1. Introduction

A fierce military conflict between Russia and Ukraine erupted in February 2022. Subsequently, many nations, led by the United States and Europe, have initiated various economic and financial sanctions such as energy import bans and the exclusion of the Society for Worldwide Interbank Financial Telecommunications (SWFIT). However, with the reduction of trade barriers and the promotion of the scientific revolution, economic globalization has emerged as the trend of the times. Economic activity from different countries is forming an organic entirety beyond borders through international trade, capital flow, technology transformation, etc., and countries rarely stand or fall alone. Thus, in the face of stern sanctions including energy ban and SWIFT ban, is it enough for the synergetic degree among different industries to sustain economic development in Russia? When severing economic ties to Russia, the authors of the sanctions and even third-party countries would not be safe. Then, once the Russian economic system has been damaged, which countries will be affected? Further, if a particular industry in Russia (such as energy, one of Russia’s pillar industries) is under attack, which industries in Russia or abroad will be affected? Which paths will the shocks propagate along through the global economic system? The response to these questions is an important issue for the world to face.

An interdependent economic system comprises industries from different countries exchanging goods and services with each other. It is important for understanding the industrial structure, also known as an industrial linkage, to explore the operating mechanisms of an economic system and the conduct mechanism of economic shocks [

1,

2]. Input–output (IO) data function to quantitatively depict the economic structure at the industrial level and reflect its operating mechanism. Recently, with the need for addressing global issues such as the problem of resources, the environment, and the international division, the Inter-Country Input–output (ICIO) table, derived from the Single-Country Input–output (SCIO) table, comes into existence and gradually matures, which makes it possible to quantitatively describe the associated features among different industries [

3,

4].

Traditional tools based on IO models play an important part in exploring economic structures, such as structural path analysis (SPA) and linkage analysis. SPA is about estimating the contributions of separate paths to particular sectors [

5,

6,

7]. Linkage analysis proceeds one step further by studying the effect of the upstream and downstream on the entire economy [

8,

9]. However, when employing these tools, few treat an economy as a complete, particular system in the IO literature [

10]. A more comprehensive perspective is extremely important but often overlooked.

Complex network theory is derived from graph theory, which focuses on exploring the relation between the structure and function of a network by analyzing the structure attributes of the node and the links within [

11,

12,

13]. All complex systems such as power networks, traffic networks, computer networks, and so on can be treated as complex networks. Similar to the above networks, the IO network borrows the idea of network theory, abstracts an IO table, namely the industrial system in reality, into a complex network, in which nodes represent industries and links connecting nodes represent the economic transactions between industries.

Research about IO networks focus on three areas: the position of a particular industry, communities among industries, and the propagation of economic shocks. First, one of the most primitive questions concerns identifying the position of a particular industry in the IO network. The IO network is a typical heterogeneous network, in which particular nodes or links play different roles. The closer to the center of the network the nodes or links are, the more important they are, from which derives the concept of centrality. In network analysis, there are some common methods to measure the centrality of nodes or links including the degree centrality [

14,

15,

16], closeness centrality [

17], betweenness centrality [

18,

19], eigenvector centrality [

20,

21], and so on. Second, identifying communities in IO network is a research topic that is neck-to-neck with measuring the centrality of the nodes and links. Nodes in the complex network usually clump together and give birth to communities, which is also a symbol of heterogeneity. Generally, nodes in the same community are relatively dense, while nodes in the different communities are relatively sparse. Popular methods for detecting communities in the complex network mainly consist of Hierarchical clustering [

22], Minimum cut [

23], the Girvan–Newman algorithm [

24], Modularity maximization [

23], and so on.

Lastly, the propagation of shocks belongs to the dynamics of networks, which is the expansion of the study about the topological structure. It immediately attracts scholars’ wide attention once introduced into the IO network area. At first, the research about the effect of shocks on the economic system mainly focused on qualitative analysis. Based on the IO model and the subsequent complex network theory, researchers have demonstrated that the propagation of microeconomic shocks would cause a Butterfly Effect, thereby leading to sizable aggregate fluctuations when there are significant asymmetries in the roles that industries play as direct or indirect suppliers to others [

25,

26,

27]. With the development of the complex network theory, it has become possible to conduct semiquantitative and even quantitative analysis about the relation between microeconomic shocks and aggregate fluctuations, such as quantifying how much the industrial shocks contribute to the aggregate output fluctuation making use of the network indexes [

28], measuring the spreading scope of the shocks [

29,

30], and analyzing industries’ long-term and short-term spreading effects [

31].

