Abstract

Corporate social responsibility (CSR) research has developed rapidly in recent years, and scholars have called for a more comprehensive picture of CSR research in family firms. In response to the call, this study conducts a systematic literature review of CSR activities in family firms from an important but understudied perspective: ownership. In addition to showing the divergent effects of ownership on family firm CSR, this research also reveals multiple mediating mechanisms and moderators for the above relationship and family ownership as a boundary condition for the relationships between family firm CSR and outcomes. Theories and methodological issues in past research are analyzed, and limitations and future research directions are also proposed.

1. Introduction

Corporate social responsibility (CSR) refers to specific firm activities that align their economic, environmental, and social objectives within their own strategies and operational decisions [1,2,3]. Firms performing CSR often show socially responsible or environmentally conscious behaviors [4]. CSR is well studied in organizational settings and has been found to be critical for building firm reputation [5,6], obtaining a firm’s legitimacy [7,8], and enhancing a firm’s competitive advantage [1,3] and the sustainable development of society [4,5,6].

A special type of firm that has been found to practice CSR and that has attracted increasing scholarly attention is the family firm. According to the “Global Family Business Survey in 2020”, the family firm is the most important form of enterprise in the global economy, accounting for more than 85% of firms in the world. In most countries, family firms are the backbone of the national economy [9], making significant contributions to job creation, gross national production, and wealth generation [10]. Different from non-family firms that perform CSR mainly to enhance corporate reputation and, hence, firm financial performance [5,6], family firms are long-term oriented [11] and perform CSR more for non-financial and socioemotional reasons, such as enhancing family image and family reputation to maintain family control and influence, achieving transgenerational succession and sustainable development [1,3], and serving the community better to gain social ties for the family firm [12,13]. Therefore, studying CSR in the family firm context can complement the existing CSR literature well in the context of non-family firms and can generate novel insights.

Despite its importance, however, CSR research in the family firm context is still in the early stages [14], with inconclusive research findings [15,16]. A specific stream of research that has attracted increasing scholarly attention is the influence of ownership on family firm CSR. Ownership can be classified into different types, such as family ownership, employee ownership, and institutional ownership [4]. Ownership determines the firm’s governance framework [17], which in turn regulates the firm’s resource mobilization decisions and behavior, including CSR activities [18,19]. Furthermore, ownership is an important indicator of firm heterogeneity [19], which plays a critical role in shaping the family firm’s CSR activities and strategies [11,18,19,20,21]. Unfortunately, existing research on the impact of ownership on family firm CSR is still limited, yielding inconclusive and fragmented findings that hinder the development of this field.

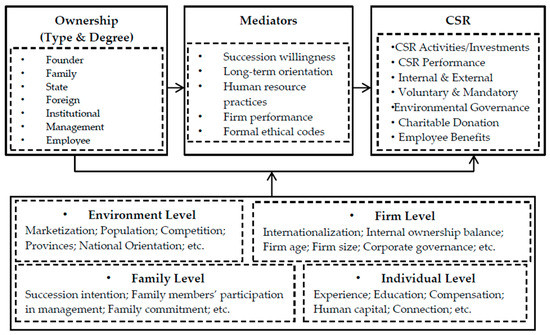

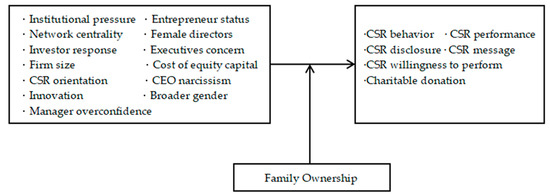

To address the above issue and to advance CSR research in the family firm context, we conducted a systematic literature review on ownership and family firm CSR. We searched the Web of Science (WOS) database and China National Knowledge Infrastructure (CNKI) for relevant peer-reviewed articles, followed specific procedures, and identified 102 relevant articles. By analyzing and synthesizing the different theoretical perspectives, core arguments, research design, and empirical findings in the existing literature, we propose a comprehensive framework on ownership and CSR (See Figure 1).

Figure 1.

Systematic literature review framework on family firm, ownership, and CSR.

In the following sections, we first introduce the materials and methodology that are used for this review and then define the key concepts, including family firm, CSR, and ownership. After that, we review the literature on the relationship between ownership and CSR, the mediators, and the contingent factors for this relationship. Finally, we analyze the theories and methods that were used in previous studies, identify our research limitations, and offer suggestions for future research.

2. Materials and Methods

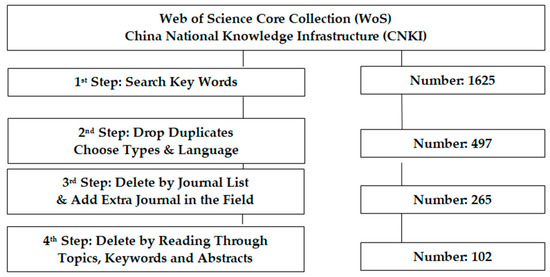

Following the best practice [22] and procedures in other published review articles [4,9,23,24], we searched the Web of Science (WOS) database and China National Knowledge Infrastructure (CNKI) for relevant peer-reviewed articles that were published in journals with a social-science citation index, a science citation index, an engineering index, and a Chinese social-science citation index. Web of Science (WOS) was widely used in previous academic research [9,25,26,27] and it is regarded as the most comprehensive source of articles in social science [9,28,29]. CNKI, the Chinese knowledge information gateway website with complete resource types and comprehensive content [30], was used because many studies that are published in top journals in China are also highly relevant to our review topic and can add significant insights. Only work that was published up to October 2021 was included in the analysis. The specific literature search procedures are listed below (also see Figure 2).

Figure 2.

Key steps for screening and selecting relevant articles.

First, keywords were identified and searched in the title, keywords, and abstracts of published articles in the selected databases. The CSR-related keywords that were used for our literature search included “corporate social responsibility”, “social responsibility”, and “CSR” [9,24]. The family-firm-related keywords were “family business”, “family firm”, “family company”, “family enterprise”, and “family owned” [9,24]. The ownership-related keywords were “ownership” and “share” [4,24]. The search in WOS yielded 1475 studies, while the search in CNKI yielded 150 outputs, resulting in 1625 articles in total. Second, results that were duplicated by using different keywords were excluded. We also excluded non-English articles that were published in the WOS database and non-Chinese articles in the CNKI database. Furthermore, we did not include book chapters and dissertations, as they were unlikely to be peer-reviewed [4,9,23,24]. After this step, 497 articles were retained. Third, we manually deleted the articles that were published in journals lower than level 2 in the British Association of Business Schools (ABS) journal ranking list [31]. The ABS journal list is well adopted and recognized by business and management scholars [32,33,34]. For journals that were not included in the ABS journal ranking list, we only kept the journals (e.g., Sustainability) that publish many articles on family firm or CSR.

Finally, one author read all the selected articles to determine whether they focused on family firm, ownership, and CSR. Another author was consulted on whether the article should be included or excluded in the review [4,9,23,24]. This step led to a total of 102 articles being included in the review, with 84 English articles and 18 Chinese articles. These articles included 6 literature review papers, 94 quantitative articles, and 2 qualitative articles. The journals that were published in English mainly included: Administrative Science Quarterly, Academy of Management Journal, Academy of Management Review, Strategic Management Journal, Journal of Management, Sustainability, Research Policy, Asia Pacific Journal of Management, Management and Organization Review, Family Business Review, Entrepreneurship Theory and Practice, and Journal of Business Ethics. The journals that were published in Chinese mainly included: Journal of Management World, Scientific Decision Making, Business Management Journal, Communication of Finance and Accounting, etc.

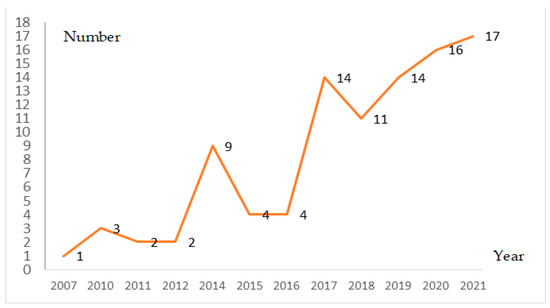

Figure 3 shows that the publishing year of all the articles selected for this review ranges between 2007 and 2021. A general upward trend was noted and shows increasing scholarly attention over the years on the topic being reviewed.

Figure 3.

Statistics of the number of studies on family firm, ownership, and CSR.

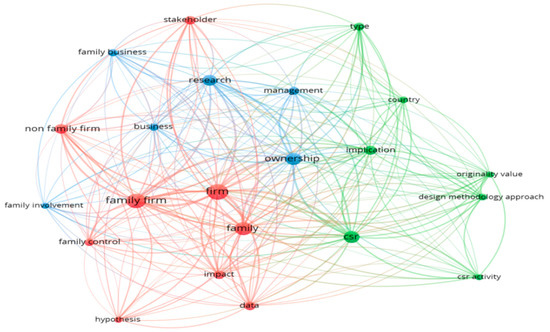

We further used VOSviewer to conduct a visual analysis of ownership and CSR research in the family firm context (see Figure 4). VOSviewer was widely adopted in prior research to generate bibliometric maps, which allow for the construction and visualization of bibliometric networks [9,24,35]. Different clusters use different colors, which make it easy to view each individual cluster and to find the structural distribution of various research hotspots, and the similarities and differences among research topics. Figure 4 shows that the keywords in this research field include ownership, family, family firm, type, non-family firm, family involvement, family control, and CSR.

