4.1. Sample and Data Processing

To fit the residual tail characteristics of time series, the sample selection of this paper involves two aspects: a real economy industry index and a fintech index. The index compilation of fintech refers to another index compilation and adopts the weighted average method with the widest application range. The weights are based on the different status of the sample stock in the market, that is, the weight with important status is large, and the weight with secondary status is small. The price of each sample stock is multiplied by its weight and summed, and then divided by the total weight to obtain the average stock price of the reporting period and the base period calculated by the weighted average method.

The index compilation in this paper imitates the s&p500 and CSI300 index (China Securities Index). The compilation criteria of the index are: (1) correlation; (2) Representativeness; (3) Stability. The financial innovation index only selects Internet finance, financial technology and other related enterprises with high relevance, while the real economy index covers agriculture, the manufacturing and processing industry, mining industry, medical and pharmaceutical industry, high-tech industry and other industries with high relevance. Ensure that the vast majority of sample stocks remain stable during the investigation period, and that the financial innovation index is comparable long-term with the real economy index.

This paper selects the daily closing price data of fintech-related stocks from January 2012 to December 2021 in the A-share market in China, uses the share capital as the weight, takes 1 January 2018 as the base period, and constructs the comprehensive index, with the base point of the comprehensive index as 1000 points. The Fintech index is prepared by the weighted average method, with its total share capital as the weight. According to the index compilation criteria descripted above, we choose 306 from 950 listed companies in fintech related fields, such as internet finance, supply chain finance and so on, among which the top ten heavy weights are PingAn Technology (19.263%), Dongfang Fortune (6.995%), CICC (3.962%), UFIDA Network (3.032%), Huayou Cobalt (2.826%), Huatai Securities (2.765%), 360-Security (2.513%), Shenwa Hongyuan (2.301%), Hang Seng Electronics (2.293%) and GF Security (2.056%).

The real economy industry index is represented by nine types of CSI industry indexes other than the CSI financial index. These nine types of CSI industry indexes are the energy, material, information technology, manufacturing, medical, telecom, consumer goods, selective consumer and public utilities industries. Similarly, the daily closing price of the Real Economy Industry index from January 2012 to December 2021 is also selected as the sample data. The return is calculated as:

where P

t is the closing price at time t.

