Determining the Extent of Economical Sustainability of a Case Study Milk Farm in Bosnia and Herzegovina Based on the Real Options Model

Abstract

:1. Introduction

2. Materials and Methods

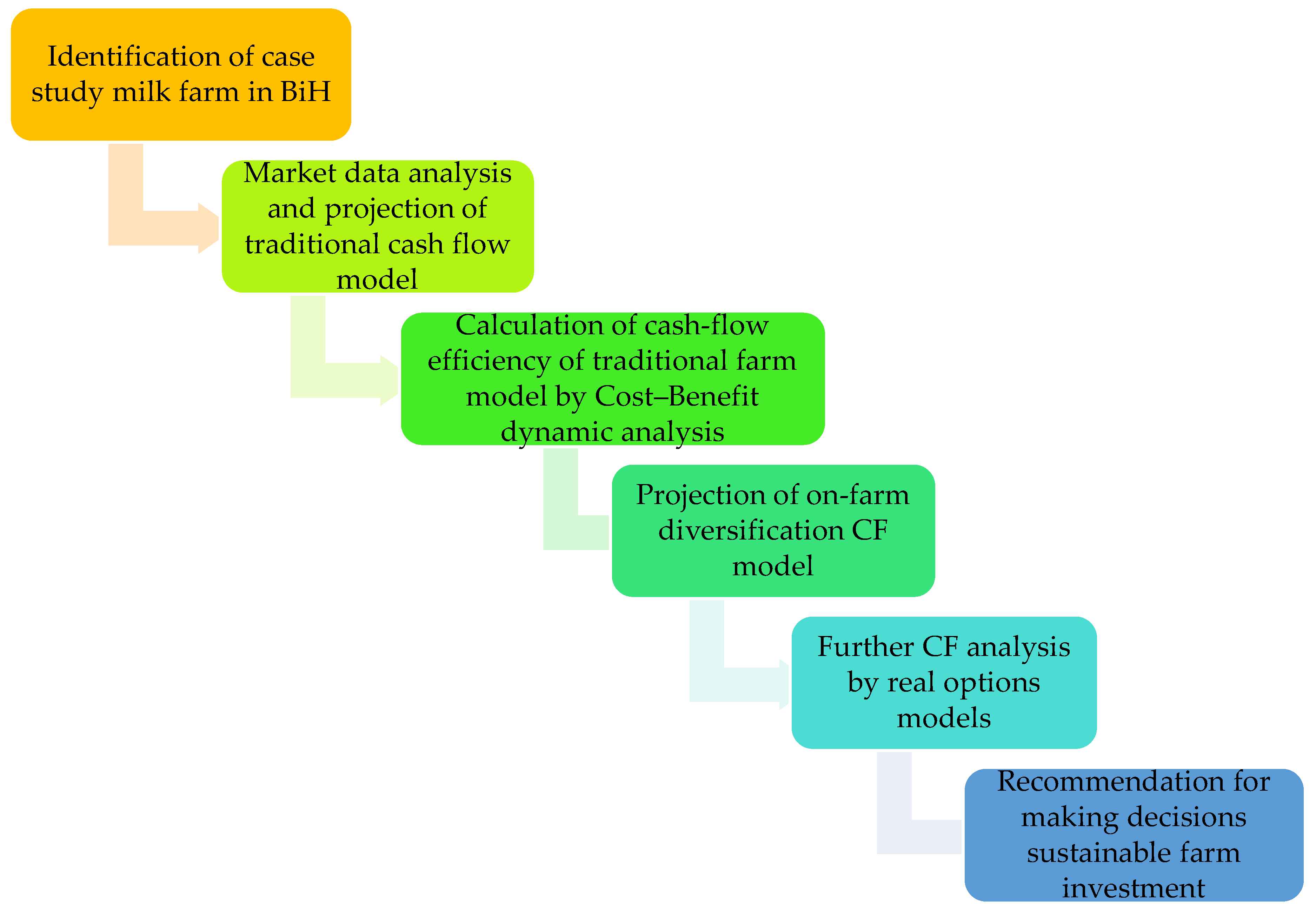

2.1. Research Framework

2.2. Case Study Milk Farm in Bosnia and Herzegovina

2.3. Net Present Value and Real Options Approach

2.3.1. Black–Scholes Model (BS)

- OV—option value (EUR)

- S—the present value of cash-flows from optional investment (EUR)

