Personal Carbon Budgets: A Pestle Review

Abstract

:1. Introduction

2. Personal Carbon Budget Models

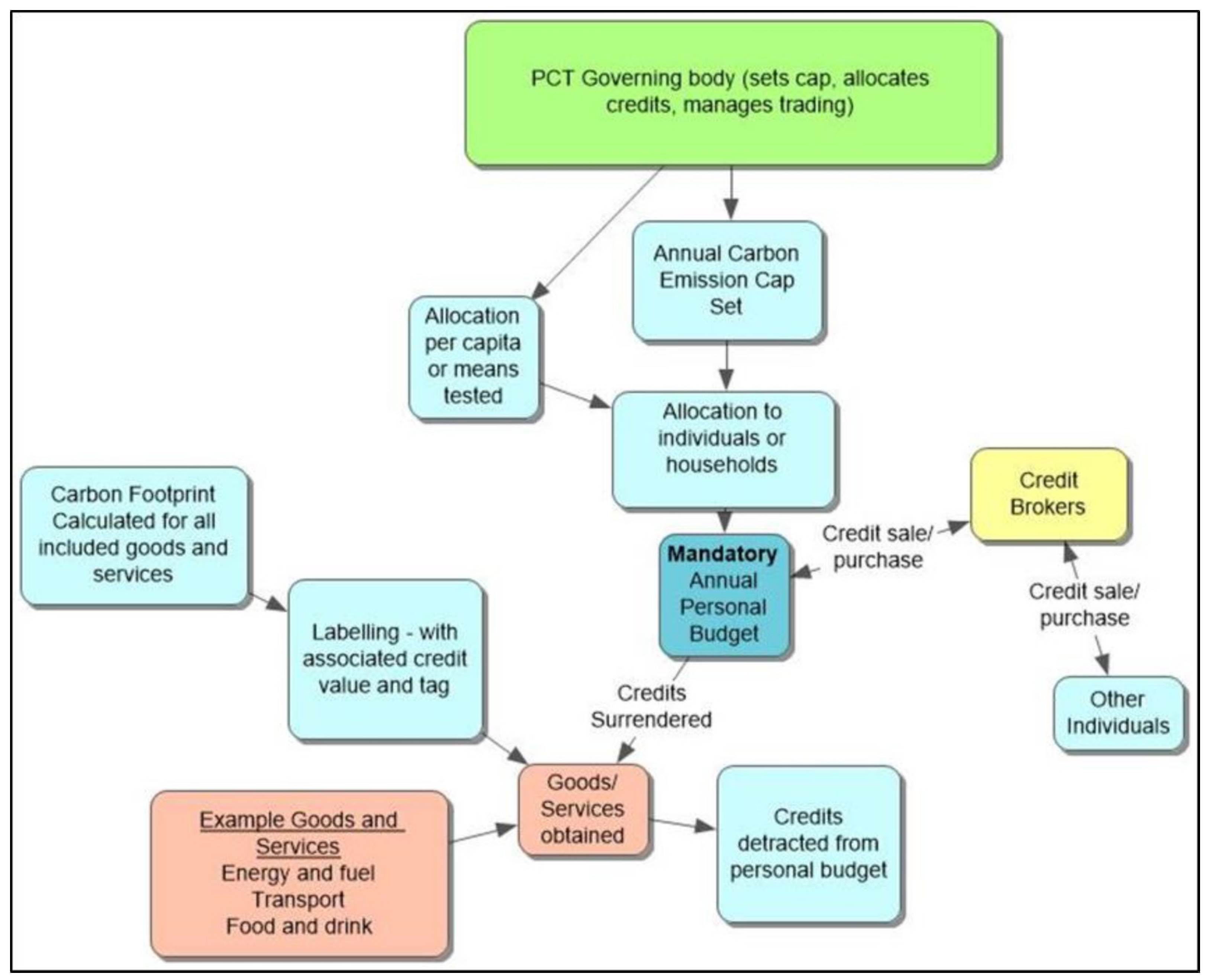

2.1. Personal Carbon Trading

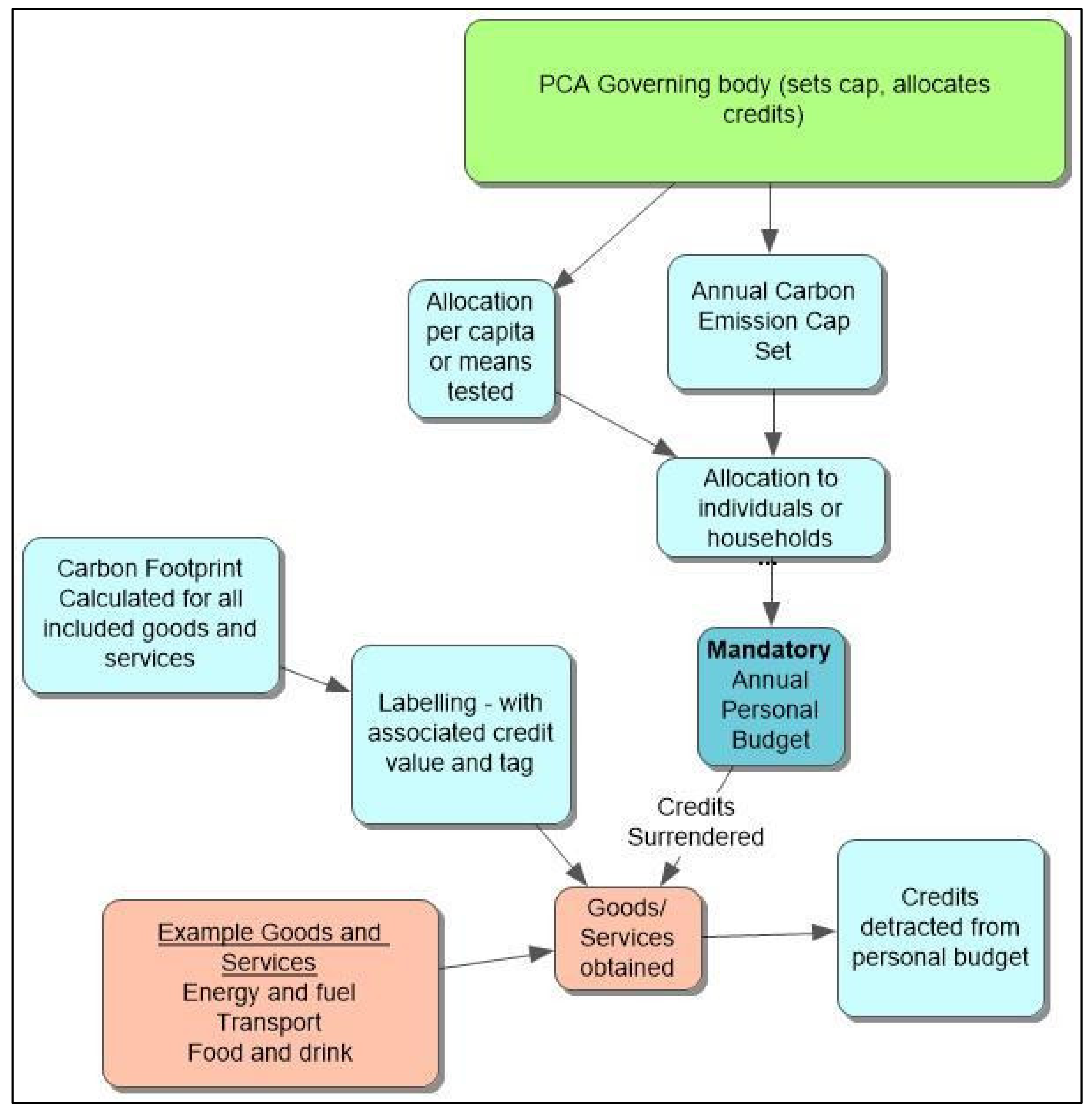

2.2. Personal Carbon Allowance (No Trading)

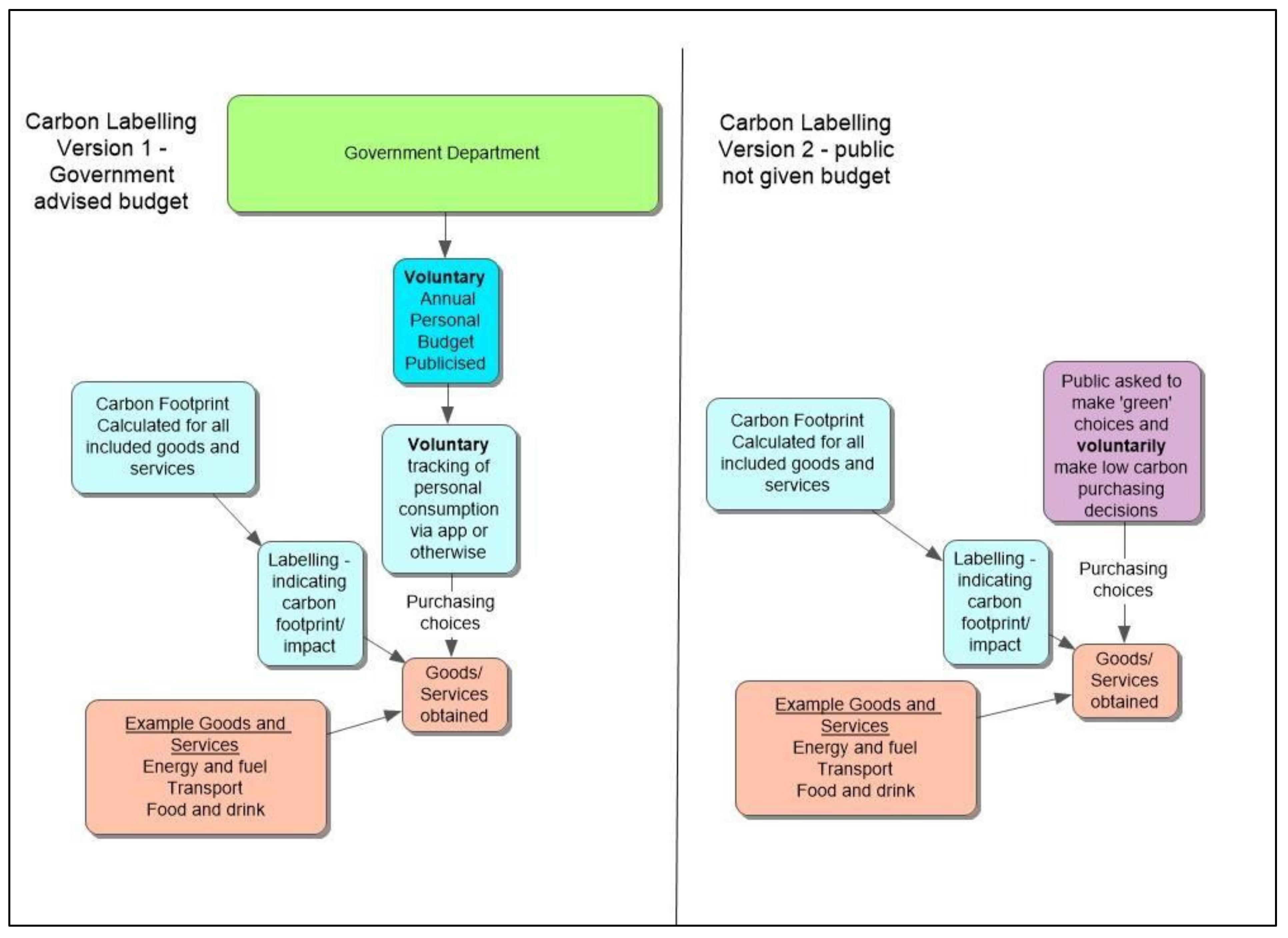

2.3. Carbon Labelling

