Economic Policy Uncertainty, Social Financing Scale and Local Fiscal Sustainability: Evidence from Local Governments in China

Abstract

:1. Introduction

2. Literature Review

3. Research Methods

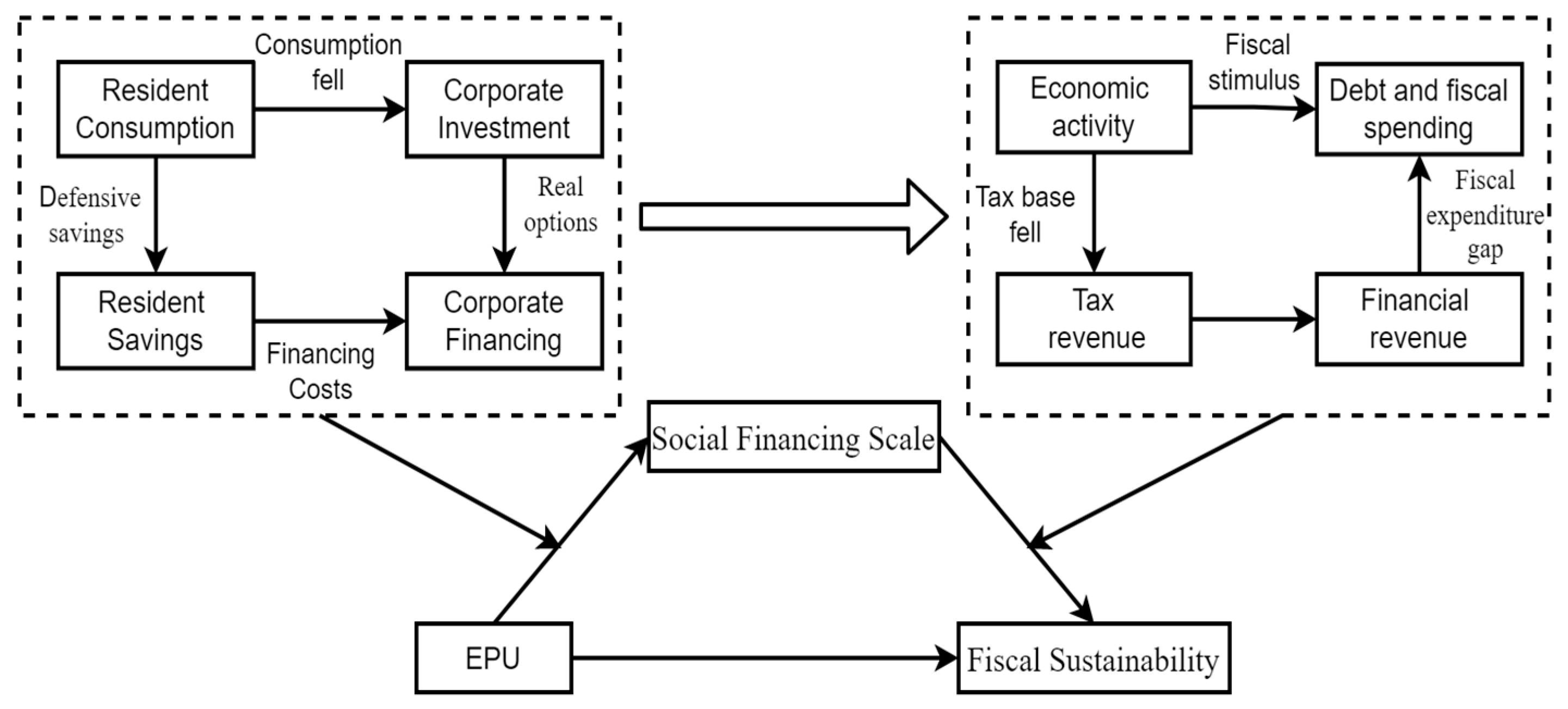

3.1. Research Hypothesis

- The direct impact of EPU on local fiscal sustainability

- The mediating effect of the social financing scale in the relationship between EPU and fiscal sustainability

