1. Introduction

With the growth of social responsibility theory and the improvement in the global market information disclosure system, enterprises have shifted their attention toward the stakeholders and social responsibility [

1]. The practical implementation of corporate social responsibility (CSR) can not only aid the management in establishing a positive corporate image and empower the businesses to increase their competitive advantages, but it can also support government to achieve sustainable development [

2]. Currently, extensive theoretical research studies have been conducted on CSR that have created a relatively complete research pedigree, including theoretical connotation, experimental paradigm, and effect analysis [

3]. Against the background of China’s political and market environment, while increasingly perfect supporting facilities promote the financial growth of the entire society, the profit-seeking trend of capital is also on the rise [

4]. Moreover, the incompleteness of government constraints on enterprises increases the inefficiency of CSR performance. The contradiction between the rapid progress of enterprises and the lack of social responsibility limits the healthy development of the market [

5].

For a long time, the overall level of CSR performance in China has been weak, with apparent differences among the enterprises. The Communist Party of China’s 19th National Congress emphasized that enterprises should promote the institutionalization of volunteer service and raise awareness of social responsibility. It is essential to elucidate the internal factors and underlying mechanisms that affect its level before that. Issues related to the factors that determine how to improve CSR performances have become a center of analysis in sustainability studies since the 1980s [

6]. Using fuzzy-set qualitative comparative analysis (fsQCA) from the variable combination perspective, this study begins with the internal environment, external environment, and organizational characteristics. It then analyzes the antecedents that affect CSR performance in China. This research examines the enterprise characteristics that tend to actively engage in social responsibility and the management methods that governments and businesses can implement to improve enterprises’ enthusiasm for social responsibility successfully. We expect to attain research conclusions closer to the enterprises’ actual situation and provide guidance for enhancing CSR performance to promote sustainable development.

2. Theoretical Background

In the 1920s, discussions on CSR started to emerge in the management circle. In 1953, for the first time, Bowen scientifically defined CSR as the corporate behavior that obliges the management to fulfill social expectations when formulating management policies and undertaking management measures [

7]. Since then, CSR has become a hot topic of research on non-market strategy and sustainable management. Up to now, CSR research has mainly focused on the management effect, social feedback, and strategic perception [

8]. While exploring antecedents, studies mainly emphasize the discussions regarding corporate governance, executive characteristics, and environmental factors but have not yet reached a consistent conclusion.

2.1. Factors Influencing CSR Performance

Due to differences in research perspectives and theoretical logic, antecedent research on CSR performance can be roughly categorized into internal factors, external factors, and corporate characteristics [

9]. Majumdar et al. claimed that the internal factors determine the intensity and effect of strategy implementation, and the formulation and implementation of strategies are entirely subject to the financial status [

10]. In contrast, Kirk stated that external factors such as the construction of the legal environment and the information disclosure system promote the non-market activities of the enterprises. In addition, it directly determines the strategic effect on the enterprises [

11]. Saharanaam et al. emphasized that corporate characteristics have a decisive impact on the strategy, ownership, and business type [

12]. Additionally, these corporate characteristics serve as the fundamental factors that lead to social behavior and propose that family ownership is more conducive to corporate social responsibility performance than other forms of the enterprise. As a result, this study incorporates three factors: the internal environment, moving on to the external environment, concluding with corporate characteristics, and thoroughly exploring the antecedent path of CSR performance.

2.1.1. Internal Factors and CSR Performance

(1) Financial Performance

Social responsibility must be cultivated over a long period based on the directness and confrontation of traditional market competition. Since it is not possible to estimate the management effect and realize the return on investment in the short term. The capital market theory holds that a sufficient capital guarantee serves as an integral material guarantee for enterprises to take long-term management measures and maintain sustainability [

10]. On this basis, Kwon et al. confirmed that financial distress will affect enterprise evaluation and strategic effects, so a reasonable capital structure plays an active role in reducing operational risks and easing financing constraints [

13]. Furthermore, the ability to discover the value of corporate social responsibility depends on the capital market, business performance, and managerial decision-making [

14]. CSR performance is easily and markedly affected by the previous financial level as sound financial performance provides continuous material support for the enterprises to fulfil social responsibilities [

10,

15]. Studies cannot obtain consistent results on the correlation between social responsibility and financial performance because of different measurement methods and variable selection. Nevertheless, most studies agreed on a certain degree of connection between CSR and previous financial performance. Implementing social responsibility activities might not directly improve corporate performance [

16,

17]. However, it is undeniable that performance serves as a primary material guarantee for enterprises to implement social responsibility practices, especially if it requires continuous investment [

18,

19].

