Has the Opening of High-Speed Rail Promoted the Balanced Development between Cities?—Evidence of Commercial and Residential Use Land Prices in China

Abstract

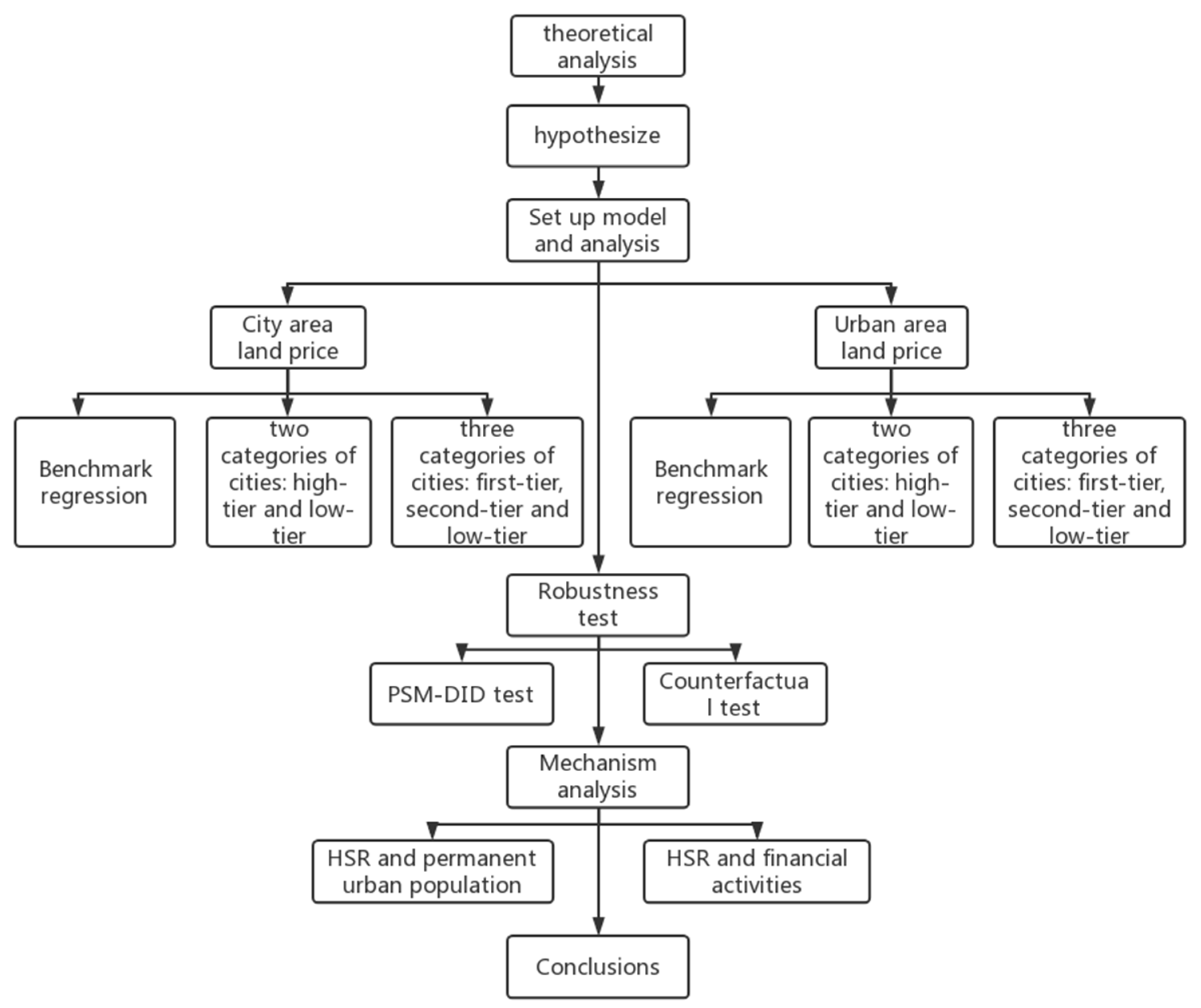

:1. Introduction

2. Theoretical Analysis and Research Hypothesis

2.1. Mathematical Model

2.1.1. Land Supply—The Government Behavior

2.1.2. Land Demand—Equilibrium Solution for the Market

2.2. Assumptions Proposed

3. Measurement Model, Variable Selection and Data Processing

3.1. Model Setting

3.2. Variable Selection

- Dependent variables

- 2.

- Core variable

- 3.

- Control variable

3.3. Data Source and Processing

4. Analysis of the Empirical Results

4.1. City Area:Regression Analysis of Commercial Use and Residential Land Prices

4.1.1. Benchmark Regression

4.1.2. Regression Results of Two Categories of Cities: High-Tier and Low-Tier

4.1.3. Regression Results of Three Categories of Cities: First-Tier, Second-Tier, and Low-Tier Cities

4.2. Urban Area:Regression Analysis of Commercial Use and Residential Land Prices

4.2.1. Benchmark Regression

4.2.2. Regression Results of Two Categories of Cities: High-Tier and Low-Tier

4.2.3. Regression Results of Three Categories of Cities: First-Tier, Second-Tier, and Low-Tier Cities

5. Robustness Test

5.1. PSM-DID Test

5.2. Counterfactual Test

6. Mechanism Analysis

6.1. Opening of HSR and Permanent Urban Population

6.2. Opening of HSR and Financial Activities

7. Conclusions

- The impact of the opening of HSR on the price of residential land is higher than that of commercial use land. The possible reason is that the lower commercial use land transfer price is an important measure for local governments to attract industries and enterprises, while residential land transfer does not consider the factor of attracting investment;

- Using 223 cities as a sample, the impact of HSR opening to city area and urban area residential land price growth become positive from the 3rd year after HSR opening. The influence duration is to at least 5 years after opening. The influence factor increases year by year;