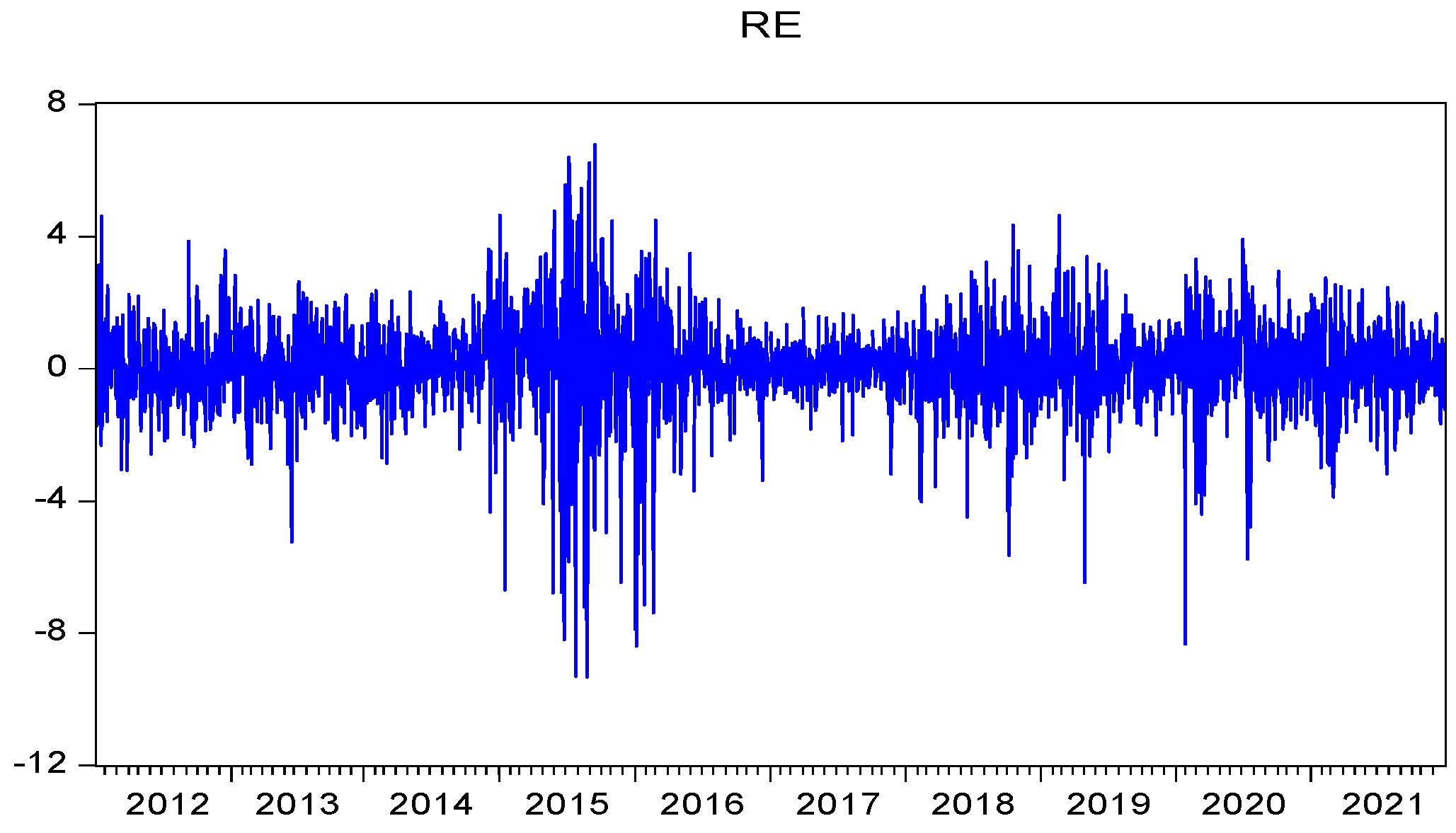

4.3. Result of Edge Distribution

Through the ADF test and the ARCH effect test, we also found that the return series of Fintech and real economy industries do not obey the normal distribution and have the characteristics of peak and thick tail. Based on this, in order to better characterize the properties of time series, this paper constructs a GARCH (1,1) model under t distribution.

In

Table 5, α

1 represents the coefficient of the ARCH term, namely the square lag term of residual error. β

1 represents the GARCH term, that is, the coefficient of the lag term of the conditional variance itself.

It can also be observed that all parameters of GARCH (1,1) are significant at the 10% confidence level, and the estimated values of each parameter are significantly positive, meeting the requirements of non-negative conditional heteroscedasticity. From the perspective of estimating the value of parameters, the α value represents the impact of external shocks on the fluctuation of the return series, and the β value represents the impact of early-stage fluctuation of the return series on later-stage fluctuation. Therefore, it can be found that the fluctuation of the return series of fintech and real economy industries is relatively less affected by external factors, and the fluctuation of the return series is closely related to its own early performance. The relationship between Fintech and the return series of various industries in the real economy α1 + β1 is close to 1, indicating that the volatility of return has strong sustainability. In addition, the ARCH term and GARCH term coefficients of each return series are significantly positive at the 95% confidence level, and α1 + β1 is less than 1, meeting the requirements of model stability.

