Impact of Digital Finance on Regional Carbon Emissions: An Empirical Study of Sustainable Development in China

Abstract

:1. Introduction

2. Literature Review

2.1. Environment and Low-Carbon Economic Development

2.2. The Green Effect of Financial Digitization

2.3. Financial Development and Regional Carbon Emissions

3. Research Hypothesis

3.1. The Relationship between Digital Finance and Regional Carbon Emissions

3.2. Non-Linear Effects of Digital Finance on Regional Carbon Emissions

3.3. Spatial Spillover Effects of Digital Finance and Carbon Emissions

4. Methodology and Data

4.1. Baseline Regression Model

4.2. Panel Threshold Model

4.3. Spatial Model

4.3.1. Moran’s I

4.3.2. Spatial Weights

4.3.3. Spatial Model

4.4. Description of the Data

4.4.1. The Dependent Variable

4.4.2. Independent Variable

4.4.3. Control Variables

- (1)

- Regional per capita GDP is a dynamic indicator reflecting the degree of change in the level of economic development in a certain period and a basic indicator reflecting whether the regional economy has internal dynamics. This paper uses the real GDP per capita of the region to measure it.

- (2)

- Employment rate is linked to the productive activities of a region, which brings about population clustering over a certain period, thus affecting economic development. Therefore, this study uses the proportion of urban unit employment to the total population of the region.

- (3)

- The level of urbanization is a common indicator used to evaluate the development of a country or region and is an important measure of urban development. In this study, the measurement of urbanization level is the ratio of population to the area, which is then processed by taking the logarithm.

- (4)

- Human capital is an important factor that affects the development of various industries; therefore, this study uses the level of education as a measure of human capital in existing studies.

- (5)

- Government intervention. Fiscal policy is one of the two major instruments of macroeconomic regulation by the government, and fiscal expenditure and taxation policies can regulate aggregate market demand, thus influencing the region’s economic development. This study measures government intervention based on the proportion of fiscal expenditure to GDP. The specific indicators are listed in Table 1.

4.5. Data Source and Processing

5. Empirical Results and Analysis

5.1. Baseline Regression and Sub-Dimensional Tests

5.2. Robustness Test

5.2.1. Robustness Results

5.2.2. Endogenous Treatment

5.3. Threshold Estimation

5.4. Heterogeneity Results

5.4.1. Heterogeneity Analysis Based on Degree of Marketization

5.4.2. Heterogeneity Analysis Based on the Characteristics of Digital Finance

5.4.3. Heterogeneity Analysis Based on Different Regions

5.5. Spatial Analysis

5.5.1. Spatial Autocorrelation Analysis

5.5.2. Moran Scatter Diagram

5.5.3. Spatial Spillover Effect

6. Further Analysis

6.1. Digital Finance and Carbon Emissions: A DID Design

6.2. Parallel Trend Test

6.3. DID and Robustness Results

- (1)

- Using the counterfactual method: This study advances the policy time of 2012 for a counterfactual test to obtain the net policy effect. It was found that when the pilot policy was advanced to 2012, the regression coefficient of this policy was still negative but no longer significant. This verifies that the inhibitory effect of the original pilot policy on carbon emissions is influenced by non-pilot policy factors, eliminates the interference of non-pilot factors in the regression results, and again verifies the conclusion that the smart city pilot can reduce regional carbon emissions.

- (2)