Figure 4.

The cluster view of research on family firm, ownership, and CSR.

3. Literature Review

3.1. Family Firm

Family firms are organizations in which individuals from the same family substantially affect the firm by holding a certain amount of ownership, by possessing voting rights, and/or by staying in important management positions [36]. Duran et al. [37] categorized family firms into four types based on their meta-analysis of 108 studies from 42 countries, including firms with a large number of family members in ownership [38], firms with a large number of family members in top management positions [39], firms with a family presence in both ownership and management [40], and firms with a family presence in either ownership or management [41]. On the other hand, Llach and Nordquist [42] proposed that the only criterion to define family firms is the family members’ perception of whether the firm is a family firm [43]. Therefore, although different studies have different definitions of family firms and the existing literature has not yet converged on a single definition [39,41], the definition of family firms often concerns characteristics such as ownership, governance, management, and transgenerational succession [44].

3.2. CSR

CSR refers to specific firm activities that align their economic, environmental, and social objectives with their strategies and operational decisions [1,2,3]. CSR is often regarded as a special type of firm strategic investment [4,45,46] that generally helps to enhance firm image and reputation [5,6] and mitigates future risk [4]. CSR is most commonly measured by dimensions that are related to employees, customers, suppliers, shareholders, creditors, the community, corporate governance, environment, and human rights [47,48,49,50,51,52,53,54,55,56,57]. Different stakeholders have different expectations towards CSR activities. Therefore, CSR is often manifested as a multi-dimensional construct [54,55]. In some research, CSR has also been classified into internal CSR and external CSR, targeting stakeholders that are internal and external to the firm, respectively. Internal CSR refers to responsible behaviors that are related to internal stakeholders, such as employee rights protection and employee development [58,59], while external CSR activities involve responsible behaviors that are related to external stakeholders, such as corporate philanthropy and environmental protection [60,61]. Some studies also classify CSR into voluntary CSR and mandatory CSR based on Carroll’s pyramid theory of CSR [62]. Voluntary CSR refers to the CSR activities that firms choose by themselves, such as charitable donation and environmental pollution governance, whereas mandatory CSR is required by law or policies, such as the economic and legal responsibilities that firms must adopt [63].

3.3. Ownership

Research about ownership can be traced back to the 1980s, when a firm’s CSR and its ownership structure emerged together as a new research field. As a result of the increasing importance of governance research, the field of ownership research has also become increasingly important, and more scholars have begun to investigate ownership types and their effects on firms [64,65]. Previous research has identified a variety of ownership types, including family ownership, state ownership, foreign ownership, institutional ownership, and ownership by stakeholders such as managers and employees [4]. Specifically, family ownership refers to shares that are owned by family members. The interests of family members often focus more on SEW, which is particularly important to family firms. Family ownership may enhance a firm’s CSR engagement, mainly because of the long-term investment horizons of family firms and their close relationships with different shareholders [1,3,11,12]. State ownership refers to shares that are held by the government and impacts CSR by driving firms to pursue certain political goals [4,11]. Institutional ownership refers to shares that are owned by institutional investors, such as pension funds, mutual funds, banks, and insurance companies, the number of which has increased rapidly in recent years. Institutional shareholders prefer CSR because it can lower the risk of investment [66,67,68,69,70,71]. Managerial ownership often refers to shares that are owned by managers of firms [46] and has become highly prominent in governance research, as managerial ownership helps to reduce conflicts between shareholders and managers and align their interests.

Different types of ownership may influence firm CSR differently due to potential different owner preferences for CSR [4,72,73], such as shareholders’ time horizon for investment, financial risk and return assumptions, and the underlying motives or objectives. Furthermore, although the impact of ownership on CSR has been widely studied, existing research findings are inconclusive, showing positive, negative, and U-shaped relationships between ownership and CSR (see Table 1). Below, we review the existing literature in detail.

4. Main Effect of Ownership on CSR

4.1. Ownership Promoting CSR

Many scholars have found a positive relationship between ownership, especially family firm ownership, and CSR activities [74,75,76], including responsibility for investors, employees [77,78], and consumers [77]; community-related CSR [19]; environmental responsibility [17,20,77,79,80,81]; legal and ethical responsibility [77]; corporate charitable donations [12,82,83,84]; and the disclosure of CSR [66,85].

The positive relationship between family ownership and CSR [1,2,3,13,41,43,44,45,86,87] can be attributed to family firm owners’ strong concerns about non-economic goals [77,88], such as the continuation of family values; organizational image and reputation enhancement [89,90]; family inheritance; family social-capital accumulation; stakeholder interests [16,91]; and family owners’ pursuit of more balanced goals [92] involving ethics [93], social performance [94,95], and environmental performance [11,80].

In addition to overall family ownership, the influence of other types of ownership that are related to the business family has also been examined. For example, related to the business family, both founder ownership [20,96] and family foundations’ ownership [96] can enhance CSR. Zeng [21] has concluded that not only firms with higher family ownership, but also family firms with the second largest shareholders engaged in more CSR activities. Jian and Dai [97] also found that a higher ownership balance ratio in family firms leads to higher levels and quality of the disclosure of social responsibility information. Another type of internal shareholder, i.e., employee owners, also increases both the supply and demand of CSR reporting [98].

Regarding external shareholders, government shares [66], business group ownership [19], and institutional investors (e.g., domestic banks, financial institutions, and foreign institutional investors) [67,71] are also positively related to CSR, such as CSR disclosure [66] and community-related CSR [19]. One reason is that institutional investors can improve the regulatory efficiency of family firms [67] and the external control of the information transparency of CSR engagement [70], thereby encouraging firms to participate in and disclose CSR.

4.2. Ownership Reducing CSR

Some scholars have found a negative relationship between family firm ownership and CSR performance [67,87,99,100], such as ESG (environmental, social, and governance) performance [20,101,102,103]. One explanation is that family owners have invested their private wealth into the firm and have both economic and personal motives to run the firm [101,104,105]. Consequently, family owners may channel firm activities to enhance their personal benefits and are concerned less about CSR. Additionally, CSR investments may reduce firm resources that could be otherwise directed toward activities that can enhance the value of the firm. As such, some family owners may oppose CSR investments [67,106,107,108,109,110]. Similarly, as observed by Jian and Dai [97] in a sample of publicly listed family-controlled Chinese companies, a higher family ownership concentration reduces CSR information disclosure. Moreover, these scholars found that a higher separation of the ownership and control of the firm also led to lower CSR information disclosure, because the family owners could use their control rights and voting rights to object to CSR investment, in order to pursue personal benefits and to manipulate CSR information disclosure.

Other research [111] also found that the greater the percentage of shares owned by the CEO or a single individual other than the CEO, the smaller the amounts that the firm will give to charity. As ownership becomes more concentrated, the options of managers are more limited and the contributions of the firm to charities will be smaller.

4.3. U-Shaped Relationship between Ownership and CSR

Different from the linear relationship between ownership and family firm CSR that was identified in the above-reviewed studies, some scholars found a U-shaped relationship. For example, Terlaak et al. [112] found a U-shaped relationship between the degree of family ownership and environmental-performance information disclosure. Disclosure propensities significantly drop as family ownership increases from low to moderate, because in such a range of family ownership, the perceived costs of disclosure exceed the perceived benefits. However, when family ownership is at the moderate to high levels, disclosure propensities moderately upswing, indicating that disclosure benefits (e.g., reputational benefits) outstrip disclosure costs. In contrast, Labelle et al. [113] found a curvilinear relationship between family ownership and CSR. At lower levels of family ownership, family firms invest more in social initiatives to gain legitimacy and to preserve their SEW. When beyond approximately 36%, family ownership begins to be negatively associated with CSR, mainly because the strategy and financial consideration prevail over SEW preservation.

Table 1.

Main effect of family firm ownership and CSR.

Table 1.

