date, AVM produces a valuation for the date of the client’s choosing.

3. Modern Technologies as Tools in the Hands of a Property Appraiser

Many of those who object to the use of automatic models in real estate value determination believe that the accuracy of such valuations is unsatisfactory [50]. However, a review of the published results of recent studies has shown that automatic models can achieve a satisfactory level of valuation accuracy, especially when multiple techniques or modern technologies are used synergistically. However, the effectiveness of the models should be assessed not only in terms of their accuracy, but also with regard to the methodological and substantive adjustment to the specificity of the analyzed phenomenon and the user’s needs. In an analysis of models based on neural networks [51,52,53], the authors obtained more than 75% of the overall model fit for market value. Models based on fuzzy logic and rough sets performed at over 90% accuracy [54]. Models proposed for forced sale value estimation based on fuzzy logic or OLS provide an accuracy of over 80% [55], models based on geostatistic techniques provide more than 85% accuracy, and models based on machine learning achieve over 89% [56,57]. This short literature review shows that the research on the applicability of modern market analysis techniques has intensified recently, and that such techniques offer high accuracy results (up to 96%). According to Demetriou [56], AVMs are highly efficient compared to conventional property valuation methods, since they can reduce the time/resource cost by 80% and provide transparency (representing a shift from an empirical process to a systematic, analytical, and standardized one). In light of these findings, the authors of this article propose an original real estate valuation model, which has the characteristics of a hybrid model. According to Renigier-Biłozor [40] the hybrid model (…) is understandable/defined as synergy in combining aspects of new and traditional components that are developed in the agile mode system creation—which means combination of iterative and incremental process based on feedback from client requirements. In this specific domain, hybrid means interchangeable use (replacement) of human (professional industry representative) and automated models with manual certified property valuer verification. Glumac and Rosiers [58] claimed that each approach and every model can be combined to form a hybrid model for property valuation. When constructing hybrid models many potential problems can emerge, as each combination has its own characteristics. Automatic solutions can be applied to the stage of valuation procedure where the direct access to data is impossible, e.g., due to a pandemic, or work efficiency is limited due to other human limitations in collecting data or processing mass information. The hybrid model aims to use interchangeably:

- -

- a manual (e.g., for coding variables and for the quality control program),

- -

- automated solutions (e.g., in determining the significance of attributes, selecting comparable properties etc.),

- -

- coordination of human intervention (e.g., field inspection, situations where physical inspection is necessary to obtain initial property characteristics, interpretation of results, and final decisions) with computer use (e.g., calculation procedures),

- -

- classical statistical methods (such as linear regression analysis and descriptive statistics) with advanced analyses (such as fuzzy logic, neural networks, genetic algorithms),

- -

- classical learning (e.g., classification, regression, clustering, association, generalizations) with neural nets and deep learning within machine learning methods (e.g., convolutional neural networks, recurrent neural networks, generative adversarial networks).

This hybrid model achieves better quality results with less development time and faster reaction to market changes. According to Glumac and Rosiers [58], each hybrid model is designed to overcome certain barriers. Therefore, a hybrid’s advantages are mostly practical, and they are designed to either surmount missing data, increase the robustness of the model, or improve its explanatory power. On the other hand, opponents have claimed that it can be difficult to control errors in hybrid models, because if the output of one model contains an error that is used as an input for the other model, then the resultant output will also be erroneous. Therefore, the validation of hybrid models must be undertaken with care and on a case-by-case basis, depending on the features of the given hybrid model. From a technical and organizational point of view, hybrid methodologies usually accept the fluidity of projects and provide for a more nimble and nuanced approach to the work. In order to verify whether the application of the proposed valuation methodology requires a new valuation basis, the basic concepts of recognized property values were compared. It is crucial that the value base is properly interpreted and appropriate to the purpose for which it will be used.

