Chief Executive Officers and the Value of US Airlines: The Moderating Effect of Carrier Type

Abstract

1. Introduction

2. Review of Literature and Hypotheses Development

2.1. Market-to-Book Value

2.2. Low-Cost Carriers (LCC)

2.3. Upper Echelon Attributes and Chief Executive Officers

3. Method

3.1. Data Collection

3.2. Illustration of Variables

3.3. Data Analysis

4. Results

4.1. Descriptive Statistics and Correlation Matrix

4.2. Results of Hypotheses Testing

5. Discussion

6. Conclusions

6.1. Theoretical Contribution

6.2. Practical Implication

6.3. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Nasdaq. United Airlines Holdings, Inc. Common Stock. 2021. Available online: https://www.nasdaq.com/market-activity/stocks/ual (accessed on 4 December 2021).

- Nasdaq. Southwest Airlines Company Common Stock. 2021. Available online: https://www.nasdaq.com/market-activity/stocks/luv (accessed on 4 December 2021).

- Finkelstein, S.; Hambrick, D.; Cannella, A. Strategic Leadership; Oxford University Press: Oxford, UK, 2009. [Google Scholar]

- Boeker, W. Executive migration and strategic change: The effect of top manager movement on product-market entry. Adm. Sci. Q. 1997, 42, 213–236. [Google Scholar] [CrossRef]

- Lee, W.; Moon, J. Determinants of CEO strategic risk-taking in the airline industry. Tour. Manag. Perspect. 2016, 18, 111–117. [Google Scholar] [CrossRef]

- Serfling, M.A. CEO age and the riskiness of corporate policies. J. Corp. Financ. 2014, 25, 251–273. [Google Scholar] [CrossRef]

- Wang, Y.; Yin, S. CEO educational background and acquisition targets selection. J. Corp. Financ. 2018, 52, 238–259. [Google Scholar] [CrossRef]

- Miller, D.; Xu, X. MBA CEOs, short-term management and performance. J. Bus. Eth. 2019, 154, 285–300. [Google Scholar] [CrossRef]

- Miller, D.; Xu, X. CEO long-term orientation and elite university education. Strat. Organ. 2020, 18, 520–546. [Google Scholar] [CrossRef]

- Forbes. 20 Reasons Why Herb Kelleher was one of the Most Beloved Leaders of Our Time. 2019. Available online: https://www.forbes.com/sites/kevinandjackiefreiberg/2019/01/04/20-reasons-why-herb-kelleher-was-one-of-the-most-beloved-leaders-of-ourtime/?sh=642a575bb311 (accessed on 4 December 2021).

- The Wall Street Journal. JetBlue Founder’s New Airline Breeze Launches as Travel Bounces Back. 2021. Available online: https://www.wsj.com/articles/breeze-airways-takes-flight-as-travel-bounces-back-competition-grows-11621598405 (accessed on 4 December 2021).

- Ramakrishnan, R.T.; Thomas, J.K. What matters from the past: Market value, book value, or earnings? Earnings valuation and sufficient statistics for prior information. J. Account. Audit. Financ. 1992, 7, 423–464. [Google Scholar] [CrossRef]

- Hirschey, M. Market structure and market value. J. Bus. 1985, 58, 89–98. [Google Scholar] [CrossRef]

- Peterkort, R.F.; Nielsen, J.F. Is the book-to-market ratio a measure of risk? J. Fin. Res. 2005, 28, 487–502. [Google Scholar] [CrossRef]

- Chen, L.; Zhao, X. On the relation between the market-to-book ratio, growth opportunity, and leverage ratio. Financ. Res. Lett. 2006, 3, 253–266. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Mason, P. Upper echelons: The organization as a reflection of its top managers. Acad. Manag. Rev. 1984, 9, 193–206. [Google Scholar] [CrossRef]

- Hambrick, D.C. Upper echelons theory: An update. Acad. Manag. Rev. 2007, 32, 334–343. [Google Scholar] [CrossRef]

- Herrmann, P.; Datta, D.K. Relationships between top management team characteristics and international diversification: An empirical investigation. Br. J. Manag. 2005, 16, 69–78. [Google Scholar] [CrossRef]

