Green Building Contractors 2025: Analyzing and Forecasting Green Building Contractors’ Market Trends in the US

Abstract

:1. Introduction

2. Literature Review

2.1. Sustainable Development and the Business Aspect of Green Buildings

2.2. The Focus on Contractors

3. Research Questions

3.1. Problem Statement and Research Gaps

3.2. Objectives

4. Methodology

4.1. Data Collection and Cleaning

4.2. Descriptive Statistics and Trend Analysis

4.3. Segmentation/Cluster Analysis of the Top 100 GBCs

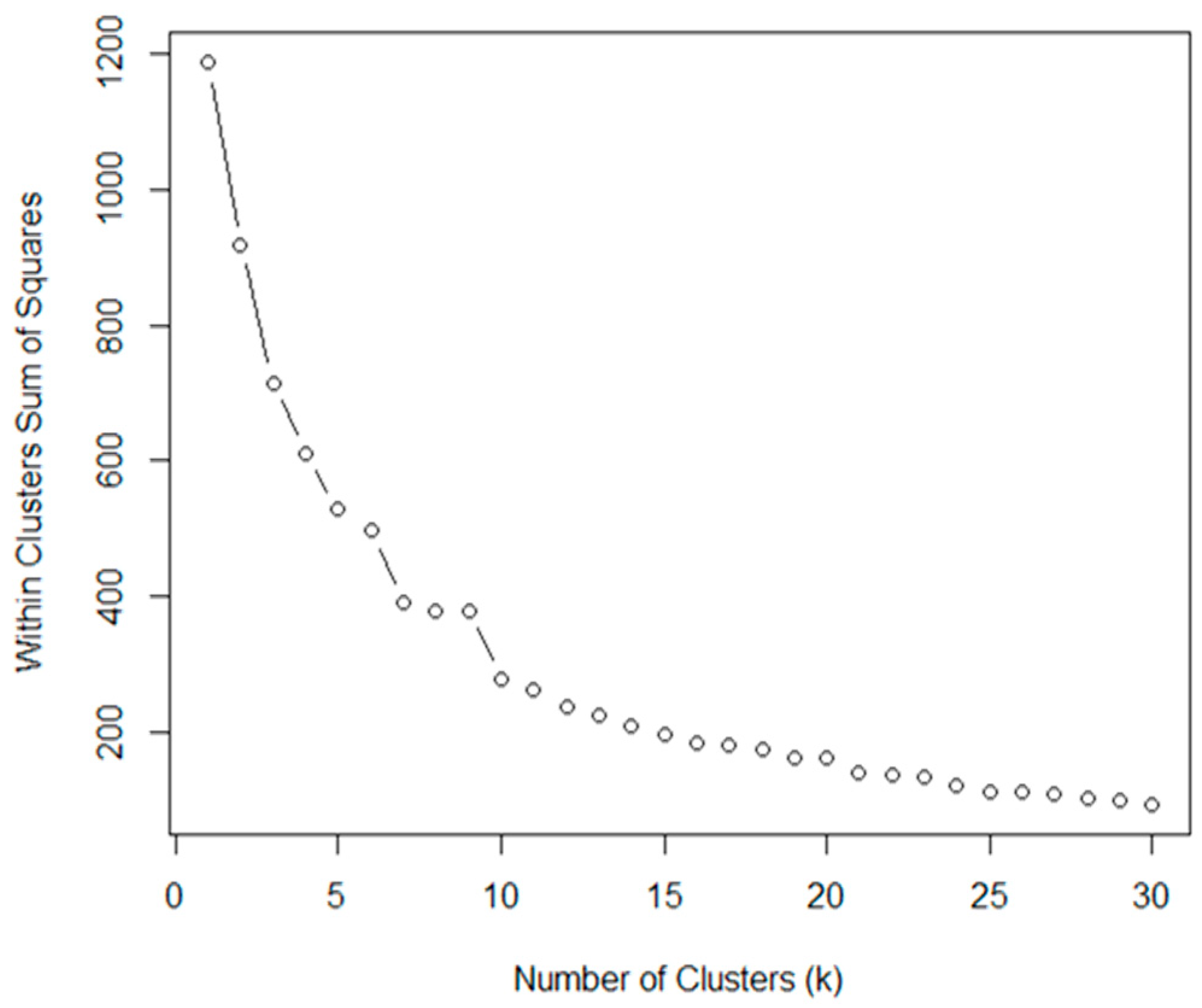

4.4. Time Series Analysis

5. Results

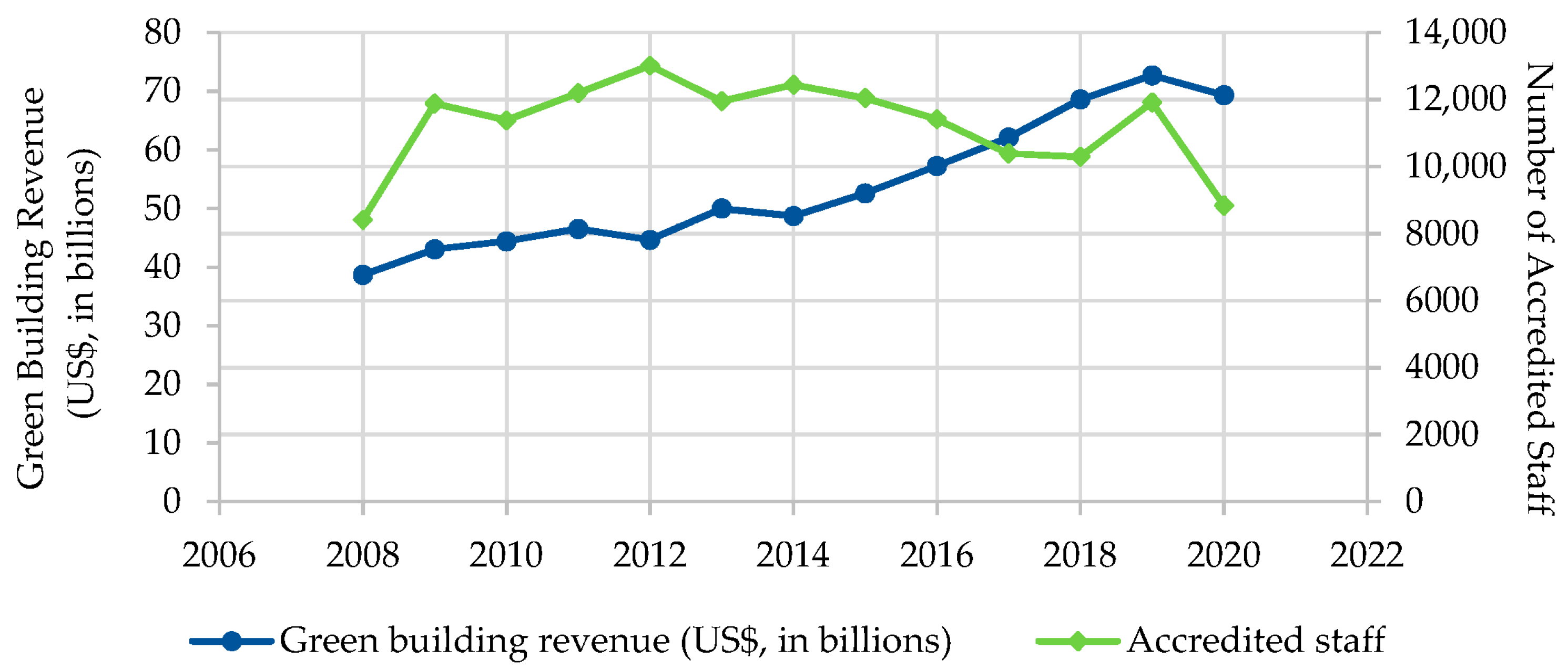

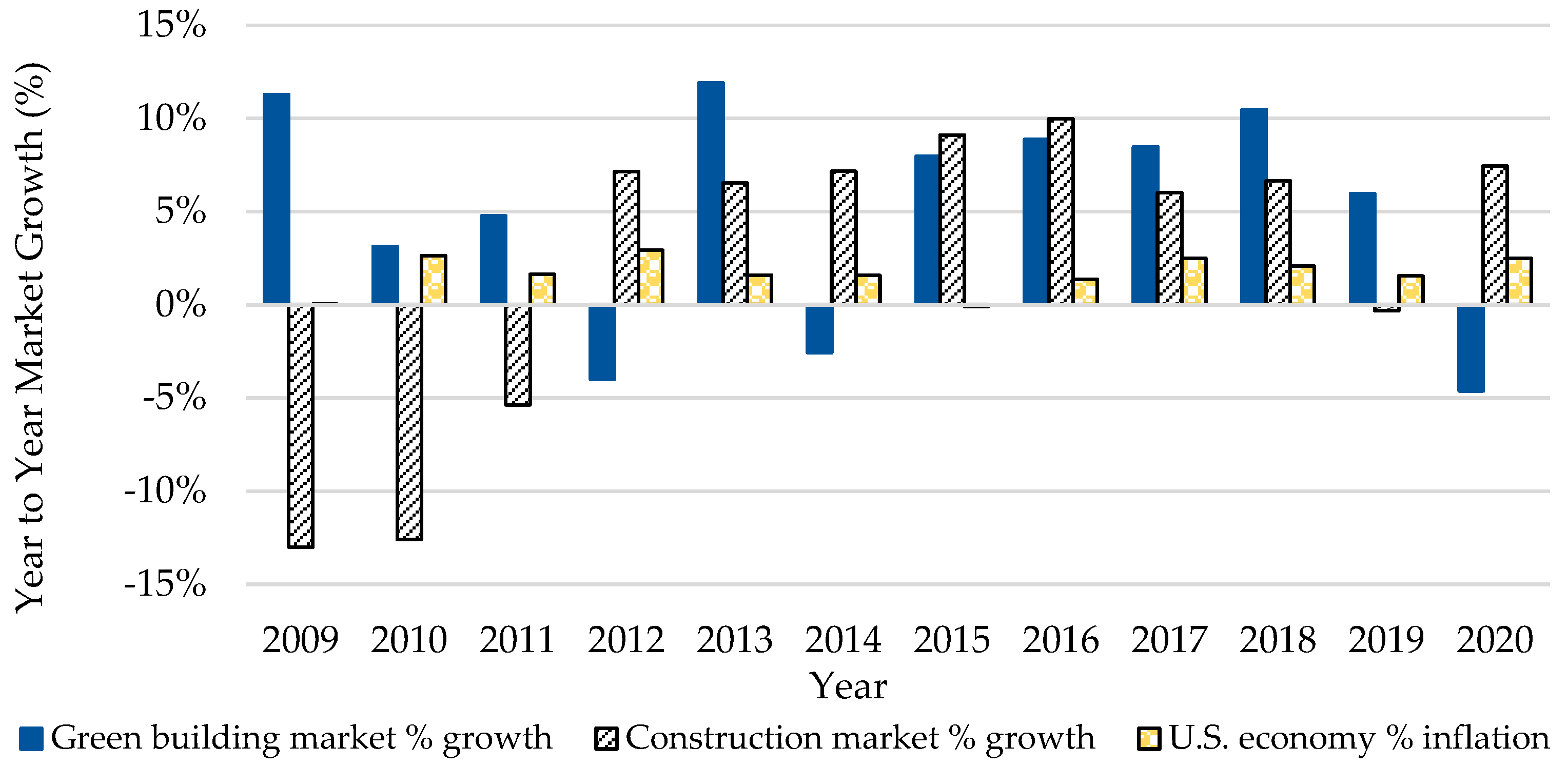

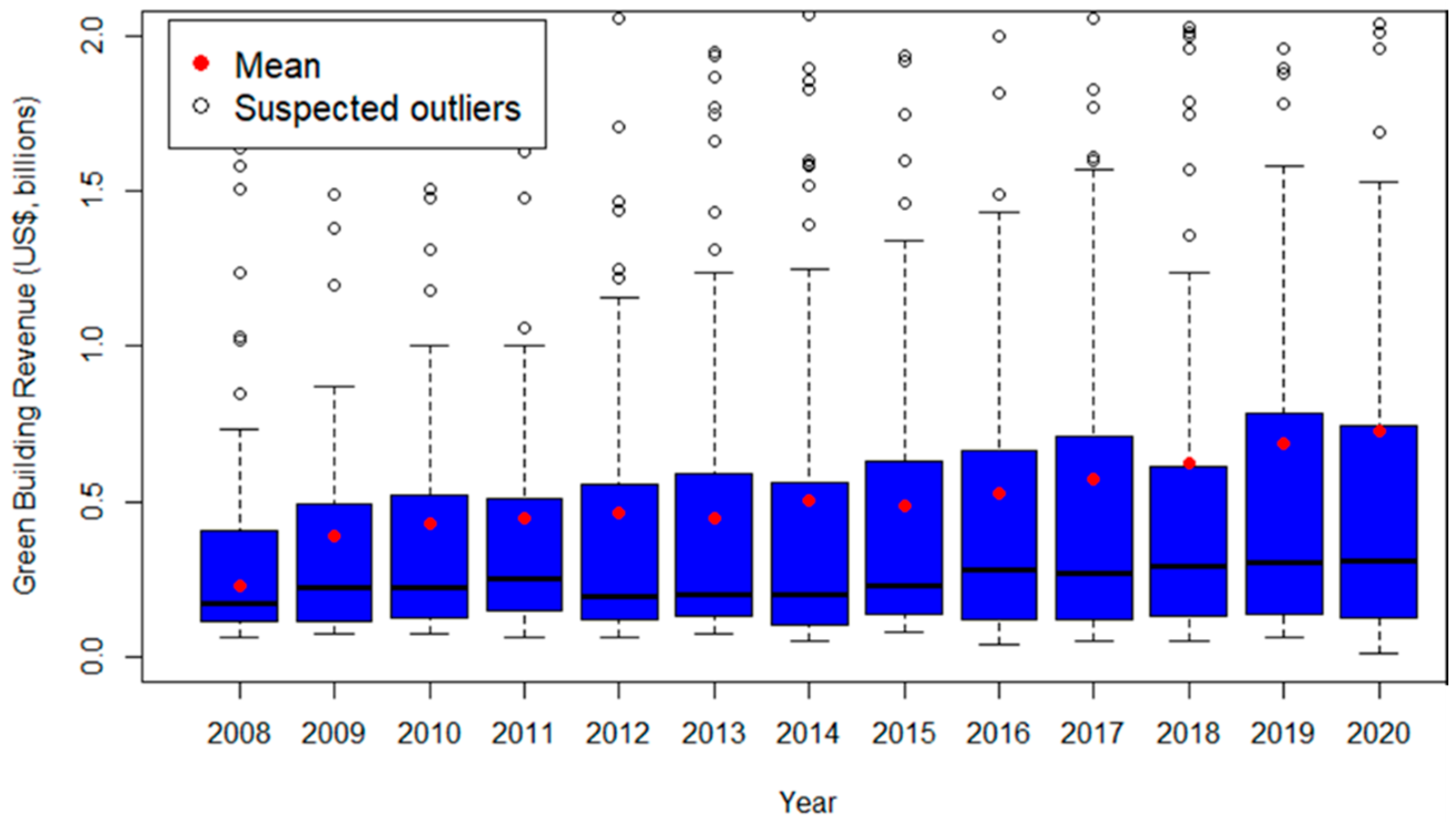

5.1. Trends for the Top 100 GBCs

5.2. Trends for Segmentation

5.3. Time-Series Analysis Results

6. Discussion and Limitations

