1. Introduction

The development of China’s real estate market has been accompanied by various regulations, and this has occurred even more frequently during the recent housing boom [

1,

2]. While previous studies mainly focus on whether strict regulations can hinder the rapid growth of housing prices or enhance the affordability of low- and moderate-income households, a consensus has not been reached [

3,

4,

5,

6,

7]. This paper suggests that regulations can be evaded at the outset through the cheating behavior of market participants, with “Yin-and-Yang” contracts acting as the key instrument.

In Yin-and-Yang contracts, participants in the housing market under-report the transaction price to the government’s real estate management center. The real price that occurs between two parties of a transaction is called a “Yang” contract, while the corresponding “Yin” contract with a lower contract price is recorded by the government. As a good way to evade high taxes in housing transactions, Yin-Yang contracts are widespread in the housing market worldwide [

8,

9].

This paper shows that under-reporting to a greater extent also helps the buyers to evade purchase regulation because “Yin” contracts are outside of the government’s supervision. This unfortunately leads to some unexpected side effects of regulation policies, such as extra tax loss and enlarged inequality. It is also worth noting that, since Yin-and-Yang contracts disguise the prices of most observed transactions, identification of direct causality between policy implementation and the tendency of housing prices may be empirically challenged.

We consider Beijing’s regulation implemented on 30 April 2010, which has been called “the most stringent regulation in history”, as a policy shock to explore market participants’ cheating under regulation. Our micro data on Beijing’s housing resales are from a major real estate broker that has recorded both real transaction prices and contract prices. When comparing transactions within a clean time window before and after the regulation, we find that the price gap between the real price and the contract price are increasing faster after the policy implementation, suggesting that market participants are under-reporting housing prices to an increasing extent. This phenomenon is more pronounced for houses that are more likely to be regulated and for families who have less liquidity pressure.

We further note that the close relationship between “Yin-and-Yang” contracts and buyers’ liquidity causes inequality concerns after regulation. Households with sufficient liquidity enjoy tax-saving and regulation-evasion benefits through further cheating, while households facing liquidity pressure cannot do so and thus may be crowded out of the market under strict price control. Another consequence resulting from the deeper level of cheating is the government’s tax loss. Although almost all transactions originally engage in Yin-and-Yang contracts to evade tax, further under-reporting after regulation causes considerable extra tax loss, which we estimate to account for approximately 1–1.5% of Beijing’s yearly fiscal income.

Time-varying omitted variables may be the key challenge in empirical studies. In this paper, we employ three methods to eliminate this concern. First, we conduct our empirical study based on a clean time window during which the targeted regulation is the only policy that occurs on the housing market. Second, we pay special attention to two groups of houses that respond differently because of their probability of being affected and find that houses that are more likely to be affected are subject to more severe under-reporting of price. Third, we conducted two placebo tests and found that there is no similar phenomenon around other cutoff time points. These methods help to confirm that further cheating on housing prices is caused by this stringent regulation instead of other omitted variables.

This paper highlights that Yin-and-Yang contracts help the market participants to evade regulations on the housing market, which contributes to a large body of literature that discusses various housing market regulations and their outcomes. While some literature acknowledges that restrictions on the housing market may have taken effect on transaction prices and volumes [

3,

10,

11,

12], other research points out that, similar to regulations in other fields, the key failure of housing regulations is in preventing resources from being allocated to those who value them the most [

13,

14,

15,

16,

17]. Price and rent controls lead to both shortage [

18,

19,

20] and misallocation of housing units [

14], in which some non-price features, such as ethnic background, education or family structure, are considered in housing allocation. This means that regulations may lead to inequality and ultimately harm those they aim to protect [

21,

22,

23,

24]. Finally, existing research has found that whether intervention policies in the property market result in desired outcomes depends on the whole structure of social relations among market participants as well as situational factors of housing [

12,

25,

26].

This paper provides new evidence for the failure of regulatory policies, by researching the stringent regulation that attempts to control housing prices and enhance affordability but eventually increases the difficulty of purchasing a home for liquidity-constrained families. To evade price control, both buyers and brokers are motivated to further under-report transaction prices, and some provisions in the policy make wealthy buyers more willing and able to cut contract prices further. As a result, after these regulations, families with liquidity pressures are crowded out by a higher requirement on down payment ratios.

This paper contributes to the literature in other three ways (we organize the relevant literature into a sequence diagram, see

Appendix A for details). First, this paper provides further details on the relationship between households’ liquidity and home-purchase choices. Research on credit conditions or households’ liquidity has emphasized their role in the housing market boom [

27,

28,

29]. Therefore, policies on mortgage lending as well as other methods to change households’ liquidity are commonly employed by governments to stimulate or regulate the housing market as needed [

30]. Previous studies have found that such policies may have unequal effects on families that vary in age, income, wealth, homeownership, or other features [

31,

32]. We provide further evidence by showing that an increase in the borrowing cost has asymmetric impacts: households with adequate liquidity would like to further reduce the contract price and make the deal (increased borrowing cost reduces the opportunity cost of engaging in a “Yin-and-Yang” contract, which will be explained in detail in

Section 2), while those with liquidity pressure are crowded out.

Second, this paper is one of the first studies of the Yin-and-Yang contracts in China’s housing market. Since most previous research pays attention to under-reporting because of its tax-evasion benefit [

33,

34,

35], this paper enriches our knowledge of Yin-and-Yang contracts from the regulation-evasion perspective.

A recent study by Agarwal et al. [

9] also studied the Yin-and-Yang contracts in China’s housing resales, but our paper differs from theirs fundamentally in the research question. The hypothesis in their paper is that, since the home-buyers under-report contract price for a tax-evasion purpose, a policy change implemented in 2013 that increases capital gains tax would encourage them to under-report to a further extent. Conversely, our research tries to reveal that even if without changes in tax provisions, price regulations also lead to further under-reporting, because Yin-and-Yang contracts also help the market participants to hide the real transaction price, and thus, evade regulations. In our paper, Yin-and-Yang contracts could be an unexpected side effect of price regulations and a key way to avoid regulations. Therefore, the policy implications of this paper are further away from theirs: if any price regulations try to take effect sustainably, the policy makers should fully consider the reaction of market participants, especially whether they can evade regulation by hiding actual prices through Yin-and-Yang contracts.

Finally, the conclusion and implications of this paper are also of great value in the context of the COVID-19 epidemic. For example, when emerging literature focuses on the debate whether the pandemic has a positive or negative effect on the housing prices [

36,

37,

38,

39], the growing “Yin-and-Yang” contracts mentioned in our research remind us not to misjudge the price trends because of market participants’ under-reporting. Some other articles have pointed out that the COVID-19 has stimulated higher demand for better-quality houses, and thus, may cause crowding out of low-income buyers [

40,

41,

42,

43]. This paper contributes to the crowding out story from the households’ liquidity perspective, as under-reporting transaction price requires higher liquidity while the pandemic has decreased households’ income and liquidity to a great extent [

44,

45]. Besides, the fluctuating property market under the background of COVID-19 may lead to more intervention policies [

46], and therefore, understanding how market participants evade regulation through misreporting transaction prices is critical to evaluate their potential effects.

