1. Introduction

Electricity is an essential commodity for any economy, and its importance for the industrial sector is expected to increase significantly as the industry strives to reduce greenhouse gas emissions [

1]. At the same time, in many developing countries, the increase in industrial electricity demand is not matched by adequate investment in generation and transmission capacity, resulting in more or less frequent brownouts of electricity supply. Consequently, industrial companies are forced to rethink the future provision of electricity.

A possible solution for industry is to engage in power generation itself, employing renewable energy resources in the process, in line with climate policy targets. For an individual company, however, the high upfront investment in electricity production capacity and in the storage facilities needed to deal with the variability of renewable energy supply is a sheer, insurmountable hurdle, especially in energy-intensive industries.

Given that industrial companies are usually located in physical proximity to each other in industrial clusters, another approach is to engage in collective electricity production from renewable resources and collective demand management. The practice of collective power generation and consumption is already being demonstrated in various communities of households worldwide and is commonly referred to as “community energy systems” [

2]. Community energy systems (CES) have widely been studied and are concluded to be especially valuable in terms of self-sufficiency and sustainability, e.g., as they contribute to decreasing the amount of power loss through the grid [

3]. Despite the extensive body of literature on CESs, the establishment and performance of such energy initiatives among industrial companies within an industrial cluster have not been adequately studied [

4]. Considering the intrinsic differences between the decision-making style/process of industrial companies and households, the conditions under which an InCES can be established in an industrial cluster are worth studying.

In this paper, we study the conditions under which industrial companies located in a geographically defined industrial cluster may be willing to engage in an industrial community energy system (InCES). Although other forms of collaboration between industries exist (e.g., Industrial Symbiosis), community energy systems in a community of industrial companies have, to date, neither been established nor studied to the best of our knowledge. We use empirical research to investigate the social, economic, environmental and institutional factors affecting the willingness of industrial companies to participate in an InCES. Empirical data are collected via a survey among the CEOs of a sample of the industrial companies in Arak industrial city, Iran.

This paper is organised as follows:

Section 2 positions this research by reviewing the literature on collaborative industrial action and renewable community energy systems. In

Section 3, the methods and measures used in this study are reported.

Section 4 presents the statistical analysis of our empirical research.

Section 5 provides our discussions, and finally,

Section 6 reflects our conclusion.

2. Related Literature on Industrial Community Energy Systems

In this research, rather than focusing on the technical (e.g., Micro-grid) or business requirements (e.g., Finance), we focus on the social, economic and environmental factors that may influence the willingness of industrial companies to join an InCES. In the remainder of this section, we reflect on the literature related to (collaborative) renewable energy generation among industrial companies.

2.1. Industrial Communiy Energy System: Motivation and Challenges

As mentioned previously, establishing an InCES would be a feasible approach for industrial companies to deal with the instabilities related to their electricity provision. These instabilities can be witnessed in developing countries more vividly, mainly for two reasons. First, there is a lag between the increase in the capacity of the electricity system by utility companies and the developments in industrial clusters [

5]. Therefore, there would be a lack of capacity for the new industrial companies and for the expansion phases of the existing industries. Second, due to long drought periods in many developing countries, access to water resources needed for cooling down the power plants is limited [

6]. Therefore, the whole system faces brownouts, especially during the hot seasons of the year.

Consequently, investing in an InCES would be a bottom-up approach for the industrial companies to tackle the aforementioned challenges. Establishment of an InCES would, however, face industrial companies with a number of serious barriers. First, due to the intermittent nature of renewable resources, the process of power generation would be stochastic throughout a day [

2]. Therefore, dealing with the baseload required by the industries is a critical challenge, requiring industrial companies to invest in high-storage capacity batteries [

7]. This would confront enterprises with high upfront investments, which might not be economically feasible considering the limited access to cost-efficient batteries, particularly in developing countries. Second, investing in an InCES would bring the participating industries into a form of partnership within which ownership dilemmas, demand management and conflicts may be pressing issues [

8].

To tackle the mentioned challenges, (a) an on-grid design may be preferred to help companies deal with baseload challenges; (b) partial investments in InCES that would fulfil the excess demand (instead of the whole demand) can be promising solutions that InCES may provide.

2.2. Industrial Collaborations and Industrial Microgrids

Collaboration among industrial companies is not new. There is an extensive body of literature on industrial symbiosis (IS), a type of collaboration in which industrial companies share resources and by-products [

9]. Among various kinds of industrial ecosystems, industrial symbiosis is defined as a structured system for exchanging water, energy, or material flows, so that flows discarded by some companies as waste flows can be used as valuable inputs by other companies. This sharing of resources leads to an overall improvement in the eco-efficiency of the local industrial cluster through reduced consumption of virgin materials and reduced production of industrial waste. A successful example is Kalundborg industrial park in Denmark [

9]. The focus of industrial collaboration in IS is on optimising resource consumption and the associated economic and environmental benefits for the industrial companies involved [

9]. Whereas collaborative power generation and demand management are not known to be part of established IS communities, there are some publications that have briefly hinted at “trust” [

10,

11,

12] and “community spirit” [

13] as the potentially influential factors for a successful IS establishment, while “economic benefit” [

10,

14,

15,

16,

17,

18,

19] has been strongly emphasised in the IS domain as a crucial factor.

A key difference between IS and InCES, however, is that while geographical proximity is a crucial element for IS projects [

20], this issue might not be an essential factor for an InCES since power can be transferred from a collective power plant to and among industrial companies through the (established) electricity grid. Furthermore, while in IS, an uneven distribution of costs and benefits between the industrial companies is known as an important barrier [

21], the case of collaborative power generation in an InCES would allow each member company to invest in the project to the extent of their electricity demand.

Besides IS, it is worthwhile mentioning that there is a noticeable body of literature on industrial microgrids in which the employment of renewable resources has been discussed. Meanwhile, this cited literature mainly investigates methods to better optimise the energy/electricity management in the industrial microgrids while considering the stochastic nature of energy generation from renewable resources [

22,

23,

24,

25,

26,

27]. Despite the relevance of this body of literature to industrial electricity management, it misses the social and institutional aspects related to the establishment of InCES as an industrial microgrid and the way in which such initiatives can emerge in an industrial cluster.