In summation, as a new research paradigm, research based on IO network theory has achieved fruitful results both in theory and application. However, there are certain limitations in the following three aspects. First, as we all know, the main function of most real-world networks such as social networks, transportation networks, and power grids, is to efficiently mobilize information or objects, in which the shortest path is the desired outcome. But the IO network is different, whose function is to maximize the value created by economic activities. The desired outcomes are the circulation of monetary flows in the IO network instead of quickly moving goods or exchanging services. So, the traditional indicators such as degree centrality and betweenness centrality based on the concept of the shortest path hardly apply to the IO network. Second, ICIO data have both industrial and regional properties. However, the previous research is mainly based on the industrial perspective instead of the regional perspective. Third, shocks in the complex network generally propagate from points to lines and surfaces. The current study focuses mostly on the propagation mechanism and scope of the shocks’ influence. However, the research on the critical path of the propagation of the shocks is relatively weak.

In view of the above problems, we are motivated to build a network model of the world economy based on the OECD-2018 ICIO table, to explore the structures among different countries and industries, and investigate the critical path of the propagation of shocks derived from economic sanctions against Russia from the regional, industrial, and critical path perspectives. The rest of this paper is organized as follows:

Section 2 describes data and methods,

Section 3 demonstrates an empirical analysis of the propagation of shocks from the regional perspective,

Section 4 provides an empirical analysis of the propagation of shocks from the industrial perspective,

Section 5 provides an empirical analysis of the propagation of shocks based on the critical path, and

Section 6 concludes the work.

2. Data and Methods

2.1. Data

Our data are the ICIO table for the year 2018 from the most recent OECD Input–output Database (2021 edition,

https://www.oecd.org/, accessed on 17 November 2021), which has 45 unique industries based on ISIC Revision 4. Data are presented for 66 countries or regions (i.e., 38 OECD countries and 28 non-OECD economies), the Rest of the World, and split tables for China and Mexico because of the special position of their manufacturing industries. The former is decomposed into Export processing activities and activities excluding export processing. The latter is decomposed into global Manufacturing and Non-global Manufacturing. To facilitate the comparison of industrial characteristics of different countries, we merge split tables for China and Mexico, which allows them to possess the same format as those of other economies. List of OECD economies and industries and corresponding abbreviations are in

Appendix A Table A1 and

Table A2 in the end.

2.2. Methods

The intermediate matrix of the ICIO table naturally maps onto a macroeconomic network based on economic and technological linkages between industries, in which nodes represent industries and links represent flows between industries. This study constructs an analytical framework from the regional, industrial, and critical path perspectives.

2.2.1. Regional Perspective

(1) Intraregional economic interaction closeness (IAEIC) VS activity index (AI)

IAEIC indicates the synergistic effect among industries in a country, which is measured by the density of the complex network, as shown in Equation (1). The value of the density is between 0 and 1. The larger the value is, the stronger the synergistic effect is [

32,

33].

where

indicates the density of a directional, node-, and link-weighted subnetwork;

indicates the weighted sum of subsistent links in the subnetwork; and

indicates the number of nodes in the subnetwork.

AI can fully reflect whether economic activities are extraverted or introversive type, as shown in Equation (2). The larger the AI of a country is, the stronger the dependence degree of its economic development is on the industrial interaction between itself and other countries. Conversely, the smaller the AI of a country is, the stronger the dependence degree of its economic development is on the domestic industrial interaction.

where

indicates the weighted sum of links starting with nodes in the subnetwork and ending with the nodes outside the subnetwork, and

indicates the weighted sum of subsistent links in the subnetwork.

IAEIC and AI can comprehensively measure whether a country depends more on the internal industrial interaction or the external industrial interaction.

