What Can Machine Learning Teach Us about Australian Climate Risk Disclosures?

Abstract

:1. Introduction

2. Background

2.1. Climate Change Context

2.2. Climate Risk Types

2.3. Climate Risk Disclosure: History, Value, and Drivers

2.4. Evaluating Existing Research on Climate Risk Disclosures

2.5. Gaps for Research

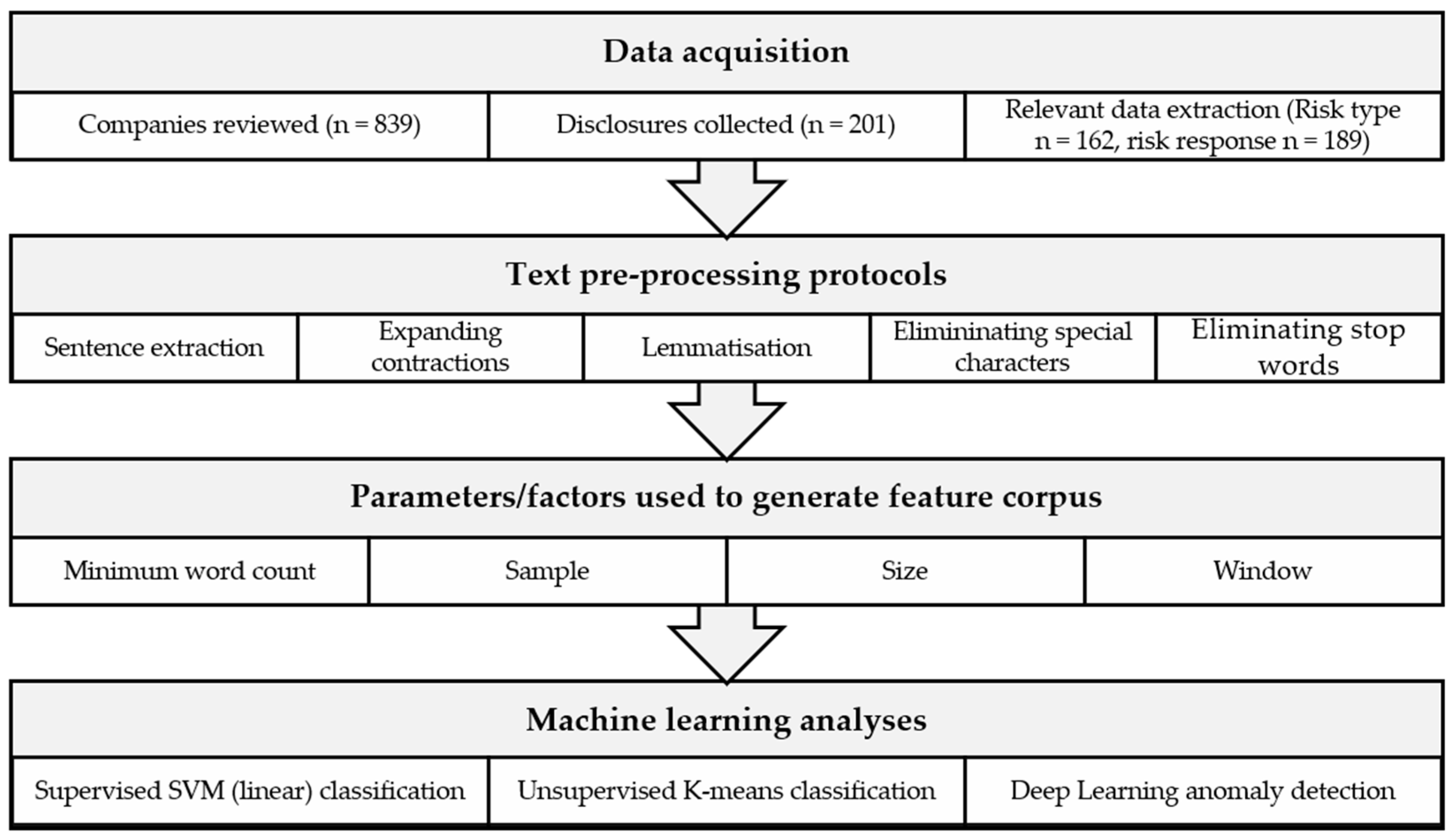

3. Materials and Methods

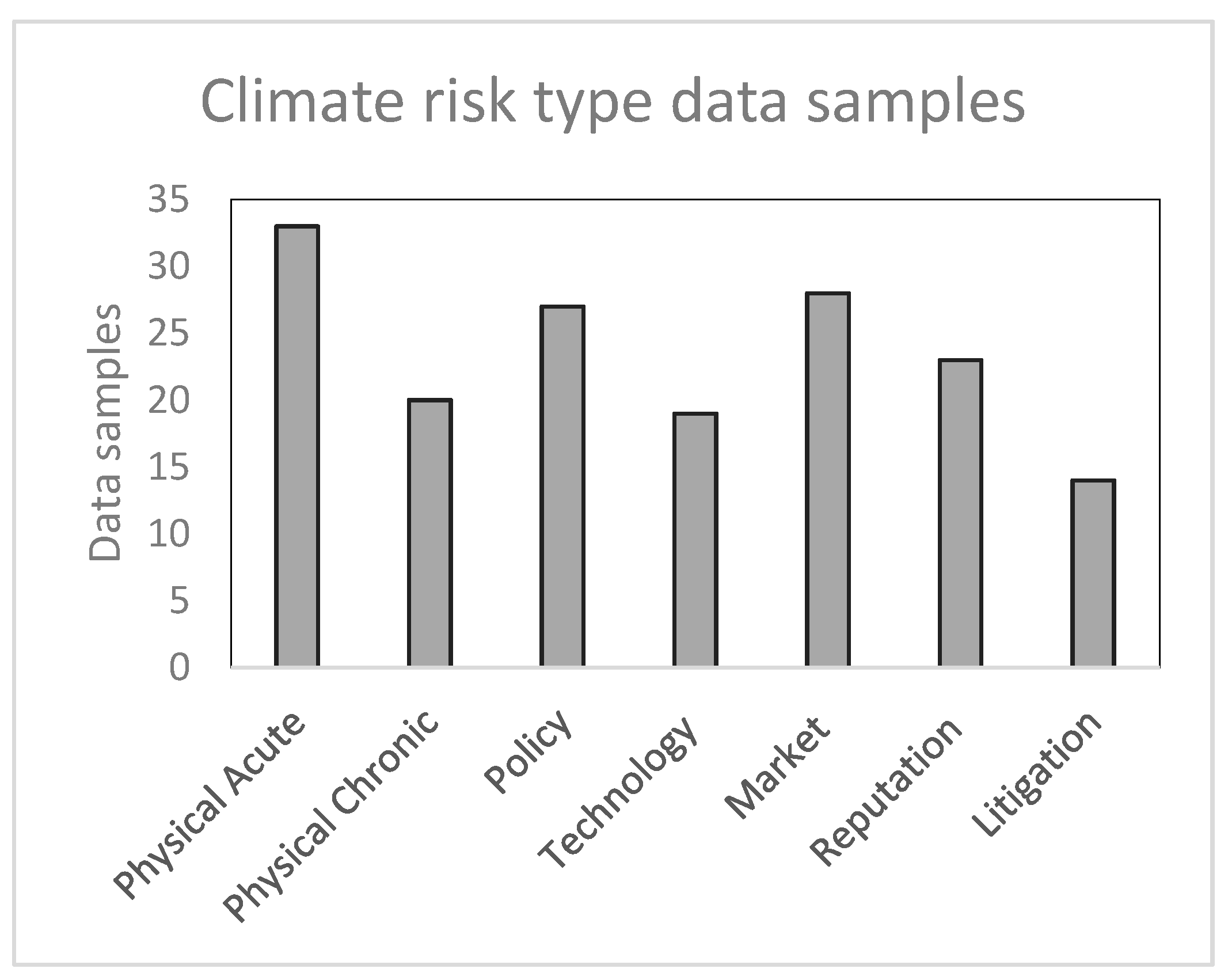

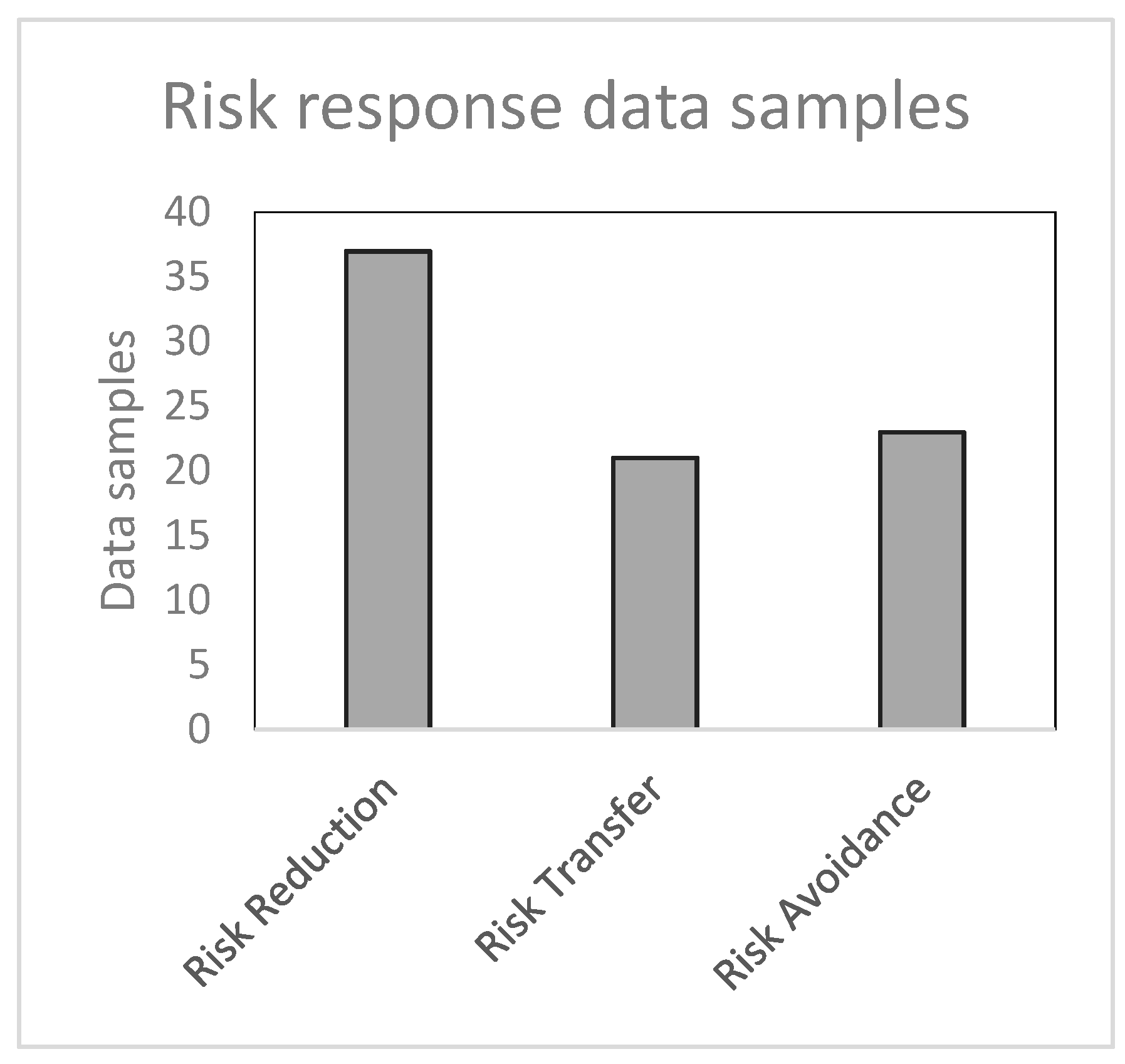

3.1. Data Acquisition

3.2. Text Pre-Processing and Parametrization

