The Impact of Financial Development and Green Finance on Regional Energy Intensity: New Evidence from 30 Chinese Provinces

Abstract

1. Introduction

2. Literature Review

2.1. Literature Review of Studies Related to Financial Development and Regional Energy Intensity

2.2. Literature Review of Studies Related to Green Finance and Regional Energy Intensity

3. Theoretical Mechanism

3.1. Financial Development and Energy Intensity: “Preference Mismatches” and “Capital Market Distortions”

3.2. Green Finance and Regional Energy Intensity: Mitigation Effects

3.3. Financial Development, Green Finance, and Regional Energy Intensity: “Moderating Effects” and “Inverted U-Shaped Effects”

3.4. Spatial Effect: “Polarization Effect” and “Bottom-To-Bottom Extrusion”

4. Variable Selection, Data Sources, and Empirical Models

4.1. Variable Descriptions and Data Sources

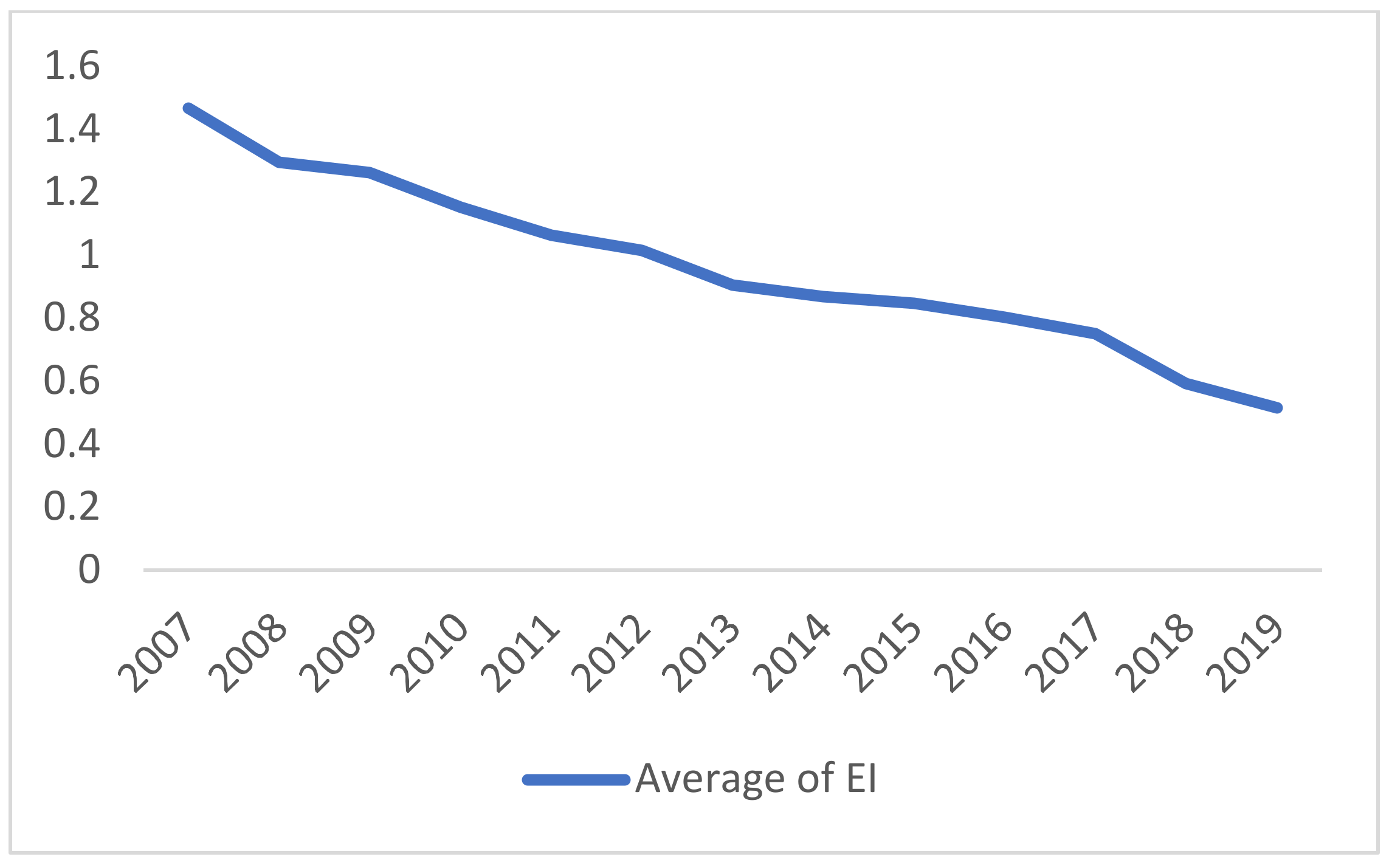

4.1.1. Descriptions and Source of Explained Variables

- (1)

- Energy intensity (EI).