(2) Interregional economic interaction closeness (IREIC)

Contrary to IAEIC, IREIC indicates the synergistic effect of industries in different countries and is a measurement of the economic dependence degree between the countries, as shown in Equation (3):

where

indicates the density between the directional subnetwork

and the directional subnetwork

,

indicates the weighted sum of links starting with nodes in the subnetwork

and ending with the nodes in the subnetwork

, and

and

indicate the number of nodes in the subnetwork

and the subnetwork

, respectively.

2.2.2. Industrial Perspective

Different industries form an interrelated and inseparable whole through exchanging goods and services with each other. Once an industry is under attack, other industries and even the whole economic system will be affected. Even when under an attack of the same order of magnitude, industries with different attributes will lead to different effects. In complex network analysis, there are some attribute indexes to measure the role of nodes in the network and then assess the effects lead by shocks, such as network centrality as well as symmetry and clustering.

(1) Network centrality

Different from the traditional concept of shortest path, which is the path connecting two particular nodes in the network with the least number of steps among all possible paths, Xu and Liang [

10] puts forward the concept of Strongest Path (SP) rooted from SPA in IO modeling, and redefines three new concepts of network centrality, SP betweenness, downstream closeness, and upstream closeness.

SP can be defined as a particular path that contributes the most to the unitary output of industry

j among all possible paths from industry

i to industry

j, which represents the most important path of all possible paths that supply from a particular industry to another. The strength of a particular SP from industry

i to industry

j is measured as

where

indicates the technical coefficient and

……

indicate industries distributed in this path in sequence.

The SP betweenness of nodes or links indicates the ability for the center to transform resources from all over the economic system into finished products to supply the whole economy. For a particular industry, the SP betweenness is defined as the weighted sum of strengths of all SPs in the IO network passing through it, not including SPs start or end at it:

Similarly, the SP betweenness for a particular link

i→

j (all of which can be coalesced into the SP matrix) is

Closeness in network analysis measures how far a particular node is to all other nodes based on their shortest paths. In IO networks, two SP-based closeness measures are defined including downstream closeness and upstream closeness.

The former represents the important role a supplier has towards downstream industries and the ability to drive the economic development, which is the average value of all SPs starting from a particular industry

i:

Similarly, the latter represents the important role a consumer has towards upstream industries that drive the economic development, which is defined as the average value of all SPs ending at a particular industry

j:

where

and

represent the outputs of industry

i and

j, respectively.

(2) Symmetry vs. Clustering

Symmetry is an important feature in the research on directed relation, which can indicate the fungibility of an industry once it is under attack. For industry

i and industry

j, if and only if

i supplies products or services directly to

j, and

j also supplies products or services directly to i, there is a symmetry between industry

i and industry

j. Symmetry is very important in the macroeconomic system. Several studies have shown that asymmetry of industrial structure is the origin of economic fluctuation [

25]. The stronger the symmetry of industrial structure is, the stronger the fungibility of the industry is. Once under attack, it will make a smaller influence on the economic system. Symmetry is defined as

in Equation (9).

where

is the number of industries that have an adjacent relationship with industry

i,

indicates the smaller flow value between industry

i and industry

j, and

indicates the larger flow value between industry

i and industry

j.

Clustering indicates the leading effect of an industry on other industries in the economic system, which is defined as

in Equation (10):

where

,

,

,

indicate the actual strength of the structure types

A,

B,

C, and

D for industry

I, respectively, and

,

,

,

indicate the potential strongest strength of the structure types

A,

B,

C and

D for industry

i, respectively.

More mathematical details about

and

are available in [

32,

34].

2.2.3. Critical Paths

Once an industry is under attack, shocks will propagate along particular paths. It is important to accurately identify the critical path for assessing and dealing with shocks. SPA is the principal method for exploring the critical path from the traditional view in the IO analysis [

5,

35,

36,

37]. However, this method ignores the fact that the industrial system is a typical complex system, in which different industries connect to, interact with, and interdepend on each other.

Since the complex network theory was introduced into the IO analysis, scholars have mainly explored the degree and scope of the effect on the economic system when particular industries were under attack and focused on the measurement of critical nodes [

26,

27,

30,

38]. The research on the critical path from the network perspective has often been ignored.