- Through city-level sample, the opening of HSR has a more obvious positive impact on land prices in high-tier cities. (1) The impact start time was earlier: in the year of HSR opening, the city area residential land price growth rate of high-tier cities increased by 0.122, and lasted 5 years. (2) In the year of HSR opening, the urban area residential land price growth rate of high-tier cities increased by 0.1439, and lasted until the 5th year after opening. (3) For low-tier cities, the positive impact of the opening did not occur until 3 years after the opening. (4) The influence is greater, and the dummy variable coefficient of high-tier cities is positive. After PSM matching processing, the positive impact of HSR is more significantly focused on high-tier cities;

- High-tier cities are classified into first-tier and second-tier cities, and it was found that the impact of HSR opening on first-tier cities was more significant, because the impact lasted longer: the growth of urban area residential land prices in first-tier cities increased to 0.1295, and positive impact lasted until 5 years after opening; while the positive impact on second-tier cities only lasted until 2 years after opening and was not significant thereafter. After PSM matching processing, the positive impact of the opening of HSR on the growth rate of residential land price in second-tier cities was not significant 2 years after the opening, while the impact on the urban area land price in first-tier cities reached 3 years after the opening, and the impact on the land price of the whole city lasted until 5 years after opening;

- In terms of residential land prices by city area and urban area, the higher the city grade, the more sensitive the urban area land price will be to the opening of HSR. Under the city level, whether PSM matching processing is carried out, the urban area residential land prices in high-tier cities will rise in the year of opening;

- Taking the loan balance of financial institutions and permanent urban population as the mechanism test, it was also found that the positive impact of HSR opening is more obvious on high-tier cities, especially first-tier cities.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

- (1)

- Consumers

- (2)

- Producer

- (3)

- Market equilibrium

References

- Donaldson, D. Railroads of the raj: Estimating the impact of transportation infrastructure; National Bureau of Economic Research: Cambridge, MA, USA, 2010. [Google Scholar]

- Shaw, S.L.; Fang, Z.; Lu, S.; Tao, R. Impacts of high speed rail on railroad network accessibility in China. J. Transp. Geogr. 2014, 40, 112–122. [Google Scholar] [CrossRef]

- Zhou, H.; Zheng, X.T. Transportation Infrastructure Quality and Economic Growth: Evidence from China. J. World Econ. 2012, 35, 78–97. [Google Scholar]

- Lin, S.; Feng, L. Japanese high-speed railway construction and its socio-economic impact. J. Urban Reg. Plan. Res. 2011, 4, 132–156. [Google Scholar]

- Zhang, J. Research on high-speed railway construction and county economic Development of—Based on satellite lighting data. J. Econ. 2017, 16, 1533–1562. [Google Scholar]

- Qin, C.L.; Zhong, Z.H. Development of high-speed railway and urban economic agglomeration along the railway. J. Econ. Probl. Explor. 2014, 7. [Google Scholar] [CrossRef]

- Kim, K.S. High-speed rail developments and spatial restructuring—A case study of the Capital region in South Korea. J. Cities 2000, 17, 251–262. [Google Scholar] [CrossRef]

- Wang, J.E.; Jiao, J.J.; Jin, F.J. Effect of high-speed railways on the strength of urban space interactions in China. J. Geogr. 2014, 69, 1833–1846. [Google Scholar]

- Chen, Y.; Meng, X.C. Impact of high-speed railway on passenger transport market, regional economy and spatial structure. J. Urban Dev. Res. 2013, 20, 119–124. [Google Scholar]

- Zhao, Q.G. Analysis of the mechanism of high-speed railway narrowing in China. J. Contemp. Financ. 2013, 4, 106–112. [Google Scholar]

- Wang, Y.F.; Ni, P.F. Economic growth spillover and regional space optimization under the influence of high-speed railway. J. Ind. Econ. China 2016, 2, 21–36. [Google Scholar]

- Zhang, X.L. Has China’s transportation infrastructure boosted regional economic growth?—On the space spillover effects of transportation infrastructure. J. Soc. Sci. China 2012, 3, 60–77. [Google Scholar]

- Shi, L.; Fu, P.; Li, L.Y. Study on the effect of high-speed rail in promoting regional Economic Integration. J. Shanghai Econ. Res. 2018, 1, 53–62 + 83. [Google Scholar]

- Li, H.C.; Linda, T.; Hu, S.X. Impact of China’s high-speed railway on the economic agglomeration and equalization of cities along the route. J. Quant. Econ. Tech. Econ. Res. 2016, 33, 127–143. [Google Scholar]

- Preston, J.; Wall, G. The Ex-ante and Ex-post Economic and Social Impacts of the Introduction of High-speed Trains in South East England. J. Plan. Pract. Res. 2008, 23, 403–422. [Google Scholar] [CrossRef]

- Hall, P. Tricky dilemmas for high speed rail. Regen. Renew. 2009, 14. [Google Scholar]

- Pol, P.M.J. The Economic Impact of the High-Speed Train on Urban Regions. J. Gen. Inf. 2003, 10, 4–18. [Google Scholar]

- Garmendia, M.; Urena, J.M.D.; Ribalaygua, C.; Leal, J.; Coronado, J.M. Urban Residential Development in Isolated Small Cities That Are Partially Integrated in Metropolitan Areas By High Speed Train. J. Eur. Urban Reg. Stud. 2008, 15, 249–264. [Google Scholar] [CrossRef]

- Zhang, K.Z.; Tao, D.J. Economic distribution effect of transportation infrastructure—Comes from the evidence of high-speed rail opening. J. Econ. Dyn. 2016, 6, 62–73. [Google Scholar]

- Huang, J.; Zhong, Y.X.; Li, J.X.; Wen, Y.Z. Economic accessibility of provincial capitals in China based on High-speed Rail Network. J. Geogr. Res. 2016, 35, 757–769. [Google Scholar]

