Abstract

Sustainable governance has become essential in corporate sustainable development. As female executives bring diversity to corporate governance, their impact on the corporate sustainability has attracted wide attention. Using the evidence from China’s listed companies in Shanghai and Shenzhen A-shares between 2010 and 2019, this paper examines the impact of gender diversity of executives on corporate green innovation. We find that the proportion of female executives has a significant negative impact on corporate green innovation. The results show: (1) Considering the heterogeneity of corporate risks, the negative impact of female executives on green innovation exists when the company is exposed to high risks, that is, in the subsample of firms with high risk-taking level and financial constraints; (2) considering the heterogeneity of corporate characteristics, female executives have a negative impact on green innovation in small non-state-owned companies with high separation of ownership and control; (3) considering the heterogeneity of industries, the effect of female executives on green innovation is significant in non-heavy pollution industries; (4) the mechanism test shows that patriarchy culture weakens the influence of female executives. In an environment where men are in power, the impact of female executives on green innovation is not significant; (5) taking the 2018 environmental fee-to-tax policy as a quasi-experiment, we find that female executives will instead promote corporate green innovation in areas where the environmental tax burden has increased significantly. The results imply that since corporate green innovation is a high-risk investment, female executives will make green innovation decisions more prudently based on corporate operating characteristics. This research provides a new perspective for understanding the role of female executives in corporate governance and corporate sustainable development.

1. Introduction

Recently, the concept of sustainable corporate governance is widely recognized, which requires companies to consider internal and external stakeholders into the decision-making process, meet social expectations, take on more responsibilities, and balance between the management team and all stakeholders [1]. In addition, emerging corporate scandals have increased society’s expectations of companies’ ethical responsibilities, in relation to sound governance, sustainable governance has become essential in corporate sustainable development. In response to the changing environment and the need to assure sustainable governance, the literature on corporate sustainability is more related to firms’ green innovation and governance structure. Innovation is an effective mean for companies to deal with external challenges and promote sustainable development [2,3]. As environmental regulations become more stringent, and public awareness of environmental protection increases, companies continue to face more constraints. As a result, companies are required to claim more social responsibilities and carry out green innovations to reduce the negative impact on the environment and gain competitive advantages [4,5]. However, there is a lack of motivation for the companies to invest in green innovation due to the double externality problem of environmental management [6,7], as well as the characteristics of green innovation such as high investment costs, long cycles, and high risks. Therefore, it has been widely discussed in the literature and in practice how to guide companies to adopt green innovation strategies. Studies have found that in addition to factors such as institutional environment [8] and organizational characteristics [9], corporate green innovation is also closely related to the characteristics of the management team [10]. Since green innovation requires continuous investment in human and physical resources, the management team of a company, as the core decision makers in green innovation strategies, plays an important role on the green innovation investment.

More women are elevating to management positions, bringing diversity to corporate governance [11,12,13]. Studies show that gender differences among executives in terms of management style, ethical responsibilities, risk appetite, and many other aspects lead to different governance levels [14,15,16]. Many developed countries such as Germany, Norway, Spain, and Sweden have enacted legislation that set quotas for female directors to increase the proportion of women in the boardrooms [17]. According to the CS Gender 3000 report released by the Credit Suisse Research Institute in 2019, the proportion of female directors has reached 20.6% globally, which has doubled in the last decade. The proportion of female directors in China is much below the world average. This has sparked conversations on whether China’s listed companies should increase the proportion of female executives. Based on the discussions on the characteristics of female executives, the increase in the proportion of female executives may hypothetically have either positive or negative impact on corporate green innovation: On the one hand, female executives pay more attention to responsibilities, which emphasizes on companies assuming social responsibilities especially on the environment [18,19]. Therefore, the participation of female executives may promote corporate green innovation. On the other hand, women generally tend to show stronger risk aversion than men [20]. Green innovation with high-risk features may be averted by female executives.

We use the panel data of listed companies in Shanghai and Shenzhen A-shares between 2010 and 2019 to examine the impact of executive gender diversity on green innovation investment. We find that the gender diversity of a corporate management team can affect green innovation, and the proportion of female executives has a significant negative impact on green innovation level. Next, we examine the heterogeneities in the effect of the female executives on corporate green innovation. In terms of corporate risks, the negative impact of female executives on green innovation is significant only when the company is exposed to a high level of risk, that is, in subsamples with a higher risk-taking level and strict financial constraints. In addition, the estimated effect is significantly negative among small non-state-owned companies with high separation of ownership and control. When we decompose the effect by industries, we find the female executives’ negative impact on green innovation is only significant in non-heavy pollution industries. Finally, we turn to the mechanism of the estimated effect: (i) Evidence shows that patriarchy culture will weaken the influence of female executives. In a corporate environment where men dominate, the impact of female executives on green innovation is not significant; (ii) market environment will change the attitude of female executives toward green innovation. We take the 2018 environmental-fee-to-tax policy as a quasi-experiment and find that in areas where the environmental tax burden has increased significantly, female executives will instead promote corporate green innovation.

This paper is aimed to provide evidence for the effect on sustainable governance by female executives and answer the questions of whether and how female executives affect corporate green innovation. Our findings contribute to the research investigating corporate green innovation from the perspective of gender diversity, as well as provides new evidence for the debate on the economic consequences of female executives’ sustainable governance. The rest of the paper is organized as follows. Section 2 introduces the motivation of our research and the testable hypotheses. Section 3 presents the empirical research design, defining the regression model and the definition of main variables. Section 4, Section 5 and Section 6 analyze the results, followed by the discussion and conclusions of Section 7.