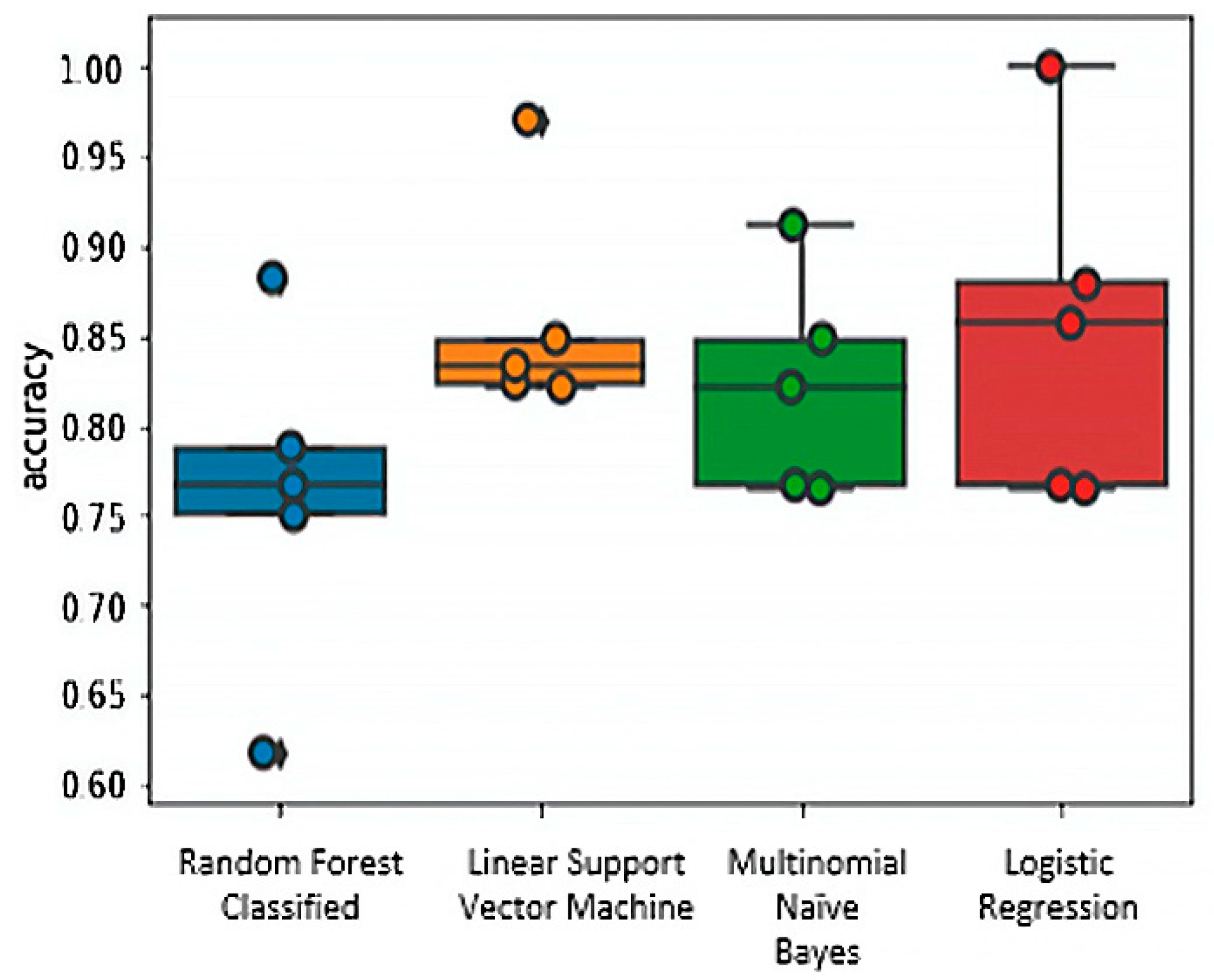

3.3. Supervised Machine Learning Models Comparison and Implementation

3.4. Unsupervised Machine Learning

4. Results

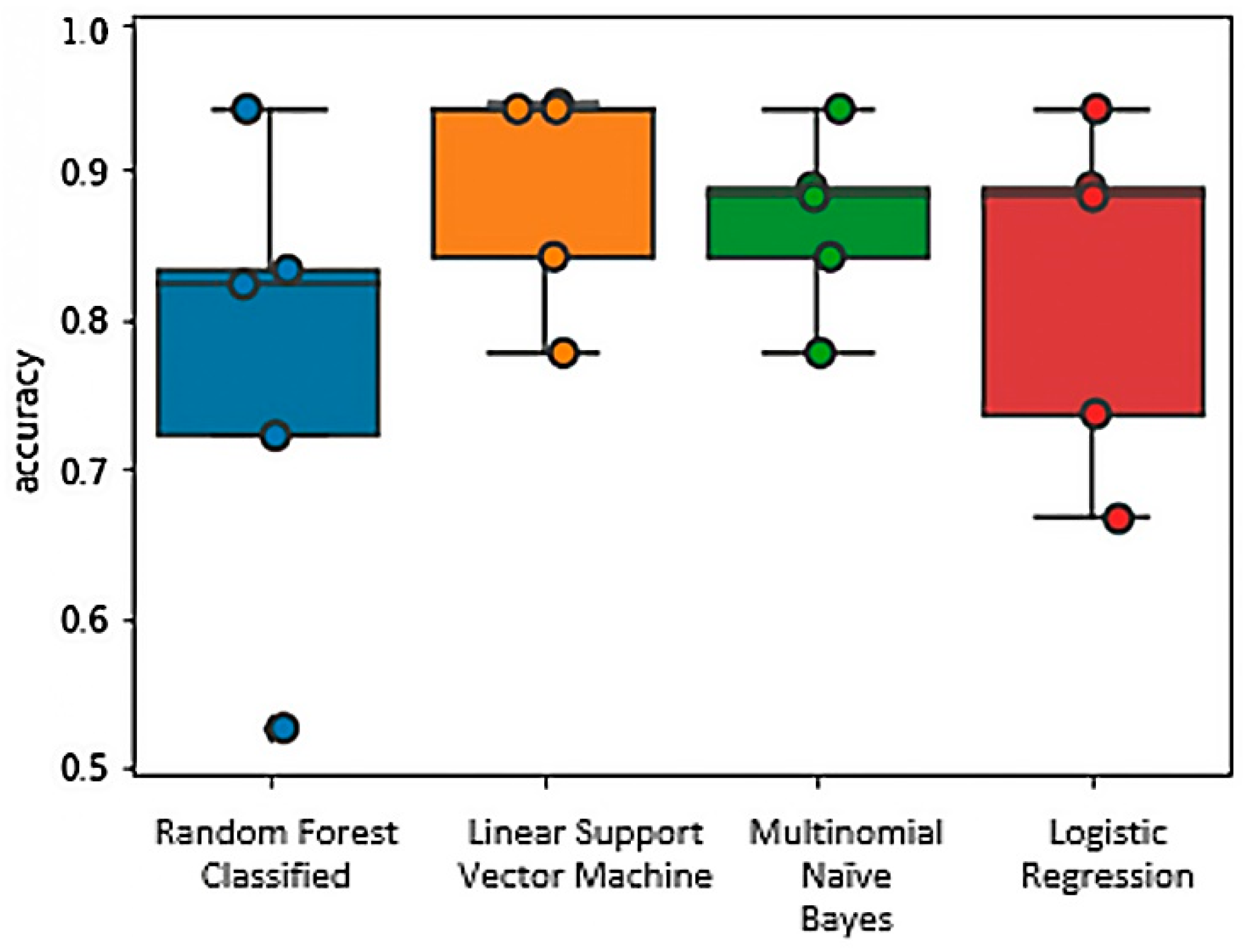

4.1. Supervised Classification

4.2. Unsupervised Classification

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- IPCC. Summary for Policymakers. In Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change; Masson-Delmotte, V., Zhai, P., Pirani, A., Connors, S.L., Péan, C., Berger, S., Caud, N., Chen, Y., Goldfarb, L., Gomis, M.I., et al., Eds.; IPCC: Geneva, Switzerland; Cambridge University Press: Cambridge, UK, 2021. [Google Scholar]

- IPCC. Global Warming of 1.5 °C. An IPCC Special Report on the Impacts of Global Warming of 1.5 °C above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways. In The Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty; Masson-Delmotte, V., Zhai, P., Pörtner, H.-O., Roberts, D., Skea, J., Shukla, P.R., Pirani, A., Moufouma-Okia, W., Péan, C., Pidcock, R., et al., Eds.; IPCC: Geneva, Switzerland, 2018. [Google Scholar]

