Less Water, Less Oil: Policy Response for the Kenyan Future, a CGE Analysis

Abstract

1. Introduction

2. Literature Review

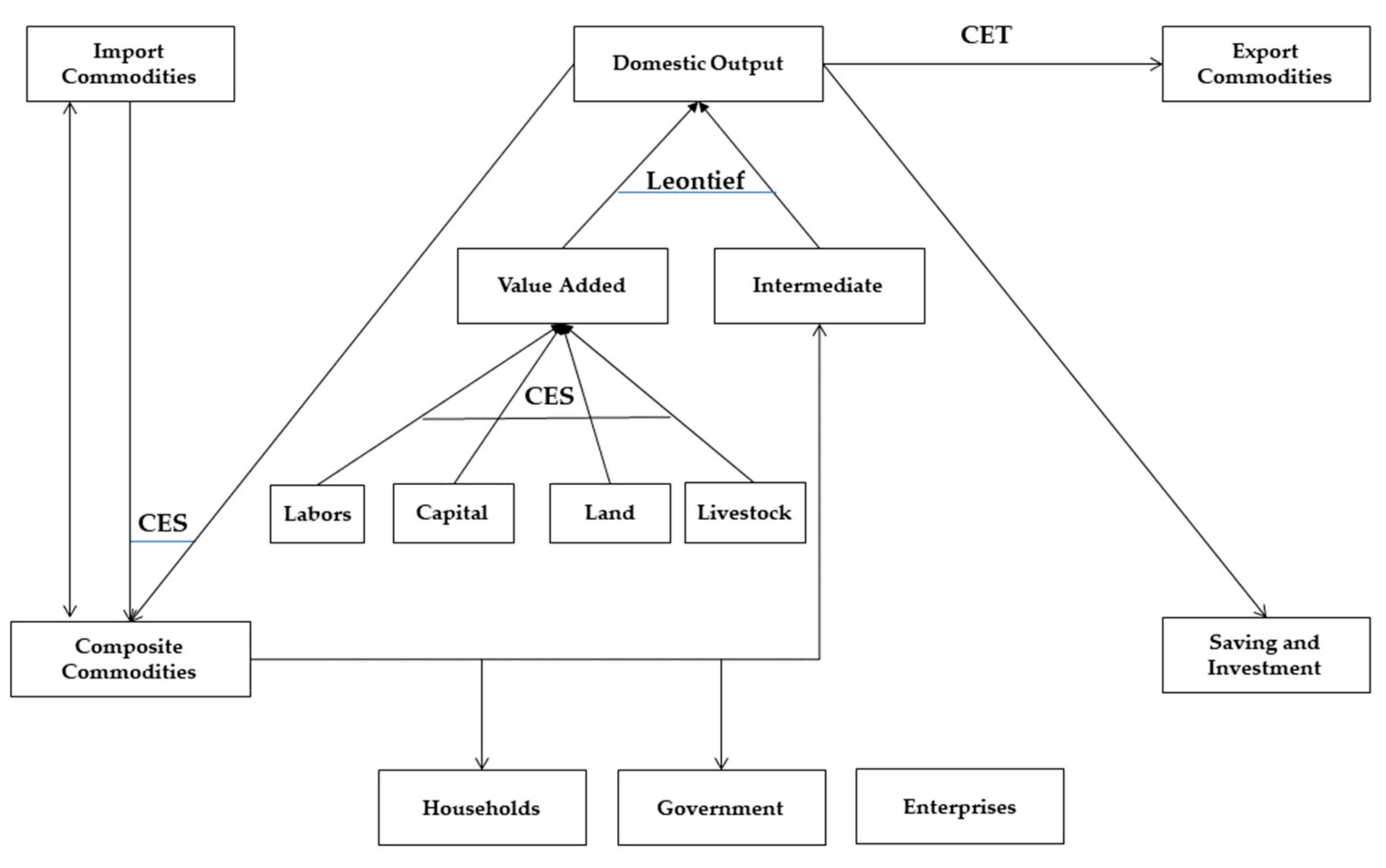

3. Methodology

4. Data and Simulations

5. Simulation Results

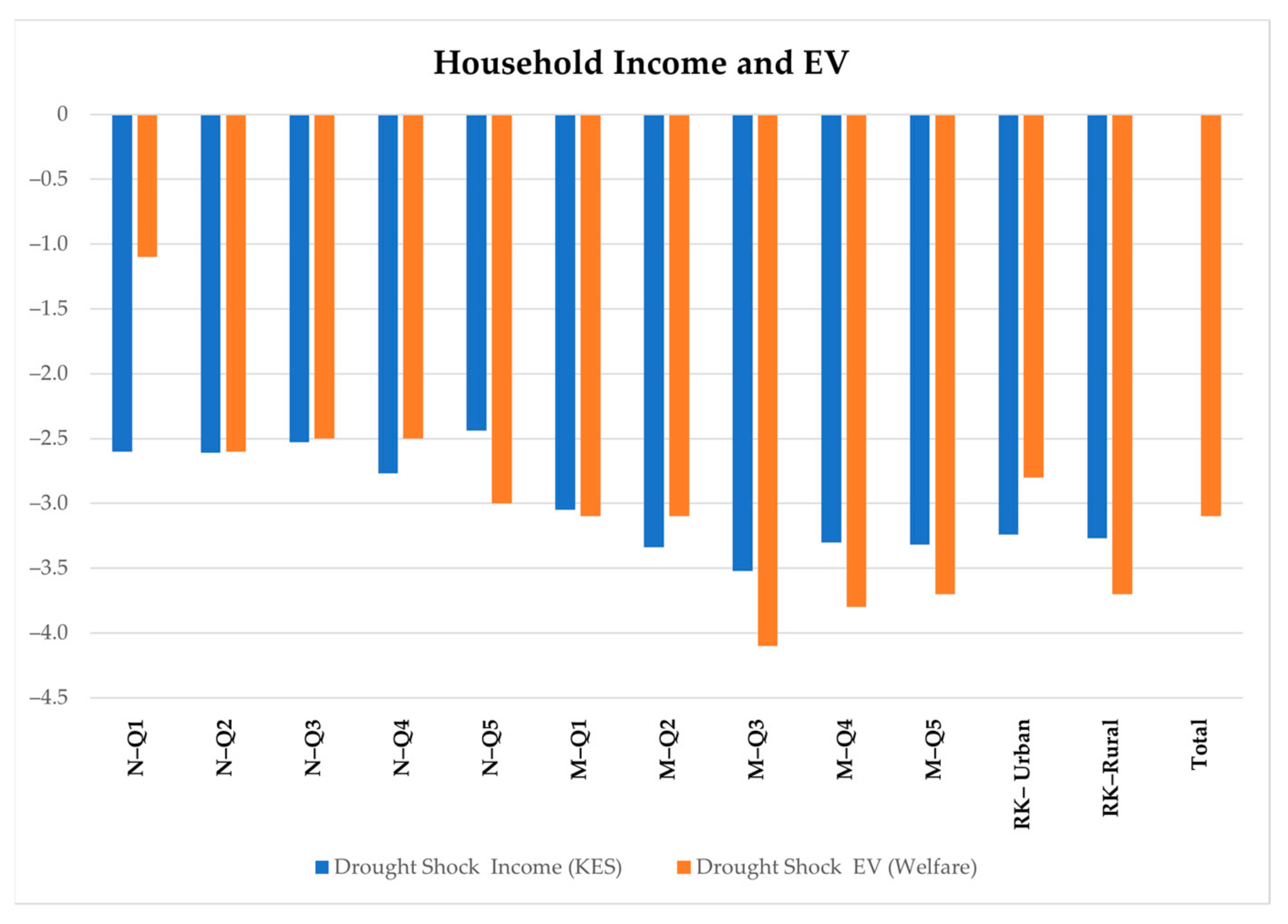

5.1. Drought Mitigation Policy Effectiveness

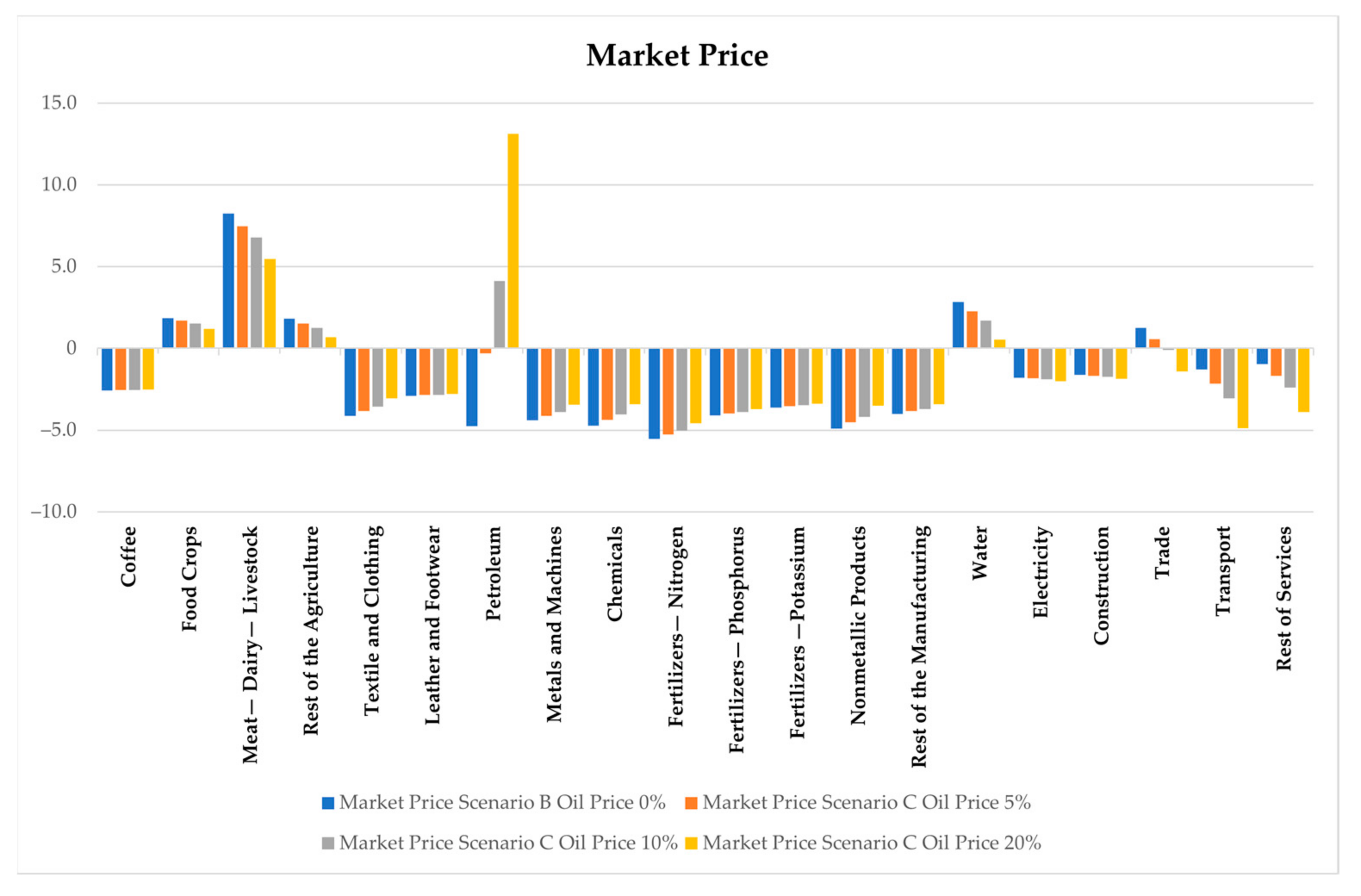

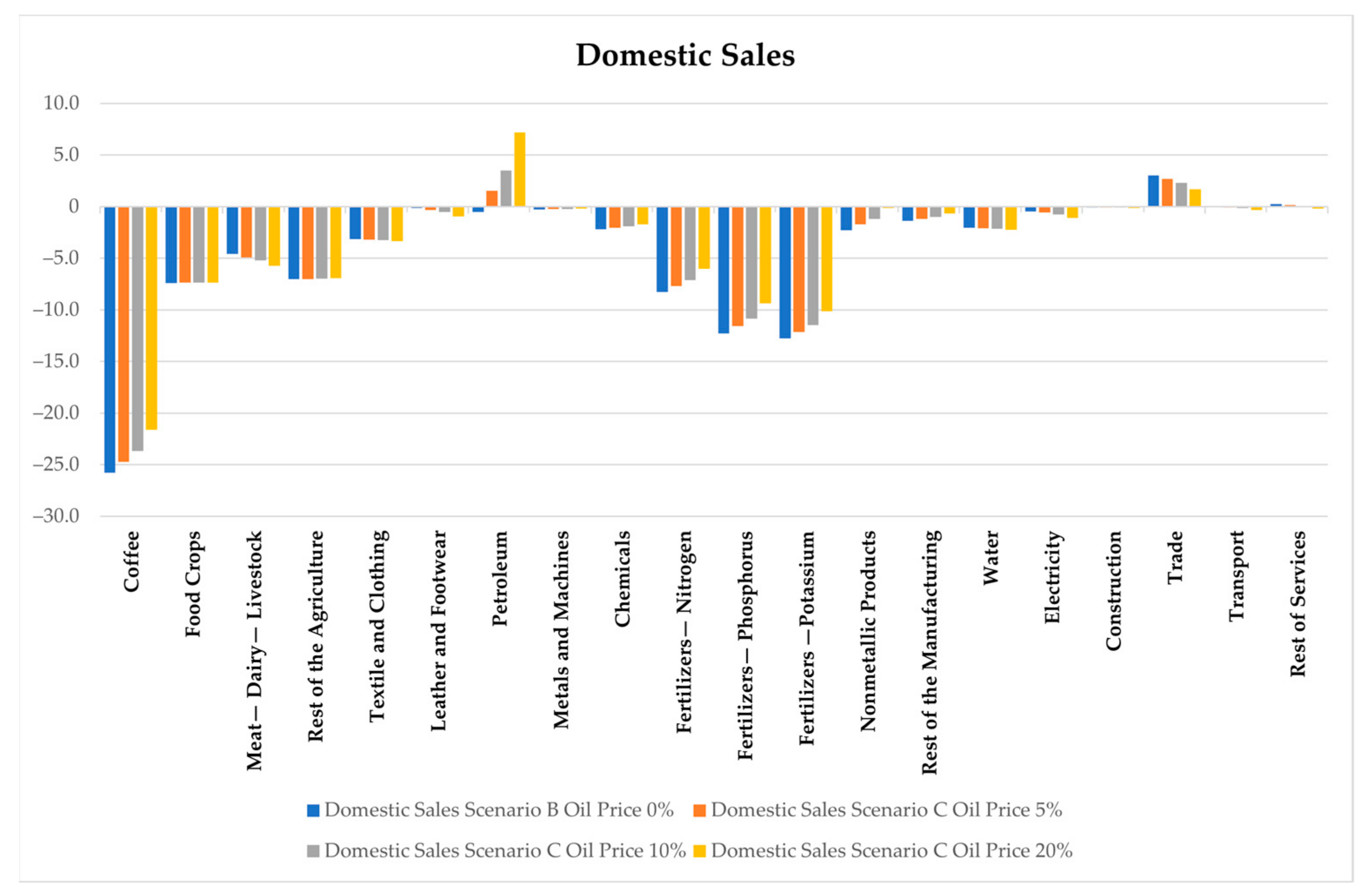

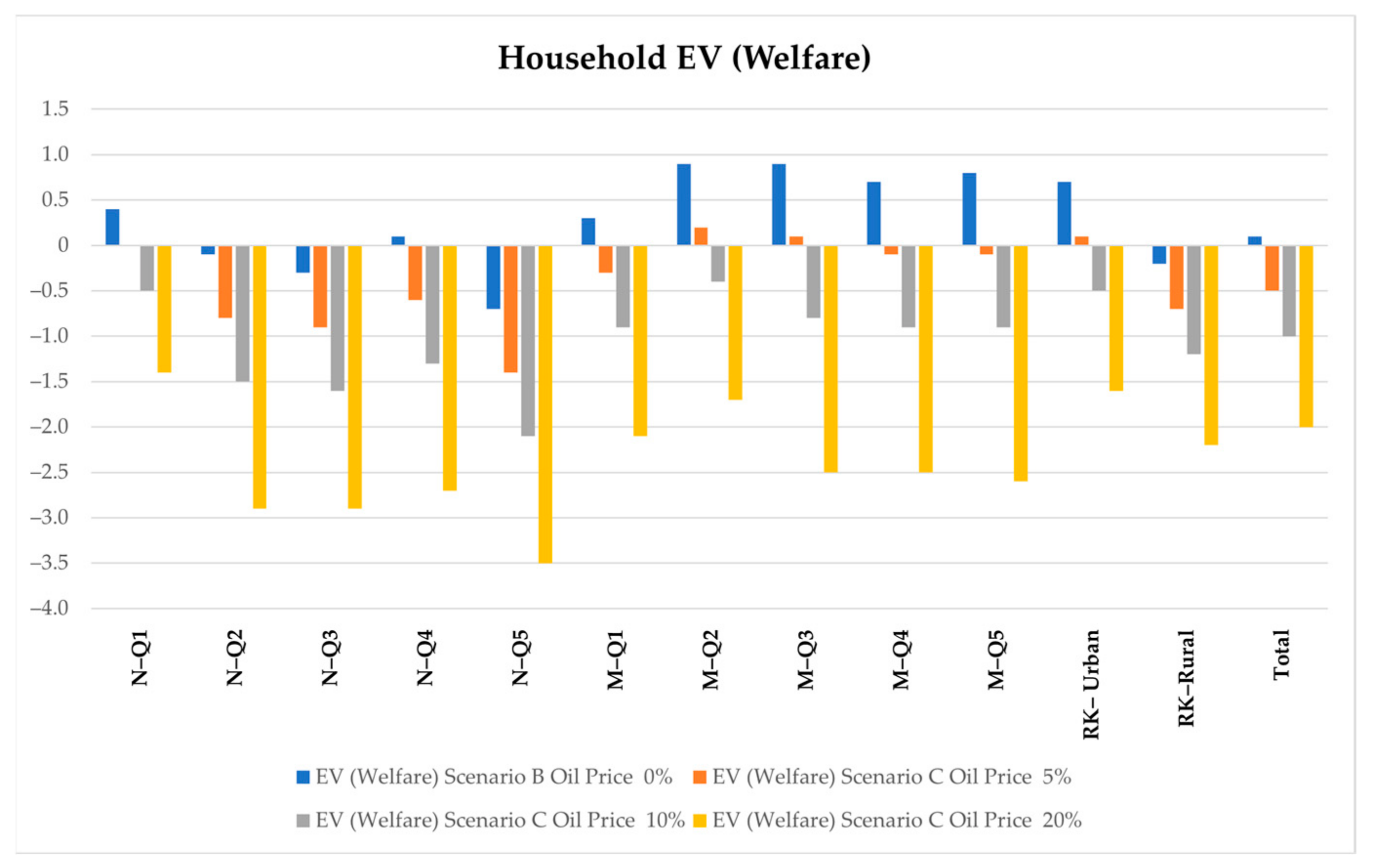

5.2. Oil Shock in the Middle of a Climate Crisis

6. Conclusions and Remarks

Author Contributions

Funding

Conflicts of Interest

Appendix A. Model Specification

| Sets | Description | Sets | Description |

| A | Activities | CM | Commodities with import |

| C | Commodities | CMN | Commodities without import |

| CD | Commodities with domestic sales | CT | Transaction service commodities |

| CDN | Commodities without domestic sales | CX | Commodities with domestic product |

| CE | Commodities with export | F | Factors |

| CEN | Commodities without export | INS | Institutions |

| INSD | Domestic institutions | INSDNG | Domestic nongovernmental institutions |

| H | Households | ALEO | Activities with Leontief technology |

| Sets | Description | Sets | Description |

| Weight of commodity c in CPI | Base-year quantity of government demand | ||

| Input–output coefficient | Base-year quantity of private investment demand | ||