2.3. Community Energy Systems

There is a vast body of literature on collective renewable electricity production in local communities of households and small businesses. Koirala et al. [

2] have provided a comprehensive review of the existing literature on CES, which are also referred to as “energy cooperatives” [

28,

29,

30,

31,

32,

33]. From this literature, many factors can be identified relevant to the successful establishment of CES, such as a lack of grid access in rural areas, especially in developing countries, where electricity cannot be obtained unless households invest in individual or community facilities [

32,

34,

35,

36]. Within the same context, in a recent publication, Joshi and Yenneti [

37] investigated cases of CES in India and concluded that the expansion and scalability of community energy projects in India, as a developing economy, need a combined policy support of both a “participatory approach” and a “top-down approach”. On the other hand, in developed economies, consumers are often willing to pay more for energy from renewable resources. For instance, 92% of Germans advocate the growth of renewable energy supply and are willing to pay more for electricity from renewable resources [

38]. Germany is one of the countries where many communities of households and small businesses have successfully established collaborative energy systems. Targeted financial incentives, such as attractive feed-in-tariffs, play an important role in the willingness of households to invest in decentralised electricity production from renewable resources [

38]. Economic stability, inflation, and interest rates are important aspects in decisions on whether or not to invest in projects with long payback periods. Environmental motivations are the major driving force behind the surge in CES implementation in many developed countries [

39]. Together with the improvements in efficiency and reliability, CESs are seen as an environmentally friendlier alternative to the centralised power supply system [

40].

The extent of social connectedness among community members is another crucial factor influencing their willingness to engage in community initiatives rather than individual actions [

28]. The stronger the community identity, the stronger the collaboration among households/citizens [

41]. The literature furthermore shows that trust is an essential condition for establishing a community energy project [

29,

42,

43]. These perceptions are typically embedded in a society’s social norms. Therefore, the chance of establishing a cooperative in a fragmented society would be marginal [

44,

45].

Speaking of the abovementioned qualities emphasises that establishing an InCES is not just a business collaboration among industries with close proximity. There are other motives, such as “trust” and “community spirit” among community members, which can act as the enabling factor for the industries to consider joining/establishing such initiatives [

5].

2.4. Identification of Potential Success Factors for InCES

All of the factors so far identified from the CES literature seem to be equally relevant for establishing community energy systems between industrial companies. Several of these factors (i.e., economic benefits, trust, and community spirit) are also highlighted as essential factors for collaboration between industrial actors in the IS literature.

In addition to these factors, we expect industrial companies to be quite sensitive about the ownership arrangement of an InCES because the capital investment will vary widely among the industrial participants, depending on, e.g., company size and energy intensity. Companies with a large electricity demand will have a stronger bearing on the necessary investments for an InCES than companies with low electricity consumption [

5]. This is unlike CES practice between households where the ownership arrangements are not considered a decisive factor influencing households’ willingness to join a CES [

2]. Nonetheless, in household CES, various ownership arrangements occur, ranging from full ownership by the community to co-ownership agreements with private or public actors [

46]. However, shared ownership can complicate cooperation in InCES as it complicates the potential exit of companies if, for some reason in the future, the partnership in this collective action is no longer beneficial for a member.

Furthermore, we assume that the company’s size can affect its willingness to join an InCES for various reasons. First, a large company has more budget to allocate for new investment projects. Second, due to the capital invested, a large company is more likely to make long-term investment decisions [

47]. Moreover, awareness regarding the availability of incentive mechanisms and knowing the benefits of RE generation is assumed to positively correlate with the industrial companies’ willingness to invest in an InCES [

2,

42,

48]. Last, energy demand is expected to be an important factor related to company size. Large companies running energy-intensive processes have to think strategically about opportunities to lower the cost of electricity use and reduce their vulnerability to service interruptions. The cost issue is critical to the risk of electricity price changes. This risk is certainly relevant in the case of Iran, where the government decides on the electricity tariff system and where consumer tariffs are heavily subsidised by surcharges on the electricity service tariffs for industry [

49].

Accordingly, from the literature on both IS and CES, we hypothesised (a) social, (b) economic, and (c) environmental factors as the impacting ones on the willingness of the industries to participate in an InCES. The above-mentioned factors are listed in

Table 1.

3. Materials and Methods

In this research, we employ survey research to investigate factors impacting the willingness of the industrial companies to invest in an InCES.

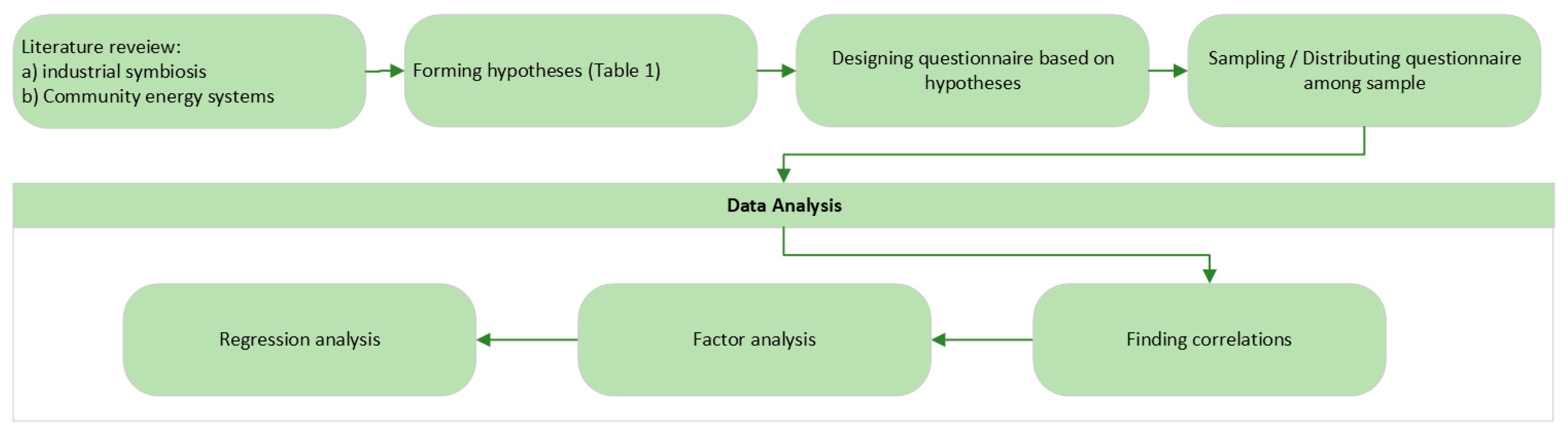

Figure 1 shows the research design.