- Yin, J.B.; Huang, X.Y.; Hong, G.Z.; Cao, X.S.; Gao, X.C. Spatial Measurement Analysis of the Impact of Traffic Access on the Convergence of Urban Growth in China. J. Geogr. 2016, 71, 1767–1783. [Google Scholar]

- Qin, Y. ‘No county left behind?’ The distributional impact of high-speed rail upgrades in China. J. Econ. Geogr. 2017, 17, 489–520. [Google Scholar] [CrossRef] [Green Version]

- Chen, F.L.; Xu, K.N.; Wang, M.C. High-speed rail development and the income gap between urban and rural residents: Evidence from Chinese cities. J. Econ. Rev. 2018, 2, 59–73. [Google Scholar]

- Dong, Y.M.; Zhu, Y.M. Can the construction of high-speed rail reshape China’s economic spatial layout—Based on the regional heterogeneity perspective of employment, wages and economic growth. J. Ind. Econ. China 2016, 10, 92–108. [Google Scholar]

- Li, X.Z.; Ji, X.L.; Zhou, L.L. Can high-speed rail improve enterprise resource allocation?—Provides microscopic evidence from the Chinese industrial enterprise database and high-speed rail geographic data. J. Econ. Rev. 2017, 6, 3–21. [Google Scholar]

- Huang, Z.K.; Liu, J.Y.; Ma, G.R. Location, High-speed Rail and Information: Evidence from China’s IPO Market. J. World Econ. 2016, 3, 127–149. [Google Scholar]

- Liu, J.H.; Zhu, M. Will geography affect the cost of IPO for Chinese enterprises?—Is based on a “soft information asymmetry” perspective. J. Econ. Manag. 2015, 37, 31–41. [Google Scholar]

- Long, Y.; Zhao, H.L.; Zhang, X.D. Venture capital under the time and space compression of—High-speed rail traffic and venture capital regional change. J. Econ. Res. 2017, 52, 14. [Google Scholar]

- Zhao, W.; Li, F. Heterogeneous labor flow and regional income gap: An extended analysis of the new economic geography model. J. Chin. Popul. Sci. 2007, 1, 27–35 + 95. [Google Scholar]

- Liu, F. High-speed railway, knowledge overflow and city innovation development—Evidence from 278 cities. J. Financ. Trade Res. 2019, 30, 14–29. [Google Scholar]

- Pagliara, F.; Delaplace, M.; Vassallo, J.M. High-speed Rail Systems and Tourists’ Destination Choice: The Case Studies of Paris and Madrid. Int. J. Sustain. Dev. Plan. Encourag. Unified Approach Achieve Sustain. 2015, 10, 399–410. [Google Scholar] [CrossRef] [Green Version]

- Pagliara, F.; Mauriello, F.; Di Martino, S. An Analysis of theLink Between High Speed Transport and Tourists’ Behaviour. Tour. Int. Interdiscip. J. 2019, 67, 116–125. [Google Scholar]

- Zhou, Y.L.; Yang, J.D.; Huang, Y.H.; Geoffrey, J.D. Hewings. The influence of high-speed rail on urban land price and its mechanism study—Evidence from micro-land transaction. J. China Ind. Econ. 2018, 5, 118–136. [Google Scholar]

- Bowes, D.R. Identifying the impacts of rail transit stations on residential property values in Atlanta. J. Urban Econ. 2001, 50, 1–25. [Google Scholar] [CrossRef]

- Zheng, S.Q.; Kahn Matthew, E. China’s bullet trains facilitate market integration and mitigate the cost of megacity growth. Proc. Natl. Acad. Sci. USA 2013, 110, E1248–E1253. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Sands, B. The Development Effects of High-Speed Rail Stations and Implications for California. Built Environ. 1993, 19, 257–284. [Google Scholar]

- Simmonds, D.; Banister, D. Regional transport and integrated land-use / transport planning tools. In Strategic Planning for Regional Development in the UK; Routledge: London, UK, 2007. [Google Scholar]

- Kanasugi, H.; Ushijima, K. The impact of a high-speed railway on residential land prices. Pap. Reg. Sci. 2018, 97, 1305–1335. [Google Scholar] [CrossRef]

- Deng, T.T.; Wang, D.D. Has China’s high-speed railway construction intensified the “urban sprawl”? Empirical evidence from prefecture-level cities. J. Financ. Res. 2018, 44, 13. [Google Scholar]

- Liu, X.X.; Zhang, H.; Cheng, Y. The influence of high-speed rail opening on the city property price—based on DID model. J. Econ. Probl. Explor. 2018, 11. [Google Scholar]

- Krugman, P.R.; Venables, A.J. The Spatial Economy: Cities, Regions, and International Trade; MIT Press: Cambridge, MA, USA, 2001. [Google Scholar]

- Hu, X.P.; Kang, Y.Z. Analysis of family migration and urban settlement willingness of the floating population. J. Stat. Decis.-Mak. 2021, 37, 76–79. [Google Scholar]

- Zhu, Z.K. Housing accumulation fund and the willingness of the new generation of migrant workers to stay in cities—Based on the empirical analysis of the floating population dynamic monitoring survey. J. China’s Rural. Econ. 2017, 12, 33–48. [Google Scholar]

