Abstract

In recent years, the market pattern of infant formula in China has changed dramatically. The market share of domestic infant formula has exceeded that of imports. The essence of the market share change of domestic and foreign brands is the change of consumers’ brand preferences. To explore which factors affected consumers’ brand preferences, our study conducted a qualitative research method based on the grounded theory, through in-depth interviews with 60 mothers in the Beijing-Tianjin-Hebei region, systematically identifying the factors which affect consumers’ brand preferences for infant formula, which allowed us to establish a theoretical model for them. We found that product characteristics and external environmental factors could directly affect the formation of consumers’ brand preferences, or indirectly through the two intermediary factors of buyers and users. In addition, in the consumption of infant formula, buyers and users were separated, and infants, as actual users, were an important factor that could not be ignored in brand preference.

1. Introduction

Infant formula milk powder is an important food for babies and infants, and one which is related to the happiness of millions of families and the future of the nation. The melamine incident in 2008 brought a serious brand and credibility crisis to China’s infant formula industry [1,2]. After this incident, the share of imports surged, while that of domestic brands decreased, with a lack of brand competitiveness in the international market [3]. However, COVID-19 swept the world in 2019, which brought a huge impact on the infant formula industry. As a result, China’s infant formula industry presents a new market pattern [4]. From the macro perspective, due to the disruption of global supply chains caused by COVID-19, China’s infant formula industry has entered a new stage of rising market share for domestic brands, and declining imports. In 2020, China’s infant formula imports dropped by 6.5%, which is the first “inflection point” of the decline after the melamine incident. In 2021, China’s infant formula imports still maintain a downward trend, dropping by 22.1%. At the same time, in recent years, for Chinese government strengthened the supervision of infant formula and issued the “infant formula product formula Registration Management Measures” and other series of policies, meaning that the quality and safety of domestic brand formula had been significantly improved. In 2020, China’s infant formula sampling qualified rate reached 99.89%, and the domestic market share increased to 54%. The domestic market’s confidence gradually recovered. From the micro perspective, the change of China’s infant formula market pattern is actually the change of consumer brand preference. It is meaningful to explore the influencing factors of consumer brand preference to understand the changes in the infant formula market.

Brand preference is the degree of consumers’ preference for a brand in a certain market and refers to the degree to which consumers tend to choose a certain brand compared with competing brands [5]. As an important signal of consumers’ choice, brand preference directly affects consumers’ purchase intention [6]. Infant formula is a kind of product with a high degree of consumer involvement and a long service cycle. Therefore, consumers are willing to spend more time considering their choice, and seriously thinking about and comparing the differences between brands, so as to make the purchase decision that best meets their needs [7]. There are numerous academic studies on consumers’ brand preferences, the most famous of which is the consumer behavior theory proposed by Howard and Sheth in 1969 and Engel in 1994. The studies emphasize the influence of direct or indirect factors in the purchase process, pointing out that brand preference is formed under the combined effect of product or brand characteristics, consumer characteristics, environmental factors, and situational factors [8,9]. Bettman’s constructive consumer choice processes theory also states that consumers’ preferences are not something inherent or pre-existing but are constructed based on the characteristics of the external environment with psycho-emotional and cognitive orientations [10]. From previous studies, we can learn that consumers’ brand preferences for infant formula are formed under the joint action of various factors.

Consumers’ brand preferences are primarily influenced by the following three aspects, according to the existing literature: product characteristics, external environment, and consumer characteristics. First, product characteristics mainly include nutrient content, price, origin, etc. Whether the nutrient content is comprehensive directly affects consumers’ brand preferences [11]. There is no consensus on the effect of price on brand preference, with some studies asserting a significant effect [12], while others take a different view [13]. Many scholars have found that origin also has a significant impact on Chinese consumers’ brand preferences due to the melamine scandal [14]. Even in the regions not affected by the melamine incident, brand preference is also influenced by the place of origin, i.e., whether the infant formula is domestically produced or imported [15]. Second, the external environment factors include recommendations from friends and relatives, professional advice, and advertising. Research has shown that consumers are more likely to use and trust the infant formula brands recommended by friends or experts [16]. Consumers’ brand preferences are sometimes promoted through advertising, but also can be negatively influenced by exaggerated and unreasonable advertising [17]. Third, consumer characteristics mainly focus on the demographic characteristics and perceptions of the buyers. Studies have found that factors, such as buyers’ educational background [18], income [19], brand trust [20], and perception of quality and safety [21] have significant effects on brand preference. Moreover, since the buyer is not the user of infant formula, infants and babies, as actual users, can affect brand preference for infant formula [22]. However, most of the current studies have been conducted from the buyer’s perspective, and few have examined the user (infants and babies) factors.

Previous studies, which mostly adopted quantitative research methods [23], have two shortcomings. Firstly, the influencing factors of brand preference they examined are limited, and some underlying factors (e.g., acceptance of formula by infants, and age of infant in months) were not studied. Secondly, there is a lack of systematic research on the influencing factors of consumer preference for infant formula brands, and the complex relationships among the influencing factors are not yet clear [24]. Changes in China’s infant formula market have raised questions that this paper aims to answer. What are the underlying factors affecting Chinese consumers’ brand preferences for infant formula? How do these factors affect consumers’ brand preferences? Based on the grounded theory and through in-depth interviews with 60 mothers in the Beijing-Tianjin-Hebei region, this study systematically examined the influencing factors of consumers’ brand preferences and their interactions in China’s infant formula market, and also distinguished the buyer and user factors. Our study further supplements and enriches the relevant research on the influencing factors of infant formula brand preference, and has important theoretical and practical significance for promoting the healthy development of China’s infant formula industry, and understanding the rule of market change.