4.1.2. Descriptions and Source of Explanatory Variables

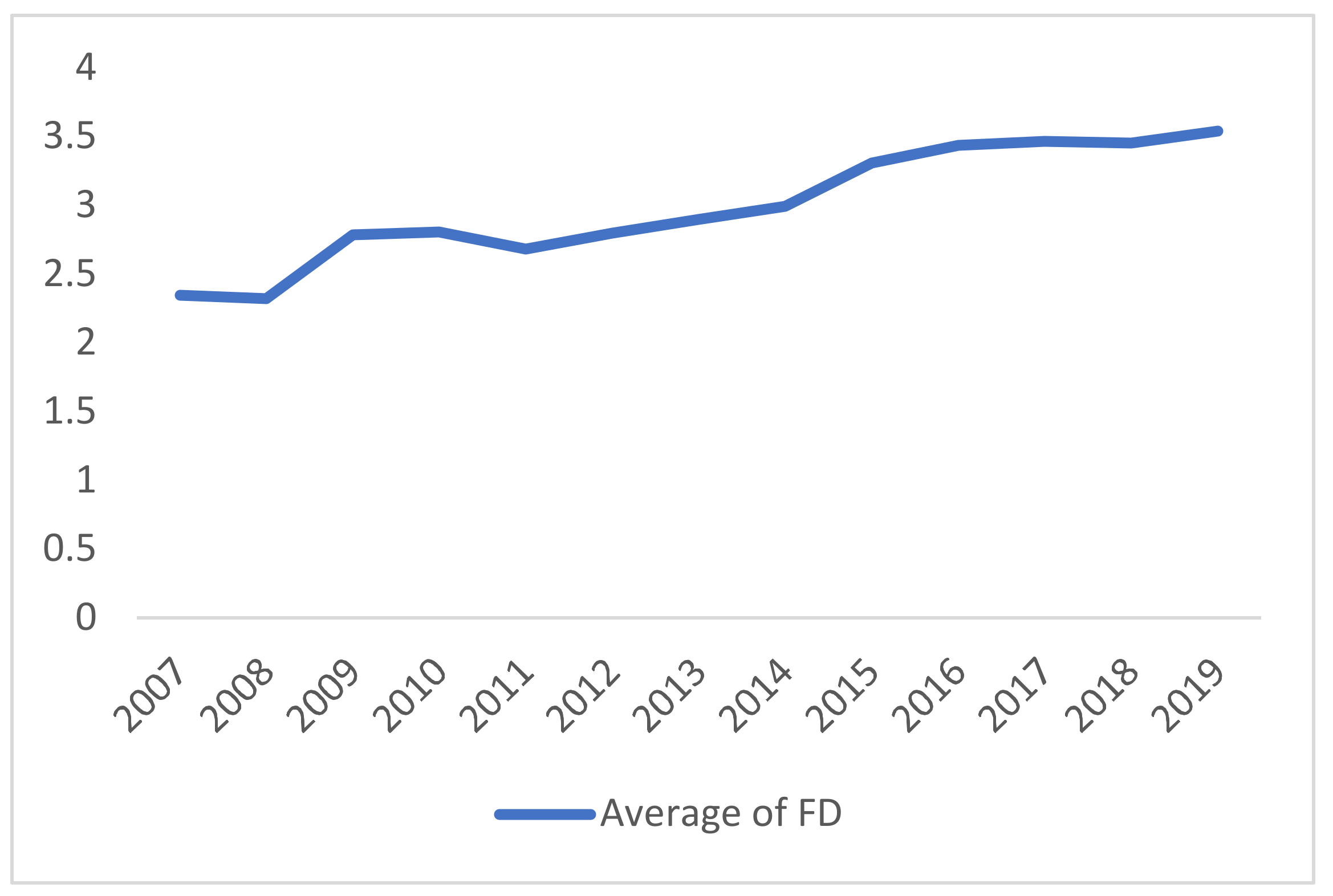

- (1)

- Financial Development Index (FD)

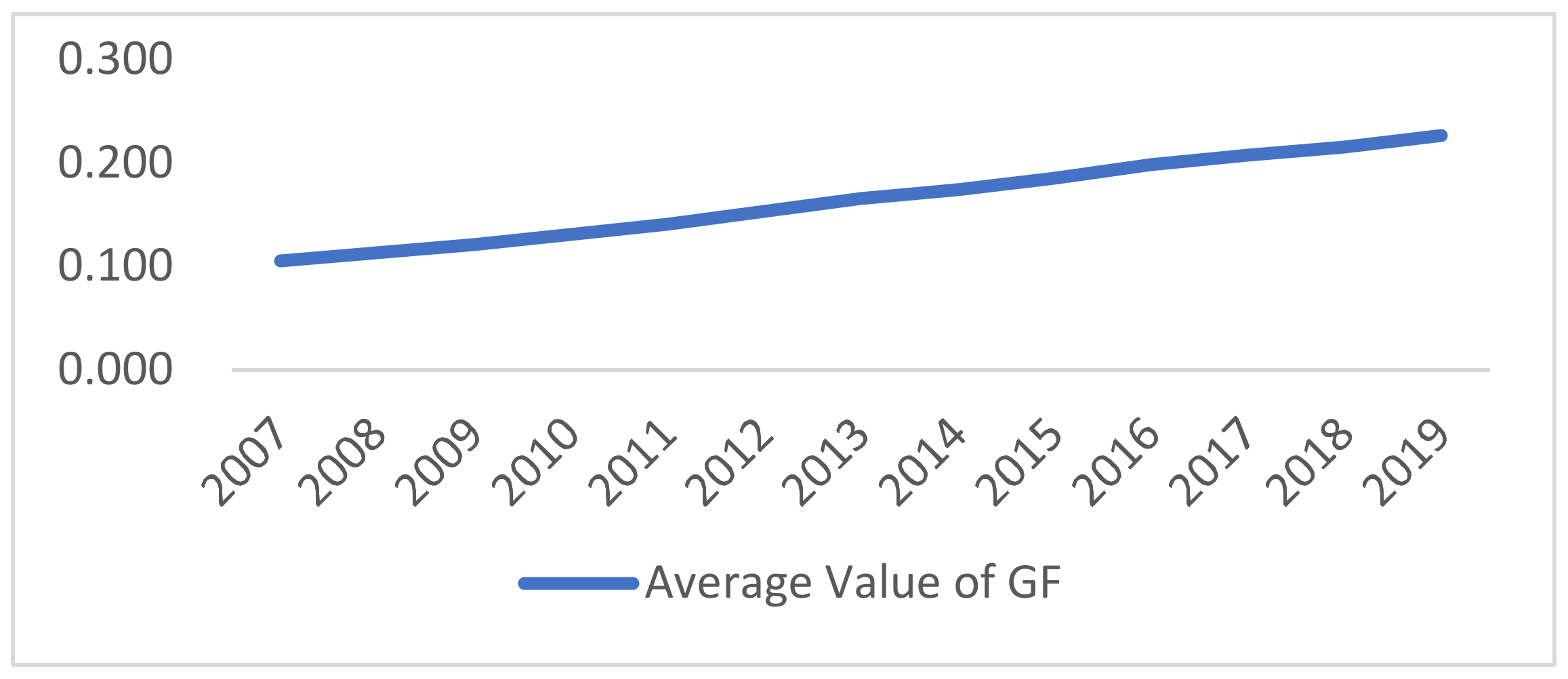

- (2)

- Green Financial Index (GF)

4.1.3. Descriptions and Source of Control Variable

- (1)

- Investment in Human Capital (HC)

- (2)

- Fiscal Transparency (FT)

- (3)

- Industrial SO2 emissions (SDE)

- (4)

- Fiscal Decentralization (FDA)

