Abstract

In the new era of the Fourth Industrial Revolution, digitalization has progressively transformed manufacturing and further affected the balance in international trade patterns. This study assesses whether and how the digital transformation in manufacturing contributes to trade imbalances. Using detailed industry-level data from the US, this study constructs an integrated evaluation to measure the level of digital transformation in manufacturing and investigates the ways in which digital transformation in manufacturing affects the US–China trade imbalance. Empirical results show that the US digital transformation in manufacturing is positively associated with the US–China total trade imbalance, which in turn is negatively associated with their related-party trade imbalance. The further analysis presents a moderated mediation model that includes the US-imported intermediate input from China (mediator for the US–China total trade imbalance), foreign direct investment in China by the US multinationals (mediator for the US–China related-party trade imbalance), and Chinese important manufacturing policy (moderator) simultaneously. The results reveal that the Chinese important manufacturing policy moderates the mediation process and the moderated mediation effect is stronger for the industries which are not involved with this policy. Our findings are informative for developing digital transformation strategies for both manufacturing firms and government authorities.

1. Introduction

It is an inspiring time for the manufacturing industry to go digital. Emerging digital technologies, such as the Internet of Things (IoT), intelligent robotics, big data, and cloud computing, are integrated into industrial operations to gain high-productivity performance, achieve business goals, and unlock sustainable improvement [,,]. Toward the new trend of digital transformation in manufacturing, there is an increasing amount of literature on this topic. The first research line has adopted technology diffusion and innovation theory and reviewed digital transformation as the organizational change motivated by digital technologies for business operation and customer service, indicating its emerging nature [,,]. The Fourth Industrial Revolution comes in the form of digital transformation, which is commonly referred to as Industry 4.0 []. The cloud platform, matching algorithm, and resource availability have influenced the utility of the manufacturing providers and consumers []. Accelerating the process of digital transformation—in broadband networking, cloud-based computing and storage, sensor technology, and more—is driving manufacturing system shifts. The second line has employed empirical approaches and identified that digital transformation has achieved greater improvement in manufacturing. The intensity of digital transformation is in positive correlation with the process-based operating performance, and in the U-shaped correlation with the profit-oriented financial performance []. The digital-related capabilities have a significant positive impact on manufacturing-company performance mainly through innovation and value co-creation []. Li et al. find that the positive effect of digitalization on manufacturing-firm performance is determined by the firm’s level of knowledge inertia [].

In relation to the term digital transformation, the other term, such as information and communication technology (ICT), has been used as the crucial driver in supporting digital transformation and promoting the upgrade of the manufacturing industry [,]. It is commonly believed that the development of the Internet and ICT have significantly stimulated international trade by improving the efficiency of information transmission and reducing transaction costs [,]. From a perspective of the comparative advantage, ICT can affect the balance in international trade patterns [], which might provide the explanation for global trade imbalances []. One salient feature of global trade imbalances has been the enormous US–China trade deficit. It is reported that the US has its largest trade deficit (defined as the difference between total imports and total exports), and has accumulated more than $5.5 trillion since 1985, with China also one of its largest trading partners. The sources of the US–China trade deficits may lie in the effective terms of trade, relative trade costs, and relative macroeconomic developments [,,,]. Naturally, two intriguing questions are raised: (i) Does digital transformation in manufacturing affect trade imbalances? (ii) By what underlying mechanism is the effect achieved?

However, to the best of our knowledge, there is limited literature available exploring the empirical relationship between digital transformation in manufacturing and trade imbalances. To go some way to filling this research gap, we conduct our study based on samples of the US manufacturing industries and the US–China trade. In particular, the US, as a leader in global manufacturing, launched the Advanced Manufacturing Partnership (AMP) in 2011, bringing national efforts to foster advanced manufacturing technologies and develop the infrastructure for manufacturers’ innovation. With the dynamics of trade imbalances, the US maintained its specialization in physical capital, human capital, and research-and-development-intensive goods. To ensure the availability and completeness of the data, we refer to the US Census data on detailed manufacturing activities collected in the annual survey, while samples from other countries cannot provide enough observations for an empirical study. Therefore, the following hypothesis is proposed:

Hypothesis 1 (H1).

The US digital transformation in manufacturing has a significant effect on the US–China trade imbalance.

2. Methods

2.1. Sample and Data Collection

The empirical analysis is based on a sample of the US six-digit North American Industrial Classification System (NAICS) industry characteristics. The US Annual Survey of Manufactures (ASM) provides complete, consistent, and reliable intercensal measures of the US manufacturing activities, widely adopted by researchers and policymakers []. We also collected bilateral imports and exports data from the US International Trade Commission (USITC). Our study covers the period from 2007 to 2018. Our selection of this time window was primarily determined by the earliest and the latest year for data available, and this is also the period that witnessed significant expansion of the US trade deficits with China and the use of digital technologies in manufacturing. After deleting data with missing values in the key variables, an unbalanced panel consisting of 3516 observations was obtained for analysis.