2. Methodology

The grounded theory approach is a qualitative research method founded by Glaser and Strauss from Columbia University in the 1960s, the main purpose of which is to build a theory based on empirical data [25]. According to this approach, researchers generally start with actual observations and then summarize the experience from primary sources without developing any theoretical assumptions at the beginning of the research [26]. This approach typically searches for core concepts that reflect the essence of phenomena based on systematic data collection, and then constructs relevant social theories through connections among these concepts [27]. As a complete and independent set of research methodology, the grounded theory is widely used in many research fields of social sciences. Infant formula is used by babies aged 0–3 and bought by their parents. Since the language expression ability of infants is not fully developed, users do not have the ability to choose independently, so buyers can only judge and evaluate the product through the behavior of infants. In addition, consumers’ brand preferences also vary from person to person. The grounded theory research method can be used to more comprehensively investigate the influencing factors of infant formula brand preference and the relationship between them, so as to better answer the research questions of this study.

There are two main reasons for selecting the Beijing-Tianjin-Hebei region as the research area. Firstly, the Beijing-Tianjin-Hebei region has large cities including municipalities and provincial capital cities, as well as rural areas. Secondly, Hebei Province is the origin of China’s melamine incident in 2008, and, thus, the study of consumer brand preferences for infant formula in this region is highly representative and typical. In accordance with the principle of purposive sampling, the study recruited purchasers of infant formula as respondents, including potential buyers, current buyers, and previous buyers, with the main focus on current buyers. Potential buyers are pregnant women with experience buying infant formula; actual buyers are those who are currently feeding or mixed feeding and have experience buying infant formula (exclusive breastfeeding is not included); previous buyers are those who bought infant formula within the last year.

The research strictly followed the research procedure of the grounded theory, coding and analyzing while collecting data, and constantly discovering new theories [28]. The research was completed in two successive phases to prevent premature end of sample collection and to avoid the impact of individual errors. Thirty-six samples were collected in the first phase from November to December 2020, followed by a continuous search for theoretical gaps by continuously collecting twenty-four samples from January to March in 2021 in accordance with the principles of theoretical sampling [29]. The sample size was determined according to the principle of theoretical saturation [30], and the final sample size was 60. The Beijing-Tianjin-Hebei sample covered seven districts of Beijing (Xicheng, Haidian, Chaoyang, Changping, Tongzhou, Miyun, and Yanqing), six districts of Tianjin (Nankai, Jinan, Hexi, Xiqing, Jizhou, and the Binhai New Area), and eight districts of Hebei (Shijiazhuang, Xingtai, Baoding, Hengshui, Langfang, Chengde, Zhangjiakou, and Handan). The research sample included 37 individuals in urban areas and 23 individuals in rural areas. The educational background ranged from high school and below, college and undergraduate, to postgraduate. The interviewees’ occupations included civil servants, public institution staff, enterprise staff service industry workers, and a stay-at-home mom. Detailed information on the interviewees is as follows (Table 1).

Table 1.

Interviewees’ information (N = 60).

We used semi-structured in-depth interviews to obtain the data. Our study was conducted in the form of one-to-one interviews in strict accordance with the criteria of reliability and validity of qualitative research. On the one hand, qualitative research mainly adopts procedural reliability, so interview materials are required to be recorded in time according to standard procedural requirements. The reliability of interview materials is to ensure that all interviewees have a consistent understanding of the question. Therefore, to ensure reliability and validity, the interviews were conducted in three steps. First, a pre-interview was conducted prior to the formal interview in order to further improve the interview content. Second, the research team made an appointment with each interviewee by phone and informed them of the interview topic so that they could reserve time to participate. Third, before the start of the formal interview, instructions were given on the collection of interview data, so that the interviewees could properly understand the interview questions. On the other hand, we followed the procedural validity of the research data, that is, to ensure that respondents’ answers are correct, honest and in line with relevant social situations. With the consent of the interviewees, the whole interview process was audio-recorded. The formal interview began with basic information about the interviewees, including age, educational background, occupation, place of residence, number of fetuses, and age of infants. Then, open-ended questions were asked, collecting information on how to choose an infant formula brand and the factors influencing their brand choice. The order of the interview questions was flexible, adjusting to the actual situation of each interviewee and allowing interviewees to propose their own questions. Focusing on the questions raised by interviewees and the concepts captured during the interviews, the interviewer asked follow-up questions based on the actual context to gain an in-depth understanding of interviewees’ brand preferences for infant formula and the influencing factors.

After each interview, the audio recordings were sorted out in time to create interview records and memos. In processing the interview data, the names of the 60 anonymous interviewees were replaced by the designations A1–A60, and six samples, A8, A13, A26, A31, A46, and A57, were randomly selected for the theoretical saturation test. The audio recordings were converted into text, and the text was organized and revised with reference to the audio. Each interview lasted for 30–40 min, resulting in a total of 156,000 words of interview material.

3. Data Analysis

3.1. Free Node Coding

The sorted interview texts were named A1-A60, imported into Nvivo12 software as internal files, and coded. The study divided three coding processes of the grounded theory—open coding, axial coding, and selective coding—into free nodes and tree nodes for coding [31]. Coding is an important step in the research of the grounded theory, which refers to decomposing, discerning, and assigning concepts to the collected empirical material [32]. Free nodes are tentative encoding processes, which are parallel encoding at a single level. In Nvivo12, the coding of the interview text was done by “New Node”. If one sentence contains multiple meanings, it can be coded twice or more, while eliminating the initial concept that occurs less than twice.

Our study resulted in 760 coded reference points and 22 free nodes. The points “recommendation from friends and relatives”, “trial pack”, “advertising”, “quality and safety awareness”, and “feeding experience” were coded as free nodes. To save space, 1–2 original statements and initial concepts were selected for each initial category, as shown in Table 2.

Table 2.

Free node coding and examples of interview text.

