1. Introduction

The central government, by manifesting its public function of distributing national income, is considered one of the main actors in socio-economic development, often assuming a constitutional and legal duty to promote the progress of society. Since the main budget functions (e.g., macro-stabilization and income distribution) are associated with central authorities, the role of local authorities in development could fall into a kind of “shadow cone”, even if the local autonomy places them as the main actors of economic and social activities, having through their competencies a high potential to influence (stimulate) the local activities and then the economic growth. Considering the decentralization trend manifested more and more within the public administration systems during recent decades, local budgets gained a more important role to play in almost all areas of the life of local communities (education, health, culture, social protection, public order and safety, economic affairs, environment, housing and community facilities, etc.). Therefore, local spending has significant potential to influence regional development if its allocative and productive efficiency is properly supported and local budgets are in “good health”, influenced by the quality of governance. Certainly, this is possible in conditions of high fiscal autonomy, promoting the responsibility and proactive attitude of local decision-makers, which enshrines the ability of local public budgets to fulfill their role as levers for influencing the economic and social life of communities.

The aim of this study is to investigate the relationship between local budget indicators of revenues and expenditures and the GDP per capita at the regional level while controlling the quality of (good) governance in the European context. We aimed to offer some empirical evidence supporting the idea that an improvement in the quality of governance, reflected in the state of local budgets could improve social welfare and enhance economic development at the local level. The sample consists of 21 countries of the European Union, and we used data extracted from the databases of Eurostat and the World Bank, for 19 years, between 2001 and 2019. We used as an independent variable the rate of change of gross domestic product at the regional level—NUTS II and 15 independent variables described in

Section 2 of the paper. The main results show that some indicators of local budgets (taxes on production and import (tpi), property income (propinc) and taxes on income and wealth (tiw), general public services (gps), economic affairs (ecaf), environmental protection (envpro), recreation, culture and religion (rcr) and social protection (sp)) exerted statistically significant positive implications on regional GDP/capita.

The current research has the following structure:

Section 2 provides a brief analysis of the literature in the field.

Section 3 presents the data and the methodology we used in order to realize the aforementioned objective of our research. In

Section 4, the empirical results are presented and discussed. In the last section, we formulated the conclusions of the study and some policy recommendations for the specialists in the field.

2. Literature Review

Consolidated local budgets can stimulate economic and social activity at the local level and can contribute to regional development through their instruments, local public expenditures, and revenues. In this sense, it could be identified numerous studies in the literature, carried out to identify and measure the effects of decentralization on economic growth and development. A research of Bojanic [

1] examined the impact of fiscal decentralization on growth for a group of twelve countries from the United States. His results show that revenue decentralization has a rather negative impact on economic growth. Regarding expenditure decentralization, the results are not very conclusive, which is similar to the results of our study. Though, the final results of this research reveal that the decentralized expenditures manifest positive effects on economic growth for developing states in the Americas. Differently from the previously mentioned research, in other study is [

2] analyzed the relationship on a sample of 23 countries of OECD for the timespan 1972–2005, using analysis techniques of type pooled mean group. The results of their research reveal that decentralization of expenditure can be associated with economic growth below normal limits, while decentralization of revenues can be associated with higher economic growth. Similar results were obtained by Rodríguez-Pose and Krøijer [

3], which indicate a negative relationship between local spending and intergovernmental transfers and a positive relationship between local taxes and the national growth rate. Though, important results are achieved by Lin and Liu [

4], demonstrating that fiscal decentralization has an important impact on economic growth in China.

However, most studies on this topic seem to show a rather negative or insignificant effect of fiscal decentralization on economic growth. Thornton [

5] conducted a study on 19 OECD countries, concluding that when local fiscal autonomy is lower, fiscal decentralization cannot manifest a statistically significant impact on economic growth. In other words, the author suggests that fiscal decentralization may manifest a positive impact on economic growth when local governments have autonomy over a large share of local fiscal resources, this being, in fact, the major impediment in most of the countries. On the other hand, we also find the need for local autonomy on the expenditures [

