Agricultural Insurance in the DOCG Area of Conegliano—Valdobbiadene: An Assessment of Policy Measures

Abstract

:1. Introduction

2. Background

3. Materials and Methods

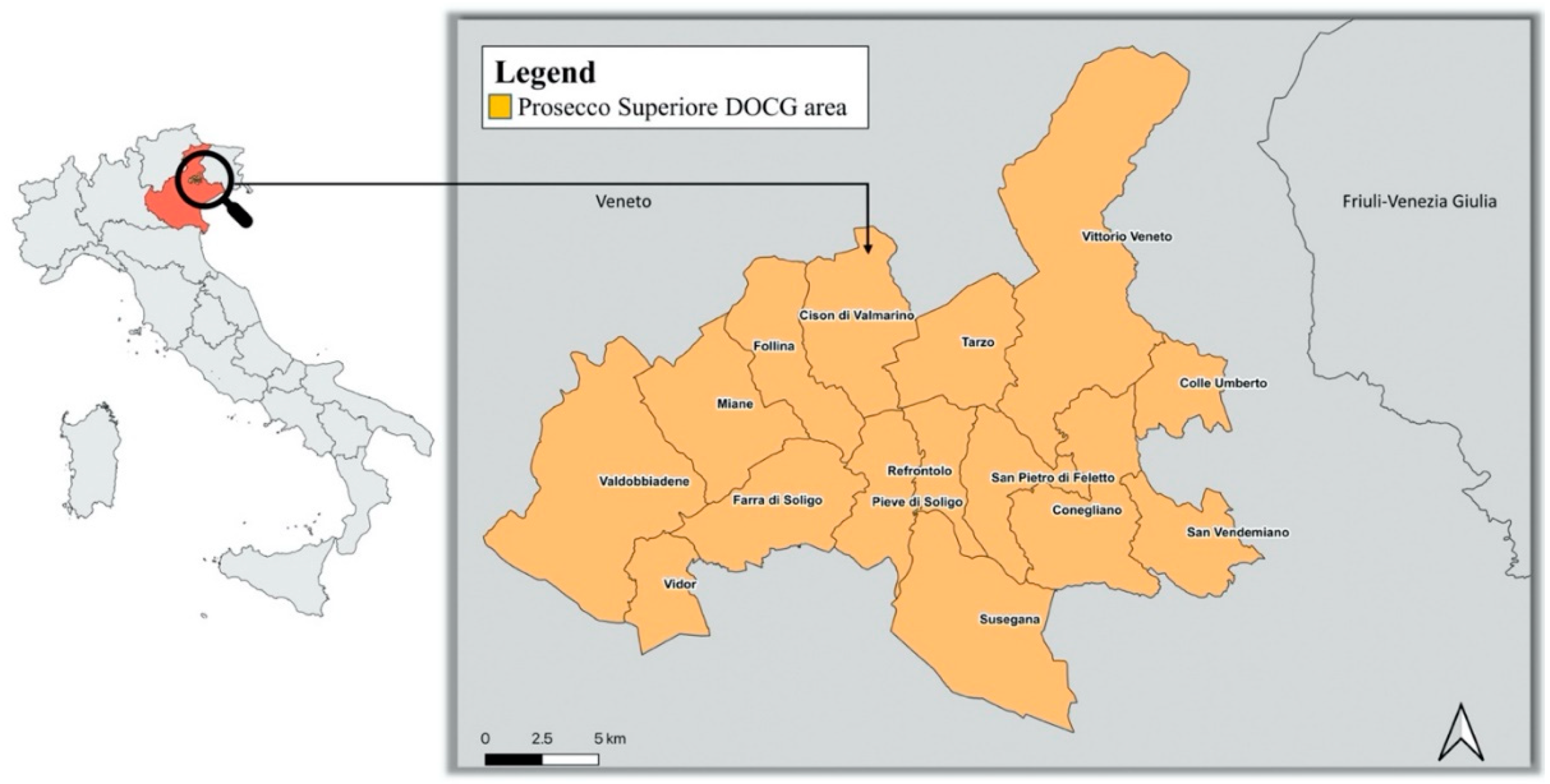

3.1. Area of Study

3.2. Data Sourcing

3.3. Methodology

4. Results

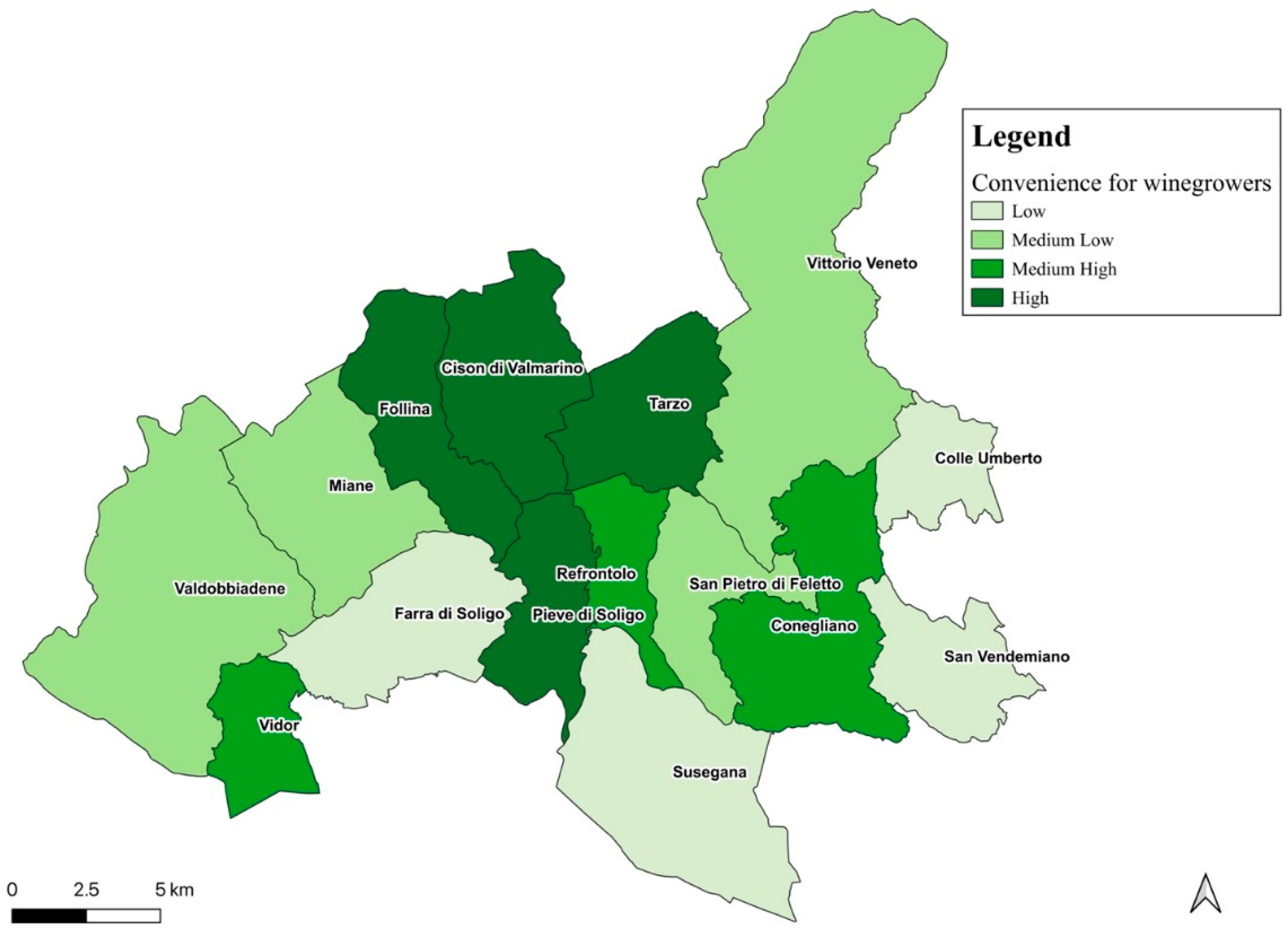

4.1. The Convenience for Winegrowers

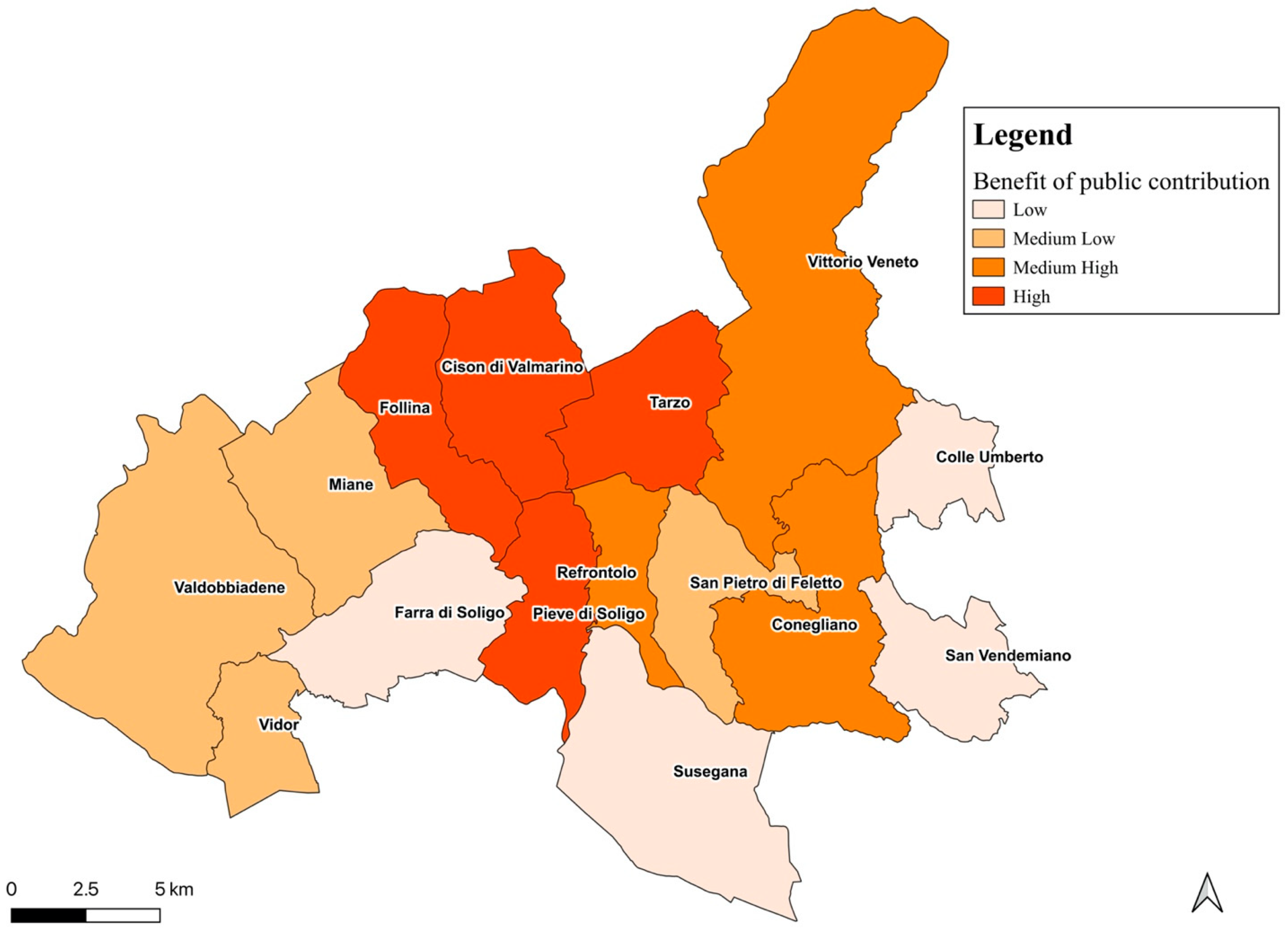

