Monopolistic vs. Competitive Supply Chain Concerning Selection of the Platform Selling Mode in Three Power Structures

Abstract

:1. Introduction

2. Literature Review

3. The Model

3.1. Model Framework

3.2. Demand Function

3.3. Timeline of the Game

3.4. Model Assumptions and Notation Definitions

4. Equilibrium Analysis

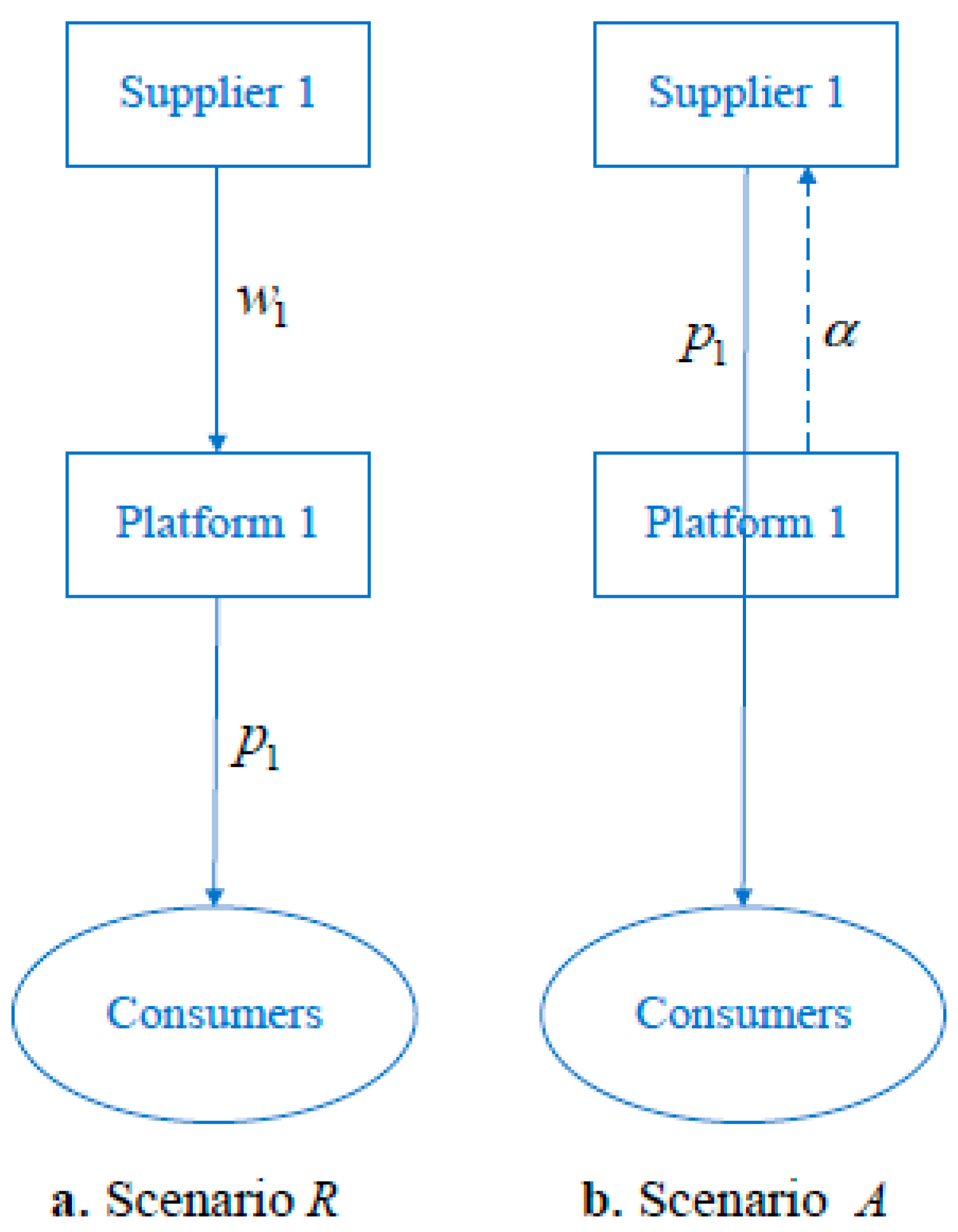

4.1. The Monopolistic Supply Chain

4.1.1. Scenario R: Reselling Mode

4.1.2. Scenario A: Agency Selling Mode

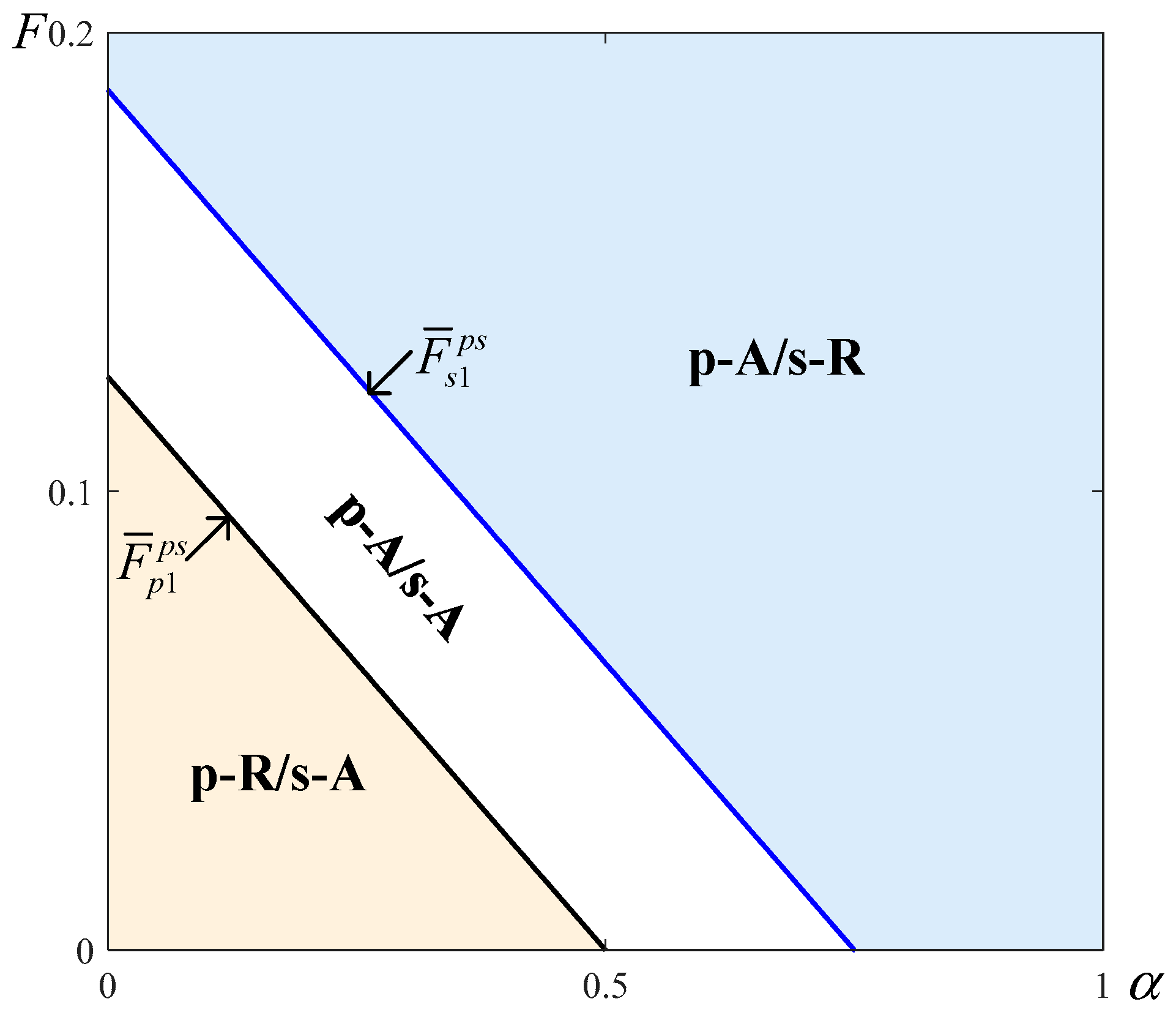

4.1.3. Equilibrium Strategy of the Selling Mode

- (i) For platform 1, the reselling mode (i.e., R) is the optimal decision if and the agency selling mode (i.e., A) otherwise;

- (ii) For supplier 1, the agency selling mode (i.e., A) is the optimal decision if and the reselling mode (i.e., R) otherwise;

- (iii) Both platform 1 and supplier1 prefer the agency selling mode if .

- where , , , , , , and .

