Abstract

Carbon emission trading market construction is an important policy tool to promote the realization of China’s “double carbon” goal. However, problems still exist, such as the lack of market trading vitality, the large difference in carbon trading prices between the eight pilot markets and the instability of the prices. In order to explore the key influencing factors on carbon trading prices, 15 factors were selected to study in detail according to the policy, green industry, economy and environment. Taking China’s eight pilot carbon trading markets as research subjects, we explored the correlation degree of each factor by using the improved gray relational analysis model (GRAM) from the two dimensions of space and time. The research results show that from the space dimension, the industrial development level, development degree of low-carbon industries, air pollution degree and green technology maturity are the main factors that affect the carbon trading price in the eight pilot areas. Meanwhile, from the time dimension, the correlation degree between various factors and carbon trading price both showed a downward trend as a whole, and the fluctuation of the correlation degree of individual factors was different from the overall trend. In conclusion, we can put forward recommendations on the pricing mechanism of the carbon trading market after this comprehensive study.

1. Introduction

In order to solve the problems of the greenhouse effect and serious environmental pollution, General Secretary Xi Jinping proposed that China’s carbon dioxide emissions should reach their peak by 2030 and that China would strive to achieve carbon neutralization by 2060 at the 75th Session of the United Nations General Assembly in September 2020. As an important means of carbon dioxide emission reduction, carbon emissions trading will play an important role in promoting China’s carbon emission reduction. Zeng [1] concluded that each 1% increase in carbon trading volume would promote a 0.9% decrease in carbon dioxide emission intensity in carbon pilot areas, and each 1% increase in carbon trading market activity would reduce carbon emissions by 0.4% per capita. However, the effect of China’s carbon trading market has not been fully developed thus far. Tang et al. [2] simulated the marginal abatement cost curves for different industries in the Chinese emissions trading scheme (ETS) and derived the optimal carbon price to meet the upper and lower carbon intensity targets from CNY 345/ton to CNY 1140/ton. According to statistics, the total carbon quotas in 8 markets was about 1.15 billion tons during the year 2020. However, the actual transaction volume was only 75.25 million tons, with the transaction ratio being less than 10%. In addition, there is an obvious gap between the carbon trading prices of the eight pilot markets. Beijing had the highest average transaction price, reaching CNY 72.8 /ton in 2021, and Shenzhen had the lowest at only CNY 12.8 /ton. At the same time, the carbon trading price is not constant and can reach as much as CNY 77.64 /ton in 2 months. In any matter, problems such as insufficient trading vitality, low carbon trading prices, large price differences between markets and unstable trading prices still exist in the carbon trading market at present.

Carbon trading prices reflect the marginal social costs of greenhouse gas emissions, thus correcting negative externalities through a “polluter pays” method. Irrationality or large fluctuations in the carbon trading price will increase the risk of loss due to carbon trading. It is difficult for enterprises to obtain benefits through emission reduction and selling carbon emissions rights, thus inhibiting the enthusiasm of enterprises and investors to participate in carbon emission trading. Therefore, a stable and reasonable carbon trading price can promote steady and healthy development of the market and effectively motivate the “polluter” to reduce carbon emissions. In order to improve the pricing mechanism of the carbon trading market as soon as possible and mobilize the vitality of market trading, an empirical study on the influencing factors on carbon trading prices was conducted.

In the present paper, the carbon trading market prices in Beijing, Shanghai, Tianjin, Chongqing, Shenzhen, Hubei, Guangdong and Fujian are used as the explained variables, and 15 influencing factors are selected. In order to reduce the amount of calculation and ensure the effectiveness of the results, we use systematic cluster analysis to preliminarily screen the factors and eliminate those with close internal relationships. Then, we calculate the correlation degree between each influencing factor and the carbon trading price through the improved gray relational analysis model. Policy recommendations are made to address the strong correlation factors, thus providing scientific reference for China to promote carbon trading and achieve the “double carbon” goal.

The remaining parts are as follows. In Section 2, the published research work related to the carbon trading market and price is introduced and summarized in brief. In Section 3, the influence of the factors on the carbon trading price by systematic cluster analysis and the preliminarily screening of the factors are presented. In Section 4, the relational degree between the influencing factors and carbon trading price are calculated and ranked using the improved gray relational analysis model. In Section 5, the empirical results are analyzed in detail. Finally, in Section 6, we put forward our conclusions and policy recommendations for the goal of “double carbon”.

2. Literature Review

In recent years, research on the carbon trading market and carbon trading price has gradually been enriched, and it is divided into four main aspects.

First, some scholars have studied the relationship between the carbon trading market and other related markets. On one hand, there was a link between the carbon trading market and the relevant energy or power industry, such as how Oberndorfer [3] showed that there is a positive relationship between the EUA price and the stock returns from the power companies covered by the EU ETS. Mo et al. [4] divided the EU ETS into two development stages and examined how the EUA price affected the corporate value from the perspective of stock returns, low-carbon operating strategies, etc. Tian et al. [5] concluded that the EUA market has an impact on EU electricity producers, and the impact depended upon the carbon intensity of the producers and EU market volatility. Li et al. [6] found that the CET market may occasionally have a higher degree of impact on the power industry. Reboredo [7] concluded that risk-adjusted returns increase when the EUA is included in a crude oil portfolio. On the other hand, there were linkages between different carbon markets or different carbon credit products, such as how Takashi [8] analyzed the association between EUA-sCER prices, and the results showed that the causes of high EUA-sCER price correlations differed across EUA price periods. Li et al. [9] explored the time-varying correlation among seven pilot carbon trading markets in China, and the results of the study demonstrated that at certain points in time, different carbon trading markets showed significant correlation with each other. Zhao et al. [10] found that there are significantly bidirectional nonlinear Granger causality relationships between the Guangdong, Hubei and Shenzhen CET markets in China, where the three markets were time-varying and influenced each other significantly. Chen et al. [11] extended the time scale of EU-ETS to phase III and showed that carbon spots and carbon futures are highly correlated.

Second, some scholars have studied the volatility of carbon trading prices, such as Byun and Cho [12], who suggested using the Brent crude oil, coal and electricity markets to predict the volatility of carbon credit prices. Tan et al. [13] concluded that coal, stock, crude oil, non-energy commodity and T-bill rates all have predictive power for EUA volatility. Lyu et al. [14] analyzed the fluctuation of carbon trading prices in Hubei, Shenzhen, Shanghai and the EU and compared the differences in their fluctuation patterns.

Third, researchers have made predictions on carbon trading prices, such as Zhu et al. [15], Sun et al. [16] and Zhou and Wang [17], who all constructed new models to predict carbon trading prices, combining EDM, LSSVM, VMD, GA, BP and BES to create more accurate and effective carbon trading price prediction models. In addition, Hao and Tian [18] analyzed the role of the crude oil price, electricity price, exchange rate and AQI in predicting carbon trading prices, which is beneficial for investors to predict carbon trading risk. Zhao et al. [19] argued that the U.S. Treasuries, Stoxx50, S&P Clean Energy Factor, and Brent oil prices in financial and energy markets contribute to carbon trading price forecasts. Zhang et al. [20] found that the EPU index has a good long-term forecasting ability for EUA futures, which can help investors achieve better utility returns.