(2) Redundant Resources

The existing studies demonstrate that redundant resources closely correlate with non-market activities [

20]. Contrary to fixed assets, the redundant resource is an existing reserve resource of the enterprise that exceeds the current needs and can be freely used quickly [

21]. As per the organization theory viewpoint, organizational flexibility can improve efficiency, and redundancy can provide a solid financial guarantee for the enterprises to fulfill social responsibilities and enhance resource allocation. Singh thought that when redundant resources were within the normal range, companies can take advantage of organizational redundancy to adjust their strategies and improve their risk-taking ability in an uncertain environment [

22]. Combining organizational theory and existing research, the more redundant resources, the higher the resource endowment and the more superior the CSR performance [

23,

24]. Gruber reported that redundant resources are buffer resources for business management. These resources help alleviate the management pressure due to internal business risks, unexpected events, and external competition [

10,

25]. CSR is more manifested in allocating existing resources and stringent requirements for the stock of redundant resources. Troilo et al. found that executives rely on the stock of redundant resources to make decisions, and redundant companies are more inclined to take aggressive management activities, such as product innovation and market development [

26]. Higher redundancy increases firms’ willingness to fulfill social duty and encourages enterprises to seek development opportunities in non-market areas. Therefore, it generally exhibits high social responsibility performance.

(3) Government Subsidy

The resource dependence theory claims that enterprise resources are limited and cannot meet all the development needs. Thus, enterprises continuously need to attain advantage resources from the external environment to achieve business sustainability, and the significance of these resources determines the degree of their dependence [

27]. The research of Pfeffer and Salancik also confirmed that the demand of the organization to obtain resources produces the dependence on the external environment, and the scarcity and importance of resources determine the strength and scope of the organization’s dependence [

28]. Christensen and Murphy advocated that the central goal of CSR activities is to gain political support and preferential government treatment. Business operations depend on subsidies, so government subsidies determine willingness and CSR performance [

29]. China implements a socialist system with characteristics. The government has the power to allocate resources, perform market supervision, and regulate market operation through subsidy policies. As a crucial scarce resource, government subsidies can inject superior resources and required capital into the enterprises, send a positive signal to the market, and boost the investment confidence of stakeholders. Therefore, the enterprises take the initiative to participate in social activities by improving the ecological environment and increasing employment rates [

30]. This sends a positive message to the local officials that enterprises are willing to actively undertake more social responsibilities to obtain additional financial subsidies.

2.1.2. External Factors and CSR Performance

(1) Marketization

The efficient market hypothesis stipulates that external systems and culture limit the choice of enterprise behavior. Moreover, the market status directly affects the strategic direction of the enterprise, which has become one of the important theoretical foundations for the study of the capital market [

10]. Levine believed that markets are rational, efficient, and unpredictable, and that developed markets effectively promote risk improvement, information collection, and management monitoring, thus increasing the willingness of companies to disclose information [

31]. China is in a particular period of transformation and development, and the long-term rapid economic progress unavoidably results in instability of the environmental development. Meanwhile, the vertical promotion of market-oriented reform and unbalanced development of the regional economy has led to significant regional differences in commodity and legal environments, further affecting enterprises’ willingness to bear social responsibility. Burks explored the correlation between information disclosure, strategic activities, and the market environment, emphasizing that the market status directly affects corporate behavior [

32]. Corporate information disclosure is more transparent in regions with high marketization, and enterprises are willing to implement CSR strategies to shape their corporate image [

11,

33]. Conversely, government integrity is most often weak in regions with low marketization. Hence, it becomes difficult for enterprises to directly obtain resources through social responsibility commitment. As a result, the willingness and CSR performance usually are poor [

34].

