Abstract

ESG (environment, social, and governance) scores are becoming mainstream proxies for evaluating sustainability in organizations. In past years, scholars and managers used ESG scores to express the sustainable development of an organization and other types of sustainability. Meanwhile, increasing literature has shown that ESG scores do not measure sustainability in terms of sustainable development. The main reason ESG scores fail to measure sustainability adequately is that ESG scores are not designed to measure sustainability concepts, such as temporality, impact, resources management, and interconnectivity. Furthermore, ESG scores apply materiality concepts, but what they measure is not always quantifiable, and most agencies that produce ESG scores lack transparency. This research reviewed the challenges and issues associated with ESG scores regarding sustainability representation. Then, based on the sustainability literature, different themes and concepts that would add more sustainability consideration to an ideal ESG score are presented. Since ESG scores are increasingly popular, this paper presents concepts and ideas that would help ESG score agencies include more sustainability principles in their methodologies while redefining the expectations of scholars using them.

Earth is facing climate and social challenges like never before, and every year, the science on climate is even more alarmist than before [1]. As it becomes more accepted that these challenges originate from the industrial world built upon the past generations, there is an increasing demand to change the capitalist system to acknowledge and try to fix these issues. Institutional investors, such as Larry Fink [2] (Larry Fink is the CEO of BlackRock. BlackRock is the world’s largest asset manager in the world), firmly believe that capitalism can be transformed and adapted to become the sustainable driver that will fix these issues.

Academics, managers, and investors needed a way to evaluate businesses on different criteria and classify them as socially responsible businesses. This evaluation process regarding climate and social issues is not easy to do. The challenge is straightforward but complex: How can one evaluate organizations and determine which is better than the other regarding sustainability and action toward climate and social change? How can one improve if there are no metrics for improvement? One solution that has become mainstream is using ESG (environment, social, and governance) scores. The idea behind ESG scores is that outside firms would develop a methodology based on assumptions, scientific consensus, and other external metrics. Then, it would be combined to provide an evaluation of businesses based on each pillar (E, S, G). Finally, the measure from each pillar is aggregated into the ESG scores to propose one metric that represents how well an organization does on the underlying issue that ESG scores represent.

Scholars need a metric of this nature and adopted ESG scores (such as KLD metrics) to measure sustainability or evaluate the consideration of a business’s ESG issues. The demand for such information originates from the need to assess companies on environmental and social problems to discriminate who is better within an industry. The mainstream metric for this purpose is ESG scores provided by different agencies that developed their methodologies and called themselves “sustainability agencies." There is one major problem: although ESG investing and ESG scores have become mainstream over the past 15 years, climate change is not slowing, and inequality is not diminishing. They are becoming worse and at a faster rate than before [1].

This theoretical study analyzed sustainability issues with ESG scores and why there is a need for a new metric that will truly capture the essence of sustainability in business. The ESG scores’ first objective is to determine what company is doing better than others sustainability-wise. However, they fail to capture environmental issues and social inequalities, as the world’s problems are more profound than ever [3]. One solution could be to produce an additional pillar to the ESG scores that would assess business sustainability and be easily understandable to complement the accuracy of ESG scores. Many sustainability measures were proposed throughout the year and Mura et al. [4] clustered many definitions presented in the literature. They mostly rely on organizations’ disclosure of sustainability practices, lack of standardization of sustainability metrics, and many critics of the reliability of sustainability measurement. No measure of sustainability has become mainstream because they are too specific to a part of sustainability (for example: focusing on CO2 emissions only or solely defined by a circular economy) and are rarely presented as a measure. Mura et al. [4] recommended adopting a multi-tiered approach that combines some of the measurements and concepts already present in the literature to define a new, more generalizable measurement definition.

This paper is structured as follows. First, a literature review of ESG scores as an actual measure of sustainability is presented, followed by a presentation of different research streams on sustainability. Then, based on the literature review, the authors propose a foundation based on sustainability theories and present what could be the core principles that a new sustainability measure should have to elevate ESG scores’ accuracy.

1. Literature Review

1.1. ESG Scores

Current ESG scores comprise a rating (expressed in letters or figures) in three main categories: environmental (e.g., environmental impact, resource consumption, impact on biodiversity, and waste management), social (e.g., impact on the community and suppliers, working conditions, and other social impacts), and governance (e.g., the organization’s transparency, its relationship with shareholders and the board of directors, executive compensation, and board diversity) [5]. ESG scores came about due to the financial world’s need to assess companies against these three criteria to identify the best performers in these aspects. Private commercial firms whose primary clients are portfolio managers and other investors use tangible and intangible data to construct ESG scores [6] to produce new data that meet investors’ needs. Organizations that are in the process of receiving or updating an ESG score use self-reporting metrics that are then audited by an independent firm [7]. The main advantage of these scores is that it makes it possible to anticipate the financial risk associated with negative impacts because of dishonest actions (e.g., corruption, child labor) or accidents (e.g., spills, nuclear accidents, destruction of natural environments). However, they are less well suited to analyzing the positive effects that arise from actions taken as a result of adopting these criteria, namely, the extent to which a company can contribute to the well-being of the society and the environment in which it operates [6,8].

The popularity of ESG scores comes from the anticipation that responsible businesses would be the ones that would prosper in the future, as responsible investment strategies had better returns on investments in previous years [9,10]. They are also a way to differentiate the bad businesses (those who do not have ESG scores) from the good businesses (the ones who have an ESG score) and present them as able to act on ESG challenges. However, it mainly represents less risk as a long-term investment since it mitigates the risk that global warming and other environmental or social issues will impact their profitability. High ESG scores can also improve corporate financial performance [11].

There are two other reasons for this increasing popularity: (1) financial clients (from institutional investors to retail investors) want to invest in companies that are proven to be responsible regarding social and environmental issues in terms of their personal or organizational convictions, and (2) the growth potential for a mid-to-long-term investment is higher for socially responsible investments [12]. It is becoming increasingly accepted in finance that sustainability will be the next growth market indicator [2,13]. Bloomberg Intelligence [14] forecasted that green investments based on ESG scores will exceed USD 53 trillion by 2025, representing more than a third of global assets under management. Milton Friedman’s doctrine [15], whereby the sole purpose of business is to make a profit and keep shareholders happy, appears to be a thing of the past. Companies must now show that they perform better on the environmental, social, and governance fronts, as investors, and, more generally, people want to avoid sinful businesses and businesses that are seen as “bad organizations” in terms of sustainability [12,16]. The proportion of S&P 500 companies (The S&P 500 is a stock market index of 500 American companies. The index represents 80% of the US market by capitalization) with an ESG score increased from 20% to 90% between 2011 and 2019 [17], illustrating the rapid growth and increase in popularity of such ratings to assess organizations and determine the good from the bad organizations [18].