Finally, some scholars have conducted studies on the factors influencing the carbon trading price. Many scholars analyzed the influence of energy prices on the carbon trading price, such as Alberola et al. [21], Marimoutou and Soury [22] and Wang and Yin [23], who argued that energy prices such as those for coal, crude oil and natural gas are important factors affecting the carbon trading price. Yu and Mallory [24] indicated that the substitutability between coal and natural gas serves as the key component that determines the carbon price. Zhou and Li [25] considered that there is a long-term equilibrium relationship between the carbon emissions trading price and energy prices. Some scholars explored the role of economically relevant factors in influencing the carbon trading price, such as Li [26], who explored the effects of trade policy, monetary policy, fiscal policy and exchange rate policy uncertainty on carbon trading prices and showed that there were significant positive effects from trade policy uncertainty and monetary policy uncertainty on CET market prices, and the effect of exchange rate policy uncertainty on the CET market’s effect was also identified as negative. However, fiscal policy uncertainty had no significant effect on the CET market. Chu et al. [27] analyzed the effect of macroeconomic level’s effect on carbon prices in different quartiles, and the results showed that medium carbon trading prices are more sensitive to changes in macroeconomic factors. Other scholars also explored the impact of other factors on the carbon trading price, such as Wang and Zhao [28], who indicated that the Global Clean Energy Index will indirectly affect the carbon trading price. Ji et al. [29] studied the carbon trading markets in Beijing, Shanghai, Guangdong, Shenzhen and Hubei and indicated that the expansion of the carbon market and centralized trading will raise carbon prices. They also analyzed the effect of carbon-intensive products such as non-ferrous metal prices and chemical product prices on carbon trading prices in different regions. Xu et al. [30] decomposed the effects of short-term market fluctuations, significant events and the long-term trend on the carbon trading price by applying the Ensemble Empirical Mode Decomposition (EEMD) method. In addition, some scholars have also studied the factors influencing the price of carbon trading by considering the time period, such as Chang et al. [31], who analyzed the impact of energy prices on carbon trading prices in each carbon trading pilot region in both the short and long term. Zhu et al. [32] argued that in the short, medium, and long term, electricity markets, stock markets and energy prices have different degrees of influence on carbon prices. Jiang et al. [33] defined a high-frequency band between 15 and 20 weeks, a medium-frequency zone between 20 and 40 weeks, and a low-frequency zone between 40 and 80 weeks. The results of the study showed that the interaction between CET market prices and coal prices is time-varying, occurring in both the low- and high-frequency bands, while the linkage between the CET market prices and new energy stock prices occurs in the medium- and low-frequency bands. Wu et al. [34] innovatively analyzed the difference in the role of each influencing factor on the carbon trading price before and after the new crown pneumonia in the context of the new crown pneumonia. The results showed that in the pre-COVID-19 period, there were negative effects from coal and natural gas, and on the contrary, the coefficient of oil was positive. In the post-COVID-19 period, all variables had positive effects on the carbon price.

Although there are many studies on the carbon trading price, the existing literature still has the following areas with room for improvement. First, the existing literature mainly analyzes the influencing factors on the carbon trading price empirically in the spatial dimension, comparing the correlations between different influencing factors and the carbon trading price in multiple markets or individual markets. However, the literature rarely analyzes the influence of the factors in the time dimension. Second, the existing literature mainly focuses on the European carbon market or individual domestic markets in China. However, less research on the comprehensive analysis of all eight pilot carbon markets in China can be found. Third, due to the short opening time of China’s pilot carbon trading market and the small volume of carbon emissions trading, the small sample size leads to less accurate results from the existing analytical models.

In order to enrich and supplement the existing studies on the factors influencing carbon trading prices, the contributions of this paper mainly include the following:

- (1)

- Compared with the existing literature, a vertical dimension is added. In the horizontal and vertical dimensions, we explore the differences in the correlation degree between the carbon trading price and factors under regional differences and time variations, and then we analyze the influence of each factor more comprehensively so as to improve the pricing mechanism of carbon trading prices and accomplish the “double carbon” goal.

- (2)

- In this paper, the entire sample of China is covered, covering all pilot carbon trading markets. This reflects the impact of market regional differences on the correlation degree more comprehensively compared with the existing literature and provides a reference for the development of China’s carbon trading market.

- (3)

- Based on the traditional gray relational analysis model, we replace the series spacing with the series variance spacing in order to reflect the price fluctuation more obviously. At the same time, the coefficient of variation method is introduced to improve the gray relational analysis method. Compared with the existing literature, the precision of the calculation of the correlation results is improved.

3. Analysis and Selection of Influencing Factors on Carbon Trading Price

3.1. Current Situation Analysis of Prices

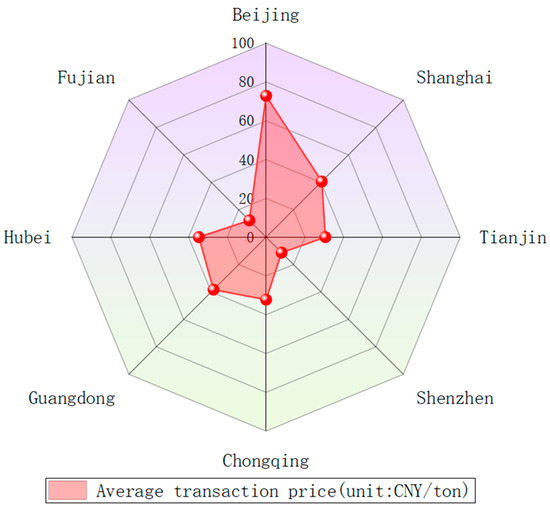

At present, the price gap of carbon trading in the eight pilot areas is obvious. The average transaction prices of the carbon markets in each region in 2021 are shown in Figure 1.

Figure 1.

The average transaction price of the 8 pilot carbon markets in 2021. Data source: CSMAR Database.

Since the opening of the Beijing carbon trading market, the transaction price has been first among all markets, with a price of CNY 72.8 /ton in 2021. The transaction price of Shanghai’s market is second only to Beijing, with a price of CNY 40.6 /ton in 2021. Tianjin, Chongqing, Guangdong and Hubei are in the range of CNY 30–40/ton, and Shenzhen and Fujian are in the range of CNY 11–13/ton.

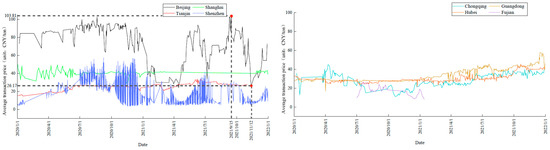

In addition, the fluctuation range of the carbon trading prices is also large. The trend of the daily average carbon trading price fluctuations in the eight pilot markets in the past three years is shown in Figure 2.

Figure 2.

The fluctuation trend of carbon trading prices in 8 regions. Data source: CSMAR Database.

According to Figure 2, the fluctuations in the carbon trading prices in Hubei and Guangdong are relatively small, with trading prices fluctuating by about CNY 20/ton. The price in Tianjin also shows a relatively stable trend due to the low trading volume of carbon emissions rights. In addition, the carbon trading prices in other five regions have fluctuated to a greater extent. Among them, Beijing’s price fluctuates the most. According to Figure 2, the average price of a transaction on 15 September 2021 was CNY 103.81/ton, and the price on 12 November 2021 was 26.17/ton. In just 2 months, Beijing’s carbon trading price fluctuated up to 77.64 CNY/ton.

From the current situation, stabilizing the carbon trading price and stimulating the vitality of carbon market transactions are crucial to improve the enthusiasm of enterprises for energy saving and emission reduction, promote the healthy development of the carbon trading market, give full play to the role of the carbon trading market in emission reduction and achieve the “double carbon” goal at a low cost. Therefore, starting with the factors affecting the carbon trading price, we analyze the effects of various factors on the price in order to provide scientific reference for stabilizing the price and improving the pricing mechanism. Then, we select the factors affecting the carbon trading price.

3.2. Selection and Mechanism Analysis of the Influencing Factors on the Carbon Trading Price

3.2.1. Selection of the Influencing Factors on the Price

By studying the related literature, it can be seen that more scholars consider energy prices an important factor affecting carbon trading prices, such as those in [21,22,23,24,25]. In addition, the authors of [21,26,27,28,35,36] argued that factors such as temperature, related policies, industry development, macroeconomic indicators and the clean energy index have significant effects on carbon trading prices. In this paper, we inherit and improve upon the existing literature and identify 15 influencing factors. According to the carbon emissions target and climate environment, the government sets the carbon emissions quota and distributes the quota to each enterprise. The enterprise introduces emission reduction technology and other methods to ensure the carbon emissions do not exceed the quota amount, and the surplus or insufficient quota can be made into profit or made up through carbon trading, respectively. At the same time, the carbon trading price will also rise and fall due to the impact of the economic environment. In conclusion, policy regulations, green industry development, economic environment and climate environment will affect the carbon trading price from different angles. Therefore, the preliminary selection of factors influencing the carbon trading price is developed from these four dimensions, as shown in Table 1.