2. Motivation and Research Hypothesis

2.1. Corporate Green Innovation

Corporate green innovation is an essential tool for companies to face external environmental challenges and promote sustainable development [2,3]. With global agenda/initiatives such as the Paris Agreement and the UN climate action summit, international society is paying more and more attention to corporate environmental performance. Companies have begun to adjust their long-term agenda of innovation and growth to the global narratives of green sustainable development. Green innovation was first introduced as environmental innovation that reduces environmental burdens and achieve ecologically sustainable development. It is essentially the application or introduction of new ideas, behaviors, products, or processes in business activities [21]. Hellström (2010) defined green innovation as sustainable innovation, and the concept became broader than environmental-focused [22]. It includes not only innovations that can reduce environmental risks, but also those that are conducive to improving the livelihood of human beings, such as safety and quality of life. This extends the realm of emphasis from concern for the environment only to the pursuit of balanced benefit between humans and nature.

Early research on green innovation often considers it as a set of corporate forward-looking environmental strategies, emphasizing on sustainability as the ultimate goal, and meeting environmental protection standards in the production process [23,24], rather than focusing on “green innovation”. However, recent studies have distinguished green innovation strategies from forward-looking environmental strategies and have highlighted the differences between the two in definition. Green innovation strategies are strategic decisions made by companies to develop eco-friendly innovation to gain competitive advantage, satisfy M&A needs, and meet the expectations of stakeholders [25], focusing on innovation itself.

As companies adopt a set of green innovation strategies in response to the external policy pressure and a dynamic competitive market environment, the driving factors of green innovation strategy can be categorized into three levels: institutional, organizational, and individual. Firstly, corporate green innovation is directly affected by the external institutional environment, which includes corporate social responsibilities and external environmental regulations [26,27]. There has been a debate on the effect of environmental regulations on corporate green innovation. The Porter Hypothesis proposes that although environmental regulations increase the cost of corporate environmental governance, they also promote corporate green innovation activities [8]. However, the Constraint Hypothesis argues that environmental regulations have a negative impact on the corporate productivity and competitiveness, reducing the efficiency of corporate investment [28]. At the organizational level, it is argued that the external environmental pressure needs to be combined with corporate characteristics and organizational structure to drive corporate green innovation. The organizational factors that influence a corporate green innovation strategy are relatively diverse, including the basic characteristics, resources, and strategic motivations [29,30]. The basic characteristics, such as firm size, age, ownership type and industry, directly impact on corporate green innovation. For example, large companies are more willing to carry out green innovation strategies, as they have more resources and capabilities. Finally, at the individual level, the Upper Echelons theory shows how the management team affects corporate green innovation strategy. The social values and awareness of the management team play an important role in the choice and implementation of corporate strategies [31]. The management team uses their somewhat subjective judgement to identify the external environment and determine whether and how to implement green innovation strategies to improve their competitive advantage [10,32]. Therefore, the stance of the management team matters in the success of green innovation projects.

2.2. Female Executives

The Upper Echelons theory states that the characteristics of executives will affect their cognition and decisions and in turn affect corporate strategic choice and performance [31]. Among all characteristics of executives, gender is the most basic and important one. Compared with men, women generally have a stronger sense of morality and altruism [14], are more risk-averse [15], and operate more steadily without overconfidence [16]. Existing studies have discussed the behavioral characteristics of female executives and their economic consequences.

Some studies believe that female executives have a positive effect on corporate governance. On the one hand, female executives are more inclined to choose lower-risk and defensive strategies [20], reduce corporate over-investment and inefficient investment [11,33], and improve earnings quality [34,35]. The existence of female executives on the board can effectively reduce the corporate risks of stock price crashes [36]. In addition, female executives also tend to reduce R&D investment risks [37], restrain high M&A premiums [38], and adopt less aggressive tax avoidance policies [39]. On the other hand, research shows that female executives are more responsible and pay more attention to the interests of corporate stakeholders. In terms of attitude and behavior, women pay more attention to ethics and morality than men [40]. Men generally prefer external performances such as money, promotion, and power, while women are more compassionate, focus more on relationships, and are more willing to help others [41]. Carter et al. (2003) use the data of the listed companies in the US and find that female directors as monitors would improve the decision-making efficiency, thus positively impacting the corporate stock market performance [42]. Female executives can also significantly reduce the incidence of financial fraud in listed companies [43] and improve the quality of board discussions [44]. Peni and Vahamaa (2010) find that the existence of female directors in the audit committee is conducive to the improvement of the corporate internal control [45]. Companies with more female directors are more willing to take on social responsibility, more charitable donations and better social responsibility performance [14,46].

However, the other side of the debate argues that female executives have no significant positive effect on companies and may even have a negative impact on corporate governance. Chapple and Humphrey (2014) find that gender diversity on the board of directors has no significant impact on company performance [47]. Sila et al. (2016) find after controlling the impact of endogenous factors, the existence of female directors on the board does not significantly reduce the corporate equity risk [48]. Faccio et al. (2016) find that the risk aversion tendency of female executives may cause misallocation of corporate resources [49]. Usman et al. (2018) use China’s A-share listed companies and find that the proportion of female directors significantly reduces the constraints on CEO power [50]. They argue that the mechanism behind the above effects is the cultural attitude toward traditional gender roles. Chinese women have long played a subordinate role in the labor market and hence face higher pressure to “obey” instead of “speak up”. Therefore, they are unable to function fully in monitor roles and to utilize their gender characteristics to perform.

In general, the effect of female executives has been controversial. At the same time, this part of the research focuses more on the impact of female executives on company performance and overall financial decision making, while few studies have explored female executives’ impact on green innovation.

2.3. Theoretical Analysis and Research Hypothesis

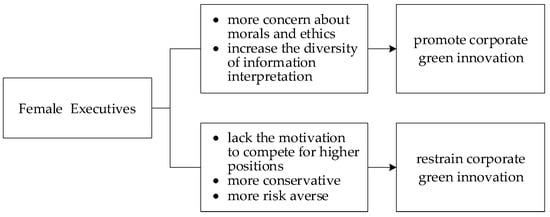

Corporate green innovation is a process that requires long-term investment and cannot be executed without the support of management teams. According to the Upper Echelons theory, the personal characteristics of executives are an important factor that affects decision making, and gender is one of the most essential among them. We argue that the effect of female executives on corporate green innovation could theoretically be either positive or negative. The analysis framework is shown in Figure 1.