The main issue is that ESG scores are the primary metric investors use to evaluate companies’ performance on ESG issues [19]. Another issue is that ESG scores are increasingly used in the academic literature to capture sustainability and are used among scholars to compare sustainability between businesses [20]. There are plenty of studies that used different methodologies and datasets to show that ESG scores do not capture the sustainability of a company [6,19,21,22,23,24,25] or the positive impact on the world [26], as they are designed to measure the risk level that comes from ESG issues. ESG scores limit the negative impact of ESG issues on investments resulting from company actions damaging the environment [26,27,28,29,30]. The ESG performance is unequal based on the country of origin [31].

ESG scores attempt to capture an organization’s sustainability performance, but they fail to capture either the sustainability or the positive impact on the world. ESG scores are best suited to evaluating an organization’s potential to survive long term. It implies considering the environment and other consequences that an organization has in its world, but only to ultimately measure the potential of survival regardless of its net impact on society or the environment.

1.2. Sustainability

1.2.1. Sustainable Development

Sustainability is a broad term with multiple definitions [32]. One that expresses sustainable development is the theory of the three pillars of sustainability (society, economy, and environment). It is commonly used in the literature regarding sustainability [33]. From this theory, sustainability can be obtained when there is an equilibrium between all three pillars [34]. Another representation of the three pillars theory shifts from a focus on equilibrium to a complete consideration of all pillars to express sustainability [33]. Therefore, economics can only be sustainable with respect to the social sphere, and those two can only be sustainable within the environment’s capacity. An applied representation of this balance is expressed with the 17 SDGs (Sustainable Development Goals) proposed by the United Nations.

The economic pillar is controversial as economic growth is essential for society’s well-being but is also the cause of social and environmental problems [35]. The social aspect refers to education, health, political system, etc., and the environmental part refers to the air quality, water quality, impact on biodiversity, etc. Sustainable development has received much critique over the past 30 years, leading to further redefinitions of the theory [36]. The three-pillar sustainability theory’s biggest strength is the definition of the three universes to consider for sustainable development.

1.2.2. Weak vs. Strong Sustainability

There are two approaches to expressing how impactful sustainability theory is: the weak sustainability perspective and the strong sustainability perspective [36]. Weak sustainability implies that humans can substitute natural capital with manufactured capital [37]. If capital is available for future generations, it is deemed sustainable regardless of the type of capital (e.g., human capital (money) or natural capital (oil)) [38].

From a strong sustainability perspective, human capital and natural capital are complementary but cannot be interchangeable [39]. Strong sustainability implies that humans cannot replace natural resources or their function with manufacturing processes or innovations.

These two visions of sustainability led to different solutions for sustainable development. For example, weak sustainability could be characterized by a green economy (e.g. carbon pricing) and strong sustainability could be described as degrowth of the economy (e.g., preservation of all forms of natural stocks and biodiversity regardless of the economic impact) [36]. Most recently, there has been a progression in the definition of sustainable development. Taghvaee et al. [40] presented a new perspective. The environmental pillar is the most important of the three pillars of sustainable development in strong sustainability development. Weak sustainability involves considering all three pillars of sustainable development equally.

New theories go beyond strong vs. weak sustainable development practices, such as health-centered sustainability and integrated sustainability [40]. The main idea behind the concept of health-centered sustainable development is that the general population’s health is the foundation of any development. It is impossible to have development if the population is unhealthy and cannot provide the work required for sustainable development. Above health-centered sustainable development is the integrated sustainability that acts as the spillover effect of all three classic pillars of sustainability [41]. Integrated sustainability implies an interconnection between all parts of the world; therefore, peace and collaboration are essential to consider when judging whether a sustainable development theory is complete.

1.2.3. Resource Sustainability

Resource sustainability means that the impact of a process should consider its impact on its environment, natural resources, and society. To persist in time, a process or system needs to consider the challenges associated with its inputs and consider that is activities might affect external entities. Something that has minimal impact on the ecosystem or natural resources can be considered sustainable regardless of its long-term durability and economic growth [42]. From this perspective, a circular economy could be seen as sustainable since it has a limited environmental impact.

If a system can reuse byproducts of another system and if the input element in the process is not coming from limited and finite sources, then the process is deemed sustainable. Based on the natural-resources-based theory [43], the idea is to define boundaries that respect the limited capacity of the planet in terms of natural resources and its capacity to filter pollution. In other words, there is a limit on the amount of non-reusable natural resources (oil, gas, gold, wood, etc.) that the planet can provide, and there is a limit to the byproducts (CO2, water filtration, nitrogen, etc.) that the Earth can treat. An organization that uses non-reusable products in its operation process and does produce byproducts that are untreated is not sustainable if we consider this form of sustainability. Consideration of an element that enters and exits a system or a process and byproduct produced from the process refers to the notion of resource sustainability.

1.2.4. Business Sustainability

Business sustainability can be expressed as the ongoing process of successful resource sustainability that is maintained over time. For a lucrative system to persist over time (generate money and profit), the lesser its impact on society and the environment, the greater chance it will sustain itself extensively. Some businesses practice integrated sustainability in their everyday operations to mitigate their impact on natural resources [44]. This sustainability integration allows businesses to extend their longevity, as they become less reliant on finite resources.

Sustainability can also be practiced within the working environment. Nobanee et al. [45] did a bibliometric analysis of sustainability and risk management. They identified risk themes that could impact business sustainability, such as supply chain risk management [46], moral responsibility in sustainable development, optimization of resources, and business impacts. Risk is an essential aspect of business sustainability, as it can affect the business’s capacity to deliver profit and perdure over time. Human actions outside the organization (e.g., cyberattacks) and within the organization (e.g., bad governance) can affect business sustainability. What seems to be the most dominant issue in business sustainability today is the unbreakable link between its activities and its impact on its environment, mainly regarding managing its resources.

2. Actual Measure of Sustainability

ESG scores, also known as sustainability scores, are widely used in the financial sector and academia to represent an organization’s sustainability [18]. ESG scores thus represent a positive step toward greater incorporation of the UN’s Sustainable Development Goals (SDGs) in financial investments [3]. Their main limitation lies in the fact that they more closely represent the financial risk (impact on profits) [47] ensuing from ESG issues rather than providing any objective measure of a company’s CSR (corporate social responsibility) performance or impact of their activities [26]. Accurate measurement might not be possible, as the definition and measurement of sustainability are complex and combine multiple elements. Nevertheless, ESG scores remain the best available measure for evaluating a company’s CSR activities [48]. They provide a quantitative assessment of actions taken by a company to protect its natural and social environment and are becoming more widespread, making them easier to use and facilitating a comparison between companies.

Different agencies produce ESG scores under different methodologies. The most popular ESG scores came from prominent financial analysts [49,50,51,52,53], who also produce well-known stock indexes in the financial world. Most of these agencies focus on reducing the risk for investors while providing valuable information that gives valuable insight into businesses.

