1. Introduction

With increasingly fierce market competition, it is difficult for a supply chain to gain a competitive advantage only by using the traditional demand forecast-driven production mode (i.e., inventory push). Usually, there is a deviation between the predicted value and the realized demand due to imperfect data and unreasonable methods of prediction. This deviation leads to lost sales or overstock, which may put the supply chain at risk of failure. Moreover, in the demand forecast-driven production mode, it is difficult for a supply chain to meet customers’ personalized demand for products characterized as multi-variant, small-batch, and having a flexible production process.

In recent years, an alternative demand-pull production mode has been adopted by an increasing number of supply chains to effectively manage the balance between supply and demand. For example, Tesla builds an order-driven optimization system for its supply chain network. With the order-driven optimization system, Tesla’s Model S product is able to be delivered within 14 days, and the committed delivery time of its customized product, Model3, is within 12 months [

1]. Tesla’s products are favored by customers as they provide them with customizable, stylish products and a desirable delivery service.

In many developed countries and even in some emerging countries, customers attach importance to the delivery time of a product. However, they pay more attention to the quality of a product. Due to an error in the inspection of suppliers’ components, there was an explosion in Samsung’s Flagship product Note7, which was launched in 2016 [

2]. Samsung Electronics Co. Ltd. (Suwon-si, Korea) has fallen into a crisis of public relations and lost most market share in China since the explosion occurred [

3].

In 2021, Qualcomm needed to make a choice between two contract manufacturers (TSMC, Taiwan, China and Samsung, Seoul, Korea) for its outsourcing production after finishing the design of the flagship Snapdragon 8GEN1 mobile phone chip. Although TSMC has the most advanced 4 nm process technology, its required production subsidy is high, and its delivery time is relatively long. Finally, Qualcomm outsourced its mobile phone chip production to Samsung with a low quoted price and a short delivery time. In the same year, Qualcomm released the Snapdragon 8GEN1 mobile phone chip. Subsequently, handset manufacturers also released smartphones with Snapdragon 8GEN1 chips. However, the market reaction to smartphones with Snapdragon 8GEN1 chips was lukewarm, and handset manufacturers had to cut the prices of their items [

4]. The reason for this is that the Snapdragon 8GEN1 chip requires a large amount of power, and thus delivers a poor user experience [

5]. In the following year, TSMC’s chip production delivery time was shortened, and the quoted price was slightly decreased under the improved 4 nm process capacity. This time, Qualcomm chose TSMC as its contract manufacturer for Snapdragon 8+ GEN1 mobile phone chip production. Due to the increase of 10% in CPU performance and the decrease of 30% in power consumption, Snapdragon 8+ GEN1 achieved a very good market response [

6].

From the above examples, high product quality and fast delivery are pursued by both the industry and customers. According to a survey conducted by Dotcom Distribution, 67% of customers are willing to pay more for products with a higher quality and shorter delivery time [

7]. In addition, a committed delivery time is key to managing customer expectations and improving customer satisfaction in a random delivery environment [

8]. Therefore, the product quality and committed delivery time have a significant impact on customers’ choices and, to a certain extent, determine whether or not supply chain management (SCM) is successful. However, improving the quality level or shortening the delivery time might incur substantial costs [

9,

10]. To the best of our knowledge, there are no studies highlighting the optimal equilibrium decisions on quality choice and committed delivery time in supply chains considering the interplay between members. Motivated by the above well-documented real-world examples, and to bridge this gap, our work addresses the following research questions:

(1) How do supply chain members interact to make decisions on quality and committed delivery time? What is the impact of the interaction between members on the performance of the supply chain?

(2) Under what conditions do the self-interested decisions of supply chain members lead to an equilibrium solution?

(3) How do market characteristics and system parameters influence the equilibrium strategies and profits of supply chain members?

(4) What insights for optimal decisions on quality and committed delivery time in supply chains can be derived from our analysis?

Specifically, we aim to study the optimal policies on quality and committed delivery time and identify the effects of system parameters in a build-to-order supply chain (BTO-SC), which consists of one contract manufacturer (CM) and one original equipment manufacturer (OEM). Under the quality–price–committed delivery time-sensitive demand, the CM decides on the committed delivery time of the supply chain product, and the OEM determines the quality level and the selling price of the supply chain product to maximize their respective profits. We first formulate the decisions of the CM and the OEM as a three-stage Stackelberg game, where the OEM is the leader. We then identify a Nash equilibrium solution for the decisions of the CM and the OEM. Finally, a sensitivity analysis is conducted, and some interesting results are found. For example, the OEM’s profit is non-monotonic in regard to the committed delivery time sensitivity of demand, and the CM’s profit is non-monotonic in terms of both the unit production subsidy paid by the OEM to the CM and the CM’s production capacity. Moreover, the optimal committed delivery time is non-monotonic regarding the unit production subsidy paid by the OEM to the CM.

We summarize the research contributions of our work (i.e., novelty of this research), as follows:

(1) Although some papers consider quality choice or committed delivery time, to the best of our knowledge, this study is the first integration of the two within a supply chain.

(2) Our results provide the OEM with insights into how to decide an optimal product quality and price, as well as the CM, in terms of how to decide on the optimal committed delivery time, in order to enhance the competitive advantages of BTO-SC. For example, the high-quality and fast-delivery product policy is worthwhile in a quality-sensitive or delivery time-sensitive market, which leads to a triple-win outcome among the CM, the OEM, and the customers.

(3) We prove the counterintuitive result that a high production capacity is not always advantageous for the supply chain product, even for the CM. In addition, a moderate production subsidy improves the quality level and delivery service.

The remainder of this paper is organized as follows. In the next section, we briefly review the relevant literature. We then describe the notation used in this paper and the assumptions made for the problem model in

Section 3. We present the problem model and show several theoretical results in

Section 4. Parametric sensitivity analysis is conducted in

Section 5, and a conclusion is provided in

Section 6. Proof of the main theoretical results is presented in the

Appendix A section at the end.

3. Notation and Assumptions

Before we model the decisions of the CM and the OEM, we define our notations and make related assumptions.

3.1. Notation

: quality level of product chosen by the OEM.

: unit selling price of product set by the OEM.

: CM committed delivery time of product.