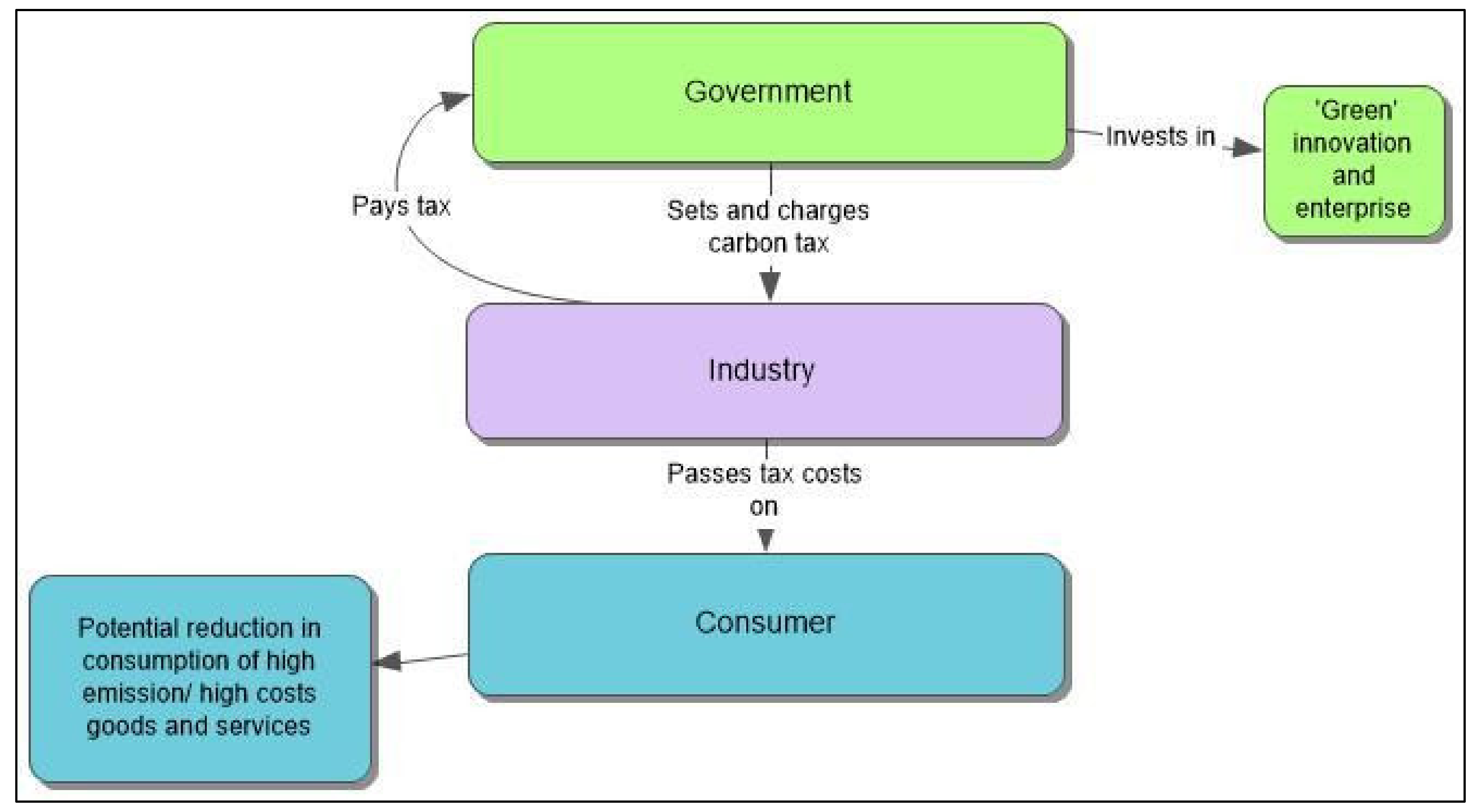

2.4. Carbon Tax

3. Pestle Analysis

3.1. Political

3.2. Economic

3.3. Social

3.4. Technologigal

3.5. Legal

3.6. Environmental

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Intergovernmental Panel on Climate Change (IPCC). Special Report: Global Warming of 1.5 °C; Intergovernmental Panel on Climate Change (IPCC): Geneva, Switzerland, 2018. [Google Scholar]

- Department for Environment Food & Rural Affairs. Data—Consumption Emissions 1997–2017 [DATASET]. 2020. Available online: https://www.gov.uk/government/statistics/uks-carbon-footprint (accessed on 9 October 2020).

- Climate Change Committee. Sixth Carbon Budget; Climate Change Committee: London, UK, 2020. [Google Scholar]

- Climate Change Committee. Advice on Reducing the UK’s Emissions—Climate Change Committee. 2021. Available online: https://www.theccc.org.uk/about/our-expertise/advice-on-reducing-the-uks-emissions/ (accessed on 17 June 2021).