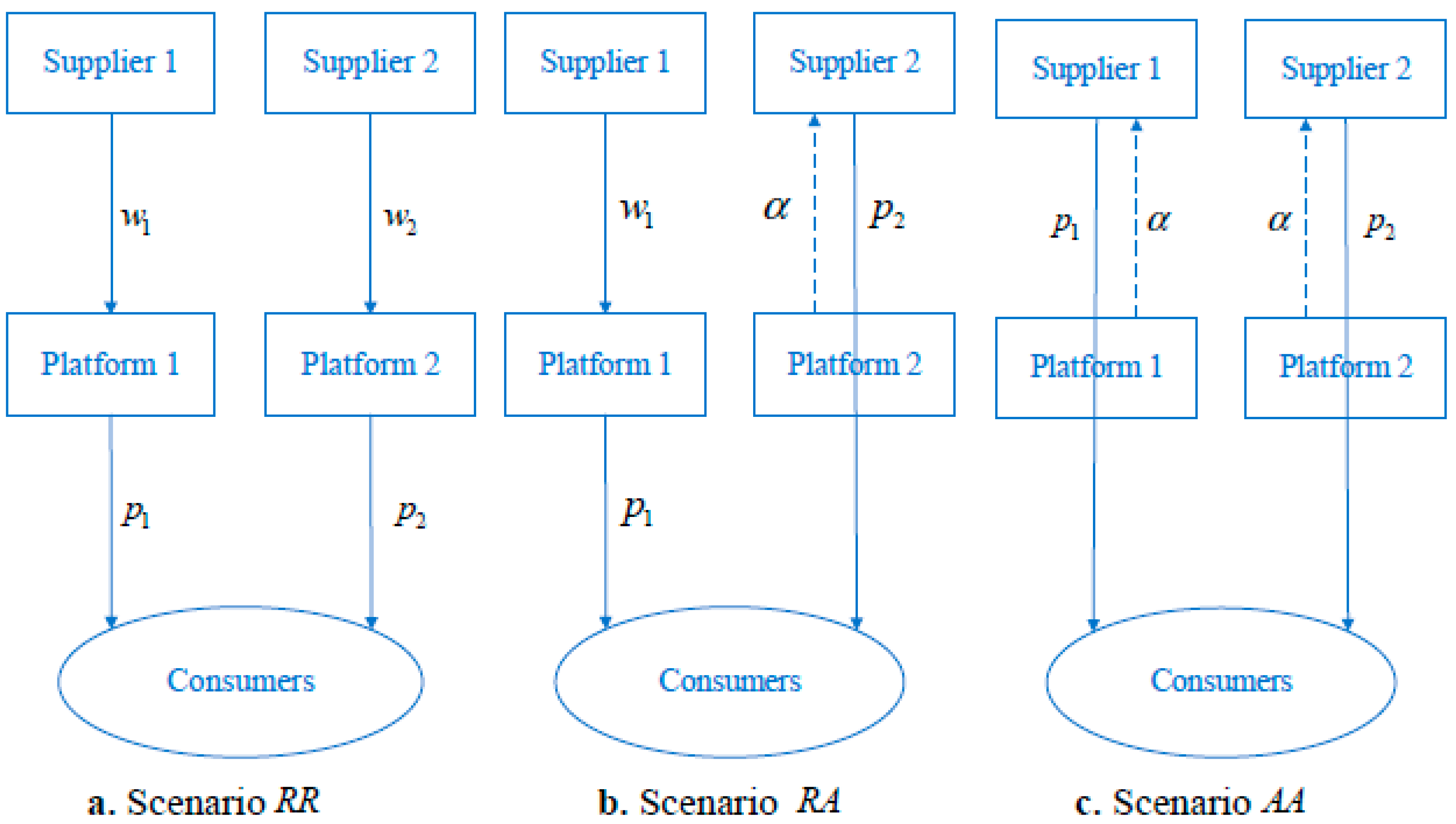

4.2. The Competitive Supply Chain

4.2.1. Scenario RR: Either Supply Chain Chooses the Reselling Mode

4.2.2. Scenario RA (or AR): Only One Supply Chain Chooses the Reselling Mode

