1. Introduction

SMEs play a vital role in the economy of both developed and developing countries across regions. In a developed country, such as Australia, SMEs serve as a means of reviving stagnant industries [

1,

2]. The importance of a healthy industrial sector cannot be overlooked; in the last two centuries, industrial production has been the main impetus for productivity and improved quality of life in developed countries [

3]. According to the European Commission’s 2011 report, the countries that have not successfully developed industrially remain poor, and SMEs are the backbone of any economy around the world due to their significant contribution. US small businesses comprise 99.7% of all employer firms, employing half of all private sectors, which have, over the past ten years, gained 60 to 80%of new jobs per year, thereby generating more than 50% of the non-governmental private GDP [

4].

Small businesses are an integral part of an economy. Data and reports from the SME subgroup also indicate that SMEs in developing countries contribute significantly to employment and an approximate 45% to an annual 33% gross domestic product [

5]. The financial needs and practices of SMEs must first be considered, as these institutions are important for the development of most economies around the world. They have contributed significantly to the development of various countries’ economies and the creation of employment opportunities. In addition, they make valuable contributions to regional income and savings, facilitate training, and create a competitive edge by helping large firms; thus, they are a stimulus for economic growth and development. The enrichment and development of SMEs have significantly helped not only by generating job opportunities but also by reducing poverty [

6].

In Pakistan, SMEs own 90% of all companies, including in the textile industry. SMEs also play a vital role in Indonesia’s national economy, as evidenced by the large number of different small businesses, which reached up to 62.9 million, which is equal to a 99.99%-unit share. However, large firms are 5460 units, which equals a 0.01%-unit share, in 2017 [

7].

In Jordan, the government believes that human, social, and economic development depends on MSMEs (micro, small, and medium-sized enterprises). The national agenda of 2006–2015 helps utilize MSMEs as a strategy to improve social security and well-being and promote economic development. In Jordan, SMEs face various problems, such as a lack of credit history, which impede their growth and development. In Bangladesh, the SME sector developed in the last twenty years and plays an indispensable role in the economy; however, Bangladesh’s SME sector is facing issues and challenges in the country [

8].

In Thailand, small firms were responsible for up to forty percent of GDP in 2008 and more than seventy-five percent of the jobs in 2013. In Vietnam, small businesses contributed 40% to GDP, and profits increased by about 20% annually [

9]. The importance of the rapid development of small businesses in all regions of Russia is explained for the period up to 2030. It is shown that, from 2015 to 2016, the number of small businesses and employees increased at the same time [

10].

While financing is an important, though sometimes challenging aspect, of SMEs’ success in all regions around the globe, several studies have pointed out various other obstacles to developing SMEs across different regions, such as marketing, technology, innovation, HR practices, skilled personnel, bureaucracy, and regulations of the regulatory authorities [

11].

These studies have demonstrated different challenges faced in SME entrepreneurship, which occasionally cause drastic failures in small-business operations. The challenges include an entrepreneur’s personal traits, internal factors of SMEs (resources), and external factors [

12,

13]. The entrepreneur plays an indispensable role in an SME’s success. The entrepreneur’s personal traits related to business operation cannot be negated, and, in particular, their education and skills really impact the success of SMEs [

14].