This study identifies the critical path based on the SP matrix, which can be constructed from Equations (4) and (6), and can best reflect the incidence relation among all the industries in the industrial system. Specific search rules are as follows:

Step 1: Determine key industries based on the index from the industrial perspective;

Step 2: Take the key industry as a starting vertex to sort link weights between the starting industry and its related industries in the downstream, and select the vertex corresponding to the most significant link weight as the next key industry in the critical path;

Step 3: Take the selected industry in Step 2 as the starting vertex, repeat the previous step to determine each key industry in the critical path, then break it up and obtain the critical path in the downstream until trapped in a circle;

Step 4: Take the key industry as a starting vertex to sort link weights between the starting industry and its related industries in the upstream, and select the vertex corresponding to the most significant link weight as the previous key industry in the critical path;

Step 5: Take the selected industry in Step 4 as the starting vertex, repeat Step 4 to determine each key industry in the critical path, break them up and obtain the critical path in the upstream until trapped in a circle.

3. An Impact Path Analysis of Russo–Ukrainian Conflict from the Regional Perspective

3.1. Overview of the Economic Structure of Russia

After growing rapidly in the first decade of the 21st century, the Russian economy has been flat since 2010. Purchasing power parity is a coefficient of equivalence between currencies calculated according to different price levels of each country, which enables a more reasonable comparison of the GDP of each country in economics [

39,

40]. According to the latest data released by the International Monetary Fund (IMF, 2021) [