4.2.3. Scenario AA: Either Supply Chain Chooses the Agency Selling Mode

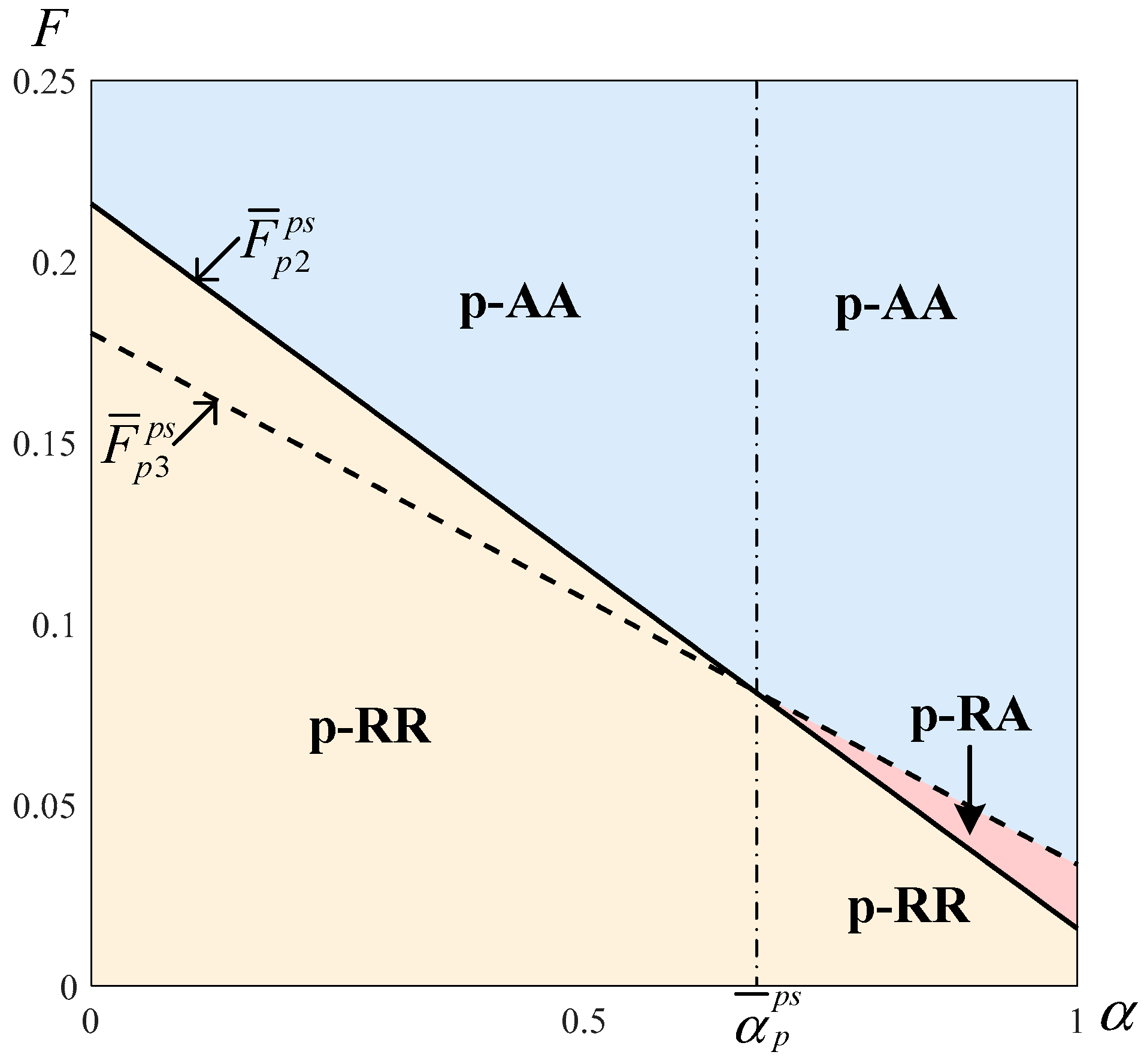

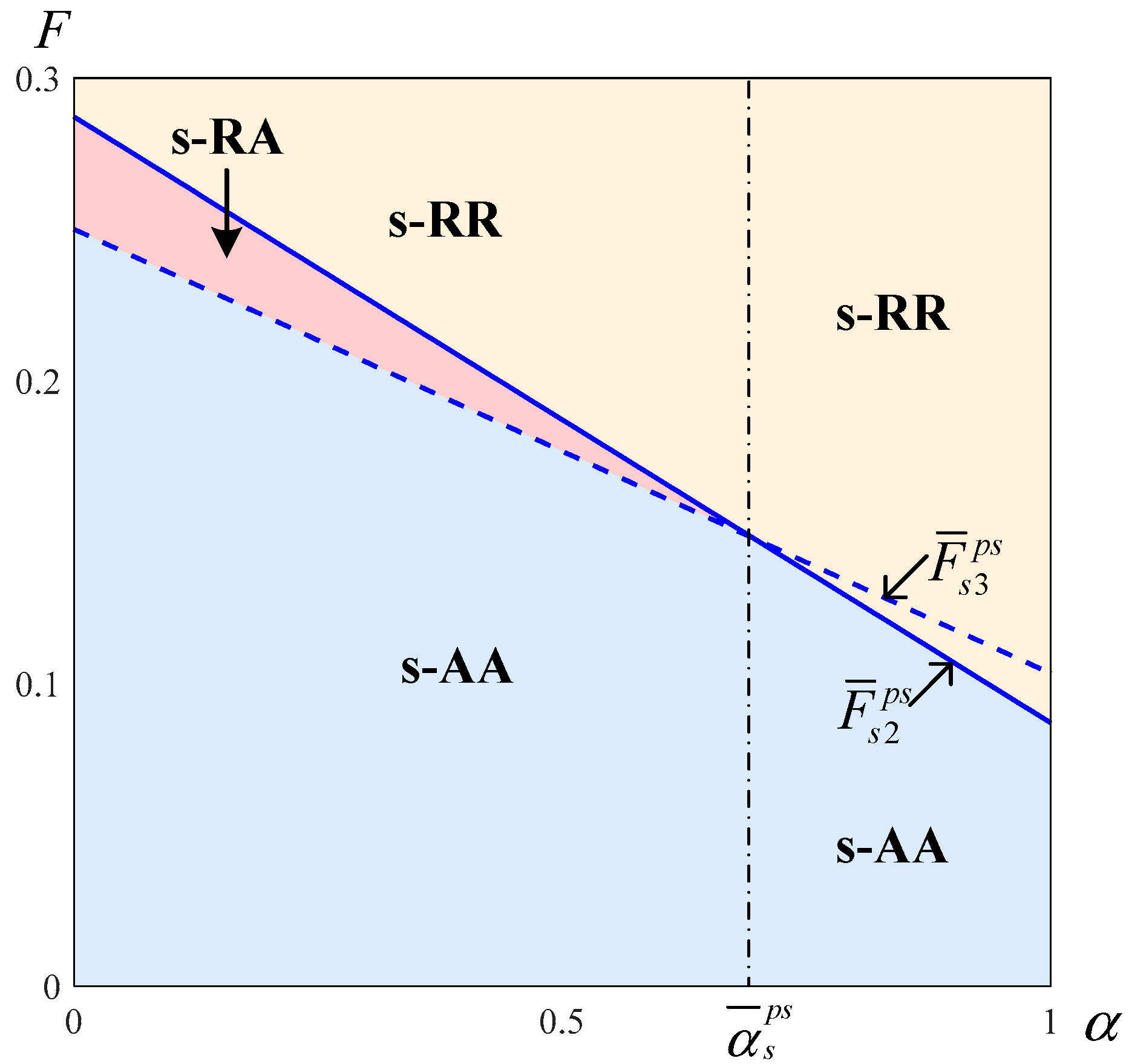

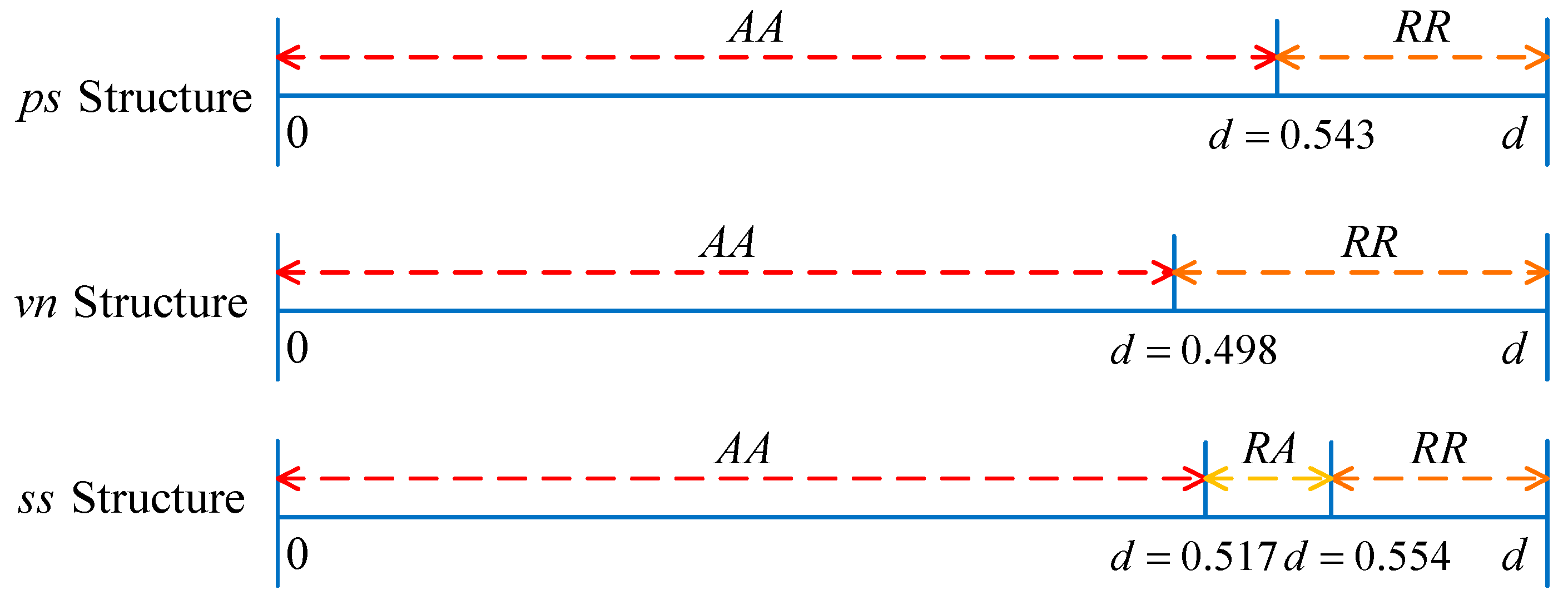

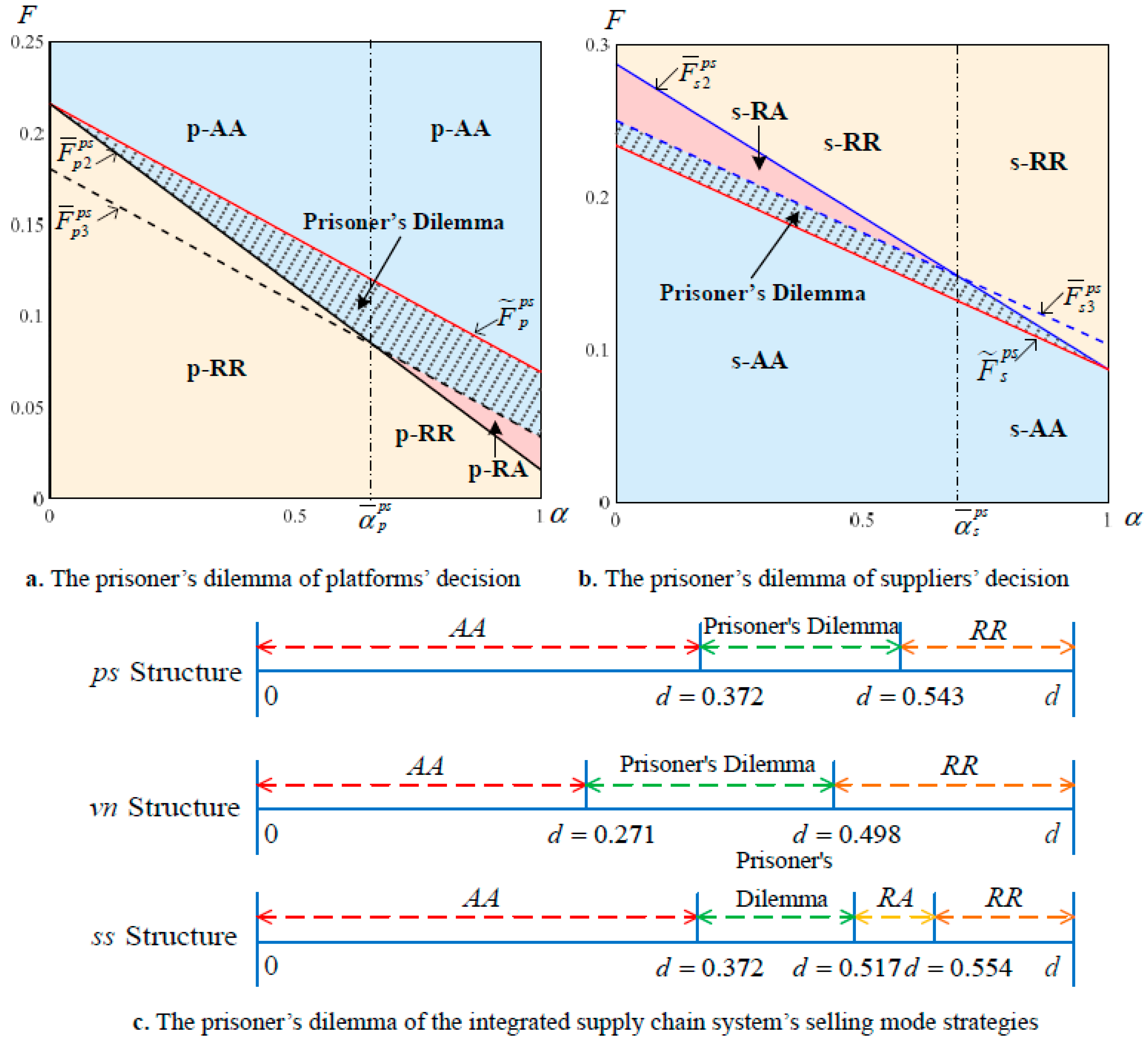