4. The Concept of Market Value and Other Non-Market Bases of Valuation

The term basis (bases) of value means “the fundamental premises on which the reported values are or will be based” [5]. Professional standards are internationally recognized and used sources of definition and interpretation of the various types of real estate values, which is why International Valuation Standards [5], European Valuation Standards [6], RICS Valuation, Global Standards [7], and European Union Legal Acts Regulation EU No 575/2013 [59] were included in the analysis. These standards are used by many countries around the world, including most European countries. Some countries set their own professional standards that are based on solutions adopted in international standards, thus supplementing the material of property valuation methodology with country-specific solutions [60,61,62]. It should be emphasized that all these regulations concordantly name market value as the most important basis of valuation. Market value is defined as “… the estimated amount for which the property should exchange on the date of valuation between a willing buyer and a willing seller acting independently of each other after proper marketing wherein the parties had each acted knowledgeably, prudently and without being under compulsion.” [6] EVS1. The USPAP [5] identifies three categories of conditions included in market value definitions: 1. the relationship, knowledge and motivation of the parties (i.e., seller and buyer); 2. the terms of sale (e.g., cash, cash equivalent, or other terms); and 3. the conditions of sale (e.g., exposure in a competitive market for a reasonable time prior to sale). The presented valuation standards also point to bases of values other than market value. They also provide examples of value bases that only appear in legal regulations in some countries or are enshrined in international treaties. These include the fair value (defined in International Financial Reporting Standards), and the fair market value (defined by the Organization for Economic Cooperation and Development). The fundamental valuation principles for an internationally accepted basis of value are presented in Table 1.

Table 1.

Valuation principles for an internationally accepted basis of value.

Table 1 shows that the analyzed concepts of value are consistent with the aforementioned fundamental assumptions for the market value. Value is described in terms of money (normally in the local currency), where the subject of valuation is a property with its physical, legal, and economic characteristics. There are, however, also important different assumptions that lead to the establishment of values under different names, e.g., shortening the time the property is exposed to the market (forced sale value), specific (not hypothetical) parties to the transaction (equitable value), value exclusive to the long-term characteristics of the property (mortgage lending-value), or value determined per the requirements of the insurance company (insurable value). These types of value can also fulfill various functions in economic and social life (for an example of relationships, see Figure 1). The authors of the standards also point out that other bases for valuation may need to be adopted for specific requirements, e.g., for the purposes of taxes (e.g., cadastral, fiscal, or tax value). USPAP [5] also introduced value concepts such as assessed value, business value, disposition value, public interest value, and use value. The author of the textbook entitled Introducing Property Valuation [63] provided a listing of different value types, including (in addition to those already mentioned): freehold value, leasehold value, asset value, alternative use value, annual value, before and after value, break-up value, book value, compulsory purchase value, deprival value, development value, divorce value, exchange value, existing use value, going concern value, gross development value, permitted development value, rateables value, residual value, site value, speculative value, surrender value, and value to the owner. In popular and practical online publications, addressed to a wider audience, one can also find types such as: rateable value, government value, registered value, and e-value. Most of these types of value are perceived as giving a very rough estimate of the approximate worth of a property. Even if they refer to the same property and are calculated at the same time, all of them (or most of them) are likely to be different numbers [64]. It is up to the appraiser to know what kind of value will be appropriate for the needs of a particular client.

5. Discussion: Is a New Type of Value Acquired by Applying HAVM Needed?

The analysis of the definitions of various valuation bases leads to the conclusion that there is no closed catalog of them and proves that valuation theoreticians and practitioners are open to expanding this list if there is such a need in economic and legal practice. However, such flexibility is sadly absent among a large number of property appraisers with regard to developing a methodology for determining these values. The main reason for this, as argued by the real estate appraiser community, is their concern for the quality of valuations, as well as the perceived threat in incorporating modern techniques for collecting and processing data in the valuation process. However, this argument does not seem to be supported by the theory of valuation, as the concepts of these values do not contain any assumptions about the methodology of its determination. It is emphasized that it is not the valuation method (model) that determines the type of obtained value. The basis of valuation is determined by the type and nature of the data fed into the valuation model and meeting the requirements (assumptions) resulting from the purpose for which the value is to be used. The role of an appraiser is to correctly select the data and accurately interpret the relationships between them. Thus, there is the open question of whether the adoption of the proposed HAVM as a modernized tool for market analysis and real estate valuation requires that the concept of market value be amended or a new type of value be introduced. Justifying an extended definition of market value and/or a new value category also needs to be considered for other important reasons, including social and economic ones. There are, among others, the following trends:

- -

- Changing requirements of clients of property valuers, who are becoming more and more knowledgeable on market trends and long-term investment strategies. In this case, advanced automatic valuation models and market analyses need to be applied whenever it is necessary to take into account many factors and forecast the value of real estate and the frequent treatment of real estate as an investment, which is perceived as more resilient/less risky than other assets. There is also the increasing role of real estate as a key urbanization element of sustainable development, providing jobs and places to live and thus increasing the sense of security. For these reasons, any assessment of real estate potential requires quick multithreaded/multi-criteria analyses carried out with the use of automatic supporting systems.

- -

- Wide access to information such as big data; platforms/open systems provide access to a very large amount of information, but also cause greater information overload. Therefore, results obtained using these tools need to be correctly interpreted. It also contributes to the disappearance of the concept of “lack of market” in more and more countries. Modern technologies and systems enable information to be acquired from many data sources and allow users to search for and select real estate and similar markets.

The following two facts are also important for the analysis:

- The progressing competitiveness of companies, including those within the appraisal industry, indicates that property appraisers who wish to keep operating on the valuation market and meet its needs must accept and adopt modern technologies and new automatic systems in their practice.

- Restrictions related to the COVID-19 pandemic and recommendations regarding “working safely” have forced a transition to online work and increased use of IT tools. Such restrictions impact the different stages of valuation, such as direct access to documents and registers containing data about the property, as well as property inspection. These simplified property valuation procedures can deteriorate the quality of the valuation. On the other hand, these shortcomings can be eliminated to a significant degree by using modern technological means of data acquisition.

The listed symptoms of the current and future functioning of society and the real estate market sector have affected and will affect appraisal professionals. The presented HAVMs can effectively support the activities of a real estate appraiser as a provider of information on the value of real estate. The question remains as to whether the obtained result will be the market value.

The authors recommend two special conditions for using HAVM:

Special condition 1: Property valuer participation in the key stages for the quality of valuation modeling, e.g., determining the time range for selected market transactions, determining the size of the analyzed market, determining the criteria and selection of real estate comparable to the subject being valued, and verification of the obtained result by comparing it with transactions from the local market.

Following these key principles guarantees that the obtained value meets the criteria of market value and the principles of its determination (as defined by professional standards). Therefore, it should be treated equally with the market value obtained using traditional, commonly accepted valuation models.

Special condition 2: Property expert participation with fewer interference in the modeling process. This may result in reduced accuracy of matching the analyzed data to the local market and the subject being valued. For this reason, the value obtained cannot be associated with the market value, although it cannot be ruled out that in many cases it will be the same amount. This result should be treated as a rough guide to what a property may approximately be worth (approximation of the market value). Within the meaning of the valuation standards and regulations of some countries, such an expertise is not the same as the preparation of an appraisal report (valuation report) but rather a judgment/suggestion regarding the value of the subject for valuation. For this reason, the authors propose to formulate a new basis of the rough value and adopt the following definition:

The rough value is an estimated amount calculated using hybrid automated methods of collecting and processing market-derived data regarding properties and factors affecting value, without compulsory verification by a property valuer during every stage of the process.

Comment to the definition: The rough value of the property may approximate its market value as much as possible using modern technology and mathematical models and may be determined with a special assumption, e.g., without taking into account the highest and best use of the subject property.

