Abstract

Corporate social responsibility (CSR) has received significant attention from practitioners, encouraging companies to consider it as a business model for their sustainable development. This study examines the effect of CSR on the dynamic efficiency of the global airline industry from 2013 to 2017. The study integrates DuPont and two-stage network data envelopment analyses to evaluate global airline efficiency and its relationship with CSR. Multiple proxies are used to establish a performance evaluation method and analyze the performance of global airlines from the perspectives of their financial structure, production performance and CSR. The study examines the influence of CSR to global airlines’ production efficiency and CSR is measured according to environmental, social and governance activities. The findings are as follows: (1) the profitability of low-cost carriers (LCCs) is superior to that of full-service carriers (FSCs); (2) the energy and wealth-creation efficiencies of LCCs are superior to those of FSCs; (3) FSCs are more committed to CSR activities, and their CSR is positively correlated with overall production efficiency; and (4) environmental and social elements in CSR improve airline efficiency levels. Overall, this study suggests that global airlines should practice CSR to address challenges in the dynamic global airline industry.

1. Introduction

Business- and tourism-related travel have thrived since the early days of economic globalization and increasing per capita income, resulting in the development of a flourishing air transportation industry. Ilkhanizadeh and Karatepe [1] reported that airlines are reshaping their business models, adopting higher levels of corporate responsibility. Aguinis and Glavas [2] further highlighted that corporate social responsibility (CSR) contributes to customer choice and enables corporations to gain competitive advantages. Despite the rapid development of global airlines, potential risks persist, such as the talent gap and longer working hours, resulting in labor disputes and strikes. These risks may negatively influence company image and operations [3]. Additionally, Khan et al. [4] emphasized that carbon emissions are indisputably linked to environmental degradation, climate change and global warming, which raises questions regarding environmental sustainability. This was supported by Khan et al. [5], who agreed that the adoption of green strategies could be a promising step toward easing environmental problems and achieving a green business ideology. Bernal-Conesa et al. [6] indicated that CSR-oriented strategies improve organizational performance and affect the sustainable competitiveness of a company. As highlighted in recent studies by Ilkhanizadeh and Karatepe [1], there is a lack of understanding about the underlying mechanism that links CSR to outcomes. Hence, the following question presents itself: will CSR play a crucial role in determining the efficiency level of the global airline industry? This study makes an early attempt to analyze CSR initiatives that have been introduced by airlines.

This study takes the airline industry as its research subject and analyzes the financial and production performance of companies to establish an objective performance evaluation method. We also make an effort to evaluate airline company performance from a financial perspective. We use DuPont analysis to understand the profitability and return on equity of a company. A ratio, based on three financial ratios (net profit margin, asset turnover and equity multiplier), is used to comprehensively analyze the financial statuses of various companies and to perform deeper analyses and comparisons of operation outcomes [7]. DuPont analysis can be used to identify the strong and weak points of the financial performance of a company. However, its ratio analysis is a single index; it does not evaluate production capacity and, therefore, cannot be used to determine the overall performance of a company. Meanwhile, conventional data envelopment analysis (DEA) is used for black box-like and unidirectional evaluations, ignoring the relationships among variables and making it unable to provide management implications.

To counter these shortcomings and explore the production capacities of airline companies, this study uses the characteristics of airlines and employs input, intermediate, and output variables to develop a production evaluation framework. We use two-stage network data envelopment analysis (NDEA) to classify the production performance of companies, in terms of their energy and wealth-creation efficiencies. The method is able to provide efficiency values and simplifies production evaluations from different stages with multiple units, inputs, and outputs, along with a time factor. Subsequently, the directional distance function (DDF) is employed to measure the distance of the difference and its direction in order to identify potential improvements. The proposed benchmark companies can be used as learning models for companies with poor efficiency in terms of resource allocation and can also serve as references for improvements. DuPont analysis and two-stage NDEA can complement each other to rapidly and intuitively elucidate the financial structure and production efficiency of airline companies; however, the efficiency value alone cannot be used to compare the advantages and disadvantages of companies. This study further explores a technique for order preference based on the level of similarity to an ideal solution, i.e., DEA (TOPSIS-DEA), in determining the production performance ranking of each airline.

In the context of CSR, the airline industry is a high fuel-consuming and highly polluting sector; therefore, the relationship between airlines and the environment is crucial. This study also calculates the energy efficiencies of airlines and uses CSR indices to analyze their commitment to CSR based on three dimensions, namely, environmental, social, and governance. The analysis results can be used to suggest ways for airline companies to increase their CSR and further explore the relationship between CSR and production performance in order to sustain competitiveness.

Taken together, this study may be summarized as follows. (1) We use DuPont analysis to explore the financial structures of airlines. (2) We use two-stage NDEA to determine their production efficiency. (3) We further employ TOPSIS-DEA to rank and compare their production performance. Finally, (4) we explore various methods to improve CSR and examine the relationship between CSR and production performance and sustainable competitiveness. Our results show that the profitability of low-cost carriers (LCCs) is greater than that of full-service carriers (FSCs). Additionally, it was found that the energy and wealth-creation efficiencies of LCCs are both superior to those of FSCs. However, the study found that FSCs are more committed to practicing CSR activities, and that the environmental and social elements of CSR are positively correlated with overall production efficiency.

Overall, this study provides contributions to the literature from a few dimensions. First, this study makes an early attempt to integrate DuPont analysis, two-stage NDEA, and CSR for an in-depth analysis of the performance evaluation of airlines. Second, in terms of practical contribution, the study analyzes energy efficiency and wealth creation efficiency to provide directions for airline management in order to improve their operational processes. Third, the study addresses the improvements and variation ratios required by the airline industry by providing the target improvement analysis. Our results provide useful insights on the relationship between CSR and its indices to production efficiency of global airlines.

The next section of this study reviews previous literature. The third section outlines the research methodology and dataset of this study, and the fourth section discusses the research findings. The final section presents the conclusions of our study.

2. Literature Review

2.1. Theoretical Discussion

Resource-based theory suggests that having valuable, rare, inimitable, and non-substitutable corporate resources gives a company a competitive advantage [8]. In order to achieve sustainable development for both the company and society, CSR activities require the coordination of resources, and the resources’ effectiveness regarding the environment and society can be a competitive advantage for companies.

Stakeholder connections are involved when businesses use resources to create wealth, including those who have direct access to those resources. Businesses must manage their connections with different stakeholders well to turn them into strategic resources and boost their competitive edge. Under the guidance of resource-based theory, this study examines the role of CSR on the efficiency of the global airline industry.

2.2. Airline DEA Efficiency Studies

International Air Transport Association’s statistics on the financial performance of international airlines shows that these airlines have made a commitment to sustained profit growth. The airline industry currently has net profit larger than its capital investment and generates approximately USD 30 billion net profit annually [9]. In addition, based on a 2018 report by the Air Transport Action Group (ATAG), global airlines provided 65.5 million job opportunities in 2016, and the economic benefits created directly or indirectly from tourism totaled USD 2.7 trillion, accounting for 3.6% of global GDP [10]. These airline trade group reports indicate that the airline industry has thrived in recent years and plays a crucial role in global economic activities.