- Wallace, K.N.; Irvine, K.N.; Wright, A.J.; Fleming, P.D. Public attitudes to personal carbon allowances: Findings from a mixed-method study. Clim. Policy 2010, 10, 385–409. [Google Scholar] [CrossRef]

- Fawcett, T.; Parag, Y. An introduction to personal carbon trading. Clim. Policy 2010, 10, 29–38. [Google Scholar] [CrossRef] [Green Version]

- Fawcett, T. Personal carbon trading: A policy ahead of its time? Energy Policy 2010, 38, 6868–6876. [Google Scholar] [CrossRef]

- Kuokkanen, A.; Sihvonen, M.; Uusitalo, V.; Huttunen, A.; Ronkainen, T.; Kahiluoto, H. A proposal for a novel urban mobility policy: Personal carbon trade experiment in Lahti city. Util. Policy 2020, 62, 100997. [Google Scholar] [CrossRef]

- Perera, R. The PESTLE Analysis, 1st ed.; Nerdynaut: Avissawella, Sri Lanka, 2017; ISBN 9781626209985. [Google Scholar]

- Parag, Y.; Capstick, S.; Poortinga, W. Policy attribute framing: A comparison between three policy instruments for personal emissions reduction. J. Policy Anal. Manag. 2011, 30, 889–905. [Google Scholar] [CrossRef]

- Carbone, J.C.; Morgenstern, R.D.; Williams, R.C.I.; Burtraw, D. Deficit reduction and carbon taxes: Budgetary, Economic, and Distributional Impacts. In Resources For the Future; RFF Centre: Washington, DC, USA, 2013. [Google Scholar]

- Elkins, P.; Baker, T. Carbon taxes and carbon emissions trading. J. Econ. Surv. 2002, 15, 325–376. [Google Scholar] [CrossRef]

- Haites, E. Carbon taxes and greenhouse gas emissions trading systems: What have we learned? Clim. Policy 2018, 18, 955–966. [Google Scholar] [CrossRef] [Green Version]

- Bristow, A.L.; Wardman, M.; Zanni, A.M.; Chintakayala, P.K. Public acceptability of personal carbon trading and carbon tax. Ecol. Econ. 2010, 69, 1824–1837. [Google Scholar] [CrossRef] [Green Version]

- Parag, Y.; Eyre, N. Barriers to personal carbon trading in the policy arena. Clim. Policy 2010, 10, 353–368. [Google Scholar] [CrossRef]

- Seyfang, G.; Lorenzoni, I.; Nye, M. Personal Carbon Trading: A Critical Examination of Proposals for the UK; Tyndall Centre for Climate Change Research: Norwich, UK, 2009. [Google Scholar]

- Roberts, S.; Thumim, J. A Rough Guide to Individual Carbon Trading: The Ideas, the Issues and the Next Steps; Department for Food And Rural Affairs: London, UK, 2006. [Google Scholar]

- Fawcett, T. Personal carbon trading: Is now the right time? Carbon Manag. 2012, 3, 283–291. [Google Scholar] [CrossRef]

- Howell, R.A. Living with a carbon allowance: The experiences of carbon rationing action groups and implications for policy. Energy Policy 2012, 41, 250–258. [Google Scholar] [CrossRef] [Green Version]

- Fawcett, T.; Hvelplund, F.; Meyer, N.I. Making it personal: Per capita carbon allowances. In Generating Electricity in a Carbon-Constrained World; Elsevier Inc.: Amsterdam, The Netherlands, 2010; pp. 87–107. [Google Scholar]

- Hyams, K. A just response to climate change: Personal carbon allowances and the normal-functioning approach. J. Soc. Philos. 2009, 40, 237–256. [Google Scholar] [CrossRef]

- Upham, P.; Dendler, L.; Bleda, M. Carbon labelling of grocery products: Public perceptions and potential emissions reductions. J. Clean. Prod. 2011, 19, 348–355. [Google Scholar] [CrossRef]

