Dynamic Co-Movements among Oil Prices and Financial Assets: A Scientometric Analysis

Abstract

1. Introduction

1.1. Knowledge Gap, Objective, and Contributions

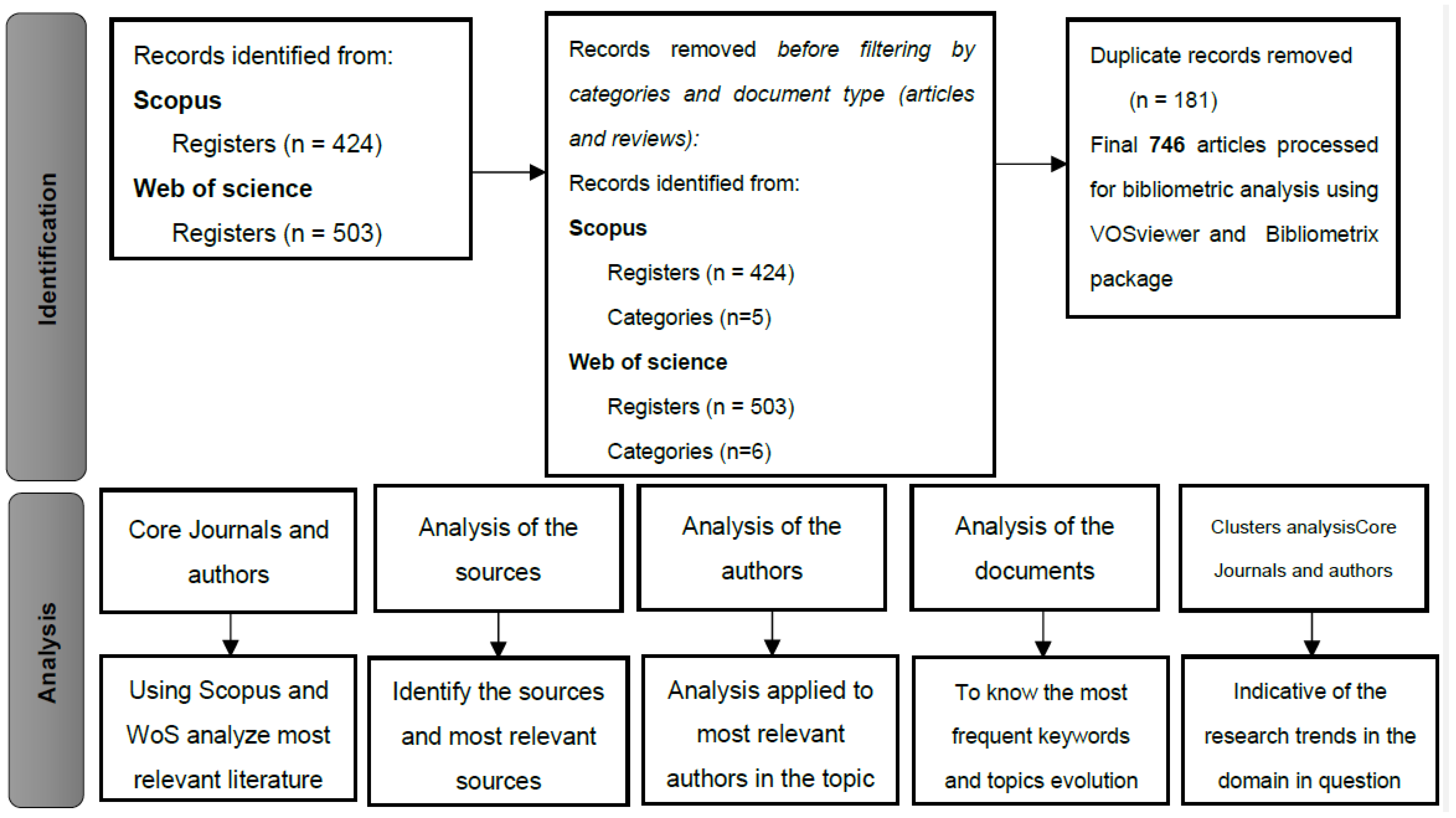

2. Materials and Methods

3. Scientometric Analysis

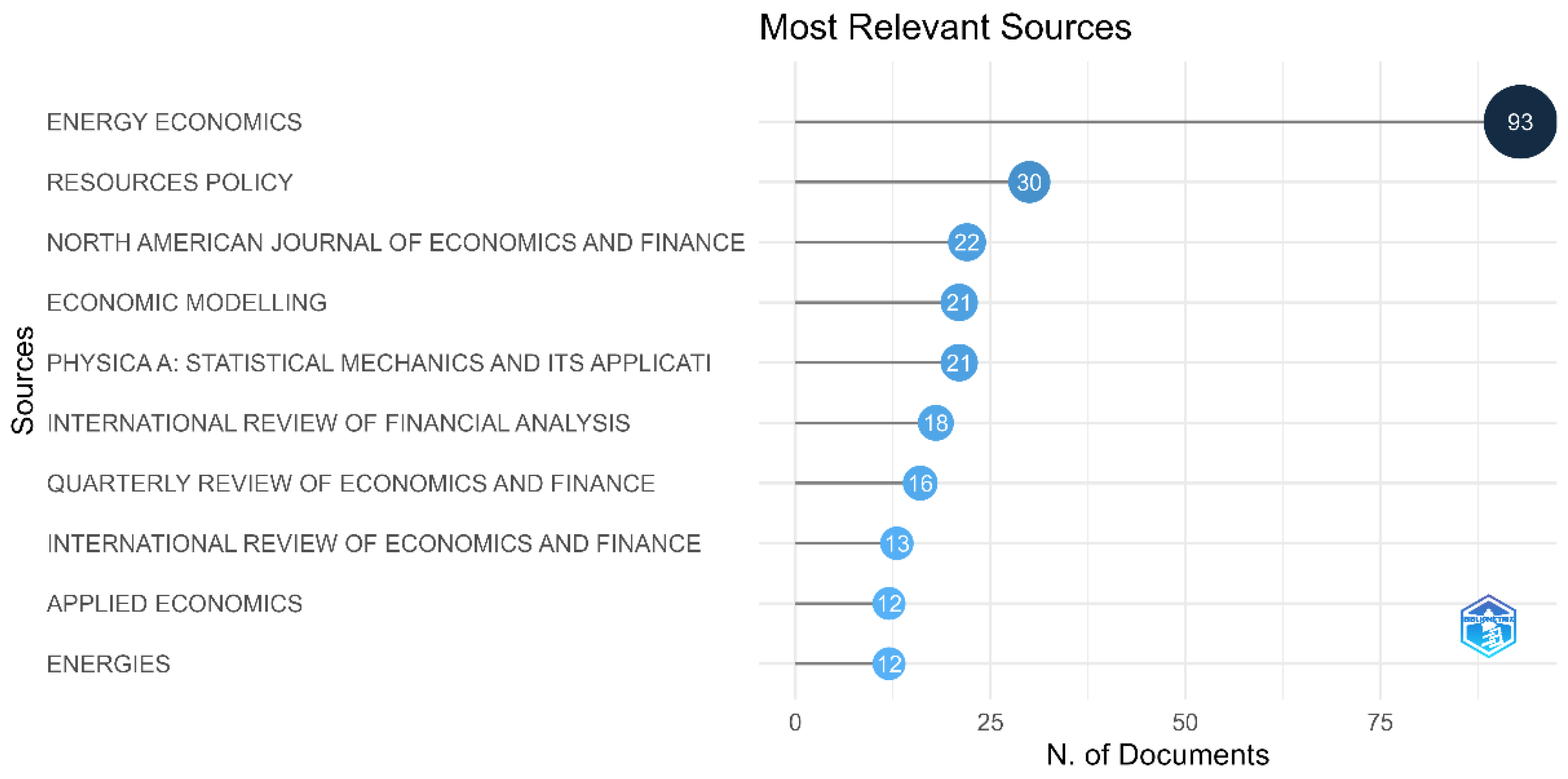

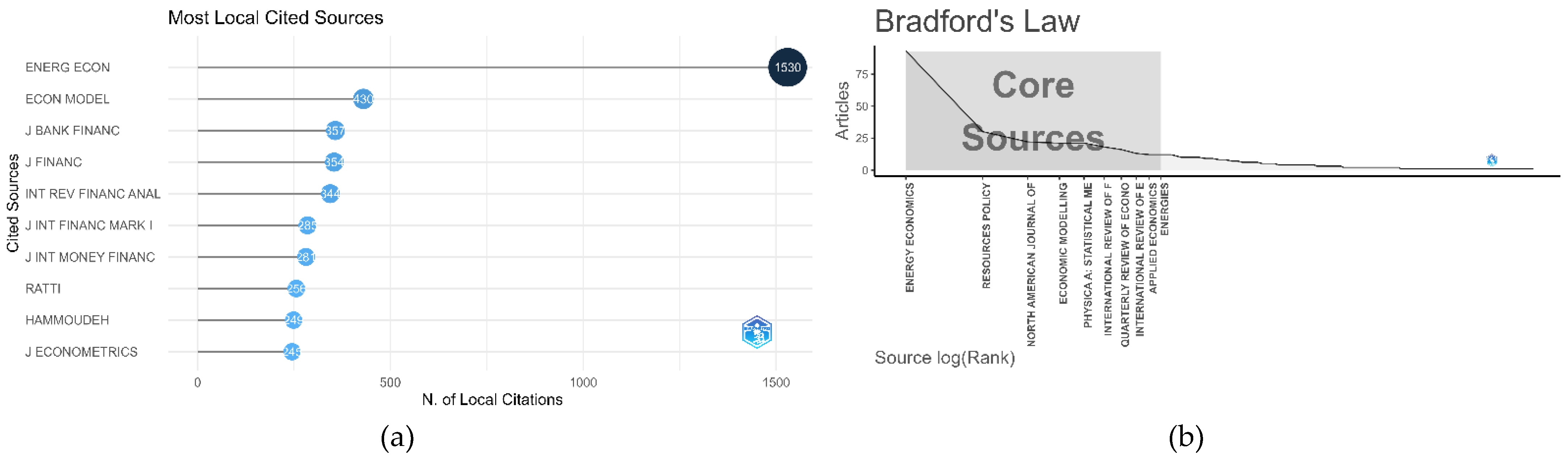

3.1. Analysis of the Sources

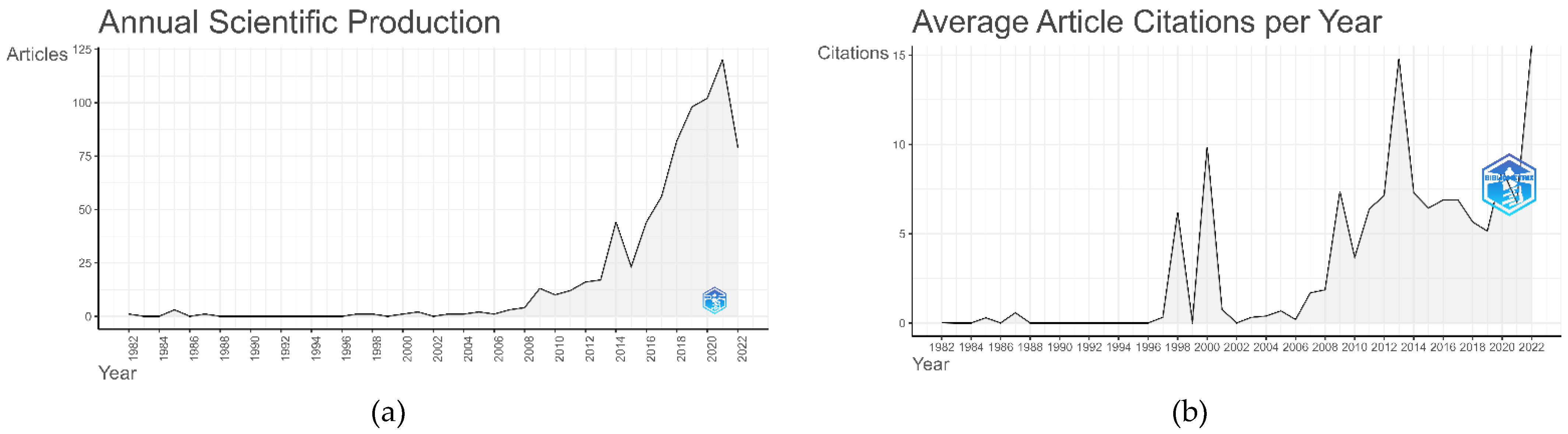

3.1.1. General Information

3.1.2. Publication Output

3.1.3. Discipline-Wise Analysis

3.1.4. Most Relevant Sources

3.2. Analysis of the Authors