2.2. Measures

2.2.1. Digital Transformation in Manufacturing (DTM)

Developing a scientific and comprehensive evaluation index system for digital transformation in manufacturing is the starting point for our empirical analysis. We consider three relevant aspects of nine indicators at the six-digit industry level described in Table 1. The construction of the index system is based on the use of digital technologies and digital services, which is not only directly related to the reliability and significance of the previous studies obtained but also helps to identify the decisions from manufacturers rather than the performance of the whole country. All indicators are beneficial.

Table 1.

Digital manufacturing evaluation indicators.

The Technique for Order Preference and Similarity to Ideal Solution (TOPSIS) developed by Yoon and Hwang [] has effectively solved complicated decision-making problems [,]. In this study, we applied the TOPSIS method to evaluate the US digital transformation in manufacturing, giving each evaluated object a specific score. The calculation procedures are presented as follows:

Since all indicators are positive indicators, we normalize the index data to eliminate the influence of different measurement units. is the maximum value of the indicator in all years, and is the minimum value of the indicator in all years.

where represents the weight of index in year , is the number of observations.

where is the evaluation year, is the information entropy of the index .

where is the redundancy of information entropy.

where is the number of indicators, represents the indicator weight of the index .

where is the level of digital transformation in manufacturing using the weighting of multiple linear functions. The larger the , the higher the level of digital transformation in manufacturing, and vice versa (for brevity, we do not present the distribution of the US digital transformation in manufacturing by industry. Data on “DTM” are available from the corresponding author upon request).

2.2.2. Other Variables

Trade imbalances. In our treatment of trade imbalances, we extend this study not only to the total terms but also to the related-party terms, emphasizing the pattern of intra-firm trade with multinational enterprises (MNEs) [,,,,]. The explained variable Tot represents the total trade imbalance, calculated as the ratio of the difference between total exports and total imports to the US output. Cross-border trade between multinational companies and their affiliates is often referred to as “intra-firm” or sometimes “related party” trade (related-party trade includes import transactions between parties with various types of relationships including “any person directly or indirectly, owning, controlling or holding power to vote, 6 percent of the outstanding voting stock or shares of any organization.” A related-party export transaction is one between a US exporter and a foreign consignee, where either party owns, directly or indirectly, 10 percent or more of the other party). It is notable that intra-firm or related-party trade accounts for around one-third of goods exports from the US, and a similar proportion of all the US goods imports. The affiliates of the US multinationals in China are responsible for China’s intra-firm trade surplus with the US, and their operations in China have helped increase the US net exports to China in recent years []. Therefore, we adopt the other explained variable Rel to represent the related-party trade imbalance, using the related-party export and import transactions between parties with various types of relationships. The reporting country is the US and the partner country is China. Specifically, trade imbalance variables are expressed as a percentage due to the relatively small value. The trade data are available on the USITC and the US Census.

Controls: Several variables that might affect trade cost or price are controlled. On the one hand, the US manufacturing cost and output at the industry level should be considered. Wage is measured as the US production worker wage per hour, and Vadd is taken as the logarithm of the US total value added. Invest proxies the US total capital expenditure, and Matcost is the growth rate of the US total cost of materials. TFP is measured as the logarithm of the US 4-factor TFP index. These data are available from the ASM. On the other hand, some factors from China should be discussed. Income represents the Chinese average income of workers, obtained from the China Labor Statistics Yearbook. Tariff, imposed by the US on Chinese commodities, is also included accessible from the World Integrated Trade Solution (WITS) database. To capture the effect of exchange rate movements, we follow the methodology developed by [] to calculate industry-specific real exchange rate RER as follows:

where the subscripts and represent the US and China, respectively. is the bilateral nominal exchange rate obtained from the Bank for International Settlements (BIS). refers to the price of industry in the US and refers to the price of industry in China, which are calculated from the USITC trade data.

2.3. Estimation Methods

The trade gravity model has been widely used in empirical examinations of the determinants of trade flows [,]. The specific factors capturing the bilateral trade cost or price are introduced into the model based on the most basic form. To test the relationship between the US digital transformation in manufacturing and the US–China total trade imbalance, the main regression model is established as follows:

To test the relationship between the US digital transformation in manufacturing and the US–China related-party trade imbalance, the main regression model is established as follows:

where the subscripts and , respectively, represent the US manufacturing industry and year . Coefficients and examine the influence of the US digital transformation in manufacturing on the US–China trade imbalance in terms of total and related-party, respectively, and is a stochastic error term. The results of the Breusch and Pagan Lagrangian multiplier test (BP test) show that unobservable individual effects exist in the sample data, so this study uses the panel data method. Furthermore, the Hausman test statistics imply that the explanatory variables and unobservable heterogeneity are correlated, so the fixed-effects model is more suitable for our analysis. is added to the model as the industry dummies to control the industry-level fixed effects. is the year dummies to control year-level fixed effects.