- Marek, E.; Raux, C.; Engelmann, D. Personal carbon allowances: Can a budget label do the trick? Transp. Policy 2018, 69, 170–178. [Google Scholar] [CrossRef]

- Vanclay, J.K.; Shortiss, J.; Aulsebrook, S.; Gillespie, A.M.; Howell, B.C.; Johanni, R.; Maher, M.J.; Mitchell, K.M.; Stewart, M.D.; Yates, J. Customer response to carbon labelling of groceries. J. Consum. Policy 2011, 34, 153–160. [Google Scholar] [CrossRef]

- Narassimhan, E.; Gallagher, K.S.; Koester, S.; Alejo, J.R. Carbon pricing in practice: A review of existing emissions trading systems. Clim. Policy 2018, 18, 967–991. [Google Scholar] [CrossRef] [Green Version]

- Seyfang, G.; Lorenzoni, I.; Nye, M. Personal Carbon Trading: Notional Concept or Workable Proposition? Exploring Theoretical, Ideological and Practical Underpinnings; Working Paper; Centre for Social and Economic Research on the Global Environment: Norwich, UK, 2007; pp. 1–31. [Google Scholar]

- Wallace, A.A. Reducing Carbon Emissions by Households: The Effects of Footprinting and Personal Allowances; Institute of Energy and Sustainable Development, De Montfort University: Leicester, UK, 2009. [Google Scholar]

- Lane, C.; Harris, R.; Roberts, S. An Analysis of the Technical Feasibility and Potential Cost of a Personal Carbon Trading Scheme; Department for Environment, Food and Rural Affairs: London, UK, 2008.

- Wintour, P. Miliband Plans Carbon Trading “Credit Cards” for Everyone; The Guardian: London, UK, 2006. [Google Scholar]

- Brohé, A. Personal carbon trading in the context of the EU emissions trading scheme. Clim. Policy 2010, 10, 462–476. [Google Scholar] [CrossRef]

- Seyfang, G.; Paavola, J. Inequality and sustainable consumption: Bridging the gaps. Local Environ. 2008, 13, 669–684. [Google Scholar] [CrossRef] [Green Version]

- Parag, Y.; Strickland, D. Personal carbon trading: A radical policy option for reducing emissions from the domestic sector. Environment 2011, 53, 29–37. [Google Scholar] [CrossRef]

- Campaign Live. PepsiCo Explains How It Measured The Carbon Footprint of Walkers Crisps 2009. Available online: https://www.campaignlive.co.uk/article/pepsico-explains-measured-carbon-footprint-walkers-crisps/941668 (accessed on 3 May 2021).

- BBC News. What’s the Carbon Footprint of a Potato? 2007. Available online: http://news.bbc.co.uk/1/hi/magazine/7002450.stm (accessed on 3 May 2021).

- Smithers, R. Tesco’s Pledge to Carbon-Label All Products Set to Take Centuries; The Guardian: London, UK, 2010. [Google Scholar]

- Vaughan, A. Tesco Drops Carbon-Label Pledge; The Guardian: London, UK, 2012. [Google Scholar]

- Oatly. Look! Oatly Cartons Come with Carbon Dioxide Equivalents|UK. 2021. Available online: https://www.oatly.com/uk/climate-footprint (accessed on 3 May 2021).

- Quorn. Quorn Unveils Carbon Footprint Labelling of Its Products and Calls on Other Brands to Follow Suit as It Launches New Campaign to Help Consumers Battle Climate Change. 2020. Available online: https://www.quorn.co.uk/company/press/quorn-unveils-carbon-footprint-labelling-of-its-products-and-calls-on-other (accessed on 3 May 2021).

- Lin, B.; Li, X. The effect of carbon tax on per capita CO2 emissions. Energy Policy 2011, 39, 5137–5146. [Google Scholar] [CrossRef]

- Sumner, J.; Bird, L.; Dobos, H. Carbon taxes: A review of experience and policy design considerations. Clim. Policy 2011, 11, 922–943. [Google Scholar] [CrossRef] [Green Version]

- Goulder, L.H.; Schein, A.R. Carbon taxes versus cap and trade: A critical review. Clim. Change Econ. 2013, 4, 1350010. [Google Scholar] [CrossRef]

- Sorrell, S. An upstream alternative to personal carbon trading. Clim. Policy 2010, 10, 481–486. [Google Scholar] [CrossRef]

- Singh, K. India’s Coal Tax Is Key to Stabilizing Its Energy Transition. Center for Strategic and International Studies. 2020. Available online: https://www.csis.org/analysis/indias-coal-tax-key-stabilizing-its-energy-transition (accessed on 7 May 2021).

