Abstract

In recent years, there has been a change in the main regulations governing the solvency of the world’s main insurance markets. Sustainability is an issue that is becoming increasingly important among to the various stakeholders in the insurance industry. It is a complex concept that has many different dimensions that can be included in these regulations, allowing for a more sustainable solvency. The paper uses a qualitative model previously designed and tested in the literature to analyse the solvency regulations of the European Union, United States of America, China, Australia, Brazil and South Africa and determine their level of convergence. It also links the criteria set out in these models to the dimensions of sustainability in order to determine the degree of sustainability of solvency systems and the questions that regulators will need to consider in the near future in order to achieve more sustainable solvency.

1. Introduction

Sustainability is an increasingly important topic in the insurance industry. The debate began in 1997 with the creation of the United Nations Environment Programme Finance Initiative (UNEP FI) [1]. This organisation promotes research and development in sustainable insurance. Among others, the global survey on the status of sustainable insurance [2], the promulgation of the Principles for Sustainable Insurance [3] and the agenda for their implementation [4].

Sustainability is a concept that has various definitions [5] and dimensions [6] in the field of insurance industry’s investments (Table 1).

Table 1.

Dimensions of sustainability in investments: Source: [6].

Solvency must be understood as the guarantee of adequate capital to meet liabilities to policyholders and beneficiaries. Regulation can be adjusted to incorporate one or more elements of the above dimensions in order to make solvency more sustainable (sustainable solvency [7]). In the insurance sector, the environmental dimension, especially climate change because of its impact on underwriting risk, and the governance dimension are important. The qualitative pillars of most insurance regulations deal with this dimension to a greater or lesser extent. However, the development of the concept of sustainable solvency in the literature is scarce and limited to several papers including [6,8,9,10,11].

The main purpose of insurers is to accept, manage and transfer Risks. Therefore, risk management is a fundamental element that must consider all these dimensions. According to [9], the dimensions in Table 1 require strategic risk management, while solvency, sustainable or not, requires tactical risk management.

In recent years, changes in solvency regulations have led to the development of tactical risk management and promoted a process of convergence, which analysis may be useful for strategic risk management. This is because some regulators [12,13,14] now consider that insurance regulation implicitly addresses the environmental and governance dimensions of sustainability and plan to address them explicitly in the future [14,15].

In the case of insurance companies, the relationship between sustainability and solvency has been through pensions [7]. Although there are areas such as Europe that have begun to establish processes such as the European commission for opinion on sustainability within Solvency II, focused on the suitability of the system, climate change mitigation and sustainable investments that are taken into account in solvency calculations [13].

Another link between these two concepts in the insurance industry is the solvency ratio related to socially responsible investments. Thus, companies that are more concerned about their sustainability also tend to have a strong focus on solvency [16]. The underlying idea is that there is a relationship between the needs of the policyholder, their future sustainability and solvency.

An evolutionary change has occurred because, since the 1990s, regulation of the global insurance industry has evolved from a simple rule-based legislation, which measures solvency in a static manner [10], to a more complex risk-based legislation, which measures solvency in a dynamic manner [11,17]. This process has been encouraged by the International Association of Insurance Supervisors (IAIS), [18,19], whose main objective is to protect the rights of policyholders and beneficiaries from insurance company insolvency. In this sense, the European Commission (EC) determines that adequate corporate governance is necessary because it leads to a more competitive and sustainable insurer in the long term [20,21].

Therefore, two regulatory models can be distinguished (Table 2) depending on how capital is incorporated into management. Some authors claim that principle-based models are more flexible [22]; however, most sophisticated models are imperfect because they depend on assumptions and inputs.

Table 2.

Regulatory solvency models. Source: Own work.

Numerous authors have investigated the predictive power of solvency models [23,24,25]; the establishment of minimum capital reduces insolvencies [26], although their complete elimination is impossible [27].

Regulation of the insurance sector may differ from country to country, depending on the structure and degree of regulators’ risk aversion, but its purpose is the same: to avoid bankruptcy.

Ref. [28] established a theoretical qualitative framework with seven criteria for model analysis and risk detection to analyse the capacity of a regulation/system to predict insolvencies. Which has been justified and critically discussed in the literature by different authors of the insurance market. This qualitative used by [29] to analyse the European Union model. Later, [30] extended this framework to eleven qualitative criteria in order to adapt them to the market changes (structures, risks and complexity), which was adapted to the latest regulatory changes by [31,32].

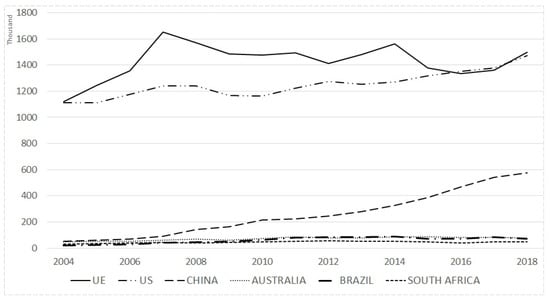

The aim of this paper is to find common principles for the development and convergence of the world’s most important solvency regulation models, which will increase innovation between different countries and therefore an increase in productivity. We will also focus our analysis on the overall structure of the schemes without going into the life and non-life business, as most insurance systems use a comprehensive approach to risk. The selection criterion used is the volume of premiums marketed in 2018, according to the Swiss Report 2019, which is amongst the most relevant in the insurance market. The countries selected for each continent are the European Union (EU), United States (US), China, Australia, Brazil and South Africa (Figure 1). America is divided into North America and Latin America, and the European Union is considered a country because it represents 95.82% of Continental Europe and has common regulations [33].

Figure 1.

Total premium volume evolution (in million dollars). Source: Data from [33,34,35,36,37,38,39,40,41,42,43,44,45,46].

Historically, the insurance market has focused on Sustainable Development Goal (SDG) 3, because survival and mortality modelling are key within life and health business.

With the incursion of new solvency valuation systems, the focus has been shifting towards SDG 8, which focuses on business continuity as well as business development, so that policyholders are protected. Actuarial climate risk pricing models for floods, storms, winds and fires are currently being implemented. These models are aligned with SDG 13.

This SDG adaptation process is being developed following IAIS guidelines [18], conducted through the Own Risk and Solvency Assessment (ORSA).

The assessment requires the inclusion of qualitative factors linked to corporate governance and decision makers [29,31]. In addition, climate risk modelling is included, with the aim of addressing the challenges of the future. Most regulatory systems, however, address sustainability through company transparency and a long-term approach that contributes to company growth and corporate governance [47]. The insurance industry advocates management based on truthful and transparent reporting to stakeholders, oriented towards a reputational benefit [48].

In the insurance sector, solvency systems are not only quantitative but corporate governance leads the insurance industry to be sustainable.

This work is structured as follows. The second section describes the evolution and current situation of the five countries’ solvency models, and a bibliographical review is presented. The eleven criteria established by [28,30] are then developed (Cummins and Holzmüller Criteria). The fourth section uses these criteria to analyse the main solvency models, and the fifth and sixth discuss the results and set out the conclusions.

2. Regulatory Changes in Insurance Solvency: Literature Review

2.1. European Union (Solvency II)

The European Union is one of the most important insurance markets in the world with a premium volume in 2018 of USD 1.49 trillion, representing 95.82% of the European market and 28.8% of the world market [46]

Prior to the Solvency II Directive (SII) [49], EU countries used a ratio-based methodology to determine solvency so that companies with different degrees of risk exposure could have the same solvency margin. SII provides for individualised risk management because the directive creates a global framework for risk management [50] and is structured on three pillars [51,52]: capital requirement, the monitoring process and corporative governance and market discipline. The paradigm change establishes new systems of corporate governance that will establish effective management, with good control of decision making as well as the qualification of decision makers. In fact, the second pillar of this directive focuses on this work, integrating governance into the day-to-day business of insurance companies [49]. Additionally, the importance of adapting to sustainability by incorporating demographic change or new environmental models. However, until it was initiated on 1 January 2016, its implementation was a long and slow process due to the complexity and number of countries involved [13].