This research conducts a survey (

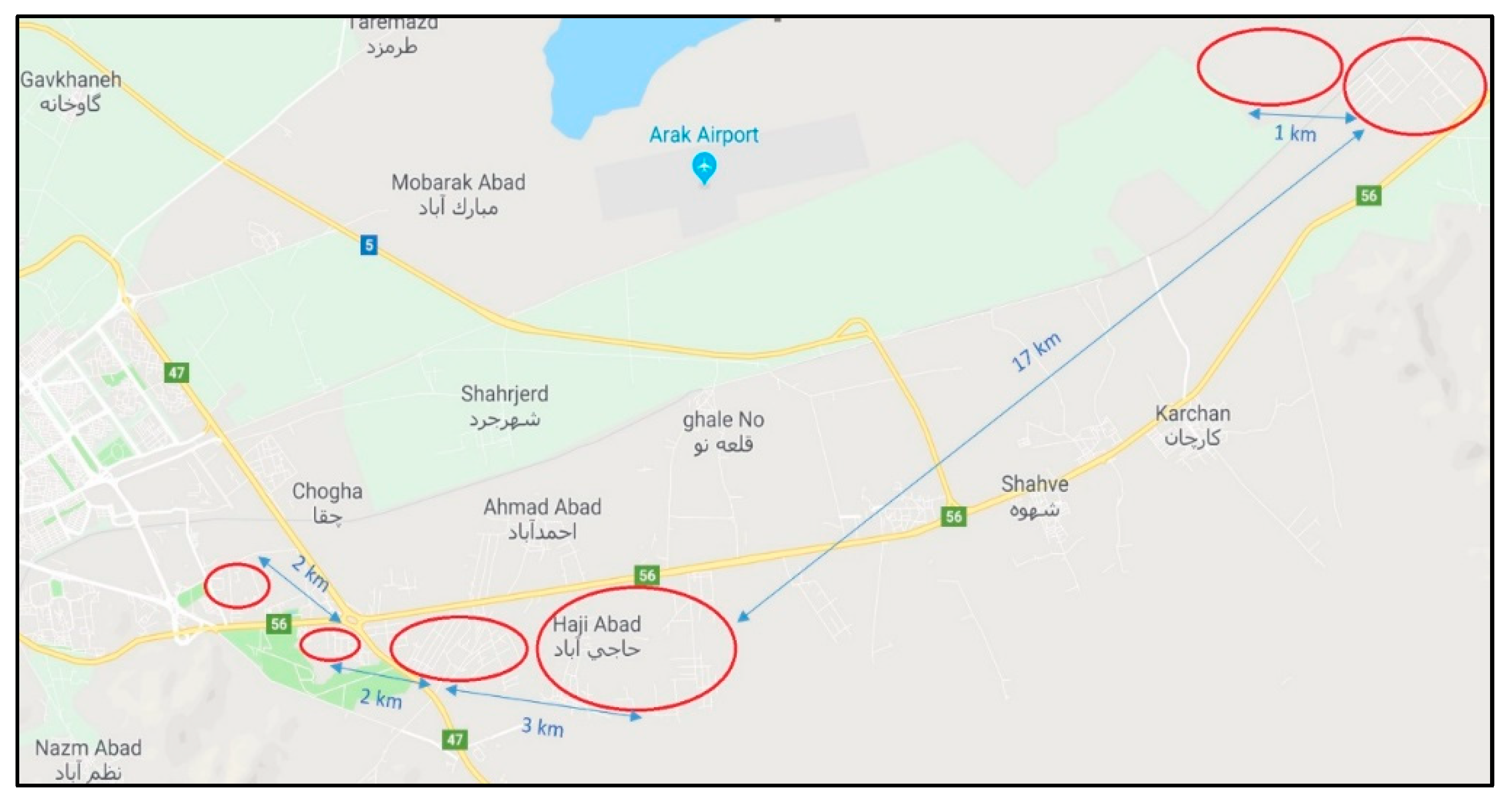

Appendix A) distributed among the CEOs of a sample of industries in Arak Industrial city. The reason behind the selection of Arak as our case study stems from the maturity of this industrial city regarding the variety in types of industries (e.g., part-making, textile, casting, polymer, glass, and food industry) and the large number of active companies. Arak industrial city numbers 603 companies, geographically distributed over six industrial clusters, as shown in

Figure 2 (each cluster ranging between 5 to 278 companies).

The questionnaire was designed to test the hypotheses formulated in

Table 1. The questionnaire addresses the extent to which the industrial companies’ executives meet with each other, how willing they are to partner with the industrial companies of their zone, and how important it is for them to become independent from the government for electricity supply. Moreover, the survey contains inquiries into the factor(s) which may hinder collaboration between the companies in an InCES, such as “trust.” Besides the companies’ opinions and behaviours, data were also collected on their attributes, including their location, number of employees, production field, electricity demand, electricity consumption pattern, and monthly electricity bill (

Appendix A). In addition to testing the hypotheses in

Table 1, the research also took an inductive approach by exploring other possible factors that could potentially affect industrial companies’ willingness to join an InCES. These factors will be further explained in the results section.

The collected data were statistically analysed using IBM SPSS STATISTICS 25, IBM, New York, NY, United States.

4. Results

4.1. Data Sample and Descriptive Statistics

In order to carry out this research, we selected a sample from each of the industrial clusters located in Arak industrial city following the systematic expert sampling method [

56]. The companies were selected from the list of provided by each cluster’s management office with the aim to cover the full range in terms of size, electricity demand, and number of employees.

The sample in which we conducted the survey covers 35% of the total number of industrial companies located in Arak (212 out of 603). The distribution of respondents, the sample, and the population among the five industrial clusters (Kheir Abad industrial cluster consists of two parts. The newer cluster is known as the “expansion phase”. Here for the sake of simplicity we showed these two clusters under the category of “Kheir Abad” industrial cluster) are shown in

Figure 3.

As reflected in

Figure 3, the survey was distributed among (the CEOs of) 212 companies, and we succeeded in collecting 96 completed responses (~46%) which can be considered as a relatively high response rate for surveys distributed among industrial executives [

57].

Table 2 gives an overview of the attributes of industries that participated in the survey.

As illustrated in

Table 2, 98% of the responsive companies are private companies. Furthermore, 66.6% of them have less than 50 workers, reflecting that most of our respondents are small-scale enterprises. The monthly electricity consumption data indicate that 57.2% of the responsive companies consume less than 10 MWh per month and 23.2% consume between 10 MWh to 50 MWh. This also confirms that around 60% of respondents can be considered as small and 23% as medium-sized enterprises, which is compatible with the number of respondent industries in terms of size (

Table 2).