- Pearson, P.J.G.; Foxon, T.J. A low carbon industrial revolution? Insights and challenges from past technological and economic transformations. Energy Policy 2012, 50, 117–127. [Google Scholar]

- Chipalkatti, N.; Le, Q.V.; Rishi, M. Sustainability and society: Do environmental, social, and governance factors matter for foreign direct investment? Energies 2021, 14, 6039. [Google Scholar] [CrossRef]

- Caldwell, Z. Corporations and climate change: An investigation of mandatory climate risk disclosure in australia. Environ. Plan. Law J. 2020, 37, 3–17. [Google Scholar]

- Sanderson, H.; Irato, D.M.; Cereto, N.P.; Duel, H.; Faria, P.; Torres, E.F. How do climate risks affect corporations and how could they address these risks? SN Appl. Sci. 2019, 1, 1720. [Google Scholar] [CrossRef]

- TCFD. Final Report: Recommendations of the Task Force on Climate-Related Financial Disclosures; Task Force on Climate-related Financial Disclosures. 2017. Available online: https://assets.bbhub.io/company/sites/60/2020/10/FINAL-2017-TCFD-Report-11052018.pdf (accessed on 8 July 2022).

- APRA. Prudential Practice Guide: Draft CPG 229 Climate Change Financial Risks; Australian Prudential Regulation Authority: Sydney, Australia, 2021.

- Council of Financial Regulators. Council of Financial Regulators Climate Change Activity Stocktake 2021. [cited 18th September 2021]. 2021. Available online: https://www.cfr.gov.au/publications/policy-statements-and-other-reports/2021/council-of-financial-regulators-climate-change-activity-stocktake-2021/ (accessed on 18 September 2021).

- Colombo, E. From bushfires to misfires: Climate-related financial risk after Mcveigh v. Retail Employees Superannuation Trust. Transnatl. Environ. Law 2021, 11, 173–199. [Google Scholar] [CrossRef]

- Harrington, L.J.; Otto, F.E.L. Attributable damage liability in a non-linear climate. Clim. Change 2019, 153, 15–20. [Google Scholar] [CrossRef]

- Burke, M.; Hsiang, S.M.; Miguel, E.J.N. Global non-linear effect of temperature on economic production. Nature 2015, 527, 235–239. [Google Scholar] [CrossRef] [PubMed]

- Dietz, S.; Bowen, A.; Dixon, C.; Gradwell, P. Climate value at risk’ of global financial assets. Nat. Clim. Change 2016, 6, 676–679. [Google Scholar] [CrossRef]

- Clarke, T. The search for sustainability in financial markets: Carbon bubbles, shifting tectonic paradigms, and natural capital coalitions. Law Financ. Mark. Rev. 2016, 10, 139–149. [Google Scholar] [CrossRef]

- Strauch, Y.; Dordi, T.; Carter, A. Constraining fossil fuels based on 2 °C carbon budgets: The rapid adoption of a transformative concept in politics and finance. Clim. Change 2020, 160, 181–201. [Google Scholar] [CrossRef]

- Chenet, H. Climate Change and Financial Risk. In Financial Risk Management and Modeling; Zopounidis, C., Benkraiem, R., Kalaitzoglou, I., Eds.; Springer International Publishing: Cham, Switzerland, 2021; pp. 393–419. [Google Scholar]

- Fakhruddin, B.S.H.M.; Boyland, K.; Wild, A.; Robertson, R. Assessing vulnerability and risk of climate change. In Climate Extremes and Their Implications for Impact and Risk Assessment; Elsevier: Amsterdam, The Netherlands, 2019; pp. 217–241. [Google Scholar]

- IPCC. Managing the Risks of Extreme Events and Disasters to Advance Climate Change Adaptation. In Special Report of Working Groups I and II of the Intergovernmental Panel on Climate Change; Field, C.B., Barros, V., Stocker, T.F., Qin, D., Dokken, D.J., Ebi, K.L., Mastrandrea, M.D., Mach, K.J., Plattner, G.-K., Allen, S.K., et al., Eds.; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2012; p. 582. [Google Scholar]

- Foerster, A.; Peel, J.; Osofsky, H.M.; McDonnell, B. Keeping good company in the transition to a low carbon economy? An evaluation of climate risk disclosure practices in Australia. Corp. Secur. Law J. 2017, 1, 3018241. [Google Scholar]

- Demaria, S.; Rigot, S. Corporate environmental reporting: Are French firms compliant with the Task Force on Climate Financial Disclosures’ recommendations? Bus. Strateg. Environ. 2021, 30, 721–738. [Google Scholar] [CrossRef]

- Evain, J.; Cardona, M.; Nicol, M. Article 173: Overview of Climate-Related Financial Disclosure after Two Years of Implementation Climate Brief No. 59; I4CE: Paris, France, 2018; p. 8. [Google Scholar]

- Carney, M. (Lloyd’s of London, London, UK); Breaking the Tragedy of the Horizon—Climate Change and Financial Stability. Speech by Mr Mark Carney, Governor of the Bank of England and Chairman of the Financial Stability Board; Bank of England: London, UK, 2015. [Google Scholar]

- De Grosbois, D.; Fennell, D.A. Determinants of climate change disclosure practices of global hotel companies: Application of institutional and stakeholder theories. Tour. Manag. 2021, 88, 104404. [Google Scholar] [CrossRef]

- Baker, M. Blue sky mine: Environmental risk disclosure in Australia. Environ. Plan. Law J. 2018, 35, 519–528. [Google Scholar]

- Christophers, B. Climate Change and Financial Instability: Risk Disclosure and the Problematics of Neoliberal Governance. Ann. Am. Assoc. Geogr. 2017, 107, 1108–1127. [Google Scholar] [CrossRef]

- Lee, S.-Y.; Park, Y.-S.; Klassen, R.D. Market Responses to Firms’ Voluntary Climate Change Information Disclosure and Carbon Communication. Corp. Soc. Responsib. Environ. Manag. 2015, 22, 1–12. [Google Scholar] [CrossRef]

- Wasim, R. Corporate (Non) Disclosure of Climate Change Information. Columbia Law Rev. 2019, 119, 1311–1354. [Google Scholar]

- Thomä, J.; Murray, C.; Jerosch-Herold, V.; Magdanz, J. Do you manage what you measure? Investor views on the question of climate actions with empirical results from the Swiss pension fund and insurance sector. J. Sustain. Financ. Invest. 2021, 11, 47–61. [Google Scholar] [CrossRef]

- Kouloukoui, D.; da Silva Gomes, S.M.; de Oliviera Marinho, M.M.; Torres, E.A.; Kiperstok, A.; de Jong, P. Disclosure of climate risk information by the world’s largest companies. Mitig. Adapt. Strateg. Glob. Change 2018, 23, 1251–1279. [Google Scholar] [CrossRef]