(2) Industry Competitiveness

Industry competitiveness is a bridge connecting the macro-economy and micro-enterprises, and its intensity will directly affect business activities. Baumol et al. put forward the contestability theory, which is used to describe the possibility of market entry, and further analyzed that potential competitive pressure will prompt enterprises to adopt efficient market behavior [

35]. According to the contestability theory, enterprises in a competitive market present a transparent state of financial and strategic information that is economically and promptly transferred to stakeholders [

36]. Thus, enterprises take the initiative to seize resources in the market and non-market environment with a stricter situation to increase competitive advantage. Since, in an industry with fierce competition and substantial homogeneity, the competition area expands to non-market areas, the willingness to attract attention to attain valuable resources through social image is robust [

37]. Further, Shepherd also believed that market structure will directly affect corporate strategy; that is, industry competitiveness affects decision-making performance through corporate behavior [

38]. While investigating antecedents of CSR performance, Flammer reported that in highly competitive industries, enterprises tend to exhibit differently from competitors by actively undertaking social responsibility to acquire political resource benefits [

39]. Conversely, the industry’s performance fluctuations and operating risks are weak with oligopolistic profits. Notably, attaining a sustainable competitive advantage through fulfilling social responsibility is not the only medium for enterprises to attain stable development, resulting in poor motivation to fulfill social responsibility [

40].

2.1.3. Organizational Characteristics and CSR Performance

(1) Executive Political Background

In the 1980s, Hambrick and Mason first proposed the upper echelons theory, pointing out that the strategic choice of an enterprise is a complex process, and the cognition or interpretation of management problems depends on the psychological structure of decision-makers [

41]; that is, the executives’ experience affects their cognition that ultimately affects their decision-making [

42,

43]. Executives with political backgrounds act as a bridge between the enterprises and government to establish mutual trust. Correspondingly, the visibility of enterprise information disclosure is enhanced, and there is a substantial increase in the pressure on the public. The enterprises actively fulfill their social responsibilities to maintain the legitimacy of operations and ensure the sustainability of government interests. Hillman et al. found that when enterprises face development obstacles (such as industry barriers), establishing government–enterprise connections through the political background of executives can enable enterprises to effectively communicate with the government and broaden the development space [

44]. In addition, executives with political links might have economic motives and self-interest motives based on their political demands [

45]. Additionally, executives with a political background are eager to rely on the enterprise to augment their relationship with the government and improve their chances of future career development [

46]. Furthermore, executives may wish to seek reputation and fame for themselves through corporate social behavior [

47]. Whether the aim is enterprise development or political promotion, the political backdrop encourages government–corporate exchanges’ proximity, increasing the desire to engage in CSR practices.

(2) Ownership Nature

According to the resource-based theory, an enterprise’s ability to govern resources directly impacts the selection and implementation of strategic activities. Wernerfelt proposed that attention to resources is the logical starting point for enterprises to make strategic choices, and emphasized that resource barriers based on heterogeneous resources, knowledge, and capabilities are the key to explaining the high profits of enterprises [

48]. Furthermore, the heterogeneity among enterprises determines the difference between competitive advantage and corporate mission, which is reflected in the determination of the strategies [

49]. As the most heterogeneous feature, ownership nature fundamentally decides the resource endowment, strategic management, and development potential [

50]. Huang et al. pointed out in the research on foreign investment that enterprise ownership affects the OFDI decision and location selection [

51]. Under the socialist market economic system, most state-owned enterprises (SOEs) have natural political connections. Such SOEs are primarily involved in life security and infrastructure construction projects, requiring massive construction investment capital. Therefore, there is a need for financial subsidies for these SOEs to maintain normal operations. To obtain more government subsidies, state-owned enterprises must actively assume social responsibilities, making CSR inevitably political and mandatory [

52]. In contrast, there is always ideological prejudice against the non-state-owned enterprises in society. Therefore, the primary pursuit of social responsibility is to seek legitimacy. However, due to inadequate institutional restrictions and an immature non-market environment, the CSR performance of non-state-owned firms is typically lower than that of state-owned enterprises.

2.2. Theoretical Framework

CSR performance is an integral part of the enterprise’s macro-strategic management. Multiple factors make it hard for a particular feature to play a decisive role. It is imperative to assess CSR’s driving factors and formation mechanism through multiple holistic perspectives from academic research integrity.