| Share of trade cost in export | Share for domestic institution i in the income of factor f | ||

| Share of trade cost in import | Share of net income of i to i | ||

| Base saving rate of domestic institutions i | Tax rate for activity a | ||

| 0–1 parameter with 1 for institutions with potentially flexed direct tax rates | Export tax rate | ||

| Export price (foreign currency) | Direct tax rate | ||

| Import price (foreign currency) | Exogenous direct tax rate for domestic institution i | ||

| 0–1 parameter with 1 for institutions with potentially flexed direct tax rates | Import tariff rate | ||

| Rate of sales tax | Transfer from factor f to institution i | ||

| Rate of value-added tax for activity a |

| Variable | Description | Variable | Description |

| Consumer price index | Savings rate scaling factor (=0 for base) | ||

| Change in domestic institution tax share (=0 for base; exogenous variable) | Quantity supplied of factor | ||

| Foreign savings (FCU) | Direct tax scaling factor (=0 for base; exogenous variable) | ||

| Government consumption adjustment factor | Wage distortion factor for factor f in activity a | ||

| Investment adjustment factor |

| Variable | Description | Variable | Description |

| DMPS | Change in domestic institution savings rates (=0 for base; exogenous variable) | Quantity consumed of commodity c by household h | |

| EG | Government expenditures | Quantity of household home consumption of commodity c from activity a for household h | |

| Consumption spending for household | Quantity of aggregate intermediate input | ||

| EXR | Exchange rate (LCU per unit of FCU) | Quantity of commodity c as intermediate input to activity a | |

| GOVSHR | government consumption shares in nominal absorption | Quantity of investment demand for the commodity | |

| GSAV | Government savings | Quantity of imports of the commodity | |

| INVSHR | Investment share in nominal absorption | Quantity of goods supplied to the domestic market (composite supply) | |

| Marginal propensity to save for domestic nongovernmental institutions (exogenous variable) | Quantity of a commodity demanded as a trade input | ||

| Activity price (unit gross revenue) | Quantity of (aggregate) value-added | ||

| Demand price for commodities produced and sold domestically | Aggregated marketed quantity of domestic output of commodity | ||

| Supply price for commodities produced and sold domestically | Quantity of marketed output of commodity c from activity a | ||

| Export price (domestic currency) | TABS | Total nominal absorption | |

| Aggregate intermediate input price for activity a | Direct tax rate for institution i | ||

| Import price (domestic currency) | Transfers from institution i. to i (both in the set INSDNG) | ||

| Composite commodity price | Average price of factor f | ||

| Value-added price (factor income per unit of activity) | Income of factor f | ||

| Aggregate producer price for the commodity | YG | Government revenue | |

| Producer price of commodity c for activity a | Income of domestic nongovernmental institution | ||

| Quantity (level) of activity | Income to domestic institution i from factor f | ||

| Quantity sold domestically of domestic output | |||

| Quantity of exports | |||

| Quantity demanded of factor f from activity a | |||

| Government consumption demand for the commodity |

| Activities | Commodities |

| Coffee Food crops Dairy (meat, dairy, livestock) Rest of agriculture Household as an activity food Household as an activity cash crop | Coffee Food crops Dairy (meat, dairy, livestock) Rest of agriculture |

| Chemicals Textile and clothing Leather and footwear Petroleum Metals and machines Fertilizers—nitrogen Fertilizers—phosphorous Fertilizers—potassium Nonmetallic product Rest of the manufacturing | Chemicals Textile and clothing Leather and footwear Petroleum Metals and machines Fertilizers—nitrogen Fertilizers—phosphorous Fertilizers—potassium Nonmetallic product Rest of the manufacturing |

