In the Pursuit of Environmental Sustainability: The Role of Environmental Accounting

Abstract

:1. Introduction

2. Literature Review

2.1. Environmental Contamination: An Overview

2.2. Environmental Pollution Is a Global Issue

2.3. The Role of Corporations in Worldwide Environmental Pollution

2.4. Environmental Practice

2.4.1. Corporate Environmental Responsibility

2.4.2. Corporate Accountability Regarding the Environment

2.4.3. Environmental Accounting/Reporting as a Medium of Accountability Practice

2.4.4. EA Disclosures

2.4.5. Environmental Accounting/Reporting and IFRS

2.5. Relations between Environmental Accounting and Performance

2.5.1. Profitability

2.5.2. Environmental Sustainability

2.5.3. AQ

2.5.4. Firm Size

2.5.5. Environmental Accounting and Performance: An Empirical Review

2.5.6. Environmental Accounting/Reporting in Developed Economies

2.5.7. Environmental Accounting/Reporting in Developing Economies

2.5.8. Kyoto Protocols and Developing Countries

2.6. Theoretical Explanations

3. Methodology

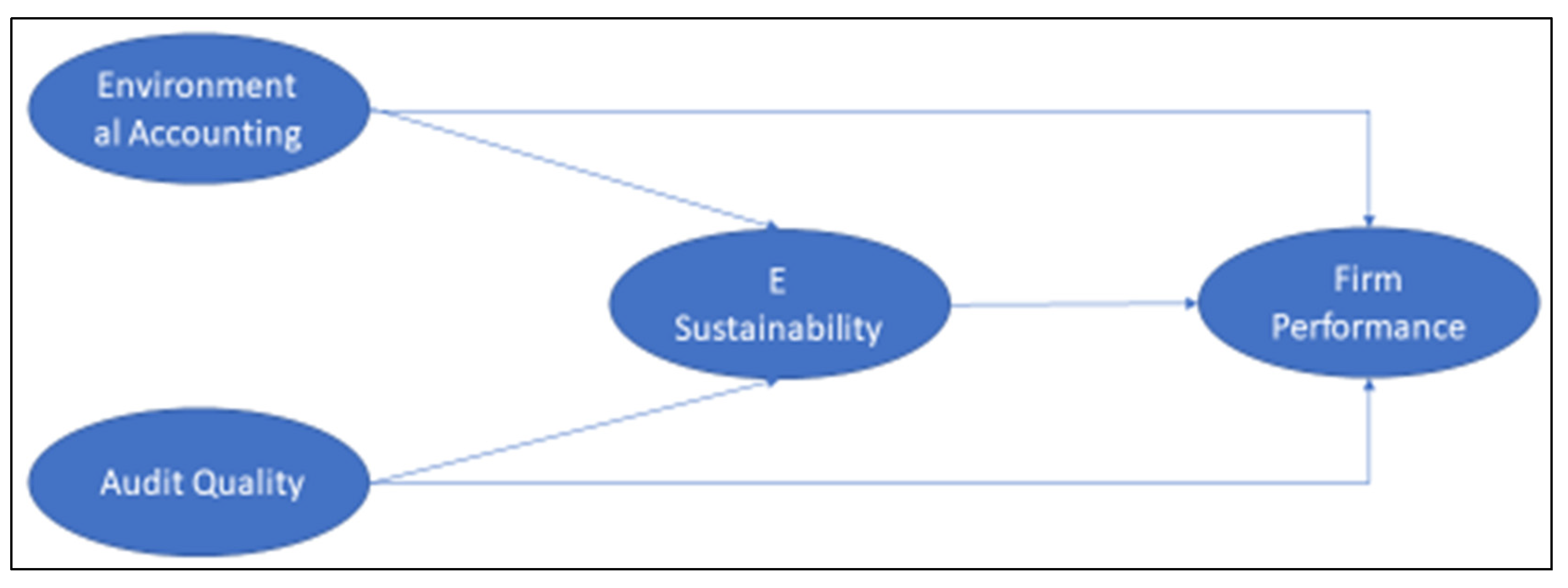

3.1. Model

3.2. Data

3.3. Statistical Techniques

4. Findings

5. Conclusions

Future Implications and Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Bebbington, J.; Gray, R. An Account of Sustainability: Failure, Success and a Reconceptualization. Crit. Perspect. Account. 2001, 12, 557–587. [Google Scholar] [CrossRef] [Green Version]

- Boutros-Ghali, B. Opening Speech on Environment and Development; Diane Publishing co.: Rio de Janeiro, Brazil, 1992. [Google Scholar]

- Callan, S.J.; Thomas, J.M. Environmental Economics and Management: Theory, Policy, and Applications, 2nd ed.; Cengage Learning: Boston, MA, USA, 2013. [Google Scholar]

- Darabaris, J. Corporate Environmental Management; CRC Press/Taylor and Francis Group: Boca Raton, FL, USA, 2007. [Google Scholar]

- Freeman, R.E. Stakeholder Management: Framework and Philosophy; Edward Elgar Publishing Limited: Mansfield, MA, USA, 1984. [Google Scholar]

- Gray, R. Is Accounting for Sustainability Actually Accounting for Sustainability and How Would We Know? An Exploration of Narratives of Organisations and the Planet. Account. Organ. Soc. 2010, 35, 47–62. [Google Scholar] [CrossRef]

- Gray, R.; Owen, D.; Adams, C. Accounting & Accountability: Changes and Challenges in Corporate Social and Environmental Reporting; Prentice Hall: Hoboken, NJ, USA, 1996; ISBN 978013175860. Available online: https://eprints.gla.ac.uk/95486/ (accessed on 29 March 2022).