Figure 1.

Analytical Framework.

Female executives may have a positive impact on corporate green innovation. First, women are relatively more concerned about morals and ethics, and place more emphasis on responsibilities [18,19]. Female executives tend to pay more attention to social performance in decision making such as work quality of employees and satisfaction of stakeholders, rather than financial performance only. The participation of female executives can encourage companies to undertake more social responsibilities [51]. Therefore, in the face of increasingly severe environmental problems, female executives are more willing to actively assume social responsibilities and promote green innovation to reduce corporate environmental burden and achieve ecologically sustainable development. Second, a gender balanced board of directors can increase the diversity of information interpretation [52], better understand the market heterogeneity, and have a more precise grasp of consumer needs and development opportunities [11], which may positively affect green innovation motivation and capabilities. Therefore, the increase in the proportion of female executives may lead to an increase in green innovation level.

However, female executives may also have a negative impact on corporate green innovation. From the perspective of risk appetite, female executives tend to show stronger risk aversion. First, women on average are less likely to move up the career ladders than their male peers [53]. Hence female executives lack the strong motivation to compete for higher positions by taking on more risky projects such as green innovation. Compared to other investment projects, green innovation exhibits the features of higher input costs, lower success rates, longer R&D cycles, and more lagged returns. These features of green innovation tend to disincentivize female executives from investing in such projects. Second, from the perspective of adopting novel concepts, female executives are more conservative than males [54]. Activities such as green innovation and green transformation need to break down the existing business model and develop a new sustainable strategy. There may be challenges for most female executives to accept these new concepts. Third, from the physiological aspect, Zuckerman et al. (1994) proposed that risk decisions are affected by a type of chemical in the human body called monoamine oxidase, the level of which is on average higher in the female body than the male body, so women are more risk averse [15]. Therefore, women’s high risk aversion tendencies may lead to insufficient motivation for corporate green innovation.

Based on the above arguments, we propose the following hypothesis.

Hypothesis 1.

The increase in the proportion of female executives will affect corporate green innovation level.

Hypothesis 1a.

The increase in the proportion of female executives will promote corporate green innovation level.

Hypothesis 1b.

The increase in the proportion of female executives will restrain corporate green innovation level.

3. Empirical Research Design

3.1. Data and Sample Selection

We use the 2010–2019 Shanghai and Shenzhen A-share listed companies as our data sample and exclude: (i) companies with missing data; (ii) companies marked with ST and *ST; and (iii) financial companies. The financial and stock transaction data of each firm are from the China Stock Market Accounting Research Database (CSMAR). We obtained the data on green innovation by matching the China National Intellectual Property and Patent database and the International Patent Classification Green Inventory of the World Intellectual Property Organization (WIPO). In order to eliminate the potential biases from the outlier effects, the variables are winsorized at the 1% and 99% percentile.

3.2. Main Variables

3.2.1. Green Innovation

We use the natural logarithm of green patent applications number of listed companies to measure the green innovation level (GI) annually. As there is no disclosure of the green R&D expenditures in the financial statements, the green patent is the second-best proxy for green innovation and is widely used in the literature [55]. In order to identify whether the patent is “green”, we use the international patent classification (IPC) published by the China National Intellectual Property Administration, and cross validate with the WIPO’s international patent classification green inventory. Due to the time lag between the application and the grant of a patent, we choose the number of green patent applications rather than the number of grants. The number of patent applications is more reliable than the number of grants.

3.2.2. Female Executives

The proportion of female executives (Feratio) is used to measure the role of female executives in the corporate management decisions [42]. In addition, the proportion of female directors on the board of directors (Feratiob) and the proportion of female senior managers in the senior management team (Feratiom) are used as robustness checks.

3.3. The Regression Model

In order to estimate the effect of female executives on corporate green innovation level, we construct a regression model (1) as follows:

The dependent variable is green innovation (GI), and the main independent variable of interest is the proportion of female executives (Feratio). The list of control variables are mainly referenced from Liang et al. (2020) [56], including firm size (Size), which is the natural logarithm of total assets; financial leverage (Lev), defined as the liability-to-asset ratio; board size (Bsize), which is the natural logarithm of board members number; company age (Age), defined as the natural logarithm of the company age at the sample year; corporate growth (Growth), measured by the growth rate of sales; and the ratio of independent directors to the total number of board members (Idratio). Detailed variable definitions are provided in Table 1.

Table 1.

Definitions of variables.

4. Empirical Results

4.1. Descriptive Analysis

Descriptive statistics of the main variables are shown in Panel A of Table 2. The mean and standard deviation of green innovation of China’s listed companies are 0.273 and 0.721, indicating that the green innovation of the sample companies is at a relatively low level. The mean and median of the proportion of female executives are 0.164 and 0.150, which are close to existing studies [57,58]. The mean of female directors is 0.125, and the mean of female senior managers is 0.139, while the maximum values are 0.444 and 0.600, indicating that the proportion of female executives in different firms is quite different. The mean age (Age) of the sample companies is 2.536, the mean firm size is 22.600, the mean growth ability is 0.199, the mean return on assets (Roa) is 0.037, and the mean financial leverage (Lev) is 0.493. The mean largest shareholder’s shareholding ratio is 37.47%, the mean of dual role of the board chairman (Dual) is 0.169, and the mean of independent directors’ ratio (Idratio) is 0.374. These statistics are all within a reasonable range. Panel B shows that the proportion of female executives has shown an upward trend by year, from 0.144 in 2010 to 0.185 in 2019, increasing 28%. The proportion of female directors rose from 0.102 in 2010 to 0.145 in 2019, increasing 39%. Female senior managers rose from 0.129 in 2010 to 0.153 in 2019, increasing 18%. Female executives are becoming an important part of corporate governance.

Table 2.

Descriptive statistics.