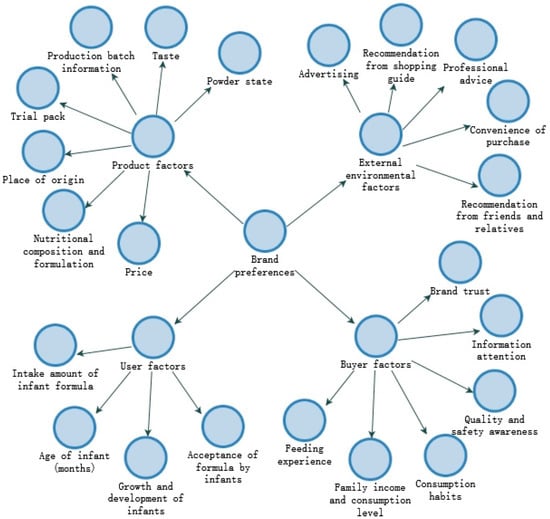

3.2. Tree Node Coding

After the free coding of all information, the free nodes were further categorized and merged with concept and theme refinement to form tree nodes with the same conceptual category. Tree nodes can describe the interrelationships between qualitative research concepts. Tree nodes are nodes that have logical relationships with free nodes and deal with the connections between nodes. Based on the tree node connection, the factors influencing consumers’ brand preferences for infant formula were grouped into the following four categories: external environmental factors, product characteristics, buyer factors, and user (babies and infants) factors. The “New Item Map” function of Nvivo12 software was used to build the model, and a visualization of the tree node diagram of the influencing factors was formed (See Figure 1).

Figure 1.

Tree Node Diagram of Factors Influencing Brand Preference for Infant Formula Milk Powder.

To verify the scientific validity of free node and tree node coding, we used word similarity for cluster analysis and the Pearson correlation coefficient in qualitative studies to measure the correlation between free nodes and higher-level tree nodes. In qualitative studies, Pearson’s coefficients of 0.8–1, 0.6–0.8, 0.4–0.6, 0.2–0.4, and less than 0.2 present strong, relatively strong, moderate, relatively weak, and weak correlations, respectively. Among the 22 free nodes and the upper tree nodes, 19 nodes (or 86.4%) showed a moderate or above Pearson’s correlation coefficient, and 13 nodes (or 59.1%) showed a strong or relatively strong correlation. The coding has a certain degree of scientific accuracy.

3.3. Brand Preference Theory Model Construction

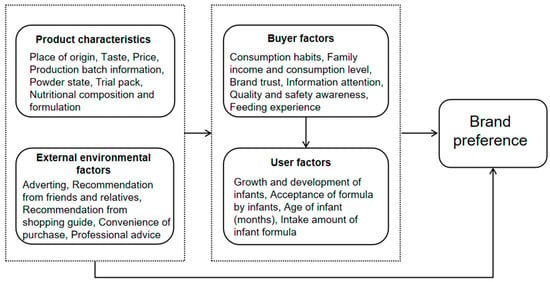

Previous studies have shown that product characteristics and external environment have a significant impact on consumers’ brand preferences [33]. On this basis, our study separated the buyers and users from the consumer factors of infant formula compounding, and then refined the factor analysis of consumers’ brand preferences. The study was guided by the theories of consumer buying behavior proposed by Howard and Sheth (1969), Engel (1994), and Bettman et al. (1998), pointing out that brand preference is formed under the combined effect of product characteristics, external environmental factors, buyer factors, and user (babies and infants) factors. According to these theories, a theoretical model of consumer brand preference for infant formula was constructed on the basis of the relationship structure of tree nodes and sub-nodes (See Figure 2). The consumer’s decision-making process is influenced by the stimulus of the external environment and the situation of the product, and then the consumer makes a decision based on his or her own situation, such as consumption habits and income. For a special product, such as infant formula, the evaluation of its effectiveness and perceived quality can only be obtained through indirect observation and summary of actual users’ (babies and infants) experience. The specific conditions of babies and infants, such as the age, the amount of use, etc., and the user’s reactions to the product will influence buyers’ brand preferences [1]. Specifically, powder state, price, the trial pack, and other product characteristics will directly affect consumers’ brand preferences. Convenience of purchase, recommendation from friends and family, and other external environmental factors will also stimulate consumers’ infant formula brand preferences. The logical relationship among the factors in our study will be explained specifically in the next section.

Figure 2.

Theoretical model of factors influencing consumers’ brand preferences for infant formula.

3.4. Theoretical Saturation Test

The theoretical saturation test is used as an identification criterion for when to stop sampling. The saturation is verified when no more conceptual categories emerge from the results of theoretical analysis [34]. The coding of the interview data of the six interviewees set aside showed that no new categories were formed, which was in line with the theoretical model of the factors influencing the brand preference for infant formula, and no new relationship was formed. Therefore, it can be assumed that the theoretical model of brand preference for infant formula is saturated.

4. Findings

4.1. The Influence of Product Characteristics on the Brand Preference for Infant Formula

Product characteristics (e.g., price, nutritional composition and formula, origin, trial pack, taste, powder state, and batch information) are the direct factors affecting the brand preference for infant formula. We found that not all product characteristics influence buyers’ brand preferences, such as production date and shelf life. These characteristics are common to all brands and have no practical significance to buyers’ brand preferences, though they were often mentioned in the interviews.