Table 1.

Influencing factors on carbon trading price.

3.2.2. Mechanism Analysis of the Influencing Factors on the Price

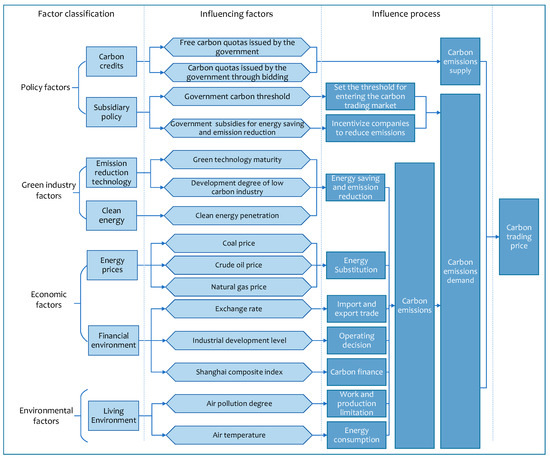

Based on the above influencing factors on the carbon trading price, we analyze the path of influencing the price by each factor. The influencing process of each factor on the carbon trading price is shown in Figure 3.

Figure 3.

Action mechanism diagram of influencing factors on carbon trading price.

- Policy Factors

In order to build the carbon trading market mechanism to reduce greenhouse gas emissions at a low cost, the government has issued policies on carbon trading management rules, the allocation of carbon emission quotas, mandatory access to the carbon trading market, issuance of special fund subsidies for energy saving and emission reduction and guiding key carbon emission enterprises to trade carbon emissions rights, which is very important to promote the healthy development of the market. Therefore, from the policy level, four factors were initially selected as influencing factors, namely free allocation of the carbon quota by the government (), carbon quotas issued by the government through bidding (), the government carbon threshold () and government subsidies for energy saving and emission reduction (). The specific analysis was conducted as follows:

① The amount of free carbon quotas issued by the government accounts for a large part of the total carbon quota allocated, which determines the supply of carbon emissions rights to a large extent. The change in the amount will lead to the rise or fall of the carbon trading price. ② The carbon quotas issued by the government through bidding are the quantity of the quota obtained by enterprises through bidding in a government auction. The bidding base price is generally the weighted average price of the market, and the income obtained from the quota issued through paid bidding shall be paid to the state treasury. The issuance of paid bidding quotas is conducive to increasing the financialization of the carbon trading market [37]. Compared with the free carbon quotas issued by the government, the carbon quotas issued by the government through bidding have a more obvious incentive effect on enterprise emissions reduction. The amount of carbon quotas issued by the government through bidding reflects the government’s efforts to encourage enterprises to reduce carbon emissions. At present, free distribution and auction distribution coexist in China. The larger the proportion of auction distribution, the greater the demand for carbon emissions rights, and the higher the carbon trading price. ③ The government carbon threshold is the criterion to judge for mandatory carbon trading enterprises, and measures shall be prescribed for the annual greenhouse gas emissions of 26,000 tons of carbon dioxide equivalent (comprehensive energy consumption of about 10,000 tons of standard coal) and more enterprises as key emissions units. The key emitting units shall discharge carbon dioxide within the permitted limits of the quotas, and each pilot area shall make appropriate adjustments to the government carbon threshold according to its own conditions. The level of the threshold reflects the government’s efforts to promote individual carbon emitters to participate in carbon trading. The more market trading participants are forced into carbon trading, the more stable the supply and demand of the market, the less serious inclination will occur due to emergencies, and the more the stability of carbon trading price will be guaranteed. ④ The government subsidies for energy saving and emissions reduction refers to the subsidy amount arranged through the central financial budget to support energy saving and emissions reduction. The subsidy scope includes energy-saving technology renovation projects of enterprises and comprehensive demonstration projects of energy saving and emissions reduction fiscal policies. After developing relevant energy-saving and emissions reduction projects, enterprises can apply to the government for special fund subsidies for energy saving and emissions reduction. The larger the subsidy amount of the government’s special fund, the greater the incentive for enterprises to reduce emissions, the smaller the carbon emissions, the smaller the demand for carbon emissions rights, and the lower the carbon trading price.

- 2.

- Green Industry Factors

In order to achieve the “double carbon” goal and tackle climate change, the state has coordinated various aspects to strengthen the research and development of emissions reduction technology, increase the utilization of clean energy and promote the development of low-carbon industries, which has a significant impact on the demand for carbon emissions rights. Therefore, from the green industry level, three factors were initially selected as influencing factors, namely green technology maturity (), the development degree of low-carbon industries () and clean energy penetration (). The specific analysis was conducted as follows:

① The green technology maturity can measure the development level of green technology. The higher the maturity of green technology, the better the development of green technology, the better the emissions reduction effect, the less carbon emissions, the smaller the demand for carbon emission rights, and the lower the carbon trading price. ② The development degree of low-carbon industries measures the development level of the low-carbon industry. “Low-carbon industry” refers to an industry based on low energy consumption and low pollution. The better the development of a low-carbon industry, the lower the carbon emissions, the smaller the demand for carbon emissions rights, and the lower the carbon trading price. ③ Clean energy penetration reflects the proportion of each subject using clean energy in the process of energy consumption. The higher the popularity of clean energy, the lower the carbon emissions, the smaller the demand for carbon emissions rights, and the lower the carbon trading price.

- 3.

- Economic Factors

Economic factors can affect the carbon trading price from three aspects, the first of which is fuel. A change in fuel price will affect the energy procurement decisions of enterprises. The carbon emissions coefficient of different fuels is different, the carbon dioxide emissions of enterprises when choosing different fuels are different, and the demand for carbon emissions rights changes, resulting in changes in the carbon trading price. At the same time, most of China’s oil and natural gas are obtained through importing. A change in the exchange rate will affect the import volume of fuel, impact the energy consumption structure and then affect the demand for carbon emissions rights, resulting in fluctuation of the carbon trading price. Second, there is the level of industrial development. For industrial enterprises, as a major subject of carbon dioxide emissions, the prosperity and recession of the whole industrial sector will affect carbon emissions and then affect the demand for carbon emissions rights, causing fluctuations in the carbon trading price. Third, there is the financial environment. The launch of carbon financial products has attracted many financial investors and injected new vitality into the carbon trading market. The development of the financial market will have an impact on the carbon trading price through carbon financial products. The economic environment is crucial to the healthy development of the carbon trading market. Therefore, from the economic level, six factors were initially selected as influencing factors, namely the coal price (), crude oil price (), natural gas price (), exchange rate (), industrial development level () and Shanghai Composite Index (). The specific analysis was conducted as follows:

① With a rise in the coal price, enterprises will consider the cost to reduce the use of coal. Under the condition of generating the same heat, the proportion of carbon dioxide produced by coal, crude oil and natural gas was 1:0.66:0.44. Coal consumption decreased, carbon emissions decreased, carbon emissions rights demand decreased, and the carbon trading price decreased. ② A change in the crude oil price will affect the purchase decisions of enterprises, and the choice of other fuels will affect carbon emissions and then affect the carbon trading price. ③ A change in the natural gas price will also affect carbon emissions by influencing the purchase decisions of enterprises, resulting in fluctuation of the carbon trading price. ④ The exchange rate is the exchange rate between the RMB and US dollar. China’s energy is characterized by rich coal, a lack of oil and less gas. The carbon emissions coefficient of coal is much higher than those of oil and natural gas. In order to change an energy structure with high carbon emissions, it is necessary to increase the consumption and importing of oil and natural gas, and the international prices of oil and natural gas are priced in US dollars. Therefore, a change in the exchange rate will impact the energy importing and consumption structure, affect the carbon demand and trigger fluctuation of the carbon trading price. ⑤ As a major subject of carbon dioxide emissions, the operation and development of industrial enterprises are closely related to carbon emissions. The higher the level of industrial development, the more carbon emissions there are, the smaller the demand for carbon emissions rights, and the lower the carbon trading price. ⑥ The Shanghai Stock Index is a weighted composite stock price index with all the stocks listed on the above stock exchanges as the calculation scope and the circulation as the weight. The Shanghai Stock Index reflects the overall trend of the stock market and the development of the financial stock market. Carbon financial products derived from carbon emissions rights are entering the financial market, and many financial investors buy carbon financially related products for speculative trading. Through the correlation of carbon finance, the prosperity and decline of the financial market will affect the carbon trading price to a certain extent.