Property appraisers worry that any changes in the value determination may have future effects, by introducing the term “quasi market value” which can be determined by unauthorized persons. Therefore, it will be the duty of the property valuer to declare which procedures were performed using HAVM (full and incomplete participation of a property expert) and indicate the appropriate type of obtained value. It is important to state what the valuation is intended for to clearly define what the desired value of the property is expected to serve as, and to follow the rules for determining it.

6. Conclusions

The present study provided a basis for formulating final conclusions, which are presented in the form of answers to the questions posed in the introduction.

- Is the incorporation of the proposed hybrid AVM (HAVM) into real estate valuation methodology sufficiently justified?

YES—the so-called “signs of the times”, characterized by modern information technologies seeping into all spheres of life and expanding a wide range of users of real estate values, determined under various assumptions (also with specific ones). Based on qualitative assessment of the use of AVM and its modified form, HAVM, it should alleviate appraisers’ concerns about the deterioration of valuation quality. Hence, HAVM should broaden the set of valuation models used under the comparative method and market-based approach.

- 2.

- Does acceptance of HAVM as a valuation model require that the current concept of market value be modified?

NO—the presented model makes it possible to take into account all the assumptions underlying the correct determination of the market value. These conditions can be met to the same extent as when using recognized traditional valuation models. It is also worth noting that HAVM can also be used to determine other existing non-market bases of valuation. A basis of value as a statement should be distinguished from the methods or techniques used to implement a chosen basis.

- 3.

- Does the value determined with the use of HAVM under specific assumptions (ones which would meet the needs of specific user groups) require a new definition of value base?

YES—HAVM can be successfully used, for example, in the areas of property consulting. Real estate market entities have been increasingly vocal about the need to assess the profitability of investments in the real estate market. Even for these purposes, it is satisfactory to have a value close to the market value but obtained in a multi-variant approach and in a short time. In this case, it is also important that the results of these calculations, usually employed for larger areas (multiple properties located in different locations), are comparable. These requirements, by automating many activities, are in line with HAVM and the proposed rough value. The non-market valuation bases defined in professional standards relate to specific valuation objectives (usually official ones) and, by definition, require a detailed approach to their determination by a valuation professional. At the same time, the introduction of rough value may be an answer to the arguments raised in the relevant literature by many proponents (academics and practitioners), arguing for openness towards incorporating modern advancements into the field of real estate valuation.

Establishing a new value base is also warranted by the need to eliminate (or at least reduce) conflicts between the opponents and proponents in the appraisal industry (valuers, researchers, AVM providers), which largely result from the lack of proper interpretation of valuation results produced with semi-automatic or automated pricing models, especially the modern, highly advanced ones. The proposed hybridization of existing AVMs should serve as an instrument to increase confidence in the result, as it would be ultimately determined by a property appraiser. HAVM cannot fully replace a property appraiser. The proposed solution to the considered dilemma (i.e., whether modern technologies can be used for real estate appraisal) does not contradict the professional standards governing the fundamental principles of appraisal commonly accepted around the world. IVS 2 deals with this issue as follows: “It is essential that both the valuer and the users of valuations clearly understand the distinction between Market Value and other bases of valuation, together with the effects that differences between these concepts may create in the valuer’s approach to the valuation and in the resulting reported value” [5].

The introduction of HAVM into valuation practice should be preceded by the development of unified standards for building hybrid automatic valuation models and the principles of their application. Actions should also be taken in the introduction of HAVM and the rough value so that both the recipients of this value and their “suppliers”—property appraisers—can be prepared. This is necessary to alleviate any fears among property appraisers that any changes to the valuation methodology may have negative future effects.

Author Contributions

Conceptualization, M.R.-B., S.Ź. and M.W.; methodology, M.R.-B., S.Ź. and M.W.; formal analysis, M.R.-B., S.Ź. and M.W.; investigation, M.R.-B., S.Ź. and M.W.; resources, M.R.-B., S.Ź. and M.W.; data curation, M.R.-B., S.Ź. and M.W.; writing—original draft preparation, M.R.-B., S.Ź., and M.W.; writing—review and editing, M.R.-B., S.Ź., and M.W.; visualization, M.R.-B., S.Ź. and M.W.; supervision, S.Ź. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the National Science Centre [grant number 2019/33/B/HS4/00072].