- Wang, Z. Analysis of the Influence of High-Speed Railway Network Structure Center on the Economic and Financial Development of Cities Along the Route. Ph.D. Thesis, Shandong University, Jinan, China, 2021. [Google Scholar]

| Variable | Symbol | Select the Significance of This Variable | |

|---|---|---|---|

| Explained variable | City area commercial use land price | lny1 | Growth rate of city area commercial use land transfer price |

| City area residential land price | lny2 | Growth rate of city area residential land transfer price | |

| Urban area commercial use land prices | lny3 | Growth rate of urban area commercial use land transfer price | |

| Urban area residential land prices | lny4 | Growth rate of urban area residential land transfer price | |

| Explanatory variable | The year of the opening of the HSR | HSR0 | The impact of HSR opening as the explanatory variable on land prices is observed through the current period and the lag period. |

| One year after the HSR was opened | HSR | ||

| 2 years after the HSR was opened | HSR2 | ||

| 3 years after the HSR was opened | HSR3 | ||

| 4 years after the HSR was opened | HSR4 | ||

| 5 years after the HSR was opened | HSR5 | ||

| Dummy variable | First-tier cities (including new first-tier cities) | LU | It is used to distinguish the impact of the opening of HSR on cities at different levels and reflect the structural effect of HSR. 21 first-tier cities: Beijing, Tianjin, Chongqing, Shanghai, Zhengzhou, city, Changsha, Wuhan, city, Shenzhen, Shenzhen, Dongguan, Chengdu, Qingdao, Hangzhou, nanbo, Xiamen, Nanjing, Wuxi, Suzhou, Shenyang, Dalian, and Xi’an. 27 s-tier cities: Shijiazhuang, Baoding, Foshan, Huizhou, Zhongshan, Nanning, Taiyuan, Jinan, Yantai, Weifang, Lanzhou, Guiyang, Kunming, Nanchang, Wenzhou, Shaoxing, Jiaxing, Jinhua, Taizhou, Fuzhou, Quanzhou, Xuzhou, Changzhou, Nantong, Hefei, Harbin, and Changchun. 48 high-tier cities: 21 first-tier and 27 s-tier cities. |

| Second-tier city | LM | ||

| High-tier city | LH | ||

| Controlled variable | GDP growth rate (%) | gdpg | For people and market entities, economic growth means more opportunities for participation and development space, so a city’s economic growth attracts population and market entities to gather, thus affecting land prices. |

| The proportion of tertiary industry (%) | tert | The tertiary industry is the main part of employment, but also the embodiment of commercial agglomeration, affecting the price of residential and commercial land. | |

| Total retail sales of consumer goods | lncons | Reflects the degree of commercial development of the city. | |

| Per capita disposable income of urban households | lnincome | Income has an impact on population mobility, leading to population clusters and thus affecting land prices. | |

| Urban resident population | lnupop | Population aggregation has a significant impact on land prices. | |

| Number of primary and secondary schools | lnschl | Reflects the level of urban public services and affects the population flow. | |

| Number of beds in health institutions | lnhosl |

| Variable | Symbol | Sample Number | Mean | Standard Deviation | Min Value | Max Value |

|---|---|---|---|---|---|---|

| City area commercial use of land price | lny1 | 1784 | 3.1849 | 0.3730 | 1.3802 | 5.2122 |

| City area residential land price | lny2 | 1784 | 3.3495 | 0.3668 | 2.2529 | 5.0236 |

| Urban area commercial use of land prices | lny3 | 1784 | 3.2962 | 0.3912 | 1.9956 | 5.2122 |

| Urban area residential land prices | lny4 | 1784 | 3.4514 | 0.3801 | 2.2625 | 5.0236 |

| GDP growth rate | gdpg | 1784 | 9.0742 | 3.4218 | −14.20 | 49.2791 |

| The proportion of tertiary industry | tert | 1784 | 40.5665 | 9.3838 | 14.3632 | 80.9817 |

| Total retail sales of consumer goods | lncons | 1784 | 2.8380 | 0.4175 | 1.7456 | 4.1529 |

| Per capita disposable income of urban households | lnincome | 1784 | 4.4386 | 0.1362 | 4.0519 | 4.9336 |

| Urban resident population | lnupop | 1784 | 2.3431 | 0.3037 | 1.5490 | 3.3490 |

| Number of primary and secondary schools | lnschl | 1784 | 2.8673 | 0.3120 | 1.9031 | 3.8134 |

| Number of beds in health institutions | lnhosl | 1784 | 4.2973 | 0.2950 | 2.9053 | 5.3145 |

| The year of the HSR opening | HSR0 | 1784 | 0.4916 | 0.5001 | 0 | 1 |

| 1 year after the HSR was opened | HSR1 | 1784 | 0.4238 | 0.4943 | 0 | 1 |

| 2 years after the HSR was opened | HSR2 | 1784 | 0.3492 | 0.4769 | 0 | 1 |

| 3 years after the HSR was opened | HSR3 | 1784 | 0.2702 | 0.4442 | 0 | 1 |

| 4 years after the HSR was opened | HSR4 | 1784 | 0.1962 | 0.3972 | 0 | 1 |

| 5 years after the HSR was opened | HSR5 | 1784 | 0.1396 | 0.3466 | 0 | 1 |

| First-tier cities (including new first-tierones) | LU | 1784 | 0.0942 | 0.2921 | 0 | 1 |

| Second-tier city | LM | 1784 | 0.1211 | 0.3263 | 0 | 1 |

| High-tier city | LH | 1784 | 0.2152 | 0.4111 | 0 | 1 |

| Impact on City Area Commercial Use Land Price (lny1) | Impact on the City Area Residential Land Price (lny2) | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| HSR0 | 0.0074 (0.36) | 0.0075 (0.37) | 0.0053 (0.33) | 0.0066 (0.42) |

| HSR1 | 0.0171 (0.89) | 0.0177 (0.92) | 0.0209 (1.25) | 0.0181 (1.14) |

| HSR2 | −0.0159 (−0.91) | −0.0162 (−0.92) | 0.0425 *** (2.69) | 0.0379 ** (2.53) |

| HSR3 | 0.0069 (0.39) | 0.0068 (0.39) | 0.0639 *** (4.00) | 0.0559 *** (3.68) |

| HSR4 | 0.0138 (0.70) | 0.0162 (0.83) | 0.0771 *** (4.37) | 0.0702 *** (4.10) |

| HSR5 | 0.0160 (0.75) | 0.0175 (0.81) | 0.0787 *** (3.94) | 0.0718 *** (3.66) |

| controlled variable | not have | have | not have | have |

| Impact on City Area Commercial Use Land Price (lny1) | Impact on City Area Residential Land Price (lny2) | |||