4.2. Public Costs and Benefits

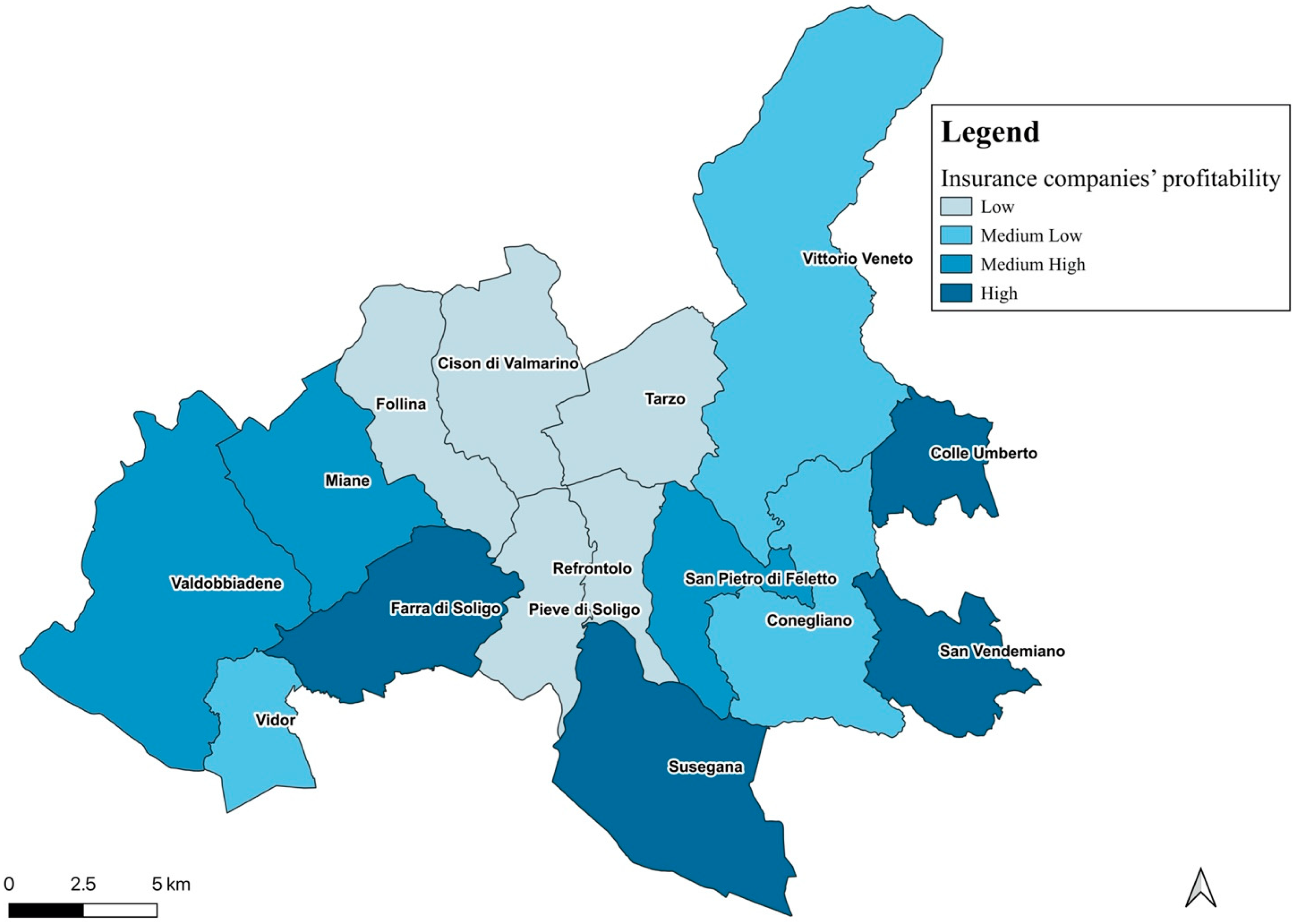

4.3. Insurance Companies’ Profitability

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kogo, B.K.; Kumar, L.; Koech, R. Climate change and variability in Kenya: A review of impacts on agriculture and food security. Environ. Dev. Sustain. 2021, 23, 23–43. [Google Scholar] [CrossRef]