In addition, studies related to the airline industry are becoming more essential as airlines develop rapidly. Lee used the variables of DuPont analysis and the return on the investment model to explore the effect of operational performance on the financial performance of airlines [11]. Kuljanin et al. [12] used fuzzy DEA to analyze and compare the performance of major European airlines. Zhang et al. [13] used two-stage NDEA and operations and stock market indices to evaluate airline performance. They opened the black box of conventional DEA and provided indices for business operators to improve their management and performance. Pineda et al. [14] proposed an integrated model that combined data mining and multiple criteria decision-making and used a combined method to identify and diagnose the financial and production performance of airlines. Other studies have indicated that a single index cannot comprehensively represent company performance. Therefore, this study combines multiple indices to construct a global airline performance evaluation method for management decision-makers.

In terms of airlines and energy, Cui et al. [15] proposed a dynamic environment DEA model and used greenhouse gas emissions as the undesirable output to research the effect of restrictions of the European Union emissions trading system on airline performance. Brueckner and Abreu [16] constructed an aviation fuel usage model to understand changes in airline fleets and airline operations and studied fuel prices, fuel usage, and carbon emissions. They proposed that reducing flight delays could reduce fuel usage and carbon emissions. Despite global airlines strongly advocating for the use of aviation biofuel, fossil fuels remain the main source of energy for most airlines. Dodd et al. [17] used case studies to explore why the progress of the renewable energy industry was stalling. They analyzed the perspectives of renewable energy producers and airlines and identified the prospects of the aviation biofuel industry to increase the percentage of airlines using renewable energy to reduce their impact on the environment. In sum, the literature has indicated that airline energy usage plays an essential role in the airline industry, and energy efficiency affects airline efficiency. Therefore, this study integrates the factors of time into its discussion of global airline performance and uses two-stage NDEA to explore the energy efficiency and wealth-creation efficiency of airlines.

2.3. CSR and Performance

Companies that are seeking to increase profit, expand investments, and increase shareholder wealth should also pursue social justice and fulfill their social responsibility [18]. CSR can be considered the responsibility of companies to all stakeholders. In other words, companies should seek a balance between company growth and social improvement in the pursuit of their companies’ operational performance goals. In addition to facilitating economic prosperity, companies should also shoulder the responsibility of social good and environmental sustainability. The airline industry is large and its carbon emissions account for 2% of global carbon emissions [10]. The entire industry is closely tied to the environment, and the CSR performance of airlines is related to the environment and human well-being worldwide. Park [19] revealed that airlines committed to CSR improved customer satisfaction and customer views of the airlines, which in turn improved airline reputations. Phillips et al. [20] reported how intangible resources of value chain capabilities, namely CSR culture and leadership, affect company performance, customer satisfaction, and financial performance. Khan et al. [21] documented that both governments and organizations’ efforts to reduce environmental hazards have become a crucial tool for attaining supply chain sustainability. The findings also revealed that three dimensions of organizational sustainability—i.e., operational, environmental, and economic performance—have a significant effect on organizational performance. Khan et al. [22] further explained that the circular economy practices that focus on the efficient use of resources may reduce business risk and improve environmental sustainability. Therefore, this study integrates CSR analysis to explore the sustainable competitiveness of airlines.

The literature review demonstrates that the airline industry is a high-growth industry. Previous studies mostly used one index to evaluate the performance of airlines. This study is the first study to combine multiple indices, namely DuPont analysis, two-stage NDEA, and CSR, for airline performance evaluation. This study analyzes airline performance from a financial structure perspective, a production performance perspective, and a CSR perspective to perform an objective and comprehensive evaluation and discover companies with growth potential and sustainable competitiveness.

3. Research Design

This section establishes the process of the airline industry’s two-stage production efficiency evaluation framework used in this study. The variables required by the framework and the financial data required for the DuPont analysis are acquired from the Compustat database. The CSR data of companies are acquired from Datastream, a global stock market and economics database. The DuPont analysis, two-stage NDEA, and CSR analysis combine three indices, namely financial indices, production performance indices, and CSR indices, to evaluate the airline industry’s performance. The evaluation of production efficiency uses the DDF to measure the efficiency value in a two-stage NDEA. Additionally, to compare the advantages and disadvantages of airlines, TOPSIS-DEA is used to rank and identify the production performance ranking of the observed airline industry.

3.1. Two-Stage Production Efficiency Evaluation Process Framework

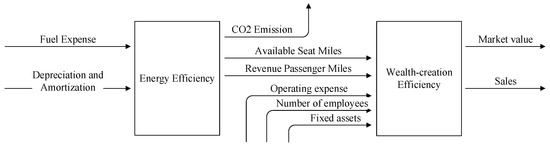

The two-stage production efficiency evaluation process framework constructed by this study is presented in Figure 1. In the first stage, the study uses fuel expense, depreciation, and amortization as inputs to measure the energy efficiency. Fuel expense includes the amount of fuel consumed by aircrafts. Depreciation and amortization refer to the loss of fixed assets and intangible assets, including tangible hardware equipment invested annually by the airline for production and intangible assets, such as software and patents. The main fixed assets of airlines are aircrafts. Through the consumption of fuel and energy, depreciation of input hardware equipment, and amortization of intangible assets, airlines produce available seat miles and revenue passenger miles, which are used to generate profits.

Figure 1.

Airline industry two-stage production efficiency evaluation process framework.

In this framework, available seat miles and revenue passenger miles are the intervening variables that link the first stage and the second stage of the production process. In order to accurately evaluate production efficiency, this study evaluates the effect of greenhouse gas emissions produced from fossil fuel consumption on the environment. As carbon dioxide is a greenhouse gas that has a major impact on the environment, this study set carbon dioxide emissions as the mediate undesirable output.

In the second stage (wealth-creation efficiency), the available seat miles and revenue passenger miles from the first stage are used as the input and operating expenses, number of employees, and fixed assets are used as mediate inputs. Financial resources, labor resources, and material resources are used to calculate the wealth that can be generated. Market value and sales are the outputs; they represent the company’s market value and revenue created from the wealth-creation process and the overall production process, respectively.

3.2. Measurements of Sustainability Performance and Corporate Performance

We collected the data from the Thomson Reuters Eikon database to measure the sustainability and corporate performance of 29 enterprises in the transport manufacturing industry from 2015 to 2019. During the sample period, the sample included 48 MNEs in the transport manufacturing industry; however, we eliminated 19 enterprises due to insufficient data. Hence, the final sample includes 145 firm-year observations. We employed a two-stage dynamic DEA model [23] that includes sustainability performance (stage 1) and corporate performance (stage 2) with a set of desirable output and undesirable outputs to examine 29 enterprises in the transport manufacturing industry adequately. This measure yields a score between 0 and 1 for efficiency. We also extend the model by using total assets as a carry-over variable, as indicated in Table 1.