Main effect of family firm ownership and CSR.

| No | Author/year | Ownership | CSR | Theories |

|---|---|---|---|---|

| The positive relationship between ownership and CSR | ||||

| 1 | Li, 2012 [114] Chen and Wen, 2017 [115] Li, 2019 [116] Madden et al., 2020 [18] Ryuand Chae, 2021 [117] | Family ownership/ ownership proportion | CSR | Socioemotional selectivity theoryLong-term development perspective |

| 2 | Zhou, 2011 [77] Isabel-Maria et al., 2021 [118] | Family ownership | Insider responsibilities (investors, employees) External liability (creditors, partners, consumers) | Stakeholder theory SEW theory |

| 3 | Zeng, 2020 [21] | Family ownership Second largest shareholder | CSR engagement | Agency theory SEW theory |

| 4 | Aguilar and Luis, 2019 [119] | Family ownership | CSR practice (environment, social) | / |

| 5 | Syed and Butt, 2017 [85] Habbash, 2017 [66] | Government ownership Family ownership | CSR disclosure practices | Legitimacy theory Agency theory |

| 6 | Liu et al., 2017 [95] | Family ownership | CSR performance | SEW theory |

| 7 | Li et al., 2020 [81] | Family control | Green governance | Agency theory SEW theory |

| 8 | Bammens and Hünermund, 2020 [17] | Family ownership/ ownership proportion | Introduction of innovation ecology | Institutional theory Mixed game logic theory |

| 9 | Rubino and Napoli, 2020 [80] | Family ownership | Environmental performance | SEW theory |

| 10 | Maria Federica and Mirella, 2018 [120] | Family ownership | CSR instrumental, moral, and relational motivation | SEW theory |

| 11 | Chen & Chen, 2014 [12] Dou et al., 2014 [82] Ye et al., 2019 [83] | Family ownership proportion | Charitable donation | Stakeholder theory SEW theory Legitimacy theory |

| 12 | Christensen-Salem et al., 2021 [78] Wu and Zhang, 2019 [84] | Family ownership/ ownership proportion | Employees perceived organizational care/ employee responsibility | SEW theory Stakeholder theory |

| 13 | Cruz et al., 2014 [13] Zhu, 2021 [86] | Family ownership/ ownership proportion | External stakeholder-related CSR | Stakeholder theory SEW theory |

| 14 | Bingham et al., 2011 [16] | Family ownership/ ownership proportion | CSR performance activities Special stakeholder-related CSR | Stakeholder theory |

| 15 | Block and Wagner, 2014 [20] | Family ownership Founder ownership | CSR concern | SEW theory |

| 16 | Giovanna and De Massis, 2015 [121] | Family ownership | Different CSR reports Different CSR themes | Institutional theory |

| 17 | Xu et al., 2018 [63] | Family ownership/ ownership proportion | Philanthropy and environment governance-related CSR behavior | SEW theory Social responsibility pyramid theory |

| 18 | Kim and Lee, 2018 [99] | Family ownership | CSR performance | Agency theory |

| 19 | Sahasranamam et al., 2019 [19] | Business group ownership Family ownership | Community-related CSR | Agency theory Sociological perspectives of institutions |

| 20 | Andrea et al., 2021 [122] | Family ownership | CSR practice | SEW theory |

| 21 | Fehre and Weber, 2019 [96] | Founder ownership; family foundation ownership | Management CSR concern | SEW theory |

| 22 | Shu and Chiang, 2020 [67] | External large shareholders Institutional investor | CSR participation | Agency theory |

| 23 | Jian and Dai, 2019 [97] | Ownership Balance ratio | Social responsibility information-disclosure quality | / |

| The negative relationship between ownership and CSR | ||||

| 1 | LaBelle et al., 2015 [113] EI Ghoul et al., 2016 [110] | Family ownership | CSR performance | Agency theory SEW theory |

| 2 | Nekhili et al., 2017 [123] | Family ownership | CSR information report | Stakeholder theory |

| 3 | Chen and Cheng, 2020 [124] | Family ownership | CSR assurance | Agency theory |

| 4 | Rees and Rodionova, 2014 [101] | Family ownership | ESG: environment, social, governance | Agency theory |

| 5 | Block and Wagner., 2014 [20] | Family ownership/ founder ownership | CSR concern | SEW theory |

| 6 | McGuire et al., 2012 [125] | Family ownership | Poor CSR performance | Resource dependence theory Stakeholder theory |

| 7 | Zhou and Zhao, 2017 [103] Zhou et al., 2020 [102] | Family ownership/ ownership proportion | Environment responsibility practice/ environmental disclosure | Agency theory SEW theory |

| 8 | Stavrou et al., 2007 [76] Block, 2010 [75] Kim et al., 2019 [74] | Family ownership/ ownership proportion | Layoff tendency; deep layoffs | Place-based view |

| 9 | Cruz et al., 2014 [13] Zhu, 2021 [86] | Family ownership/ ownership proportion | Internal stakeholder-related CSR | Stakeholder theory SEW theory |

| 10 | Bingham et al., 2010 [16] | Family ownership/ ownership proportion | CSR social initiative CSR social concern | Stakeholder theory |

| 11 | Block and Wagner, 2014 [20] | Family ownership founder ownership | Community-related CSR CSR concern | Organizational and family identity view SEW theory |

| 12 | Giovanna and De Massis, 2015 [121] | Family ownership | CSR standards | Institutional theory |

| 13 | Xu et al., 2018 [63] | Family ownership/ ownership proportion | Philanthropy and environment governance-related CSR willingness | SEW theory Social responsibility pyramid theory |

| 14 | Kim and Lee, 2018 [99] | Family ownership | Corporate governance | Agency theory |

| 15 | Jian and Dai, 2019 [97] | Ownership concentration | Equity balance level Management shareholding ratio | / |

| 16 | Wu and Zhang, 2019 [84] | Family ownership/ ownership proportion | Charitable donation | Stakeholder SEW theory |

| 17 | Ye et al., 2019 [83] | Family ownership/ ownership proportion | Internal employee welfare | Stakeholder theory SEW theory Legitimacy theory |

| 18 | Andrea et al., 2021 [122] | Family ownership | CSR communication | SEW theory |

| 19 | Shu and Chiang, 2020 [67] | Internal large shareholders including directors | CSR motivation | Agency theory |

| 20 | Dick et al., 2021 [126] | Founder-controlled family firms | CSR participation | Social emotional endowment perspective |

| 21 | Atkinson and Galaskiewicz, 1988 [111] | Shares owned by CEO or single individuals | Charity | Agency theory |

| Other relationships between ownership and CSR | ||||

| 1 | Terlaak et al., 2018 [112] | The degree of family ownership | U-shaped relationship—the tendency of environmental performance disclosure | SEW theory |

| 2 | Labelle, et al., 2015 [113] | Family ownership | Curvilinear relationship Corporate social performance | Agency theory SEW theory |

5. Mediators for the Relationship between Ownership and CSR

In addition to the main effect of ownership on CSR, some studies also revealed the mediating mechanisms linking ownership and CSR, such as a family firm descendant’s succession willingness, the long-term orientation, human resource practices, and firm performance (see Table 2). Drawing on SEW theory, scholars found that high family ownership could increase the long-term orientation of a family firm [11] and a family firm descendant’s succession willingness [12], which in turn, promote family firm CSR. The reason is that high family ownership may drive family firms to preserve and enhance SEW [12,13,127,128,129,130,131], and the SEW endowment can drive family owners to consider more about the needs of stakeholders.

High family ownership, however, may also have a negative influence on mediators and CSR. For instance, because firms with high family ownership may be characterized by high levels of nepotism, they may attend to the needs of non-family member employees less as a workforce and have inferior human resource practices, thereby performing lower levels of CSR [132]. Similarly, Cuadrado et al. [133] also found that, compared with non-family firms, family firms are less likely to use formal ethical codes because they often operate in a more informal environment with a lower degree of formalization, and the use of informal ethical codes may reduce the effective promotion of corporate social responsibility and then, corporate social performance.

Finally, firm performance can be another mediator, such that the higher the family ownership, the more efficient the decision making, which leads to higher firm financial performance and higher levels of CSR [134].

Table 2.

Mediators for the relationship between family firm ownership and CSR.

Table 2.

Mediators for the relationship between family firm ownership and CSR.

| Family level |

|

| Firm level |

|

| Family firm level |

|

6. Contingent Factors for the Relationship between Family Firm Ownership and CSR

An increasing number of scholars have begun to explore the contingencies on the relationship between ownership and CSR. Contingent factors found in existing research are divided into four categories: environment level, firm level, family level, and individual level (see Table 3).

First, environment-level contingent factors include institutional environment [13,63], regional population [74], and market competition [124]. Prior research suggests that high-quality and CSR-concerned institutional environments, such as a high degree of marketization [63], high levels of regional institutional development [87], stakeholder-oriented countries [113], and regions with stringent environmental regulations, push firms with high family ownership to perform more CSR, such as performing more voluntary CSR [63], performing more internal and external CSR [87], and tackling more social and environmental issues [113]. The research findings of Yu et al. [136] showed that family firms with ownership and strategic control gain more environmental performance premium in low-competition product markets, which satisfies the family’s affective needs (e.g., reduction in risk and preservation of family wealth), and in provinces with more stringent environmental regulations, which motivate family firms to avoid regulation violations that threaten the legitimacy, reputation, and succession of their family firms.

Kim et al. [74] concluded that family firms exhibit a lower tendency to lay off employees compared with non-family firms, and this relationship is particularly strong when the population is low, where the negative social externalities that are related to layoffs tend to be higher.

Finally, Desender and Epure [100] examined the effect of investment company ownership and government ownership on CSR and found that investment company ownership reduces, whereas government ownership increases corporate social performance more in liberal market economies than in coordinated market economies, which counterbalance the interests of multiple stakeholders.

