Digital Transformation, Ambidextrous Innovation and Enterprise Value: Empirical Analysis Based on Listed Chinese Manufacturing Companies

Abstract

:1. Introduction

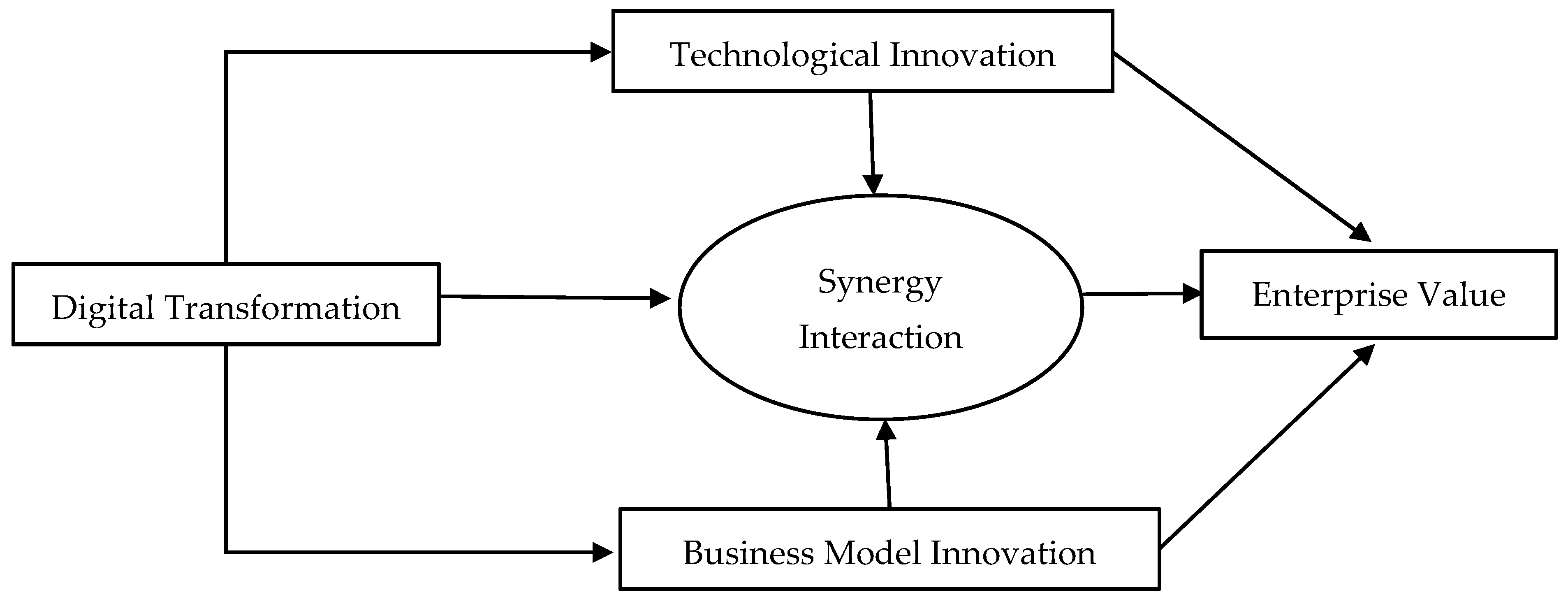

2. Theoretical Analysis and Research Hypotheses

2.1. Enterprise Digital Transformation and Its Impact on Enterprise Value

2.2. Mediating Role of Technological Innovation

2.3. Mediating Role of Business Model Innovation

2.4. Mediating Role of Technological Innovation and Business Model Innovation

3. Research Design and Model Construction

3.1. Data Sources

3.2. Definition of Variables

3.2.1. Explained Variable

3.2.2. Explanatory Variable

3.2.3. Mediating Variables

3.2.4. Controlled Variables

3.3. Model Construction

4. Empirical Results and Analysis

4.1. Descriptive Statistics

4.2. Correlation Analysis

4.3. Regression Analysis

4.4. Mediating Effect Analysis

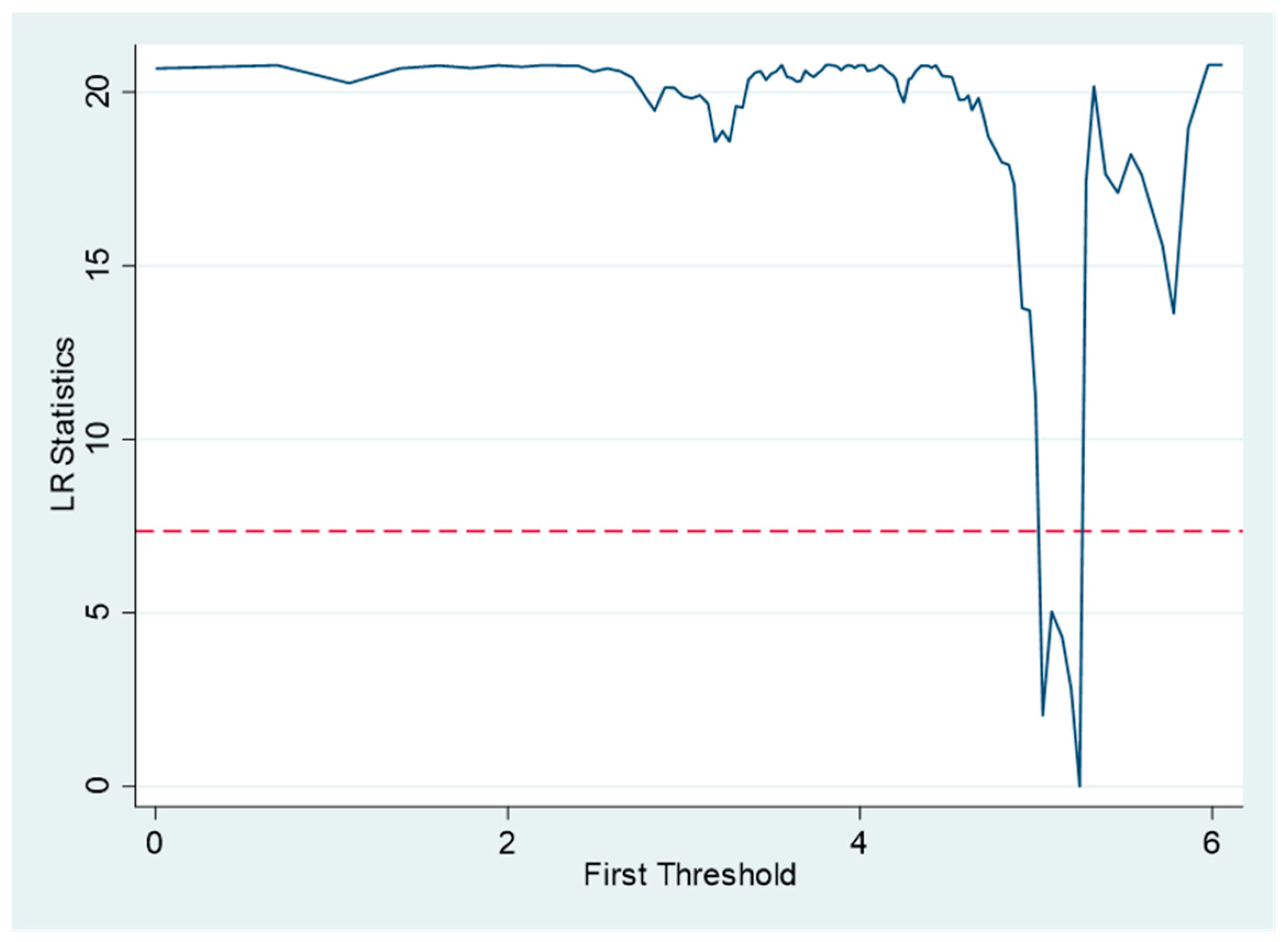

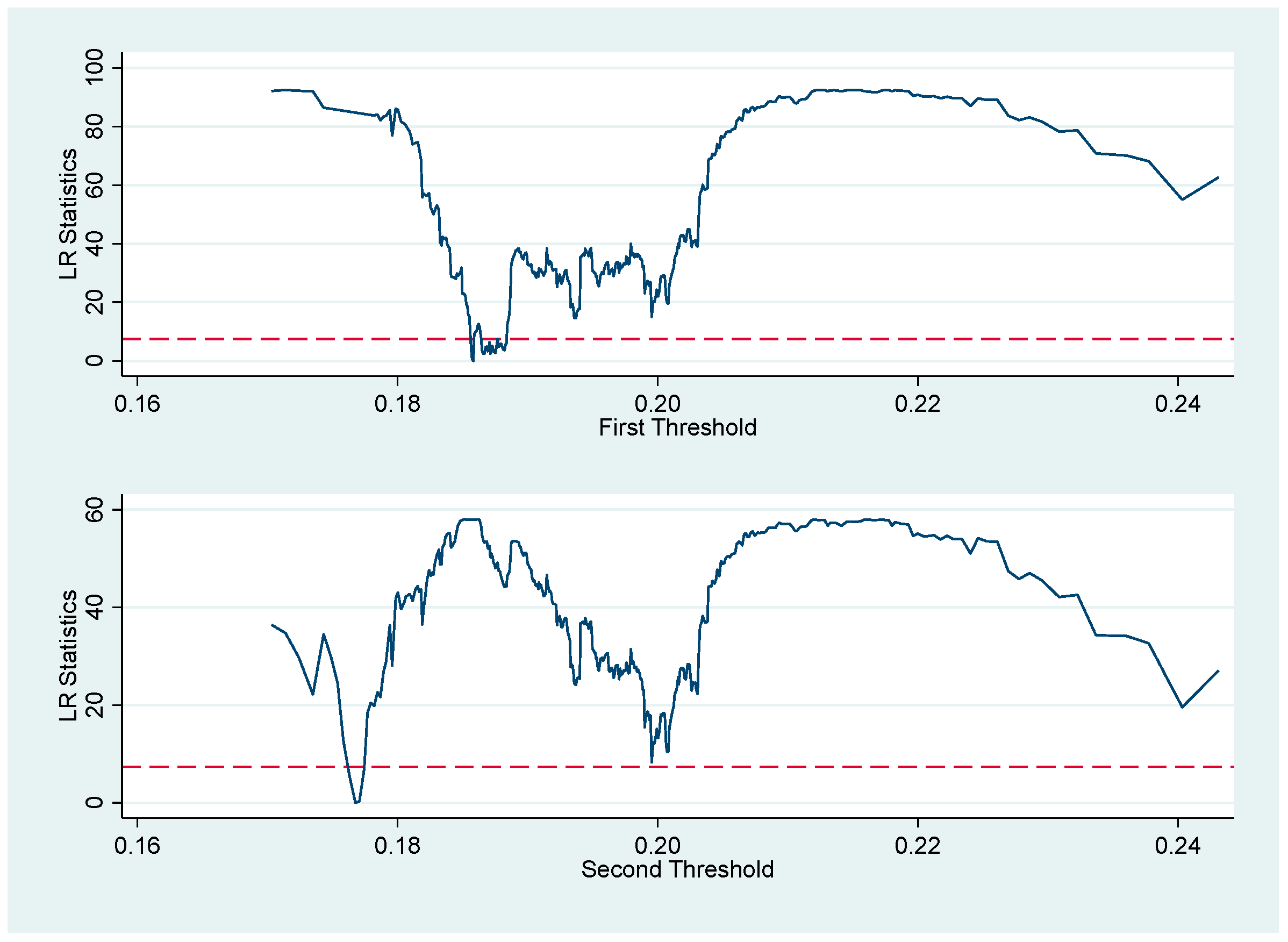

4.5. Threshold Effect Analysis

4.6. Heterogeneity Analysis

