Multi-Agent Simulation of Product Diffusion in Online Social Networks from the Perspective of Overconfidence and Network Effects

Abstract

1. Introduction

2. Literature Review

2.1. Product Diffusion in OSNs

2.2. Overconfidence Theory

2.3. Network Effects

2.4. Multi-Agent Simulation and Game Theory

3. Methodology

3.1. Assumptions

- Products are abstractions of common features and attributes of the product that are diffused in OSNs. The unique characteristics of some internet products are not considered.

- We only consider the diffusion of one product on the OSNs.

- Consumers are assumed to have bounded rationality. They only know the strategies of their neighbors and their ultimate goal in decision-making is to maximize their interests.

- Individual overconfidence leads to bias in expected utility estimation.

- Some consumers have free-riding behavior and they are punished for it.

3.2. Conceptual Model of Product Diffusion in OSNs

3.2.1. Conceptual Model of Product Diffusion in OSNs Based on Game Theory

3.2.2. Conceptual Model of Product Diffusion in OSNs Considering Network Effects

3.2.3. Conceptual Model of Product Diffusion in OSNs Considering Overconfidence

- Overestimation. We defined that is the degree of overestimation and , where and represent the perceived benefit and actual benefits of individuals adopting the product. The value utility of adoption and rejection under the global and local network effects at the timestamp can be expressed as follows, respectively:

- Overprecision. We defined as the degree of overprecision. Additionally, we assume the linear function of each individual’s expected benefit can be expressed by where . represents the perceived benefit, represents the actual benefits, is a random disturbance, is the actual variance, is the stabilized random disturbance. The value utility of adoption and rejection under the global and local network effects at the timestamp can be expressed as follows, respectively:

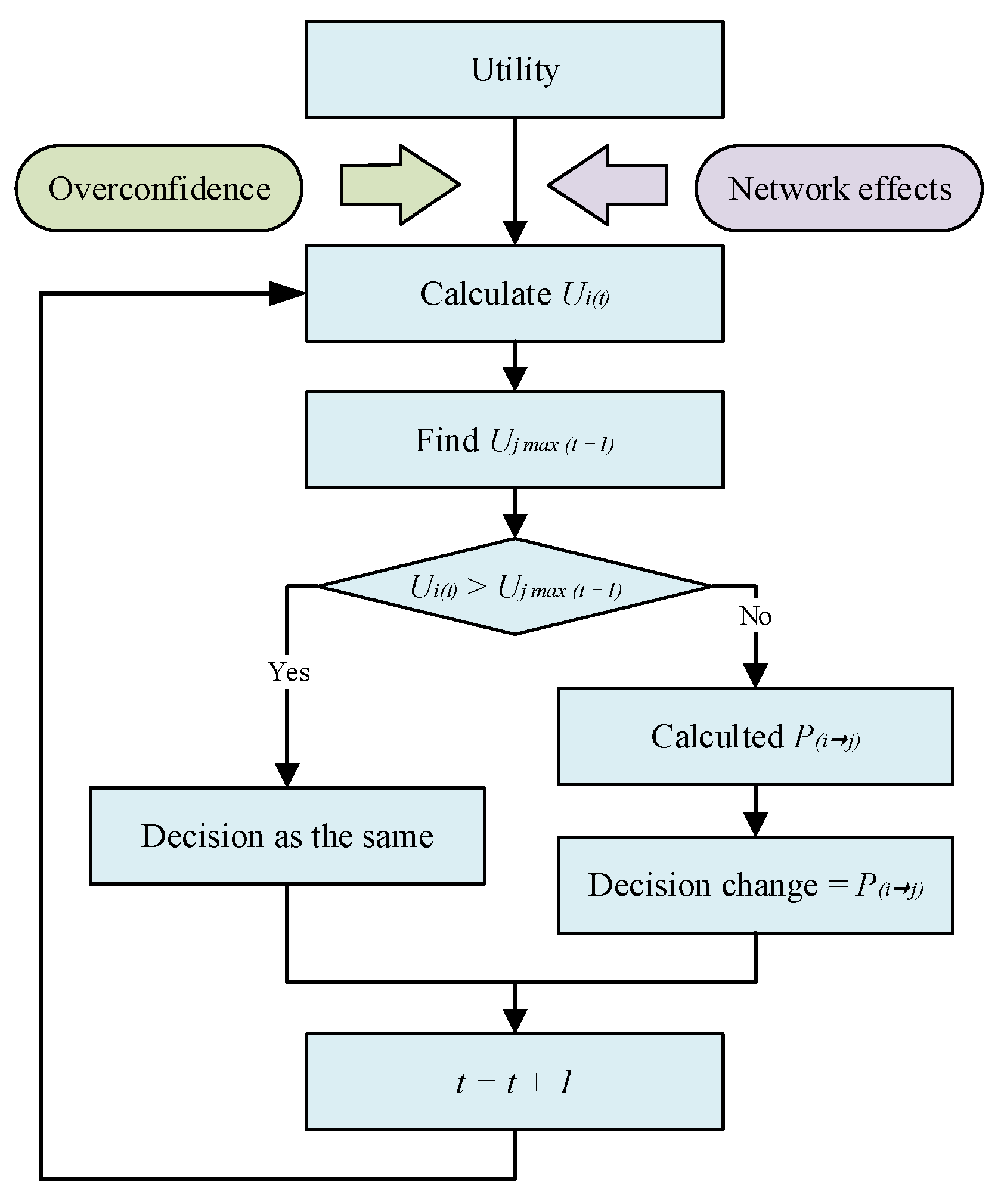

3.2.4. The Game Learning Algorithm for Users in the Product Diffusion

3.3. Simulation Model with Multi-Agents

3.3.1. Basic Multi-Agent Simulation Model

- is the set of agents. , where is the number of consumers in the network. Each agent is a consumer in the online social network.

- is the decision-making state of the consumer at time . , where means purchase and means refusal.

- is the neighbor set of the Agent. , where . That is, consists of agents connected to the Agent.

- is the set of overconfidence parameters, and . is the degree of overestimation, and is the degree of overprecision.

- is the consumer’s decision transfer function, that is, the current state of an individual is related to the state of itself and its neighbors, overconfidence, and network effects at the last moment.

- is the system clock, and is the basis of the simulation system.

3.3.2. State Transition Rules of Multi-Agent Simulation Model

3.3.3. Model Validation of Multi-Agent Simulation Model

4. Simulation Results

4.1. Experimental System and Default Parameters

- The number of agents is at as 400.

- For the random network, the node layout is set as a ring type and the number of agents in the neighborhood of each node (i.e., average degree distribution) is set at 6.

- For the small-world network, the node layout is set as an arranged type. The average degree distribution is set at 6, and the reconnection probability of each edge (i.e., rewiring probability) is 0.6.

- For the scale-free network, the node layout is set at random and the number of large nodes is 5.