3.2. Research Variables

- Dependent variable

- Independent variables

- Mediating variables

- Control variables

3.3. Research Methods & Models

3.4. Experiments

3.4.1. Sample and Data

3.4.2. Experiments Protocol

4. Findings

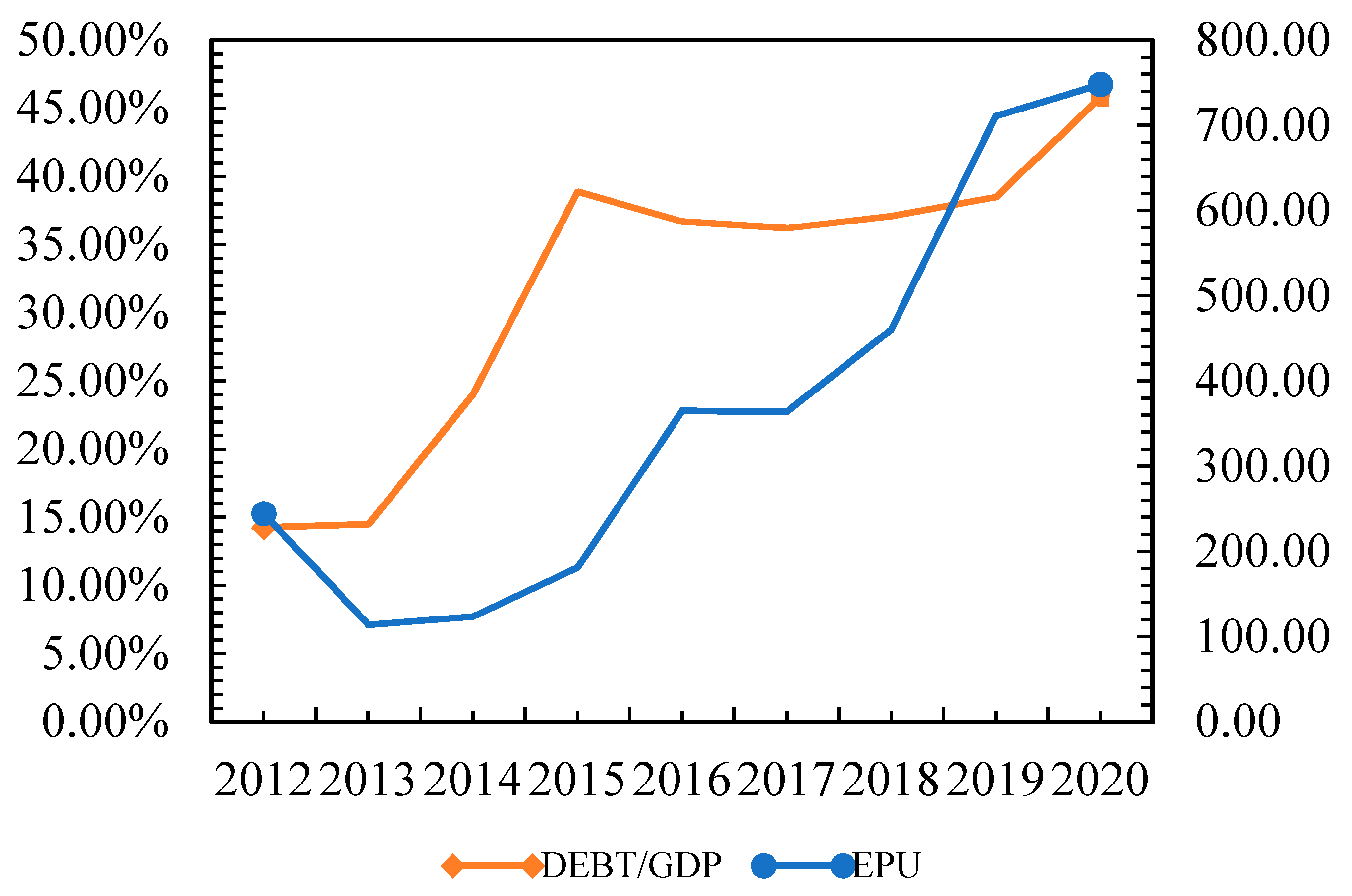

4.1. Descriptive Statistics

4.2. Test Results of the Main Hypothesis

4.3. Test Results of the Mediation Effect

4.4. Endogenous Test Results

5. Discussion and Conclusions

5.1. Discussion

5.2. Managerial Implications

5.3. Limitations and Future Work

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wen, F.; Li, C.; Sha, H.; Shao, L. How does economic policy uncertainty affect corporate risk-taking? Evidence from China. Financ. Res. Lett. 2020, 41, 101840. [Google Scholar] [CrossRef]

- Iyke, B.N. Economic Policy Uncertainty in Times of COVID-19 Pandemic. Asian Econ. Lett. 2020, 1, 17665. [Google Scholar] [CrossRef]

- Jiang, Y.; Tian, G.; Wu, Y.; Mo, B. Impacts of geopolitical risks and economic policy uncertainty on Chinese tourism-listed company stock. Int. J. Financ. Econ. 2020, 27, 320–333. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring Economic Policy Uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Istiak, K.; Serletis, A. Economic policy uncertainty and real output: Evidence from the G7 countries. Appl. Econ. 2018, 50, 4222–4233. [Google Scholar] [CrossRef]

- Phan DH, B.; Iyke, B.N.; Sharma, S.S.; Affandi, Y. Economic policy uncertainty and financial stability–Is there a relation? Econ. Model. 2021, 94, 1018–1029. [Google Scholar] [CrossRef]

- Bloom, N. The Impact of Uncertainty Shocks. Econometrica 2009, 77, 623–685. [Google Scholar] [CrossRef] [Green Version]

- Kang, W.; Lee, K.; Ratti, R.A. Economic policy uncertainty and firm-level investment. J. Macroecon. 2014, 39, 42–53. [Google Scholar] [CrossRef] [Green Version]