4.7. Robustness Test

5. Conclusions

5.1. Research Conclusions and Implications

5.2. Research Limitations and Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhou, J. Intelligent Manufacturing—Main Direction of “Made in China 2025”. China Mech. Eng. 2015, 26, 2273–2284. [Google Scholar]

- Karagiannaki, A.; Vergados, G.; Fouskas, K. The The impact of digital transformation in the financial services industry: Insights from an open innovation initiative in fintech in Greece. In Mediterranean Conference on Information Systems (MCIS); Association for Information Systems: Atlanta, GA, USA, 2017; Available online: http://aisel.aisnet.org/mcis2017/2 (accessed on 18 January 2022).

- Liu, D.-Y.; Chen, S.-W.; Chout, T.-C. Resource fit in digital transformation Lessons learned from the CBC Bank global e-banking project. Manag. Decis. 2011, 49, 1728–1742. [Google Scholar] [CrossRef]

- Martini, A.; Laugen, B.T.; Gastaldi, L.; Corso, M. Continuous innovation: Towards a paradoxical, ambidextrous combination of exploration and exploitation. Int. J. Technol. Manag. 2013, 61, 1–22. [Google Scholar] [CrossRef]

- Rayna, T.; Striukova, L. From rapid prototyping to home fabrication: How 3D printing is changing business model innovation. Technol. Forecast. Soc. Chang. 2016, 102, 214–224. [Google Scholar] [CrossRef] [Green Version]

- Pan, X.; Zhang, J.; Song, M.; Ai, B. Innovation resources integration pattern in high-tech entrepreneurial enterprises. International Entrep. Manag. J. 2018, 14, 51–66. [Google Scholar] [CrossRef]

- Kaulio, M.; Thoren, K.; Rohrbeck, R. Double ambidexterity: How a Telco incumbent used business-model and technology innovations to successfully respond to three major disruptions. Creat. Innov. Manag. 2017, 26, 339–352. [Google Scholar] [CrossRef] [Green Version]

- Xinhua News Agency. Outline of the People’s Republic of China 14th Five-Year Plan for National Economic and Social Development and Long-Range Objectives for 2035 [EB/OL]. 2021. Available online: http://www.gov.cn/xinwen/2021-03/13/content_5592681.htm (accessed on 1 June 2022).