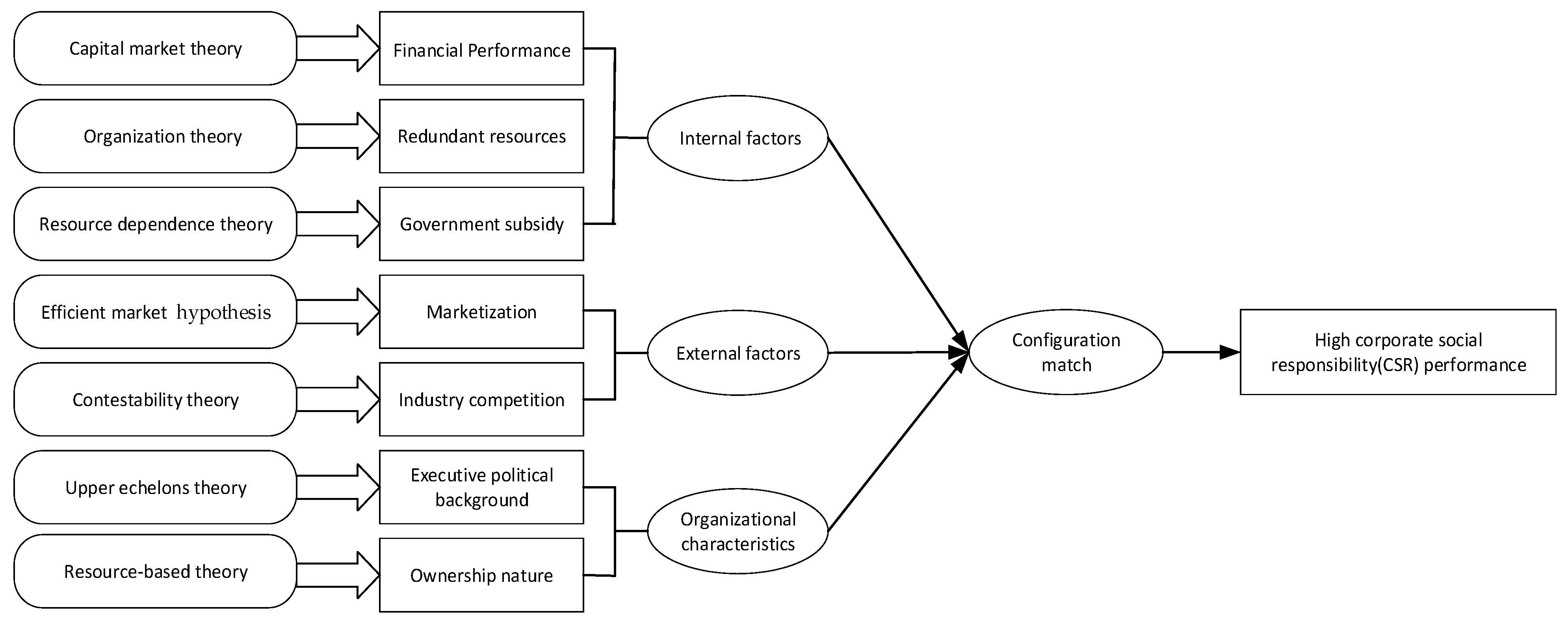

Based on the literature review and theoretical analysis, combined with the existing research results, this study comprehensively analyzes the factors that affect the social responsibility effect from seven aspects to elucidate the internal driving mechanism of CSR performance. Financial performance, redundant resources, and government subsidies are internal, while marketization and industry competition are external factors. Similarly, the political background and ownership nature belong to organizational characteristics. Moreover, the realistic background is that the overall CSR performance of Chinese listed companies is poor, and the objective of this study is to investigate the causal–oriented relationship between corporate characteristics and CSR performance. Moreover, this study aims to summarize the antecedents of high performance to improve future CSR behaviors of the corporations. Thus, the theoretical and practical significance of the configuration research on low-level CSR performance is not high; hence, this research study only sets the outcome variable of high CSR performance. Additionally, the method selection emphasizes configuration and comprehensiveness to improve fixed thinking about the impact of a single variable on the results. The theoretical framework proposed in this study is depicted in

Figure 1.

5. Discussion

5.1. Market Developed Type

Configurations 1, 5, and 6 were defined as the market-developed type. The expected points of these three configurations were high marketization, intense industry competition, and sound financial performance. Bloom’s research showed that when the market environment is unstable, companies will be more cautious in investment decisions and more inclined to hold cash assets [

63]. Similarly, Im et al. also found that market uncertainty reduces CSR performance, whereas high marketization increases social responsibility enthusiasm [

64]. Since the information among enterprises, governments, markets, and consumers is not entirely symmetrical, it is prone to information lag. Parallel to the market information barrier effect, in the case of information asymmetry, enterprises in highly competitive industries are limited by competitors that result in increased business risks and financial pressures and tend to obtain policy asylum and financial subsidies through CSR activities. In a developed market and competitive environment, enterprises with good performance typically have more excellent CSR performance. Moreover, the high CSR performance in mature Western markets reflects the same view [