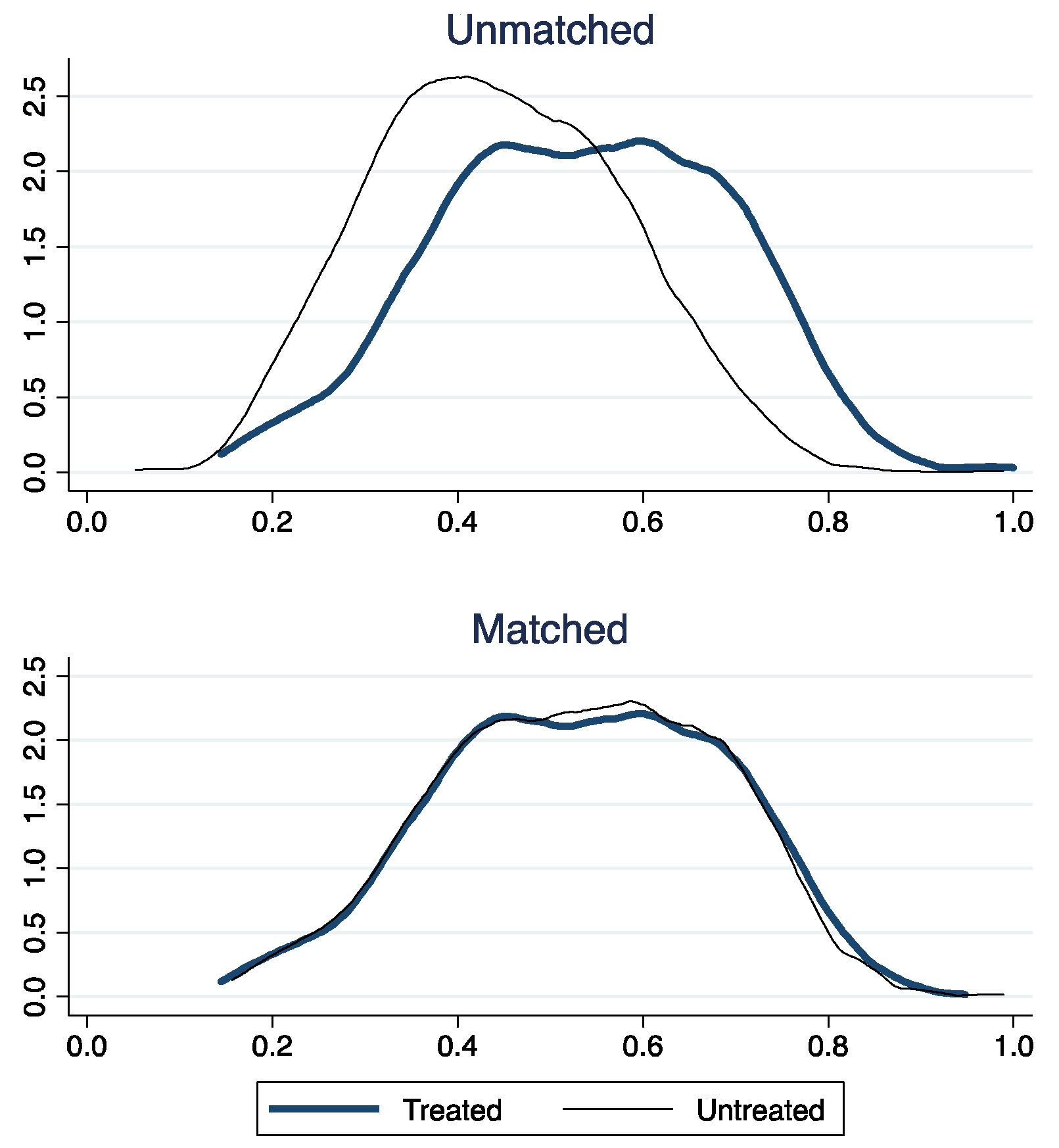

- Propensity score matching method (PSM-DID): To satisfy the randomization of quasi-natural experiments and avoid selection bias in the estimation results, we use propensity score matching to solve this problem by first conducting a logic regression on the policy experiment group. We then use kernel matching to find the city with the closest situation to the treatment group as the matching city for the pilot city. Before that, the common trend assumption has to be satisfied; therefore, the study uses kernel density plots to test the matching effect. Figure 3 shows the results of kernel matching, and the results showed a significant difference between the scores of the treatment and control groups when they were not matched. After matching, the probability density function values of the two sets of samples became extremely close, indicating that the sample selectivity bias problem was eliminated. Column 7 shows the results obtained using the kernel matching method. The results show that the coefficient between smart cities and carbon emissions is −0.145 and is significant at the 1% confidence level. These results again demonstrate the reliability of the study’s findings.

- (3)