| Water Electricity Construction Trade Transport Rest of services | Water Electricity Construction Trade Transport Rest of services |

| Factors of Production | Institution Account |

| Labor—skilled Nairobi Labor—semiskilled Nairobi Labor—unskilled Nairobi Labor—skilled Mombasa Labor—semiskilled Mombasa Labor—unskilled Mombasa Labor—skilled rainfall Labor—semiskilled rainfall Labor—unskilled rainfall Labor—skilled rest of Kenya Labor—semiskilled rest of Kenya Labor—unskilled rest of Kenya Land irrigated Land nonirrigated Livestock Capital agricultural Capital nonagricultural | Nairobi—quintile 1 (richest) Nairobi—quintile 2 Nairobi—quintile 3 Nairobi—quintile 4 Nairobi—quintile 5 (poorest) Mombasa—quintile 1 (richest) Mombasa—quintile 2 Mombasa—quintile 3 Mombasa—quintile 4 Mombasa—quintile 5 (poorest) Rest of Kenya—rural Rest of Kenya—urban Government Enterprises Rest of the world |

| Tax Accounts | Other Accounts |

| Factor tax Direct tax Indirect tax Sales tax Tariffs on the rest of the world | Investment |

Appendix A.1. Activities

Appendix A.2. Commodity Market

Appendix A.3. Institutions

Appendix A.4. Market Clearing Conditions

Appendix B. Scenario A

| Sectors | Arndt and Tarp (2001) for 20% Output Loss | This Study for 10% Output Loss |

| Basic food crops | 0.75 | 0.25 |

| Dairy | 0.85 | 0.45 |

| Rest of agriculture | 0.67 | 0.27 |

Appendix B.1. Simulation Results of Scenario A

Appendix B.1.1. Scenario A: The Effect of a Drought

| Marketed Commodities | Drought Shock | |||||

| Domestic Output | Composite Commodities | Market Price | Domestic Sales | Import | Export | |

| Coffee | −18.69 | −15.90 | −0.16 | −18.67 | −15.29 | −18.69 |

| Food crops | −7.74 | −4.64 | 3.45 | −7.56 | 5.22 | −11.52 |

| Meat–dairy–livestock | −6.69 | −5.20 | 4.94 | −6.59 | 17.87 | −11.58 |

| Rest of the agriculture | −8.20 | −3.50 | 2.06 | −7.10 | 5.18 | −9.82 |

| Textile and clothing | 2.99 | −2.74 | 0.30 | −0.29 | −3.06 | 4.37 |

| Leather and footwear | −0.26 | −1.11 | −1.46 | −0.52 | −2.73 | 5.22 |

| Petroleum | 0.53 | −1.65 | 0.51 | −0.06 | −2.03 | 2.97 |

| Metals and machines | 0.15 | −0.40 | −0.98 | −0.16 | −1.50 | 4.09 |

| Chemicals | 0.33 | −3.16 | 0.38 | −0.28 | −3.79 | 4.82 |

| Fertilizers—nitrogen | −3.08 | −9.05 | −1.15 | −3.91 | −11.57 | 7.84 |

| Fertilizers—phosphorus | −5.37 | −9.57 | −1.01 | −6.26 | −11.70 | 2.24 |

| Fertilizers—potassium | −6.17 | −9.64 | −1.09 | −7.02 | −11.75 | 0.59 |

| Nonmetallic products | 2.40 | −0.14 | 0.59 | 1.40 | −0.51 | 4.21 |

| Rest of the manufacturing | 1.32 | −1.08 | −0.38 | 0.49 | −2.64 | 5.37 |

| Water | −1.80 | −1.80 | 1.99 | −1.80 | 0.00 | 0.00 |

| Electricity | −1.00 | −1.00 | −3.54 | −1.00 | 0.00 | 0.00 |

| Construction | −0.12 | −0.12 | −1.33 | −0.12 | 0.00 | 0.00 |

| Trade | 1.28 | 1.00 | −2.63 | 1.02 | −0.79 | 2.87 |

| Transport | −0.18 | −0.87 | −4.69 | −0.75 | −3.67 | 2.26 |

| Rest of services | −0.57 | −0.65 | −3.76 | −0.62 | −2.99 | 1.80 |

| Real GDP and National Accounts | Drought Shock |

| Absorption | −2.12 |

| Private consumption | −3.05 |

| Exports | −2.59 |

| Imports | −1.36 |

| GDP (at market prices) | −2.47 |

| Exchange rate | 0.93 |

References

- Geda, A. The Historical Origin of the African Economic Crisis: From Colonialism to China; Cambridge Scholars Publishing: Newcastle upon Tyne, UK, 2019. [Google Scholar]

- Calvo, C.; Dercon, S. Measuring Individual Vulnerability; Discussion Paper No. 229; University of Oxford: Oxford, UK, 2005. [Google Scholar]

- Shepherd, A.; Mitchell, T.; Lewis, K.; Lenhardt, A.; Jones, L.; Scott, L.; Muir-Wood, R. The Geography of Poverty, Disasters and Climate Extremes in 2030; ODI Report; ODI: London, UK, 2013. [Google Scholar]

- Pradhan, K.C.; Mukherjee, S. Covariate and idiosyncratic shocks and coping strategies for poor and non-poor rural households in India. J. Quant. Econ. 2018, 16, 101–127. [Google Scholar] [CrossRef]

- Bazzana, D.; Foltz, J.; Zhang, Y. Impact of climate smart agriculture on food security: An agent-based analysis. Food Policy 2022, 111, 102304. [Google Scholar] [CrossRef]

- Njoka, J.T.; Yanda, P.; Maganga, F.; Liwenga, E.; Kateka, A.; Henku, A.; Mabhuye, E.; Malik, N.; Bavo, C. Kenya: Country Situation Assessment. 2016. Available online: https://idl-bncidrc.dspacedirect.org/bitstream/handle/10625/58566/IDL-58566.pdf (accessed on 2 July 2022).