- Chen, H.; Hsu, W.T.; Huang, Y. Top management team characteristics, R&D investment and capital structure in the IT industry. Small Bus. Econ. 2010, 35, 319–333. [Google Scholar]

- Zhou, B.; Dutta, S.; Zhu, P. CEO tenure and mergers and acquisitions. Financ. Res. Lett. 2020, 34, 101277. [Google Scholar] [CrossRef]

- Elsharkawy, M.; Paterson, A.; Sherif, M. Now you see me: Diversity, CEO education, and bank performance in the UK. Investig. Manag. Financ. Innov. 2018, 1, 277–291. [Google Scholar] [CrossRef]

- Abuzayed, B.; Molyneux, P.; Al-Fayoumi, N. Market value, book value and earnings: Is bank efficiency a missing link? Manag. Financ. 2009, 35, 156–179. [Google Scholar]

- Dita, A.H.; Murtaqi, I. The effect of net profit margin, price to book value and debt to equity ratio to stock return in the Indonesian consumer goods industry. J. Bus. Manag. 2014, 3, 305–315. [Google Scholar]

- Ariffin, A.; Yahaya, M. The relationship between airport image, national identity and passengers delight: A case study of the Malaysian low cost carrier terminal (LCCT). J. Air Trans. Manag. 2013, 31, 33–36. [Google Scholar]

- Graham, A. Understanding the low cost carrier and airport relationship: A critical analysis of the salient issues. Tour Manag. 2013, 36, 66–76. [Google Scholar] [CrossRef]

- Lim, J.; Lee, H.C. Comparisons of service quality perceptions between full service carriers and low cost carriers in airline travel. Curr. Issues Tour. 2020, 23, 1261–1276. [Google Scholar] [CrossRef]

- Wittman, M. Are low-cost carrier passengers less likely to complain about service quality? J. Air Trans. Manag. 2014, 35, 64–71. [Google Scholar] [CrossRef]

- Tan, W.; Wang, W.J. The application of information values and construal level theory for examining low cost carrier advertisements. J. Air Trans. Manag. 2021, 90, 101957. [Google Scholar] [CrossRef]

- Seo, K.; Moon, J.; Lee, S. Synergy of corporate social responsibility and service quality for airlines: The moderating role of carrier type. J. Air Trans. Manag. 2015, 47, 126–134. [Google Scholar] [CrossRef]

- Penman, S.H. The articulation of price-earnings ratios and market-to-book ratios and the evaluation of growth. J. Account. Res. 1996, 34, 235–259. [Google Scholar] [CrossRef]

- Saenz, J. Human capital indicators, business performance and market-to-book ratio. J. Intellect. Cap. 2005, 6, 374–384. [Google Scholar] [CrossRef]

- Simoens, M.; Vander Vennet, R. Bank performance in Europe and the US: A divergence in market-to-book ratios. Financ. Res. Lett. 2021, 40, 101672. [Google Scholar] [CrossRef]

- Liang, C.J.; Yao, M.L. The value-relevance of financial and nonfinancial information—Evidence from Taiwan’s information electronics industry. Rev. Quant. Financ Account. 2005, 24, 135–157. [Google Scholar] [CrossRef]

- Tekin, B. The Factors Affecting the Market Value/Book Value and Profitability of REITs in Turkey. Int. Real Estate Rev. 2021, 24, 469–499. [Google Scholar] [CrossRef]

- Windle, R.; Dresner, M. Competitive responses to low cost carrier entry. Trans. Res. Part E Logist. Transp. Rev. 1999, 35, 59–75. [Google Scholar] [CrossRef]

- Dennis, N. End of the free lunch? The responses of traditional European airlines to the low-cost carrier threat. J. Air Trans. Manag. 2007, 13, 311–321. [Google Scholar] [CrossRef]

- Wensveen, J.G.; Leick, R. The long-haul low-cost carrier: A unique business model. J. Air Trans. Manag. 2009, 15, 127–133. [Google Scholar] [CrossRef]

