Does High-Speed Railway Promote High-Quality Development of Enterprises? Evidence from China’s Listed Companies

Abstract

:1. Introduction

- Enterprises’ environmental responsibility is ignored or included in social responsibility (its independence is not recognized) in existing literature, and systematic research on the exploration of the concept of the high-quality development of enterprises is still lacking. This paper combed the related study of the concept of the high-quality development of enterprises, which will be “sustainable environmental value creation ability of independent conceptual framework into high quality for the business enterprise development, defining the high-quality development of enterprises is the enterprise to create economic value, social value and environmental value as the goal orientation, emphasized with the sustainable development of an enterprise development paradigm of ability or potential.”

- Few pieces of literature discuss the connection between the HSR and the high-quality development of enterprises. This paper studies the impact of the HSR on the high-quality development of enterprises from a micro perspective. We explored the heterogeneous effect of the HSR on the high-quality development of enterprises based on different aspects of urban agglomerations, city, industry, and enterprise. Furthermore, it provides new empirical evidence for the HSR enabling the high-quality development of enterprises.

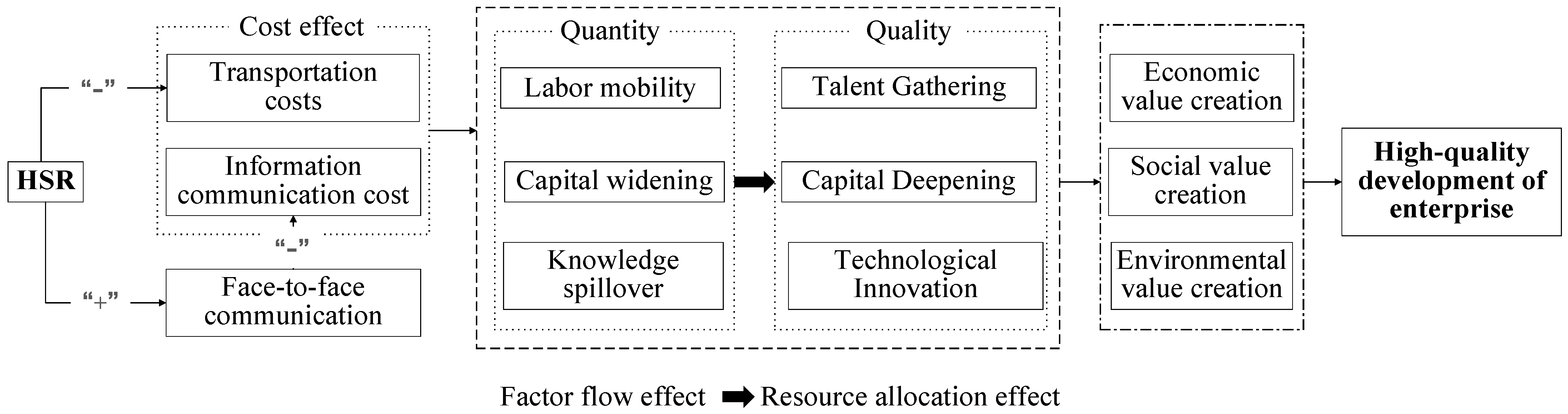

- The mechanism of the HSR on the high-quality development of enterprises needs to be further explored. From the perspective of production factors, this paper focuses on two aspects of “quantitative change” and “qualitative change.” We discussed HSR’s effect on the high-quality development of enterprises from six mechanisms: labor flow, talent agglomeration, capital popularization, capital deepening, knowledge spillover, and technological innovation. This paper compares and analyzes the similarities and differences between smart city construction and HSR mechanisms for the high-quality development of enterprises. It enriches the impact path of the HSR on the high-quality development of enterprises. It provides a detailed policy basis for improving the quality and efficiency of HSR construction in the new era and promoting enterprise quality development.

2. Theoretical Analysis

2.1. Literature Review

2.2. Concept Carding

| Nouns | Content | Literature |

|---|---|---|

| Quality (social property) | It measures the extent to which a substance satisfies the subject of use and is thus used to determine the degree of merit of the substance itself. | Huang (2018) [12] |

| Refers to the use-value characteristics based on the products that meet the needs of the social market | Ren (2018) [60] | |

| The degree to which a substance satisfies the subject of use to judge the substance’s pros and cons. | Jin (2018) [55] | |

| Quality of enterprise development | The process of change of connotation:

| Marshall (2004) [56] |

| Teece et al. (1997) [57] Hofer (1978) [58] | |

| Brundtland (1987) [59] | |

| Degree of excellence in enterprise development. | Huang (2018) [12] | |

| High-quality development of the enterprise | The target state or development paradigm for enterprises to pursue excellent, leading, efficient economic and social value creation, as well as to shape excellent quality capabilities for continuous growth and value creation. | Huang (2018) [12] |

| High-quality development of enterprises refers to the pursuit of a high level and high efficiency of economic value and social value creation, with innovation serving as the first impetus. | Zhao et al. (2021) [25] | |

| An enterprise development paradigm that focuses on the creation of economic value, social value, and environmental value, as well as emphasizes the ability or potential of sustainable development. | This paper |

2.3. Mechanisms

2.3.1. HSR, Labor, and High-Quality Development of Enterprises

2.3.2. HSR, Capital, and High-Quality Development of Enterprises

2.3.3. HSR, Innovation, and High-Quality Development of Enterprises

3. Data and Methodology

3.1. Measurement of the High-Quality Development of Enterprises

3.1.1. Construction of High-Quality Development of Enterprise Index System

- Input indicators: in this paper, based on labor input, capital input, and intermediate input, R&D input is included in the input indicators regarding the studies of Yu and Feng [73] and Ren [74]. Some scholars also innovatively added energy inputs to the input side variables in constructing green total factor production efficiency [75,76,77]. However, due to the serious problem of missing data, energy inputs and intermediate inputs are not considered in this paper. In addition, besides the above-mentioned input indicators, such as labor, capital, and R&D, government subsidies are also one of the critical variables on the input side of enterprises [78,79]. Therefore, it is added as the fourth input indicator in this paper.

- Output indicators: To more comprehensively measure the high-quality development of enterprises, more and more studies started to explore a multi-output green total factor productivity indicator system. Not only do they include “bad outputs” (also called environmental outputs), such as CO2, SO2 emissions, forestry soot emissions, and environmental management as non-desired outputs in the output index system [80,81,82], but they also add social-type outputs as the second type of desired output based on economic outputs as desired outputs [83]. This is consistent with the internal logic of this paper that economic value, social value, and environmental value creation are the three major goal orientations of enterprise quality development.