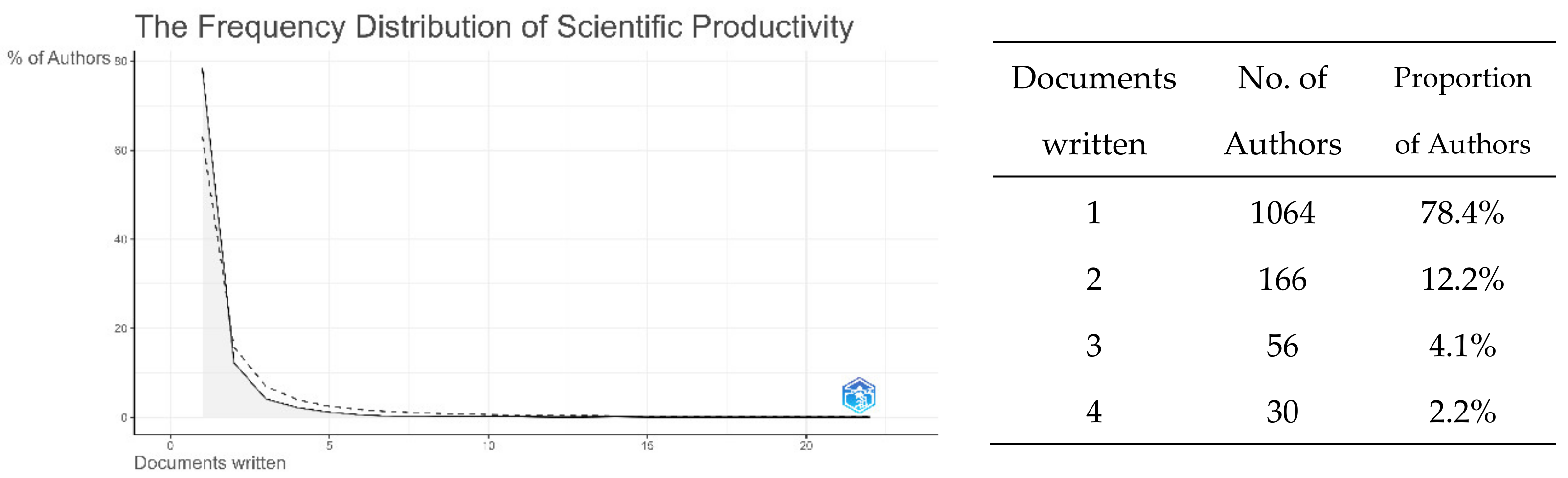

3.2.1. Authors’ Productivity

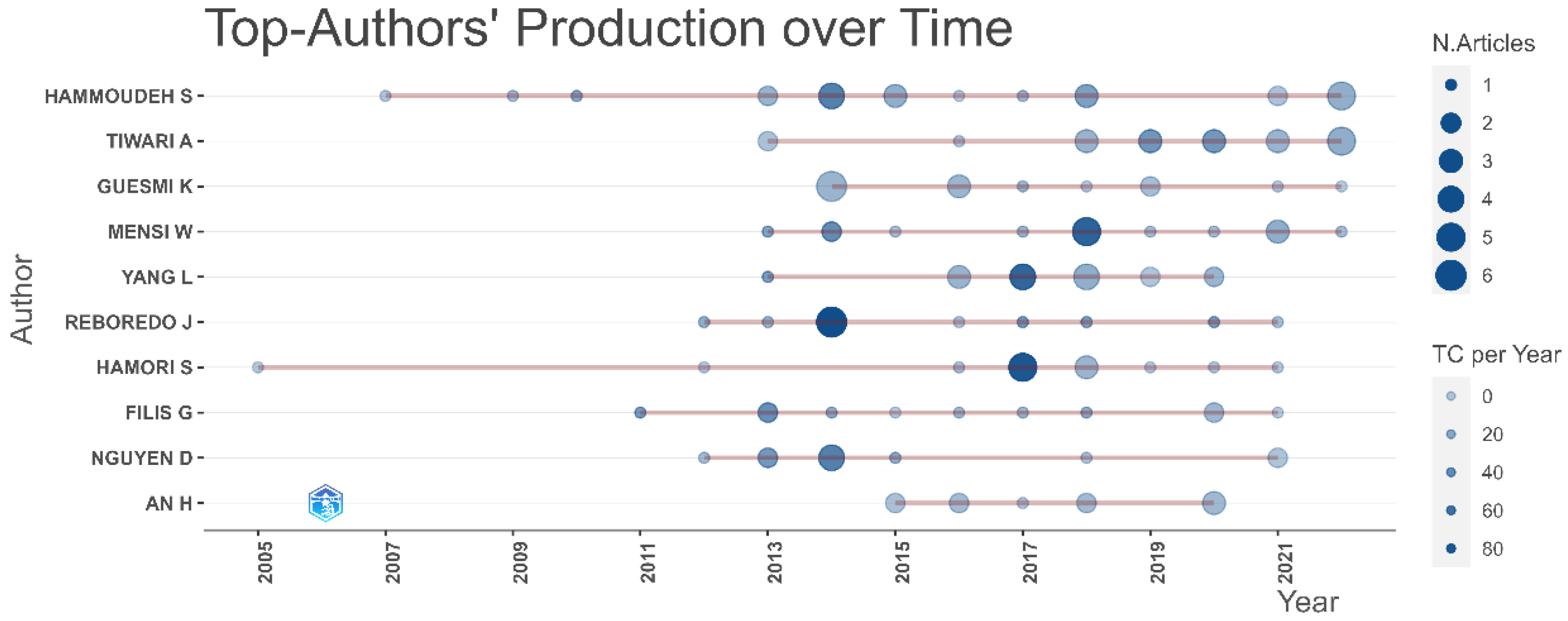

3.2.2. Most Relevant Authors and Authors’ Impacts

3.2.3. Authors’ Production over Time

3.2.4. The Leading Countries and Institutions

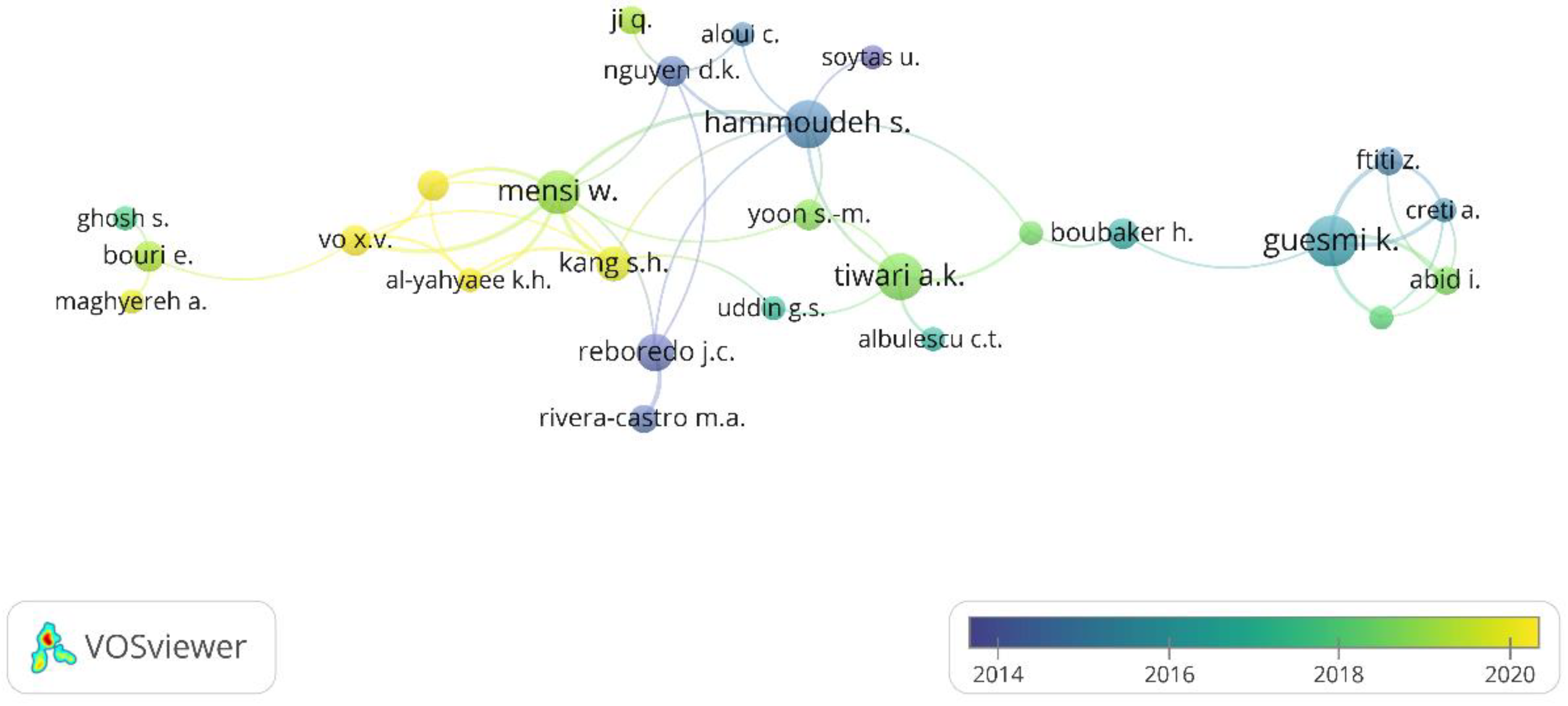

3.2.5. Co-Author Analysis

3.3. Analysis of the Documents

3.3.1. The Most Impactful Documents

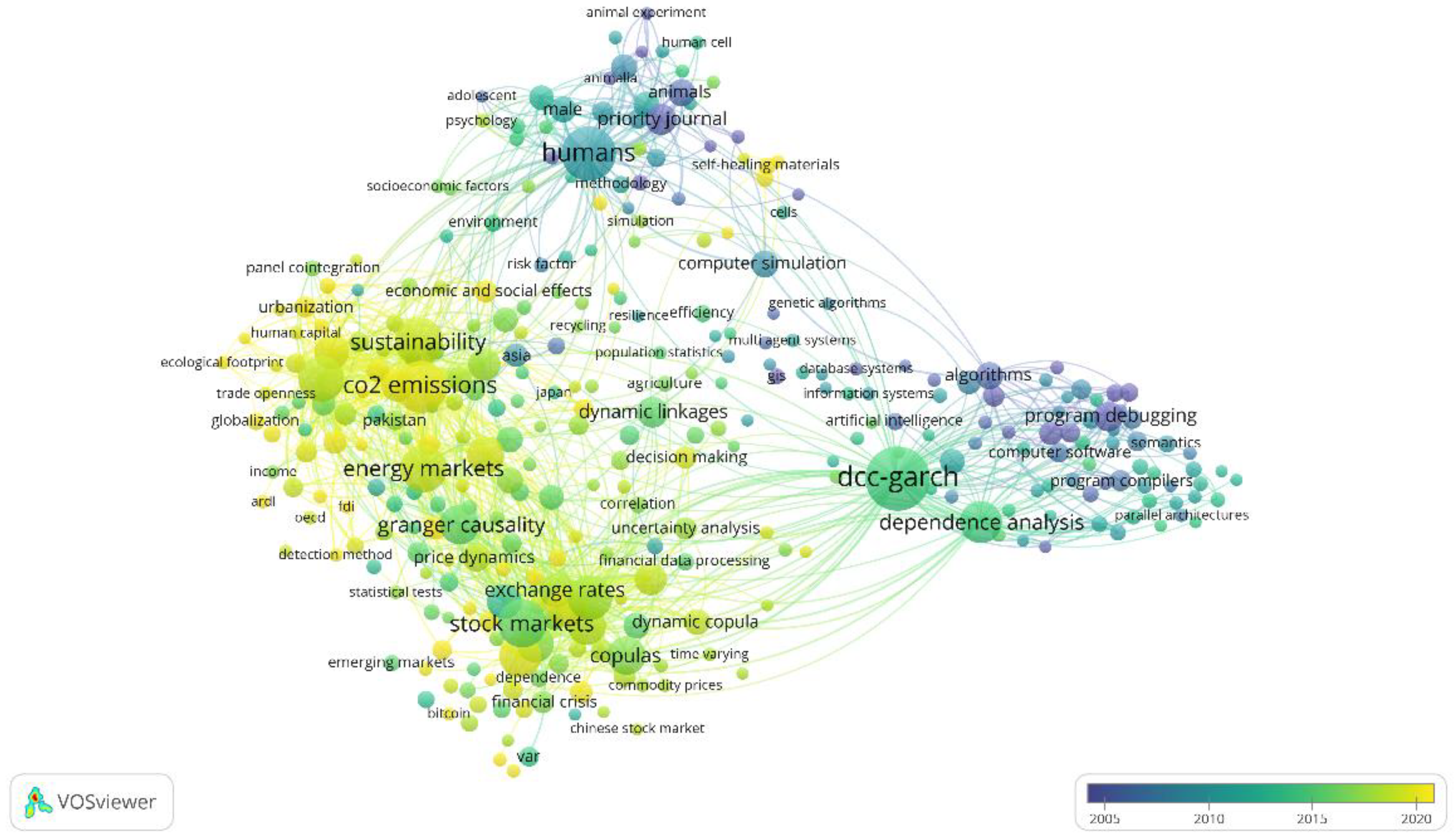

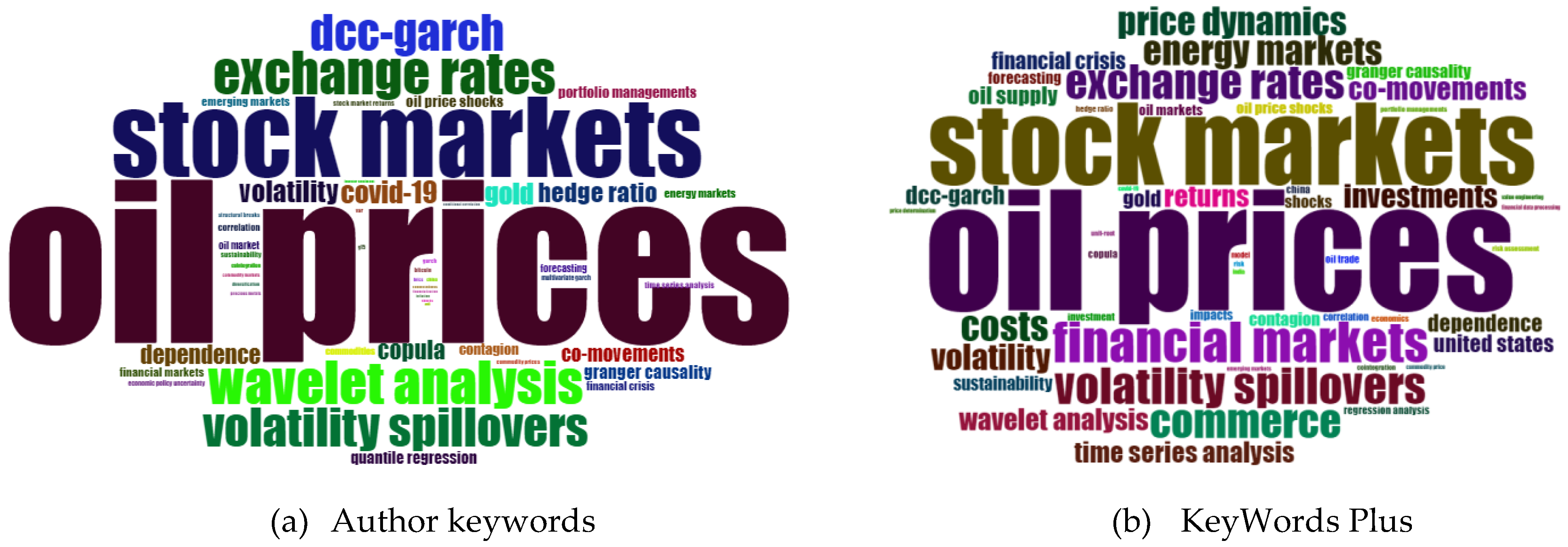

3.3.2. Most Frequent Keywords

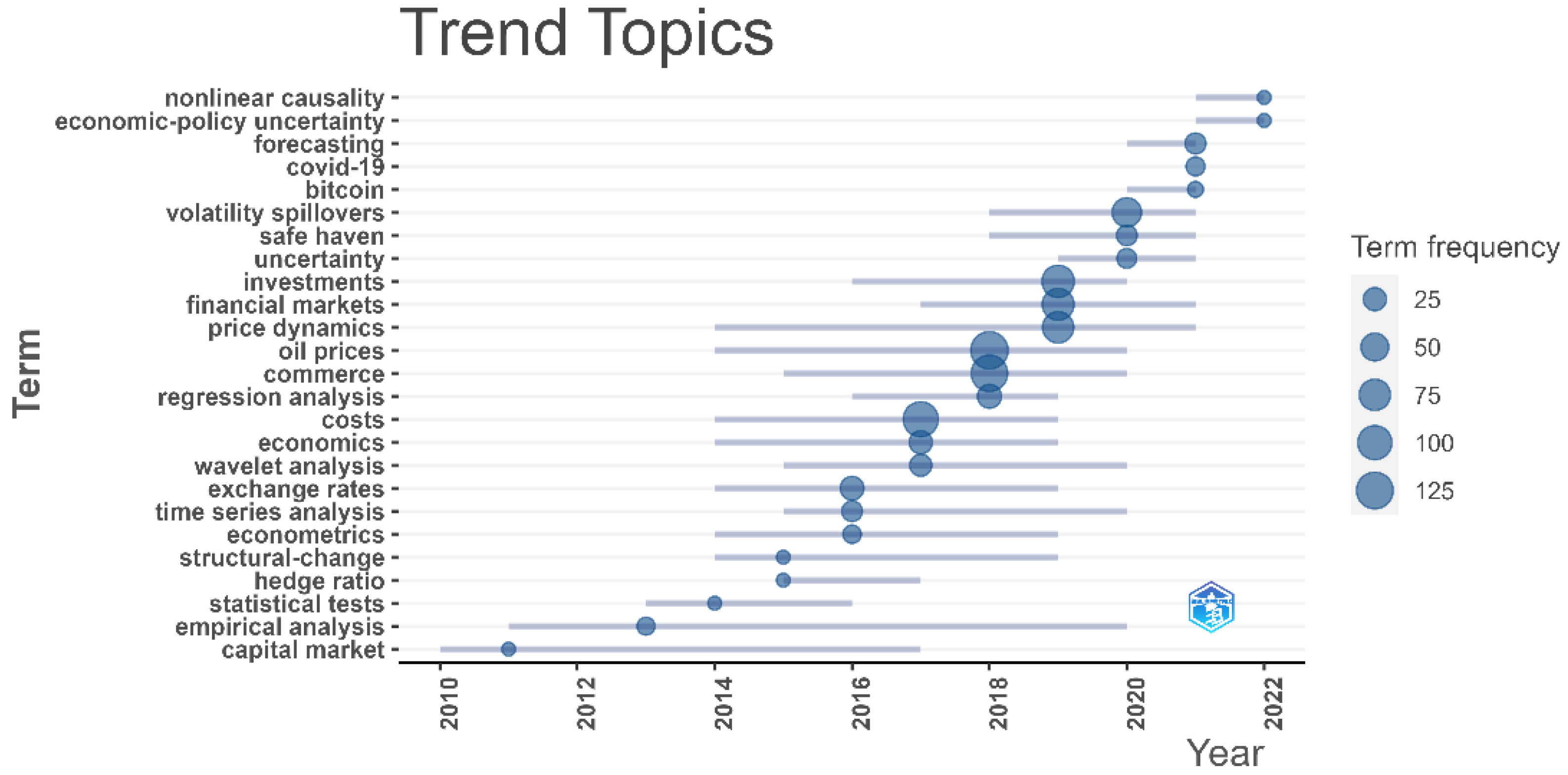

