2.1. The General Equilibrium Model

We develop a quantitative general equilibrium model incorporating input–output linkage, GVC characteristics, and roundabout trade for empirical analysis. There are

N countries and

j sectors. We denote countries by

m,

k,

i,

j and sectors by

s,

r. Labor is mobile within the country but not across countries. Markets are perfectly competitive and production requires only one factor: labor. We use

Z to denote intermediate goods and

F denotes the final goods.

denotes the flow of sectors’ intermediate goods in country

i to country

j and sector

r for production. It is worth noting that we included a simple Cobb–Douglas function form; similarly, our model may easily be expanded to a constant elasticity of substitution (CES) function form. Households. Representative households maximize utility by consuming final goods.

denotes household preference in country

j.

denotes the consumption of households in country

j for the final goods in sector s.

denotes the final demand share and

. Households have two sources of income: labor income (wages) and transfer payments (Transfer payments arise from the collection of tariffs by the government, which transfers the revenue from the tariffs to households without compensation as part of their income to purchase goods for consumption.).

Intermediate goods production. Each sector

s produces a continuum of goods

, and producers use Cobb–Douglas constant-returns-to-scale technology, demanding labor and intermediate inputs from all sectors. The production function of

is

denotes productivity of

from sector

s in country

j and, as set by Eaton and Kortum (2002) [

1], the production technology has the Fréchet distribution (The Fréchet distribution function takes the form

,

> 0.

is the location parameter of the distribution, reflecting the average technology level of the country, with the greater

implies a larger probability that produces any good

ω with a higher productivity, reflecting the country’s absolute advantage in producing a continuum of goods.

θ > 0,

θ (consistent for individual countries) is the shape parameter of the distribution, reflecting the variation within the distribution in cross-country production. Relative productivity heterogeneity is also an indicator of comparative advantage, with greater

θ implying less variability.).

denotes the amount of labor input in production.

denotes the share of labor in total inputs.

denotes the amount of intermediate goods from sector

r required for producing

. The parameter

denotes the share of intermediate inputs from sector

r in total inputs and

.

Based on the assumption of constant returns to scale and perfect competition, firms set their prices based on unit production costs

, and

denotes the cost of the input bundle

is a constant and denotes the wage in country j. denotes the price of intermediate inputs from sector r used by sector s in country j.

Composite intermediates production. The composite intermediate goods in country

j and sector

s consist of two components: the final goods (

) and the intermediate goods (

) inputs. The composite intermediate goods production function is a CES aggregator, as reported in Dixit and Stiglitz (1977) [

24].

denotes demand for intermediates from the lowest cost suppliers in sector s of country j. The parameter denotes the elasticity of substitution of intermediates. Producers in country j and sector s produce intermediates from the lowest cost suppliers across countries.

is the unit price of composite intermediate goods, and

is the unit price of

.