3.1.2. Färe–Primont Index

3.2. Empirical Analysis Model Construction

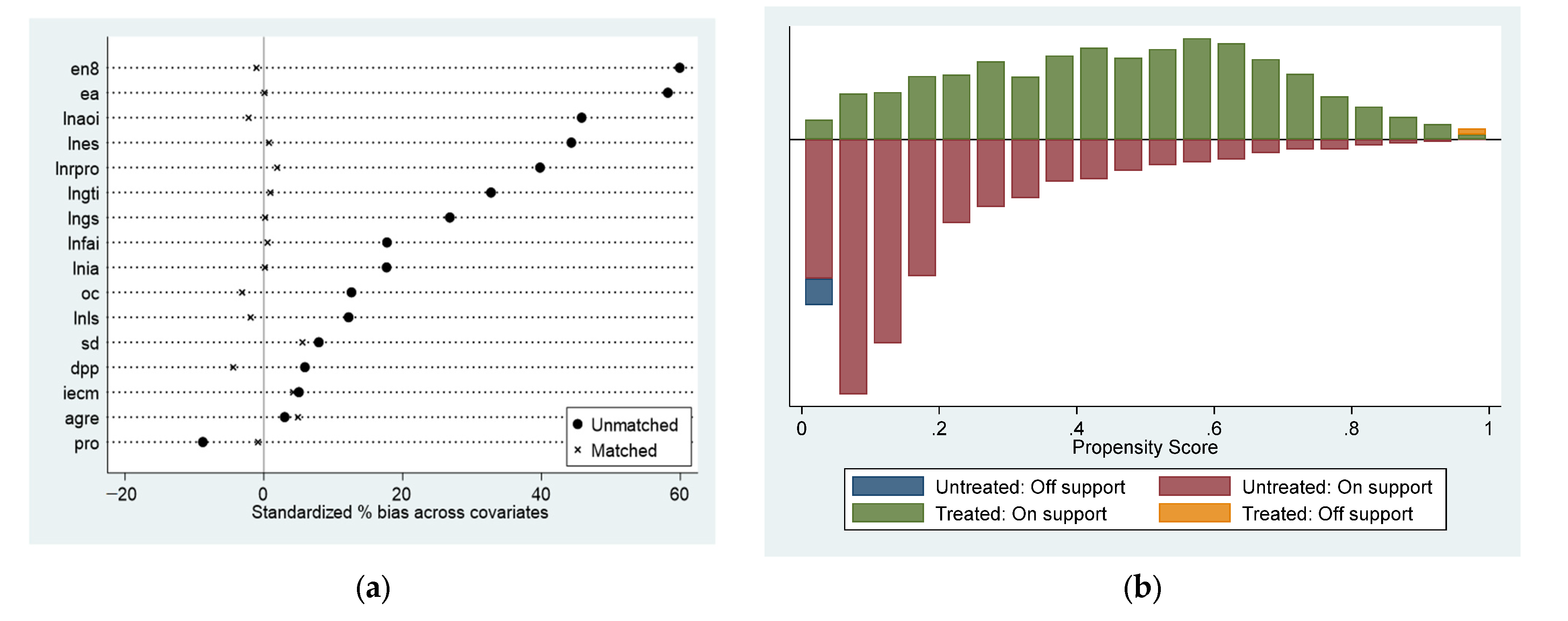

3.2.1. PSM-DID

3.2.2. Mediated Effect Model

3.3. Data

3.4. Descriptions Analysis

4. Empirical Analysis Results

4.1. Model Feasibility Test

4.2. Benchmark Regression Analysis

4.3. Heterogeneity Analysis

4.3.1. Heterogeneity Analysis Based on Urban Agglomerations

4.3.2. Heterogeneity Analysis Based on City Location and City Size

4.3.3. Heterogeneity Analysis Based on Different Industries

4.3.4. Heterogeneity Analysis Based on Different Enterprises

4.4. Robustness Tests

4.4.1. Change the Time of Policy Implementation

4.4.2. Replace the Explained Variable

4.4.3. Replace Explanatory Variables

4.4.4. Endogenous Analysis

4.4.5. Random Sample Regression

5. Mechanism Inspection and Further Expansion Analysis

5.1. Mechanism Test

5.1.1. Analysis of Mediating Effect Based on Labor Mobility and Talent Gathering

5.1.2. Analysis of Mediating Effect Based on Capital Widening and Capital Deepening

5.1.3. Analysis of Mediating Effect Based on Knowledge Spillover and Technological Innovation

5.2. Further Analysis

6. Discussion

6.1. Does HSR Promote the High-Quality Development of Enterprises?

6.2. What Is Primary Mechanism by Which the HSR Impacts Enterprises’ High-Quality Development?

7. Conclusions Implications and Future Research

7.1. Conclusions

7.2. Implications

7.2.1. Theoretical Contributions

7.2.2. Management Enlightenment

7.2.3. Policy Implications

7.3. Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wen, Y.B.; Zhang, M.; Yu, F. A study on the resource reallocation effect of China’s transportation infrastructure. Econ. Res. J. 2022, 57, 155–171. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=JJYJ202201013&DbName=CJFQ2022 (accessed on 13 March 2021).

- Vickerman, R.W. Can high-speed rail have a transformative effect on the economy? Transp. Policy 2017, 62, 31–37. [Google Scholar] [CrossRef]

- Jiang, C.; Liu, X. Does high-speed rail operation reduce ecological environment pressure? —Empirical evidence from China. Sustainability 2022, 14, 3152. [Google Scholar] [CrossRef]

- Miwa, N.; Bhatt, A.; Kato, H. High-speed rail development and regional inequalities: Evidence from Japan. Transp. Res. Rec. 2022, 2676, 363–378. [Google Scholar] [CrossRef]

- Liu, L.; Zhang, M. The impacts of high-speed rail on regional accessibility and spatial development—Updated evidence from China’s Mid-Yangtze River city-cluster region. Sustainability 2021, 13, 4227. [Google Scholar] [CrossRef]

- Liu, S.; Wan, Y.; Zhang, A. Does China’s high-speed rail development lead to regional disparities? A network perspective. Transp. Res. Part A Policy Pract. 2020, 138, 299–321. [Google Scholar] [CrossRef]

- Ahlfeldt, G.M.; Feddersen, A. From periphery to core: Measuring agglomeration effects using high-speed rail. J. Econ. Geogr. 2018, 18, 355–390. [Google Scholar] [CrossRef]

- Fosu, P. Does Railway Lines Investments Matter for Economic Growth? Econ.-Innov. Econ. Res. J. 2021, 9, 11–24. [Google Scholar] [CrossRef]

- Hayakawa, K.; Koster, H.; Tabuchi, T.; Thisse, J.F. High-Speed Rail and the Spatial Distribution of Economic Activity: Evidence from Japan’s Shinkansen. 1 February 2021. CEPR Discussion Paper No. DP15771. 1–67. Available online: https://ssrn.com/abstract=3783997 (accessed on 5 June 2022).