- d1—lognormal distribution of d1

- d2—lognormal distribution of d2

- X—investment expenditure (EUR)

- r—annual risk-free continuously compounded rate (%)

- σ—annualized variance (risk) of the investment’s project

- t—period until investment (years)

- e-rt—the exponential term (2.71828)

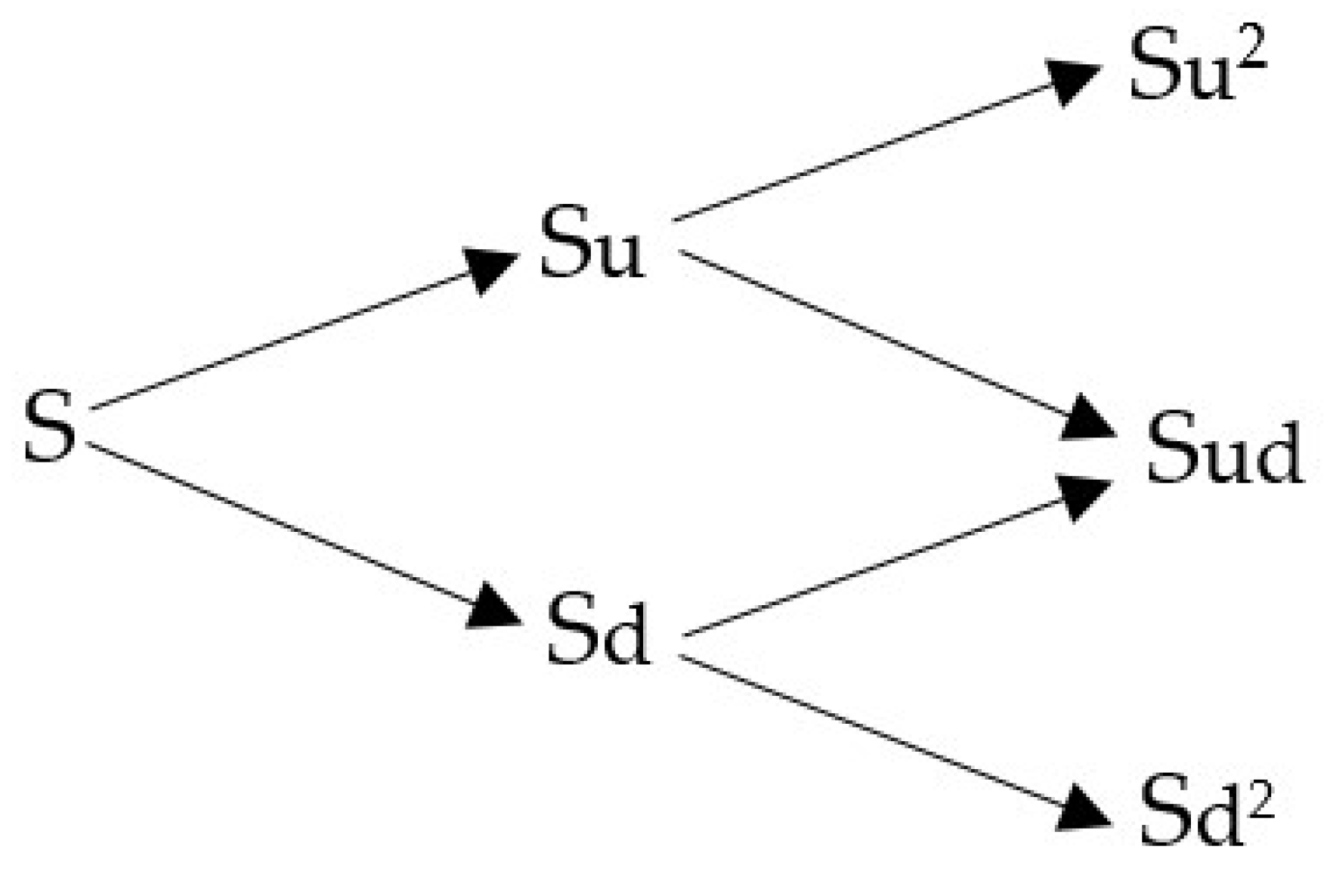

2.3.2. Binomial Model

- S—underlying asset; its value (S) is calculated with the DCF method;

- exercise price—is the cost of implementing the project; the model is working under the assumption that this is constant in real terms and is affected only by inflation;

- time to maturity—is established as the period that an investor enjoys exclusivity for the analyzed project or at least has an important competitive advantage that allows him to defer the project without risking its achievement by another firm;

- risk-free rate—is represented by the expected rate of return for riskless security (treasury bill or treasury bond), with the same maturity as the real option;

- volatility of the underlying asset—it appears because of the errors associated with the estimation of the financial cash-flows and value of the underlying asset, and it is the most difficult element to appraise because the underlying asset is not traded

- dividend yield—delay of investment generates a loss of cash-flows for each year.