The price, origin, and nutritional composition and formulation of infant formula have significant effects on buyers’ brand preferences. Previous quantitative studies have paid much attention to these three aspects, but they are usually described by statistical variables. In terms of price, there are differences in the price sensitivity of buyers. Some buyers think that a high price is good, some consider cost-effectiveness, and some others are not concerned about the price. In addition, the in-depth interviews informed us that buyers also attach great importance to price stability. For example, some brands have fluctuating prices due to different sales channels or other reasons, leading to buyers’ distrust of the brand, which is a potential factor not covered in previous quantitative studies. Brand preference is also influenced by a range of origin factors, including the level of economic development of the country of origin, the infant formula industry policies, and ecological conditions. For example, Australia has a superior ecological environment, and European countries have the strictest management standards for infant formula. However, in recent years, the gap between Chinese buyers’ willingness to pay for domestic infant formula brands and that willingness for foreign brands (i.e., different origins) has gradually narrowed [35]. The interviews also inform us that some buyers are actually not clear about the true origin of imported or domestic brands. Buyers cannot distinguish between foreign-invested brands and foreign brands, so they may not be able to identify foreign and domestic brands [36]. In terms of nutritional composition and formula, infant formula, as a substitute for breast milk, provides essential nutrients for the growth and development of babies and infants. Buyers will pay attention to various nutritional elements and formulas that affect the growth and development of babies and infants, such as the content of OPO, DNA, choline, and various trace elements in different brands. At the same time, the concept that “domestic formulas are more suitable for Chinese babies” has become popular, which has an increasingly obvious influence on buyers’ brand preferences.

The powder state and taste of the infant formula are the direct sensory characteristics of the product. The main characteristics of taste include sweetness, fishy taste, and off-flavor. Many mothers make their choices by tasting the formula themselves. For example, mothers are concerned that the sweetness may lead to tooth decay and affect the babies’ intake of complementary foods and other nutrition at a later stage. In terms of powder state, normal infant formula should be dry, show uniform particles, and have no lumps or clumps [37]. Powder state can determine the solubility of the formula, which will affect brand preference. Specifically, mothers will assess whether the infant formula is easily digested and absorbed by the baby based on the size of powder particles and whether the texture is thick.

Trial pack and batch information are also influential factors that cannot be ignored in the product characteristics. As the “first milk for infants”, the trial pack is crucial and will directly interfere with the brand choice of buyers [38]. Since they are not sure whether babies and infants will accept a particular brand, buyers will give preference to a trial pack. In addition, in the process of baby’s transition from breast milk to infant formula or changing formula brands, trial pack plays an important role in preventing waste due to babies’ non-acceptance. Batch information is also becoming an increasingly important influencing factor. The Administrative Measures for Product Formula Registration of Infants Formula stipulated that the management of the formula in China would be changed from an endorsement system to a registration system, and that brands that did not obtain registration would not be allowed to sell in China from 1 January 2018. As the information of formula is increasingly transparent, buyers have begun to pay attention to product information and to the disclosure of substandard infant formula batches on relevant websites.

4.2. Influence of External Environmental Factors on Brand Preference for Infant Formula

External environmental factors are the stimulus factors that influence the brand preference of infant formula, mainly including recommendation from friends and relatives, purchasing convenience, advertisement, recommendation from shopping guides, and professional advice. Previous quantitative studies have tended to examine the significance of the influence of external environmental factors on brand preference, but there has been no in-depth research on the aspect of how the external environment affects the formation of brand preference.

Recommendation from friends and relatives, professional advice, and convenience of purchase have a positive effect on the formation of brand preference. Recommendations from friends and relatives mainly convey information to buyers through word-of-mouth communication. Brand preference is subject to group orientation [39,40]. For infant formula, the degree of adaptation of infants and detailed experience of consumption will greatly increase the acceptance of recommendations from friends and relatives. The recommendations may not only influence the initial brand preferences of buyers, but also influence the brand changes. At the same time, brand preference is shaped by the evaluation and feedback on the formula, either through offline communication or online platforms [41]. Professional advice refers to brand recommendations from health care providers, especially nurses, consultants, or other personnel in hospitals and clinics, who have a significant influence on brand preferences of buyers [42]. Due to the different physical conditions of infants and babies, hospitals will recommend a designated brand of infant formula. Professional advice is offered if the infants and babies become lactose intolerant or allergic after hospitalisation. Buyers will choose the brand advised by doctors, because they have a high degree of trust in professional advice. Convenience of purchase refers to easy access and smooth supply. It is also important to consider whether having easy access to foreign surrogate resources will affect buyers’ brand preferences. Some purchasers do not choose foreign brands because of the long logistics time. At the same time, the convenience of purchase is also reflected in the choice of online and offline channels, e.g., physical stores or offline supermarkets that can provide delivery services.

The role of shopping guides’ recommendations and advertising in forming brand preferences for infant formula is not consistent. As one of the most important tools in marketing, advertisement can play a key role in policies and strategies, such as customer relations, new product introduction, and brand image modification [43]. The brand promotion and advertisement of infant formula, such as using the slogan “suitable to Chinese babies’ physique” and “the golden source of milk”, influences the brand preferences of buyers. However, advertising does not always have a positive effect on the brand preferences of buyers. Many buyers show little trust in advertising messages, believing that overwhelming advertising can affect the authenticity of the product. The shopping guide can quickly convey the information and highlights of the infant formula to the buyer, which has a direct effect on brand preference. Maternal and infant stores and large supermarkets are the main offline providers of infant formula. The shopping guides’ recommendations can further enhance the brand preference of buyers during the sales promotion. However, many buyers do not fully trust shopping guides’ recommendations, as they believe that most of the guides only highlight the advantages and avoid the shortcomings of the products to increase sales and profits.

4.3. Influence of Buyer Factors on Brand Preference for Infant Formula

Buyer factors can be categorized into objective factors and subjective factors. The objective factors refer to family income, consumption level, and feeding experience, while the subjective factors include quality and safety awareness, information concern, consumption habits, and brand trust.