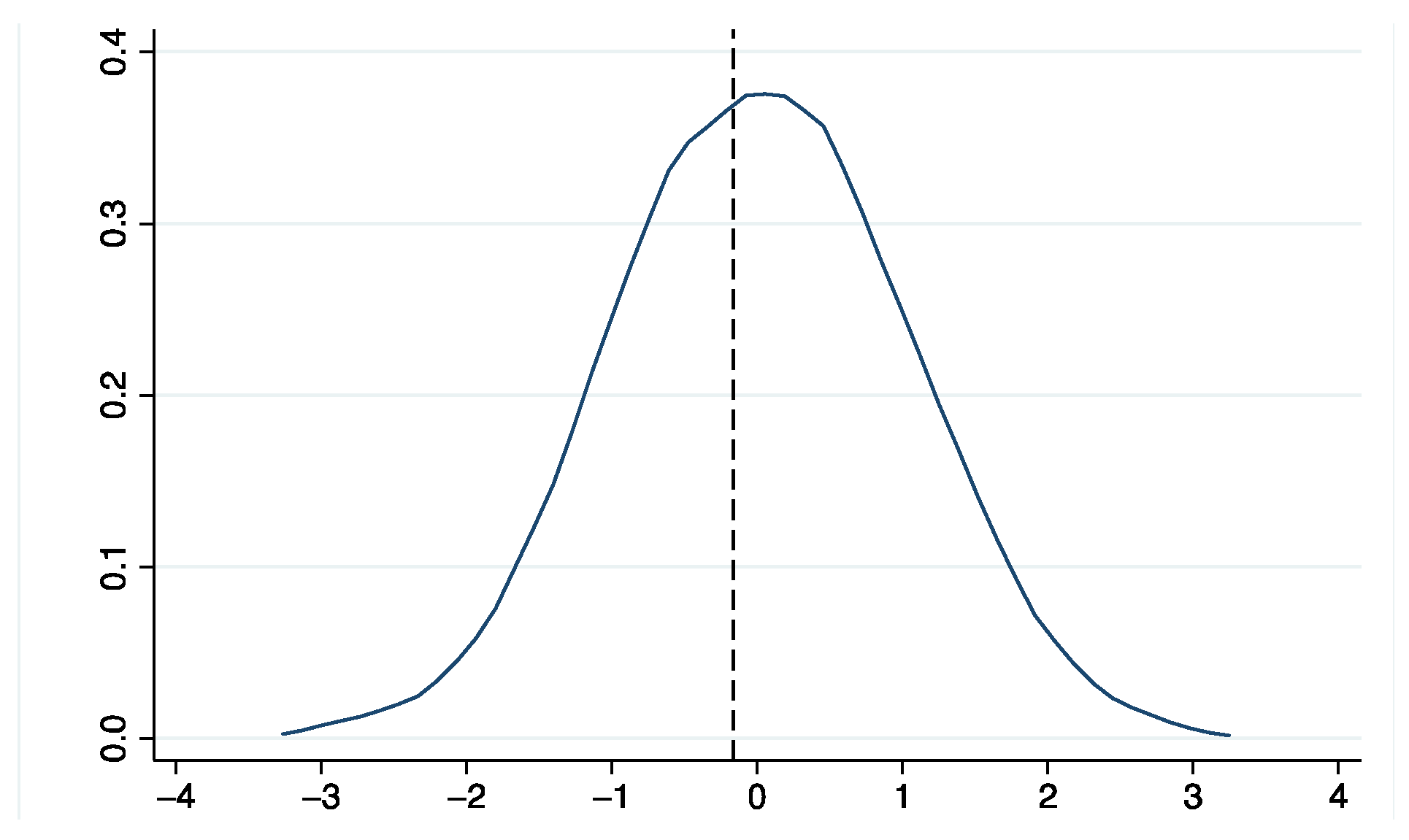

- Placebo test: In this study, the smart city pilot randomly generated part of the treatment group list, with the rest of the sample set as a control group. The extracted data were regressed 1000 times, and the regression coefficients were counted 1000 times. Suppose the coefficients are distributed around zero and not significant; the effect of unobservable factors on the results can be excluded. Figure 4 shows the kernel density plot of the placebo test; its estimated coefficient follows a normal distribution with a mean approximation of 0. The results in column 6 of Table 13 also show that their estimated coefficients are significantly different from those of the true treatment and control groups; that is, the unobserved factors did not affect the estimated results in this study, which further verifies the robustness of the results.

7. Conclusions

7.1. Conclusions

7.2. Discussion of Results

7.3. Research Limitations and Future Perspectives

7.4. Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Li, X.; Cui, S.; Lai, X. Can Digital Finance Increase the Value of Listed Companies?—Theoretical Mechanism Analysis and Empirical Test. Mod. Financ. Econ.-J. Tianjin Univ. Financ. Econ. 2020, 40, 83–95. [Google Scholar] [CrossRef]

- Bollaert, H.; Silanes, F.; Schwienbacher, A. Fintech and access to finance. J. Corp. Financ. 2021, 68, 101941. [Google Scholar] [CrossRef]

- Guo, P.; Jia, X. The structure and reform of rural finance in China. China Agric. Econ. Rev. 2009, 1, 212–226. [Google Scholar] [CrossRef]

- He, Z.; Song, X. How Dose Digital Finance Promote Household Consumption. Financ. Trade Econ. 2020, 41, 65–79. [Google Scholar] [CrossRef]

- Lee, W.C.; Cheong, T.S.; Wu, Y.; Wu, J. The Impacts of Financial Development, Urbanization, and Globalization on Income Inequality: A Regression-based Decomposition Approach. Asian Econ. Pap. 2019, 18, 126–141. [Google Scholar] [CrossRef] [Green Version]

- Jiang, X.; Wang, X.; Ren, J. The Nexus between Digital Finance and Economic Development: Evidence from China. Sustainability 2021, 13, 7289. [Google Scholar] [CrossRef]

- Li, C.; Gan, Y. The spatial spillover effects of green finance on ecological environment—Empirical research based on spatial econometric model. Environ. Sci. Pollut. Res. 2021, 28, 5651–5665. [Google Scholar] [CrossRef]

- Wu, Y.; Luo, C.; Luo, L. The impact of the development of the digital economy on Sulfur Dioxide emissions: Empirical evidence based on provincial panel data. J. Wuhan Polytech. 2021, 20, 82–88. [Google Scholar]

- Bai, L.; Chen, X. Research on the synergy of green economy and digital economy in stimulus policies. J. Dongbei Univ. Financ. Econ. 2020, 131, 73–81. [Google Scholar]

- Beck, T.; Levine, R.; Loayza, N. Finance and the sources of growth. J. Financ. Econ. 2000, 58, 261–300. [Google Scholar] [CrossRef] [Green Version]

- Lu, G.; Wang, Z.; Zang, C. Research on the Performance of Subsidizing Innovation for Chinese Strategic Emerging Industry. Econ. Res. J. 2014, 49, 44–55. [Google Scholar]

- He, J.Q.; Liu, R.X. Research on the Model of China’s Banking Industry Participating in Carbon Finance. East China Econ. Manag. 2012, 7, 75–79. [Google Scholar]

- Asongu, S.; Boateng, A. Introduction to Special Issue: Mobile Technologies and Inclusive Development in Africa. J. Afr. Bus. 2018, 19, 297–301. [Google Scholar] [CrossRef]

- Ding, X.; Zhou, J.G.; Qiao, J. Innovation of Policy Mechanism for Low Carbon Economy Development under the Target of Energy Saving and Emission Reduction. Sci. Technol. Manag. Res. 2014, 21, 243–250. [Google Scholar]