3.3.3. Trend Topics over the Years

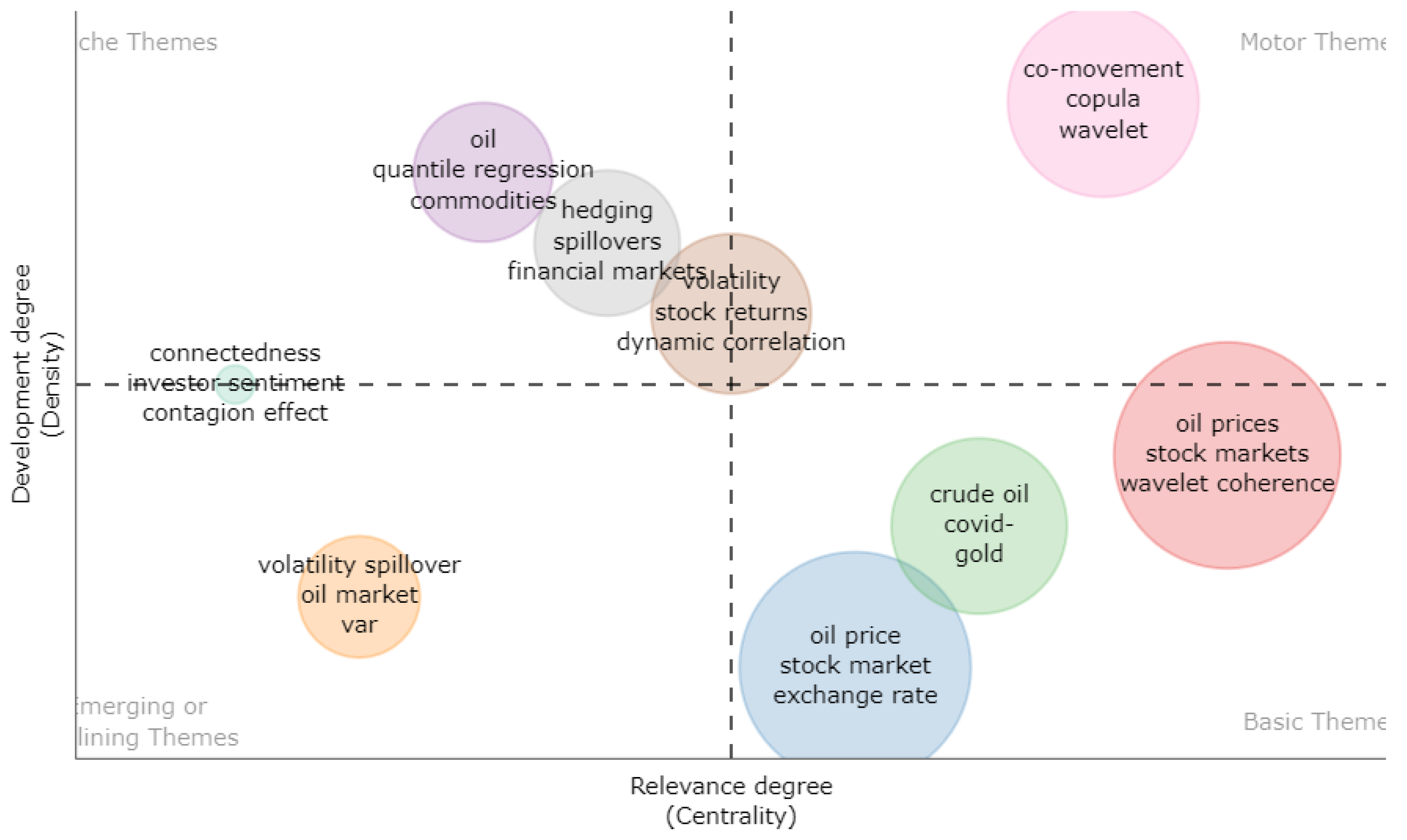

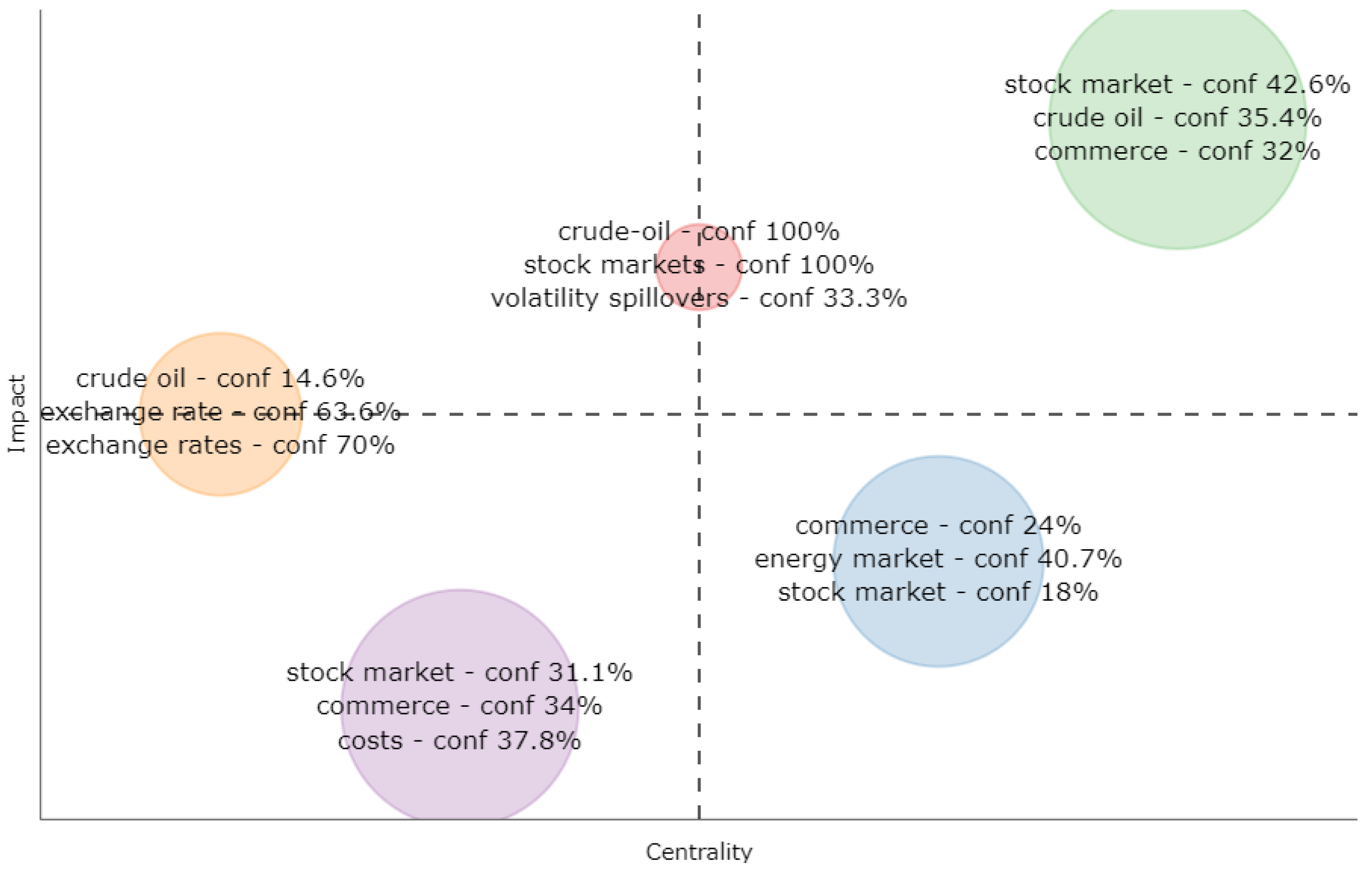

3.3.4. Thematic Map

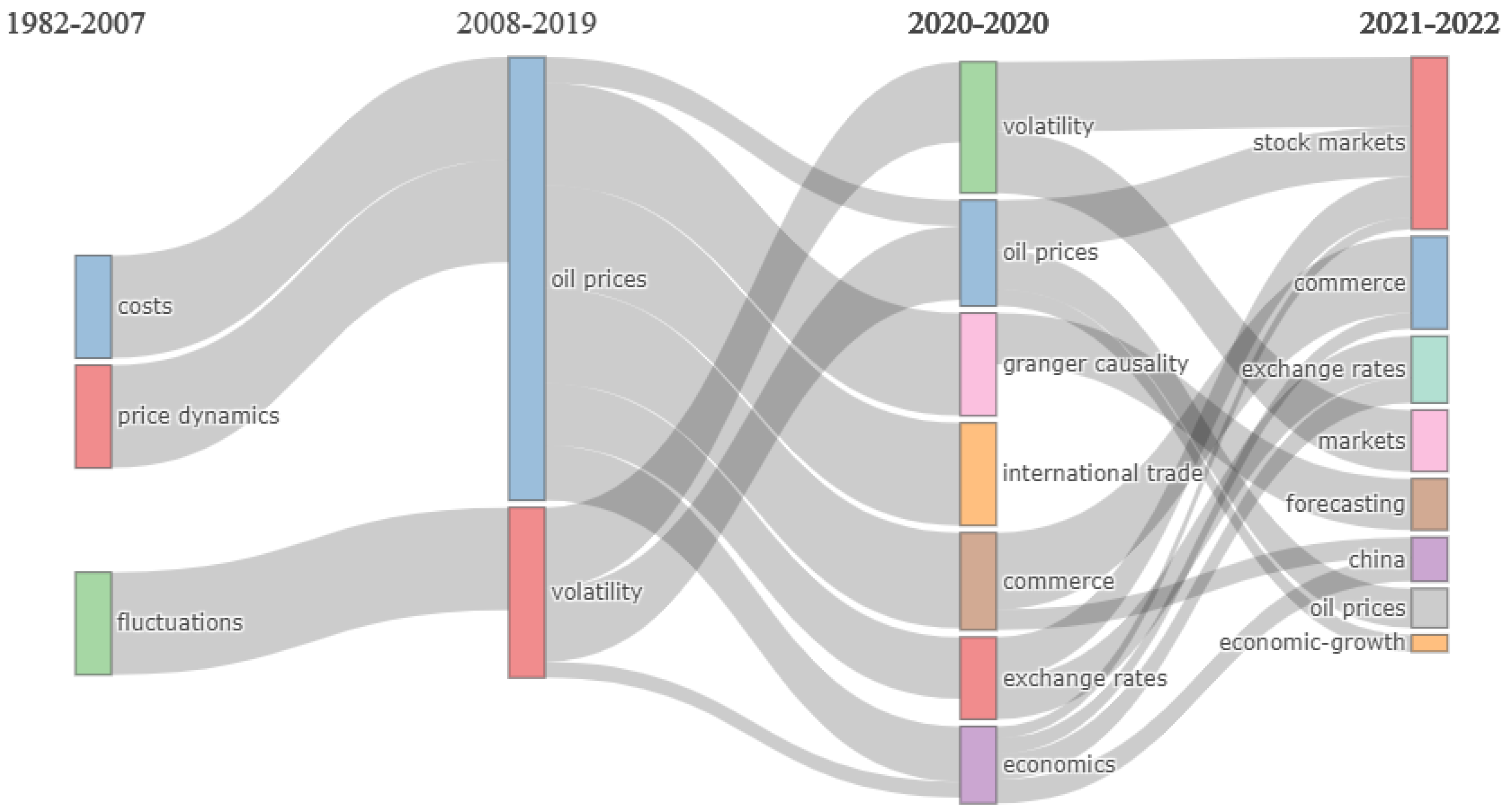

3.3.5. Thematic Evolution

3.4. Clusters Analysis

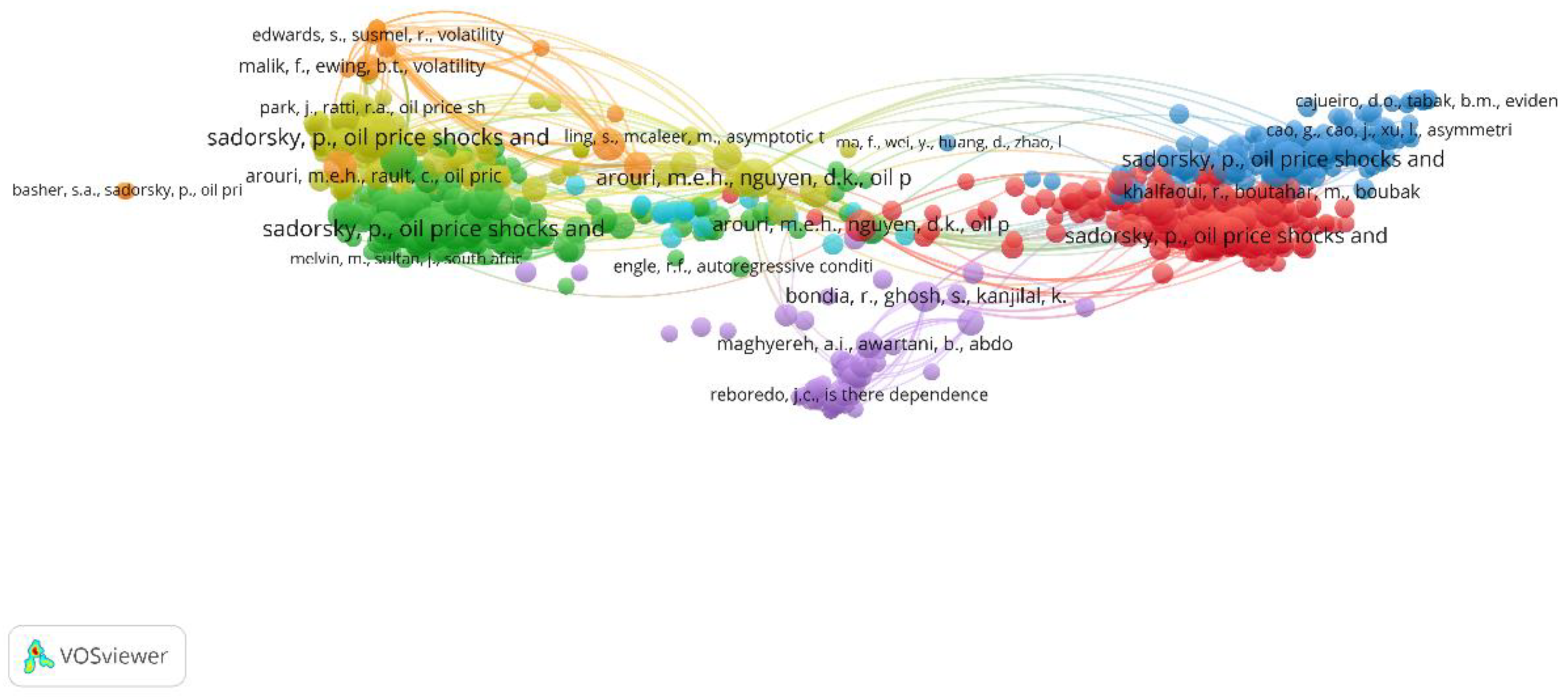

3.4.1. Co-Citation Networks Analyses

| Cluster | Relevant Citations |

|---|---|

| Cluster 1 (Red) | Basher, Haug, and Sadorsky [47]; Diebold and Yilmaz [43,48]; Hamilton [3]; Jammazi and Reboredo [44]; Jammazi [49]; Kilian and Park [28]; Mensi and Hammoudeh [50]; Park and Ratti [51], Reboredo and Rivera-Castro [52]; Sadorsky [8] and Wang, Torrence, and Compo [53]; Wu and Yang [32]. |

| Cluster 2 (Green) | Aloui, Hammoudeh and Nguyen [54]; Arouri, Jouini, and Nguyen [55]; Basher, Haug, and Sadorsky [47]; Bollerslev [56]; Chiang, Jeon, and Li [45]; Dutta [57]; Engle [58]; Engle and Granger [59]; Golub [60]; Kang and Ratti [61]; Mensi [62]; Narayan and Narayan [46]. |

| Cluster 3 (Blue) | Apergis and Miller [63]; Andrews [64]; Bai and Perron [65]; Basher and Sadorsky [66]; Chen [67]; Engle and Kroner [68]; Jones and Kaul [9]; Kilian and Park [28]; Ma et al. [69]; Park and Ratti [51]; Sadorsky [8]. |

| Cluster 4 (Yellow) | Amano and Van Norden [11]; Chen and Roll [70]; Ciner [71]; Cong et al. [72]; Elder and Serletis [73]; Golub [60]; Hamilton [3]; Hammoudeh, Dibooglu and Aleisa [74]; Kilian [75]; Lee, Ni and Ratti [76]; Park and Ratti [51]; Sadorsky [8,77,78]. |

| Cluster 5 (Purple) | Apergis and Miller [63]; Hamilton [3,79]; Henriques and Sadorsky [80]; Jones and Kaul [9]; Reboredo and Rivera-Castro [52]; Sadorsky [8,77,78]. |