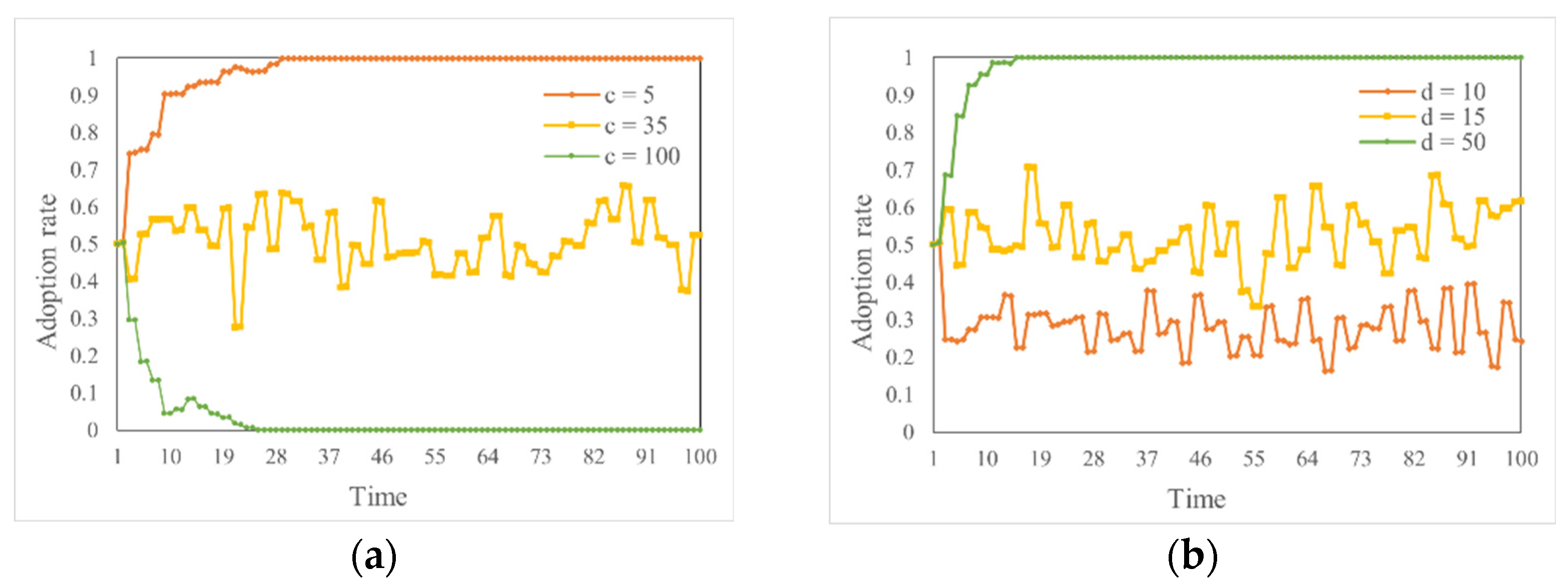

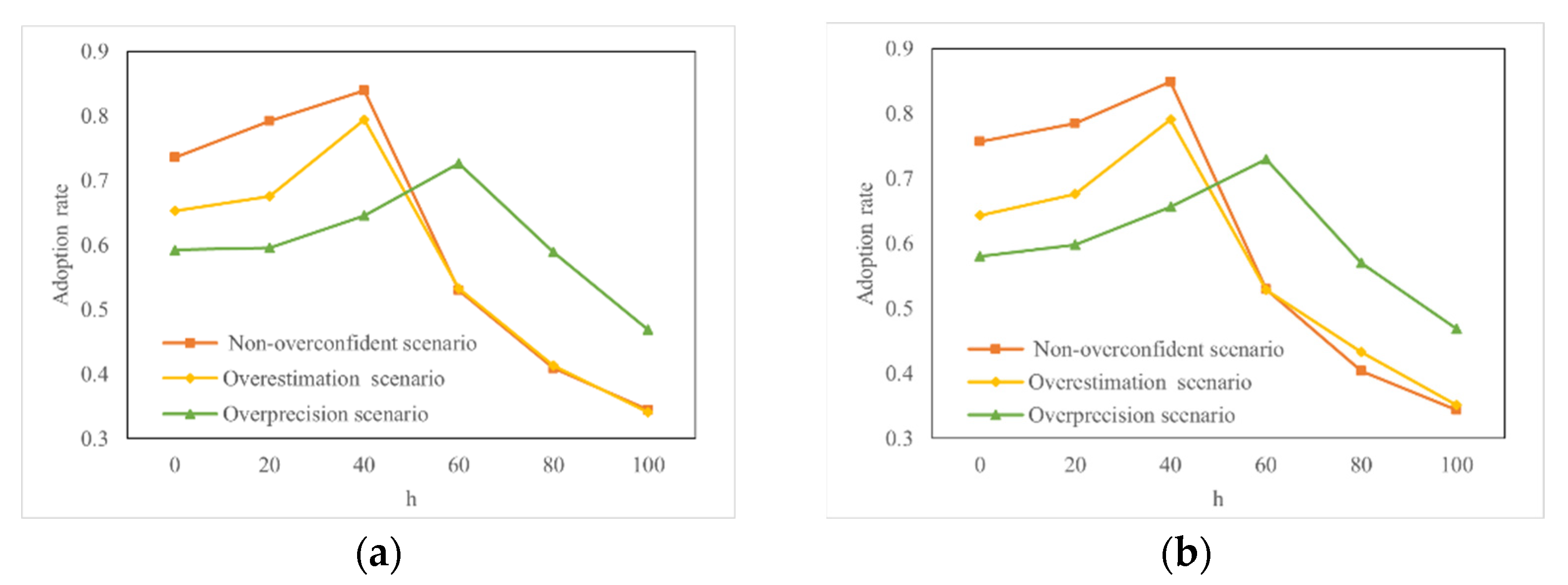

4.2. Parameters Related to Overconfidence

4.3. Parameters Related to Network Effects

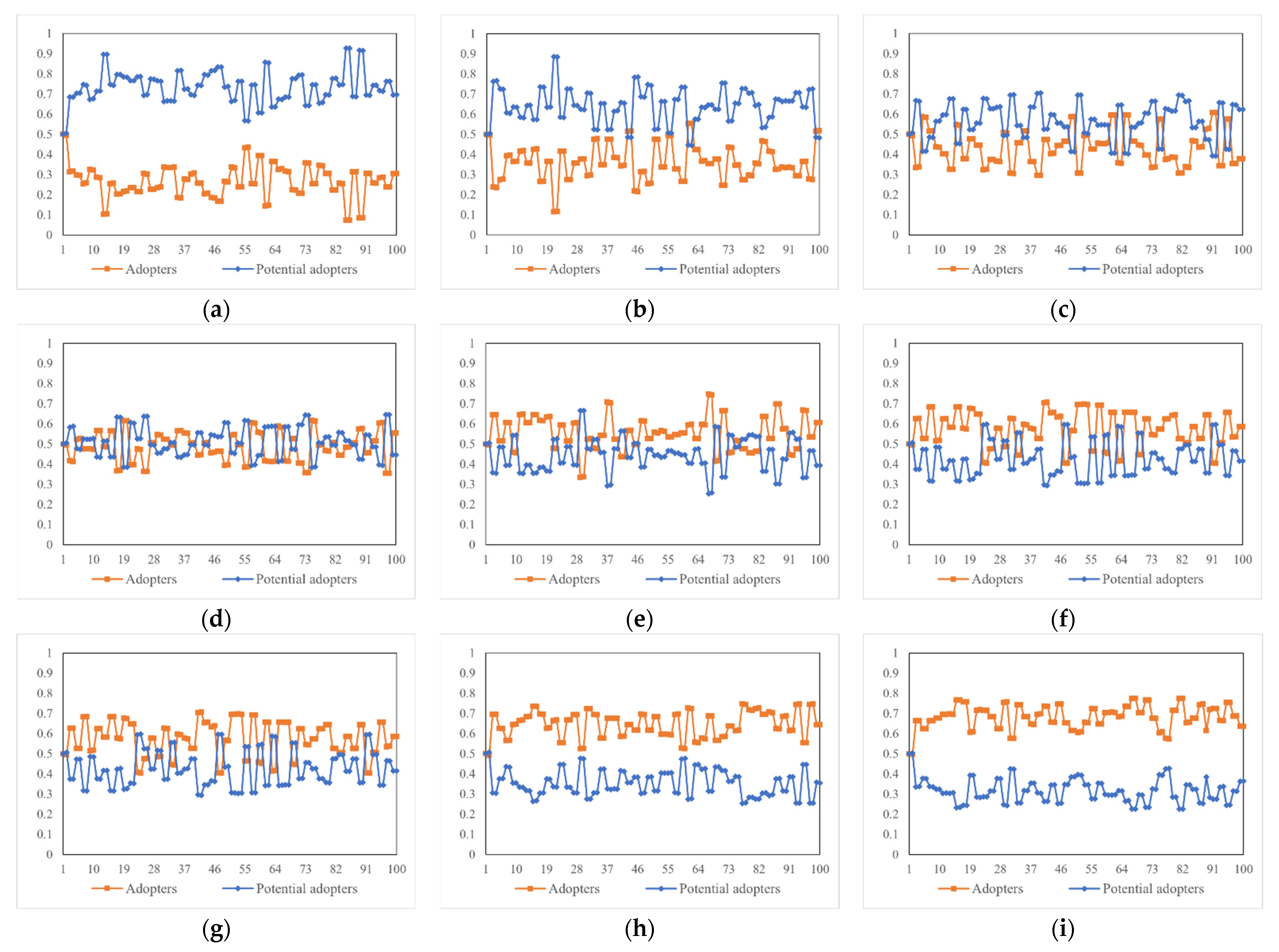

4.4. Parameters Related to Network Structure

5. Conclusions

- Enterprises should fully display the product information so that consumers have a proper overestimate of the benefits of buying the product. However, at the same time, enterprises should not exaggerate the utility of products too much, to prevent consumers from changing their purchase decisions when their expectations are inconsistent with reality.

- Companies should not invest too much capital in enhancing network effects. Moderate promotion can yield high returns, but over-enhancing social network effects often backfires, for example by making consumers loathe them. When the social network effects intensity is low, enterprises should try to reduce the degree of overconfidence of consumers. When it is high, they should try to improve the overprecision of consumers but control their overestimation.

