4.1. Variables and ARDL Model

The role of new energy and fossil energy consumption on economic growth has been widely confirmed [

17,

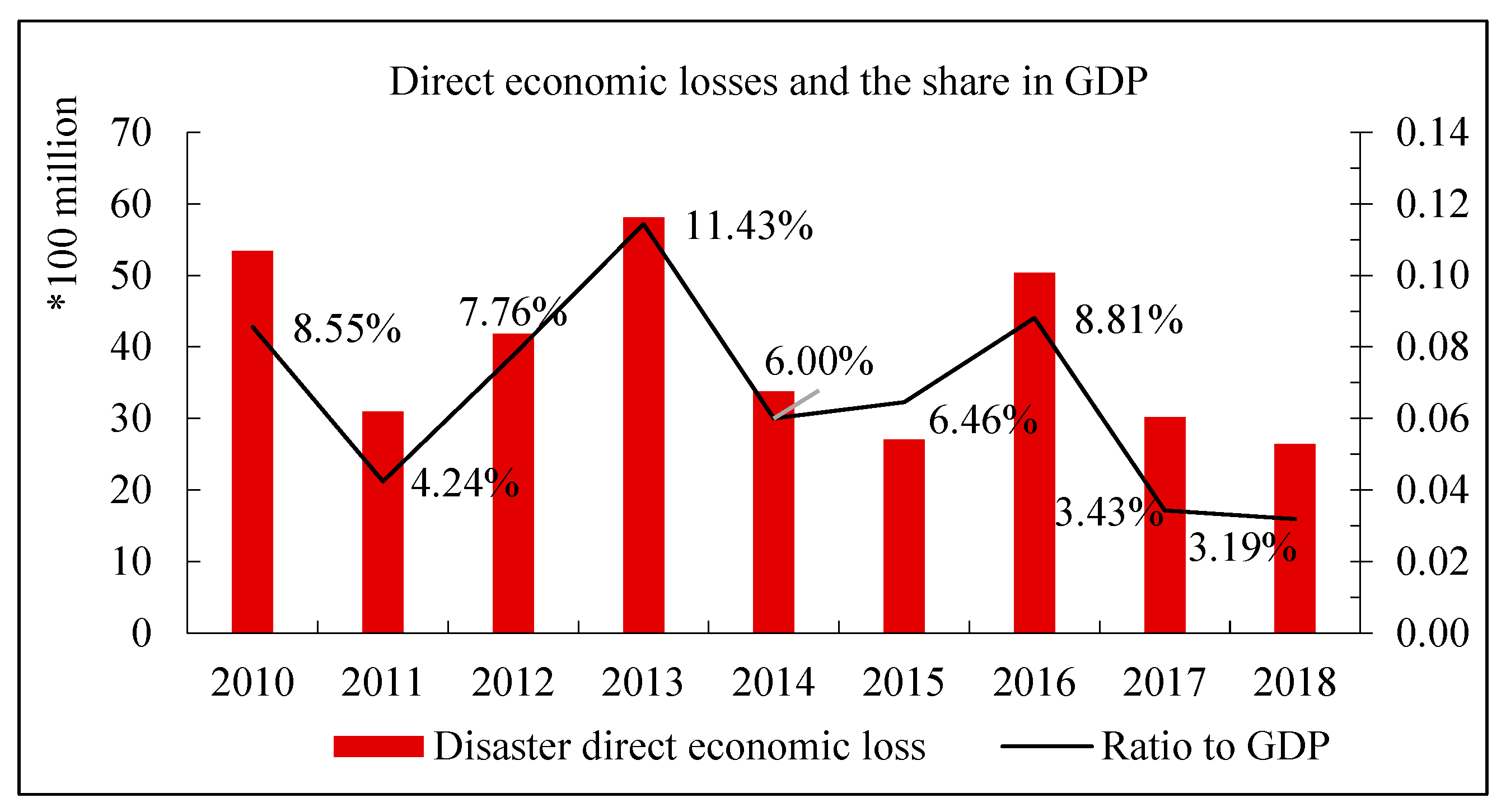

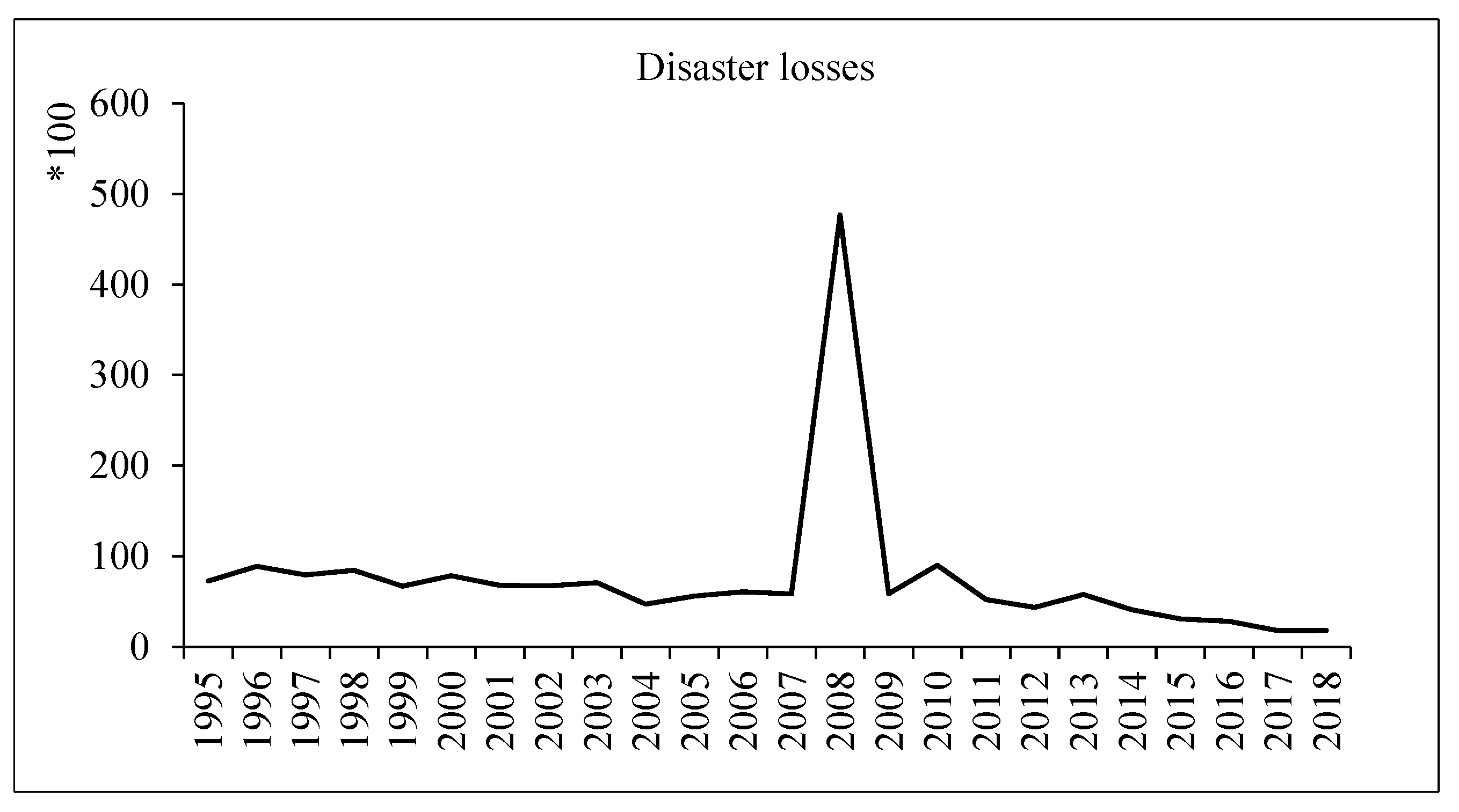

18]. In this paper, the variables that affect economic growth were selected as fixed asset investment, fossil energy consumption, new energy consumption, and natural disaster losses. Among these, disaster losses are the calculation results presented in the above section. Other data are from the China Statistical Yearbook. The research interval is from 1995 to 2018.