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- U.S. Energy Information Administration (EIA). Use of Energy Explained. 2021. Available online: https://www.eia.gov/energyexplained/use-of-energy/ (accessed on 1 November 2021).

- Global Alliance for Buildings and Construction, 2020 Global Status Report for Buildings and Construction; UN Environment Program: Nairobi, Kenya, 2020; Available online: https://wedocs.unep.org/bitstream/handle/20.500.11822/34572/GSR_ES.pdf (accessed on 1 November 2021).

- International Resource Panel, Resource Efficiency and Climate Change; UN Environment Program: Nairobi, Kenya, 2020; Available online: https://wedocs.unep.org/bitstream/handle/20.500.11822/34351/RECCR.pdf?sequence=1&isAllowed=y (accessed on 1 November 2021).

- Karim, M.R.; Zain, M.F.; Jamil, M.; Lai, F.C.; Islam, M.N. Use of wastes in construction industries as an energy saving approach. Energy Procedia 2011, 12, 915–919. [Google Scholar] [CrossRef] [Green Version]

- Berizzi, C.; Nirta, S.; Terlicher, G.N.; Trabattoni, L. Sustainable and Affordable Prefabricated Construction: Developing a Natural, Recycled, and Recyclable Mobile Home. Sustainability 2021, 13, 8296. [Google Scholar] [CrossRef]

- Windapo, A.O. Examination of green building drivers in the South African construction industry: Economics versus ecology. Sustainability 2014, 6, 6088–6106. [Google Scholar] [CrossRef] [Green Version]

- Wang, G.; Zeng, S.; Xia, B.; Wu, G.; Xia, D. Influence of financial conditions on the environmental information disclosure of construction firms. J. Manag. Eng. 2022, 38, 04021078. [Google Scholar] [CrossRef]

- Yan, M.-R. Project-based market competition and policy implications for sustainable developments in building and construction sectors. Sustainability 2015, 7, 15423–15448. [Google Scholar] [CrossRef] [Green Version]

- He, Q.; Wang, Z.; Wang, G.; Xie, J.; Chen, Z. The Dark Side of Environmental Sustainability in Projects: Unraveling Greenwashing Behaviors. Proj. Manag. J. 2021, 53, 87569728211042705. [Google Scholar] [CrossRef]

- Torelli, R.; Balluchi, F.; Lazzini, A. Greenwashing and environmental communication: Effects on stakeholders’ perceptions. Bus. Strategy Environ. 2020, 29, 407–421. [Google Scholar] [CrossRef] [Green Version]

- Qian, Q.K.; Chan, E.H.; Khalid, A.G. Challenges in delivering green building projects: Unearthing the transaction costs (TCs). Sustainability 2015, 7, 3615–3636. [Google Scholar] [CrossRef] [Green Version]