6] as a condition for the concretization of the positive impact of decentralization on the economy. The respective study is conducted for a group of 12 Eastern European countries from 2002 to 2008, using the General Method of Moments (GMM). The two aforementioned studies draw attention to the urgent needs concerning local public administrations (especially those in Eastern Europe) to increase the level of local financial autonomy, as well as to reduce the level of mandatory expenditures in order to enhance the growth and development of the private sector. In this sense, the results of Mladenovska and Tashevska [

7] seem to be eloquent as the authors also show that decentralization manifests a negative impact on the GDP per capita growth rate for a sample of CEE countries for the period 1999–2012. Similarly, Davoodi and Zou [

8] reveal that intergovernmental transfers have a negative impact on economic growth in developing countries.

Similar research to ours is Baskaran and Feld [

9], also conducting a panel data analysis but for a different sample of 23 countries of OECD and for a different period, 1975–2001. Their results reveal that fiscal decentralization cannot be related to economic growth, which is different from ours. Our value-added consists of the fact that some of the selected decentralization indicators have a positive and significant influence on the regional GDP per capita, thus highlighting the important role of sound local public finances in achieving objectives of regional development.

The connection between good governance, (local) fiscal consolidation, and regional development starts from the following premises. In general, the governance of a state has the significance of ensuring at this level the premises of an optimal functionality of the whole system, starting from the establishment of a common and adequate (harmonized) framework from a political, social, economic, financial, fiscal and budgetary point of view, to ensure the achievement of the objectives targeted/declared in a certain moment or time interval. Related to these, the relationship between good governance and budgetary consolidation becomes a bivalent one, and the process of budgetary consolidation (even seen as a particular episode) will be, by the nature of its link with public authority, ante-conditioned of the quality of public governance associated with the studied system and, conversely, the results of budgetary consolidation will be the basis for the configuration and evaluation of governance in that system.

In the context of our paper, we emphasize that good governance facilitates the public decision-making processes and their implementation mechanisms, thus representing one of the prerequisites for achieving the objectives of fiscal decentralization, local autonomy, and the optimal allocation and redistribution of (local) expenditures to destinations. Further, these represent essential conditions for the proper functioning of local public budgets, implicitly, for the fulfillment of their role as local economic actors of regional development. We found some relevant research regarding the positive implications of good governance for economic growth. AlShiab et al. [

10] conducted a study for 29 countries using a three stages empirical analysis. First, the authors estimated the impact of the six World Governance Indicators of the World Bank on economic growth, then computed a global governance index and tested its effects on economic growth. The paper shows that the quality of governance has positive effects on economic growth both for developed and developing countries. Emara and Jhonsa [

11] also examined the effects of the Worldwide Governance Indicators on economic growth in a sample of 197 countries. They used a two-stage least square model showing that there is a bidirectional relationship between good governance indicators and economic growth. In line with these, Al-Naser and Hamdan [

12] investigated the way public governance exerts its influence on the economic growth of the countries of the Gulf Cooperation Council for the years 1996 to 2019. The results confirm that the most important indicators exerting positive and significant influence on economic growth are control of corruption and the rule of law, followed by government effectiveness and regulatory quality. Similar results were obtained by Bayar [

13] and Al-Naser [

14]. Finally, even though the literature is inconclusive concerning the relationship between fiscal decentralization and economic growth [

15], from our point of view, there is not any doubt concerning the capacity of sound local finances to achieve the objectives of economic growth and of (regional) development, (e.g., poverty reduction and decrease in regional disparities). In this sense, the targeted results are conditioned in each country by the quality of governance, the quality of institutions, fiscal reforms, and sound fiscal consolidation.

3. Data and Methodology

In this study, we propose the analysis of the implications of local public finances on regional development from the empirical perspective of a sample of 21 EU Member States. We selected only 21 countries from the 27 EU Member States because of data availability. The independent variables are represented by various indicators of local public revenues and expenditures: taxes on production and imports (tpi), property income (propinc), current taxes on income and wealth (tiw), capital transfers (caprev), and local public expenditures for general public services (gps), public order and safety (pos), economic affairs (ecaf), environmental protection (envpro), housing and community amenities (hca), recreation, culture and religion (rcr), education (edu), and social protection (sp).). Most of these have been used in other studies as follows. Rodríguez-Pose and Krøijer [

3] also selected subnational government revenues as tax revenue of subnational governments and intergovernmental transfers, and Davoodi and Zou [

8] also included in their research the intergovernmental transfers. On the spending side, the various components of expenditures were used in other research also: Oprea et al. [

16]—the main functions of local budgets; Jeong et al. [

17]—all categories of expenditures included in COFOG (Classification of the Functions of Government).