- Migdadi, Y. The impact of airline alliance strategy on the perceived service quality: A global survey. J. Qual. Assur. Hosp. Tour. 2022, 23, 415–446. [Google Scholar] [CrossRef]

- Brüggen, A.; Klose, L. How fleet commonality influences low-cost airline operating performance: Empirical evidence. J. Air Trans. Manag. 2010, 16, 299–303. [Google Scholar] [CrossRef]

- Klophaus, R.; Conrady, R.; Fichert, F. Low cost carriers going hybrid: Evidence from Europe. J. Air Trans. Manag. 2012, 23, 54–58. [Google Scholar] [CrossRef]

- Budd, L.; Francis, G.; Humphreys, I.; Ison, S. Grounded: Characterising the market exit of European low cost airlines. J. Air Trans. Manag. 2014, 34, 78–85. [Google Scholar] [CrossRef]

- Fernando, Y.; Saad, N.M.; Haron, M.S. New marketing definition: A future agenda for low cost carrier airlines in Indonesia. Bus. Strat. Ser. 2012, 13, 31–40. [Google Scholar] [CrossRef]

- Dziedzic, M.; Warnock-Smith, D. The role of secondary airports for today’s low-cost carrier business models: The European case. Res. Transp. Bus. Manag. 2016, 21, 19–32. [Google Scholar] [CrossRef]

- Moktar, N.; Myeda, N. Procurement of facilities management services designated for office buildings of airline corporate organisations in Asia. Facilities 2022. ahead-of-print. [Google Scholar] [CrossRef]

- Kim, Y.K.; Lee, H. Customer satisfaction using low cost carriers. Tour. Manag. 2011, 32, 235–243. [Google Scholar] [CrossRef]

- David Mc, A. Service quality and customer satisfaction in the airline industry: A comparison between legacy airlines and low-cost airlines. Am. J. Tour. Res. 2013, 2, 67–77. [Google Scholar]

- Liu, C.H.; Lee, T. Service quality and price perception of service: Influence on word-of-mouth and revisit intention. J. Air Trans. Manag. 2016, 52, 42–54. [Google Scholar] [CrossRef]

- Hong, S.J.; Savoie, M.; Joiner, S.; Kincaid, T. Analysis of airline employees’ perceptions of corporate preparedness for COVID-19 disruptions to airline operations. Transp. Policy 2022, 119, 45–55. [Google Scholar] [CrossRef]

- Miles, R.E.; Snow, C.C. Organization Strategy, Structure and Process; McGraw-Hill: New York, NY, USA, 1978. [Google Scholar]

- Florido-Benítez, L. The effects of COVID-19 on Andalusian tourism and aviation sector. Tour. Rev. 2021, 76, 829–857. [Google Scholar] [CrossRef]

- Florido-Benítez, L. The Pre/On/Post of Low-Cost carriers in Spanish tourist destinations. Rev. Tur. Estud. E Prát. 2022, 11, 1–26. [Google Scholar]

- Ting, I.W.; Azizan, N.; Kweh, Q. Upper echelon theory revisited: The relationship between CEO personal characteristics and financial leverage decision. Procedia-Soc. Behav. Sci. 2015, 195, 686–694. [Google Scholar] [CrossRef]

- Andreou, P.; Louca, C.; Petrou, A.P. CEO age and stock price crash risk. Rev. Financ. 2017, 21, 1287–1325. [Google Scholar] [CrossRef]

- Rose, R.E.; Wong, C. The MBA and corporate leadership: If a CEO of a large corporation has a graduate degrees, it likely is an MBA. Bus. Horiz. 1989, 32, 54–58. [Google Scholar] [CrossRef]

- Slater, D.J.; Dixon-Fowler, H.R. The future of the planet in the hands of MBAs: An examination of CEO MBA education and corporate environmental performance. Acad. Manag. Learn. Edu. 2010, 9, 429–441. [Google Scholar]

- Elsaid, E.; Benson, B.W.; Worrell, D.L. Successor CEO functional and educational backgrounds: Influence of predecessor characteristics and performance antecedents. J. Appl. Bus. Res. 2016, 32, 1179–1198. [Google Scholar] [CrossRef][Green Version]