- Carattini, S.; Kallbekken, S.; Orlov, A. How to win public support for a global carbon tax. Nature 2019, 565, 289–291. [Google Scholar] [CrossRef]

- Dissanayake, S.; Mahadevan, R.; Asafu-Adjaye, J. Evaluating the efficiency of carbon emissions policies in a large emitting developing country. Energy Policy 2020, 136, 111080. [Google Scholar] [CrossRef]

- Nuccitelli, D. Canada Passed a Carbon Tax That Will Give Most Canadians More Money; The Guardian: London, UK, 2018. [Google Scholar]

- BBC News. Australia Votes to Repeal Carbon Tax. BBC News. 2014. Available online: https://www.bbc.co.uk/news/world-asia-28339663 (accessed on 7 May 2021).

- Milman, O. Australia Records Biggest Emissions Drop in a Decade as Carbon Tax Kicks In; The Guardian: London, UK, 2014. [Google Scholar]

- Taylor, L. Australia Kills off Carbon Tax; The Guardian: London, UK, 2014. [Google Scholar]

- Joselow, M. National Carbon Tax Uphel14d by Canada’s Supreme Court. Scientific American. 2021. Available online: https://www.scientificamerican.com/article/national-carbon-tax-upheld-by-canadas-supreme-court/ (accessed on 6 May 2021).

- Hansen, P.G.; Jespersen, A.M. Nudge and the manipulation of choice: A framework for the responsible use of the nudge approach to behaviour change in public policy. Eur. J. Risk Regul. 2013, 4, 3–28. [Google Scholar] [CrossRef] [Green Version]

- Stratton, S. Nudge Theory Back in Fashion with Tories; The Guardian: London, UK, 2009. [Google Scholar]

- Rigby, S. COVID-19: “Nudges” Change Intentions but Not Behaviour—BBC Science Focus Magazine. Science Focus. 2020. Available online: https://www.sciencefocus.com/news/covid-19-psychological-nudges-change-intentions-but-not-behaviour/ (accessed on 14 January 2021).

- Yates, T. Why Is the Government Relying on Nudge Theory to Fight Coronavirus? The Guardian: London, UK,, 2020. [Google Scholar]

- Sodha, S. Nudge Theory Is a Poor Substitute for Hard Science in Matters of Life or Death; The Guardian: London, UK, 2020. [Google Scholar]

- Forrest, A. Coronavirus: Scientists Cast Doubt on Government ‘Nudge’ Messaging during Outbreak; The Independent: London, UK, 2020. [Google Scholar]

- Sibony, A.L. The UK COVID-19 response: A behavioural irony? Eur. J. Risk Regul. 2020, 11, 350–357. [Google Scholar] [CrossRef] [Green Version]

- Callan, T.; Lyons, S.; Scott, S.; Tol, R.S.J.; Verde, S. The distributional implications of a carbon tax in Ireland. Energy Policy 2009, 37, 407–412. [Google Scholar] [CrossRef] [Green Version]

- Al-Guthmy, F.M.O.; Yan, W. Mind the gap: Personal carbon trading for road transport in Kenya. Clim. Policy 2020, 20, 1141–1160. [Google Scholar] [CrossRef]

- Goodland, R. The concept of environmental sustainability. Annu. Rev. Ecol. Syst. 1995, 2, 1–24. [Google Scholar] [CrossRef]

- Sandberg, M.; Klockars, K.; Wilén, K. Green growth or degrowth? Assessing the normative justifications for environmental sustainability and economic growth through critical social theory. J. Clean. Prod. 2019, 206, 133–141. [Google Scholar] [CrossRef]

- Li, J.; Fan, J.; Zhao, D.; Wang, S. Allowance price and distributional effects under a personal carbon trading scheme. J. Clean. Prod. 2015, 103, 319–329. [Google Scholar] [CrossRef]

- Swain, F. Can Rationing Carbon Help Fight Climate Change? BBC Future. BBC. 2020. Available online: https://www.bbc.com/future/article/20200217-can-rationing-carbon-help-fight-climate-change (accessed on 3 May 2021).