The control variables are the average of the indicators of good governance—wgi, associated with a variable of budgetary consolidation in a broad sense, the data being collected and processed from the statistical records of the World Bank, the inflation rate, and the long-term interest rate, intrst (representing the convergence criterion for Economic and Monetary Union, established by the Maastricht Treaty)—with both of them being indicators of the side of public monetary policy (this also being a tool in stabilizing the economy, achieving the objectives of growth and development). The indicators of good governance of the World Bank are obtained by applying surveys to a large number of respondents (both individuals and legal entities) from developed countries and developing countries. Therefore, they reflect the opinion of the respondents participating in the surveys and not the official opinion of the World Bank nor of its executive directors. The score of each indicator varies between a minimum −2.5 and a maximum 2.5.

The dependent variable is the rate of change in the gross domestic product at the regional level—NUTS II. This is in line with Gemmell et al. [

2], Abdellatif et al. [

6] and Mladenovska and Tashevska [

7].

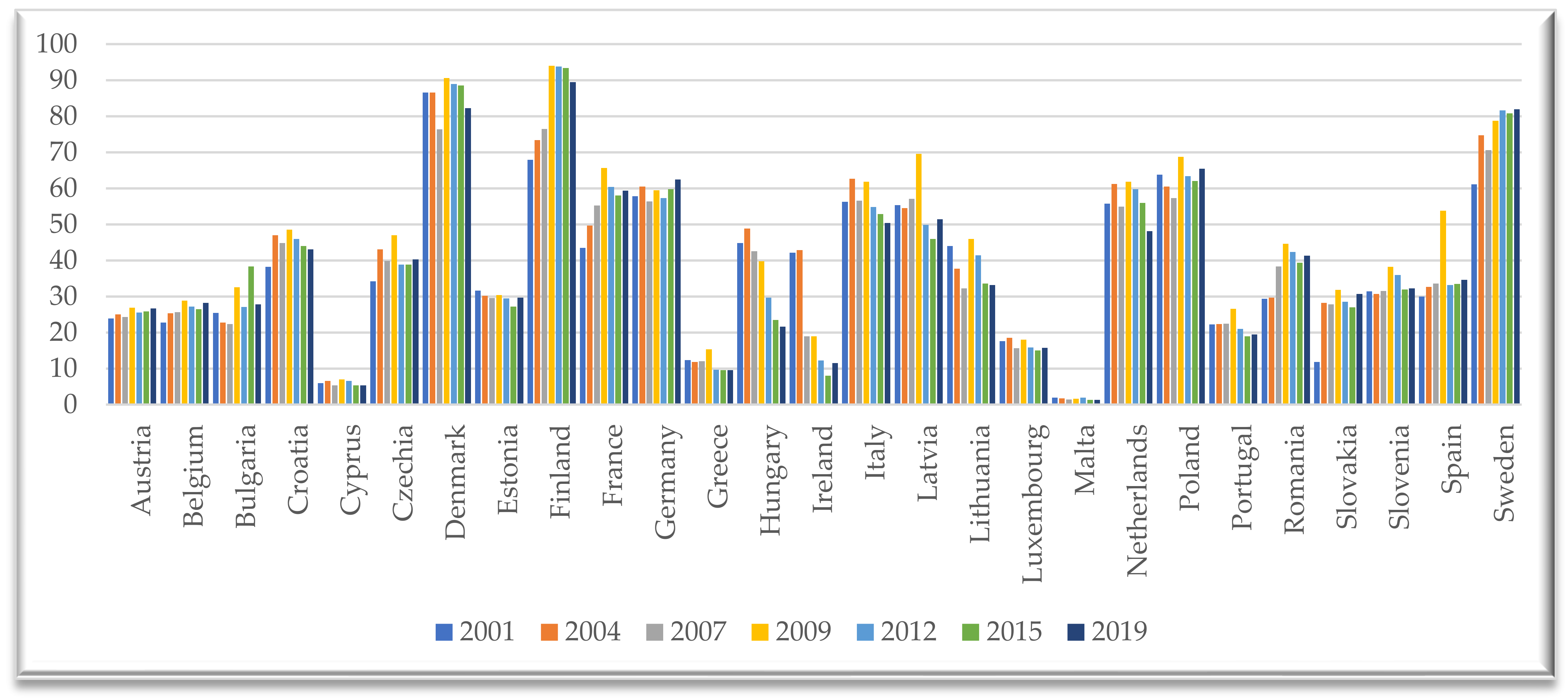

As it is already known, the European “landscape” of fiscal decentralization is a heterogeneous one. In general, it could be observed great differences between the countries from the North and those from the rest of the European Union. The level of expenditures and revenues decentralization is provided in

Figure 1 and

Figure 2, computed as the percentage of the central government expenditures and revenues.

The countries with the higher level of fiscal decentralization are Denmark, Finland, and Sweden (with levels of fiscal decentralization between 80% and 90%). These are followed by countries such as Germany, the Netherlands, France, and Poland. The lowest level of fiscal decentralization is reported by Malta (which is an exception because of its restricted national territory), Cyprus, Greece, and Ireland.

Possibly, it is no coincidence that the countries with the highest level of fiscal decentralization are considered some of the most developed countries. However, the differences in the matter of fiscal decentralization in the European context may be based on the governing regime, the internal territorial structure, and other specific conditions of each country regarding the organization of its budgetary system. Achieving fiscal decentralization at the highest possible level implies benefits both in terms of meeting the needs of local authorities, as well as benefits in terms of streamlining public financial flows. An essential precondition for meeting the expected benefits of decentralization is that each decentralized expenditure is accompanied by a legally stable and predictable source of income. This is necessary in order not to affect the local financial autonomy or possibly increase it, as well as the responsibility of the local public managers. These represent prolific conditions for local governments to activate as responsible actors in their subnational territories as there it could be possible for their contribution to regional development to be felt by all and to be evaluated as such.