- United Nations. Agenda 21 United Nations Conference on Environment & Development Rio de Janeiro; Brazil, 1992. Available online: https://sustainabledevelopment.un.org/content/documents/Agenda21.pdf (accessed on 29 March 2022).

- United Nations. In Proceedings of the United Nations Conference on Sustainable Development, Rio+20, Rio de Janeiro, Brazil, 20 June 2012. Available online: https://sustainabledevelopment.un.org/conferences (accessed on 29 March 2022).

- Unerman, J. Stakeholder Engagement and Dialogue. In Sustainability Accounting and Accountability; Unerman, J., Bebbington, J., O’Dwyer, B., Eds.; Routledge: London, UK, 2007. [Google Scholar]

- Baker, M.; Schaltegger, S. Pragmatism and New Directions in Social and Environmental Accountability Research. Account. Audit. Account. J. 2015, 28, 263–294. [Google Scholar] [CrossRef]

- Capusneanu, S.; Topor, D.I.; Hint, M.S.; Ionescu, C.A.; Coman, M.D.; Paschia, L.; Nicolau, N.L.G.; Ivan, O.R. Mathematical Model for Identifying and Quantifying the Overall Environmental Cost. J. Bus. Econ. Manag. 2020, 21, 1307–1328. [Google Scholar] [CrossRef]

- United Nation Environment Programme. UNEP 2006 Annual Report; United Nation Environment Programme: Nairobi, Kenya, 2006; p. 87. [Google Scholar] [CrossRef]

- Lee, C.T.; Lim, J.S.; Van Fan, Y.; Liu, X.; Fujiwara, T.; Klemeš, J.J. Enabling Low-Carbon Emissions for Sustainable Development in Asia and Beyond. J. Clean. Prod. 2018, 176, 726–735. [Google Scholar] [CrossRef]

- Dowell, G.; Hart, S.; Yeung, B. Do Corporate Global Environmental Standards Create or Destroy Market Value? Manag. Sci. 2000, 46, 1059–1074. [Google Scholar] [CrossRef] [Green Version]

- Chiang, C. Insights into Current Practices in Auditing Environmental Matters. Manag. Audit. J. 2010, 25, 912–933. [Google Scholar] [CrossRef]

- Moalla, M.; Salhi, B.; Jarboui, A. An Empirical Investigation of Factors Influencing the Environmental Reporting Quality: Evidence from France. Soc. Responsib. J. 2020. [Google Scholar] [CrossRef]

- Ganga, G. Green Audit for the Environmental Sustainability. In Green Public Procurement Strategies for Environmental Sustainability; IGI Global: Hershey, PA, USA, 2019; pp. 45–58. [Google Scholar] [CrossRef]

- Abbasi, K.; Jiao, Z.; Shahbaz, M.; Khan, A. Asymmetric Impact of Renewable and Non-Renewable Energy on Economic Growth in Pakistan: New Evidence from a Nonlinear Analysis. Energy Explor. Exploit. 2020, 38, 1946–1967. [Google Scholar] [CrossRef]

- Tadros, H.; Magnan, M. How Does Environmental Performance Map into Environmental Disclosure? A Look at Underlying Economic Incentives and Legitimacy Aims. Sustain. Account. Manag. Policy J. 2019, 10, 62–96. [Google Scholar] [CrossRef]

- Rustam, A.; Wang, Y.; Zameer, H. Does Foreign Ownership Affect Corporate Sustainability Disclosure in Pakistan? A Sequential Mixed Methods Approach. Environ. Sci. Pollut. Res. 2019, 26, 31178–31197. [Google Scholar] [CrossRef] [PubMed]

- Dasanayaka, C.H.; Murphy, D.F.; Nagirikandalage, P.; Abeykoon, C. The Application of Management Accounting Practices towards the Sustainable Development of Family Businesses: A Critical Review. Clean. Environ. Syst. 2021, 3, 100064. [Google Scholar] [CrossRef]

- Baboukardos, D.; Mangena, M.; Ishola, A. Integrated Thinking and Sustainability Reporting Assurance: International Evidence. Bus. Strategy Environ. 2021, 30, 1580–1597. [Google Scholar] [CrossRef]

- Kinney, W.R. Information Quality Assurance and Internal Control for Management Decision Making. Issues Account. Educ. 2000, 15, 347. [Google Scholar]

- Mercer, M. How Do Investors Assess the Credibility of Management Disclosures? Account. Horiz. 2004, 18, 185–196. [Google Scholar] [CrossRef]

- Pflugrath, G.; Roebuck, P.; Simnett, R. Impact of Assurance and Assurer’s Professional Affiliation on Financial Analysts’ Assessment of Credibility of Corporate Social Responsibility Information. Audit. A J. Pract. Theory 2011, 30, 239–254. [Google Scholar] [CrossRef]

- Birkey, R.N.; Michelon, G.; Patten, D.M.; Sankara, J. Does Assurance on CSR Reporting Enhance Environmental Reputation? An Examination in the US Context. In Accounting Forum; Taylor & Francis: Abingdon, UK, 2016; Volume 40, pp. 143–152. [Google Scholar]

- Sheldon, M.D.; Jenkins, J.G. The Influence of Firm Performance and (Level of) Assurance on the Believability of Management’s Environmental Report. Account. Audit. Account. J. 2020, 33, 501–528. [Google Scholar] [CrossRef]

- United Nations. The United Nations Framework Convention on Climate Change (UNFCCC). In Proceedings of the UN Climate Change Conference COP 25, Madrid, Spain, 2–13 December 2019. [Google Scholar]

- Ullah, R.; Malik, R.N.; Qadir, A. Assessment of Groundwater Contamination in an Industrial City, Sialkot, Pakistan. Afr. J. Environ. Sci. Technol. 2009, 3, 429–446. [Google Scholar]