- − The binomial tree for the value of the underlying asset

- − The binomial tree for the CALL option to delay the project

- NPVs—strategic value of the real option (EUR),

- NPVt—the traditional value of project investment,

- OV—option value

3. Results

4. Discussion

5. Conclusions

- The price of raw milk and complementary products is not enough to cover the high costs of this production. Certainly, direct payments enable milk farms to survive, but their long-term sustainability is threatened without subsidies.

- The conducted research confirmed that raw milk production with the farm size of ten cows is not financially viable.

- Based on this case study, taking into account milk yield and other parameters in the model, after 14 years of the project effectuation, a negative NPV (EUR −33,373) was recorded, which imposes two possibilities for the producer. The first is to leave milk production, and the second possibility would be to start dealing with milk on-farm processing. The second option is analyzed as the processing of raw milk into cheese at the same farm.

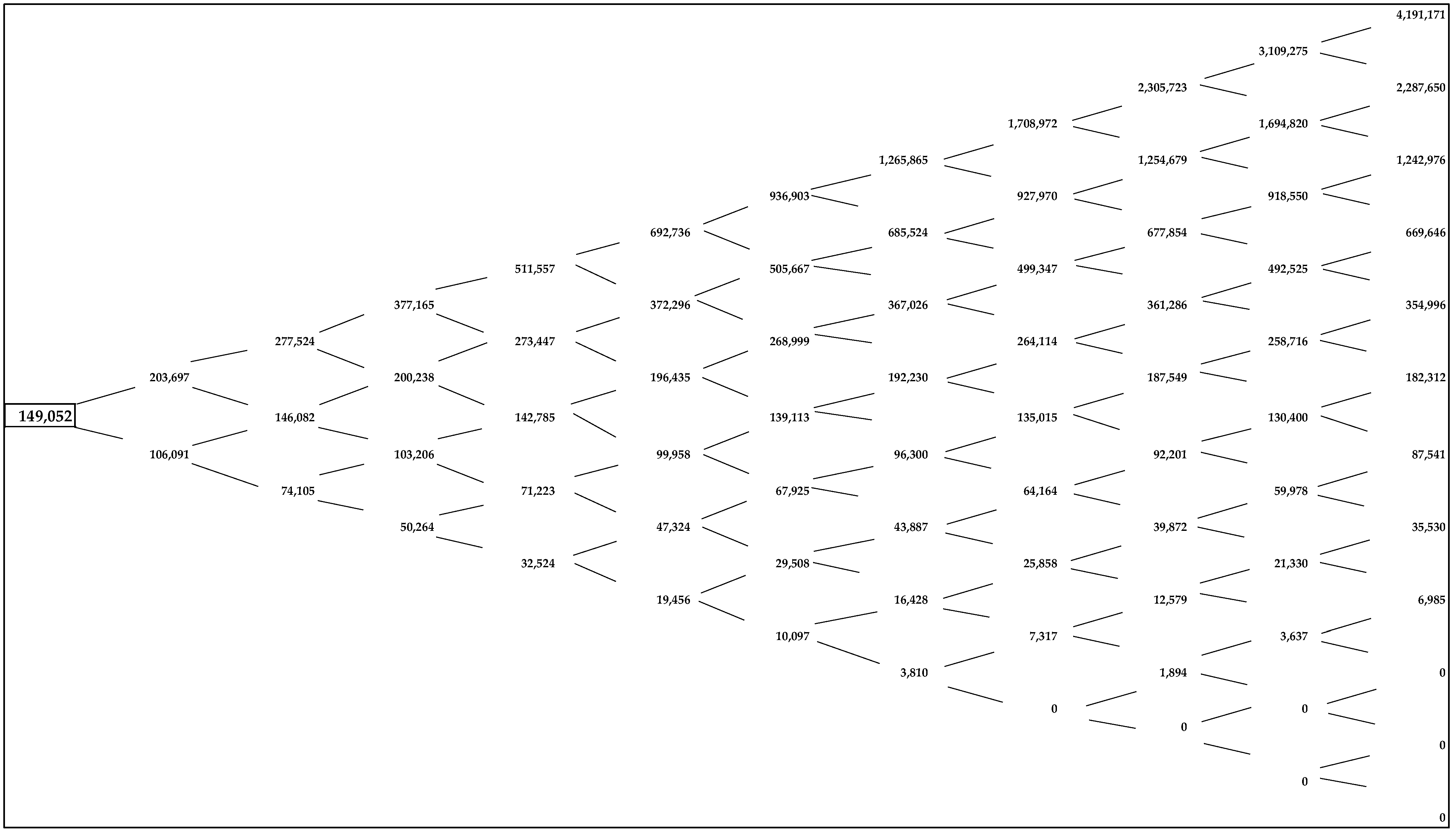

- By applying Black–Scholes and binomial methods, strategic NPV was calculated. According to the Black–Scholes model, the value of the option is EUR 144,155, and the strategic NPV has a value of EUR 110,783. Based on the binomial model, the option value is EUR 149,052 and the strategic NPV is EUR 115,679.

- Additional investment and workforce employment, despite the increase in costs, bring much higher revenue due to adding value to the milk and returning a positive strategic NPV to the farm. Moreover, conversely, the calculated values of the key indicators confirmed the research hypothesis that it is economically valuable to diversify a milk business into on-farm cheese processing.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kodukula, P.; Papudesu, C. Project Valuation Using Real Options: A Practitioner’s Guide; J. Ross Publishing: Fort Lauderdale, FL, USA, 2006; pp. 1–234. [Google Scholar]