- Morales-Castilla, I.; de Cortázar-Atauri, I.G.; Cook, B.I.; Lacombe, T.; Parker, A.; van Leeuwen, C.; Nicholas, K.A.; Wolkovich, E.M. Diversity buffers winegrowing regions from climate change losses. Proc. Natl. Acad. Sci. USA 2020, 117, 2864–2869. [Google Scholar] [CrossRef] [PubMed]

- Asseng, S.; Martre, P.; Maiorano, A.; Rötter, R.P.; O’Leary, G.J.; Fitzgerald, G.J.; Girousse, C.; Motzo, R.; Giunta, F.; Ali Babar, M.; et al. Climate change impact and adaptation for wheat protein. Glob. Chang. Biol. 2019, 25, 155–173. [Google Scholar] [CrossRef] [Green Version]

- De Castro, P.; Adinolfi, F.; Capitanio, F.; Di Falco, S. Building a new framework for Common Agricultural Policy: A responsibility towards the overall community. Eurochoices 2011, 10, 32–36. [Google Scholar] [CrossRef]

- De Castro, P.; Adinolfi, F.; Capitanio, F.; Di Falco, S.; Di Mambro, A. The Politics of Land and Food Scarcity; Taylor & Francis Group Ltd: Oxford, UK, 2012. [Google Scholar]

- Severini, S.; Biagini, L.; Finger, R. Modeling agricultural risk management policies—The implementation of the Income Stabilization Tool in Italy. J. Policy Model. 2019, 41, 140–155. [Google Scholar] [CrossRef]

- Meuwissen, M.; Mey, Y.; van Asseldonk, M. Prospects for agricultural insurance in Europe. Agric. Financ. Rev. 2018, 78, 174–182. [Google Scholar] [CrossRef]

- Santeramo, F. Imperfect information and participation in insurance markets: Evidence from Italy. Agric. Financ. Rev. 2018, 78, 183–194. [Google Scholar] [CrossRef] [Green Version]

- Enjolras, G.; Capitanio, F.; Adinolfi, F. The demand for crop insurance: Combined approaches for France and Italy. Agric. Econ. Rev. 2012, 13, 5–22. [Google Scholar] [CrossRef]

- Bozzola, M.; Massetti, E.; Mendelsohn, R.; Capitanio, F.A. Ricardian analysis of the impact of climate change on Italian agriculture. Eur. Rev. Agric. Econ. 2018, 45, 57–79. [Google Scholar] [CrossRef] [Green Version]

- Chavas, J.P.; Di Falco, S.; Adinolfi, F.; Capitanio, F. Weather Effects and their Long-Term Impact on the Distribution of Agricultural Yields: Evidence from Italy. Eur. Rev. Agric. Econ. 2019, 46, 29–51. [Google Scholar] [CrossRef]

- ISMEA. Proceedings International Conference on Risk Management in Agriculture in Italy 28 November 2019. 2020. Available online: http://www.ismea.it/flex/cm/pages/ServeBLOB.php/L/IT/IDPagina/11159 (accessed on 28 May 2022).

- Garrido, A.; Zilberman, D. Revisiting the demand for agricultural insurance: The case of Spain. Agric. Financ. Rev. 2008, 68, 43–66. [Google Scholar] [CrossRef] [Green Version]

- De Castro, P.; Miglietta, P.P.; Vecchio, Y. The Common Agricultural Policy 2021–2027: A new history for European agriculture. Ital. Rev. Agric. Econ. 2020, 75, 5–12. [Google Scholar] [CrossRef]

- Knight, T.O.; Coble, K.H. Survey of US multiple peril crop insurance literature since 1980. Appl. Econ. Perspect. Policy 1997, 19, 128–156. [Google Scholar] [CrossRef]

- Babcock, B.A. The impact of US biofuel policies on agricultural price levels and volatility. China Agric. Econ. Rev. 2012, 4, 407–426. [Google Scholar] [CrossRef]