The description of the variables used is represented in

Table 1. We employed the rate of change in order to highlight the impact of dynamics over time on regional development.

In line with the results of previous research by Davoodi and Zou [

8], Lin and Liu [

4], Rodríguez-Pose and Krøijer [

3], Abdellatif et al. [

6], and Bojanic [

1] for each of the explanatory variables, we assume the following hypotheses.

Rate of change in local revenues from taxes on production and imports (tpi): they are associated with indirect taxes, as own fiscal resource of local budgets can have a positive effect on development;

Rate of change in local property income (propinc): they are associated with direct taxes, constituting own fiscal resources of local budgets and offering autonomy to local authorities in their use; they lead to a positive influence on the level of development; We assume similar results in the case of the rate of change in local income from current taxes on income, wealth (tiw);

Rate of change in local revenues from capital transfers (caprev): as they increase the local financial autonomy, they can have a positive impact on local economic development;

Rate of change in general public services (gps): we assume a small influence on development because these represent current expenditures without having concrete material purposes;

Rate of change in public order and safety (pos): we admit positive effects on development, as these are intended to ensure an adequate environment for social and economic activities;

Rate of change in economic affairs expenditures (ecaf): these have a significant impact on regional development, as they usually represent investments expenditures; We assume a similar impact in the case of the rate of change of environmental protection (envpro) and in the case of the rate of change in housing and community amenities expenditures (hca);

Rate of change in education expenditures (edu): as investments in human capital and material infrastructure related to education, they produce a favorable outcome on development; similarly, rate of change in recreation, culture, and religion expenditures (rcr);

Rate of change in social protection expenditures (sp): they harm regional development, as these cannot be associated with a creative capacity in the economy;

Rate of change in the average of good governance indicators (wgi): as an alternative to fiscal consolidation in the broadest sense, we assume a positive influence on development;

Inflation rate change (infl): it can also manifest a positive and negative impact on regional development;

Long-term interest rate change (intrst): a high level of the interest rate may negatively affect development.