4.2.4. Equilibrium Strategy of the Selling Mode

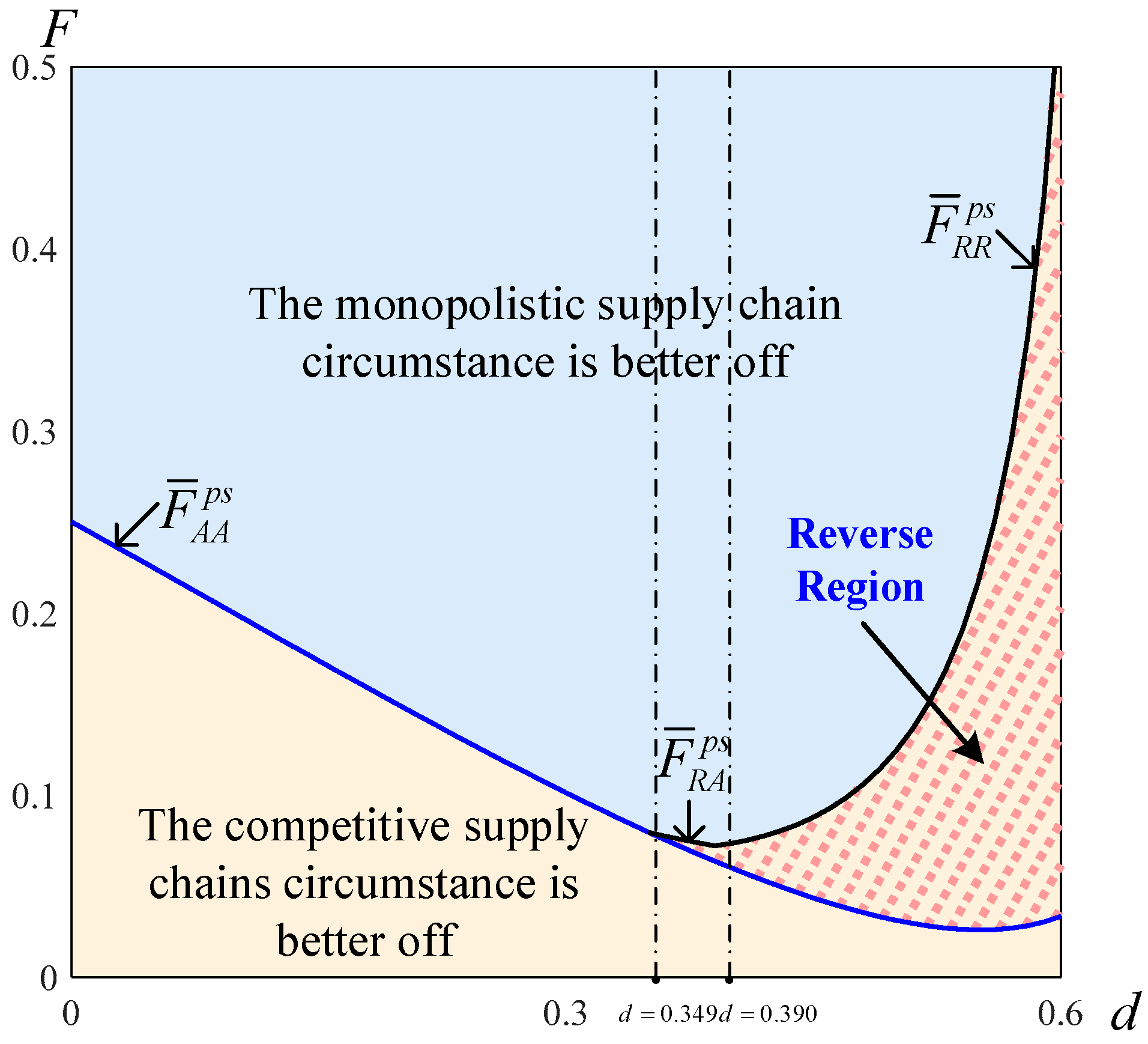

- (i) Each player prefers the agency selling mode (i.e., AA) as the equilibrium decision in the regions ;

- (ii) Each player prefers the opposite selling mode (i.e., RA or AR) as the equilibrium decision in the regions ;

- (iii) Each player prefers the reselling mode (i.e., RR) as the equilibrium decision in the regions ,

- where , , , , , , , , , and .