- Leduc, S.; Liu, Z. Uncertainty shocks are aggregate demand shocks. J. Monetary Econ. 2016, 82, 20–35. [Google Scholar] [CrossRef] [Green Version]

- Hardouvelis, G.A.; Karalas, G.; Karanastasis, D.; Samartzis, P. Economic policy uncertainty, political uncertainty and the greek economic crisis. Political Uncertain. Greek Econ. Crisis 2018. [Google Scholar] [CrossRef] [Green Version]

- Devarajan, S.; Swaroop, V.; Zou, H.-F. The composition of public expenditure and economic growth. J. Monet. Econ. 1996, 37, 313–344. [Google Scholar] [CrossRef] [Green Version]

- Taha, R.; Loganathan, N. Causality between tax revenue and government spending in Malaysia. Int. J. Bus. Financ. Res. 2008, 2, 63–73. [Google Scholar]

- Roşoiu, I. The Impact of the Government Revenues and Expenditures on the Economic Growth. Procedia Econ. Financ. 2015, 32, 526–533. [Google Scholar] [CrossRef] [Green Version]

- Vasconcelos, V.V. Social justice and sustainable regional development: Reflections on discourse and practice in public policies and public budget. Insights Reg. Dev. 2021, 3, 10–28. [Google Scholar] [CrossRef]

- Buckle, R.A.; Cruickshank, A.A. The Requirements for Long-Run Fiscal Sustainability; New Zealand Treasury: Wellington, New Zealand, 2013; Available online: http://hdl.handle.net/10419/205644 (accessed on 22 November 2020).

- Vaquero-García, A.; Cadaval-Sampedro, M.; Lago-Peñas, S. Do Political Factors Affect Fiscal Consolidation? Evidence from Spanish Regional Governments. SAGE Open 2022, 12, 21582440221085002. [Google Scholar] [CrossRef]

- Bulow, J.; Reinhart, C.; Rogoff, K.; Trebesch, C. The debt pandemic. Financ. Dev. 2020, 57. Available online: https://isni.org/isni/0000000404811396 (accessed on 18 May 2021).