- Koster, H.; Tabuchi, T.; Thisse, J.F. To be connected or not to be connected? the role of long-haul economies. J. Econ. Geogr. 2022, 22, 711–753. [Google Scholar] [CrossRef]

- Kong, L.; Zhang, Z. Does infrastructure upgrading make cities more entrepreneurial? Evidence from high-speed railway and smart city construction. Foreign Econ. Manag. 2020, 42, 139–152. [Google Scholar] [CrossRef]

- Huang, S.; Xiao, H.; Wang, X. Study on high-quality development of the state-owed enterprises. China Ind. Econ. 2018, 10, 19–41. [Google Scholar] [CrossRef]

- Wu, B.; Li, W.; Chen, J. Networked Transport and Economic Growth: Does High-Speed Rail Narrow the Gap between Cities in China? Sustainability 2022, 14, 5937. [Google Scholar] [CrossRef]

- Lin, S.; Dhakal, P.R.; Wu, Z. The Impact of High-Speed Railway on China’s Regional Economic Growth Based on the Perspective of Regional Heterogeneity of Quality of Place. Sustainability 2021, 13, 4820. [Google Scholar] [CrossRef]

- Baum-Snow, N.; Henderson, J.V.; Turner, M.A.; Zhang, Q.; Brandt, L. Does investment in national highways help or hurt hinterland city growth? J. Urban Econ. 2020, 115, 103124. [Google Scholar] [CrossRef]

- Baum-Snow, N.; Brandt, L.; Henderson, J.V.; Turner, M.A.; Zhang, Q. Roads, railroads, and decentralization of Chinese cities. Rev. Econ. Stat. 2020, 99, 435–448. [Google Scholar] [CrossRef]

- Baum-Snow, N. Did highways cause suburbanization? Q. J. Econ. 2007, 122, 775–805. [Google Scholar] [CrossRef]

- Lv, Y.; Wu, Y. The effect of high-speed rail and the reconstruction of economic geography in the Yangtze River Delta: Based on the perspective of new industrial revolution. Mod. Econ. Res. 2019, 9, 74–77. [Google Scholar] [CrossRef]

- Sun, W.; Niu, D.; Wan, G. Transportation infrastructure and industrial structure upgrading: Evidence from China’s high-speed railway. J. Manag. World 2022, 38, 19–34+58+35–41. [Google Scholar] [CrossRef]

- Lu, Y.; Yang, S.; Li, J. The influence of high-speed rails on urban innovation and the underlying mechanism. PLoS ONE 2022, 17, e0264779. [Google Scholar] [CrossRef]

- Bian, Y.; Wu, L.; Bai, J. Does high-speed rail improve regional innovation in China? J. Financ. Res. 2019, 6, 132–149. [Google Scholar]

- Jia, R.; Shao, S.; Yang, L. High-speed rail and CO2 emissions in urban China: A spatial difference-in-differences approach. Energy Econ. 2022, 99, 105271. [Google Scholar] [CrossRef]

- Li, Q.; Dong, A.; Zhang, B. Impact of the opening of high-speed rail on environmental pollution in the Yangtze River Economic Belt: Promoting or inhibiting? Int. J. Environ. Sci. Technol. 2022, 1–16. [Google Scholar] [CrossRef]

- Hu, H.; Sun, L. Has the opening of high-speed rail promoted the high-quality development of enterprises in non-hub city? Res. Financ. Econ. Issues 2021, 12, 123–132. [Google Scholar] [CrossRef]

- Zhao, T.; Xiao, X.; Dai, Q. Transportation infrastructure construction and high-quality development of enterprises: Evidence from the quasi-natural experiment of high-speed railway opening in China. Sustainability 2021, 13, 13316. [Google Scholar] [CrossRef]

- Xian, J.; Wang, W. High-speed railway and productivity of servicing enterprises: Evidence from Chinese listed companies. J. Bus. Econ. 2020, 10, 73–85. [Google Scholar]

- Xu, Y.; Li, Y.; Li, S. Does high-speed rail help or hurt total factor productivity of enterprises in marginal cities. Res. Transp. Bus. Manag. 2022, 43, 100837. [Google Scholar] [CrossRef]

- Yang, X.; Lin, S.; Zhang, J. Does high-speed rail promote enterprises productivity? Evidence from China. J. Adv. Transp. 2019, 2019, 1279489. [Google Scholar] [CrossRef]

- Wang, Z.; Wang, H. Low-carbon city pilot policy and high quality development of enterprises: From the perspective of economic effiency and social benefit. Bus. Manag. J. 2022, 44, 43–62. [Google Scholar] [CrossRef]

- Dai, G.; Wang, Y. High quality development of private small, medium and micro enterprises: Connotation, dilemma and path. Econ. Probl. 2019, 8, 54–61. [Google Scholar] [CrossRef]

- Luo, B.; Liu, Y. Tax incentives, innovation input and high quality development of businesses. Tax Econ. Res. 2020, 25, 13–21. [Google Scholar] [CrossRef]

- Liu, H.; Liu, C.; Zheng, S. The effect of new ambient air quality standards on the high-quality development of Chinese enterprises. China Soft Sci. 2020, 10, 45–55. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=ZGRK202010005&DbName=CJFQ2020 (accessed on 15 April 2021).

- Li, Q. The dynamic mechanism and realization paths of high-quality development of the manufacturing enterprises in the new era. Financ. Econ. 2019, 6, 57–69. Available online: https://css.researchcommons.org/journal/vol2020/iss3/4 (accessed on 15 April 2021).

- Gladwin, T.N.; Kennelly, J.J.; Krause, T.-S. Shifting paradigms for sustainable development: Implications for management theory and research. Acad. Manag. Rev. 1995, 20, 874–907. [Google Scholar] [CrossRef]

- Chen, L.; Fu, Y. The dynamic characteristics of technological innovation affecting the high-quality development of enterprises under the constraints of financing. China Soft Sci. 2019, 12, 108–128. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=ZGRK201912010&DbName=CJFQ2019 (accessed on 21 October 2021).