The objective factors influence brand preference. Specifically, buyers will make choices according to their disposable income and consumption situation. Income is the main factor affecting the choice of infant formula brands [44], based on a survey on buyers in Beijing and using the Logit model. Meanwhile, buyers will choose infant formula within the range they can afford according to the price of different brands, the amount consumed by infants and babies, and other factors. Feeding experience in terms of the overall growth and development of the infant influences the buyer’s judgment. Specifically, if the infant positively accepts the formula, and his/her growth and development is satisfactory, the buyer is likely to continue buying the same brand. If the infant shows slow growth or has other adverse reactions to the formula, the buyer will change the brand.

The subjective factors also have great influence on brand preference. Chinese buyers are still sensitive to quality issues, though many years have passed since the melamine scandal. Once a brand has a bad consumption event, it will seriously affect consumers’ brand preferences. We found that most buyers trust the quality and safety of domestic brands, as the government has increased regulation of the infant formula industry. In addition, the COVID-19 pandemic has severely affected buyers’ perception of the quality and safety of foreign brands, and it has raised concerns about the risks involved in the processing or shipping of formula. Since the domestic epidemic is well controlled, buyers have increased trust in the quality and safety of domestic formula brands in terms of milk source and transportation. In terms of information concern, buyers have incomplete access to information about imported brands and domestic brands of infant formula, which affects buyers’ brand preferences. The better the buyers are informed about the product, the more objective and rational their attitude will be [45]. Although more and more buyers are keen to use online platforms to obtain information, such as maternal and infant groups, the WeChat Public Platform, pregnancy and baby apps, short video platforms, etc., there are also some buyers who are not concerned about the information on infant formula because they are busy with work or other things. Different consumption habits are influenced by personal values and emotional assessments [46]. Some buyers are more sensitive to the information and will make a choice based on the information they obtain, while others have a herd mentality and blindly follow the crowd [47]. When it comes to brand trust, buyers will trust a brand because of its fame, good reputation, security, and high recognition of the brand [48]. More than 80% of interviewees said they would trust big brands more. Moreover, buyers with high trust in the brand they buy are likely to recommend the brand to others.

4.4. Influence of User (Infant) Factors on Brand Preference for Infant Formula

The user (infant) factors, including infants’ acceptance of formula, formula intake, age (months), and growth and development, play a key role in forming the brand preference for infant formula [49]. The buyer is not the user of infant formula. The user (babies and infants) factors moderate brand preference in the following two aspects: prepositioning (i.e., pre-purchase) and post-positioning (i.e., post-purchase).

Infants’ age and formula intake are the prepositioning factors. On one hand, the younger the infant, the more cautious the buyers are, and the more likely they are to choose a brand with a high price. As the age of infant increases, complementary food can be gradually added, and infant formula is no longer the only food for babies. Therefore, the perception of quality and safety of buyers will decrease, which may lead to changes in brand preferences [50]. At the same time, as the age of infants increases, buyers may change the brand when the stage of infant formula upgrades. On the other hand, the intake of infant formula consumption can also have an effect. Parents with exclusively formula-fed infants are generally more cautious and more concerned about price, due to the large amount of consumption and the high perceived risk. Conversely, parents mainly breastfeeding their infants with formula as an occasional supplement are relatively less sensitive to price and other information.

Infants’ acceptance of formula, as well as growth and development, are the post-positioning factors. Infant acceptance mainly refers to whether infants drink a certain brand of formula and whether they like it. After the purchase, if the infant does not accept or physically does not adapt, the buyer is forced to change brands. Especially for lactose intolerant babies, moderately hydrolyzed and deeply hydrolyzed infant formula brands will be chosen. If infants can accept it, the probability that the buyer will continue to buy the same brand will be greatly increased. Growth and development mainly refer to whether the baby’s physical condition is up to standard and whether there are other abnormalities in the body. Buyers make their brand choices by observing the growth and development of their babies. If the child is in good health and developing well, the brand preference will be enhanced; on the contrary, if certain brand of infant formula is found to cause tooth decay, overweight, thinness or other abnormalities in the child, the buyer will not continue to choose the same brand.

5. Conclusions

Our study provides a comprehensive and systematic analysis of the factors influencing consumers’ brand preferences for infant formula. We found that product characteristics, external environmental factors, buyer factors, and user (infant) factors have significant effects on brand preference. In other words, brand preference for infant formula is influenced by a constellation of various factors. The specific findings are as follows: (1) Product characteristics, such as whether the price of the product is acceptable, whether the nutritional composition is comprehensive, and whether there is a trial pack, are the direct factors influencing the formation of brand preference for infant formula. (2) The external environment factors are the stimulant factors influencing the brand preference for infant formula, among which recommendation from friends and relatives, purchasing convenience, and professional advice have positive effects on the formation of brand preference, while recommendations from shopping guides and advertisement do not necessarily have positive effects on the formation of brand preference. (3) Product characteristics and external environmental factors can influence consumers’ brand preferences alone, and may influence brand preference through interacting with buyer factors and user (infant) factors. For example, a buyer’s brand preference is shaped by his or her own situation, with reference to the recommendations from friends and relatives due to the comprehensive nutritional composition or high infant acceptance of the brand. (4) User (infant) factors are key factors influencing brand preference for infant formula. Before purchase, the age of infants (months) and the intake amount of infant formula will affect buyers’ brand preferences. After a buyer makes a choice, brand preference is finally formed according to the acceptance, determined by the growth and development of infants. If the infant does not accept the brand chosen by the buyer or if there is physical discomfort, the buyer will switch to another brand. (5) Buyer factors are determinants of brand preference for infant formula. The users of infant formula are infants and babies, who do not have the ability to make purchase decisions. Buyers’ brand preference for infant formula is influenced by user factors, external environmental factors, and product characteristics. In other words, buyers form their final brand preferences based on many factors.

6. Discussion

6.1. Theoretical Contributions

Through in-depth interviews, our study comprehensively explores the influencing factors of consumers’ infant formula brand preference. The theoretical contribution of our study is mainly reflected in three aspects as follows.