SII has increased the need to develop and apply new methodologies for risk analysis [53] and requires the determination of solvency capital requirement (SCR) and minimum capital requirement (MCR), which can be calculated using two methods: standard formula or internal model. According to [54], there are several approaches that can be used for the standard formula (factor-based formula, scenario simulation, etc.), to guide companies towards better governance and thus more sustainability.

2.2. United States of America

Premium volume in 2018 in the US was USD 1.47 trillion, representing 92% of the North American market and 28.29% of the world market [46].

The US experienced major insolvencies in the 1980s and 1990s, which increased the interest of supervisors in regulation [55]. State regulators developed—through the National Association of Insurance Commissioners (NAIC)—a uniform system composed of risk modules that established categories in which risk was measured by means of risk-based capital models [33]. This model was subsequently improved in many ways, including the development of life insurance scenarios. However, compared to other systems, it tends to separate the calculations according to whether the line of business is claims, life, etc.

In 2008, the Solvency Modernisation Initiative (SMI) began. This regulation has various objectives, including protecting policyholder interests and determining a solvency capital in line with the risk [38]; updating the regulatory framework for insurers, which dates back to the 1980s [39]; and limiting the frequency and severity of insurers’ insolvencies, which are very costly for policyholders and beneficiaries [56]. The SMI assesses solvency and also other areas of insurers such as capital requirements, governance and risk management, group supervision, statutory accounting and financial reporting and reinsurance [57]. These practices and processes support good management and are part of the increased importance of corporate governance to be developed in the light of the 2007–2013 crisis [58].

2.3. China

China’s premium volume has progressively increased and in 2018 was USD 574.877 billion, representing 11.06% of the world market and placing it behind the US.

The supervisory body is the China Insurance Regulatory Commission (CIRC) and its solvency model is the China Risk-Oriented Solvency System (C-ROSS), the project for which began in 2012 and was implemented in 2016. C-ROSS is consistent with a structure that requires asset and liability management [32] and focuses on three objectives: quantitative risk assessment, developing minimum capital and implementing a regulatory system.

The Chinese system follows the guidelines of the IAIS, [19] and the experience of SII. It is based on three pillars, according to its objectives: quantitative capital requirements, qualitative supervisory requirements and market discipline. Governance is addressed in the second and third pillars. Firstly, by establishing management requirements, as well as the evaluation of the company and its decision-makers. It then addresses the obligation of transparency of information and reporting to authorities.

2.4. Australia

Australia’s premium volume in 2018 was USD 79.98 million, ranking it thirteenth worldwide with 1.5% of the world market [46].

The supervisory and control body is the Australian Prudential Regulation Authority (APRA). The solvency model was introduced in 1973 by establishing the requirements for access to the insurance market [59], and in 2013 it was updated with the Life and General Insurance Capital Standards (LAGIC), whose aim is to standardize capital requirements and increase risk sensitivity.

The Australian model is similar to SII and is based on three pillars [60]. An insurer is compliant if its capital base exceeds 90% of the capital requirements [61,62,63] and also has appropriate valuation strategies and systems in place. However, it goes deeper into governance since its requirements are prescriptive, although the requirement for public information is more diffuse. Being part of the analysis not simply technical but of management and governance.

2.5. Brazil

Brazil is the leader in Latin America with 44.8% of the premium volume and ranks sixteenth worldwide with 1.4% of the world market [46].

The supervisory and control body is the Superintendence of Private Insurance (SUSEP). This body deals with the minimum capital requirement (MCR) for access to insurance activity, the definitions for the subsequent development of the solvency regulations and the capital requirements are in [64]. Current legislation identifies the MCR [55] and the main requirements for valuation [65,66].

2.6. South Africa

South Africa’s premium volume in 2018 was USD 48.269 million, ranking it nineteenth worldwide with 0.9% of the world market [46]. The supervisory and control body is the South African Reserve Bank. The regulation governing solvency is the Solvency Assessment and Management, which began in 2010 and was implemented in 2018.

This regulation complies with the Insurance Core Principles of the IAIS [19], is similar to SII and is based on three pillars: its objectives are to align the capital requirement with risk, to develop appropriate risk models for all insurers, to encourage the use of more sophisticated risk monitoring tools and to maintain financial stability [67]. Promotes governance, increases reporting and processes focused on the ORSA.

3. Materials and Methods

The models are a simplified representation of reality. An insurer’s solvency depends on numerous factors and all cannot be measured [54]. Likewise, simple measures can be as effective as complex ones [58].

Ref. [28] established a theoretical framework with seven criteria for model analysis and risk detection and this analysis was used by [29]. In the face of major changes in the markets and in insurance companies’ structures, risks and product complexity have evolved [68]. In fact, [30] extended the criteria to eleven and analysed the US, EU and Swiss regulations, focusing on the possibility of dynamic changes and market capital. This model (Cummins and Holzmüller criteria) was subsequently used by [31,32] with the latest regulatory changes.

These criteria are:

- C1: The risk-based capital formula should provide incentives for weak companies to hold more capital and/or reduce their risk exposure without significantly distorting insurers’ financial decisions.

In this approach a rule-based model will be simple and less risk oriented [29]. The capital requirement in a rule-based model is obtained as a function of determined magnitudes, such as size.

The supervisor sets minimum requirements that insurers must meet to avoid intervention and that are public, which provides an incentive to maintain capital in line with the risk [29]. The establishment of several capital requirements allows for early intervention and the creation of an efficient and stable structure. An appropriate system should therefore:

- Facilitate the rehabilitation of weak insurance companies.

- Facilitate the orderly liquidation of companies.

- Limit the risk of insurers at risk of insolvency

- C2: The risk-based capital formula should reflect the main risks affecting insurers and be sensitive to how these risks differ between insurers.

The identification of risk types and risk sensitivity allows the detection of weak insurers and the reduction of arbitrage possibilities, which entails:

- The establishment of internal controls and an appropriate governance structure, which can reduce bankruptcies because these are often due to a combination of risks [69,70].

- Risk sensitivity reflecting the differences between different insurers [30]; however, it should not encourage discrimination against small insurers by setting excessive requirements that could drive them out of the market, thereby harming supply and market freedom [68].

- C3: The weight of each risk must be proportional to its impact on the total insolvency risk. The criterion is met if:

- The regulation promotes a calculation method in which the majority of risks are considered, and their weight is according to the importance in insolvencies [29]. To this end, risks must be adequately calibrated [30] and the case-by-case approach of each insurer must be considered [28].

- An insurer’s insolvency probability is calculated using a consistent risk measure [71] and the parameters are correctly estimated to avoid distorting the weight of risks or misleading capital requirements [29].

- The risk dependency structure is considered. In this way, the correlations reflect the dependencies and can even be developed using internal models [30].

- C4: The risk-based capital system should focus on identifying insurers who generate the highest insolvency costs.

Insolvency of small insurers is usually more frequent but large insurers generate a higher cost to the economy. The regulator is therefore interested in reducing bankruptcies of insurers with higher systemic risk [28,29].