- Chen, Z.; Liu, Y. Government subsidies, enterprise innovation and high-quality development of manufacturing enterprises. Reform 2019, 8, 140–151. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=REFO201908012&DbName=CJFQ2019 (accessed on 11 July 2021).

- Lu, X.; Lian, Y. Estimation of total factor productivity of industrial enterprises in China: 1999-2007. China Econ. Q. 2012, 11, 541–558. [Google Scholar] [CrossRef]

- Zhou, J.; Fan, X.; Yu, A. The impact of high-speed railway accession on agricultural exports: Evidence from Chinese agriculture-related enterprises. Complexity 2021, 2021, 4225671. [Google Scholar] [CrossRef]

- Liu, X.; Wen, S. Should financial institutions be environmentally responsible in China? Facts, theory and evidence. Econ. Res. J. 2019, 54, 38–54. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=JJYJ201903004&DbName=CJFQ2019 (accessed on 20 April 2021).

- Zhai, S.; Bi, X.; Li, S. The Enterprise dualistic innovation investment under time and space compression: The Evidence of high-speed railway opening. South China J. Econ. 2020, 9, 54–68. [Google Scholar] [CrossRef]

- Ma, G.; Cheng, X.; Yang, E. How does transportation infrastructure affect capital flows—A study from high-speed rail and cross-region investment of listed companies. China Ind. Econ. 2020, 6, 5–23. [Google Scholar] [CrossRef]

- Wen, W.; Huang, Y.; Song, J. Does the construction of transportation infrastructure improve the efficiency of corporate investment?—Quasi-natural experiment based on the opening of High-speed railway in China. J. Zhongnan Univ. Econ. Law 2019, 2, 42–52. [Google Scholar] [CrossRef]

- Tang, Y.; Yu, F.; Lin, F.; Zhang, M. China’s high-speed railway, trade cost and firm export. Econ. Res. J. 2019, 54, 158–173. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=JJYJ201907012&DbName=CJFQ2019 (accessed on 13 March 2021).

- Zhu, S.; Li, S. How does opening high speed railway affect the export products quality of firms. J. Macro-Qual. Res. 2020, 8, 14–30. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=HGLY202003003&DbName=CJFQ2020 (accessed on 13 March 2021). [CrossRef]

- Xiao, L.; Dai, W. High-speed rail hub and enterprise innovation: An interpretation from the perspective of peer effect. J. Technol. Econ. 2021, 40, 11–24. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=JSJI202112003&DbName=CJFQ2021 (accessed on 13 May 2021).

- Chen, J.; Fang, J. Transportation infrastructure improvement and dynamic adjustment of firm capital structure: Empirical evidence based on high-speed railway coverage. Foreign Econ. Manag. 2022, 44, 138–152. [Google Scholar] [CrossRef]

- Tan, J.; Ding, H.; Tan, Z. High speed rail opening and corporate innovation—Based on the Quasi-natural experiment on high-speed railway opening. J. Shanxi Univ. Financ. Econ. 2019, 41, 60–70. [Google Scholar] [CrossRef]

- Ji, Y.; Yang, Q. Can the high-speed rail service promote enterprise innovation? A study based on Quasi-natural experiments. J. World Econ. 2020, 43, 147–166. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=SJJJ202002008&DbName=CJFQ2020 (accessed on 21 October 2021).

- Zhu, Z.; Huang, X.; Wang, H. Does traffic infrastructure promote innovation? A quasi-natural experiment based on the expansion of the high-speed railway network in China. J. Financ. Res. 2019, 11, 153–169. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=JRYJ201911009&DbName=CJFQ2019 (accessed on 13 March 2021).

- Wang, Y.; Ni, P.; Zhao, J.; Wang, Y. Travel distance, commuting frequency and corporate innovation from the perspective of high-speed rail and spatial relationship with central cities. Financ. Trade Econ. 2021, 42, 150–165. [Google Scholar] [CrossRef]

- Sun, W.; Zhang, J. Can the high-speed rail network promote high-quality innovation in Manufacturing enterprises? J. World Econ. 2020, 43, 151–175. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=SJJJ202012008&DbName=CJFQ2020 (accessed on 13 March 2021).

- Sun, W.; Zhang, J. High-speed rail network, factor reverse agglomeration and manufacturing corporate innovation. J. Xi’an Jiaotong Univ. (Soc. Sci.) 2022, 42, 85–95. [Google Scholar] [CrossRef]

- Li, X.; Ji, X.; Zhou, L. Can high-speed railway improve enterprises’ resource allocation? Micro-evidence from the annual survey of industrial firms in china and high-speed railway geographic data. Econ. Rev. 2017, 6, 3–21. [Google Scholar] [CrossRef]

- Wang, Y.; Pan, P.; Tang, C. Opening of HSR, geographical location and the governance effect of PE. Economic Geography (accepted). Available online: http://kns.cnki.net/kcms/detail/43.1126.K.20200710.1411.002.html (accessed on 13 March 2021).

- Jin, B. Study on the “high-quality development” economics. China Ind. Econ. 2018, 4, 5–18. [Google Scholar] [CrossRef]

- Marshall, A. The principles of economics. Political Sci. Q. 2004, 77, 519–524. Available online: http://socserv.mcmaster.ca/econ/ugcm/3ll3/marshall/prin/index.html (accessed on 13 March 2021).

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Hofer, C.W.; Schendel, D. Strategy formulation: Analytical concepts. West Pub. 1978, 51, 6989–6992. [Google Scholar] [CrossRef]

- Brundtland, G.H. Our common future—call for action. Environ. Conserv. 1987, 14, 291–294. [Google Scholar] [CrossRef]

- Ren. The theoretical logic of political economy of high-quality development in the new era and its relevance. J. Humanit. 2018, 2, 26–34. [Google Scholar] [CrossRef]

- Chu, J.; Fang, J. Improvement of transport infrastructure and bank loan decision: Based on a quasi-natural experiment of high-speed railway in China. Account. Econ. Res. 2019, 33, 38–60. [Google Scholar] [CrossRef]

- Wang, W.; Ma, H. High-speed railway network, labor transfer and industrial space agglomeration. Contemp. Econ. Manag. 2019, 41, 38–48. [Google Scholar] [CrossRef]

- Li, S.A.; Gong, L.; Pan, S.; Luo, F. Wage and price differences, technology gap and labor flow dynamics. Econ. Model. 2020, 88, 211–222. [Google Scholar] [CrossRef]

- Dong, X.; Zheng, S.; Kahn, M.E. The role of transportation speed in facilitating high skilled teamwork across cities. J. Urban Econ. 2019, 115, 103212. [Google Scholar] [CrossRef]

- Yang, X.; Zhang, H.; Li, Y. High-speed railway, factor flow and enterprise innovation efficiency: An empirical analysis on micro data. Socio-Econ. Plan. Sci. 2022, 82, 101305. [Google Scholar] [CrossRef]

- Liang, L.; Lu, Y. Research on the influence of multidimensional proximity on the performance of school-enterprise innovation cooperation. J. Technol. Econ. 2022, 41, 62–74. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=JSJI202202006&DbName=CJFQ2022 (accessed on 21 October 2021).