- Enterprises should try to introduce influential KOLs (Key Opinion Leaders) into social networks to transform the small-world network into a scale-free network to achieve a higher level of product diffusion. This avoids fluctuations in consumer overconfidence and network effects on product proliferation.

- The psychological effects (overconfidence) and network effects perspectives opened up an entirely new way of looking at product diffusion in OSNs. This study adds to the theoretical foundation for the new product diffusion model by including additional behavioral theories and complex network theories.

- This research uncovered several different modeling strategies for complicated group behavior resulting from individual interaction. The micro-basis of the multi-agent simulation model was overconfidence theory, which was utilized to discover probable individual-level processes. This multi-method provides a fundamental framework for testing dynamic group behavior using a mix of a multi-agent method, network effects theory, and a psychological theory.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

Appendix B

References

- Wang, Y.; Wang, J.; Wang, H.; Zhang, R.; Li, M. Users’ Mobility Enhances Information Diffusion in Online Social Networks. Inf. Sci. 2021, 546, 329–348. [Google Scholar] [CrossRef]

- Wu, Y.; Pan, L. SG-PAC: A stochastic game approach to generate personal privacy paradox access-control policies in social networks. Comput. Secur. 2021, 102, 102157. [Google Scholar] [CrossRef]

- Zhang, H.; Vorobeychik, Y. Empirically grounded agent-based models of innovation diffusion: A critical review. Artif. Intell. Rev. 2019, 52, 707–741. [Google Scholar] [CrossRef]

- Muller, E.; Peres, R. The effect of social networks structure on innovation performance: A review and directions for research. Int. J. Res. Mark. 2019, 36, 3–19. [Google Scholar] [CrossRef]

- Wei, X.; Zhang, Y.; Fan, Y.; Nie, G. Online Social Network Information Dissemination Integrating Overconfidence and Evolutionary Game Theory. IEEE. Access 2021, 9, 90061–90074. [Google Scholar] [CrossRef]

- Saxton, G.D.; Wang, L. The Social Network Effect: The Determinants of Giving Through Social Media. Nonprof. Volunt. Sec. 2014, 43, 850–868. [Google Scholar] [CrossRef]

- Oren, S.S.; Schwartz, R.G. Diffusion of new products in risk-sensitive markets. J. Forecast. 1988, 7, 273–287. [Google Scholar] [CrossRef]

- Starcke, K.; Brand, M. Decision making under stress: A selective review. Neurosci. Biobehav. Rev. 2012, 36, 1228–1248. [Google Scholar] [CrossRef]