Regarding the working shifts, we can see that the majority of the industrial companies (60%) that took part in this survey had only one shift per day schedule (at the time of the survey, Iran’s economy was experiencing a deep recession due to US sanctions against Iran). Therefore, many companies were forced to operate no more than one shift per day).

4.2. Factors Affecting the Willingness to Join an InCES

4.2.1. Dependent Variable

Since the objective of this research is to characterise the willingness of the industrial companies in Arak to engage in an InCES, the dependent variable in our survey is: “Eventually, in case there is an InCES in your zone (or is going to be initiated), would you be willing to invest in it?”. Respondents could score this question between 1 to 10, reflecting whether they completely disagree or completely agree with this phrase, respectively. For the sake of better visibility, in our tables and figures, we labelled this question as “INCES-INVESTMENT”.

4.2.2. Independent Variables

To investigate the impact of the factors hypothesised previously in

Table 1, we designed the survey in such a way as to reflect the opinion of the respondents regarding a range of variables which can be clustered into three categories:

(a) social factors,

(b) economic factors, and

(c) environmental factors. Within the mentioned categories, besides the hypothesised factors (

Table 1), we also collected data on some other aspects that we found to be informative/impacting regarding the willingness of the industrial companies to invest in an InCES. These factors are marked as “exploratory” in

Table 3.

These variables and their designated labels are listed in

Table 3.

4.2.3. Correlation Tables

The results of the Spearman correlation test for each of the three categories are shown in this section respectively.

- (a)

Social and demographic factors:

Table 4 shows the correlation matrix related to social and demographic factors.

According to the results presented in

Table 4, there are significant positive correlations between “education” (0.32), “the degree by which industrial companies are willing to join partnerships in their industrial zone” (0.298), “the degree by which it is important for industrial companies to be a part of socially and environmentally friendly projects (regardless of the economic feasibility of these projects)” (0.655), “the degree of positive motivation induced by prominent companies of their zone investing in an InCES” (0.569), “the degree by which the decision making in the InCES will be organised democratically” (0.391), “the degree by which companies believe that proper institutions can overcome the complexities in partnerships” (0.547) and “the willingness of the industrial companies to invest in InCES”. Besides these positive correlations, the factor “not trusting other members in terms of them being erratic in financial issues, etc.” negatively correlates with our dependent variable (−0.374).

Based on these correlation coefficients, it appears that the factor “being interested in being a part of a socially and environmentally friendly project” has a substantial impact on companies’ willingness to invest in an InCES. This factor is also positively correlated with education and company size, implying that bigger companies with more educated decision makers are more likely to invest in socially and environmentally friendly plans. Furthermore, we can see that bigger companies tend to be more socially connected to their peers in their industrial cluster and are more prone to join partnerships and to take a leadership role. This reflects the hypothesised role of bigger, more prominent companies in encouraging other companies in their industrial cluster to join an InCES.

Besides, as expected, a lack of trust in other companies as potential members of an InCES has a negative impact on joining one. Interestingly though, a lack of trust in the government’s plans to promote renewable energy does not significantly correlate with almost any of the factors above. Apparently, the respondents are indifferent about government and government policies, which may be interpreted as looking at a potential InCES as a completely bottom-up initiative without any role for the government.

The preference of respondents for a partnership in which the decision-making processes are being carried out democratically is an important parameter to be taken into account for the institutional setting of an InCES. This preference may be related to previous experiences of industrial companies in partnerships with uneven dominance levels between members [

5].