Insolvencies in the insurance sector are caused by shocks related to assets, liabilities or both [50]. Historically the prediction of these shocks has focused on liabilities because they are more frequent in weakly capitalised insurers [69].

- C5: The formula and/or measurement of real capital should reflect, where possible, the economic values of assets and liabilities.

An insurance company’s balance sheet can sometimes be far from economic. The calculation of technical provisions and minimum permitted capital must therefore be made using the economic value of assets and liabilities because book values may provide biased results [30]. The International Financial Reporting Standards (IFRS) use this principle and therefore compliance with the criterion leads to convergence with them, especially in the case of liabilities [72,73].

- C6: Whenever possible, the risk-based capital system should prevent inaccurate reporting or loss of reserves and other forms of insurer manipulation.

The criterion’s relevance is due to the accounting frauds discovered in the 2008 crisis. Supervisory and control regulations focus on policyholder safety and/or market efficiency, while an accountant must avoid inaccurate information, but without neglecting qualitative characteristics.

Market efficiency and competitiveness depends on participants, especially the supervisor, having access to relevant information. Information accuracy requires instruments that detect and sanction fraud. Therefore, the solvency regulation should reflect the risks and control them in a feasible way [28] and formalise corporate governance or on-site assessment [30]. In the case of insolvency, the supervisor is the reference agent, so sanctions must be clearly defined and made known to the other agents [30].

- C7: The formula should avoid complexity by maintaining equity in the increased accuracy for risk measurement.

This criterion is complex because the models must encourage risk management and reduce insolvency costs [29]. Two positions can be found (Table 3).

Table 3.

Main characteristics of the calculation formula. Source: Own work.

The balance is difficult and the insurance industry is complex by nature. However, the formula’s level of complexity must on the one hand be appropriate and encourage overall risk management [70] and on the other hand not make premiums more expensive or reduce innovation [68]. In this sense, it should be noted that there may be simple formulae underlying complex calculations [76] and that inappropriate formulas will worsen market security [77]. Internal models are more risk sensitive and are included in the management of an insurer [76,78] but they are complex and costly [50]. While complexity is somewhat necessary, it should be at an appropriate level with a comprehensive approach to risk [70]. In addition, the internal models are more in line with good governance.

- C8: The structure must be appropriate to economic crises and systemic risk. Regulation should anticipate systemic risk and prevent the insurance industry from being involved in the economic cycle when crises occur.

Systemic risk has mainly been associated with the banking sector, but globalisation has increased its importance in insurance. The lack of regulation encourages systemic risk [30], although the use of the same model provokes the same response to similar events.

Internal models [79] are a tool for systemic risk reduction [80]. These models arise from the evolution of profit testing that emerged in the 1980s [81]. They relate risk to an insurer’s experience and risk profile and are the basis for risk management and assessment [82].

- C9: The regulation must carry out an evaluation of the management processes and must mainly consider the determinants of the management capacities. This criterion requires:

- A structure and instruments that allow the regulator to detect situations and causes of insolvency in its early stages [70]. There must be an indicator that prevents the lack of solvency capital.

- Qualitative analyses to be conducted which detect those qualitative factors that lead to an insurer’s insolvency—such as management inexperience, incorrect business plans [30,69], mismanagement or strategic risk [29,83,84]—and those that provide for it—such as internal controls or expert advice—which can be even more effective than strict capital requirements [69].

- Regulators to have supervisory and monitoring tools in addition to capital requirements [85].

- C10: Flexibility of the structure to adapt to the times. The model must be flexible in general concepts and parameters. Empirical understanding and theoretical development, as models and concepts, must lead to the structure’s improvement. This criterion analyses whether:

- The market moves faster than regulation, so imbalances can affect policyholders [30]. The sustainability of the regulatory regimes, mainly those of solvency, is thus based on the level of market competition and a system’s capacity to adapt to change. A system that is very demanding in terms of the levels of solvency capital requirement can push more insurers out of the market than is necessary [50], which results in a reduction in the number of entities that make up the market by changing from an atomised to a centralised market.

- The degree of market competitiveness when agents interfere tends to limit regulation. Highly regulated markets allow firms to be highly competitive and each individual player has less power [86].

- C11: Strength of risk management and market transparency. Solvency regulation requires insurers to manage risk quantitatively. Increased market transparency ultimately reduces the need for regulation.

Regulation must include market discipline and not be limited to solvency capital. To this end, transparency must be increased, which provides information that allows insurers to be evaluated [50] so they adapt to regulation and maintain an adequate risk level, and so that the market is more efficient and information asymmetries are reduced.

The model must therefore analyse internal factors such as quality or suitability of management, adapting governance and risk management [70].

4. Results

The regulation of the main insurance markets is analysed (Appendix A) based on the Cummins criteria set out in the methodology section.

4.1. C1: Provides Appropriate Incentives

SII will not significantly alter the asset structure of EU insurers with good credit ratings [87], although capital optimisation will bring them value [70] and internal models may lead to regulatory arbitrage and consequently increased risk [20].

Brazil is evolving to a principle-based system and therefore partially complies with C1 because it includes the main risks but does not contemplate internal models, while Australia and South Africa have a risk-oriented system. The US and China have a rule-based approach, although in both cases the current regulations have improved on the previous ones.

The supervisor sets capital requirements that allow for early intervention which can prevent insolvency. In this sense, the most developed systems are in the EU and Australia (SII), followed by South Africa and Brazil (SII oriented), which have double capital requirements. The standard SII formula may not achieve all the legislative objectives, but internal models allow for individualised risk management, as in Australia [62].

China is aligning itself with C1 as the CIRC establishes greater regulation for insurers with weak results. When risk is poorly managed, it can lead to weak corporate governance. This leads to a penalty in the form of higher capital requirements. However, distortions can occur as in SII or risk-based capital [32]. In the US, the valuation of assets was aligned with C1 before the SMI came into force [30], so the main changes are in liabilities. The NAIC [88] developed an ORSA process that provides incentives to insurers who are in line with C1.

4.2. C2: Risk-Sensitive Formula

SII aims to ensure that all business insurance risks are taken into account [22] and the system is risk sensitive, the standard formula is simple and well-calibrated and allows for internal models [39,40]. The standard formula includes the main risks (market, credit, underwriting and operational) and is therefore C2 compliant, although underwriting risks in non-life and health insurance can be refined to increase risk sensitivity [29].

RBC employs a rule-based approach with detailed calculation, which considers the various risks and the relationship between them, although it presents difficulties in identifying financial weaknesses [16]. The NAIC plans to implement a principle-based, risk-oriented approach that is not as meticulous as SII, but it can detect weakly capitalised companies by business line. Furthermore, operational risk is not explicitly identified [88], although it is planned to incorporate it.

China covers most risks, requires a minimum capital requirement and the risk assessment is more qualitative. Brazil can improve on C2 because it mainly uses accounting information and does not consider disaster risk. Australia stresses risks such as mortality and morbidity to assess disaster risk.

Operational risk is complex to assess quantitatively [29], but qualitative requirements can be used [20]. Australia devotes legislation to this risk [63], the EU and South Africa set qualitative requirements, but quantitative requirements could be improved, and Brazil uses a premium-based formula.

After the 2008 crisis, liquidity risk has become relevant. However, many models, such as the Australian or Brazilian model, do not mention it [63].

The Chinese C-ROSS is C2 compliant, as it considers most of the important risks, although some risks (operational, strategic, reputational or liquidity) are addressed in a qualitative way [32], which can be improved. The system forces the use of the standard formula and limits parameters and scenarios.

4.3. C3: Well-Calibrated Formula

European Union, Australia, Brazil and South Africa consider the dependence between risks and some sub-risks by means of correlations, so it complies with C3.

