Exploring the Trend of Commodity Prices: A Review and Bibliometric Analysis

Abstract

:1. Introduction

2. Methods and Data

3. Statistical Analysis of Commodity Prices

3.1. Research on the Overall Growth Trend

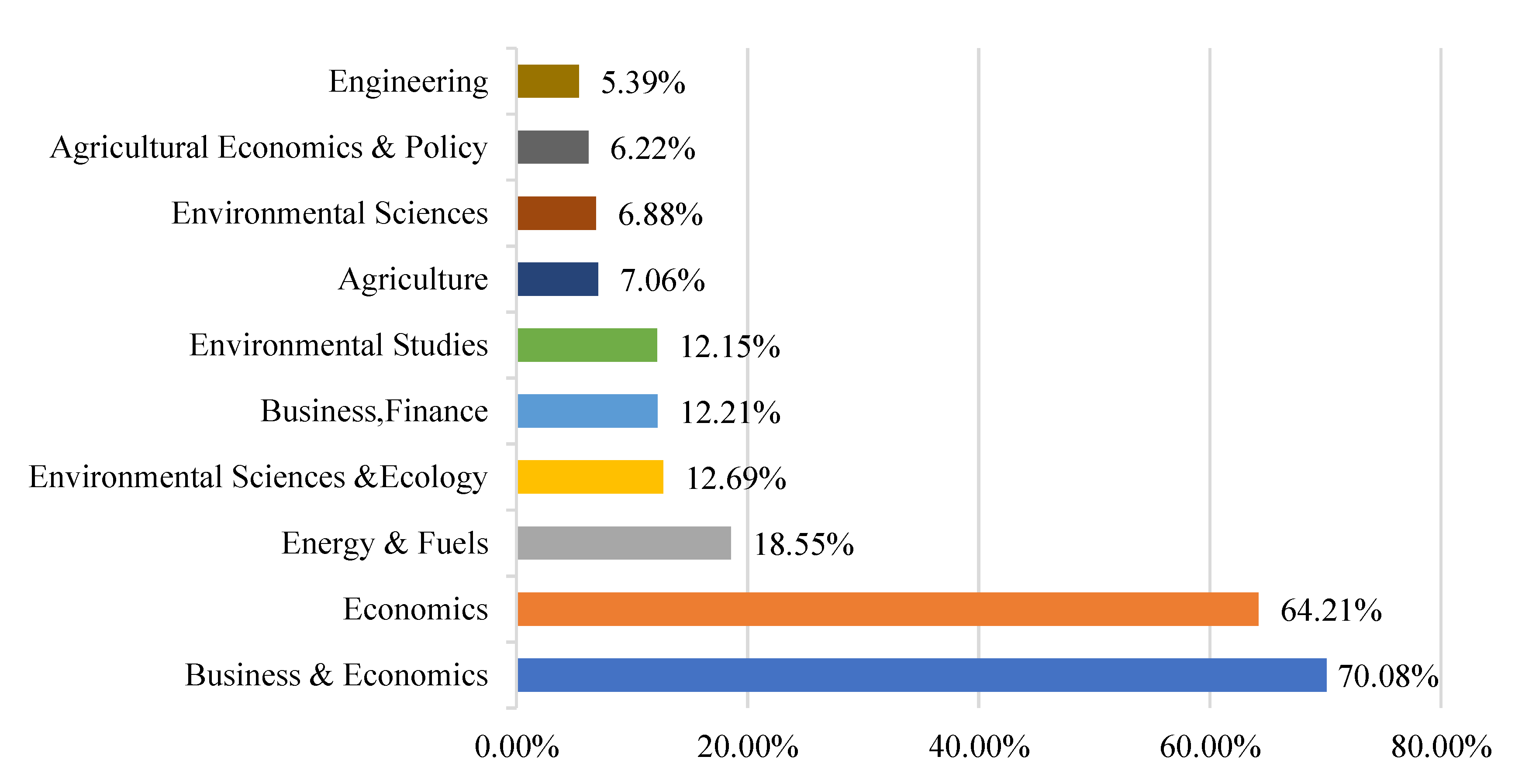

3.2. Publication Sources

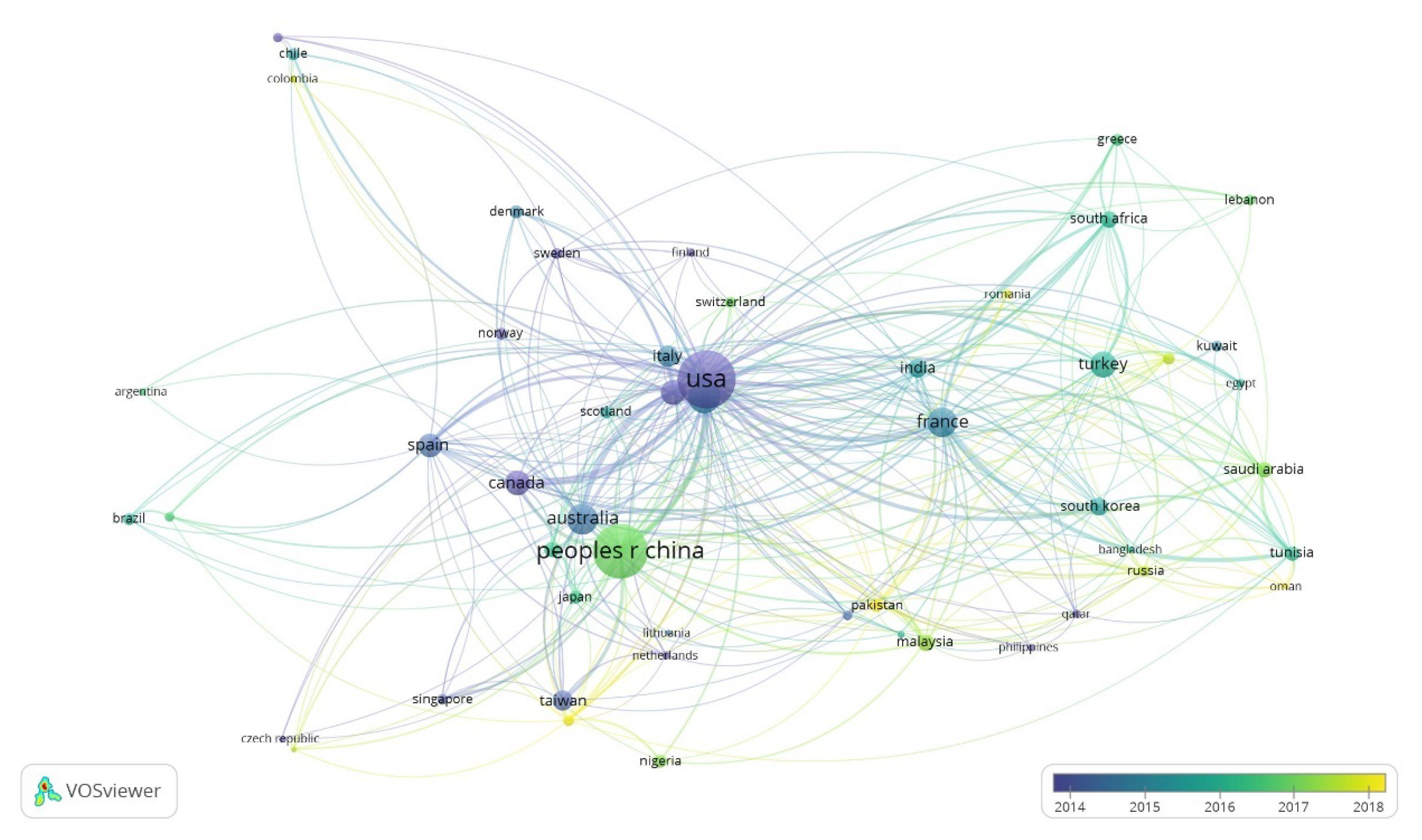

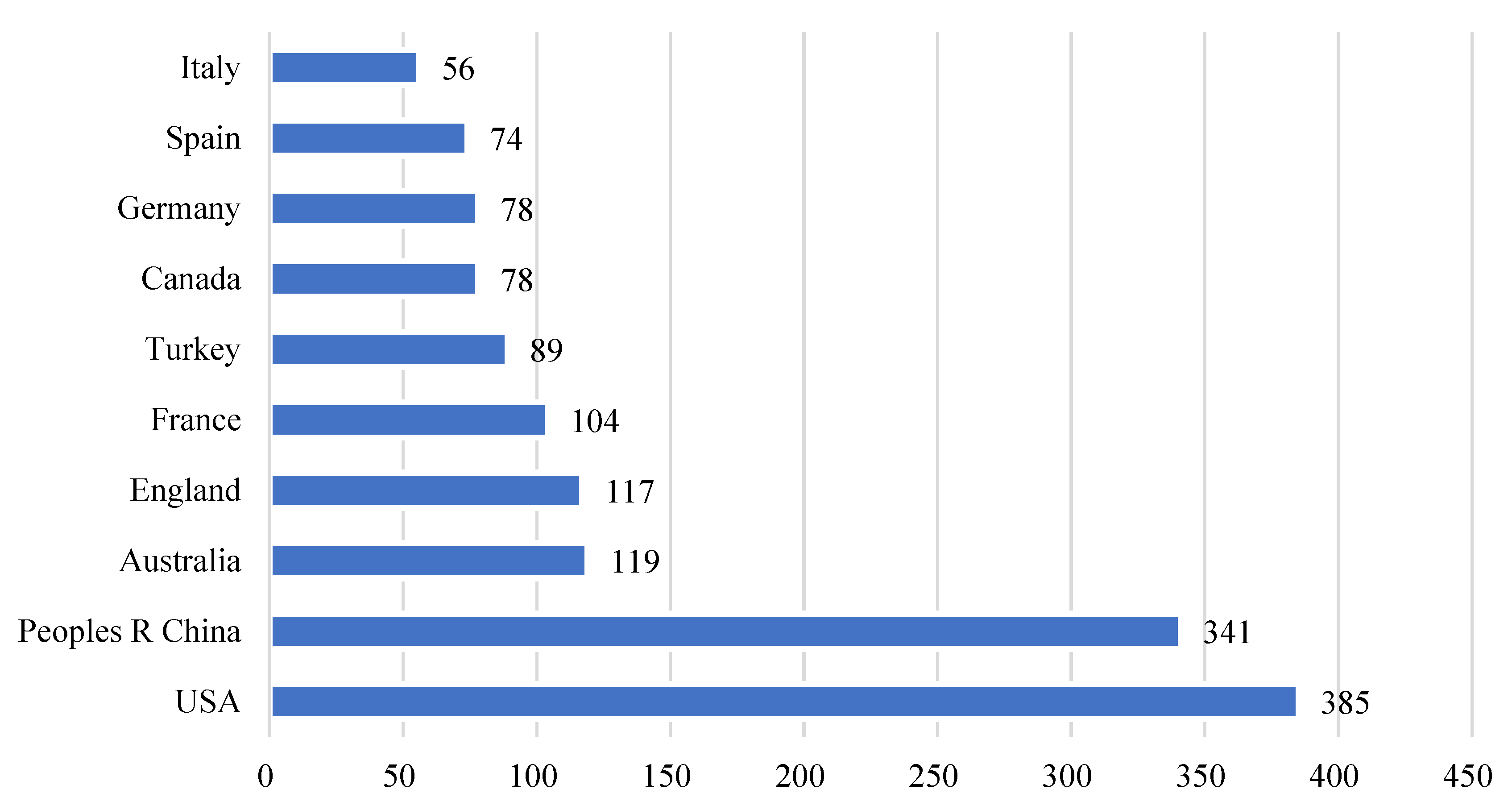

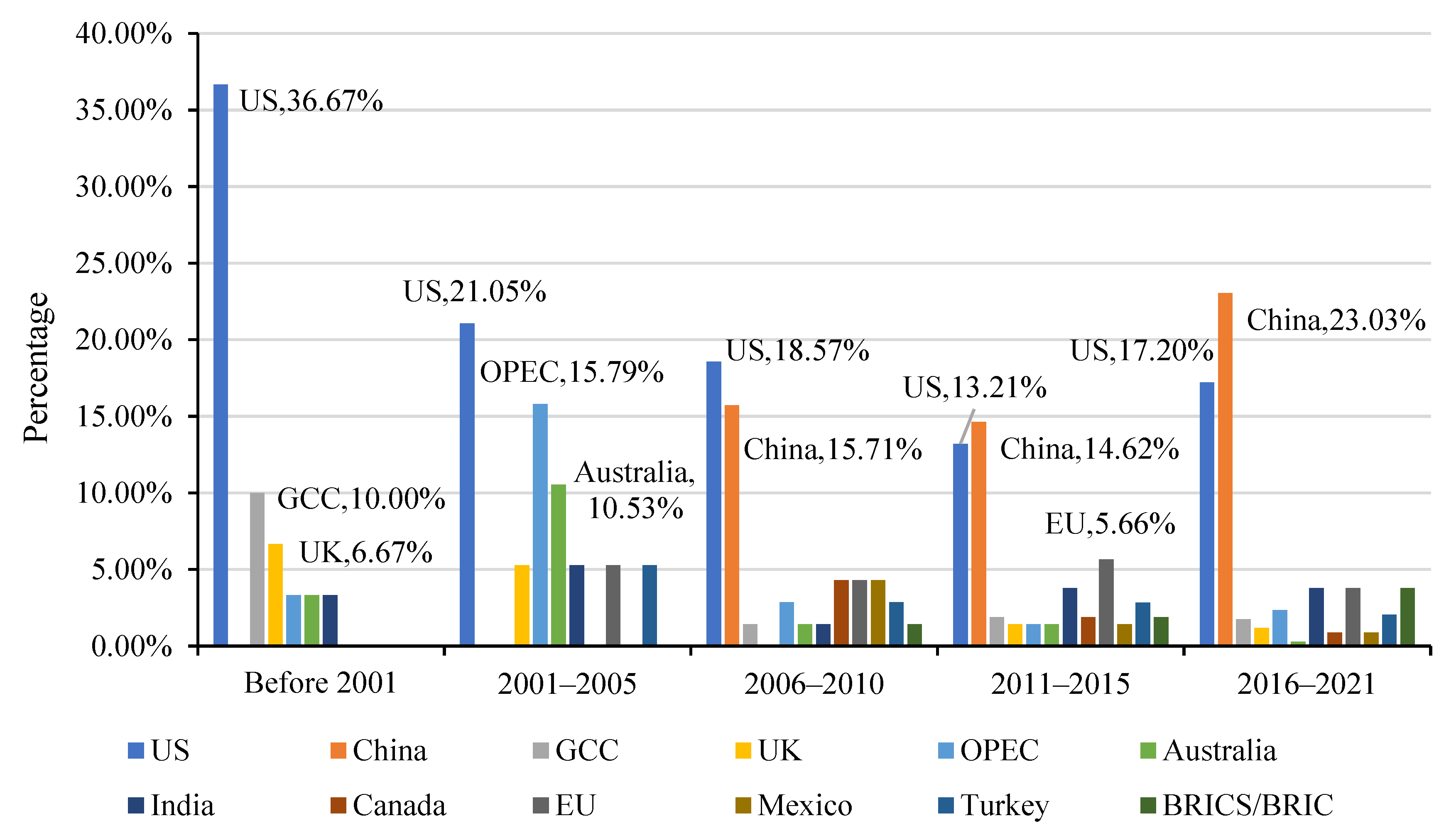

3.3. Research Countries

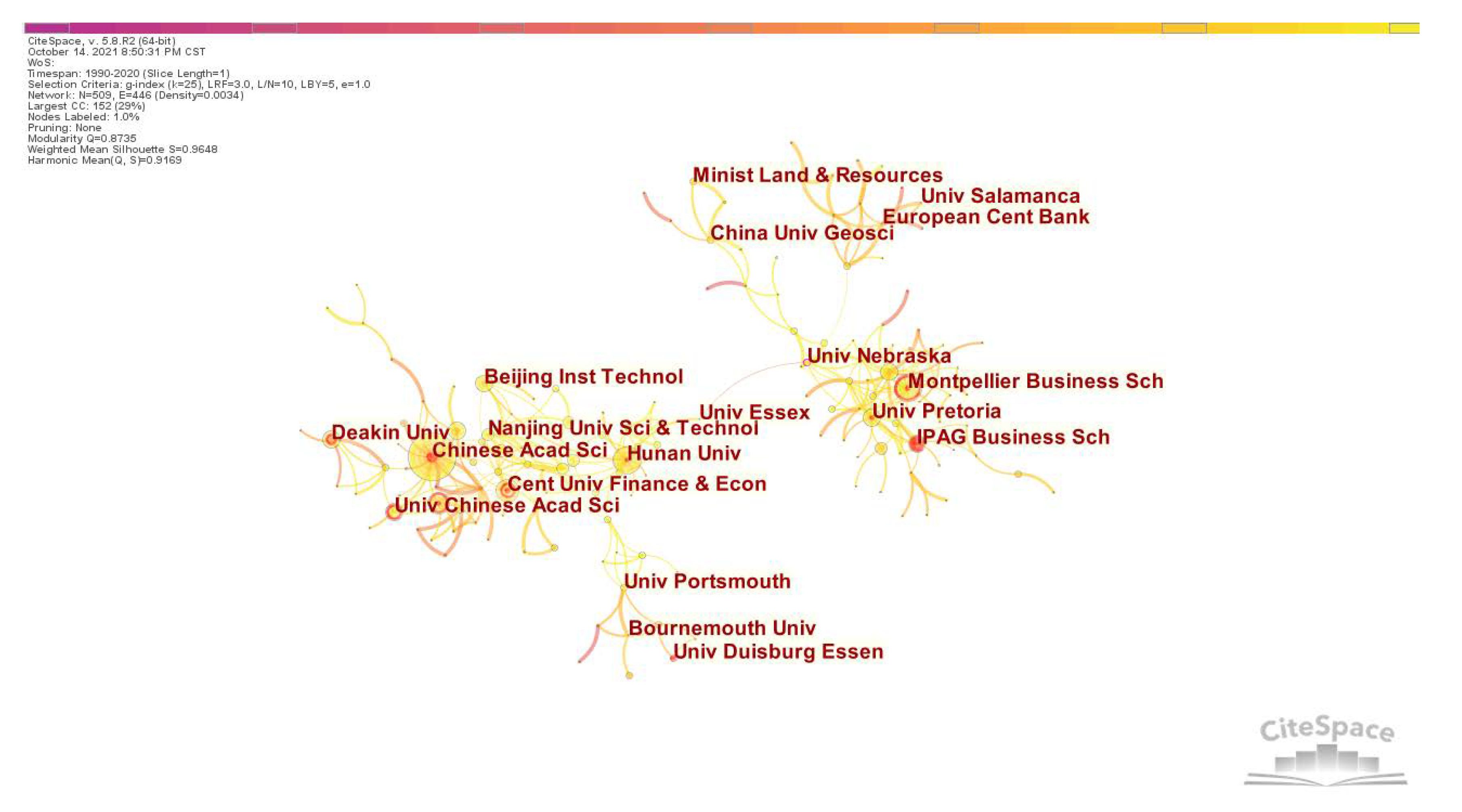