The rest of this paper is organized as follows.

Section 2 introduces the stringent regulations on the Chinese housing market implemented in April 2010 and buyers’ decisions on Yin-and-Yang contracts, especially within the context of regulations.

Section 3 provides intuitional descriptions of the patterns of “Yin-and-Yang” contracts according to our micro data.

Section 4 presents the empirical strategy, followed by the empirical results in

Section 5.

Section 6 provides an estimation of the extra tax loss caused by further cheating after regulation.

Section 7 concludes the paper.

2. “Yin-and-Yang” Contracts against the Background of Stringent Regulations

2.1. House-Purchasing Regulations in 2010

The real estate market of first-tier cities such as Beijing and Shanghai has seen a dramatic increase in housing prices in the recent decade, leading to widespread concerns about asset bubbles and inequality issues. Beijing’s housing prices appreciated nearly 55% in the year 2009 (according to the “China Quality-Controlled Housing Price Index” released by Hang Lung Center for Real Estate, Tsinghua University,

http://www.cre.tsinghua.edu.cn/publish/cre/9252/index.html, accessed on 30 July 2018), almost equaling the total growth of the previous 5 years. The estimated price-to-income ratio for Beijing varied from 10 to 18 in early 2010 [

47], resulting in a noticeable affordability problem for middle- and low-income citizens. To cool the overheated housing market, Beijing’s government implemented the most stringent regulations in history on 30 April 2010. Within this bundle of policies, there are three main types of methods to regulate the housing market.

First, the local government attempts to reduce housing demand both institutionally and financially. On the extensive margin, the regulation rules block many families from the housing market. Families with local Beijing “Hukou” (“Hukou” is a system of household registration in mainland China and Taiwan; it determines whether one can purchase a home and enjoy the public services of the city) could purchase a maximum of 1 more home, while migrants without “Hukou” were not allowed to purchase any more homes. On the intensive margin, regulative policies significantly increase the financial costs of purchasing a home. The required down payment ratio is increased from 20% to 30% for a household’s first home purchase if the house is larger than 90 m2 in size. For a household’s second home purchase, the required down payment ratio is increased from 40% to 50% and the mortgage rate is increased 1.1 times regardless of the house size. In addition, mortgage loans for a household’s third home purchase are prohibited. In this section, we will discuss how the increment in financial costs affects home buyers’ choices in relation to “Yin-and-Yang” contracts.

Second, as required by the central government, Beijing plans to adjust the housing supply structure and increase the share of affordable houses. However, it takes time for the housing supply to come online [

48]. To obtain a relatively “clean” effect of the 2010 regulations, we focus on a time window after the previous regulation and before the next one, which is quite short. We believe that within this period, little change could occur in either the amount or the structure of the housing supply.

Third, Beijing has attempted to strengthen supervision of housing transactions. In particular, developers and brokers are warned or even punished for price rigging. The overly rapid growth of recorded housing transaction prices for any agent may result in economic punishment or administrative penalty. Thus, market participants must mind their behavior after the policy implementation. As a direct outcome, they are motivated to cheat on transaction prices to avoid regulation.

2.2. “Yin-and-Yang” Contracts

The primary incentive to engage in a Yin-and-Yang contract during second-hand housing transactions is to evade some transaction-related taxes. Each transaction should be filed in the local government’s real estate management center and taxed according to the recorded price (referred to as the “contract price” below). Taxes in second-hand housing transactions have three components. The contract tax is calculated as a constant share of the contract price, which is 1% for a family’s first house if smaller than 90 m2 in size, 1.5% for a first house if larger than 90 m2, and 3% for a family’s second house. The added-value tax is 5.38% of the contract price for houses resold within 2 years of their previous handover and otherwise is 5.38% of the premium from the previous to the present transaction. The income tax is exempted for houses that are the owner’s only house and that are resold more than 5 years from the last transaction; otherwise, it is 20% of the price difference or 1% of the contract price.

Thus, the transaction-related tax is approximately 5–10% of the contract price recorded in the real estate management center. In our dataset, the average price of a second house in 2010 was approximately 1,800,000 RMB; thus, the transaction-related tax varied from 90,000 RMB to 180,000 RMB, which is a considerably large amount compared to the average personal income of 50,415 RMB for Beijing citizens in 2010 (according to the Beijing Municipal Bureau of Statistics,

http://www.bjstats.gov.cn/tjsj/, accessed on 30 July 2018). Due to the inelastic demand of the second-hand housing market [

49], buyers bear the burden of all of these taxes.

Because the considerable taxes are calculated as a share of the recorded contract price, buyers are motivated to reduce this price as much as possible. In fact, most buyers engage in a Yin-and-Yang contract to lower their taxes. Specifically, in a Yin-and-Yang contract, the contract price recorded in the local government’s real estate management center is much less than the actual amount that occurs between the two parties of a transaction (referred to as the “real price” below). The difference between the real price and the contract price is paid to the seller in private and is not put on record.

2.3. Trade-Off Concerns of “Yin-and-Yang” Contracts

Buyers who sign a “Yin-and-Yang” contract may face a trade-off between tax-saving benefits and higher one-time payments, which produces a higher liquidity pressure to households. Therefore, we may infer that the extent to which buyers lower their contract prices depends on the relationship between tax-saving benefits and liquidity constraints. When there are fewer tax-saving benefits or higher liquidity pressure, buyers are more conservative in signing “Yin-and-Yang” contracts and vice versa. We provide more details on this trade-off below and illustrate the effects of stringent regulations on engagement in “Yin-and-Yang” contracts.

First, as mentioned above, the price difference paid in private to the seller is another part of the “down payment”. A higher down payment leads to liquidity problems, which means that families without sufficient cash have difficulty engaging in “Yin-and-Yang” contracts. Second, the price difference is also a rearrangement of future payments, with opportunity costs such as returns from saving or investing in other assets for the current period. However, due to a lack of many investment opportunities in China, most buyers are willing to invest in “Yin-and-Yang” contracts to save taxes, which can be observed from our dataset in a later part of the paper. Finally, “Yin-and-Yang” contracts are not protected by law, and some local governments issued documents to crack down on “Yin-and-Yang” contracts in second-hand housing transactions during the period of 2008–2009. However, due to the lack of nationwide regulations and strict implementation, “Yin-and-Yang” contracts are still extremely common during the sample period of this article.

The 2010 regulation on the housing market imposes marginal changes on both the liquidity constraints and the opportunity cost concerns of “Yin-and-Yang” contracts. On the one hand, the increased ratio of down payment puts more liquidity pressure on buyers, which makes it difficult to lower the contract price and pay the difference immediately. On the other hand, the higher mortgage rate increases the cost of future installments, which means the interest expense for every 1 RMB borrowed is higher. Hence, transferring future payments to current payments becomes more attractive.

Taking a house with an average total value of 1.8 million RMB for the year 2010 in Beijing as an example,

Table 1 presents the possible payment arrangements for the buyer in different scenarios. If the buyer is not engaged in a Yin-and-Yang contract, the payment is reported in Column (1). The buyer pays a minimum 20% down payment, which is 360,000 RMB, and borrows the other 1.44 million RMB from a commercial bank at a mortgage rate of 4.9% in 2010. The tax would be 90,000 to 180,000 RMB, as stated above.