- Almas, Z.-H. Pakistan’s Current Account Deficit: Tackling the Sustainability Issue. Policy Perspect. 2008, 5, 85–113. [Google Scholar]

- Gul, S.; Muhammad, F.; Rashid, A. Corporate Governance and Corporate Social Responsibility: The Case of Small, Medium, and Large Firms. Pak. J. Commer. Soc. Sci. 2017, 11, 1–34. [Google Scholar]

- Rafique, M.A.; Malik, Q.A.; Waheed, A.; Khan, N.-U. Corporate Governance and Environmental Reporting in Pakistan. Pak. Adm. Rev. 2017, 1, 103–114. [Google Scholar]

- Kyoto Protocol. United Nations Framework Convention on Climate Change (UNFCCC). In Kyoto Protocol to the United Nations Framework Convention on Climate Change; Kyoto Protocol: Kyoto, Japan, 1998. [Google Scholar]

- Carroll, A.B. The Pyramid of Corporate Social Responsibility: Toward the Moral Management of Organizational Stakeholders. Bus. Horiz. 1991, 34, 39–48. [Google Scholar] [CrossRef]

- Dillard, J.; Layzell, D. An Ongoing Journey of Corporate Social Responsibility. In Accounting forum; Elsevier: Amsterdam, The Netherlands, 2014; Volume 38, pp. 212–226. [Google Scholar] [CrossRef]

- Freeman, R.E.; Liedtka, J. Corporate Social Responsibility: A Critical Approach. Bus. Horiz. 1991, 34, 92–98. [Google Scholar] [CrossRef]

- O’Dwyer, B. Conceptions of Corporate Social Responsibility: The Nature of Managerial Capture. Account. Audit. Account. J. 2003, 16, 523–557. [Google Scholar] [CrossRef] [Green Version]

- Freedman, M.; Jaggi, B. Pollution Disclosures, Pollution Performance and Economic Performance. Omega 1982, 10, 167–176. [Google Scholar] [CrossRef]

- Friedman, M. Capitalism and Freedom, 1st ed.; University of Chicago Press: Chicago, IL, USA, 1962; Available online: https://press.uchicago.edu/ucp/books/book/chicago/C/bo68666099.html (accessed on 29 March 2022).

- Lauwo, S.; Otusanya, O.J. Corporate Accountability and Human Rights Disclosures: A Case Study of Barrick Gold Mine in Tanzania. Account. Forum 2014, 38, 91–108. [Google Scholar] [CrossRef]

- Sikka, P. Smoke and Mirrors: Corporate Social Responsibility and Tax Avoidance—A Reply to Hasseldine and Morris. Account. Forum 2013, 37, 15–28. [Google Scholar] [CrossRef]

- Sikka, P. Smoke and Mirrors: Corporate Social Responsibility and Tax Avoidance. Account. Forum 2010, 34, 153–168. [Google Scholar] [CrossRef]

- Adams, C.A. The Ethical, Social and Environmental Reporting-Performance Portrayal Gap. Account. Audit. Account. J. 2004, 17, 731–757. [Google Scholar] [CrossRef]

- Belal, A.R.; Cooper, S.M.; Khan, N.A. Corporate Environmental Responsibility and Accountability: What Chance in Vulnerable Bangladesh? Crit. Perspect. Account. 2015, 33, 44–58. [Google Scholar] [CrossRef] [Green Version]

- Cho, C.H.; Michelon, G.; Patten, D.M. Impression Management in Sustainability Reports: An Empirical Investigation of the Use of Graphs. Account. Public Interest 2012, 12, 16–37. [Google Scholar] [CrossRef]

- Hassan, A.; Kouhy, R. Gas Flaring in Nigeria: Analysis of Changes in Its Consequent Carbon Emission and Reporting. Account. Forum 2013, 37, 124–134. [Google Scholar] [CrossRef]

- Deegan, C. EBOOK: Financial Accounting Theory: European Edition; McGraw Hill: New York, NY, USA, 2011; Available online: https://books.google.com.pk/books?hl=en&lr=&id=tsovEAAAQBAJ&oi=fnd&pg=PR1&dq=Deegan,+C.+EBOOK:+Financial+Accounting+Theory:+European+Edition%3B+McGraw+Hill:+New+York,+NY,+USA,+2011&ots=3Jk6MAKD-J&sig=ikmcsS7u9uoJa7gUwxKvWg2WzrQ&redir_esc=y#v=onepage&q&f=false (accessed on 29 March 2022).

- Freedman, M.; Patten, D.M. Evidence on the Pernicious Effect of Financial Report Environmental Disclosure. In Accounting Forum; Elsevier: Amsterdam, The Netherlands, 2004; Volume 28, pp. 27–41. [Google Scholar] [CrossRef]

- Gray, R.; Owen, D.; Maunders, K. Corporate Social Reporting: Emerging Trends in Accountability and the Social Contract. Account. Audit. Account. J. 1988, 1, 6–20. [Google Scholar] [CrossRef]

- Gray, R.; Adams, C.; Owen, D. Accountability, Social Responsibility and Sustainability: Accounting for Society and the Environment: Pearson Higher Ed.; Pearson Education: London, UK, 2014; Available online: https://www.pearson.com/uk/educators/higher-education-educators/program/Gray-Accountability-Social-Responsibility-and-Sustainability-Accounting-for-Society-and-the-Environment/PGM780327.html (accessed on 29 March 2022).

- Gray, R.; Bebbington, J. Accounting for the Environment; Sage: London, UK, 2001; ISBN 9780761971368. Available online: http://eprints.gla.ac.uk/33528/ (accessed on 29 March 2022).