3. Results

3.1. Main Results

Table 2 gives the OLS regression results for hypothesis H1. Columns (1) and (3) include only trade imbalances and DTM variables; columns (2) and (4) add controls. In the model of total trade imbalance, the coefficient of DTM is 0.0219, which is significant at the 1% level. It reveals that the digital transformation in manufacturing is positively correlated with total trade imbalance; the higher the US digital transformation in manufacturing, the greater the total trade imbalance between the US and China. When the DTM is added to the related-party trade model, its coefficient is −0.1492, significant at the 1% level. There is a significantly negative relationship between the digital transformation in manufacturing and related-party trade imbalance, and the higher the US digital transformation in manufacturing, the smaller the related-party trade imbalance between the US and China. Thus, hypothesis H1 is confirmed.

Table 2.

Main regression results.

3.2. Robustness Test

Some research has stated that production specialization has taken place not only within industries but also across industries, thus driving trade imbalances at the industry level [,]. To obtain more robust empirical results, we adopt a quantile regression for analyzing heterogeneity [,,] across different industries with quantiles of 0.25, 0.50, and 0.75. As seen in Table 3, the coefficients of the DTM remain robust and stable with our previous analysis. Although the margin effects of the DTM decrease as the quantile q increases, it suggests that alternative regression methods do not alter our findings on the impact of digital transformation in manufacturing on trade imbalances.

Table 3.

Quantile regression.

As shown in Table 4, we further conduct other robustness tests. Because of possible extreme outlier concerns, we winsorize the distribution of DTM within each wave at the 1st and 99th percentiles, and the results are presented in columns (1) and (3). The sign and significance of the DTM are consistent with those reported above, indicating the robustness of the basic empirical results. Moreover, as the 2008 financial crisis led to a great recession worldwide, the trade flow might be influenced abnormally. Therefore, we removed the 2008 sample and re-estimated the models. Columns (2) and (4) report the results, remaining statistically significant.

Table 4.

Robustness checks Ⅰ.

In the robustness check, the variables of digitalization and trade relations are added to our main analysis to control external impacts. On the one hand, the effects of digitalization integrating hardware, software, and research should be identified in a comprehensive mapping. The US Bureau of Economic Analysis (BEA) includes the types of infrastructure, e-commerce, and priced digital services to quantitatively measure the US digital economy. Therefore, we take the logarithm of the US digital economy output by industry (DI) estimated by BEA as the proxy variable of digitalization. On the other hand, most countries rely on each other in international trade networks. The role of governments is a matter of importance for trade relations [,,]. By drawing on the available methods of measuring other economic relations [], we improve a measure of the US–China trade relations (TR) as follows:

where the subscripts and , respectively, represent China and industry . represents the US exports to the country of industry, represents the US imports from the country of industry, and is the number of countries. The higher is, the more significant China is to the US in terms of exports. The lower is, the more significant China is to the US in terms of imports.

The estimated coefficients reported in Table 5 are mostly consistent and significant; thus, our empirical results are robust with respect to these additional control variables.

Table 5.

Robustness checks Ⅱ.

3.3. IV Estimation

To address the potential for reverse causality, we implement an IV approach to test the robustness. The explanatory variable DTM in the later stage (Lag) is used as the first instrument to deal with the two-way causality problem, but it may miss useful information about the current period. Hence, we construct the second instrumental variable using the logarithm of the US quantity of electricity purchased (Elec) at the six-digit industry level from ASM [].

Furthermore, we employ the IV estimations via two-stage least squares (2SLS), presented in Table 6. It is found that these IV estimates are mostly larger than the OLS results and still statistically significant at the 5% level. Most importantly, the “LM statistic” and “Wald F statistic” columns in each panel show that the IV estimates are robust and reliable, confirming the effectiveness of the IV method.

Table 6.

IV estimations.

4. Mechanism

Based on the baseline results, we further explore the latent mechanisms of the relationship between digital transformation in manufacturing and trade imbalances.

4.1. Mediation Analysis

The first important underlying mechanism from the perspective of global production sharing is the trade in intermediate inputs, that is, the parts and materials sourced from abroad are used to make products either consumed domestically or exported. Indirect trade processing intermediate goods across countries has risen. The manufacturing sector purchases inputs from nonmanufacturing sectors to produce []. Prior studies have confirmed that intermediate input imports can improve export performance by increasing the new variety of inputs for production [,,] and obtaining more inputs for innovation [,,]. Therefore, we argue that the US-imported intermediate inputs may raise the US exports and thereby generate an improvement in the trade balance. Moreover, the digital transformation in manufacturing achieves significant changes in production systems and promotes production efficiency [,], which tends to boost the demand for intermediate goods. Taken together, we posit the following hypothesis:

Hypothesis 2a (H2a).

Imported intermediate input mediates the positive relationship between the US digital transformation in manufacturing and the US–China total trade imbalance.