The buyer could reduce the tax cost by lowering the contract price, as described in Column (2). With a contract price of 1 million RMB, the buyer would pay the other 0.8 million RMB to the seller in private. Accordingly, the tax would be 50,000 to 100,000 RMB. Because the amount of the mortgage loan is also calculated based on the contract price, the buyer could only obtain a loan of 0.8 million from the bank. Thus, the one-time payment would be 1 million RMB, including an official down payment and the price difference paid in private, compared to 0.36 million RMB in Column (1). By engaging in a Yin-and-Yang contract, the buyer transfers 0.54 million RMB from future payments to the current period to save approximately 40,000 to 80,000 RMB in transaction-related tax. Whether the buyer makes such a decision depends on their liquidity constraints and the opportunity cost of the rearranged 0.54 million RMB.

Column (3) reports the payment with the above “Yin-and-Yang” contract in the context of the 2010 regulations. First, the official down payment must be increased to 30% if it is the buyer’s second home, which would be 0.3 million. Compared to Column (2), the one-time payment is increased to 1.1 million, and the other 0.7 million RMB could be borrowed from a bank. The additional 0.1 million would certainly impose more liquidity pressure and discourage the buyer from engaging in the “Yin-and-Yang” contract with such a large price difference. Second, based on the mortgage rate of 4.9% in 2010, the buyer in Column (2) would have to pay an installment of 7,642 RMB/month for the next 30 years. The interest expense for every 1 RMB borrowed is 0.91 RMB. After the regulation was implemented, the mortgage rate was 1.1 times the previous rate, leading to an installment of 3926 RMB/month for the 0.7-million loan. The interest expense for every 1 RMB borrowed is increased to 1.02 RMB, making current payments more attractive than future installments. We can infer from Column (3) that families with high liquidity constraints would have to decrease the price difference of their “Yin-and-Yang” contracts after the 2010 regulation, while those with abundant cash would be motivated to enlarge the price difference.

“Yin-and-Yang” contracts may also serve as a hedge against market regulations. Because the local government supervises the housing market based on the recorded contract prices in the real estate management center, brokers are encouraged to facilitate transactions with “Yin-and-Yang” contracts to a greater extent if the company violates the government’s price-control policies. This implies that buyers who are willing and able to lower the contract price are more likely to make a deal.

As stated above, whether motivated by the higher interest expenses of loans or encouragement by brokers, buyers have incentives to further reduce their contract price relative to the real price after the implementation of the 2010 regulations. However, a buyer’s final decision regarding a “Yin-and-Yang” contract depends on their liquidity constraints. The increase in the required ratio of the down payment after the regulation puts more liquidity pressure on buyers and provides less room for them to further lower the contract price. Therefore, if we observe that the price difference in “Yin-and-Yang” contracts is widened after the regulations; thus, we can infer that families with strong liquidity constraints may have been forced out of the housing market and, on the contrary, those with abundant cash would have more access to facilitate housing transactions. Below, we will describe these patterns first intuitively and then empirically.

3. Data and Intuitional Patterns

Our micro data on resale housing transactions come from a major real estate broker, “

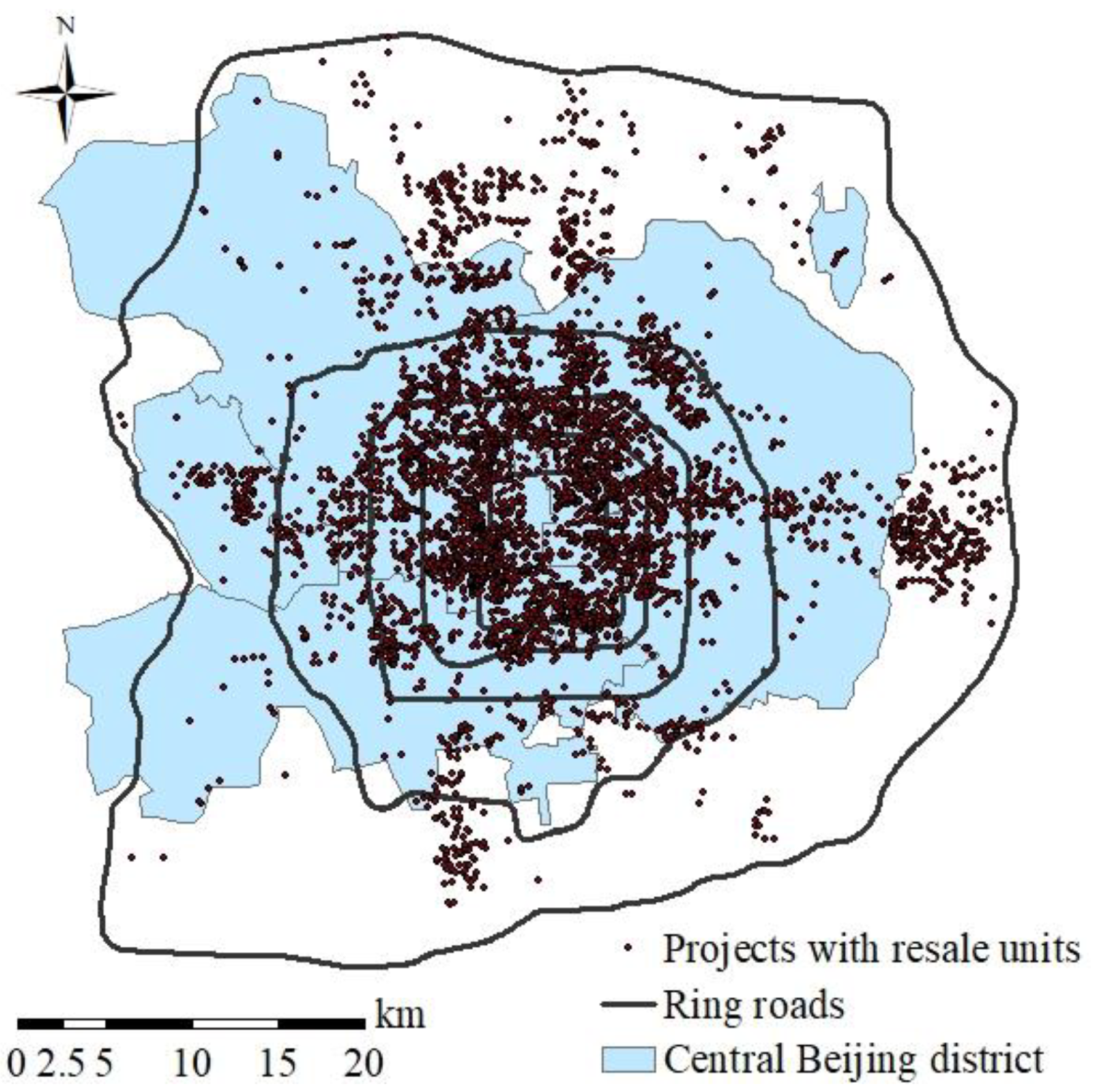

WoAiWoJia”, in Beijing. During our “clean” period from 11 January 2010 to 28 September 2010, the sample contains 5295 resale transactions covering more than 1477 residential complexes (housing development in Chinese cities typically occurs at a large scale and with a high degree of homogeneity within a residential “complex”, and a complex usually contains hundreds or even thousands of units with the same location, architectural design, structure, appliances and finishes), which are distributed all over Beijing.