Table 1.

Operational definition of DEA variables.

3.3. Data Source and Variables Used for DEA

This study analyzed the data of 23 global airlines from 2013 to 2017, including 13 of the top 22 airlines listed in the 2019 Forbes Global 2000, a ranking of the top 2000 public companies worldwide. Data of this study were obtained up to the year of 2017 as the global financial conditions were tightened in 2018 [24], and most of the emerging markets were affected. In other words, this study focused on the CSR to airline performance before the global financial crisis in 2018 for consistency purposes and without any outlier issues.

These 13 airlines account for 75.75% of all market value and 80.22% of all profit in the airline industry. This study uses the International Civil Aviation Organization [25] classification to classify airlines as FSCs and LCCs and explores the two classes separately.

DEA is a nonparametric analysis method that does not require a production function or efficient frontier for its input and output. This performance evaluation method can evaluate multiple input variables, output variables, and evaluation subjects simultaneously. The Kolmogorov–Smirnov test is used to calculate the p value of all the variables and all the results are smaller than 0.01, indicating that the data distribution is not a normal distribution and is suitable for DEA. When performing DEA, all the evaluated subjects, namely airlines, are considered as a single decision-making unit (DMU).

The correlation analysis of the variables indicates that the input and output of the first stage, the second stage, and the overall evaluation model are positively correlated. This result conforms to the requirement for an isotonic relationship between the input and output of the DEA and the requirement for homogeneity within the research subject population of the DEA. In terms of the number of DMUs required for the DEA, this study uses the standard proposed by Dyson et al. [26], which argued that the number of DMUs evaluated cannot be less than two times the product of the number of input variables and the number of output variables [27].

This study uses two inputs, one mediate undesirable output, two intervening variables, three mediate inputs, and two outputs as factors to assess the energy efficiency and wealth-creation efficiency of the production process. The definitions and related references are listed in Table 1. This study follows the prior studies [14,27,28,29,30,31] for DEA variable selection. This study uses the CSR scoring indices of the Global Reporting Initiative, and employs the dimensions of environmental, social, and governance (ESG) to evaluate CSR. The ESG indices of the Datastream database are used to obtain the proxy variables of CSR from each perspective. The definitions of the variables used are listed in Table 2.

Table 2.

Definitions of proxy variables in CSR.

3.4. Methodology

3.4.1. DuPont Model

DuPont analysis is a comprehensive analysis system constructed by DuPont de Numours, Inc. DuPont analysis makes a simultaneous analysis of efficiency and profitability possible, and it shows how they interact to determine the return on assets [32]. The system is based on factors of return on equities (ROE) and is a method used to factorize financial ratios. It can effectively reflect the interconnections between indices that affect the profitability of a company and reasonably analyze the financial status and operation results of a company. DuPont analysis explains how ROE is affected by three factors, namely operation efficiency, asset usage efficiency, and financial leverage. Operation efficiency, asset usage efficiency, and financial leverage are assessed using net profit margin (NPM), asset turnover (ATO), and equity multiplier (EM). The model represents the profitability, management capability, and financial structure of a company, respectively. The calculation equation is as follows:

ROE = NPM × AT × EM

NPM = Net income/revenue; AT = sales/average total assets; EM = average total assets/average shareholders’ equity.

3.4.2. Two-Stage NDEA and DDF

This study next integrates DEA to conduct performance evaluations to interpret the production efficiency. We employ a DEA model as it provides a more precise measure of performance by implicitly allowing for weighting among inputs [33]. Moreover, almost all DEA models undertake multi-input and multi-output indicators to evaluate the efficiency scores [34], thereby can account for multiple dimensions concurrently. Charnes et al. [35] proposed window analysis, which places data from a multiyear period into a model for analysis. They compared the DMU performance from different periods to overcome the disadvantages of conventional DEA, which only analyzes the cross-sectional data of one period. In addition, DDF using a slack-based measure is able to process the problem of non-radial difference and overcome a limitation of the conventional DEA, which requires nonnegative data to be operated [36]. Fukuyama and Matousek [37] proposed a two-stage NDEA by opening the black box of the conventional DEA and dividing the production process into two stages. The two-stage NDEA analyzes the efficiency of different stages simultaneously, which yields details of the production process and helps managers make improvements. Chiu et al. [38] and Premachandra et al. [39] included intermediate input and undesirable output, respectively, and revised the efficiency deviation during the performance evaluation process. By applying the two-stage DEA model, the study can obtain the efficiency score of each stage and its corresponding rank [40]. Hence, we can utilize the relative advantages of the two stages when conducting an efficiency decomposition. This study integrates two-stage NDEA and DDF. The data have number of airlines, and each airline is an independent DMU. Each includes number of inputs, number of intervening variables, and number of outputs in the first and second stages. Let the input and output of the production possibility set be the convex set, and define set as the intervening variables generated from the input , and the output generated from the intervening variables . The definition of the DDF equation of the two-stage DEA is presented as follows:

This study follows the work of Chiu et al. [38] and uses as the reference function of DDF. Therefore, the evaluation of the efficiency under the convex limitation can be presented with the following linear function:

where subscript is the evaluated airline, is the input of the company, is the intervening variable of the variable and is the output of the company. and are the nonnegative weight vectors of the first and second stage, respectively.

The efficiency of the first stage is defined as and represents the energy efficiency; the efficiency value is between 0 and 1. The efficiency of the second stage is defined as and represents the wealth-creation efficiency. To ensure consistency among the efficiencies, the efficiency value of the wealth-creation efficiency uses a derivative between 0 and 1. The energy efficiency of an airline in stage one and the wealth-creation efficiency in stage two are considered efficient if and are both equal to 1.

The study next employs TOPSIS-DEA ranking [41,42,43] to rank the DMUs using the calculated efficiency values. DEA is applicable for identifying efficient benchmark learning models; however, all the DMUs located at the efficient frontier are benchmark companies, with an efficiency value of one. This method incorporated the advantages of DEA and multiple criteria decision-making (MCDM) and resolves problems that occur in other methods. TOPSIS-DEA integrates the concept of the best and worst benchmark of TOPSIS into the DEA. Two virtual DMUs, namely the ideal decision-making unit (IDMU) and anti-ideal decision-making unit (ADMU), are added into the DEA. IDMU represents the best company that used the lowest number of inputs to generate the highest number of outputs and the lowest number of undesirable outputs. Contrarily, ADMU indicates the worst company that used the highest number of inputs, but generated the lowest number of outputs and the highest number of undesirable outputs. The virtual best company and worst company in the first stage and the virtual best company and worst company in the second stage are defined as follows:

The constructed and are separately added into the DMUs of the DEA efficiency model and inefficiency model to calculate the efficiency value. In other words, the efficiency model and the inefficiency model in the first stage and the second stage both had DMUs that are used to find solutions. In the functions, and represent the of the best virtual company and the best relative efficiency of the evaluated airline , respectively; and denote the of the worst virtual company and the worst relative efficiency of the evaluated airline , respectively. The relative closeness between the evaluated airline and the best virtual company is defined as follows:

In this function, is the distance in the efficiency model between the evaluated airline and the best benchmark , whereas is the distance in the inefficiency model between the evaluated airline and the worst benchmark . A smaller and a larger indicate that the evaluated airline is closer to the best benchmark and further from the worst benchmark, signifying that the company has high performance. Therefore, a larger signifies that the production performance of a company improved. In addition, and are located on the efficient frontier and the inefficient frontier, respectively. Therefore, and are both equal to 1, and can be interpreted as the distance between the evaluated DMU and the two frontiers. A larger indicates that the DMU is closer to the efficient frontier and further from the inefficient frontier and implies a higher ranking. The index combines the best and worst relative efficiency of each DMU. Therefore, it can be used to provide an overall evaluation for each DMU and obtain the overall ranking for number of actual DMUs.

3.5. Regression Model

The study employs bootstrap ordinary least square (OLS) regression, as bootstrapping is a statistical procedure that resamples a single dataset to create many simulated samples. This process allows for the calculation of standard errors, confidence intervals, and hypothesis testing. To achieve the research objective to examine the role of CSR in the efficiency of the global airline industry, we have the following research equation model:

where β0 is a constant term; βn, n = 1 to 6, are coefficients of the respective independent/control variables; i = firm; t = year; and ε is an error term. Eff represents efficiency using three efficiency measurements, namely overall productive efficiency, energy efficiency and wealth-creation efficiency. CSR is measured by environmental, social, and governance. E is environmental; S is social; G is governance. We include firm characteristics to control for performance specificity. Return on assets (ROA) is controlled, as it is related to the net income included in the output variables of the DEA model [44]. We also control the firm size (SIZE) [45] and equity multiplier (EM) [46].

4. Empirical Results

4.1. Financial Structure Analysis

Following the work of Valeri and Baggio [47], Valeri and Baggio [48] and Valeri [49] to identify the samples’ features, we classify all observations into three groups, full sample, FSC and LCC. Table 3 demonstrates the DuPont analysis results, which include ROE, NPM, AT and EM from 2013 to 2017. The univariate results show that the airline industry benefitted from global oil price drops in the second half of 2014, which reduced operating cost; thus, ROE and NPM increased from 2013 to 2015 for all groups. However, the results show that ROE and NPM decreased in 2016 and 2017 for all groups. In addition, the Mann–Whitney U Test (M–W U Test) results document that the differences between the ROE of FSCs and LCCs are insignificant, but are found to be significant for NPM.

Table 3.

DuPont analysis results.

With respect to AT, Table 3 shows that AT of the full sample, FSCs, and LCCs did not change considerably over the course of 5 years, signifying that the asset usage rate and asset management model did not change much. In terms of EM, the results reveal that EM of all groups decreased from 2015 to 2017, particularly for FSCs, and the decrement rate was more than that of LCCs. This implies that shareholder equity grew at a faster pace than the growth of total assets, the EM and the debt ratio decreased rapidly, and the financial structure was stable. On the other hand, the M–W U Test result demonstrates that the EM of FSCs is significantly larger than that of LCCs. FSCs are larger and provide more services; hence, they establish affiliated companies to divide the workloads. FSCs have more diverse performance in financial indices such as accounts payable and accounts receivable.

4.2. Production Efficiency, Energy Efficiency and Wealth-Creation Efficiency Analysis

The study next employs DEA to compare the efficiency from three perspectives, namely overall production efficiency, energy efficiency and wealth-creation efficiency. First, the overall production efficiency is analyzed, and the results are listed in Table 4. The annual coefficient of variation (CV) is calculated for the measurement of the dispersion of the overall efficiency value. The results document that the average efficiency value of the full sample, FSCs and LCCs is 0.6743, 0.6416 and 0.7357, respectively. This implies that LCCs demonstrated a higher production efficiency level, as compared to the full sample and FSCs. However, CV of FSCs converged, indicating that the efficiency of the operation models of FSCs experienced a higher dispersion, as compared to the full sample and LCCs.

Table 4.

Comparison of efficiency change.

With respect to energy efficiency, from 2013 to 2016, the efficiency of the full sample and FSCs increased annually, and the CVs of different airlines converged. From 2013 to 2015, the efficiency of LCCs showed a similar trend to that of the airline industry and FSCs, and the efficiency did not change much in 2016. This implies that from 2013 to 2016, FSCs and LCCs stably reduced their energy usage; the difference between the efficiency of the two classes of airlines reduced and the airline industry became more mature. Consistently, LCCs still maintained the higher energy efficiency level as compared to the full sample and FSCs on average from 2013 to 2017. In addition, it was found that the CV of FSCs was larger than that of LCCs during the observed period, indicating that the growth of FSCs was superior to that of LCCs. Therefore, the energy efficiency of FSCs was lower than that of LCCs in general because LCCs mostly offer short-haul flights. In recent years, FSCs have established LCC subsidiary companies for strategic purposes. According to the significant result of the M–W U test, this is explained as there is a significant difference in the energy efficiency level between FSCs and LCCs. A possible explanation is that FSCs have many LCC subsidiary companies.

The results remain quantitatively the same when the study compares the wealth-creation efficiency level among the three groups. Table 4 also presents the wealth-creation efficiency value. The results show that full sample and FSCs’ wealth-creation efficiency level increased stably from 2013 to 2017, with the exception of 2014, and the CVs of different airlines converged. The efficiency of LCCs reduced annually during the same time. Therefore, the wealth-creation capability of FSCs increased annually, whereas the wealth-creation capability of LCCs decreased annually from 2014 to 2017. However, it is observed that the average wealth-creation efficiency level of LCCs remained the highest, as compared to the full sample and FSC. On the other hand, the CV of the 5-year efficiency value of LCCs was greater than that of FSCs, indicating that the wealth-creation efficiency of LCCs had larger fluctuations. FSCs operate at a larger scale; therefore, they have more stable wealth-creation efficiency performances. The M–W U test result demonstrates that the difference between the efficiency of FSCs and LCCs is significant and the result implies that the wealth-creation efficiency of FSCs is currently lower than that of LCCs. As a whole, the energy efficiency of FSCs and LCCs was superior to their wealth-creation efficiency, and the difference between the energy efficiency of the three groups was smaller than the difference between the wealth-creation efficiency level. Therefore, compared to wealth creation, the airline industry can improve its energy efficiency. In addition, airline companies with lower wealth-creation efficiency should improve their management of production factors that are falling behind and rapidly improve their production competitiveness.