The risk measurement is carried out using a risk measure. The EU, Australia, South Africa and China use VaR with a 99.5% confidence level, although in the latter market it is only for catastrophic risks. The US risk-based capital and Brazil use the same risk measure with a 99% confidence level [89].

Risk-based capital was not effective in identifying weaknesses in the past. The SMI improves the adequacy and risk weighting, but since the NAIC has no authority to implement methods or parameters, because it can only make suggestions but not enforce their implementation [88], there is room for improvement in C3.

C-ROSS determines capital requirements by using solvency ratios and aggregating them by means of a correlation matrix. It also considers the dependence between insurers by classifying them. These would all be in line with C3 [32]; however, the ratios do not fully capture capital needs [30].

4.4. C4: Identification of High Insolvency Costs

All systems except China and the US are principle-based systems and calculate capital requirements using VaR, which increases risk orientation [89].

Internal models can optimise the capital requirement and reduce it [30]. SII, Australia and South Africa allow such models, while Brazil does not mention them in its regulation, although some authors advise their inclusion [89,90].

South Africa considers an insurer’s size [91] and Australia, in addition, considers the complexity of the operations [62], both of which are in line with C4.

Risk-based capital can be refined using either size adjustments or adjustments for catastrophic risk exposure [22]. These size adjustments are complex and these needs to be taken into account because different sized companies could have the same result [30], which is against C4. The fundamental objective of risk-based capital is to limit the frequency and size of insolvencies by reducing their cost to policyholders [58]; however, delegating supervision and control to states makes this task difficult, which is detrimental to C4.

China has a rule-based system, takes a deterministic approach and does not allow internal models, which is contrary to C4. However, insurers that pose a systemic risk are required to have greater controls and capital requirements in line with C4.

4.5. C5: Economic Values Considered

In EU, creditworthiness is measured using market values rather than historical costs. Brazil uses a model with market-consistent valuations, Australian LAGIC uses economic values linked to market values, best estimate and IFRS guidelines, and South Africa follows the same path as Australia. All these regulations therefore comply with C5.

The RBC uses standardised data, obtained from the balance sheet and close to market values [30], so it complies with C5—although there is room for improvement. In China, liabilities are valued at market value, except for non-life insurers, which must value assets and liabilities at book value, so C5 is partially compliant.

4.6. C6: Avoid Inaccurate Information

Solvency II regulation and the regulations that take it as a reference use two capital requirements, which improves the prediction of insolvency by establishing two barriers to it. This regulation is one of the most advanced and effective systems [22], reduces inaccurate information and has tools to avoid errors in reporting, although the reports do not explicitly address erroneous information [30]. The second pillar of the South African regulations includes corporate governance and carries out on-site capital monitoring. In Australia, corporate governance is highly developed and focuses on internal audits and technical basics. All these regulations comply with C6.

The systems in Australia, Brazil, South Africa and the EU are principle-based and reduce inaccurate reporting [30]; they provide for internal controls that mainly focus on accounting audits [65] and therefore comply with C6. However, some systems use data at book value, making it difficult to comply with this criterion.

China’s Solvency Aligned Risk-Management Requirements and Assessment qualitatively assesses internal control [32] and establishes reporting requirements with high penalties for non-compliance, although corporate governance can be improved.

In the US, the NAIC is the federal agency in charge of designing control systems based on the experience of the 2007 crisis. The SMI’s objective is a global reform covering capital requirements, governance and risk management, group supervision, statutory accounting and financial reporting and reinsurance [57]. It therefore complies with C6.

4.7. C7: Simple Formula

The risk measure used by all systems is VaR, except in the US where the NAIC cannot impose its use. Unlike TvaR, VaR is not generally a consistent risk measure [92]; however, it is analytically and numerically calculable. It is therefore more practical than TvaR [30], although the latter is more compliant with C7.

SII uses VaR complemented by the development and application of methodologies for analysis [53], while Australia, Brazil and South Africa use a dynamic approach based on SII. All these systems except Brazil—with a 99% confidence level—use VaR with a 99.5% confidence level and are therefore C7 compliant. These systems additionally allow for internal models and the inclusion of scenarios, which encourages C7. Brazil also requires the publication of information on the calculation of the MCR, which makes its value verifiable.

The risk-based capital for the life sector has introduced changes in interest rate risk [93], which improves insolvency prediction in exchange for a more complex and costly model and a reduction in the comparability of the results.

China uses deterministic models with parameters set by the CIRC, making the formulation simpler and the cost of the model lower.

4.8. C8: Structure Appropriate to the Crisis

None of the systems analysed explicitly consider systemic risk, although Australia, European Union and South Africa allow internal models, which can indirectly reduce such risk and would therefore be in line with C8. The Brazilian system does not address internal models [65].

C-ROSS requires a capital charge to address systemic risk and introduces mechanisms to adjust capital requirements to market fluctuations. However, it does not allow for the development of internal models, which makes compliance with C8 difficult.

No system provides for a review period that ensures their adaptation to a dynamic financial environment [50] and avoids results contrary to the initial objectives [94], which makes it difficult to comply with C8.

4.9. C9: Evaluation of the Management System

SII explains corporate governance, internal control and the ORSA process [49]. Australia addresses corporate governance and actuarial advice and South Africa requires actuaries to be professionals with appropriate knowledge and experience to carry out their work. China conducts a thorough inspection and requires management to have ongoing training [32]. All of these systems comply with C9 and are orientated to a better corporate governance and for instance to the sustainability.

Brazil requires managers to be experts in the field [65] and provides for internal controls, which focus on accounting audits rather than overall analysis of corporate governance, and thus partially complies with C9.

None of the systems define or address strategic risk, or business risk, to the detriment of C9.

4.10. C10: Flexibility in Adaptation

In the US, the states are responsible for developing regulations for the supervision and control of insurers. In Brazil, the numerous interest groups and the geographical extension make system changes difficult. In the EU there are also multiple stakeholders and, in addition, SII is being reviewed to adapt to the new developments introduced by the Lisbon Treaty and the new financial supervision measures. All these circumstances make it difficult to comply with C10.

In China, by contrast, the CIRC makes the decisions and has implemented C-ROSS within four years, so the system is unbureaucratic and very flexible to change. Australia and South Africa also have a single monitoring and control body, which gives them a good capacity to adapt to change. All these systems are in compliance with C10.

4.11. C11: Strength of Management and Market Transparency

The Australian and EU systems’ third pillar provides that insurers are obliged to report information to the supervisor and be transparent, thus reducing information asymmetry problems. The South African system’s third pillar also promotes an internal system and market discipline. The second pillar of the Chinese C-ROSS establishes the obligation for management to be involved in the risk management process and direct and up-to-date reporting requirements to the supervisor, along with sanctions for non-compliance. All these systems are in compliance with C11.

Although the obligation to inform the SUSEP is established, the Brazilian system does not contemplate corporate governance and has therefore been left behind.

5. Discussion

The Cummins and Holzmüller criteria establish a framework for analysing different solvency systems. Using this framework, it can be said that the Australia and South Africa followed by the European Union and Chinese systems are the most developed, largely due to their approach to the path marked out by SII. Australia, Brazil and South Africa use the SII model as a reference.

The US is gradually moving towards a risk-based model and Brazil needs to improve some of the criteria as can be seen in Table 3:

After reviewing the EU, US, Chinese, Australian, Brazilian, and South African systems, it is clear some systems are more developed than others (Table 4). All of them are relevant and have undergone a renewal process in the last decade, which has tended to be mainly based on dynamic criteria for evaluation. It should also be noted that the risk measure used by these systems is VaR with a one-year time horizon and various levels of confidence (99%; 99.5%).