Figure 1 shows the spatial distribution of all the resale transactions in our dataset.

For each transaction, we have detailed information on both the real price (

price_real) and the contract price (

price_con), so we can observe the extent to which buyers engaged in Yin and Yang contracts. In addition, we have the following key information: address, unit size (

size), level of decoration (

decoration, decoration = 1 denotes undecorated houses,

decoration = 2 indicates simply decorated ones,

decoration = 3 indicates moderately decorated houses and

decoration = 4 indicates well decorated houses), the orientation of the house (

towards, according to the traditional preference of Chinese buyers, houses facing south or southeast are the best,

towards = 2, followed by west, east or southwest,

towards = 1, and the worst is north,

towards = 0), on which floor the housing is located (

floor) and whether the housing is on the top floor (

top). By geo-coding all resales on Beijing’s GIS map, we construct several location measures for each residential complex, including the distance from each residential complex to the city center (

d_CBD) and whether the complex is within 2 km of a “key” primary school (

school) or a “Grade-A” hospital (

hospital) and within 1 km of a subway stop (

subway). The different thresholds are because a reasonable “walkable” distance to key public infrastructures such as hospitals and subway stations is 1 km [

50]; however, the school districts of key primary schools are usually the surrounding area, i.e., within 2 km of the corresponding school. Summary statistics are provided in

Table 2.

3.1. Patterns of Yin and Yang Contracts

According to our sample, the real price was 15,610 RMB/m

2 on average in the period of 2005–2011, while the contract price was only 8958 RMB/m

2, which is 57% of the former. We focus on the clean window before and after the 2010 regulation and scatter the two prices of each transaction in

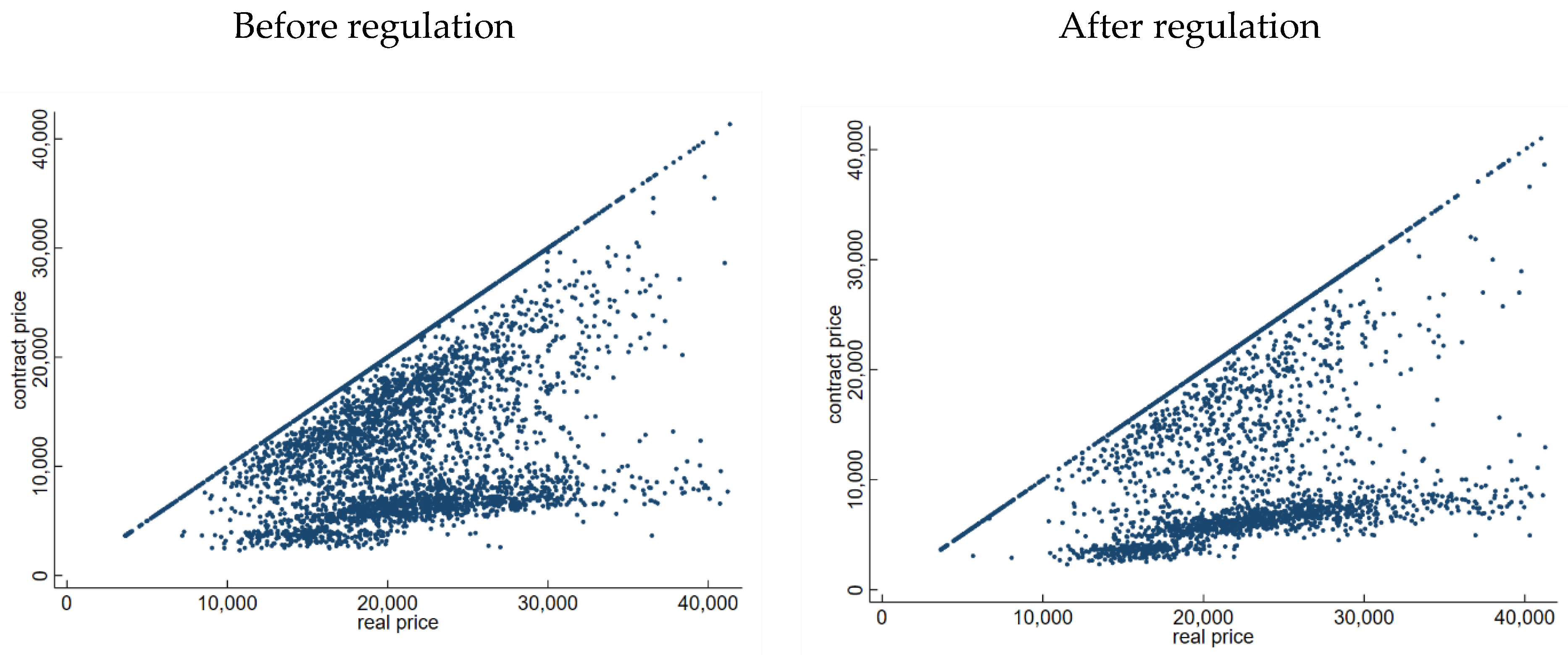

Figure 2, with the real price on the horizonal axis and the contract price on the vertical axis. The left panel shows transactions before the regulation implementation, while the right panel includes those after. Obviously, the contract price is not higher than the real price for each micro transaction over the sample period. When comparing the two panels, we find that the transaction volume after the regulation is much less than before, and the proportion of samples with a higher price gap is much larger. On average, the real price is 1.58 times the contract price before the regulation and 1.98 times after.

3.2. Trends of “Yin-and-Yang” Contracts before and after Regulation

For each transaction, we define a new variable, price gap (

pricegap), as the ratio of the real price to the contract price. The higher the value of this variable, the greater the difference between the actual transaction price and the contract price.