- Ameli, N.; Drummond, P.; Bisaro, A.; Grubb, M.; Chenet, H. Climate finance and disclosure for institutional investors: Why transparency is not enough. Clim. Change 2020, 160, 565–589. [Google Scholar] [CrossRef]

- Dahl, T.; Fløttum, K. Climate change as a corporate strategy issue: A discourse analysis of three climate reports from the energy sector. Corp. Commun. 2019, 24, 499–514. [Google Scholar] [CrossRef]

- Flammer, C.; Toffel, M.W.; Viswanathan, K. Shareholder activism and firms’ voluntary disclosure of climate change risks. Strateg. Manag. J. 2021, 42, 1850–1879. [Google Scholar] [CrossRef]

- Hirsch, P.B. There’s a change in the weather: Corporate reputation and climate change. J. Bus. Strateg. 2021, 42, 288–291. [Google Scholar] [CrossRef]

- Kouloukoui, D.; Sant’Anna, A.M.O.; da Silva Gomes, S.M.; de Oliveira Marinho, M.M.; de Jong, P.; Kiperstok, A.; Torres, E.A. Factors influencing the level of environmental disclosures in sustainability reports: Case of climate risk disclosure by Brazilian companies. Corp. Soc. Responsab. Environ. Manag. 2019, 26, 791–804. [Google Scholar] [CrossRef]

- O’Dwyer, B.; Unerman, J. Shifting the focus of sustainability accounting from impacts to risks and dependencies: Researching the transformative potential of TCFD reporting. Account. Audit. Account. 2020, 33, 1113–1141. [Google Scholar] [CrossRef]

- Schiemann, F.; Sakhel, A. Carbon Disclosure, Contextual Factors, and Information Asymmetry: The Case of Physical Risk Reporting. Eur. Account. Rev. 2019, 28, 791–818. [Google Scholar] [CrossRef]

- Chithambo, L.; Tingbani, I.; Agyapong, G.A.; Gyapong, E.; Damoah, I.S. Corporate voluntary greenhouse gas reporting: Stakeholder pressure and the mediating role of the chief executive officer. Bus. Strateg. Environ. 2020, 29, 1666–1683. [Google Scholar] [CrossRef]

- Achenbach, M. Transparency of Climate-Related Risks and Opportunities: Determinants Influencing the Disclosure in Line with the Task Force on Climate-Related Financial Disclosures. Glocality 2021, 4, 1. [Google Scholar]

- Parris, D.L.; Dapko, J.L.; Arnold, R.W.; Arnold, D. Exploring transparency: A new framework for responsible business management. Manag. Decis. 2016, 54, 222–247. [Google Scholar] [CrossRef]

- Harrast, S.; Olsen, L. Climate Change Disclosures Are Getting Hotter. J. Corp. Account. Financ. 2016, 27, 21–28. [Google Scholar] [CrossRef]

- Amran, A.; Periasamy, V.; Zulkafli, A.H. Determinants of Climate Change Disclosure by Developed and Emerging Countries in Asia Pacific. Sust. Dev. 2014, 22, 188–204. [Google Scholar] [CrossRef]

- Siew, R.Y.J. Climate-related financial disclosure and the property and construction sector. In Proceedings of the Institution of Civil Engineers-Engineering Sustainability; Thomas Telford Ltd.: London, UK, 2020; Volume 174, pp. 3–8. [Google Scholar]

- Efimova, O.; Rozhnova, O.; Zvyagintseva, E. Creation of a System for Climate-Related Risks Disclosures in Companies’ Reporting. In Lecture Notes in Networks and Systems; Springer: Berlin/Heidelberg, Germany, 2021; pp. 201–211. [Google Scholar]

- Sakhel, A. Corporate climate risk management: Are European companies prepared? J. Clean. Prod. 2017, 165, 103–118. [Google Scholar] [CrossRef]

- Haque, S.; Irvine, H. The climate change-related disclosures and accountability practices of NGOs: Evidence from Australia. Financ. Account. Manag. 2018, 34, 45–63. [Google Scholar] [CrossRef]

- Demertzidis, N.; Tsalis, T.A.; Loupa, G.; Nikolaou, I.E. A benchmarking framework to evaluate business climate change risks: A practical tool suitable for investors decision-making process. Clim. Risk Manag. 2015, 10, 95–105. [Google Scholar] [CrossRef]

- Busch, T.; Berger, S.G.; Paquin, R. Managing for Climate Risk. In Environmental Leadership: A Reference Handbook; Gallagher, D.R., Ed.; SAGE Publications, Inc.: Thousand Oaks, CA, USA, 2012; Chapter 56. [Google Scholar]

- Rybak, N.; Hassall, M. Deep Learning Unsupervised Text-Based Detection of Anomalies in US Chemical Safety and Hazard Investigation Board Reports. In Proceedings of the International Conference on Electrical, Computer, Communications and Mechatronics Engineering (ICECCME), Moka, Mauritius, 7–8 October 2021. [Google Scholar]

- Abraham, A.; Dutta, P.; Mandal, J.K.; Bhattacharya, A.; Dutta, S. Emerging Technologies in Data Mining and Information Security; Springer: Singapore, 2018; pp. 495–505. [Google Scholar]

- Hapke, H.; Howard, C.; Lane, H. Natural Language Processing in Action: Understanding, Analyzing, and Generating Text with Python; Simon and Schuster: New York, NY, USA, 2019. [Google Scholar]

- Szymański, J. Comparative analysis of text representation methods using classification. Cybern. Syst. 2014, 45, 180–199. [Google Scholar] [CrossRef]

- Krishnan, S.; Aydin, N.Y.; Comes, T. Planning Support Systems for Long-Term Climate Resilience: A Critical Review. In Urban Book Series; Springer: Berlin/Heidelberg, Germany, 2021; pp. 465–498. [Google Scholar]

- Žižka, J.; Dařena, F.; Svoboda, A. Text Mining with Machine Learning: Principles and Techniques; CRC Press: Boca Raton, FL, USA, 2019. [Google Scholar]

- Yildiz, B.; Tezgider, M. Improving word embedding quality with innovative automated approaches to hyperparameters. Concurr. Comput. Pract. Exp. 2021, 33, e6091. [Google Scholar] [CrossRef]

- Rybak, N.; Hassall, M. Machine Learning Enhanced Decision-Making. In Handbook of Smart Materials, Technologies, and Devices: Applications of Industry 4.0; Hussain, C.M., Di Sia, P., Eds.; Springer International Publishing: Cham, Switzerland, 2020; pp. 1–41. [Google Scholar]

- Grimmer, J.; Roberts, M.E.; Stewart, B.M. Machine Learning for Social Science: An Agnostic Approach. Annu. Rev. Political Sci. 2021, 24, 395–419. [Google Scholar] [CrossRef]