- Bohn, H. The Behavior of U. S. Public Debt and Deficits. Q. J. Econ. 1998, 113, 949–963. [Google Scholar] [CrossRef]

- Ghosh, A.R.; Kim, J.I.; Mendoza, E.G.; Ostry, J.D.; Qureshi, M.S. Fiscal fatigue, fiscal space and debt sustainability in advanced economies. Econ. J. 2013, 123, F4–F30. [Google Scholar] [CrossRef]

- Li, T.; Du, T. Vertical fiscal imbalance, transfer payments, and fiscal sustainability of local governments in China. Int. Rev. Econ. Financ. 2021, 74, 392–404. [Google Scholar] [CrossRef]

- Caldara, D.; Iacoviello, M.; Molligo, P.; Prestipino, A.; Raffo, A. The economic effects of trade policy uncertainty. J. Monet. Econ. 2020, 109, 38–59. [Google Scholar] [CrossRef]

- Cong, L.W.; Gao, H.; Ponticelli, J.; Yang, X. Credit allocation under economic stimulus: Evidence from China. Rev. Financ. Stud. 2019, 32, 3412–3460. [Google Scholar] [CrossRef]

- Chatjuthamard, P.; Wongboonsin, P.; Kongsompong, K.; Jiraporn, P. Does economic policy uncertainty influence executive risk-taking incentives? Financ. Res. Lett. 2019, 37, 101385. [Google Scholar] [CrossRef]

- Shen, S. The Contrastive Empirical Study of Social Financing Scale Increment and Stock. J. Math. Financ. 2020, 10, 377–387. [Google Scholar] [CrossRef]

- Bhagat, S.; Ghosh, P.; Rangan, S. Economic policy uncertainty and growth in India. Econ. Political Wkly. 2016, 51, 72–81. [Google Scholar] [CrossRef] [Green Version]

- Julio, B.; Yook, Y. Political Uncertainty and Corporate Investment Cycles. J. Financ. 2012, 67, 45–83. [Google Scholar] [CrossRef]

- Kaviani, M.S.; Kryzanowski, L.; Maleki, H.; Savor, P. Policy uncertainty and corporate credit spreads. J. Financ. Econ. 2020, 138, 838–865. [Google Scholar] [CrossRef]

- Gulen, H.; Ion, M. Policy Uncertainty and Corporate Investment. Rev. Financ. Stud. 2015, 29, 523–564. [Google Scholar] [CrossRef]

- Bekaert, G.; Hoerova, M.; Duca, M.L. Risk, uncertainty and monetary policy. J. Monet. Econ. 2013, 60, 771–788. [Google Scholar] [CrossRef] [Green Version]

- Jurado, K.; Ludvigson, S.C.; Ng, S. Measuring uncertainty. Am. Econ. Rev. 2015, 105, 1177–1216. [Google Scholar] [CrossRef]

- Ashraf, B.N. Is Economic Uncertainty a Risk Factor in Bank Loan Pricing Decisions? International Evidence. Risks 2021, 9, 81. [Google Scholar] [CrossRef]

- Balli, F.; Billah, M.; Balli, H.O.; Gregory-Allen, R. Economic uncertainties, macroeconomic announcements and sukuk spreads. Appl. Econ. 2020, 52, 3748–3769. [Google Scholar] [CrossRef]

- Bloom, N.; Floetotto, M.; Jaimovich, N.; Saporta-Eksten, I.; Terry, S.J. Really Uncertain Business Cycles. Econometrica 2018, 86, 1031–1065. [Google Scholar] [CrossRef]

- Born, B.; Pfeifer, J. Policy risk and the business cycle. J. Monet. Econ. 2014, 68, 68–85. [Google Scholar] [CrossRef] [Green Version]

- Han, X.; Chen, K.; Huang, X. Economic Policy Uncertainty and Corporate Mergers and Acquisitions. J. Econ. Sci. Res. 2020, 3. [Google Scholar] [CrossRef]