- 4.

- Environmental Factors

In recent years, air pollution has been serious. We have taken a series of countermeasures, including limiting work and production and issuing governance policies. At the same time, temperature changes will also increase energy consumption and lead to emitting more carbon dioxide. These environmental problems are closely related to carbon dioxide emissions. Therefore, from the environmental level, two factors were initially selected as influencing factors, namely air pollution degree () and air temperature (). The specific analysis was conducted as follows:

① Air pollution includes haze and other pollution phenomenon caused by humans’ excessive emissions of carbon dioxide. When air pollution is serious, the state restricts production and vigorously controls carbon emissions. The carbon emissions decrease, the demand for carbon emissions rights decreases, and then the carbon trading price decreases. ② Temperature mainly affects the carbon trading price by affecting energy consumption. When the temperature rises or falls, people will increase the use of air conditioning equipment or heating equipment, enterprises will consume more energy to meet social needs, carbon emissions will increase, the demand for carbon emissions rights will increase, and the carbon trading price will rise.

3.2.3. Data

The launch of China’s national carbon trading market in 2017 is an important node in the development of China’s carbon trading market. In addition, considering the availability of recent data, all index data in this paper are monthly data from 2017 to 2020. Some indicators are annual data, which are calculated as monthly data after averaging.

① The amount of subsidies allocated by the government to local governments for energy saving and emissions reduction comes from the local distribution results of subsidy funds for energy saving and emissions reduction issued by the Ministry of finance.

② The unit net value of the Haifutong CSI Mainland Low-Carbon Index Fund was selected to reflect the development degree of the low-carbon industry. China’s Low-Carbon Index companies includes more than 30 listed companies in the low-carbon industry. China’s Low-Carbon Index is an index reflecting the development and securitization degree of China’s low-carbon industry. The data are from China’s carbon trading website.

③ The energy purchase channels and prices of enterprises located in the same pilot area are different, so it is impossible to accurately determine the energy prices of each region from the regional perspective. Therefore, we unified the energy prices of the eight regions and selected the monthly average price of power coal around the Bohai Sea and the monthly average settlement price of Brent crude oil futures and the monthly average settlement price of IPE UK natural gas futures to reflect the prices of coal, crude oil and natural gas, respectively. All economic index data are from the database.

④ The air quality index and air temperature were derived from the database and relevant official websites. The data of the provinces of Guangdong, Hubei and Fujian were obtained by averaging the data of the major cities in each province.

3.3. Systematic Cluster Analysis of the Influencing Factors on the Carbon Trading Price

Based on the preliminary analysis of the mechanism of the above factors, the influencing factors were divided into four categories: policy, green industry, economy and environment. In order to reduce the correlation between factors and reduce the workload of calculating the correlation degree of high-correlation factors, we conducted correlation screening for the factors first and eliminated some factors with high correlation and similar change rules. However, the inherent correlation between factors could not be easily reflected through theoretical analysis, and data analysis of the factors needed to be carried out. Therefore, systematic cluster analysis was introduced to conduct the preliminary screening of influencing factors.

3.3.1. Systematic Cluster Analysis

Common index screening methods include principal component analysis, the analytic hierarchy process, systematic cluster analysis and so on. Principal component analysis (PCA) aims to transform a group of possible correlated variables into a group of linear unrelated variables by orthogonal transformation. Hierarchical analysis refers to a complex multi-objective decision-making problem as a system, decomposing the objective into several levels of multiple indicators and aggregating and combining factors at different levels according to their interrelated effects and affiliation, forming a multi-level analysis structure model so that the problem finally boils down to the determination of the relative importance weights of the lowest level (solutions, measures, etc. for decision making) relative to the highest level (the total objective) or the ranking of relative advantages and disadvantages. Systematic clustering analysis is a multivariate statistical analysis method for classifying indicators. “Clustering” means to divide sample data into several classes or clusters according to the spacing between samples, and the same samples obtained have great similarity. In this paper, the screening index does not transform the variables into completely linear irrelevant variables, such as in the principal component analysis method, nor does it use the fuzzy quantitative method of qualitative indicators for hierarchical ranking and decision making, such as in the analytic hierarchy process. Instead, it selects some indicators with high correlation and a similar variation law according to the relationship between the data so as to reduce the unnecessary workload in the later correlation degree calculation, Therefore, we used systematic cluster analysis to cluster the influencing factors and then remove some high correlation indicators from the similar factors.

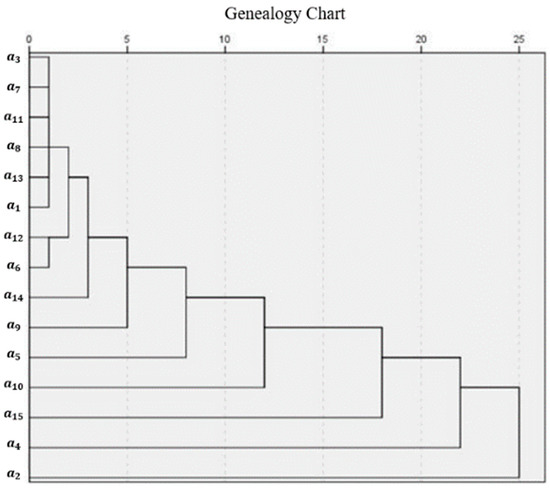

In this paper, 15 influencing factors were selected first, and the monthly data of the above indicators from 2017 to 2020 were systematically analyzed by SPSS to reduce the correlation between the factors and reduce the workload in the later period. Then, a genealogy chart of the 15 factors was obtained, as shown in Figure 4.

Figure 4.

Cluster analysis results of influencing factors on carbon trading price.

3.3.2. Cluster Results Analysis

The principle of cluster analysis is to start from the leftmost side, let factor form a category and then merge the two most similar categories; that is, the horizontal lines are continuously merged, and then the distance or similarity between the new category and other categories is recalculated. It can be seen that the earlier a factor is clustered, the higher its similarity with factors of the same kind and factors that have been classified is. Therefore, we took the cluster analysis results and impact of factors on the carbon trading price into consideration to further screen the influencing factors.