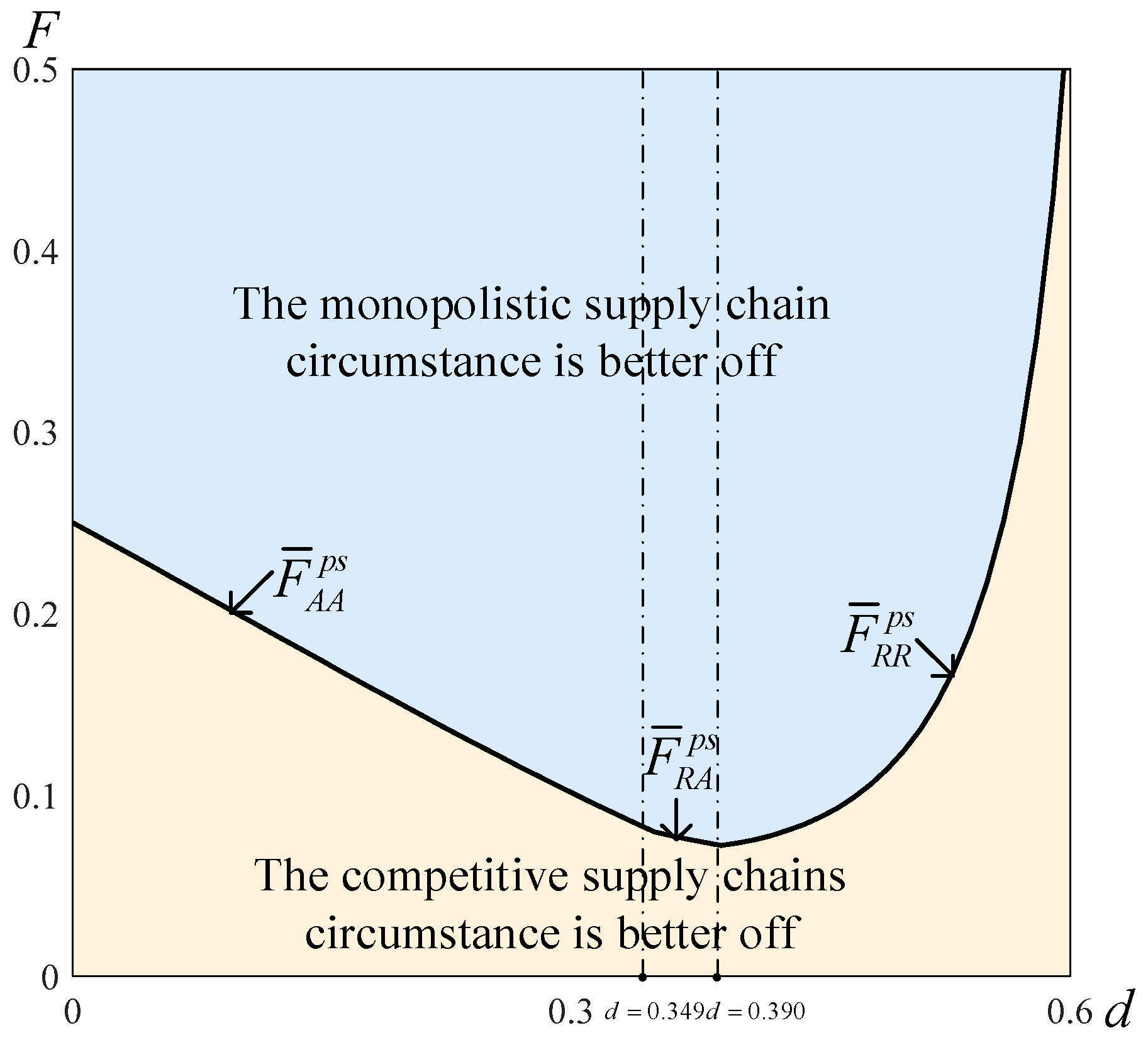

5. Comparative Analysis

5.1. Comparison of Monopolistic and Competitive Supply Chains

5.2. Comparison of Power Structures

6. Concluding Remarks

6.1. Conclusions

6.2. Managerial Insights

6.3. Limitations and Future Research Directions

Supplementary Materials

Author Contributions

Funding

Conflicts of Interest

References

- Abhishek, V.; Jerath, K.; Zhang, Z.J. Agency selling or reselling? Channel structures in electronic retailing. Manag. Sci. 2016, 62, 2259–2280. [Google Scholar] [CrossRef]

- Tian, L.; Vakharia, A.J.; Tan, Y.; Xu, Y. Marketplace. reseller, or hybrid: Strategic analysis of an emerging e-commerce model. Prod. Oper. Manag. 2018, 27, 1595–1610. [Google Scholar] [CrossRef]

- Zennyo, Y. Strategic contracting and hybrid use of agency and wholesale contracts in e-commerce platforms. Eur. J. Oper. Res. 2020, 281, 231–239. [Google Scholar] [CrossRef]

- Pu, X.; Zhang, S.; Ji, B.; Han, G. Online channel strategies under different offline channel power structures. J. Retail. Consum. Serv. 2021, 60, 102479. [Google Scholar] [CrossRef]

- Wei, J.; Lu, J.H.; Zhao, J. Interactions of competing manufacturers’ leader-follower relationship and sales format on online platforms, Eur. J. Oper. Res. 2020, 280, 508–522. [Google Scholar] [CrossRef]

- Zhang, X.Y.; Hou, W.H. The impacts of e-tailer’s private label on the sales mode selection: From the perspectives of economic and environmental sustainability. Eur. J. Oper. Res. 2021, 296, 601–614. [Google Scholar] [CrossRef]

- Chen, P.; Zhao, R.; Yan, Y.; Li, X. Promotional pricing and online business model choice in the presence of retail competition. Omega 2021, 94, 102085. [Google Scholar] [CrossRef]

- Ha, A.Y.; Luo, H.J.; Shang, W.X. Supplier Encroachment, Information Sharing, and Channel Structure in Online Retail Platforms. Prod. Oper. Manag. 2022, 31, 1235–1251. [Google Scholar] [CrossRef]

- Boyaci, T.; Gallego, G. Supply chain coordination in a market with customer service competition. Prod. Oper. Manag. 2004, 13, 3–22. [Google Scholar] [CrossRef]