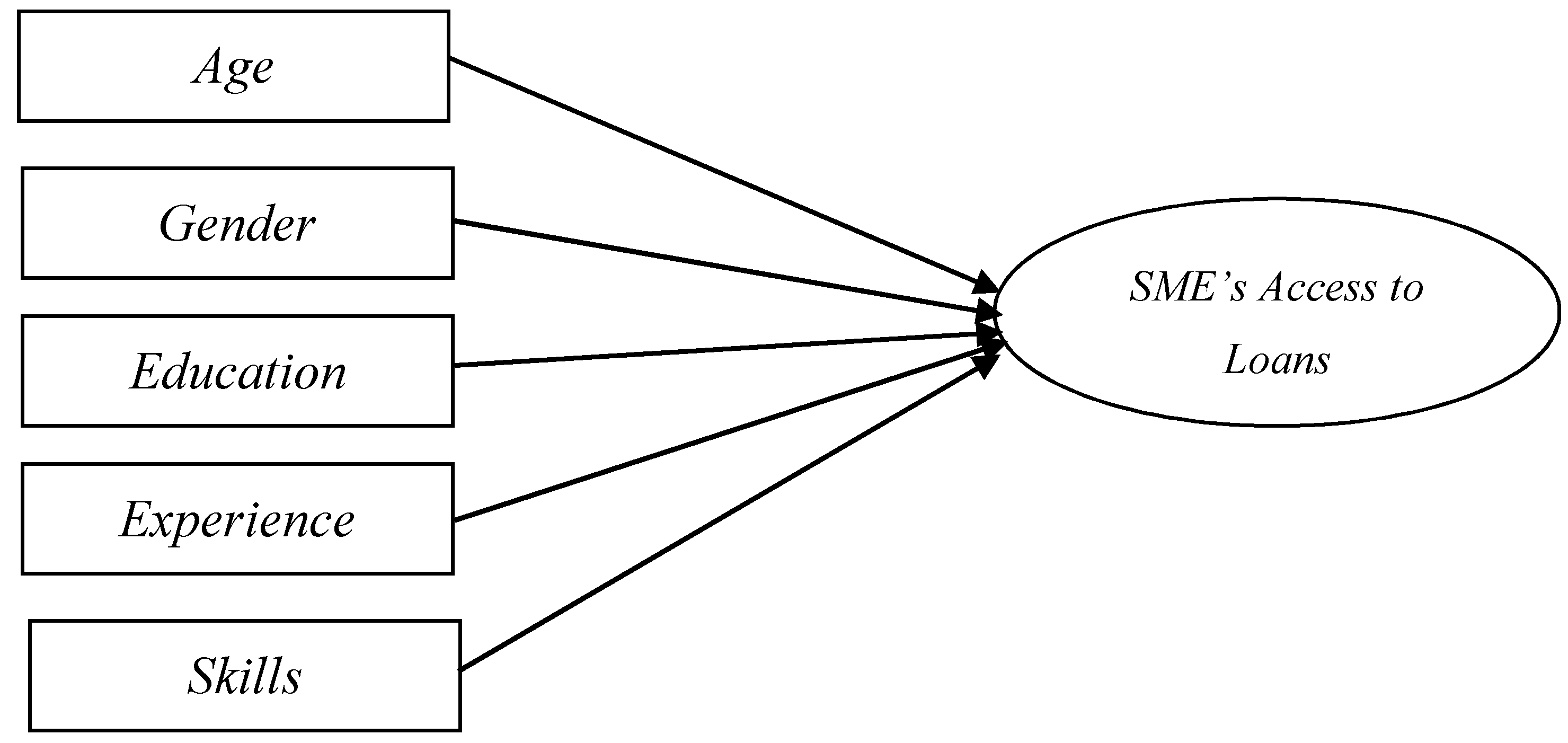

Despite the entrepreneurial-specific characteristics, resources and financial-related factors have also been a challenge to the SME sector. The SME sector has been facing hurdles when approaching banks and other formal financial institutions in the country, and it has been revealed that banks and other formal financial institutions prefer to finance the corporate sector and large enterprises and ignore the SME sector in the country. The promotion and development of the SME sector in KP is primarily weakened by a lack of financing, which negatively affects a large portion of industrial units; thus, a comprehensive study is required to find a better solution. Furthermore, a study is needed to elaborate upon the factors which impact the loan access of SMEs. Therefore, this study seeks to address the factors that play a crucial role to obtain financing from banks and other formal financial institutions in KP. In particular, this study has the following objectives:

O1. To elaborates the access of financing and the role of entrepreneurial characteristics in obtaining the loan.

O2. To observes the entrepreneurial personal traits and their due role in access to bank financing in KP.

O3. The study will also pose some suggestions and recommendations for the SME sector, banks, and other lending institutions for how to deal with SMEs, particularly in KP and generally across Pakistan.

The remaining paper has been structured as follows:

Section 2 pertaining to literature review and hypotheses, followed by methodology in

Section 3, data analysis in

Section 4, discussion and conclusions in

Section 5, implications of the study in

Section 6; and the study’s limitations and future research directions in

Section 7. The paper concludes with a comprehensive reference list.