According to Figure 4, the categories generated by the first clustering included the government carbon threshold (), the clean energy penetration (), the exchange rate (), the coal price (), the shanghai composite index () and the free carbon quotas issued by the government (). The category generated by the second clustering added the industrial development level () and the development degree of the low-carbon industry () on the basis of the first category. The third clustering category added the air pollution degree (). Among the categories generated by the first clustering, the similarity between each other was the highest, and in the second and third clustering, the similarity between each factor decreased in turn. Next, we eliminated certain factors:

① First, the exchange rate () was excluded. As the factor clustered for the first time, the exchange rate () indirectly affected the carbon trading price by affecting the energy import price. Therefore, the exchange rate () was excluded, and the imported energy price index was retained for the latter analysis. ② Secondly, excluding the natural gas price (), most of China’s crude oil and natural gas comes from imports, in which the proportion of natural gas consumption in energy consumption is low, and the carbon emissions coefficient of natural gas is also low compared with other fossil energies, which has little impact on carbon emissions and the carbon trading price. Therefore, we excluded the natural gas price () and finally retained the crude oil price () to analyze the influencing factors on the carbon trading price ③ Once again, the Shanghai Composite Index () was excluded. As a factor clustered for the first time, the Shanghai Composite Index () reflected the development of the whole financial and stock market and could not accurately reflect the financial development related to carbon. As an index reflecting the development and securitization degree of China’s low-carbon industry, the China Low-Carbon Index accurately reflects the development of low-carbon financial products and the low-carbon industry on the basis of the Shanghai Composite Index (). Therefore, we excluded the Shanghai Composite Index () and retained the development degree of the low-carbon industry () for factor analysis. ④ Finally, excluding the government subsidies for energy saving and emissions reduction (), with the maturity and popularization of current energy saving and emissions reduction technology, the amount of government subsidies for energy saving and emissions reduction was gradually reduced, and the role of encouraging enterprises to save energy and engage in emissions reduction was gradually weakened, which had little impact on carbon emissions and the carbon trading price. Although the free carbon quotas issued by the government () and the government carbon threshold () belonged to the factors in the first cluster, they had low similarity in the impact process of the carbon trading price. Therefore, we excluded the government subsidies for energy saving and emissions reduction () and retained the free carbon quotas issued by the government () and the government carbon threshold () for factor analysis.

The correlation of factors after systematic clustering screening was reduced, which not only reduced the amount of calculation but also ensured the effectiveness of the research results. After screening of the systematic cluster analysis model, 11 influencing factors were finally identified, and they are shown in Table 2.

Table 2.

Influencing factors on carbon trading price after screening.

4. Improved Gray Relational Analysis Model

After the above systematic cluster analysis, 11 low-correlation influencing factors on the carbon trading price were selected. Then, we conducted gray relational analysis between these 11 factors and the carbon trading price and ranked the correlation degrees between each factor and the carbon trading price from high to low. The specific application of the model was as follows.

4.1. Gray Relational Analysis Model

The gray relational analysis model is a correlation analysis model that measures the degree of association between factors by the similarity or dissimilarity of the trends between them. The application of gray relational analysis in this paper was to measure the correlation of each influencing factor with the carbon trading price and to rank the correlations of each factor. Gray relational analysis is designed to analyze the development trend, and there is no requirement for the sample size, so gray relational analysis is suitable for analyzing data with a small sample size, and the results can be obtained from a small amount of data that are more consistent with other regression models. Therefore, the gray relational analysis model was selected to analyze the influencing factors on the carbon trading price filtered by the above cluster analysis. At the same time, we improved the model based on the traditional model with the research content.

4.2. Improvement of the Gray Relational Analysis Model

4.2.1. The Traditional Gray Relational Model

- Determine the Parent Sequence and Characteristic Sequence

The parent sequence is the data sequence , which is the carbon trading price. The characteristic sequence is the data sequence as the i-th influencing factor.

The sequence forms the following matrix:

where is the number of influencing factors and (excluding the factors eliminated in the previous systematic cluster analysis).

- 2.

- Dimensionless Treatment

In this paper, the mean value method is used to render the data dimensionless. Dimensionless processing eliminates the error caused by the absolute size of different feature sequence data and effectively reflects the relative size of the data. The processing formula is

where and are standardized data, is the data of the k-th row of the i-th influencing factor, is the average value of the i-th influencing factor data, is the data of the k-th row of the carbon trading price and is the average of the carbon trading price data.The processed sequence forms the following matrix:

- 3.

- Calculate the Correlation Coefficient

- 4.

- Calculate the Correlation Degree

4.2.2. Improved Gray Relational Model

According to the above definition, the idea of the traditional gray relational analysis model is to calculate multiple correlation coefficients according to the distance between the corresponding points of the sequence and then calculate the correlation degree between the sequences from the arithmetic average of the correlation coefficients of each point. Based on the traditional gray relational analysis model, we made two improvements. First, the traditional model calculates the correlation coefficient according to the distance between a sequence of corresponding points, which is suitable for all data analysis but lacks pertinence. Considering the volatility of the carbon trading price, we replaced the distance between a sequence’s corresponding points in the traditional model with the distance of variance between a sequence’s corresponding points and more accurately calculated the correlation degree between the carbon trading price and the factors. Second, the traditional model averages the correlation coefficients of each sequence point to derive the correlation degree of the sequence as a whole without considering the different degrees of influence of different sequence points on the sequence as a whole. To improve the accuracy of the correlation degree, the coefficient of variation method was used to objectively assign weights to each sequence point, replacing the average weight method in the traditional model with the coefficient of variation weight method to improve the accuracy of the calculation results. The specific improvement process is as follows:

Improvement 1. Sequence Variance Distance

Let , and then replace it with in the traditional gray correlation model. The correlation coefficient is calculated according to the distance of variance between sequence points. The improved formula is as follows:

where is the improved correlation coefficient between the k-th data of the i-th influencing factor and the k-th data of the carbon trading price and is the resolution coefficient, which is generally taken to be .

Improvement 2. Weight Calculation

In this paper, the coefficient of variation method is introduced to determine the weight of each index. The coefficient of variation method is an objective weighting method that assigns weights to all the indicators to be identified based on the magnitude of variation of their measured values, and it assigns weights by the inherent association between the data, resulting in accurate and objective weighting results. Taking the free carbon quotas issued by the government as an example, the correlation coefficient between the monthly free carbon quotas issued by the government and the current month’s carbon trading price constitutes the correlation degree between the free carbon quotas issued by the government and the carbon trading price according to a certain weight. The specific process of the coefficient of variation method is as follows.

There were 8 pilot areas, and each area had 48 months of data. In order to calculate the weight of each month, we can construct a matrix to the order of 48 × 8 as follows:

where is the free carbon quotas issued by the government for month in region .

- Calculate the Coefficient of Variation

We calculated the coefficient of variation according to the value of the month in different regions. The standard deviation is

According to this, the coefficient of variation of month is

where is the average number of free carbon quotas issued by the government in month for the eight regions.

- 2.

- Terming Weight

After obtaining the coefficients of variation for all months, we obtained the weights of each dimension as follows:

In other words, the weight vector of 48 months is , where > 0,= 1.

4.2.3. Add the Positive and Negative Correlations

Gray relational analysis can measure the correlation degree between factors but cannot measure the positive or negative correlations. To make up for the shortcomings of gray relational analysis, data analysis was used to calculate the correlation coefficients of the carbon trading price and each influencing factor and to determine the positive and negative correlations of each influencing factor with the carbon trading price according to the positivity and negativity of each correlation coefficient.

5. Empirical Analysis and Results

5.1. Spatial Dimension

Spatial dimension analysis was aimed at analyzing the correlation between various factors and the carbon trading price in the eight pilot regions. The monthly average carbon trading price from 2017 to 2020 was used as the parent sequence, denoted as . According to Table 1, the characteristic sequence of the measurement indicators of each influencing factor was (excluding the factors that were removed in the previous systematic cluster analysis).

5.1.1. Correlation Results of the Spatial Dimension

According to the calculations, the correlation degree and positive and negative relationships between various influencing factors and the carbon trading price in different regions are shown in Table 3.

Table 3.

Correlation degree and positive and negative relationships of each factor in 8 regions.