: actual delivery time of the product.

: potential market size for the product.

: selling price sensitivity of demand.

: quality sensitivity of demand.

: committed delivery time sensitivity of demand.

: mean arrival rate or expected demand per unit time.

: technical parameter indicating the investment level needed for quality improvement.

: marginal cost related to the quality.

: unit production subsidy related to the quality paid by the OEM to the CM.

: CM’s capacity per unit time.

: unit compensation fees (penalty costs) paid by the CM to the customer.

: OEM’s expected profit per unit time.

: CM’s expected profit per unit time.

3.2. Assumptions

We assume that customers arrive at the BTO-SC system to place an order according to a Poisson process. The mean arrival rate depends linearly on the selling price, the product quality level, and the committed delivery time. We also assume that the mean arrival rate decreases in accordance with the selling price and in the committed delivery time, and increases in accordance with the product quality level [

24,

32,

39], i.e.,

Similarly to Boyaci and Ray [

9], we assume that both the OEM and the CM consider maximizing their expected profits per unit time. Clearly, the expected demand per unit time is equal to the mean arrival rate under our assumption that each arriving customer would buy only one product.

The OEM decides the product quality level and takes on the fixed expenses of quality investment

, which involves investment in design, device, and process [

40,

41,

42].

The CM organizes the production and takes on the variable expenses of quality investment in each product

, which involves investment in raw materials and skilled laborers. For simplicity, we only consider the variable costs related to the quality. Following the industry standard, the OEM pays a subsidy

to the CM for producing each product [

32]. Here, the assumption of

is needed to ensure that the CM makes positive production profits.

For a BTO-SC system, we further assume that the CM’s capacity per unit time is much greater than the mean arrival rate (i.e.,

). This means that the actual delivery time of a product is approximately equal to its production time. As shown in the literature [

43], the production time distribution is well approximated by the exponential distribution. Therefore, we reasonably assume that the actual delivery time

follows the exponential distribution with the parameter

.

A certain compensation fee amount is paid by the CM to the customer when a random customer’s actual delivery time is later than the committed delivery time [

44]. In this paper, we refer to the compensation fees as the penalty costs incurred by the CM. Under our exponential actual delivery time assumption, the mean compensation fees for each customer are:

In this paper, all the variables and parameters are assumed to be positive. Furthermore, we assume that both the OEM and the CM are risk neutral, and all the information is symmetrical between them.

Remark 1. We consider both the unit production subsidyand the unit compensation feesas exogenous parameters, not decision variables, which is reasonable for a well-established industry. In fact,andare able to be set through referring to the industry standard or negotiation between the CM and the OEM.

5. Sensitivity Analysis

In this section, we conduct a sensitivity analysis to explore the influences of several main system parameters on the optimal supply chain members’ decisions and their profits.

5.1. Description

According to our theoretic research results, the existence of equilibrium points can be guaranteed if parameters here simultaneously satisfy the following conditions:

Let

,

,

,

,

,

,

,

,

. For the above value of parameters, we can obtain a unique Nash equilibrium solution