- Zhu, Y.; Sun, Y.; Xiang, X. Economic policy uncertainty and enterprise value: Evidence from Chinese listed enterprises. Econ. Syst. 2020, 44, 100831. [Google Scholar] [CrossRef]

- Panousi, V.; Papanikolaou, D. Investment, idiosyncratic risk, and ownership. J. Financ. 2012, 67, 1113–1148. [Google Scholar] [CrossRef] [Green Version]

- Suh, H.; Yang, J.Y. Global uncertainty and Global Economic Policy Uncertainty: Different implications for firm investment. Econ. Lett. 2021, 200, 109767. [Google Scholar] [CrossRef]

- Iuga, I.C.; Mihalciuc, A. Major Crises of the XXIst Century and Impact on Economic Growth. Sustainability 2020, 12, 9373. [Google Scholar] [CrossRef]

- Chen, Y.; Shen, X.; Wang, L. The Heterogeneity Research of the Impact of EPU on Environmental Pollution: Empirical Evidence Based on 15 Countries. Sustainability 2021, 13, 4166. [Google Scholar] [CrossRef]

- Barraza, S.; Civelli, A. Economic policy uncertainty and the supply of business loans. J. Bank. Financ. 2020, 121, 105983. [Google Scholar] [CrossRef]

- Pan, W.F.; Wang, X.; Yang, S. Debt maturity, leverage, and political uncertainty. N. Am. J. Econ. Financ. 2019, 50, 100981. [Google Scholar] [CrossRef]

- Parker, J.A.; Souleles, N.S.; Johnson, D.S.; McClelland, R. Consumer spending and the economic stimulus payments of 2008. Am. Econ. Rev. 2013, 103, 2530–2553. [Google Scholar] [CrossRef] [Green Version]

- Senthilnathan, S. Relationships and Hypotheses in Social Science Research. 2017. Available online: https://ssrn.com/abstract=3032284 (accessed on 25 October 2021).

- Goldstein, I.; Koijen RS, J.; Mueller, H.M. COVID-19 and its impact on financial markets and the real economy. Rev. Financ. Stud. 2021, 34, 5135–5148. [Google Scholar] [CrossRef]

- Li, X.; Liu, B.; Tian, X. Policy Uncertainty and Household Credit Access: Evidence from Peer-to-Peer Crowdfunding. PBCSF-NIFR Research Paper, 2018. Available online: https://ssrn.com/abstract=3084388 (accessed on 10 April 2021).

- Bansal, R.; Yaron, A. Risks for the Long Run: A Potential Resolution of Asset Pricing Puzzles. J. Financ. 2004, 59, 1481–1509. [Google Scholar] [CrossRef] [Green Version]

- Duong, H.N.; Nguyen, J.H.; Nguyen, M.; Rhee, S.G. Navigating through economic policy uncertainty: The role of corporate cash holdings. J. Corp. Financ. 2020, 62, 101607. [Google Scholar] [CrossRef]

- Fajgelbaum, P.D.; Schaal, E.; Taschereau-Dumouchel, M. Uncertainty traps. Q. J. Econ. 2017, 132, 1641–1692. [Google Scholar] [CrossRef]

- Tran, Q.T. Economic policy uncertainty and cost of debt financing: International evidence. N. Am. J. Eco-Nomics Financ. 2021, 57, 101419. [Google Scholar] [CrossRef]

- Valencia, F. Aggregate uncertainty and the supply of credit. J. Bank. Financ. 2017, 81, 150–165. [Google Scholar] [CrossRef] [Green Version]

- Chi, Q.; Li, W. Economic policy uncertainty, credit risks and banks’ lending decisions: Evidence from Chinese commercial banks. China J. Account. Res. 2017, 10, 33–50. [Google Scholar] [CrossRef]

- Demir, E.; Ersan, O. Economic policy uncertainty and cash holdings: Evidence from BRIC countries. Emerg. Mark. Rev. 2017, 33, 189–200. [Google Scholar] [CrossRef]