4.2. Main Regression Results

Table 3 reports the regression results of the hypotheses, and the dependent variable is Green Innovation (GI). Column (1) contains the control variables and performs OLS regression, while controlling the annual and industry effects. The results show that the proportion of female executives is significantly related to the green innovation of listed companies. The coefficient of the proportion of female executives is significantly negative at the 1% level, indicating that the higher the proportion of female executives, the lower green innovation level, which is consistent with the hypothesis H1b. In addition, the coefficient of company age (Age) is significantly negative, indicating as the listed company becomes more mature, its green innovation motivation tends to decline. The coefficient of firm size (Size) is significantly positive, indicating that the larger the company, the more investment in green innovation. Column (2) makes cluster adjustments to the standard errors of regression coefficients. It is consistent with the findings in column (1). The coefficient of the proportion of female executives is still significantly negative, which is consistent with the research hypothesis H1b.

Table 3.

The female executives and green innovation.

4.3. Robustness Tests

4.3.1. Lagging Independent Variables

In order to alleviate the endogenous problem of causal inversion between the proportion of female executives and innovation investment, we lag the proportion of female executives by one and two periods, respectively. The results are shown in columns (1) and (2) of Table 4. The coefficient of the proportion of female executives (Feratio) is still significantly negative at the 1% level.

Table 4.

Robustness tests.

4.3.2. Replacing the Control Variables

We change the definition of some control variables, such as measuring the corporate profitability by return on equity (Roe), and corporate growth potential by the net cash flow generated by operating activities/total assets (Cflow). The regression results are shown in columns (3) and (4) of Table 4. The coefficient of the proportion of female executives (Feratio) is still significantly negative at the 1% level.

4.3.3. Replacing the Measurement of Female Executives

Furthermore, the regression was performed by replacing the independent variables with the proportion of female directors (Feratiob) and the proportion of female senior managers (Feratiom). Column (1) of Table 5 shows that the proportion of female directors to green innovation is significantly negative at the level of 5%. The higher the proportion of female directors, the lower green innovation level. Column (2) shows that the proportion of female senior managers also has a significant negative impact on green innovation at the level of 1%. The increase in the proportion of female directors and managers has a negative impact on corporate green innovation, which is consistent with the main regression.

Table 5.

The female directors/managers and green innovation.

5. Heterogeneity Test

5.1. Heterogeneity of the Corporate Risk

Based on the previous analysis, female executives are more prudent than male executives, which is an important reason for the negative impact on corporate green innovation. As the corporate risk level changes, the prudence of female executives will change accordingly, and the negative impact on green innovation will be different. This inference is explored in this section.

5.1.1. Heterogeneity of the Risk-Taking Level

With reference to John (2008) [59], the corporate risk-taking level is measured by the volatility level of earnings, that is, the standard deviation of the earnings in the previous three years. According to the annual-industry median of the risk-taking level, the sample companies are divided into the high-risk group (risk-taking level higher than the median) and the low-risk group (risk-taking level lower than or equal to the median). The results are shown in columns (1) and (2) of Table 6, indicating that the proportion of female executives in the high-risk group is significantly negatively correlated with corporate green innovation at the level of 1%, while in the low-risk group, the proportion of female executives did not significantly affect corporate green innovation. It shows that female executives are more prudent in making green innovation decisions when the company is exposed to higher operating risks.

Table 6.

Heterogeneity test of the corporate risk.

5.1.2. Heterogeneity of the Financial Constraints

We use the SA index to measure the financial constraints of listed companies. The SA index is determined by two variables, the size and age of the listed company, which are completely exogenous, so that the financial constraint evaluation is relatively robust [60]. The SA index is the absolute value of −0.737Size + 0.043Size2 − 0.04Age. The larger the value, the higher the degree of financing constraints. According to the annual-industry median of financial constraints, the sample companies are divided into the high financial constraints group (financial constraints higher than the median) and the low financial constraints group (financial constraints lower than or equal to the median). The results are shown in columns (3) and (4) of Table 6, indicating that the proportion of female executives in the high financial constraint group is significantly negative to green innovation at the level of 1%, while in the low financial constraints group the proportion of female executives did not significantly affect green innovation. It shows that female executives are more prudent in making green innovation decisions when the company faces higher financial pressures.

5.2. Heterogeneity of the Corporate Characteristics

Based on the previous analysis, the corporate characteristics will influence the female executives’ attitudes toward green innovation. This inference is explored in this section.

5.2.1. Heterogeneity of the Firm Size

The ability to withstand risks is different in different-sized companies. Compared with small companies, large companies are more able to tolerate risks of innovation failure. Therefore, it is expected that the female executives are more prudent in green innovation decision making in the smaller firms. According to the annual-industry median of firm size, the sample companies are divided into the large-scale group (firm size bigger than the median) and the small-scale group (firm size smaller than or equal to the median). The results are shown in columns (1) and (2) of Table 7. The proportion of female executives in the small-scale group is significantly negative to green innovation at the level of 1%. While in the large-scale group, the coefficient of the proportion of female executives is positive, but not significant. Female executives in large companies with strong risk resistance will not significantly inhibit green innovation.

Table 7.

Heterogeneity test based on the corporate characteristics.

5.2.2. Heterogeneity of the Separation of Ownership and Control

When ownership and control of the large shareholders are highly separated, the shareholder’s self-interest will be more motivated [61], and the decision making will deviate from rationality. As an important part of corporate governance, female executives will play a stronger role when the separation of ownership and control is higher. According to the annual-industry median of corporate separation of ownership and control, the sample companies are divided into the high degree of separation group (the degree of separation of ownership and control is higher than the mean) and the low degree of separation group (the degree of separation of ownership and control is less than or equal to mean). The calculation of separation of ownership and control is the control rights minus the cash-flow rights of the ultimate owner, and the data are from the CSMAR database. The results are shown in columns (3) and (4) of Table 7. The proportion of female executives in the high separation group is significantly negative to corporate green innovation at the level of 1%. While in the low degree of separation group, the proportion of female executives did not significantly affect corporate green innovation. The results are in line with expectations.