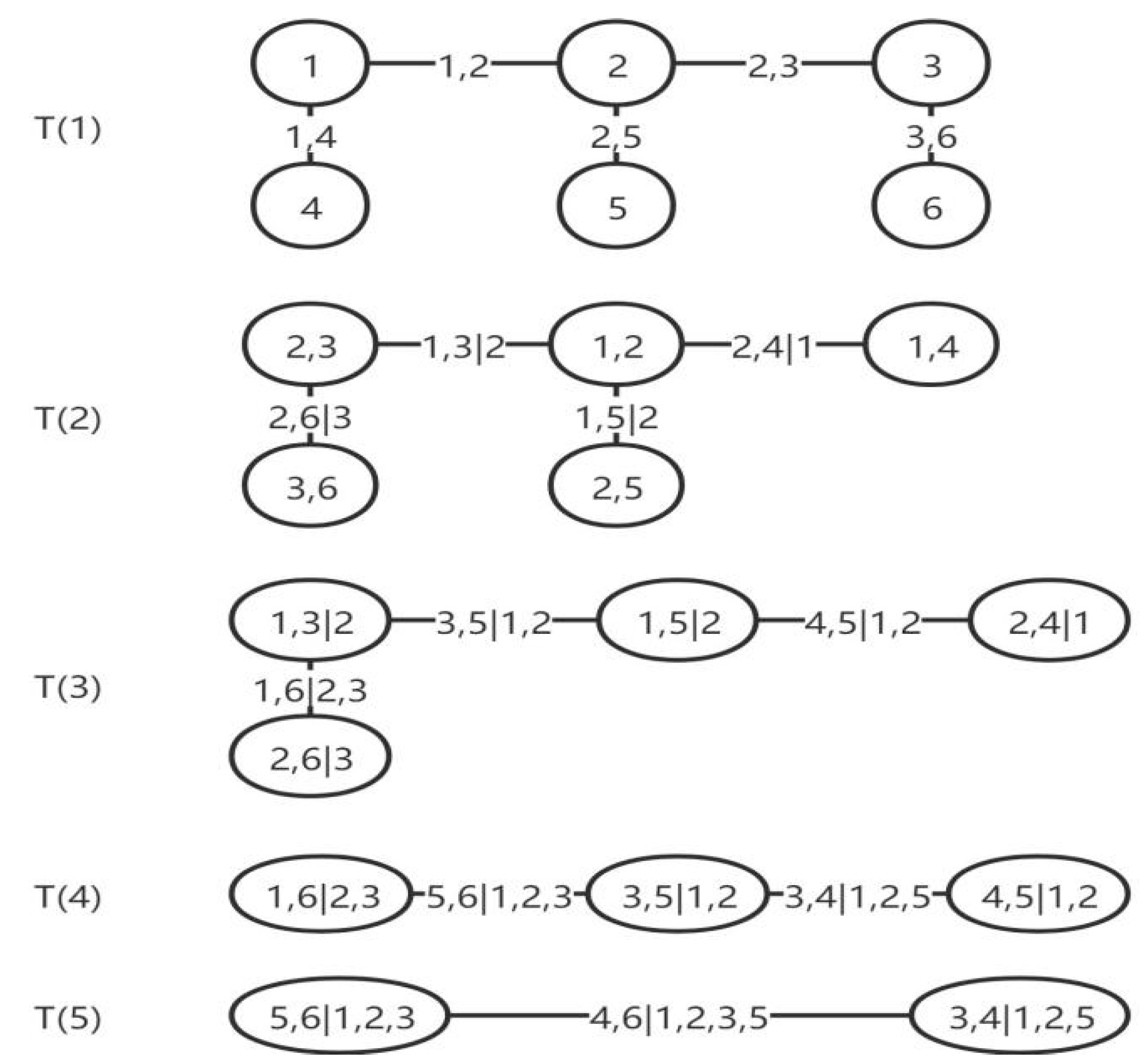

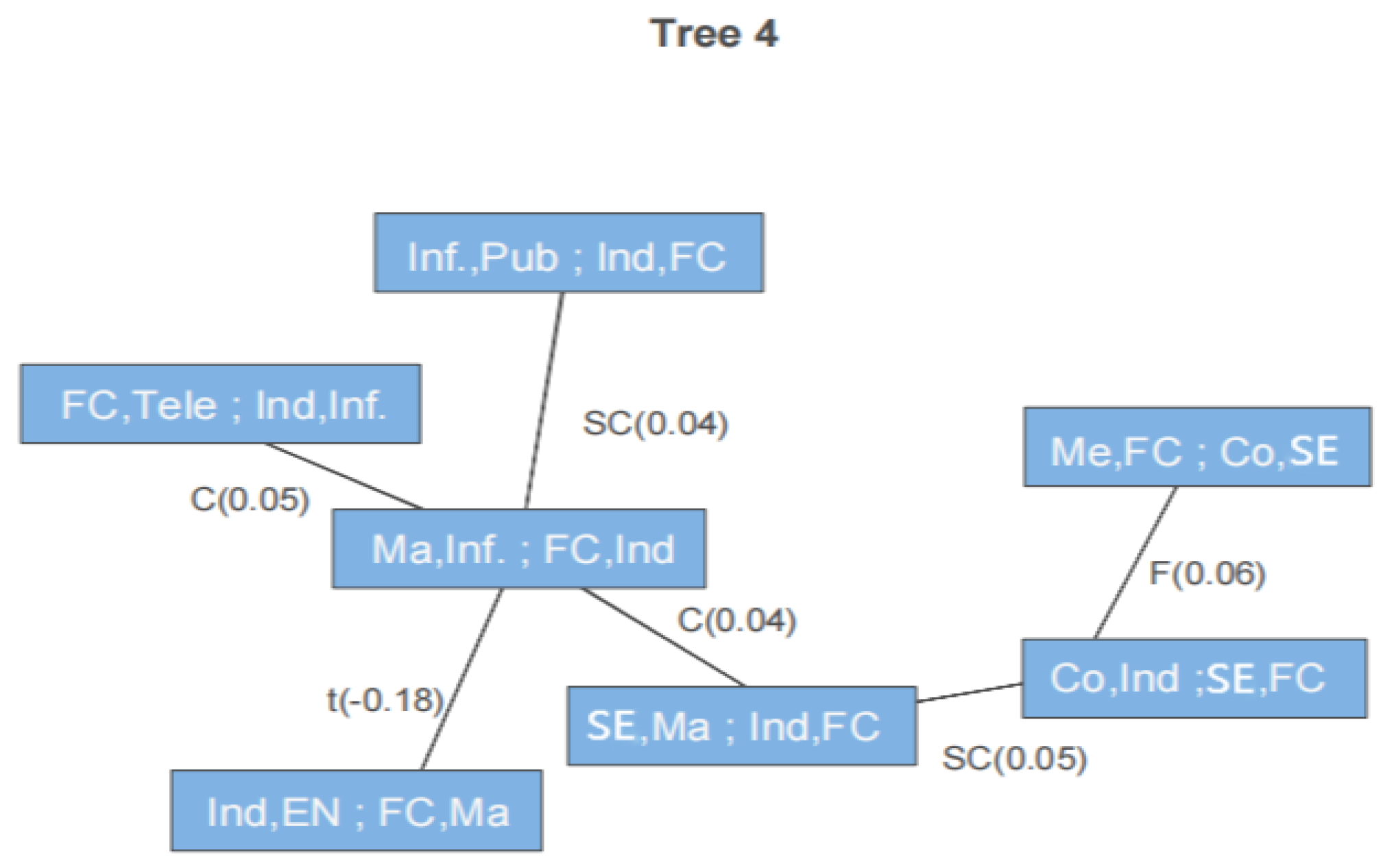

4.4. Results of Dependent Structure by R-Vine Copula Model

To more intuitively and comprehensively express the dependent structural relationship between Fintech and various industries of the real economy, this paper analyzes the first four trees of the R-vine model. The standardized residual sequences after probability integral transformation are firstly fitted, the R-vine model is constructed and the parameters are estimated to judge the dependency relationship and dependency structure between Fintech and various industries of the real economy. After selecting the optimal Pair copula function based on AIC and BIC information criteria, the tail dependence among industries is analyzed. The strength of the dependence is compared by the Kendall τ of the Copula function.

Figure 5,

Figure 6,

Figure 7 and

Figure 8 show the first four trees of the R-vine. The abbreviations in the box are the industries, where FC represents financial technology, CO represents consumer industry, Ma represents material industry, EN represents energy industry, ME represents medical industry, PUB represents public utility industry, Ind represents manufacturing industry, Inf represents information industry, Tele represents telecommunications industry and SE represents other selective consumer industry. The connection between the box and the middle of the box shows the form of multivariate Copula function, and the value in parentheses is the Kendall τ of the two markets.

It can be seen from the figures that Fintech is located in the center of overall network connection and has a certain degree of correlation with various industries, which shows that the financial industry has established extensive correlation with industries such as materials and information technology. It not only shows that financial technology products and services can help the development of real economy industry, but also makes the spread of financial risks more complex and hidden. In addition, the core position of financial technology also shows that financial technology is an important medium for transmitting risks.

The R-vine estimation results show that Fintech has a strong correlation with the manufacturing, material, public utilities and selective consumer industries. Among them, Fintech has the highest correlation with the manufacturing industry, whose Kendall τ value is 0.71, followed by the material industry, selective consumer industry and public industry. The medical and consumer industries are not closely connected with Fintech and are far away from the central node.