- Yu, Y.; Pan, Y. Does high-speed rail reduce the rural-urban income disparity? An interpretation based on the perspective of heterogeneous labor mobility. Chin. Rural. Econ. 2019, 1, 79–95. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=ZNJJ201901006&DbName=CJFQ2019 (accessed on 13 March 2021).

- Shen, H.; Cheng, X.; Yang, M. Does the opening of the high-speed rail increase the efficiency of the capital market?—A study based on stock price synchronicity. Chin. Rev. Financ. Stud. 2020, 12, 48–68+124–125. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=JRPL202001006&DbName=CJFQ2020 (accessed on 9 March 2022).

- Wei, S.; Gu, J.; Jiang, Y. A review of knowledge spillover, absorptive capacity and economic Performance. Mod. Econ. Res. 2017, 9, 123–132. [Google Scholar] [CrossRef]

- Guo, J.; Bai, J. How CHSR construction drives the innovation of enterprises. Econ. Theory Bus. Manag. 2019, 5, 60–74. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=JJLL201905006&DbName=CJFQ2019 (accessed on 13 March 2021).

- Zong, G.; Zhang, X. High-speed railway, technological innovation and high-quality economic development—Empirical test and mechanism research. J. Shanxi Univ. Financ. Econ. 2020, 42, 1–14. [Google Scholar] [CrossRef]

- Levinsohn, J.; Petrin, A. Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 2003, 70, 317–341. [Google Scholar] [CrossRef]

- Yu, X.; Feng, X.; Kang, Z.; Yu, W. COVID-119, social security reduction and total factor productivity of enterprises. Econ. Sci. 2022, 4, 108–123. [Google Scholar]

- Ren, Y.; Zhang, X.; Wu, J.; Chu, Z. Government subsides, R&D investment and total factor productivity: An empirical study of Chinese manufacturing enterprises. Sci. Decis. Mak. 2022, 7, 44–62. [Google Scholar]

- Yang, W.; Wang, Q. Can resolving overcapacity improve green total factor productivity? A Quasi-natural experiment based on China’s industrial de-capcity. Econ. Probl. 2022, 7, 1–12. [Google Scholar] [CrossRef]

- He, L.; Qi, X. Environmental regulation and green total factor productivity—Evidence from Chinese industrial enterprises. Econ. Perspect. 2022, 6, 97–114. [Google Scholar]

- Cai, L.; Wang, P. Digital economy and urban green total factor productivity: Influencing mechanism and empirical evidence. Stat. Decis. 2022, 38, 11–16. [Google Scholar] [CrossRef]

- Ren, S.; Lv, Z. The financial constraints, the government subsides and the factor productivity: A case study on the equipment-manufacturing enterprises in China. J. Manag. World 2014, 11, 10–23+187. [Google Scholar] [CrossRef]

- Zhang, Z.; Liu, Z. Do government innovation subsidies improve firm’s total factor productivity? A comparative study on the impacts of innovation and non-innovation subsidies. Ind. Econ. Res. 2022, 3, 113–127. [Google Scholar] [CrossRef]

- Pang, R.; Wang, L. Is the development of Chinese service industry definitely green?—Based on Analysis of environmental total factor efficiency of service industry. Ind. Econ. Res. 2016, 4, 18–28. [Google Scholar]

- Yin, X.; Ouyang, F. The re-estimation of total factor productivity and the economic growth sustainability comparison among different economic growth model in China. J. Quant. Tech. Econ. 2019, 36, 72–91. [Google Scholar] [CrossRef]

- Zhan, Y.; Li, S. Smart city construction, entrepreneurial vitality and high-quality economic development: Analysis based on the GTFP perspective. J. Financ. Econ. 2022, 48, 4–18. [Google Scholar] [CrossRef]

- Gao, Y.; Yang, G.; Xie, Q. Impact of environmental regulation on green total factor productivity from the perspective of public participation theory: Testing based on spatial econometric model and threshold effect. Sci. Technol. Manag. Res. 2020, 40, 232–240. [Google Scholar]

- Tang, P.; Yang, S. Research on corporate social responsibility investment pattern: Based on value criterion. China Ind. Econ. 2016, 7, 109–126. [Google Scholar] [CrossRef]

- Yang, H.; Shi, X.; Wang, S. The Impact of Heterogeneous Corporate Social Responsibility on Green Technology Innovation. Shandong Soc. Sci. 2022, 2, 165–175. [Google Scholar] [CrossRef]

- O’Donnell, C.J. The Sources of Productivity Change in the Manufacturing Sectors of the U.S. Economy. CEPA Working Papers Series 2011, 1–56. Available online: http://www.uq.edu.au/economics/cepa/docs/WP/WP072011.pdf (accessed on 9 March 2022).

- Wen, Z.; Zhang, L.; Hou, J.; Liu, H. Testing and application of the mediating effects. Acta Psychol. Sin. 2004, 5, 614–620. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=XLXB200405016&DbName=CJFQ2004 (accessed on 9 March 2021).