- Vintila, N. Real Options in Capital Budgeting. Pricing the Option to Delay and the Option to Abandon a Project. Theor. Appl. Econ. Asoc. Gen. A Econ. Din Rom. 2007, 7, 47–58. [Google Scholar]

- Hadelan, L.; Par, V.; Njavro, M.; Lovrinov, M. Real Option Approach to Economic Analysis of European Sea Bass (Dicetrar-chus labrax) Farming in Croatia. Agric. Conspec. Scintificus 2012, 77, 161–165. [Google Scholar]

- Pažek, K.; Rozman, Č. The real options approach for assessment of business opportunities in spelt processing. Agric. Maribor 2008, 6, 13–17. [Google Scholar]

- Na, S.; Kim, K.; Jang, W.; Lee, C. Real Options Analysis for Land and Water Solar Deployment in Idle Areas of Agricultural Dam: A Case Study of South Korea. Sustainability 2022, 14, 2297. [Google Scholar] [CrossRef]

- Tzouramani, I.; Mattas, K. Employing real options methodology to evaluate the organic agriculture scheme in Greece. In Proceedings of the 87th EAAE-Seminar. Assessing Rural Development of the CAP, Vienna, Austria, 21–24 April 2004; pp. 1–10. [Google Scholar]

- Pažek, K.; Rozman, Č.; Par, V.; Hadelan, L. Investment Projects Assessments and Evaluation in Agriculture Using Option Models. In Proceedings of the 5 Conference DAES, Sodobni Izzivi Menedžmenta v Agroživilstvu, Pivola, Slovenia, 18–19 March 2010; pp. 41–49. [Google Scholar]

- Hadelan, L.; Njavro, M.; Par, V. Plum Plantation Value Based on Real Option Contribution. Poljoprivreda 2009, 15, 51–56. [Google Scholar]

- Michailidis, A.; Mattas, K. Using Real Options Theory to Irrigation Dam Investment Analysis: An Application of Binomial Option Pricing Model. Water Resour. Manag. 2007, 21, 1717–1733. [Google Scholar] [CrossRef]

- Tubetov, D.; Musshoff, O.; Kellner, U. Investments in Kazakhstani Dairy Farming: A Comparison of Classical Investment Theory and the Real Options Approach. J. Int. Agric. 2012, 51, 257–284. [Google Scholar]

- Xavier, D.T.; Peres, A.A.C.; Almeida, G.L.; Carvalho, C.A.B. Application of the “real options theory” method to the production systems used in dairy cattle farming. Arq. Bras. Med. Vet. Zootec. 2020, 72, 2288–2296. [Google Scholar] [CrossRef]