- Cioffi, A.; Capitanio, F. Gestione del Rischio in Agricoltura ed Intervento Pubblico: Evoluzione, Sostenibilità e Prospettive del Sistema Italiano. Econ. Dirit. Agroaliment. 2011, 16, 395–410. [Google Scholar]

- Capitanio, F.; De Pin, A. Measures of Efficiency of Agricultural Insurance in Italy, Economic Evaluations. Risks 2018, 6, 126. [Google Scholar] [CrossRef] [Green Version]

- De Pin, A.; Capitanio, F. La gestione del rischio nella zona DOCG Conegliano-Valdobbiadene, valutazioni economiche. Ital. Rev. Agric. Econ. 2018, 73, 37–61. [Google Scholar] [CrossRef]

- Santeramo, F.C.; Adinolfi, F.; Capitanio, F.; Goodwin, B. Farmer Participation, Entry and Exit Decisions in the Italian Crop Insurance Program. J. Agric. Econ. 2016, 67, 639–657. [Google Scholar] [CrossRef]

- Fusco, G.; Miglietta, P.; Porrini, D. Post-Adversities Recovery and Profitability: The Case of Italian Farmers. Int. J. Environ. Res. Public Health 2019, 16, 3189. [Google Scholar] [CrossRef] [Green Version]

- Cafiero, C.; Capitanio, F.; Cioffi, A.; Coppola, A. Risk and crisis management in the reformed European agricultural policy. Can. J. Agric. Econ. Rev. Can. D’Agroecon. 2007, 55, 419–441. [Google Scholar] [CrossRef]

- Capitanio, F.; Bielza, M.D.C.; Cafiero, C.; Adinolfi, F. Does market competitiveness significantly affect public intervention in agricultural insurance: The case in Italy. Appl. Econ. 2011, 43, 4149–4159. [Google Scholar] [CrossRef]

- Vladisavljević, R.; Soleša, D.; Puvača, N. Internet of things (IoT) in a function of smart agriculture development. J. Agron. Technol. Eng. Manag. 2019, 2, 287–294. [Google Scholar]

| Total Premium | Supplementary Policy | Net Premium | Consortium Contributions | Tot. Winegrower Costs | Compensation | Compensation—Tot. Costs | % π | Compensation—Tot. Costs (%) | Compensation/Tot.Costs | Compensation/Net Premium | Costs on Insured Value (%) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| a | b | c | a + b + c | d | d − (a + b + c) | d/b | e | |||||

| Cison di Valmarino | 430,844 | 72,363 | 134,712 | 9558 | 216,634 | 847,115 | 630,482 | 291.0 | 7.6 | 3.91 | 6.29 | 20.7 |

| Pieve di Soligo | 815,355 | 107,690 | 265,092 | 16,872 | 389,654 | 1,449,731 | 1,060,077 | 272.1 | 12.8 | 3.72 | 5.47 | 20.1 |

| Tarzo | 642,347 | 82,135 | 213,767 | 13,995 | 309,897 | 1,079,248 | 769,352 | 248.3 | 9.3 | 3.48 | 5.05 | 18.8 |

| Follina | 238,054 | 40,204 | 75,354 | 5952 | 121,510 | 353,334 | 231,825 | 190.8 | 2.8 | 2.91 | 4.69 | 14.1 |

| Refrontolo | 1,238,585 | 148,506 | 416,445 | 29,196 | 594,146 | 1,594,926 | 1,000,780 | 168.4 | 12.1 | 2.68 | 3.83 | 12.6 |

| Vidor | 137,771 | 11,444 | 46,703 | 3349 | 61,496 | 141,694 | 80,198 | 130.4 | 1.0 | 2.30 | 3.03 | 10.3 |

| Conegliano | 3,447,418 | 379,313 | 1,169,703 | 79,247 | 1,628,263 | 3,448,347 | 1,820,083 | 111.8 | 22.0 | 2.12 | 2.95 | 10.5 |