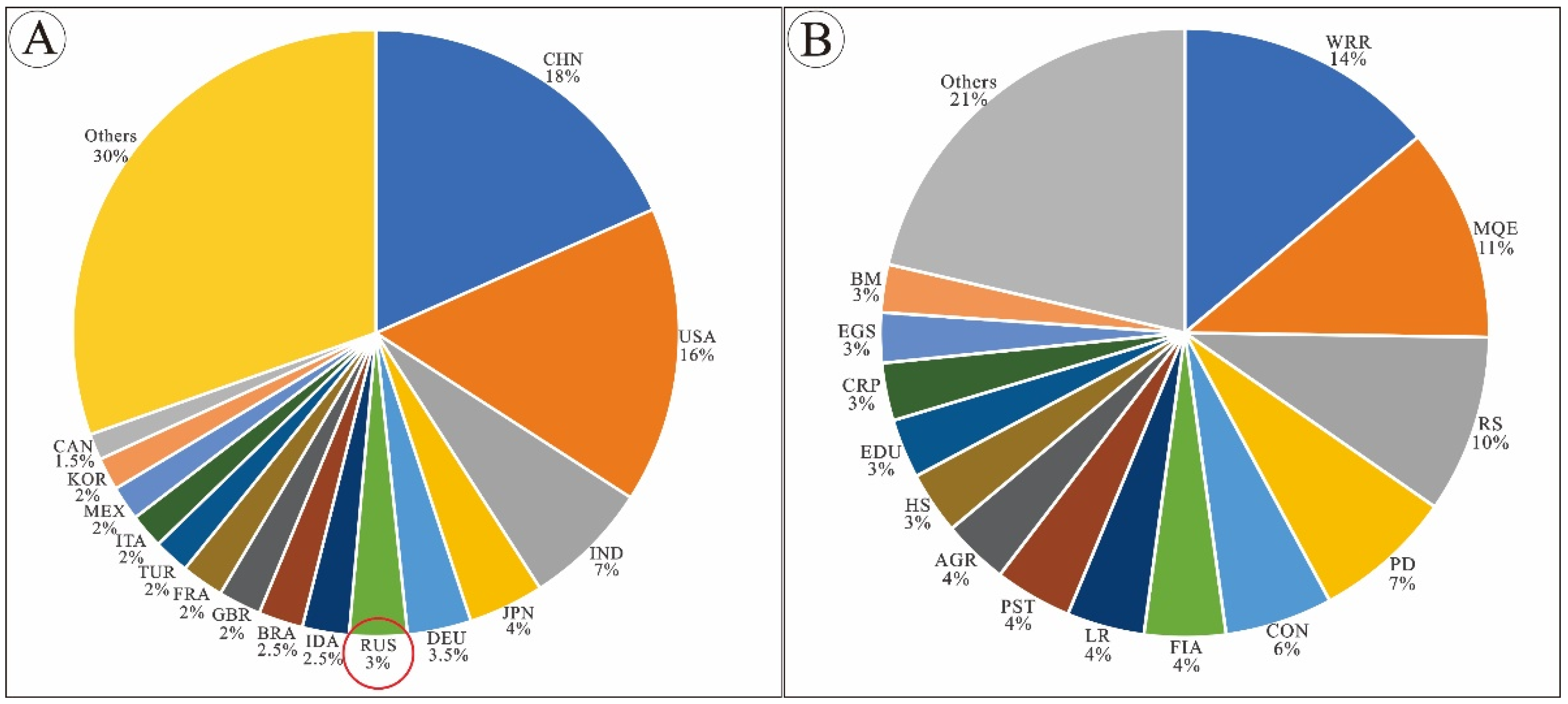

41], the GDP valued at purchasing power parity for Russia ranks sixth, accounting for 3% worldwide in 2020 (

Figure 1A). According to the output value, the leading industries in Russia mainly include WRR, MQE, RS, and PD (

Figure 1B).

3.2. IAEIC and AI of Russia and Other Countries in the World

The IAEIC and AI of all the countries are measured by Equations (1) and (2), and map into

Figure 2 (concrete data are included in

Supplementary Material Table S1). As the top two countries in the rankings of GDP, CHN, and USA are within Quadrant II, they possess the strongest IAEIC and the weakest AI, which indicates their economic development depends more on the interaction among domestic industries. Along with JPN, DEU, GBR, FRA, BRA, etc., RUS is in the second league within Quadrant II, indicating that their industrial systems have a relatively strong synergistic ability and self-repairing capability once under attack. IRL, LUX, HUN, MLT, and so on are within Quadrant IV (the weakest IAEIC and strongest AI), indicating that they highly depend on other countries.

3.3. IREIC between RUS and Other Countries

The IREIC between RUS and other countries are measured by Equation (3), which map into

Figure 3 and

Figure 4, respectively (concrete data are show in

Supplementary Material Table S1).

Figure 3 shows the economic dependence degree of Russia on other countries.

Figure 4 shows the economic dependence degree of other countries on Russia. Overall, RUS highly depends on CHN, DEU, USA, ITA, and so on. CHN, DEU, USA, FRA, etc., highly depend on USA. This means that economic shocks caused by various economic and financial sanctions against RUS will spread to the above countries by a large margin.

4. An Impact Path Analysis of Russo–Ukrainian Conflict from the Industrial Perspective

4.1. The Ability of the Center to Transform Resources of Industries in RUS

The SP betweenness or link indicates the ability of the center to transform resources from all over the economic system into finished products to supply the whole economy. Based on the algorithm concerning network centrality in

Section 2.2, we obtain all the SPs by Equation (4), then calculate the SP betweenness of all the industries by Equation (5), to measure the ability of the center to transform resources from all over the world into finished products to supply the globe.

Table 1 shows the SP betweenness of the industries in RUS (the full list of the betweenness of the nodes is show in

Supplementary Material Table S2).

Overall, the SP betweenness of MQE, CRP, WRR, BM, and CON in RUS ranks in the top 200, including not only sectors related to energy, which is the well-known economic specialty of RUS, but also the service sector, such as WRR. These industries possess a fairly strong ability to transform resources, and they have much more importance than the role of GDP. If they do not recover in time, there will be quite a large impact on economic development in RUS and even the whole world. So, attention should be paid by the Russia government and relevant enterprises to these industries both during or after the conflict.

4.2. The Ability of the Center to Transform Resources for Links between All Industries in RUS

In addition to the abovementioned industries, the SP betweenness for links (namely the SP matrix) between all industries in the world by Equations (4) and (6) can also reflect the ability to transform resources.

Table 2 shows the SP betweenness of the links between industries in RUS (the full list of the betweenness of the links for all countries is show in

Supplementary Material Table S2).

The data on the industries included in the

Table 2, which ranks the top 2000 of the 4,143,687 links in the world, are all from RUS, and thus corroborates that the economic development in RUS depends more on the interactions among its domestic industries (

Figure 2). More precisely, the SP betweenness of the links—RUS-MQE→RUS-CRP, RUS-LR→RUS-WRR, RUS-RS→RUS-WRR, RUS-AGR→RUS-FBT, and RUS-MQE→RUS-EGS—is quite high, ranking in the top 500 in the nearly 4.2 million links worldwide. It indicates that for all these industries related to energy, AGR and WRR play an important role in transforming resources, which is indeed worthy of attention.