denotes the lowest price of intermediate goods

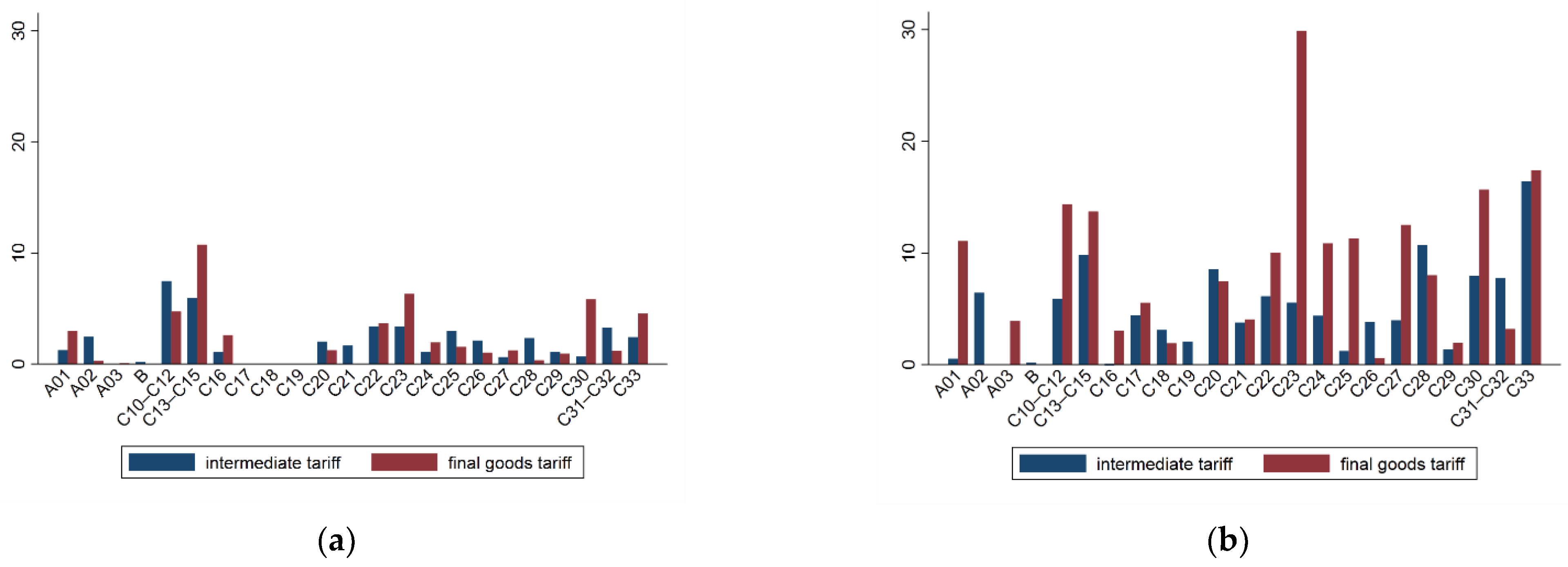

Trade costs. We assume heterogeneous tariffs

set by specific countries and sectors.

denotes the tariffs imposed by sector

s in country

j on the imports of intermediate goods from sector

r in country

i and

denotes the tariffs imposed by sector

s in country

j on the imports of final goods from sector

r in country

i. The heterogeneity reflects in the input–output linkages and tariff barriers set on intermediates and final goods (according to the theory related to effective tariff rates, a country may impose heterogeneous tariffs on goods with different uses). We then obtain the trade cost of intermediate goods

and final goods

as

and

. We also assume they both satisfy the

(

for the “iceberg cost” (Samuelson, 1954) [

25]. The iceberg cost of transporting a unit of final and intermediate goods is the same.).

Prices of intermediate and final products. The unit price of tradable intermediate goods

produced in country

i available in country

j is

=

. The price of intermediate goods in country

j is,

According to Equation (5), the price of intermediate goods

is the weighted price of inputs purchased by sector

s in country

j from the lowest country-sector suppliers in the world; thus, we set a continuum of commodity

as a CES function of prices,

Following Fréchet’s distribution assumption of Eaton and Kortum (2002) [

1], the price of intermediate goods

(According to Equations (6) and (7), the distribution function of

is determined by the distribution of

. According to the Fréchet distribution function property, Equation (8) can be obtained.

and

are the parameters of Fréchet distribution function. Similarly, we suppose that intermediate and final commodities have distinct trade elasticities, and we designate the intermediate trade elasticity as

and the final trade elasticity as

.)

Similarly, the households consume the final goods in sector

r and country

j at the lowest cost

, which is

Then, the consumer price index of Cobb–Douglas preferences for households is in country

j.