5.2.3. Heterogeneity of the Ownership Type

State-owned enterprises and non-state-owned enterprises face different pressures in continuous operation, and therefore female executives have different prudence toward green innovation. Innovation activity itself is a high-risk, long-term investment. Once it fails, it will affect the continuous operation of the enterprise. It is expected that due to the fiercer competition in the external market faced by non-state-owned enterprises, female executives are more prudent in making green innovation decisions in non-state-owned enterprises. According to the ownership type, the sample companies are divided into the state-owned and non-state-owned enterprises groups. The results are shown in columns (5) and (6) of Table 7. The proportion of female executives in non-state-owned enterprises is significantly negative to corporate green innovation at the level of 1%,while in state-owned enterprises the proportion of female executives did not significantly affect corporate green innovation. The results are in line with expectations.

5.3. Heterogeneity of the Industries

Green innovation has different meanings for companies in different industries. Although green innovation is an investment activity with high risks, it is a necessary way for companies in heavy pollution industries to transform, upgrade, and sustainably develop. In the heavily polluting industries, green innovation is not only a value-added investment, but also an important determinant for the sustainability of business operations. Therefore, despite female executives being more prudent in green innovation decision making, it is expected that female executives in heavy-polluting industries will not restrain their green innovation, and the negative impact of female executives on green innovation only exists in firms in non-polluting industries. The results are shown in Table 8. Columns (1) shows that when a company is in a heavily polluting industry, the proportion of female executives does not significantly affect corporate green innovation. Columns (2) shows that in non-polluting companies, the proportion of female executives is significantly negative to corporate green innovation at the level of 1%. The results are in line with expectations.

Table 8.

Heterogeneity test based on industries.

6. Mechanism Tests

6.1. The Influence of Patriarchy Culture

The long-term historical status, traditional concepts, and the role of childbirth have affected the influence of female executives. The patriarchy cultural environment will weaken the influence of female executives, and thus female executives have less impact on corporate green innovation decisions.

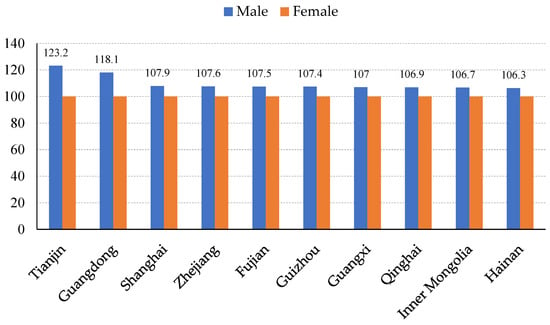

We use the gender imbalance in each province of China to measure the patriarchy culture in different regions. According to the data from “China Statistical Yearbook (2020)”, China’s average gender ratio (the number of males to females) was 104.46 (females = 100) in 2019. The top three regions are Tianjin, Guangdong and Shanghai, reaching 123.2, 118.1 and 107.9. The top 10 regions are Tianjin, Guangdong, Shanghai, Zhejiang, Fujian, Guizhou, Guangxi, Qinghai, Inner Mongolia, and Hainan, all whose gender ratio is higher than average, as shown in Figure 2.

Figure 2.

The ratio of men to women. Data source: China Statistical Yearbook, China Health Statistics Yearbook.

According to the gender ratio of men to women, the sample companies are divided into the gender-imbalanced provinces (top 10 regions) and other provinces. The regression results are shown in Table 9. Column (1) shows that female executives have no significant impact on corporate green innovation in the gender-imbalanced provinces. Columns (2) and (3) also indicate that female directors and female senior managers have not significantly affected corporate green innovation. Column (4) shows that in other regions, the proportion of female executives is significantly negative at the 5% level. In columns (5) and (6), female directors and female senior managers are also significantly negative to corporate green innovation at the level of 10% and 1%. It shows that patriarchy culture will affect female executives’ influence on corporate green innovation.

Table 9.

The influence of patriarchy culture.

6.2. The Influence of Environmental Regulation Policy

Based on the market environment that companies face, external policies will have an impact on the prudence of female executives in decision making. The institutional theory believes that institutional pressure, such as environmental regulation, is the driving force for the corporate green transformation. In 2016, China promulgated the “Environmental Protection Tax Law of the People’s Republic of China” (referred to as environmental tax) and implemented it on January 1, 2018. The legislative concept of the environmental tax is to regulate the collection and payment of environmental protection taxes in accordance with the Constitution, protect and improve the environment, and promote the construction of ecological civilization. The environmental tax aims to promote polluting companies to control pollution and allow environmentally friendly companies to enjoy preferential treatment. As the tax burden in some regions increases, the corporate environmental externality converts into internal environmental costs, which need to be reduced through green transformation. In this section, we discuss whether the 2018 environmental fee-to-tax policy changes female executives’ attitude toward corporate green innovation.

Based on the implementation of the environmental fee-to-tax policy, we select the subsample as the province with tax burden increased significantly. Provinces with significant increases in tax burdens can be one of three categories: (i) Provinces that adopt classification and partition standards to connect with the original environmental fee system, including: Hebei, Jiangsu, and Shandong; (ii) provinces that are forced to raise their tax burden standards to prevent the pollution transfer from surrounding provinces, including: Henan, Hunan, Sichuan, Chongqing, Guizhou, Hainan, Guangxi, Shanxi; (iii) provinces that directly set the tax standard as the upper limit of the tax amount due to the high environmental cost, including Beijing.

With a significant increase in environmental tax burdens, female executives’ attitudes toward green innovation may change. We take the environmental protection fee-to-tax policy as a quasi-experiment and select listed companies with significant tax burden increases as the sample companies. The Differences-in-Differences method is used to test the attitudes of female executives toward corporate green innovation. We perform DID regression according to model (2).