- Ministry of Industry and Information Technology. Guiding Opinions on Accelerating the Cultivation and Development of Quality Enterprises in Manufacturing Industry [EB/OL]. 2021. Available online: https://www.miit.gov.cn/xwdt/gxdt/art/2021/art_abd0fedab15b47a095c7c75ed6f7684a.html (accessed on 1 June 2022).

- Zhu, Y.L.; Sun, Y.N.; Xiang, X.Y. Economic policy uncertainty and enterprise value: Evidence from Chinese listed enterprises. Econ. Syst. 2020, 44, 100831. [Google Scholar] [CrossRef]

- Liu, Z.; Mu, R.; Hu, S.; Wang, L.; Wang, S. Intellectual property protection, technological innovation and enterprise value-An empirical study on panel data of 80 advanced manufacturing SMEs. Cogn. Syst. Res. 2018, 52, 741–746. [Google Scholar] [CrossRef]

- Hao, X.Y.; Chen, F.L.; Chen, Z.F. Does green innovation increase enterprise value? Bus. Strategy Environ. 2022, 31, 1232–1247. [Google Scholar] [CrossRef]

- Miles, S.J.; van Clieaf, M. Strategic fit: Key to growing enterprise value through organizational capital. Bus. Horiz. 2017, 60, 55–65. [Google Scholar] [CrossRef]

- Liu, X.; Zhang, C. Corporate governance, social responsibility information disclosure, and enterprise value in China. J. Clean. Prod. 2017, 142, 1075–1084. [Google Scholar] [CrossRef]

- Llopis-Albert, C.; Rubio, F.; Valero, F. Impact of digital transformation on the automotive industry. Technol. Forecast. Soc. Chang. 2021, 162, 120343. [Google Scholar] [CrossRef]

- Gebauer, H.; Fleisch, E.; Lamprecht, C.; Wortmann, F. Growth paths for overcoming the digitalization paradox. Bus. Horiz. 2020, 63, 313–323. [Google Scholar] [CrossRef]

- Pan, W.; Xie, T.; Wang, Z.; Ma, L. Digital economy: An innovation driver for total factor productivity. J. Bus. Res. 2022, 139, 303–311. [Google Scholar] [CrossRef]

- Opazo-Basaez, M.; Vendrell-Herrero, F.; Bustinza, O.E. Uncovering Productivity Gains of Digital and Green Servitization: Implications from the Automotive Industry. Sustainability 2018, 10, 1524. [Google Scholar] [CrossRef] [Green Version]

- Usai, A.; Fiano, F.; Petruzzelli, A.M.; Paoloni, P.; Briamonte, M.F.; Orlando, B. Unveiling the impact of the adoption of digital technologies on firms; innovation performance. J. Bus. Res. 2021, 133, 327–336. [Google Scholar] [CrossRef]

- Autio, E.; Nambisan, S.; Thomas, L.D.; Wright, M. Digital affordances, spatial affordances, and the genesis of entrepreneurial ecosystems. Strateg. Entrep. J. 2018, 12, 72–95. [Google Scholar] [CrossRef]

- Chen, S.T.; Yu, D.K. The impacts of ambidextrous innovation on organizational obsolescence in turbulent environments. Kybernetes 2022, 51, 1009–1037. [Google Scholar] [CrossRef]

- Meng, F.; Zhao, G. Research on the Influence Factors of Traditional Manufacturing to the Development of Intelligent Manufacturing. Sci. Technol. Prog. Policy 2018, 35, 66–72. [Google Scholar]

- Jiao, H.; Yang, J.; Wang, P.; Li, Q. Research on Data-driven Operation Mechanism of Dynamic Capabilities—Based on Analysis of Digital Transformation Process from the Data Lifecycle Management. China Ind. Econ. 2021, 11, 174–192. [Google Scholar] [CrossRef]

- Yang, Z.; Dong, Y.; Yang, L. Digitalization, Servitization and Performance of Manufacturing Enterprises: Research based on the Moderating Mediator Model. Enterp. Econ. 2021, 40, 35–43. [Google Scholar] [CrossRef]

- Wu, X.; Zhu, M.; Chen, B. “Internet+” Enterprises’ Strategic Choice and Transformation Performance: Based on the Perspective of Transaction Cost. China Account. Rev. 2017, 15, 133–154. [Google Scholar]

- Goldfarb, A.; Tucker, C. Digital Economics. J. Econ. Lit. 2019, 57, 3–43. [Google Scholar] [CrossRef] [Green Version]

- Büchi, G.; Cugno, M.; Castagnoli, R. Economies of Scale and Network Economies in Industry 4.0. Symph. Emerg. Issues Manag. 2018, 2, 66–76. [Google Scholar] [CrossRef] [Green Version]