| Vittorio Veneto | 3,785,633 | 367,129 | 1,327,900 | 82,876 | 1,777,905 | 3,760,208 | 1,982,303 | 111.5 | 24.0 | 2.11 | 2.83 | 10.7 |

| San Pietro di Feletto | 1,691,920 | 196,159 | 569,570 | 40,695 | 806,424 | 1,352,863 | 546,439 | 67.8 | 6.6 | 1.68 | 2.38 | 8.0 |

| Valdobbiadene | 1,018,673 | 140,605 | 337,753 | 21,752 | 500,111 | 674,769 | 174,658 | 34.9 | 2.1 | 1.35 | 2.00 | 7.0 |

| Miane | 185,905 | 25,828 | 58,549 | 5116 | 89,494 | 110,829 | 21,335 | 23.8 | 0.3 | 1.24 | 1.89 | 5.2 |

| Colle Umberto | 1,547,572 | 144,139 | 542,315 | 36,802 | 723,256 | 845,144 | 121,888 | 16.9 | 1.5 | 1.17 | 1.56 | 5.5 |

| Farra di Soligo | 831,893 | 133,158 | 256,045 | 19,951 | 409,154 | 410,029 | 875 | 0.2 | 0.0 | 1.00 | 1.60 | 4.9 |

| San Vendemiano | 868,681 | 144,086 | 275,899 | 21,757 | 441,741 | 396,016 | −45,725 | −10.4 | −0.6 | 0.90 | 1.44 | 4.6 |

| Susegana | 1,987,023 | 228,615 | 668,121 | 62,811 | 959,548 | 825,292 | −134,256 | −14.0 | −1.6 | 0.86 | 1.24 | 3.5 |

| Total | 18,867,674 | 2,221,376 | 6,357,927 | 449,928 | 9,029,231 | 17,289,546 | 8,260,316 | 91.5 | 100 | 1.91 | 2.72 | 9.3 |

| Contribution | Compensation | Comp.-Contr. | Comp/Contr | IES | %Δ Ha | %Δ I.V. | |

|---|---|---|---|---|---|---|---|

| Cison di Valmarino | 226,826 | 847,115 | 620,290 | 3.73 | 2.73 | 5.88 | −3.57 |

| Pieve di Soligo | 444,476 | 1,449,731 | 1,005,256 | 3.26 | 2.26 | 41.50 | 27.15 |

| Tarzo | 350,687 | 1,079,248 | 728,561 | 3.08 | 2.08 | 8.71 | 20.75 |

| Follina | 124,286 | 353,334 | 229,048 | 2.84 | 1.84 | 73.18 | 73.59 |

| Refrontolo | 674,608 | 1,594,926 | 920,318 | 2.36 | 1.36 | 2.55 | 39.13 |

| Conegliano | 1,900,918 | 3,448,347 | 1,547,429 | 1.81 | 0.81 | 2.17 | 39.18 |

| Vittorio Veneto | 2,111,819 | 3,760,208 | 1,648,389 | 1.78 | 0.78 | 10.68 | 50.43 |

| Vidor | 80,008 | 141,694 | 61,686 | 1.77 | 0.77 | 0.16 | −41.93 |

| S. Pietro di Feletto | 934,783 | 1,352,863 | 418,080 | 1.45 | 0.45 | 6.32 | 32.06 |

| Valdobbiadene | 547,076 | 674,769 | 127,692 | 1.23 | 0.23 | −0.93 | 70.87 |

| Miane | 101,482 | 110,829 | 9347 | 1.09 | 0.09 | 0.17 | 31.96 |

| Colle Umberto | 865,398 | 845,144 | −20,254 | 0.98 | −0.02 | −0.03 | 44.87 |

| Farra di Soligo | 443,462 | 410,029 | −33,433 | 0.92 | −0.08 | 63.12 | 11.99 |

| S. Vendemiano | 453,327 | 396,016 | −57,311 | 0.87 | −0.13 | 0.56 | 65.55 |

| Susegana | 1,099,006 | 825,292 | −273,714 | 0.75 | −0.25 | −2.82 | 44.27 |

| Total | 10,358,161 | 17,289,546 | 6,931,385 | 1.67 | 0.67 | 4.79 | 39.89 |

| Ins. Value | Premium | Comp. | C/Pr (Loss Ratio) | % C/IV (Exper. Rate) | % PR/IV (Rates) | Pr-Comp (Gross Margin) | % π | |