- Bajaj, M.Y.; Kashiramka, S.; Singh, S. Economic policy uncertainty and leverage dynamics: Evidence from an emerging economy. Int. Rev. Financ. Anal. 2021, 77, 101836. [Google Scholar] [CrossRef]

- Biolsi, C.; Kim, H.Y. Analyzing state government spending: Balanced budget rules or forward-looking decisions? Int. Tax Public Financ. 2021, 28, 1035–1079. [Google Scholar] [CrossRef]

- Pradhan, K. Analytical Framework for Fiscal Sustainability: A Review. Rev. Dev. Chang. 2019, 24, 100–122. [Google Scholar] [CrossRef]

- Lin, Y.C.; Deng, W.S. Does the Feldstein–Horioka relationship vary with economic policy uncertainty? Appl. Econ. Lett. 2021, 28, 1187–1194. [Google Scholar] [CrossRef]

- Köthenbürger, M. Tax Competition and Fiscal Equalization. Int. Tax Public Financ. 2002, 9, 391–408. [Google Scholar] [CrossRef]

- Liu, Z. Land-based finance and property tax in China. Area Dev. Policy 2019, 4, 367–381. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Canes-Wrone, B.; Davis, S.J.; Rodden, J. Why has US policy uncertainty risen since 1960? Am. Econ. Rev. 2014, 104, 56–60. [Google Scholar] [CrossRef] [Green Version]

- Gopalakrishnan, B.; Jacob, J.; Mohapatra, S. Government Responses, Business Continuity, and Management Sentiment: Impact on Debt Financing during COVID-19; Indian Institute of Management Ahmedabad, Research and Publication Department: Ahmedabad, India, 2021; Available online: http://hdl.handle.net/11718/25479 (accessed on 25 February 2022).

- Hall, R.E. Fiscal stability of high-debt nations under volatile economic conditions. Ger. Econ. Rev. 2014, 15, 4–22. [Google Scholar] [CrossRef] [Green Version]

- Imai, K.; Kim, I.S. On the use of two-way fixed effects regression models for causal inference with panel data. Political Anal. 2021, 29, 405–415. [Google Scholar] [CrossRef]

- Petersen, M.A. Estimating standard errors in finance panel data sets: Comparing approaches. Rev. Financ. Stud. 2009, 22, 435–480. [Google Scholar] [CrossRef] [Green Version]

- Zhang, S.; Collins, A.R.; Etienne, X.L.; Ding, R. The Environmental Effects of International Trade in China: Measuring the Mediating Effects of Technology Spillovers of Import Trade on Industrial Air Pollution. Sustainability 2021, 13, 6895. [Google Scholar] [CrossRef]

- Staiger, D.; Stock, J.H. Instrumental Variables Regression with Weak Instruments. Econometrica 1997, 65, 557–563. [Google Scholar] [CrossRef]

| Variable Type | Variable Name | Variable Abbreviation | Variable Description |

|---|---|---|---|

| Explanatory variables | Fiscal sustainability | SUSTAIN | Balanced relationship between fiscal revenue and debt |

| Interpreted variables | Economic policy uncertainty | EPU | Economic Policy Uncertainty Index |

| Mediating variables | Regional social financing scale | SR | Refers to the total amount of funds received by the real economy from the financial system in a certain province in a certain period of time |

| Control variables | GDP growth rate | GGDP | (Current year regional GDP–previous year regional GDP)/previous year regional GDP |

| Fiscal deficit | FG | Local government annual fiscal expenditure—annual fiscal revenue | |

| Transfer payments | TRANSFER | Central subsidy income | |

| Fiscal decentralization | FD | Public budget revenue per capita in each province/(public budget revenue per capita in each province + public budget revenue per capita in the central government) | |

| Debt burden ratio | DEBT | Accumulated outstanding debt balance of the year/GDP | |

| Urbanization rate | URBAN | Urban population/total population | |

| Growth rate of fixed asset investment | FIG | Growth rate of fixed asset investment by provinces | |