65]. A healthy market is more conducive to cultivating social awareness and welfare awareness. Nevertheless, it is not sufficient to only include marketization, competitiveness, and performance. The difference between the three configurations was the executives’ political background and redundant resources. Configuration 1 had a political background, which helped encourage the company to participate in CSR practices from the management’s perspective. Conversely, configurations 5 and 6 did not show political backgrounds of the executives, but they had abundant redundant resources. These resources give a financial guarantee for undertaking social activities and ensure that businesses can continue participating in CSR activities even if they have no political links.

5.2. Political Link Type

Configuration 2 stands for the political link type. Enterprises demonstrate a more active attitude toward social responsibility when leaders have strong political ties, good performance, and adequate organizational redundancy, which is particularly visible in non-state-owned enterprises with tough competition. The political motivation theory believes that the purpose of CSR is to obtain political resources, that is to say, CSR and political demands are in an interactive relationship. Non-state-owned businesses have a more complex external environment and more rigorous resource constraints than SOEs. This makes the enterprises eager to seek strategic resources through political connections. Excellent performance is a long-term material guarantee, and sufficient redundant resources are financial provisions for immediate social activities. The upper echelons theory points out that the management’s existing cognitive structure and value system determines the explanatory power of relevant information. The executives’ political background helps the enterprise build connections with the government. As a result, a favorable non-market environment is created for the company by actively undertaking social responsibilities. The primary goal of the firm is mainly to obtain tax incentives and preferential policies to create a healthy environment for strategic transformation. However, the political background does not always bring positive effects, and there is no need to deliberately pursue executives’ political relationships. Excessive political ties also might produce strong altruistic motives to pursue personal political connections and social prestige. Although it produces high CSR performance, it may be more manifested in the protection of public welfare, such as environment construction, harming the interests of internal stakeholders. Indeed, only when the company has adequate financial strength can a superior political relationship enable it to seek more benefits.

5.3. Financial Performance Type

Configuration 3 belongs to the financial performance type. The enterprises with a weak dependence on subsidies and substantial advantages of performance and redundant resources are reported to perform better in terms of CSR practices. As Mishina et al. concluded, stable financial performance increases stakeholders’ expectations for the company’s development, which makes them more willing to devote resources to CSR to create a competitive advantage [

66]. The capital supply theory highlights the importance of company material resources for strategic actions in providing security. According to the Waddock and Graves study, companies in financial hardship may have limited discretionary CSR investments, such as charity, although they also want to strengthen their operational legitimacy through CSR initiatives [

67]. This situation mainly prevails in the non-state-owned enterprises with a weak executive political background that cannot build government contacts through their management. It is worth noting that the immediate receipt of subsidies may not be the only reason enterprises display CSR behaviors. The enterprises tend to participate in CSR activities when they are in good operating condition and have adequate working capital, although the enterprises do not rely too much on the financial subsidies for the time being. According to Buendía et al., entrepreneurship and charity promote altruistic social action without the expectation of immediate rewards [

68]. Notably, while temporary subsidies or immediate incentives may not be the direct cause of corporate social practices, companies are born with economic motivations. As a result, CSR cannot be entirely selfless. The objectives of non-market activities are not aimed at obtaining direct subsidies but could also be due to ethical pursuits, market access requirements, or even future government benefits.

5.4. State-Owned Enterprise Subsidy Type

Configuration 4 belongs to the state-owned enterprise subsidy type characterized by good performance, adequate redundant resources, and high government subsidy. Chinese state-owned enterprises are generally involved in fields associated with the country’s economic lifeline and strategic resources. These SOEs represent the essential national public welfare undertakings, with significant capital investment and long revenue cycles. Even the operating income and profits also rely on government subsidies; therefore, numerous financial subsidies are needed to sustain the development of these enterprises. The state-owned enterprise subsidy type leads to high CSR performance, which is the product of China’s unique economic system. The difference from western countries is that state-owned enterprises have dual characteristics of economic and social owing to the mission of safeguarding public interests and even bearing part of the government’s responsibility. The SOEs can attain government subsidies and achieve sustainable development by assuming social responsibility. However, government subsidies have a double effect. According to the resource dependence theory, enterprises that receive high subsidies are highly dependent on the government. This encourages the enterprises to follow government requirements, weakens the management initiative, and the government functions excessively intervene in enterprise management. The enterprises cannot reasonably grasp the matching between CSR and operation while undertaking the CSR initiatives. This results in the “high input—low output” phenomenon, in which enterprises cannot benefit from CSR, making the social responsibility of highly subsidized SOEs still inefficient, although it has always been higher than that of non-state-owned enterprises. The ability to manage the significant reliance on government subsidies and appropriately match the business elements of CSR operations is an urgent issue that limits the CSR performance of Chinese enterprises, mainly state-owned firms.