When a sustainability agency (which is a name that is attributed to agencies that provide and build ESG scores) provides an ESG score, its purpose and target end clients will significantly impact the representativeness and scope of the ESG score that is issued [21]. Moreover, depending on the geographical location of the companies appraised, qualitative information may be available to a greater or lesser extent, thus affecting the representativeness of their ESG score [54]. Different agencies assign different weights to different variables and consider the various data sources used (in whole or in part) differently [6,23,25]. These considerations can cause ESG scores to vary significantly from one rating agency to another.

Berg et al. [27] found only a weak correlation between the different ESG scores issued by the agencies. Between ratings issued by MSCI and Refinitiv, a correlation of 38% was present. At best, a correlation of 70% was present between Sustainalytics and Vigeo Eiris. Overall, there was an average correlation of 60% across the industry. For reference, corporate credit ratings issued by Moody’s and Standard & Poor’s showed a 99% correlation [27]. Problematic correlation levels were confirmed in other studies, such as Dimson et al. [55] and Hughes et al. [56].

Discrepancies between ESG scores and the low correlation of indices are issues that can be accounted for by the lack of clear consensus around what should be measured when putting together an ESG rating [57]. ESG scores are not commensurate: different agencies measure different attributes differently [21,27,57,58]. Further factors that were shown to cause problems in measuring and standardizing ESG scores include the choice of information sources, discrepancies in the measures used, information overload, and the manual imputation of specific data in the databases, as well as the absence of a response in many cases to all the variables measured [25,58]. Finally, the ESG scores assigned are weighted to facilitate comparison with companies in the same industry or by geographical location [11,55], further complicating their reliability.

Defining and quantifying environmental issues is challenging [59,60]. ESG scores appear to be an excellent candidate to capture sustainability in terms of organization longevity but are less effective in capturing sustainability in terms of the consequences and impacts an organization could have. In 2011, when academia was beginning to take an interest in ESG scores, Hedesström [61] was already questioning how these scores measured sustainability. Later, Escrig-Olmedo et al. [6] attempted to measure whether ESG rating agencies considered sustainability issues. Unfortunately, although some effort is discernible from these agencies, they do not always sufficiently recognize sustainability issues in the composition of the ESG scores they produce. ESG scores still do not consider climate change or global warming [62]. While ESG scores integrate certain notions of resource sustainability, they cannot be used to represent this on their own.

As presented, ESG scores are a great tool with utility, especially in the financial sector. However, the measurement is less adequate for academic objectives or the measure of sustainability as a whole. Furthermore, ESG is one of the only measures that quantify some aspect of CSR [48] but are not intended to measure sustainability [6,19,21,22,23,24,25]. Nevertheless, an increasing number of scholars and managers are using ESG scores to analyze the sustainability of organizations and compare the level of sustainability between organizations [20]. This expresses a need to develop a new measure that would follow ESG score principles but that would be more in line with the objective of measuring the level of sustainability in organizations.

3. The Theoretical Proposition of a New Measure of Sustainability

3.1. Characteristics of Sustainability to Improve ESG Measurement Methodologies

Defining sustainability is challenging because it is a concept with no clear definition, as it is a normative term [63] and everyone has their definition. Purvis et al. [33] tried to discover where the description of the three pillars of sustainability (economic, social, and environmental) came from. They found no definition of sustainability that has a large consensus, mainly due to various researchers’ backgrounds and schools of thought. Many definitions are available to describe sustainability, and because there are so many, the word sustainability is not meaningful or representative of a definite and precise concept [64]. Based on that, it is challenging to build on previous knowledge with the conviction that it is the right path to develop new knowledge on sustainability.

As mentioned by Mura et al. [4], the multiple facets of sustainability need to be evaluated with different methodologies, making it challenging to define a robust and straightforward measure. In the business context, aspects of sustainability related to business and their interactions with the environment or society should be considered.

This theoretical proposition aims to reflect on sustainability theory that could overcome ESG score limits by adding more sustainability principles in ESG measurement. Based on the literature review on sustainability, it seems important to propose abstract ideas related to business sustainability and sustainable development that are characterized as follows: temporality, impact, resource management, and interconnectivity. Other concepts are closely related to the accuracy of measuring ESG scores, namely, quantifiability, materiality, and transparency, as presented below.

3.2. Sustainability Concepts

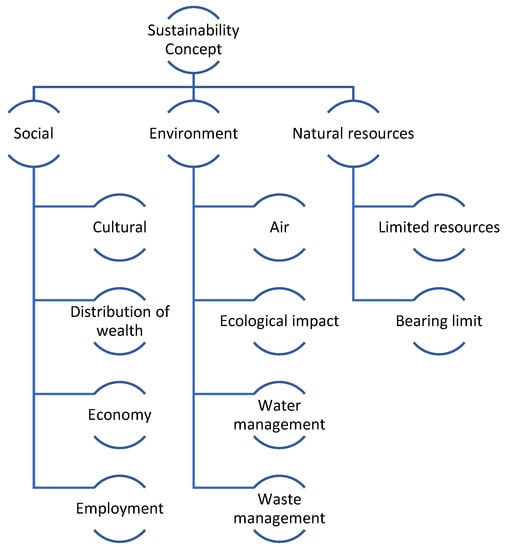

Sustainability can be linked to a myriad of parameters [65] but in this study, concepts are related to the specific types of sustainability presented in Figure 1. This study aimed to include more sustainable development practices in ESG scores to assess business sustainability evaluation. It refers to environmental influence directly: air pollution, waste management, water management, and ecological impact. Any kind of interaction between the environment and the organization is considered. Organizations also have social influence. They have the power to transform our culture, and they influence working conditions and employment relations. Globally, the world is undeniably impacted by business practices. Environmental and social sustainability influences are irrelevant if natural resource capacity and nature-bearing limits are not considered. This study is related to the ecological value of sustainability and natural resources influencing business sustainability for sustainable development.

Figure 1.

Sustainability concepts that are related to the theoretical proposition.

3.2.1. Temporality

According to Bansal and Desjardines [66], sustainability requires considering time, as true sustainability is achieved from a long-term perspective. The problem is that an organization tends to favor short-term initiatives for many aspects of its management. The underlying notion of time in sustainability is essential when considering organization sustainability. In business, doing something for perpetuity is sustainable if and only if the inputs required for the process are always available.

Mainstream measurements that are used in business are based on short-term metrics such as return on investment, return on assets, market share, and sales. All these measures are almost always quarterly based. More importantly, all these measures are either growth- or market-based measurements, implying that to do better on those metrics, one needs to do more, produce more, or be more efficient.

Those imperatives of short-termism that require doing more right now regardless of the future are unsustainable, even though the actions may seem sustainable [66]. Short-term decisions can create other problems while managing an organization, as it fails to recognize the importance of long-term thinking. Once an organization engages in short-termism decision-making, it is not easy to shift to long-term perspective management afterward [67]. A long-term perspective consideration is fundamental for breaking the short-termism loop of the appearance of sustainability for archiving sustainability that lasts.