2. Literature Review and Hypotheses Development

Pakistan’s economy is based on agriculture, fisheries, and forestry, which contribute about twenty-percent of the country’s GDP. The manufacturing sector in Pakistan has been growing since 1950, but due to the scarcity of resources, the newly established economy of Pakistan faces a problematic trade deficit and external debt burden. In 1970, the government nationalized all the major industrial sectors of the country but failed to obtain the desired economic results. In 1980 and 1990, denationalization encouraged the private sector, most of which focused on the larger sector of industrial units. Subsequently, after 1990, the government focused on agriculture, privatization, and developing the SME sector through entrepreneurship in the country. Later on, the Small and Medium Enterprises Development Authority, (SMEDA) an independent body that which looks after the SME sector in the country and has regional offices in major cities across Pakistan, began working for the development and growth of SMEs in the country. SMEDA and SME banks were being developed by the government of Pakistan to cater to the needs of the SME sector, providing support through policy formulations and infrastructure development in the country. SMEDA has been working for entrepreneurs and the SME sector in the country and has opened provincial offices across Pakistan. Additionally, SME banks have also been established in each and every major city across the country for purposes of supporting entrepreneurship and the SME sector.

Currently, governments, along with other bodies, are working to promote entrepreneurship culture in the country by introducing various programs and initiatives to develop and promote SME and entrepreneurship in Pakistan. Recently, the government of Pakistan launched schemes for the youth and women entrepreneurs in the country by providing financing for the skillful individuals who work for their family and encourage entrepreneurial culture in the country [

15].

It has been important to know about the entrepreneur-specific characteristics and how these personal traits influence business operations of the SME sector and the entrepreneurs. Keeping in mind this importance, various studies have been undertaken on these personal traits of entrepreneurs across the globe. Some of the studies have also been undertaken during the educational careers of the students, which elaborated upon these personal traits in their studentship. Likewise, a study in Iran conducted by [

16] addressed the entrepreneurial personal traits, consisting of eight factors of the undergraduate students of the three universities in the country. Additionally, a similar study has also been conducted in Brazil [

17]. Thus, as is evident from the literature, the entrepreneurial personal traits play an important role in promoting entrepreneurial culture and developing the SME sector of a country.

Entrepreneurial-specific features or personal traits of SMEs’ owners/managers have a huge impact on access to finance. A study in the UK and the US points out that SMEs’ success is associated with education, age, net worth, and several years of work [

18]. The study discovered that the personal values of owners and managers, the strategies they adopt when running their companies, and the results of their business performance are inwardly related, observing a positive relationship between owner/manager personal traits and business performance of SMEs [

19]. Previous literature suggests that financing factors for firms are owner characteristics, company characteristics, and ownership [

20,

21,

22]. Meanwhile, it is factors such as financial issues (including short and long-term loans), good access to infrastructure, reliable supply chain systems, work experience, and educational background that drive the success of SMEs.

A study conducted by [

23] focuses on the experiences of entrepreneurs and the personal attributes that prevent them from starting a business at the micro level in Pakistan. A total of eighty-four families in rural Sindh, Pakistan were interviewed. The findings reveal that religious, social, economic, and structural forces play a key role in suppressing social and cultural capital in rural Pakistan, which explains the low level of entrepreneurship in these areas. Social and cultural capital require a specific socio-economic perspective to promote business in Pakistan.

2.1. Age of SME’s Entrepreneur

An entrepreneur’s age is found to also be relevant in the development of SMEs and entrepreneurship culture as observed by [

24]. Many studies have examined the access to loans and the age of the owner/manager. While some show that there is some importance with an observed positive impact on bank loan accessibility [

25], some have shown that age does not have any association with access to finance [

26]. A study examined the financial behavior of SMEs using two datasets comprised of 15,750 and 3239 SMEs from the UK and the US, respectively. The results reveal that younger owner-managers use more bank loans, credit cards, savings, and family resources than older ones, who rely on income. The young owners had a better chance of survival in SMEs compared to the older owners [

27]. Based on the literature, the proposed hypothesis will be

Hypothesis 1 (H1). The age of an SMEs entrepreneur has a significant relation toaccess to loans.