- UNEP and the Government of Kenya. Kenya Drought: Impacts on Agriculture, Lifestock and Wildlife; UNEP and the Government of Kenya: Nairobi, Kenya, 2006. [Google Scholar]

- Huho, J.M.; Mugalavai, E.M. The Effects of Droughts on Food Security in Kenya. Int. J. Clim. Chang. Impacts Responses 2010, 2, 61–72. [Google Scholar] [CrossRef]

- Government of the Republic of Kenya. Kenya Post-Disaster Needs Assessment (PDNA) 2008–2011 Drought. 2012. Available online: https://www.gfdrr.org/sites/default/files/publication/pda-2011-kenya.pdf (accessed on 2 July 2022).

- Hamilton, J.D. Historical Oil Shocks. In Routledge Handbook of Major Events in Economic History; Parker, R.E., Whaples, R., Eds.; Routledge Taylor and Francis Group: New York, NY, USA, 2013; pp. 239–265. [Google Scholar]

- Odhiambo, N.M.; Nyasha, S. Oil price and economic growth in Kenya: A trivariate simulation. Int. J. Sustain. Energy Plan. Manag. 2019, 19, 3–12. [Google Scholar] [CrossRef]

- World Bank Group. Commodity Markets Outlook: Urbanization and Commodity Demand, October 2021; World Bank: Washington, DC, USA, 2021. [Google Scholar]

- EPRA. ENERGY & PETROLEUM STATISTICS REPORT 2019. Available online: https://www.epra.go.ke/wp-content/uploads/2020/09/Energy-and-Petroleum-Statistics-Report-2019-1.pdf (accessed on 2 July 2022).

- Hamilton, J.D. This is what happened to the oil price-macroeconomy relationship. J. Monet. Econ. 1996, 38, 215–220. [Google Scholar] [CrossRef]

- Berument, M.H.; Ceylan, N.B.; Dogan, N. The Impact of Oil Price Shocks on the Economic Growth of Selected MENA Countries. Energy J. 2010, 31, 149–176. Available online: http://www.jstor.org/stable/41323274 (accessed on 2 July 2022).

- Mainar Causapé, A.J.; Boulanger, P.; Dudu, H.; Ferrari, E.; McDonald, S.; Caivano, A. Social Accounting Matrix of Kenya 2014; Publications Office of the European Union: Seville, Spain, 2018. [Google Scholar]

- Narayan, P.K. Macroeconomic impact of natural disasters on a small island economy: Evidence from a CGE model. Appl. Econ. Lett. 2003, 10, 721–723. [Google Scholar] [CrossRef]

- Zhou, L.; Chen, Z. Are CGE models reliable for disaster impact analyses? Econ. Syst. Res. 2021, 33, 20–46. [Google Scholar] [CrossRef]

- Arndt, C.; Tarp, F. Who gets the goods? A general equilibrium perspective on food aid in Mozambique. Food Policy 2001, 26, 107–119. [Google Scholar] [CrossRef]

- Juana, J.S.; Makepe, P.M.; Mangadi, K.T.; Narayana, N. The Socio-economic Impact of Drought in Botswana. Int. J. Environ. Dev. 2014, 11, 43–60. [Google Scholar]

- Borgomeo, E.; Vadheim, B.; Woldeyes, F.B.; Alamirew, T.; Tamru, S.; Charles, K.J.; Kebede, S.; Walker, O. The Distributional and Multi-Sectoral Impacts of Rainfall Shocks: Evidence from Computable General Equilibrium Modelling for the Awash Basin, Ethiopia. Ecol. Econ. 2018, 146, 621–632. [Google Scholar] [CrossRef]

- Kilimani, N.; Van Heerden, J.H.; Bohlmann, H.; Roos, L. Economy-wide impact of drought induced productivity losses. Disaster Prev. Manag. Int. J. 2018, 27, 636–648. [Google Scholar] [CrossRef]

- Gebreegziabher, Z.; Stage, J.; Mekonnen, A.; Alemu, A. Climate change and the Ethiopian economy: A CGE analysis. Environ. Dev. Econ. 2016, 21, 205–225. [Google Scholar] [CrossRef]

- Ntombela, S.M.; Nyhodo, B.; Ngqangweni, S.; Phahlane, H.; Lubinga, M.H. Economy-wide effects of drought on South African Agriculture: A computable general equilibrium (CGE) analysis. J. Dev. Agric. Econ. 2017, 9, 46–56. [Google Scholar]

- Manuel, L.; Chiziane, O.; Mandhlate, G.; Hartley, F.; Tostão, E. Impact of climate change on the agriculture sector and household welfare in Mozambique: An analysis based on a dynamic computable general equilibrium model. Clim. Chang. 2021, 6, 167. [Google Scholar] [CrossRef]

- Hatibu, H.; Semboja, H. The effects of energy taxes on the Kenyan economy: A CGE analysis. Energy Econ. 1994, 16, 205–215. [Google Scholar] [CrossRef]

- Sánchez, M.V. Welfare Effects of Rising Oil Prices In Oil-Importing Developing Countries. Dev. Econ. 2011, 49, 321–346. [Google Scholar] [CrossRef]

- Pradhan, B.K.; Sahoo, A. Oil Price Shocks and Poverty in a CGE Framework. In Proceedings of the MIMAP Training Program, Manila, Philippines, 28 February–9 March 2000. [Google Scholar]

- Solaymani, S.; Yusof, N.Y.B.M.; Yavari, A. The role of government climate policy in an oil price shock: A CGE simulation analysis. In Proceedings of the 2015 International Conference on Modeling, Simulation and Applied Mathematics, Phuket, Thailand, 23–24 August 2015; pp. 260–263. [Google Scholar]

- Gershon, O.; Ezenwa, N.E.; Osabohien, R. Implications of oil price shocks on net oil-importing African countries. Heliyon 2019, 5, 02208. [Google Scholar] [CrossRef]