The explanatory variables of the model (2) include time dummy variables (Dt), group dummy variables (Dgender), and the interaction (Posttreat). Dt reflects whether the policy is implemented in the current year. We record January 1, 2018 as the time of the policy implementation, with a value of 0 before 2018 and a value of 1 after 2018. Dgender is the experimental group with a high female executives’ ratio. If the company is in the experimental group, it is assigned a value of 1. The control group is the low female executive ratio group, with a value of 0. The interaction (Posttreat) is the core explanatory variable. If the sample company is in the experimental group and the year is after the policy implementation, it equals 1, otherwise 0.

Table 10 reports the results of model (2). Column (1) is the result of controlling the annual effect and industry effect, and column (2) is the result of clustering adjustment to the standard error of the regression coefficient. The regression results show that the coefficient of Posttreat is 0.087, which is significantly positive at the 10% level. After 2018, in provinces where the environmental tax burden has increased, female executives have a positive impact on corporate green innovation instead. Items (3) and (4) are listed as placebo tests of the policy effect. Dt1 is the year before the policy is implemented, equals 1 after 2017, otherwise 0. The interaction term Posttreat1 is the core explanatory variable. If the sample company is in the experimental group and the year is after 2017, it equals 1, otherwise 0. The coefficient of Posttreat1 is not significant. The placebo test further confirms the conclusion that female executives will promote corporate green innovation when the intensity of environmental regulations is high.

Table 10.

The influence of environmental regulation policy.

7. Discussion and Conclusions

7.1. Conclusions

We use the 2010–2019 Shanghai and Shenzhen A-share listed companies as a data sample and find that the proportion of female executives has a significant negative impact on corporate green innovation. The results imply that the stronger risk aversion tendency of female executives restrains corporate green innovation motivation. Further research shows:

First, the negative impact of female executives on green innovation will change based on risk level. Considering the heterogeneity of corporate risks, female executives are more prudent in green innovation decision making when the corporate risk-taking level is higher or faced with higher financial pressure.

Second, the negative impact of female executives on green innovation will change based on corporate characteristics. Considering the heterogeneity of corporate characteristics, the smaller the company, the higher the risk of innovation failure, and female executives are more prudent in green innovation decisions; the greater the separation of ownership and control, the stronger the governance effect of female executives and the more prudent in green innovation decisions. As non-state-owned enterprises face more intense competition in the external market, female executives are more prudent in green innovation decisions in non-state-owned enterprises.

Third, the negative impact of female executives on green innovation will change in different industries. For companies in heavy pollution industries, green innovation is a necessary way for their transformation, upgrading, and sustainable development. Considering the heterogeneity of industries, although female executives are more prudent in green innovation decision making, female executives do not restrain their green innovation in heavily polluting industries.

Finally, the mechanism test shows that: (i) The patriarchy culture will weaken the influence of female executives. In a patriarchy cultural environment, female executives do not have a significant impact on green innovation; (ii) environmental regulations will change the female executives’ attitude toward green innovation. Taking the environmental fee-to-tax reform event in 2018 as a quasi-experiment, we find that in areas where the environmental tax burden has increased significantly, female executives will instead promote corporate green innovation.

The results show that since corporate green innovation is a high-risk behavior, female executives will make decisions more prudently based on the corporate operating characteristics. When companies face different external pressures, female executives have different attitudes toward green innovation. Overall, female executives have a stronger sense of risk aversion, which leads to a negative impact on corporate green innovation. However, when companies face strong environmental regulations, female executives will have a positive impact on corporate green innovation instead.

Our findings on female executives are in line with previous studies, indicating female executives show governance effect and risk aversion tendency [20,49]. However, in addition to previous studies, our study focused on the sustainable governance effect of female executives by examining the impact of female executives on corporate green innovation, as well as pointing out that the patriarchy cultural environment will weaken the sustainable governance effect of female executives.

7.2. Implications

The findings of the study theoretically expand the research on the determinant of corporate sustainable governance and green innovation investment from the perspective of executive gender and provide a better understanding of female executive behavior in different environments. The findings may also have practical implications, as there is still a certain gap between the proportion of female directors in China (about 13%) and developed countries (more than 30%). An appropriate increase in the proportion of female executives can reduce blind investment in green innovation and enhance corporate ethical responsibilities alleviating problems such as substantive innovation, which are common phenomena in east Asian countries [62].

7.3. Limitations

The limitations of the study are as follows: although our empirical results reveal the causal relationship between female executives and green innovation investment, the motivations of female executives for green innovation investment are still unclear. Future research can try to explore the behavioral characteristics of female executives. For example, the sustainable governance effect of female executives is caused by the strategic choices out of consideration of competitive advantage based on comparative analysis of costs and benefits, or simply the ecological protection behaviors adopted by government regulation or other institutional pressures. It is also possible to explore the relationship between female executives and corporate green innovation from the characteristics of female executives’ age, education, and personal experience in future studies.

Author Contributions

Conceptualization, Z.M. and G.S.; Data curation, Z.M., Q.W. and L.W.; Formal analysis, G.S. and Q.W.; Funding acquisition, Z.M. and Q.W.; Investigation, G.S.; Methodology, G.S.; Supervision, Z.M.; Visualization, G.S.; Writing—original draft, G.S.; Writing—review & editing, Z.M., Q.W. and L.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Fundamental Research Funds for the Central Universities, grant number 2020YJS068 and the Beijing Municipal Office of Philosophy and Social Science Planning, grant number 19GLB021.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Publicly available datasets were analyzed in this study. These data can be found at the websites of CSMAR database.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Cardoni, A.; Kiseleva, E.; Lombardi, R. A sustainable governance model to prevent corporate corruption: Integrating anticorruption practices, corporate strategy and business processes. Bus. Strategy Environ. 2020, 29, 1173–1185. [Google Scholar] [CrossRef]

- Carrillo-Hermosilla, J.; Rio, P.D.; Koennoelae, T. Diversity of eco-innovations: Reflections from selected case studies. J. Clean. Prod. 2010, 18, 1073–1083. [Google Scholar] [CrossRef]