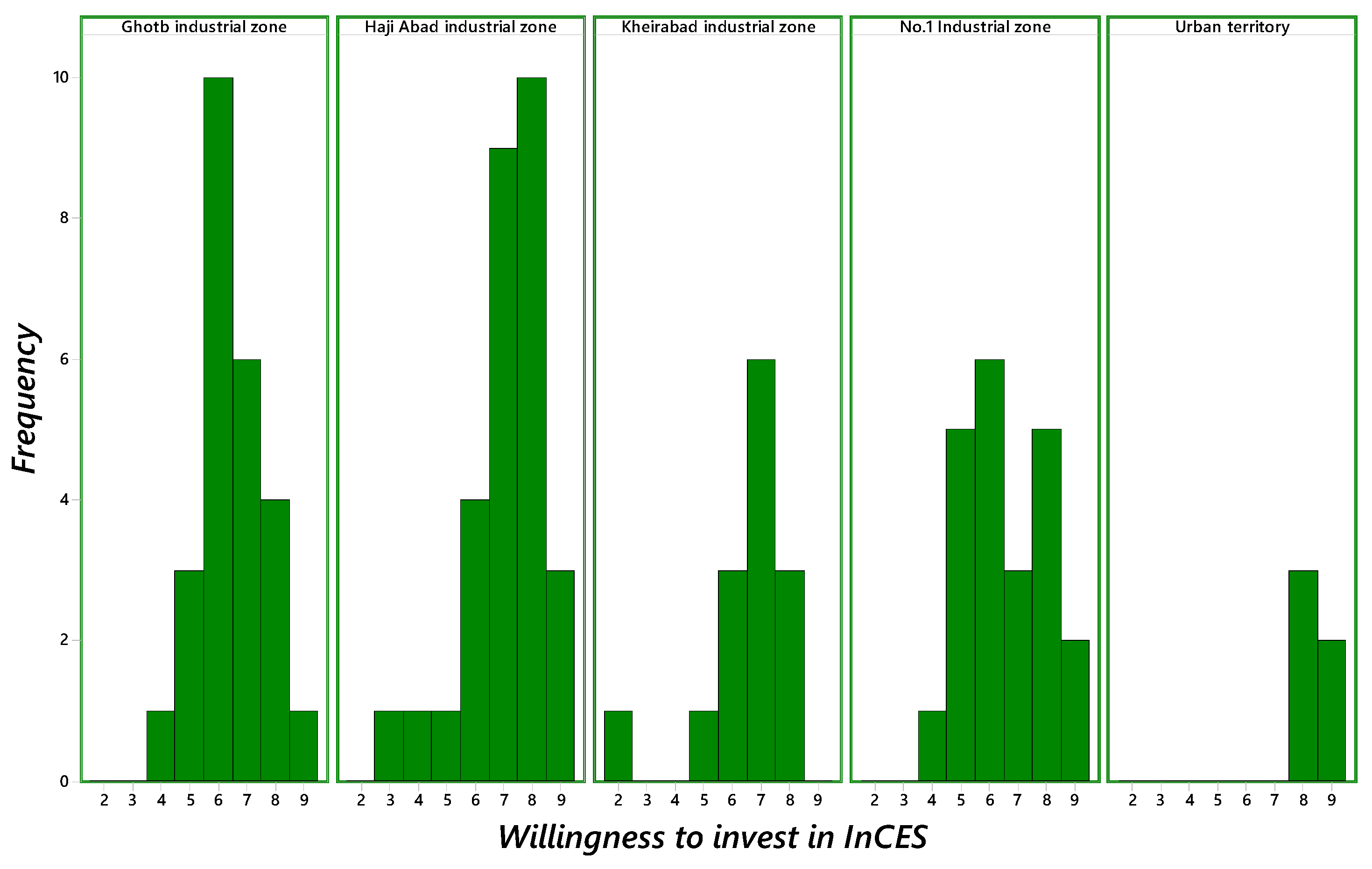

Besides analysing the social and demographic factors and their correlation with our dependent variable, we evaluated the willingness of the industrial companies to invest in InCES for each of the different industrial clusters. The results are shown in

Figure 4.

Figure 4 shows that the industrial companies located in Haji Abad and Urban Territory have significantly scored higher on willingness to invest in an InCES. This may be explained by the fact that these two industrial zones have the longest history, as they were the first industrial clusters to be established in Arak. Moreover, companies located in Urban Territory are significantly bigger than those in other industrial clusters. While historically, the location of these companies was outside the urban territory of Arak, it is through the development of the city over time that they have now become part of Arak’s urban territory. It is worth mentioning that the companies located in Haji Abad also turned out to be the most socially bonded companies (SOCI-BOND factor,

Table 3), according to their responses to the questionnaire.

- (b)

Economic factors:

Table 5 illustrates the correlation matrix related to economic factors:

The correlation coefficients in

Table 5 show a positive correlation of “education” (0.32), “willingness to invest in projects with lower ROI” (0.320), “willingness to allocate a larger part of annual revenue to an InCES” (0.360), and “being interested in easily tradable shares in an InCES” (0.752) with the “willingness of industrial companies to invest in an InCES”. There is a negative correlation (−0.374) between the degree of the companies’ awareness of the benefits and incentives related to RE generation and their willingness to invest in an InCES.

Moreover, we see a significant positive correlation between the size of industrial companies and their willingness to allocate a larger share of their annual revenue to an InCES (if they choose to invest), reflecting the role of bigger companies in bearing the upfront investment costs related to RE generation projects. This is also consistent with the behaviour of bigger companies with respect to the social variables previously discussed.

A strong, significant positive correlation (0.752) is found between the degree to which the industrial companies expect the price of electricity to increase and their willingness to evade this threat by pursuing independence in power supply through an InCES. This expectation fits with the trend of de-subsidising electricity prices in many oil-rich countries. Interestingly,

Table 5 also shows that this notion negatively correlates (−0.419) with a feeling of entitlement to cheap and abundant electricity, which still persists in oil-rich countries.

The significant positive correlation between the willingness of industrial companies to join in partnerships where their share is legally credible and easily tradable highlights the importance of a clear exit policy to be accounted for in the institutional setting of an InCES. Companies are more willing to join an InCES if they can be reassured about possible complications which might arise in case they decide to end their participation.