Share of expenditure. The input–output table has a distinct variation between final and intermediate goods that a country purchases from the same sector in other countries. Meanwhile, a country purchases different amounts of intermediate and final goods from different industries in a specific country (We can observe the phenomenon easily from input–output tables such as world input–output tables (WIOTs).). The heterogeneity of trade costs for products with different uses determines a country’s share of trade in intermediate and final goods. Country

j’s total expenditures

on sector

r is divided into expenditures on intermediate and final goods in sector

r. The share of country

j’s expenditures on intermediate goods in sector

r is the probability that country

i in sector

r supplies the goods at the lowest price,

Based on Fréchet distribution, the share of expenditures on sector r intermediate goods in country i is ( is the one derived from the fact that is the lowest cost and . Given , we can obtain = = yields:

which denotes the contribution of country

i to the price in country

j. Considering the continuum assumption, this probability is also the fraction of goods that country

j purchases from country

i. The same reason leads to the formula for the

,

Similarly, the share of expenditures on sector

r final goods in country

i is

Market clearing. For sector

s of country

j, the total output is equal to the sales of intermediate goods and final goods. The sales of intermediate goods are used as intermediate inputs by producers and sales of final goods are consumed by consumers in all countries (including one’s own country) (We obtain commodity market clearing by considering heterogeneous shares of intermediate and final goods which differs significantly from Caliendo and Parro (2015) [

2]. We refer

as the total output, rather than expenditures of country

j in sector

s (including sector

s of countries

j and all countries) in Caliendo and Parro (2015) [

2].),

where

is the total income of country

k, including labor income

, tariff revenue

, and the trade surplus

,

Imports of country

j are equal to exports plus the trade surplus expressed as imports of intermediate goods

and final goods

(including domestic countries). Exports of country

j include exports of intermediate goods

and final goods

.

is the trade surplus.

denotes imports of intermediate goods from country i in sector s by country j’s sector r. denotes country j’s imports of final goods from country i in sector s. The total consumer expenditure on final goods in country j is equal to the sum of all national and sectoral imports of final goods. The total income equals . denotes country j’s exports of intermediate goods to country i in sector r. denotes exports of final goods from country j in sector s to country i.

Defining equilibrium. Under a tariff the equilibrium of wages and prices satisfies the following equilibrium conditions.

The price of intermediate goods:

The price of the final goods:

Expenditure shares in intermediate goods:

Expenditure shares in final goods:

Defining the changing equilibrium. We define = , the intermediate goods tariff change and the final goods change , respectively. According to Formula (17)–(23), we further define the changing balance, namely, the trade costs of intermediate products and the trade costs of final products have changed in the case of the change in the trade cost structure (define ), respectively. The equilibrium of wage level and price change is to satisfy the change equilibrium condition according to Equations (17)–(23).

2.3. Mechanism for Actual Wage and Welfare Changes

2.3.1. Changes in Real Wages

The real wages can be expressed as the consumer price-adjusted nominal wage

, where

denotes the nominal wage, in Equation (3).

denotes the consumer price index, in Equation (11). A rise in the real wages signifies a gain in buying power since it represents the quantity of a basket of products that can be purchased with wage income. There are two main channels through which real wages can increase: one is a constant nominal wage and a relative decrease in prices; the other is a constant price and a relative increase in nominal wages. We decompose the relative change in real wages

(the change in real wages in logarithmic form) based on the change in the consumer price index

and the change in nominal wages

. We decompose the relative change in real wages

(the change in real wages in logarithmic form) based on the change in the consumer price index

and the change in nominal wages

. (The detailed derivation process is shown in

Supplementary Materials).

Using the decomposition results of Equation (26), we find that the change in real wages can be decomposed into the change in the share of domestic final goods expenditure in each industry

and the change in the price of intermediate goods inputs relative to the price of final goods in each industry

. This also means that changes in real wages are unrelated to the percentage of domestic intermediate products traded, but solely to the share of domestic final goods traded, which is one of the key contrasts between the conclusions of this research and those of classic trade welfare studies (For example, Arkolakis et al. (2012) [

26] and Caliendo and Parro (2015) [

2] argue that under a variety of trade models, the percentage of expenditures on domestic products and trade elasticities are the only two statistics that can be used to quantify trade profits. However, none of the discussions of domestic trade shares distinguish between the share of trade in intermediate goods and the share of trade in final goods).