Table 4.

Summary of criteria. Source: Own work.

6. Conclusions

In recent years, regulatory changes in the world’s major insurance markets have promoted a process of convergence and the development of risk management, both in quantitative and qualitative terms. However, solvency regulations still need to be improved in order to develop the qualitative aspects and to include the different dimensions of sustainability in order to make them sustainable.

The Cummins and Hozmüller criteria, with the exception of C5 and C7, make it possible to determine the degree of sustainability of solvency from a tactical risk management point of view. In addition, criteria C2, C6, C9 and C11 make it possible to do so from a strategic point of view by considering governance, one of the dimensions of sustainability (Table 1). None of them permits to determine the environmental and social dimensions of sustainability.

All these criteria have been analysed for the solvency regulations of the European Union, United States of America, China, Australia, Brazil and South Africa. Likewise, the results obtained for C2, C6, C9 and C11 allow us to establish an ordinal ranking of the degree of sustainability of these regulations in the area of governance. Australia, China and South Africa rank first, the EU second, Brazil third and the US fourth. Therefore, the regulation of the latter two countries has a margin for progress in terms of both sustainability and degree of convergence with the regulations of the rest of the countries analysed.

The regulators play a key role in the sustainability of the insurance industry. They establish a regulatory framework that encourages sustainable decision-making and sets restrictions and/or limitations on decisions that damage sustainability. This facilitates the transfer of financial resources to sustainable alternatives, which should ultimately facilitate the transition to a more sustainable insurance industry.

In this sense, many regulators have started to incorporate various aspects of sustainability into their supervisory process [95] in order to make solvency more sustainable. These modifications have mainly taken place in the area of governance, while at present no regulation explicitly includes the environmental and social dimensions of sustainability. So that all regulators can make their solvency systems more sustainable by incorporating one or more of the elements of the environmental and social dimensions shown in Table 1.

The process requires the interaction of regulators with insurance stakeholders, in particular with major insurance companies, many of which have also started to incorporate various aspects of sustainability into their management processes with the aim of becoming sustainable insurers and responsible investors [96]. Insurers need to incorporate climate risk and its effects into both their offerings and the management of their insurance business.

- (i)

- Establishing limits and restrictions on investments, activities, energies and/or technologies that are considered unsustainable;

- (ii)

- Providing incentives for those that are sustainable;

- (iii)

- Creating new lines of business to offer products and services that are sustainable, promote sustainability and create social value or have a positive impact on the environment;

- (iv)

- Complying with current and future standards, especially those related to sustainability.

To do so, they need to adapt or modify their strategy, create new departments and re-strengthen some existing ones, establish or increase collaboration, communication and transparency with existing public or private institutions or with new actors to increase the sustainability of the business and protect the data of the insurer’s stakeholders, especially the customers.

In that direction, the regulator should focus on generating scenarios, rather than strict formulas, for adequate long-term sustainability of insurance companies, as better risk management increases business sustainability. In addition, any country that wishes to increase the protection of policyholders should increase the control of corporate governance by requiring at least quarterly reporting and public publication of this information by the companies. These actions would increase market transparency. In the same sense, the technical department should integrate professionals with appropriate expertise into senior management. It is therefore necessary to establish criteria for monitoring the quality of professional qualifications, as is the case in Europe or China.

As far as the control of the solvency, corporate governance and sustainability of companies is concerned, a change in structure will be required. Internal control departments must be set up to verify the correctness of results with solvency regulations, as is the case in Australia, South Africa or the EU. In addition, companies must develop their own analysis of their situation with ORSA-type reports established by the IAIS. All of this implies an increase in the cost of business.

As far as investors are concerned, any increase in transparency, improved management and image, implies the continuity of the company and therefore represents a benefit for them.

The experience obtained in the area of insurance market solvency regulation may be useful in addressing the reforms required by the Principles for Sustainable Insurance [3].

Finally, the Cummins and Hozmüller criteria analyse the degree to which a solvency regulation is able to determine whether an insurer’s capital is enough to meet the obligations of policyholders and beneficiaries. However, these criteria are not sufficient on their own to analyse the sustainability of such regulation because, as discussed in this paper, they only consider one of its dimensions: governance. Therefore, it would be useful to complement them with other criteria to analyse the other dimensions of sustainability: environmental and social. This would make it possible to determine whether the solvency regulation of an insurance market is sustainable, as well as the level of convergence towards the sustainability of the solvency of the different insurance markets.

Author Contributions

Conceptualization, A.G. and J.I.D.l.P.; Data curation, E.T.; Formal analysis, A.G., J.I.D.l.P. and E.T.; Funding acquisition, A.G. and J.I.D.l.P.; Investigation, A.G., J.I.D.l.P. and E.T.; Methodology, A.G., J.I.D.l.P. and E.T.; Resources, A.G.; Software, A.G., J.I.D.l.P. and E.T.; Supervision, A.G., J.I.D.l.P. and E.T.; Validation, A.G., J.I.D.l.P. and E.T.; Visualization, A.G., J.I.D.l.P. and E.T.; Writing—original draft, A.G., J.I.D.l.P. and E.T.; Writing—review and editing, A.G., J.I.D.l.P. and E.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Consolidated Research Group Eusko Jaurlaritza/Gobierno Vasco EJ/GV grant number IT1523-22.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

The authors acknowledge support from the Polibienestar Research Institute. The authors acknowledge language help from Julie Walker-Jones.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Summary of the Models Analysed

Table A1.

Summary of global regulatory models analysed. Source: Own work.

Table A1.

Summary of global regulatory models analysed. Source: Own work.

| System | EU (SII) | US | China | Brazil | Australia | South Africa |

|---|---|---|---|---|---|---|

| 1.General information | ||||||

| 1.1. Country of application | European Union | Unites States | China | Brazil MCR | Australia | South Africa |

| 1.2. Year of introduction | 2016 | 2008 | 2016 | 2015 | 2013 | 2018 |

| 1.3. Main pillars | 1. Quantitative requirements on capital | 1. Rule-based formula | 1. Quantitative requirements on capital | 1. Quantitative requirements on capital | 1. Quantitative requirements on capital | 1. Quantitative requirements on capital |

| 2. Qualitative review by the supervisor | 2. Qualitative review by the supervisor | 2. Qualitative requirements on the characteristics of the investments | 2. Qualitative review by the supervisor | 2. Qualitative review by the supervisor | ||

| 3. Public information | 3. Public information | 3. Public information | 3. Public information | |||

| 1.4. Regulated companies | Insurance and reinsurance companies | Insurance and reinsurance companies | Insurance and reinsurance companies | Insurance and reinsurance companies | Insurance and reinsurance companies | Insurance and reinsurance companies |

| 1.5. Consideration of management risk | Slightly catch 2 | No | Yes | No | ||

| 1.6. Public information requirements | Yes | Yes | Yes | Yes, but administrations | Yes | Yes |

| 2.Definition of required capital | ||||||

| 2.1. Typology of the model | Static factors + dynamic cash flow models | Static factors | Static factors + dynamic cash flow models | Static factors + dynamic cash flow models | Static factors + dynamic cash flow models | Static factors + dynamic cash flow models |

| 2.2. Rule-based/Principle-based | Principle-based | Rule-based | Rule-based | Principle-based | Principle-based | Principle-based |