- Kallias, A. Managing Uncertainty in the Process of Going Public. Doctoral Dissertation, University of Sussex, Brighton, UK, 2016. [Google Scholar]

- Gounopoulos, D.; Loukopoulos, G.; Loukopoulos, P. CEO education and the ability to raise capital. Corp. Gov. Int. Rev. 2021, 29, 67–99. [Google Scholar] [CrossRef]

- Sun, H.; Zhu, J.; Wang, T.; Wang, Y. MBA CEOs and corporate social responsibility: Empirical evidence from China. J. Clean. Prod. 2021, 290, 125801. [Google Scholar] [CrossRef]

- King, T.; Srivastav, A.; Williams, J. What’s in an education? Implications of CEO education for bank performance. J. Corp. Financ. 2016, 37, 287–308. [Google Scholar] [CrossRef]

- Gujarati, D.; Porter, D. Basic Econometrics; McGraw-Hill International Edition: New York, NY, USA, 2009. [Google Scholar]

- Baltagi, B. Econometric Analysis of Panel Data; John Wiley & Sons: New York, NY, USA, 2008. [Google Scholar]

- Wooldridge, J. Introductory Econometrics: A Modern Approach; South Western, Cengage Learning: Boston, MA, USA, 2009. [Google Scholar]

- De Chaisemartin, C.; d’Haultfoeuille, X. Two-way fixed effects estimators with heterogeneous treatment effects. Am. Econ. Rev. 2020, 110, 2964–2996. [Google Scholar] [CrossRef]

- Hair, J.; Anderson, R.; Babin, B.; Black, W. Multivariate Data Analysis: A Global Perspective; Pearson: Upper Saddle River, NJ, USA, 2010; Volume 7. [Google Scholar]

- Jing, L.; Moon, J. Airline chief executive officer and corporate social responsibility. Sustainability 2021, 13, 8599. [Google Scholar] [CrossRef]

| Airline Name | Carrier Type | Current Company Status |

|---|---|---|

| American Airline Group Inc. | Full-service carrier | Trading at stock market |

| Alaska Air Group Inc. | Full-service carrier | Trading at stock market |

| Northwest Airlines Inc. | Full-service carrier | Merged with Delta |

| Delta Airlines Inc. | Full-service carrier | Trading at stock market |

| Southwest Airlines | Low-cost carrier | Trading at stock market |

| US Airway Group Inc. | Full-service carrier | Merged with American airline |

| Mesa Air Group Inc. | Full-service carrier | Trading at stock market |

| United Continental Holding Inc. | Full-service carrier | Trading at stock market |

| Frontier Airlines Holding | Low-cost carrier | Trading at stock market |

| Midwest Air Group Inc. | Full-service carrier | Merged with Republic airway holding |

| Skywest Inc. | Full-service carrier | Trading at stock market |

| FLYi Inc. | Full-service carrier | Bankrupt in 2005 |

| Airtran Holding Inc. | Full-service carrier | Merged with Southwest airlines |

| JetBlue Airways Corp | Low-cost carrier | Trading at stock market |

| Allegiant Travel Co | Low-cost carrier | Trading at stock market |

| Variable | Description | Data Source | Measure |

|---|---|---|---|

| MTB | Market-to-book value | Compustat | Market value total/Book value total |

| AGE | CEO’s age | Execucomp | Physical age of CEO |

| TEN | CEO’s tenure | Execucomp | Working period as CEO (Unit: Year) |

| EDU | CEO’s education | CEO academic terminal degree (0 = Others, 1 = MBA or JD) | |

| SHO | CEO’s value of share | Execucomp | Value of share possessed by CEO (Unit: Thousand: US dollars) |

| STO | CEO’s value of stock option | Execucomp | Value of stock option possessed by CEO (Unit: Thousand: US dollars) |

| ROA | Return on assets | Compustat | Net income/Total assets |

| SIZE | Firm size | Compustat | Total assets (Unit: Million: US dollars) |

| DEBT | Financial leverage | Compustat | Total debt/Total assets |

| LCC | Low-cost carrier | Compustat | 0 = non- low-cost carrier, 1 = low cost carrier |