3.4. Analysis of High-Level Scientific Research Institutions

3.5. Analysis of Core Authors

4. Co-Citation Analysis of Commodity Prices

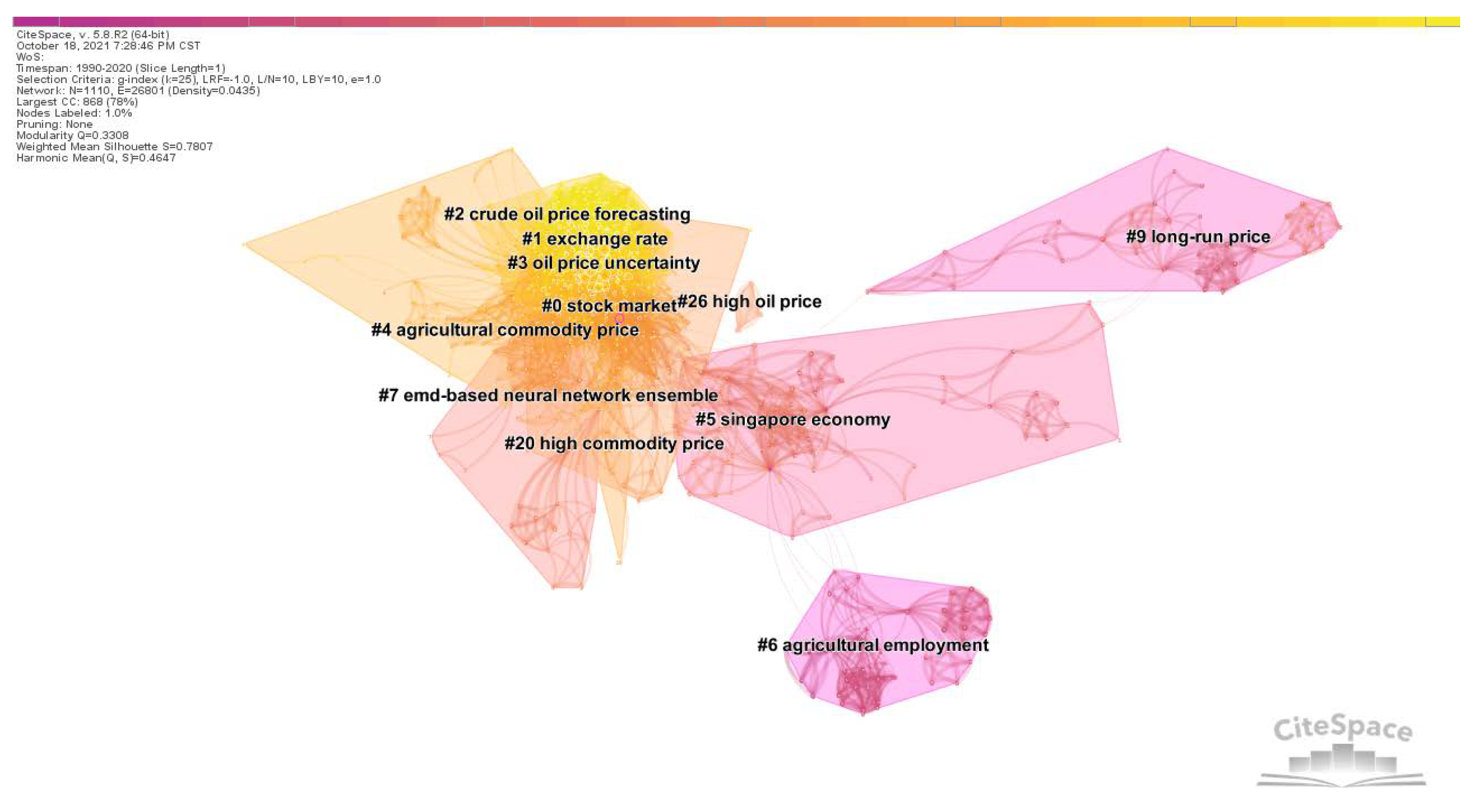

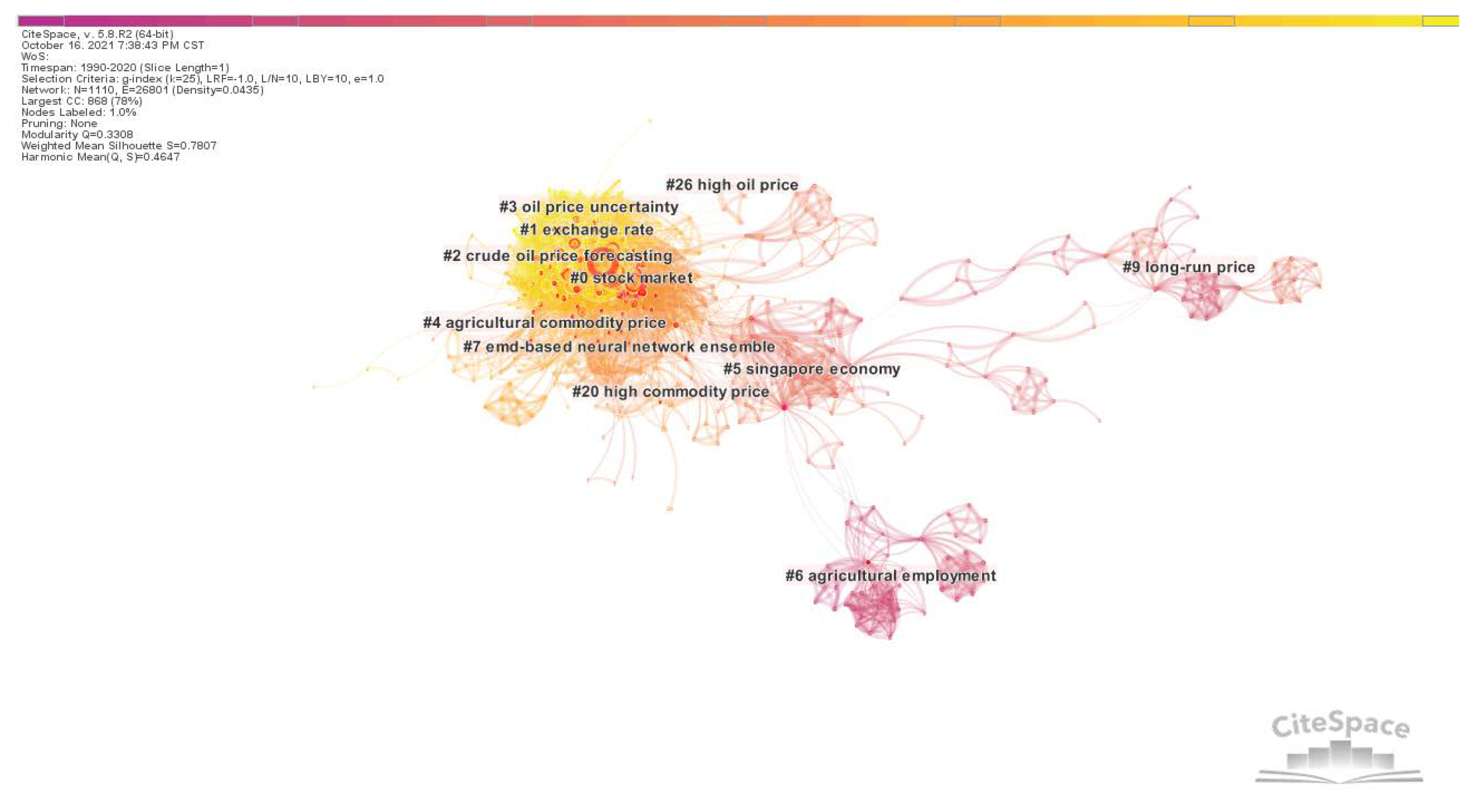

4.1. Cluster Analysis of Co-Cited Articles

- (1)

- Influencing factors of commodity prices (Cluster #1, #9, #20, #26)

- (2)

- The impact of commodity price fluctuations on macro economy (Cluster #3, #4, #5, #6)

- (3)

- Commodity price forecast (Cluster #2, #7)

- (4)

- Financialization of commodities (Cluster #0)