Table 2 gives the variables and instructions.

Denote that ln(

x) is the natural logarithm of variable

x and ln(

x)I represent the increment of ln(

x). The statistical description of each variable is shown in

Table 3.

Next, we used the autoregressive distributive lag model (ARDL) to estimate the relationship between carbon emissions and natural disaster losses. The ARDL model is very effective, even for different levels of integration and small sample sizes [

19,

20,

21]. On the other hand, the ARDL bound testing technique even takes into account the endogenous regressors and only requires that the integral order of the regression variable not exceed 1.

Firstly, the following model was established to test whether there was a long-term cointegration relationship between variables:

where

indicates the constant intercept,

indicates the difference operator,

indicates the short-run and long-run coefficients, respectively, and

ki is the optimal lag period that is determined by AIC or SC criterion.

The null hypothesis of no cointegration among the variables in the above Equation (1) was set as

and the alternative hypothesis was set as

If the value of the F-statistic was above the upper bound I(1), then we would reject the null hypothesis of no cointegration and conclude that there was a long-term stable relationship among the variables of interest; then, the short-run dynamics would be examined by the following error correction model (ECM).

where

are the short-run growth coefficients and

is the coefficient of error correction term, which shows the speed of adjustment towards long-run equilibrium.

Further, the following model can be established to estimate the long-term coefficients:

where

are the long-run growth coefficients.

4.2. Results Analysis

First of all, unit root tests were conducted, and the results are shown in

Table 4.

We found that variables were integrated with order zero I(0) or I(1), which indicated that the preconditions of the boundary cointegration test were satisfied. The optimal lag order was selected as 2 according to the AIC criterion, and the ARDL bounds test results are shown in

Table 5.

The results in

Table 5 reveal that there exists a long-term equilibrium relationship among the various explanatory variables. The short-term estimation results based on ECM and the long-term estimation results of model 1 are shown in

Table 6 and

Table 7, respectively.

In addition, the Ramsey RESET test in

Table 8 also shows that there is a setting bias in the model.

Table 9 shows the VIF test of the model. It can be seen that most of the Centered VIF value are less than 10, themulticollinearity on the whole can be almost negligibled.

Next, we turned to nonlinear analysis and expanded model 3 into the following form.

Compared with the threshold regression model, the ARDL model, constructed as model 4, can analyze the short-term and long-term relationships between variables, although it cannot find multiple threshold values.

Comparing the estimation results of the two models, it can be determined that the results of the nonlinear model are better than that of the linear model, and the quadratic function is more practical to describe the impact of disaster losses on economic growth.

From the perspective of fixed asset investment, both in the short run and the long run, it has a negative effect on economic growth that is, increasing the growth rate of fixed asset investment cannot effectively promote economic growth.

Whether in the long run or the short run, fossil energy consumption and new energy consumption have similar effects on economic growth, but the effect of fossil energy is more significant. Both types of energy consumption can drive economic growth in the long run, promote economic growth in the short run, but restrain economic growth in the first lag period.

From the results of the nonlinear model analysis, it can be seen that there is a significant inverted U-shaped relationship between economic growth and disaster loss; that is, a small degree of disaster contributes to economic growth, but a large degree of disaster loss will hinder economic growth.

Table 12 shows that there is no sequence correlation or heteroscedasticity, and the residuals obey a normal distribution. The Ramsey test also shows that the model is reliable.

We have also built the Cointegration model (FMOLS) for comparison with the ARDL model, and the results are shown in

Table 13.