5.1.2. Analysis of Results

- Overall Analysis

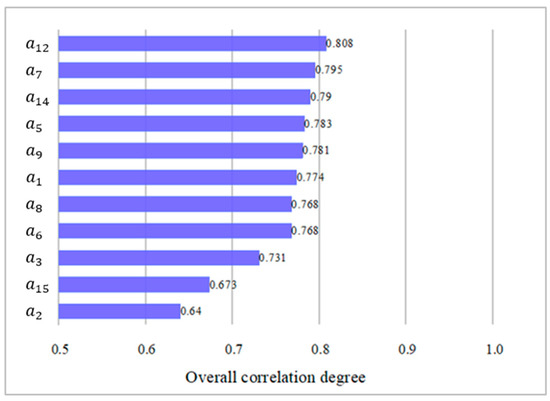

In order to analyze the correlation between various factors and the carbon trading price from an overall perspective, according to Table 4, we averaged the correlation degrees of the eight pilot areas to obtain the overall correlation degree, and each correlation degree is shown in Figure 5.

Table 4.

Ranking of correlation degrees.

Figure 5.

The overall correlation degree of each influencing factor.

According to Figure 5, the correlation degree between the 11 factors and the carbon trading price was greater than 0.5, which shows that the above 11 factors had a significant impact on the carbon trading price. The correlation degrees of the industrial development level (), low-carbon industry development level (), air pollution () and green technology maturity (), which were in the top four positions, were 0.808, 0.795, 0.790 and 0.783, respectively. These factors had the most significant correlation with the carbon trading price, and the influence degree decreased in turn. The top four correlations included one economic factor, one environmental factor and two green industry factors. The free carbon quotas issued by the government (), with the largest relevance among the policy factors, ranked sixth. It can be seen that among the four factors, the policy factors had the lowest impact on the carbon trading price.

Due to the different levels of economic development, energy consumption and carbon market construction in different regions, there were differences in the impacts of various influencing factors on the carbon trading price in different regions. Next, combined with the regional characteristics, we analyzed the correlation results of the above four influencing factors.

- Industrial Development Level

The industrial development level had a negative impact on the carbon trading price in Beijing, Shanghai, Tianjin, Chongqing, Guangdong and Hubei, with correlation degrees of 0.839, 0.866, 0.776, 0.756, 0.904 and 0.759, respectively. On the contrary, it had a positive impact on the carbon trading price in Shenzhen and Fujian, and the correlation degrees were 0.773 and 0.791, respectively.

In terms of the correlation degree, the correlation degree of each region was more than 0.7, which shows that there was a significant correlation between the industrial development level and carbon trading price in the eight regions. Li and Song [36] also identified industrial development as an important factor influencing the carbon trading price. According to Table 3, Guangdong and Shanghai had the highest correlation degree, with both greater than 0.8, because Guangdong and Shanghai are located in the Yangtze River Delta and Pearl River Delta, which are important industrial areas in China. Industrial enterprises are concentrated, and industrial development can affect the carbon trading price to a greater extent.

In terms of positive and negative correlation, the industrial development level was negatively correlated with the carbon trading price in six regions. However, Zhu et al. [38] argued that industrial development implies an increase in energy inputs, leading to an increase in the carbon trading price. While our findings were similar to the findings of Zhou and Li [25], the industrial index had a negative impact on the carbon trading price. This phenomenon may be due to the continuous acceleration of China’s industrialization process in recent years, and the resource consumption has far exceeded the speed of resource regeneration and the environmental carrying capacity. With the continuous investment of national capital and technology, industrial upgrading has accelerated, and the energy intensive heavy industry has begun to transform. While ensuring the development of enterprises, carbon emissions were reduced, the demand for carbon emissions rights was reduced, and the carbon trading price was reduced.

- Development Degree of the Low-Carbon Industry

The development degree of the low-carbon industry had a positive impact on the carbon trading price in Beijing, Tianjin, Shenzhen, Chongqing, Guangdong and Fujian, with correlation degrees of 0.818, 0.790, 0.755, 0.749, 0.896 and 0.773, respectively. On the contrary, it had a negative impact on the carbon trading price in Shanghai and Hubei, and the correlation degrees were 0.851 and 0.729, respectively.

In terms of the correlation degree, the correlation degree of each region was more than 0.7. It can be seen that the correlation between the development degree of the low-carbon industry and carbon trading price was significant in all regions. The correlation between the development degree of the low-carbon industry and carbon trading price in Guangdong and Shanghai was high, with both being greater than 0.8, which was similar to the ranking of the total value of the energy saving and environmental protection industry in the two regions. The total value of the energy saving and environmental protection industry in the two regions was at the forefront of the ranking of the eight regions. Compared with other regions, the development degree of the low-carbon industry in Guangdong and Shanghai affected the local carbon trading price to a greater extent.

In terms of positive and negative correlation, the three green industry factors had a positive relationship with the carbon trading price in most regions, which was contrary to the action mechanism mentioned above that the better the development of the green industry, the fewer carbon emissions, and the lower the carbon trading price. This is because with more subjects conducting carbon trading, the carbon trading price is in the rising stage. The development of the green industry is at a preliminary stage, and although it can reduce carbon emissions and provide surplus carbon allowances, thus reducing the carbon trading price, it is not enough to change the overall trend of rising carbon trading prices, so a negative relationship was shown in the data analysis results.

- Air Pollution Degree

The air pollution degree had a negative impact on the carbon trading price in Beijing, Shanghai, Tianjin, Shenzhen, Chongqing and Guangdong, with correlation degrees of 0.813, 0.813, 0.744, 0.795, 0.747 and 0.915, respectively. On the contrary, it had a positive impact on the carbon trading price in Hubei and Fujian, and the correlation degrees were 0.724 and 0.766, respectively.

In terms of the correlation degree, the correlation degree of each region was more than 0.7. It can be seen that the correlation between the air pollution degree and carbon trading price in the eight regions was significant.

In terms of positive and negative correlation, the air pollution degree in Hubei and Fujian was positively correlated with the carbon trading price and negatively correlated in other regions. An increase in the composite air quality index leads the government tends to control carbon emissions and reduce carbon allowances, which will lead to increased demand for carbon allowances and higher carbon trading prices [25]. However, we argue that the emission reduction measures taken by the government in response to air pollution do not include the reduction of carbon quotas because the cycle of allocating carbon quotas happens every year, and there is a lag in the policy. On the contrary, the government is urging industrial enterprises to cut production and limit traffic in cars and construction enterprises to reduce earthwork. The more the carbon emissions of enterprises decrease, the smaller the demand for carbon emissions rights, and the lower the carbon trading price. Except for Hubei and Fujian, the other regions were in line with the action mechanism of the air pollution degree mentioned above, and the air pollution degree was positively correlated with the carbon trading price. However, the Hubei and Fujian regions showed abnormalities, and the air pollution degree was negatively correlated with the local carbon trading price, indicating that local emissions reduction policies were not effectively implemented. It can be seen that Hubei and Fujian made few efforts to reduce emissions in response to air pollution, as the carbon emissions of enterprises had not been reduced to a certain extent, and the demand for carbon emission rights had not been reduced. Therefore, when air pollution was serious, it did not led to a decline in the carbon trading price in Hubei and Fujian.

- Green Technology Maturity

Green technology maturity had a positive impact on the carbon trading price in Beijing, Shanghai, Tianjin, Chongqing, Guangdong and Hubei, with correlation degrees of 0.862, 0.726, 0.786, 0.754, 0.923 and 0.669, respectively. On the contrary, it had a negative impact on the carbon trading price in Shenzhen and Fujian, and the correlation degrees were 0.740 and 0.802, respectively.

In terms of the correlation degree, the correlation degree of each region was more than 0.7. It can be seen that the correlation between green technology maturity and the carbon trading price in most regions was significant. Beijing and Guangdong had the highest correlation degree, which was similar to the ranking of the number of green patents authorized in the two regions. The number of green patents authorized in Beijing and Guangdong ranked first among cities or provinces at the same level, and the correlation with the carbon trading price was more significant.

In terms of positive and negative correlation, green technology maturity had a positive relationship with the carbon trading price in most regions. Technological innovation helps foster a low-carbon economy [39], further contributing to economic prosperity and driving up the carbon trading price [28].

- 2.