4.3. The Roles as Suppliers or Consumers of Industries in RUS

The downstream closeness and upstream closeness of all the industries in the world are calculated by Equations (7) and (8), respectively (the full list of the downstream and upstream closeness is show in

Supplementary Material Table S2).

Table 3 shows the downstream closeness of industries in RUS, which represents its important role as a supplier to downstream industries and thus towards driving economic development.

Table 4 shows the upstream closeness of industries in RUS, which represents its important role as a consumer of upstream industries and thus towards driving economic development.

The downstream closeness of industries including MQE, WRR, CRP, LR, BM, EGS, RS, TS, and PST rank in the top 260 of all 2948 industries around the world. Once these industries are hit, there will be an immediate impact on the economic development because they play an important role as suppliers to downstream industries.

The upstream closeness of industries including WRR, CON, CRP, FBT, PD, BM, LR, MQE, and EGS rank in the top approximately 300 of all 2948 industries around the world. Once these industries are hit, there will be an immediate impact on the economic development because they play an important role as consumers to upstream industries.

4.4. Symmetry and Clustering of Industries in RUS

Industrial symmetry and clustering are dynamic attributes of an industry from the perspective of the network. The former indicates the stability of supply and demand between a particular industry and its neighboring industries in the overall economic network under attack, showing the characteristics of fungibility. The latter reflects the co-driving ability of an industry to the adjacent industries, indicating the size and scope of the impact on the economic system. Therefore, the combination of the two indexes can more systematically analyze the impact of specific industries on the macroeconomic system under attack. Industries with strong symmetry and weak clustering and those with weak symmetry and strong clustering should be of significant concern. The former has a relatively balanced bidirectional relationship with other industries and does not easily follow the same direction as other industries. Generally speaking, the impact of these industries on the whole economic system is relatively controllable. On the contrary, the latter tends to act asymmetrically as a single supplier or consumer of the economic system, and has a strong inflammatory effect, which easily spreads the industrial shock to the surrounding industries. Then, it will often seriously affect the overall industrial structure after the initial damage.

The distribution of industries in RUS based on symmetry and clustering is shown in

Figure 5 (the full list of symmetry and clustering is show in

Supplementary Material Table S2). Industries such as MQE, CRP, CCP, CON, AR, and PD are within Quadrant IV (weak clustering and strong symmetry), which indicates that they will experience a significant impact on their economic networks once they are hit. Moreover, these industries will easily spread shocks to other industries. Therefore, they should be an area of close concern for the Russian government. On the contrary, most of the industries such as TEL, TTP, WR, PMB, CEO, FIA, and RPP in RUS are within Quadrant II (strong symmetry and weak clustering). They have a strong fungibility and do not easily follow the same direction as other industries. So, their impact derived from shocks on the entire economic system is relatively controllable.

5. A Critical Path Analysis of Russo–Ukrainian Conflict

By

Section 4.2, we can see the strongest link in RUS is from RUS-MOE→RUS-CRP. Moreover, all of the SP betweenness, downstream closeness, and upstream closeness values of the two industries rank close to the top among all the industries. So, we take RUS-CRP as a starting vertex to identify the critical path in the downstream based on the algorithm in

Section 2.2. Then, we take RUS-MOE as a starting vertex to identify the critical path in the upstream in the SP matrix based on the same algorithm. Finally, we obtain a critical path, RUS-LR→

RUS-MQE→RUS-CRP→RUS-LR→RUS-WRR. We find that all of these industries distributed in the strongest critical path are from RUS, which is again the proof of the greater reliance of the economic development in RUS on the interaction among its domestic industries (

Figure 2).

However, aside from than the critical path in RUS, we are more concerned about the critical path starting from industries in RUS but ending with industries beyond RUS. Then, we clear the data about RUS in the SP matrix, and identify the critical path based on the algorithm in

Section 2.2, taking the key industries, RUS-LR,

RUS-MQE,

RUS-CRP, RUS-LR, and RUS-WRR, as starting vertices, respectively. Finally, we obtain a worldwide critical path (

Figure 6), which indicates the specific impact path of key industries in RUS on industries worldwide.