- Rutten, C.J.; Steeneveld, W.; Oude Lansink, A.G.J.M.; Hogeveen, H. Delaying investments in sensor technology: The rationality of dairy farmers’ investment decisions illustrated within the framework of real options theory. J. Dairy Sci. 2018, 101, 7650–7660. [Google Scholar] [CrossRef] [PubMed]

- Engel, P.D.; Hyde, J. A Real Options Analysis of Automatic Milking Systems. Agric. Resour. Econ. Rev. 2003, 32, 282–294. [Google Scholar] [CrossRef]

- Tauer, L.W. When to Get In and Out of Dairy Farming: A Real Option Analysis. Agric. Resour. Econ. Rev. 2006, 35, 339–347. [Google Scholar] [CrossRef]

- Hellstrand, S. Animal Production in a Sustainable Agriculture. Environ. Dev. Sustain. 2013, 15, 999–1036. [Google Scholar] [CrossRef]

- Popescu, A. Research on Milk Cost, Return and Profitability in Milk Farming. Sci. Pap. Ser. Manag. Econ. Eng. Agric. Rural Dev. 2014, 14, 219–222. [Google Scholar]

- Republic of Srpska, Institute of Statistics. Available online: https://www.Rzs.Rs.Ba/Front/Category/8/?Left_mi=287&add=287 (accessed on 6 June 2022).

- Pandurevic, T.; Mojevic, M.; Rankic, I.; Ristanovic, B. Analysis of Some Cattle Farms Focused on Milk Production. Acta Agric. Serbica 2015, 20, 127–135. [Google Scholar] [CrossRef]

- Vaško, Ž.; Ostojić, A.; Rokvić, G.; Drinić, L.; Mrdalj, V.; Figurek, A.; Brković, D. Poljoprivreda I Ruralni Razvoj U Republici Srpskoj Do 2020. Godine; Faculty of Agriculure, University of Banja Luka: Banja Luka, Bosnia and Herzegovina, 2016; pp. 1–361. [Google Scholar]

- Al Sidawi, R.; Urushadze, T.; Ploeger, A. Factors and Components Affecting Milk Smallholder Farmers and the Local Value Chain— Kvemo Kartli as an Example. Sustainability 2021, 13, 5749. [Google Scholar] [CrossRef]

- Krizsan, S.J.; Chagas, J.C.; Pang, D.; Cabezas-Garcia, E.H. Sustainability Aspects of Milk Production in Sweden. Grass Forage Sci. 2021, 76, 205–214. [Google Scholar] [CrossRef]

- Imadi, S.R.; Shazadi, K.; Gul, A.; Hakeem, K.R. Sustainable Crop Production System. In Plant, Soil and Microbes; Hakeem, K.R., Akhtar, M.S., Abdullah, S.N.A., Eds.; Springer International Publishing: Cham, Germany, 2016; pp. 103–116. [Google Scholar] [CrossRef]

- Debertin, D.L.; Pagoulatos, A. Production Practices and Systems in Sustainable Agriculture; Department of Agricultural Economics, The University of Kentucky, 2015. Staff Paper 488. pp. 1–31. Available online: https://econpapers.repec.org/paper/agsukysps/200248.htm (accessed on 9 July 2022).

- Mickiewicz, B.; Volkava, K. Global Consumer Trends for Sustainable Milk and Milk Production. VUZF Rev. 2022, 7, 183–192. [Google Scholar] [CrossRef]

- Spicka, J.; Hlavsa, T.; Soukupova, K.; Stolbova, M. Approaches to Estimation the Farm-Level Economic Viability and Sustainability in Agriculture: A Literature Review. Agric. Econ. Zemědělská Ekon. 2019, 65, 289–297. [Google Scholar] [CrossRef]

- Ministy of Agriculture, Forestry and Water Management of the Republic Srpska. Analiza Stanja u Sektoru Poljoprivrede i Ruralnim Područjima Republike Srpske u Periodu 2014–2018. In GodinaAnalysis of the State of Development of Agriculture and Rural Areas in the Republic of Srpska for the Period 2014–2018 (Internal Document); Ministy of Agriculture, Forestry and Water Management of the Republic Srpska: Banja Luka, Bosnia and Herzegovina, 2020. [Google Scholar]

- Ivanković, M.; Vaško, Ž. Investment in Agriculture; Faculty of Agriculture and Food Technology, University of Mostar: Mostar, Bosnia and Herzegovina, 2013; pp. 1–256. [Google Scholar]