The selected sample consists of 21 Member States of the European Union (selected according to the availability of statistical data)—Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Finland, Germany, Greece, Italy, Latvia, Lithuania, Luxembourg, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, and Hungary. We used data taken from the Eurostat and World Bank databases for a period of 19 years, from 2001 to 2019.

Table 2 presents the statistical description of the selected variables.

The panel data selected have 380 observations. The values of the dependent variable range between a maximum of 32.609 and a minimum of −21.43, the mean is 4.875, and the standard deviation is equal to 6.289.

Model Specification

The analysis it is realized on is the panel data of 21 EU Member States (selected based on data availability) for a period of 19 years, from 2001 to 2019, to evaluate the effects of public finances on the GDP per capita at the regional level in the European space. According to the first test, the variables are stationary (see

Appendix A). When selecting the model, the criteria were based on the construction of three OLS regressions—with fixed effects and with random effects and simple—to test the cross-section dependence, but the hypothesis was violated for each of them, as the Pesaran test has a probability less than 0.05 (see

Appendix B). The hypothesis of the normality of the errors was also violated, according to the Jarque–Bera Test (see

Appendix C). Therefore, the econometric model used is the Generalized Linear Model (GLM).

The general form of the equation is —the linear combination of predictors.

4. Results and Discussion

The results we obtained by the aforementioned model, GLM, for the dependent variable, the rate of change of GDP/inhabitant at the regional level-NUTS II, are presented in

Table 3 (

Appendix D).

According to the model results, the variables on the local government revenue side regarding the rate of change in production and import income (tpi), property income (propinc), and current taxes on income and wealth (tiw) have a positive and significant influence on the rate change of GDP/capita, with coefficients of 0.0303, 0.0345 and 0.0326. Similar results were obtained by: Oprea et al. [

16], and Rodríguez-Pose and Krøijer [

3]. Thus, for example, as the rate of change in production and import income increases, it determines an increase in the rate of change in GDP/capita at the NUTS II regional level by 0.0303 units. The results provide expression to the assumptions of our research and reflect significant empirical evidence on the role of local public finances in regional development. These must be interpreted from the perspective of the level of local autonomy. A high level of local financial autonomy can automatically involve increasing the responsibility and financial autonomy of local public managers as a premise for the efficiency of local public financial resources and, therefore, for better fulfillment of local public needs.

The variable rate of change in capital transfers (caprev) has a negative and statistically insignificant impact on the change rate in GDP/capita, suggesting a certain fragility of this source of revenue for local public budgets, in the sense of insufficiently clear regulation and or in the sense of a relatively low volume of this source of income. This is in line with Davoodi and Zou [

8], revealing that transfers from the central to local level involve negative effects on economic growth in developing countries.

As for local expenditures, general public services (gps), economic affairs (ecaf), environmental protection (envpro), recreation, culture and religion (rcr), and social protection (sp) manifest a positive and significant influence on the regional GDP per capita, highlighting on this side of local public finances, their important role in regional development. Similar results were obtained by Dziemianowicz et al. [

18] and Carniti et al. [

19]. It should be emphasized that the formulation of local political programs must focus in particular on expenditure on economic affairs, which has direct implications for the economic side of development. At the same time, it is necessary to prioritize the expenses for recreation, culture, and religion, as they have implications on a balanced psycho-social climate, which generally conditions the level of performance of a social group. In terms of environmental protection spending, the impact on development is also indirect, aiming at combating pollution and maintaining a clean environment as a prerequisite for maintaining the health of the population, preserving and regenerating natural resources, and, therefore, for the normal development of economic and social relations.