Another critical mechanism is the foreign direct investment (FDI) activities of multinationals. Extant studies have already documented the complementary relationship between FDI and exports [,,]. The US parents increase exports to their foreign affiliates, along with their prior investments in these foreign markets []. Driven by expanding outward FDI, the US multinational firms are more likely to export to their foreign affiliates, thus helping to balance the related-party trade. In addition, FDI, as the important channel of international technology spillovers and transfers, potentially helps industries in host countries catch up with the international technology frontier [,,,,]. For instance, in 2016, General Electric Company (GE) invested 11 million dollars to open a digital innovation workshop in Shanghai aimed at supporting local digital industrial innovation and aggregating ecosystem resources to collaborate with customers. Thus, the US digital transformation in manufacturing facilitates the US multinationals’ acceleration of technology transfer, with an increase in FDI. To sum up, we expect that the interaction of digital transformation in US manufacturing with FDI may influence the trade flows between affiliates and parent companies. Therefore, this study anticipates mediation effects and proposes the following hypothesis:

Hypothesis 2b (H2b).

Foreign direct investment mediates the negative relationship between the US digital transformation in manufacturing and the US–China related-party trade imbalance.

To test the mediation model, we perform the Sobel test []. In this study, the mediator Input is the logarithm of the US-imported intermediates from China share in the US output by industry. The mediator FDI is the logarithm of the foreign direct investment in China by the US Multinational Enterprises (MNEs) by industry. These measurements use data released by BEA.

As seen in Table 7, digital transformation in manufacturing has significant impacts on trade imbalances in terms of total and related party, which are consistent with H1. The variable of DTM is significantly and positively associated with imported intermediate input and foreign direct investment. The imported intermediate input is significantly and negatively correlated with the US–China total trade imbalance at the 1% level. Additionally, foreign direct investment is negatively correlated with the US–China related-party trade imbalance. Thus, H2a and H2b are supported.

Table 7.

Mediation effects.

4.2. Moderated Mediation Effect

The Five-Year Plan, as China’s policy blueprint for medium-term social and economic development, optimizes domestic resources allocation and promotes industrial policy. We have noticed that China’s exports made remarkable achievements during the period of the Five-Year Plan, increasing from 9.75 billion dollars in 1978 to 2.48 trillion dollars in 2018. It is found that the industrial policy taken by the government has significant positive effects on developing industrial clusters and contributing to greater productivity growth, which indirectly influences the comparative advantages of international trade [,,]. Moreover, an industrial policy aimed at revitalizing domestic industry is likely to affect the magnitude and direction of imported intermediates inputs and FDI spillovers []. Given this, we propose that China’s five-year plan may moderate the link between imported intermediate inputs (foreign direct investment) and total trade imbalance (related-party trade imbalance).

By reading the “10th Five-Year Plan”, “11th Five-Year Plan”, “12th Five-Year Plan” and “13th Five-Year Plan” documents, we manually sorted out the key industries mentioned in official documents and constructed the important manufacturing policy (IMP) indicator at the industry level. Thus, we introduce the IMP dummy variable as the moderator to illustrate the indirect effect on trade imbalances, which values ‘1’ if the industry is on the list of the Five-Year Plan. Accordingly, the following hypotheses are suggested:

Hypothesis 3a (H3a).

IMP moderates the association between imported intermediate input and the US–China total trade imbalance.

Hypothesis 3b (H3b).

IMP moderates the association between foreign direct investment and the US–China related-party trade imbalance.

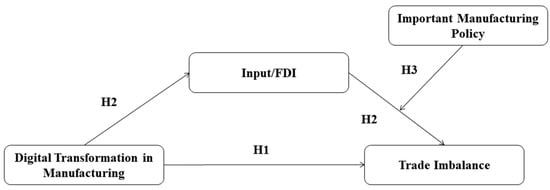

The research hypotheses constitute a moderated mediation model. Figure 1 presents the relationships between the examined variables.

Figure 1.

Hypothesized model.

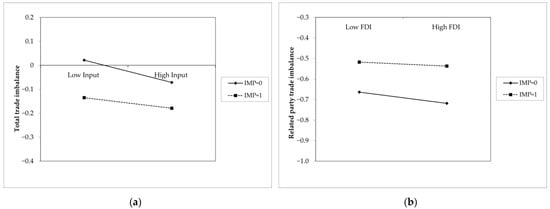

To test H3a and H3b, we examined the moderated mediation effect. The bootstrapped confidence intervals (CIs) tests confirm the existence of indirect effects, that is, the indirect effect can be considered significant if the bootstrapped CIs do not include zero. Table 8 presents the results of the moderated mediation effects. For the mediator Input, the bootstrap results indicate that IMP moderates the association between imported intermediate input and the US–China total trade imbalance, with a bootstrapped 95% of CIs not containing zero. The moderated mediation effect is stronger for the industries which are not involved with IMP. For the mediator FDI, the bootstrap results show that the indirect effect of foreign direct investment on the US–China related-party trade imbalance is significantly negative in conditions where the value of IMP is zero, whereas the indirect effects are not statistically significant in conditions where the value of IMP is one. Hence, both H3a and H3b are supported. We also illustrated the moderating effects further by plotting the impact of mediators on trade imbalances at different levels of IMP. Figure 2a,b show that the slope of the negative effect of the imported intermediate input (foreign direct investment) on total trade imbalance (related-party trade imbalance) is larger when the IMP equals zero, which confirms the H3a and H3b.