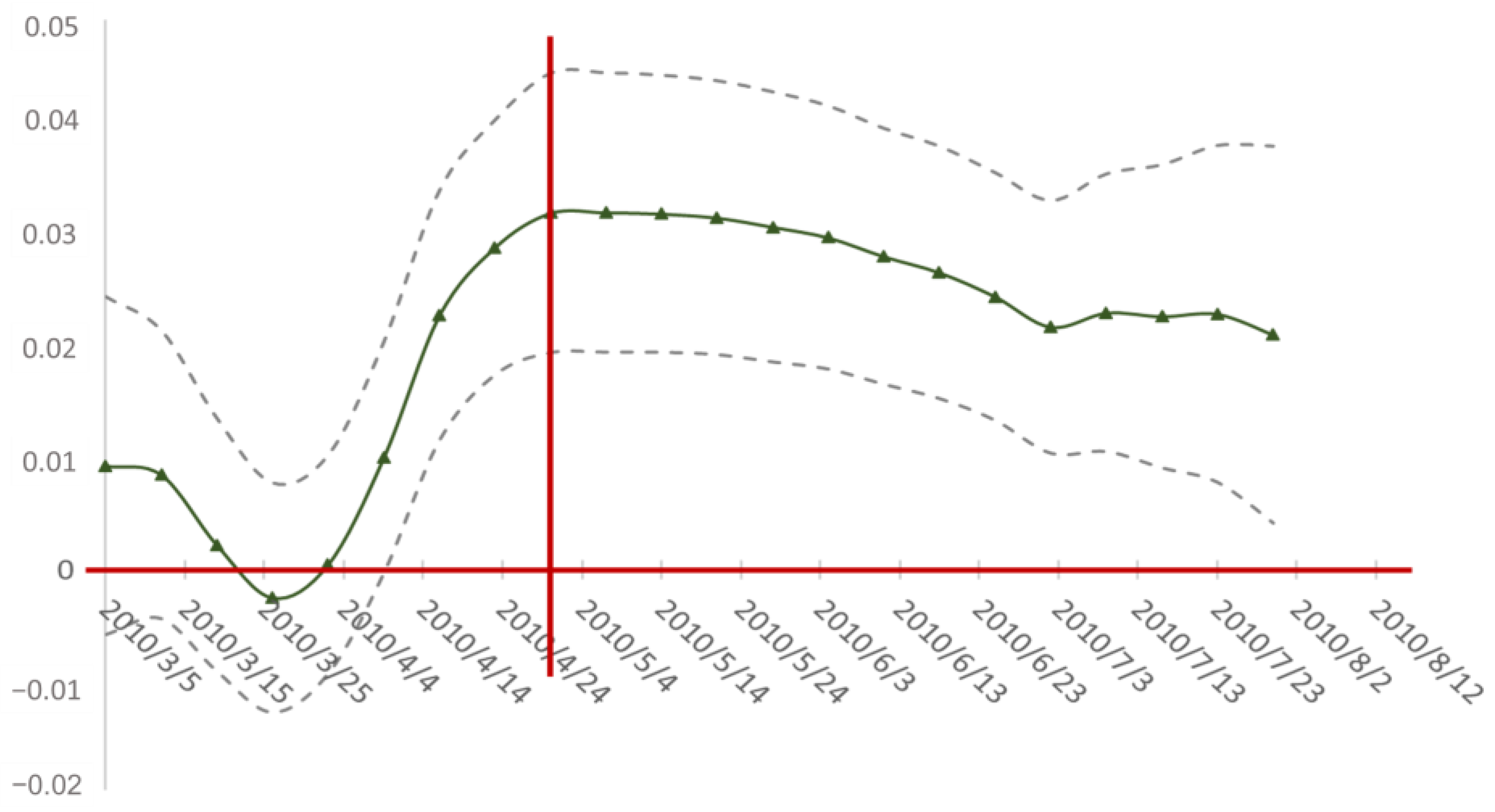

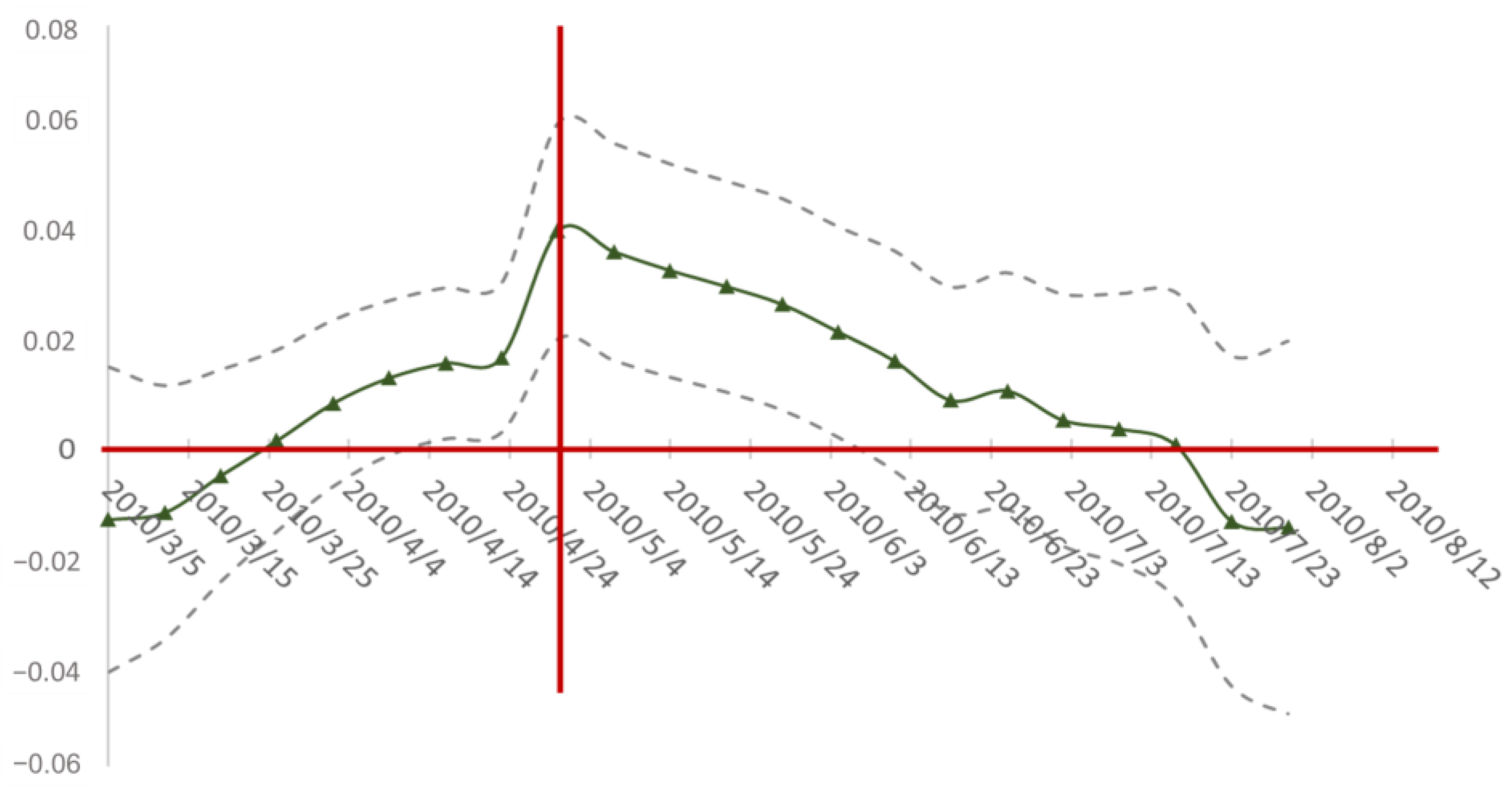

Figure 3 scatters the weekly average. After the implementation of the house-purchasing regulation (referred to as “HPR” in the following sections), the gap between the two prices initially drops sharply but then increases at a faster rate. The price difference returns to the original gap level in approximately 6 weeks and continues to rise at the higher growth rate. This pattern is quantitively described in the empirical section.