- Zhang, X.; Xu, Y.; Ma, L. Research on Successful Factors and Influencing Mechanism of the Digital Transformation in SMEs. Sustainability 2022, 14, 2549. [Google Scholar] [CrossRef]

- Acemoglu, D. Labor and Capital-Augmenting Technical change. J. Eur. Econ. Assoc. 2003, 1, 1–37. [Google Scholar] [CrossRef] [Green Version]

- Chen, X.; Peng, Y.; Lu, C. An Empirical Study on the Relationship between Innovation and Corporate Value of China Listed Companies. Stud. Sci. Sci. 2011, 29, 138–146. [Google Scholar] [CrossRef]

- Borowski, P.F. Digitization, Digital Twins, Blockchain, and Industry 4.0 as Elements of Management Process in Enterprises in the Energy Sector. Energies 2021, 14, 1885. [Google Scholar] [CrossRef]

- Borowski, P.F. Innovation strategy on the example of companies using bamboo. J. Innov. Entrep. 2021, 10, 3. [Google Scholar] [CrossRef]

- Li, H. Research on Managerial Traits, Innovation and Firm Value. Econ. Probl. 2017, 6, 91–97. [Google Scholar] [CrossRef]

- Li, W.; Zhu, J.; Zhang, Y. Research on the Impact of Business Model Innovation on Firm Performance—An Examination Based on Meta-Analysis Method. Price: Theory & Practice. China Acad. J. 2019, 11, 113–116. [Google Scholar] [CrossRef]

- Vial, G. Understanding digital transformation: A review and a research agenda. J. Strateg. Inf. Syst. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- Feng, L. Digital Transformation of Business Models in Creative Industries: Emergence of the Portfolio Model. In Academy of Management Proceedings; Academy of Management: Briarcliff Manor, NY, USA, 2014; Volume 2014, p. 11863. [Google Scholar]

- Qi, H.; Cao, X.; Liu, Y. The Influence of Digital Economy on Corporate Governance: Analyzed from Information Asymmetry and Irrational Behavior Perspective. Reform 2020, 4, 50–64. [Google Scholar]

- Daft, R.L. A Dual-Core Model of Organizational Innovation. Acad. Manag. J. 1978, 21, 193–210. [Google Scholar]

- Zott, C.; Amit, R.H.; Massa, L. The Business Model: Recent Developments and Future Research. J. Manag. 2011, 37, 1019–1042. [Google Scholar]

- Visnjic, I.; Wiengarten, F.; Neely, A. Only the Brave: Product Innovation, Service Business Model Innovation, and Their Impact on Performance. J. Prod. Innov. Manag. 2016, 33, 36–52. [Google Scholar] [CrossRef] [Green Version]

- Tong, Z.; Li, P.; Yang, L.; Wang, S. Impact of the Matching of Business Model Innovation and Technological Innovation on the Performance of Latecomer Firms: An Empirical Study from Text Analysis of Annual Reports. Sci. Technol. Prog. Policy 2022, 39, 84–93. [Google Scholar]

- Chen, J.; Yang, W.; Yu, F. Ecological Collaborative Innovation Strategy in Digital Transformation: A Strategic Discussion based on Huawei’s Enterprise Business Group (EBG) China. Tsinghua Bus. Rev. 2019, 6, 22–26. [Google Scholar]

- Liu, L.; Du, J. The Impact of Enterprise Financialization on Firm Value: Identification and Governance of Excessive Financialization. South China J. Econ. 2021, 10, 122–136. [Google Scholar] [CrossRef]

- Zhao, C.; Wang, W.; Li, X. How Does Digital Transformation Affect the Total Factor Productivity of Enterprises? Financ. Trade Econ. 2021, 42, 114–129. [Google Scholar] [CrossRef]

- Hu, N.; Qiu, F.; Liang, P. Competitive Strategy and Earnings Quality: An Empirical Study Based on Text Analysis. Contemp. Financ. Econ. 2020, 9, 138–148. [Google Scholar] [CrossRef]

- Liu, Z.; Wang, J.; Qiao, H.; Wang, S. The Influence of Business Model on Enterprise Performance: Based on the Data of Listed New Energy Enterprises. Manag. Rev. 2019, 31, 264–273. [Google Scholar] [CrossRef]

- Sun, H.; Ma, D. Vertical Environmental Regulations, Executive Compensation Incentives, and Business Model Innovation for Heavy Polluting Enterprises: Regulatory Role of Government Subsidies. Ecol. Econ. 2021, 37, 169–173+181. [Google Scholar]