- O’Dwyer, B.; Owen, D.L. Assurance Statement Practice in Environmental, Social and Sustainability Reporting: A Critical Evaluation. Br. Account. Rev. 2005, 37, 205–229. [Google Scholar] [CrossRef]

- Buhr, N. Environmental Performance, Legislation and Annual Report Disclosure: The Case of Acid Rain and Falconbridge. Account. Audit. Account. J. 1998, 11, 163–190. [Google Scholar] [CrossRef]

- Dierkes, M.; Preston, L.E. Corporate Social Accounting Reporting for the Physical Environment: A Critical Review and Implementation Proposal. Account. Organ. Soc. 1977, 2, 3–22. [Google Scholar] [CrossRef]

- Mathews, M.R. Twenty-Five Years of Social and Environmental Accounting Research: Is There a Silver Jubilee to Celebrate? Account. Audit. Account. J. 1997, 10, 481–531. [Google Scholar] [CrossRef]

- Clapp, J. Global Environmental Governance for Corporate Responsibility and Accountability. Glob. Environ. Politics 2005, 5, 23–34. [Google Scholar] [CrossRef]

- Corfee-Morlot, J.; Kamal-Chaoui, L.; Donovan, M.G.; Cochran, I.; Robert, A.; Teasdale, P.-J. Cities, Climate Change and Multilevel Governance; OECD: Paris, France, 2009. [Google Scholar] [CrossRef]

- Jagger, N. Environmental Careers and Environmental Scientists. In The Environment, Employment and Sustainable Development; Routledge: London, UK, 2002; pp. 116–122. [Google Scholar]

- Mitchell, A.V.; Sikka, P. Taming the Corporations; Association for Accountancy & Business Affairs Basildon: 2005. Available online: https://www.yumpu.com/en/document/read/50923267/taming-the-corporations-it-works (accessed on 29 March 2022).

- Anderson, S.; Cavanagh, J. Report on the Top 200 Corporations. In Inst. Policy Stud.; 2000; Available online: https://www.iatp.org/sites/default/files/Top_200_The_Rise_of_Corporate_Global_Power.pdf (accessed on 29 March 2022).

- Sikka, P. Accounting for Human Rights: The Challenge of Globalization and Foreign Investment Agreements. Crit. Perspect. Account. 2011, 22, 811–827. [Google Scholar] [CrossRef]

- World Health Organization; Regional Office for the Eastern Mediterranean. World Health Organization Annual Report 2019 WHO Country Office Lebanon: Health for All. 2020. Available online: https://apps.who.int/iris/bitstream/handle/10665/333249/9789290223214-eng.pdf (accessed on 29 March 2022).

- United Nations Environment Programme. Emissions Gap Report 2020; United Nations Environment Programme: Nairobi, Kenya, 2020; Available online: https://www.unep.org/emissions-gap-report-2020 (accessed on 29 March 2022).

- Hasnat, G.T.; Kabir, M.A.; Hossain, M.A. Major Environmental Issues and Problems of South Asia, Particularly Bangladesh. In Handbook of Environmental Materials Management; 2018; pp. 1–40. Available online: https://www.researchgate.net/publication/323264078_Major_Environmental_Issues_and_Problems_of_South_Asia_Particularly_Bangladesh (accessed on 29 March 2022).

- United Nation Environment Programme. UNEP 2011 Annual Report; United Nation Environment Programme: Nairobi, Kenya, 2011; p. 116. ISBN 978-92-807-3244-3. [Google Scholar]

- Brundtland, G.H. Report of the World Commission on Environment and Development: “Our Common Future”; UN: New York, NY, USA, 1987; pp. 1–300. [Google Scholar]

- Stewart, J.D. The Role of Information in Public Accountability. Issues Public Sect. Account. 1987. Available online: https://sswm.info/sites/default/files/reference_attachments/UN%20WCED%201987%20Brundtland%20Report.pdf (accessed on 29 March 2022).

- Brophy, M.; Starkey, R. Environmental Reporting. Corp. Environ. Manag. 1 Syst. Strategy. 1998, 175–196. [Google Scholar] [CrossRef]

- Noah, A.O. Accounting for the Environment: The Accountability of the Nigerian Cement Industry. Ph.D. Thesis, University of Essex, Essex, UK, 2017. [Google Scholar]

- Adams, C.A.; Hill, W.-Y.; Roberts, C.B. Corporate Social Reporting Practices in Western Europe: Legitimating Corporate Behaviour? Br. Account. Rev. 1998, 30, 1–21. [Google Scholar] [CrossRef]

- Bagur-Femenías, L.; Perramon, J.; Amat, O. Impact of Quality and Environmental Investment on Business Competitiveness and Profitability in Small Service Business: The Case of Travel Agencies. Total Qual. Manag. Bus. Excell. 2015, 26, 840–853. [Google Scholar] [CrossRef]

- Bhattarai, B.; Beilin, R.; Ford, R. Gender, Agrobiodiversity, and Climate Change: A Study of Adaptation Practices in the Nepal Himalayas. World Dev. 2015, 70, 122–132. [Google Scholar] [CrossRef]

- Makori, D.M.; Jagongo, A. Environmental Accounting and Firm Profitability: An Empirical Analysis of Selected Firms Listed in Bombay Stock Exchange, India. Int. J. Humanit. Soc. Sci. 2013, 3, 248–256. [Google Scholar]

- Cormier, D.; Gordon, I.M.; Magnan, M. Corporate Environmental Disclosure: Contrasting Management’s Perceptions with Reality. J. Bus. Ethics 2004, 49, 143–165. [Google Scholar] [CrossRef]

- Neu, D.; Warsame, H.; Pedwell, K. Managing Public Impressions: Environmental Disclosures in Annual Reports. Account. Organ. Soc. 1998, 23, 265–282. [Google Scholar] [CrossRef]

- Oliveira, J.; Rodrigues, L.L.; Craig, R. Risk-Related Disclosures by Non-Finance Companies: Portuguese Practices and Disclosure Characteristics. Manag. Audit. J. 2011, 26, 817–839. [Google Scholar] [CrossRef] [Green Version]