First, compared with previous studies, the influencing factors of consumers’ brand preferences for infant formula were summarized in a more in-depth and comprehensive way, and user infant factors were included in the study. Previous studies have pointed out the influence of acceptability and physical development on brand preference, and consumers tend to choose infant formula with better absorption [51]. Infant formula has an important impact on the physical development level of infants, which confirms that the growth and development of users affect the brand preference [52]. However, there is no specific discussion on the formula intake and the age (months), and our study fills that gap. We find that the user (infant) factor is the key factor affecting the brand preference of infant powder mix, including infants’ acceptance of formula, formula intake, age (months), and growth and development.

Second, the logical relationship among the influencing factors was systematically sorted out based on the grounded theory, and the theoretical model of the influencing factors of consumers’ brand preferences for infant formula was developed. Previous studies of brand preference have focused on the pre-purchase stage and ignored the post-purchase behaviour. The use cycle of infant formula is long, and the post-purchase behaviour is more critical for buyers’ re-selection and infant formula manufacturers. If users respond well after purchase and promote the active purchasing behaviour of consumers, brand preference will be enhanced [33]. On the contrary, if buyers do not use it after purchase or users do not feel good after using it, brand preference will decrease, which is crucial for products with a long cycle and high brand loyalty. Our study fully considered user factors and incorporated buyer–user interactions to develop a systematic theoretical framework for the brand preference of infant formula.

Third, the mutual influence effect within the consumer groups of infant formula is obvious, confirming the influence of group effect on brand preference. The purchase of surrounding consumers will significantly affect consumers’ brand preference [53]. This group influence affects not only buyers’ initial brand preferences, but also the brand change. Previous buyers influence current buyers and potential buyers, current buyers influence potential buyers, and current buyers influence each other. Buyers not only communicate with relatives and friends, but are also keen to obtain information from online sources. With maternal and infant groups, the WeChat Public Platform, maternity and infant apps, and short video platforms, sharing information makes the interaction between consumer groups more obvious [54,55].

6.2. Practical Implicationgs

Our findings also have important practical implications. From the macro aspect, our study can provide a theoretical explanation for the development and change of the infant formula industry. It can also provide a theoretical reference for the Chinese government to formulate infant formula regulatory policy. We can learn that the government and relevant departments should strengthen the construction of infant formula quality and safety systems, strengthen the disclosure of infant formula supervision information, and constantly improve consumer quality and safety awareness and brand trust. From the micro aspect, it can also provide decision-making basis for the strategic development and market share of infant formula dispensing enterprises. Infant formula production enterprises can improve the product cost performance, improve the sensory characteristics of the product, enhance the convenience of consumers to buy, and constantly develop new products to meet the needs of infants, so as to expand brand competitiveness.

6.3. Limitations and Future Research

Our study developed a theoretical model of the factors influencing consumer brand preferences from the economic perspective and drew upon the consumer behavior theories. However, consumer behavior is also affected by consumer psychology. Future studies can incorporate psychological and behavioral experiments and other methods for in-depth research to understand the psychological motivations and psychological needs of consumers. As a qualitative research method, the grounded theory still has several shortcomings in reliability and validity. Other empirical studies can be conducted in the future using quantitative methods, such as questionnaires and scale measurements.

Author Contributions

Y.T., Responsible for the completion of the main work of the paper, the main framework construction, content writing, model analysis, etc.; H.P., Method application of grounded theory and guidance of NVIVO12 operation method; X.D., Improve the structure and content of the study, Sample selection, industry background, revision and guidance of research conclusions; L.L., The guidance of theoretical model construction, Discussion and guidance of consumer behaviour theory; W.Z., Assist in sample collection and collation, help organize recordings. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Ministry of Agriculture and Rural Affairs of the People’s Republic of China, Fresh milk quality and safety supervision project (No.125D0301) and the Central Public-interest Scientific Institution Basal Research Fund (No. JBYW-AII-2022-41).

Institutional Review Board Statement

The study uses semi-structured in-depth interviews to obtain data. With the consent of the interviewees, the whole interview process was recorded. No formal approval of the Institutional Review Board of the local Ethics Committee was required. Nonetheless, all subjects were informed about the study and participation was fully on a voluntary basis. Participants were ensured of confidentiality and anonymity of the information associated with the surveys. The study was conducted according to the guidelines of the Declaration of Helsinki.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Not applicable.

Acknowledgments

The authors appreciate the anonymous reviewers for their constructive comments and suggestions that significantly improved the quality of this manuscript.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Yang, X.; Guo, W.; Li, X.; Chen, Y. The influence factors on channel selection: A study on online shopping for infant milk powders. In Proceedings of the 2016 IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), Tehran, Iran, 25–26 January 2016; pp. 1830–1834. [Google Scholar]

- Quan, S.; Yu, X.; Zeng, Y. A Study on consumers’ preference for milk powder origin in China: A comparative analysis based on choice experiment and display preference data. J. Agrotech. Econ. 2017, 1, 52–66. [Google Scholar]

- Liu, C.; Han, L.; Zhang, Y. International comparison and development ideas of Chinese dairy industry competitiveness. Chin. Rural Econ. 2018, 7, 130–144. [Google Scholar]

- Yu, J. Reflections and suggestions on the development of China’s dairy industry under the COVID-19 epidemic. Chin. DairyInd. 2020, 9, 11–13. [Google Scholar]

- Foxall, G.R.; Oliveira, J.M.; Schrezenmaier, T.C. The Behavioral Economics of Consumer Brand Choice: Patterns of Reinforcement and Utility Maximization. J. Behav. Process. 2004, 66, 235–260. [Google Scholar] [CrossRef]