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data presented are available on request from the corresponding author.

Conflicts of Interest

The authors declare that they have no conflict of interest.

References and Note

- Duraj, J. Aksjologiczny Wymiar Wartości Przedsiębiorstwa. In Wartość Przedsiębiorstwa-z Teorii i Praktyki Zarządzania; Duraj, J., Ed.; Wydawnictwo Naukowe NOVUM: Płock, Poland, 2000. [Google Scholar]

- Lind, H.; Nordlund, B. Advanced Issues in Property Valuation; John Wiley & Sons: Hoboken, NJ, USA, 2021. [Google Scholar]

- Francois, P. Comment on Artificial Intelligence and Economic Growth. In The Economics of Artificial Intelligence: An Agenda; Agrawal, A., Gans, J., Goldfarb, A., Eds.; University of Chicago Press: Chicago, IL, USA, 2018; pp. 282–289. [Google Scholar]

- International Valuation Standards Council (IVSC). 2021. International Valuation Standards (IVS). Available online: https://www.ivsc.org/standards/ (accessed on 21 January 2022).

- The Appraisal Foundation. 2020-2021. The Uniform Standards of Professional Appraisal Practice (USPAP). Available online: https://www.appraisalfoundation.org/iMIS/TAF/USPAP.aspx (accessed on 21 January 2022).

- The European Group of Valuers’ Associations (TEGOVA). 2020. European Valuation Standards (EVS). Available online: https://tegova.org/european-valuation-standards-evs (accessed on 21 January 2022).

- The Royal Institution of Chartered Surveyors (RICS). 2021. Valuation-Global Standards (Red Book Global Standards). Available online: https://www.rics.org/globalassets/rics-website/media/upholding-professional-standards/sector-standards/valuation/2021-11-25_rics-valuation--global-standards-effective-2022.pdf (accessed on 21 January 2022).

- Jaki, A. Kategoria wartości w wycenie biznesowej. Świat Nieruchom. 2011, 2, 12–20. [Google Scholar]

- Droj, G.; Droj, L. GIS based automated valuation models–A Genuine Solution for Real Estate Valuation in Romania. RevCAD J. 2016, 20, 45–52. [Google Scholar]

- Morano, P.; Tajani, F.; Locurcio, M. Land use, economic welfare and property values: An analysis of the interdependencies of the real-estate market with zonal and socio-economic variables in the municipalities of Apulia region (Italy). In Sustainable Infrastructure: Breakthroughs in Research and Practice; IGI Global: Hershey, PA, USA, 2020; pp. 414–437. [Google Scholar]

- Abdullahi, A.; Usman, H.; Ibrahim, I. Determining house price for mass appraisal using multiple regression analysis modeling in Kaduna North, Nigeria. ATBU J. Environ. Technol. 2018, 11, 26–40. [Google Scholar]

- Archontoulis, S.V.; Miguez, F.E. Nonlinear regression models and applications in agricultural research. Agron. J. 2015, 107, 786–798. [Google Scholar] [CrossRef]

- Hulcombe, B. The 10 Innovations and Disruptions That Will Impact Property Valuation. 2020. Available online: https://www.cbre.com.au/about/content-feeds/expert-opinions/articles/the-10-innovations-and-disruptions-that-will-impact-property-valuation (accessed on 21 January 2022).