6. Discussion

6.1. Conclusions

By sifting through the available research on CSR antecedents, this paper uncovered seven theoretical and seven causal variables. It also used configuration thinking to investigate the path of variable combination that influences CSR performance, leading to identifying four distinct forms of high CSR performance. The following are the study’s specific research conclusions:

First, high CSR performance is influenced by the combination of multiple factors, and any single condition is not a necessary cause of it. Similarly, the combination of variables leading to high CSR performance is not unique, and the combination of different variables might contribute to the occurrence of corporate social activities. Integrating and improving current studies includes examining the antecedent combination of high CSR performance from different perspectives.

Second, this paper used fsQCA to calculate and robustly test 2244 pieces of data from 748 companies. As a result, it found four types that promote high CSR performance: market developed type, political link type, financial performance type, and state-owned enterprises subsidy type. That is, enterprises with the above characteristics tend to show better CSR performance.

Third, regardless of the type, financial performance is a fundamental condition. Commonly, CSR investment is continuous and long-term by nature, and even the return cannot be determined in a short time. As a result, it is more reliant on material resources. CSR investments will not yield the required economic and strategic outcomes without solid corporate performance.

Finally, the inefficiency of CSR in the corporate sector of China has existed for a long time, and the antecedents of low CSR performance are comprehensive. One of the reasons for the inefficiency of CSR lies in the low compatibility of CSR activities with corporate operations and the inability of resource investment to bring profits, thereby reducing the enthusiasm for CSR. As a result, raising awareness and increasing CSR quality is not solely the responsibility of enterprises; it also necessitates government, market, and policy environment collaboration and cooperation.

6.2. Research Innovations

This study analyzed the antecedent configuration of high CSR performance through fsQCA. Therefore, it carries the elements of innovation in the research content and research methods.

The innovation of the research method was to apply fsQCA to the antecedent exploration of CSR performance, which alters the framework of the correlation between a single variable and CSR performance. The research studies on the antecedents of CSR performance are abundant. However, most of these studies are limited to a single perspective or a single theoretical basis, and the completeness of the research is relatively insufficient. The strategic effect results from the multi-factor interaction, and the explanation of a single variable is incomplete. The fsQCA adopts configuration thinking, which enriches the research on CSR performance from multiple perspectives and confirms the impact of different element combinations on it. The research findings align with actual corporate management, and the acquired path selection addresses some of the existing research’s weaknesses by enhancing the consistency of CSR performance antecedent research. This study also adds to the applicability of fsQCA. It offers a fresh viewpoint on management motivation by allowing the antecedents to be examined from the perspective of multi-factor combinations.

In contrast, the innovation of the research content was to examine precedents of high CSR performance by comprehensively considering internal factors, external factors, and organizational characteristics from seven causal variables. This type of analysis incorporated previous theoretical findings and improves the research integrity. The vast majority of existing studies focus on a single variable. However, the conclusions are rigorous and practical since they did not entirely match the actual operation and cannot truly guide development. The multi-factor variable combination analysis avoids this defect as it can better grasp the integrity of the research and has more practical guiding significance. The selection of causal variables is not blind but rooted in the management theory and research conclusions, which have a reliable theoretical basis. Moreover, this paper explicitly explains the connotation of the four types. The research findings examined the reasons for China’s long-term sluggish CSR performance, particularly immature market development and low CSR investment aligning with the business direction.

6.3. Management Implications

Enterprises with different feature combinations adopt different paths to attain high CSR performance. Accordingly, enterprises and government organizations can adopt the following management implications.