According to the last term of Equation (26) , the final goods tariff reduction leads to a decrease in the price of final goods in sector s in country j (a decrease in ) which, if all other things are equal, leads to an increase in the real wage level and consumers in country j ultimately benefit from the expansion of imports. However, a decline in will also indirectly lead to a decline in the share of domestic final goods expenditure , raising the real wage level.

The impact of tariff reductions on intermediate goods is slightly more complex; on the one hand, a reduction in intermediate goods tariffs will bring about a decrease in the price of imported intermediate goods , as well as an increase in real wages. However, a fall in will also lead to a fall in domestic production costs (), which in turn will lead to a rise in the share of domestic final goods expenditures . As a result, the impact of lower tariffs on imported intermediate items on real wages is determined by how these two pressures interact.

2.3.2. Changes in Welfare

Representative consumer benefits in country

j is

(Welfare is a measure of how much a country really spends. Tariff transfers occur when the government sets tariffs, and the welfare of a country’s consumers is influenced not just by real wages, but also tariff transfers and trade surpluses.), where

denotes total income, which can be obtained by Equation (15).

denotes the consumer price index, in Equation (11). We further differenced the logarithmic form of welfare

, according to the equilibrium conditions of the model change to obtain the structural decomposition of the change in

. (The detailed derivation process is shown in

Supplementary Materials).

According to Equation (29), the welfare change may be split into two primary elements: one being the terms of trade and income impact of final goods, and the other being the terms of trade and income effect of intermediate goods, which is one of the other significant discrepancies between this paper and Caliendo and Parro (2015) [

2].

The first term denotes the final goods terms-of-trade effect. The above equation expresses the difference between the change in the unit cost of exported products weighted by the share of revenue of final goods exports from all sectors to all countries in country j, and the change in the unit cost of imported products weighted by the share of revenue of final goods imports from all countries and sectors in that country, and is used to portray the impact of tariff changes (whether final or intermediate goods tariffs) on the terms of the trade of final goods. The second term stands for the trade volume effect of final goods, which is calculated as the total amount of change in the final goods import trade volume (excluding the effect of import price changes) divided by the revenue share of final goods import tariff revenue from all countries and sectors in country j. It is used to show how changes in the final products’ import volume affect tariff income as a result of tariff modifications (whether final goods tariff or intermediate goods tariff). Similarly, the third and fourth term depict the impact of tariff increases on the intermediate goods terms of trade and the impact of changes in the volume of intermediate goods imports caused by tariff changes on tariff revenues, respectively.

A drop in import tariffs, according to the theoretical model, will increase the import share. The volume impacts of trade in intermediate and final items are dependent on the change in the import share relative to the price of the imported product, as indicated in terms 2 and 4. As a result, with the price of imported items (i.e., costs) remaining unchanged after tariff prices are removed, tariff reductions on intermediate and final goods will result in a positive change in the income impact, improving welfare. In fact, according to the standard trade model, lowering import tariffs will result in an increase in import supply as well as an increase in the marginal cost of production in the supplying country, increasing the price of imported products excluding the tariff price. However, because the general elasticity of demand is greater than 1 and the magnitude of price change is less than the magnitude of change in the trade volume (), the tariff reduction will not increase the price of imported products excluding the tariff price.

Unlike the income impact, the tariff increase has the exact opposite effect on the conditions of trade. According to the theoretical and standard models, a country’s unilateral increase in tariffs, which raises the price of imported products excluding tariff prices, will result in negative trade effect terms with no change in the price of exported goods, resulting in a worsening of the terms of trade. Since an increase in import tariffs on final goods does not affect the pricing of a country’s exports, an increase in intermediate goods tariffs will increase the prices of exports manufactured with imported inputs. As a result, raising tariffs on intermediate or final items will have a negative effect on the terms of trade, reducing overall welfare.

The amount of the overall welfare, whether positive or negative, is determined by relative changes in the terms-of-trade impact and the tariff revenue effect, weighted by the percentage of exports and imports in total expenditures.