In the first tree in

Figure 5, the telecommunication, public utilities, medical and energy industries constitute four separate branches, indicating that when extreme risks occur in these industries, they are often transmitted to other industries through Fintech products and services. In the second tree, Fintech and the manufacturing industry are located in the center, indicating that the manufacturing industry has a wide correlation. Compared with other real economy industries, the impact of the manufacturing industry is more profound. In addition, after adding industry, it can be found that Fintech and the information industry also have a strong correlation. Then the material and information industries were added to the center of the dependent structure, and the addition of material changed the basic form of the tree structure, so that the tree shape no longer shows the characteristics of four branches, but produces a sub center including the manufacturing industry, Fintech and information industry, showing that the information industry is highly related to public utilities, telecommunication and other industries. After the information industry is added to the center of the fourth tree, the tree shape returns to the four-branch structure similar to the first two trees. On the whole, there is a wide connection between Fintech and various industries of the real economy. Among them, Fintech, the manufacturing industry, the material industry and the information industry are highly related to other industries, and the dependent structure between them is more significant, while the manufacturing industry association relationship to the medical and other industries is relatively simple, showing the characteristics of strong independency.

The existence of tail dependence and the strength of the dependent relationship can judge whether there is extreme risk of infection among industries. The estimation of the first four trees of the R-vine is shown in

Table 6. There are 30 groups of correlations in total. In the column Type, t represents the two-dimensional t-Copula function, n represents the two-dimensional normal Copula function, G represents the two-dimensional Gumbel Copula function, SG represents the two-dimensional Gumble Copula function corresponding to 180 degrees of rotation, C represents the two-dimensional Clayton Copula function, f represents the Frank Copula function and j represents the Joe Copula function. The number after the letter represents the rotation angle. For example, G270 represents the Gumbel Copula function rotating 270 degrees. par is the parameter estimated by the pair–Copula function corresponding to each group of correlation, par2 is the degree of freedom of the pair–Copula function, Kendall’s τ is the rank correlation coefficient, and λ

U and λ

L represent the upper and lower tail correlation coefficients, respectively.

According to the estimation results of the R-vine copula model in

Table 6, it can also be found that there is a general positive linkage between industries in the real economy, and this result is also consistent with the conclusion in the previous discussion.

In addition, in the estimation results of the R-vine Copula model, we observed a positive conditional dependence between Fintech, the medical industry and the consumer industry, which reflects that the medical industry and the consumer industry is relatively weak; they are not independent of each other, and extreme risk events in the field of Fintech can also have a negative impact on the medical industry and consumer industry through transmission between markets.

The model estimation results also show that there is a nonlinear dependence between Fintech and real economy industries. The Copula function forms of the first tree in the table are symmetrical t-Copula functions. Kendall’s τ value represents the unconditioned correlation coefficient between industries. It can be found that the upper and lower tail correlation coefficients show symmetrical characteristics, while the model forms of the second tree to the fourth tree are more diversified.

In the first tree, there is a significant positive correlation between Fintech and the manufacturing industry, material industry, public utility industry and selective industry, in which the rank correlation coefficient is above 0.5. Generally speaking, the higher the upper and lower tail correlation coefficient, the greater the possibility of market rise and fall synchronization, so the higher the possibility of risk spillover. Among them, the upper and lower tail correlation coefficient of Fintech and the manufacturing industry is the largest, indicating that the correlation between the two markets is high, and extreme risk is easily transmitted between the two markets. The upper and lower tail correlation coefficient of the selective industry and the consumer industry is the smallest; it shows that the industry relevance of the two industries is weak and the ability to resist extreme risks is relatively strong.

It can be observed that the correlation coefficient between the information technology and the telecommunication industry is high, which indicates that when extreme risks occur in Fintech and overflow to the information technology industry, it may also be transmitted to other industries. On the whole, the correlation coefficients between Fintech and various industries of the real economy are above 0.2, which shows that the real economy industry has weak awareness and ability to resist external extreme risks. When extreme risk events occur in Fintech or other real economy industries, it is easy to have a negative impact on other relevant industries. This feature also reflects the sensitivity and vulnerability of Fintech itself. When the real economy industry is impacted by extreme risk events, it has varying degrees of negative impact on the capital market and even whole financial markets.