Think of an organization that gives a certain amount of money per year to a charitable cause. Perceived as a sustainable action by the organization, it fails to resolve the problem from a long-term perspective. Giving money to charity is not sustainable, as it does not fix the underlying issue that requires monetary donations. Sustainability is not a responsibility of doing the action right now that appears sustainable. It is a practice requiring temporal trade-offs and a broader vision of the future [66].

Therefore, in formulating an updated ESG score with a sustainability measurement, temporality would be an essential factor that influences the end value of the score. Sustainable actions toward short-term impact would be considered less critical than sustainable actions that, although they might appear less sustainable today, are made to solve issues from a long-term perspective.

Regarding temporality, accountability needs to be a factor in measuring sustainability. ESG scores consider the targets and goals of organizations that will be fulfilled in the future (like waste reduction, CO2 reduction, and other commitments in line with environmental or social improvement). However, there is no consequence on the ESG scores if the organization fails to respect these self-declared objectives [68]. It implies that as long as an organization has a goal of lowering or limiting its negative impact, its ESG scores will be high regardless of previous mistakes. A sustainability measurement that considers temporality would be influenced by the capacity of organizations to fulfill the goals and promises they make. It is linked to the concept of resource sustainability, which considers available natural resources and the limit of the environment to absorb CO2 emissions or filter water, for example. In contrast with today’s evaluation, temporality would explicitly moderate the impact of the organization’s future ambitions in terms of environmental or social amelioration goals based on its capacity to fulfill past goals and objectives.

3.2.2. Impact

The positive and negative impacts are integral to sustainability [69]. The impact of an organization is not considered in the methodologies of most sustainable agencies’ ESG scores rating [26,68,70]. The positive impact here refers to the ability of an organization to produce a sustainable positive outcome from its operation process. A positive impact refers to an organization’s solutions that do something different from its peers resulting of an external positive outcome for the environment and society. If the impact caused by the process used in the organization is harmful to society and the environment, the impact portion of the sustainability measurement would be affected accordingly. An organization’s impact on its environment affects the potential of its sustainability. The notion of strong sustainability could be obtained from the impact made by circular economy resource management [71].

Thus, organizations’ processes and their impacts on the environment and society need to be considered when establishing the sustainability part of an updated ESG score. This consideration would not condemn polluters that substantially negatively impact the world. They could mitigate their negative impact with a solution to lower the impact of their activities. They could engage in practices that have a positive impact to compensate for the negative impact issue caused by their primary activities. Business sustainability impact parameters can be linked to the 17 SDGs [72] that are designed to differentiate the different categories on which it is possible to have an impact.

3.2.3. Resource Management

How an organization manages resources (particularly natural resources) is central to developing a sustainability measure, especially since it is not considered in ESG methodologies [73]. Natural resources can be limited (such as water, wood, metal, etc.) or the ecosystem can absorb a maximum amount of contaminants (CO2 emissions, industrial waste, water filtration, etc.), and therefore, sustainability is possible only within those limited parameters. ESG scores assume that being less damaging than their direct competitor is good enough to be regarded as resource-sustainable [23,25,68]. This sustainability measurement will take the limited capacity of the planet to produce and recycle the byproducts into consideration. The most significant improvement in the updated ESG scores would be in terms of how it conceptualizes resource management. The result of ESG scores is based on an organization’s ability to do better than its direct competitors. This is probably the most critical reason ESG scores fail to measure sustainability. Even if the industry uses natural resources well beyond the natural capacity of the environment, if an organization does slightly better than its peers, top-grade ESG scores are attributed. Updated ESG scores will act differently, as they would be grounded in existing influent theory regarding natural resources management, which considers resources to be finite. Theories about available stocks of resources and the renewal rate of those resources should link to the way organizations use resources.

One way of globally evaluating resource sustainability is by assessing the global impact of pollution caused by human activities and natural resource extraction on a planetary scale [74]. Combining the renewal rate of the planet with the consumption rate of natural resources will provide a metric known as the ecological footprint [75]. The ecological footprint is often expressed in terms of how many planets we need to keep our way of living based on the rate of consumption of natural resources by human activity and the regenerative capacity rate of the planet [76].

The exciting aspect of the ecological footprint measure of resources in sustainability is that it combines the renewal rate of the planet with the human consumption impact on the capital stock of natural resources. Metrics are based on scientific evidence and are adjusted through the years as new research becomes available. It considers that resources are limited, as well as the renewal of those resources, and that human activities impact both. This theory, which could be developed and adjusted over time, is essential in establishing a sustainability measure. It is likely that once a sustainable solution is found, everyone will want to adopt it. However, suppose everyone is adopting the same solution. In that case, the chances are that this way of doing it will not be sustainable for a long time using the planet boundary theory since it would stress the source of natural resources required for that sustainable innovation.

Hanley’s [77] paper presents two mainstream sustainability measures: flow-based and stock-based measurements. The latter is closely related to the notions of an ecological footprint and planet boundary. It considers that natural resources are limited and that exponential economic growth appears impossible in the long term. The flow base sustainability measurement is that the net national product should consider natural stock resources in its calculation. The environmentally adjusted net national product (EANNP) tries to maximize wealth within the limits of the natural resources availabilities. The EANNP would maximize revenue streams without jeopardizing future revenue stream availability. This theory could be implemented as solution for ESG scores since it follows the same core principle as the planet boundary: resources are limited and the renewal rate of those resources is done at a specific rate that cannot be expedited. There are probably other ways of managing natural resources. The idea is to link the planet’s capacity to the consumption of natural resources and emissions of byproducts that organizations produce.

Companies that employ circular production methods or focus on recycling and sustainable manufacturing methods would have a considerable advantage in establishing their sustainability measurement in the updated ESG score, as it would have minimal impact on the planet’s resources and capacity. The methodology of the sustainability aspect in the score should make it complicated for those who continue to rely on traditional production methods involving the exploitation of rare and non-renewable natural resources to score at the top end of the scale. With actual ESG scores, the simple fact of doing better than direct competitors allows for a spot at the top of the scale.

3.2.4. Interconnectivity

Nature follows phases and cycles. In nature, the world’s ecosystem usually proceeds through a recurring cycle consisting of four phases: rapid growth, conservation, release, and reorganization [78]. Creativity and innovation emerge from the chaos that occurs in these cycles. Destruction is creative. When destruction happens, an innovative cycle emerges [78]. Natural sustainability is complex, as ecosystems and processes affect its ability to stay sustainable on its own. When businesses interact and disturb those natural processes, they impact environmental sustainability by changing the ecosystem with their actions.

Even the life of an individual is not sustainable after all. You are born, develop, mature, then die. From an individual perspective, this cycle is unsustainable. However, when considering a broader level by shifting from an individual perspective to a humanity perspective, the cycle is sustainable, as it allows for a new human to be born and the old one to die. The perspective adopted in interpreting a cycle and its constituents has significant consequences on the action that an individual could take.