- Medeiros, J.; Ribeiro, J.; Cortimiglia, M.N. Success factors for environmentally sustainable product innovation: A systematic literature review. J. Clean. Prod. 2014, 65, 76–86. [Google Scholar] [CrossRef]

- Henriques, I.; Sadorsky, P. The relationship between environmental commitment and managerial perceptions of stakeholder importance. Acad. Manag. J. 1999, 42, 87–99. [Google Scholar]

- Banerjee, S.B.; Iyer, E.S.; Kashyap, R.K. Corporate environmentalism: Antecedents and influence of industry type. J. Mark. 2003, 67, 106–122. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Newell, R.G.; Stavins, R.N. A tale of two market failures: Technology and environmental policy. Ecol. Econ. 2005, 54, 164–174. [Google Scholar] [CrossRef] [Green Version]

- Rennings, K. Redefining innovation—Eco-innovation research and the contribution from ecological economics. Ecol. Econ. 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Porter, M.; Van De Linde, C. Green and competitive: Ending the stalemate. Harv. Bus. Rev. 1995, 33, 109–134. [Google Scholar]

- Ketata, I.; Sofka, W.; Grimpe, C. The role of internal capabilities and firms’ environment for sustainable innovation: Evidence for Germany. RD Manag. 2015, 45, 60–75. [Google Scholar] [CrossRef]

- Kaplan, S. Research in cognition and strategy: Reflections on two decades of progress and a look to the future. J. Manag. Stud. 2011, 48, 665–695. [Google Scholar] [CrossRef]

- Adams, R.B.; Ferreira, D. Women in the boardroom and their impact on governance and performance. J. Financ. Econ. 2009, 94, 291–309. [Google Scholar] [CrossRef] [Green Version]

- Ahern, K.R.; Dittmar, A.K. The changing of the boards: The impact on firm valuation of mandated female board representation. Q. J. Econ. 2011, 127, 137–197. [Google Scholar] [CrossRef]

- Anda, A.S.; Dragos, P.; Florin, S.D. Sustainability of financial performance in relation to gender diverse boards: A comparative analysis of French and Romanian listed companies on stock exchanges. Sustainability 2021, 13, 10282. [Google Scholar]

- Williams, R.J. Women on corporate boards of directors and their influence on corporate philanthropy. J. Bus. Ethics 2003, 42, 1–10. [Google Scholar] [CrossRef]

- Zuckerman, M. Behavioral Expression and Biosocial Bases of Sensation Seeking; Cambridge University Press: New York, NY, USA, 1994. [Google Scholar]

- Barber, B.M.; Odean, T. Boys will be boys: Gender, overconfidence, and common stock investment. Q. J. Econ. 2001, 116, 261–292. [Google Scholar] [CrossRef]

- Adams, R.; Funk, P. Beyond the glass ceiling: Does gender matter? Manag. Sci. 2012, 58, 219–235. [Google Scholar] [CrossRef] [Green Version]

- Lamsa, A.M.; Vehkapera, M.; Puttonen, T.; Pesonen, H.L. Effect of business education on women and men students’ attitudes on corporate responsibility in society. J. Bus. Ethics 2008, 82, 45–58. [Google Scholar] [CrossRef]

- Ibrahim, N.A.; Angelidis, J.; Tomic, I.M. Managers’ attitudes toward codes of ethics: Are there gender differences? J. Bus. Ethics 2009, 90, 343–353. [Google Scholar] [CrossRef]

- Boohene, R.; Sheridan, A.; Kotey, B. Gender, personal values, strategies and small business performance: A Ghanaian case study. Equal Oppor. Int. 2008, 27, 237–257. [Google Scholar] [CrossRef]

- Braun, E.; Wield, D. Regulation as a means for the social control of technology. Technol. Anal. Strateg. Manag. 1994, 6, 259–272. [Google Scholar] [CrossRef]

- Hellström, T. Dimensions of environmentally sustainable innovation: The structure of eco-innovation concepts. Sustain. Dev. 2010, 15, 148–159. [Google Scholar] [CrossRef]

- Sharma, S.; Vredenburg, H. Proactive corporate environmental strategy and the development of competitively valuable organizational capabilities. Strateg. Manag. J. 1998, 19, 729–753. [Google Scholar] [CrossRef]

- Banerjee, S.B. Managerial perceptions of corporate environmentalism: Interpretations from industry and strategic implications for organizations. J. Manag. Stud. 2001, 38, 488–513. [Google Scholar] [CrossRef]

- Zhang, G.; Zhang, X.J. Review and prospect of overseas green innovation research. Foreign Econ. Manag. 2011, 33, 25–32. [Google Scholar]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L.R. Necessity as the mother of ‘green’ inventions: Institutional pressures and environmental innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Palmer, K. Environmental regulation and innovation: A panel data study. Rev. Econ. Stat. 1997, 79, 610–619. [Google Scholar] [CrossRef]

- Jaffe, A.B. Environmental regulation and the competitiveness of U.S. manufacturing: What does the evidence tell us? J. Econ. Lit. 1995, 33, 132–163. [Google Scholar]

- Bowen, F. Organizational slack and corporate greening: Broadening the debate. Br. J. Manag. 2002, 13, 305–316. [Google Scholar] [CrossRef]

- Worthington, I.; Patton, D. Strategic intent in the management of the green environment within SMEs: An analysis of the UK screen-printing sector. Long Range Plan. 2005, 38, 197–212. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Mason, P.A. Upper echelons: The organization as a reflection of its top managers. Acad. Manag. Rev. 1984, 9, 193–206. [Google Scholar] [CrossRef]

- Sarkis, J.; Gonzalez-torre, P.; Adenso-diaz, B. Stakeholder pressure and the adoption of environmental practices: The mediating effect of training. J. Oper. Manag. 2010, 28, 163–176. [Google Scholar] [CrossRef]

- Zhu, J.G.; Ye, K.T.; Yan, D. Risk avoidance of women directors and firm investment: From the perspective of financial crisis. Financ. Trade Econ. 2012, 04, 50–58. [Google Scholar]