- Zhang, L.; Wu, J.; Liu, H. Turning green into gold: A review on the economics of green buildings. J. Clean. Prod. 2018, 172, 2234–2245. [Google Scholar] [CrossRef]

- Mangialardo, A.; Micelli, E.; Saccani, F. Does sustainability affect real estate market values? Empirical evidence from the office buildings market in Milan (Italy). Sustainability 2019, 11, 12. [Google Scholar] [CrossRef] [Green Version]

- Yang, X.; Zhang, J.; Zhao, X. Factors affecting green residential building development: Social network analysis. Sustainability 2018, 10, 1389. [Google Scholar] [CrossRef] [Green Version]

- Guo, K.; Yuan, Y. Geographic Distribution and Influencing Factor Analysis of Green Residential Buildings in China. Sustainability 2021, 13, 12060. [Google Scholar] [CrossRef]

- Engineering News Record (ENR). ENR Top 100 Green Design Firms and Contractors: Green Market Growth Stunted. 2021. Available online: https://www.enr.com/toplists/2021-Top-100-Green-Building-Contractors-Preview (accessed on 15 August 2021).

- Olubunmi, O.A.; Xia, P.B.; Skitmore, M. Green building incentives: A review. Renew. Sustain. Energy Rev. 2016, 59, 1611–1621. [Google Scholar] [CrossRef] [Green Version]

- Abidin, N.Z. Sustainable construction in Malaysia–Developers’ awareness. World Acad. Sci. Eng. Technol. 2009, 53, 807–814. [Google Scholar]

- Teng, J.; Mu, X.; Wang, W.; Xu, C.; Liu, W. Strategies for sustainable development of green buildings. Sustain. Cities Soc. 2019, 44, 215–226. [Google Scholar] [CrossRef]

- Rakitta, M.; Wernery, J. Cognitive Biases in Building Energy Decisions. Sustainability 2021, 13, 9960. [Google Scholar] [CrossRef]

- Azouz, M.; Kim, J.-L. Examining contemporary issues for green buildings from contractors’ perspectives. Procedia Eng. 2015, 118, 470–478. [Google Scholar] [CrossRef] [Green Version]

- Hwang, B.-G.; Zhu, L.; Wang, Y.; Cheong, X. Green building construction projects in Singapore: Cost premiums and cost performance. Proj. Manag. J. 2017, 48, 67–79. [Google Scholar] [CrossRef] [Green Version]

- Chan, A.P.C.; Darko, A.; Ameyaw, E.E. Strategies for promoting green building technologies adoption in the construction industry—An international study. Sustainability 2017, 9, 969. [Google Scholar] [CrossRef] [Green Version]

- Li, Y.Y.; Chen, P.-H.; Chew, D.A.S.; Teo, C.C.; Ding, R.G. Critical project management factors of AEC firms for delivering green building projects in Singapore. J. Constr. Eng. Manag. 2011, 137, 1153–1163. [Google Scholar] [CrossRef]

- Sang, P.; Liu, J.; Zhang, L.; Zheng, L.; Yao, H.; Wang, Y. Effects of project manager competency on green construction performance: The Chinese context. Sustainability 2018, 10, 3406. [Google Scholar] [CrossRef] [Green Version]

- Market Research Future. Green Buildings Market to grow at 14.3% CAGR by 2027 | Market Research Future (MRFR). 2021. Available online: https://www.globenewswire.com/en/news-release/2021/05/19/2232352/0/en/Green-Buildings-Market-to-grow-at-14-3-CAGR-by-2027-Market-Research-Future-MRFR.html (accessed on 2 November 2021).

- Sanboskani, H.; El Asmar, M.; Azar, E. Analyzing and Forecasting Contractors’ Green Building Revenues. In Proceedings of the Fourth European and Mediterranean Structural Engineering and Construction, Leipzig, Germany, 20–25 June 2022; Volume 9. [Google Scholar]

- Engineering News Record (ENR). The Top 100 Green Buildings Contractors. 2009. Available online: https://www.enr.com/ext/resources/static_pages/PDFs/national_toplists/Green-Contractors/2009-Top_100_Green_Contractors.pdf (accessed on 15 August 2021).

- Engineering News Record (ENR). The Top 100 Green Contractors. 2010. Available online: https://www.enr.com/ext/resources/static_pages/PDFs/national_toplists/Green-Contractors/2010-Top_100_Green_Contractors.pdf (accessed on 15 August 2021).

- Engineering News Record (ENR). The Top 100 Green Buildings Contractors: Public Construction and Sustainable-Building Laws Push Green Contracting Ahead. 2011. Available online: https://www.enr.com/ext/resources/static_pages/PDFs/national_toplists/Green-Contractors/2011-Top_100_Green_Contractors.pdf (accessed on 15 August 2021).