Second, at the firm level, the moderators include firm internationalization [103], firm age [18,125], firm size [83,119], and corporate governance [87,137]. Some of the moderators facilitate the positive or weaken the negative relationship between family ownership and CSR, resulting in higher levels of CSR. Specifically, Zhou and Zhao [103] indicated that internationalization is an important driving factor for family firms to fulfill their environmental responsibilities based on SEW theory [138]. That study found that internationalization weakened the negative effect of family ownership on the firm environmental performance. Some scholars confirmed the firm size effect, showing that family ownership promotes CSR more in younger firms than older firms [18,83], and one possible reason based on socioemotional selectivity theory is that older family firms become more selective and invest less in CSR activities than younger firms.

Another facilitating moderating factor is good governance arrangement. For instance, McGuire et al. [125] used the KLD social performance index and found that family firms show better social performance than non-family firms. With better corporate governance mechanisms, family firms demonstrate better proactive social performance than non-family firms. Graafland [139] concluded that the effect of family ownership on environmental performance is negative for family firms that are only managed by family members, but positive for firms that are jointly managed by both family and non-family members. Ye and Li [87] highlighted the role of ownership balance and found that high levels of an ownership balance ratio reduce the negative effect of family involvement on internal CSR.

The effect of firm age, however, is inconclusive, with some scholars finding that family firm ownership promotes CSR in small companies [139], whereas others observed a negative effect between family ownership and CSR in small firms [119]. This topic thus needs further exploration.

In contrast to the above-reviewed studies, prior research has also revealed that some moderators weaken the positive relationship between family ownership and CSR. For instance, Li [116], and Chen and Wen [115] found that the positive relationship between family ownership and CSR is weakened when family firms implement higher salary incentives for their top management teams; the tendency of family firms to perform CSR weakens because the salary incentives still mainly use financial performance-related KPIs and lead to managers’ short-term behaviors of investing less in CSR.

Third, at the family level, family-related factors, such as succession intention [11,17,114] and family commitment [11,12], may also affect the relationship between ownership and family firm CSR. Succession-related factors, such as succession intention [82,114] and the transgenerational intention of family firms [17], have been generally shown to be a factor facilitating family firms’ engagements in CSR. One explanation is that the strong succession intentions show a family firm’s long-term orientation, which aligns well with caring for stakeholders being reflected in CSR activities.

Abeysekera and Femando [140] found that family firms show more responsibility to shareholders than non-family firms in environmental investment. When the interests of shareholders converge with societal interests, family firms are at least as good as non-family firms in protecting the interests of shareholders in the face of mitigating environmental problems that may harm society and increasing the company’s risk exposure. However, when shareholders’ interest and societal interests diverge, family firms make less environmental investment to protect shareholders’ interests.

Fourth, at the individual level, personal characteristics (e.g., experience, education, compensation, and personal network) of the founders, the CEOs, and the managers have also been shown to affect the relationship between family firm ownership and family firm CSR. Specifically, in some studies, the presence of a family or founder CEO has been found to motivate family firms to show higher CSR concerns [20] and CSR disclosure [137] and to demonstrate better CSR performance [141]. These research results are consistent with the predictions of SEW theory.

In contrast, Kim and Lee [99] used a sample of Korean family firms and found that family firms that are managed by family CEOs show lower corporate social performance, but that chaebol family firms show higher corporate social performance compared with non-family firms. Dick et al. [126] also found that founder-controlled family firms engage less in CSR, mainly because engagement in CSR activities could challenge their control and thus their socioemotional endowment. Zeng [21] also concluded that family firms in which family members are CEOs, presidents, or board chairpersons engage in less CSR. Interestingly, however, when family firms are run by overconfident executives who tend to underestimate the family’s control risk, focus on reputation building, and exhibit superior CSR performance, the negative relationship between family ownership and CSR engagement can be mitigated.

In terms of the human capital effect, enhancing effects have been shown. That is, the higher the human capital of the founder, actual controller, or managers, the more motivated family-owned firms are to engage in more CSR [81,119]. Cordeiro et al. [142] have also shown that most family owners and dual-class owners interact with board gender diversity to positively influence corporate environmental performance.

Different from amplifying the effects of human capital, the actual controllers’ political connections have been found to weaken the positive relationship between family ownership and the green governance of family firms [81].

Table 3.

Moderators list for the relationship between family firm ownership and CSR research.

Table 3.

Moderators list for the relationship between family firm ownership and CSR research.

| Environment level |

|

| Firm level |

|

| Family Level |

|

| Individual level |

|

| Others |

|

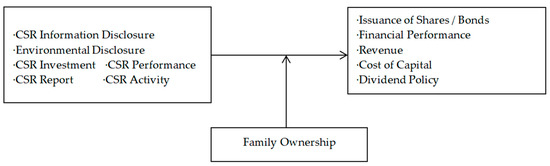

7. Family Ownership as a Moderator

A certain number of prior studies also examined whether family firm CSR as a result of its antecedents or its impact on outcomes depends on the level of ownership (see Figure 5 and Figure 6, respectively). Among the different types of ownership, family ownership has been studied the most. Consequently, in the following sections, we review articles using family ownership as the moderator in their research.

Figure 5.

Review on how the moderator of family ownership affects CSR.

Figure 6.

Review on the interacting effect of family ownership as the moderator and CSR.

7.1. Family Ownership as Moderator for the Relationship between Antecedents and CSR

Among the studies investigating the effects of antecedents on CSR with family ownership as the moderator, the research findings are divergent given the different theoretical lenses that are used. Some studies have found that higher family ownership promotes CSR as a result of antecedents, whereas other studies demonstrate a weakening effect. In the former stream of literature, for example, Ge and Evelyn [144] investigated Chinese private firms and found that family ownership exacerbates the impact of institutional pressure on corporate philanthropy. Family firms donate more to improve their social standing in the eyes of external stakeholders [145].

Yang et al. [146] have drawn on SEW theory and showed that family ownership has a significant positive moderating effect on the relationship between entrepreneurs’ status (including both economic and social status) and CSR. In firms with high family ownership, entrepreneurs’ higher status helps align the entrepreneurs’ values and the family firm management values, thereby enabling family firms to better perform CSR.

Moreover, Li et al. [147] found that managers’ overconfidence is positively related to CSR behavior and that family involvement strengthens this relationship. Rodríguez-Ariza et al. [148] researched the moderating effect of family ownership on the relationship between the role of female directors and CSR practice. Chen et al. [149] found that family ownership weakens the negative relationship between CEO narcissism and embedded CSR, which refers to CSR activities that are integrated into the firms’ strategy, routine, and operation, which helps build on the firms’ core competencies, such as green product design, green research and development, and green manufacturing. Embedded CSR is conducive to the preservation of SEW, so family ownership always prioritizes the pursuit of SEW, suggesting that narcissistic CEOs need to divert attention to embedded CSR.

In contrast to the above reviewed research, Zhou [150] conducted empirical research based on Chinese manufacturing family firms from an organizational relationship network perspective and found that family ownership negatively moderates the relationship between network centrality and internal, external, and public responsibility. When the level of family ownership decreases, the communication between family firms and their partners is more frequent and open. In this way, the effect of resource mobilization through networks will be strengthened and the impact of network centrality on family firm CSR will be increased.

Hajawiyah et al. [151] used a sample of Indonesian manufacturing firms and investigated the sequential effect of equity capital cost on CSR disclosure with family ownership as the moderator. They found that firms with high-equity capital cost in previous years had extensive CSR disclosure and would obtain lower costs of equity capital in the following year. Accordingly, family ownership weakens the effect of cost of equity capital in the previous year on CSR disclosure.

Finally, the positive effect of female directors on promoting CSR practices has been found to be weaker in family firms than non-family firms, possibly because family firms could be more socially responsible toward their external stakeholders but less so toward internal stakeholders.

7.2. Family Ownership as Moderator for the Relationship between CSR and Outcomes

Family ownership can also moderate the relationship between CSR and other outcomes (see Figure 6), such as firm performance and tax-avoidance behavior. Generally, previous research has shown that family ownership strengthens the positive relationship between CSR and firm performance-related outcomes, such as financial performance [152,153] and firm market value [123]. One explanation is that high family ownership preserves SEW and forms a strong identification between the owning family and the firm. As such, family firms behave consistently with stakeholders’ expectations, and firm reputation and image will be enhanced [72,90,125,130]. Such a good reputation can increase stakeholders’ trust in family firms’ CSR reporting and reduce stakeholder skepticism [154], thereby strengthening the positive effect of CSR reporting and activities on firm performance.

8. Discussion and Conclusions

In this study, we systematically reviewed articles that were related to ownership and family firm CSR, aiming to emphasize the heterogeneity of the family firm. We not only focused on the main effect of ownership on family firm CSR, but also emphasized the mediators and the contingent factors for how ownership affects CSR in family firms. Below, we analyze the theories and methods that were adopted in prior research, offer practical implications, identify limitations of the existing literature, and suggest avenues for future research.