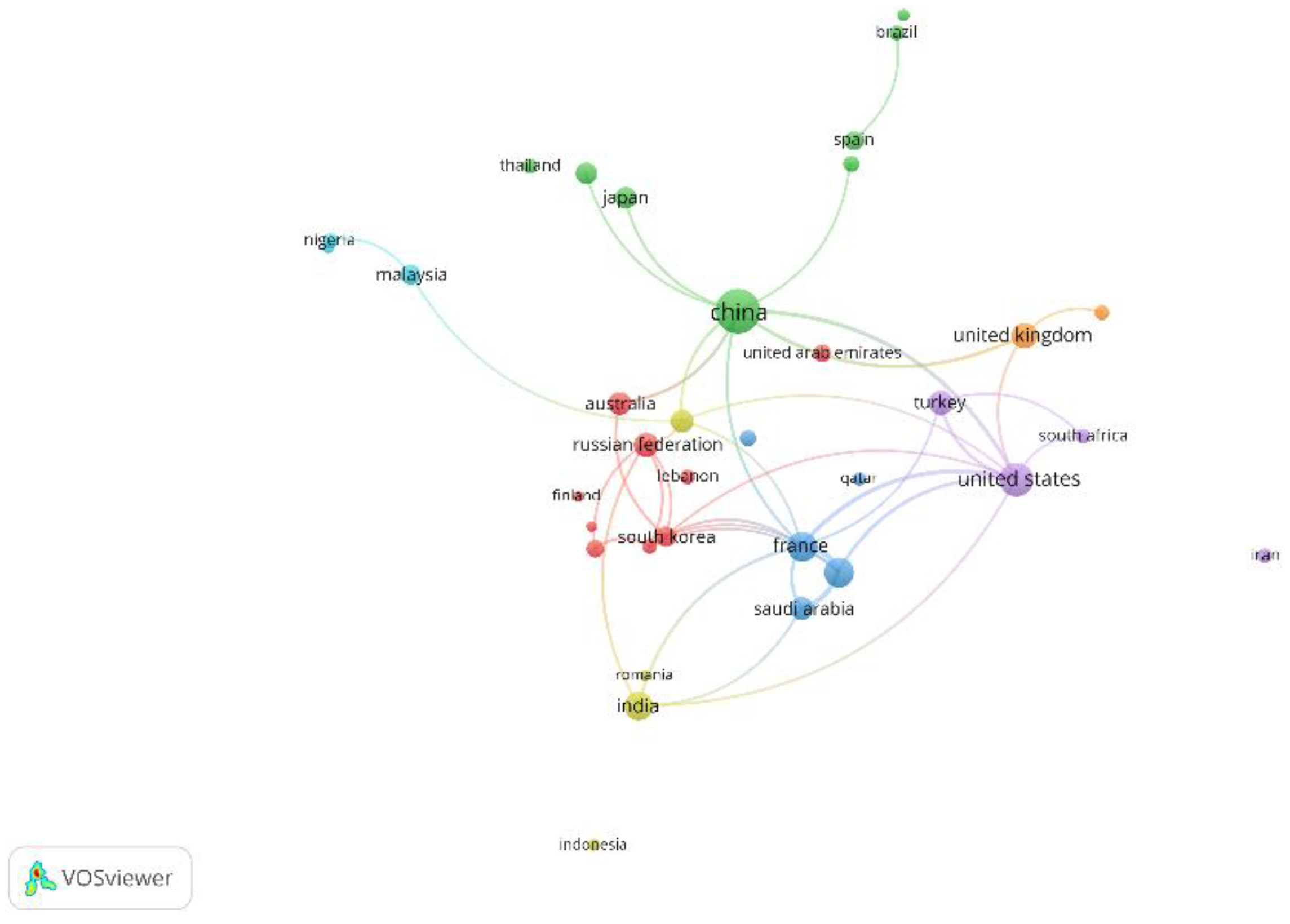

3.4.2. Countries and Regions Network

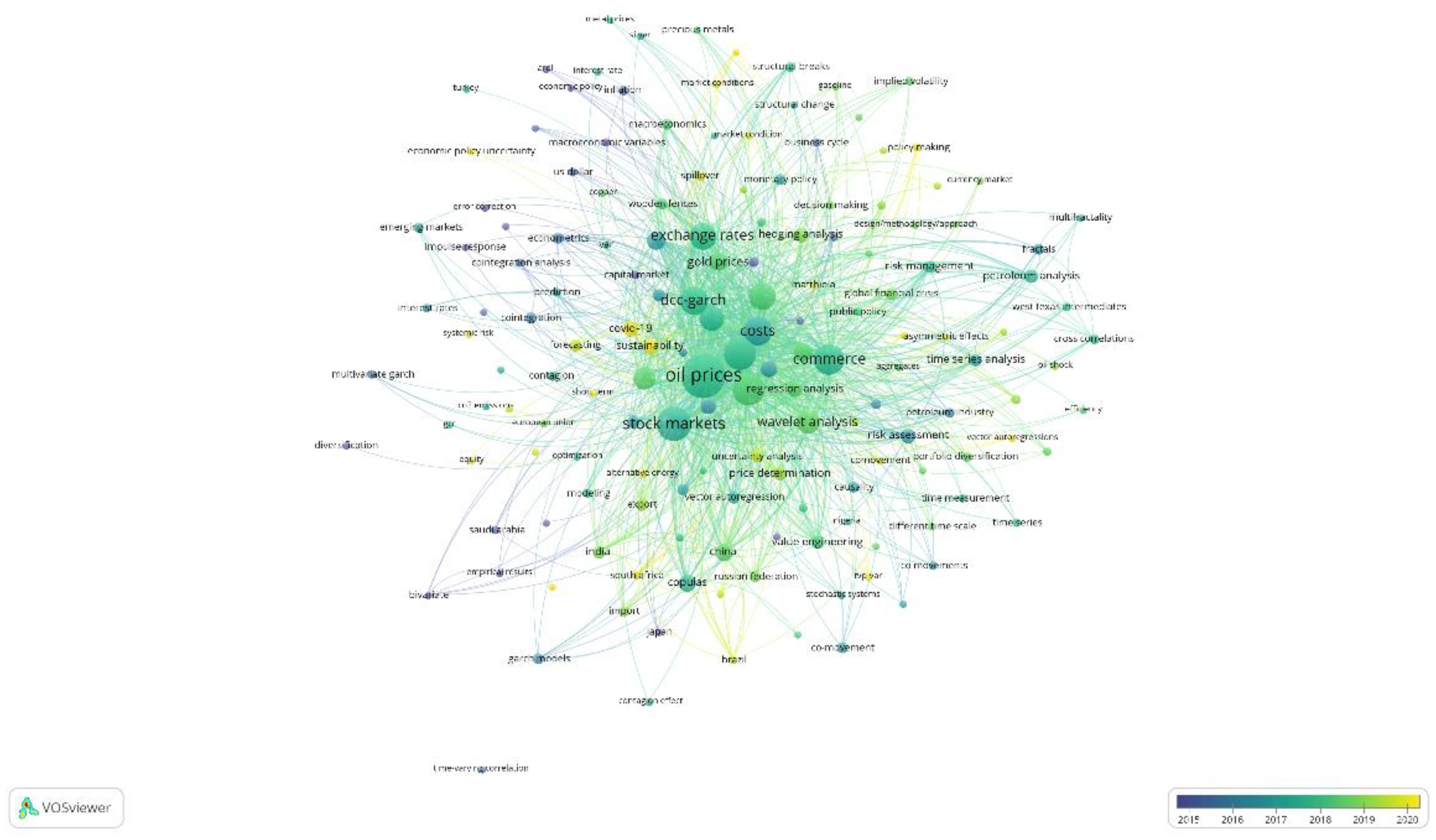

3.4.3. Co-Word Analysis

4. Discussion

4.1. Co-Movements: Contagion or Interdependence?

4.2. Measuring the Co-Movements: Bibliometric Coupling of Documents

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Burandt, T. Decarbonizing the Global Energy System: Modelling Global and Regional Transformation Pathways with Multi-Sector Energy System Models; Technische Universität Berlin: Berlin, Germany, 2021. [Google Scholar]

- Mensi, W.; Rehman, M.U.; Maitra, D.; Al-Yahyaee, K.H.; Vo, X.V. Oil, Natural Gas and BRICS Stock Markets: Evidence of Systemic Risks and Co-Movements in the Time-Frequency Domain. Resour. Policy 2021, 72, 102062. [Google Scholar] [CrossRef]

- Hamilton, J.D. Oil and the Macroeconomy since World War II. J. Polit. Econ. 1983, 91, 228–248. [Google Scholar] [CrossRef]

- Bashir, M.F. Oil Price Shocks, Stock Market Returns, and Volatility Spillovers: A Bibliometric Analysis and Its Implications. Environ. Sci. Pollut. Res. 2022, 29, 22809–22828. [Google Scholar] [CrossRef] [PubMed]

- Bashir, M.F.; Ma, B.; Shahbaz, M.; Jiao, Z. The Nexus between Environmental Tax and Carbon Emissions with the Roles of Environmental Technology and Financial Development. PLoS ONE 2020, 15, e0242412. [Google Scholar] [CrossRef]

- Bashir, M.F.; Ma, B.; Shahzad, L.; Liu, B.; Ruan, Q. China’s Quest for Economic Dominance and Energy Consumption: Can Asian Economies Provide Natural Resources for the Success of One Belt One Road? Manag. Decis. Econ. 2021, 42, 570–587. [Google Scholar] [CrossRef]

- Huang, R.D.; Masulis, R.W.; Stoll, H.R. Energy Shocks and Financial Markets. J. Futures Mark. 1996, 16, 1–27. [Google Scholar] [CrossRef]

- Sadorsky, P. Oil Price Shocks and Stock Market Activity. Energy Econ. 1999, 21, 449–469. [Google Scholar] [CrossRef]

- Jones, C.M.; Kaul, G. Oil and the Stock Markets. J. Financ. 1996, 51, 463–491. [Google Scholar] [CrossRef]

- Amano, R.A.; van Norden, S. Exchange Rates and Oil Prices. Rev. Int. Econ. 1998, 6, 683–694. [Google Scholar] [CrossRef]

- Amano, R.A.; van Norden, S. Oil Prices and the Rise and Fall of the US Real Exchange Rate. J. Int. Money Financ. 1998, 17, 299–316. [Google Scholar] [CrossRef]

- Darby, M.R. The Price of Oil and World Inflation and Recession. Am. Econ. Rev. 1982, 72, 738–751. [Google Scholar]

- Albulescu, C.T.; Demirer, R.; Raheem, I.D.; Tiwari, A.K. Does the U.S. Economic Policy Uncertainty Connect Financial Markets? Evidence from Oil and Commodity Currencies. Energy Econ. 2019, 83, 375–388. [Google Scholar] [CrossRef]

- Chen, Y.-C.; Rogoff, K. Commodity Currencies. J. Int. Econ. 2003, 60, 133–160. [Google Scholar] [CrossRef]

- Marín-Rodríguez, N.J.; González-Ruiz, J.D.; Botero, S. Dynamic Relationships among Green Bonds, CO2 Emissions, and Oil Prices. Front. Environ. Sci. 2022, 10, 992726. [Google Scholar] [CrossRef]

- Ren, X.; Shao, Q.; Zhong, R. Nexus between Green Finance, Non-Fossil Energy Use, and Carbon Intensity: Empirical Evidence from China Based on a Vector Error Correction Model. J. Clean. Prod. 2020, 277, 122844. [Google Scholar] [CrossRef]

- Sahu, P.K.; Solarin, S.A.; Al-mulali, U.; Ozturk, I. Investigating the Asymmetry Effects of Crude Oil Price on Renewable Energy Consumption in the United States. Environ. Sci. Pollut. Res. 2022, 29, 817–827. [Google Scholar] [CrossRef]

- Lee, C.-C.; Lee, C.-C.; Li, Y.-Y. Oil Price Shocks, Geopolitical Risks, and Green Bond Market Dynamics. North Am. J. Econ. Financ. 2021, 55, 101309. [Google Scholar] [CrossRef]

- Li, H.; Zhou, D.; Hu, J.; Guo, L. Dynamic Linkages among Oil Price, Green Bond, Carbon Market and Low-Carbon Footprint Company Stock Price: Evidence from the TVP-VAR Model. Energy Rep. 2022, 8, 11249–11258. [Google Scholar] [CrossRef]

- Beirne, J.; Gieck, J. Interdependence and Contagion in Global Asset Markets. Rev. Int. Econ. 2014, 22, 639–659. [Google Scholar] [CrossRef]

- Rasheed, M.Q.; Haseeb, A.; Adebayo, T.S.; Ahmed, Z.; Ahmad, M. The Long-Run Relationship between Energy Consumption, Oil Prices, and Carbon Dioxide Emissions in European Countries. Environ. Sci. Pollut. Res. 2022, 29, 24234–24247. [Google Scholar] [CrossRef]

- Lin, B.; Su, T. Mapping the Oil Price-Stock Market Nexus Researches: A Scientometric Review. Int. Rev. Econ. Financ. 2020, 67, 133–147. [Google Scholar] [CrossRef]

- Patel, R.; Goodell, J.W.; Oriani, M.E.; Paltrinieri, A.; Yarovaya, L. A Bibliometric Review of Financial Market Integration Literature. Int. Rev. Financ. Anal. 2022, 80, 102035. [Google Scholar] [CrossRef]

- Van Eck, N.J.; Waltman, L. Citation-Based Clustering of Publications Using CitNetExplorer and VOSviewer. Scientometrics 2017, 111, 1053–1070. [Google Scholar] [CrossRef]

- Aria, M.; Cuccurullo, C. Bibliometrix: An R-Tool for Comprehensive Science Mapping Analysis. J. Informetr. 2017, 11, 959–975. [Google Scholar] [CrossRef]

- Bradford, S.C. Sources of Information on Specific Subjects. Engineering 1934, 137, 85–86. [Google Scholar]

- Lotka, A.J. The Frequency Distribution of Scientific Productivity. J. Wash. Acad. Sci. 1926, 16, 317–323. [Google Scholar]

- Kilian, L.; Park, C. The Impact of Oil Price Shocks on the U.S. Stock Market. Int. Econ. Rev. 2009, 50, 1267–1287. [Google Scholar] [CrossRef]

- Sharif, A.; Aloui, C.; Yarovaya, L. COVID-19 Pandemic, Oil Prices, Stock Market, Geopolitical Risk and Policy Uncertainty Nexus in the US Economy: Fresh Evidence from the Wavelet-Based Approach. Int. Rev. Financ. Anal. 2020, 70, 101496. [Google Scholar] [CrossRef]

- Filis, G.; Degiannakis, S.; Floros, C. Dynamic Correlation between Stock Market and Oil Prices: The Case of Oil-Importing and Oil-Exporting Countries. Int. Rev. Financ. Anal. 2011, 20, 152–164. [Google Scholar] [CrossRef]

- Sari, R.; Hammoudeh, S.; Soytas, U. Dynamics of Oil Price, Precious Metal Prices, and Exchange Rate. Energy Econ. 2010, 32, 351–362. [Google Scholar] [CrossRef]

- Wang, Y.; Wu, C.; Yang, L. Oil Price Shocks and Stock Market Activities: Evidence from Oil-Importing and Oil-Exporting Countries. J. Comp. Econ. 2013, 41, 1220–1239. [Google Scholar] [CrossRef]

- Antonakakis, N.; Chatziantoniou, I.; Filis, G. Dynamic Co-Movements of Stock Market Returns, Implied Volatility and Policy Uncertainty. Econ. Lett. 2013, 120, 87–92. [Google Scholar] [CrossRef]

- Mensi, W.; Beljid, M.; Boubaker, A.; Managi, S. Correlations and Volatility Spillovers across Commodity and Stock Markets: Linking Energies, Food, and Gold. Econ. Model. 2013, 32, 15–22. [Google Scholar] [CrossRef]

- Basher, S.A.; Sadorsky, P. Hedging Emerging Market Stock Prices with Oil, Gold, VIX, and Bonds: A Comparison between DCC, ADCC and GO-GARCH. Energy Econ. 2016, 54, 235–247. [Google Scholar] [CrossRef]

- Creti, A.; Joëts, M.; Mignon, V. On the Links between Stock and Commodity Markets’ Volatility. Energy Econ. 2013, 37, 16–28. [Google Scholar] [CrossRef]