- Cao, Q.; Gedajlovic, E.; Zhang, H. Unpacking Organizational Ambidexterity: Dimensions, Contingencies, and Synergistic Effects. Organ. Sci. 2009, 20, 781–796. [Google Scholar] [CrossRef] [Green Version]

- Wen, Z.; Ye, B. Analyses of Mediating Effects: The Development of Methods and Models. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar] [CrossRef]

- Hansen, B.E. Threshold effects in non-dynamic panels: Estimation, testing, and inference. J. Econom. 1999, 93, 345–368. [Google Scholar] [CrossRef] [Green Version]

- Wang, Q. Fixed-effect panel threshold model using Stata. Stata J. 2015, 15, 121–134. [Google Scholar] [CrossRef] [Green Version]

| Variable | Symbol | Annotation | |

|---|---|---|---|

| Enterprise value | EVA | Net operating profit after tax—all capital inputs | |

| Digital transformation | DIGI | Proportion of the total word frequency of 188 “digital transformation” words in the total word frequency of MD&A × 100 | |

| Technological innovation | RES | Natural logarithm of the number of patents + 1 | |

| Business model innovation | BMI | Value creation | X1: quick ratio = current assets/current liabilities |

| X2: debt coverage ratio = cash flow from operating activities/total liabilities | |||

| X3: equity-liability ratio = owner’s equities/total liabilities | |||

| Value transmission | X4: inventory turnover rate = cost of sales/average inventory | ||

| X5: accounts receivable turnover rate = sales revenue/average accounts receivable | |||

| X6: total asset turnover = sales revenue/average total assets | |||

| Value realization | X7: year-on-year growth rate of operating revenue = operating revenue of the current year/operating revenue of the previous year − 1 | ||

| X8: year-on-year growth rate of net profit = net profit of the current year/profit of the previous year − 1 | |||

| X9: profit margin of main business = operating profit/operating revenue | |||

| Combination | CD | Product of business model innovation and technological innovation | |

| Enterprise size | SIZE | Natural logarithm of total assets | |

| Enterprise age | AGE | Year of current year minus year of establishment | |

| Current ratio | CR | Ratio of current assets to total assets | |

| Ownership concentration | SHARE | Total shareholding ratio of top 5 major shareholders | |

| Capital intensity | CI | Ratio of total assets to operating income | |

| CEO duality | TJIO | 1 for the CEO duality of the chairman and general manager and 0 otherwise | |

| Industry dummy variables | INDUSTRY | A total of 29 industry virtual variables set according to the standards specified in the Guidelines for Industry Classification of Listed Companies (2012 Edition) | |

| Year dummy variables | YEAR | 8 years of dummy variables set within the sample time span of 2013–2020 | |

| Variable | Observed Value | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| EVA | 7312 | 1.184 | 7.348 | −19.51 | 45.58 |