- Pažek, K.; Rozman, Č. The Simulation Model for Cost-Benefit Analysis on Organic Farms. Agron. Glas. 2007, 3, 209–222. [Google Scholar]

- Vaško, Ž. Costs and Calculations in Agricultural Production, Theory and Examples; Faculty of Agriculture, University of Banja Luka: Banja Luka, Bosnia and Herzegovina, 2019; pp. 1–319. [Google Scholar]

- Rovčanin, A. Investment as Real Options. Proceedings of Rijeka Faculty of Economics. J. Econ. Bus. 2004, 22, 85–93. [Google Scholar]

- Leuhrman, T. Investment Opportunities as Real Options: Getting Started on the Numbers. Harv. Bus. Rev. 1998, 76, 51–67. [Google Scholar]

- Cox, J.; Ross, S.; Rubinstein, M. Option Pricing: A Simplified Approach. J. Financ. Econ. 1979, 7, 229–263. [Google Scholar] [CrossRef]

- Damodaran, A. The Promise and Peril of Real Options; New York University—Stern School of Business: New York, NY, USA, 2005. [Google Scholar]

- The Republic of Srpska Investment-Development Bank (IRBRS). Available online: https://www.irbrs.org/azuro3/a3/?id=53 (accessed on 11 May 2022).

- Glavić, M.; Zenunović, A.; Budiša, A. The Production, Purchase and Processing of Milk in Bosnia and Herzegovina. Agro-Knowl. J. 2017, 18, 187–198. [Google Scholar] [CrossRef]

- Blakeney, M. Agricultural Innovation and Sustainable Development. Sustainability 2022, 14, 2698. [Google Scholar] [CrossRef]

- Martinovska Stojcheska, A.; Kotevska, A.; Janeska Stamenkovska, I.; Dimitrievski, D.; Zhllima, E.; Vaško, Ž.; Bajramović, S.; Kerolli Mustafa, M.; Spahić, M.; Kovačević, V.; et al. Recent Agricultural Policy Developments in the Context of the EU Approximation Process in the Pre-Accession Countries; EUR 30687 EN; Martinovska Stojcheska, A., Kotevska, A., Ciaian, P., Ilic, B., Pavlos-Ka-Gjorgjieska, D., Salputra, G., Eds.; Publications Office of the European Union: Luxembourg, 2021; JRC124502; ISBN 978-92-76-37270-7. [Google Scholar] [CrossRef]

- FAO. The Meat and Milk Sector in Bosnia and Herzegovina. In Preparation of IPARD Sector Analysis in Bosnia and Herze-Govina; FAO Regional Office for Europe and Central Asia: Ankara, Türkiye, 2012. [Google Scholar]

- Amistu, K.; Sanago, S.; Dawit, C. Cow Milk Production, Processing and Marketing Situation in Tello District. Afr. J. Agric. Res. 2016, 24, 41–47. [Google Scholar]

- Kaur, H.; Kaur, I.; Singh, V.P.; Wakchaure, N.S. Cost-Benefit Analysis of Different Milk Products at Farm Level in Punjab State. Indian J. Milk Sci. 2022, 75, 181–189. Available online: https://Epubs.Icar.Org.in/Index.Php/IJDS/Article/View/96859 (accessed on 17 June 2022).

- Becker, K.M.; Parsons, R.L.; Kolodinsky, J.; Matiru, G.N. A Cost and Returns Evaluation of Alternative Milk Products to Determine Capital Investment and Operational Feasibility of a Small-Scale Milk Processing Facility. J. Milk Sci. 2007, 90, 2506–2516. [Google Scholar] [CrossRef]

- Popescu, A. Research Concerning the Use of Regression Function in Gross Margin Forecast. Bull. UASVM Hortic. 2010, 67, 197–202. [Google Scholar]

- Trigeorgis, L.; Reuer, J.J. Real options theory in strategic management. Strateg. Manag. J. 2017, 38, 42–63. [Google Scholar] [CrossRef]