- Yang, Q. Analysis on the Mechanism of Energy Saving and Emission Reduction of China’s Green Credit Policy. Acad. Forum 2011, 34, 126–130. [Google Scholar]

- Chousa, J.; Tamazian, A.; Vadlamannati, K. Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy 2009, 37, 246–253. [Google Scholar]

- Halimanjaya, A. Climate mitigation fifinance across developing countries: What are the major determinants? Clim. Policy 2015, 15, 223–252. [Google Scholar] [CrossRef]

- Fisher-Vanden, K.; Jefffferson, G.H.; Liu, H. What is driving China’s decline in energy intensity? Resour. Energy Econ. 2004, 26, 77–97. [Google Scholar] [CrossRef]

- Gujba, H.; Thorne, S.; Mulugetta, Y. Financing low carbon energy access in Africa. Energy Policy 2012, 47, 71–78. [Google Scholar] [CrossRef]

- Selden, T.; Song, D. Environmental Quality and Development: Is There a Kuznets Curve for Air Pollution Emissions? J. Environ. Econ. Manag. 1994, 27, 147–162. [Google Scholar] [CrossRef]

- Hu, J.; Wang, M. Development of China’s Finance and Carbon Dioxide Emission: A Study Based on the Panel Data at Province Level from 1998 to 2015. Shandong Soc. Sci. 2018, 272, 118–124. [Google Scholar]

- Harbaugh, W.; Levinson, A.; Wilson, D. Reexamining the Empirical Evidence for an Environmental Kuznets Curve. Rev. Econ. Stat. 2002, 84, 54–551. [Google Scholar] [CrossRef]

- Agras, J.; Chapman, D. A Dynamic Approach to the Environmental Kuznets Curve Hypothesis. Ecol. Econ. 1999, 28, 267–277. [Google Scholar] [CrossRef]

- Frankel, A.; Romer, D. Dose trade Cause Growth? Am. Econ. Rev. 1999, 89, 379–399. [Google Scholar] [CrossRef] [Green Version]

- He, G.; Zhang, Y. Influence Factors and Environmental Kuznets Curve Relink Effect of Chinese Industry’s Carbon Dioxide Emission. China Ind. Econ. 2012, 286, 26–35. [Google Scholar]

- Shahbaz, M.; Solarin, S.; Mahmood, H. Does Financial Development Reduce CO2 Emissions in Malaysian Economy? A Time Series Analysis. Econ. Model. 2013, 35, 145–152. [Google Scholar] [CrossRef] [Green Version]

- Li, Z.; Takeuchi, H. Informal Lenders and Rural Finance in China: A Report from the Field. Mod. China 2010, 36, 302–328. [Google Scholar] [CrossRef]

- Dollar, D.; Kraay, A. Growth is Good for the Poor. J. Econ. Growth 2002, 7, 195–225. [Google Scholar] [CrossRef]

- Liang, S.L.; Liu, P.P. Digital Inclusive Finance and the Income Gap Between Urban and Rural Areas. J. Cap. Univ. Econ. Bus. 2019, 21, 33–41. [Google Scholar] [CrossRef]

- Li, M.; Feng, S.; Xie, X. Heterogeneity Effects of Digital Inclusive Finance on Urban-Rural Income Gap. J. Nanjing Agric. Univ. Soc. Sci. Ed. 2020, 20, 132–145. [Google Scholar] [CrossRef]

- Puschmann, T.; Hoffmann, C.; Khmarskyi, V. How Green FinTech Can Alleviate the Impact of Climate Change—The Case of Switzerland. Sustainability 2020, 12, 691. [Google Scholar] [CrossRef]

- Dong, Z.; Cai, X.; Wang, L. The Direction of Technical Change, Urban Land Size and Environment Quality. Econ. Res. J. 2014, 10, 111–124. [Google Scholar]

- Tamazian, A.; Rao, B.B. Do Economic, Financial and Institutional Developments Matter for Environmental Degradation? Evidence from Transitional Economies. Energy Econ. 2010, 32, 137–145. [Google Scholar] [CrossRef] [Green Version]

- Mookerjee, R.; Kalipioni, P. Availability of financial services and income inequality: The evidence from many countries. Emerg. Mark. Rev. 2010, 11, 404–408. [Google Scholar] [CrossRef]

- Fowowe, B.; Folarin, E.O. The effects of fragility and financial inequalities on inclusive growth in African countries. Rev. Dev. Econ. 2019, 23, 1141–1176. [Google Scholar] [CrossRef]

- Greenwood, J.; Jovanovic, B. Financial Development, Growth, and the Distribution of Income. J. Polit. Econ. 1990, 98, 1076–1107. [Google Scholar] [CrossRef] [Green Version]

- Burgess, R.; Pande, R. Do Rural Banks Matter? Evidence from the Indian Social Banking Experiment. Am. Econ. Rev. 2005, 95, 780–795. [Google Scholar] [CrossRef] [Green Version]

- Townsend, R.M.; Ueda, K. Financial Deepening, Inequality, and Growth: A Model-Based Quantitative Evaluation1. Rev. Econ. Stud. 2006, 73, 251–293. [Google Scholar] [CrossRef]

- He, Y.; Sheng, P.; Vochozka, M. Pollution caused by finance and the relative policy analysis in China. Energy Environ. 2017, 28, 808–823. [Google Scholar] [CrossRef]