Regarding the rate of change in social protection (sp) and general public services (gsp) the results are contrary to our expectations. Thus, although they are associated with public consumption expenditures, which are unproductive, the results of the analysis show that they cause positive changes in GDP/capita. The results are similar to the study by Devarajan et al. [

20], according to which the current expenditures present a positive influence on the economy. For our analysis, a possible explanation refers to the fact that these categories of expenditures have a larger volume in the daily consumption of the beneficiaries, although their relative size may be low for several countries in the selected sample (e.g., western, central, northern). Even if the effect of the rate of increase in social protection on the rate of change of regional GDP is positive, this should certainly not imply policies/actions to encourage social assistance. Local and central public managers must create more rigorous legal framework premises in order to rationally diminish the multitude of beneficiaries, which means establishing a clear source of funding and well-defined criteria for determining eligible beneficiaries and balancing the implementation of sustainable economic development policies.

Regarding the impact of the rate of change in expenditure on general public services (gsp) on the rate of change in GDP/capita, the explanations are similar, these being allocated to the salaries of civil servants and other current government expenditure, which by their nature do not directly present a creative capacity in the economy, but have some multiplier effects.

Local spending on public order and safety (pos) and education (edu) also manifest positive but statistically insignificant effects on GDP/capita, while local spending on housing and community amenities (hca) has a negative and insignificant impact. Possible explanations may relate to the misallocation of public resources to the destinations mentioned (e.g., mandatory and centrally managed) without being based on real needs at the community level. Furthermore, their relatively low level in total local spending implies a weak contribution to growth and development processes. On the other hand, it should be noted that for some expenditures, the effects on development are highlighted and evaluated after long periods. The result for education expenditure is also in line with Devarajan et al. [

20]. When making the estimates, the authors included education expenditures in the category of productive expenditures, and contrary to expectations, they obtained negative or insignificant results on economic growth.

For public order and safety expenditures, the possible explanations refer to the characteristics of the services provided at this level of administration, so their impact is rather an indirect one. Thus, although they create preconditions for the safety of society in general, such implications on GDP growth may be difficult to evaluate. Similarly, Sijabat [

21] shows that public order and safety spending has a negative impact on economic growth. The author is of the opinion that their positive impact could be visible in the long run.

As regards the control variables, good governance indicators and the long-term interest rate manifest negative and insignificant effects, while the inflation rate exerts a positive and insignificant impact.

By ranking depending on the calculated coefficient, the variables of interest (having a higher impact on the rate of change of GDP/inhabitant) are the rate of change of spending on recreation, culture and religion (rcr), economic affairs (ecaf), environmental protection (envpro), followed by social protection expenditure (sp), property income (propinc), current tax on income and wealth (tiw), taxes on production and import (tpi), and local general public service expenditure (gps).

To test the robustness of the results, we further estimated the model for shorter time spans again, first for the period 2001–2006 and later for the period 2007–2019. The results obtained by the Generalized Linear Model (GLM) for the period 2001–2006 are presented in

Table 4.

By recomputation the equation for the time span 2001–2006, it is outlined the results robustness for many of the variables included in the model, especially for those of interest. Thus, for the years 2001–2006, on the side of local revenues, we attained positive and significant results for taxes on production and imports (tpi) and current taxes on income and wealth (tiw), similar to the results of the initial equation. The results are also robust for local revenues from capital transfers (caprev), which are negative and statistically insignificant in both cases.

On the local spending side, the results are robust for: spending on economic affairs (ecaf), environmental protection (envpro), religion, culture, and recreation (rcr), being positive and statistically significant and spending on education (edu), being positive but statistically insignificant.

The results of the equation are different for property income (propinc); when the time interval decreases, the impact on the rate of change of GDP/capita becomes insignificant. Similar results are obtained for the expenditures for general public services (gps) and those for social protection (sp), in fact, reflecting their unproductive character on the economy, confirming the hypotheses stated at the beginning of the study.

Also, the robustness test includes the re-estimation of the equation for the time interval 2007–2019 (

Table 5).

In this case, the results are robust for the following variables: rate of change for taxes on production and imports (tpi), property income (propinc), expenditure on economic affairs (ecaf), environmental protection (envpro), recreation, culture and religion (rcr), being statistically positive and significant. We even obtained similar results for general public service (gps) and social protection (sp) spending. The results are also robust for the variables rate of change of local revenues from capital transfers (caprev)—negative and statistically insignificant—and for the rate of change of local expenditures for education (edu)—positive and statistically insignificant.