Interestingly, the extent of under-reporting eases shortly after the regulation and then quickly recovers. Recall that Yin-and-Yang contracts are used to save tax at the cost of a higher one-time payment. When the amount of value-added tax is decreased due to a lower premium over the previous sale, buyers are willing to sign a higher contract price to relieve liquidity pressure. However, we cannot observe the repeat-sale samples directly from our data, which means we are unable to test this quantitively. Hence, we provide a rough estimation of the premium over the previous sale: by week and by residential complex, we calculate the average premium over its average price of 1 year before, 2 years before, 3 years before and 4 years before. We plot a city-wide average premium in

Figure 4.

The four panels in

Figure 4 are very similar in their patterns: the average premium drops sharply immediately after regulation and then recovers quickly, which is consistent with the trend of housing prices after regulation (Sun et al., 2017). Therefore, we infer that in the short period when the premium over the last sale decreases, buyers are less willing to under-report than they are thereafter, which leads the price spread (

pricegap) to drop temporarily, as shown in

Figure 3.

3.3. Patterns of Houses’ Key Features before and after the Regulation

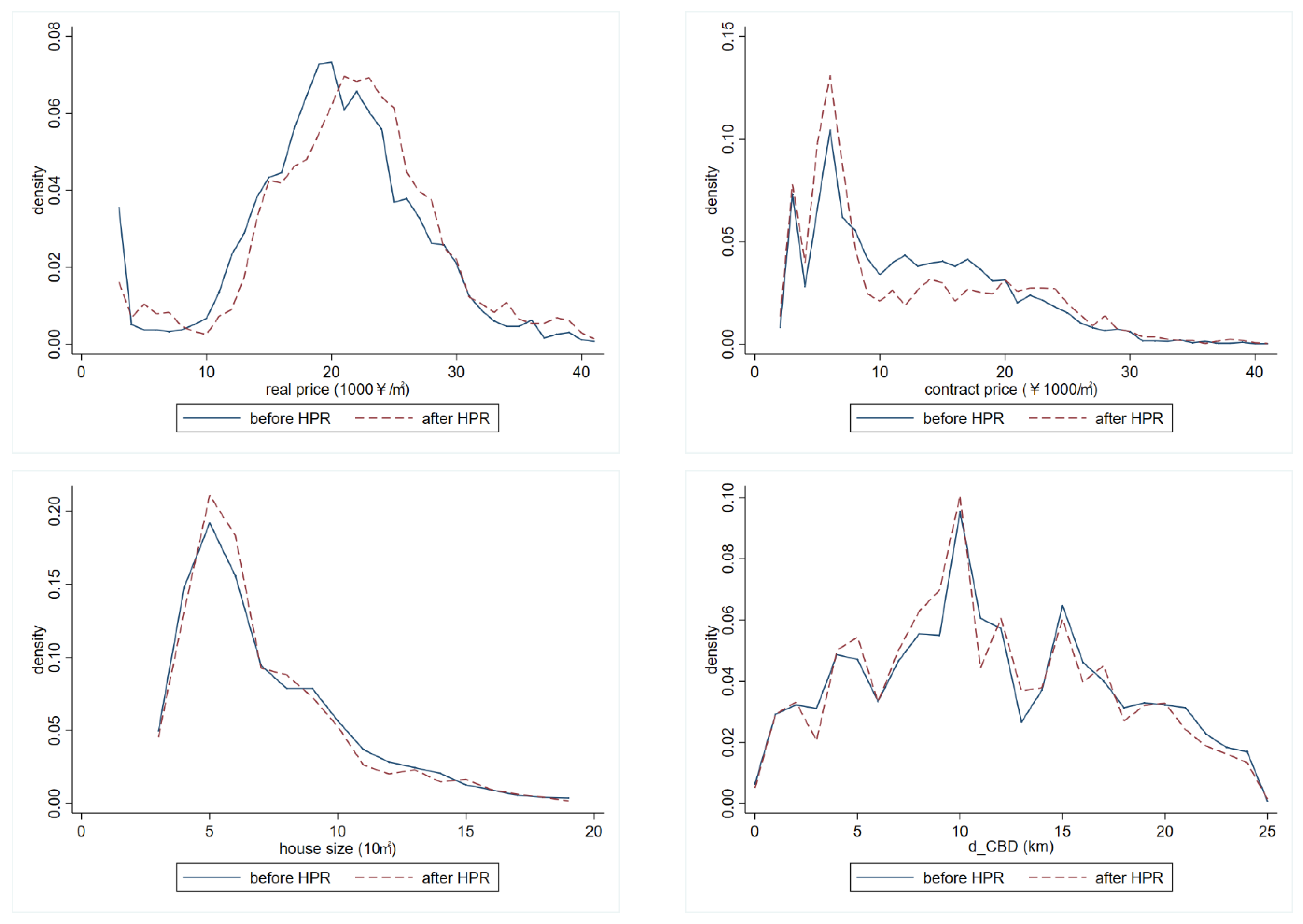

One concern is that the housing market may experience some structural changes in the physical or location attributes of transacted houses after regulation. If the change in the price difference of the real price and the contract-recorded disclosed price in this article reveals the abovementioned changes rather than the payment transformation of home buyers, we first intuitively observe the data distribution of the physical and locational attributes of these microtransactions as well as their prices before and after the purchase restriction policies, as shown in

Figure 5. The figure in the top left indicates that the distribution of the real price shifted to the right significantly after regulation; in other words, the transaction prices became higher. In contrast, transactions with lower contract prices accounted for a larger proportion after the HPR, as shown by the figure in the top right. The figures in the bottom panel reveal that the distribution of two key physical and locational attributes, unit size (

size) and distance to the city center (

d_CBD), show little change. Therefore, we believe the following empirical results are not induced by the structural changes of resale transactions’ physical or locational features.

6. An Estimation of Extra Tax Loss

In addition to the enlarged inequality issues stated in the previous section, further cheating on transaction price leads to extra tax loss to the government, which may be ignored when evaluating the policy outcomes. In this section, we conduct a counterfactual estimation of this extra tax loss according to our baseline regressions and find it quite considerable even compared to Beijing’s total government revenue.