| Percentage of land premium revenue | LTF | Land grant revenue/public budget revenue |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| SUSTAIN | 270 | 0.602 | 0.235 | 0.010 | 1.310 |

| LnEPU | 270 | 5.499 | 0.590 | 4.735 | 6.674 |

| LnSR | 270 | 8.225 | 0.967 | 4.836 | 9.960 |

| LnGGDP | 270 | 2.172 | 0.347 | 0.693 | 2.797 |

| LnFG | 270 | 16.596 | 0.674 | 14.687 | 17.875 |

| LnTRANSFER | 270 | 7.353 | 0.579 | 6.029 | 8.480 |

| LnFIG | 270 | 9.375 | 0.813 | 6.925 | 10.919 |

| LnLTF | 270 | 15.712 | 1.320 | 7.666 | 18.688 |

| URBAN | 270 | 56.905 | 12.752 | 33.810 | 89.600 |

| DEBT | 270 | 0.235 | 0.144 | 0.015 | 0.965 |

| FD | 270 | 0.737 | 0.093 | 0.533 | 0.950 |

| (1) | (2) | (3) | |

|---|---|---|---|

| SUSTAIN | SUSTAIN | SUSTAIN | |

| LnEPU | −0.247 *** | −0.126 ** | |

| (−6.06) | (−3.14) | ||

| LnGGDP | 0.0676 | 0.0483 | |

| (1.26) | (0.91) | ||

| LnFG | −0.162 *** | −0.136 *** | |

| (−5.07) | (−4.20) | ||

| LnTRANSFER | 0.197 *** | 0.184 *** | |

| (6.20) | (5.84) | ||

| LnFIG | −0.0722 * | −0.0606 * | |

| (−2.43) | (−2.06) | ||

| LnLTF | −0.00196 | −0.00519 | |

| (−0.13) | (−0.35) | ||

| URBAN | 0.0000255 | 0.000162 | |

| (0.01) | (0.08) | ||

| DEBT | −0.226 * | -0.206 * | |

| (−2.23) | (−2.07) | ||

| FD | −0.00977 | 0.0331 | |

| (−0.04) | (0.12) | ||

| Fixed Effects | Province | Province | Province |

| Year | Year | Year | |

| cons | 1.962 *** | 2.462 *** | 2.763 *** |

| (8.73) | (4.48) | (5.04) | |

| N | 270 | 270 | 270 |

| R2 | 0.133 | 0.305 | 0.333 |

| adj. R2 | 0.024 | 0.194 | 0.223 |

| F | 36.734 | 12.668 | 12.783 |

| (1) | (2) | (3) | |

|---|---|---|---|

| LnSR | LnSR | LnSR | |

| LnEPU | −0.229 * | −0.435 *** | |

| (−1.99) | (−3.72) | ||

| LnGGDP | −0.0735 | 0.213 | |

| (−0.36) | (1.08) | ||

| LnFG | 0.221 | 0.125 | |

| (1.82) | (0.99) | ||

| LnTRANSFER | −0.117 | −0.237 | |

| (−0.97) | (−1.87) | ||

| LnFIG | 0.568 *** | 0.507 *** | |

| (5.02) | (4.45) | ||

| LnLTF | −0.0115 | 0.0929 | |

| (−0.20) | (1.68) | ||

| URBAN | 0.0254 ** | 0.0150 | |

| (3.07) | (1.83) | ||

| DEBT | 0.788 * | 0.668 | |

| (2.04) | (1.69) | ||

| FD | −0.483 | −0.253 | |

| (−0.46) | (−0.24) | ||

| Fixed Effects | Province | Province | Province |

| Year | Year | Year | |

| cons | 9.210 *** | −0.846 | 2.782 |

| (15.09) | (−0.40) | (1.32) | |

| N | 270 | 270 | 270 |

| R2 | 0.029 | 0.310 | 0.330 |

| adj. R2 | −0.093 | 0.199 | 0.206 |

| F | 7.054 | 12.941 | 14.458 |

| (1) | (2) | (3) | |

|---|---|---|---|

| SUSTAIN | SUSTAIN | SUSTAIN | |

| LnEPU | −0.221 *** | −0.127 ** | |

| (−5.49) | (−3.18) | ||

| LnSR | 0.0608 *** | 0.0337 * | 0.0344 * |