| 2.3. Orientation to the global balance | Yes | No | Yes | Yes | Yes | Yes |

| 2.4. Time horizon | 1 year | 1 year | 1 year | 3 months | 1 year | 1 year |

| 2.5. Risk/calibration measure | 99.5% VaR | VaR 99% | VaR 99.5% (Catastrophic risk) | VaR 99% | 99.5% VaR | 99.5% VaR |

| 2.6. Operational risk | Qualitatively | No | Qualitatively | Yes | Yes | Qualitatively |

| 2.7. Catastrophic risk | Yes | No | Yes | No | Yes | Yes |

| 2.9. Internal models | Yes | No | No | No | Yes | Yes |

| 3.Definition of available capital | ||||||

| 3.1. Definition based on market or accounting values | Market values | Book values | Book and market values | Market values | Market values | Market values |

| 3.2. Classification of available capital | Yes (3) | No | Yes (4) | Unspoken | Yes | Yes |

| 3.3. Considerations of off-balance sheet items | Yes | No | No | No | Yes | Yes |

| 4.Intervention | ||||||

| 4.1. Levels of intervention | 2 | 4 | 4 | 2 | 2 | 3 |

| 4.2. Transparency of sanctions | Are not explicit | Strict, regulated | Strict, regulated | Yes, deadlines but no sanctions | Are not explicit | Are not explicit |

References

- Orie, M. The UN shift from social research to protecting the environment to governance-from Stockholm to Rio 1992 to Rio + 20 to the principles of sustainable insurance. Risk Man News 2012, 51, 12–16. [Google Scholar]

- UNEP, FI. The Global State of Sustainable Insurance Understanding and Integrating Environmental, Social and Governance Factors in Insurance. 2009. Available online: https://www.unepfi.org/fileadmin/documents/global-state-of-sustainable-insurance_01.pdf (accessed on 4 April 2022).

- UNEP, FI. Principles for Sustainable Insurance. 2012. Available online: https://www.unepfi.org/fileadmin/documents/PSI_document-en.pdf (accessed on 4 April 2022).

- UNEP, FI. Insurance 2030 Harnessing Insurance for Sustainable Development. 2009. Available online: https://www.unepfi.org/psi/wp-content/uploads/2015/10/Insurance_2030_FINAL6Oct2015.pdf (accessed on 4 April 2022).

- Nogueira, F.G.; Lucena, A.F.P.; Nogueira, R. Sustainable insurance assessment: Towards an integrative model. Geneva Pap. Risk Insur.—Issues Pract. 2017, 43, 275–299. [Google Scholar] [CrossRef]

- Gatzert, N.; Reichel, P.; Zitzmann, A. Sustainability risks & opportunities in the insurance industry. German J. Risk Insur. 2020, 109, 311–331. [Google Scholar]

- Zhao, Y.; Bai, M.; Liu, Y.; Hao, J. Quantitative analyses of transition pension liabilities and solvency sustainability in China. Sustainability 2017, 9, 2252. [Google Scholar] [CrossRef] [Green Version]

- Mills, E. From Risk to Opportunity: 2007: Insurer Responses to Climate Change, Ceres. 2007. Available online: https://insurance.lbl.gov/opportunities.html (accessed on 4 April 2022).

- Scordis, N.A.; Suzawa, Y.; Zwick, A.; Ruckner, L. Principles for Sustainable Insurance: Risk Management and Value. Risk Manag. Insur. Rev. 2014, 17, 265–276. [Google Scholar] [CrossRef]

- Campagne, C.; van der Loo, A.; Yntema, J. Contribution to the method of calculating the stabilization reserve in life assurance business. In Gedenkboek Verzekeringskamer 1923–1948; Staatsdrukkerij- en uitgeverijbedrijf: Den Haag, The Netherlands, 1948; pp. 338–378. [Google Scholar]

- Campagne, C. Minimum Standards of Solvency for Insurance Firms; Report to the Report of the ad hoc Working Party on Minimum Standards of Solvency. OECD. TFD/PC/(61); OECD: Paris, France, 1961; Volume 1. [Google Scholar]

- PRA. The impact of climate change on the UK insurance sector. In A Climate Change Adaptation; Prudential Regulation Authority: London, UK, 2015. [Google Scholar]

- EIOPA. Opinion on Sustainability within Solvency II; EIOPA-BoS-19/241 30; European Insurance and Occupational Pensions Authority: Frankfurt am Main, Germany, September 2019. [Google Scholar]

- Grund, F. Sustainability: A duty and a challenge for the insurance industry. BaFin Perspect. 2019, 2, 29–33. [Google Scholar]

- EIOPA. Opinion on the Supervision of the Use of Climate Change Risk Scenarios in ORSA; EIOPA-BoS-21-127; European Insurance and Occupational Pensions Authority: Frankfurt am Main, Germany, 19 April 2021. [Google Scholar]

- Brogi, M.; Cappiello, A.; Lagasio, V.; Santoboni, F. Determinants of insurance companies’ environmental, social, and governance awareness. Corp. Soc. Responsib. Environ. Manag. 2022, 1–13. [Google Scholar] [CrossRef]

- Eling, M.; Holzmüller, I. An overview and comparison of risk-based capital standards. J. Insur. Regul. 2008, 26, 31–60. [Google Scholar]

- IAIS. Principles on Capital Adequacy & Solvency; International Association of Insurance Supervisors: Basel, Switzerland, January 2002. Available online: http://amf.gov.al/pdf/publikime2/edukimi/sigurime/Principles%20on%20capital%20adequacy%20and%20solvency.pdf (accessed on 30 May 2021).

- IAIS. Insurance Core Principles; International Association of Insurance Supervisors: Basel, Switzerland, November 2018. [Google Scholar]

- EC. Recommendations on the Quality of the Information Presented in Relation to Corporate Governance; European Comission: Brussels, Belgium, 2014. [Google Scholar]

- Rajoria, D.K. Corporate governance and non-disclosure of material information: An insight into the Wadia case. Comp. Law J. 2020, 1, 33–40. [Google Scholar]

- Klein, R.W. Principles for insurance regulation: An evaluation of current practices and potential reforms. Geneva Pap. Risk Insur.—Issues Pract. 2011, 37, 175–199. [Google Scholar] [CrossRef] [Green Version]

- Cummins, J.D.; Harrington, S.; Klein, R.W. Insolvency experience, risk-based capital, and prompt corrective action in property–liability insurance. J. Bank Financ. 1995, 19, 511–527. [Google Scholar] [CrossRef]

- Cummins, J.D.; Grace, M.F.; Phillips, R.D. Regulatory Solvency prediction in property-liability insurance: Risk-based capital, audit ratios, and cash flow simulation. J. Risk Insur. 1999, 66, 417–458. [Google Scholar] [CrossRef]

- Grace, M.; Harrington, S.; Klein, R.W. Risk-based capital and solvency screening in property-liability insurance. J. Risk Insur. 1998, 65, 213–243. [Google Scholar] [CrossRef]

- Munch, T.; Smallwood, D.E. Theory of Solvency Regulation in the Property Casualty Insurance Industry; Cambridge ED: Boston, MA, USA, 1981. [Google Scholar]

- Park, S.C.; Tokutsune, Y. Do japanese policyholders care about insurers’ credit quality? Geneva Pap. Risk Insur.—Issues Pract. 2013, 38, 1–21. [Google Scholar] [CrossRef]

- Cummins, J.D.; Harrington, S.; Niehaus, G. An economic overview of risk-based capital requirements for the property–liability insurance industry. J. Insur. Regul. 1994, 11, 427–447. [Google Scholar]

- Doff, R. A critical analysis of the solvency II proposals. Geneva Pap. Risk Insur.—Issues Pract. 2008, 33, 193–206. [Google Scholar] [CrossRef] [Green Version]

- Holzmüller, I. The United States RBC standards, solvency II and the Swiss solvency test: A comparative assessment. Geneva Pap. Risk Insur.—Issues Pract. 2009, 34, 56–77. [Google Scholar] [CrossRef]

- Garayeta, A.; De la Peña, J.I. Looking for a global standard of solvency for the insurance industry: Pros and cons in three systems. Transform. Bus. Econ. 2017, 16, 55–75. [Google Scholar]

- Fung, D.W.H.; Jou, D.; Shao, A.J.; Yeh, J.J.H. The china risk-oriented solvency system: A comparative assessment with other risk-based supervisory frameworks. Geneva Pap. Risk Insur.—Issues Pract. 2018, 43, 16–36. [Google Scholar] [CrossRef]

- Swiss Re. World Insurance in 2019: Solid, But Mature Life Markets Weigh on Growth. Sigma, No.3. 2019. Available online: http://www.swissre.com/sigma/ (accessed on 30 May 2021).