- Bekhet, H.A.; Yusop, N.Y.M. Assessing the relationship between oil prices, energy consumption and macroeconomic performance in Malaysia: Co-integration and vector error correction model (VECM) approach. Int. Bus. Res. 2009, 2, 152–175. [Google Scholar] [CrossRef]

- Yildirim, Z.; Arifli, A. Oil price shocks, exchange rate and macroeconomic fluctuations in a small oil-exporting economy. Energy 2021, 219, 119527. [Google Scholar] [CrossRef]

- Kamasa, K.; Amponsah, B.D.; Forson, P. Do Crude Oil Price Changes Affect Economic Welfare? Empirical Evidence from Ghana. Ghana Min. J. 2020, 20, 51–58. [Google Scholar]

- Robinson, S.; Yúnez-Naude, A.; Hinojosa-Ojeda, R.; Lewis, J.D.; Devarajan, S. From stylized to applied models: Building multisector CGE models for policy analysis. N. Am. J. Econ. Financ. 1999, 10, 5–38. [Google Scholar] [CrossRef]

- Löfgren, H. External Shocks and Domestic Poverty Alleviation: Simulation with a CGE Model of Malawi; 1043 TMD Discussion Paper 71; International Food Policy Research Institute: Washington, WA, USA, 2001. [Google Scholar]

- Frisch, R. A complete scheme for computing all direct and cross elasticities in a model with many sectors. Econometrica 1959, 27, 177–196. [Google Scholar] [CrossRef]

- Lluch, C. Consumer Demand Functions, Spain, 1958–1964. Eur. Econ. Rev. 1971, 2, 277–302. [Google Scholar] [CrossRef]

- Vigani, M.; Dudu, H.; Ferrari, E.; Causape, A.M. Estimation of Food Demand Parameters in Kenya. A Quadratic Almost Ideal Demand System (QUAIDS) Approach; EUR 29657 EN; PUBSY No. JRC115472; Publications Office of the European Union: Luxembourg, 2019; ISBN 978-92-76-00025-9. [Google Scholar] [CrossRef]

- Aragie, E.A.; McDonald, S. Semi-subsistence farm households and their implications for policy response. In Proceedings of the 17th Annual Conference on Global Economic Analysis, Dakar, Senegal, 18–20 June 2014. [Google Scholar]

- Dupuy, A. Hicks Neutral Technical Change Revisited: CES Production Function and Information of General Order. Top. Macroecon. 2006, 6. [Google Scholar] [CrossRef][Green Version]

- McDonald, S. Drought in Southern Africa: A study for Botswana. In Proceedings of the XIII International Conference on Input-Output Techniques, Macerata, Italy, 21–25 August 2000. [Google Scholar]

- Hertel, T.W.; Burke, M.B.; Lobell, D.B. The poverty implications of climate-induced crop yield changes by 2030. Glob. Environ. Chang. 2010, 20, 577–585. [Google Scholar] [CrossRef]

- Tebaldi, C.; Lobell, D.B. Towards probabilistic projections of climate change impacts on global crop yields. Geophys. Res. Lett. 2008, 35, L08705. [Google Scholar] [CrossRef]

- Republic of Kenya. Sector Plan for Drought Risk Management and Ending Drought Emergencies; Republic of Kenya: Nairobi, Kenya, 2014; Available online: http://www.alnap.org/help-library/sector-plan-for-droughtrisk-management-and-ending-drought-emergencies (accessed on 2 July 2022).

- Republic of Kenya. National Drought Early Warning Bulletin for December; Republic of Kenya: Nairobi, Kenya, 2016; Available online: http://www.alnap.org/help-library/national-drought-early-warning-bulletin-fordecember (accessed on 2 July 2022).

- Fitzgibbon, C. Shock-Responsive Social Protection in Practice: Kenya’s Experience in Scaling Up Cash Transfers. Humanitarian Policy; HPN/ODI: London, UK, 2016; Available online: http://www.alnap.org/help-library/shock-responsive-social-protection-in-practice-kenya%E2%80%99sexperience-in-scaling-up-cash (accessed on 2 July 2022).

- Obrecht, A. Adapting According to Plan: Early Action and Adaptive Drought Response in Kenya; ALNAP Country Study; ODI/ALNAP: London, UK, 2019. [Google Scholar]

- Blonigen, B.A.; Flynn, J.E.; Reinert, K.A. Sector-Focused General Equilibrium Modeling, in Applied Methods of Trade Policy Analysis: A Handbook; Francois, J.F., Reinert, K.A., Eds.; Cambridge University Press: Cambridge, UK, 1997; pp. 189–230. [Google Scholar]

- Johansen, L. A Multi-Sectoral Study of Economic Growth; North-Holland Publishing Co.: Amsterdam, The Netherland, 1960. [Google Scholar]

- Rattsø, J. Different macroclosures of the original Johansen model and their impact on policy evaluation. J. Policy Model. 1982, 4, 85–97. [Google Scholar] [CrossRef]

| Origin of the Shock | Date | Recorded Oil Price Increase |

|---|---|---|

| Suez Crisis | August 1957 | January 1957–February 1957 (9%) |

| OAPEC embargo (Arab–Israel War) | October 1973 | November 1973–February 1974 (51%) |

| Iranian Revolution | January 1980 | May 1979–January 1980 (57%) |

| Iran–Iraq War controls lifted | July 1981 | November 1980–February 1981 (45%) |

| Gulf War I | July 1990 | August 1990–October 1990 (93%) |

| Venezuela unrest, Gulf War II | December 2002 | November 2002–March 2003 (28%) |