4.1.4. Spatial Weight Matrix

4.1.5. The Spatial Distribution of Core Variables

4.2. Empirical Models

4.2.1. Spatial Econometric Model Construction

4.2.2. Panel Threshold Model Construction

5. Empirical Results and Analysis

5.1. Spatial Econometric Model Analysis

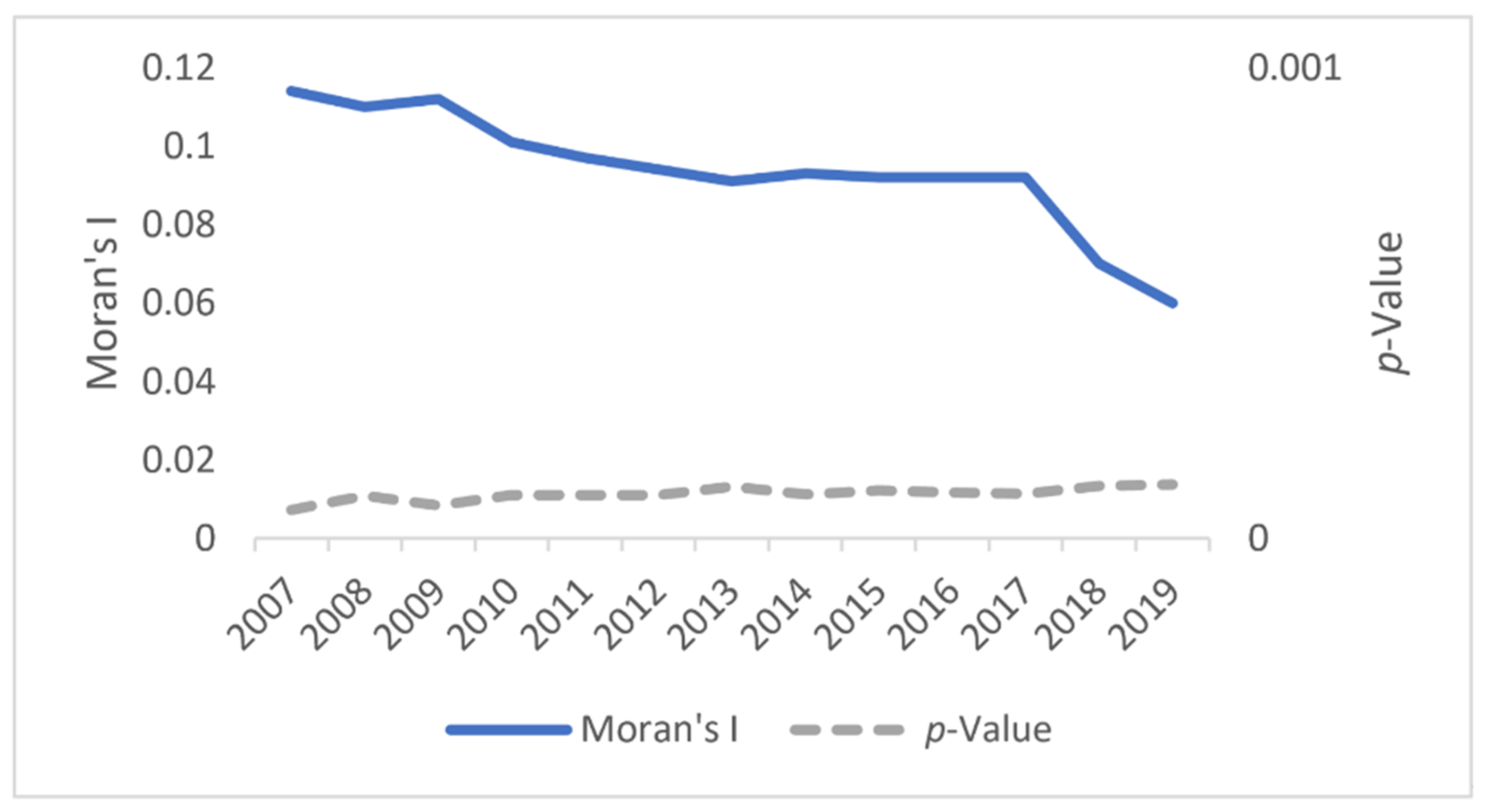

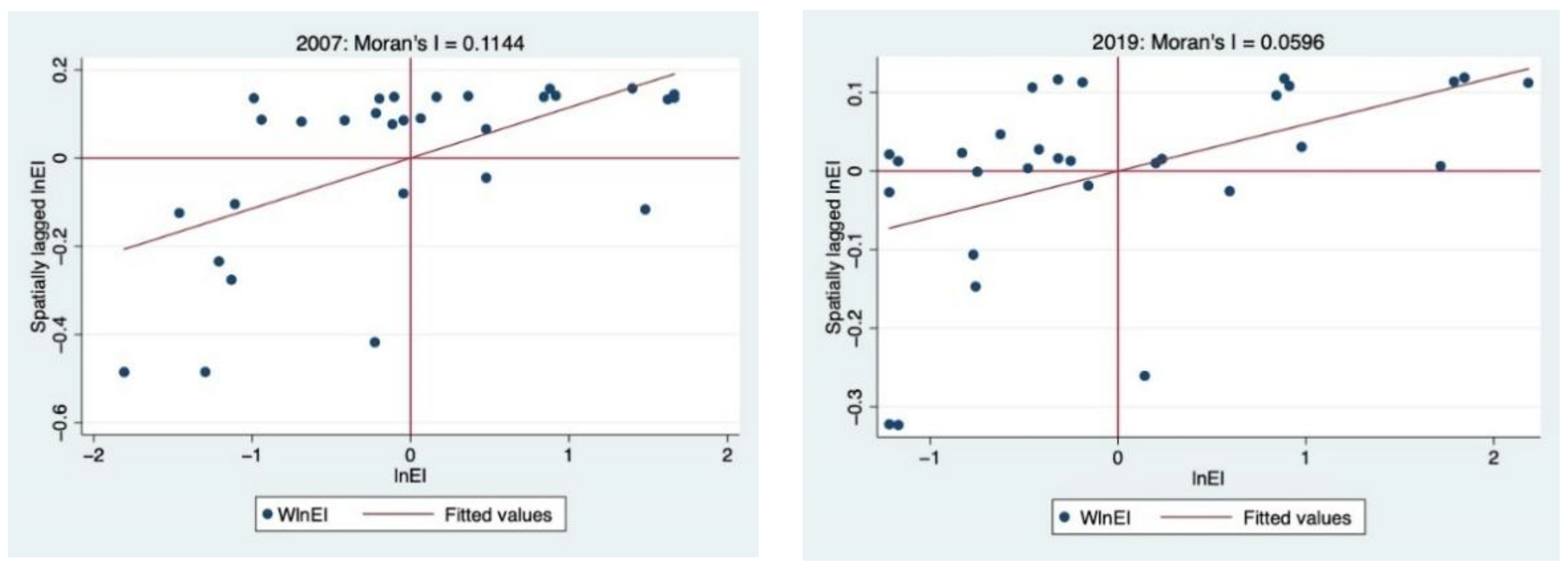

5.1.1. Spatial Global Moran Index Test

5.1.2. Model Selection and Testing

- (1)

- LM test

- (2)

- LR test

- (3)

- Wald test

- (4)

- Hausman test

5.1.3. Analysis of the Spatial Econometric Estimation Results

5.1.4. Extended Analysis

- (1)

- The parameter estimation of the spatial Durbin model in the mideastern provinces was basically the same as the estimation results under the full sample, but the spatial spillover effect coefficient of the financial development index of the mideastern provinces was significant at the level of 1%, and the value was −0.786. This result indicates that in the mideastern regions of China, based on the economic space weight matrix, the financial development of a province has a significant negative spatial conduction effect on the energy intensity of other provinces. The reason is the relatively high level of financial development in the mideastern regions, which has formed a clear spatial conduction path and mechanism. From the perspective of the direction of the coefficient, financial development mainly produces evasive competition effects from the perspective of regional competition in the mideastern regions. That is, through regional competition, the regional innovation level is improved and energy utilization efficiency is improved. The negative externalities generated by energy efficiency have a spatial effect consistent with the full sample on local high-tech industries and green technology industries.