- Swiss Re. World Insurance in 2006: Moderate Premium Growth, Attractive Profitability. Sigma, No.5. 2006. Available online: http://www.swissre.com/sigma/ (accessed on 28 February 2021).

- Swiss Re. World Insurance in 2007: Premiums Back to “Life”. Sigma, No.4. 2007. Available online: http://www.swissre.com/sigma/ (accessed on 28 February 2021).

- Swiss Re. Swiss Re. World Insurance in 2008: Emerging Markets Leading the Way. Sigma, No.3. 2008. Available online: http://www.swissre.com/sigma/ (accessed on 28 February 2021).

- Swiss Re. World Insurance in 2009: Life Premiums Fall in the Industrialised Countries—Strong Growth in the Emerging Economies. Sigma, No.3. 2009. Available online: http://www.swissre.com/sigma/ (accessed on 28 February 2021).

- Swiss Re. World Insurance in 2010: Premiums Dipped but Industry Capital Improved. Sigma, No.2. 2010. Available online: http://www.swissre.com/sigma/ (accessed on 28 February 2021).

- Swiss Re. World Insurance in 2011: Premiums Back to Growth—Capital Increase. Sigma, No.2. 2011. Available online: http://www.swissre.com/sigma/ (accessed on 28 February 2021).

- Swiss Re. World Insurance in 2012: Non-Life Ready for Take-Off. Sigma, No.3. 2012. Available online: http://www.swissre.com/sigma/ (accessed on 28 February 2021).

- Swiss Re. World Insurance in 2012: Progressing on the Long and Winding Road to Recovery. Sigma 2013, No.3. 2013. Available online: http://www.swissre.com/sigma/ (accessed on 30 May 2021).

- Swiss Re. World Insurance in 2013: Steering towards Recovery. Sigma, No 3. 2014. Available online: http://www.swissre.com/sigma/ (accessed on 30 May 2021).

- Swiss Re. World Insurance in 2015: Back to life. Sigma, No.4. 2015. Available online: http://www.swissre.com/sigma/ (accessed on 30 May 2021).

- Swiss Re. World Insurance in 2016: Steady Growth amid Regional Disparities. Sigma, No.3. 2016. Available online: http://www.swissre.com/sigma/ (accessed on 30 May 2021).

- Swiss Re. World Insurance in 2017: The China Growth Engine Steams Ahead. Sigma, No.3. 2017. Available online: http://www.swissre.com/sigma/ (accessed on 30 May 2021).

- Swiss Re. World Insurance in 2018: Solid, But Mature Life Markets Weigh on Growth. Sigma, No.3. 2018. Available online: http://www.swissre.com/sigma/ (accessed on 30 May 2021).

- Fung, B. The demand and need for transparency and disclosure in corporate governance. Univ. J. Manag. 2014, 2, 72–80. [Google Scholar] [CrossRef]

- Orzes, G.; Moretto, A.M.; Moro, M.; Rossi, M.; Sartor, M.; Caniato, F.; Nassimbeni, G. The impact of the United Nations global compact on firm performance: A longitudinal analysis. Int. J. Prod. Econ. 2020, 227, 107664. [Google Scholar] [CrossRef]

- EC. Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the Taking-Up and Pursuit of the Business of Insurance and Reinsurance (Solvency II); European Commission: Brussel, Belgium, 2019. [Google Scholar]

- Eling, M.; Schmeiser, H.; Schmit, J.T. The solvency II process: Overview and critical analysis. Risk Manag. Insur. Rev. 2007, 10, 69–85. [Google Scholar] [CrossRef] [Green Version]

- Stein, R.W. Are you ready for Solvency II? Bests Rev. 2006, 106, 88. [Google Scholar]

- Tarantino, A. Globalization efforts to improve internal controls. Account. Tod. 2005, 19, 37. [Google Scholar]

- Hernández Barros, R.; Martínez Torre-Enciso, M.I. Capital assessment of operational risk for the solvency of health insurance companies. J. Operat. Risk 2012, 7, 43–65. [Google Scholar] [CrossRef]

- EC. The Draft Second wave calls for Advice from CEIOPS and Stakeholder Consultation on Solvency II; Markt/2515/04, Working Paper; European Commission: Brussels, Belgium, 2004. [Google Scholar]

- Powers, M.R. A theory of risk, return and solvency. Insur Math Econ. 1995, 17, 101–118. [Google Scholar] [CrossRef]

- AAA. Joint Report on SMI Project: 1–90; American Academy of Actuaries: Washington, DC, USA, 2011; Available online: http://www.actuary.org/content/joint-report-smi-project-0 (accessed on 30 May 2021).

- NAIC. Capital Requirements Governance & Risk Management; NAIC: 1–10. 2012; National Association of Insurance Commissioners: Kansas, MO, USA, 2012. [Google Scholar]

- Pottier, S.W.; Sommer, D.W. The effectiveness of public and private sector summary risk measures in predicting insurer insolvencies. J. Financial Serv. Res. 2002, 21, 101–116. [Google Scholar] [CrossRef]

- AG. Insurance Act 1973 N° 76; 1976, Compilation N° 55; Australian Government: Canberra, Australian, 1973. [Google Scholar]

- PwC. Insurance Facts and Figures; Asian Region; PriceWaterhouseCoopers: Barangaroo, Australia, 2013. [Google Scholar]

- APRA. Life Insurance (Prudential Standard) Determination N°8 2012; Prudential Standard LPS 100 Solvency Standard; Australian Prudential Regulation Authority: Sydney, Australia. 2012. Available online: https://www.apra.gov.au/sites/default/files/120912_LAGIC_letter_life_insurance_temporary_solvency_standard_0.pdf (accessed on 18 May 2022).

- APRA. Life Insurance (Prudential Standard) Determination N°2 2012; Prudential Standard LPS 110 Capital Adequacy. Australian Prudential Regulation Authority: Sydney, Australia. 2012. Available online: https://jade.io/article/846159?at.hl=Life++Insurance+(prudential+standard)+determination+No+2+of+2012. (accessed on 18 May 2022).

- APRA. Life Insurance (Prudential Standard) Determination N°7 2012; Prudential Standard LPS 118 Capital Adequacy: Operational Risk Charge. Australian Prudential Regulation Authority: Sydney, Australia. 2012. Available online: https://jade.io/article/846154?at.hl=Life++Insurance+(prudential+standard)+determination+No+7+of+2012. (accessed on 18 May 2022).