- Chetroiu, R.; Cișmileanu, A.E.; Cofas, E.; Petre, I.L.; Rodino, S.; Dragomir, V.; Marin, A.; Turek-Rahoveanu, P.A. Assessment of the Relations for Determining the Profitability of Milk Farms, A Premise of Their Economic Sustainability. Sustainability 2022, 14, 7466. [Google Scholar] [CrossRef]

| Call Option | Variable | Investment Opportunity |

|---|---|---|

| Stock price | S | Present value of a project’s operating assets to be acquired |

| Exercise price | X | Expenditure required to acquire the project assets |

| Time to expiration | t | Length of time the decision may be deferred |

| The risk-free rate of return | rf | Time value of money |

| Var. of returns on stock | σ2 | The riskiness of the project assets |

| Year of the Project Lifetime | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net cash-flow (non-disc.) | −88,873 | 5280 | 5280 | 5280 | 5280 | 5280 | 5280 | −14,720 | 5280 | 3280 | 5280 | 5280 | 5280 | 32,617 | −14,898 |

| Present value net cash-flow | −85,784 | 4919 | 4748 | 4583 | 4424 | 4270 | 4122 | −11,093 | 3840 | 3707 | 2223 | 3454 | 3334 | 19,880 | −33,373 |

| Year of Project | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash inflow | 59,320 | 49,735 | 49,735 | 49,735 | 49,735 | 49,735 | 49,735 | 49,735 | 49,735 | 49,735 | 66,737 |

| Cash outflow | 61,234 | 29,284 | 29,284 | 29,284 | 29,284 | 29,284 | 29,284 | 29,284 | 29,284 | 29,284 | 29,284 |

| Net cash-flow (non-disc.) | −1914 | 20,451 | 20,451 | 20,451 | 20,451 | 20,451 | 20,451 | 20,451 | 20,451 | 20,451 | 37,453 |

| Discounted net cash-flow | −1661 | 17,136 | 16,541 | 15,966 | 15,411 | 14,876 | 14,359 | 13,860 | 13,378 | 12,913 | 22,827 |

| Present value of the optional investment (S) | 155,607 | ||||||||||

| Investment expenditure | 31,950 | ||||||||||

| Present value of investment expenditure (X) | 27,735 |

| Parameters | Value |

|---|---|

| Present value of the optional investment (S) | 155,607 |

| Present value of investment expenditure (X) | 27,735 |

| Exponential function | 2.71828 |

| Risk-free rate (r) | 8.00% |

| Period of investment expiry (t) | 11 |

| Variance (risk) of investment’s project (v) | 30% |

| Black–Scholes option evaluation | |

| d1 | 3.115 |

| d2 | 2.120 |

| Lognormal distribution N (d1) | 0.999 |

| Lognormal distribution N (d2) | 0.983 |

| Call option value of cheese production | 144,155 |

| Parameters | Value |

|---|---|

| Present value of the optional investment (S) | 155,607 |

| Present value of investment expenditure (X) | 27,735 |

| Exponential function | 2.71828 |

| Risk-free rate (r) | 8.00% |

| Period of investment expiry (t) | 11 |

| Variance (risk) of investment’s project (v) | 30% |

| Binomial model of option evaluation | |

| Up factor (u) | 1.350 |

| Down factor (d) | 0.741 |

| Risk neutral probability (p) | 0.562 |

| Risk neutral probability (1-p) | 0.438 |

| NPVtraditional | Option Value | NPVstrategic (NPVtraditional + OV) | |

|---|---|---|---|

| Black–Scholes evaluation | −33,373 | 144,155 | 110,783 |

| Binomial evaluation | −33,373 | 149,052 | 115,679 |

| Not accepted | Accepted |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jalić, N.; Rozman, Č.; Vaško, Ž.; Pažek, K. Determining the Extent of Economical Sustainability of a Case Study Milk Farm in Bosnia and Herzegovina Based on the Real Options Model. Sustainability 2022, 14, 11993. https://doi.org/10.3390/su141911993

Jalić N, Rozman Č, Vaško Ž, Pažek K. Determining the Extent of Economical Sustainability of a Case Study Milk Farm in Bosnia and Herzegovina Based on the Real Options Model. Sustainability. 2022; 14(19):11993. https://doi.org/10.3390/su141911993

Chicago/Turabian StyleJalić, Nemanja, Črtomir Rozman, Željko Vaško, and Karmen Pažek. 2022. "Determining the Extent of Economical Sustainability of a Case Study Milk Farm in Bosnia and Herzegovina Based on the Real Options Model" Sustainability 14, no. 19: 11993. https://doi.org/10.3390/su141911993

APA StyleJalić, N., Rozman, Č., Vaško, Ž., & Pažek, K. (2022). Determining the Extent of Economical Sustainability of a Case Study Milk Farm in Bosnia and Herzegovina Based on the Real Options Model. Sustainability, 14(19), 11993. https://doi.org/10.3390/su141911993