- Susskind, R.; Susskind, D. The Future of the Professions: How Technology Will Transform the Work of Human Experts; Oxford University Press: Chicago, IL, USA, 2015. [Google Scholar]

- Kucharska-Stasiak, E.; Źróbek, S.; Cellmer, R. Forms and Effectiveness of the Client’s Influence on the Market Value of Property—Case Study. Real Estate Manag. Valuat. 2018, 26, 82–92. [Google Scholar] [CrossRef]

- McCluskey, W.J.; McCord, M.; Davis, P.T.; Haran, M.; McIlhatton, D. Prediction accuracy in mass appraisal: A comparison of modern approaches. J. Prop. Res. 2013, 30, 239–265. [Google Scholar] [CrossRef]

- Wang, D.; Li, V.J. Mass Appraisal Models of Real Estate in the 21st Century: A Systematic Literature Review. Sustainability 2019, 11, 7006. [Google Scholar] [CrossRef]

- Isakson, H.R.; Ecker, M.D.; Kennedy, L. Principles for calculating AVM performance metrics. Apprais. J. 2020, 14–29. Available online: https://www.appraisalinstitute.org/assets/1/29/TAJ_Win20_014-029_Feat1-AVM_ForWeb.pdf (accessed on 16 September 2022).

- Act of 21 August 1997 on real estate management.

- Galiniene, B.; Marčinskas, A.; Deveikis, S. The professional and ethical potential of Lithuanian property valuers. Int. J. Strateg. Prop. Manag. 2005, 9, 43–50. [Google Scholar] [CrossRef][Green Version]

- French, N. Pricing to Market—An investigation into the Use of Comparable Evidence in Property Valuation. TEGoVa. 2020. Available online: https://tegova.org/static/062574e026cb01499849ffe9a6d29f00/Pr.%20Nick%20French%20Report%20(296%20KB).pdf (accessed on 21 January 2022).

- Bag, S.; Tiwari, M.K.; Chan, F.T. Predicting the consumer’s purchase intention of durable goods: An attribute-level analysis. J. Bus. Res. 2019, 94, 408–419. [Google Scholar] [CrossRef]

- Barańska, A. Real estate mass appraisal in selected countries–functioning systems and proposed solutions. Real Estate Manag. Valuat. 2013, 21, 35–42. [Google Scholar] [CrossRef]

- Parygin, D.S.; Malikov, V.P.; Golubev, A.V.; Sadovnikova, N.P.; Petrova, T.M.; Finogeev, A.G. Categorical data processing for real estate objects valuation using statistical analysis. In Journal of Physics: Conference Series; IOP Publishing: Bristol, UK, 2018; Volume 1015, p. 032102. [Google Scholar]

- Kokot, S.G. Jakość danych o cenach transakcyjnych na rynku nieruchomości. Acta Sci. Pol. Adm. Locorum 2015, 14, 43–49. [Google Scholar]

- Crosby, N.; French, N.; Matysiak, G. Seek carefully and ye shall find. Estates Gaz. 2002, 234, 76–77. [Google Scholar]

- Brzezicka, J.; Wisniewski, R. Identifying selected behavioral determinants of risk and uncertainty on the real estate market. Real Estate Manag. Valuat. 2014, 22, 30–40. [Google Scholar] [CrossRef]

- Renigier-Biłozor, M.; Janowski, A.; Walacik, M.; Chmielewska, A. Human emotion recognition in the significance assessment of property attributes. J. Hous. Built Environ. 2021, 37, 23–56. [Google Scholar] [CrossRef]

- Mazzucato, M. The Value of Everything: Making and Taking in the Global Economy; Hachette: London, UK, 2018. [Google Scholar]

- Źróbek, S.; Kucharska-Stasiak, E.; Renigier-Biłozor, M. Today’s Market Needs Modernized Property Appraisers. Real Estate Manag. Valuat. 2020, 28, 93–103. [Google Scholar] [CrossRef]

- TEGOVA. 2020. Valuation during the Pandemic. Available online: https://tegova.org/news/valuation-during-pandemic (accessed on 21 January 2022).

- RICS. Impact of COVID-19 on Valuation. 2020. Available online: https://www.rics.org/globalassets/rics-website/media/upholding-professional-standards/sector-standards/valuation/impact-of-covid-19-on-valuation-vn2.pdf (accessed on 21 January 2022).