by solving the system of equations

and

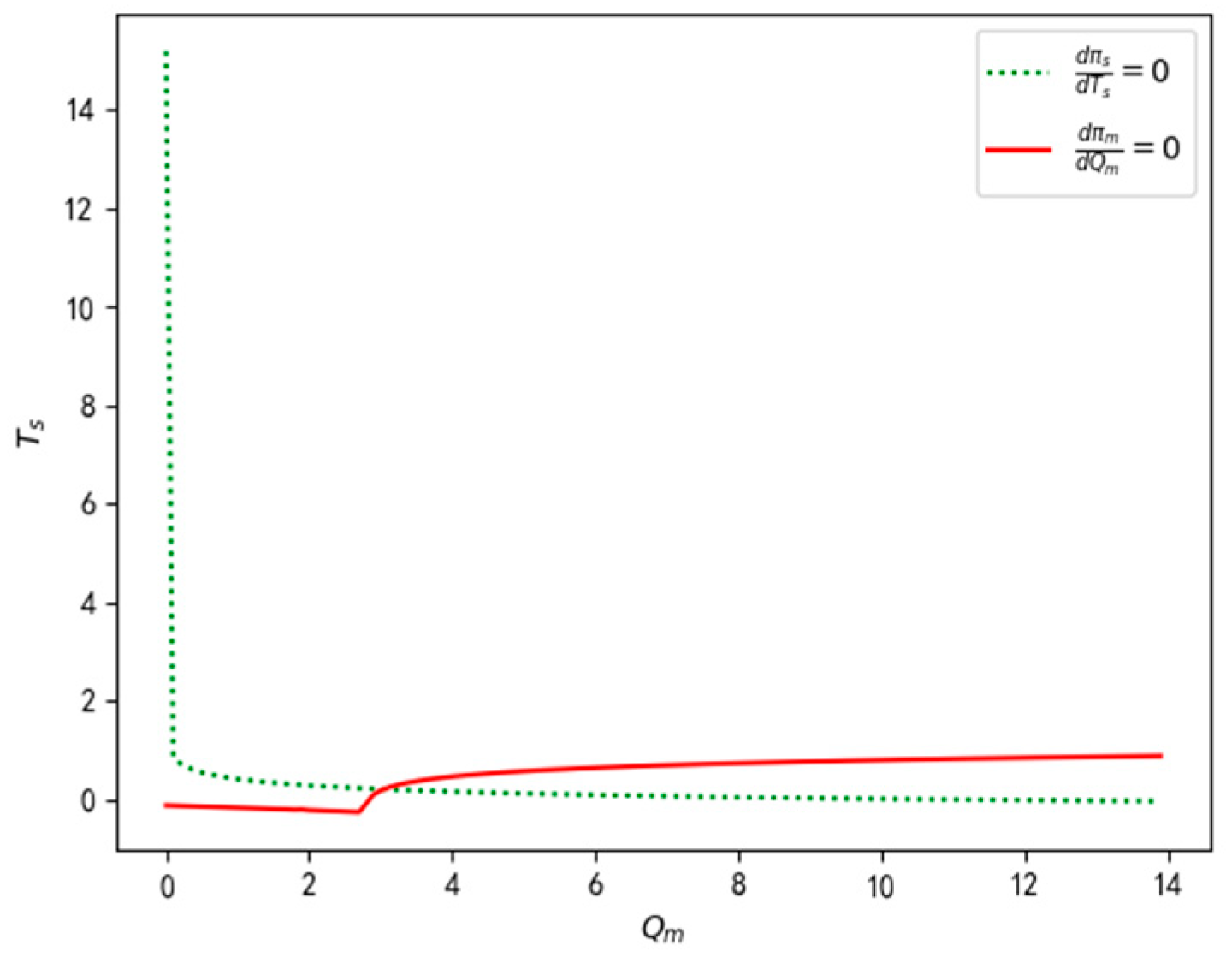

. As shown in

Figure 2, there is a unique Nash equilibrium point

. Therefore, we take them as a set of basic value of parameters. However, there may be multiple Nash equilibrium points as the value of some parameters is changed. For the situation where there are multiple Nash equilibrium points, we only consider the equilibrium point at which the leader OEM’s profit is maximized.

In addition, our search for the equilibrium points is limited to the area

so as to improve the computational efficiency, where

5.2. Sensitivity to Parameter

To study the sensitivity of the optimal decisions and profits to parameter , we vary the value of and fix a basic value for the other parameters.

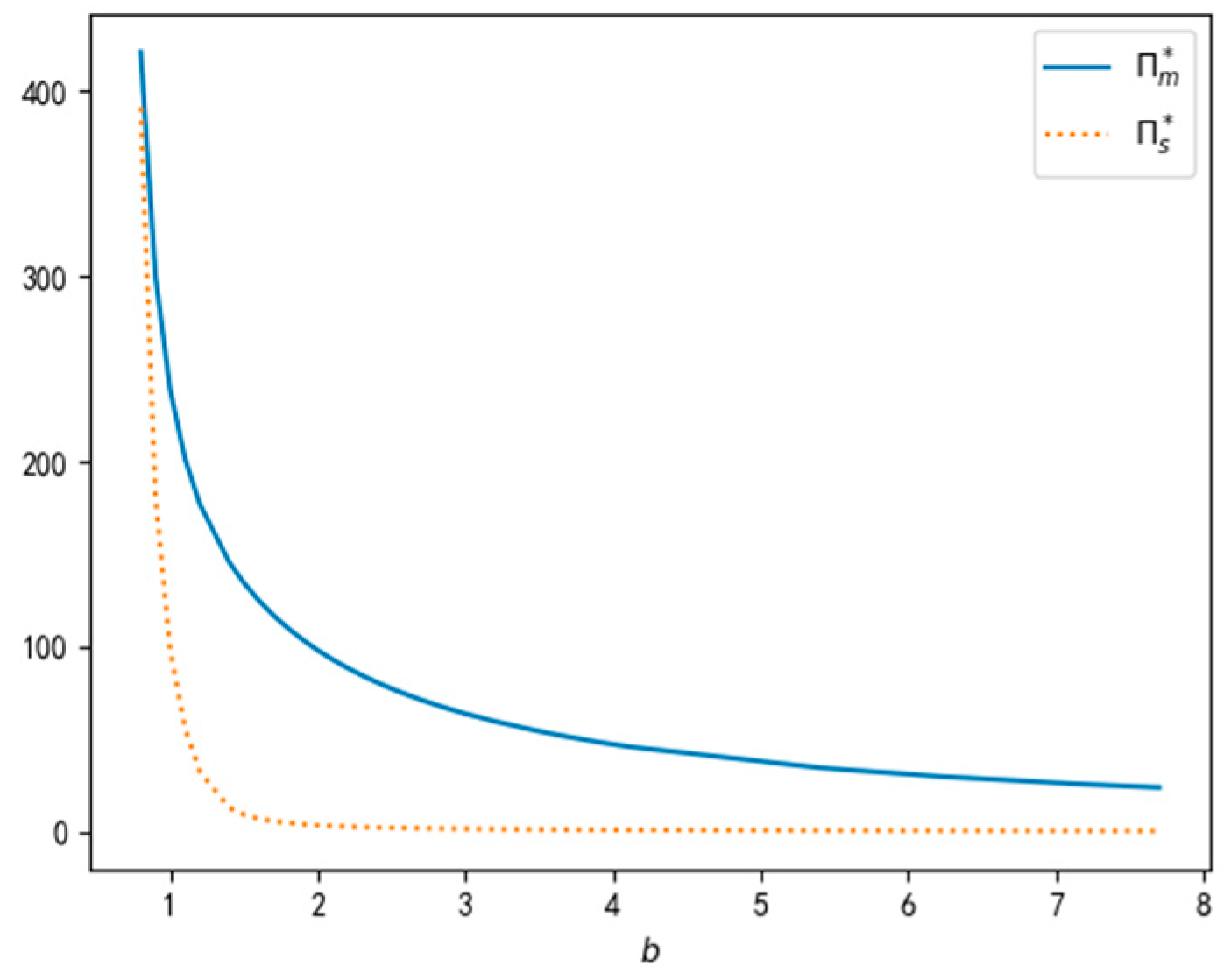

As shown in

Figure 3, the selling price and the quality level set by the OEM decrease first sharply and then more slowly, while the delivery time set by the CM slowly increases with the selling price sensitivity of demand. The explanation for this is that the OEM’s first response is to cut the selling price to promote demand when customers become more sensitive to the selling price of a product. As a result, the OEM correspondingly lowers the quality level considering the cost of quality investment and the low marginal sales revenue. The CM obtains the low unit production subsidy for the low-quality level and thus has no incentive to promote the demand by shortening the delivery time considering the penalty costs.

Although the selling price falls, the low-quality level and the long delivery time of the product still lead to a corresponding reduction in the demand from our computational results. Therefore, both the OEM’s profit and the CM’s profit decrease sharply initially and then more slowly as the selling price sensitivity of demand increases, as shown in

Figure 4. This leads to the observation that a market of price-sensitive customers does not improve the quality and delivery service, or the profits of supply chain members. Furthermore, when the selling price sensitivity of demand exceeds a certain threshold value, supply chain members may withdraw from the market since the CM is unprofitable and the OEM’s profit is also very low.