| Variable | Mean | SD | Minimum | Maximum |

|---|---|---|---|---|

| MTB | 0.57 | 0.56 | 0 | 2.53 |

| AGE | 53.49 | 6.29 | 37 | 69 |

| TEN | 7.14 | 8.35 | 1 | 41 |

| EDU | 0.56 | 0.49 | 0 | 1 |

| SHO | 967.25 | 1575.43 | 0 | 10,783.28 |

| STO | 320.40 | 1018.20 | 0 | 10,377.85 |

| ROA | 0.01 | 0.12 | −1.09 | 0.90 |

| SIZE | 13,793.98 | 15,989.26 | 170.08 | 64,532.00 |

| DEBT | 0.78 | 0.24 | 0.28 | 2.32 |

| LCC | 0.29 | 0.45 | 0 | 1 |

| Variable | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

|---|---|---|---|---|---|---|---|---|---|

| 1.MTB | 1. | ||||||||

| 2.AGE | 232 * | 1 | |||||||

| 3.TEN | 0.144 * | 0.366 * | 1 | ||||||

| 4.EDU | 0.012 | 0.131 | 0.193 * | 1 | |||||

| 5.SHO | 0.336 * | 0.038 | 0.238 * | 0.083 | 1 | ||||

| 6.STO | −0.057 | 0.110 | −0.032 | −0.031 | −0.039 | 1 | |||

| 7.ROA | 0.393 * | 0.092 | 0.114 | 0.061 | 0.114 | 0.346 * | 1 | ||

| 8.SIZE | −0.243 * | 0.199 * | −0.224 * | 0.109 | −0.104 | 0.371 * | 0.018 | 1 | |

| 9.DEBT | −0.586 * | −0.011 | −0.279 * | 0.005 | −0.144 * | 0.047 | −0.628 * | 0.348 * | 1 |

| 10.LCC | 0.416 * | 0.011 | −0.039 | −0.160 * | 0.344 * | −0.144 * | 0.169 * | −0.265 * | −0.382 * |

| Variable | Model1 Two-Way FE β(t-Stat) | Model2 FGLS β(Wald) | Results |

|---|---|---|---|

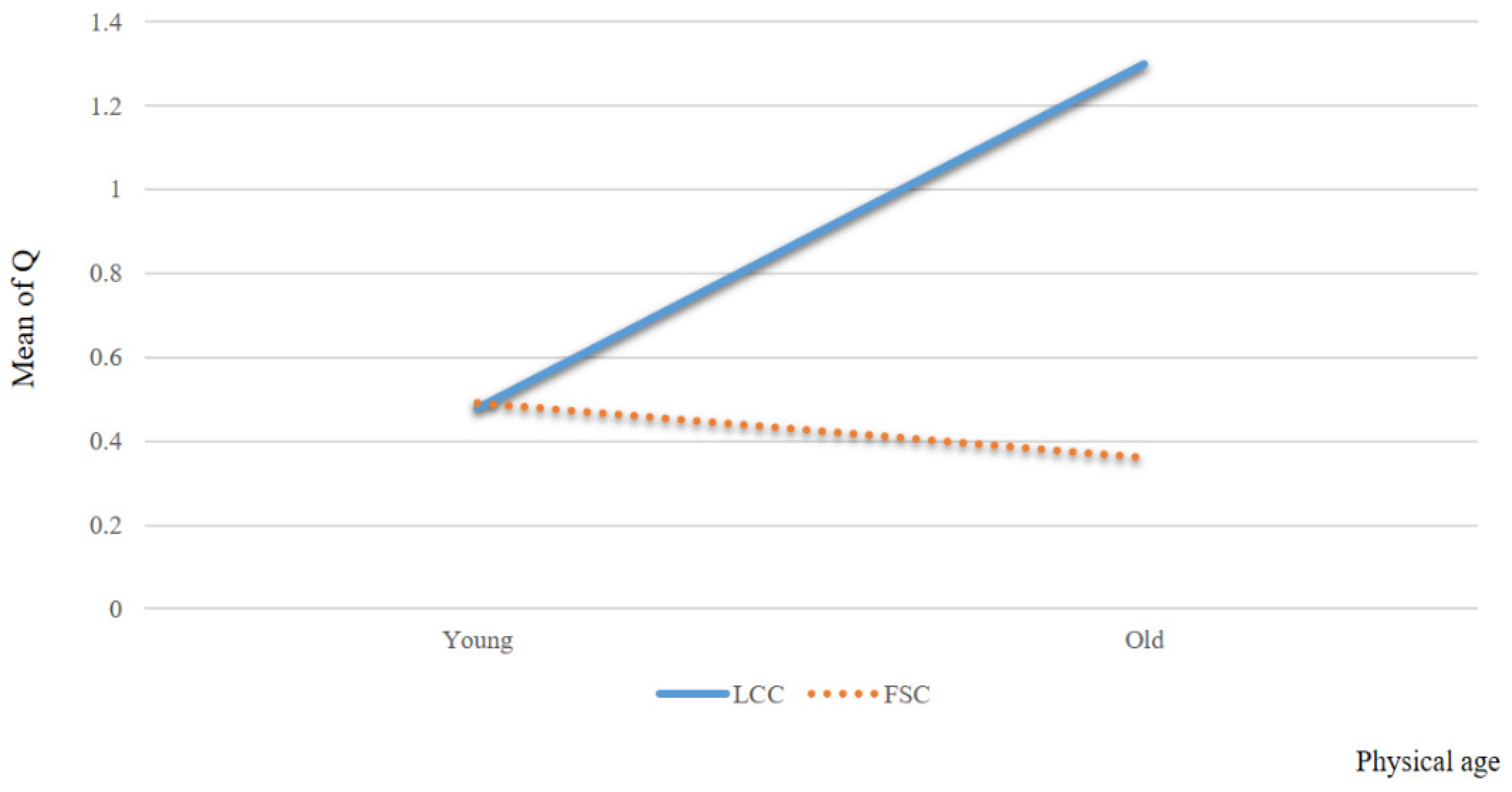