- Engineering News Record (ENR). The Top 100 Green Buildings Contractors: Green Building Spreads Slowly. 2012. Available online: https://www.enr.com/ext/resources/static_pages/PDFs/national_toplists/Green-Contractors/ENR09172012_100_GreenContractors.pdf (accessed on 15 August 2021).

- Engineering News Record (ENR). The Top 100 Green Buildings Contractors: The Battle for Green’s Future. 2013. Available online: https://www.enr.com/ext/resources/static_pages/PDFs/national_toplists/Green-Contractors/enr_top_100_green_contractors_2013.pdf (accessed on 15 August 2021).

- Engineering News Record (ENR). The Top 100 Green Buildings Contractors: Assuming a Greater Role. 2014. Available online: https://www.enr.com/ext/resources/static_pages/PDFs/national_toplists/Green-Contractors/2014_enr_top-100_green_contractors.pdf (accessed on 15 August 2021).

- Engineering News Record (ENR). Greening More than Buildings. 2015. Available online: https://www.enr.com/toplists/2015_Top_100_Green_Building_Contractors (accessed on 15 August 2021).

- Engineering News Record (ENR). Green Building Standards Grow. 2016. Available online: https://www.enr.com/toplists/2016-Top-100-Green-Building-Contractors (accessed on 15 August 2021).

- Engineering News Record (ENR). The Sustainable Market Grows. 2017. Available online: https://www.enr.com/toplists/2017-Top-100-Green-Building-Contractors (accessed on 15 August 2021).

- Engineering News Record (ENR). Green Is Growing in New Ways. 2018. Available online: https://www.enr.com/toplists/2018-Top-100-Green-Building-Contractors (accessed on 15 August 2021).

- Engineering News Record (ENR). 2019 Top 100 Green Building Contractors and Design Firms: Sustainability Intensifies. 2019. Available online: https://www.enr.com/toplists/2019-Top-100-Green-Building-Contractors (accessed on 15 August 2021).

- Engineering News Record (ENR). ENR Top 100 Green Design Firms and Contractors: Reshaping Green Building Ideas. 2020. Available online: https://www.enr.com/toplists/2020-Top-100-Green-Building-Contractors-Preview (accessed on 15 August 2021).

- U.S. Bureau of Labor Statistics. CPI Inflation Calculator. 2021. Available online: https://www.bls.gov/data/inflation_calculator.htm (accessed on 12 November 2021).

- Jain, A.K. Data clustering: 50 years beyond K-means. Pattern Recognit. Lett. 2010, 31, 651–666. [Google Scholar] [CrossRef]

- Verma, M.; Srivastava, M.; Chack, N.; Diswar, A.K.; Gupta, N. A comparative study of various clustering algorithms in data mining. Int. J. Eng. Res. Appl. (IJERA) 2012, 2, 1379–1384. [Google Scholar]

- Venkatkumar, I.A.; Shardaben, S.J.K. Comparative study of data mining clustering algorithms. In Proceedings of the 2016 International Conference on Data Science and Engineering (ICDSE), Cochin, India, 23–25 August 2016; IEEE: Piscataway, NJ, USA, 2016; pp. 1–7. [Google Scholar]

- Vashani, H.; Sullivan, J.; El Asmar, M. DB 2020: Analyzing and forecasting design-build market trends. J. Constr. Eng. Manag. 2016, 142, 04016008. [Google Scholar] [CrossRef]

- MacQueen, J. Some methods for classification and analysis of multivariate observations. In Proceedings of the Fifth Berkeley Symposium on Mathematical Statistics and Probability 1967, Oakland, CA, USA, 7 January 1967; pp. 281–297. [Google Scholar]

- Kodinariya, T.M.; Makwana, P.R. Review on determining number of Cluster in K-Means Clustering. Int. J. 2013, 1, 90–95. [Google Scholar]

- Likas, A.; Vlassis, N.; Verbeek, J.J. The global k-means clustering algorithm. Pattern Recognit. 2003, 36, 451–461. [Google Scholar] [CrossRef] [Green Version]

- Boehmke, B. K-Means Cluster Analysis. Available online: https://www.iea.org/news/covid-crisis-deepens-energy-efficiency-slowdown-intensifying-need-for-urgent-action (accessed on 5 November 2021).

- Wooldridge, J.M. Basic regression analysis with time series data. In Introductory Econometrics: A Modern Approach; South-Western College Publishing: Cincinnati, OH, USA, 2000. [Google Scholar]

- Reddy, T.A. Applied Data Analysis and Modeling for Energy Engineers and Scientists. ProQuest Ebook Central. 2011. Available online: https://ebookcentral-proquest-com.ezproxy1.lib.asu.edu/lib/asulib-ebooks/detail.action?docID=770188 (accessed on 5 November 2021).