| Research Hotspots | Representative Articles | Main Research Content |

|---|---|---|

| Influencing factors of commodity prices | Hamilton (2009) [20] Dube and Vargas (2013) [25] Zhang et al. (2009) [29] |

|

| The impact of commodity price fluctuations on macroeconomy | Hamilton (1983) [30] Jiménez-Rodríguez (2005) [33] Lardic and Mignon (2006) [34] Ji et al. (2019) [42] Wu et al. (2012) [46] |

|

| Commodity price forecast | Yu et al. (2008) [65] Zhang et al. (2015) [68] Jammazi and Aloui (2012) [82] Zhao et al. (2017) [83] |

|

| Financialization of commodities | Sadorsky (1999) [70] Kilian and Park (2009) [74] Filis et al. (2011) [84] Sim and Zhou (2015) [85] |

|

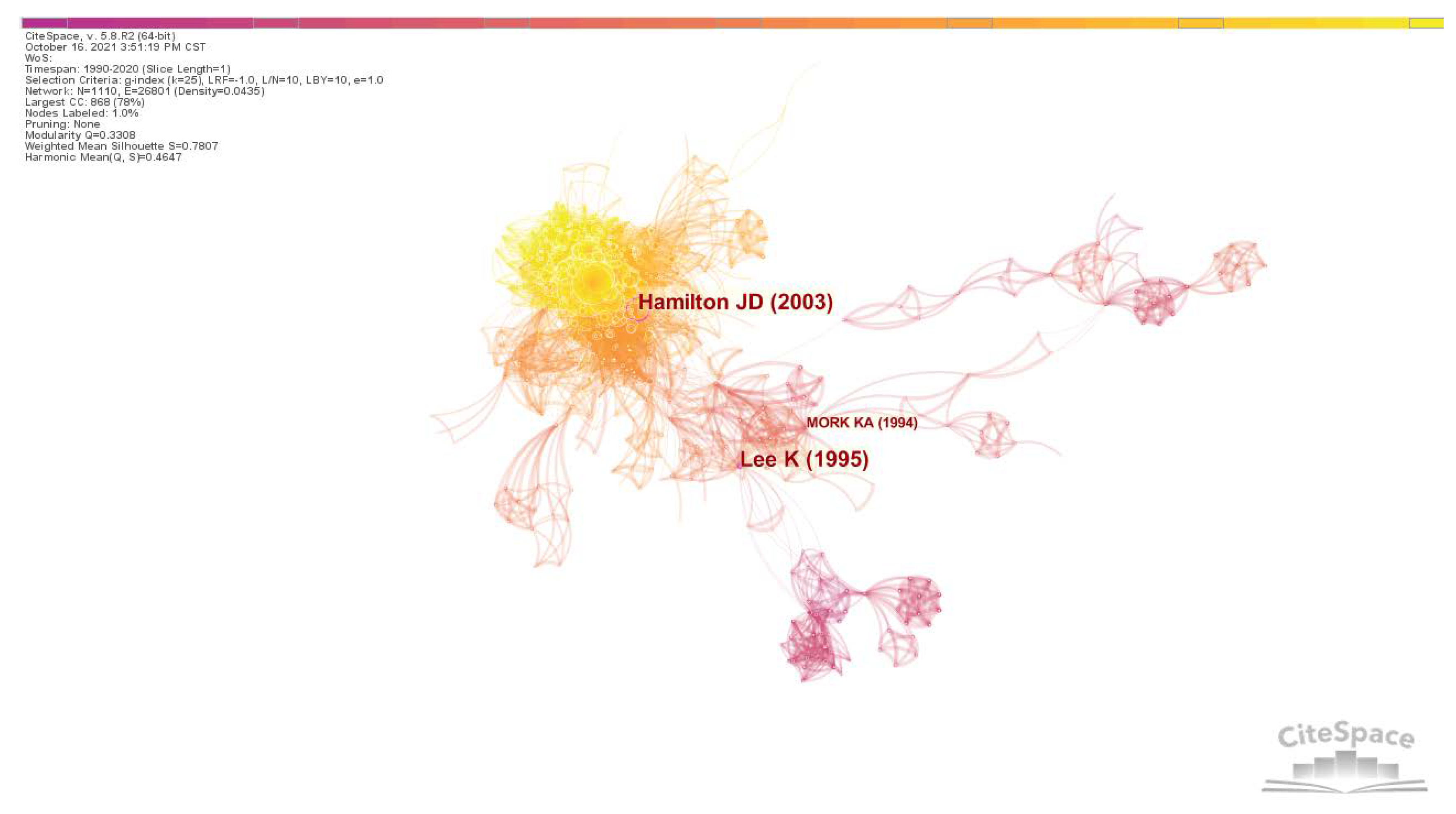

4.2. Analysis of Landmark and Pivot Nodes

| Author | Title | Journal | Cited Frequency | Cluster ID |

|---|---|---|---|---|

| Pivot node | ||||

| Lee et al. (1995) [86] | Oil shocks and the macroeconomy: The role of price variability | The Energy Journal | 24 | #5 |