- Sadorsky, P. The Impact of Financial Development on Energy Consumption in Emerging Economies. Energy Policy 2010, 38, 2528–2535. [Google Scholar] [CrossRef]

- Kotarski, K. Financial deepening and income inequality: Is there any financial Kuznets curve in China? The political economy analysis. China Econ. J. 2015, 8, 18–39. [Google Scholar] [CrossRef]

- Sicular, T.; Yue, X.; Gustafsson, B.; Li, S. The urban–rural income gap and inequality in China. Rev. Income Wealth 2010, 53, 93–126. [Google Scholar] [CrossRef] [Green Version]

- Zhou, Y.; Fang, Z.; Li, N. How Does Financial Development Affect Reductions in Carbon Emissions in High-Energy Industries?—A Perspective on Technological Progress. Int. J. Environ. Res. Public Health 2019, 16, 3018. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Li, X.; Liu, J.; Ni, P. The Impact of the Digital Economy on CO2 Emissions: A Theoretical and Empirical Analysis. Sustainability 2021, 13, 7267. [Google Scholar] [CrossRef]

- Ozili, P.K. Impact of digital finance on financial inclusion and stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Tong, H.; Lim, K.S. Threshold autoregression, limit cycles and cyclical data with discussion. J. R. Stat. Soc. 1980, 42, 245–292. [Google Scholar]

- Arif, M.; Lu, Y.; Mahmud, A. Regional Development of China’s Inclusive Finance Through Financial Technology. SAGE Open 2020, 10, 1–16. [Google Scholar] [CrossRef]

- Yin, Z.; Yang, Y.; Zhang, H. Financial Inclusion and Households’ Income Inequality in Beijing-Tianjin-Hebei Region: Evidence from CHFS Data. J. Beijing Technol. Bus. Univ. Soc. Sci. 2017, 32, 13–21. [Google Scholar] [CrossRef]

- Feng, D.; Dai, Y.; Zhang, S. Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Sci. Total Environ. 2019, 653, 565–577. [Google Scholar]

- Arestis, P.; Caner, A. Financial liberalization and the geography of poverty. Camb. J. Reg. Econ. Soc. 2009, 2, 229–244. [Google Scholar] [CrossRef]

- Yan, Y.; An, H. Segmental Economic Space in China: Empirical Research Based on Economic Growth Spillover among Regions. Mod. Econ. Sci. 2014, 36, 47–57. [Google Scholar]

- Hansen, B.E. Threshold effects in non-dynamic panels: Estimation, testing, and inference. J. Econom. 1999, 93, 345–368. [Google Scholar] [CrossRef] [Green Version]

- Lin, G.; Long, Z.; Wu, M. A Spatial Analysis of Regional Economic Convergence in China: 1978–2002. China Econ. Q. 2005, 4, 349–356. [Google Scholar] [CrossRef]

- Gottmann, J.; O’Brien, R. Global Financial Integration: The End of Geography. Geogr. J. 1993, 159, 101. [Google Scholar] [CrossRef]

- Han, F.; Xie, R. Does the Agglomeration of Producer Services Reduce Carbon Emissions? J. Quant. Tech. Econ. 2017, 34, 40–58. [Google Scholar] [CrossRef]

- Guo, F.; Wang, J.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z. Measuring the Development of Digital Inclusive Finance in China: Index Compilation and Spatial Characteristics. China Econ. Q. 2020, 19, 1401–1418. [Google Scholar] [CrossRef]

- Zhang, Y.J. The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 2011, 34, 2197–2203. [Google Scholar] [CrossRef]

- Jiang, H.; Jiang, P. Research on the Effect of Digital Inclusive Finance on the Improvement of Consumption Level and Structure Optimization. Mod. Financ. Econ. 2020, 40, 18–32. [Google Scholar] [CrossRef]

- Sutherland, W.; Jarrahi, M.H. The sharing economy and digital platforms: A review and research agenda. Int. J. Inform. Manag. 2018, 43, 328–341. [Google Scholar] [CrossRef]

- Claessens, S.; Perotti, E. Finance and inequality: Channels and evidence. J. Comp. Econ. 2007, 35, 748–773. [Google Scholar] [CrossRef]

- Yan, C.; Li, T.; Lan, W. Financial Development, Innovation and Carbon Emission. J. Financ. Res. 2016, 1, 14–30. [Google Scholar]

- Zhao, H.; Yang, Y.; Li, N.; Liu, D.; Li, H. How Does Digital Finance Affect Carbon Emissions? Evidence from an Emerging Market. Sustainability 2021, 13, 12303. [Google Scholar] [CrossRef]

- Yermack, D. Corporate Governance and Blockchains. Rev. Financ. 2017, 1, 7–31. [Google Scholar] [CrossRef] [Green Version]

- Meo, M.; Karim, M. The role of green finance in reducing CO2 emissions: An empirical analysis. Borsa Istanb. Rev. 2021. [Google Scholar] [CrossRef]

- Caragnano, A.; Mariani, M.; Pizzutilo, F.; Zito, M. Is it worth reducing GHG emissions? Exploring the effect on the cost of debt financing. J. Environ. Manag. 2020, 270, 110860. [Google Scholar] [CrossRef] [PubMed]