- Li, K.; Cong, R.; Wu, T.; Wang, L. Bluffing promotes overconfidence on social networks. Sci. Rep. 2014, 4, 5491. [Google Scholar] [CrossRef]

- Song, P.; Xue, L.; Rai, A.; Zhang, C. The ecosystem of software platform: A study of asymmetric cross-side network effects and platform governance. MIS Q. 2018, 42, 121–142. [Google Scholar] [CrossRef]

- Gibbons, D.E. Network structure and innovation ambiguity effects on diffusion in dynamic organizational fields. Acad. Manag. J. 2004, 47, 938–951. [Google Scholar] [CrossRef]

- Tseng, F.C.; Pham, T.T.L.; Cheng, T.C.E.; Teng, C.I. Enhancing customer loyalty to mobile instant messaging: Perspectives of network effect and self-determination theories. Telemat. Inform. 2018, 35, 1133–1143. [Google Scholar] [CrossRef]

- Fu, W.; Wang, Q.; Zhao, X. The influence of platform service innovation on value co-creation activities and the network effect. J. Serv. Manag. 2017, 28, 348–388. [Google Scholar] [CrossRef]

- Bass, F.M. A new product growth for model consumer durables. Manag. Sci. 1969, 15, 215–227. [Google Scholar] [CrossRef]

- Dawid, H.; Decker, R.; Hermann, T.; Jahnke, H.; Klat, W.; König, R.; Stummer, C. Management science in the era of smart consumer products: Challenges and research perspectives. Cent. Eur. J. Oper. Res. 2017, 25, 203–230. [Google Scholar] [CrossRef]

- Zhou, L.; Lin, J.; Li, Y.; Zhang, Z. Innovation diffusion of mobile applications in social networks: A multi-agent system. Sustainability 2020, 12, 2884. [Google Scholar] [CrossRef]

- Moore, D.A.; Healy, P.J. The trouble with overconfidence. Psychol. Rev. 2008, 115, 502. [Google Scholar] [CrossRef]

- Malmendier, U.; Tate, G. CEO overconfidence and corporate investment. J. Financ. 2005, 60, 2661–2700. [Google Scholar] [CrossRef]

- Malmendier, U.; Tate, G. Who makes acquisitions? CEO overconfidence and the market’s reaction. J. Financ. Econ. 2008, 89, 20–43. [Google Scholar] [CrossRef]

- Chen, G.; Crossland, C.; Luo, S. Making the same mistake all over again: CEO overconfidence and corporate resistance to corrective feedback. Strateg. Manag. J. 2015, 36, 1513–1535. [Google Scholar] [CrossRef]

- Van den Steen, E. Overconfidence by Bayesian-rational agents. Manag. Sci. 2011, 57, 884–896. [Google Scholar] [CrossRef]

- Malmendier, U.; Della Vigna, S. Paying not to go to the gym. Am. Econ. Rev. 2006, 96, 694–719. [Google Scholar] [CrossRef]

- Xia, T.; Wang, Z.; Li, K. Financial literacy overconfidence and stock market participation. Soc. Indic. Res. 2014, 119, 1233–1245. [Google Scholar] [CrossRef]

- Dowling, K.; Stich, L.; Spann, M. An experimental analysis of overconfidence in tariff choice. Rev. Manag. Sci. 2020, 8, 1–23. [Google Scholar] [CrossRef]

- Li, K.; Szolnoki, A.; Cong, R.; Wang, L. The coevolution of overconfidence and bluffing in the resource competition game. Sci. Rep. 2016, 6, 21104. [Google Scholar] [CrossRef]

- Xiang, Z.; Xu, M. Dynamic Game Strategies of a Two-stage Remanufacturing Closed-loop Supply Chain Considering Big Data Marketing, Technological Innovation and Overconfidence. Comput. Ind. Eng. 2020, 145, 106538. [Google Scholar] [CrossRef]

- Katz, M.L.; Shapiro, C. Network externalities, competition, and compatibility. Am. Econ. Rev. 1985, 75, 424–440. [Google Scholar]