| Mork et al. (1994) [87] | Macroeconomic responses to oil price increases and decreases in seven OECD countries | The Energy Journal | 23 | #5 |

| Landmark node | ||||

| Hamilton (2003) [88] | What is an oil shock? | Journal of Econometrics | 78 | #0 |

| Highly cited articles | ||||

| Kilian (2009) [74] | Not all oil price shocks are alike: Disentangling demand and supply shocks in the crude oil market | American Economic Review | 295 | #0 |

| Kilian and Park (2009) [90] | The impact of oil price shocks on the US stock market | International Economic Review | 158 | #1 |

| Park and Ratti (2008) [76] | Oil price shocks and stock markets in the US and 13 European countries | Energy Economics | 115 | #0 |

| Kilian and Murphy (2014) [91] | The role of inventories and speculative trading in the global market for crude oil | Journal of Applied Econometrics | 113 | #2 |

| Basher et al. (2012) [89] | Oil prices, stock returns and emerging stock markets | Energy Economics | 89 | #1 |

4.3. Analysis of References with Citation Bursts

5. Conclusions and Future New Research Direction

- (1)

- Increased attention to the impact of major events

- (2)

- Method innovation and selection of commodity price forecasting

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Jacks, D.S.; Stuermer, M. What drives commodity price booms and busts? Energy Econ. 2020, 85, 104035. [Google Scholar] [CrossRef]

- Ghoshray, A. Do international primary commodity prices exhibit asymmetric adjustment? J. Commod. Mark. 2019, 14, 40–50. [Google Scholar] [CrossRef]

- Carter, C.A.; Rausser, G.C.; Smith, A. Commodity booms and busts. Annu. Rev. Resour. Econ. 2011, 3, 87–118. [Google Scholar] [CrossRef]

- Paolantonio, A. OECD-FAO, Agricultural Outlook 2008–2017; Firenze University Press: Firenze, Italy, 2008; pp. 119–123. Available online: http://digital.casalini.it/10.1400/185067 (accessed on 4 October 2021).

- Knez, S.; Šimić, G.; Milovanović, A.; Starikova, S.; Županič, F.Ž. Prices of conventional and renewable energy as determinants of sustainable and secure energy development: Regression model analysis. Energy Sustain. Soc. 2022, 12, 6. [Google Scholar] [CrossRef]

- Wang, G.; Sharma, P.; Jain, V.; Shukla, A.; Shahzad Shabbir, M.; Tabash, M.I.; Chawla, C. The relationship among oil prices volatility, inflation rate, and sustainable economic growth: Evidence from top oil importer and exporter countries. Resour. Policy 2022, 77, 102674. [Google Scholar] [CrossRef]

- Sajid, M.J.; Yu, Z.; Rehman, S.A. The coal, petroleum, and gas embedded in the sectoral demand-and-supply chain: Evidence from China. Sustainability 2022, 14, 1888. [Google Scholar] [CrossRef]

- Borzuei, D.; Moosavian, S.F.; Ahmadi, A. Investigating the dependence of energy prices and economic growth rates with emphasis on the development of renewable energy for sustainable development in Iran. Sustain. Dev. 2022, 1–7. [Google Scholar] [CrossRef]

- Gracia, A.; Gómez, M.I. Food sustainability and waste reduction in Spain: Consumer preferences for local, suboptimal, and/or unwashed fresh food products. Sustainability 2020, 12, 4148. [Google Scholar] [CrossRef]

- Khan, M.M.; Akram, M.T.; Janke, R.; Qadri, R.W.K.; Al-Sadi, A.M.; Farooque, A.A. Urban horticulture for food secure cities through and beyond COVID-19. Sustainability 2020, 12, 9592. [Google Scholar] [CrossRef]

- Yang, M.X.; Chen, W.S.; Zhou, Q.Y.; Yang, B.Y. Visualizing the landscape and trend of Chinese leadership research: 1949–2018. Nankai Bus. Rev. 2019, 22, 80–94. [Google Scholar]

- Chiroma, H.; Abdul-kareem, S.; Shukri Mohd Noor, A.; Abubakar, A.I.; Sohrabi Safa, N.; Shuib, L.; Fatihu Hamza, M.; Ya’u Gital, A.; Herawan, T. A review on artificial intelligence methodologies for the forecasting of crude oil price. Intell. Autom. Soft Comput. 2016, 22, 449–462. [Google Scholar] [CrossRef]

- Ederington, L.H.; Fernando, C.S.; Hoelscher, S.A.; Lee, T.K.; Linn, S.C. A review of the evidence on the relation between crude oil prices and petroleum product prices. J. Commod. Mark. 2019, 13, 1–15. [Google Scholar] [CrossRef]

- Ben Abdallah, M.; Fekete-Farkas, M.; Lakner, Z. Exploring the link between food security and food price dynamics: A bibliometric analysis. Agriculture 2021, 11, 263. [Google Scholar] [CrossRef]

- Leung, X.Y.; Sun, J.; Bai, B. Bibliometrics of social media research: A co-citation and co-word analysis. Int. J. Hosp. Manag. 2017, 66, 35–45. [Google Scholar] [CrossRef]

- Van Eck, N.J.; Waltman, L. Visualizing Bibliometric Networks; Springer: Cham, Switzerland, 2014; pp. 285–320. [Google Scholar] [CrossRef]

- Liu, H.; Li, X.; Wang, S. A bibliometric analysis of 30 years of platform research: Developing the research agenda for platforms, the associated technologies and social impacts. Technol. Forecast. Soc. Chang. 2021, 169, 682–689. [Google Scholar] [CrossRef]

- Li, X.R.; Zhang, X.X.; Li, Z.Y. A bibliometric analysis on business models. Syst. Eng. Theory Pract. 2016, 36, 273–287. [Google Scholar]

- Li, J.; Chen, C.M. Text Mining and Visualization in Scientific Literature, 2nd ed.; Capital University of Economics and Business Press: Beijing, China, 2017. [Google Scholar]

- Hamilton, J.D. Understanding crude oil prices. Energy J. 2009, 30, 179–206. [Google Scholar] [CrossRef] [Green Version]

- Mueller, S.A.; Anderson, J.E.; Wallington, T.J. Impact of biofuel production and other supply and demand factors on food price increases in 2008. Biomass Bioenergy 2011, 35, 1623–1632. [Google Scholar] [CrossRef]

- Awan, O.A. Price discovery or noise: The role of arbitrage and speculation in explaining crude oil price behaviour. J. Commod. Mark. 2019, 16, 100086. [Google Scholar] [CrossRef]

- Baumeister, C.; Kilian, L. Forty years of oil price fluctuations: Why the price of oil may still surprise us. J. Econ. Perspect. 2016, 30, 139–160. [Google Scholar] [CrossRef] [Green Version]

- Chen, S.-T.; Kuo, H.-I.; Chen, C.-C. Modeling the relationship between the oil price and global food prices. Appl. Energy 2010, 87, 2517–2525. [Google Scholar] [CrossRef]

- Dube, O.; Vargas, J.F. Commodity price shocks and civil conflict: Evidence from Colombia. Rev. Econ. Stud. 2013, 80, 1384–1421. [Google Scholar] [CrossRef]