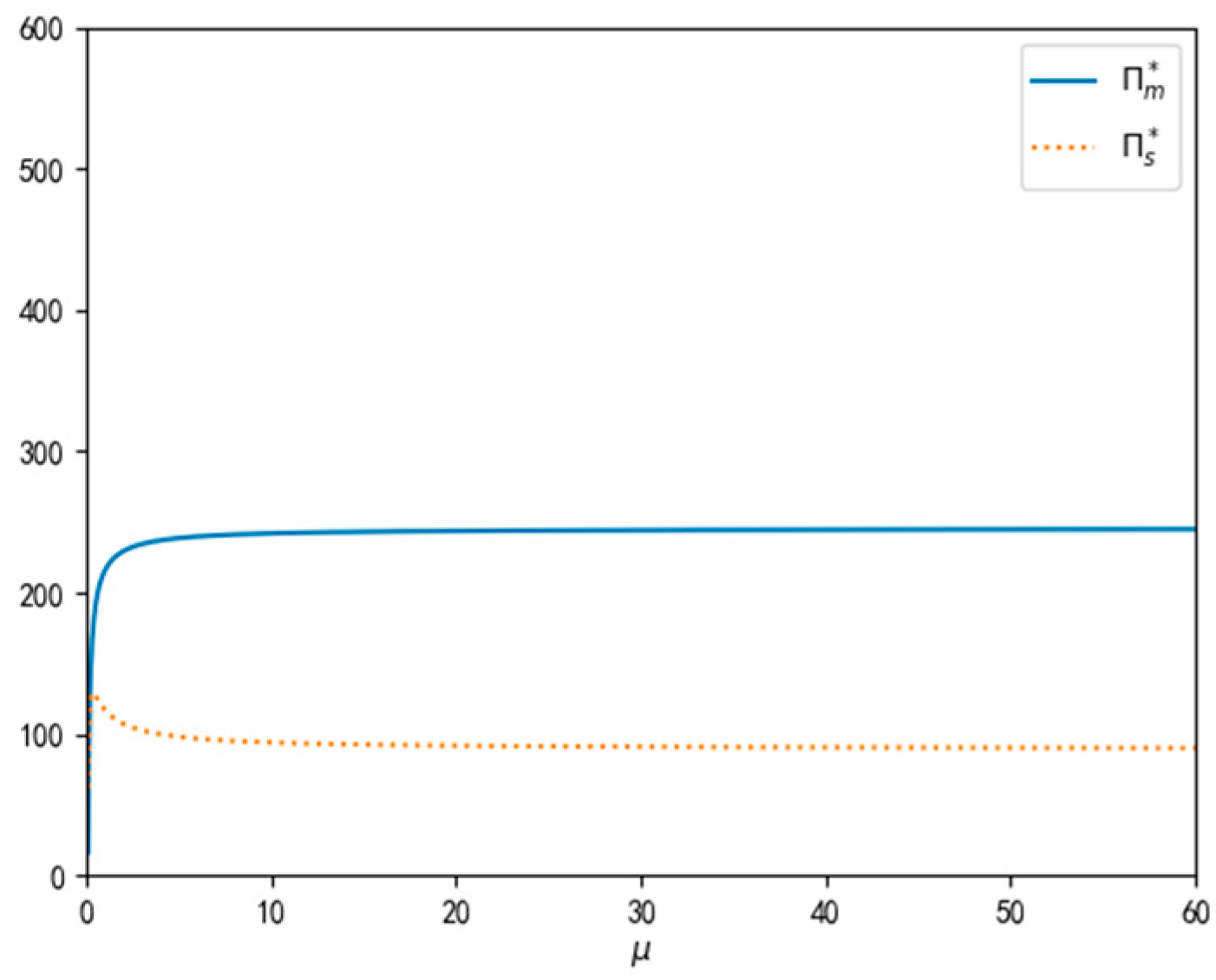

5.3. Sensitivity to Parameter

In this section, we fix a basic value for the other parameters and vary the value of to examine its effect on optimal decisions and profits.

Intuitively, the selling price and the quality level set by the OEM increase with the quality sensitivity of demand. Interestingly, the delivery time set by the CM decreases with the quality sensitivity of demand, as shown in

Figure 5. The reason for this is that the OEM tends to improve the quality and reasonably raise the selling price when customers value the quality of a product. In view of the high unit production subsidy related to the high quality level, the CM has an incentive to commit to a short delivery time so as to promote the demand and thus obtain more production subsidies. This implies that the high customer awareness of quality benefits the interactions between supply chain members. Therefore, as shown in

Figure 6, the supply chain members’ profits increase as the demand increases. More interestingly, the follower CM’s profit even exceeds the leader OEM’s profit if the quality sensitivity of demand is high enough.

In summary, a market of quality-sensitive customers helps to improve the quality of a product and the delivery service and increase supply chain members’ profits, hence enabling a triple-win outcome.