| DIGI | 7312 | 0.333 | 0.394 | 0 | 1.941 |

| RES | 7312 | 2.225 | 1.730 | 0 | 9.549 |

| BMI | 7312 | 0.198 | 0.0166 | 0.105 | 0.433 |

| CD | 7312 | 0.441 | 0.347 | 0 | 1.923 |

| SIZE | 7312 | 22.30 | 1.152 | 17.64 | 27.55 |

| AGE | 7312 | 17.97 | 5.628 | 4 | 53 |

| CR | 7312 | 2.530 | 3.590 | 0.106 | 144.0 |

| SHARE | 7312 | 50.14 | 14.69 | 6.908 | 99.23 |

| CI | 7312 | 2.182 | 2.278 | 0.145 | 80.47 |

| TJIO | 7312 | 0.260 | 0.439 | 0 | 1 |

| EVA | DIGI | RES | BMI | SIZE | AGE | CR | |

|---|---|---|---|---|---|---|---|

| EVA | 1 | ||||||

| DIGI | 0.065 *** | 1 | |||||

| RES | 0.159 *** | 0.244 *** | 1 | ||||

| BMI | 0.245 *** | −0.00100 | 0.0150 | 1 | |||

| SIZE | 0.300 *** | 0.096 *** | 0.298 *** | −0.053 *** | 1 | ||

| AGE | 0.046 *** | 0.0100 | −0.118 *** | −0.00700 | 0.169 *** | 1 | |

| CR | −0.00400 | −0.00300 | −0.049 *** | 0.384 *** | −0.265 *** | −0.107 *** | 1 |

| SHARE | 0.155 *** | 0.00400 | 0.051 *** | 0.129 *** | 0.132 *** | −0.123 *** | 0.058 *** |

| CI | −0.112 *** | −0.037 *** | −0.099 *** | −0.304 *** | −0.083 *** | 0.00400 | 0.219 *** |

| TJIO | 0.0190 | 0.070 *** | −0.00300 | −0.022 * | −0.124 *** | −0.073 *** | 0.059 *** |

| SHARE | CI | TJIO | |||||

| SHARE | 1 | ||||||

| CI | −0.059 *** | 1 | |||||

| TJIO | −0.0140 | 0.033 *** | 1 |

| (1) | (2) | |

|---|---|---|

| VARIABLES | EVA | EVA |

| DIGI | 1.740 *** | 0.809 *** |

| (6.43) | (3.38) | |

| SIZE | 2.009 *** | |

| (13.28) | ||

| AGE | 0.009 | |

| (0.53) | ||

| CR | 0.173 *** | |

| (4.23) | ||

| SHARE | 0.059 *** | |

| (9.26) | ||

| CI | −0.328 *** | |

| (−5.08) | ||

| TJIO | 0.936 *** | |

| (4.96) | ||

| Observations | 7312 | 7312 |

| R-squared | 0.062 | 0.174 |

| Industry FE | YES | YES |

| Year FE | YES | YES |

| F test | 1.35 × 10−10 | 0 |

| r2_a | 0.0576 | 0.169 |

| F | 41.36 | 45.10 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Variable | EVA | RES | EVA | BMI | EVA | CD | EVA |

| DIGI | 0.809 *** | 0.637 *** | 0.537 ** | 0.002 *** | 0.593 ** | 0.132 *** | 0.435 * |

| (3.38) | (12.01) | (2.22) | (3.53) | (2.56) | (12.42) | (1.80) | |

| RES | 0.427 *** | ||||||

| (5.57) | |||||||

| BMI | 126.621 *** | ||||||

| (16.75) | |||||||

| CD | 2.841 *** | ||||||

| (7.30) | |||||||

| SIZE | 2.009 *** | 0.488 *** | 1.801 *** | 0.000 | 1.987 *** | 0.098 *** | 1.729 *** |

| (13.28) | (24.86) | (12.47) | (0.87) | (13.64) | (24.97) | (12.06) | |

| AGE | 0.009 | −0.036 *** | 0.024 | 0.000 *** | −0.013 | −0.007 *** | 0.028 * |

| (0.53) | (−10.03) | (1.44) | (5.42) | (−0.84) | (−9.61) | (1.70) | |

| CR | 0.173 *** | 0.016 *** | 0.166 *** | 0.002 *** | −0.106 *** | 0.007 *** | 0.152 *** |

| (4.23) | (2.97) | (4.22) | (16.78) | (−2.96) | (5.67) | (3.93) | |

| SHARE | 0.059 *** | −0.004 *** | 0.060 *** | 0.000 *** | 0.047 *** | −0.000 * | 0.060 *** |

| (9.26) | (−2.85) | (9.64) | (6.58) | (7.77) | (−1.85) | (9.68) | |

| CI | −0.328 *** | −0.064 *** | −0.300 *** | −0.003 *** | 0.014 | −0.018 *** | −0.278 *** |

| (−5.08) | (−4.23) | (−4.99) | (−4.76) | (0.33) | (−4.59) | (−4.89) | |

| TJIO | 0.936 *** | −0.024 | 0.946 *** | −0.001 ** | 1.044 *** | −0.004 | 0.948 *** |

| (4.96) | (−0.57) | (5.08) | (−2.35) | (5.69) | (−0.51) | (5.13) | |

| Observations | 7312 | 7312 | 7312 | 7312 | 7312 | 7312 | 7312 |

| R-squared | 0.174 | 0.283 | 0.181 | 0.384 | 0.224 | 0.279 | 0.187 |

| Industry FE | YES | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES | YES |

| F test | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| r2_a | 0.169 | 0.279 | 0.176 | 0.380 | 0.219 | 0.274 | 0.182 |

| F | 45.10 | 146.2 | 41.76 | 96.02 | 69.94 | 144.6 | 44.08 |

| Threshold Variables | Model | F-Value | p-Value | Bootstrap Sampling Times | Threshold | ||