- Doku, I.; Ncwadi, R.; Phiri, A. Examining the role of climate finance in the Environmental Kuznets Curve for Sub-Sahara African countries. Cogent Econ. Financ. 2021, 9, 1965357. [Google Scholar] [CrossRef]

- Ciocoiu, C.N. Integrating digital economy and green economy: Opportunities for sustainable development. Theor. Empir. 2011, 6, 33–43. [Google Scholar]

- Peng, H.; Tan, X.; Li, Y.; Hu, L. Economic Growth, Foreign Direct Investment and CO2 Emissions in China: A Panel Granger Causality Analysis. Sustainability 2016, 8, 233. [Google Scholar] [CrossRef] [Green Version]

| Variable Types | Variables | Abbreviation | Data Calculation |

|---|---|---|---|

| Dependent variable | Carbon emissions | CO2 | CO2 = C1 + C2 + C3 |

| Independent variable | Digital finance | DF | Peking University Digital Financial Inclusion Index |

| Threshold variables | Digital threshold | DGT | Number of network access users/total population |

| Green threshold | GRT | Logarithm of green utility model inventions in the year | |

| Control variables | per capita GDP | GDP | Regional real GDP per capita |

| Employment rate | EMP | Proportion of urban unit employment to total population | |

| Urbanization | URB | Share of population and area by province | |

| Human capital | HUM | Number of students in higher education/total population | |

| Government intervention | GOV | Fiscal spending/GDP |

| Variables | N | Mean | Std.Dev. | Min | Max |

|---|---|---|---|---|---|

| CO2 | 2502 | 5.0055 | 0.5101 | 3.0569 | 5.7735 |

| DF | 2502 | 6.4132 | 1.1268 | 2.7462 | 9.6032 |

| DGT | 2502 | 4.1753 | 0.9153 | 1.4483 | 7.3364 |

| GRT | 2502 | 4.3653 | 1.6095 | 0.0000 | 9.1350 |

| GDP | 2502 | 10.957 | 0.5656 | 8.3270 | 15.675 |

| EMP | 2502 | 0.2114 | 0.1841 | 0.0051 | 4.3462 |

| URB | 2502 | 0.0944 | 0.1449 | 0.0012 | 5.1754 |

| HUM | 2502 | 5.8202 | 0.9801 | 0.5137 | 10.174 |

| GOV | 2502 | 0.1542 | 2.9983 | −2.9773 | 10.980 |

| Variables | Baseline Regression | Sub-Dimensional Test | |||

|---|---|---|---|---|---|

| (1) FE | (2) OLS | (3) CO2 | (4) CO2 | (5) CO2 | |

| DF | −6.286 *** | −9.967 *** | |||

| (0.305) | (2.780) | ||||

| Coverage breadth | −3.159 *** | ||||

| (0.198) | |||||

| Usage depth | −4.589 *** | ||||

| (0.245) | |||||

| Digitization level | −1.661 *** | ||||

| (0.150) | |||||

| Square items | 0.737 *** | 1.118 *** | 0.415 *** | 0.559 *** | 0.217 *** |

| (0.0328) | (0.269) | (0.0223) | (0.0263) | (0.0167) | |

| Per capita GDP | 0.251 *** | 0.557 *** | 0.282 *** | 0.220 *** | 0.452 *** |

| (0.0431) | (0.0402) | (0.0445) | (0.0423) | (0.0481) | |

| Employment rate | −0.0578 | 0.563 *** | −0.0877 | 0.0573 | −0.0939 |

| (0.139) | (0.162) | (0.144) | (0.137) | (0.157) | |

| Urbanization | −0.101 | 1.819 *** | −0.0435 | −0.0282 | −0.0750 |

| (0.0770) | (0.242) | (0.0798) | (0.0756) | (0.0868) | |

| Human capital | 2.78 × 10−5 | 0.0001 ** | 2.80 × 10−5 | 5.30 × 10−6 | 1.45 × 10−5 |

| (2.75 × 10−5) | (4.18 × 10−5) | (2.85 × 10−5) | (2.71 × 10−5) | (3.12 × 10−5) | |

| Government intervention | −2.50 × 10−7 *** | 5.03 × 10−7 *** | −7.95×10−8 | −1.93×10−7 *** | 1.85 × 10−7 *** |

| (6.50 × 10−8) | (3.42 × 10−8) | (6.59 × 10−8) | (6.31 × 10−8) | (7.18 × 10−8) | |

| Time fixed effect | yes | yes | yes | yes | yes |

| Urban fixed effect | yes | yes | yes | yes | yes |

| Constant | 21.31 *** | 8.709 *** | 12.87 *** | 4.094 *** | 21.31 *** |

| (7.210) | (0.665) | (0.757) | (0.642) | (7.210) | |

| R-squared | 0.485 | 0.571 | 0.447 | 0.497 | 0.339 |

| Variables | (1) FE | (2) OLS | (3) Wastewater | (4) SO2 | (5) Solid waste | (6) 2013–2019 | (7) CO2 |