- Gilbert, C.L.; Morgan, C.W. Food price volatility. Philos. Trans. R. Soc. B. Biol. Sci. 2010, 365, 3023–3034. [Google Scholar] [CrossRef] [PubMed]

- Ji, Q.; Guo, J.-F. Oil price volatility and oil-related events: An Internet concern study perspective. Appl. Energy 2015, 137, 256–264. [Google Scholar] [CrossRef]

- Nazlioglu, S. World oil and agricultural commodity prices: Evidence from nonlinear causality. Energy Policy 2011, 39, 2935–2943. [Google Scholar] [CrossRef]

- Zhang, X.; Yu, L.; Wang, S.; Lai, K.K. Estimating the impact of extreme events on crude oil price: An EMD-based event analysis method. Energy Econ. 2009, 31, 768–778. [Google Scholar] [CrossRef]

- Hamilton, J.D. Oil and the macroeconomy since World War II. J. Political Econ. 1983, 91, 228–248. [Google Scholar] [CrossRef]

- Balcilar, M.; Van Eyden, R.; Uwilingiye, J.; Gupta, R. The impact of oil price on South African GDP growth: A Bayesian Markov switching-VAR analysis. Afr. Dev. Rev. 2017, 29, 319–336. [Google Scholar] [CrossRef] [Green Version]

- Benhmad, F. Dynamic cyclical comovements between oil prices and US GDP: A wavelet perspective. Energy Policy 2013, 57, 141–151. [Google Scholar] [CrossRef]

- Jiménez-Rodríguez, R.; Sánchez, M. Oil price shocks and real GDP growth: Empirical evidence for some OECD countries. Appl. Econ. 2005, 37, 201–228. [Google Scholar] [CrossRef]

- Lardic, S.; Mignon, V. The impact of oil prices on GDP in European countries: An empirical investigation based on asymmetric cointegration. Energy Policy 2006, 34, 3910–3915. [Google Scholar] [CrossRef]

- Jiménez-Rodríguez, R. Oil price shocks and real GDP growth: Testing for non-linearity. Energy J. 2009, 30, 1–23. [Google Scholar] [CrossRef]

- Khan, M.A.; Husnain, M.I.U.; Abbas, Q.; Shah, S.Z.A. Asymmetric effects of oil price shocks on Asian economies: A nonlinear analysis. Empir. Econ. 2018, 57, 1319–1350. [Google Scholar] [CrossRef]

- Kilian, L.; Vigfusson, R.J. Do oil prices help forecast U.S. real GDP? The role of nonlinearities and asymmetries. J. Bus. Econ. Stat. 2013, 31, 78–93. [Google Scholar] [CrossRef]

- Chen, S.S.; Chen, H.C. Oil prices and real exchange rates. Energy Econ. 2007, 29, 390–404. [Google Scholar] [CrossRef]

- Aloui, R.; Ben Aïssa, M.S.; Nguyen, D.K. Conditional dependence structure between oil prices and exchange rates: A copula-GARCH approach. J. Int. Money Financ. 2013, 32, 719–738. [Google Scholar] [CrossRef]

- Ghosh, S. Examining crude oil price—Exchange rate nexus for India during the period of extreme oil price volatility. Appl. Energy 2011, 88, 1886–1889. [Google Scholar] [CrossRef]

- Huang, Y.; Guo, F. The role of oil price shocks on China’s real exchange rate. China Econ. Rev. 2007, 18, 403–416. [Google Scholar] [CrossRef]

- Ji, Q.; Liu, B.-Y.; Fan, Y. Risk dependence of CoVaR and structural change between oil prices and exchange rates: A time-varying copula model. Energy Econ. 2019, 77, 80–92. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Rivera-Castro, M.A. A wavelet decomposition approach to crude oil price and exchange rate dependence. Econ. Model. 2013, 32, 42–57. [Google Scholar] [CrossRef]

- Sari, R.; Hammoudeh, S.; Soytas, U. Dynamics of oil price, precious metal prices, and exchange rate. Energy Econ. 2010, 32, 351–362. [Google Scholar] [CrossRef]

- Tule, M.K.; Salisu, A.A.; Chiemeke, C.C. Can agricultural commodity prices predict Nigeria’s inflation? J. Commod. Mark. 2019, 16, 100087. [Google Scholar] [CrossRef]

- Wu, C.-C.; Chung, H.; Chang, Y.-H. The economic value of co-movement between oil price and exchange rate using copula-based GARCH models. Energy Econ. 2012, 34, 270–282. [Google Scholar] [CrossRef]

- Papapetrou, E. Oil price shocks, stock market, economic activity and employment in Greece. Energy Econ. 2001, 23, 511–532. [Google Scholar] [CrossRef]

- Ewing, B.T.; Thompson, M.A. Dynamic cyclical comovements of oil prices with industrial production, consumer prices, unemployment, and stock prices. Energy Policy 2007, 35, 5535–5540. [Google Scholar] [CrossRef]

- Guerrero-Escobar, S.; Hernandez-del-Valle, G.; Hernandez-Vega, M. Do heterogeneous countries respond differently to oil price shocks? J. Commod. Mark. 2019, 16, 100084. [Google Scholar] [CrossRef] [Green Version]

- Li, R.; Leung, G.C.K. The relationship between energy prices, economic growth and renewable energy consumption: Evidence from Europe. Energy Rep. 2021, 7, 1712–1719. [Google Scholar] [CrossRef]

- Mukhtarov, S.; Mikayilov, J.I.; Humbatova, S.; Muradov, V. Do high oil prices obstruct the transition to renewable energy consumption? Sustainability 2020, 12, 4689. [Google Scholar] [CrossRef]

- Karacan, R.; Mukhtarov, S.; Barış, İ.; İşleyen, A.; Yardımcı, M.E. The impact of oil price on transition toward renewable energy consumption? Evidence from Russia. Energies 2021, 14, 2947. [Google Scholar] [CrossRef]

- Mukhtarov, S.; Mikayilov, J.I.; Maharramov, S.; Aliyev, J.; Suleymanov, E. Higher oil prices, are they good or bad for renewable energy consumption: The case of Iran? Renew. Energy 2022, 186, 411–419. [Google Scholar] [CrossRef]

- Umar, B.; Alam, M.M.; Al-Amin, A.Q. Exploring the contribution of energy price to carbon emissions in African countries. Environ. Sci. Pollut. Res. Int. 2021, 28, 1973–1982. [Google Scholar] [CrossRef]

- Ma, Y.; Zhang, L.; Song, S.; Yu, S. Impacts of energy price on agricultural production, energy consumption, and carbon emission in China: A Price Endogenous Partial Equilibrium Model Analysis. Sustainability 2022, 14, 3002. [Google Scholar] [CrossRef]

- Sha, R.; Ge, T.; Li, J. How Energy price distortions affect China’s economic growth and carbon emissions. Sustainability 2022, 14, 7312. [Google Scholar] [CrossRef]

- Lee, S.; Chong, W.O. Causal relationships of energy consumption, price, and CO2 emissions in the U.S. building sector. Resour. Conserv. Recycl. 2016, 107, 220–226. [Google Scholar] [CrossRef]

- Guo, Z.; Zhang, X.; Wang, D.; Zhao, X. The impacts of an energy price decline associated with a carbon tax on the energy-economy-environment system in China. Emerg. Mark. Financ. Trade 2019, 55, 2689–2702. [Google Scholar] [CrossRef]

- Malik, M.Y.; Latif, K.; Khan, Z.; Butt, H.D.; Hussain, M.; Nadeem, M.A. Symmetric and asymmetric impact of oil price, FDI and economic growth on carbon emission in Pakistan: Evidence from ARDL and non-linear ARDL approach. Sci. Total Environ. 2020, 726, 138421. [Google Scholar] [CrossRef] [PubMed]

- Ike, G.N.; Usman, O.; Alola, A.A.; Sarkodie, S.A. Environmental quality effects of income, energy prices and trade: The role of renewable energy consumption in G-7 countries. Sci. Total Environ. 2020, 721, 137813. [Google Scholar] [CrossRef]