- Źróbek, S.; Walacik, M. Real Estate Market Value in the Light of Valuation Practices. Świat Nieruchom. 2016, 4, 37–40. [Google Scholar]

- Pagourtzi, E.; Assimakopoulos, V.; Hatzichristos, T.; French, N. Real estate appraisal: A review of valuation methods. J. Prop. Invest. Financ. 2003, 21, 383–401. [Google Scholar] [CrossRef]

- Sarip, A.G.; Hafez, M.B.; Daud, M.N. Application of fuzzy regression model for real estate price prediction. Malays. J. Comput. Sci. 2016, 29, 15–27. [Google Scholar] [CrossRef]

- Bełej, M.; Figurska, M. 3D Modeling of Discontinuity in the spatial distribution of apartment prices using voronoi diagrams. Remote Sens. 2020, 12, 229. [Google Scholar] [CrossRef]

- Renigier-Biłozor, M.; Janowski, A.; Walacik, M.; Chmielewska, A. Modern challenges of property market analysis- homogeneous areas determination. Land Use Policy 2022, 119, 106209. [Google Scholar] [CrossRef]

- Renigier-Bilozor, M.; Janowski, A.; Walacik, M. Geoscience methods in real estate market analyses subjectivity decrease. Geosciences 2019, 9, 130. [Google Scholar] [CrossRef]

- Źróbek, S.; Kovalyshyn, O.; Renigier-Biłozor, M.; Kovalyshyn, S.; Kovalyshyn, O. Fuzzy logic method of valuation supporting sustainable development of the agricultural land market. Sustain. Dev. 2020, 1, 1094–1105. [Google Scholar] [CrossRef]

- Renigier-Biłozor, M.; Źróbek, S.; Walacik, M.; Janowski, A. Hybridization of valuation procedures as a medicine supporting the real estate market and sustainable land use development during the covid-19 pandemic and afterwards. Land Use Policy 2020, 99, 105070. [Google Scholar] [CrossRef] [PubMed]

- Bin, J.; Tang, S.; Liu, Y.; Wang, G.; Gardiner, B.; Liu, Z.; Li, E. Regression model for appraisal of real estate using recurrent neural network and boosting tree. In Proceedings of the 2017 2nd IEEE International Conference on Computational Intelligence and Applications (ICCIA), Beijing, China, 8–11 September 2017; IEEE: Piscataway, NJ, USA, 2017; pp. 209–213. [Google Scholar]

- Del Giudice, V.; De Paola, P.; Forte, F. Using genetic algorithms for real estate appraisals. Buildings 2017, 7, 31. [Google Scholar] [CrossRef]

- Georgiadis, A. Real estate valuation using regression models and artificial neural networks: An applied study in Thessaloniki. RELAND Int. J. Real Estate Land Plan. 2018, 1, 292–303. [Google Scholar]

- Manganelli, B.; Paola, P.D.; Giudice, V.D. A multi-objective analysis model in mass real estate appraisal. Int. J. Bus. Intell. Data Min. 2018, 13, 441–455. [Google Scholar] [CrossRef]

- Mei, H.; Fang, H. A Study on the Real Estate Price Forecast Model in the Midwest of China–Based on Provincial Panel Data Analysis. In Proceedings of the Tenth International Conference on Management Science and Engineering Management, Baku, Azerbaijan, 30 August–4 September 2016; Springer: Singapore, 2017; pp. 525–536. [Google Scholar]

- Yalpir, S.; Ozkan, G. Knowledge-based FIS and ANFIS models development and comparison for residential real estate valuation. International J. Strateg. Prop. Manag. 2018, 22, 110–118. [Google Scholar] [CrossRef]

- Yeh, I.C.; Hsu, T.K. Building real estate valuation models with comparative approach through case-based reasoning. Appl. Soft Comput. 2018, 65, 260–271. [Google Scholar] [CrossRef]

- Zhou, G.; Ji, Y.; Chen, X.; Zhang, F. Artificial Neural Networks and the Mass Appraisal of Real Estate. Int. J. Online Eng. 2018, 14, 180. [Google Scholar] [CrossRef]