- Niemczyk, J.; Trzaska, R.; Wilczyński, M.; Borowski, K. Business Models 4.0 Using Network Effects: Case Study of the Cyfrowy Polsat Group. Sustainability 2021, 13, 11570. [Google Scholar] [CrossRef]

- Tseng, F.C.; Teng, C.I. Carefulness matters: Consumer responses to short message service advertising. Int. J. Electron. Comm. 2016, 20, 525–550. [Google Scholar] [CrossRef]

- Parker, G.G.; Van Alstyne, M.W. Two-Sided Network Effects: A Theory of Information Product Design. Manage. Sci. 2005, 51, 1494–1504. [Google Scholar] [CrossRef]

- Sundquist, A.; Bigdeli, S.; Jalili, R.; Druzin, M.L.; Waller, S.; Pullen, K.M.; Ronaghi, M. Bacterial flora-typing with targeted, chip-based Pyrosequencing. BMC. Microbiol. 2007, 7, 108. [Google Scholar] [CrossRef] [PubMed]

- Zhou, Q.; Yang, F. Innovation Diffusion with Network Effects and Band-wagon Effects Based on Complex Networks. WHICEB 2020 Proc. 2020, 23, 546–555. Available online: https://aisel.aisnet.org/whiceb2020/23 (accessed on 7 May 2020).

- Katona, Z.; Zubcsek, P.P.; Sarvary, M. Network effects and personal influences: The diffusion of an online social network. J. Mark. Res. 2011, 48, 425–443. [Google Scholar] [CrossRef]

- Kiesling, E.; Günther, M.; Stummer, C.; Wakolbinger, L.M. Agent-based simulation of innovation diffusion: A review. Cent. Eur. J. Oper. Res. 2012, 20, 183–230. [Google Scholar] [CrossRef]

- Jiang, G.; Tadikamalla, P.R.; Shang, J.; Zhao, L. Impacts of knowledge on online brand success: An agent-based model for online market share enhancement. Eur. J. Oper. Res. 2016, 248, 1093–1103. [Google Scholar] [CrossRef]

- Stummer, C.; Kiesling, E.; Günther, M.; Vetschera, R. Innovation diffusion of repeat purchase products in a competitive market: An agent-based simulation approach. Eur. J. Oper. Res. 2015, 245, 157–167. [Google Scholar] [CrossRef]

- Bohlmann, J.D.; Calantone, R.J.; Zhao, M. The Effects of Market Network Heterogeneity on Innovation Diffusion: An Agent-Based Modeling Approach. J. Prod. Innov. Manag. 2010, 27, 741–760. [Google Scholar] [CrossRef]

- Jiang, G.; Feng, X.; Liu, W.; Liu, X. Clicking position and user posting behavior in online review systems: A data-driven agent-based modeling approach. Inf. Sci. 2020, 512, 161–174. [Google Scholar] [CrossRef]

- Berger, T. Agent-based spatial models applied to agriculture: A simulation tool for technology diffusion, resource use changes and policy analysis. Agric. Econ. 2001, 25, 245–260. [Google Scholar] [CrossRef]

- Zhang, Q.; Wang, H.; Feng, Z. Three-Sided Matching Game Based Joint Bandwidth and Caching Resource Allocation for UAVs. In Proceedings of the 2021 IEEE/CIC International Conference on Communications in China (ICCC), Xiamen, China, 28–30 July 2021; IEEE: New York, NY, USA, 2021. [Google Scholar] [CrossRef]

- Rocha, A.B.D.; Salomão, G.M. Environmental policy regulation and corporate compliance in evolutionary game models with well-mixed and structured populations. Eur. J. Oper. Res. 2019, 279, 486–501. [Google Scholar] [CrossRef]

- Shi, Y.; Han, B.; Zeng, Y. Simulating policy interventions in the interfirm diffusion of low-carbon technologies: An agent-based evolutionary game model. J. Clean. Prod. 2019, 250, 119449. [Google Scholar] [CrossRef]