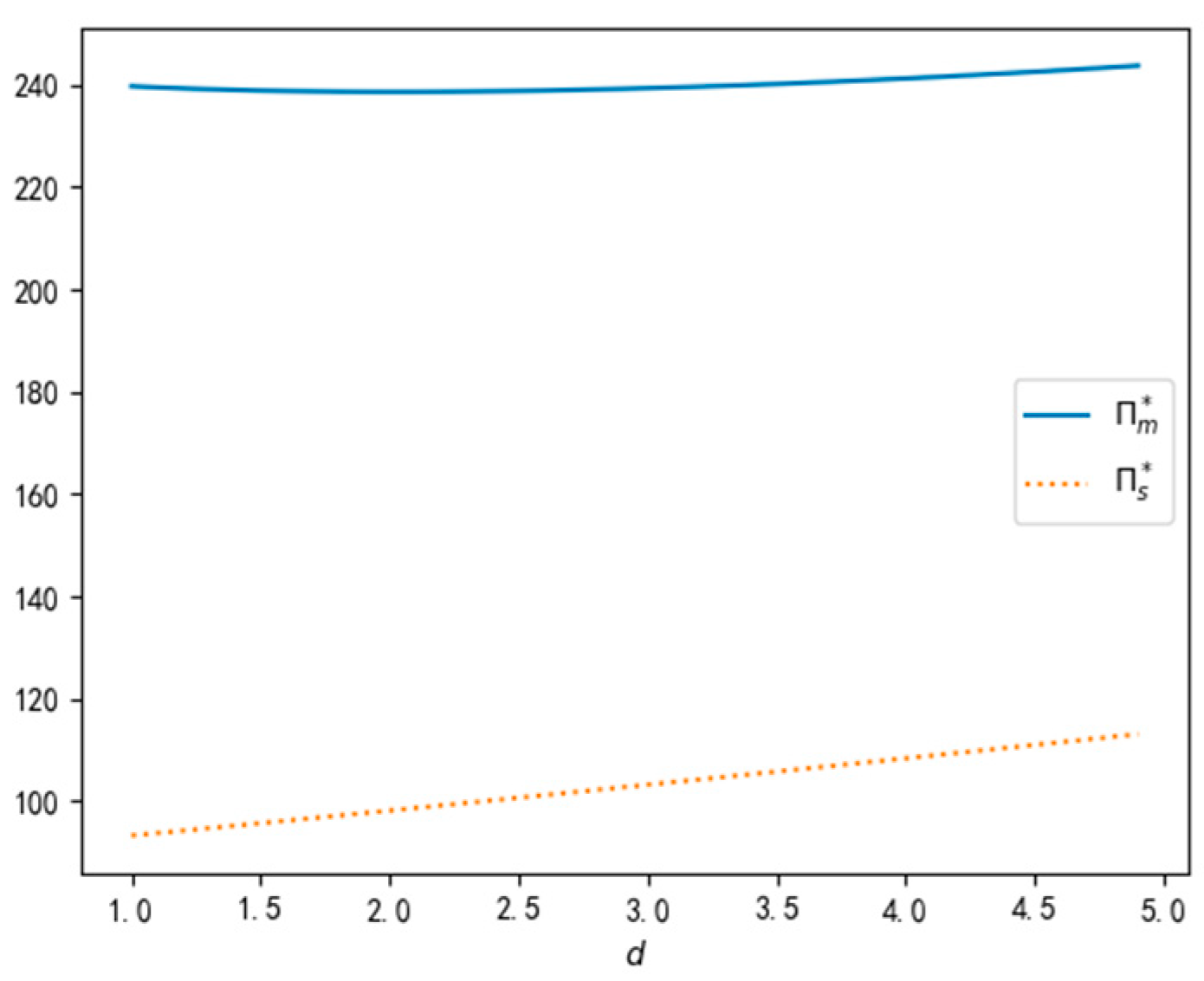

5.4. Sensitivity to Parameter

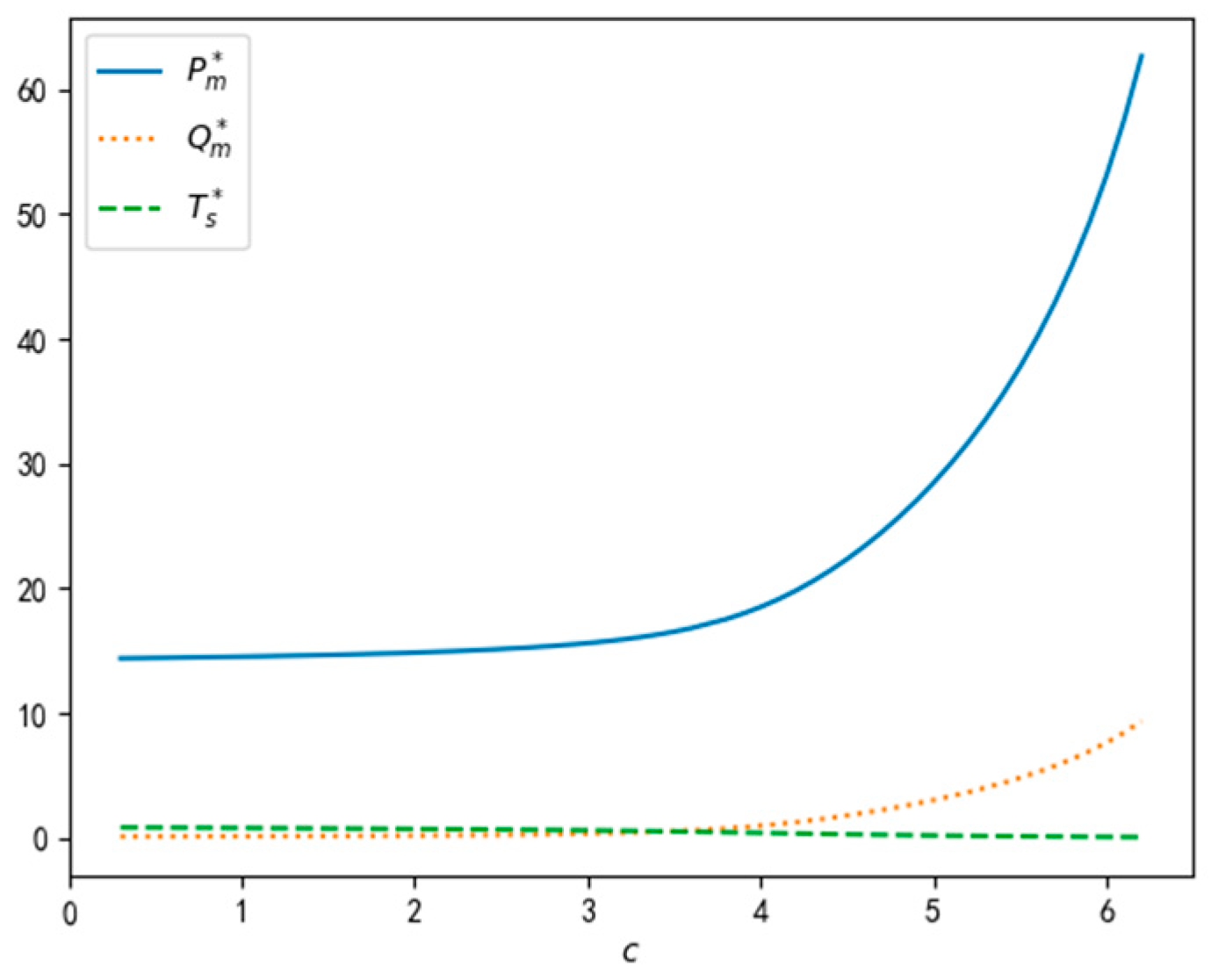

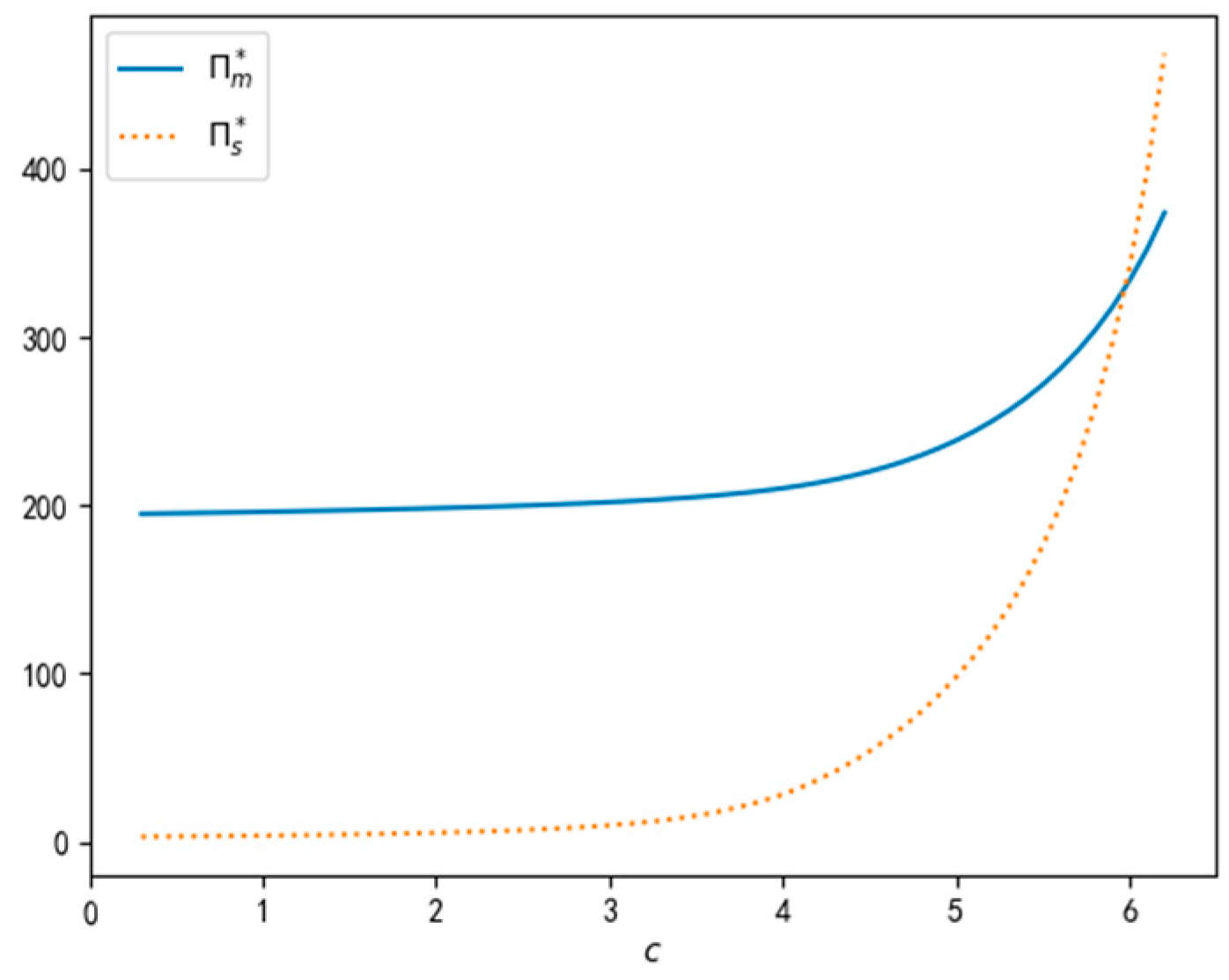

To explore the impact of parameter on the optimal decisions and profits, we vary the value of and fix a basic value for the other parameters.

Compared with parameter

, parameter

has the same trend of impact on the optimal decisions, but the sensitivities of the selling price and the quality level of it are much smaller, as shown in

Figure 7. The explanation for this is that the CM has an incentive to commit to a short delivery time to promote the demand when customers value the delivery service of a product. However, the CM’s effort level depends on the quality level chosen by the OEM since the production subsidy is related to the quality. Predicting the CM’s response and considering the costs of quality investment, the OEM moderately increases the quality level to encourage the CM to shorten the delivery time. Conditional on the small increase in the quality by the OEM, the CM also slightly shortens the delivery time considering the penalty costs. Correspondingly, the OEM gradually increases the selling price. From our computational results, the demand first decreases and then increases slowly as the committed delivery time sensitivity of demand increases. This implies that the selling price initially has a more dominant influence on the demand than the quality level and the delivery time. As a result, the OEM’s profit has the same variation pattern as the demand when the committed delivery time sensitivity of demand varies, as shown in

Figure 8, whereas intuitively, the CM’s profit increases with the committed delivery time sensitivity of demand due to the increased quality level.

In summary, a market of high delivery time-sensitive customers has a small positive impact on improving the quality and the delivery service and increasing supply chain members’ profits. A medium delivery time sensitivity of demand is not beneficial to the leader OEM. Counterintuitively, customers can enjoy the high-quality product alongside a fast delivery service when they become more sensitive to the committed delivery time.