Table 8.

Conditional indirect effects.

Figure 2.

Two-way linear interaction effects. (a) Interaction effect of imported intermediate input and important manufacturing policy on total trade imbalance; (b) Interaction effect of foreign direct investment and important manufacturing policy on related-party trade imbalance.

5. Conclusions and Discussion

5.1. Conclusions

Digital technologies have revolutionized how manufacturers work and interact across sectors. In relation to the emerging literature on digital transformation, this study exploits novel industry-level data to provide some of the first evidence on how the US digital transformation in manufacturing affects the US–China trade imbalance, which contributes to the literature on both digital transformation and the driving forces behind global imbalances. Specifically, based on a sample of US manufacturing from 2007 to 2018, we constructed an aggregate measure of the US digital transformation in manufacturing at the six-digit industry level to evaluate. Moreover, we distinguished between total trade flows and related-party trade flows because the reasons behind each may be different. Additionally, the empirical results show they do differ significantly when responding to the changes in digital transformation in manufacturing. Overall, the empirical results are suggestive of a positive and robust link between the US digital transformation in manufacturing and the US–China total trade imbalance, although establishing a clear negative impact of the US digital transformation on the US–China related-party trade imbalance.

In addition, this study proposed a moderated mediation model to unveil the underlying mechanism of digital transformation on trade imbalances. We found strong empirical evidence that the positive association between the US digital transformation in manufacturing and the US–China total trade imbalance is mediated by imported intermediate inputs, which is a vital connection reflecting the role of imported inputs embedded in trade in shaping the process of production. Considering the existence of complementarity between foreign direct investment and the export decision of manufacturers to serve the foreign market, we found that foreign direct investment in China by the US multinationals mediates the negative relationship between the US digital manufacturing and the US–China related-party trade imbalance. Furthermore, we observed that the indirect effect of imported intermediate inputs on total trade imbalance, as well as FDI on related-party trade imbalance, is weakened when the industries are affected by the Chinese important manufacturing policy.

5.2. Limitations and Implications for Future Research

This study has several limitations. Firstly, although the US is a leader in global innovation and manufacturing, the design of a single country provides us with limited insights into understanding this issue. Future studies could be extended to other developed countries or emerging markets for comparative analysis. Secondly, considering the availability of panel data, it neglects to measure the level of digital transformation in manufacturing from the Chinese side. Thirdly, there is a need for additional research to control confounding variables in statistical models of moderated mediation and to broaden the conditions of the moderating effects. Finally, the integrated evaluation of digital transformation in manufacturing in this study remains uncertain in its validity. To overcome this limitation, we can improve the measurement and consider more digital-attributed components.

The empirical evidence documented in this study has three important implications for future research. First, it highlights the fact that the level of the US digital transformation in manufacturing is closely related to the US–China trade imbalance, thereby providing a new perspective on the source of large and persistent imbalances. Second, it presents a big picture that illustrates the different roles that digital transformation plays in different types of trade flows. Accordingly, policies interacting with these flows may need to be distinct as well. Third, it is suggested to further develop the trade model with digital transformation and establish a global unified database on digital transformation.

Author Contributions

Conceptualization, W.Z.; Data curation, W.Z.; Formal analysis, W.Z.; Funding acquisition, G.G.; Investigation, W.Z.; Methodology, W.Z.; Resources, G.G. and S.L.; Software, W.Z.; Supervision, G.G. and S.L.; Writing—original draft, W.Z.; Writing—review and editing, W.Z., G.G. and S.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by the National Natural Science Foundation of China (grant number: 72141305).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All data are available under request to the author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Gal, P.; Nicoletti, G.; Renault, T.; Sorbe, S.; Timiliotis, C. Digitalisation and Productivity: In Search of the Holy Grail—Firm-Level Empirical Evidence from EU Countries; OECD: Paris, France, 2019. [Google Scholar]

- UN. The Impact of Digital Technologies. Available online: https://www.un.org/en/un75/impact-digital-technologies (accessed on 20 May 2022).