The second tree in

Figure 6 represents the conditional dependence with an industry as the conditional variable. The estimation results show that the correlation between industries is significantly weakened after introducing an industry as a conditional variable. There is a weak positive correlation between Fintech and the energy industry, IT industry and consumer industry, after excluding the influence of the manufacturing industry, material industry and selective industry, respectively. At the same time, the correlation between real economy industries is also weakened after excluding the influence of Fintech.

The rank correlation coefficient and upper and lower tail correlation coefficient of the third tree in

Figure 7 and the fourth tree in

Figure 8 tend to 0, which indicates that the more conditional industries are introduced, the weaker the correlation between industries. When extreme risks occur in an industry, risk transmission tends to spread among the three closely related industries; although the risks cannot be completely dispersed, its impact on other industries is limited.

It can be seen from the R-vine Copula model trees that Fintech occupies the central position of the dependent structure, which proves that Fintech has established a broad and profound correlation with the market, and the real economy industries with weak correlation are also linked by Fintech products and services. However, the improvement of the degree of correlation not only enhances the availability of financial products and services, but also has new risk threats that are difficult to prevent by the traditional risk prevention and control system. The establishment of this dependent structure provides a way for the spread of potential risks. While accelerating the spread of extreme risks, the degree of harm is further deepened. The tail risk estimation in the estimation results of the R-vine Copula model also shows this problem. The upper and lower tail correlation coefficient is significantly positive, indicating that the extreme risk of one industry increases the risk level of other industries.

In the R-vine Copula model, the correlation between Fintech and industries with large capital demand and relatively slow turnover speed, such as the manufacturing industry, IT industry and material industry, is higher, which further confirms that enterprises with a long capital chain and large capital demand are more closely related to the financial system; such enterprises are more sensitive to Fintech products and services than enterprises with a short capital chain. Fintech and the medical industry have developed in the fields of integration of medicine and medical resources, innovation of medical insurance products and financial services, but it has a low correlation with Fintech, so the impact of financial risk on the medical industry is also relatively limited. From a macro perspective, Fintech in the medical industry may help to reduce medical costs, optimize the allocation of medical resources and supplement the shortcomings of the existing social security and medical insurance systems. However, how Fintech products and services adapt to the market demand in the medical industry still needs to be further explored.