- Regional Analysis

After analyzing the results of the overall correlation degree, we then analyzed the ranking of the factor correlation degree in each region. The top four rankings of the correlation degree in each region are shown in Table 4.

Next, we compared the top four influencing factors in each region with the top four influencing factors overall and conducted a specific analysis of the influencing factors of different rankings from the perspective of regional characteristics.

- Crude Oil Price

Alberola et al. [21], Marimoutou and Soury [22], Wang and Yin [23] and Zhou and Li [25] demonstrated that energy prices are important factors influencing the carbon trading price. Coal and crude oil are important energy sources for industrial production. The combustion of these energy sources is the main source of carbon dioxide emissions. Energy prices have an important relationship with the carbon trading price. However, the overall correlation between the crude oil price and carbon trading price was ranked fifth in our paper, which was higher than the correlation ranking for the coal price, which is related to China’s energy consumption structure. China’s coal consumption is much higher than that of crude oil. Due to the low demand price elasticity of coal caused by the high demand for coal, the correlation between the crude oil price and carbon trading price in various regions was therefore significant.

However, the correlation degree between the crude oil price and carbon trading prices in Shanghai and Fujian was low because the coal consumed in Shanghai comes from external procurement. Therefore, the correlation between the coal price and carbon trading price in Shanghai was more significant than that for the crude oil price. Fujian’s carbon trading market has been open for a short period of time. The carbon trading price there is more affected by the policy of free allocation of carbon quotas, and the correlation with energy prices was weak.

- Clean Energy Penetration

According to Table 3, clean energy penetration was positively correlated with the carbon trading price in all eight carbon trading pilot regions, which is consistent with the findings of Wang and Zhao [28]. The clean energy penetration in Shanghai and Tianjin had a relatively high correlation with the carbon trading price. The penetration rate of clean energy in Shanghai was higher among the eight regions, and Shanghai, as the most economically developed city in China, is a pioneer in the implementation of national policies. In order to comply with the national “carbon peak, carbon neutralization” policy and encourage the use of clean energy, it can be explained that the penetration of clean energy is an important factor affecting the carbon trading price in Shanghai. From the correlation degree ranking of Tianjin, we can see that the green industry factors were in the top four, which shows that Tianjin has made great efforts to promote the green industry under the guidance of national policies.

- Air Temperature

There was a more significant effect from the temperature on the carbon trading price in Chongqing and Guangdong. Alberola et al. [21] and Mansanet-Bataller et al. [35] provided empirical evidence that extreme temperatures affect the EU ETS carbon price. Ji et al. [29] argued that in the long run, both high and low temperatures will increase the use of cooling and heating equipment, which will increase the demand for electricity and push up the carbon trading price. In contrast, the data analysis period of our paper was short, and the analysis results were partially different from those in the existing literature. According to Table 4, overall, the air temperature had little impact on the carbon trading price, and the correlation between the air temperature and carbon trading price in Chongqing and Guangdong was relatively high. This is consistent with the summer temperature rankings of the two regions. Chongqing is located in the east of the Sichuan Basin with a low average altitude. Affected by the vertical decline in temperature, the downdraft is not easy to diffuse, and the temperature increases rapidly, resulting in extremely high temperatures in Chongqing in the summer. At the same time, Guangdong is located in the southernmost part of China, and the temperatures are also high in the summer. The high temperatures lead to the high utilization rate of air conditioning in the two regions, which will consume more energy and emit more carbon dioxide, which will affect the carbon trading price to a greater extent.

- Coal Price

As a whole, the correlation degree between the coal price and carbon trading price was not highly ranked. At the same time, Marimoutou and Soury [22] and Zhou and Li [25] concluded that there is a low correlation effect between the coal price and carbon trading price. However, the analysis results show that the correlation between Shanghai’s coal price and the carbon trading price was relatively high. This is because the Yangtze River Delta, where Shanghai is located, does not produce coal, but coal is an essential resource in the development process. Therefore, Shanghai’s coal source is basically purchased from the outside. It can be explained that the change in the coal price has a great impact on Shanghai’s carbon trading price.

- Free Carbon Quotas Issued by the Government

The free carbon quotas issued by the government in Fujian had a high correlation with the carbon trading price. Due to the shortest time of opening the carbon market in Fujian, the policy factors in the early stage of the market opening played a great role in guiding the carbon trading price. The amount of free carbon quotas issued by the government, which determine the supply of carbon emission rights, had an especially great impact on the carbon trading price. Therefore, it can be explained that the free carbon quotas issued by the government were an important factor affecting the carbon trading price in Fujian.

5.2. Temporal Dimension

The time dimension analysis was aimed at analyzing the relationship between various factors and carbon trading price in each month from 2017 to 2020. The average carbon trading price of the eight regions was used as the parent sequence, denoted as The data of each influencing factor measurement index in the eight regions were used as the characteristic sequence, denoted as (excluding the factors eliminated in the previous systematic cluster analysis).

5.2.1. Correlation Results of the Temporal Dimension

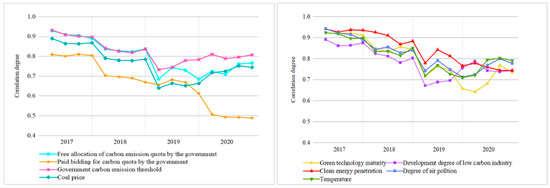

Through the gray relational analysis of the data, the correlation degree of each factor in each time period was obtained, and they are shown in Figure 6.

Figure 6.

Line chart of correlation degree of each influencing factor (Note: Since the data of the Shanghai Industrial Index, Bohai-Rim Steam-Coal Price Index and Brent crude oil price selected in different regions were the same, after averaging each index, the value of the above indicators in each region was 1. At the same time, the carbon trading price was the same in the same month in the same region. Therefore, after the same calculation steps, the correlation degrees between the above corresponding factors and the carbon trading price at the same time were also the same. Furthermore, the correlation degree curves of the industrial development level, coal price, crude oil price and carbon trading price were the same and coincided. For clarity, only the correlation degree curve of the coal price is shown in this figure).

5.2.2. Analysis of Results

- Overall Analysis

According to Figure 6, with the change in time, although the correlation between various influencing factors and the carbon trading price showed an upward trend in individual stages, it showed a downward trend as a whole. This shows that with the operation of the carbon trading market, the improvement of the trading mechanism and the standardization of market rules, the maturity of the carbon trading market is higher, the carbon trading price is more stable, and the fluctuation range of the carbon trading price caused by the change of an influencing factor was smaller.

- 2.

- Regional Analysis

The change trend of the correlation degrees of various influencing factors was also different. Next, the ranking of the correlation degrees of various influencing factors in different stages is analyzed.

- Policy Factors

According to Figure 6, the change trend of the correlation degree between the free carbon quotas issued by the government and the government carbon threshold was similar to the overall trend. Among the three policy factors, the association between the free carbon quotas issued by the government and the carbon trading price always remained first. It can be seen that among the policy factors, the free carbon quotas issued by the government were the most important factor affecting the carbon trading price. Compared with the free carbon quotas issued by the government, the government carbon threshold had a lesser impact on the carbon trading price.

Among the policy factors, the correlation degree between the carbon quotas issued by the government through bidding and the carbon trading price was the lowest, and the correlation degree trend deviated the most from the whole. Especially in 2020, the correlation degree curve between the carbon quotas issued by the government through bidding and the carbon trading price deviated the most obviously. This is because the number of paid bidding quotas issued by the government accounts for a small proportion of the total government carbon quota. The largest annual paid bidding quota was only 5 million tons, and the number of paid bidding quotas in 4 regions was 0, while the number of free allocation quotas amounted to thousands or even tens of thousands of tons. The very small number of paid bidding quotas had a weak impact on the carbon trading price. Moreover, in 2020, the four regions with paid bidding quotas reduced the number of paid bidding quotas, resulting in a sharp decrease in the correlation between the carbon quotas issued by the government through bidding and the carbon trading price in 2020.