- (2)

- The direction of the main effect coefficients in the western region was basically the same as the estimated results under the full sample, but the spatial autoregression of the explained variables in the western region was not significant, indicating that there was no significant spatial spillover effect in the western region. This is because, due to historical reasons and the limited level of economic development, the financial development level of the western region is lagging, financial transactions and factor flows are not active, and the economic exchanges between regions are not as active as those in the mideastern regions, so there is no intra-regional economic exchange, forming a spatial effect.

5.1.5. Robustness Test

- (1)

- Eliminate years that would cause interference

- (2)

- Exclude samples from special areas

- (3)

- Addition of possible left out variables

5.2. Panel Threshold Model Analysis

5.2.1. Threshold Effects Test and Determination of Thresholds

5.2.2. Analysis of Panel Threshold Regression Results

6. Conclusions and Policy Recommendations

6.1. Conclusions

6.2. Policy Recommendations

7. Possible Research Contributions and Shortcomings

7.1. Possible Research Contributions

- (1)

- Most of the existing studies argue that financial development can bring abundant funds for the R&D of enterprises. Thus, financial development can improve regional energy efficiently as a whole. This kind of view ignores the “preference mismatch” behavior of financial subjects caused by the oligopoly of Chinese state-owned commercial banks in the financial market and thus underestimates the distortion of financial development in regional energy efficiency.

- (2)

- Most of the existing studies state that green finance can improve the environment and promote economic development in the direction of high quality, which has a positive effect on regional ecological environment improvement and energy intensity mitigation. This view ignores the fact that green finance does not adequately correct the distortion of regional energy efficiency at the early stage of development due to the existing problems and thus ignores the fact that the impact of green finance on energy intensity is actually non-linear.

- (3)

- The two economic factors of financial development and green finance can actually be regarded as “growth and ecology” issues in the financial field. However, few studies have included financial development, green finance, and regional energy intensity in a unified research framework for analysis, and there are gaps in the study of their underlying mechanisms and related findings.

- (1)

- Reviewing the relationship between regional financial development and regional energy intensity from the perspectives of “preference mismatch” and “capital market distortion,” it is concluded through empirical analysis that under the Chinese system, financial development reinforces regional energy intensity.

- (2)

- The spatial effect of green finance formation has been analyzed and verified through the spatial Durbin model. Existing studies have proved that green finance has mechanisms to mitigate regional energy intensity. On this basis, this paper further proves that green finance in China has a significant spatially reinforcing effect on energy intensity under the distortion of “zero-sum games” and disorderly competition between provinces and regions.

- (3)

- For the first time, financial development, green finance, and regional energy intensity are analyzed in a unified research framework. Through a panel threshold model, this paper investigates the joint mechanism of green finance and financial development with respect to regional energy intensity. It is found that the effect of financial development on regional energy intensity shows an inverted U-shape under the threshold effect of green finance. In addition, this paper also finds that the phenomena of “green washing” and “green bleaching” exist in the early development of green finance, which cannot correct the distortion factors in the process of regional financial development, breaking through the existing research.

- (4)

- Through sub-sample regression and sub-region parameter estimation, it was determined that there are significant differences in financial and green financial development processes between the mideastern regions and the western regions of China. The research provides a reference for policy recommendations for each region, tailored to the local context.

- (5)

- On the basis of mechanism analysis and empirical analysis, policy recommendations are proposed for properly guiding financial development and green finance to jointly promote regional energy efficiency improvement and effectively mitigate regional energy intensity. These recommendations provide relevant references for the government to make decisions at the levels of the marketization process, industrial policy guidance, regional coordination, and localized development.

7.2. Possible Research Shortcomings

- (1)

- In terms of regional panel data selection, this paper uses panel data at the provincial level for macro-regional analysis but not at the level of smaller administrative divisions. Since there are a lot of missing data at the prefecture and district levels in China, this data selection is based on data availability. However, this is at fault since it does not provide a thorough examination of the mechanisms relating to financial development, green financing, and energy intensity in China at the prefecture and district levels. On this issue, we consider the use of substitution proxy variables, text analysis, and data mining to address the missing data issue and obtain more detailed analysis results.

- (2)

- In this paper, the relationship between financial development, green finance, and regional energy intensity is examined at a macro level, but in reality, corporations are the primary consumers of energy, and changes in business groups’ energy consumption patterns are directly related to variations in regional energy intensity. We therefore consider obtaining and measuring relevant data from enterprises to fully investigate the mechanisms of financial development, green finance, and energy intensity at the micro level.

- (3)

- Through the use of some findings from related studies, this paper’s mechanism and hypothesis are inferred, which has some persuasive power. In the future, we plan to use rigorous mathematical logic and combine game theory, complex network theory, and other theories to analyze the specific mechanism of the research object in this paper, so as to strengthen mechanism analysis in mathematical language, making mechanism analysis more convincing.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Mardani, A.; Streimikiene, D.; Cavallaro, F. Carbon dioxide (CO2) emissions and economic growth: A systematic review of two decades of research from 1995 to 2017. Sci. Total. Environ. 2019, 649, 31–49. [Google Scholar] [CrossRef] [PubMed]

- Ren, S.; Hao, Y.; Wu, H. The role of outward foreign direct investment (OFDI) on green total factor energy efficiency: Does institutional quality matters? Evidence from China. Resour. Policy 2022, 76, 102–114. [Google Scholar] [CrossRef]

- Yang, S.; Su, X.; Ran, Q. Assessing the impact of energy internet and energy misallocation on carbon emissions: New insights from China. Environ. Sci. Pollut. Res. 2021, 29, 23436–23460. [Google Scholar] [CrossRef] [PubMed]

- Li, B.; Wu, J.; Chen, S. Urbanization, industrialization, informatization, and energy intensity in China. Chin. Popul. Resour. Environ. 2015, 25, 69–76. [Google Scholar]

- Chang, M. Energy intensity, target level of energy intensity, and room for improvement in energy intensity: An application to the study of regions in the EU. Energ. Policy 2014, 67, 648–655. [Google Scholar] [CrossRef]