- Hagiu, A. Merchant or two-sided platform? Rev. Netw. Econ. 2007, 6, 115–133. [Google Scholar] [CrossRef]

- Ryan, J.K.; Sun, D.; Zhao, X. Competition and coordination in online marketplaces. Prod. Oper. Manag. 2012, 21, 997–1014. [Google Scholar] [CrossRef]

- Tan, Y.; Carrillo, J.E.; Cheng, H.K. The agency model for digital goods. Decis. Sci. 2016, 47, 628–660. [Google Scholar] [CrossRef]

- Tan, Y.; Carrillo, J.E. Strategic analysis of the agency model for digital goods. Prod. Oper. Manag. 2017, 26, 724–741. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X. Free or bundled: Channel selection decisions under different power structures. Omega 2015, 53, 11–20. [Google Scholar] [CrossRef]

- Hagiu, A.; Wright, J. Marketplace or reseller? Manag. Sci. 2015, 61, 184–203. [Google Scholar] [CrossRef]

- Yan, Y.; Zhao, R.; Xing, T. Strategic introduction of the marketplace channel under dual upstream disadvantages in sales efficiency and demand information. Eur. J. Oper. Res. 2019, 273, 968–982. [Google Scholar] [CrossRef]

- Qin, X.L.; Liu, Z.X.; Tian, L. The optimal combination between selling mode and logistics service strategy in an e-commerce market. Eur. J. Oper. Res. 2021, 289, 639–651. [Google Scholar] [CrossRef]

- Sarkar, B.; Dey, B.K.; Sarkar, M.; AlArjani, A. A Sustainable Online-to-Offline (O2O) Retailing Strategy for a Supply Chain Management under Controllable Lead Time and Variable Demand. Sustainability 2021, 13, 1756. [Google Scholar] [CrossRef]

- Xia, Y.F.; Guo, Q.; Sun, H.; Li, K.; Mu, Z.Y. Green R&D Financing Strategy in Platform Supply Chain with Data-Driven Marketing. Sustainability 2022, 14, 9172. [Google Scholar] [CrossRef]

- McGuire, T.W.; Staelin, R. An industry equilibrium analysis of downstream vertical integration. Mark. Sci. 1983, 2, 161–191. [Google Scholar] [CrossRef]

- Anderson, E.J.; Bao, Y. Price competition with integrated and decentralized supply chain. Eur. J. Oper. Res. 2010, 200, 227–234. [Google Scholar] [CrossRef]

- Du, W.Y.; Fan, Y.B.; Yan, L.N. Pricing Strategies for Competitive Water Supply Chains under Different Power Structures: An Application to the South-to-North Water Diversion Project in China. Sustainability 2018, 10, 2892. [Google Scholar] [CrossRef]

- Feng, Q.H.; Liu, T. Selection Strategy and Coordination of Green Product R&D in Sustainable Competitive Supply Chain. Sustainability 2022, 14, 8884. [Google Scholar] [CrossRef]

- Li, X.; Li, Y. Chain-to-chain competition on product sustainability. J. Clean. Prod. 2016, 112, 2058–2065. [Google Scholar] [CrossRef]

- Wu, D.; Baron, O.; Berman, O. Bargaining in competing supply chain with uncertainty. Eur. J. Oper. Res. 2009, 197, 548–556. [Google Scholar] [CrossRef]

- Wu, C.; Mallik, S. Cross sales in supply chain: An equilibrium analysis. Int. J. Prod. Econ. 2010, 126, 158–167. [Google Scholar] [CrossRef]

- Zhao, X.; Atkins, D.R. Newsvendor under simultaneous price and inventory competition. Manuf. Serv. Oper. Manag. 2008, 10, 539–546. [Google Scholar] [CrossRef]

- Zhao, X.; Shi, C. Structuring and contracting in competing supply chain. Int. J. Prod. Econ. 2011, 134, 434–446. [Google Scholar] [CrossRef]

- Choi, S.C. Price competition in a channel structure with a common retailer. Mark. Sci. 1991, 10, 271–296. [Google Scholar] [CrossRef]

- Cai, G.G.; Zhang, Z.G.; Zhang, M. Game theoretical perspectives on dual-channel supply chain competition with price discounts and pricing schemes. Int. J. Prod. Econ. 2009, 117, 80–96. [Google Scholar] [CrossRef]

- Chen, L.G.; Ding, D.; Ou, J. Power structure and profitability in assembly supply chain. Prod. Oper. Manag. 2014, 23, 1599–1616. [Google Scholar] [CrossRef]

- Li, Z.; Xu, Y.Y.; Deng, F.M.; Liang, X.D. Impacts of Power Structure on Sustainable Supply Chain Management. Sustainability 2018, 10, 55. [Google Scholar] [CrossRef]

- Shi, R.; Zhang, J.; Ru, J. Impacts of power structure on supply chain with uncertain demand. Prod. Oper. Manag. 2013, 22, 1232–1249. [Google Scholar] [CrossRef]

- Xue, K.L.; Sun, G.H.; Wang, Y.Y.; Niu, S.Y. Optimal Pricing and Green Product Design Strategies in a Sustainable Supply Chain Considering Government Subsidy and Different Channel Power Structures. Sustainability 2021, 13, 12446. [Google Scholar] [CrossRef]

- Chakraborty, T.; Chauhan, S.S.; Huang, X. Quality competition between national and store brands. Int. J. Prod. Res. 2021, 60, 2703–2732. [Google Scholar] [CrossRef]

- Dennis, Z.Y.; Cheong, T.; Sun, D. Impact of supply chain power and drop-shipping on a manufacturer’s optimal distribution channel strategy. Eur. J. Oper. Res. 2017, 259, 554–563. [Google Scholar]

- Luo, Z.; Chen, X.; Chen, J.; Wang, X. Optimal pricing policies for differentiated brands under different supply chain power structures. Eur. J. Oper. Res. 2017, 259, 437–451. [Google Scholar] [CrossRef]

- Zhang, L.H.; Zhang, C.; Yang, J. Impacts of power structure and financing choice on manufacturer’s encroachment in a supply chain. Ann. Oper. Res. 2022, 1–47. [Google Scholar] [CrossRef]

- Vipin, B.; Amit, R.K. Wholesale price versus buyback: A comparison of contracts in a supply chain with a behavioral retailer. Comput. Ind. Eng. 2021, 162, 107689. [Google Scholar] [CrossRef]