- Green Industry Factors

According to Figure 6, the correlation between three green industry factors and the carbon trading price has always been relatively high, but in 2020, the correlation degree of the three factors declined to a certain extent. Wu et al. [38] verified the difference in the role of each influencing factor in relation to the carbon trading price before and after the new crown pneumonia. Therefore, it is reasonable to assume that in 2020, as COVID-19 ravaged, the carbon emissions decreased significantly, the demand for carbon emissions from enterprises decreased, and the income of enterprises developing carbon reduction technologies from carbon emission trading decreased, which restrained the development of green industries to a certain extent. This led to a downward trend in the correlation between the three green industry factors and carbon trading prices in 2020.

- Economic Factors

The change trend of the correlation degree between the economic factors and carbon trading price is reflected in the coal price curve in Figure 6. During the 4-year analysis period, the ranking of the correlation degree between the economic factors and carbon trading price was relatively stable, and the change trend was similar to the overall trend without any special changes.

- Environmental Factors

According to Figure 6, the ranking of the correlation degree between the two environmental factors and the carbon trading price was relatively stable, which was similar to the change trend of the overall correlation degree. Due to the limited development of the green industry in 2020, the correlation degree between the two environmental factors and the carbon trading price in 2020 was ranked ahead of clean energy penetration and the development degree of the low-carbon industry.

6. Conclusions and Recommendations

6.1. Conclusions

By analyzing four types of factors that affect the carbon trading prices in eight regions of China—policy factors, green industry factors, economic factors, and environmental factors—and using an improved gray relational analysis method, we conducted an empirical study of the influencing factors that affect the carbon trading price in both the spatial and temporal dimensions, and we concluded the following:

- From the perspective of the spatial dimension, on the whole, the correlation between the industrial development level and carbon trading price in the economic factors was the most significant, followed by the development degree of the low-carbon industry in the green industry factors, air pollution degree in the environmental factors and finally green technology maturity in the green industry factors. In addition, due to the different levels of economic development, energy consumption and construction of the carbon trading market in different regions, the correlation degree ranking of factors in different regions was different from the overall ranking. For example, the correlation degree between the crude oil price and local carbon trading price in Beijing, Tianjin, Shenzhen, Chongqing, Guangdong and Hubei was high. The clean energy penetration in Shanghai and Tianjin was highly correlated with the local carbon trading price. Shanghai had the highest correlation degree between the coal price and local carbon trading price.

- From the perspective of the temporal dimension, with the development and improvement of the carbon trading market, the correlation degree between various factors and the carbon trading price showed a downward trend as a whole, and the fluctuation of the correlation degree of individual factors was different from the overall trend. It can be seen that the carbon trading market gradually matured, and the carbon trading price gradually became stable. The change of a certain factor will not lead to a sharp fluctuation in the carbon trading price. This reduces the risk of loss of enterprises due to sharp fluctuations in the carbon trading price and can effectively promote enterprises to conduct carbon trading, increase the trading volume and make the carbon trading mechanism play a better role in emissions reduction. This is a good sign for the realization of the “double carbon” goal in the future.

6.2. Recommendations

Based on the above analysis results and conclusions, we put forward the following suggestions:

- Promote new industrialization, and control the number of carbon quotas.

Industrial production is the main source of carbon dioxide emissions, and industrial development is the part that needs to be focused on. The results show that there is a significant correlation between the industrial development level and carbon trading price. In most regions, the industrial development level has a negative relationship with the local carbon trading price. The better the industrial development level is, the lower the carbon trading price is. Due to the promotion of China’s new industrialization policy, the carbon emissions of industrial enterprises are gradually reduced, and the demand for carbon emissions rights is reduced, resulting in the reduction of the carbon trading price. Therefore, while changing the mode of production and taking the road of new industrialization, the government should, in combination with the process of new industrialization in various regions, clarify the characteristics of industries covered by carbon trading and the differences in industrial distribution in different regions, define the limit of the total amount of the carbon quota, prevent the excessive supply of a quota from leading to a sharp decline in the carbon trading price and carbon emission costs, eliminate the enthusiasm of enterprises to take the road of new industrialization and actively reduce environmental pollution and then weaken the effectiveness of the market mechanism.

- 2.

- Encourage the development of low-carbon industries and promote the sharing of green technologies.

With the introduction of carbon reduction policies, the development of green low-carbon industries has broad prospects. The analysis results show that there is a significant correlation between the development degree of the low-carbon industry, green technology maturity and the carbon trading price. At present, due to the overall upward trend of the carbon trading price, the initial development degree of the low-carbon industry is not enough to lead to a decline in the carbon trading price, which is a good opportunity for China to encourage the development of the low-carbon industry. The upward trend of the carbon trading price can effectively stimulate enterprises to carry out low-carbon technology research and development and gain from trading surplus quotas. Therefore, we should accelerate the formation of a new energy-led energy structure, vigorously promote the overall green transformation of social development, urge industry, communities and individuals to explore renewable energy and green technologies, strengthen the green and low-carbon industries and accelerate the development of clean energy application industries. At the same time, the exchange and sharing of the green and low-carbon technologies among regions should increase, and they should work together to achieve the goal of “double carbon”.

- 3.

- Steadily improve the ecological environment and prevent the rebound of air pollution.

The environment and climate are closely related to carbon dioxide emissions. The results show that there is a significant correlation between the air pollution degree and carbon trading price. Ensuring the stability of the environment and climate is very important for stabilizing the carbon trading price. Therefore, we should strictly abide by the red line of ecological protection, continue to promote air pollution control, steadily improve global air quality, prevent the rebound of air pollution, establish a scientific air quality control system (emissions list, sources and causes, control measures, implementation supervision, monitoring and evaluation) and accurately prevent dust emission. Stable air quality is conducive to a stable price for carbon trading. This weakens the negative impact of carbon trading price fluctuations to a certain extent.

- 4.

- Increase the number of allocation quotas through bidding, and appropriately increase the cost of carbon emissions.

The analysis results show that the amount of carbon quotas through bidding was very small compared with the number of free carbon quotas, resulting in a low correlation with the carbon trading price, and the change trend was also different from the change trend of the overall correlation. At present, four of the eight regions have not set carbon quotas through bidding. An appropriate carbon quota through bidding can increase the carbon emissions costs of enterprises, promote energy saving and emissions reduction and enable enterprises to gradually adapt to and accept carbon emissions trading. At the same time, the base price of paid bidding is generally the market-weighted average price, which helps to maintain stable operation of the carbon trading price to a certain extent.

6.3. Limitations and Future Research

Our paper selected 11 carbon trading price-influencing factors, constructed an improved gray correlation analysis model to obtain the strong correlation factors of the carbon trading price and proposed targeted policy suggestions to promote the development of China’s carbon trading market based on the analysis results. However, our paper also has the following limitations. First, the influencing factors selected in this paper are still not comprehensive enough, and the number of factors can be further expanded. Second, China’s carbon trading market is still relatively short in its development time. In this paper, a short time period was selected for analysis in the vertical dimension. With the development of a carbon trading market, the correlation trend between various influencing factors and the carbon trading price over a longer period of time can be studied further to obtain a more accurate and representative regularity. Third, the comparison of the results of 15 factors and 11 factors is worthy of validation, and the scientific nature of factor exclusion deserves further exploration.

Author Contributions

X.S., conceptualization, writing—editing, supervision and funding acquisition; W.Z., methodology, conducting empirical analysis and writing the original manuscript; Z.G., writing—review and editing and data curation; S.H., writing—review and editing; Y.H., conceptualization; S.X., writing—review and editing. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the “Natural Science Foundation of China Project” (Grant No. 72074074).

Data Availability Statement

Not applicable.

Acknowledgments

We would like to express our great thanks to the editor and reviewers, any remaining errors belong to the authors.

Conflicts of Interest

The authors declare no conflict of interest.

References