These cycles, even the destruction cycle, are inevitable. Humans or any external activity that tries to fix or avoid the destruction phase will result in the opposite, sometimes causing more harm than good. On occasion, having saved a component in the destruction phase of the cycle will lead to the destruction phase of the related cycle outside the current one. Walker and Salt [78] advocated that it is impossible to understand or successfully manage a system if you focus only on one scale. The interconnection between systems is crucial if one wants a positive outcome when acting on the system, especially in socio-ecological systems and biodiversity.

Therefore, sustainability measures would consider that a sustainable system is only sustainable if there is a consideration of outside processes that are not easily identifiable. A better understanding of the interconnecting system is needed to build a high level of fidelity in sustainability measurement. However, being aware that a sustainable system does not work in isolation and considering available interactions as they are discovered should be enough to start. As new information and interactions become available, they will need to be incorporated into the methodology. The interconnectivity is not something that all organizations can efficiently act upon, as phases and cycles stated previously will happen regardless of the potential action to control cycles. The goal of the interconnectivity aspect in sustainability measures is only to acknowledge that there is an interaction between systems and that they are not working in isolation, affecting other systems in other cycles. Ultimately, organization sustainability evaluation would be affected with different levels of intensity based on the knowledge available about known interconnectivity.

3.3. Measuring ESG Score Concepts

This section is related to the measurement itself rather than sustainability theories. To develop ESG scores reflecting more adequality sustainability practices, the sustainability assessment needs to follow to fully grasp the sustainability performances of the organizations.

3.3.1. Quantifiability

A vital characteristic of the sustainability measurement is that it should be quantifiable and could follow the scale used for ESG scores. Therefore, the sustainability measurement aspect would have quantifiable metrics to facilitate comparison and evaluation, just like other metrics in the ESG score methodology. Despite the complications that arise when quantifying qualitative information, it is essential to come up with a score or a quantitative measure to replace the ESG scores’ function as a whole when expressing sustainability.

Since ESG scores are used by many for their simplicity [20,48], the final score will be easy to understand by scholars and the general population. The goal is to democratize this new sustainability measurement inside ESG scores. Thus, doing so is likely more accessible with a quantifiable metric.

3.3.2. Materiality

Materiality should be considered to evaluate all companies’ sustainability performances. Organizations will not face the same sustainability challenges equally based on the industry they’re in. For example, the banking industry’s sustainability evaluation metrics will not be the same for the pharmaceutical or oil industries. Considering that every industry has its challenges and particularities, the sustainability measurement will keep its purpose within and across sectors.

The other challenge in measuring sustainability is that attention to organizational issues must be addressed appropriately. "Large-scale processes such as those related to climate change require a broader attentional extent while small-scale processes, such as those related to local variations in poverty, require fine attentional grain” [79]. When adopting a measure of sustainability, it is essential to consider these elements, as they might affect organizations differently based on their size, other specific details based on the industry, and geographical specificity. When materiality maps are applied to ESG scores, they give results that are significantly different from the standardized measure [80].

An organization’s sustainability must be adapted to its reality for that sustainability measurement will reflect the organization’s real challenges and measure sustainability efficiently across industries. The sustainability measure needs to use materiality in its assessment, as sustainability challenges are not the same for all.

3.3.3. Transparency

A sustainability measurement methodology should be freely available in the public domain. Anyone wishing to participate in improving the methodology or access the data that underlies the results can do so without restriction. In the event of the non-disclosure of certain information by an organization, the lowest score should be assigned for the relevant attribute to encourage transparency within the corporation, even if the truth is not ideal. ESG scores omit a criterion from the calculation when an organization refuses to reveal the related data on its specific metrics. An open discussion on the methodology that is used for this new sustainability measure should always be encouraged. It needs to include new scientific discoveries in sustainability measurement and allow for total transparency. It would allow the constant evolution and adaptation of the measure to meet new challenges that will need to be addressed in time.

Finally, a new sustainability measurement would ideally avoid awarding the maximum score based on best practices in any industry. Full marks would be reserved for companies that exceed expectations (regardless of industry) with innovative projects that positively affect the environment and society.

4. Conclusions

Bothello and Salles-Djelic [81] investigated the evolution of the term sustainability and, more broadly, the conceptualization of organizational environmentalism. They discovered that the term sustainability is shifting to the term resilience. Resilience is the "capacity for a system to handle risk and prevent, endure and recover from crises and shocks" [81]. Resilience is thus an update of sustainability. It considers that systems should be able to receive some uncertainty and be ready to handle difficulties and absorb change and disturbance [82].

Resilience might be the keyword for the challenge that lies ahead. It seems that change inertia toward climate change influences the population. As an indirect consequence, the leaders of systems and organizations are not inclined to force change that would benefit the planet. While the population figures out that their actions and personal choices are essential for the solution to climate change [83,84,85], there is a need to measure the sustainability of organizations and evaluate their impact on the world. Scholars could get invested in research toward evaluating sustainability performance. ESG scores are currently more of a risk score and are not designed to consider the resource’s sustainability or the organization’s impact on the world in the way they are built today [25,68]. Actual ESG scores are best suited for evaluating the probability that an organization will exist in the future while mitigating the risk of an investment that could come from ESG issues related to those organizations.

Nevertheless, scholars keep using ESG scores to compare the sustainability of organizations against each other, along with other metrics to make assumptions about the sustainably they represent [20]. This theoretical study was not designed to demonize actual ESG scores. These scores have their purpose and make organizations aware of the importance of addressing environmental, social, and governance issues [86,87].

However, in a world where climate change, social challenges, and environmental issues are becoming increasingly dominant, the world cannot rely on an ESG score to evaluate the organization’s sustainability. They are characteristics of sustainability theories that could be used to update ESG methodologies and reflect sustainability practices in their evaluation. Temporality is vital for sustainability theory, as sustainability implies a notion of time in its assessment. The impact cannot be dissociated from sustainability theories. If there is no impact on stakeholders, there is no need to consider sustainability. Resource management is essential in business, as resources are the foundation of any business operation. Finally, materiality, quantifiability, interconnectivity, and transparency are not thematic of sustainable practices but are essential considerations to operationalize the evaluation and give accurate measurements of business sustainability. Considering these factors allows the sustainability evaluation of motley business with fair and equitable considerations.

Governments and citizens of the world are slow to act on problems about global issues. For many decades, science has been warning people about future challenges. Much research is done on climate change and its impact, but little is done to evaluate organizations regarding sustainability issues that could lower the effects of climate change. If the world does not need a sustainability measure based on the latest scientific consensus that considers the planet’s limits today, it will definitely need it tomorrow.