- Huang, S.-C.; Wu, C.-F. Energy commodity price forecasting with deep multiple kernel learning. Energies 2018, 11, 3029. [Google Scholar] [CrossRef] [Green Version]

- Herrera, A.M.; Hu, L.; Pastor, D. Forecasting crude oil price volatility. Int. J. Forecast. 2018, 34, 3029. [Google Scholar] [CrossRef]

- Gupta, R.; Wohar, M. Forecasting oil and stock returns with a Qual VAR using over 150 years off data. Energy Econ. 2017, 62, 181–186. [Google Scholar] [CrossRef] [Green Version]

- Gavriilidis, K.; Kambouroudis, D.S.; Tsakou, K.; Tsouknidis, D.A. Volatility forecasting across tanker freight rates: The role of oil price shocks. Transp. Res. Part E Logist. Transp. Rev. 2018, 118, 376–391. [Google Scholar] [CrossRef] [Green Version]

- Yu, L.; Wang, S.; Lai, K.K. Forecasting crude oil price with an EMD-based neural network ensemble learning paradigm. Energy Econ. 2008, 30, 2623–2635. [Google Scholar] [CrossRef]

- Wang, J.; Li, X. A combined neural network model for commodity price forecasting with SSA. Soft Comput. 2018, 22, 5323–5333. [Google Scholar] [CrossRef]

- Zhang, Y.; Na, S. A Novel agricultural commodity price forecasting model based on fuzzy information granulation and MEA-SVM model. Math. Probl. Eng. 2018, 2018, 2540681. [Google Scholar] [CrossRef]

- Zhang, J.-L.; Zhang, Y.-J.; Zhang, L. A novel hybrid method for crude oil price forecasting. Energy Econ. 2015, 49, 649–659. [Google Scholar] [CrossRef]

- Kristjanpoller, W.; Minutolo, M.C. Forecasting volatility of oil price using an artificial neural network-GARCH model. Expert Sys. Appl. 2016, 65, 233–241. [Google Scholar] [CrossRef]

- Sadorsky, P. Oil price shocks and stock market activity. Energy Econ. 1999, 21, 449–469. [Google Scholar] [CrossRef]

- Hedi Arouri, M.E.; Khuong Nguyen, D. Oil prices, stock markets and portfolio investment: Evidence from sector analysis in Europe over the last decade. Energy Policy 2010, 38, 4528–4539. [Google Scholar] [CrossRef] [Green Version]

- Hedi Arouri, M.E.; Jouini, J.; Nguyen, D.K. Volatility spillovers between oil prices and stock sector returns: Implications for portfolio management. J. Int. Money Financ. 2011, 30, 1387–1405. [Google Scholar] [CrossRef]

- Cong, R.-G.; Wei, Y.-M.; Jiao, J.-L.; Fan, Y. Relationships between oil price shocks and stock market: An empirical analysis from China. Energy Policy 2008, 36, 3544–3553. [Google Scholar] [CrossRef]

- Kilian, L. Not all oil price shocks are alike: Disentangling demand and supply shocks in the crude oil market. Am. Econ. Rev. 2009, 99, 1053–1069. [Google Scholar] [CrossRef] [Green Version]

- Narayan, P.K.; Narayan, S. Modelling the impact of oil prices on Vietnam’s stock prices. Appl. Energy 2010, 87, 356–361. [Google Scholar] [CrossRef]

- Park, J.; Ratti, R.A. Oil price shocks and stock markets in the U.S. and 13 European countries. Energy Econ. 2008, 30, 2587–2608. [Google Scholar] [CrossRef]

- Salisu, A.A.; Oloko, T.F. Modeling oil price–US stock nexus: A VARMA–BEKK–AGARCH approach. Energy Econ. 2015, 50, 1–12. [Google Scholar] [CrossRef]

- Morana, C. Oil price dynamics, macro-finance interactions and the role of financial speculation. J. Bank. Financ. 2013, 37, 206–226. [Google Scholar] [CrossRef] [Green Version]

- Tilton, J.E.; Humphreys, D.; Radetzki, M. Investor demand and spot commodity prices. Resour. Policy 2011, 36, 187–195. [Google Scholar] [CrossRef]

- Ohashi, K.; Okimoto, T. Increasing trends in the excess comovement of commodity prices. J. Commod. Mark. 2016, 1, 48–64. [Google Scholar] [CrossRef] [Green Version]

- Hong, Y.; Wang, S. Big data, machine learning and statistics: Challenges and opportunities. China J. Econom. 2021, 1, 17–35. [Google Scholar]

- Jammazi, R.; Aloui, C. Crude oil price forecasting: Experimental evidence from wavelet decomposition and neural network modeling. Energy Econ. 2012, 34, 828–841. [Google Scholar] [CrossRef]

- Zhao, Y.; Li, J.; Yu, L. A deep learning ensemble approach for crude oil price forecasting. Energy Econ. 2017, 66, 9–16. [Google Scholar] [CrossRef]

- Filis, G.; Degiannakis, S.; Floros, C. Dynamic correlation between stock market and oil prices: The case of oil-importing and oil-exporting countries. Int. Rev. Financ. Anal. 2011, 20, 152–164. [Google Scholar] [CrossRef]

- Sim, N.; Zhou, H. Oil prices, US stock return, and the dependence between their quantiles. J. Bank. Financ. 2015, 55, 1–8. [Google Scholar] [CrossRef]

- Lee, K.; Ni, S.; Ratti, R.A. Oil shocks and the macroeconomy: The role of price variability. Energy J. 1995, 16, 39–56. [Google Scholar] [CrossRef] [Green Version]

- Mork, K.A.; Olsen, O.; Mysen, H.T. Macroeconomic responses to oil price increases and decreases in seven OECD countries. Energy J. 1994, 15, 19–35. [Google Scholar] [CrossRef] [Green Version]

- Hamilton, J.D. What is an oil shock? J. Econom. 2003, 113, 363–398. [Google Scholar] [CrossRef]

- Basher, S.A.; Haug, A.A.; Sadorsky, P. Oil prices, stock returns and emerging stock markets. Energy Econ. 2012, 34, 227–240. [Google Scholar] [CrossRef] [Green Version]

- Kilian, L.; Park, C. The impact of oil price shocks on the US stock market. Int. Econ. Rev. 2009, 50, 1267–1287. [Google Scholar] [CrossRef]

- Kilian, L.; Murphy, D.P. The role of inventories and speculative trading in the global market for crude oil. J. Appl. Econom. 2014, 29, 454–478. [Google Scholar] [CrossRef]

- Davis, S.J.; Haltiwanger, J. Sectoral job creation and destruction responses to oil price changes. J. Monet. Econ. 2001, 48, 465–512. [Google Scholar] [CrossRef] [Green Version]

- Hooker, M.A. Are oil shocks inflationary? Asymmetric and nonlinear specifications versus changes in regime. J. Money Credit. Bank. 2002, 34, 540–561. Available online: https://www.jstor.org/stable/3270701 (accessed on 6 October 2021). [CrossRef] [Green Version]

- Jones, D.W.; Leiby, P.N.; Paik, I.K. Oil price shocks and the macroeconomy: What has been learned since 1996. Energy J. 2004, 25, 1–32. [Google Scholar] [CrossRef]

- Barsky, R.B.; Kilian, L. Oil and the macroeconomy since the 1970s. J. Econ. Perspect. 2004, 18, 115–134. [Google Scholar] [CrossRef] [Green Version]

- Bernanke, B.; Gertler, M.; Watson, M.W. Oil shocks and aggregate macroeconomic behavior: The role of monetary policy: A Reply. J. Money Credit. Bank. 2004, 36, 287–291. [Google Scholar] [CrossRef]

- Cunado, J.; Perez de Gracia, F. Oil prices, economic activity and inflation: Evidence for some Asian countries. Q. Rev. Econ. Financ. 2005, 45, 65–83. [Google Scholar] [CrossRef] [Green Version]