4.3. Target Improvement Analysis

This study further analyzes the target improvements required by FSCs and LCCs to further explore the usage of each variable of the two different operation models. Table 5 demonstrates the improvements and variation ratios required by the full sample, FSCs, and LCCs from each factor of production. In terms of the inputs of the full sample, the factor of production that requires the largest improvement is operating expenses, followed by fuel expense, depreciation and amortization, number of employees, and fixed assets. This indicates that the airline industry should prioritize improving its management of costs, which can be achieved by methods such as organization reforms, strict management of sales, and fee management, to reduce unnecessary expenditures; these methods can improve the usage of financial resources, labor resources, and material resources. The improvement methods include precisely tracking global oil price fluctuations and signing periodical fuel contracts with oil companies to reduce fuel expenses or using more fuel-efficient flight modes to reduce costs and carbon dioxide emissions. Retiring older aircrafts and purchasing newer aircrafts or upgrading current aircrafts can reduce depreciation and amortization and increase fuel efficiency, thereby reducing fuel requirements and carbon dioxide emissions. These measures can reduce costs and protect the environment by reducing companies’ carbon footprint. Improving the management of labor resources can be achieved by downsizing; after downsizing, orders can be executed quickly to thoroughly exert employee value and avoid wasting labor resources. After costs and business development strategies are taken into consideration, tasks with large labor or financial costs could be outsourced to improve internal management efficiency.

Table 5.

Target improvement analysis.

In terms of the usage of fixed assets, old aircrafts with low fuel efficiency should be retired and replaced with newer models to improve the use efficiency of fixed assets. The airline industry has high fixed costs, which results in high operating costs. Therefore, airlines must ensure that their operating profit stays higher than their variable costs and attempt to create more output to compensate for their fixed costs, thereby creating the economic benefits of production. The industry is capable of effectively producing available seat miles and revenue passenger miles; however, its market value and sales still have considerable room for improvement. Airlines can improve their transparency by revealing their operation statuses and publishing comprehensive and precise financial reports to provide investors with a clearer understanding of company operations. Companies can also increase their CSR practice or improve their company image to improve investor confidence, in turn generating higher market value. In addition, companies can use frequent flyer plans to increase customer loyalty and return rates, form strategic alliances with other airlines, and sign code sharing agreements. These measures can help airlines to expand their routes offered and strengthen their goodwill and public image. Moreover, airlines can also share the large cost of the development of new jet engines to reduce the risk of research and development.

Improvements in the factors of production of FSCs and LCCs are explained as follows. In terms of inputs, the ratios of fuel expenses, depreciation and amortization, and operating expenses that FSCs should improve are higher than those of LCCs. Fuel demand increases as flight miles increase, and LCCs avoid using older aircrafts with low fuel efficiency to minimize their operating costs. Therefore, FSCs require more reductions in their fuel expense than LCCs, which mainly operate short-haul flights. In addition, FSCs provide more services and have more fixed assets and intangible assets, which results in greater depreciation and amortization. FSCs may take advantage of their larger scale and superior bargaining power to purchase cheaper fuel from oil companies. Additionally, they may also upgrade aircraft performance and use fuel-efficient flight modes to reduce their fuel demands. By managing their assets to reduce fuel expenses, depreciation and amortization, and operating expenses annually, FSCs can improve the use efficiency of their costs.

In terms of the usage of fixed assets, FSCs exhibit superior usage of their fixed assets compared to LCCs, possibly because FSCs are larger, have been operating longer, and have higher goodwill than LCCs. This enables FSCs to generate the same wealth using fewer fixed assets. In terms of output, the required rate of reduction in carbon dioxide emissions of FSCs is reducing annually, and the performance of FSCs is superior to that of LCCs. This indicates that FSCs have endeavored to improve the efficiency of their energy usage and reduce their environmental impacts; they strive to protect the environment during production.

With respect to the available seat miles and revenue passenger miles, the improvement ratios of FSCs and LCCs are similar because the airline industry is a high operating cost industry. This has prompted airlines to optimize aircraft usage and increase available seats, resulting in little room for improvement. In terms of market value, the performance of LCCs is superior to that of FSCs; however, FSCs have an edge over LCCs in sales.

4.4. TOPSIS-DEA Ranking

This study next integrates the TOPSIS-DEA of Rakhshan [42] into the two-stage production efficiency evaluation process and uses the variable returns to scale (VRS) model to calculate the efficiency values and inefficiency values. This method is employed to obtain the TOPSIS-DEA ranking of each DMU during the energy efficiency stage. Subsequently, the results demonstrate the rankings of the 23 global airlines based on the energy efficiency level, wealth-creation efficiency level, average efficiency level and overall efficiency level during the observed period.

Table 6 shows the TOPSIS-DEA efficiency rankings of the 23 global airline companies. With respect to energy efficiency level, the three airlines with the highest rankings in order were SkyWest, Controladora Vuela Compania, and Spirit Airlines; SkyWest is an FSC, whereas Vuela Compania and Spirit Airlines are LCCs. The three airlines with the lowest rankings were China Eastern Airlines, China Southern Airlines, and Air France-KLM and all three airlines are FSCs. Despite SkyWest, the airline with the highest ranking, is an FSC and the average ranking of LCCs is 7.75, which is higher than the average ranking of FSCs (14.27). In addition, the three airlines with the lowest rankings are all FSCs. In other words, most LCCs had a higher ranking than FSCs in the energy efficiency stage.

Table 6.

TOPSIS-DEA overall efficiency ranking.

The study also uses the TOPSIS-DEA ranking method to calculate the ranking of global airlines’ wealth-creation efficiency level. The results document that Controladora Vuela Compania, Allegiant Travel Company, and Hawaiian Holdings were the top three highest ranking in the wealth-creation efficiency stage. Controladora Vuela Compania and Allegiant Travel Company are LCCs, whereas Hawaiian Holdings is an FSC. The three airlines with the lowest rankings are Ryanair Holdings, Deutsche Lufthansa, and SkyWest; Ryanair Holdings is an LCC, whereas Deutsche Lufthansa and SkyWest are both FSCs. The average ranking of LCCs is 10.13, slightly higher than the average ranking of FSCs [19]. However, FSCs and LCCs have large differences within their respective class, in terms of wealth-creation efficiency. Therefore, the rankings of FSCs and LCCs in wealth-creation efficiency show small differences.

The study further compares the average ranking based on the energy efficiency ranking and the wealth-creation efficiency ranking and uses the average to rank the airlines again and obtain an overall efficiency ranking. The three airlines with the highest overall efficiency rankings are Controladora Vuela Compania (LCC), Allegiant Travel Company (LCC), and Hawaiian Holdings (FSC). This implies that the LCC low-cost operation strategy is more competitive in the airline industry. The three airlines with the lowest rankings are Deutsche Lufthansa, LATAM Airlines Group, and Air France-KLM; all three airlines are FSCs. In other words, the comparison of average efficiency level demonstrates that LCCs have higher rankings.