- Mensi, W.; Hammoudeh, S.; Reboredo, J.C.; Nguyen, D.K. Do Global Factors Impact BRICS Stock Markets? A Quantile Regression Approach. Emerg. Mark. Rev. 2014, 19, 1–17. [Google Scholar] [CrossRef]

- Garfield, E. Citation Indexing for Studying Science. Nature 1970, 227, 669–671. [Google Scholar] [CrossRef]

- Chansanam, W.; Li, C. Scientometrics of Poverty Research for Sustainability Development: Trend Analysis of the 1964–2022 Data through Scopus. Sustainability 2022, 14, 5339. [Google Scholar] [CrossRef]

- Moral-Munoz, J.A.; Arroyo-Morales, M.; Herrera-Viedma, E.; Cobo, M.J. An Overview of Thematic Evolution of Physical Therapy Research Area From 1951 to 2013. Front. Res. Metr. Anal. 2018, 3, 13. [Google Scholar] [CrossRef]

- Chen, X.; Lun, Y.; Yan, J.; Hao, T.; Weng, H. Discovering Thematic Change and Evolution of Utilizing Social Media for Healthcare Research. BMC Med. Inform. Decis. Mak. 2019, 19, 50. [Google Scholar] [CrossRef]

- Mumu, J.R.; Saona, P.; Russell, H.I.; Azad, M.A.K. Corporate Governance and Remuneration: A Bibliometric Analysis. J. Asian Bus. Econ. Stud. 2021, 28, 242–262. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. Better to Give than to Receive: Predictive Directional Measurement of Volatility Spillovers. Int. J. Forecast. 2012, 28, 57–66. [Google Scholar] [CrossRef]

- Jammazi, R.; Reboredo, J.C. Dependence and Risk Management in Oil and Stock Markets. A Wavelet-Copula Analysis. Energy 2016, 107, 866–888. [Google Scholar] [CrossRef]

- Chiang, T.C.; Jeon, B.N.; Li, H. Dynamic Correlation Analysis of Financial Contagion: Evidence from Asian Markets. J. Int. Money Financ. 2007, 26, 1206–1228. [Google Scholar] [CrossRef]

- Narayan, P.K.; Narayan, S. Modelling the Impact of Oil Prices on Vietnam’s Stock Prices. Appl. Energy 2010, 87, 356–361. [Google Scholar] [CrossRef]

- Basher, S.A.; Haug, A.A.; Sadorsky, P. Oil Prices, Exchange Rates and Emerging Stock Markets. Energy Econ. 2012, 34, 227–240. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. Measuring Financial Asset Return and Volatility Spillovers, with Application to Global Equity Markets. Econ. J. 2009, 119, 158–171. [Google Scholar] [CrossRef]

- Jammazi, R. Cross Dynamics of Oil-Stock Interactions: A Redundant Wavelet Analysis. Energy 2012, 44, 750–777. [Google Scholar] [CrossRef]

- Mensi, W.; Hammoudeh, S.; Yoon, S.-M. Structural Breaks, Dynamic Correlations, Asymmetric Volatility Transmission, and Hedging Strategies for Petroleum Prices and USD Exchange Rate. Energy Econ. 2015, 48, 46–60. [Google Scholar] [CrossRef]

- Park, J.; Ratti, R.A. Oil Price Shocks and Stock Markets in the U.S. and 13 European Countries. Energy Econ. 2008, 30, 2587–2608. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Rivera-Castro, M.A. Wavelet-Based Evidence of the Impact of Oil Prices on Stock Returns. Int. Rev. Econ. Financ. 2014, 29, 145–176. [Google Scholar] [CrossRef]

- Torrence, C.; Compo, G.P. A Practical Guide to Wavelet Analysis. Bull. Am. Meteorol. 1998, 79, 61–78. [Google Scholar] [CrossRef]

- Aloui, R.; Hammoudeh, S.; Nguyen, D.K. A Time-Varying Copula Approach to Oil and Stock Market Dependence: The Case of Transition Economies. Energy Econ. 2013, 39, 208–221. [Google Scholar] [CrossRef]

- Arouri, M.E.H.; Jouini, J.; Nguyen, D.K. On the Impacts of Oil Price Fluctuations on European Equity Markets: Volatility Spillover and Hedging Effectiveness. Energy Econ. 2012, 34, 611–617. [Google Scholar] [CrossRef]

- Bollerslev, T. Generalized Autoregressive Conditional Heteroskedasticity. J. Econ. 1986, 31, 307–327. [Google Scholar] [CrossRef]

- Dutta, A. Implied Volatility Linkages between the U.S. and Emerging Equity Markets: A Note. Glob. Financ. J. 2018, 35, 138–146. [Google Scholar] [CrossRef]

- Engle, R. Dynamic Conditional Correlation: A Simple Class of Multivariate Generalized Autoregressive Conditional Heteroskedasticity Models. J. Bus. Econ. Stat. 2002, 20, 339–350. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W.J. Co-Integration and Error Correction: Representation, Estimation, and Testing. Econometrica 1987, 55, 251. [Google Scholar] [CrossRef]

- Golub, S.S. Oil Prices and Exchange Rates. Econ. J. 1983, 93, 576. [Google Scholar] [CrossRef]

- Kang, W.; Ratti, R.A. Structural Oil Price Shocks and Policy Uncertainty. Econ. Model. 2013, 35, 314–319. [Google Scholar] [CrossRef]

- Mensi, W. Global Financial Crisis and Co-Movements between Oil Prices and Sector Stock Markets in Saudi Arabia: A VaR Based Wavelet. Borsa Istanb. Rev. 2019, 19, 24–38. [Google Scholar] [CrossRef]

- Apergis, N.; Miller, S.M. Do Structural Oil-Market Shocks Affect Stock Prices? Energy Econ. 2009, 31, 569–575. [Google Scholar] [CrossRef]

- Andrews, D.W.K. Tests for Parameter Instability and Structural Change with Unknown Change Point: A Corrigendum. Econometrica 2003, 71, 395–397. [Google Scholar] [CrossRef]

- Bai, J.; Perron, P. Computation and Analysis of Multiple Structural Change Models. J. Appl. Econom. 2003, 18, 1–22. [Google Scholar] [CrossRef]

- Basher, S.A.; Sadorsky, P. Oil Price Risk and Emerging Stock Markets. Glob. Financ. J. 2006, 17, 224–251. [Google Scholar] [CrossRef]

- Chen, S.-S. Do Higher Oil Prices Push the Stock Market into Bear Territory? Energy Econ. 2010, 32, 490–495. [Google Scholar] [CrossRef]

- Engle, R.; Kroner, K. Multivariate Simultaneous Generalized ARCH. Econom. Theory 1995, 11, 122–150. [Google Scholar] [CrossRef]

- Ma, F.; Wei, Y.; Huang, D.; Zhao, L. Cross-Correlations between West Texas Intermediate Crude Oil and the Stock Markets of the BRIC. Phys. A: Stat. Mech. Its Appl. 2013, 392, 5356–5368. [Google Scholar] [CrossRef]

- Chen, N.-F.; Roll, R.; Ross, S.A. Economic Forces and the Stock Market. J. Bus. 1986, 383–403. [Google Scholar] [CrossRef]

- Ciner, C. Energy Shocks and Financial Markets: Nonlinear Linkages. Stud. Nonlinear Dyn. Econom. 2001, 5, 1079. [Google Scholar] [CrossRef]

- Cong, R.-G.; Wei, Y.-M.; Jiao, J.-L.; Fan, Y. Relationships between Oil Price Shocks and Stock Market: An Empirical Analysis from China. Energy Policy 2008, 36, 3544–3553. [Google Scholar] [CrossRef]

- Elder, J.; Serletis, A. Oil Price Uncertainty. J. Money Credit Bank. 2010, 42, 1137–1159. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Dibooglu, S.; Aleisa, E. Relationships among U.S. Oil Prices and Oil Industry Equity Indices. Int. Rev. Econ. Financ. 2004, 13, 427–453. [Google Scholar] [CrossRef]

- Kilian, L. Not All Oil Price Shocks Are Alike: Disentangling Demand and Supply Shocks in the Crude Oil Market. Am. Econ. Rev. 2009, 99, 1053–1069. [Google Scholar] [CrossRef]

- Lee, K.; Ni, S.; Ratti, R.A. Oil Shocks and the Macroeconomy: The Role of Price Variability. Energy J. 1995, 16, 39–56. [Google Scholar] [CrossRef]

- Sadorsky, P. Risk Factors in Stock Returns of Canadian Oil and Gas Companies. Energy Econ. 2001, 23, 17–28. [Google Scholar] [CrossRef]

- Sadorsky, P. Modeling Volatility and Correlations between Emerging Market Stock Prices and the Prices of Copper, Oil and Wheat. Energy Econ. 2014, 43, 72–81. [Google Scholar] [CrossRef]

- Hamilton, J.D. What Is an Oil Shock? J. Econom. 2003, 113, 363–398. [Google Scholar] [CrossRef]

- Henriques, I.; Sadorsky, P. Oil Prices and the Stock Prices of Alternative Energy Companies. Energy Econ. 2008, 30, 998–1010. [Google Scholar] [CrossRef]

- Orlov, A.G. A Cospectral Analysis of Exchange Rate Comovements during Asian Financial Crisis. J. Int. Financ. Mark. Inst. Money 2009, 19, 742–758. [Google Scholar] [CrossRef]

- Bodart, V.; Candelon, B. Evidence of Interdependence and Contagion Using a Frequency Domain Framework. Emerg. Mark. Rev. 2009, 10, 140–150. [Google Scholar] [CrossRef]

- Dewandaru, G.; Rizvi, S.A.R.; Masih, R.; Masih, M.; Alhabshi, S.O. Stock Market Co-Movements: Islamic versus Conventional Equity Indices with Multi-Timescales Analysis. Econ. Syst. 2014, 38, 553–571. [Google Scholar] [CrossRef]

- Pericoli, M.; Sbracia, M. A Primer on Financial Contagion. J. Econ. Surv. 2003, 17, 571–608. [Google Scholar] [CrossRef]

- Forbes, K.; Rigobon, R. Measuring Contagion: Conceptual and Empirical Issues. In International Financial Contagion; Springer: Berlin/Heidelberg, Germany, 2001; pp. 43–66. [Google Scholar]

- Forbes, K.J.; Rigobon, R. No Contagion, Only Interdependence: Measuring Stock Market Comovements. J. Financ. 2002, 57, 2223–2261. [Google Scholar] [CrossRef]

- Vayá-Valcarce, E.; Frexedas, O.V. Financial Contagion between Economies: An Exploratory Spatial Analysis. Estud. De Econ. Apl. 2005, 23, 151–166. [Google Scholar]

- Mitra, A.; Bhattacharjee, K. Financial Interdependence of International Stock Markets: A Literature Review. Indian J. Financ. 2015, 9, 20–33. [Google Scholar] [CrossRef]