- Feroz, A.K.; Zo, H.; Chiravuri, A. Digital Transformation and Environmental Sustainability: A Review and Research Agenda. Sustainability 2021, 13, 1530. [Google Scholar] [CrossRef]

- Matt, C.; Hess, T.; Benlian, A. Digital Transformation Strategies. Bus. Inf. Syst. Eng. 2015, 57, 339–343. [Google Scholar] [CrossRef]

- Vial, G. Understanding Digital Transformation: A Review and a Research Agenda. J. Strateg. Inf. Syst. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- Hanelt, A.; Bohnsack, R.; Marz, D.; Antunes Marante, C. A Systematic Review of the Literature on Digital Transformation: Insights and Implications for Strategy and Organizational Change. J. Manag. Stud. 2021, 58, 1159–1197. [Google Scholar] [CrossRef]

- Ghobakhloo, M.; Fathi, M. Industry 4.0 and Opportunities for Energy Sustainability. J. Clean. Prod. 2021, 295, 126427. [Google Scholar] [CrossRef]

- Delaram, J.; Houshamand, M.; Ashtiani, F.; Fatahi Valilai, O. A Utility-Based Matching Mechanism for Stable and Optimal Resource Allocation in Cloud Manufacturing Platforms Using Deferred Acceptance Algorithm. J. Manuf. Syst. 2021, 60, 569–584. [Google Scholar] [CrossRef]

- Guo, L.; Xu, L. The Effects of Digital Transformation on Firm Performance: Evidence from China’s Manufacturing Sector. Sustainability 2021, 13, 12844. [Google Scholar] [CrossRef]

- Wang, X.; Gu, Y.; Ahmad, M.; Xue, C. The Impact of Digital Capability on Manufacturing Company Performance. Sustainability 2022, 14, 6214. [Google Scholar] [CrossRef]

- Li, L.; Ye, F.; Zhan, Y.; Kumar, A.; Schiavone, F.; Li, Y. Unraveling the Performance Puzzle of Digitalization: Evidence from Manufacturing Firms. J. Bus. Res. 2022, 149, 54–64. [Google Scholar] [CrossRef]

- Oztemel, E.; Gursev, S. Literature Review of Industry 4.0 and Related Technologies. J. Intell. Manuf. 2020, 31, 127–182. [Google Scholar] [CrossRef]

- Sun, Y.; Li, L.; Shi, H.; Chong, D. The Transformation and Upgrade of China’s Manufacturing Industry in Industry 4.0 Era. Syst. Res. Behav. Sci. 2020, 37, 734–740. [Google Scholar] [CrossRef]

- Freund, C.L.; Weinhold, D. The Effect of the Internet on International Trade. J. Int. Econ. 2004, 62, 171–189. [Google Scholar] [CrossRef] [Green Version]

- Liu, L.; Nath, H.K. Information and Communications Technology and Trade in Emerging Market Economies. Emerg. Mark. Financ. Trade 2013, 49, 67–87. [Google Scholar] [CrossRef]

- Wang, Y.; Li, J. ICT’s Effect on Trade: Perspective of Comparative Advantage. Econ. Lett. 2017, 155, 96–99. [Google Scholar] [CrossRef]

- Shen, J.H.; Long, Z.; Lee, C.-C.; Zhang, J. Comparative Advantage, Endowment Structure, and Trade Imbalances. Struct. Chang. Econ. Dyn. 2022, 60, 365–375. [Google Scholar] [CrossRef]

- Chiu, Y.-B.; Lee, C.-C.; Sun, C.-H. The U.S. Trade Imbalance and Real Exchange Rate: An Application of the Heterogeneous Panel Cointegration Method. Econ. Model. 2010, 27, 705–716. [Google Scholar] [CrossRef]

- Cheung, C.; Furceri, D.; Rusticelli, E. Structural and Cyclical Factors behind Current Account Balances. Rev. Int. Econ. 2013, 21, 923–944. [Google Scholar] [CrossRef]

- Kim, M.H. The U.S.–China Trade Deficit. Int. Trade J. 2014, 28, 65–83. [Google Scholar] [CrossRef]

- Yilmazkuday, H. Accounting for Trade Deficits. J. Int. Money Financ. 2021, 115, 102385. [Google Scholar] [CrossRef]

- FORT, T.C. Technology and Production Fragmentation: Domestic versus Foreign Sourcing. Rev. Econ. Stud. 2017, 84, 650–687. [Google Scholar]

- Hwang, C.-L.; Yoon, K. (Eds.) Methods for Multiple Attribute Decision Making. In Multiple Attribute Decision Making: Methods and Applications A State-of-the-Art Survey; Lecture Notes in Economics and Mathematical Systems; Springer: Berlin/Heidelberg, Germany, 1981; pp. 58–191. ISBN 978-3-642-48318-9. [Google Scholar]

- Zavadskas, E.K.; Mardani, A.; Turskis, Z.; Jusoh, A.; Nor, K.M. Development of TOPSIS Method to Solve Complicated Decision-Making Problems—An Overview on Developments from 2000 to 2015. Int. J. Inf. Technol. Decis. Mak. 2016, 15, 645–682. [Google Scholar] [CrossRef]

- Li, Y.; Yang, J.; Wen, J. Entropy-Based Redundancy Analysis and Information Screening. Digit. Commun. Netw. 2021; in press. [Google Scholar] [CrossRef]