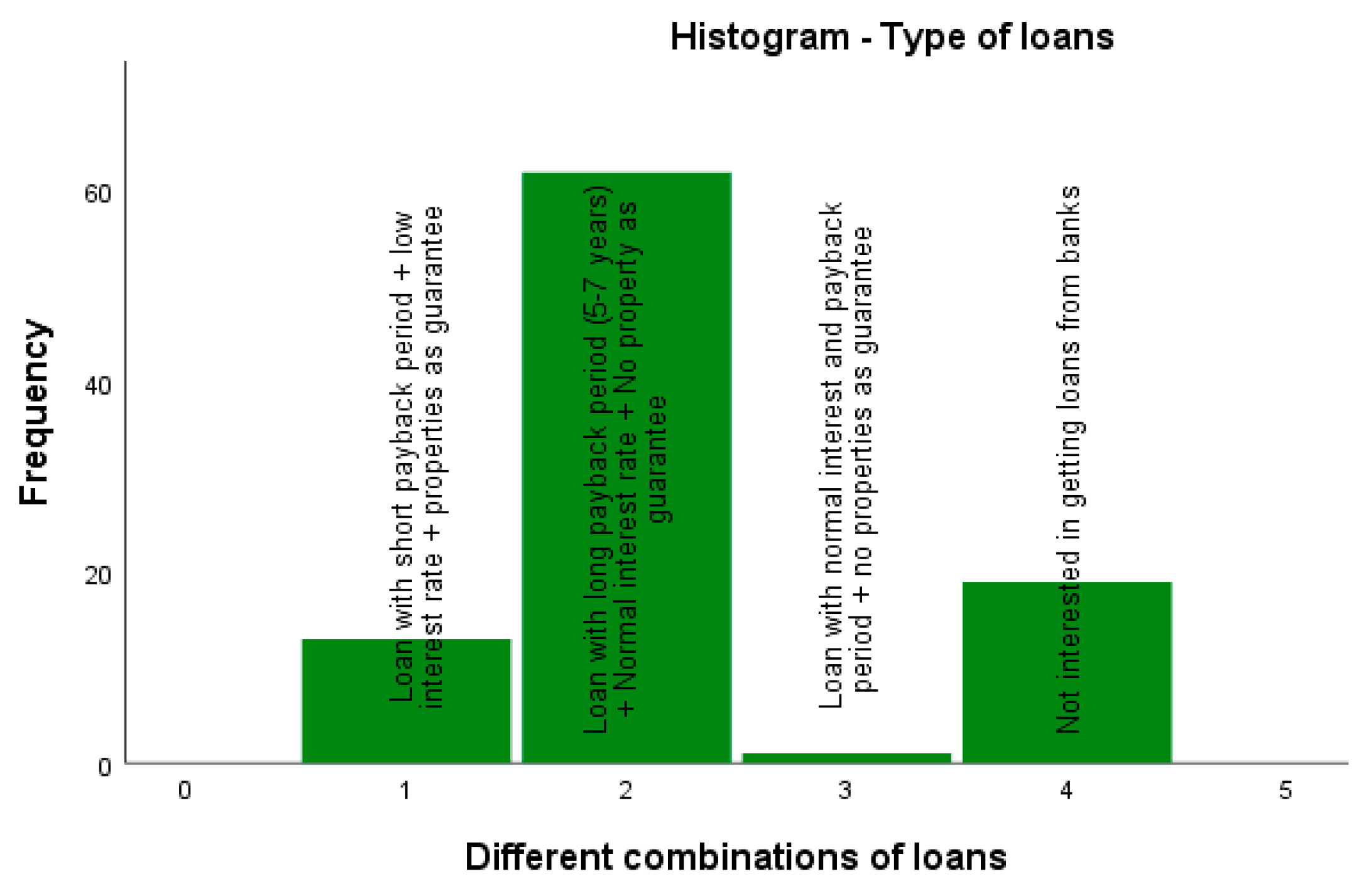

Besides the results shown in

Table 5, we explored the behaviour of the industrial companies in financing their participation in an InCES. For this purpose, we asked them, “

In case you are interested in investing in an InCES by getting loans from banks, which of the following would be more interesting to you?”

Figure 5 shows the histogram chart of the companies’ responses to this question. This chart indicates that 65.3% of the industrial companies which have participated in our survey are more willing to seek loans with longer payback periods (we have interpreted a duration of 5 to 7 years as a long payback period by taking Iran’s economic characteristics into consideration. This might not be interpreted as a long payback period in other countries with different economic attributes. In the same context, a loan with a payback period of up to 3 years is considered a short-term loan) and use other types of credits (such as the financial value of the installed solar technology) as the guarantee of the loans rather than a real-estate guarantee. These results reveal a crucial hint for policymakers to promote transitioning to RE in the industrial sector by introducing loans that accept RE technology assets as (a part of) the loan guarantee.

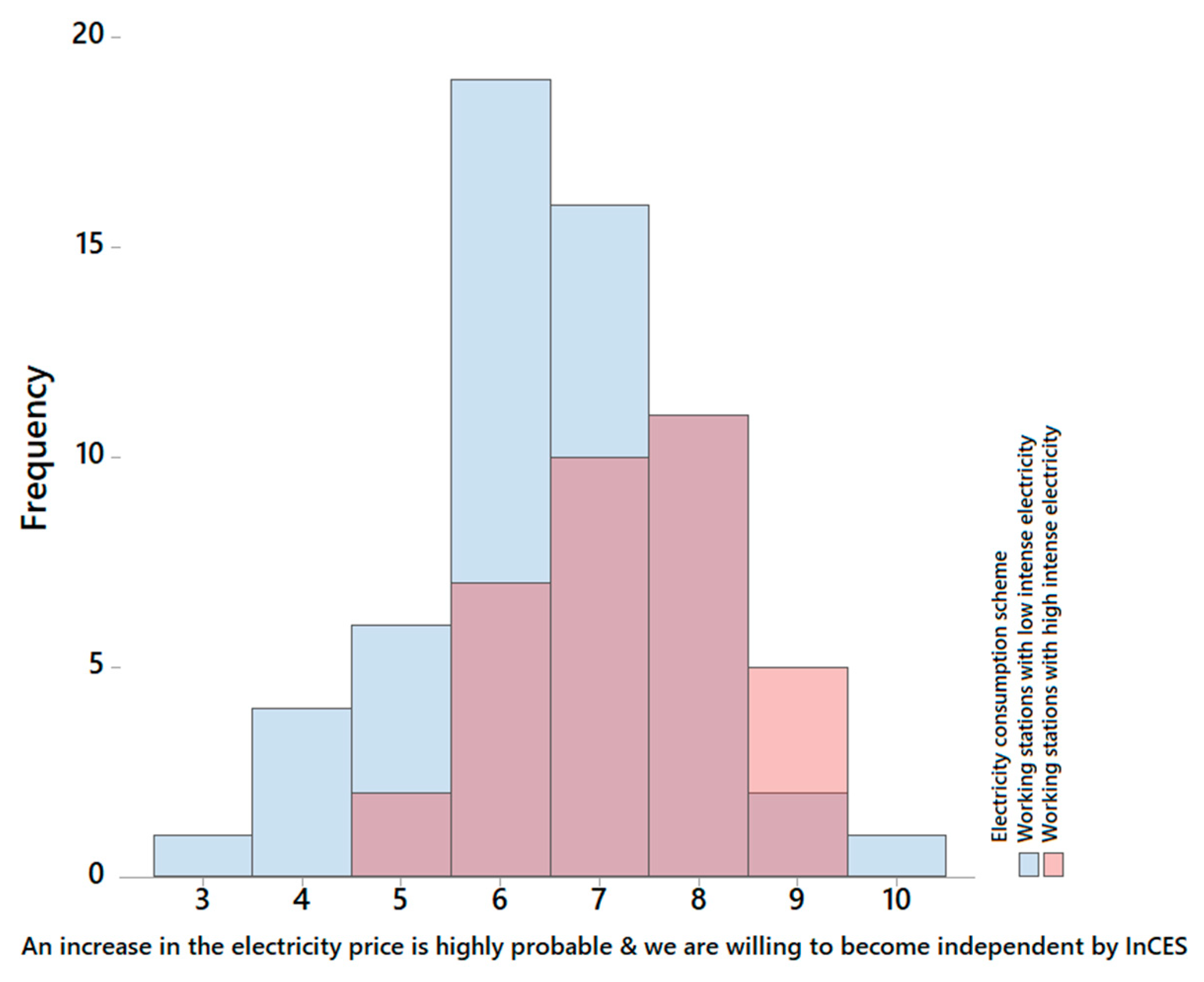

Electricity consumption scheme:

To dig into more detail, we explored the relationship between the electricity consumption schemes of the industrial companies and the degree to which they are willing to become independent from the grid due to the high probability of an increase in the price of electricity.

Figure 6 shows the difference in the mean value of the scores which industrial companies with different electricity consumption schemes assigned to the phrase

“Similar to other energy carriers, we assume that an increase in the price of electricity is probable and we are willing to invest in InCES to become gradually independent”. According to

Table 6, this difference is statistically significant.

This difference appears to be related to a significant difference in the share of electricity in the production costs. Companies where the production costs strongly depend on the electricity price have a strong incentive to neutralise the threat of an increase in the price of electricity.