Author Contributions

A.C.: Idea, literature review, theorical proposition, writing (original, draft, reviewing and editing). É.R.: Thesis supervisor, writing (revision). L.T.: Thesis supervisor, writing (revision). All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No data to provide.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Masson-Delmotte, V. IPCC Climate Change 2021: The Physical Science Basis: Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. Available online: https://www.ipcc.ch/report/ar6/wg1/downloads/report/IPCC_AR6_WGI_FullReport.pdf (accessed on 9 August 2021).

- Fink, L. Larry Fink’s Annual 2022 Letter to CEOs | BlackRock. Available online: https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter (accessed on 6 February 2022).

- Eurosif. European SRI Study. Available online: https://www.eurosif.org/news/eurosif-2018-sri-study-is-out/ (accessed on 31 July 2022).

- Mura, M.; Longo, M.; Micheli, P.; Bolzani, D. The Evolution of Sustainability Measurement Research. Int. J. Manag. Rev. 2018, 20, 661–695. [Google Scholar] [CrossRef]

- Ribando, J.M.; Bonne, G. A New Quality Factor: Finding Alpha with ASSET4 ESG Data. Available online: https://www.thomsonreuters.com/content/dam/openweb/documents/pdf/tr-com-financial/report/starmine-quant-research-note-on-asset4-data.pdf (accessed on 31 July 2022).

- Escrig-Olmedo, E.; Fernández-Izquierdo, M.Á; Ferrero-Ferrero, I.; Rivera-Lirio, J.M.; Muñoz-Torres, M.J. Rating the Raters: Evaluating How ESG Rating Agencies Integrate Sustainability Principles. Sustainability 2019, 11, 915. [Google Scholar] [CrossRef]

- Lai, A.; Melloni, G.; Stacchezzini, R. Corporate Sustainable Development: Is “Integrated Reporting” a Legitimation Strategy? Bus. Strategy Environ. 2016, 25, 165–177. [Google Scholar] [CrossRef]

- Baker, A.M.; Donthu, N.; Kumar, V. Investigating How Word-of-Mouth Conversations about Brands Influence Purchase and Retransmission. J. Mark. Res. 2016, 53, 225–239. [Google Scholar] [CrossRef]

- Kempf, A.; Osthoff, P. The Effect of Socially Responsible Investing on Portfolio Performance. Eur. Financ. Manag. 2007, 13, 908–922. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and Financial Performance: Aggregated Evidence from More than 2000 Empirical Studies. J. Sustain. Financ. Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Lisin, A.; Kushnir, A.; Koryakov, A.G.; Fomenko, N.; Shchukina, T. Financial Stability in Companies with High ESG Scores: Evidence from North America Using the Ohlson O-Score. Sustainability 2022, 14, 479. [Google Scholar] [CrossRef]

- Whelan, T.; Atz, U.; Clark, C. ESG and Financial Performance: Uncovering the Relationship by Aggregating Evidence from 1000 Plus Studies. Available online: https://www.stern.nyu.edu/sites/default/files/assets/documents/NYU-RAM_ESG-Paper_2021%20Rev_0.pdf (accessed on 19 July 2021).

- Morgan Stanley. Sustainable Signals: Growth and Opportunity in Asset Management. Available online: https://www.morganstanley.com/assets/pdfs/2415532_Sustainable_Signals_Asset_Mgmt_L.pdf (accessed on 19 July 2021).

- Bloomberg Intelligence. ESG Assets May Hit $53 Trillion by 2025, a Third of Global AUM | Bloomberg Professional Services. Available online: https://www.bloomberg.com/professional/blog/esg-assets-may-hit-53-trillion-by-2025-a-third-of-global-aum/ (accessed on 19 July 2021).

- Friedman, M. N. Y. Times Magazine. September 13 1970, pp. 13–19.

- Atz, U.; van Holt, T.; Douglas, E.; Whelan, T. The Return on Sustainability Investment (ROSI): Monetizing Financial Benefits of Sustainability Actions in Companies. Sustain. Consum. Prod. 2021, 2, 303–354. [Google Scholar] [CrossRef]

- Chua, J.M. The Rise in ESG Ratings: What’s the Score? Available online: https://www.voguebusiness.com/sustainability/the-rise-in-esg-ratings-whats-the-score (accessed on 31 July 2022).

- Tamimi, N.; Sebastianelli, R. Transparency among S&P 500 Companies: An Analysis of ESG Disclosure Scores. Manag. Decis. 2017, 55, 1660–1680. [Google Scholar] [CrossRef]

- Widyawati, L. A Systematic Literature Review of Socially Responsible Investment and Environmental Social Governance Metrics. Bus. Strategy Environ. 2020, 29, 619–637. [Google Scholar] [CrossRef]

- Clément, A.; Robinot, É.; Trespeuch, L. The Use of ESG Scores in Academic Literature, a Meta Analysis. In Proceedings of the Academy of Innovation, Entrepreneurship and Knowledge (ACIEK), Nanjing, China, 15–17 October 2022. [Google Scholar]

- Eccles, R.G.; Lee, L.E.; Stroehle, J.C. The Social Origins of ESG: An Analysis of Innovest and KLD. Organ. Environ. 2020, 33, 575–596. [Google Scholar] [CrossRef]

- Eccles, R.G.; Stroehle, J.C. Exploring Social Origins in the Construction of Environmental, Social and Governance Measures; Elsevier: Amsterdam, The Netherlands, 2018. [Google Scholar] [CrossRef]

- Olmedo, E.E.; Torres, M.J.M.; Izquierdo, M.A.F. Socially Responsible Investing: Sustainability Indices, ESG Rating and Information Provider Agencies. Int. J. Sustain. Econ. 2010, 2, 442. [Google Scholar] [CrossRef]

- Gillan, S.L.; Koch, A.; Starks, L.T. Firms and Social Responsibility: A Review of ESG and CSR Research in Corporate Finance. J. Corp. Financ. 2021, 66, 101889. [Google Scholar] [CrossRef]

- Kotsantonis, S.; Serafeim, G. Four Things No One Will Tell You about ESG Data. J. Appl. Corp. Financ. 2019, 31, 50–58. [Google Scholar] [CrossRef]

- Bernier-Monzon, S.; Serafimov, V.; Couteaux, B. Les Entreprises Responsables Les Mieux Notées Le Sont-Elles Vraiment? Available online: https://www.sigmagestion.com/wp-content/uploads/2019/10/etude-de-cas-unilever.pdf (accessed on 31 July 2022).

- Berg, F.; Koelbel, J.; Rigobon, R. Aggregate Confusion: The Divergence of ESG Ratings; Elsevier: Amsterdam, The Netherlands, 2019; pp. 1–64. [Google Scholar] [CrossRef]

- Taparia, H. Change the Misleading ESG Ratings System to Fix ESG Investing. Available online: https://ssir.org/articles/entry/the_world_may_be_better_off_without_esg_investing (accessed on 19 July 2021).