8.1. Analysis of Theories Adopted in Past Research

Three theories have been adopted in many previous studies on ownership and family firm CSR. They are stakeholder theory, SEW theory, and agency theory. Stakeholder theory is one of the most commonly adopted theories in the articles that were reviewed and argues that family firms perform CSR because they can obtain benefits from stakeholders by being socially responsible for them [54,62,135]. SEW theory is widely employed in family firm research and emphasizes five dimensions (family control and influence, family members’ identification with the firm, binding social ties, emotional attachment, and renewal of family bonds to the firm through dynastic succession) that play critical roles in the decision making of family firms and that distinguish between family firms and non-family firms [12,13,135]. SEW theory is highly relevant to family firm CSR research because the more emphasis that family firms attach to the five socio-emotional wealth dimensions, the stronger their willingness may be to perform CSR. Agency theory in the context of family firms is often used to highlight the principal–principal problem because the owners of family firms are likely to be the managers of the firms and conflicts of interest are more likely to exist among family owners, large shareholders, and minority shareholders. Family shareholders may pursue their own interests, i.e., the family interests, at the expense of other shareholders’ interests [40,141], and this pursuit may also reduce a family firm’s engagement in CSR if family owners have a weak preference for CSR [80]. The use of different theoretical lenses helps to explain the divergent (positive vs. negative) effects of family ownership on CSR. Our review has shown that stakeholder theory and SEW theory are often adopted to explain the positive effect of family ownership on CSR, whereas agency theory is used in studies showing the detrimental effect of family ownership on CSR.

Recently, some scholars drew on new theoretical lenses to study family firm CSR. For example, institutional theory provides a useful theoretical framework and refers to a generalized perception that both the objectives and behaviors of firms should comply with social norms, values, and beliefs to gain legitimacy [85]. The inconsistency between a firm’s values and social values challenges the legitimacy, control, and influence of family firms, and family firms’ CSR decisions can help them to achieve, maintain, and improve legitimacy and preserve their SEW [95].

Identity theory is another emerging theoretical lens that is adopted in family business CSR research [20]. Indeed, identity theory is not only used in CSR research, but also in the general family firm literature. For example, Shepherd and Haynie [155] proposed the “family-business meta-identity”, which is at the intersection of family and business identities and can be used to resolve the conflicts between family identity and business identity in family firms. At the same time, institutional pressures may also modify how family-business meta-identity can work to facilitate the long-term success of family firms [156]. As a result, future research may give more consideration to using identity theory and other new and insightful theoretical lenses for investigating family firm CSR behaviors.

8.2. Analysis of Methods Adopted in Past Research

In terms of research methods, a quantitative approach is mostly adopted to examine the relationship between family firm ownership and family firm CSR. Most of the existing studies use secondary data to test hypotheses but may not be able to examine topics that are related to individuals’ emotions and cognition, because these psychological variables are not commonly available in secondary data sets. Moreover, among studies using survey design, cross-sectional surveys are used more than longitudinal surveys [9]. Therefore, the direction of the effect among variables cannot be accurately determined. We thus encourage future research to develop longitudinal data sets related to family firm CSR that can trace how family firms make decisions about CSR strategies and activities, and what factors (e.g., family-, firm-, and environment-related factors) may influence family firms’ decisions and behaviors over time. Future researchers can also consider using different research methods, such as case studies, qualitative research methods, qualitative comparative analyses (QCA), multilevel quantitative research designs, experiments, meta-analyses, and mixed methods, to better understand the ownership heterogeneity and CSR heterogeneity of family firms.

8.3. Practical Implications

This paper offers practical implications for the founders, (potential) successors, and top management team members of family firms and to policy makers.

First, given that ownership types other than family firm ownership also exert significant influences on the CSR activities of family firms, and that family firm ownership has not only positive, but also negative impacts on CSR, the founders and (potential) successors of family firms should direct more attention to the ownership structure of their family firms. Instead of adopting a high percentage of family ownership, they may also consider introducing other types of ownership (e.g., employee ownership and institutional ownership) that can enhance the quality of governance and firm decisions, and the performance and impact of the family firms.

Second, the founders and the top management team members of family firms should also be aware of the wide range of CSR activities that are performed by family firms and their important effect on firm performance and make wise CSR decisions. For instance, can the family firm choose to perform multiple CSR activities to benefit more stakeholders while optimizing financial and non-financial benefits for the family firm? If resource constraints exist, should the family firm attach more importance to internal or external stakeholders when making CSR-related decisions? Will the family firm perform voluntary CSR activities? When should they perform these activities? Family firms may also need to choose different CSR activities to comply with the different life-cycle stages of the firm, their long-term orientations, and their specific strategic goals.

Third, given that the next-generation family members’ succession willingness is a critical mediating mechanism through which higher family firm ownership can enhance family firm CSR, founders of a socially responsible family firm should make effective succession plans and foster the next-generation family members’ succession willingness. Furthermore, the next-generation family members should also be aware of the long-term benefits of being socially responsible for their family firms. They can then be more involved in their family firms, not only to develop their willingness to succeed into it, but also to assist their family firms in engaging in more CSR activities.

Finally, policy makers should be aware that family firms are an important type of corporate socially responsible organization that brings social and environmental benefits to the various stakeholders in society. Therefore, policy makers can consider designing supportive policies to motivate more family firms to be socially and environmentally responsible. Furthermore, they should also take a balanced view and make sure that they do not perform CSR activities at the expense of the family firm’s financial performance so that local and national economic development is not hindered or harmed.

8.4. Limitations and Future Research

First, some important but unaddressed questions for future research on CSR in the context of family firms emerged: for example, what is the specific impact of different SEW dimensions and interactions thereof on CSR practices and dynamics in family firms? Moreover, future research can adopt an interdisciplinary approach and explore new theoretical perspectives to examine the impact of ownership on family firm CSR. For instance, family firm researchers have recently called for examining the psychological foundation of family firm phenomena [157,158,159]. Future research may consider adopting psychological theories to investigate ownership and family firm CSR-related questions.

Second, most of the literature only focuses on family ownership in family firm CSR research, with less attention being given to the effect of other types of ownership. According to Faller and Dodo [4], founder ownership, state ownership, foreign ownership, institutional ownership, employee ownership, and management ownership are also ownership types that may exert an important influence on family firm CSR. Future research can continue exploring the heterogeneity of family firms in their CSR-related behaviors from the ownership perspective by examining the impact of the understudied types of ownership on family firm CSR and their underlying mechanisms. This is consistent with calls from other scholars, such as Sahasranamam et al. [19] and Zeng [21], who emphasized the significance of the ownership structure impacting CSR.

Third, although an increasing number of scholars support the multi-dimensional nature of CSR and the heterogeneity of CSR investment [18], less research has investigated multiple CSR dimensions simultaneously. Most empirical studies either use CSR score to measure the overall level of CSR or study a single dimension of CSR, such as charitable donation or environmental responsibility. We found that CSR is treated as an umbrella concept, including CSR disclosure, sustainability, sustainability reporting, environmental performance, social performance, gender diversity, philanthropy, business ethics, and responsibility for various internal and external stakeholders. Future research exploring how family ownership and other types of ownership affect different CSR dimensions is worthwhile.

Fourth, although we identified the underlying mechanism, as well as different internal and external contingent factors that affect the relationship between family ownership and CSR, empirical research in this area needs to be further expanded. Among the 102 reviewed articles, only seven articles investigated mediators for the relationship between family firm ownership and family firm CSR. More factors need to be analyzed, and how family firm ownership affects family firm CSR needs to be determined. Some scholars also proposed additional moderators to be further explored in future research [14], including (1) family and educational background, including values and parenting; (2) corporate governance, including composition of the board; (3) firm environment, including community demographics, institutional logics, technological innovation, as well as technological and economic conditions; (4) the nature of the organization, including organizational strategy, structure, bureaucracy, and external contacts.

In conclusion, this systematic literature review deepens our understanding of why, when, and how family firms perform CSR, and particularly enriches our knowledge about the role of ownership in family firm CSR and the heterogeneity of family firms from the ownership perspective. Although family firm, CSR, and ownership research has developed rapidly in recent years, the intersection of these three topics has not been systematically reviewed. In this paper, in addition to reviewing past research on the various influence of ownership on family firm CSR and developing a comprehensive conceptual framework, we also analyzed the theoretical and methodological developments in this field; offered practical implications for family firm founders, (potential) successors, and managers; identified research limitations; and proposed future research directions. Family firm CSR from an ownership perspective has great research potential and is worth further exploration.

Author Contributions

Conceptualization, S.S., F.Z. and H.Z.; methodology, S.S.; software, S.S.; validation, F.Z.; formal analysis, S.S. and F.Z.; investigation, S.S.; resources, S.S.; data curation, S.S.; writing—original draft preparation, S.S.; writing—review and editing, F.Z. and H.Z.; visualization, S.S.; supervision, F.Z. and H.Z.; project administration, S.S.; funding acquisition, S.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

This research was supported by Zhejiang Provincial Soft Science Research Plan Project in 2022 (Project No.: 2022C35120).

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, or in the decision to publish the results.