Regarding the variable rate of change in the average of good governance indicators (wgi), being associated with a broader budgetary consolidation alternative (of qualitative type), the results show that this time the impact is positive and significant but different from the results of the first two equations, where the impact is negative. The positive impact of good governance indicators on economic growth also are exhibited by Emara and Jhonsa [

11], Bayar [

13], and AlShiab et al. [

10]. Although fragile, however, our results are optimistic and should be of new interest to political leaders. An example of how governance positively influences budget consolidation is the adherence to the principles of transparency, participation, equity, efficiency (allocation and productivity of public resources), etc., which is a favorable premise for combating the underground economy and reducing public debt, a solution which could be much more effective than raising taxes, as is often the case and is easier to follow. By the logic of the relationship between good governance and fiscal consolidation, the orientation towards promoting the principles of good governance regarding the act of governing a state marks a structural approach to the origin of dysfunctions in terms of budget consolidation, offering the possibility of resolving them by removing the cause, as is natural, avoiding the formulation of short-term surface solutions (which can have several negative long-term implications, most often).

5. Conclusions

In this study, we analyzed the impact of local budget revenues and expenditures on regional development in the European context in order to strengthen the fact that they have a defining potential to achieve the objectives of well-being and regional development. The dependent variable is the change rate of GDP/capita at the regional level, NUTS II, and the independent variables are 12 indicators of local budget revenues and expenditures according to the functional classification of public expenditure. We also used three control variables: average of good governance indicators, associated with a broad-based fiscal consolidation variable, inflation rate, and long-term interest rate, the last representing variables on the side of monetary policy.

The results of the Generalized Linear Model show that the variables on the local government revenue side regarding the rate of change in taxes on production and import (tpi), property income (propinc), and taxes on income and wealth (tiw) have a positive and significant influence on GDP/capita change rates. On the side of local government spending, general public services (gps), economic affairs (ecaf), environmental protection (envpro), recreation, culture and religion (rcr), and social protection (sp) have a positive and significant influence on the regional GDP per capita, highlighting on this side of local public finances, their important role in regional development. Reporting to this, we believe that, further (especially in the countries of South-Eastern Europe), local fiscal autonomy and local decision-making autonomy must be increased, and local public spending must be streamlined, as parts of a broad and coherent process of consolidating public finances, in order to create opportunities to lead viable regional development projects, to fight poverty, to reduce disparities, and to consecrate the role of local budgets as a promoter of local prosperity, growth, and development.

When relating to our research and its results, our policy recommendations mainly refer to the increase in the financial autonomy of local governments and the optimization of the structure of local spending. Specifically, we formulate the following policy recommendations:

- ▪

strengthening local financial autonomy by consolidating the fiscal base and optimizing its flexibility and stability, and also increase in non-tax revenues;

- ▪

establishing some objective criteria regarding the realization of inter-administrative transfers;

- ▪

it is recommended to optimize the ratio between current and capital expenditures, so in recession times, aiming to increase investment expenditures and decrease current (unproductive) expenditures;

- ▪

avoidance of mandatory financing of local public spending, it is preferable to establish stable and predictable sources of income and judicial substantiation of current expenditures;

- ▪

strengthening budgetary control (anterior, concomitant, and posterior), this being followed by possible incentives/penalties;

- ▪

inclusion in public policy programs of explicit objectives regarding the compliance of public authorities with the principles of good governance and their observance;

- ▪

evaluating the application of the principles of good governance by political leaders through representatives of specialized agencies and explicitly presenting the results of the control in public reports;

The main limitations of the study refer to the selected sample and the time period, which keeps reservations about the results obtained. Different results may be obtained for a longer period of time, for a large sample of countries but also if including other macroeconomic variables.

The future research directions we are looking for are related to a more elaborate analysis of the causal (empirical) relationship between good governance and fiscal consolidation, with encouraging premises in this regard, according to the results of our study, which empirically confirm the positive relationship between good governance and regional development. Another future direction of research refers to a more in-depth analysis of institutions as an essential pillar of governance and their impact on development or the influence it exerts on budget consolidation if we refer mainly to profile institutions (e.g., Fiscal Council).