- Kamal, Y.; Deegan, C. Corporate Social and Environment-Related Governance Disclosure Practices in the Textile and Garment Industry: Evidence from a Developing Country. Aust. Account. Rev. 2013, 23, 117–134. [Google Scholar] [CrossRef]

- Camacho-Gingerich, A.; Branco-Rodriguez, S.; Pitteri, R.; Javier, R. Psychological Adjustment, Cultural, and Legal Issues. In Handbook of Adoption: Implications for Researchers, Practitioner, and Families; Sage: Thousand Oaks, CA, USA, 2007; pp. 149–159. [Google Scholar]

- Baker, C.R.; Barbu, E.M. Evolution of Research on International Accounting Harmonization: A Historical and Institutional Perspective. Socio-Econ. Rev. 2007, 5, 603–632. [Google Scholar] [CrossRef]

- Holthausen, R.W. Accounting Standards, Financial Reporting Outcomes, and Enforcement. J. Account. Res. 2009, 47, 447–458. [Google Scholar] [CrossRef] [Green Version]

- Kvaal, E.; Nobes, C. International Differences in IFRS Policy Choice: A Research Note; 2010. Available online: https://www.jstor.org/stable/25548027 (accessed on 29 March 2022).

- Soufeljil, M.; Sghaier, A.; Kheireddine, H.; Mighri, Z. Ownership Structure and Corporate Performance: The Case of Listed Tunisian Firms. J. Bus. Financ. Aff. 2016, 5, 1–8. [Google Scholar]

- Lucia, L.; Panggabean, R.R. The Effect of Firm’s Characteristic and Corporate Governance to Sustainability Report Disclosure. SEEIJ (Soc. Econ. Ecol. Int. J.) 2018, 2, 18–28. [Google Scholar] [CrossRef]

- Eyigege, A.I. Influence of Firm Size on Financial Performance of Deposit Money Banks Quoted on the Nigeria Stock Exchange. Int. J. Econ. Financ. Res. 2018, 4, 297–302. [Google Scholar]

- Babalola, Y.A. The Effect of Firm Size on Firms Profitability in Nigeria. J. Econ. Sustain. Dev. 2013, 4, 90–94. [Google Scholar]

- Hall, M.; Weiss, L. Firm Size and Profitability. Rev. Econ. Stat. 1967, 49, 319–331. [Google Scholar] [CrossRef]

- Marcus, M. Profitability and Size of Firm: Some Further Evidence. Rev. Econ. Stat. 1969, 51, 104–107. [Google Scholar] [CrossRef]

- Chiu, T.-K.; Wang, Y.-H. Determinants of Social Disclosure Quality in Taiwan: An Application of Stakeholder Theory. J. Bus. Ethics 2015, 129, 379–398. [Google Scholar] [CrossRef]

- Roberts, R.W. Determinants of Corporate Social Responsibility Disclosure: An Application of Stakeholder Theory. Account. Organ. Soc. 1992, 17, 595–612. [Google Scholar] [CrossRef] [Green Version]

- Ezeagba, C. Financial Reporting in Small and Medium Enterprises (SMEs) in Nigeria. Challenges and Options. Int. J. Acad. Res. Account. Financ. Manag. Sci. 2017, 7, 1–10. [Google Scholar] [CrossRef] [Green Version]

- Şimsek, H.; Ozturk, G. Evaluation of the Relationship between Environmental Accounting and Business Performance: The Case of Istanbul Province. Green Financ. 2021, 3, 46–58. [Google Scholar] [CrossRef]

- Murray, A.; Sinclair, D.; Power, D.; Gray, R. Do Financial Markets Care about Social and Environmental Disclosure? Further Evidence and Exploration from the UK. Account. Audit. Account. J. 2006, 19, 228–255. [Google Scholar] [CrossRef]

- Chen, L.; Srinidhi, B.; Tsang, A.; Yu, W. Audited Financial Reporting and Voluntary Disclosure of Corporate Social Responsibility (CSR) Reports. J. Manag. Account. Res. 2016, 28, 53–76. [Google Scholar] [CrossRef]

- Montalban, M.; Raduriau, G. Financialisation of Strategies, Risk Transfer, Liquidity, Property and Control (In French); Groupement de Recherches Economiques et Sociales, 2007; Available online: https://econpapers.repec.org/paper/grswpegrs/2007-09.htm (accessed on 29 March 2022).

- Simpson, D.F.; Power, D.J. Use the Supply Relationship to Develop Lean and Green Suppliers. Supply Chain. Manag. Int. J. 2005, 10, 60–68. [Google Scholar] [CrossRef]

- Azapagic, A.; Bore, J.; Cheserek, B.; Kamunya, S.; Elbehri, A. The Global Warming Potential of Production and Consumption of Kenyan Tea. J. Clean. Prod. 2016, 112, 4031–4040. [Google Scholar] [CrossRef]

- Tian, D.; Zhao, F.; Mu, W.; Kanianska, R.; Feng, J. Environmental Efficiency of Chinese Open-Field Grape Production: An Evaluation Using Data Envelopment Analysis and Spatial Autocorrelation. Sustainability 2016, 8, 1246. [Google Scholar] [CrossRef] [Green Version]

- Buallay, A. Sustainability Reporting and Firm’s Performance: Comparative Study between Manufacturing and Banking Sectors. Int. J. Product. Perform. Manag. 2019, 69, 431–445. [Google Scholar] [CrossRef]

- Lozano, R. Analysing the Use of Tools, Initiatives, and Approaches to Promote Sustainability in Corporations. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 982–998. [Google Scholar] [CrossRef]