- Hornibrook, S.A.; Mccarthy, M.; Fearne, A. Consumers’ Perception of Risk: The Case of Beef Purchases in Irish Supermarkets. Int. J. Retail. Distrib. Manag. 2005, 33, 701–715. [Google Scholar] [CrossRef]

- Roman, S.; Sanchez, L.M. Parents’ choice criteria for infant food brands: A scale development and validation. Food Qual. Prefer. 2018, 64, 1–10. [Google Scholar] [CrossRef]

- Howard, J.A.; Sheth, J.N. The Theory of Buyer Behavior; Journal of the American Statistical Association: New York, NY, USA, 1969. [Google Scholar]

- Engel, J.; Blackwell, R.D.; Miniard, P.W. Consumer Behavior, 8th ed.; The Dryden Press: New York, NY, USA, 1994. [Google Scholar]

- Bettman, J.R.; Luce, M.F.; Payne, J.W. Constructive consumer choice processes. J. Consum. Res. 1998, 25, 187–217. [Google Scholar] [CrossRef]

- Ahsan, M.F.; Kumara, P.S.; Herath, S.K. The country image effects on the milk powder market of southern region in Sri Lanka. Int. J. Manag. Enterp. Dev. 2007, 4, 82. [Google Scholar] [CrossRef]

- Liu, H.; Chen, Y. Analysis of factors influencing the purchase behavior of infant formula consumers: Based on survey data from 167 consumers in Nanjing. J. Hunan Agric. Univ. (Soc. Sci.) 2013, 14, 22–28+41. [Google Scholar]

- Ji, N.; Yan, Y. Quantitative analysis of infant formula milk powder sales based on multivariate statistics. J. Inn. Mong. Univ. Technol. (Nat. Sci. Ed.) 2019, 38, 315–320. [Google Scholar]

- Qian, G.; Tong, C.; Li, M. Consumer choice of domestic and imported brands of infant formula: An analysis based on consumer survey data in urban areas of Hohhot. Agric. Econ. Manag. 2014, 5, 45–51. [Google Scholar]

- Pavithra, S. Factors influencing on the mothers’ brand choice in baby milk formula: A study in Vavuniya District, Sri Lanka. J. Mark. Consum. Res. 2018, 44, 74–80. [Google Scholar]

- Yang, M.; Zhang, X.; Lu, Y. Factors influencing residents’ purchasing behavior of domestic and foreign infant milk powder under information asymmetry: A case study of Nanjing city. Mod. Bus. 2018, 12, 15–17. [Google Scholar]

- Dellarocas, C. Strategic Manipulation of Internet Opinion Forums: Implications for Consumers and Firms. Manag. Sci. 2006, 52, 1577–1593. [Google Scholar] [CrossRef] [Green Version]

- Zhou, J.; He, M.; Zhang, H. Analysis of the factors influencing the consumption behavior of foreign milk powder based on the perspective of delegated purchase. China Dairy Ind. 2016, 44, 42–45. [Google Scholar]

- Hu, N. Research on factors influencing consumers’ consumption behavior of domestic milk powder: An empirical analysis based on a questionnaire survey in Chongqing. Fortune Today 2019, 8, 214–215. [Google Scholar]

- Wang, L.; Li, C. A study on the influence of brand memory on infant formula brand preference under the dairy product injury crisis. Heilongjiang Anim. Sci. Vet. Med. 2016, 12, 23–25+29. [Google Scholar]

- Tan, K.Y.; Beek, E.M.; Kuznesof, S.A. Perception and understanding of health claims on milk powder for children: A focus group study among mothers in Indonesia, Singapore and Thailand. Appetite 2016, 105, 747–757. [Google Scholar] [CrossRef] [Green Version]

- Alfaleh, K.; Ailuwaimi, E.; Aijefri, S.; Osaimi, A.; Behaisi, M. Infant formula in Saudi Arabia: A cross sectional survey. Kuwait Med. J. 2014, 46, 328–332. [Google Scholar]

- Wu, L.; Yin, S.; Xu, Y.; Zhu, D. Effectiveness of China’s organic food certification policy: Consumer preferences for infant milk formula with different organic certification labels. Can. J. Agric. Econ./Rev. Can. D’agroeconomie 2014, 62, 545–568. [Google Scholar] [CrossRef]

- Gatdula, A.A.; Prasetyo, Y.T. Understanding the influencing factors and the preference of infant milk formula: A PLS-SEM. In Proceedings of the 2021 IEEE 8th International Conference on Industrial Engineering and Applications (ICIEA), Kyoto, Japan, 23–26 April 2021; pp. 73–78. [Google Scholar]

- Glaser, B.G.; Strauss, A.L. The Discovery of Grounded Theory: Strategies for Qualitative Research. Chicago: Nursing Research. 1967. Available online: http://www.sciepub.com/reference/58253 (accessed on 12 May 2022).

- Chen, X. Ideas and methods of grounded theory. Educ. Res. Exp. 1999, 4, 58–63+73. [Google Scholar]

- Strauss, A.L.; Corbin, J.M. Basics of qualitative research: Techniques and procedures for developing grounded theory. J. Thousand Oaks Ca Sage Tashakkori A Teddlie C 2014, 36, 129. [Google Scholar]

- Guest, G.; Bunce, A.; Johnson, L. How Many Interviews Are Enough? An Experiment with Data Saturation and Variability. Field Methods 2006, 18, 59–82. [Google Scholar] [CrossRef]

- Charmaz, K.C. Constructing Grounded Theory: A Practical Guide Through Qualitative Analysis. Int. J. Qual. Stud. Health Well-Being 2006, 1, 84. [Google Scholar]

- O’Reilly, M.; Parker, N. Unsatisfactory Saturation: A critical exploration of the notion of saturated sample sizes in qualitative research. Qual. Res. 2013, 13, 190–197. [Google Scholar] [CrossRef]