- Montgomery, D.C.; Jennings, C.L.; Kulahci, M. Introduction to Time Series Analysis and Forecasting; Wiley: New York, NY, USA, 2011. [Google Scholar]

- Alghamdi, T.; Elgazzar, K.; Bayoumi, M.; Sharaf, T.; Shah, S. Forecasting traffic congestion using ARIMA modeling. In Proceedings of the 2019 15th International Wireless Communications & Mobile Computing Conference (IWCMC), Tangier, Morocco, 24–28 June 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 1227–1232. [Google Scholar] [CrossRef]

- U.S. Census Bureau. Construction Spending. 2021. Available online: https://www.census.gov/construction/c30/prpdf.html (accessed on 12 November 2021).

- Minitab 18 Support, Graphs for ARIMA. 2018. Available online: https://support.minitab.com/en-us/minitab/18/help-and-how-to/modeling-statistics/time-series/how-to/arima/interpret-the-results/all-statistics-and-graphs/graphs/ (accessed on 10 November 2021).

- Research and Markets. Non-Residential Green Buildings Industry 2020–2030—Market Expected to Recover from the COVID-19 Pandemic and Reach $103 Billion in 2023. 2020. Available online: https://www.globenewswire.com/news-release/2020/08/19/2080474/0/en/Non-residential-Green-Buildings-Industry-2020-2030-Market-Expected-to-Recover-from-the-COVID-19-Pandemic-and-Reach-103-Billion-in-2023.html (accessed on 1 December 2021).

- Tan, Y.; Shen, L.; Yao, H. Sustainable construction practice and contractors’ competitiveness: A preliminary study. Habitat Int. 2011, 35, 225–230. [Google Scholar] [CrossRef]

- Slaper, T.F.; Hall, T.J. The triple bottom line: What is it and how does it work. Indiana Bus. Rev. 2011, 86, 4–8. [Google Scholar]

- Chokor, A.; El Asmar, M.; Tilton, C.; Srour, I. Dual assessment framework to evaluate LEED-certified facilities’ occupant satisfaction and energy performance: Macro and micro approaches. J. Archit. Eng. 2016, 22, A4015003. [Google Scholar] [CrossRef]

- Wang, G.; Li, Y.; Zuo, J.; Hu, W.; Nie, Q.; Lei, H. Who drives green innovations? Characteristics and policy implications for green building collaborative innovation networks in China. Renew. Sustain. Energy Rev. 2021, 143, 110875. [Google Scholar] [CrossRef]

- Zhao, D.X.; He, B.J.; Johnson, C.; Mou, B. Social problems of green buildings: From the humanistic needs to social acceptance. Renew. Sustain. Energy Rev. 2015, 51, 1594–1609. [Google Scholar] [CrossRef]

- Bon-Gang, H. Cost Premium, Performance and Improvement of Green Construction Projects. In Performance and Improvement of Green Construction Projects; Butterworth-Heinemann: Oxford, UK, 2018; pp. 103–118. [Google Scholar] [CrossRef]

- Kats, G. Greening Our Built World: Costs, Benefits, and Strategies; Island Press: New York, NY, USA, 2013. [Google Scholar]

- Aghimien, D.O.; Adegbembo, T.F.; Aghimien, E.I.; Awodele, O.A. Challenges of sustainable construction: A study of educational buildings in Nigeria. Int. J. Built Environ. Sustain. 2018, 5, 33–46. [Google Scholar] [CrossRef]

- Emergen Research, Green Construction Market by Product (Exterior Products, Interior Products, Solar Products, Building Systems, Others), By Application (Residential Buildings, Non-Residential Buildings, Others), and By Region, Forecasts to 2027. 2020. Available online: https://www.emergenresearch.com/industry-report/green-construction-market (accessed on 8 December 2021).

- U.S. Census Bureau. Monthly Construction Spending, March 2020. Available online: https://www.census.gov/construction/c30/pdf/pr202003.pdf (accessed on 1 November 2021).