- Srinidhi, B.; Gul, F.A.; Tsui, J. Female directors and earnings quality. Contemp. Account. Res. 2011, 28, 1610–1644. [Google Scholar] [CrossRef]

- Luo, J.; Xiang, Y.; Huang, Z. Female directors and real activities manipulation: Evidence from China. China J. Account. Res. 2017, 10, 141–166. [Google Scholar] [CrossRef]

- Kim, J.B.; Li, Y.; Zhang, L. CFOs versus CEOs: Equity incentives and crashes. J. Financ. Econ. 2011, 101, 713–730. [Google Scholar] [CrossRef]

- Chen, S.; Ni, X.; Tong, J.Y. Gender diversity in the boardroom and risk management: A case of R&D investment. J. Bus. Ethics 2016, 136, 599–621. [Google Scholar]

- Levi, M.; Li, K.; Zhang, F. Director gender and mergers and acquisitions. J. Corp. Financ. 2014, 28, 185–200. [Google Scholar] [CrossRef]

- Lanis, R.; Richardson, G.; Taylor, G. Board of director gender and corporate tax aggressiveness: An empirical analysis. J. Bus. Ethics 2017, 144, 577–596. [Google Scholar] [CrossRef]

- Nguyen, H.H.D.; Ryan, A.M. Does stereotype threat affect test performance of minorities and women? A meta-analysis of experimental evidence. J. Appl. Psychol. 2008, 93, 1314–1334. [Google Scholar] [CrossRef]

- Betz, M.; O’Connell, L.; Shepard, J.M. Gender differences in proclivity for unethical behavior. J. Bus. Ethics 1989, 8, 321–324. [Google Scholar] [CrossRef]

- Carter, D.; Simkins, B.; Simpson, G. Corporate governance, board diversity, and firm value. Financ. Rev. 2003, 38, 33–53. [Google Scholar] [CrossRef]

- Cumming, D.; Leung, T.Y.; Rui, O. Gender diversity and securities fraud. Acad. Manag. J. 2015, 58, 1572–1593. [Google Scholar] [CrossRef]

- Gul, F.A.; Srinidhi, B.; Ng, A.C. Does board gender diversity improve the informativeness of stock prices? J. Corp. Financ. 2011, 51, 314–338. [Google Scholar] [CrossRef]

- Peni, E.; Vahamaa, S. Female executives and earnings management. Manag. Financ. 2010, 36, 629–645. [Google Scholar] [CrossRef]

- Harjoto, M.; Laksmana, I.; Lee, R. Board diversity and corporate social responsibility. J. Bus. Ethics 2015, 132, 641–660. [Google Scholar] [CrossRef]

- Chapple, L.; Humphrey, J.E. Does board gender diversity have a financial impact? Evidence using stock portfolio performance. J. Bus. Ethics 2014, 122, 709–723. [Google Scholar] [CrossRef] [Green Version]

- Sila, V.; Gonzalez, A.; Hagendorff, J. Women on board: Does boardroom gender diversity affect firm risk? J. Corp. Financ. 2016, 36, 26–53. [Google Scholar] [CrossRef] [Green Version]

- Faccio, M.; Marchica, M.T.; Mura, R. CEO gender, corporate risk-taking, and the efficiency of capital allocation. J. Corp. Financ. 2016, 39, 193–209. [Google Scholar] [CrossRef] [Green Version]

- Usman, M.; Zhang, J.; Farooq, M.U. Female directors and CEO power. Econ. Lett. 2018, 165, 44–47. [Google Scholar] [CrossRef]

- Zhu, W.L.; Deng, L. Can female executives promote corporate social responsibility? Evidence form Listed Firms in China. China Econ. Stud. 2017, 04, 119–135. [Google Scholar]

- Rose, C. Does female board representation influence firm performance? The Danish evidence. Corp. Gov. 2007, 15, 404–413. [Google Scholar] [CrossRef]

- Segovia-Pérez, M.; Castro, B.; Santero, R.; Laguna, P. Being a woman in an ICT job: An analysis of the gender pay gap and discrimination in Spain. New Technol. Work Employ. 2020, 35, 20–39. [Google Scholar] [CrossRef]

- Manuel, M.M.; Manuel, R.T.K.; Rubio-Andrés, M.; González-PérezNever, S. Too late to learn: How education helps female entrepreneurs at overcoming barriers in the digital economy. Sustainability 2021, 13, 11037. [Google Scholar]

- Qi, S.Z.; Lin, S.; Cui, J.B. Do environmental rights trading schemes induce green innovation? Evidence from listed firms in China. Econ. Res. J. 2018, 53, 129–143. [Google Scholar]

- Liang, S.K.; Yan, Z.L.; Xu, C.Y. Female executives and company’s innovations: Evidence from Chinese capital market. Financ. Res. 2020, 3, 39–53. [Google Scholar]

- Zeng, P.; Wu, Q.H. The impact of female executives participation on technological innovation: Evidence from Chinese GEM companies. Stud. Sci. Sci. 2012, 5, 773–781. [Google Scholar]

- Li, S.G. Female managers, over-investment and corporate value: Evidence from Chinese capital market. Econ. Manag. 2013, 7, 74–84. [Google Scholar]

- John, K.; Litov, L.; Yeung, B. Corporate governance and risk-taking. J. Financ. 2008, 63, 1679–1728. [Google Scholar] [CrossRef]

- Hadlock, C.J.; Pierce, J.R. New evidence on measuring financial constraints: Moving beyond the KZ index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Claessens, S.; Djankov, S.; Lang, L.H. The separation of ownership and control in East Asian corporations. J. Financ. Econ. 2000, 58, 81–112. [Google Scholar] [CrossRef]

- Li, W.J.; Zeng, M.N. Is it substantive innovation or strategic innovation? Impact of macroeconomic policies on micro-enterprises’ innovation. Econ. Res. J. 2016, 4, 60–73. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).