- Ikpor, I.M.; Bracci, E.; Kanu, C.I.; Ievoli, R.; Okezie, B.; Mlanga, S.; Ogbaekirigwe, C. Drivers of Sustainability Accounting and Reporting in Emerging Economies: Evidence from Nigeria. Sustainability 2022, 14, 3780. [Google Scholar] [CrossRef]

- Ching, H.Y.; Gerab, F.; Toste, T.H. The Quality of Sustainability Reports and Corporate Financial Performance: Evidence from Brazilian Listed Companies. Sage Open 2017. [Google Scholar] [CrossRef]

- Endrikat, J.; Guenther, E.; Hoppe, H. Making Sense of Conflicting Empirical Findings: A Meta-Analytic Review of the Relationship between Corporate Environmental and Financial Performance. Eur. Manag. J. 2014, 32, 735–751. [Google Scholar] [CrossRef]

- Lu, W.; Taylor, M.E. Which Factors Moderate the Relationship between Sustainability Performance and Financial Performance? A Meta-Analysis Study. J. Int. Account. Res. 2016, 15, 1–15. [Google Scholar] [CrossRef]

- Huang, D.Z. Environmental, Social and Governance (ESG) Activity and Firm Performance: A Review and Consolidation. Account. Financ. 2021, 61, 335–360. [Google Scholar] [CrossRef]

- Margolis, J.D.; Elfenbein, H.A.; Walsh, J.P. Does It Pay to Be Good? A Meta-Analysis and Redirection of Research on the Relationship between Corporate Social and Financial Performance. Ann. Arbor. 2007, 1001, 1–68. [Google Scholar]

- Post, C.; Byron, K. Women on Boards and Firm Financial Performance: A Meta-Analysis. Acad. Manag. J. 2015, 58, 1546–1571. [Google Scholar] [CrossRef]

- Joshi, P.L.; Suwaidan, M.S.; Kumar, R. Determinants of Environmental Disclosures by Indian Industrial Listed Companies: Empirical Study. Int. J. Account. Financ. 2011, 3, 109–130. [Google Scholar] [CrossRef]

- Che-Ahmad, A.; Osazuwa, N.P.; Mgbame, C.O. Environmental Accounting and Firm Profitability in Nigeria: Do Firm-Specific Effects Matter? IUP J. Account. Res. Audit. Pract. 2015, 14, 43–54. [Google Scholar]

- Jones, M.J.; Solomon, J.F. Social and Environmental Report Assurance: Some Interview Evidence. In Accounting Forum; Elsevier: Amsterdam, The Netherlands, 2010; Volume 34, pp. 20–31. [Google Scholar] [CrossRef]

- Boiral, O.; Heras-Saizarbitoria, I. Sustainability Reporting Assurance: Creating Stakeholder Accountability through Hyperreality? J. Clean. Prod. 2020, 243. [Google Scholar] [CrossRef]

- Belal, A.R. Environmental Reporting in Developing Countries: Empirical Evidence from Bangladesh. Eco-Manag. Audit. J. Corp. Environ. Manag. 2000, 7, 114–121. [Google Scholar] [CrossRef]

- Christensen, L.; Gallo, P. Firm Size Matters: An Empirical Investigation of Organisational Size and Ownership on Sustainability-Related Behaviours. Bus. Soc. 2011, 50, 315–349. [Google Scholar]

- Dienes, D.; Sassen, R.; Fischer, J. What Are the Drivers of Sustainability Reporting? A Systematic Review. Sustain. Account. Manag. Policy J. 2016. [Google Scholar] [CrossRef]

- Faller, C.M.; zu Knyphausen-Aufseß, D. Does Equity Ownership Matter for Corporate Social Responsibility? A Literature Review of Theories and Recent Empirical Findings. J. Bus. Ethics 2018, 150, 15–40. [Google Scholar] [CrossRef]

- Andrew, B.; Gul, F.; Guthrie, J.; Teoh, H.Y. A Note on Corporate Social Disclosure Practices in Developing Countries: The Case of Malaysia and Singapore. Br. Account. Rev. 1989, 21, 371–376. [Google Scholar] [CrossRef]

- Teoh, H.-Y.; Thong, G. Another Look at Corporate Social Responsibility and Reporting: An Empirical Study in a Developing Country. Account. Organ. Soc. 1984, 9, 189–206. [Google Scholar] [CrossRef]

- Comyns, B. Determinants of GHG Reporting: An Analysis of Global Oil and Gas Companies. J. Bus. Ethics 2016, 136, 349–369. [Google Scholar] [CrossRef]

- Khan, A.; Muttakin, M.B.; Siddiqui, J. Corporate Governance and Corporate Social Responsibility Disclosures: Evidence from an Emerging Economy. J. Bus. Ethics 2013, 114, 207–223. [Google Scholar] [CrossRef]

- Lu, Y.; Abeysekera, I.; Cortese, C. Corporate Social Responsibility Reporting Quality, Board Characteristics and Corporate Social Reputation: Evidence from China. Pac. Account. Rev. 2015, 27, 95–118. [Google Scholar] [CrossRef]

- Dissanayake, D.; Tilt, C.; Xydias-Lobo, M. Sustainability Reporting by Publicly Listed Companies in Sri Lanka. J. Clean. Prod. 2016, 129, 169–182. [Google Scholar] [CrossRef]

- Khan, I.; Wasim, F. Impact of Corporate Governance and Ownership Structure on Capital Structure. Int. J. Manag. Sci. Bus. Res. 2016, 5. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2880423 (accessed on 29 March 2022).