- Jiang, X.; Duan, Y.; Green, C. Regional disparity in energy intensity of China and the role of industrial and export structure. Resour. Conserv. Recycl. 2017, 120, 209–218. [Google Scholar] [CrossRef]

- Ana, F.; Manuel, D.; Jorge De, B.; Ricardo, M. Relating carbon and energy intensity of best-performing retailers with policy, strategy, and building practice. Energy Effic. 2020, 13, 597–619. [Google Scholar]

- Hamidi, S.; Benabdeljlil, N. Managerial and technological innovations: Any relationship? Procedia-Soc. Behav. Sci. 2015, 181, 286–292. [Google Scholar] [CrossRef][Green Version]

- Yang, X. Spatial effects of financial scale and financial structure on technological innovation of enterprises. In Proceedings of the 2019 4th International Conference on Financial Innovation and Economic Development, Sanya, China, 4 February 2019. [Google Scholar]

- Ren, S.; Hao, Y.; Wu, H. How does green investment affect environmental pollution? Evidence from China. Environ. Resour. Econ. 2022, 81, 25–51. [Google Scholar] [CrossRef]

- Park, K. Testing for competition in the South Korean and Chinese commercial banking markets. Asia-Pac. J. Financ. Stud. 2013, 42, 56–75. [Google Scholar] [CrossRef]

- Zhou, X.; Pei, Z.; Qin, B. Assessing market competition in the Chinese banking industry based on a conjectural variation model. China World Econ. 2021, 29, 73–98. [Google Scholar] [CrossRef]

- Treado, C. Pittsburgh’s evolving steel legacy and the steel technology cluster. Camb. J. Reg. Econ. Soc. 2010, 3, 105–120. [Google Scholar] [CrossRef]

- Islam, F.; Shahbaz, M.; Ahmed, A. Financial development and energy consumption nexus in Malaysia: A multivariate time series analysis. Econ. Model. 2013, 30, 435–441. [Google Scholar] [CrossRef]

- Mahalik, M.; Babu, M.; Loganathan, N. Does financial development intensify energy consumption in Saudi Arabia? Renew. Sustain. Energy Rev. 2017, 75, 1022–1034. [Google Scholar] [CrossRef]

- Salahuddin, M.; Gow, J.; Ozturk, I. Is the long-run relationship between economic growth, electricity consumption, carbon dioxide emissions and financial development in Gulf Cooperation Council Countries robust? Renew. Sustain. Energy Rev. 2015, 51, 317–326. [Google Scholar] [CrossRef]

- Dogan, E.; Seker, F. The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew. Sustain. Energy Rev. 2016, 60, 1074–1085. [Google Scholar] [CrossRef]

- Shahbazet, M.; Solarin, S.; Mahmood, H.; Arouri, M. Does financial development reduce CO2 emissions in the Malaysian economy? A Time Series Analysis. Econ. Model. 2013, 35, 145–152. [Google Scholar] [CrossRef]

- Tamazian, A.; Chousa, J.; Vadlamannati, K. Does higher economic and financial development lead to environmental degradation? Evidence from BRIC countries. Energy Policy 2009, 37, 246–253. [Google Scholar] [CrossRef]

- Sun, P.; Wang, Y.; Cen, Y. Does financial development affect the structure of energy consumption? A cross-country empirical analysis. Nankai Econ. Res. 2011, 2, 28–41. [Google Scholar]

- Kong, Y.; Wei, F. Financial development, financial structure and carbon emission. Environ. Eng. Manag. J. 2017, 16, 1609–1622. [Google Scholar]

- Xiang, X.; Yang, G.; Sun, H. The impact of the digital economy on low-carbon, inclusive growth: Promoting or restraining. Sustainability 2022, 14, 7187. [Google Scholar] [CrossRef]

- Lagoardesegot, T. Sustainable finance. A critical realist perspective. Res. Int. Bus. Financ. 2019, 47, 1–9. [Google Scholar] [CrossRef]

- Wang, C.; Dong, G. Research on green financial ecology construction based on low carbon economy. Ekoloji 2019, 28, 3635–3641. [Google Scholar]

- Weber, W.; Domazlicky, B. Does environmental protection lead to slower productivity growth in the chemical industry. Environ. Resour. Econ. 2004, 28, 301–324. [Google Scholar]

- Zhang, K.; Chen, H.; Tang, L. Green finance, innovation and the energy-environment-climate nexus. Front. Environ. Sci. 2022, 10, 87–99. [Google Scholar] [CrossRef]

- Yu, C.; Wu, X.; Zhang, D. Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 2021, 153, 112–125. [Google Scholar] [CrossRef]

- He, L.; Gan, S.; Zhong, T. The impact of green credit policy on firms’ green strategy choices: Green innovation or green-washing? Environ. Sci. Pollut. Res. 2022, 10, 107–116. [Google Scholar] [CrossRef]

- Yu, J.; Fu, J. Credit rationing, innovation, and productivity: Evidence from small and medium-sized enterprises in China. Econ. Model. 2021, 97, 220–230. [Google Scholar] [CrossRef]

- Parekh, N.; Attuel, L. Social entrepreneurship finance: The gaps in an innovative discipline. Int. J. Entrep. Behav. Res. 2021, 28, 135–155. [Google Scholar] [CrossRef]

- Chava, S.; Nanda, V.; Xiao, S. Lending to innovative firms. Rev. Corp. Financ. Stud. 2017, 6, 234–289. [Google Scholar] [CrossRef]

- Feng, G.; Serletis, A. Undesirable outputs and a primal Divisia productivity index based on the directional output distance function. J. Econom. 2014, 183, 135–146. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Fatih, K.; Yasser, Y. Is technological change biased toward energy? A multi-sectoral analysis for the French economy. Energy Policy 2009, 38, 1842–1850. [Google Scholar]

- Stigler, G. Monopoly and oligopoly by merger. Am. Econ. Rev. 2009, 5, 23–34. [Google Scholar]

- Haltiwanger, J.; Harrington, J. The impact of cyclical demand movements on collusive behaviour. Rand. J. Econ. 2010, 22, 89–106. [Google Scholar] [CrossRef]

- Dong, M.; Stella, H.; Sun, H.; Zhou, C. A macroeconomic theory of banking oligopoly. Eur. Econ. Rev. 2020, 138, 103–126. [Google Scholar] [CrossRef]

- Hu, K.; Shi, D. The impact of government-enterprise collusion on environmental pollution in China. J. Environ. Manag. 2021, 292, 112–119. [Google Scholar] [CrossRef]

- Lee, J. Green finance and sustainable development goals: The case of China. J. Asian Financ. Econ. 2020, 7, 577–586. [Google Scholar] [CrossRef]