- Babbie, E.R. Social Research Methods; Huaxia Publishing House: Beijing, China, 2009. [Google Scholar]

- Ishak, N.; Bakar, A. Qualitative data management and analysis using NVivo: An approach used to examine leadership qualities among student leaders. Educ. Res. J. 2012, 2, 94–103. [Google Scholar]

- Wang, Y.; Xiao, Z. The Dual Effects of Consumer Satisfaction on Brand Switching Intention of Sharing Apparel. Sustainability 2022, 14, 4526. [Google Scholar] [CrossRef]

- Pandit, N.R. The creation of theory: A recent application of the grounded theory method. Qual. Rep. 1996, 2, 1–15. [Google Scholar] [CrossRef]

- Xu, Y.; Xu, Z.; Chen, Y.; Wang, J. Origin, brand and awareness of domestic products: A study on the country of origin effect of infant formula milk powder. Econ. Surv. 2017, 34, 86–91. [Google Scholar]

- Shan, L.; Li, C.; Yu, Z.; Regan, Á.; Lu, T.; Wall, P. Consumer perceptions on the origin of infant formula: A survey with urban Chinese mothers. J. Dairy Res. 2021, 88, 226–237. [Google Scholar] [CrossRef]

- Cong, Y.; Ma, R.; Wang, L.; Liu, S. Comparative study on the sensory quality of different brands of domestic infant formula. Food Eng. 2019, 2, 27–32+55. [Google Scholar]

- Zhang, L.; Mu, M.; Nie, W.; Song, S.; Gao, Q.; Nie, J. Effect of milk powder recommendation and trial on breastfeeding behavior of mothers of infants aged 0 to 6 months in rural poor areas. Chin. J. Public Health 2021, 37, 280–285. [Google Scholar]

- Li, Q.; Cui, C. A Longitudinal Grounded Study of Local Brand Counterattack and Consumer Preference Reversal. J. Manag. Sci. 2018, 31, 42–55. [Google Scholar]

- Kendall, H.; Kuznesof, S.; Dean, M.; Chan, M.-Y.; Clark, B.; Home, R.; Stolz, H.; Zhong, Q.; Liu, C.; Brereton, P.; et al. Chinese consumer’s attitudes, perceptions and behavioural responses towards food fraud. Food Control 2019, 95, 339–351. [Google Scholar] [CrossRef]

- Shen, N.; Zhuang, G.; Zhu, M. The causal relationship between brand post retweets and brand preference. J. Manag. Sci. 2016, 29, 86–94. [Google Scholar]

- Greenway, C.W.; Rees, E.A. Teaching assistants’ facilitators and barriers to effective practice working with children with ADHD: A qualitative study. Br. J. Spec. Educ. 2021, 48, 347–368. [Google Scholar] [CrossRef]

- Rust, R.T.; Lemon, K.N.; Zeithaml, V.A. Return on Marketing: Using Customer Equity to Focus Marketing Strategy. J. Mark. 2004, 68, 109–127. [Google Scholar] [CrossRef] [Green Version]

- Yu, H.; Li, B. A study on the purchase behavior of infant milk powder brands among Chinese urban residents: A case study of Beijing. J. Stat. Inf. 2012, 27, 101–106. [Google Scholar]

- Zhu, L.; Wang, S.; Lu, X. Research on Chinese and foreign brand preferences of Chinese urban consumers. Manag. World 2003, 9, 122–128. [Google Scholar]

- Hansen, J.; Holm, L.; Frewer, L.; Robinson, P.; Sande, P. Beyond the knowledge deficit: Recent research into lay and expert attitudes to food risks. Appetite 2003, 41, 111–121. [Google Scholar] [CrossRef]

- Li, Y.; Li, T. A study on the factors of the prevalence of delegated purchase of foreign milk powder on WeChat moments—A perspective based on consumer psychology. Mark. Wkly. 2020, 33, 78–79. [Google Scholar]

- Bart, Y.; Shankar, V.; Sultan, F.; Urban, G.L. Are the Drivers and Role of Online Trust the Same for All Web Sites and Consumers? A Large-Scale Exploratory Empirical Study. J. Mark. 2005, 69, 133–152. [Google Scholar] [CrossRef] [Green Version]

- Gu, Y.N. Interpretation: Factors influencing the purchase behavior of infant milk powder market by multiple regression. Mark. Ind. 2019, 30, 2. [Google Scholar]

- Cui, L.; Li, C.; Jiang, B. Consumers’ Perception deviation of Quality and safety Risk of Domestic Infant milk powder and Its Influencing Factors. J. China Agric. Univ. 2022, 27, 13. [Google Scholar]

- Xu, J.; Qin, G.; Yang, X.; Weng, Y. Comparison and exploration of imported milk powder and domestic milk powder. China. Int. Financ. Econ. 2021, 2018–7, 53–55. (In Chinese) [Google Scholar]

- Li, Y.; Jin, H.; Li, D. Consumer word-of-mouth generation in social Network context: A grounded Study based on real word-of-mouth text. Nankai Manag. Rev. 2018, 21, 12. [Google Scholar]

- De Vries, L.; Gensler, S.; Leeflang, P.S. Popularity of brand posts on brand fan pages: An investigation of the effects of social media marketing. J. Interact. Mark. 2012, 26, 83–91. [Google Scholar] [CrossRef]

- Lohan, A.; Ganguly, A.; Kumar, C.; Talukdar, A. Foreign Product Preference among Indian Consumers: The Role of Product Reviews. Word Mouth Qual. Shar. Inf. J. Inf. Knowl. Manag. 2021, 20, 2150048. [Google Scholar] [CrossRef]

- Zayed, M.F.; Gaber, H.R.; El Essawi, N. Examining the Factors That Affect Consumers’ Purchase Intention of Organic Food Products in a Developing Country. Sustainability 2022, 14, 5868. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).