|---|---|---|---|---|

| (5) | (6) | (7) | (8) | |

| HSR0 | 0.0062 (0.29) | 0.0068 (0.33) | −0.0159 (−0.96) | −0.0126 (−0.79) |

| HSR1 | 0.0115 (0.58) | 0.0129 (0.66) | −0.0049 (−0.28) | −0.0043 (−0.27) |

| HSR2 | −0.0128 (−0.65) | −0.0118 (−0.60) | 0.0183 (1.07) | 0.0184 (1.11) |

| HSR3 | 0.0177 (0.93) | 0.0182 (0.96) | 0.0285 * (1.74) | 0.0255 * (1.61) |

| HSR4 | 0.0126 (0.55) | 0.0167 (0.72) | 0.0347 * (1.80) | 0.0340 * (1.80) |

| HSR5 | 0.0111 (0.41) | 0.0143 (0.51) | 0.0275 (1.19) | 0.0270 (1.17) |

| HSR0 × LH | 0.0076 (0.12) | 0.0046 (0.08) | 0.1354 *** (3.01) | 0.1220 *** (2.79) |

| HSR1 × LH | 0.0271 (0.55) | 0.0237 (0.50) | 0.1250 *** (3.35) | 0.1108 *** (3.08) |

| HSR2 × LH | −0.0118 (−0.32) | −0.0168 (−0.48) | 0.0909 *** (2.77) | 0.0757 *** (2.39) |

| HSR3 × LH | −0.0319 (−0.91) | −0.0348 (−1.02) | 0.1043 *** (3.21) | 0.0926 *** (2.89) |

| HSR4 × LH | 0.0028 (0.08) | −0.0012 (−0.03) | 0.0994 *** (3.13) | 0.0872 *** (2.76) |

| HSR5 × LH | 0.0098 (0.27) | 0.0065 (0.18) | 0.1033 *** (3.05) | 0.0921 *** (2.67) |

| Controlled variable | Not have | Have | Not have | Have |

| Impact on City Area Commercial Use Land Price (lny1) | Impact on City Area Residential Land Price (lny2) | |||

|---|---|---|---|---|

| (9) | (10) | (11) | (12) | |

| HSR0 | 0.0063 (0.30) | 0.0068 (0.33) | −0.0159 (−0.96) | −0.0126 (−0.79) |

| HSR1 | 0.0117 (0.59) | 0.0130 (0.66) | −0.0048 (−0.28) | −0.0043 (−0.27) |

| HSR2 | −0.0127 (−0.64) | −0.0118 (−0.60) | 0.0182 (1.06) | 0.0183 (1.11) |

| HSR3 | 0.0178 (0.93) | 0.0182 (0.96) | 0.0283 * (1.73) | 0.0254 * (1.61) |

| HSR4 | 0.0126 (0.55) | 0.0166 (0.72) | 0.0347 * (1.80) | 0.0342 * (1.80) |

| HSR5 | 0.0111 (0.41) | 0.0143 (0.51) | 0.0275 (1.19) | 0.0270 (1.17) |

| HSR0 × LU | −0.1216 (−1.27) | −0.1156 (−1.23) | 0.1204 (1.19) | 0.1137 (1.27) |

| HSR1 × LU | −0.0702 (−1.13) | −0.0658 (−1.07) | 0.1175 (1.56) | 0.1036 (1.51) |

| HSR2 × LU | −0.0481 (−0.92) | −0.0481 (−0.93) | 0.1275 *** (2.82) | 0.1104 *** (2.70) |

| HSR3 × LU | −0.0435 (−0.92) | −0.0428 (−0.91) | 0.1560 *** (3.85) | 0.1429 *** (3.57) |

| HSR4 × LU | −0.0131 (−0.29) | −0.0146 (−0.33) | 0.1501 *** (3.82) | 0.1363 *** (3.46) |

| HSR5 × LU | 0.0189 (0.41) | 0.0174 (0.37) | 0.1414 *** (3.38) | 0.1277 *** (2.98) |

| HSR0 × LM | 0.0476 (0.68) | 0.0419 (0.62) | 0.1400 *** (2.91) | 0.1246 ** (2.55) |

| HSR1 × LM | 0.0753 (1.26) | 0.0678 (1.17) | 0.1287 *** (3.35) | 0.1144 *** (2.97) |

| HSR2 × LM | 0.0155 (0.34) | 0.0065 (0.15) | 0.0635 (1.50) | 0.0497 (1.18) |

| HSR3 × LM | −0.0205 (−0.44) | −0.0270 (−0.59) | 0.0536 (1.23) | 0.0440 (1.02) |

| HSR4 × LM | 0.0212 (0.47) | 0.0142 (0.31) | 0.0405 (1.94) | 0.0311 (0.80) |

| HSR5 × LM | −0.0013 (−0.33) | −0.0062 (−0.14) | 0.0570 (1.41) | 0.0501 (1.23) |

| Controlled variable | Not have | Have | Not have | Have |

| Impact on Urban Area Commercial Use Land Price (lny3) | Impact on Urban Area Residential Land Price (lny4) | |||

|---|---|---|---|---|

| (13) | (14) | (15) | (16) | |

| HSR0 | 0.0042 (0.17) | 0.0046 (0.19) | 0.0048 (0.24) | 0.0069 (0.35) |

| HSR1 | 0.0023 (0.09) | 0.0024 (0.10) | 0.0199 (1.10) | 0.0172 (0.98) |

| HSR2 | −0.0167 (−0.73) | −0.0175 (−0.76) | 0.0441 ** (2.52) | 0.0384 ** (2.27) |

| HSR3 | −0.0237 (−1.02) | −0.0260 (−1.13) | 0.0651 *** (3.69) | 0.0554 *** (3.25) |

| HSR4 | −0.0057 (−0.23) | −0.0070 (−0.29) | 0.0768 *** (4.02) | 0.0674 *** (3.62) |

| HSR5 | 0.0247 (0.96) | 0.0234 (0.91) | 0.0772 *** (3.76) | 0.0687 *** (3.38) |

| Controlled variable | Not have | Have | Not have | Have |

| Impact on Urban Area Commercial Use Land Price (lny3) | Impact on Urban Area Residential Land Price (lny4) | |||