|---|---|---|---|---|---|---|---|

| 1% | 5% | 10% | |||||

| RES | Single Threshold | 20.81 | 0.0233 | 300 | 23.9463 | 15.9425 | 13.5210 |

| Double Threshold | 6.93 | 0.3833 | 300 | 23.4399 | 14.9176 | 12.6435 | |

| BMI | Single Threshold | 129.09 | 0.0000 | 300 | 37.6464 | 24.1055 | 17.1313 |

| Double Threshold | 58.12 | 0.0033 | 300 | 38.4250 | 22.8718 | 18.2507 | |

| Triple Threshold | 53.59 | 0.4700 | 300 | 111.9707 | 94.0022 | 83.6108 | |

| (1) | (2) | |

|---|---|---|

| VARIABLES | EVA | EVA |

| DIGI·I | 0.579 | −7.895 *** |

| (Th ≤ q1) | (1.60) | (−4.50) |

| DIGI·I | 3.045 * | −1.953 *** |

| (q1 < Th < q2) | (1.93) | (−2.69) |

| DIGI·I | 1.392 *** | |

| (Th ≥ q2) | (3.11) | |

| RES | 0.134 | |

| (1.39) | ||

| BMI | 120.631 *** | |

| (7.65) | ||

| SIZE | 1.758 *** | 2.037 *** |

| (4.55) | (5.10) | |

| AGE | 0.061 | 0.057 |

| (1.29) | (1.25) | |

| CR | 0.062 *** | −0.195 *** |

| (2.66) | (−5.13) | |

| SHARE | 0.037 ** | 0.022 |

| (2.23) | (1.24) | |

| CI | −0.282 * | 0.010 |

| (−1.86) | (0.14) | |

| TJIO | −0.060 | 0.006 |

| (−0.27) | (0.03) | |

| Constant | −41.035 *** | −70.014 *** |

| (−4.94) | (−7.60) | |

| Observations | 7312 | 7312 |

| Number of code | 914 | 914 |

| R-squared | 0.043 | 0.121 |

| F test | 2.62 × 10−8 | 0 |

| r2_a | 0.0418 | 0.120 |

| F | 6.069 | 13.60 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| VARIABLES | Non-State-Owned Enterprises | State-Owned Enterprises | Small-Scale Enterprises | Large-Scale Enterprises |

| DIGI | 0.593 ** | 1.154 ** | 0.274 *** | 1.128 ** |

| (2.32) | (2.09) | (3.42) | (2.18) | |

| SIZE | 2.582 *** | 1.546 *** | 0.212 *** | 4.377 *** |

| (14.03) | (6.24) | (4.10) | (12.07) | |

| AGE | 0.087 *** | −0.069 | 0.010 * | −0.058 * |

| (4.86) | (−1.62) | (1.72) | (−1.70) | |

| CR | 0.148 *** | 0.406 *** | 0.033 *** | 0.695 * |

| (3.73) | (2.59) | (3.11) | (1.96) | |

| SHARE | 0.040 *** | 0.112 *** | 0.019 *** | 0.079 *** |

| (6.31) | (8.01) | (8.65) | (6.12) | |

| CI | −0.320 *** | −0.378 *** | −0.100 *** | −0.571 *** |

| (−3.68) | (−3.53) | (−3.57) | (−3.36) | |

| TJIO | 0.780 *** | 0.460 | 0.044 | 1.909 *** |

| (4.25) | (0.76) | (0.72) | (4.37) | |

| Observations | 4640 | 2672 | 4029 | 3282 |

| R-squared | 0.230 | 0.201 | 0.102 | 0.244 |

| Industry FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| F test | 0 | 0 | 0 | 0 |

| r2_a | 0.223 | 0.189 | 0.0925 | 0.235 |

| F | 37.51 | 19.01 | 18.77 | 39.16 |

| Path | Sobel Test | Bootstrap 95% Confidence Interval | ||

|---|---|---|---|---|

| Z | p | Lower Limit | Upper Limit | |

| Digital transformation → technological innovation → enterprise value | 6.78 | 1.202 × 10−11 | 0.1671921 | 0.3827405 |

| Digital transformation → business model innovation → enterprise value | 3.783 | 0.00015504 | 0.0875685 | 0.3393852 |

| Digital transformation → combination → enterprise value | 8.31 | 0 | 0.2565182 | 0.489755 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ma, H.; Jia, X.; Wang, X. Digital Transformation, Ambidextrous Innovation and Enterprise Value: Empirical Analysis Based on Listed Chinese Manufacturing Companies. Sustainability 2022, 14, 9482. https://doi.org/10.3390/su14159482

Ma H, Jia X, Wang X. Digital Transformation, Ambidextrous Innovation and Enterprise Value: Empirical Analysis Based on Listed Chinese Manufacturing Companies. Sustainability. 2022; 14(15):9482. https://doi.org/10.3390/su14159482

Chicago/Turabian StyleMa, Hedan, Xinliang Jia, and Xin Wang. 2022. "Digital Transformation, Ambidextrous Innovation and Enterprise Value: Empirical Analysis Based on Listed Chinese Manufacturing Companies" Sustainability 14, no. 15: 9482. https://doi.org/10.3390/su14159482

APA StyleMa, H., Jia, X., & Wang, X. (2022). Digital Transformation, Ambidextrous Innovation and Enterprise Value: Empirical Analysis Based on Listed Chinese Manufacturing Companies. Sustainability, 14(15), 9482. https://doi.org/10.3390/su14159482