- Shi, D.; Hu, K.; Chen, J. Does urban civilization promote the high-quality development of enterprises? A research based on the perspectives of environmental regulation and transaction cost. Ind. Econ. Res. 2019, 6, 27–38. [Google Scholar] [CrossRef]

- Angrist, J.D.; Keueger, A.B. Does compulsory school attendance affect schooling and earnings? Q. J. Econ. 1991, 106, 979–1014. [Google Scholar] [CrossRef]

- Coronado, J.M.; Ureña, J.M.D.; Miralles, J.L. Short-and long-term population and project implications of high-speed rail for served cities: Analysis of all served Spanish cities and re-evaluation of Ciudad Real and Puertollano. Eur. Plan. Stud. 2019, 27, 434–460. [Google Scholar] [CrossRef]

- Lu, G.; Dong, R.; Ye, C. Does “the Belt and Road Initiative” promote high-quality exports—Evidence from firms in China. China Ind. Econ. 2021, 3, 80–98. [Google Scholar] [CrossRef]

- Duflo, E. Schooling and labor market consequences of school construction in Indonesia: Evidence from an unusual policy experiment. Am. Econ. Rev. 2001, 91, 795–813. [Google Scholar] [CrossRef]

- Lu, Y.; Wang, J.; Zhu, L. Place-based policies, creation, and agglomeration economies: Evidence from China’s economic zone program. Am. Econ. J. Econ. Policy 2019, 11, 325–360. [Google Scholar] [CrossRef]

- Bouraima, M.B.; Stević, Ž.; Tanackov, I.; Qiu, Y. Assessing the performance of Sub-Saharan African (SSA) railways based on an integrated Entropy-MARCOS approach. Oper. Res. Eng. Sci. Theory Appl. 2021, 4, 13–35. [Google Scholar] [CrossRef]

| Index | Primary Indicator | Secondary Indicator | Tertiary Indicator |

|---|---|---|---|

| Input | Labor | Labor scale | Labor scale |

| Capital | Fixed assets investment | Fixed assets investment | |

| Government subsidies | The number of government subsidies | Government subsidies | |

| Innovation | R&D investment | R&D investment | |

| Output | Economic performance | Profitability | Return on equity |

| Solvency | Asset liability ratio | ||

| Social responsibility | Employee responsibility | Annual employment growth rate, employee compensation payable growth rate | |

| Social responsibility | Total tax payment, social donations | ||

| Environmental responsibility | Environmental awareness | Environmental awareness | |

| Environmental disclosure | Disclosure of sudden environmental accidents, environmental supervision, and certification | ||

| Environmental governance | Environmental protection investment amount |

| Indexes | Symbol | Meaning |

|---|---|---|

| Technical progress | TFP* | Technological progress beyond production technology |

| Technical efficiency | OTE | Production technology progress |

| Scale efficiency | OSE | Efficiency value increase caused by the enterprise-scale change |

| Residual mixing efficiency | RME | Productivity growth is promoted by resource allocation efficiency |

| Types | A Share | B Share | ST, *ST Share |

|---|---|---|---|

| Number of listed companies | 1331 | 14 | 156 |

| Proportion (%) | 88.67 | 0.93 | 10.39 |

| Year | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Treatment | 0 | 102 | 135 | 195 | 361 | 408 | 426 | 519 | 630 | 672 | 687 | 716 | 719 |

| Control | 1331 | 1229 | 1196 | 1136 | 970 | 923 | 905 | 812 | 701 | 659 | 644 | 615 | 612 |

| Variables | Symbol | Measurement | Obs. | Mean | Std. Err. | Min. | Max. |

|---|---|---|---|---|---|---|---|

| Explained variable | |||||||

| High-quality development of enterprises | hqde | The logarithm of TFP | 17,303 | 0.0343 | 0.1159 | −1.5089 | 4.0160 |

| Explanatory variable | |||||||

| Treatment effect | did | HSR opening or not | 17,303 | 0.2969 | 0.4569 | 0 | 1 |

| Firm control variables | |||||||

| Firm size | lnes | The logarithm of the total assets of the enterprise | 17,303 | 20.7838 | 1.6208 | 17.8396 | 26.4485 |

| Firm age | ea | Firm age | 17,303 | 17.2540 | 5.5590 | 5.0000 | 31.0000 |

| Ownership concentration | oc | Shareholding ratio of the first shareholder | 17,303 | 35.0800 | 15.3300 | 8.4800 | 74.9600 |

| Annual foreign investment amount | lnaoi | The logarithm of the annual foreign investment amount | 17,303 | 17.0574 | 2.5978 | 3.8101 | 21.9926 |

| Net profit | rpro | Net profit | 17,303 | 20,100 | 79,900 | −37,100 | 656,000 |

| City control variables | |||||||

| Environmental pollution | lniw | The logarithm of industrial wastewater discharge | 17,303 | 9.0831 | 1.0076 | 5.8348 | 11.2013 |

| Opening | lnfdi | FDI in logarithm | 17,303 | 12.1444 | 1.8991 | 2.3227 | 15.0094 |

| Fixed investment | lntfai | The logarithm of total fixed asset investment | 17,303 | 7.4441 | 1.1353 | 4.6643 | 9.4764 |

| Economic development | lngdp | GDP in logarithm | 17,303 | 15.2925 | 2.6740 | 5.5106 | 18.8262 |

| Industrial structure | dtid | Weight of tertiary sector in GNP | 17,303 | 49.4505 | 12.7123 | 25.1300 | 80.9800 |

| Technology expenditure | lnsre | Technology expenditure logarithm | 17,303 | 10.3652 | 1.8429 | 5.9635 | 14.3461 |

| Infrastructure | lnra | The actual urban road area at the end of the year | 17,303 | 8.2932 | 0.9792 | 5.6937 | 9.6998 |

| Financial development | lndfdn | Loan balance as a percentage of GDP | 17,303 | 15.6121 | 2.8543 | 3.9479 | 21.6705 |

| Employment | lnre | Citywide employed population | 17,303 | 5.4258 | 1.0613 | 2.9739 | 7.3680 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) |

|---|---|---|---|---|---|---|---|

| Basic Regression | Add X_It | Different Fixed Effects | Different Clustering Robustness Criteria Errors | PSM-DID | |||

| did | 0.388 *** | 0.071 | 0.052 | 0.314 ** | 0.314 ** | 0.314 ** | 0.269 ** |

| (0.054) | (0.084) | (0.091) | (0.123) | (0.126) | (0.126) | (0.126) | |

| _cons | −13.821 *** | −12.907 *** | −12.571 *** | −18.257 *** | −18.257 *** | −18.257 *** | −14.619 *** |

| (0.033) | (0.959) | (1.356) | (3.907) | (5.544) | (5.686) | (5.338) | |

| Year fixed | No | No | Yes | Yes | Yes | Yes | Yes |

| Firm fixed | No | No | No | Yes | Yes | Yes | Yes |

| Clustering robust standard error | No | No | No | No | Yes | Yes | Yes |

| N | 17,303 | 17,303 | 17,303 | 17,303 | 17,303 | 17,303 | 17,303 |

| Adj. R2 | — | — | — | 0.149 | 0.149 | 0.149 | 0.144 |

| Variables | Beijing–Tianjin–Hebei | Yangtze River Delta | Pearl River Delta | The Triangle of Central China | Chengdu and Chongqing | Central Plains |