2.2. Gender of SME’s Entrepreneur

Like other entrepreneurial-specific characteristics, the entrepreneur’s gender also plays a vital role in an SME’s efficient operation [

28,

29,

30]. The study found an association of gender and external finance access and reveals that both men and black and ethnic minority participants are inclined to the advice of family and friends, while women are more likely than men to use a business link [

31]. A study by [

32] does not provide any evidence to suggest a financial gap in the small businesses in Australia. In addition, the study further found no gender difference treatment by the financial institutions with respect to financing. Meanwhile, a study in the USA examined the views of SMEs’ owner/managers regarding the gender differences and obtaining loans. Their results show that business owner/managers and male and female partners of bankers had a higher confidence level to loan and banking knowledge [

33].

The women surveyed showed that the raising of funds by females was easier than by their male counterparts, while ethnic minority businesses, especially black owners, had the most difficulty obtaining financial assistance, which is why they resorted to financing. Based on the literature, the following hypothesis is empirically tested:

Hypothesis 2 (H2). The gender of an SME’s entrepreneur has a significant relation to access to loans.

2.3. Education of SME’s Entrepreneur

Entrepreneurship plays a vital role in a country’s economy. For a good entrepreneurship, an individual’s education and skills have a significant role. In this sense, education plays a key role in enhancing an individual’s skills and abilities, as the business trend increases employment opportunities and serves as an engine to boost the country’s economy [

34]. Reference [

35] provided an excellent case study of a frontline business family, Memons, (a family name) in Pakistan, whose business-based community structure largely reflects the educational preferences of other business families in Pakistan. It was found that, contrary to the preferences of most educated youth, Memon considered himself unwelcome in government jobs and preferred to start his own business and encouraged entrepreneurial culture in the country. It is suggested that the higher level of education tends towards a positive role in the access to credit from banks (39). In addition, considering the education factors, including the gender and ethnicity of the owner/manager, the result shows that graduates had less difficulty obtaining funding than college students. It has been found that there is a positive association of owners’ education level and loan availability [

36]. Similarly, a study used the level of education of senior managers and revealed a relation with access to loans [

37]. The impact of education level and training on indirect bank loan access through business trends was investigated. SMEs with an entrepreneur who has a professional level of education have a legal right of access to creditor a higher chance of success [

38]. Therefore, the researchers propose the following hypothesis;

Hypothesis 3 (H3). The education of an SME’s entrepreneur has a significant relation to access to loans.

2.4. Professional Experience and Skills of SME’s Entrepreneur

An entrepreneur’s experience is one of the main factors of an SMEs business operations and efficient utilization of their resources [

39]. Experience is an important factor for external financing from the formal and informal financial institutions [

40]. In addition, business size, gender, and location of owners are important factors at the company level that influence companies’ reliance on informal credibility. Finally, the level of economic development in the country has significant implications in reducing the everyday use of credit. Most companies rely heavily on prior knowledge and experience [

41].

Entrepreneurial skill has been proven to be the main factor of an SME’s success [

42]. Skill (managerial and business development) plays its role in attaining the funding from formal and informal financing sources. A study clarified that previous experience and skills were associated with access to loans from external sources for SMEs [

43]. Experienced entrepreneurs perform well compared to less-experienced entrepreneurs in SMEs. It is thus advisable to include experience in loan credibility [

44]. A significant relation has been proved with management skills and experiences in Bangladeshi SMEs [

45]. Thus, the following hypotheses are proposed:

Hypothesis 4 (H4). The experience of an SME’s entrepreneur has a significant relation to access to loans.

Hypothesis 5 (H5). The skills of an SME’s entrepreneur have a significant relation to access to loans.

Figure 1 is the proposed conceptual framework of the current study, i.e.,

3. Methodology of the Study

3.1. Binary Logistic Regression

This type of regression is employed when predicting an association in variables. The dependent variables are binary, having two choices (yes/no, male/female) and not more than that are termed as binary logistics. Binary logistics regression analysis is performed by multiple descriptive variables and the relationship between one single binary response variable, a categorical variable with two types [

46].

where Log(P/1 − P) = Log(likelihood)

P = ea+bx ÷ 1+ ea+bx

P = Target variable (0 to 1)

B0 = Constant

B1 = Coefficient of variable X1 and so on

X1 = Independent variable

E = Error term.

Based on the above regression equation, the regression model of the study is as follows:

Access to finance = B0 + B1 (Age) + B2 (Gender) + B3 (Education) + B4 (Experience) + B5 (Skills) + E.