- (c)

Environmental factors:

As illustrated in

Table 7, there are significant positive correlations (0.697) between the willingness of CEOs to pay more for RE in their households for environmental concerns and their willingness to invest in an InCES. This positive correlation can also be seen between the degree by which the CEOs of the companies believe that fossil fuel-based energies should be replaced by RE due to environmental concerns and their willingness to invest in an InCES (0.552). It is also noteworthy that education shows a significant positive correlation with both of the aforementioned factors. In other words, we can expect companies with CEOs who are more educated and more inclined to transition to RE in their personal lives to be more willing to invest in an InCES.

4.3. Factor Analysis

Besides the obtained results from the correlation tables discussed earlier, we ran a factor analysis test to explore how our responsive population can be divided into different clusters based on their responses to the independent variables. The Kaiser–Meyer–Olkin (KMO) test, which indicates that the sampling adequacy was 0.786, shows that the correlation patterns are compact and that the factor analysis should generate reliable and distinct factors. Moreover, Bartlett’s Test of Sphericity was significant (χ2(190) = 787, p = 0.00). Both the KMO test and Bartlett’s test confirmed that the factor analysis (principal component analysis) could be appropriately applied for this sample dataset to reduce dimensions and provide some segmentation based on the respondents’ responses.

Initially, five factors were chosen due to having eigenvalues over one and covering 63% of the variance. The extraction method used is the principal component analysis [

58].

As expected, the factors had intercorrelations, so the direct oblimin rotation method was used [

58], generating five rotated factors reflected in

Table 8.

The first group includes companies whose managers are more environmentally concerned and more socially aware. The second group are those companies with bigger size, whose managers are more likely to tolerate economic risks and are confident to initiate an InCES and lead it. The third group are those companies who, as the residents of an oil-rich country, entitle themselves to cheap electricity and are not interested in investing in renewable energy or energy autonomy. The fourth group consists of companies currently unaware of the incentives and benefits of RE-based power generation in Iran. Finally, the fifth group includes companies that are reluctant to share information related to their electricity consumption.

4.4. Regression Analysis

Finally, to predict willingness to invest in InCES, we performed a regression analysis. To determine those variables with the highest predictability power (for the willingness of the industrial companies to invest in an InCES), we entered variables from the factor analysis with noticeable eigenvalue into the regression model.

In order to nullify the multi-collinearity effect between the variables, we selected a

stepwise linear regression model to specify which of these variables really contributes to predicting the willingness of the industrial companies to invest in an InCES. This model arrived at six variables with the highest predictability power, which are shown in

Table 9. The adjusted r-square after including these six variables is 0.596, indicating that our six predictors (variables) account for about 60% of the variance in the overall willingness of the companies to invest in an InCES.

As we used the factors derived from the factor analysis method, the multicollinearity effect is already nullified. In

Appendix B, the linearity and homoscedasticity as the preconditions of a proper linear regression model are discussed.

Since our variables have identical scales, we prefer interpreting the coefficients rather than the beta coefficients. Accordingly, our final model reflects that:

where Y accounts for the dependent variable and (X

n)s are the independent variables according to

Table 9. This equation implies that among our affecting variables, “

Degree of your willingness to participate in socially and environmentally friendly plans regardless of their economic benefits”, “

Degree by which you believe that the complexities of partnerships can be overcome by establishing proper institutions”, “

Degree by which you are not aware of the incentives and benefits of RE in Iran”, “

being aligned to prominent companies of the industrial sector in terms of joining an InCES”, “

Willingness to make partnership with other companies” and, “

Degree by which you believe that RE should replace fossil-based energies because of environmental concerns” have the highest impacts in predicting the willingness of the industrial companies to invest in an InCES.

5. Discussions

The quantitative analysis of the responses of the CEOs of our sample revealed several important insights that can play important roles in the direction of a company regarding its decision to join/not join InCES in the future. We will discuss these insights here.

In line with the first and second hypotheses (

Table 1), companies which are more willing to allocate bigger shares of their annual revenue to an InCES and the ones which are inclined to invest in projects with lower ROI were shown to be more willing to invest in an InCES.

According to the results, as also formulated in the second hypothesis, high upfront investment costs proved to be a pivotal barrier for RE to become mainstream. Of course, our case only proves this for developing countries with relatively unstable economies, but this may potentially hold for developed nations as well because of the relatively larger investment requirement, considering industrial electricity demands. Bank loans are therefore crucial parts of RE incentives globally. Our case study shows that bank loans can be effective as RE stimuli if they allow for extended payback periods and accept the RE technology assets as part of the loan guarantee rather than real estate. The latter practice undermines financing opportunities for companies conducting their business in a rented workshop (not owning the place in which you live or work and still wanting to participate in RE transition is one of the basic motivations for joining community energy services, when it would be unreasonable for you to invest in installing RE technology in a place in which your stay is not guaranteed for a long time) and causes them to shy away from participating in an InCES.

Similarly to the willingness of households to engage in a CES and in line with the third hypothesis, industrial companies are more willing to join an InCES if the strategic decision maker is environmentally concerned. CEOs who believe in the necessity of shifting from fossil fuel-based to RE resources and who are willing to pay more for RE in their own household are more likely to invest in an InCES.

Moreover, in line with the fourth hypothesis, willingness to be known as a social and environmental pioneer on both collective and personal levels seems to be a crucial impacting factor with a high level of predictability (as mentioned in the regression analysis) on the willingness of the industrial companies to invest in an InCES.

Furthermore, in accordance with the fifth hypothesis, not having trust in other industrial companies was shown to negatively impact the willingness of the industrial companies to invest in an InCES. Interestingly, the degree of trust to the government’s supporting plans did not prove to be a crucial decisive factor for the industries, if they want to consider investing in an InCES. This can be interpreted as looking at a potential InCES as a completely bottom-up initiative, without any role for the government.

In line with our sixth hypothesis, in contrast to communities of households, the role of “ownership” is found to be a crucial factor in the willingness of industrial companies to join an InCES. As such, industrial companies are more willing to invest in an InCES in which their share is legally credible and easily tradable. This implies that companies are more inclined to join an InCES if the exit rules are more relaxed and there is room for strategic manoeuvre for possible profits if trading is also allowed.

In accordance with the seventh hypothesis, the results also emphasise the need for awareness-raising policies. Companies which are not aware of renewable energy technologies and their financial benefits have no interest in joining an InCES. This finding signals that consulting companies may have an important role in catalysing the industrial energy transition by informing companies about RE policy incentives and technologies.