|---|---|---|---|---|---|---|---|---|

| Susegana | 23,357,559 | 1,987,023 | 825,292 | 0.42 | 3.53 | 8.51 | 1,161,731 | 140.8 |

| S. Vendemiano | 8,611,855 | 868,681 | 396,016 | 0.46 | 4.60 | 10.09 | 472,665 | 119.4 |

| Farra di Soligo | 8,422,308 | 831,893 | 410,029 | 0.49 | 4.87 | 9.88 | 421,864 | 102.9 |

| Colle Umberto | 15,246,100 | 1,547,572 | 845,144 | 0.55 | 5.54 | 10.15 | 702,428 | 83.1 |

| Miane | 2,150,092 | 185,905 | 110,829 | 0.60 | 5.15 | 8.65 | 75,076 | 67.7 |

| Valdobbiadene | 9,630,856 | 1,018,673 | 674,769 | 0.66 | 7.01 | 10.58 | 343,904 | 51.0 |

| S. Pietro di Feletto | 16,966,549 | 1,691,920 | 1,352,863 | 0.80 | 7.97 | 9.97 | 339,057 | 25.1 |

| Vittorio Veneto | 35,057,562 | 3,785,633 | 3,760,208 | 0.99 | 10.73 | 10.80 | 25,425 | 0.7 |

| Conegliano | 32,953,417 | 3,447,418 | 3,448,347 | 1.00 | 10.46 | 10.46 | −929 | 0.0 |

| Vidor | 1,376,806 | 137,771 | 141,694 | 1.03 | 10.29 | 10.01 | −3923 | −2.8 |

| Refrontolo | 12,675,773 | 1,238,585 | 1,594,926 | 1.29 | 12.58 | 9.77 | −356,341 | −22.3 |

| Follina | 2,498,357 | 238,054 | 353,334 | 1.48 | 14.14 | 9.53 | −115,281 | −32.6 |

| Tarzo | 5,748,109 | 642,347 | 1,079,248 | 1.68 | 18.78 | 11.17 | −436,902 | −40.5 |

| Pieve di Soligo | 7,229,217 | 815,355 | 1,449,731 | 1.78 | 20.05 | 11.28 | −634,377 | −43.8 |

| Cison di Valmarino | 4,089,627 | 430,844 | 847,115 | 1.97 | 20.71 | 10.54 | −416,271 | −49.1 |

| Total | 186,014,185 | 18,867,674 | 17,289,546 | 0.92 | 9.29 | 10.14 | 1,578,127 | 9.1 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

De Pin, A.; Miglietta, P.P.; Coluccia, B.; Capitanio, F. Agricultural Insurance in the DOCG Area of Conegliano—Valdobbiadene: An Assessment of Policy Measures. Sustainability 2022, 14, 6912. https://doi.org/10.3390/su14116912

De Pin A, Miglietta PP, Coluccia B, Capitanio F. Agricultural Insurance in the DOCG Area of Conegliano—Valdobbiadene: An Assessment of Policy Measures. Sustainability. 2022; 14(11):6912. https://doi.org/10.3390/su14116912

Chicago/Turabian StyleDe Pin, Antonio, Pier Paolo Miglietta, Benedetta Coluccia, and Fabian Capitanio. 2022. "Agricultural Insurance in the DOCG Area of Conegliano—Valdobbiadene: An Assessment of Policy Measures" Sustainability 14, no. 11: 6912. https://doi.org/10.3390/su14116912

APA StyleDe Pin, A., Miglietta, P. P., Coluccia, B., & Capitanio, F. (2022). Agricultural Insurance in the DOCG Area of Conegliano—Valdobbiadene: An Assessment of Policy Measures. Sustainability, 14(11), 6912. https://doi.org/10.3390/su14116912