4.5. Relationship between CSR and Production Performance

The United Nations Global Compact indicated that companies should practice CSR and help societies improve while making a profit [29]. This green circular economy of giving back to society can help companies earn a reputation for philanthropy and represents the sustainable competitiveness of companies. This study uses the ESG scores to represent CSR initiatives. At this section, the study evaluates the ESG scores and compares the scores among the three groups.

The data presented in Table 7 show the ESG scores of the full sample, FSCs and LCCs. On average, FSCs have lower ESG combined scores and ESG controversies scores than LCCs, but FSCs are collectively superior to those of LCCs in ESG score. Moreover, the study further broke down the CSR score into its three main elements, environmental, social and governance. The results report that the three elements’ scores of CSR are higher in FSCs as compared to LCCs. We can, therefore, observe that FSCs had superior performance in practicing CSR. The results also reveal that FSCs have larger asset scales than LCCs; hence, they are more easily followed by the media, and have more reports of controversies and CSR initiative and the operation model of LCCs focuses more on cost-cutting. Overall, FSCs perform the best in CSR among the three groups when we focus on the three elements of ESG.

Table 7.

Descriptive statistics of CSR proxy variables and asset scale.

4.6. Correlation Analysis between CSR and Efficiency

In Table 8, the study findings on the correlation of CSR proxies, namely ESG combined score, ESG controversies score, ESG score and its three elements (environmental, social and governance), are displayed. The findings imply that CSR proxies are significantly correlated with each other. The ESG score is found to be significantly positively correlated with the ESG combined score, but significantly negatively correlated with the ESG controversies score. In addition, the higher the controversies score, the lower the environmental, social and governance scores. Companies with poor (low) ESG controversies scores should prioritize improving this score to rapidly improve their ESG combined score. The ESG score is positively correlated with environmental factors and social factors. Therefore, improving environmental and social factors enable companies to obtain a higher ESG score, whereas corporate improvement of governance factors is less important. The environmental score is found to be significantly positively correlated to the social and governance score.

Table 8.

CSR proxy variable correlation analysis.

In Table 9, overall production efficiency is positively correlated with ESG score, indicating that practicing CSR policies has a positive relationship with overall production efficiency. This implies that airline companies with CSR practices can generate a positive brand image, establish brand trust in consumers, and increase brand loyalty, resulting in stable and long-term financial benefits. Moreover, the correlation analysis also shows that CSR initiatives enhance the energy efficiency and wealth-creation efficiency of the global airline industry. However, it is found that the ESG controversies score has a significantly negative relationship with energy efficiency of the observed airline companies.

Table 9.

Correlation analysis of production efficiency and CSR proxies.

4.7. Regression Analysis between CSR and Efficiency

This study further conducts a regression test to examine the impacts of the three elements of ESG on the efficiency of the global airline industry. Table 10 presents the bootstrap truncated regression results of ESG for three different measures of efficiency, namely overall production efficiency, energy efficiency and wealth-creation efficiency. Based on the regression results, the coefficient value of the environmental element is positively associated with overall production efficiency and wealth-creation efficiency. That is, the environmental element in CSR improves the airline efficiency level. This suggests that environmental friendliness can be effective in increasing corporate value and efficiency and the finding is consistent with the work of Khan et al. [21]. In addition, Table 10 also shows that the social element positively and significantly affects wealth-creation efficiency and this implies that social responsibility commitment and initiatives can be used to improve firm efficiency levels, which is in line with the results of Philips et al. [20], who agreed that social activity improves firm performance. However, it is found that governance is insignificantly positively associated with efficiency and this indicates that governance does not enhance the global airline efficiency level. This is supported by Shakil et al. [50]’s study, which found that the governance pillar has no significant impact on the 93 emerging markets’ bank performance.

Table 10.

Regression results.

5. Conclusions and Discussion

5.1. Findings Discussion

To avoid the limitations of evaluating airlines with a single index, this study integrates DuPont analysis, two-stage NDEA, and CSR analysis to evaluate the performance of the airline industry and individual airlines. The study results reveal that the airline industry was flourishing during the study period. Our study concludes the following. First, from a financial perspective, the profitability of LCCs is superior to that of FSCs. However, FSCs can use their large scale as an advantage to defend against the impacts of global oil price fluctuations and maintain stable profits. Second, from the production efficiency perspective, LCCs have superior performance compared to FSCs in energy efficiency and wealth-creation efficiency. However, the energy efficiency and wealth-creation efficiency of FSCs are increasing annually and are reducing the difference between FSCs and LCCs. The energy usage capability of both classes of airlines is superior to the wealth-creation capability of both classes of airlines. Third, most LCCs rank higher in the energy efficiency ranking than FSCs; however, in the wealth-creation efficiency ranking, the difference in the ranking of both classes is small. Most airlines employ their advantage in energy efficiency to generate more wealth. Fourth, in terms of CSR performance, the ESG performance of FSCs is superior to that of LCCs; therefore, the ESG score of FSCs is higher. However, most FSCs have a larger asset scale and attract more media attention, including negative attention. Consequently, the ESG combined score of the two classes of airlines is similar. If FSCs can improve their brand image and reduce the number of controversies they are involved in in the media, their CSR performance would quickly surpass that of LCCs. Energy efficiency and wealth-creation efficiency are positively correlated with ESG score. Overall production efficiency is also positively correlated with ESG score. Based on the OLS regression results, environmental and social elements in CSR activities improve airline efficiency levels.

5.2. Research Implications and Contributions

This study provides significant research implications. For the theoretical implication, resource-based theory suggests that there is a need for environmental and societal well-being improvement that will bring significant impact to corporate efficiency. In addition, the theoretical basis of this study can be used to investigate the organizational need for significant elements of environmental care and society, and governance. Regarding practical implication, practicing CSR is significantly positively correlated with overall production efficiency. Hence, companies that strive to practice CSR can generate positive reputations, establish brand trust, and increase brand loyalty, resulting in stable and long-term financial benefits. However, as the airline industry is developing, CSR cannot be ignored; companies should not sacrifice social welfare, including the environment and labor rights, for higher profit. In recent years, labor disputes concerning overtime pay have become an urgent problem for companies; it requires companies to balance reducing costs and providing a suitable work environment.

In conclusion, LCCs has developed rapidly during the study period, and their 5-year average performances are superior from a financial perspective, a production perspective, and a CSR perspective; they have excellent competitiveness. However, FSCs are growing steadily and their performance is stable. This study uses multiple indices to evaluate airlines’ performance, analyze airlines’ financial structures, explore airlines’ production efficiency, and rank airlines according to their efficiency. In addition, this study identifies the crucial factor of production for each airline and integrates production performance and CSR to determine whether an airline has sustainable competitiveness. The objectives of this study are achieved, and the results can provide company managers with a reference for making improvements.