- Maiti, M. Is ESG the Succeeding Risk Factor? J. Sustain. Financ. Invest. 2021, 11, 199–213. [Google Scholar] [CrossRef]

- Cornell, B.; Damodaran, A. Valuing ESG: Doing Good or Sounding Good? J. Impact ESG Invest. 2020, 1, 76–93. [Google Scholar] [CrossRef]

- Daugaard, D.; Ding, A. Global Drivers for ESG Performance: The Body of Knowledge. Sustainability 2022, 14, 2322. [Google Scholar] [CrossRef]

- Glavič, P.; Lukman, R. Review of Sustainability Terms and Their Definitions. J. Clean. Prod. 2007, 15, 1875–1885. [Google Scholar] [CrossRef]

- Purvis, B.; Mao, Y.; Robinson, D. Three Pillars of Sustainability: In Search of Conceptual Origins. Sustain. Sci. 2019, 14, 681–695. [Google Scholar] [CrossRef]

- Kuhlman, T.; Farrington, J. What Is Sustainability? Sustainability 2010, 2, 3436–3448. [Google Scholar] [CrossRef]

- Gómez-Baggethun, E.; Naredo, J.M. In Search of Lost Time: The Rise and Fall of Limits to Growth in International Sustainability Policy. Sustain. Sci. 2015, 10, 385–395. [Google Scholar] [CrossRef]

- Ruggerio, C.A. Sustainability and Sustainable Development: A Review of Principles and Definitions. Sci. Total Environ. 2021, 786, 147481. [Google Scholar] [CrossRef]

- Gutes, M.C. The Concept of Weak Sustainability. Ecol. Econ. 1996, 17, 147–156. [Google Scholar] [CrossRef]

- Figge, F. Capital Substitutability and Weak Sustainability Revisited: The Conditions for Capital Substitution in the Presence of Risk. Environ. Values 2005, 14, 185–201. [Google Scholar] [CrossRef]

- Ekins, P.; Simon, S.; Deutsch, L.; Folke, C.; de Groot, R. A Framework for the Practical Application of the Concepts of Critical Natural Capital and Strong Sustainability. Ecol. Econ. 2003, 44, 165–185. [Google Scholar] [CrossRef]

- Taghvaee, V.M.; Nodehi, M.; Saber, R.M.; Mohebi, M. Sustainable Development Goals and Transportation Modes: Analyzing Sustainability Pillars of Environment, Health, and Economy. World Dev. Sustain. 2022, 1, 100018. [Google Scholar] [CrossRef]

- Mohamad Taghvaee, V.; Assari Arani, A.; Agheli, L. Sustainable Development Spillover Effects between North America and MENA: Analyzing the Integrated Sustainability Perspective. Environ. Sustain. Indic. 2022, 14, 100182. [Google Scholar] [CrossRef]

- Becker, C.D. Human Ecology and Resource Sustainability: The Importance of Institutional Diversity. Annu. Rev. Ecol. Syst. 1995, 26, 113–133. [Google Scholar] [CrossRef]

- Hart, S.L. A Natural-Resource-Based View of the Firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef]

- Gerassimidou, S.; Martin, O.V.; Chapman, S.P.; Hahladakis, J.N.; Iacovidou, E. Development of an Integrated Sustainability Matrix to Depict Challenges and Trade-Offs of Introducing Bio-Based Plastics in the Food Packaging Value Chain. J. Clean. Prod. 2021, 286, 125378. [Google Scholar] [CrossRef]

- Nobanee, H.; al Hamadi, F.Y.; Abdulaziz, F.A.; Abukarsh, L.S.; Alqahtani, A.F.; Alsubaey, S.K.; Alqahtani, S.M.; Almansoori, H.A. A Bibliometric Analysis of Sustainability and Risk Management. Sustainability 2021, 13, 3277. [Google Scholar] [CrossRef]

- Giannakis, M.; Papadopoulos, T. Supply Chain Sustainability: A Risk Management Approach. Int. J. Prod. Econ. 2016, 171, 455–470. [Google Scholar] [CrossRef]

- Viviers, S.; Eccles, N.S. 35 Years of Socially Responsible Investing (SRI) Research: General Trends over Time. J. Bus. Manag. 2011, 43, 4. [Google Scholar] [CrossRef]

- Cini, A.C.; Ricci, C. CSR as a Driver Where ESG Performance. Symph. Emerg. Issues Manag. 2018, 1, 68–75. [Google Scholar] [CrossRef]

- Refinitiv. Environmental, Social and Governance (ESG) Scores from Refinitiv. Available online: https://www.refinitiv.com/content/dam/marketing/en_us/documents/methodology/esg-scores-methodology.pdf (accessed on 31 July 2022).

- Vigeo Eiris. ESG Assessment Methodology; Vigeo Eiris: Paris, France, 2020. [Google Scholar]

- MSCI. ESG Ratings Methodology. Available online: https://www.msci.com/documents/1296102/21901542/ESG-Ratings-Methodology-Exec-Summary.pdf (accessed on 31 July 2022).

- RobecoSAM. Corporate Sustainability Assessment—Annual Scoring & Methodology Review. Available online: https://portal.csa.spglobal.com/survey/documents/CSA_AnnualScoring_Methodology_2021.pdf (accessed on 31 July 2022).

- Sustainalytics. ESG Risk Ratings—Methodology Abstract. Available online: https://connect.sustainalytics.com/esg-risk-ratings-methodology (accessed on 31 July 2022).

- Baldini, M.; Maso, L.D.; Liberatore, G.; Mazzi, F.; Terzani, S. Role of Country- and Firm-Level Determinants in Environmental, Social, and Governance Disclosure. J. Bus. Ethics 2018, 150, 79–98. [Google Scholar] [CrossRef]

- Dimson, E.; Marsh, P.; Staunton, M. Divergent ESG Ratings. J. Portf. Manag. 2020, 47, 75–86. [Google Scholar] [CrossRef]

- Hughes, A.; Urban, M.A.; Wójcik, D. Alternative Esg Ratings: How Technological Innovation Is Reshaping Sustainable Investment. Sustainability 2021, 13, 3551. [Google Scholar] [CrossRef]

- Chatterji, A.K.; Durand, R.; Levine, D.I.; Touboul, S. Do Ratings of Firms Converge? Implications for Managers, Investors and Strategy Researchers. Strateg. Manag. J. 2016, 37, 1597–1614. [Google Scholar] [CrossRef]

- Delmas, M.A.; Etzion, D.; Nairn-Birch, N. Triangulating Environmental Performance. Acad. Manag. Perspect. 2013, 27, 255–267. [Google Scholar] [CrossRef]

- Steffen, W.; Richardson, K.; Rockström, J.; Cornell, S.E.; Fetzer, I.; Bennett, E.M.; Biggs, R.; Carpenter, S.R.; de Vries, W.; de Wit, C.A.; et al. Planetary Boundaries: Guiding Human Development on a Changing Planet. Science 2015, 347, 6223. [Google Scholar] [CrossRef]