| (3.92) | (1.98) | (2.05) | |

| LnGGDP | 0.0651 | 0.0456 | |

| (1.22) | (0.87) | ||

| LnFG | −0.155 *** | −0.128 *** | |

| (−4.83) | (−3.95) | ||

| LnTRANSFER | 0.193 *** | 0.180 *** | |

| (6.10) | (5.74) | ||

| LnFIG | −0.0531 | −0.0409 | |

| (−1.71) | (−1.33) | ||

| LnLTF | −0.00234 | −0.00562 | |

| (−0.15) | (−0.38) | ||

| URBAN | 0.000880 | 0.00104 | |

| (0.40) | (0.48) | ||

| DEBT | −0.199 | −0.179 | |

| (−1.96) | (−1.79) | ||

| FD | −0.0260 | 0.0169 | |

| (−0.09) | (0.06) | ||

| Fixed Effects | Province | Province | Province |

| Year | Year | Year | |

| cons | 2.316 *** | 2.434 *** | 2.737 *** |

| (9.80) | (4.45) | (5.02) | |

| N | 270 | 270 | 270 |

| R2 | 0.186 | 0.316 | 0.345 |

| adj. R2 | 0.080 | 0.203 | 0.234 |

| F | 27.142 | 11.832 | 12.08 |

| (1) | (2) | |

|---|---|---|

| LnEPU | SUSTAIN | |

| LnEPU | −0.139 ** | |

| (−2.153) | ||

| IV | 0.283 *** | |

| (4.372) | ||

| LnGGDP | −0.054 *** | 0.007 |

| (−4.231) | (0.369) | |

| LnFG | 0.288 *** | −0.356 *** |

| (4.322) | (−3.109) | |

| LnTRANSFER | −0.095 | 0.452 *** |

| (−1.345) | (5.208) | |

| LnFIG | 0.122 * | −0.032 |

| (1.960) | (−0.437) | |

| LnLTF | −0.072 ** | −0.043 |

| (−2.422) | (−1.159) | |

| URBAN | 0.011 ** | −0.004 |

| (2.538) | (−0.703) | |

| DEBT | 0.608 *** | −0.887 *** |

| 0.456 | 3.563 *** | |

| FD | (0.401) | (2.743) |

| (−1.536) | (−0.036) | |

| Fixed Effects | Province | Province |

| Year | Year | |

| cons | 2.316 *** | 2.434 *** |

| (9.80) | (4.45) | |

| N | 270 | 270 |

| R2 | 0.421 | 0.279 |

| Wald Chi-square/F | 39.89 *** | 20.972 *** |

| Stage 1 F | 16.15 *** | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xia, Y.; Hu, W.; Su, Z. Economic Policy Uncertainty, Social Financing Scale and Local Fiscal Sustainability: Evidence from Local Governments in China. Sustainability 2022, 14, 7343. https://doi.org/10.3390/su14127343

Xia Y, Hu W, Su Z. Economic Policy Uncertainty, Social Financing Scale and Local Fiscal Sustainability: Evidence from Local Governments in China. Sustainability. 2022; 14(12):7343. https://doi.org/10.3390/su14127343

Chicago/Turabian StyleXia, Yuanting, Wenxiu Hu, and Zhenxing Su. 2022. "Economic Policy Uncertainty, Social Financing Scale and Local Fiscal Sustainability: Evidence from Local Governments in China" Sustainability 14, no. 12: 7343. https://doi.org/10.3390/su14127343

APA StyleXia, Y., Hu, W., & Su, Z. (2022). Economic Policy Uncertainty, Social Financing Scale and Local Fiscal Sustainability: Evidence from Local Governments in China. Sustainability, 14(12), 7343. https://doi.org/10.3390/su14127343