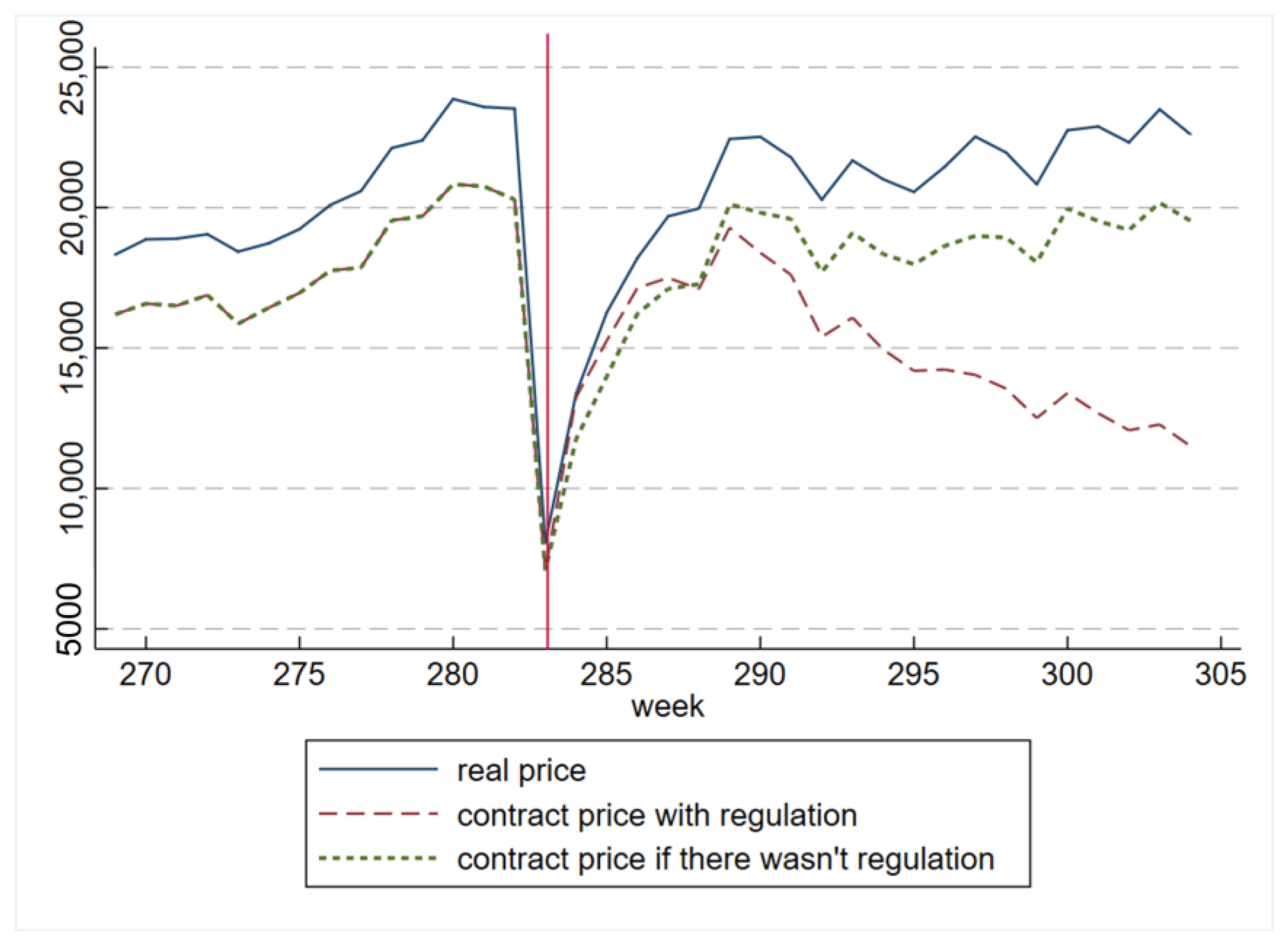

Under-reporting of the transaction price for the purpose of saving tax has been widely observed on the housing market and resulted in great tax loss. We take this as the default and attempt to calculate how much extra tax loss has been caused by the greater extent of cheating after regulation. We graph the real price, the predicted contract price and a counterfactual contract price (we predict the counter-factual contract price based on our empirical results by letting

HPR = 0), as shown in

Figure 8. The solid line in blue shows the weekly average real price per square meter, which drops temporarily 2–3 weeks after regulation but recovers quickly. The long-dashed line in red represents the predicted contract price when buyers are under-reporting the transaction price to an increasing extent to avoid regulation, as revealed in our baseline regression. The short-dashed line in green denotes our counterfactual estimated contract price, or what the contract price would be if there were no regulations or if people did not cheat more to avoid regulation.

The gap between the solid blue line and the short-dashed green line implies a tax loss when buyers under-report only to evade transaction tax, and the gap between the short-dashed green line and the long-dashed red line implies an extra tax loss when buyers attempt to avoid regulation by further cheating. The former is almost constant, while the latter gap is zero before the regulation but enlarges quickly thereafter.

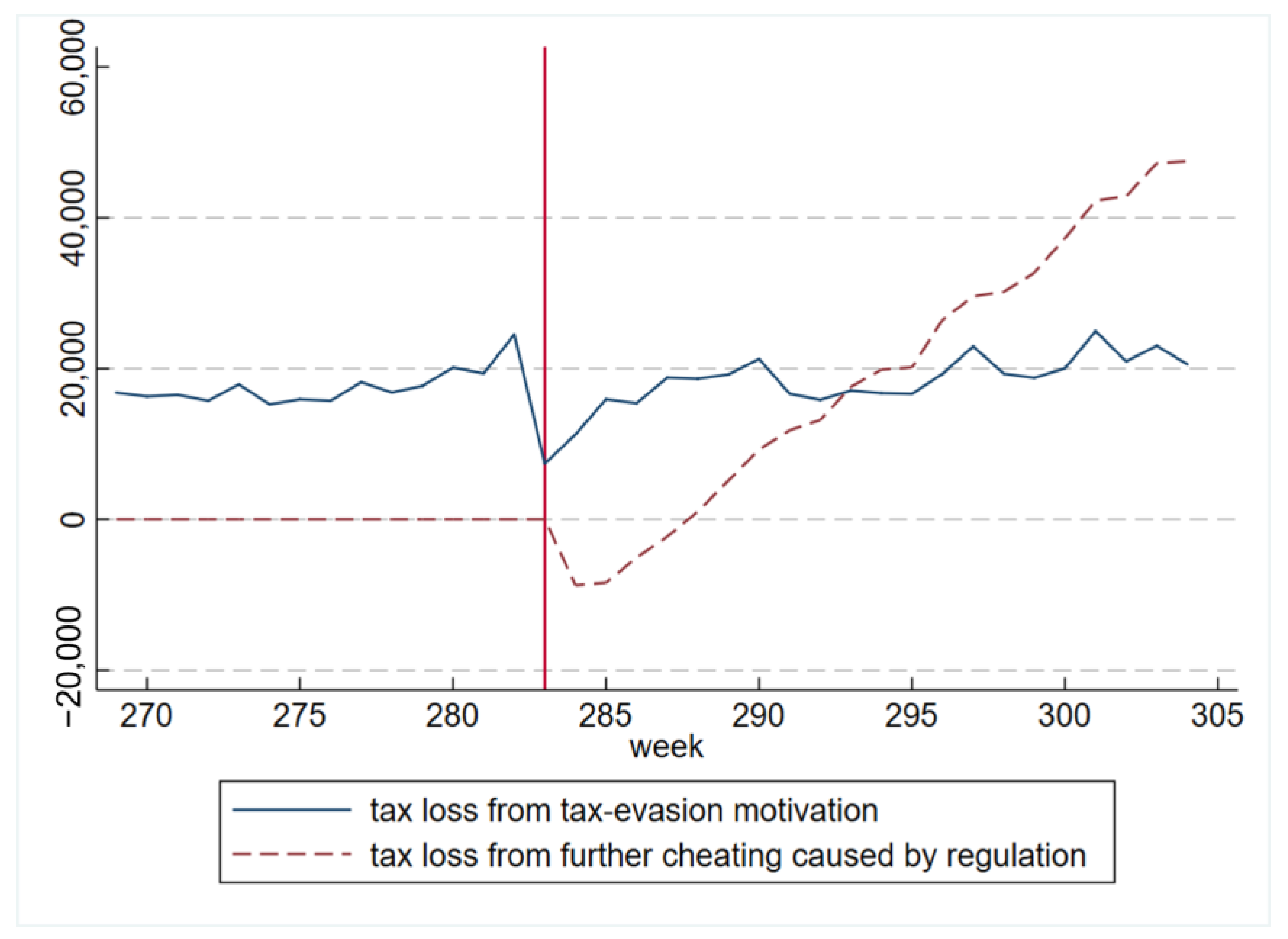

To estimate the amount of extra tax loss from further under-reporting of transaction prices, we multiply the above price gaps by the tax rate for house resales in Beijing in 2010, as shown in

Figure 9. The blue solid line graphs the estimated tax loss of Yin-and-Yang contracts with the purpose of saving tax but without any incentive to avoid house-purchasing regulation, which we find to be approximately constant at approximately 20,000 RMB per transaction. The red dashed line shows the extra tax loss when buyers further under-report the price to avoid regulation: it is zero before the implementation of regulation but grows quickly and reaches 40,000 RMB per transaction.