- Uusitalo, V.; Huttunen, A. Motivating Citizens to Reduce Their Mobility Emissions through Personal Carbon Trading; European Union: Lahti, Finland, 2021. [Google Scholar]

- Satoh, I. IT-enabled personal-level carbon emission allowance. Procedia Comput. Sci. 2014, 32, 665–672. [Google Scholar] [CrossRef] [Green Version]

- California Environmental Protection Agency. California Cap and Trade Program Overview. 2015; pp. 1–2. Available online: www.Arb.caGov (accessed on 21 June 2021).

- Thomas, G.O.; Sautkina, E.; Poortinga, W.; Wolstenholme, E.; Whitmarsh, L. The English plastic bag charge changed behavior and increased support for other charges to reduce plastic waste. Front. Psychol. 2019, 10, 266. [Google Scholar] [CrossRef] [Green Version]

- Zheng, Z.; Liu, Z.; Liu, C.; Shiwakoti, N. Understanding public response to a congestion charge: A random-effects ordered logit approach. Transp. Res. Part A Policy Pract. 2014, 70, 117–134. [Google Scholar] [CrossRef] [Green Version]

- Preston, I.; White, V.; Thumim, J.; Bridgeman, T. Distribution of Household Carbon Emissions in the UK; Joseph Rowntree Foundation: York, UK, 2013. [Google Scholar]

- Hargreaves, K.; Preston, I.; White, V.; Thumim, J. The Distribution of Household CO2 Emissions in Great Britain; Joseph Rowntree Foundation: York, UK, 2013. [Google Scholar]

- Fremstad, A.; Paul, M. The impact of a carbon tax on inequality. Ecol. Econ. 2019, 163, 88–97. [Google Scholar] [CrossRef]

- DEFRA. Synthesis Report on the Findings from Defra’s Pre-Feasibility Study into Personal Carbon Trading; Department for Environment Food & Rural Affairs: London, UK, 2008; Volume 26.

- CAIT. CAIT Historical—Explore Historic Greenhouse Gas Emissions. Climate Data Explorer. 2021. Available online: http://cait.wri.org/historical/CountryGHGEmissions (accessed on 24 March 2021).

- Fleming, D.; Chamberlin, S. TEQs Tradable Energy Quotas A Policy Framework for Peak Oil and Climate Change; The All Party Parliamentary Group on Peak Oil & The Lean Economy Connection: London, UK, 2011.

- Starkey, R.; Anderson, K. Domestic Tradable Quotas: A Policy Instrument for the Reduction of Greenhouse Gas Emissions; Tyndall Centre for Climate Change Research: Norwich, UK, 2005. [Google Scholar]

| Model | Features | Shortcomings | Literature |

|---|---|---|---|

| Carbon Tax (Mandatory) |

|

| [7,10,11,12,13,14] |

| Personal Carbon Trading (Mandatory) |

|

| [14,15,16,17,18,19,20,21] |

| Personal Carbon Allowance With No Trading (Mandatory) |

|

| [7,18,19,20,21] |

| Carbon Labelling (Voluntary) |

|

| [22,23,24] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Brock, A.; Kemp, S.; Williams, I.D. Personal Carbon Budgets: A Pestle Review. Sustainability 2022, 14, 9238. https://doi.org/10.3390/su14159238

Brock A, Kemp S, Williams ID. Personal Carbon Budgets: A Pestle Review. Sustainability. 2022; 14(15):9238. https://doi.org/10.3390/su14159238

Chicago/Turabian StyleBrock, Alice, Simon Kemp, and Ian D. Williams. 2022. "Personal Carbon Budgets: A Pestle Review" Sustainability 14, no. 15: 9238. https://doi.org/10.3390/su14159238

APA StyleBrock, A., Kemp, S., & Williams, I. D. (2022). Personal Carbon Budgets: A Pestle Review. Sustainability, 14(15), 9238. https://doi.org/10.3390/su14159238