|---|---|---|---|---|

| (17) | (18) | (19) | (20) | |

| HSR0 | −0.0032 (−0.12) | −0.0035 (−0.14) | −0.0198 (−0.94) | −0.0158 (−0.77) |

| HSR1 | −0.0133 (−0.48) | −0.0140 (−0.50) | −0.0092 (−0.49) | −0.0090 (−0.49) |

| HSR2 | −0.0276 (−1.03) | −0.0288 (−1.07) | 0.0139 (0.69) | 0.0122 (0.62) |

| HSR3 | −0.0244 (−0.92) | −0.0276 (−1.05) | 0.0355 * (1.88) | 0.0298 (1.62) |

| HSR4 | −0.0180 (−0.59) | −0.0196 (−0.64) | 0.0444 ** (2.08) | 0.0395 * (1.88) |

| HSR5 | 0.0206 (0.58) | 0.0186 (0.52) | 0.0487 ** (2.02) | 0.0454 * (1.87) |

| HSR0 × LH | 0.0470 (0.73) | 0.0515 (0.81) | 0.1567 *** (3.79) | 0.1439 *** (3.60) |

| HSR1 × LH | 0.0754 (1.51) | 0.0810 * (1.65) | 0.1411 *** (4.00) | 0.1292 *** (3.77) |

| HSR2 × LH | 0.0409 (1.00) | 0.0439 (1.11) | 0.1137 *** (3.48) | 0.1014 *** (3.22) |

| HSR3 × LH | 0.0021 (0.05) | 0.0050 (0.12) | 0.0869 ** (2.49) | 0.0781 ** (2.23) |

| HSR4 × LH | 0.0289 (0.67) | 0.0306 (0.72) | 0.0759 ** (2.24) | 0.0672 *** (1.97) |

| HSR5 × LH | 0.0082 (0.19) | 0.0099 (0.23) | 0.0574 (1.62) | 0.0479 (1.32) |

| Controlled variable | Not have | Have | Not have | Have |

| Impact on Urban Area Commercial Use Land Price (lny3) | Impact on Urban Area Residential Land Price (lny4) | |||

|---|---|---|---|---|

| (21) | (22) | (23) | (24) | |

| HSR0 | −0.0031 (−0.12) | −0.0035 (−0.14) | −0.0197 (−0.94) | −0.0158 (−0.77) |

| HSR1 | −0.0131 (−0.47) | −0.0140 (−0.50) | −0.0092 (−0.49) | −0.0090 (−0.49) |

| HSR2 | −0.0274 (−1.02) | −0.0288 (−1.07) | 0.0138 (0.69) | 0.0122 (0.62) |

| HSR3 | −0.0243 (−0.92) | −0.0276 (−1.05) | 0.0353 * (1.87) | 0.0297 (1.61) |

| HSR4 | −0.0180 (−0.59) | −0.0197 (−0.65) | 0.0444 ** (2.08) | 0.0397 * (1.89) |

| HSR5 | 0.0206 (0.58) | 0.0186 (0.52) | 0.0487 ** (2.02) | 0.0454 * (1.87) |

| HSR0 × LU | −0.0525 (−0.78) | −0.0431 (−0.68) | 0.1425 * (1.70) | 0.1295 ** (1.77) |

| HSR1 × LU | 0.0008 (0.02) | 0.0122 (0.25) | 0.1430 ** (2.19) | 0.1287 ** (2.24) |

| HSR2 × LU | 0.0043 (0.08) | 0.0097 (0.19) | 0.1418 *** (3.19) | 0.1256 *** (3.21) |

| HSR3 × LU | −0.0235 (−0.44) | −0.0187 (−0.36) | 0.1347 *** (3.21) | 0.1235 *** (3.01) |

| HSR4 × LU | −0.0007 (−0.01) | 0.0029 (0.06) | 0.1224 *** (3.13) | 0.1122 *** (2.88) |

| HSR5 × LU | 0.0042 (0.08) | 0.0076 (0.15) | 0.1028 ** (2.50) | 0.0911 ** (2.14) |

| HSR0 × LM | 0.0778 (1.00) | 0.0807 (1.05) | 0.1611 *** (3.57) | 0.1483 *** (3.31) |

| HSR1 × LM | 0.1123 * (1.76) | 0.1149 * (1.82) | 0.1401 *** (3.69) | 0.1295 *** (3.36) |

| HSR2 × LM | 0.0683 (1.36) | 0.0694 (1.39) | 0.0925 ** (2.28) | 0.0834 ** (2.06) |

| HSR3 × LM | 0.0272 (0.47) | 0.0280 (0.49) | 0.0402 (0.82) | 0.0341 (0.70) |

| HSR4 × LM | 0.0633 (1.10) | 0.0623 (1.08) | 0.0221 (0.48) | 0.0156 (0.34) |

| HSR5 × LM | −0.0165 (0.24) | 0.0126 (0.23) | 0.0023 (0.05) | −0.0028 (−0.06) |

| Controlled variable | Not have | Have | Not have | Have |

| Impact on City Area Commercial Use Land Price (lny1) | Impact on City Area Residential Land Price (lny2) | Impact on Urban Area Commercial Use Land Price (lny3) | Impact on Urban Area Residential Land Price (lny4) | |