- Palencia, J.; Furubayashi, T.; Toshihiko, N. Analysis of CO2 emissions reduction potential in secondary production and semi fabrication of non-ferrous metals. Energy Policy 2013, 52, 328–341. [Google Scholar] [CrossRef]

- Sheinbaum, C.; Ruiz, B.; Ozawa, L. Energy consumption and related CO2 emissions in five Latin American countries: Changes from 1990 to 2006 and perspectives. Energy Policy 2011, 36, 3629–3638. [Google Scholar] [CrossRef]

- Steckel, J.; Jakob, M. The role of financing cost and de-risking strategies for clean energy investment. Int. Econ. 2018, 155, 19–28. [Google Scholar] [CrossRef]

- Tao, H.; Zhuang, S.; Xue, R.; Cao, W.; Tian, J.; Shan, Y. Environmental finance: An interdisciplinary review. Technol. Forecast. Soc. 2022, 179, 121–149. [Google Scholar] [CrossRef]

- Climent, F.; Soriano, P. Green and good? The investment performance of US environmental mutual funds. J. Bus. Ethics. 2011, 103, 275–287. [Google Scholar] [CrossRef]

- Sinha, A.; Mishra, S.; Sharif, A.; Yarovaya, L. Does green financing help to improve environmental & social responsibility? Designing SDG framework through advanced quantile modeling. J. Environ. Manag. 2021, 292, 112–123. [Google Scholar]

- Tu, Q.; Mo, J.; Liu, Z.; Gong, C.; Fan, Y. Using green finance to counteract the adverse effects of COVID-19 pandemic on renewable energy investment-The case of offshore wind power in China. Energy Policy 2021, 158, 123–136. [Google Scholar] [CrossRef]

- Zheng, G.; Siddik, A.; Masukujjaman, M.; Fatema, N. Factors affecting the sustainability performance of financial institutions in Bangladesh: The role of green finance. Sustainability 2021, 13, 10165. [Google Scholar] [CrossRef]

- Arif, A.; Hieu, V.; Ma, C.; Leow, W.; Md, I.; Gniewko, N. Natural resources commodity prices volatility and economic performance: Evaluating the role of green finance. Resour. Policy 2022, 76, 102–143. [Google Scholar] [CrossRef]

- Leiter, M.; Parolini, A.; Winner, H. Environmental regulation and investment: Evidence from European industry data. Ecol. Econ. 2011, 70, 759–770. [Google Scholar] [CrossRef]

- Sun, Z.; Zhang, W. Do government regulations prevent greenwashing? An evolutionary game analysis of heterogeneous enterprises. J. Clean. Prod. 2019, 231, 1489–1502. [Google Scholar] [CrossRef]

- Orman, C. Organization of innovation and capital markets. N. Am. J. Econ. Financ. 2015, 33, 94–114. [Google Scholar] [CrossRef][Green Version]

- Zhu, N.; Bu, Y.; Jin, M.; Mbroh, N. Green financial behavior and green development strategy of Chinese power companies in the context of carbon tax. J. Clean. Prod. 2020, 245, 118–127. [Google Scholar] [CrossRef]

- Campbell, J. A note on the notion of growth pole. Growth. Chang. 2006, 5, 43–45. [Google Scholar] [CrossRef]

- Ozkaya, A. R&D team’s competencies, innovation, and growth with knowledge information flow. IEEE Trans. Eng. Manag. 2010, 57, 416–429. [Google Scholar]

- Theophile, T.; Dienei, M. Polarization patterns in economic development and innovation. Struct. Chang. Econ. Dyn. 2012, 23, 421–436. [Google Scholar]

- Hu, D.; Qiu, L.; She, M.; Wang, Y. Sustaining the Sustainable Development: How do Firms Turn Government Green Subsidies into Financial Performance Through Green Innovation? Bus. Strategy Environ. 2021, 30, 2271–2292. [Google Scholar] [CrossRef]

- Jayaram, R.; Singh, S. Sustainable finance: A systematic review. Int. J. Indian Cult. Bus. Manag. 2020, 1, 317–399. [Google Scholar] [CrossRef]

- Falcone, P. Environmental regulation and green investments: The role of green finance. Int. J. Green Econ. 2020, 14, 159–173. [Google Scholar] [CrossRef]

- Han, C.; Gu, Z.; Yang, H. Investigate the effects of industrial agglomeration on nitrogen dioxide pollution using spatial panel Durbin and panel threshold models. Front. Environ. Sci. 2022, 10, 338–347. [Google Scholar] [CrossRef]

- Yue, Y.; Tian, L.; Yue, Q. Spatiotemporal variations in energy consumption and their influencing factors in China based on the integration of the DMSP-OLS and NPP-VIIRS nighttime light datasets. Remote Sens. 2020, 12, 1151. [Google Scholar] [CrossRef]

- Zhang, J.; Wang, J.; Yang, X.; Ren, S.; Ran, Q.; Hao, Y. Does local government competition aggravate haze pollution? A new perspective of factor market distortion. Socio-Econ. Plan. Sci. 2021, 76, 119–126. [Google Scholar] [CrossRef]

- Liu, H.; Song, Y. Financial development and carbon emissions in China since the recent world financial crisis: Evidence from a spatial-temporal analysis and a spatial Durbin model. Sci. Total Environ. 2020, 715, 136–145. [Google Scholar] [CrossRef]

- Zhang, H.; Ke, H. Spatial spillover effects of directed technical change on urban carbon intensity, based on 283 cities in China from 2008 to 2019. Int. J. Environ. Res. Public Health 2022, 19, 1679. [Google Scholar] [CrossRef]

- Liu, J.; Li, X.; Zhong, S. Does innovation efficiency promote energy consumption intensity? New evidence from China. Energy Rep. 2022, 8, 426–436. [Google Scholar] [CrossRef]

- Tajudeen, I.; Wossink, A. The underlying trend of OPEC energy intensity and the environmental implications. OPEC Eng. Rev. 2020, 44, 63–65. [Google Scholar] [CrossRef]

- Bai, J.; Lu, J. Research on the mechanism of fiscal decentralization’s impact on environmental pollution. J. Polit. Econ. 2017, 10, 37–56. [Google Scholar]

- Anselin, L.; Rey, S. Properties of tests for spatial dependence in linear regression. Geogr. Anal. 1991, 23, 112–131. [Google Scholar] [CrossRef]

- Anselin, L. Lagrange multiplier test diagnostics for spatial dependence and spatial heterogeneity. Geogr. Anal. 1988, 20, 1–17. [Google Scholar] [CrossRef]

- Le, S.; Pace, R. Introduction to spatial econometrics. J. Reg. Sci. 2010, 5, 1014–1015. [Google Scholar]

- Hansen, B. Threshold effects in non-dynamic panels: Estimation, testing, and inference. J. Econom. 1999, 10, 101–117. [Google Scholar] [CrossRef]