3.2. Population and Data

The population of the study is based on the SME sector of KP, Pakistan. According to the Census Report 2017 of Pakistan, KP, a province of Pakistan, had a population of more than 35.50 million. A total of more than 2.50 million individuals have been employed in different sectors of the economy, such as agriculture, trade, and commerce. The majority of the work force involved in the sub-sectors of SME in the province, e.g., textile, leather, and apparel; food and beverage; flour mills; and the tobacco sector.

According to the Small and Medium Enterprises Development Authority (SMEDA), there are more than 2250 industrial units operating in the province [

47]. This is more than a14% contribution in the share of the SME sector in the country by KP.

There are different industrial zones in KP, spread in Peshawar, Gadoon, Hattar, DI Khan, Swat, and other provinces. This study focuses on the Peshawar district, the capital of KP. The industrial zone is located in Hayatabad Peshawar, the main city of the capital, and is the province’s hub for business. The Hayatabad Industrial Sector has various kinds of industries and units of SMEs working. There are 431 firms working in Hayatabad Industrial Zone Peshawar, and this is the target population of the current study.

According to Cochran formula, the study’s sample size is calculated for 204 SMEs. Therefore, 204 questionnaires are distributed randomly in Hayatabad.

According to the Cochran formula [

48] the Hayatabad Industrial Sector was selected for data gathering and a total of 204 questionnaires distributed randomly among the owners and managers of SMEs. Of the 204, 197 questionnaires were successfully filled and returned, among which 192 were used for data analysis (response rate is 94%), and five were excluded due to lack of data or an incomplete identification of subject domain.

3.3. Variables of the Study

This section is comprised of the variables used in the study.

Table 1 shows the details of the study variables. There is one dependent variable and five explanatory variables that predict the dependent variable. The variable age and experience have six categories, followed by gender having two options, and level of education has four categories, while both the skills (managerial and business development) and access to finance have two options in the questionnaire and details as shown in

Table 1.

4. Analysis and Results

The data analyzed through binary logistic regression as the dependent variables (access to finance) are categorical and have two options (yes/no), and the explanatory variables are age, gender, education, experience, and skills. Therefore, the binary logistic is suitable for analysis. Before analyzing, some assumptions are mandatory to check the data, such as running a normality test.

Table 2 shows the Shapiro-Wilk test; if the value of significance is >0.05, then data are normally distributed.

Table 2 indicates that the

p values of each variable are greater than 0.05, confirming that the data are normal.

The study also uses tolerance and VIF to check collinearity of the data. If the tolerance value is less than 0.1 or the VIF value is larger than five, there is a correlation between the variables.

Table 3 shows that the value of tolerance of each variable is greater than 0.1, and the value of VIF is less than 5; thus, it means that the variables have no collinearity and are hence feasible for logistic regression analysis.

Table 4 shows the output results of the dependent and explanatory variables of the study; according to the table, age (

p < 0.000 and the value of the odds ratio are 5.488) is significantly associated with access to finance of SMEs. It means that if the age is increasing, there is a 1.703-unit increase in access to finance of the SMEs; therefore, null hypothesis is rejected at a 1% level of significance. This could imply that whenever the age of the entrepreneur (owner/manager) of SMEs increases, they know the business better. They have seen many activities involving the business, including financing and different strategies for external funding opportunities for their business compared to the younger individuals.

The education (p < 0.040 and the value of the odds ratio are 1.801) also has a significant association with access to finance and, hence, rejects the null hypothesis at the 5% significance level, accepting the alternate hypothesis. When education increases by 0.589 units, there is an increase in access to loans by the owner/manager of the SME. As the entrepreneurs (owner/manager) of SMEs have more education, they can easily obtain the business’ financing compared to the individual who has less education. Banking and other financial institutions hesitate and do not encourage the owner and manager of SMEs with less education for credit opportunities compared to more educated owner/managers of SMEs.

Although the gender, experience, and skills of an entrepreneur (owner/manager) of SMEs are important personal traits and impact the business decisions, including financing and external sources for obtaining funds for the SMEs, in the present study, gender, experience, and skills have not been significant. The p-value is (0.995, 0.459, and 0.535) respectively, which means that these three factors have no significant relation to finance access in the current study.