- CNSP. Resolução CNSP n° 302. 2013; Provision on Minimum Capital Requirement for Authorisation and Operation and Solvency Regularisation Scheme for Insurance Companies, Open-End Supplementary Pension Fund Institutions, Capitalisation Societies and Local Reinsurers. Conselho Nacional De Seguros Privados: Brasilia, Brazil, 2013.

- CNSP. CNSP n° 321. 2015; Provides for Technical Provisions, Assets That Reduce the Need to Cover Technical Provisions, Risk Capital Based on Subscription, Credit, Operational and Market Risks, Adjusted Net Equity, Minimum Capital Required, Solvency Regularization Plan, Retention Limits, Criteria for Investments, Accounting Standards, Accounting Audit and Independent Actuarial Audit and Audit Committee for Insurance Companies, Open Complementary Pension Fund Entities, Capitalization Companies and Reinsurers. Conselho Nacional De Seguros Privados: Brasilia, Brazil, 2015.

- CNSP. Resolução CNSP n° 343 2016 26 de Dezembro; Conselho Nacional De Seguros Privados: Brasilia, Brazil, 26 December 2016.

- FSB. Solvency Assessment and Management (SAM) Roadmap; Financial Services Board: Pretoria, South Africa, November 2010. [Google Scholar]

- Van Rossum, A. Regulation and insurance economics. Geneva Pap. Risk Insur.—Issues Pr. 2005, 30, 156–177. [Google Scholar] [CrossRef]

- Ashby, S.P.; Sharma, P.; McDonnel, W. Lessons About Risk: Analyzing the Causal Chain of Insurance Company Failure; Working Paper; Financial Services Authority: London, UK, 2003. [Google Scholar]

- Sharma, P. Prudential Supervision of Insurance Undertaking. In Conference of Insurance Supervisory Services of Member states of the European Union. DT/UK/232/02/REV6: Paris, France. December 2002. Available online: https://www.knf.gov.pl/knf/pl/komponenty/img/Prudential_supervision_of_insurance_undertakings_18431.pdf (accessed on 18 May 2022).

- Artzner, P.; Eisele, K.-T. Supervisory insurance accounting. Mathematics for provision and solvency capital requirements. Astin Bull. 2010, 40, 569–585. [Google Scholar]

- IASB. International Accounting Standards Board Preliminary Views on Insurance Contracts; discussion paper, IASB; International Accounting Standards Board: London, UK, May 2007. [Google Scholar]

- IASB. International Finance Reporting Standards 17 Insurance Contracts; International Accounting Standards Board: London, UK, 2017. [Google Scholar]

- Trainar, P. The challenge of solvency reform for European insurers. Geneva Pap. Risk Insur.—Issues Pract. 2006, 31, 169–185. [Google Scholar] [CrossRef]

- Butt, M. Insurance, finance, solvency II and financial market interaction. Geneva Pap. Risk Insur.—Issues Pract. 2007, 32, 42–45. [Google Scholar] [CrossRef] [Green Version]

- Klein, R.W.; Wang, S. Catastrophe risk financing in the US and the EU: A comparative analysis of alternative regulatory approaches. J. Risk Insur. 2007, 76, 607–637. [Google Scholar] [CrossRef]

- Farny, D. Security of insurers: The American risk-based capital model versus the European model of solvability for property and casualty insurers. Geneva Pap. Risk Insur.—Issues Pract. 1997, 22, 69–75. [Google Scholar] [CrossRef]

- Linder, U.; Ronkainen, V. Solvency II: Towards a new insurance supervisory system in the EU. Scand. Actuar. J. 2004, 104, 462–474. [Google Scholar] [CrossRef]

- Vaughan, T.M. Financial stability and insurance supervision: The future of prudential supervision. Geneva Pap. Risk Insur.—Issues Pract. 2004, 29, 258–272. [Google Scholar] [CrossRef]

- Nebel, R. Regulations as a source of systemic risk: The need for economic impact analysis. Geneva Pap. Risk Insur.—Issues Pract. 2004, 29, 273–283. [Google Scholar] [CrossRef]

- Liebwein, P. Risk models for capital adequacy: Applications in the context of solvency II and beyond. Geneva Pap. Risk Insur.—Issues Pract. 2006, 31, 528–550. [Google Scholar] [CrossRef]

- Ronkainen, V.; Koskinen, L.; Berglund, R. Topical modelling issues in Solvency II. Scand. Actuar. J. 2007, 2007, 135–146. [Google Scholar]

- Kuritzkes, A.; Schuermann, T. What we know, don’t know and can’t know about bank risk: A view from the trenches. In The Known, the Unknown and the Unknowable in Financial Risk Management: Measurement and Theory Advancing Practice; Diebold, F.X., Herring, R.J., Eds.; Princeton University Press: Princeton, NJ, USA, 2006. [Google Scholar]

- IAA. A Global Framework for Insurer Solvency Assessment, Research Report of the Insurer Solvency Assessment Working Party; International Actuarial Association: Ottawa, ON, Canada, 2004. [Google Scholar]

- IAIS. Insurance core Principles and Methodology; International Association of Insurance Supervisors: Basel, The Swizerland, 2003. [Google Scholar]

- Adams, M.B.; Tower, G.D. Theories of regulation: Some reflections on the statutory supervision of insurance companies in anglo-american countries. Geneva Pap. Risk Insur.—Issues Pract. 1994, 19, 156–177. [Google Scholar] [CrossRef]

- Höring, D. Will solvency II market risk requirements bite? The impact of solvency II on insurers’ asset allocation. Geneva Pap. Risk Insur.—Issues Pr. 2012, 38, 250–273. [Google Scholar] [CrossRef]

- NAIC. NAIC. NAIC White Paper. In The U.S. National State-Based System of Insurance Financial Regulation and the Solvency Modernization Initiative; National Association of Insurance Commissioners: Kansas, MO, USA, 2013. [Google Scholar]

- Chan, B.L.; Marques, F.T. Impacts of the regulatory model for market risk capital: Application in a special savings company, an insurance company, and a pension fund. Rev. Contab. E Financ. 2017, 28, 465–477. [Google Scholar] [CrossRef]

- Cafasso, P.A.L.; Chela, J.L.; Kimura, H. Market risk-based capital for Brazilian insurance companies: A stochastic approach. Futur. Bus. J. 2018, 4, 206–218. [Google Scholar] [CrossRef]

- FSB. In Solvency Assessment and Management Pillar I—Subcommittee Capital Requirements Task Group Discussion Document 78; Non-life Underwriting Risk: Structure and Calibration; Financial Services Board: Pretoria, South Africa, 28 November 2016.

- Artzner, P.; Delbaen, F.; Eber, J.M.; Heath, D. Coherent measures of risk. Math Financ. 1999, 9, 203–228. [Google Scholar] [CrossRef]

- NAIC. Risk-Based Capital General Overview, II; National Association of Insurance Commissioners: Kansas, MO, USA, 2009. [Google Scholar]

- Grabowski, H.; Viscusi, W.K.; Evants, W.K. Price and availability tradeoffs of automobile insurance regulation. J. Risk Insur. 1989, 56, 275–299. [Google Scholar] [CrossRef]

- UNEP, FI. Sustainable Insurance the Emerging Agenda for Supervisors and Regulators. 2017. Available online: http://www.unepfi.org/psi/wp-content/uploads/2017/08/Sustainable_Insurance_The_Emerging_Agenda.pdf (accessed on 4 April 2022).

- Majewska, A. Sustainable insurance. In Ziolo, M. Finance and Sustainable Development: Designing Sustainable Financial Systems; Routledge: London, UK, 2020; pp. 79–98. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).