|---|---|---|---|---|---|---|---|

| DF | −0.234 *** | −0.213 *** | −0.453 *** | −0.783 *** | −0.460 *** | −18.55 *** | −6.123 *** |

| (0.0074) | (0.0196) | (0.0220) | (0.0337) | (0.0350) | (1.842) | (0.315) | |

| Control variables | yes | yes | yes | yes | yes | yes | yes |

| Time fixed effect | yes | yes | yes | yes | yes | yes | yes |

| Urban fixed effect | yes | yes | yes | yes | yes | yes | yes |

| Constant | 5.884 *** | 4.055 *** | 11.04 *** | 17.02 *** | 15.32 *** | 47.28 *** | 9.723 *** |

| (0.141) | (0.186) | (0.448) | (0.686) | (0.711) | (4.820) | (1.286) | |

| R-squared | 0.455 | 0.129 | 0.298 | 0.469 | 0.210 | 0.536 | 0.911 |

| Variables | (1) CO2 Lagged One Period | (2) Control Variables Lagged by One Period | (3) IV1 | (4) IV2 | (5) Control of Traditional Finance | (6) SYS-GMM |

|---|---|---|---|---|---|---|

| DF | −7.301 *** | −14.31 *** | −17.649 *** | −1.430 ** | −12.131 *** | |

| (0.708) | (0.806) | (2.113) | (0.638) | (0.668) | ||

| L. CO2/ Instrumental variables | 0.600 *** | −0.080 *** | 0.576 *** | |||

| (0.0191) | (0.003) | (0.018) | ||||

| Traditional finance | −5.845 *** | |||||

| (1.157) | ||||||

| Control variables | yes | yes | yes | yes | yes | yes |

| Time fixed effect | yes | yes | yes | yes | yes | yes |

| Urban fixed effect | yes | yes | yes | yes | yes | yes |

| Provincial fixed effects | no | no | no | no | Yes | no |

| Constant | 18.09 *** | 37.03 *** | 2.413 *** | 39.945 | 9.723 *** | 27.637 *** |

| (1.849) | (2.072) | (0.007) | (5.440) | (1.286) | (1.715) | |

| R-squared/Sargan | 0.689 | 0.517 | 0.999 | 0.506 | 0.911 | 0.998 |

| Threshold Variable | Model | F-Value | p-Value | Critical Value (1%) | Critical Value (5%) | Critical Value (10%) |

|---|---|---|---|---|---|---|

| Digital threshold | Single-threshold | 44.32 | 0.0000 | 36.8633 | 24.1433 | 19.5367 |

| Double-threshold | 34.44 | 0.0033 | 27.6970 | 18.7614 | 16.1396 | |

| Three-threshold | 13.97 | 0.5967 | 48.5343 | 29.1474 | 29.1474 | |

| Green threshold | Single-threshold | 49.24 | 0.0033 | 41.4757 | 36.9190 | 31.7317 |

| Double-threshold | 25.94 | 0.0700 | 39.5161 | 28.8093 | 23.6279 | |

| Three-threshold | 15.53 | 0.7733 | 54.6588 | 45.3760 | 39.2516 |

| Threshold Variable | Model | Threshold Interval | Regression Coefficients | Threshold Variable | Model | Threshold Interval | Regression Coefficients |

|---|---|---|---|---|---|---|---|

| Digital threshold (digi) | Single- threshold | digi ≤ 4.277 | −4.532 *** | Green threshold (gre) | Single- threshold | gre ≤ 3.218 | −4.820 *** |

| (0.3542) | (0.3369) | ||||||

| digi > 4.277 | −4.487 *** | gre > 3.218 | −4.778 *** | ||||

| (0.3561) | (0.3386) | ||||||

| Double- threshold | digi ≤ 4.277 | −4.466 *** | Double- threshold | gre ≤ 3.218 | −4.776 *** | ||

| (0.3507) | (0.3349) | ||||||

| 4.277 < digi ≤ 4.585 | −4.413 *** | 3.218 < gre ≤ 4.382 | −4.729 *** | ||||

| (0.3511) | (0.3353) | ||||||

| digi > 4.585 | −4.359 *** | gre > 4.382 | −4.681 *** | ||||

| (0.3530) | (0.3371) |

| Variables | Degree of Marketization | |

|---|---|---|

| High | Low | |

| DF | −12.34 *** | −3.784 *** |

| (0.725) | (0.456) | |

| Control variables | yes | yes |

| Time fixed effect | yes | yes |

| Urban fixed effect | yes | yes |

| Constant | 22.26 *** | 7.218 *** |

| (3.891) | (0.921) | |

| R-squared | 0.411 | 0.402 |

| Variables | Financial Development Level | Digitization Level | ||

|---|---|---|---|---|

| Development | Under-Development | High | Low | |

| DF | −13.67 *** | −3.640 *** | −11.48 *** | −2.724 *** |

| (1.208) | (0.343) | (0.770) | (0.302) | |

| Control variables | yes | yes | yes | yes |

| Time fixed effect | yes | yes | yes | yes |

| Urban fixed effect | yes | yes | yes | yes |

| Constant | 33.25 *** | 9.573 *** | 27.39 *** | 8.248 *** |

| (3.181) | (0.964) | (2.116) | (0.808) | |

| R-squared | 0.506 | 0.337 | 0.452 | 0.376 |

| Variables | (1) Central | (2) Eastern | (3) Western | (4) Central Cities | (5) Non-Central Cities |