5.3. Limitations and Future Studies

This study is limited by the completeness of data and only analyzes data of 23 airlines between the years 2013 and 2017. Future studies can extend the study period and analyze more comprehensive data. This study provides suggestions for academia, industry, and the government. In terms of academia, this study integrates DuPont analysis, two-stage NDEA, and CSR, and uses TOPSIS-DEA to rank the production performance of companies and identify benchmark companies. Multiple indices are used to establish a performance evaluation method, which is used to analyze airlines from a financial, production, and CSR perspective and determine their sustainable competitiveness. This method can be applied in future studies of different industries. The factor of production in the two-stage production efficiency evaluation process framework must be substituted when evaluating different industries to match the industry characteristics.

Future studies can also explore and compare the airline industry with other industries and provide different perspectives to achieve a more objective and in-depth study. In terms of the industry, the results of the study can provide directions of improvement for company managers, so that companies with relatively poor performance can learn from the practices of benchmark companies. Airlines worldwide can also mimic these benchmark companies to improve their production capacity and promote the development of the airline industry. In terms of policy, the study results can be used by the government to provide assistance to companies, improve policies, and stimulate industry development. Since early 2020, industries worldwide have been affected by the COVID-19 pandemic [22]. Consequently, several airlines announced the suspension of flights and possible future bankruptcy. Given the impact of the coronavirus pandemic, the spatial and temporal background of the research period is drastically different from that of the date of writing. Future studies can analyze how major incidents impact and affect the airline industry and provide managers with suggestions to overcome the current predicament.

Author Contributions

Conceptualization, F.-C.K.; methodology, I.W.K.T.; software, F.-C.K.; validation, F.-C.K.; formal analysis, F.-C.K.; investigation, F.-C.K.; resources, H.-C.C.; data curation, H.-C.C.; writing—original draft preparation, I.W.K.T.; writing—review and editing, F.-C.K.; visualization, Y.-S.L.; supervision, F.-C.K.; project administration, I.W.K.T. All authors have read and agreed to the published version of the manuscript.

Funding

The authors would like to thank Universiti Malaysia Pahang for financially supporting this research (University Research Grant Scheme RDU223303).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data that support the findings of this study are available from the corresponding author, upon reasonable request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ilkhanizadeh, S.; Karatepe, O.M. An examination of the consequences of corporate social responsibility in the airline industry: Work engagement, career satisfaction, and voice behavior. J. Air Transp. Manag. 2017, 59, 8–17. [Google Scholar] [CrossRef]

- Aguinis, H.; Glavas, A. What we know and don’t know about corporate social responsibility: A review and research agenda. J. Manag. 2012, 38, 932–968. [Google Scholar] [CrossRef]

- Malandri, C.; Mantecchini, L.; Reis, V. Aircraft turnaround and industrial actions: How ground handlers’ strikes affect airport airside operational efficiency. J. Air Transp. Manag. 2019, 78, 23–32. [Google Scholar] [CrossRef]

- Khan, S.A.R.; Ponce, P.; Yu, Z. Technological innovation and environmental taxes toward a carbon-free economy: An empirical study in the context of COP-21. J. Environ. Manag. 2021, 298, 1–12. [Google Scholar] [CrossRef] [PubMed]

- Khan, S.A.R.; Yu, Z.; Umar, M.; Tanveer, M. Green capabilities and green purchasing practices: A strategy striving towards sustainable operations. Bus. Strategy Environ. 2022. [Google Scholar] [CrossRef]

- Bernal Conesa, J.A.; De Nieves Nieto, C.; Briones Penalver, A.J. CSR strategy in technology companies: Its influence on performance, competitiveness and sustainability. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 96–107. [Google Scholar] [CrossRef]

- Soliman, M.T. The use of DuPont analysis by market participants. Account. Rev. 2008, 83, 823–853. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- International Air Transport Association. India’s Air Transport Sector: The Future Is Bright but Not without Its Challenges. 2019. Available online: https://www.iata.org/publications/economics/Reports/India-aviation-summit-Aug18.pdf (accessed on 10 November 2021).

- Air Transport Action Group. Aviation: Benefits beyond Borders. 2018. Available online: https://aviationbenefits.org/media/166344/abbb18_full-report_web.pdf (accessed on 10 November 2021).

- Lee, J. Effects of operational performance on financial performance. Manag. Sci. Lett. 2019, 9, 25–32. [Google Scholar] [CrossRef]

- Kuljanin, J.; Kalic, M.; Caggiani, L.; Ottomanelli, M.A. Comparative efficiency and productivity analysis: Implication to airlines located in Central and South-East Europe. J. Air Transp. Manag. 2019, 78, 152–163. [Google Scholar] [CrossRef]

- Zhang, Q.; Koutmos, D.; Chen, K.; Zhu, J. Using Operational and Stock Analytics to Measure Airline Performance: A Network DEA Approach. Decis. Sci. 2021, 52, 720–748. [Google Scholar] [CrossRef]

- Pineda, P.J.G.; Liou, J.J.; Hsu, C.C.; Chuang, Y.C. An integrated MCDM model for improving airline operational and financial performance. J. Air Transp. Manag. 2018, 68, 103–117. [Google Scholar] [CrossRef]

- Cui, Q.; Wei, Y.M.; Li, Y. Exploring the impacts of the EU ETS emission limits on airline performance via the Dynamic Environmental DEA approach. Appl. Energy 2016, 183, 984–994. [Google Scholar] [CrossRef]

- Brueckner, J.K.; Abreu, C. Airline fuel usage and carbon emissions: Determining factors. J. Air Transp. Manag. 2017, 62, 10–17. [Google Scholar] [CrossRef]

- Dodd, T.; Orlitzky, M.; Nelson, T. What stalls a renewable energy industry? Industry outlook of the aviation biofuels industry in Australia, Germany, and the USA. Energy Policy 2018, 123, 92–103. [Google Scholar] [CrossRef]

- Yu, M.M.; Chen, L.H.; Chiang, H. The effects of alliances and size on airlines’ dynamic operational performance. Transp. Res. Part A Policy Pract. 2017, 106, 197–214. [Google Scholar] [CrossRef]

- Park, E. Corporate social responsibility as a determinant of corporate reputation in the airline industry. J. Retail. Consum. Serv. 2019, 47, 215–221. [Google Scholar] [CrossRef]

- Phillips, S.; Thai, V.V.; Halim, Z. Airline value chain capabilities and CSR performance: The connection between CSR leadership and CSR culture with CSR performance, customer satisfaction and financial performance. Asian J. Shipp. Logist. 2019, 35, 30–40. [Google Scholar] [CrossRef]

- Khan, S.A.R.; Godil, D.I.; Jabbour, C.J.C.; Shujaat, S.; Razzaq, A.; Yu, Z. Green data analytics, blockchain technology for sustainable development, and sustainable supply chain practices: Evidence from small and medium enterprises. Ann. Oper. Res. 2021, 1–25. [Google Scholar] [CrossRef]

- Khan, S.A.R.; Ponce, P.; Thomas, G.; Yu, Z.; Al-Ahmadi, M.S.; Tanveer, M. Digital technologies, circular economy practices and environmental policies in the era of COVID-19. Sustainability 2021, 13, 12790. [Google Scholar] [CrossRef]

- Tone, K.; Tsutsui, M. Dynamic DEA: A slacks-based measure approach. Omega 2010, 38, 145–156. [Google Scholar] [CrossRef]

- Azarenkova, G.; Shkodina, I.; Samorodov, B.; Babenko, M. The influence of financial technologies on the global financial system stability. Invest. Manag. Financ. Innov. 2018, 15, 229–238. [Google Scholar] [CrossRef]

- International Civil Aviation Organization. List of Low-Cost-Carriers (LCCs). 2017. Available online: https://www.icao.int/sustainability/Documents/LCC-List.pdf (accessed on 9 September 2021).