- Markusen, J.R.; Venables, A.J. Multinational Firms and the New Trade Theory. J. Int. Econ. 1998, 46, 183–203. [Google Scholar] [CrossRef] [Green Version]

- Bernard, A.B.; Jensen, J.B.; Schott, P.K. Importers, Exporters, and Multinationals: A Portrait of Firms in the U.S. That Trade Goods; Working Paper Series; National Bureau of Economic Research: Cambridge, MA, USA, 2005. [Google Scholar]

- Egger, H.; Egger, P.; Greenaway, D. Intra-Industry Trade with Multinational Firms. Eur. Econ. Rev. 2007, 51, 1959–1984. [Google Scholar] [CrossRef] [Green Version]

- Antràs, P.; Yeaple, S.R. Chapter 2—Multinational Firms and the Structure of International Trade. In Handbook of International Economics; Gopinath, G., Helpman, E., Rogoff, K., Eds.; Elsevier: Amsterdam, The Netherlands, 2014; Volume 4, pp. 55–130. [Google Scholar]

- Ruhl, K.J. How Well Is US Intrafirm Trade Measured? Am. Econ. Rev. 2015, 105, 524–529. [Google Scholar] [CrossRef] [Green Version]

- Xu, Y.; Lin, G.; Sun, H. Accounting for the China–US Trade Imbalance: An Ownership-Based Approach. Rev. Int. Econ. 2010, 18, 540–551. [Google Scholar] [CrossRef]

- Sato, K.; Shimizu, J.; Shrestha, N.; Zhang, S. Industry-Specific Exchange Rate Volatility and Intermediate Goods Trade in Asia. Scott. J. Polit. Econ. 2016, 63, 89–109. [Google Scholar] [CrossRef] [Green Version]

- Markusen, J.R.; Maskus, K.E. Discriminating Among Alternative Theories of the Multinational Enterprise. Rev. Int. Econ. 2002, 10, 694–707. [Google Scholar] [CrossRef]

- Barattieri, A. Comparative Advantage, Service Trade, and Global Imbalances. J. Int. Econ. 2014, 92, 1–13. [Google Scholar] [CrossRef] [Green Version]

- Song, E.Y.; Zhao, C. Does Specialization Matter for Trade Imbalance at Industry Level? East Asian Econ. Rev. 2012, 16, 227–247. [Google Scholar] [CrossRef]

- Clark, D.P. Intra-Industry Specialization in United States–China Trade. Int. Trade J. 2013, 27, 225–242. [Google Scholar] [CrossRef]

- Buchinsky, M. Estimating the Asymptotic Covariance Matrix for Quantile Regression Models a Monte Carlo Study. J. Econom. 1995, 68, 303–338. [Google Scholar] [CrossRef]

- Tomlin, B.; Fung, L. The Effect of Exchange Rate Movements on Heterogeneous Plants: A Quantile Regression Analysis; Bank of Canada: Ottawa, ON, Canada, 2010. [Google Scholar]

- Gebka, B.; Wohar, M.E. Causality between Trading Volume and Returns: Evidence from Quantile Regressions. Int. Rev. Econ. Finance 2013, 27, 144–159. [Google Scholar] [CrossRef]

- Fordham, B.O.; Kleinberg, K.B. International Trade and US Relations with China. Foreign Policy Anal. 2011, 7, 217–236. [Google Scholar] [CrossRef]

- Wu, D.; Zhu, S.; Memon, A.A.; Memon, H. Financial Attributes, Environmental Performance, and Environmental Disclosure in China. Int. J. Environ. Res. Public. Health 2020, 17, 8796. [Google Scholar] [CrossRef]

- Wu, D.; Memon, H. Public Pressure, Environmental Policy Uncertainty, and Enterprises’ Environmental Information Disclosure. Sustainability 2022, 14, 6948. [Google Scholar] [CrossRef]

- Zhao, Y.; Liu, X.; Wang, S.; Ge, Y. Energy Relations between China and the Countries along the Belt and Road: An Analysis of the Distribution of Energy Resources and Interdependence Relationships. Renew. Sustain. Energy Rev. 2019, 107, 133–144. [Google Scholar] [CrossRef]

- Johnson, R.C.; Noguera, G. Accounting for Intermediates: Production Sharing and Trade in Value Added. J. Int. Econ. 2012, 86, 224–236. [Google Scholar] [CrossRef] [Green Version]

- Ahn, J.; Khandelwal, A.K.; Wei, S.-J. The Role of Intermediaries in Facilitating Trade. J. Int. Econ. 2011, 84, 73–85. [Google Scholar] [CrossRef] [Green Version]

- Bas, M.; Strauss-Kahn, V. Does Importing More Inputs Raise Exports? Firm-Level Evidence from France. Rev. World Econ. 2014, 150, 241–275. [Google Scholar] [CrossRef] [Green Version]