- Azar, E.; Alaifan, B.; Lin, M.; Trepci, E.; El Asmar, M. Drivers of energy consumption in Kuwaiti buildings: Insights from a hybrid statistical and building performance simulation approach. Energy Policy 2021, 150, 112154. [Google Scholar] [CrossRef]

- Azar, E.; O’Brien, W.; Carlucci, S.; Hong, T.; Sonta, A.; Kim, J.; Andargie, M.S.; Abuimara, T.; El Asmar, M.; Jain, R.K.; et al. Simulation-aided occupant-centric building design: A critical review of tools, methods, and applications. Energy Build. 2020, 224, 110292. [Google Scholar] [CrossRef]

| Firm Name | Firm a | Firm b | …… | …… | Firm z |

|---|---|---|---|---|---|

| Rank | 1 | 2 | …… | …… | 100 |

| Accredited staff | 756 | 436 | …… | …… | NA |

| Green revenue (USD, in millions) | 6797.1 | 4568.78 | …… | …… | 5.09 |

| Percentage of total revenue | 47 | 79 | …… | …… | 1 |

| Green Contracting by Sector (Percentage) | 2008 | 2009 | …… | …… | 2020 |

|---|---|---|---|---|---|

| Airports | - | - | …… | …… | 7.9 |

| Educational facilities | 15.4 | 18.8 | …… | …… | 12.1 |

| Government offices | 12.1 | 13.6 | …… | …… | 8.0 |

| Healthcare | 9.6 | 14.8 | …… | …… | 7.8 |

| Hotels | 8.4 | 3.5 | …… | …… | 3.3 |

| Manufacturing and industrial | 3.3 | 3.0 | …… | …… | 3.2 |

| Multi-unit residential | 10.3 | 7.0 | …… | …… | 11.4 |

| Retail/office | 28.2 | 21.4 | …… | …… | 25.9 |

| Sports, entertainment, and civic | 4.2 | 6.5 | …… | …… | 5.0 |

| Telecommunication | 2.3 | 3.0 | …… | …… | 6.0 |

| Non-building miscellaneous | 0.3 | 0.7 | …… | …… | 6.0 |

| Other buildings | 6.0 | 7.7 | …… | …… | 4.0 |

| Spending (US$, in Billions) | January | February | …… | …… | December | Total Construction Spending |

|---|---|---|---|---|---|---|

| Year 2008 spending | 1121.5 | 1121.6 | …… | …… | 1053.7 | 13,075.9 |

| …… | …… | …… | …… | …… | …… | …… |

| Year 2020 spending | 1369.2 | 1366.8 | …… | …… | 1490.4 | 16,733.9 |

| Rank | 2008–2009 | 2009–2010 | …… | …… | 2019–2020 |

|---|---|---|---|---|---|

| 1 | 0.14 | 0.18 | …… | …… | 0.04 |

| 2 | −0.04 | 0.03 | …… | …… | −0.06 |

| …… | …… | …… | …… | …… | …… |

| 100 | 0.13 | −0.01 | …… | …… | −0.91 |

| Subset | 2020 Revenue | 2025 Predicted Revenues | 95% Lower Limit | 95% Upper Limit |

|---|---|---|---|---|

| Top 9 | 31.92 | 40.25 | 31.91 | 48.59 |

| 10–20 | 15.70 | 19.98 | 18.83 | 21.12 |

| 21–37 | 11.12 | 12.93 | 12.11 | 13.75 |

| 38–45 | 3.26 | 3.86 | 1.87 | 5.84 |

| 46–64 | 4.71 | 5.27 | 4.55 | 6 |

| 65–75 | 1.68 | 1.64 | 1.46 | 1.82 |

| 76–81 | 0.66 | 0.68 | 0.66 | 0.71 |

| 82–85 | 0.32 | 0.4 | 0.37 | 0.42 |

| 86–93 | 0.37 | 0.58 | 0.42 | 0.73 |

| 94–100 | 0.42 | 0.4 | 0.25 | 0.55 |

| Top 100 cumulative | 70.16 | 85.99 | 72.43 | 99.53 |

| Top 100 model | 83.33 | 66.17 | 100.48 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sanboskani, H.; El Asmar, M.; Azar, E. Green Building Contractors 2025: Analyzing and Forecasting Green Building Contractors’ Market Trends in the US. Sustainability 2022, 14, 8808. https://doi.org/10.3390/su14148808

Sanboskani H, El Asmar M, Azar E. Green Building Contractors 2025: Analyzing and Forecasting Green Building Contractors’ Market Trends in the US. Sustainability. 2022; 14(14):8808. https://doi.org/10.3390/su14148808

Chicago/Turabian StyleSanboskani, Hala, Mounir El Asmar, and Elie Azar. 2022. "Green Building Contractors 2025: Analyzing and Forecasting Green Building Contractors’ Market Trends in the US" Sustainability 14, no. 14: 8808. https://doi.org/10.3390/su14148808

APA StyleSanboskani, H., El Asmar, M., & Azar, E. (2022). Green Building Contractors 2025: Analyzing and Forecasting Green Building Contractors’ Market Trends in the US. Sustainability, 14(14), 8808. https://doi.org/10.3390/su14148808