|---|---|---|---|---|---|---|

| did | 0.241 | 0.410 | 0.733 ** | 0.855 ** | 0.584 | 0.430 |

| (0.538) | (0.241) | (0.242) | (0.395) | (0.482) | (0.678) | |

| _cons | −62.975 ** | 4.371 | −19.287 | −16.195 | −38.620 *** | −20.988 |

| (24.392) | (9.027) | (60.277) | (17.499) | (8.335) | (25.178) | |

| N | 581 | 1921 | 645 | 498 | 318 | 154 |

| Adj. R2 | 0.031 | 0.081 | 0.097 | 0.065 | 0.146 | 0.142 |

| Variables | Different City Locations | Different City Scales | ||||

|---|---|---|---|---|---|---|

| Eastern Region | Central Region | Western Region | Small and Medium-Sized Cities | Large Cities | Supercities and Megacities | |

| did | 0.139 | 0.583 ** | 0.490 | 4.615 *** | 0.506 | 0.190 |

| (0.167) | (0.267) | (0.331) | (0.000) | (0.332) | (0.166) | |

| _cons | −14.638 ** | −13.085 | −11.944 | 6.059 *** | −15.392 | −13.990 ** |

| (6.786) | (11.612) | (28.403) | (0.004) | (16.141) | (6.165) | |

| N | 3949 | 1121 | 785 | 45 | 1129 | 3808 |

| Adj. R2 | 0.145 | 0.142 | 0.165 | 1.000 | 0.119 | 0.143 |

| Variables | Manufacturing | Wholesale and Retail Trade | Scientific Research, Technical Services, and Geological Exploration Industry | Culture, Sports, and Entertainment |

|---|---|---|---|---|

| did | 0.475 *** | 102.722 *** | 132.247 *** | −2.758 *** |

| (0.170) | (0.313) | (0.461) | (0.000) | |

| _cons | −10.908 ** | 394.379 *** | 2899.217 *** | −101.106 *** |

| (5.341) | (2.363) | (9.806) | (0.027) | |

| N | 3124 | 38 | 9 | 31 |

| Adj. R2 | 0.141 | 1.000 | 1.000 | 1.000 |

| Region Name | Industry Name | Influence Coefficient | Cluster Robust Standard Error |

|---|---|---|---|

| Eastern Region | Mining | −1.863 * | −1.01 |

| Wholesale and retail trade | −7.352 *** | −0.059 | |

| Scientific research, technical services, and geological exploration industry | 132.247 *** | −0.461 | |

| Water, environment, and public facilities management industry | −28.202 *** | −0.161 | |

| Culture, sports, and entertainment | −153.590 *** | −0.714 | |

| Central Region | Mining | −13.523 *** | −0.009 |

| Manufacturing | 0.675 * | −0.383 | |

| Transportation, storage, and postal industry | −2.422 ** | −1.013 | |

| Scientific research, technical services, and geological exploration industry | 49.555 *** | −0.027 | |

| Culture, sports, and entertainment | −6.312 *** | −0.008 | |

| Comprehensive industry | 116.600 *** | −0.222 | |

| Western Region | Culture, sports, and entertainment | 0.453 *** | −0.003 |

| Variables | Enterprise Age (Years) | Enterprise Size (Million Yuan) | ||||

|---|---|---|---|---|---|---|

| <7 | 7–12 | ≥12 | >6 | 6~200 | >200 | |

| did | 8.891 *** | 0.252 | 0.176 | −8.489 *** | 0.228 * | 0.200 |

| (1.517) | (0.428) | (0.150) | (0.000) | (0.125) | (0.129) | |

| _cons | 547.427 ** | −9.337 | −8.536 | 209.408 *** | −14.760 *** | −15.356 *** |

| (231.785) | (21.418) | (5.641) | (0.011) | (4.871) | (5.282) | |

| N | 116 | 925 | 4423 | 30 | 5754 | 5263 |

| Adj. R2 | 0.727 | 0.237 | 0.128 | 1.000 | 0.134 | 0.128 |

| Variables | State-Owned Enterprises | Private Enterprise | Foreign-Invested Enterprises | Other Enterprises |

|---|---|---|---|---|

| did | 0.218 | 0.490 * | −0.830 | 0.477 |

| (0.156) | (0.256) | (0.977) | (0.854) | |

| _cons | −18.762 *** | −8.798 | −54.048 | 53.281 |

| (6.502) | (8.412) | (39.632) | (56.859) | |

| N | 3740 | 1777 | 168 | 149 |

| Adj. R2 | 0.122 | 0.172 | 0.234 | 0.242 |

| Year | 2009 | 2010 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|

| did | 0.269 ** | 0.269 ** | 0.277 ** | 0.222 * | 0.241 * | 0.200 | 0.120 | 0.150 | 0.174 |

| (0.126) | (0.126) | (0.130) | (0.134) | (0.140) | (0.162) | (0.196) | (0.298) | (0.437) | |

| _cons | −14.619 *** | −14.619 *** | −14.921 *** | −14.815 *** | −14.748 *** | −14.676 *** | −14.600 *** | −14.321 *** | −14.134 *** |

| (5.338) | (5.338) | (5.343) | (5.342) | (5.340) | (5.351) | (5.382) | (5.344) | (5.282) | |

| N | 5464 | 5464 | 5464 | 5464 | 5464 | 5464 | 5464 | 5464 | 5464 |

| Adj. R2 | 0.138 | 0.138 | 0.138 | 0.138 | 0.138 | 0.138 | 0.137 | 0.137 | 0.137 |

| Variables | Replace the Explained Variable | Replace Explanatory Variables | |||

|---|---|---|---|---|---|

| hqde | L1. hqde | hqde.industry | l_hsr | f_hsr | |

| core explanatory variables | −0.001 | 0.013 | 0.321 ** | −0.084 * | 0.017 |

| (0.003) | (0.026) | (0.133) | (0.049) | (0.131) | |

| _cons | −0.041 | −0.446 | −6.035 | −14.823 *** | −14.660 *** |

| (0.207) | (0.530) | (4.162) | (3.497) | (3.373) | |

| N | 5464 | 5059 | 6443 | 6952 | 6952 |

| Adj. R2 | 0.022 | 0.015 | 0.161 | 0.053 | 0.053 |

| IV | |

|---|---|

| Panel A: Second Stage Regression | |

| did | −3.055 *** |

| (1.053) | |

| _cons | Yes |

| Year fixed | Yes |

| Firm fixed | Yes |

| Panel B: First Stage Regression | |

| did | −0.013 *** |

| (0.003) | |

| KP-Wald F-statistic | 16.364 |

| CD-Wald F-statistic | 65.720 |

| N | 5340 |

| Adj. R2 | 0.371 |

| Variables | Labor flow | Talent Gathering | ||||||

|---|---|---|---|---|---|---|---|---|

| lnls | hqde | lnre | hqde | med1 | hqde | lnsre | hqde | |

| did | −0.033 | 0.266 *** | −0.069 *** | 0.276 ** | 3.8 × 106 | 0.257 ** | −0.028 | 0.250 ** |