- Locke, R.M. The Promise and Limits of Private Power. Aust. J. Hum. Rights 2013, 19, 3. [Google Scholar] [CrossRef]

- Hedesström, M.; Lundqvist, U.; Biel, A. Investigating Consistency of Judgement across Sustainability Analyst Organizations. Sustain. Dev. 2011, 19, 119–134. [Google Scholar] [CrossRef]

- Rekker, S.A.C.; Humphrey, J.E.; O’Brien, K.R. Do Sustainability Rating Schemes Capture Climate Goals? Bus. Soc. 2021, 60, 125–160. [Google Scholar] [CrossRef]

- Ramsey, J.L. On Not Defining Sustainability. J. Agric. Environ. Ethics 2015, 28, 1075–1087. [Google Scholar] [CrossRef]

- Farley, H.M.; Smith, Z.A. Sustainability: If It’s Everything, Is It Nothing? Routledge: New-York, NY, USA, 2020. [Google Scholar]

- Onat, N.; Bayar, H. The Sustainability Indicators of Power Production Systems. Renew. Sustain. Energy Rev. 2010, 14, 9. [Google Scholar] [CrossRef]

- Bansal, P.; DesJardine, M. Business Sustainability: It Is about Time. Strateg. Organ. 2014, 12, 70–78. [Google Scholar] [CrossRef]

- Perlow, L.A.; Okhuysen, G.A.; Repenning, N.P. The Speed Trap: Exploring the Relationship between Decision Making and Temporal Context. Acad. Manag. 2002, 45, 931–955. [Google Scholar] [CrossRef]

- Serafeim, G.; Kramer, M.; Porter, B.M.E.; Serafeim, G.; October, M.K. Where ESG Fails. Available online: https://www.institutionalinvestor.com/article/b1hm5ghqtxj9s7/Where-ESG-Fails (accessed on 31 July 2022).

- Li, J.; Wu, D. Do Corporate Social Responsibility Engagements Lead to Real Environmental, Social, and Governance Impact? Manag. Sci. 2020, 66, 2564–2588. [Google Scholar] [CrossRef]

- Muñoz-Torres, M.J.; Fernández-Izquierdo, M.Á.; Rivera-Lirio, J.M.; Ferrero-Ferrero, I.; Escrig-Olmedo, E.; Gisbert-Navarro, J.V.; Marullo, M.C. An Assessment Tool to Integrate Sustainability Principles into the Global Supply Chain. Sustainability 2018, 10, 535. [Google Scholar] [CrossRef]

- Schröder, P.; Bengtsson, M.; Cohen, M.; Dewick, P.; Hoffstetter, J.; Sarkis, J. Degrowth within—Aligning Circular Economy and Strong Sustainability Narratives. Resour. Conserv. Recycl. 2019, 146, 190–191. [Google Scholar] [CrossRef]

- Allen, C.; Metternicht, G.; Wiedmann, T. Initial Progress in Implementing the Sustainable Development Goals (SDGs): A Review of Evidence from Countries. Sustain. Sci. 2018, 13, 1453–1467. [Google Scholar] [CrossRef]

- Eurosif. European SRI Study. Available online: https://www.eurosif.org/wp-content/uploads/2022/03/Eurosif-SRI-Study-2014.pdf (accessed on 31 July 2022).

- Borucke, M.; Moore, D.; Cranston, G.; Gracey, K.; Iha, K.; Larson, J.; Lazarus, E.; Morales, J.C.; Wackernagel, M.; Galli, A. Accounting for Demand and Supply of the Biosphere’s Regenerative Capacity: The National Footprint Accounts’ Underlying Methodology and Framework. Ecol. Indic. 2013, 24, 518–533. [Google Scholar] [CrossRef]

- Wackernagel, M.; Onisto, L.; Bello, P.; Linares, A.C.; Falfán, I.S.L.; García, J.M.; Guerrero, A.I.S.; Guerrero, M.G.S. National Natural Capital Accounting with the Ecological Footprint Concept. Ecol. Econ. 1999, 29, 375–390. [Google Scholar] [CrossRef]

- Lin, D.; Hanscom, L.; Murthy, A.; Galli, A.; Evans, M.; Neill, E.; Mancini, M.S.; Martindill, J.; Medouar, F.-Z.; Huang, S.; et al. Ecological Footprint Accounting for Countries: Updates and Results of the National Footprint Accounts, 2012–2018. Resources 2018, 7, 58. [Google Scholar] [CrossRef]

- Hanley, N. Macroeconomic Measures of ‘Sustainability’. J. Econ. Surv. 2000, 14, 1–30. [Google Scholar] [CrossRef]

- Walker, B.; Salt, D. Resilience Thinking; Island Press: Washington, DC, USA, 2006. [Google Scholar]

- Bansal, P.; Anna, K.I.M.; Wood, M.O. Hidden in Plain Sight: The Importance of Scale in Organizations’ Attention to Issues. Acad. Manag. Rev. 2018, 43, 217–241. [Google Scholar] [CrossRef]

- Madison, N.; Schiehll, E. The Effect of Financial Materiality on ESG Performance Assessment. Sustainability 2021, 13, 3652. [Google Scholar] [CrossRef]

- Bothello, J.; Salles-Djelic, M.L. Evolving Conceptualizations of Organizational Environmentalism: A Path Generation Account. Organ. Stud. 2018, 39, 93–119. [Google Scholar] [CrossRef]

- Hoiling, C.S. Resilience and Stability of Ecological Systems. Annu. Rev. Ecol. Syst. 1973, 4, 1–23. [Google Scholar] [CrossRef]

- Ostrom, E. Polycentric Systems for Coping with Collective Action and Global Environmental Change. Glob. Environ. Change 2010, 20, 550–557. [Google Scholar] [CrossRef]

- Robinot, É.; Corne, A.; Peypoch, N.; Trespeuch, L. Environmental Actions and Consumer Participation: Which Impacts on Brand Relationship? The Multiple Realities of the Hospitality Sector. Int. J. Hosp. Manag. 2021, 92, 102713. [Google Scholar] [CrossRef]

- Trespeuch, L.; Robinot, É.; Botti, L.; Bousquet, J.; Corne, A.; de Ferran, F.; Durif, F.; Ertz, M.; Fontan, J.M.; Giannelloni, J.L.; et al. Are We Moving towards a More Responsible Society Thanks to the COVID-19 Pandemic? Nat. Sci. Sociétés 2021, 29, 479–486. [Google Scholar] [CrossRef]

- Drempetic, S.; Klein, C.; Zwergel, B. The Influence of Firm Size on the ESG Score: Corporate Sustainability Ratings under Review. J. Bus. Ethics 2020, 167, 333–360. [Google Scholar] [CrossRef]

- Cort, T.; Esty, D. ESG Standards: Looming Challenges and Pathways Forward. Organ. Environ. 2020, 33, 491–510. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).