- Allen, K.J.; Hope, P.; Lam, D.; Brown, J.R.; Wasson, R.J. Improving Australia’s flood record for planning purposes–can we do better? Aust. J. Water Resour. 2020, 24, 36–45. [Google Scholar] [CrossRef]

- Henley, B.J.; Peel, C.M.; Nathan, R.; King, A.D.; Ukkola, A.M.; Karoly, D.J.; Tan, K.S. Amplification of risks to water supply at 1.5 °C and 2 °C in drying climates: A case study for Melbourne, Australia. Environ. Res. Lett. 2019, 14, 084028. [Google Scholar] [CrossRef]

- Phillips, N.; Nogrady, B. The race to decipher how climate change influenced Australia’s record fires. Nature 2020, 577, 610–612. [Google Scholar] [CrossRef]

- Raupach, T.H.; Martius, O.; Allen, J.T.; Kunz, M.; Lasher-Trapp, S.; Mohr, S.; Rasmussen, K.L.; Trapp, R.J.; Zhang, Q. The effects of climate change on hailstorms. Nat. Rev. Earth Environ. 2021, 2, 213–226. [Google Scholar] [CrossRef]

- Kytomaa, H.K.; Boehm, P.; Osteraas, J.; Haddad, B.; Hacker, J.; Gilman, L.; Jampole, E.; Murphy, P.; Souri, S. An integrated method for quantifying and managing extreme weather risks and liabilities for industrial infrastructure and operations. Process Saf. Prog. 2019, 38, e12087. [Google Scholar] [CrossRef]

- Pfrommer, T.; Goeschl, T.; Proelss, A.; Carrier, M.; Lenhard, J.; Martin, H.; Niemeier, U.; Schmidt, H. Establishing causation in climate litigation: Admissibility and reliability. Clim. Change 2019, 152, 67–84. [Google Scholar] [CrossRef]

- Ganguly, G.; Setzer, J.; Heyvaert, V. If at First You Don’t Succeed: Suing Corporations for Climate Change. Oxf. J. Legal Stud. 2018, 38, 841–868. [Google Scholar] [CrossRef]

- MacDonald, C.; Sloman, P. Resource Extraction, Economic Growth, and the Climate Dilemma in Canada and Australia. Political Q. 2020, 91, 780–785. [Google Scholar] [CrossRef]

- Hindmarsh, R.; Alidoust, S. Rethinking Australian CSG transitions in participatory contexts of local social conflict, community engagement, and shifts towards cleaner energy. Energy Policy 2019, 132, 272–282. [Google Scholar] [CrossRef]

- Horne, J. Water security in Australia. In Water Resources Development and Management; Springer: Cham, Switzerland, 2018; pp. 21–52. [Google Scholar]

- Baranova, P. Transition to a low-carbon economy: On the cusp of emerging challenges and opportunities. In The Low Carbon Economy: Understanding and Supporting a Sustainable Transition; Springer: Cham, Switzerland, 2017; pp. 1–14. [Google Scholar]

- Kumarasiri, J. Stakeholder pressure on carbon emissions: Strategies and the use of management accounting. Aust. J. Environ. Manag. 2017, 24, 339–354. [Google Scholar] [CrossRef]

- Jiang, Y.; Luo, L.; Xu, J.; Shao, X. The value relevance of corporate voluntary carbon disclosure: Evidence from the United States and BRIC countries. J. Contemp. Account. Econ. 2021, 17, 100279. [Google Scholar] [CrossRef]

- Biesbroek, R.; Badloe, S.; Athanasiadis, I.N. Machine learning for research on climate change adaptation policy integration: An exploratory UK case study. Reg. Environ. Change 2020, 20, 85. [Google Scholar] [CrossRef]

- Koo, Y.; Lee, Y.; Kim, Y.G. The differentiated impact of emissions trading system based on company size. Clim. Policy 2019, 19, 923–936. [Google Scholar] [CrossRef]

- Kang, J.E.; Yoon, D.K.; Rhee, J. Factors contributing to business actions in response to climate change in Korea. J. Risk Res. 2017, 20, 385–403. [Google Scholar] [CrossRef]

- Bui, B.; de Villiers, C. Business strategies and management accounting in response to climate change risk exposure and regulatory uncertainty. Br. Account. Rev. 2017, 49, 4–24. [Google Scholar] [CrossRef]

- Luo, L.; Tang, Q. Corporate governance and carbon performance: Role of carbon strategy and awareness of climate risk. Account. Financ. 2021, 61, 2891–2934. [Google Scholar] [CrossRef]

- Hart, P. Energy is at the root of Australia’s political crisis: Building a resilient renewable grid. Dams Reserv. 2019, 29, 158–163. [Google Scholar] [CrossRef]

- Mojtahedi, M.; Newton, S.; Von Meding, J. Predicting the resilience of transport infrastructure to a natural disaster using Cox’s proportional hazards regression model. Nat. Hazards 2017, 85, 1119–1133. [Google Scholar] [CrossRef]

- Perkol-Finkel, S.; Sella, I.; Rella, A.; Musella, R.; Moriarty, D. Bringing concrete to life: Harnessing biological processes for building resilient ports and coastal infrastructure. In Proceedings of the Australasian Coasts and Ports 2019, Tasmania, Australia, 10–13 September 2019. [Google Scholar]

- McAneney, J.; Sandercock, B.; Crompton, R.; Mortlock, T.; Musulin, R.; Pielke, R., Jr.; Gissing, A. Normalised insurance losses from Australian natural disasters: 1966–2017. Environ. Hazards 2019, 18, 414–433. [Google Scholar] [CrossRef]

- Maraseni, T.; Reardon-Smith, K. Meeting national emissions reduction obligations: A case study of Australia. Energies 2019, 12, 428. [Google Scholar] [CrossRef]

- Sjafjell, B. Beyond climate risk: Integrating sustainability into the duties of the corporate board. Deakin Law Rev. 2018, 23, 41–61. [Google Scholar] [CrossRef]

- Tsalis, T.A.; Botsaropoulou, V.D.; Nikolaou, I.E. A methodology to evaluate the disclosure practices of organisations related to climate change risks: A case study of international airports. Int. J. Glob. Warm. 2018, 15, 257–276. [Google Scholar] [CrossRef]

| Physical Risks | Transitional Risks | Litigation Risks | ||||

|---|---|---|---|---|---|---|

| Acute Physical | Chronic Physical | Market | Regulatory | Technology | Reputation | Liability |

| Dust storm Hail Extreme sea level | Ice melt/Permafrost melt Ocean acidification | Ambiguity in market indicators | Increased emissions reporting obligations | Replacement of existing products and services | Change in consumer preferences | Exposure to litigation |

| Drought Extreme wind Tornadoes | Changes in precipitation patterns Sustained temperature rise | Changing customer behaviour | Mandates on and regulation of existing products and services | Investment in unproductive new technologies | Stigmatisation of sectors | |