The likelihood ratio test value is 29.468 with a p-value of 0.000, which indicates that the overall fit of the model is good and statistically significant. The value of Cox and Snell R-square is 0.694, and the Nagelkerke R-square is 0.941, which shows that the model is good and shows the explanatory variables in the model explained between 69.4% and 94.1% of the changes in the dependent variable.

In

Table 4, the Hosmer–Lemeshow test shows the goodness of fit of the model; the higher the value of the test, the better-fitted the model. The value of the test is (Chi-square 2.248(8), 0.945); this gives the predictive quality of the model, and it results in correctly predicting at a value of 94.5%, which is a very high value and close to 1. Thus, the model has high goodness of fit. Based on the Omnibus test, the corresponding Chi-square value is reported 227.437, with eight degrees of freedom with the

p-value (

p < 0.0001), so the explanatory variables used in the model have significantly contributed as compared to the model where the predictors are not used.

Table 5 is about the classification table and shows the dependent variable (access to finance) having a yes or no option. The classification table is another way of estimating the accuracy of the logistic regression model. This table contains the observed values (user-defined cut-off value, for example,

p = 0.50) for dependent results and predicted values. This table shows the individual’s percentage of the choice of the variable’s answer in the model. The overall percentage of the model is 95.31%, which shows that the model is accurate.

5. Discussions and Conclusions

The results of the binary regression analysis show that age and education are the two variables with significant results at 1% and 5% significance level and reject the null hypotheses at 1% and 5%. These results are similar to [

49,

50,

51,

52,

53], who have also reported the same findings in their studies about a significant association of age and experience of entrepreneurs with their access to loans.

Although gender, experience, and skills of an entrepreneur (owner/manager) of an SME are important personal traits and impact business decisions, including financing and external sources for obtaining funds for the SMEs, in the present study, gender, experience, and skills have no significant relation to finance. These results are similar to the studies by [

54,

55,

56,

57].

Financial institutions are usually reluctant to lend to startups because of the high risks of loan default. Another personal aspect of the problem may be that credit officials as a group of clients can pose a threat to women entrepreneurs, thinking that women have less knowledge. Many banks’ marketing strategies are based on a user profile that may not be suitable for female business people. Facing cultural barriers that women entrepreneurs face, e.g., maximized mobility and time demands, further limit women and their ability to access finance.

Some studies have mixed results regarding the entrepreneurial-specific characteristics and access to finance. A study by [

58] reveal that loan accessibility in Kenya is not related to knowledge of financing but related to income level, age, marital status, gender, and education. A study examined that the owner/manager’s age has a relation with access to loans for SMEs. On the other hand, access to bank loans has no significant effect on the educational level.

It is concluded that different factors related to the firm’s entrepreneur (owner/manager of the SME) are influencing the financing and credit availability from the financial institutions operating in the country and specifically in KP. The entrepreneur’s factors, such as educational background, experiences, professional skills (managerial and business development), age, and gender influence the SME’s business operations. All these personal traits of the SME’s entrepreneur are important in its operations and especially in obtaining the financing from the external sources for the SMEs in KP. It summarized that age and experience, both the unique features of the entrepreneurs of SMEs, are significantly positively associated with access to financing from external sources, including formal and informal banking and financial institutions who deal in providing the funds to the businesses in the KP. On the other hand, other factors, education, and skills of the owner/managers of SMEs are insignificant with the access to financing. Although these factors also play an important role, this study showed that these are not relevant in SMEs working in KP.

The education is the major contributor in the development of an entrepreneur’s personal traits. Without education, it is very difficult for an entrepreneur to easily understand the business environment of an SME. Above all, educational background must have developed an entrepreneur’s personality in all aspects of their personal and business life. If an entrepreneur’s level of education increases, their power of knowledge and understanding definitely increases, which leads them to efficient utilization of business resources and results in better performance of SMEs. Entrepreneurs with rich educational backgrounds can easily handle complex problems and challenges they face as compared to the entrepreneurs who lack education or have a low level of that. Hence, the well-educated entrepreneurs can easily access loans and funds in a professional manner while dealing with financial institutions, including banks, Non-Governmental Organizations (NGOs), and other funding agencies working for the promotion of entrepreneurial culture and the development of SME sector in the country.