| (0.036) | (0.125) | (0.013) | (0.125) | (3.3 × 106) | (0.122) | (0.021) | (0.123) | |

| med | −0.189 *** | −0.327 * | 5.2 × 10−9 *** | −0.067 | ||||

| (0.094) | (0.197) | (1.4 × 10−9) | (0.100) | |||||

| _cons | 8.7 × 10−5 *** | −18.629 *** | 1.727 *** | −20.435 *** | −3.9 × 108 *** | −19.211 *** | −8.261 *** | −18.264 *** |

| (1.397) | (5.186) | (0.566) | (5.291) | (1.4 × 108) | (5.267) | (0.698) | (4.643) | |

| N | 6885 | 5855 | 6885 | 5855 | 6885 | 5855 | 6871 | 5844 |

| Adj. R2 | 0.582 | 0.144 | 0.8145 | 0.138 | 0.212 | 0.144 | 0.873 | 0.138 |

| Variables | Capital Widening | Capital Deepening | ||||||

|---|---|---|---|---|---|---|---|---|

| lnfai | hqde | tfai | hqde | med2 | hqde | o3 | hqde | |

| did | 0.045 | 0.267 ** | 0.057 *** | 0.267 ** | 5.6 × 105 * | 0.264 ** | 0.918 | 0.318 ** |

| (0.036) | (0.125) | (0.014) | (0.125) | (3.3 × 105) | (0.125) | (0.733) | (0.150) | |

| med | −0.258 *** | −6.9 × 10−6 *** | 3.7 × 10−9 | 0.004 | ||||

| (0.077) | (3.85 × 10−5) | (4.3 × 10−9) | (0.004) | |||||

| _cons | 4.238 *** | −18.629 *** | 4339.660 | −18.629 *** | −3.2 × 107 | −18.525 *** | 18.347 | −13.489 ** |

| (1.374) | (5.186) | (3420.582) | (5.186) | (4.8 × 107) | (5.198) | (20.494) | (6.173) | |

| N | 6885 | 5855 | 6885 | 5855 | 6885 | 5855 | 5185 | 4374 |

| Adj. R2 | 0.532 | 0.138 | 0.549 | 0.138 | 0.168 | 0.138 | 0.015 | 0.129 |

| Knowledge Spillovers | Technological Innovation | |||||||

|---|---|---|---|---|---|---|---|---|

| lnrdi | lnhqde | lntein_3 | lnhqde | lnia | lnhqde | o5 | lnhqde | |

| did | 0.047 | 0.094 | 0.052 *** | 0.240 ** | −0.095 * | 0.250 ** | 1.186 *** | 0.314 ** |

| (0.083) | (0.215) | (0.018) | (0.124) | (0.050) | (0.123) | (0.437) | (0.150) | |

| med | −0.149 ** | 0.160 *** | −0.045 | 0.004 | ||||

| (0.073) | (0.090) | (0.042) | (0.009) | |||||

| _cons | 0.041 | −14.222 ** | 8.893 *** | −19.442 *** | 49.397 *** | −13.692 ** | −8.211 *** | −18.629 |

| (2.198) | (6.347) | (0.499) | (4.620) | (16.932) | (6.223) | (0.740) | (5.186) | |

| N | 3396 | 2376 | 6870 | 5846 | 5160 | 4374 | 6885 | 5855 |

| Adj. R2 | 0.417 | 0.056 | 0.268 | 0.140 | 0.025 | 0.129 | 0.875 | 0.144 |

| Knowledge Spillovers | Technological Innovation | |||||||

|---|---|---|---|---|---|---|---|---|

| lnrdi | lnhqde | lntein_3 | lnhqde | lnia | lnhqde | o5 | lnhqde | |

| DID | −0.030 | 0.155 | −0.180 *** | 0.065 | −0.020 | 0.019 | −1.034 ** | 0.018 |

| (0.085) | (0.256) | (0.032) | (0.155) | (0.063) | (0.153) | (0.433) | (0.165) | |

| med | −0.181 ** | 0.207 ** | −0.053 | 0.024 ** | ||||

| (0.085) | (0.096) | (0.053) | (0.011) | |||||

| _cons | 0.041 | −14.222 ** | 8.893 *** | −19.442 *** | −0.579 | −18.022 *** | 63.326 *** | −12.581 * |

| (2.198) | (6.347) | (0.499) | (4.620) | (1.862) | (6.054) | (16.388) | (6.818) | |

| N | 3201 | 2239 | 6249 | 5286 | 6273 | 5302 | 4644 | 3913 |

| Adj. R2 | 0.445 | 0.057 | 0.217 | 0.137 | 0.320 | 0.135 | 0.029 | 0.124 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Y.; Yang, J.; Zhang, W.; Zhou, Z.; Cong, J. Does High-Speed Railway Promote High-Quality Development of Enterprises? Evidence from China’s Listed Companies. Sustainability 2022, 14, 11330. https://doi.org/10.3390/su141811330

Li Y, Yang J, Zhang W, Zhou Z, Cong J. Does High-Speed Railway Promote High-Quality Development of Enterprises? Evidence from China’s Listed Companies. Sustainability. 2022; 14(18):11330. https://doi.org/10.3390/su141811330

Chicago/Turabian StyleLi, Yongling, Junxian Yang, Weiqiang Zhang, Zhou Zhou, and Jianhui Cong. 2022. "Does High-Speed Railway Promote High-Quality Development of Enterprises? Evidence from China’s Listed Companies" Sustainability 14, no. 18: 11330. https://doi.org/10.3390/su141811330

APA StyleLi, Y., Yang, J., Zhang, W., Zhou, Z., & Cong, J. (2022). Does High-Speed Railway Promote High-Quality Development of Enterprises? Evidence from China’s Listed Companies. Sustainability, 14(18), 11330. https://doi.org/10.3390/su141811330