References

- Dahlsrud, A. How corporate social responsibility is defined: An analysis of 37 definitions. Corp. Soc. Responsib. Environ. Manag. 2008, 15, 1–13. [Google Scholar] [CrossRef]

- Montiel, I. Corporate Social Responsibility and Corporate Sustainability: Separate Pasts, Common Futures. Organ. Environ. 2008, 21, 245–269. [Google Scholar] [CrossRef] [Green Version]

- Uhlaner, L.M.; Berent-Braun, M.M.; Jeurissen, R.J.M.; de Wit, G. Beyond Size: Predicting Engagement in Environmental Management Practices of Dutch SMEs. J. Bus. Ethics 2012, 109, 411–429. [Google Scholar] [CrossRef]

- Faller, C.M.; Knyphausen-Aufseß, D.Z. Does Equity Ownership Matter for Corporate Social Responsibility? A Literature Review of Theories and Recent Empirical Findings. J. Bus. Ethics 2018, 150, 15–40. [Google Scholar] [CrossRef]

- Du, S.; Vieira, E.T., Jr. Striving for Legitimacy Through Corporate Social Responsibility: Insights from Oil Companies. J. Bus. Ethics 2012, 110, 413–427. [Google Scholar] [CrossRef]

- Panwar, R.; Paul, K.; Nybakk, E.; Hansen, E.; Thompson, D. The Legitimacy of CSR Actions of Publicly Traded Companies Versus Family-Owned Companies. J. Bus. Ethics 2013, 125, 481–496. [Google Scholar] [CrossRef]

- Bansal, P.; Roth, K. Why Companies Go Green: A Model of Ecological Responsiveness. Acad. Manag. J. 2000, 43, 717–736. [Google Scholar]

- Sharma, S. Managerial Interpretations and Organizational Context as Predictors of Corporate Choice of Environmental Strategy. Acad. Manag. J. 2000, 43, 681–697. [Google Scholar]

- Mariani, M.M.; Al-Sultan, K.; De Massis, A. Corporate social responsibility in family firms: A systematic literature review. J. Small Bus. Manag. 2021, 1–55. [Google Scholar] [CrossRef]

- Kelly, L.M.; Athanassiou, N.; Crittenden, W.F. Founder Centrality and Strategic Behavior in the Family-Owned Firm. Entrep. Theory Pract. 2000, 25, 27–42. [Google Scholar] [CrossRef]

- Dou, J.; Su, E.; Wang, S. When Does Family Ownership Promote Proactive Environmental Strategy? The Role of the Firm’s Long-Term Orientation. J. Bus. Ethics 2017, 158, 81–95. [Google Scholar] [CrossRef]

- Ling, C.; Huali, C. The Clan Involvement, the Socio-emotional Wealth and the Corporate Charitable Contributions: A Case Study Based on the Survey of the Private Enterprises All over China. Manag. World 2014, 8, 90–101+188. [Google Scholar]

- Cruz, C.; Martin, L.-K.; Lucía, G.-G.; Pascual, B. Are Family Firms Really More Socially Responsible? Entrep. Theory Pract. 2014, 38, 1295–1316. [Google Scholar] [CrossRef] [Green Version]

- Le Breton-Miller, I.; Miller, D. Family firms and practices of sustainability: A contingency view. J. Fam. Bus. Strat. 2016, 7, 26–33. [Google Scholar] [CrossRef]

- Morck, R.; Yeung, B. Family Control and the Rent–Seeking Society. Entrep. Theory Pract. 2004, 28, 391–409. [Google Scholar] [CrossRef] [Green Version]

- Bingham, J.B.; Dyer, W.G.; Smith, I.; Adams, G.L. A Stakeholder Identity Orientation Approach to Corporate Social Performance in Family Firms. J. Bus. Ethics 2010, 99, 565–585. [Google Scholar] [CrossRef]

- Bammens, Y.; Hünermund, P. Nonfinancial considerations in eco-innovation decisions: The role of family ownership and reputation concerns. J. Prod. Innov. Manag. 2020, 37, 431–453. [Google Scholar] [CrossRef]

- Madden, L.; McMillan, A.; Harris, O. Drivers of selectivity in family firms: Understanding the impact of age and ownership on CSR. J. Fam. Bus. Strat. 2020, 11, 100335. [Google Scholar] [CrossRef]

- Sahasranamam, S.; Arya, B.; Sud, M. Ownership structure and corporate social responsibility in an emerging market. Asia Pac. J. Manag. 2019, 37, 1165–1192. [Google Scholar] [CrossRef] [Green Version]

- Block, J.; Wagner, M. Ownership versus management effects on corporate social responsibility concerns in large family and founder firms. J. Fam. Bus. Strat. 2014, 5, 339–346. [Google Scholar] [CrossRef]

- Zeng, T. Corporate social responsibility (CSR) in Canadian family firms. Soc. Responsib. J. 2020. [Google Scholar] [CrossRef]

- Short, J. The Art of Writing a Review Article. J. Manag. 2009, 35, 1312–1317. [Google Scholar] [CrossRef]

- Newman, A.; Martin Obschonka, J.M.; Gemma, G.C. Entrepreneurial Passion: A Review, Synthesis, and Agenda for Future Research. Appl. Psychol. 2021, 70, 816–860. [Google Scholar] [CrossRef] [Green Version]

- Ramos-Hidalgo, E.; Orta-Pérez, M.; Agustí, M.A. Ethics and Social Responsibility in Family Firms. Research Domain and Future Research Trends from a Bibliometric Perspective. Sustainability 2021, 13, 14009. [Google Scholar] [CrossRef]

- Liñán, F.; Alain, F. A Systematic Literature Review on Entrepreneurial Intentions. Int. Entrep. Manag. J. 2015, 11, 907–933. [Google Scholar] [CrossRef]

- Mariani, M.M.; Borghi, M. Industry 4.0: A bibliometric review of its managerial intellectual structure and potential evolution in the service industries. Technol. Forecast. Soc. Chang. 2019, 149, 119752. [Google Scholar] [CrossRef]

- Zupic, I.; Čater, T. Bibliometric methods in management and organization. Organ. Res. Methods 2015, 18, 429–472. [Google Scholar] [CrossRef]

- Mongeon, P.; Paul-Hus, A. The journal coverage of Web of Science and Scopus: A comparative analysis. Scientometrics 2016, 106, 213–228. [Google Scholar] [CrossRef]

- Vieira, E.S.; Gomes, J. A Comparison of Scopus and Web of Science for a Typical University. Scientometrics 2009, 81, 587–600. [Google Scholar] [CrossRef]

- CNKI. “CNKI Introduction”. Available online: https://oversea.cnki.net/index/Support/en/Introduction.html (accessed on 16 May 2022).

- Mingers, J.; Yang, L. Evaluating journal quality: A review of journal citation indicators and ranking in business and management. Eur. J. Oper. Res. 2017, 257, 323–337. [Google Scholar] [CrossRef]

- Hoepner, A.G.F.; Unerman, J. Explicit and Implicit Subject Bias in the ABS Journal Quality Guide. Account. Educ. 2012, 21, 3–15. [Google Scholar] [CrossRef]

- Hussain, S. Journal List Fetishism and the ‘sign of 4’ in the ABS Guide: A Question of Trust? Organization 2015, 22, 119–138. [Google Scholar] [CrossRef] [Green Version]

- Morris, H.; Harvey, C.; Kelly, A. Journal rankings and the ABS Journal Quality Guide. Manag. Decis. 2009, 47, 1441–1451. [Google Scholar] [CrossRef] [Green Version]

- Van Eck, N.J.; Waltman, L. Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics 2009, 84, 523–538. [Google Scholar] [CrossRef] [Green Version]

- König, A.; Nadine, K.; Albrecht, E. The family innovator’s dilemma: How family influence affects the adoption of discontinuous technologies by incumbent firms. Acad. Manag. Rev. 2013, 38, 418–441. [Google Scholar] [CrossRef] [Green Version]

- Duran, P.; Kammerlander, N.; Van Essen, M.; Zellweger, T. Doing more with less: Innovation input and output in family firms. Acad. Manag. J. 2016, 59, 1224–1264. [Google Scholar] [CrossRef] [Green Version]

- Peng, M.W.; Jiang, Y. Institutions Behind Family Ownership and Control in Large Firms. J. Manag. Stud. 2010, 47, 253–273. [Google Scholar] [CrossRef]

- Miller, D.; Le Breton-Miller, I.; Lester, R.H.; Cannella, A.A. Are Family Firms Really Superior Performers? J. Corp. Financ. 2007, 5, 829–858. [Google Scholar] [CrossRef]

- Gomez–Mejia, L.R.; Campbell, J.T.; Martin, G.; Hoskisson, R.E.; Makri, M.; Sirmon, D.G. Socioemotional Wealth as a Mixed Gamble: Revisiting Family Firm R&D Investments with the Behavioral Agency Model. Entrep. Theory Pract. 2014, 38, 1351–1374. [Google Scholar] [CrossRef]

- Villalonga, B.; Amit, R. How Do Family Ownership, Control and Management Affect Firm Value? J. Financ. Econ. 2006, 80, 385–417. [Google Scholar] [CrossRef] [Green Version]

- Llach, J.; Nordqvist, M. Innovation in family and non-family businesses: A resource perspective. Int. J. Entrep. Ventur. 2010, 2, 381. [Google Scholar] [CrossRef]

- Chua, J.H.; Chrisman, J.J.; Sharma, P. Defining the Family Business by Behavior. Entrep. Theory Pract. 1999, 23, 19–39. [Google Scholar] [CrossRef]