- Kirshner, S.N.; Ovchinnikov, A. Heterogeneity of reference effects in the competitive newsvendor problem. Manuf. Serv. Oper. Manag. 2018, 21, 571–581. [Google Scholar] [CrossRef]

- Schweitzer, M.E.; Cachon, G.P. Decision bias in the newsvendor problem with a known demand distribution: Experimental evidence. Manag. Sci. 2000, 46, 404–420. [Google Scholar] [CrossRef] [Green Version]

- Baležentis, T.; Morkūnas, M.; Žičkienė, A.; Volkov, A.; Ribašauskienė, E.; Štreimikienė, D. Policies for Rapid Mitigation of the Crisis’ Effects on Agricultural Supply Chains: A Multi-Criteria Decision Support System with Monte Carlo Simulation. Sustainability 2021, 13, 11899. [Google Scholar] [CrossRef]

- Cantini, A.; Peron, M.; Carlo, F.D.; Sgarbossa, F. A decision support system for configuring spare parts supply chains considering different manufacturing technologies. Int. J. Prod. Res. 2022, 1–21. [Google Scholar] [CrossRef]

- Chaudhuri, A.; Bhatia, M.S.; Kayikci, Y.; Fernandes, K.J.; Fosso-Wamba, S. Improving social sustainability and reducing supply chain risks through blockchain implementation: Role of outcome and behavioural mechanisms. Ann. Oper. Res. 2021, 1–33. [Google Scholar] [CrossRef]

- Pournader, M.; Ghaderi, H.; Hassanzadegan, A.; Fahimnia, B. Artificial intelligence applications in supply chain management. Int. J. Prod. Econ. 2021, 241, 108250. [Google Scholar] [CrossRef]

- D’Urso, D.; Chiacchio, F.; Demerouti, E. Measuring how decision support systems improve Newsvendors’ performance: The subjects’ version. Sustainability 2021, 13, 10251. [Google Scholar] [CrossRef]

- Agatz, N.A.H.; Fleischmann, M.; Van Nunen, J.A.E.E. E-fulfillment and multi-channel distribution: A review. Eur. J. Oper. Res. 2008, 187, 339–356. [Google Scholar] [CrossRef]

- Kapner, S. How the web drags on some retailers. Wall Str. J. 2014. Available online: http://www.wsj.com/articles/how-the-web-drags-on-some-retailers-1417477790 (accessed on 30 November 2015).

- Cai, G.G. Channel selection and coordination in dual-channel supply chain. J. Retail. 2010, 86, 22–36. [Google Scholar] [CrossRef]

- Häckner, J. A note on price and quantity competition in differentiated oligopolies. J. Econ. Theory 2000, 93, 233–239. [Google Scholar] [CrossRef]

- Li, M.; Sethi, S.P.; Zhang, J. Competing with bandit supply chain. Ann. Oper. Res. 2016, 240, 617–640. [Google Scholar] [CrossRef]

- Zhang, L.H.; Tian, L.; Chang, L.Y. Equilibrium strategies of channel structure and RFID technology deployment in a supply chain with manufacturer encroachment. Int. J. Prod. Res. 2022, 60, 1890–1912. [Google Scholar] [CrossRef]

- Zhang, L.H.; Zhang, C. Manufacturer encroachment with capital-constrained competitive retailers. Eur. J. Oper. Res. 2022, 296, 1067–1083. [Google Scholar] [CrossRef]

| Reference | Selling Mode Selection | Competitive Supply Chain | Power Structure | |||

|---|---|---|---|---|---|---|

| Reselling or Agency Selling | Upstream Competition | Downstream Competition | SS | VN | PS | |

| Hagiu and Wright (2015) [15] | ✓ | ✓ | ||||

| Abhishek et al. (2016) [1] | ✓ | ✓ | ||||

| Tian et al. (2018) [2] | ✓ | ✓ | ||||

| Zennyo (2020) [3] | ✓ | ✓ | ||||

| Wu et al. (2009) [25] | ✓ | ✓ | ✓ | ✓ | ||

| Wu and Mallik (2010) [26] | ✓ | ✓ | ||||

| Anderson and Bao (2010) [21] | ✓ | ✓ | ✓ | |||

| Zhao and Shi (2011) [28] | ✓ | ✓ | ||||

| Du et al. (2018) [22] | ✓ | ✓ | ||||

| Feng and Liu (2022) [23] | ✓ | ✓ | ||||

| Cai et al. (2009) [30] | ✓ | ✓ | ✓ | |||

| Luo et al. (2017) [37] | ✓ | ✓ | ✓ | ✓ | ||

| Pu et al. (2021) [4] | ✓ | ✓ | ✓ | ✓ | ✓ | |

| This Paper | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Notation | Explanation |

|---|---|

| Market size. | |

| Competition intensity of the two supply chains. | |

| The platform fee rate. | |

| The order fulfillment cost, where . | |

| The customer demand of supply chain in scenario under power structure, where and . | |

| The sales price of supply chain in scenario under power structure. | |

| The platform’s marginal profit with supply chain in scenario under power structure. | |

| The supplier’s wholesale price with supply chain in scenario under power structure. | |

| The platform’s profit of supply chain in scenario under power structure. | |

| The supplier’s profit with supply chain in scenario under power structure. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, L.; Fan, T.; Yang, J.; Zhang, L. Monopolistic vs. Competitive Supply Chain Concerning Selection of the Platform Selling Mode in Three Power Structures. Sustainability 2022, 14, 11016. https://doi.org/10.3390/su141711016

Zhou L, Fan T, Yang J, Zhang L. Monopolistic vs. Competitive Supply Chain Concerning Selection of the Platform Selling Mode in Three Power Structures. Sustainability. 2022; 14(17):11016. https://doi.org/10.3390/su141711016

Chicago/Turabian StyleZhou, Lixi, Tijun Fan, Jie Yang, and Lihao Zhang. 2022. "Monopolistic vs. Competitive Supply Chain Concerning Selection of the Platform Selling Mode in Three Power Structures" Sustainability 14, no. 17: 11016. https://doi.org/10.3390/su141711016

APA StyleZhou, L., Fan, T., Yang, J., & Zhang, L. (2022). Monopolistic vs. Competitive Supply Chain Concerning Selection of the Platform Selling Mode in Three Power Structures. Sustainability, 14(17), 11016. https://doi.org/10.3390/su141711016