- Belkaoui, A. The Impact of the Disclosure of the Environmental Effects of Organizational Behavior on the Market. Financ. Manag. 1976, 5, 26–31. [Google Scholar] [CrossRef]

- Friedman, M. 13. September 1970, The Social Responsibility of Business Is to Increase Its Profits. New York Times Mag. 1970, 3, 122–126. [Google Scholar]

- Erusalimsky, A.; Gray, R.; Spence, C. Towards a More Systematic Study of Standalone Corporate Social and Environmental: An Exploratory Pilot Study of UK Reporting. Soc. Environ. Account. J. 2006, 26, 12–19. [Google Scholar] [CrossRef]

- Ahmed, S.S.; Guozhu, J.; Mubarik, S.; Khan, M.; Khan, E. Intellectual capital and business performance: The role of dimensions of absorptive capacity. J. Intellect. Capital. 2019, 21, 23–39. [Google Scholar] [CrossRef]

- Deegan, C.; Blomquist, C. Stakeholder Influence on Corporate Reporting: An Exploration of the Interaction between WWF-Australia and the Australian Minerals Industry. Account. Organ. Soc. 2006, 31, 343–372. [Google Scholar] [CrossRef]

- United Nation Development Program (UNDP). United Nation Development Program Annual Report 2006; United Nation Development Program: New York, NY, USA, 2006. [Google Scholar]

- Morgera, E. The UN and Corporate Environmental Responsibility: Between International Regulation and Partnerships. Rev. Eur. Community Int. Environ. Law 2006, 15, 93–109. [Google Scholar] [CrossRef]

- Belal, A.; Momin, M. Corporate Social Reporting (CSR) in Emerging Economies: A Review and Future Direction. Res. Account. Emerg. Econ. 2009, 9. [Google Scholar] [CrossRef]

- Kuasirikun, N.; Sherer, M. Corporate Social Accounting Disclosure in Thailand. Account. Audit. Account. J. 2004, 17, 629–660. [Google Scholar] [CrossRef]

- Maali, B.; Casson, P.; Napier, C. Social Reporting by Islamic Banks. Abacus 2006, 42, 266–289. [Google Scholar] [CrossRef]

- Naser, K.; Al-Hussaini, A.; Al-Kwari, D.; Nuseibeh, R. Determinants of Corporate Social Disclosure in Developing Countries: The Case of Qatar. Adv. Int. Account. 2006, 19, 1–23. [Google Scholar] [CrossRef]

- Balsalobre-Lorente, D.; Sinha, A.; Driha, O.M.; Mubarik, M.S. Assessing the impacts of ageing and natural resource extraction on carbon emissions: A proposed policy framework for European economies. J. Clean. Prod. 2021, 296, 126470. [Google Scholar] [CrossRef]

- Ali, W.; Frynas, J.G.; Mahmood, Z. Determinants of Corporate Social Responsibility (CSR) Disclosure in Developed and Developing Countries: A Literature Review. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 273–294. [Google Scholar] [CrossRef]

- Al Astal, A.Y.M. Empirical Study on Corporate Social Responsibility in United Arab Emirates. Master’s Thesis, Kuala Lumpur: International Islamic University Malaysia, Kuala Lumpur, Malaysia, 2014. Available online: https://lib.iium.edu.my/mom/services/mom/document/getFile/UnZf9tTmOgoTrHwA1cKKxVNx3EFsmUxV20141218150248156 (accessed on 29 March 2022).

- Bae, S.C.; Chang, K.; Yi, H.-C. Corporate Social Responsibility, Credit Rating, and Private Debt Contracting: New Evidence from Syndicated Loan Market. Rev. Quant. Financ. Account. 2018, 50, 261–299. [Google Scholar] [CrossRef]

- Ibrahim, M.S.; Darus, F.; Yusoff, H.; Muhamad, R. Analysis of Earnings Management Practices and Sustainability Reporting for Corporations That Offer Islamic Products & Services. Procedia Econ. Financ. 2015, 28, 176–182. [Google Scholar] [CrossRef] [Green Version]

- Hassan, M.; Khan Afridi, M.; Irfan Khan, M. Energy Policies and Environmental Security: A Multi-Criteria Analysis of Energy Policies of Pakistan. Int. J. Green Energy 2019, 16, 510–519. [Google Scholar] [CrossRef]

- Jacoby, H.D.; Wing, I.S. Adjustment Time, Capital Malleability and Policy Cost. Energy J. 1999, 20. [Google Scholar] [CrossRef]

- Bosetti, V.; Frankel, J.A. Global Climate Policy Architecture and Political Feasibility: Specific Formulas and Emission Targets to Attain 460 PPM CO2 Concentrations; National Bureau of Economic Research: Cambridge, MA, USA, 2009. [Google Scholar]

- Reilly, J.; Prinn, R.; Harnisch, J.; Fitzmaurice, J.; Jacoby, H.; Kicklighter, D.; Melillo, J.; Stone, P.; Sokolov, A.; Wang, C. Multi-Gas Assessment of the Kyoto Protocol. Nature 1999, 401, 549–555. [Google Scholar] [CrossRef]

- Babiker, M.H.; Jacoby, H.D. Developing Country Effects of Kyoto-Type Emissions Restrictions; MIT Joint Program on the Science and Policy of Global Change: Cambridge, MA, USA, 1999. [Google Scholar]

- Barley, S.R.; Tolbert, P.S. Institutionalization and Structuration: Studying the Links between Action and Institution. Organ. Stud. 1997, 18, 93–117. [Google Scholar] [CrossRef] [Green Version]

- Greening, D.W.; Gray, B. Testing a Model of Organizational Response to Social and Political Issues. Acad. Manag. J. 1994, 37, 467–498. [Google Scholar]

- Jamil, C.Z.M. The Moderating and Mediating Effect of the Environmental Management Control Systems on Environmental Performance: The Case of Malaysian Hotel Sector; Bangor University: Bangor, UK, 2008. Available online: https://etd.uum.edu.my/4929/ (accessed on 29 March 2022).