The most important aspect for enterprises is to understand CSR’s strategic importance and organize their strategic conduct accordingly. CSR has a significant impact on the long-term development of businesses and the healthy evolution of markets, not only in the economic but also in the social sphere. Classic literature on the business administration asserts that while CSR may bring short-term costs, it pays off in the long run. The fundamental cause for China’s inefficiency in CSR performance is no positive feedback between CSR investment and economic value development. The primary reason for developing corporate strategies is to create value. The corporate social responsibility-oriented strategic behavior does not bring the improvement in profits (especially short-term profits), damages the interests of stakeholders, and ultimately leads to the reduction in CSR intention. Aguilera et al. pointed out that institutional investors in the capital market attach importance to profit remuneration and consider CSR returns in investment decisions [

69]. As a result, enterprises must reinforce their CSR strategy and principles. Moreover, businesses should increase the alignment of their mission and social responsibility initiatives and make CSR an auxiliary strategy to boost their competitive advantage.

There is not only one way to promote high CSR performance. The critical point is that enterprises should reasonably choose the type of CSR implementation that aligns with their business conditions. Enterprises must clarify their financial condition and development capacities since they cannot blindly implement social responsibility measures. Sufficient redundant resources and performance are always the basis for enterprises to undertake CSR. Notably, enterprises must always protect stakeholders’ interests, maximize the social and economic benefits of CSR, and form a virtuous circle of social responsibility investment and corporate performance improvement. This will help to enhance the social awareness and corporate value of the company and improve the CSR performance in the entire industry and even the entire market. As a result, the enterprise will be able to eliminate the predicament of China’s sluggish corporate social responsibility. It should also be noted that, in the implementation of social responsibility, companies should not excessively pursue the political background of executives, and altruistic motives sometimes bring adverse effects to the business operations. Political capital can provide good support for the development of the enterprise only based on substantial financial performance.

The foundation of raising the social responsibility consciousness of the entire society for governments is to improve the market and institutional environment. According to traditional strategic management theory, the external environment has a critical role in the formation of corporate strategy. Additionally, it directly affects the strategic decision and strategic effect. The research showed that in addition to relying on financial performance and redundant resources, CSR performance is also significantly influenced by marketization and competition. The socialist market economy with Chinese characteristics emphasizes the market and competition. It pays attention to the system and hierarchy, a remarkable feature of the Chinese market different from the western market. In some cases, the policy orientation and institutional direction have a decisive impact on CSR implementation.

Public management theory points out that the government has the responsibility to ensure social affairs and promote social development by integrating social resources and using political or economic means [

70]. At the helm of the market, industrial, and political environment, the government should actively create a healthy macro-environment, strengthen the construction of a clean government, and stabilize industry competition. Most of the listed businesses are located in provinces with high degrees of marketization, which has increased the sense of competition and accountability. From the perspective of the institutional environment, the government should also take targeted measures to improve local comprehensive management ability and a fair legal environment to improve the overall marketization degree and effectively enhance the motivation of enterprises to fulfill social responsibilities consciously. In addition, corporate behavior is affected by government subsidies. Remarkably, the enterprises that receive higher government subsidies commonly show better CSR performance. Enterprises deliver a more favorable strategic response when CSR brings substantial business-related benefits. Therefore, to improve CSR performance, the government can gradually cultivate CSR awareness and further develop public welfare habits through economic means such as policy subsidies and tax incentives. Furthermore, the government should manage the market and businesses, encouraging them to develop social responsibility knowledge and habits and raising the general degree of social responsibility.

6.4. Limitations

This study has some limitations that are worth acknowledging. First, although the antecedents of high CSR performance are explained in detail from external, internal, and organizational characteristics, these factors still warrant further investigation, such as behavioral psychology and organizational structure. The choice and implementation of management strategies are related to managers’ decision-making and organizational structure. Since the CSR of Chinese companies is more obviously non-market and political, the selection of variables at the level of the organizational characteristics emphasizes the politics of executives. Therefore, selecting variables related to the organizational characteristics only emphasizes the executive political background and enterprise’s ownership nature, but more subtle variables still have the value of further mining. Second, the life cycle of an enterprise impacts plans execution since different growth stages may have different perspectives on CSR, resulting in varying CSR performance. Limited by the research content and volume, this study did not involve the discussion of the differentiation of CSR performance in different periods and did not conduct a longitudinal time-comparative analysis. Finally, although fsQCA research has no requirements on the number of cases, the research results would still be more convincing if the information was collected more comprehensively. Hence, future research can discuss CSR performance by supplementing cases, adding longitudinal tracking, and enriching the variables to examine the mechanism of Chinese CSR performance comprehensively.