The current study contributed that the educational factor is the main personal trait of entrepreneurs in the context of KP, Pakistan. The current study also contributed in the sense that entrepreneurs play a vital role in SMEs’ business operations in obtaining access to loans. Age is one of the important factors of entrepreneurial personal traits. Older entrepreneurs will have the knowledge and understand the ups and downs in their business operations. They handle pressure of any sort well (e.g., lack of supplies and resources) in contrast with the younger entrepreneurs, who may have not faced such business dealings in their career. The older entrepreneurs deal with the lending institutions in a professional manner and understand the tricks to convince the bankers and lenders in obtaining funds for their business. In short, it has been summarized that an entrepreneurs’ age is also important in an SME’s business operations and access to financing in the context of KP, Pakistan.

It has been evident that a number of studies have been undertaken on large enterprises in Pakistan and the SME sector. Specifically, in the SME sector of the country, various researchers have focused on the different aspects of SMEs and access to financing in KP, but the researchers have not found any particular study which has elaborated the entrepreneurial personal traits and their impact on financing and access to bank loans in KP. Thus, the current study pioneers the subject domain in KP. The present research has a major contribution in the subject under consideration and will also be helpful for future researchers to further elaborate upon the SMEs in KP, Pakistan.

The study has also added to the existing literature and opened a new area for further elaboration by comparing various aspects of SMEs and entrepreneurial personal traits. Additionally, the study will also be useful in policy formulation for the SME sector to further improve and strengthen the entrepreneurial personal traits through training and development, conduct seminars & workshops, and, above all, involve the entrepreneurs in live case studies of the developed nations across the globe through which they can understand and enhance their ability, skills and work environment according to the current requirement and development of the SME sector in KP, Pakistan.

6. Implications & Recommendations of the Study

The implications & recommendations of the study are threefold for policy-makers who will formulate policies and strategies for the SME sector in the country and will keep in mind the need of the small business, especially for their resources and financing. That is how they can easily acquire funds and loans for their business operations and their efficient utilization to obtain the maximum benefit and lead to the success and performance of the SME sector in the country.

The implications for entrepreneurs are that, while starting their business at early stage, they will have hired human capital in a well-judged manner, especially keeping in mind the personal characteristics of personnel, as it has been proven that entrepreneurial personal traits will play a major role in the success of a business, especially in the SME sector. In a later stage, once a business is established, a proper measure should be undertaken for the professional development of the entrepreneurs of SMEs.

It has been recommended that the top management and owners of the business must focus on the personal characteristics and enhance these factors through educating, training, conducting seminars & workshops, and hands on practices during training and development activities. Through their professional and personality development, an entrepreneur will enrich their education, experiences, and professional skills to deal business operations in the best way and will also enhance their ability and cognitive skills, which benefit them in solving complex problems and scenarios they face.

The banks and other formal financial institutions will have also benefited in the sense that, whenever an SME’s entrepreneur approaches them for their financing and loan opportunities, they can analyze all aspects of their business and thus be comfortable in dealing with the entrepreneurs having rich qualities and traits. Because the bankers and other lenders are convinced by SME entrepreneurs, this will result in the granting of loans and funds for their business.

7. Limitations & Future Research

The present study limited to the SME sector of the country, in which only the manufacturing SMEs of Pakistan have been considered. The entrepreneurial-specific characteristics, including age of not more than 60 years along with experience of not more than 30 years, have not been considered. The study is limited to only one province of Pakistan and has not considered other provinces of the country. The informally documented SMEs of KP have not been under consideration of the current study.

The study only focused on the Hayatabad Industrial of Khyber Pakhtunkhwa as cluster sampling through which a total of 204 SMEs has been selected and has not considered the other industrial zones across the province

The study suggests that future researchers explicitly narrate the entrepreneurial specific-characteristics with a large sample while comparing the small and medium-sized enterprises separately in KP, Pakistan. The study should also consider various sub-sectors of SMEs in KP. Additionally, it should observe how personal traits of entrepreneurs’ impact accessibility to bank financing in the country and formulate strategies and policies for strengthening these entrepreneurial-specific characteristics through training and development and personality growth for the efficient operations of the SME sector in Pakistan. Nevertheless, a cross-provincial analysis will also apply in which the SME sector of one province with the other province of the country will be observed and will observe how the entrepreneurial-specific characteristics impact the financing decision and access to bank loans in Pakistan.