|---|---|---|---|---|

| HSR0 | −0.0166 (−0.70) | −0.0514 (−0.38) | −0.0121 (−0.43) | −0.0153 (−0.64) |

| HSR1 | 0.0218 (0.93) | −0.0060 (−0.67) | 0.0047 (0.14) | −0.0197 (−0.83) |

| HSR2 | −0.0243 (−0.96) | −0.0060 (−0.27) | −0.0452 (−1.26) | 0.0028 (0.10) |

| HSR3 | −0.0145 (−0.52) | −0.0070 (−0.37) | −0.0756 ** (−2.14) | −0.0022 (−0.10) |

| HSR4 | 0.0167 (0.46) | 0.0184 (0.72) | −0.0354 (−0.79) | −0.0018 (−0.08) |

| HSR5 | 0.0415 (1.08) | −0.0264 (−0.83) | 0.0573 (1.11) | 0.0254 (0.75) |

| HSR0 × LH | 0.0246 (0.39) | 0.0850 (2.24) | 0.0751 (1.09) | 0.1308 *** (3.12) |

| HSR1 × LH | 0.0112 (0.22) | 0.0931 *** (2.42) | 0.0856 (1.49) | 0.1221 *** (3.16) |

| HSR2 × LH | −0.0130 (−0.34) | 0.0670 ** (1.89) | 0.0500 (1.08) | 0.0697 * (1.88) |

| HSR3 × LH | 0.0065 (0.16) | 0.0889 *** (2.61) | 0.0502 (0.96) | 0.0528 * (1.36) |

| HSR4 × LH | 0.0399 (0.93) | 0.0699 ** (2.03) | 0.0501 (1.01) | 0.0716 * (1.76) |

| HSR5 × LH | −0.0051 (−0.12) | 0.1052 *** (2.72) | −0.0433 (−0.84) | 0.00258 (0.60) |

| Controlled variable | Have | Have | Have | Have |

| Impact on City Area Commercial Use Land Price (lny1) | Impact on City Area Residential Land Price (lny2) | Impact on Urban Area Commercial Use Land Price (lny3) | Impact on Urban Area Residential Land Price (lny4) | |

|---|---|---|---|---|

| HSR0 | −0.0164 (−0.69) | −0.0514 (−0.38) | −0.0119 (−0.42) | −0.0153 (−0.64) |

| HSR1 | 0.0216 (0.92) | −0.0141 (−0.67) | 0.0046 (0.14) | −0.0198 (−0.83) |

| HSR2 | −0.0247 (−0.98) | −0.0055 (−0.85) | −0.0457 (−1.27) | 0.0031 (0.12) |

| HSR3 | −0.0147 (−0.53) | −0.0068 (−0.36) | −0.0758 ** (−2.14) | −0.0020 (−0.09) |

| HSR4 | 0.0166 (0.46) | 0.0199 (0.79) | −0.0355 (−0.78) | −0.0015 (−0.06) |

| HSR5 | 0.0412 (1.07) | −0.0272 (−0.85) | 0.0572 (1.11) | 0.0259 (0.76) |

| HSR0 × LU | −0.0907 (−0.84) | 0.1042 (1.22) | −0.0231 (−0.32) | 0.1342 ** (1.65) |

| HSR1 × LU | −0.0949 (−1.51) | 0.0797 (1.11) | 0.0028 (0.05) | 0.1080 ** (1.70) |

| HSR2 × LU | −0.0448 (−0.81) | 0.0976 ** (2.25) | 0.0172 (0.30) | 0.0914 ** (1.97) |

| HSR3 × LU | −0.0187 (−0.34) | 0.1251 *** (3.14) | 0.0104 (0.16) | 0.0842 ** (1.95) |

| HSR4 × LU | 0.0366 (0.77) | 0.1244 *** (2.86) | 0.0476 (0.87) | 0.0996 ** (2.07) |

| HSR5 × LU | 0.0092 (0.18) | 0.1383 *** (2.91) | −0.0396 (−0.68) | 0.0524 ** (1.65) |

| HSR0 × LM | 0.0595 (0.85) | 0.0745 (1.96) | 0.1048 (1.26) | 0.1298 *** (2.82) |

| HSR1 × LM | 0.0645 (1.06) | 0.0998 ** (2.55) | 0.1271 * (1.77) | 0.1292 *** (3.12) |

| HSR2 × LM | 0.0146 (0.32) | 0.0403 (0.86) | 0.0785 (1.37) | 0.0507 (1.11) |

| HSR3 × LM | 0.0316 (0.66) | 0.0528 (1.05) | 0.09 (1.29) | 0.0215 (0.37) |

| HSR4 × LM | 0.0438 (0.76) | 0.0052 (0.14) | 0.0531 (0.83) | 0.0334 (0.60) |

| HSR5 × LM | −0.0228 (−0.46) | 0.0641 (1.55) | −0.0480 (−0.82) | −0.0142 (−0.28) |

| Controlled variable | Have | Have | Have | Have |

| Impact on City Area Commercial Use Land Price (lny1) | Impact on City Area Residential Land Price (lny2) | Impact on Urban Area Commercial Use Land Price (lny3) | Impact on Urban Area Residential Land Price (lny4) | |

|---|---|---|---|---|

| HSR0 | −0.0075 (−0.37) | −0.0066 (−0.42) | −0.0046 (−0.19) | −0.0069 (−0.35) |

| HSR1 | −0.0177 (−0.92) | −0.0181 (−1.14) | −0.0024 (−0.10) | −0.0172 (−0.98) |

| HSR2 | 0.0162 (0.92) | −0.0379 ** (−2.53) | 0.0175 (0.76) | −0.0384 ** (−2.27) |

| HSR3 | −0.0068 (−0.39) | −0.0559 *** (−3.68) | 0.0260 (1.13) | −0.0554 *** (−3.25) |

| HSR4 | −0.0162 (−0.83) | −0.0702 *** (−4.10) | 0.0070 (0.29) | −0.0674 *** (−3.62) |

| HSR5 | −0.0175 (−0.81) | −0.0718 *** (−3.66) | −0.0234 (−0.91) | −0.0687 *** (−3.38) |

| Controlled variable | Have | Have | Have | Have |

| Impact on City Area Commercial Use Land Price (lny1) | Impact on City Area Residential Land Price (lny2) | Impact on Urban Area Commercial Use Land Price (lny3) | Impact on Urban Area Residential Land Price (lny4) | |