- Wang, Q.; Yang, X.; Li, R. The impact of the COVID-19 pandemic on the energy market—A comparative relationship between oil and coal. Energy Strategy Rev. 2022, 39, 100761. [Google Scholar] [CrossRef]

- Chai, J.; Lu, Q.; Hu, Y.; Wang, S.; Lai, K.K.; Liu, H. Analysis and Bayes statistical probability inference of crude oil price change point. Technol. Forecast. Soc. Chang. 2018, 126, 271–283. [Google Scholar] [CrossRef]

- Zhang, J.; Yuan, X. COVID-19 risk assessment: Contributing to maintaining urban public health security and achieving sustainable urban development. Sustainability 2021, 13, 4208. [Google Scholar] [CrossRef]

| Citations | Number of Articles Published | Journal | 5 Year Impact Factor |

|---|---|---|---|

| 1051 | 269 | Energy Economics | 7.571 |

| 687 | 79 | Energy Policy | 6.581 |

| 324 | 54 | Energy | 6.845 |

| 466 | 44 | Economic Modelling | 3.412 |

| 433 | 41 | Energy Journal | 2.786 |

| 333 | 38 | Applied Economics | 1.88 |

| 227 | 38 | Resources Policy | 5.654 |

| 299 | 31 | Applied Energy | 9.953 |

| 119 | 30 | Applied Economics Letters | 1.2 |

| 207 | 27 | American Journal of Agricultural Economics | 4.461 |

| Institution | Field | Publications | Regions |

|---|---|---|---|

| Chinese Academy of Sciences | Crude oil price forecasting; factors influencing crude oil prices; crude oil prices and the stock market | 48 | China |

| Hunan University | Crude oil prices and the stock market return; crude oil price forecasting | 26 | China |

| Montpellier Business School | Oil price and precious metal prices; oil price and economy | 21 | France |

| University of Pretoria | The impact of oil price fluctuations on macroeconomy | 20 | South Africa |

| World Bank | Causes and effects of food price crisis; food security; linkage between commodity prices | 18 | |

| Central University of Finance and Economics | Co-movement of commodity prices; crude oil prices and the stock market return; macroeconomic uncertainty and commodity prices | 18 | China |

| Beijing Institute of Technology | Oil price forecasting; oil price and stock return | 18 | China |

| Drexel University | Influencing factors of commodity prices; the impact of commodity price shocks on other factors | 18 | USA |

| University of Chinese Academy of Sciences | Crude oil price forecasting | 16 | China |

| IPAG Business School | Commodity prices and their determinant | 15 | France |

| Rank | Author | Number of People | Number of Articles Published | Proportion of Total/% |

|---|---|---|---|---|

| 1 | Wang S | 1 | 18 | 1.49% |

| 2 | Tiwari A K | 1 | 16 | 1.32% |

| 3 | Hammoudeh S, Gupta R | 2 | 15 | 2.48% |

| 4 | Kilian L | 1 | 14 | 1.16% |

| 5 | Ratti R A, An H | 2 | 11 | 1.82% |

| 6 | Yu L | 1 | 10 | 0.83% |

| 7 | Narayan P K, Wang Y, Zhang Y J, Yin L, Serletis A, Salisu A A, Nguyen D K | 7 | 9 | 5.20% |

| 8 | Wen F, Balcilar M, Reboredo J C, Tang L | 4 | 8 | 2.64% |

| 9 | Baumeister C, Ji Q, Ghoshray A, Nonejad N, Zhao L | 5 | 7 | 2.89% |

| 10 | Liu L, Yu W, Zhu H, Herrera A M, Soytas U, Jiménez-Rodríguez R, Fan Y | 7 | 6 | 3.47% |

| 11 | Arouri M E H, Shahbaz M, De Gracia F P, Uri N D | 4 | 5 | 1.65% |

| 12 | Castro C, Maghyereh A, Zhang C, Huang X, Lai K K, Wohar M E, Shahzad S J H, Nazlioglu S, Huang S, Karaki M B, Pierdzioch C, Gao X, Wei Y, Tao R, Boyd R, Filis G, Baek J | 17 | 4 | 5.61% |

| Total | 52 | 370 | 30.53% |

| Cluster ID | Cluster Label | Cluster Size | Silhouette | Year (Average) |

|---|---|---|---|---|

| #0 | stock market | 209 | 0.656 | 2006 |

| #1 | exchange rate | 141 | 0.698 | 2013 |

| #2 | crude oil price forecasting | 126 | 0.729 | 2012 |

| #3 | oil price uncertainty | 103 | 0.749 | 2014 |

| #4 | agricultural commodity price | 76 | 0.854 | 2009 |

| #5 | Singapore economy | 70 | 0.954 | 1996 |

| #6 | agricultural employment | 47 | 0.995 | 1991 |

| #7 | EMD-based neural network ensemble | 47 | 0.969 | 2001 |

| #9 | long-run price | 38 | 1 | 1993 |

| #20 | high commodity price | 7 | 0.996 | 2008 |

| #26 | high oil price | 4 | 0.996 | 2003 |

| Author | Title | Journal | Year | Strength | Begin | End | Burst Period: 1990–2020 | Cluster |

|---|---|---|---|---|---|---|---|---|

| Davis and Haltiwanger [92] | Sectoral job creation and destruction responses to oil price changes | Journal of Monetary Economics | 2001 | 14.41 | 2003 | 2011 |  | #0 |

| Hamilton [88] | What is an oil shock? | Journal of Econometrics | 2003 | 37.64 | 2005 | 2013 |  | #0 |

| Sadorsky [70] | Oil price shocks and stock market activity | Energy Economics | 1999 | 10.36 | 2005 | 2009 |  | #0 |

| Jiménez-Rodríguez and Sánchez [33] | Oil price shocks and real GDP growth: empirical evidence for some OECD countries | Applied Economics | 2005 | 17.53 | 2007 | 2015 |  | #0 |

| Hooker [93] | Are oil shocks inflationary? Asymmetric and nonlinear specifications versus changes in regime | Journal of Money, Credit, and Banking | 2002 | 12.44 | 2007 | 2011 |  | #0 |

| Jones et al. [94] | Oil price shocks and the macroeconomy: what has been learned since 1996 | The Energy Journal | 2004 | 11.85 | 2007 | 2014 |  | #0 |

| Papapetrou [47] | Oil price shocks, stock market, economic activity and employment in Greece | Energy Economics | 2001 | 11.25 | 2007 | 2011 |  | #0 |

| Barsky and Kilian [95] | Oil and the macroeconomy since the 1970s | Journal of Economic Perspectives | 2004 | 24.28 | 2008 | 2014 |  | #0 |

| Bernanke et al. [96] | Oil shocks and aggregate macroeconomic behavior: The role of monetary policy: A reply | Journal of Money, Credit, and Banking | 2004 | 19.11 | 2008 | 2014 |  | #4 |

| Cunado et al. [97] | Oil prices, economic activity and inflation: evidence for some Asian countries | The Quarterly Review of Economics and Finance | 2005 | 14.73 | 2008 | 2015 |  | #0 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Q.; Hu, Y.; Jiao, J.; Wang, S. Exploring the Trend of Commodity Prices: A Review and Bibliometric Analysis. Sustainability 2022, 14, 9536. https://doi.org/10.3390/su14159536

Zhang Q, Hu Y, Jiao J, Wang S. Exploring the Trend of Commodity Prices: A Review and Bibliometric Analysis. Sustainability. 2022; 14(15):9536. https://doi.org/10.3390/su14159536

Chicago/Turabian StyleZhang, Qi, Yi Hu, Jianbin Jiao, and Shouyang Wang. 2022. "Exploring the Trend of Commodity Prices: A Review and Bibliometric Analysis" Sustainability 14, no. 15: 9536. https://doi.org/10.3390/su14159536

APA StyleZhang, Q., Hu, Y., Jiao, J., & Wang, S. (2022). Exploring the Trend of Commodity Prices: A Review and Bibliometric Analysis. Sustainability, 14(15), 9536. https://doi.org/10.3390/su14159536