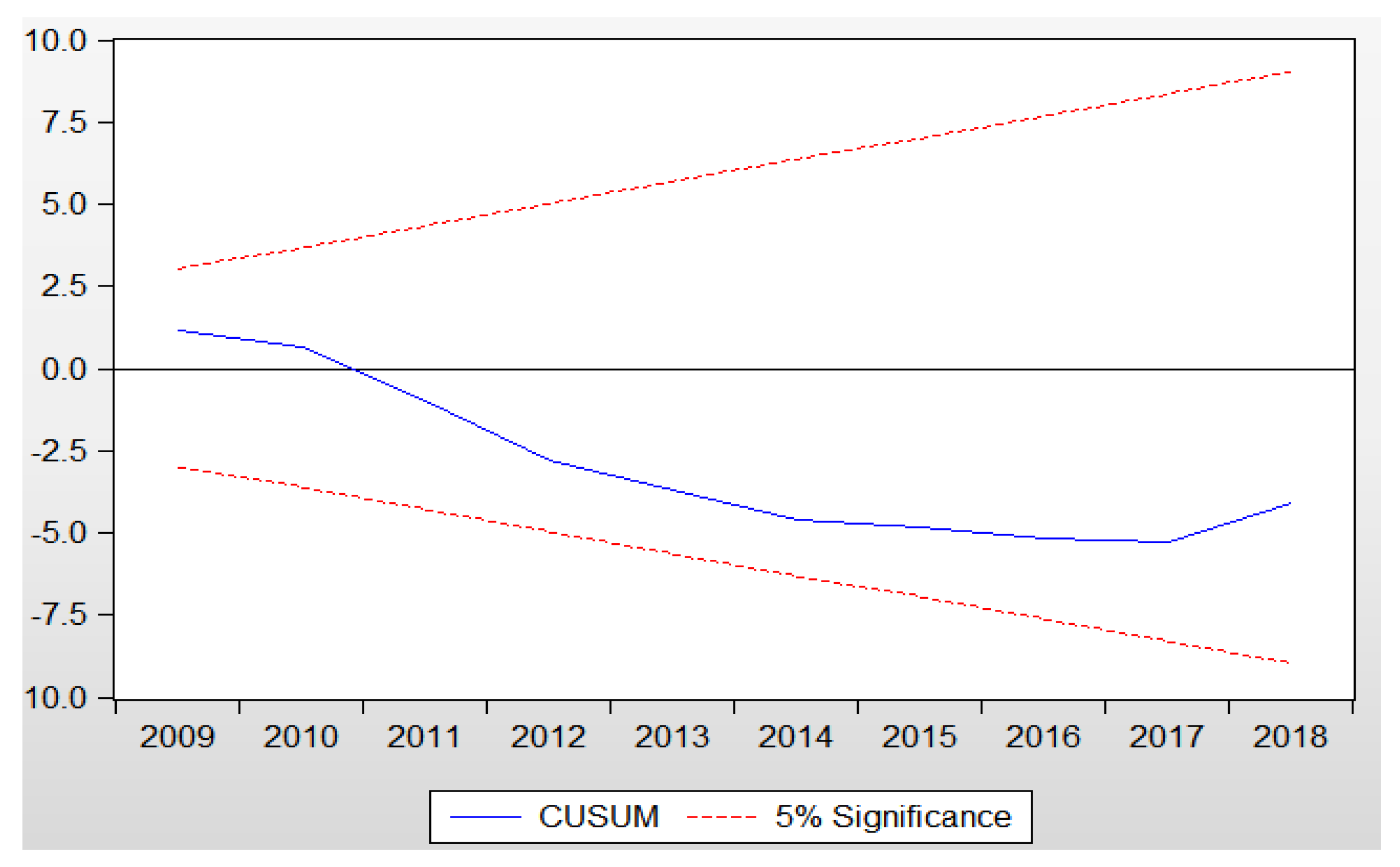

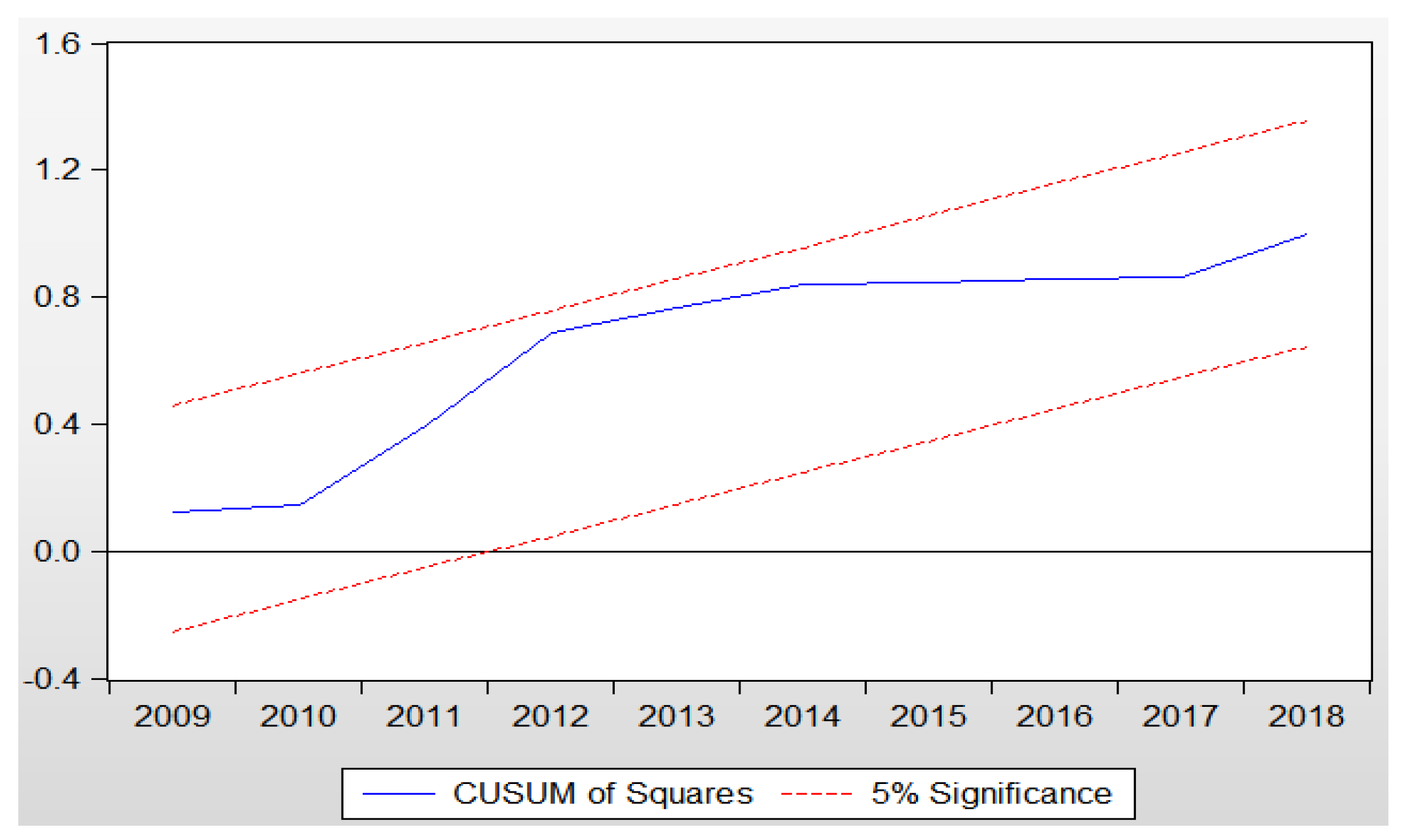

It can be determined that the fitting effect of the ARDL model is better than that of the FMOLS model. To avoid model unreliability caused by parameter instability, recursive residual accumulations (CUSUM) and recursive residual squares cumulative (CUSUMSQ) were used to test the theoretical model constructed above. The results are shown in

Figure 4 and

Figure 5, which show that the estimated coefficient of the nonlinear ARDL model has parameter stability.