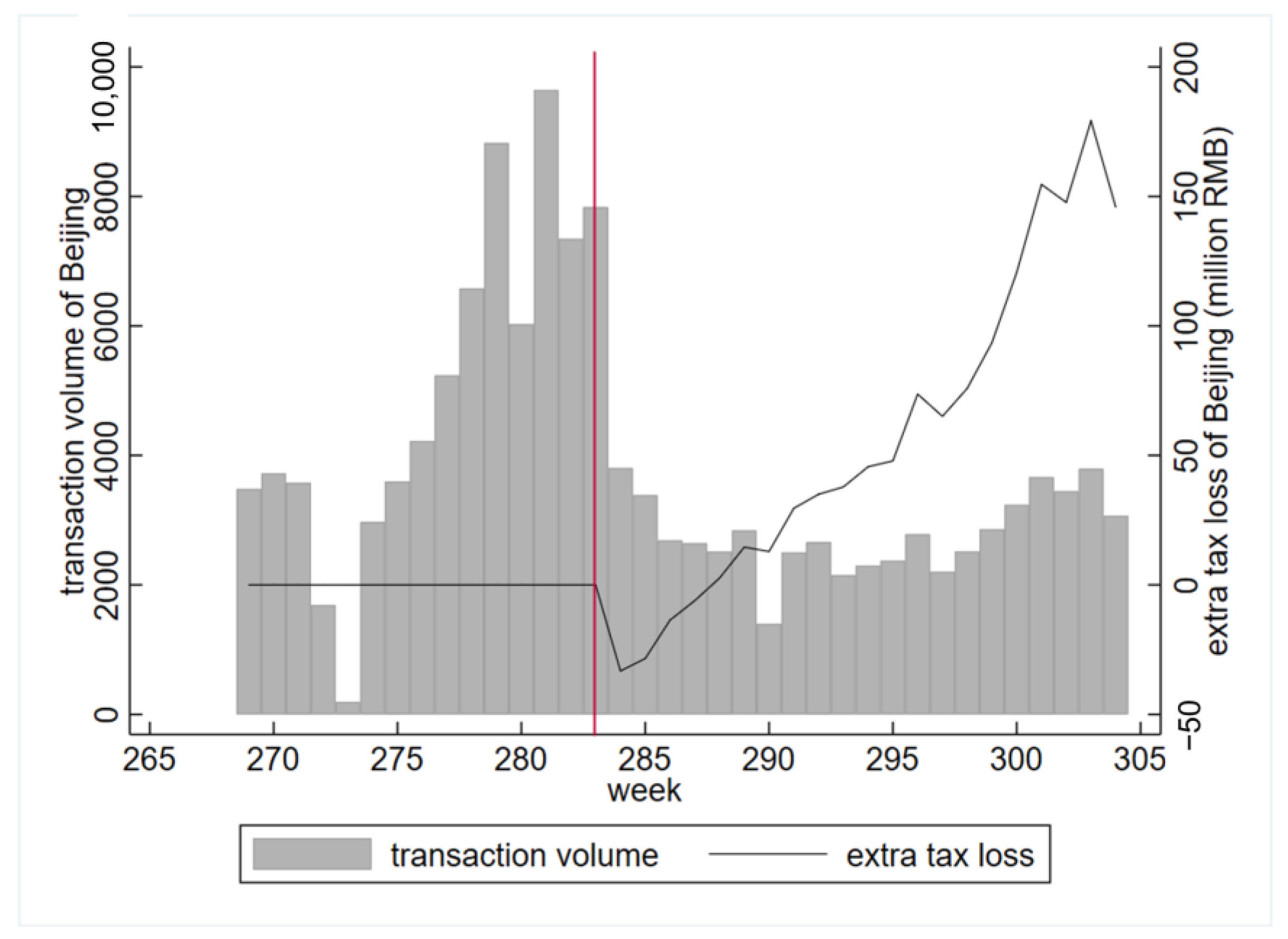

To move forward, we combine the extra tax loss of each transaction and the transaction volumes of Beijing in

Figure 10 so that we can estimate the total amount of tax loss. In our clean time window, the Beijing government loses an extra 58 million RMB from people further cheating each week after regulation. Given that the monthly fiscal revenue of Beijing within our time window varies from 15 to 22 billion RMB, the extra tax loss after stringent regulation is considerably large, accounting for approximately 1–1.5% of the government’s total fiscal income. It is worth noting that we take the tax loss from “Yin-and-Yang” contracts as the default and estimate the extra loss from an even lower contract price with regulation. We find that the extra price gap approximately equals the initial price gap without any further incentive to avoid regulation. Thus, the total loss from Yin-and-Yang contracts in housing resales almost accounts for 2–3% of Beijing’s fiscal revenue.

7. Conclusions and Implications

This paper studies the price difference in Yin-and-Yang contracts on the housing market and investigates how price differences grow before and after the implementation of stringent regulation. Despite the initial purpose of reducing transaction-based tax, the market participants further under-report the transaction price to evade regulations. Because Yin-and-Yang contracts and strict regulations both impose liquidity pressure on buyers, we note that the faster-growing price gap implies an inflow of less liquidity-constrained households and a crowding out of more constrained ones on the housing market, which is also a signal of enlarged inequality after regulation.

Empirically, we find a positive break in the linear trend of the price gap with the implementation of regulations, which is more pronounced for houses with a higher probability to be treated and for households with less liquidity constraints. The faster-growing process is prevented if new purchases by richer households are strictly prohibited. We also attempt to estimate the extra tax loss when buyers further under-report the transaction price to evade regulation.

As the first paper to emphasize Yin-and-Yang contracts on the housing market and to use them as an opportunity to observe the enlarged inequality of regulation, this paper has meaningful implications. First, when investigating any policies or events that may affect housing prices, attention should be paid to the actual transaction price, which may be disguised by Yin-and-Yang contracts, leading to a bias in empirical studies. Second, this paper sheds light on the side effects of regulations on the housing market that lead to non-price allocation mechanisms and enlarged inequality, similar to regulations in the other fields, which may even fail directly in controlling prices with the presence of market participants’ cheating behavior.