- Long, X.; Zhu, Y.; Cai, W.; Li, S. An empirical analysis of tax competition among county governments in China based on the spatial econometric model. Econ. Res. 2014, 49, 41–53. [Google Scholar]

- Moran, P. Notes on continuous stochastic phenomena. Biometrika 1950, 37, 17–23. [Google Scholar] [CrossRef]

- Elhorst, J. Matlab software for spatial panels. Int. Regional Sci. Rev. 2014, 37, 389–405. [Google Scholar] [CrossRef]

- Burridge, P. On the Cliff-Ord test for spatial autocorrelation. J. R. Stat. Soc. B 1980, 42, 107–108. [Google Scholar]

- Bera, A.; Yoon, M. Specification testing with locally misspecified alternatives. Econ. Theory 1993, 9, 649–658. [Google Scholar] [CrossRef]

- Anselin, L.; Bera, A.K.; Florax, R.; Mann, J.Y. Simple diagnostic tests for spatial dependence. Reg. Sci. Urban Econom. 1996, 26, 77–104. [Google Scholar] [CrossRef]

- Anselin, L. A Companion to Theoretical Econometrics; Blackwell Publishing Ltd: Malden, MA, USA, 2001; pp. 310–330. [Google Scholar]

- Agresti, A. Categorical Data Analysis; John Wiley and Son: New York, NY, USA, 1990. [Google Scholar]

- Polit, D. Data Analysis and Statistics for Nursing Research; Appleton & Lange: Stamford, CT, USA, 1996. [Google Scholar]

- Hausman, J. Specification tests in econometrics. Econometrica 1978, 46, 1251–1271. [Google Scholar] [CrossRef]

- Pace, R.; Le, S. A spatial Hausman test. Econ. Lett. 2008, 101, 282–284. [Google Scholar] [CrossRef]

- Li, Q. The view of technological innovation in coal industry under the vision of carbon neutralization. Int. J. Coal Sci. Technol. 2021, 8, 1197–1207. [Google Scholar] [CrossRef]

| Level I Indicators | Characterization Indicators | Description of Indicators | Indicator Attributes |

|---|---|---|---|

| Green Credit | Percentage of interest expenses in high energy-consuming industries | Interest expenses of the six most energy-intensive industries/total industrial interest expenses | − |

| Green Investment | Investment in environmental pollution control as a share of GDP | Investment in environmental pollution control/GDP | + |

| Green Insurance | Investment in environmental pollution control as a share of GDP | Agricultural insurance income/Gross agricultural output | + |

| Government Support | Percentage of fiscal environmental protection expenditure | Financial environmental protection expenditure/Financial general budget expenditure | − |

| Variable | Connotation | Average Value | Variance (Statistic) | Minimum | Largest |

|---|---|---|---|---|---|

| EI | Energy Intensity | 0.962 | 0.560 | 0.206 | 2.674 |

| a | Financial Development Index | 2.985 | 1.135 | 1.288 | 8.131 |

| GF | Green Financial Index | 0.165 | 0.101 | 0.056 | 0.793 |

| FDA | Financial Decentralization | 0.508 | 0.194 | 0.148 | 0.951 |

| HC | Investment in Human Capital | 0.053 | 0.014 | 0.020 | 0.086 |

| FT | Financial Transparency | 33.793 | 18.495 | 1.12 | 109.7 |

| SDE | Industrial SO2 Emissions (tonnes) | 600,520.1 | 411,132.5 | 2800 | 1,800,000 |

| Brochure | N = 390 | ||||

| Age | 2007–2019 | ||||

| Test Items | Test Value | p-Value |

|---|---|---|

| LM test no spatial lag | 168.459 *** | 0.000 |

| Robust LM test no spatial lag | 37.250 *** | 0.000 |

| LM test no spatial error | 171.632 *** | 0.000 |

| Robust LM test no spatial error | 40.423 *** | 0.000 |

| Hausman test | 17.30 *** | 0.0040 |

| LR test for Time | 566.15 *** | 0.0000 |

| LR test for Ind | 48.76 *** | 0.0000 |

| Wald test for SAR | 8.67 ** | 0.0131 |

| Wald test for SEM | 8.91 ** | 0.0116 |

| LR test for SAR | 28.79 *** | 0.0000 |

| LR test for SEM | 29.90 *** | 0.0000 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| lnEI | lnEI | lnEI | lnEI | lnEI | |