Impressively, in line with our eighth hypothesis, we find an important role for the bigger companies in an industrial cluster in initiating such projects. It appears that bigger companies are more open to tolerating the risks of joining projects with lower ROI and allocating a larger share of their annual revenue if they decide to participate in an InCES. Bigger companies are also more inclined to take the leadership of an InCES. The bigger companies appear to be more socially bonded and more willing to establish partnerships with their peer industries. This provides a significant lead for policymakers wishing to stimulate the use of renewable energy resources in the industrial sector. They can encourage the establishment of an InCES by targeted incentives and support large industries to initiate and lead an InCES in their industrial zone. This would create a seed for forming a potential InCES in an industrial cluster and would raise the interest and offer knowledge on the InCES to the follower companies in the cluster. Availability of knowledge plays a vital role in the uptake or start of InCES, as we will discuss later in this section.

Contrary to the ninth hypothesis, the amount of electricity demand did not prove to impact the willingness of the industrial companies to join an InCES. Importantly though, we find a high motivation to engage in an InCES among those companies that expect electricity prices to increase substantially. This motivation is strongest in energy-intensive companies which are directly connected to the high voltage grid, such as companies operating high-capacity induction furnaces.

As mentioned previously, apart from the hypothesised factors, a number of other factors were also explored inductively and were shown to have a crucial impact on the willingness of the industrial companies to invest in an InCES. Consequently, it was shown by regression analysis that industrial companies in an industrial cluster pay attention to other companies’ behaviour in their cluster or proximity. Therefore, bringing prominent companies on board is found to be a crucial factor in encouraging other companies to join such environmentally sustainable projects as it is positively correlated with companies’ willingness to engage in an InCES.

Besides this, it has also become evident that transparency and democratic decision making are important prerequisites for industrial companies to join an InCES. This complies with Elinor Ostrom’s design principles for robust collective action and strengthens the case to consider an InCES as a collective action endeavour [

5]. In the same context, it is interesting that CEOs who believe that proper institutions can overcome the complexities of a partnership have scored significantly higher on the willingness to invest in an InCES.

The education level of the strategic decision makers, as a factor which was not hypothesised in the beginning of this research, positively and significantly correlates with the willingness of industries to join an InCES. The analysis also reveals that high education levels not only correlate with the awareness of the complexities of such a partnership, but also with the notion that these complexities can be overcome by proper institutional arrangements.

The results of the factor analysis gave us a different dimension of the data, showing five different latent mentalities of the industrial companies in approaching InCES projects. These mindsets or attitudes of the company leaders can help policymakers to provide alternative incentive schemes or to adopt a range of policy measures to encourage/incentivise the companies to join RE, since a one-size-fits-all approach has proven to be less effective in jumpstarting such initiatives.

Finally, regression analysis additionally showed that among all aforementioned factors, “believing in proper institutional design to overcome the partnership complexities”, “willingness to be known as a social and environmental pioneer in both collective and personal levels”, “willingness to follow the role model of prominent companies if they engage in an InCES”, “being aware of the benefits and incentives of transitioning to RE in Iran” and “willingness to partner with other industrial peers in their cluster”, had the strongest predicting power in determining the willingness of an industrial company to invest in an InCES.

6. Conclusions

This research aimed to identify factors that influence industrial companies’ willingness to invest in an InCES. We performed elaborate statistical analysis on the empirical data collected from the CEOs of a large sample of industrial companies located in Arak industrial city.

We looked into the existing literature on industrial collaboration in the domain of industrial symbiosis and the literature on community energy systems to formulate hypotheses regarding the most influential factors for the formation of an InCES. By considering the mentioned hypotheses, a questionnaire was designed to collect data on the opinions of the industrial executives regarding their willingness to invest in an InCES. Besides these hypotheses, additional data were collected to gain more potential insights into this problem in an inductive fashion.

As expected, a combination of social, economic, environmental, and demographic factors (size and education) impact the willingness of industrial companies in Arak to invest in an InCES.

All hypothesised factors, except the electricity demand, are shown to be statistically significant impacting factors on the willingness of the industrial companies to invest in an InCES. Besides these hypothesised factors, “being aligned with prominent companies of the cluster”, “transparency” and “democratic decision-making process” in an established InCES, “believing in overcoming the complexities of a partnership by designing proper institutions”, and “having a CEO (as a strategic decision-maker) with higher levels of education” have shown to be crucial impacting factors on the willingness of an industrial company to invest in an InCES which were extracted by exploring the data inductively.

According to the findings of this research, besides those that should be taken care of by industrial companies, some aspects can be aided with the help of policymakers. Consequently, to adequately stimulate the willingness of the industrial companies to invest in an InCES, it is suggested to policymakers to (a) prevent one-size-fits-all incentive design approaches, (b) reach out to larger companies with targeted incentive schemes since these companies are entities which are more prone to tolerate investing in initiatives with lower ROIs and are more likely to initiate such collective actions and take their leadership, (c) introduce specially designed bank loans with extended payback periods and with the ability to accept the RE technology as the loan guarantee, (d) make use of consulting companies in the field of renewable energies to increase the awareness of industrial companies regarding the technical and economic benefits of transitioning to RE, and (e) introducing environment-related promotion plans such as tax incentives to increase the willingness of the industries to take part in environmentally-friendly projects.

While this research was performed in the context of Iran as an oil-rich developing country, we believe that the results can, to a large extent, be generalised to other developing economies. First, although Iran has substantial oil and gas resources, the country has a strategic plan to increase the share of renewables in its energy supplement mix [

59]. Second, there are quite noticeable similarities between Iran’s economic and political situation and many of other developing countries which are struggling in a similar fashion with unstable economic conditions and consequently with high uncertainty about future electricity prices, and where the accomplishment of environmental and climate policy goals may be driven more by the personal motivation of industrial decision-makers than by strict enforcement.

Although this research sheds light on the factors stimulating the willingness of the industrial companies in Iran to invest in such projects, it is limited in the sense that the opinions of the industrial executives may be influenced by the economic sanctions against Iran, positioning the transition to RE as a lesser-priority plan. Yet, according to the findings of this research and the abovementioned reasons, transitioning to RE in Iran’s industrial sectors seems to be a valid area of research which can be continued by performing cost–benefit analyses while bringing different introduced incentive mechanisms [

60] and the best renewable technologies [

61] to be used in the spotlight.