| Flood Landslide | ||||||

| Wildfire | ||||||

| Tropical cyclones Extreme temperature | Water stress Sea level rise | Higher cost of raw materials | Pricing of GHG emissions | Costs of transition to lower emission technologies. | Amplified stakeholder concern | |

| Extreme precipitation | Negative stakeholder feedback | |||||

| ASX Sector | Companies > $100 m Market Capitalisation | TCFD | ESG | GRI | CDP | Financial Report | Total Disclosures (% Reporting) |

|---|---|---|---|---|---|---|---|

| Automobiles and Components | 9 | 0 | 1 | 1 | 0 | 0 | 2 (22) |

| Banks | 15 | 4 | 2 | 0 | 1 | 2 | 9 (60) |

| Capital Goods | 29 | 3 | 0 | 1 | 0 | 2 | 6 (21) |

| Commercial and Professional Services | 19 | 4 | 2 | 0 | 0 | 1 | 7 (37) |

| Consumer Durables and Apparel | 7 | 0 | 0 | 0 | 0 | 0 | 0 (0) |

| Consumer Services | 34 | 2 | 0 | 0 | 0 | 4 | 6 (18) |

| Diversified Financials | 50 | 6 | 2 | 0 | 1 | 7 | 16 (32) |

| Energy | 44 | 15 | 0 | 0 | 0 | 6 | 21 (48) |

| Food Staples and Retailing | 4 | 2 | 0 | 0 | 0 | 1 | 3 (75) |

| Food Beverage and Tobacco | 25 | 4 | 0 | 0 | 0 | 12 | 16 (64) |

| Healthcare Equipment and Services | 48 | 2 | 0 | 0 | 0 | 8 | 10 (21) |

| Household and Personal Products | 4 | 2 | 0 | 0 | 0 | 0 | 2 (50) |

| Insurance | 10 | 4 | 0 | 0 | 0 | 3 | 7 (70) |

| Materials | 203 | 31 | 0 | 0 | 1 | 12 | 44 (22) |

| Media and Entertainment | 25 | 0 | 0 | 0 | 1 | 2 | 3 (12) |

| Not Applicable | 64 | 0 | 0 | 0 | 0 | 3 | 3 (5) |

| Pharmaceuticals, Biotech and Life Sciences | 34 | 0 | 0 | 0 | 0 | 2 | 2 (6) |

| Real Estate | 57 | 11 | 1 | 0 | 1 | 9 | 22 (39) |

| Retailing | 38 | 1 | 0 | 0 | 1 | 1 | 3 (8) |

| Semiconductors and Semiconductor Equipment | 4 | 0 | 0 | 0 | 0 | 0 | 0 (0) |

| Software and Services | 64 | 1 | 0 | 0 | 0 | 2 | 3 (5) |

| Technology Hardware and Equipment | 10 | 0 | 0 | 0 | 0 | 0 | 0 (0) |

| Telecommunication Services | 14 | 2 | 0 | 0 | 0 | 0 | 2 (14) |

| Transportation | 14 | 5 | 0 | 0 | 0 | 1 | 6 (43) |

| Utilities | 14 | 5 | 0 | 0 | 0 | 3 | 8 (57) |

| Total | 839 | 104 | 8 | 2 | 6 | 81 | 201 (24) |

| Risk Response Objective | |||

|---|---|---|---|

| Indicator | Risk Management | Risk Transfer | Risk Avoidance |

| 1. | Monitoring | Trading/banking | Divestment |

| 2. | Reporting | Hedging | Investment (carbon-free) |

| 3. | Dialogue | Offsetting | Energy mix (carbon-free) |

| 4. | Influencing | Outsourcing | Relocation |

| 5. | Sponsoring | Insurance | |

| 6. | Membership | ||

| 7. | Investment (low carbon) | ||

| 8. | Planning | ||

| 9. | Strategy | ||

| 10. | Diversification | ||

| 11. | Reduction target | ||

| 12. | Supply chain | ||

| 13. | Energy mix (low carbon) | ||

| Risk Type | Risk Response | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Physical Risks | Transition Risks | Litigation Risks | ||||||||

| Sector | Acute Physical Risk (%) | Chronic Physical Risk (%) | Regulatory Risk (%) | Technology Risk (%) | Market Risk (%) | Reputation Risk (%) | Liability Risk (%) | Risk Reduction (%) | Risk Transfer (%) | Risk Avoidance (%) |

| Automobiles and components | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 2 (100) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 0 (0) |

| Banks | 3 (43) | 0 (0) | 0 (0) | 0 (0) | 1 (14) | 3 (43) | 0 (0) | 8 (89) | 0 (0) | 1 (11) |

| Capital Goods | 2 (50) | 0 (0) | 2 (50) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 5 (100) | 0 (0) | 0 (0) |

| Commercial and Professional Services | 4 (66) | 0 (0) | 1 (17) | 0 (0) | 1 (17) | 0 (0) | 0 (0) | 4 (57) | 2 (29) | 1 (14) |

| Consumer Services | 2 (29) | 0 (0) | 0 (0) | 0 (0) | 5 (71) | 0 (0) | 0 (0) | 5 (83) | 0 (0) | 1 (17) |

| Diversified financials | 3 (43) | 1 (14) | 2 (29) | 0 (0) | 0 (0) | 1 (14) | 0 (0) | 13 (81) | 0 (0) | 3 (19) |

| Energy | 1 (5) | 2 (10) | 4 (20) | 4 (20) | 9 (45) | 0 (0) | 0 (0) | 18 (95) | 0 (0) | 1 (5) |

| Food and staples retailing | 2 (67) | 0 (0) | 1 (33) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 3 (100) | 0 (0) | 0 (0) |

| Food, beverages, and tobacco | 8 (53) | 3 (20) | 2 (13) | 0 (0) | 1 (7) | 1 (7) | 0 (0) | 15 (100) | 0 (0) | 0 (0) |

| Healthcare equipment and services | 3 (50) | 1 (17) | 0 (0) | 0 (0) | 1 (17) | 0 (0) | 1 (17) | 6 (86) | 0 (0) | 1 (14) |

| Household and personal products | 1 (50) | 0 (0) | 0 (0) | 0 (0) | 1 (50) | 0 (0) | 0 (0) | 2 (100) | 0 (0) | 0 (0) |

| Insurance | 3 (60) | 1 (20) | 0 (0) | 0 (0) | 0 (0) | 1 (20) | 0 (0) | 7 (100) | 0 (0) | 0 (0) |

| Materials | 17 (46) | 4 (11) | 5 (14) | 1 (3) | 5 (14) | 5 (14) | 0 (0) | 42 (95) | 0 (0) | 2 (5) |

| Media and entertainment | 1 (33) | 0 (0) | 0 (0) | 0 (0) | 1 (33) | 1 (33) | 0 (0) | 2 (100) | 0 (0) | 0 (0) |

| Not applicable | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 1 (100) | 0 (0) | 3 (100) | 0 (0) | 0 (0) |