- Ahmed, M.; Mubarik, M.S.; Shahbaz, M. Factors affecting the outcome of corporate sustainability policy: A review paper. Environ. Sci. Pollut. Research. 2021, 28, 10335–10356. [Google Scholar] [CrossRef]

- Adhikari, P.; Kuruppu, C.; Matilal, S. Dissemination and Institutionalization of Public Sector Accounting Reforms in Less Developed Countries: A Comparative Study of the Nepalese and Sri Lankan Central Governments. Account. Forum 2013, 37, 213–230. [Google Scholar] [CrossRef]

- Carpenter, V.L.; Feroz, E.H. Institutional Theory and Accounting Rule Choice: An Analysis of Four US State Governments’ Decisions to Adopt Generally Accepted Accounting Principles. Account. Organ. Soc. 2001, 26, 565–596. [Google Scholar] [CrossRef]

- Guerreiro, M.S.; Rodrigues, L.L.; Craig, R. Voluntary Adoption of International Financial Reporting Standards by Large Unlisted Companies in Portugal–Institutional Logics and Strategic Responses. Account. Organ. Soc. 2012, 37, 482–499. [Google Scholar] [CrossRef]

- Hidayati, N.D. Pattern of Corporate Social Responsibility Programs: A Case Study. Soc. Responsib. J. 2011, 7, 104–117. [Google Scholar] [CrossRef]

- Mubarik, M.S.; Chandran, V.G.R.; Devadason, E.S. Measuring human capital in small and medium manufacturing enterprises: What matters? Soc. Indic. Res. 2018, 137, 605–623. [Google Scholar] [CrossRef]

- Mubarik, S.; Chandran, V.G.; Devadason, E.S. Relational capital quality and client loyalty: Firm-level evidence from pharmaceuticals, Pakistan. Learn. Organ. 2016, 23, 43–60. [Google Scholar] [CrossRef]

- Mubarik, S.; Naghavi, N.; Mubarik, M.F. Governance-led intellectual capital disclosure: Empirical evidence from Pakistan. Humanit. Soc. Sci. Letters. 2019, 7, 141–155. [Google Scholar] [CrossRef]

- International Union for Conservation of Nature (IUCN). Environmental Accounting: What’s It All About? International Union for Conservation of Nature: Gland, Switzerland, 2021. [Google Scholar]

| Code | Dependent Variables | Measurements |

|---|---|---|

| Size | Firm Size | Log (total assets) |

| Pro | Profitability | ROA and ROE |

| ES | Interactive Variable Environmental Sustainability | The measure of environment, social, and governance disclosures |

| Independent Variables | ||

| Audtq | Audit Quality | 1 for big 4 firms, or 0 |

| EA | Environmental-Accounting Disclosure | Environmental cost |

| Variables | Code | Unit-Root Test | |

|---|---|---|---|

| ADF | p-Value | ||

| Environmental Accounting | EA | 355.2376 | 0.000 |

| Audit Quality | AQ | 250.9004 | 0.000 |

| Sustainability | Sus | 1077.401 | 0.000 |

| Environmental-Accountability Sustainability | AES | 933.2709 | 0.000 |

| Audit-Quality Sustainability | AQS | 867.2139 | 0.000 |

| Test Value | p-Value | |

|---|---|---|

| Lagrange Multiplier Test | 41.96 | 0.0000 |

| Hausman Test | 9.22 | 0.0558 |

| Endogeneity Test | 1.38 | 0.167 |

| Variable | I | II | III | IV |

|---|---|---|---|---|

| EA | −1.643 *** | −2.889 ** | - | - |

| GDP | 5.633 | 5.859 | 1.706 | 1.967 |

| TA | −4.116 | −4.195 | −5.04 | −5.238 |

| EAS | - | 0.677 * | - | - |

| Sus | - | −12.737 | - | −1.952 |

| AQ | - | - | 4.787 | 3.738 |

| AQS | - | - | - | 0.571 |

| Const. | 6.509 | 27.236 | 58.352 | 60.478 |

| Adj.R_Sq. | 0.284 | 0.285 | 0.155 | 0.154 |

| F-Ratio | 3.71 ** | 2.93 ** | 1.76 | 1.30 |

| Hypotheses | Level | Relationship | |

|---|---|---|---|

| H1 | There is no impact of e-accounting disclosures on a firm’s performance. | Reject | Negative |

| H2 | There is no impact of sustainability on a firm’s performance. | Reject | Positive |

| H3 | There is no mediating role that the firm’s environmental sustainability plays in the association between e-accounting disclosures and a firm’s performance. | Reject | Positive |

| H4 | There is no impact of audit quality on a firm’s performance. | Fail to reject | Insignificant |

| H5 | There is an influential role that the firm’s environmental sustainability plays in the association between audit quality and performance. | Fail to reject | Insignificant |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Majid, M.F.; Meraj, M.; Mubarik, M.S. In the Pursuit of Environmental Sustainability: The Role of Environmental Accounting. Sustainability 2022, 14, 6526. https://doi.org/10.3390/su14116526

Majid MF, Meraj M, Mubarik MS. In the Pursuit of Environmental Sustainability: The Role of Environmental Accounting. Sustainability. 2022; 14(11):6526. https://doi.org/10.3390/su14116526

Chicago/Turabian StyleMajid, Muhammad Faisal, Muhammad Meraj, and Muhammad Shujaat Mubarik. 2022. "In the Pursuit of Environmental Sustainability: The Role of Environmental Accounting" Sustainability 14, no. 11: 6526. https://doi.org/10.3390/su14116526

APA StyleMajid, M. F., Meraj, M., & Mubarik, M. S. (2022). In the Pursuit of Environmental Sustainability: The Role of Environmental Accounting. Sustainability, 14(11), 6526. https://doi.org/10.3390/su14116526