| Accounts | Details | Numbers |

|---|---|---|

| Activities | Activities | 20 |

| Household as an activity | 2 | |

| Commodities | Marketed commodities | 20 |

| Factors of production | Labors | 12 |

| Capital | 2 | |

| Land | 2 | |

| Livestock | 1 | |

| Domestic nongovernmental institutions | Households | 12 |

| Enterprises | 1 | |

| Government | Government | 1 |

| Taxes | Direct tax | 1 |

| Indirect tax | 1 | |

| Factor tax | 1 | |

| Sales tax | 1 | |

| Tariff on rest of the world | 1 | |

| Rest of the world | Rest of the world | 1 |

| Saving and investment | Investment | 1 |

| Household Units | Transfers from the Government (Billion KES) |

|---|---|

| Nairobi Quantile 1 (Richest) | 13.821 |

| Nairobi Quantile 2 | 4.93 |

| Nairobi Quantile 3 | 3.055 |

| Nairobi Quantile 4 | 2.231 |

| Nairobi Quantile 5 (Poorest) | 0.648 |

| Mombasa Quantile 1 (Richest) | 2.094 |

| Mombasa Quantile 2 | 1.363 |

| Mombasa Quantile 3 | 0.82 |

| Mombasa Quantile 4 | 0.48 |

| Mombasa Quantile 5 (Poorest) | 0.217 |

| Rest of Kenya Urban | 24.218 |

| Rest of Kenya Rural | 75.258 |

| Total | 129.135 |

| Real GDP and National Accounts | Drought Shock | |

|---|---|---|

| Scenario A, without Policy | Scenario B, with Policy | |

| Absorption | −2.12 | 0.06 |

| Private consumption | −3.05 | 0.09 |

| Exports | −2.59 | −9.20 |

| Imports | −1.36 | 2.34 |

| GDP (at market prices) | −2.47 | −2.35 |

| Exchange rate | 0.93 | −5.24 |

| Marketed Commodities | Drought Shock Policy and Oil Shock | |||||||

|---|---|---|---|---|---|---|---|---|

| Import Quantity | Export Quantity | |||||||

| Scenario B | Scenario C | Scenario B | Scenario C | |||||

| Oil Price +0% | Oil Price +5% | Oil Price +10% | Oil Price +20% | Oil Price 0% | Oil Price +5% | Oil Price +10% | Oil Price +20% | |

| Coffee | −22.72 | −21.71 | −20.73 | −18.73 | −29.27 | −27.83 | −26.42 | −23.53 |

| Food crops | 15.96 | 14.33 | 12.77 | 9.74 | −17.30 | −16.50 | −15.73 | −14.18 |

| Meat–dairy–livestock | 19.84 | 19.02 | 18.46 | 17.53 | −19.69 | −18.75 | −17.88 | −16.14 |

| Rest of the agriculture | 9.90 | 9.13 | 8.39 | 6.91 | −16.84 | −15.94 | −15.07 | −13.31 |

| Textile and clothing | 1.84 | 1.22 | 0.60 | −0.65 | −10.87 | −9.94 | −9.07 | −7.29 |

| Leather and footwear | −0.18 | −0.37 | −0.60 | −1.04 | −4.88 | −4.21 | −3.58 | −2.38 |

| Petroleum | 1.05 | −0.83 | −2.59 | −5.61 | −3.20 | −4.98 | −6.82 | −10.62 |

| Metals and machines | −2.69 | −2.32 | −1.99 | −1.36 | −1.46 | −1.10 | −0.75 | −0.02 |

| Chemicals | 0.48 | 0.04 | −0.41 | −1.35 | −5.98 | −5.03 | −4.13 | −2.27 |

| Fertilizers—nitrogen | −11.18 | −11.17 | −11.16 | −11.16 | −5.01 | −3.51 | −2.03 | 1.05 |

| Fertilizers—phosphorus | −10.65 | −10.69 | −10.73 | −10.82 | −15.59 | −13.68 | −11.78 | −7.80 |

| Fertilizers—potassium | −10.40 | −10.43 | −10.47 | −10.55 | −17.34 | −15.55 | −13.79 | −10.09 |

| Nonmetallic products | −1.01 | −0.89 | −0.78 | −0.58 | −4.27 | −3.11 | −1.97 | 0.40 |

| Rest of manufacturing | 1.03 | 0.57 | 0.11 | −0.82 | −5.40 | −4.22 | −3.07 | −0.70 |

| Water | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Electricity | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Construction | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Trade | 6.53 | 5.53 | 4.60 | 2.79 | −0.35 | −0.11 | 0.11 | 0.60 |

| Transport | 2.13 | 1.34 | 0.56 | −1.05 | −2.13 | −1.49 | −0.86 | 0.43 |

| Rest of services | 2.53 | 1.80 | 1.09 | −0.37 | −1.97 | −1.46 | −0.97 | 0.02 |

| Real GDP and National Accounts | Drought Shock Policy and Oil Shock | |||

|---|---|---|---|---|

| Scenario B | Scenario C | |||

| Oil Price +0% | Oil Price +5% | Oil Price +10% | Oil Price +20% | |

| Absorption | 0.06 | −0.31 | −0.68 | −1.40 |

| Private consumption | 0.09 | −0.45 | −0.98 | −2.00 |

| Exports | −9.20 | −8.49 | −7.81 | −6.43 |

| Imports | 2.34 | 1.50 | 0.70 | −0.77 |

| GDP (at market prices) | −2.35 | −2.38 | −2.42 | −2.50 |

| Exchange rate | −5.24 | −4.78 | −4.36 | −3.5 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bazzana, D.; Mobasser, A.; Vergalli, S. Less Water, Less Oil: Policy Response for the Kenyan Future, a CGE Analysis. Sustainability 2022, 14, 11273. https://doi.org/10.3390/su141811273

Bazzana D, Mobasser A, Vergalli S. Less Water, Less Oil: Policy Response for the Kenyan Future, a CGE Analysis. Sustainability. 2022; 14(18):11273. https://doi.org/10.3390/su141811273

Chicago/Turabian StyleBazzana, Davide, Aidin Mobasser, and Sergio Vergalli. 2022. "Less Water, Less Oil: Policy Response for the Kenyan Future, a CGE Analysis" Sustainability 14, no. 18: 11273. https://doi.org/10.3390/su141811273

APA StyleBazzana, D., Mobasser, A., & Vergalli, S. (2022). Less Water, Less Oil: Policy Response for the Kenyan Future, a CGE Analysis. Sustainability, 14(18), 11273. https://doi.org/10.3390/su141811273