- Chrisman, J.J.; Chua, J.H.; Sharma, P. Trends and Directions in the Development of a Strategic Management Theory of the Family Firm. Entrep. Theory Pract. 2005, 29, 555–575. [Google Scholar] [CrossRef]

- Oh, W.Y.; Chang, Y.K.; Martynov, A. The Effect of Ownership Structure on Corporate Social Responsibility: Empirical Evidence from Korea. J. Bus. Ethics 2011, 104, 283–297. [Google Scholar] [CrossRef]

- Jia, M.; Zhang, Z. Managerial Ownership and Corporate Social Performance: Evidence from Privately Owned Chinese Firms’ Response to the Sichuan Earthquake. Corp. Soc. Responsib. Environ. Manag. 2012, 20, 257–274. [Google Scholar] [CrossRef]

- Su, R.; Chunping, L.; Weili, T. The heterogeneous effects of CSR dimensions on financial performance—A new approach for csr measurement. J. Bus. Econ. Manag. 2020, 21, 987–1009. [Google Scholar] [CrossRef]

- Cavaco, S.; Crifo, P. CSR and Financial Performance: Complementarity between Environmental, Social and Business Behaviours. Appl. Econ. 2014, 46, 3323–3338. [Google Scholar] [CrossRef]

- Girerd-Potin, I.; Jimenez-Garcès, S.; Louvet, P. Which Dimensions of Social Responsibility Concern Financial Investors? J. Bus. Ethics 2014, 121, 559–576. [Google Scholar] [CrossRef] [Green Version]

- Inoue, Y.; Lee, S. Effects of different dimensions of corporate social responsibility on corporate financial performance in tourism-related industries. Tour. Manag. 2011, 32, 790–804. [Google Scholar] [CrossRef]

- Wang, Z.; Reimsbach, D.; Braam, G. Political Embeddedness and the Diffusion of Corporate Social Responsibility Prac-tices in China: A Trade-off between Financial and CSR Performance? J. Clean. Prod. 2018, 198, 1185–1197. [Google Scholar] [CrossRef]

- Turban, D.B.; Greening, D.W. Corporate Social Performance and Organizational Attractiveness to Prospective Employees. Acad. Manag. J. 1997, 40, 658–672. [Google Scholar]

- Waddock, S.A.; Graves, S.B. The corporate social performance-financial performance link. Strateg. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Clarkson, M.B.E. A Stakeholder Framework for Analyzing and Evaluating Corporate Social Performance. Acad. Manag. Rev. 1995, 20, 92–117. [Google Scholar] [CrossRef]

- Peloza, J.; Papania, L. The Missing Link between Corporate Social Responsibility and Financial Performance: Stakeholder Salience and Identification. Corp. Reput. Rev. 2008, 11, 169–181. [Google Scholar] [CrossRef]

- Contini, M.; Annunziata, E.; Rizzi, F.; Frey, M. Exploring the influence of Corporate Social Responsibility (CSR) domains on consumers’ loyalty: An experiment in BRICS countries. J. Clean. Prod. 2019, 247, 119158. [Google Scholar] [CrossRef]

- Flammer, C.; Hong, B.; Minor, D. Corporate governance and the rise of integrating corporate social responsibility criteria in executive compensation: Effectiveness and implications for firm outcomes. Strat. Manag. J. 2019, 40, 1097–1122. [Google Scholar] [CrossRef]

- Hur, W.-M.; Moon, T.-W.; Choi, W.-H. When are internal and external corporate social responsibility initiatives amplified? Employee engagement in corporate social responsibility initiatives on prosocial and proactive behaviors. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 849–858. [Google Scholar] [CrossRef]

- Skudiene, V.; Auruskeviciene, V. The contribution of corporate social responsibility to internal employee motivation. Balt. J. Manag. 2012, 7, 49–67. [Google Scholar] [CrossRef]

- Al-Shammari, M.; Rasheed, A.; Al-Shammari, H.A. CEO Narcissism and Corporate Social Responsibility: Does CEO Narcissism Affect CSR Focus? J. Bus. Res. 2019, 104, 106–117. [Google Scholar] [CrossRef]

- Brammer, S.; Millington, A.; Rayton, B. The contribution of corporate social responsibility to organizational commitment. Int. J. Hum. Resour. Manag. 2007, 18, 1701–1719. [Google Scholar] [CrossRef] [Green Version]

- Carroll, A.B. Managing ethically with global stakeholders: A present and future challenge. Acad. Manag. Perspect. 2004, 18, 114–120. [Google Scholar] [CrossRef]

- Xu, J.; Li, S.; Zhang, D. Family Involvement, Institutional Environment and Corporate Voluntary Social Responsibility: Study Based on the Tenth Survey of the Private Enterprises All over China. Bus. Manag. J. 2018, 40, 37–53. [Google Scholar]

- Lee, M.-D.P. Does Ownership Form Matter for Corporate Social Responsibility? A Longitudinal Comparison of Environmental Performance between Public, Private, and Joint-venture Firms. Bus. Soc. Rev. 2009, 114, 435–456. [Google Scholar] [CrossRef]

- Tetrault Sirsly, C.-A.; Sujit, S. Strategies for Sustainability Initiatives: Why Ownership Matters. Corp. Gov. 2013, 13, 541–550. [Google Scholar] [CrossRef]

- Habbash, M. Corporate Governance and Corporate Social Responsibility Disclosure: Evidence from Saudi Arabia. Int. J. Corp. Strategy Soc. Responsib. 2017, 1, 161–178. [Google Scholar]

- Shu, P.-G.; Chiang, S.-J. The impact of corporate governance on corporate social performance: Cases from listed firms in Taiwan. Pac. Basin Financ. J. 2020, 61, 101332. [Google Scholar] [CrossRef]

- Grougiou, V.; Dedoulis, E.; Leventis, S. Corporate Social Responsibility Reporting and Organizational Stigma: The Case of “Sin” Industries. J. Bus. Res. 2016, 69, 905–914. [Google Scholar] [CrossRef]

- Venkataraman, I.; Lulseged, A. Does Family Status Impact US Firms’ Sustainability Reporting? Sustain. Account. Manag. Policy J. 2013, 4, 163–189. [Google Scholar]

- Jo, H.; Harjoto, M.A. Corporate Governance and Firm Value: The Impact of Corporate Social Responsibility. J. Bus. Ethics 2011, 103, 351–383. [Google Scholar] [CrossRef]

- Panicker, V.S. Ownership and corporate social responsibility in Indian firms. Soc. Responsib. J. 2017, 13, 714–727. [Google Scholar] [CrossRef]

- Pascual, B.; Cruz, C.; Gomez-Mejia, L.R.; Larraza-Kintana, M. Socioemotional Wealth and Corporate Responses to Institutional Pressures: Do Family-Controlled Firms Pollute Less? Adm. Sci. Q. 2010, 55, 82–113. [Google Scholar]

- Baumann-Pauly, D.; Wickert, C.; Spence, L.J.; Scherer, A.G. Organizing Corporate Social Responsibility in Small and Large Firms: Size Matters. J. Bus. Ethics 2013, 115, 693–705. [Google Scholar] [CrossRef] [Green Version]

- Kim, K.; Haider, Z.A.; Wu, Z.; Dou, J. Corporate Social Performance of Family Firms: A Place-Based Perspective in the Context of Layoffs. J. Bus. Ethics 2019, 167, 235–252. [Google Scholar] [CrossRef]

- Block, J. Family Management, Family Ownership, and Downsizing: Evidence from S&P 500 Firms. Fam. Bus. Rev. 2010, 23, 109–130. [Google Scholar]

- Stavrou, E.; Kassinis, G.; Filotheou, A. Downsizing and Stakeholder Orientation among the Fortune 500: Does Family Ownership Matter? J. Bus. Ethics 2007, 72, 149–162. [Google Scholar] [CrossRef]

- Zhou, L. Family Involvement and Corporate Social Responsibility: Manufacturing Evidence from China Economic Management. J. Chin. Sociol. 2011, 33, 45–53. [Google Scholar]

- Christensen-Salem, A.; Mesquita, L.F.; Hashimoto, M.; Hom, P.W.; Gomez-Mejia, L.R. Family firms are indeed better places to work than non-family firms! Socioemotional wealth and employees’ perceived organizational caring. J. Fam. Bus. Strat. 2021, 12, 100412. [Google Scholar] [CrossRef]

- Berrone, P.; Cruz, C.; Gomez-Mejia, L.R. Socioemotional Wealth in Family Firms. Fam. Bus. Rev. 2012, 25, 258–279. [Google Scholar] [CrossRef]

- Rubino, F.; Napoli, F. What Impact Does Corporate Governance Have on Corporate Environmental Performances. An Empirical Study of Italian Listed Firms. Sustainability 2020, 12, 5742. [Google Scholar] [CrossRef]

- Li, X.; Li, W.; Zhang, Y. Family Control, Political Connection, and Corporate Green Governance. Sustainability 2020, 12, 7068. [Google Scholar] [CrossRef]

- Dou, J.; Zhang, Z.; Su, E. Does Family Involvement Make Firms Donate More? Empirical Evidence From Chinese Private Firms. Fam. Bus. Rev. 2014, 27, 259–274. [Google Scholar] [CrossRef] [Green Version]