| FD | 0.114 *** | 0.101 *** | 0.101 *** | 0.103 *** | 0.0985 *** |

| (3.63) | (3.34) | (3.33) | (3.38) | (3.22) | |

| GF | −1.115 *** | −0.832 ** | −0.844 ** | −0.824 ** | −0.962 *** |

| (−3.07) | (−2.38) | (−2.42) | (−2.36) | (−2.74) | |

| SDE | 0.000000326 *** | 0.000000318 *** | 0.000000325 *** | 0.000000332 *** | |

| (5.55) | (5.36) | (5.44) | (5.60) | ||

| FT | −0.000605 | −0.000555 | −0.000584 | ||

| (−1.00) | (−0.91) | (−0.97) | |||

| HC | 1.811 | 2.225 | |||

| (1.09) | (1.34) | ||||

| FDA | −0.610 ** | ||||

| (−2.33) | |||||

| W × FD | −0.102 | 0.0346 | 0.0558 | 0.0242 | −0.161 |

| (−0.31) | (0.11) | (0.18) | (0.08) | (−0.48) | |

| W × GF | 3.411 *** | 2.784 ** | 3.557 ** | 3.425 ** | 7.425 *** |

| (2.62) | (2.23) | (2.45) | (2.35) | (2.94) | |

| W × SDE | 0.00000293 *** | 0.00000308 *** | −0.00000306 *** | −0.00000387 *** | |

| (−4.95) | (−4.93) | (−4.76) | (−4.75) | ||

| W × FT | 0.00918 | 0.00992 | 0.0124 | ||

| (1.14) | (1.17) | (1.46) | |||

| W × HC | −13.15 | −16.60 | |||

| (−0.61) | (−0.77) | ||||

| W × FDA | 7.354 ** | ||||

| (2.15) | |||||

| Time fixed effect | control | control | control | control | control |

| Area fixed effect | control | control | control | control | control |

| Spatial | |||||

| rho | −0.694 * | −0.700 * | −0.706 * | −0.724 * | −0.739 ** |

| (−1.90) | (−1.90) | (−1.91) | (−1.94) | (−1.97) | |

| N | 390 | 390 | 390 | 390 | 390 |

| R2 | 0.040 | 0.193 | 0.232 | 0.243 | 0.273 |

| Mideastern Provinces | Western Provinces | |

|---|---|---|

| lnEI | lnEI | |

| FD | 0.0992 *** | 0.215 *** |

| (3.05) | (2.71) | |

| GF | −0.802 *** | −6.791 ** |

| (−2.68) | (−2.27) | |

| SDE | 0.000000110 * | 0.000000831 *** |

| (1.83) | (4.13) | |

| FT | −0.0000302 | −0.00344 * |

| (−0.05) | (−1.90) | |

| HC | 5.407 *** | −2.126 |

| (3.09) | (−0.51) | |

| FDA | −0.706 *** | 0.115 |

| (−2.95) | (0.11) | |

| W × FD | −0.786 *** | −0.861 |

| (−3.34) | (−1.04) | |

| W × GF | 5.316 *** | 44.44 |

| (2.75) | (1.31) | |

| W × SDE | −0.00000278 *** | −0.00000467 *** |

| (−4.15) | (−2.85) | |

| W × FT | −0.0226 *** | 0.0395 ** |

| (−3.00) | (2.16) | |

| W × HC | −68.45 *** | −37.55 |

| (−2.98) | (−0.79) | |

| W × FDA | 7.961 *** | 2.781 |

| (3.35) | (0.29) | |

| Time fixed effect | control | control |

| Area fixed effect | control | control |

| Spatial | ||

| rho | −4.026 *** | −0.516 |

| (−4.64) | (−1.28) | |

| N | 260 | 130 |

| R2 | 0.149 | 0.221 |

| Variable | Parameter Estimates | t-Statistic |

|---|---|---|

| FD | 0.0885 *** | 2.75 |

| FM | −0.891 ** | −2.30 |

| SDE | 0.000000320 *** | 4.96 |

| FT | −0.000747 | −1.13 |

| HC | 1.943 | 1.05 |

| FDA | −0.577 ** | −2.11 |

| W × FD | 0.0784 | 0.21 |

| W × FM | 7.709 *** | 2.89 |

| W × SDE | −0.00000389 *** | −4.60 |

| W × FT | 0.00908 | 0.96 |

| W × HC | −0.908 | −0.04 |

| W × FDA | 7.500 ** | 2.09 |

| Time fixed effect | control | control |

| Area fixed effect | control | control |

| Spatial | ||

| rho | −0.732 * | −1.88 |

| N | 360 | |

| R2 | 0.253 | |

| Variable | Parameter Estimates | t-Statistic |

|---|---|---|

| FD | 0.134 *** | 3.66 |

| FM | −1.450 ** | −2.20 |

| SDE | 0.000000298 *** | 4.66 |

| FT | −0.000569 | −0.86 |

| HC | 2.851 | 1.62 |

| FDA | −0.711 ** | −2.45 |

| W × FD | −0.0523 | −0.08 |

| W × FM | 22.51 *** | 2.91 |

| W × SDE | −0.00000308 *** | −2.68 |

| W × FT | 0.0208 * | 1.95 |

| W × HC | −14.40 | −0.49 |

| W × FDA | 13.88 *** | 3.16 |

| Time fixed effect | control | control |

| Area fixed effect | control | control |

| Spatial | ||

| rho | −0.736 * | −1.79 |

| N | 338 | |

| R2 | 0.226 | |

| Variable | Parameter Estimates | t-Statistic |

|---|---|---|

| FD | 0.0748 ** | 2.45 |

| GF | −0.803 ** | −2.29 |

| SDE | 0.000000282 *** | 4.67 |

| FT | −0.000615 | −1.03 |

| HC | 1.263 | 0.78 |

| FDA | −0.627 ** | −2.45 |

| Label | −0.0000332 | −0.54 |

| GS | 0.0567 | 0.49 |

| PD | −0.0000187 | −1.07 |

| Forest | −0.0101 * | −1.87 |

| W × FD | −0.0753 | −0.21 |

| W × GF | 5.557 * | 1.81 |

| W × SDE | −0.00000237 ** | −2.46 |

| W × FT | 0.0246 ** | 2.45 |

| W × HC | 7.147 | 0.30 |

| W × FDA | 10.41 *** | 3.03 |

| W × Label | 0.00460 *** | 4.88 |

| W × GS | 2.386 | 0.98 |

| W × PD | 0.000234 | 0.68 |

| W × Forest | −0.0112 | −0.18 |

| Time fixed effect | control | control |

| Area fixed effect | control | control |

| Spatial | ||

| rho | −1.218 *** | −2.64 |

| N | 390 | |

| R2 | 0.109 | |

| Threshold Variables | Threshold Sequence | Threshold Value | p-Value | 95% Confidence Interval | Number of BS | Seed Value |

|---|---|---|---|---|---|---|

| FDA | single threshold | 0.0910 *** | 0.0033 | [0.0895, 0.0920] | 300 | 101 |

| double threshold | 0.1340 *** | 0.0000 | [0.1320, 0.1350] | 300 | 101 | |

| Three thresholds | 0.2000 | 0.9367 | [0.1895, 0.2010] | 300 | 101 |

| Variable | Parameter Estimates | t-Statistic |

|---|---|---|

| SDE | 0.000000372 *** | 3.12 |

| FT | −0.00461 *** | −4.15 |

| HC | 7.891 ** | 2.25 |

| FDA | 0.654 * | 1.72 |

| FD (GF ≤ 0.0910) | 0.121 ** | 2.56 |

| FD (0.0910 < GF ≤ 0.1340) | 0.00611 | 0.15 |

| FD (GF > 0.1340) | −0.0847 * | −1.77 |

| _cons | −0.919 ** | −2.56 |

| N | 390 | |

| R2 | 0.743 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lv, K.; Yu, S.; Fu, D.; Wang, J.; Wang, C.; Pan, J. The Impact of Financial Development and Green Finance on Regional Energy Intensity: New Evidence from 30 Chinese Provinces. Sustainability 2022, 14, 9207. https://doi.org/10.3390/su14159207

Lv K, Yu S, Fu D, Wang J, Wang C, Pan J. The Impact of Financial Development and Green Finance on Regional Energy Intensity: New Evidence from 30 Chinese Provinces. Sustainability. 2022; 14(15):9207. https://doi.org/10.3390/su14159207

Chicago/Turabian StyleLv, Kun, Shurong Yu, Dian Fu, Jingwen Wang, Chencheng Wang, and Junbai Pan. 2022. "The Impact of Financial Development and Green Finance on Regional Energy Intensity: New Evidence from 30 Chinese Provinces" Sustainability 14, no. 15: 9207. https://doi.org/10.3390/su14159207

APA StyleLv, K., Yu, S., Fu, D., Wang, J., Wang, C., & Pan, J. (2022). The Impact of Financial Development and Green Finance on Regional Energy Intensity: New Evidence from 30 Chinese Provinces. Sustainability, 14(15), 9207. https://doi.org/10.3390/su14159207