| Intercept ROA SIZE DEBT SHO STO AGE TEN EDU LCC AGE × LCC TEN × LCC EDU × LCC F-value Wald χ2 R2 Adjusted R2 | 1.477(2.85) * 0.313(0.99) −0.371(−0.89) 0.171(−1.61) 0.001(3.24) * −0.001(−0.11) −0.017(−2.02) * −0.004(−0.69) −0.001(0.01) 1.491(4.66) * 0.055(3.23) * −0.021(−0.93) 0.204(1.18) 10.76 * - 0.7469 0.6775 | 1.477(3.22) * 0.313(1.12) 0.001(1.01) −0.372(−1.82) 0.001(3.67) * −0.001(−0.12) −0.017(−2.29) * −0.004(−0.69) −0.001(0.01) 1.491(5.27) * 0.055(3.65) * −0.021(−1.06) 0.207(1.34) - 619.83 * - - | H1 Supported H2 Not supported H3 Not supported |

| AGE | ||

|---|---|---|

| Young | Old | |

| LCC | 0.48 | 1.30 |

| FSC | 0.49 | 0.54 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Moon, J.; Lee, W.S.; Shim, J. Chief Executive Officers and the Value of US Airlines: The Moderating Effect of Carrier Type. Sustainability 2022, 14, 7929. https://doi.org/10.3390/su14137929

Moon J, Lee WS, Shim J. Chief Executive Officers and the Value of US Airlines: The Moderating Effect of Carrier Type. Sustainability. 2022; 14(13):7929. https://doi.org/10.3390/su14137929

Chicago/Turabian StyleMoon, Joonho, Won Seok Lee, and Jimin Shim. 2022. "Chief Executive Officers and the Value of US Airlines: The Moderating Effect of Carrier Type" Sustainability 14, no. 13: 7929. https://doi.org/10.3390/su14137929

APA StyleMoon, J., Lee, W. S., & Shim, J. (2022). Chief Executive Officers and the Value of US Airlines: The Moderating Effect of Carrier Type. Sustainability, 14(13), 7929. https://doi.org/10.3390/su14137929