It is evident that there is relatively strong incidence relation between key industries in RUS and DEU-MAC, NLD-MSS, FRA-OTE, and USA-PST in the upstream, indicating their important role as consumers. There is a relatively strong incidence relation between key industries in RUS and CHN-CRP and JPN-CON in the downstream, indicating their important role as suppliers. It is remarkable that all of the industries including CRP, MQE, and WRR play an important role as suppliers to CRP in CHN. China needs to focus on the protection of CRP and avoid losses as much as possible.

6. Conclusions and Policy Implications

(1) The Russian economy tends to be introversive, and its economic development depends more on the interaction among its domestic industries, so it has a certain self-repairing ability in the face of sanctions. The impact of sanctions on the Russian economy will be limited, and the result that the Russian economy will crumble seems to be wishful thinking from the USA and Europe.

(2) The Economic dependence of RUS on CHN, DEU, USA, and ITA is relatively high. In contrast, CHN, DEU, USA, and FRA are highly dependent on RUS in terms of economics. This relationship shows that sanctions can be a two-edged sword. Once the Russian economy is hit hard by the recession, not only the authors of the sanctions but also third-party countries will be affected, notably CHN, DEU, USA, ITA, and FRA. In the face of direct and large economic shocks, these countries need to pay special attention to their own economic development.

(3) The SP betweenness of industries such as MQE, CRP, WRR, BM, CON, EGS, and LR in RUS ranks close to top worldwide; the downstream closeness of industries such as MQE, WRR, CRP, LR, BM, EGS, and RS in RUS ranks close to the top worldwide; and the upstream closeness of industries such as WRR, CON, CRP, FBT, PD, BM, and LR in RUS ranks close to the top worldwide.

These industries act either as the center for transforming resources or as important suppliers or consumers for adjacent industries. Moreover, some industries appear in two or three lists, such as CRP, WRR, BM, and LR, indicating that they are probably more important than others that are ranked higher on only one of the lists. Once the above industries are damaged, it will not only hit the Russian economy, but also impact the world economy, especially those countries who have close trade ties in these industries with RUS. Therefore, special protections and supports should be placed on these industries.

(4) Due to the weak symmetry and strong clustering, industries including MQE, CRP, CCP, CON, AR, and PD in RUS may directly cause the imbalance of the supply and demand structure of the entire economic system, and rapidly expand in the system once impacted, which is the key area of attention for economic recovery.

On the contrary, more industries such as TEL, TTP, WR, PMB, CEO, FIA, and RPP in RUS have strong symmetry and weak clustering. Once they are hit, the impact on the whole economic system is relatively controllable and can even be handled flexibly in industrial regulation. For example, the government can allocate the human, physical, and financial resources of these industries to other ones that are more immediately important when necessary.

(5) The critical path for RUS is RUS-LR→RUS-MQE→RUS-CRP→RUS-LR→RUS-WRR. These key industries play an important role as consumers for DEU-MAC, NLD-MSS, FRA-OTE, and USA-PST in the upstream, and as suppliers for CHN-CRP and JPN-CON in the downstream. The relevant countries should place emphasis on the protection of correlative industries and avoid losses as much as possible. For example, they can actively seek alternative importing countries to supply their own demand, and alternative exporting countries for their own products and services.

7. Limitations of this Study and Directions of Further Research

Firstly, due to the limited coverage of the OECD database, many economies that play an important role in the global economic environment have been left out. Secondly, due to the hysteresis quality of the OECD database, there are some errors when we discuss the issue for the year 2022 using the data for the year 2018. Finally, the Russo–Ukrainian Conflict broke just about four months ago and many studies may be ongoing and have yet to be published, and we have not compared the findings of this study with that of previous studies.

Therefore, in our further research, we plan to use some ICIO databases with better coverage, such as EORA [

42], which covers about 190 countries in the world and the years from 1990 to 2021, though data for the last three years has charged. Moreover, we will more systematically compare the findings of this study with those of previous studies to demonstrate the method and principle of our research.