- Nagayev, R.; Disli, M.; Inghelbrecht, K.; Ng, A. On the Dynamic Links between Commodities and Islamic Equity. Energy Econ. 2016, 58, 125–140. [Google Scholar] [CrossRef]

- Antonakakis, N.; Chatziantoniou, I.; Filis, G. Oil Shocks and Stock Markets: Dynamic Connectedness under the Prism of Recent Geopolitical and Economic Unrest. Int. Rev. Financ. Anal. 2017, 50, 1–26. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Mensi, W.; Hammoudeh, S.; Rehman, M.U.; Al-Yahyaee, K.H. Extreme Dependence and Risk Spillovers between Oil and Islamic Stock Markets. Emerg. Mark. Rev. 2018, 34, 42–63. [Google Scholar] [CrossRef]

- Roy, R.P.; Roy, S.S. Financial Contagion and Volatility Spillover: An Exploration into Indian Commodity Derivative Market. Econ. Model. 2017, 67, 368–380. [Google Scholar] [CrossRef]

- Disli, M.; Nagayev, R.; Salim, K.; Rizkiah, S.K.; Aysan, A.F. In Search of Safe Haven Assets during COVID-19 Pandemic: An Empirical Analysis of Different Investor Types. Res. Int. Bus. Financ. 2021, 58, 101461. [Google Scholar] [CrossRef]

- Pal, D.; Mitra, S.K. Oil Price and Automobile Stock Return Co-Movement: A Wavelet Coherence Analysis. Econ. Model. 2019, 76, 172–181. [Google Scholar] [CrossRef]

- Ftiti, Z.; Guesmi, K.; Abid, I. Oil Price and Stock Market Co-Movement: What Can We Learn from Time-Scale Approaches? Int. Rev. Financ. Anal. 2016, 46, 266–280. [Google Scholar] [CrossRef]

- Bouri, E.; Chen, Q.; Lien, D.; Lv, X. Causality between Oil Prices and the Stock Market in China: The Relevance of the Reformed Oil Product Pricing Mechanism. Int. Rev. Econ. Financ. 2017, 48, 34–48. [Google Scholar] [CrossRef]

- Maghyereh, A.; Abdoh, H. Extreme Dependence between Structural Oil Shocks and Stock Markets in GCC Countries. Resour. Policy 2022, 76, 102626. [Google Scholar] [CrossRef]

- Boldanov, R.; Degiannakis, S.; Filis, G. Time-Varying Correlation between Oil and Stock Market Volatilities: Evidence from Oil-Importing and Oil-Exporting Countries. Int. Rev. Financ. Anal. 2016, 48, 209–220. [Google Scholar] [CrossRef]

- Belhassine, O. Volatility Spillovers and Hedging Effectiveness between the Oil Market and Eurozone Sectors: A Tale of Two Crises. Res. Int. Bus. Financ. 2020, 53, 101195. [Google Scholar] [CrossRef]

- Ali, S.R.M.; Mensi, W.; Anik, K.I.; Rahman, M.; Kang, S.H. The Impacts of COVID-19 Crisis on Spillovers between the Oil and Stock Markets: Evidence from the Largest Oil Importers and Exporters. Econ. Anal. Policy 2022, 73, 345–372. [Google Scholar] [CrossRef]

- Ren, C. Volatility Spillovers and Nexus across Oil, Gold, and Stock European Markets. Am. Bus. Rev. 2022, 25, 52–185. [Google Scholar] [CrossRef]

- Aloui, R.; ben Aïssa, M.S.; Nguyen, D.K. Conditional Dependence Structure between Oil Prices and Exchange Rates: A Copula-GARCH Approach. J. Int. Money Financ. 2013, 32, 719–738. [Google Scholar] [CrossRef]

- Feng, Y.; Cui, Y. Dual and Single Hedging Strategy: A Novel Comparison from the Direct and Cross Hedging Perspective. China Financ. Rev. Int. 2022, 12, 161–179. [Google Scholar] [CrossRef]

| Description | Results | Description | Results |

|---|---|---|---|

| MAIN INFORMATION | DOCUMENT TYPES (continued) | ||

| Timespan | 1982:2022 | Conference review | 1 |

| Sources (journals, books, etc.) | 289 | Erratum | 2 |

| Documents | 746 | Note | 1 |

| Annual growth rate % | 11.54 | Retracted | 2 |

| Document average age | 4.37 | Review | 8 |

| Average citations per doc | 26.79 | DOCUMENT CONTENTS | |

| References | 27,756 | KeyWords Plus (ID) | 1778 |

| DOCUMENT TYPES | Author keywords (DE) | 1792 | |

| Article | 672 | AUTHORS | |

| Article; book chapter | 1 | Authors | 1358 |

| Article; early access | 8 | Authors of single-authored docs | 91 |

| Article; proceedings paper | 2 | AUTHORS COLLABORATION | |

| Book | 1 | Single-authored docs | 112 |

| Book chapter | 13 | Co-authors per doc | 2.71 |

| Conference paper | 35 | International co-authorships % | 14.08 |

| Element | H_index | G_index | M_index | TC | NP | PY_start | |

|---|---|---|---|---|---|---|---|

| 1 | Hammoudeh, S. | 16 | 22 | 1 | 1549 | 22 | 2007 |

| 2 | Reboredo, J. | 13 | 13 | 1.18 | 1680 | 13 | 2012 |

| 3 | Mensi, W. | 12 | 14 | 1.2 | 1104 | 14 | 2013 |

| 4 | Tiwari, A. | 12 | 18 | 1.2 | 478 | 18 | 2013 |

| 5 | Yang, L. | 11 | 14 | 1.1 | 783 | 14 | 2013 |

| 6 | Hamori, S. | 10 | 12 | 0.56 | 454 | 12 | 2005 |

| 7 | Filis, G. | 9 | 11 | 0.75 | 1299 | 11 | 2011 |

| 8 | Nguyen, D. | 9 | 11 | 0.82 | 1101 | 11 | 2012 |

| 9 | An, H. | 8 | 9 | 1 | 247 | 10 | 2015 |

| 10 | Kang, S. | 8 | 10 | 1.14 | 321 | 10 | 2016 |

| 11 | Guesmi, K. | 7 | 14 | 0.78 | 359 | 15 | 2014 |

| 12 | Wang, Y. | 7 | 8 | 0.7 | 508 | 9 | 2013 |

| 13 | Zhang, Y. | 7 | 8 | 1 | 343 | 8 | 2017 |

| 14 | Aloui, C. | 6 | 7 | 0.55 | 856 | 7 | 2012 |

| 15 | Cai, X. | 6 | 6 | 0.86 | 352 | 6 | 2016 |

| 16 | Huang, S. | 6 | 6 | 0.86 | 170 | 7 | 2016 |

| 17 | Al-Yahyaee, K. | 5 | 5 | 1 | 242 | 5 | 2018 |

| 18 | Antonakakis, N. | 5 | 5 | 0.5 | 632 | 5 | 2013 |

| 19 | Ftiti, Z. | 5 | 5 | 0.56 | 157 | 5 | 2014 |

| 20 | Ghorbel, A. | 5 | 6 | 0.455 | 59 | 6 | 2012 |

| Country | No. of Articles | |

|---|---|---|

| 1 | China | 160 |

| 2 | United States | 50 |

| 3 | France | 33 |

| 4 | India | 30 |

| 5 | Turkey | 30 |

| 6 | Korea | 25 |

| 7 | United Kingdom | 22 |

| 8 | Japan | 21 |

| 9 | Saudi Arabia | 20 |

| 10 | Tunisia | 18 |

| Affiliation | No. of Articles | |

|---|---|---|

| 1 | Drexel University | 22 |

| 2 | IPAG Business School | 15 |

| 3 | Hunan University | 12 |

| 4 | Pusan National University | 12 |

| 5 | Kobe University | 10 |

| 6 | Montpellier Business School | 10 |

| 7 | South Ural State University | 10 |

| 8 | University of Sfax | 10 |

| 9 | Chiang Mai University | 10 |

| 10 | Zhongnan University of Economics and Law | 9 |

| # | Author | Source | Total Citations | TC per Year | Normalized TC |

|---|---|---|---|---|---|

| 1 | Kilian and Park [28] | International Economic Review | 865 | 61.79 | 9.07 |

| 2 | Sharif, Aloui, and Yarovaya [29] | International Review of Financial Analysis | 517 | 172.33 | 30.15 |

| 3 | Filis, Degiannakis, and Floros [30] | International Review of Financial Analysis | 403 | 33.58 | 5.74 |

| 4 | Sari, Hammoudeh, and Soytas [31] | Energy Economics | 315 | 24.23 | 7.19 |

| 5 | Wang, Wu, and Yang [32] | Journal of Comparative Economics | 314 | 31.40 | 2.36 |

| 6 | Antonakakis, Chatziantoniou, and Filis [33] | Economics Letters | 307 | 30.70 | 2.31 |

| 7 | Mensi et al. [34] | Economic Modelling | 264 | 26.40 | 1.99 |

| 8 | Basher and Sadorsky [35] | Energy Economics | 263 | 37.57 | 6.37 |

| 9 | Creti, Joëts, and Mignon [36] | Energy Economics | 252 | 25.20 | 1.90 |

| 10 | Mensi et al. [37] | Emerging Markets Review | 246 | 27.33 | 4.23 |

| Author Keywords | Occurrences | KeyWords Plus | Occurrences | |

|---|---|---|---|---|

| 1 | oil prices | 314 | oil prices | 465 |

| 2 | stock markets | 156 | stock markets | 317 |

| 3 | wavelet analysis | 84 | financial markets | 158 |

| 4 | exchange rates | 83 | volatility spillovers | 143 |

| 5 | volatility spillovers | 75 | exchange rates | 134 |

| 6 | DCC-GARCH | 71 | commerce | 132 |

| 7 | COVID-19 | 43 | costs | 119 |

| 8 | volatility | 42 | energy markets | 113 |

| 9 | hedge ratio | 39 | price dynamics | 110 |

| 10 | copula | 37 | volatility | 100 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Marín-Rodríguez, N.J.; González-Ruiz, J.D.; Botero Botero, S. Dynamic Co-Movements among Oil Prices and Financial Assets: A Scientometric Analysis. Sustainability 2022, 14, 12796. https://doi.org/10.3390/su141912796

Marín-Rodríguez NJ, González-Ruiz JD, Botero Botero S. Dynamic Co-Movements among Oil Prices and Financial Assets: A Scientometric Analysis. Sustainability. 2022; 14(19):12796. https://doi.org/10.3390/su141912796

Chicago/Turabian StyleMarín-Rodríguez, Nini Johana, Juan David González-Ruiz, and Sergio Botero Botero. 2022. "Dynamic Co-Movements among Oil Prices and Financial Assets: A Scientometric Analysis" Sustainability 14, no. 19: 12796. https://doi.org/10.3390/su141912796

APA StyleMarín-Rodríguez, N. J., González-Ruiz, J. D., & Botero Botero, S. (2022). Dynamic Co-Movements among Oil Prices and Financial Assets: A Scientometric Analysis. Sustainability, 14(19), 12796. https://doi.org/10.3390/su141912796