- Halpern, L.; Koren, M.; Szeidl, A. Imported Inputs and Productivity. Am. Econ. Rev. 2015, 105, 3660–3703. [Google Scholar] [CrossRef] [Green Version]

- Goldberg, P.K.; Khandelwal, A.K.; Pavcnik, N.; Topalova, P. Imported Intermediate Inputs and Domestic Product Growth: Evidence from India. Q. J. Econ. 2010, 125, 1727–1767. [Google Scholar] [CrossRef]

- Liu, Q.; Qiu, L.D. Intermediate Input Imports and Innovations: Evidence from Chinese Firms’ Patent Filings. J. Int. Econ. 2016, 103, 166–183. [Google Scholar] [CrossRef]

- Xu, J.; Mao, Q. On the Relationship between Intermediate Input Imports and Export Quality in China. Econ. Transit. Inst. Chang. 2018, 26, 429–467. [Google Scholar] [CrossRef]

- Schumacher, S.; Bildstein, A.; Bauernhansl, T. The Impact of the Digital Transformation on Lean Production Systems. Procedia CIRP 2020, 93, 783–788. [Google Scholar] [CrossRef]

- Zhang, T.; Shi, Z.-Z.; Shi, Y.-R.; Chen, N.-J. Enterprise Digital Transformation and Production Efficiency: Mechanism Analysis and Empirical Research. Econ. Res.-Ekon. Istraživanja 2021, 2021, 1–12. [Google Scholar] [CrossRef]

- Pantulu, J.; Poon, J.P.H. Foreign Direct Investment and International Trade: Evidence from the US and Japan. J. Econ. Geogr. 2003, 3, 241–259. [Google Scholar] [CrossRef]

- Martínez-San Román, V.; Bengoa, M.; Sánchez-Robles, B. Foreign Direct Investment, Trade Integration and the Home Bias: Evidence from the European Union. Empir. Econ. 2016, 50, 197–229. [Google Scholar] [CrossRef]

- Maza, A.; Gutiérrez-Portilla, P. Outward FDI and Exports Relation: A Heterogeneous Panel Approach Dealing with Cross-Sectional Dependence. Int. Econ. 2022, 170, 174–189. [Google Scholar] [CrossRef]

- Co, C.Y. Intra- and Inter-Firm US Trade. Int. Rev. Econ. Financ. 2010, 19, 260–277. [Google Scholar] [CrossRef]

- Wang, J.-Y.; Blomström, M. Foreign Investment and Technology Transfer: A Simple Model. Eur. Econ. Rev. 1992, 36, 137–155. [Google Scholar] [CrossRef]

- Ketteni, E.; Kottaridi, C.; Mamuneas, T.P. Information and Communication Technology and Foreign Direct Investment: Interactions and Contributions to Economic Growth. Empir. Econ. 2015, 48, 1525–1539. [Google Scholar] [CrossRef]

- Newman, C.; Rand, J.; Talbot, T.; Tarp, F. Technology Transfers, Foreign Investment and Productivity Spillovers. Eur. Econ. Rev. 2015, 76, 168–187. [Google Scholar] [CrossRef] [Green Version]

- Razzaq, A.; An, H.; Delpachitra, S. Does Technology Gap Increase FDI Spillovers on Productivity Growth? Evidence from Chinese Outward FDI in Belt and Road Host Countries. Technol. Forecast. Soc. Chang. 2021, 172, 121050. [Google Scholar] [CrossRef]

- Vujanović, N.; Radošević, S.; Stojčić, N.; Hisarciklilar, M.; Hashi, I. FDI Spillover Effects on Innovation Activities of Knowledge Using and Knowledge Creating Firms: Evidence from an Emerging Economy. Technovation 2022, 118, 102512. [Google Scholar] [CrossRef]

- Sobel, M.E. Asymptotic Confidence Intervals for Indirect Effects in Structural Equation Models. Sociol. Methodol. 1982, 13, 290–312. [Google Scholar] [CrossRef]

- Aghion, P.; Cai, J.; Dewatripont, M.; Du, L.; Harrison, A.; Legros, P. Industrial Policy and Competition. Am. Econ. J. Macroecon. 2015, 7, 1–32. [Google Scholar] [CrossRef] [Green Version]

- Landesmann, M.A.; Stöllinger, R. Structural Change, Trade and Global Production Networks: An ‘Appropriate Industrial Policy’ for Peripheral and Catching-up Economies. Struct. Chang. Econ. Dyn. 2019, 48, 7–23. [Google Scholar] [CrossRef]

- Mao, J.; Tang, S.; Xiao, Z.; Zhi, Q. Industrial Policy Intensity, Technological Change, and Productivity Growth: Evidence from China. Res. Policy 2021, 50, 104287. [Google Scholar] [CrossRef]

- Du, L.; Harrison, A.; Jefferson, G. FDI Spillovers and Industrial Policy: The Role of Tariffs and Tax Holidays. World Dev. 2014, 64, 366–383. [Google Scholar] [CrossRef] [Green Version]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).