|---|---|---|---|---|---|

| DF | −5.371 *** | −5.188 *** | −5.491 *** | −5.058 *** | −5.840 *** |

| (0.440) | (0.518) | (0.601) | (0.482) | (0.346) | |

| Control variable | yes | yes | yes | yes | yes |

| Time fixed effect | yes | yes | yes | yes | yes |

| Urban fixed effect | yes | yes | yes | yes | yes |

| Constant | 13.50 *** | 14.48 *** | 16.48 *** | 17.24 *** | 15.33 *** |

| (1.288) | (1.543) | (1.630) | (1.468) | (0.978) | |

| R-squared | 0.542 | 0.546 | 0.530 | 0.560 | 0.540 |

| Year | Digital Finance | CO2 Emissions | ||

|---|---|---|---|---|

| Moran’s I | Z-Value | Moran’s I | Z-Value | |

| 2011 | 0.274 *** | 9.077 | 0.134 *** | 4.814 |

| 2012 | 0.253 *** | 8.380 | 0.138 *** | 4.916 |

| 2013 | 0.282 *** | 9.336 | 0.142 *** | 5.040 |

| 2014 | 0.288 *** | 9.535 | 0.137 *** | 4.841 |

| 2015 | 0.288 *** | 9.532 | 0.130 *** | 4.621 |

| 2016 | 0.266 *** | 8.795 | 0.138 *** | 4.920 |

| 2017 | 0.255 *** | 8.454 | 0.115 *** | 3.977 |

| 2018 | 0.213 *** | 7.067 | 0.112 *** | 3.871 |

| 2019 | 0.199 *** | 6.622 | 0.104 *** | 3.600 |

| Variables | Geographical Distance Matrix | Economic Distance Matrix | ||||

|---|---|---|---|---|---|---|

| SAR | SEM | SDM | SAR | SEM | SDM | |

| DF | −3.048 ** | −4.437 *** | −5.038 *** | −3.212 ** | −3.545 *** | −1.881 |

| (1.331) | (1.427) | (1.489) | (1.391) | (1.363) | (1.562) | |

| ρ/λ | −2.053 *** | −2.429 *** | −1.199 *** | 0.0233 | −0.0866 ** | −0.0794 ** |

| (0.176) | (0.161) | (0.334) | (0.0310) | (0.0348) | (0.0351) | |

| W × DF | −77.18 *** | −7.434 ** | ||||

| (26.45) | (3.026) | |||||

| Control variable | yes | yes | yes | yes | yes | yes |

| Sigma | 1.477 *** | 1.482 *** | 1.454 *** | 1.611 *** | 1.605 *** | 1.580 *** |

| (0.0407) | (0.0420) | (0.0408) | (0.0455) | (0.0454) | (0.0447) | |

| Log-likelihood | −4088.548 | −4061.345 | −4037.565 | −4146.475 | −4143.665 | −4122.614 |

| Spatial effect decomposition | Direct effect | Indirect effect | Total effect | Direct effect | Indirect effect | Total effect |

| DF | −4.781 *** | −34.57 ** | −39.35 ** | −1.745 | −6.904 ** | −8.649 *** |

| (1.512) | (15.99) | (16.43) | (1.620) | (2.841) | (2.490) | |

| R-squared | 0.321 | 0.174 | 0.080 | 0.186 | 0.187 | 0.158 |

| Variables | (1) CO2 | (2) CO2 | (3) Winsorized | (4) Counterfactual Method | (5) PSM-DID | (6) Placebo |

|---|---|---|---|---|---|---|

| treati×postt | −0.167 *** | −0.101 ** | −0.138 *** | −0.079 | −0.145 *** | −0.018 |

| (0.0559) | (0.0503) | (0.0498) | (0.0510) | (0.0532) | (0.0229) | |

| Constant | 0.0115 | −5.972 *** | −1.298 *** | 0.126 | −1.626 *** | −2.831 *** |

| (0.630) | (0.568) | (0.494) | (0.502) | (0.528) | (0.516) | |

| Control variable | yes | yes | yes | yes | yes | yes |

| Time fixed effect | yes | no | yes | yes | yes | yes |

| Urban fixed effect | yes | no | yes | yes | yes | yes |

| R-squared | 0.397 | 0.349 | 0.251 | 0.410 | 0.252 | 0.464 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xue, Q.; Feng, S.; Chen, K.; Li, M. Impact of Digital Finance on Regional Carbon Emissions: An Empirical Study of Sustainable Development in China. Sustainability 2022, 14, 8340. https://doi.org/10.3390/su14148340

Xue Q, Feng S, Chen K, Li M. Impact of Digital Finance on Regional Carbon Emissions: An Empirical Study of Sustainable Development in China. Sustainability. 2022; 14(14):8340. https://doi.org/10.3390/su14148340

Chicago/Turabian StyleXue, Qiutong, Sixian Feng, Kairan Chen, and Muchen Li. 2022. "Impact of Digital Finance on Regional Carbon Emissions: An Empirical Study of Sustainable Development in China" Sustainability 14, no. 14: 8340. https://doi.org/10.3390/su14148340

APA StyleXue, Q., Feng, S., Chen, K., & Li, M. (2022). Impact of Digital Finance on Regional Carbon Emissions: An Empirical Study of Sustainable Development in China. Sustainability, 14(14), 8340. https://doi.org/10.3390/su14148340