| Pharmaceuticals, biotech and life sciences | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 1 (50) | 1 (50) | 0 (0) | 2 (100) | 0 (0) | 0 (0) |

| Real estate | 9 (53) | 0 (0) | 1 (6) | 0 (0) | 7 (41) | 0 (0) | 0 (0) | 21 (100) | 0 (0) | 0 (0) |

| Retailing | 2 (67) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 1 (33) | 3 (100) | 0 (0) | 0 (0) |

| Software and services | 1 (100) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 3 (100) | 0 (0) | 0 (0) |

| Telecommunication | 1 (50) | 0 (0) | 0 (0) | 0 (0) | 1 (50) | 0 (0) | 0 (0) | 2 (100) | 0 (0) | 0 (0) |

| Transportation | 1 (20) | 1 (20) | 2 (40) | 0 (0) | 1 (20) | 0 (0) | 0 (0) | 6 (100) | 0 (0) | 0 (0) |

| Utilities | 4 (57) | 0 (0) | 2 (29) | 1 (14) | 0 (0) | 0 | 0 (0) | 5 (71) | 0 (0) | 2 (29) |

| Total | 68 (42) | 13 (8) | 22 (13) | 6 (4) | 37 (23) | 14 (9) | 2 (1) | 175 (93) | 2 (1) | 12 (6) |

| Risk Type | Risk Response | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Sector | Water, Related, Security (%) | Environmental, Response, Security (%) | Opportunities, Transition (%) | Financial, Assessment, Assets (%) | New Infrastructure, Building, Costs, Expenditure (%) | Property, Insurance (%) | Carbon, tax, Emissions, Trading (%) | Emissions, Transition (%) | Transition, Greenhouse Reduction (%) | Investment, Risk, Impacts (%) |

| Automobiles and components | 1 (50) | 0 (0) | 0 (0) | 0 (0) | 1 (50) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 0 (0) |

| Banks | 0 (0) | 1 (14) | 0 (0) | 0 (0) | 0 (0) | 5 (71) | 1 (14) | 2 (22) | 4 (44) | 3 (33) |

| Capital goods | 1 (25) | 0 (0) | 1 (25) | 1 (25) | 0 (0) | 0 (0) | 1 (25) | 1 (20) | 2 (40) | 2 (40) |

| Commercial and professional services | 0 (0) | 0 (0) | 0 (0) | 4 ((57) | 1 (14) | 0 (0) | 2 (29) | 3 (43) | 1 (14) | 3 (43) |

| Consumer services | 1 (14) | 1 (14) | 3 (43) | 1 (14) | 1 (14) | 0 (0) | 0 (0) | 1 (17) | 1 (17) | 4 (66) |

| Diversified financials | 0 (0) | 0 (0) | 4 (57) | 2 (29) | 0 (0) | 1 (14) | 0 (0) | 4 (27) | 3 (20) | 8 (53) |

| Energy | 0 (0) | 2 (10) | 2 (10) | 6 (30) | 4 (20) | 2 (10) | 4 (20) | 2 (11) | 5 (26) | 12 (63) |

| Food and staples retailing | 1 (33) | 0 (0) | 0 (0) | 2 (66) | 0 (0) | 0 (0) | 0 (0) | 3 (100) | 0 (0) | 0 (0) |

| Food, beverages, and tobacco | 3 (20) | 3 (20) | 3 (20) | 1 (7) | 1 (7) | 3 (20) | 1 (7) | 4 (27) | 5 (33) | 6 (40) |

| Healthcare equipment and services | 2 (33) | 1 (17) | 1 (17) | 0 (0) | 1 (17) | 1 (17) | 0 (0) | 1 (14) | 1 (14) | 5 (71) |

| Household and personal products | 0 (0) | 0 (0) | 0 (0) | 2 (100) | 0 (0) | 0 (0) | 0 (0) | 1 (50) | 1 (50) | 0 (0) |

| Insurance | 0 (0) | 0 (0) | 1 (20) | 0 (0) | 0 (0) | 4 (80) | 0 (0) | 3 (43) | 0 (0) | 4 (57) |

| Materials | 12 (32) | 9 (24) | 4 (11) | 3 (8) | 6 (16) | 2 (5) | 1 (3) | 10 (23) | 11 (25) | 23 (55) |

| Media and entertainment | 0 (0) | 1 (33) | 1 (33) | 0 (0) | 0 (0) | 1 (33) | 0 (0) | 0 (0) | 1 (50) | 1 (50) |

| Not applicable | 0 (0) | 0 (0) | 1 (100) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 1 (33) | 2 (67) |

| Pharmaceuticals, biotech and life sciences | 1 (50) | 0 (0) | 1 (50) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 2 (100) | 0 (0) |

| Real estate | 1 (6) | 0 (0) | 1 (6) | 9 (53) | 2 (12) | 4 (24) | 0 (0) | 6 (29) | 6 (29) | 9 (42) |

| Retailing | 0 (0) | 0 (0) | 1 (33) | 1 (33) | 0 (0) | 1 (33) | 0 (0) | 1 (33) | 2 (67) | 0 (0) |

| Software and services | 0 (0) | 0 (0) | 1 (100) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 1 (33) | 2 (67) |

| Telecommunication | 0 (0) | 1 (50) | 1 (50) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 1 (50) | 0 (0) | 1 (50) |

| Transportation | 2 (40) | 0 (0) | 1 (20) | 1 (20) | 0 (0) | 0 (0) | 1 (20) | 3 (50) | 2 (33) | 1 (17) |

| Utilities | 1 (14) | 0 (0) | 1 (14) | 3 (43) | 0 (0) | 2 (29) | 0 (0) | 2 (29) | 2 (29) | 3 (42) |

| Total | 26(16) | 19 (12) | 28 (17) | 36 (22) | 17 (10) | 26 (16) | 11 (7) | 48 (26) | 51 (27) | 89 (47) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Harker, C.; Hassall, M.; Lant, P.; Rybak, N.; Dargusch, P. What Can Machine Learning Teach Us about Australian Climate Risk Disclosures? Sustainability 2022, 14, 10000. https://doi.org/10.3390/su141610000

Harker C, Hassall M, Lant P, Rybak N, Dargusch P. What Can Machine Learning Teach Us about Australian Climate Risk Disclosures? Sustainability. 2022; 14(16):10000. https://doi.org/10.3390/su141610000

Chicago/Turabian StyleHarker, Callan, Maureen Hassall, Paul Lant, Nikodem Rybak, and Paul Dargusch. 2022. "What Can Machine Learning Teach Us about Australian Climate Risk Disclosures?" Sustainability 14, no. 16: 10000. https://doi.org/10.3390/su141610000

APA StyleHarker, C., Hassall, M., Lant, P., Rybak, N., & Dargusch, P. (2022). What Can Machine Learning Teach Us about Australian Climate Risk Disclosures? Sustainability, 14(16), 10000. https://doi.org/10.3390/su141610000