- Bryson, J.J.; Ando, Y.; Lehmann, H. Agent-based modelling as scientific method: A case study analysing primate social behaviour. Philos. Trans. R. Soc. B Biol. Sci. 2007, 362, 1685–1699. [Google Scholar] [CrossRef] [PubMed][Green Version]

- Joseph, J.; Gaba, V. Organizational structure, information processing, and decision-making: A retrospective and road map for research. Acad. Manag. Ann. 2020, 14, 267–302. [Google Scholar] [CrossRef]

- Delaram, J.; Houshamand, M.; Ashtiani, F.; Valilai, O.F. A utility-based matching mechanism for stable and optimal resource allocation in cloud manufacturing platforms using deferred acceptance algorithm. J. Manuf. Syst. 2021, 60, 569–584. [Google Scholar] [CrossRef]

- Hann, I.H.; Hui, K.L.; Lee, S.Y.T.; Png, I.P. Overcoming online information privacy concerns: An information-processing theory approach. J. Manag. Inf. Syst. 2007, 24, 13–42. [Google Scholar] [CrossRef]

- Dellarocas, C. Strategic manipulation of internet opinion forums: Implications for consumers and firms. Manag. Sci. 2006, 52, 1577–1593. [Google Scholar] [CrossRef]

- Yang, H.X.; Tian, L. Enhancement of cooperation through conformity-driven reproductive ability. Chaos Solitons Fractals 2017, 103, 159–162. [Google Scholar] [CrossRef]

- Szabó, G.; Tőke, C. Evolutionary prisoner’s dilemma game on a square lattice. Phys. Rev. E 1998, 58, 69. [Google Scholar] [CrossRef]

- Knoeri, C.; Binder, C.R.; Althaus, H.J. An agent operationalization approach for context specific agent-based modeling. JASSS-J. Artif. Soc. S 2011, 14, 4. [Google Scholar] [CrossRef]

- Du, W.B.; Cao, X.B.; Hu, M.B.; Yang, H.X.; Zhou, H. Effects of expectation and noise on evolutionary games. Phys. A 2009, 388, 2215–2220. [Google Scholar] [CrossRef]

- Mäs, M.; Nax, H.H. A behavioral study of “noise” in coordination games. J. Econ. Theory 2016, 162, 195–208. [Google Scholar] [CrossRef]

| Player 1 | Player 2 | |

|---|---|---|

| Adoption | Rejection | |

| Adoption | ||

| Rejection | ||

| No. | Parameter | Description | Default |

|---|---|---|---|

| 1 | Network-type | Type of network | Small-world |

| 2 | Value of in Table 1 | 55 | |

| 3 | Value of in Table 1 | 35 | |

| 4 | Value of in Table 1 | 15 | |

| 5 | Percentage of users holding an adoption strategy | 0.5 | |

| 6 | Information noise | 0.1 | |

| 7 | The overestimation parameter | 0 | |

| 8 | The overprecision parameter | 1 | |

| 9 | The network effects intensity | 100 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wei, X.; Zhang, Y.; Liao, Q.; Nie, G. Multi-Agent Simulation of Product Diffusion in Online Social Networks from the Perspective of Overconfidence and Network Effects. Sustainability 2022, 14, 6589. https://doi.org/10.3390/su14116589

Wei X, Zhang Y, Liao Q, Nie G. Multi-Agent Simulation of Product Diffusion in Online Social Networks from the Perspective of Overconfidence and Network Effects. Sustainability. 2022; 14(11):6589. https://doi.org/10.3390/su14116589

Chicago/Turabian StyleWei, Xiaochao, Yanfei Zhang, Qi Liao, and Guihua Nie. 2022. "Multi-Agent Simulation of Product Diffusion in Online Social Networks from the Perspective of Overconfidence and Network Effects" Sustainability 14, no. 11: 6589. https://doi.org/10.3390/su14116589

APA StyleWei, X., Zhang, Y., Liao, Q., & Nie, G. (2022). Multi-Agent Simulation of Product Diffusion in Online Social Networks from the Perspective of Overconfidence and Network Effects. Sustainability, 14(11), 6589. https://doi.org/10.3390/su14116589