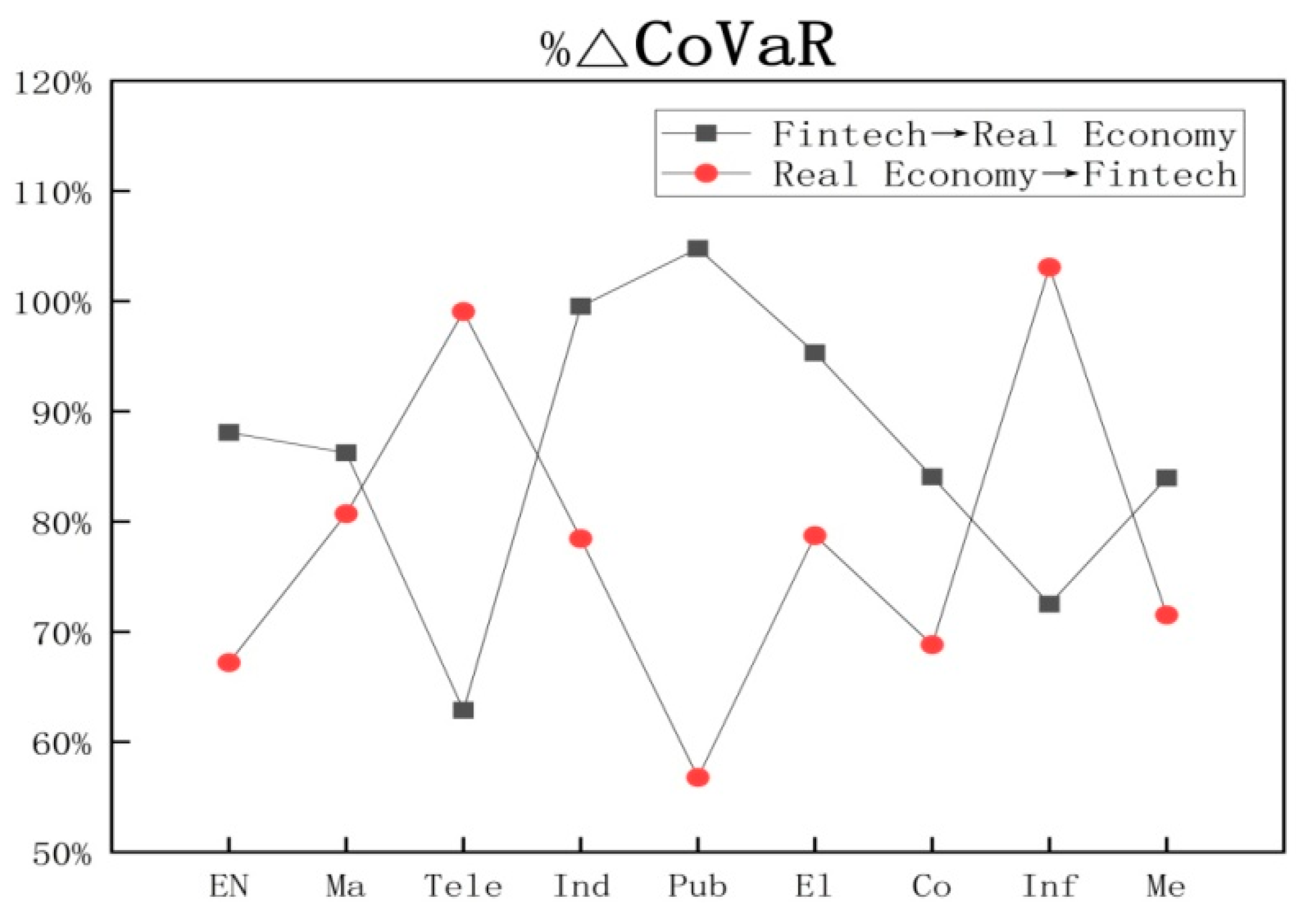

4.5. Result of Risk Spillover Effect

From the research results of the R-vine copula, it can be found that the dependences between Fintech and various industries of the real economy are different, but they have formed a wide range of correlation, indicating a strong risk transmission effect. VaR, CoVaR, ∆CoVaR and % ∆CoVaR are calculated to measure the two-way risk spillover effect. The CoVaR value is generally greater than 4, ∆ Covar is greater than 3 and the% ∆ Covar value is also more than 60%, which indicates that when extreme risks occur in Fintech, it is very likely to have a different degree of negative impact on industries of the real economy, and the risk spillover level is higher than the risk level of the real economy industry itself.

Table 7 shows the degree of risk spillover to various industries of the real economy when extreme risks occur in the Fintech industry at the 95% confidence level.

The estimation result is consistent with the correlation result of the R-vine Copula. Compared with other industries, Fintech has the strongest risk spillover level to the manufacturing industry, public utilities industry and selective industries. According to the empirical analysis results, it can be seen that there is a high correlation between the manufacturing industry and Fintech. Although the public utilities industry and selective industries have a weak relationship with Fintech, they are also vulnerable to extreme risk spillovers in Fintech due to their weak financial risk prevention ability.

Table 8 shows the Risk Spillover degree to all industries of the real economy when extreme risks occur in the Fintech industries at the 95% confidence level. It can be seen that the CoVaR value is greater than 3, the ∆CoVaR value is above 2 and the % ∆CoVaR value is also greater than 50%, which indicates that various industries of the real economy are likely to have different degrees of negative impact on Fintech in the event of extreme risks, and the risk overflow level is higher than the risk level of Fintech itself. Compared with other industries, the telecommunication industry and IT industry have the strongest risk spillover effect on Fintech. This characteristic shows that Fintech is highly dependent on modern information technologies such as big data and cloud platforms. Risk events in related industries have a great negative effect on Fintech.

From the figures it can be seen that the risk spillover effect of extreme risks in Fintech on most industries of the real economy is relatively strong, while the CoVaR results of various industries of the real economy are relatively small, which has a slightly smaller impact than that caused by extreme risks in Fintech. This can also reflect that the concealment and harmfulness of financial risk contagion are strong, and the risk prevention ability and awareness of Fintech are also better than those of the real economy.