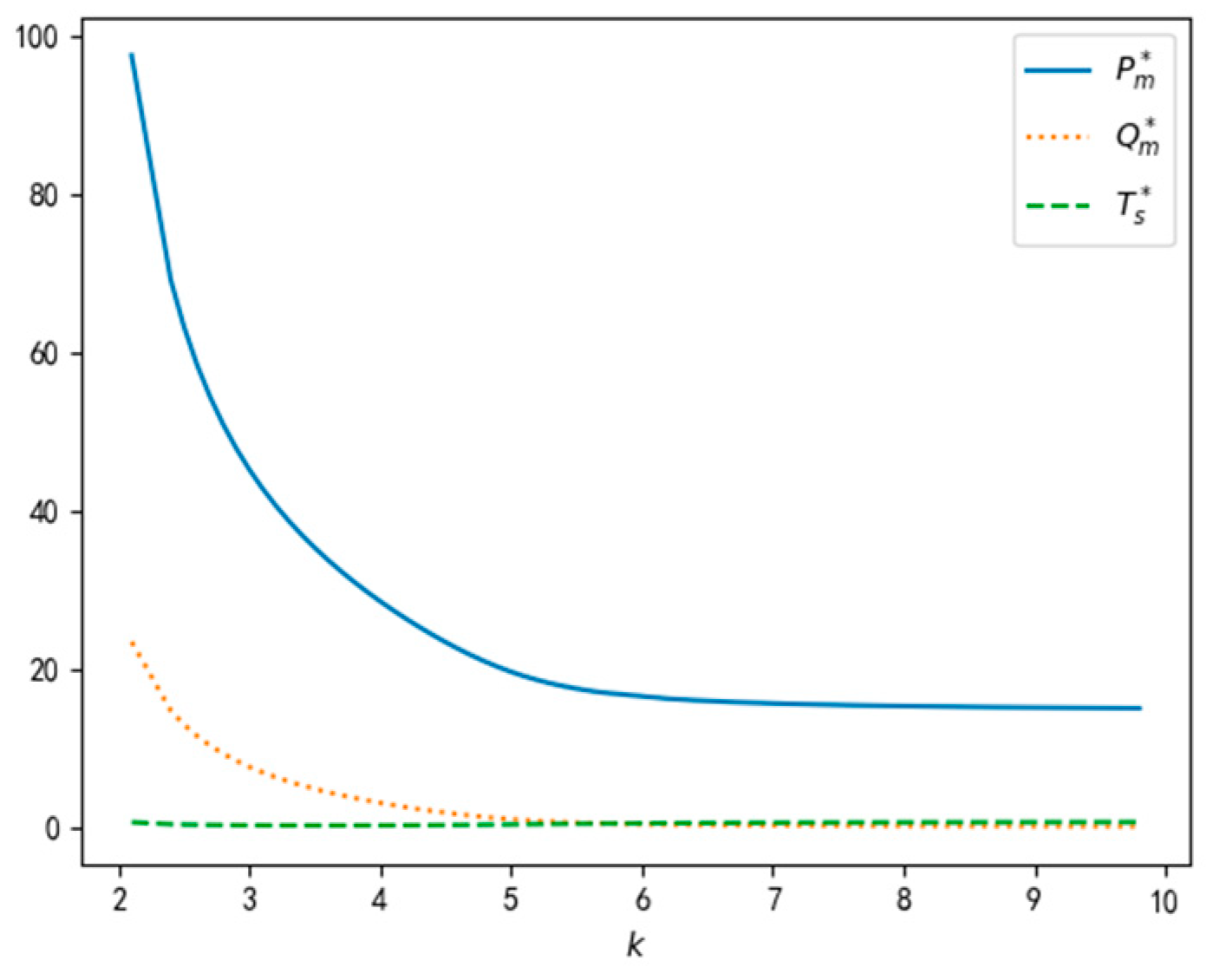

5.5. Sensitivity to Parameter

In this section, we study the impact of the unit production subsidy related to the quality on the optimal decisions and profits by varying the value of parameter .

As shown in

Figure 9, the selling price and the quality level set by the OEM decrease, while the delivery time set by the CM first decreases and then increases as the unit production subsidy related to the quality increases. The OEM’s profit decreases intuitively, while the CM’s profit first increases and then decreases as the value of parameter

increases, as shown in

Figure 10. The explanation for this is that, when the value of parameter

increases, the OEM lowers the quality level to reduce the transfer payment and correspondingly cuts the selling price to promote the demand. The CM initially has an incentive to shorten the delivery time as the unit production subsidy increases. However, such an incentive gradually becomes weak as the quality level decreases, and then the CM prolongs the delivery time considering the penalty costs. From our computational results, the demand continues to decrease in the equilibrium, which leads to a decrease in the OEM’s profit. Interestingly, the increase in the unit production subsidy is harmful to the CM after it exceeds the threshold value.

In summary, too high a unit production subsidy does not improve the quality and the delivery service, and even damages supply chain members’ profits. If is determined through negotiation between the CM and the OEM, it is good for the CM to claim a moderate unit production subsidy instead of asking for excessively high processing compensation.