- Ye, Y.; Li, K.; Hu, G. The Selective Participation in Corporate Social Responsibility in Family Enterprises. J. Beijing Inst. Technol. 2019, 21, 76–85. [Google Scholar]

- Wu, F.; Zhang, Y. Family Involvement, Non-Market Strategies and Corporate Performance: From the Multi-Dimensional Per-spective of Social Emotional Wealth. Contemp. Financ. Econ. 2019, 3, 81–93. [Google Scholar]

- Syed, M.A.; Butt, S.A. Financial and non-financial determinants of corporate social responsibility: Empirical evidence from Pakistan. Soc. Responsib. J. 2017, 13, 780–797. [Google Scholar] [CrossRef]

- Zhu, B. The self-centered philanthropist: Family involvement and corporate social responsibility in private enterprises. J. Chin. Sociol. 2021, 8, 21. [Google Scholar] [CrossRef]

- Yan, Y.; Li, K. Impact of Family Involvement on Internal and External Corporate Social Responsibilities: Evidence from Chinese Publicly Listed Firms. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 352–365. [Google Scholar]

- Zhu, H.; Ye, Q.; Li, X. Social Emotional Wealth Theory and its Breakthrough in Family Firms Research. Foreign Econ. Manag. 2012, 34, 56–62. [Google Scholar]

- Godfrey, P.C. The Relationship Between Corporate Philanthropy And Shareholder Wealth: A Risk Management Perspective. Acad. Manag. Rev. 2005, 30, 777–798. [Google Scholar] [CrossRef] [Green Version]

- Gibb, D.W., Jr.; Whetten, D.A. Family Firms and Social Responsibility: Preliminary Evidence from the S&P 500. Entrep. Theory Pract. 2006, 30, 785–802. [Google Scholar]

- Miller, D.; Le Breton-Miller, I. Managing for the Long Run: Lessons in Competitive Advantage from Great Family Businesses; Harvard Business Press: Boston, MA, USA, 2005. [Google Scholar]

- Lloyd, S. Variants of Agency Contracts in Family-financed Ventures as a Continuum of Familial Altruistic and Market Rational-ities. J. Bus. Ventur. 2003, 18, 597–618. [Google Scholar]

- Vazquez, P. Family Business Ethics: At the Crossroads of Business Ethics and Family Business. J. Bus. Ethics 2016, 150, 691–709. [Google Scholar] [CrossRef]

- de la Cruz Déniz Déniz, M.; Suárez, M.K.C. Corporate Social Responsibility and Family Business in Spain. J. Bus. Ethics 2005, 56, 27–41. [Google Scholar] [CrossRef]

- Liu, M.; Shi, Y.; Wilson, C.; Zhenyu Wu, Z. Does Family Involvement Explain Why Corporate Social Responsibility Affects Earnings Management? J. Bus. Res. 2017, 75, 8–16. [Google Scholar] [CrossRef]

- Fehre, K.; Weber, F. Why some are more equal: Family firm heterogeneity and the effect on management’s attention to CSR. Bus. Ethics A Eur. Rev. 2018, 28, 321–334. [Google Scholar] [CrossRef]

- Jian, R.; Dai, C. Research on the Impact of Ownership Structure Characteristics on the Quality of Social Responsibility Information Disclosure: Based on the Data Analysis of Family Listed Companies in China. Sci. Decis. Mak. 2019, 4, 41–57. [Google Scholar]

- Malik, M. Value-Enhancing Capabilities of CSR: A Brief Review of Contemporary Literature. J. Bus. Ethics 2014, 127, 419–438. [Google Scholar] [CrossRef]

- Kim, A.; Lee, Y. Family firms and corporate social performance: Evidence from Korean firms. Asia Pac. Bus. Rev. 2018, 24, 693–713. [Google Scholar] [CrossRef]

- Desender, K.; Epure, M. The Pressure behind Corporate Social Performance: Ownership and Institutional Configurations. Glob. Strategy J. 2021, 11, 210–244. [Google Scholar] [CrossRef]

- Rees, W.; Rodionova, T. The Influence of Family Ownership on Corporate Social Responsibility: An International Analysis of Publicly Listed Companies. Corp. Gov. Int. Rev. 2014, 23, 184–202. [Google Scholar] [CrossRef]

- Zhou, Z.; Lai, Y.; Yi, X.; Zeng, H. Can Controlling Family Involvement Promote Enterprises to Fulfill Environmental Responsibilities? Based on the Evidence of A-share Listed Companies in China. J. Nanjing Audit. Univ. 2020, 17, 37–46. [Google Scholar]

- Zhou, W.; Zhao, J. Family Involvement, International Operation and Corporate Environmental Responsibility. Jilin Univ. J. Soc. Sci. Ed. 2017, 57, 84–94+205. [Google Scholar]

- Anderson, R.C.; Reeb, D.M. Founding-Family Ownership and Firm Performance: Evidence from the S&P 500. J. Financ. 2003, 58, 1301–1328. [Google Scholar] [CrossRef]

- Andres, C. Large shareholders and firm performance—An empirical examination of founding-family ownership. J. Corp. Financ. 2008, 14, 431–445. [Google Scholar] [CrossRef]

- Barnea, A.; Rubin, A. Corporate Social Responsibility as a Conflict Between Shareholders. J. Bus. Ethics 2010, 97, 71–86. [Google Scholar] [CrossRef]

- Rees, W.; Rodionova, T. What type of controlling investors impact on which elements of corporate social responsibility? J. Sustain. Financ. Invest. 2013, 3, 238–263. [Google Scholar] [CrossRef]

- Bertrand, M.; Mehta, P.; Mullainathan, S. Ferreting Out Tunneling: An Application to Indian Business Groups. Q. J. Econ. 2000, 117, 121–148. [Google Scholar] [CrossRef]

- DeAngelo, H.; DeAngelo, L. Controlling stockholders and the disciplinary role of corporate payout policy: A study of the Times Mirror Company. J. Financ. Econ. 2000, 56, 153–207. [Google Scholar] [CrossRef]

- EI Ghoul, S.; Guedhami, O.; Wang, H.; Kwok, C.C.Y. Family Control and Corporate Social Responsibility. J. Bank. Financ. 2016, 73, 131–146. [Google Scholar] [CrossRef]

- Atkinson, L.; Galaskiewicz, J. Stock Ownership and Company Contributions to Charity. Adm. Sci. Q. 1988, 33, 82. [Google Scholar] [CrossRef]

- Terlaak, A.; Kim, S.; Roh, T. Not Good, Not Bad: The Effect of Family Control on Environmental Performance Disclosure by Business Group Firms. J. Bus. Ethics 2018, 153, 977–996. [Google Scholar] [CrossRef]

- Labelle, R.; Hafsi, T.; Francoeur, C.; Ben Amar, W. Family Firms’ Corporate Social Performance: A Calculated Quest for Socioemotional Wealth. J. Bus. Ethics 2015, 148, 511–525. [Google Scholar] [CrossRef]

- Li, X. Empirical study on family involvement, and agricultural enterprises corporate social responsibility. Guangdong Agri-Cult. Sci. 2012, 39, 233–236. [Google Scholar]

- Chen, J.; Wen, Z. Family Control, Executive Incentive and Corporate Social Responsibility: An Empirical Study Based on Chinese Listed Companies. J. Nanjing Audit. Univ. 2017, 14, 66–74. [Google Scholar]

- Li, Y. Family Involvement, Executive Compensation and Corporate Social Responsibility. Commun. Financ. Account. 2019, 24, 67–70. [Google Scholar]

- Ryu, H.; Chae, S.-J. Family Firms, Chaebol Affiliations, and Corporate Social Responsibility. Sustainability 2021, 13, 3016. [Google Scholar] [CrossRef]

- García-Sánchez, I.M.; Martín-Moreno, J.; Khan, S.A.; Hussain, N. Socio-emotional Wealth and Corporate Responses to Environmental Hostility: Are Family Firms More Stakeholder Oriented? Bus. Strategy Environ. 2021, 30, 1003–1018. [Google Scholar] [CrossRef]

- Aguilar, E.; Luis, J. Corporate Social Responsibility Practices Developed by Mexican Family and Non-family Business-es. J. Fam. Bus. Manag. 2019, 9, 40–53. [Google Scholar] [CrossRef]

- Izzo, M.F.; Ciaburri, M. Why Do They Do That? Motives and Dimensions of Family Firms’ CSR Engagement. Soc. Responsib. J. 2018, 14, 633–650. [Google Scholar] [CrossRef]

- Campopiano, G.; De Massis, A. Corporate Social Responsibility Reporting: A Content Analysis in Family and Non-family Firms. J. Bus. Ethics 2015, 129, 511–534. [Google Scholar] [CrossRef]

- Venturelli, A.; Principale, S.; Ligorio, L.; Cosma, S. Walking the Talk in Family Firms. An Empirical Investigation of CSR Communication and Practices. Corp. Soc.-Responsib. Environ. Manag. 2021, 28, 497–510. [Google Scholar] [CrossRef]