- Dyson, R.G.; Allen, R.; Camanho, A.S.; Podinovski, V.V.; Sarrico, C.S.; Shale, E.A. Pitfalls and protocols in DEA. Eur. J. Oper. Res. 2001, 132, 245–259. [Google Scholar] [CrossRef]

- Chiu, C.R.; Chiu, Y.H.; Chen, Y.C.; Fang, C.L. Exploring the source of metafrontier inefficiency for various bank types in the two-stage network system with undesirable output. Pac.-Basin Financ. J. 2016, 36, 1–13. [Google Scholar] [CrossRef]

- Arjomandi, A.; Dakpo, K.H.; Seufert, J.H. Have Asian airlines caught up with European Airlines? A by-production efficiency analysis. Transp. Res. Part A Policy Pract. 2018, 116, 389–403. [Google Scholar] [CrossRef]

- Chen, Z.; Wanke, P.; Antunes, J.J.M.; Zhang, N. Chinese airline efficiency under CO2 emissions and flight delays: A stochastic network DEA model. Energy Econ. 2017, 68, 89–108. [Google Scholar] [CrossRef]

- Kottas, A.T.; Madas, M.A. Comparative efficiency analysis of major international airlines using data envelopment analysis: Exploring effects of alliance membership and other operational efficiency determinants. J. Air Transp. Manag. 2018, 70, 1–17. [Google Scholar] [CrossRef]

- Tone, K.; Kweh, Q.L.; Lu, W.M.; Ting, I.W.K. Modeling investments in the dynamic network performance of insurance companies. Omega 2019, 88, 237–247. [Google Scholar] [CrossRef]

- Dehning, B.; Stratopoulos, T. DuPont analysis of an IT-enabled competitive advantage. Int. J. Account. Inf. Syst. 2002, 3, 165–176. [Google Scholar] [CrossRef]

- Baik, B.; Chae, J.; Choi, S.; Farber, D.B. Changes in operational efficiency and firm performance: A frontier analysis approach. Contemp. Account. Res. 2013, 30, 996–1026. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some models for estimating technical and scale inefficiencies in data envelopment analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef]

- Charnes, A.; Clark, C.T.; Cooper, W.W.; Golany, B. A Developmental Study of Data Envelopment Analysis in Measuring the Efficiency of Maintenance Units in the US Air Forces (No. CCS-RR-460); Texas University at Austin Center for Cybernetic Studies: Austin, TX, USA, 1983. [Google Scholar]

- Portela, M.S.; Thanassoulis, E.; Simpson, G. Negative data in DEA: A directional distance approach applied to bank branches. J. Oper. Res. Soc. 2004, 55, 1111–1121. [Google Scholar] [CrossRef]

- Fukuyama, H.; Matousek, R. Efficiency of Turkish banking: Two-stage network system. Variable returns to scale model. J. Int. Financ. Mark. Inst. Money. 2011, 21, 75–91. [Google Scholar] [CrossRef]

- Chiu, C.R.; Liou, J.L.; Wu, P.I.; Fang, C.L. Decomposition of the environmental inefficiency of the meta-frontier with undesirable output. Energy Econ. 2012, 34, 1392–1399. [Google Scholar] [CrossRef]

- Premachandra, I.; Zhu, J.; Watson, J.; Galagedera, D.U. Best-performing US mutual fund families from 1993 to 2008: Evidence from a novel two-stage DEA model for efficiency decomposition. J. Bank. Finance 2012, 36, 3302–3317. [Google Scholar] [CrossRef]

- Li, H.; Xiong, J.; Xie, J.; Zhou, Z.; Zhang, J.A. Unified approach to efficiency decomposition for a two-stage network DEA model with application of performance evaluation in banks and sustainable product design. Sustainability 2019, 11, 4401. [Google Scholar] [CrossRef]

- Jahanshahloo, G.R.; Khodabakhshi, M.; Lotfi, F.H.; Goudarzi, M.M. A cross-efficiency model based on super-efficiency for ranking units through the TOPSIS approach and its extension to the interval case. Math. Comp. Model. 2011, 53, 1946–1955. [Google Scholar]

- Rakhshan, S.A. Efficiency ranking of decision making units in data envelopment analysis by using TOPSIS-DEA method. J. Oper. Res. Soc. 2017, 68, 906–918. [Google Scholar] [CrossRef]

- Wang, Y.M.; Luo, Y. DEA efficiency assessment using ideal and anti-ideal decision-making units. Appl. Math. Comp. 2006, 173, 902–915. [Google Scholar] [CrossRef]

- Ahmad, N.; Ting, I.W.K.; Tebourbi, I.; Kweh, Q.L. Non-linearity between family control and firm financial sustainability: Moderating effects of CEO tenure and education. Eurasian Bus. Rev. 2022, 1–23. [Google Scholar] [CrossRef]

- Kweh, Q.L.; Ting, I.W.K.; Le, H.T.M.; Nourani, M. Nonlinear impacts of board independence on debt financing: Contingent on the shareholdings of the largest shareholder. Int. J. Finance Econ. 2021, 26, 2289–2306. [Google Scholar] [CrossRef]

- Lu, W.M.; Kweh, Q.L.; Wang, C.W. Integration and application of rough sets and data envelopment analysis for assessments of the investment trusts industry. Ann. Oper. Res. 2021, 296, 163–194. [Google Scholar] [CrossRef]

- Valeri, M.; Baggio, R. Social network analysis: Organizational implications in tourism management. Int. J. Organ. Anal. 2020, 29, 342–353. [Google Scholar] [CrossRef]

- Valeri, M.; Baggio, R. Italian tourism intermediaries: A social network analysis exploration. Curr. Issues Tour. 2021, 24, 1270–1283. [Google Scholar] [CrossRef]

- Valeri, M. New Governance and Management in Tourist Destinations; IGI Global Publishing: Hershey, PA, USA, 2022. [Google Scholar]

- Shakil, M.H.; Mahmood, N.; Tasnia, M.; Munim, Z.H. Do environmental, social and governance performance affect the financial performance of banks? A cross-country study of emerging market banks. Manag. Environ. Qual. Int. J. 2019, 30, 1331–1344. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).