- Renigier-Biłozor, M.; Źróbek, S.; Walacik, M.; Borst, R.; Grover, R.; d’Amato, M. International acceptance of automated modern tools use must-have for sustainable real estate market development. Land Use Policy 2022, 113, 105876. [Google Scholar] [CrossRef]

- Kucharska-Stasiak, E. Statistics in the Context of Economic Theory and the Limits of Automated Valuation Models in the Valuation of Individual Properties. University of Lodz. 2018. Available online: https://tegova.org/static/122bd0262bac2998f2537f75e04988c2/Pr.%20Dr.%20Ewa%20Kucharska-Stasiak%20Report%20(3820%20KB).pdf (accessed on 21 January 2022).

- Oshodi, O.S.; Thwala, W.D.; Odubiyi, T.B.; Abidoye, R.B.; Aigbavboa, C.O. Using neural network model to estimate the rental price of residential properties. J. Financ. Manag. Prop. Constr. 2019, 24, 217–230. [Google Scholar] [CrossRef]

- McCluskey, W.; Davis, P.; Haran, M.; McCord, M.; McIlhatton, D. The potential of artificial neural networks in mass appraisal: The case revisited. J. Financ. Manag. Prop. Constr. 2012, 17, 274–292. [Google Scholar] [CrossRef]

- Demetriou, D. A spatially based artificial neural network mass valuation model for land consolidation. Environ. Plan. B Urban Anal. City Sci. 2017, 44, 864–883. [Google Scholar] [CrossRef]

- Renigier-Biłozor, M.; Janowski, A.; d’Amato, M. Automated Valuation Model based on fuzzy and rough set theory for real estate market with insufficient source data. Land Use Policy 2019, 87, 104021. [Google Scholar] [CrossRef]

- Renigier-Biłozor, M.; Walacik, M.; Źróbek, S.; d’Amato, M. Forced sale discount on property market–How to assess it? Land Use Policy 2018, 78, 104–115. [Google Scholar] [CrossRef]

- Całka, B. Estimating residential property values on the basis of clustering and geostatistics. Geosciences 2019, 9, 143. [Google Scholar] [CrossRef]

- Sisman, S.; Akar, A.U.; Yalpir, S. The novelty hybrid model development proposal for mass appraisal of real estates in sustainable land management. Surv. Rev. 2021, 120. [Google Scholar] [CrossRef]

- Glumac, B.; Des Rosiers, F. Real Estate and Land Property Automated Valuation Systems: A Taxonomy and Conceptual Model; Working Paper Series 2018-09; Luxembourg Institute of Socio-Economic Research (LISER): Luxembourg, 2018. [Google Scholar]

- Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32013R0575 (accessed on 16 September 2022).

- Gabrel, K. Standardy Zawodowe Rzeczoznawców Majątkowych w Kompetencjach Środowiska Zawodowego. Polska Federacja Stowarzyszeń Rzeczoznawców Majątkowych. 2021. Available online: https://pfsrm.pl/aktualnosci/item/645-standardy-zawodowe-rzeczoznawcow-majatkowych-w-kompetencjach-srodowiska-zawodowego (accessed on 21 January 2022).

- Michael, F. Market Value & Fair Market Value. 2021. Available online: https://mfford.com/html/value_definitions.html (accessed on 21 January 2022).

- Sanders, M.V. 2018 Market Value: What Does It Really Mean? The Appraisal Journal. Available online: https://www.appraisalinstitute.org/assets/1/29/TAJ_Sum18_206-218_Feat3-MarketValue_ForWeb.pdf (accessed on 21 January 2022).

- Blackledge, M. Introducing Property Valuation; Routledge: London, UK, 2009. [Google Scholar]

- Boyd, R. Property Values: Understanding the Different Types. 2015. Available online: https://www.westpac.co.nz/rednews/property-values-understanding-the-different-types/ (accessed on 21 January 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).