|---|---|---|---|---|

| HSR0 | 0.0114 (0.20) | 0.1094 *** (2.59) | 0.0479 (0.80) | 0.1281 *** (3.45) |

| HSR1 | 0.0366 (0.80) | 0.1065 *** (3.08) | 0.0670 (1.53) | 0.1202 *** (3.74) |

| HSR2 | −0.0286 (−0.90) | 0.0940 *** (3.31) | 0.0151 (0.45) | 0.1136 *** (4.37) |

| HSR3 | −0.0166 (−0.53) | 0.1182 *** (4.06) | −0.0226 (−0.60) | 0.1079 *** (3.42) |

| HSR4 | 0.0155 (0.52) | 0.1212 *** (4.39) | 0.0110 (0.32) | 0.1067 *** (3.60) |

| HSR5 | 0.0208 (0.72) | 0.1191 *** (4.21) | 0.0285 (0.91) | 0.0933 *** (3.11) |

| HSR0 × L | −0.0046 (−0.08) | −0.1220 *** (−2.79) | −0.0515 (−0.81) | −0.1439 *** (−3.60) |

| HSR1 × L | −0.0237 (−0.50) | −0.1108 *** (−3.08) | −0.0810 * (−1.65) | −0.1292 *** (−3.77) |

| HSR2 × L | 0.0168 (0.48) | −0.0757 ** (−2.39) | −0.0439 (−1.11) | −0.1014 *** (−3.22) |

| HSR3 × L | 0.0348 (1.02) | −0.0926 *** (−2.89) | −0.0050 (−0.12) | −0.0781 ** (−2.23) |

| HSR4 × L | 0.0012 (0.03) | −0.0872 *** (−2.76) | −0.0306 (−0.72) | −0.0672 ** (−1.97) |

| HSR5 × L | −0.0065 (−0.18) | −0.0921 *** (−2.67) | −0.0099 (−0.23) | −0.0479 (−1.32) |

| Controlled variable | Have | Have | Have | Have |

| Dummy Variable | Regression Results of β2 | Dummy Variable | Regression Results of α | Dummy Variable | Regression Results of α |

|---|---|---|---|---|---|

| HSR0 | −11.6045 *** (−3.48) | HSR0 × LU | 54.3990 ** (1.82) | HSR0 × LM | 3.3067 (0.64) |

| HSR1 | −11.7680 *** (−3.14) | HSR1 × LU | 28.5653 ** (1.89) | HSR1 × LM | 1.6312 (0.36) |

| HSR2 | −10.8363 *** (−3.66) | HSR2 × LU | 36.3549 *** (2.19) | HSR2 × LM | 3.4732 (0.73) |

| HSR3 | −8.3992 *** (−2.93) | HSR3 × LU | 35.3182 * (1.78) | HSR3 × LM | 5.0999 (0.90) |

| HSR4 | −0.0423 (−0.01) | HSR4 × LU | 35.2313 * (1.67) | HSR4 × LM | 7.0014 (0.61) |

| HSR5 | −6.2873 (−1.04) | HSR5 × LU | 65.2061 *** (2.59) | HSR5 × LM | 31.6076 * (1.82) |

| Controlled variable | Have | Have | Have |

| Dummy Variable | Regression Results of β2 | Dummy Variable | Regression Results of α | Dummy Variable | Regression Results of α |

|---|---|---|---|---|---|

| HSR0 | −1282.58 *** (−3.18) | HSR0 × LU | 4999.23 *** (2.70) | HSR0 × LM | 1947.64 *** (4.61) |

| HSR1 | −1562.67 *** (−4.09) | HSR1 × LU | 6401.60 *** (3.45) | HSR1 × LM | 2116.26 *** (5.81) |

| HSR2 | −1868.58 *** (−3.56) | HSR2 × LU | 6799.80 *** (4.58) | HSR2 × LM | 2621.06 *** (3.56) |

| HSR3 | −1586.38 *** (−3.70) | HSR3 × LU | 7769.02 *** (5.33) | HSR3 × LM | 2321.16 *** (3.84) |

| HSR4 | −2411.75 *** (−3.88) | HSR4 × LU | 9300.72 *** (6.57) | HSR4 × LM | 3717.97 *** (3.10) |

| HSR5 | −1446.00 *** (−3.03) | HSR5 × LU | 7536.03 *** (5.53) | HSR5 × LM | 2077.21 * (1.86) |

| Controlled variable | Have | Have | Have |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, J.; Chen, X.; Li, T. Has the Opening of High-Speed Rail Promoted the Balanced Development between Cities?—Evidence of Commercial and Residential Use Land Prices in China. Sustainability 2022, 14, 9437. https://doi.org/10.3390/su14159437

Chen J, Chen X, Li T. Has the Opening of High-Speed Rail Promoted the Balanced Development between Cities?—Evidence of Commercial and Residential Use Land Prices in China. Sustainability. 2022; 14(15):9437. https://doi.org/10.3390/su14159437

Chicago/Turabian StyleChen, Jiansheng, Xin Chen, and Ting Li. 2022. "Has the Opening of High-Speed Rail Promoted the Balanced Development between Cities?—Evidence of Commercial and Residential Use Land Prices in China" Sustainability 14, no. 15: 9437. https://doi.org/10.3390/su14159437

APA StyleChen, J., Chen, X., & Li, T. (2022). Has the Opening of High-Speed Rail Promoted the Balanced Development between Cities?—Evidence of Commercial and Residential Use Land Prices in China. Sustainability, 14(15), 9437. https://doi.org/10.3390/su14159437