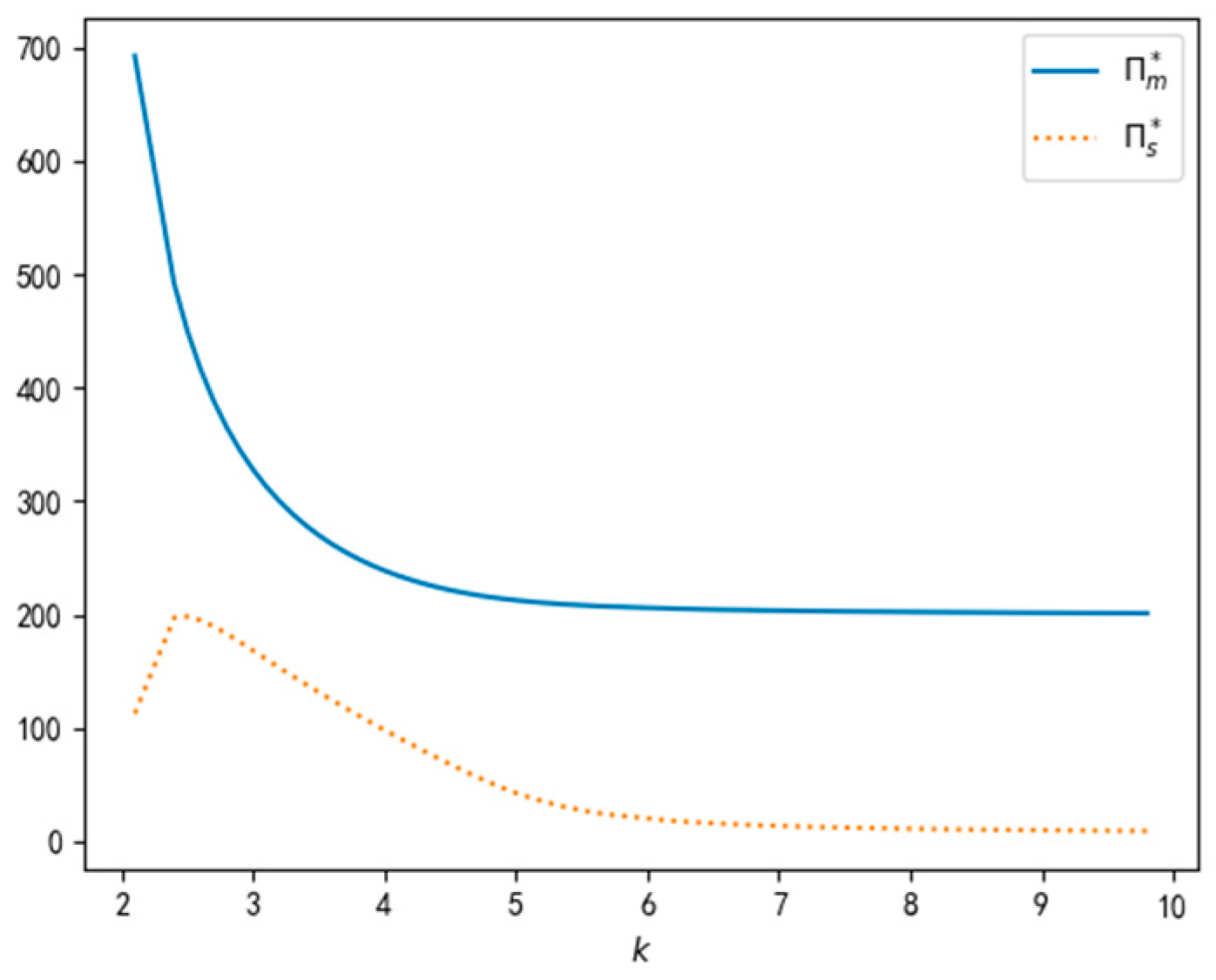

5.6. Sensitivity to Parameter

To examine the impact of the CM’s capacity on the optimal decisions and profits, we vary the value of parameter and fix a basic value for the other parameters.

Both the quality level and the selling price set by the OEM decrease slowly, while the delivery time set by the CM is almost constant, and the OEM’s profit increases with the CM’s capacity, as shown in

Figure 11 and

Figure 12, whereas the impact of the CM’s capacity on its own profit is non-monotonic; that is, the CM’s profit first increases temporally and then decreases continuously as the CM’s capacity increases, as shown in

Figure 12. The reason for this is that, when the CM’s capacity increases, the CM is willing to commit to a short delivery time due to the decrease in the expected penalty costs. Predicting this, the OEM chooses to lower the quality level so as to save the quality investment costs and accordingly reduce the selling price to promote the demand. As the quality level continuously decreases, the demand decreases from our computational results. As a result, the OEM’s profit increases slowly due to the decrease in quality investment costs, although the demand decreases slowly. The initial increase in the CM’s profit results from the decrease in expected penalty costs. However, the production subsidy decreases as the quality level continuously decreases, and thus the demand decreases. This results in the change pattern of the CM’s profit shown in

Figure 12 when its capacity changes. Interestingly, the improvement in the CM’s capacity always benefits the leader OEM, while the CM’s over-capacity can even harm it.

In summary, a high production capacity helps to lower the selling price but can harm the quality, and a medium production capacity increases supply chain members’ profits. Surprisingly, the delivery time in the equilibrium is not sensitive to the CM’s production capacity.

6. Conclusions

This paper studies the optimal quality choice and committed delivery time in a build-to-order supply chain, which consists of one contract manufacturer and one original equipment manufacturer. Under our assumptions, we provide closed-form or easily computed solutions regarding the decisions of the contract manufacturer and the original equipment manufacturer. We prove the existence of an equilibrium solution for their decisions. A detailed sensitivity analysis identifies how various system parameters affect the optimal supply chain members’ decisions and profits. This analysis enables us to identify several valuable insights into build-to-order supply chains.

(1) From Proposition 2, Proposition 4 and Proposition 5, the high-quality and fast-delivery product policy is worthwhile in a quality-sensitive or delivery time-sensitive market, which leads to a triple-win outcome among the contract manufacturer, the original equipment manufacturer, and the customers. This mirrors Tesla’s product policy cited in the Introduction.

(2) A moderate production subsidy can improve the quality and the delivery service (

Figure 9), as well as supply chain members’ profits (

Figure 10). Hence, the contract manufacturer’s rational compromises in processing compensation help not only the original equipment manufacturer but also itself. This mirrors Qualcomm’s outsourcing production policy cited in the Introduction.

(3) A high production capacity does not always mean an advantage for the supply chain product, even for the contract manufacturer (

Figure 12). A medium production capacity is desirable in a quality-sensitive market since over-capacity hurts the quality of the product (

Figure 11).

(4) Supply chain members typically benefit from their cooperation partners improving the quality level or the delivery service. In a highly quality-sensitive market, the follower’s profit may even exceed the leader’s through the latter’s efforts in quality improvement. In a highly delivery time-sensitive market, as a leader, the original equipment manufacturer is encouraged to select a contract manufacturer with a relatively high production capacity [

27].

(5) Considering the opportunity costs of quality investment, supply chain members are encouraged to drop unprofitable businesses in a market of highly selling price-sensitive customers. This mirrors Johnson & Johnson’s drug-coated stent market policy [

45].

Our work suggests several interesting directions for further research. First, a similar problem can be studied under the different random demand, for example, the renewal process with a nonlinear mean arrival rate. Second, here, we assume that supply chain members are risk neutral. It should be possible to generalize our results to consider supply chain members with different risk attitudes. Third, it would be interesting to study a horizontal competitive environment with multiple contract suppliers of different production capacities. Finally, a game events sequence different from those considered here can be explored. In conclusion, we hope that our work will encourage the further investigation of the intriguing and important topic of product and service operation management in supply chains.