Fairness-Enabling Practices in Agro-Food Chain

Abstract

1. Introduction

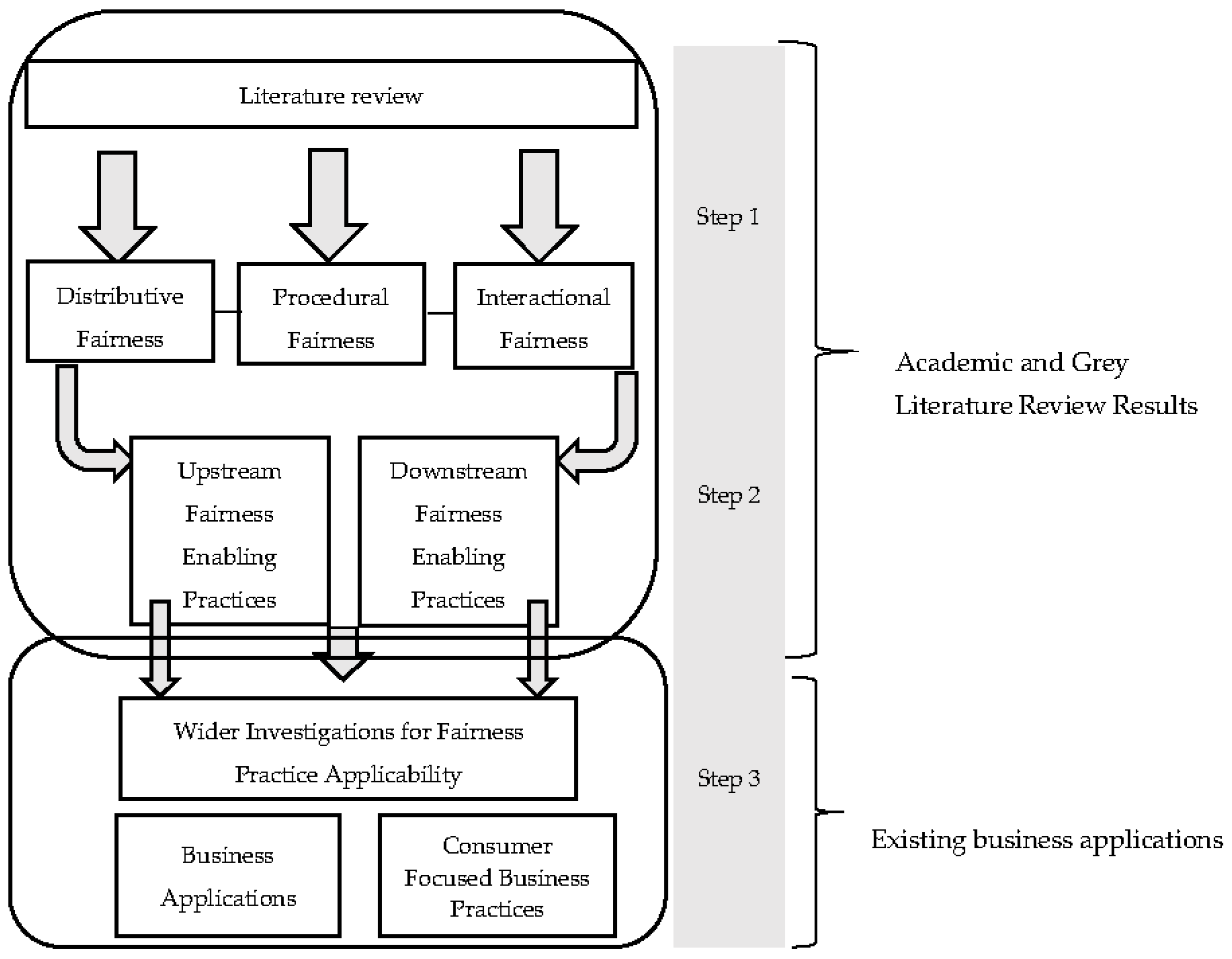

2. Materials and Methods

3. Results

3.1. Main Types of Fairness

3.1.1. Distributive Fairness

3.1.2. Procedural Fairness

3.1.3. Interactional Fairness

3.1.4. Interrelations between the Types of Fairness

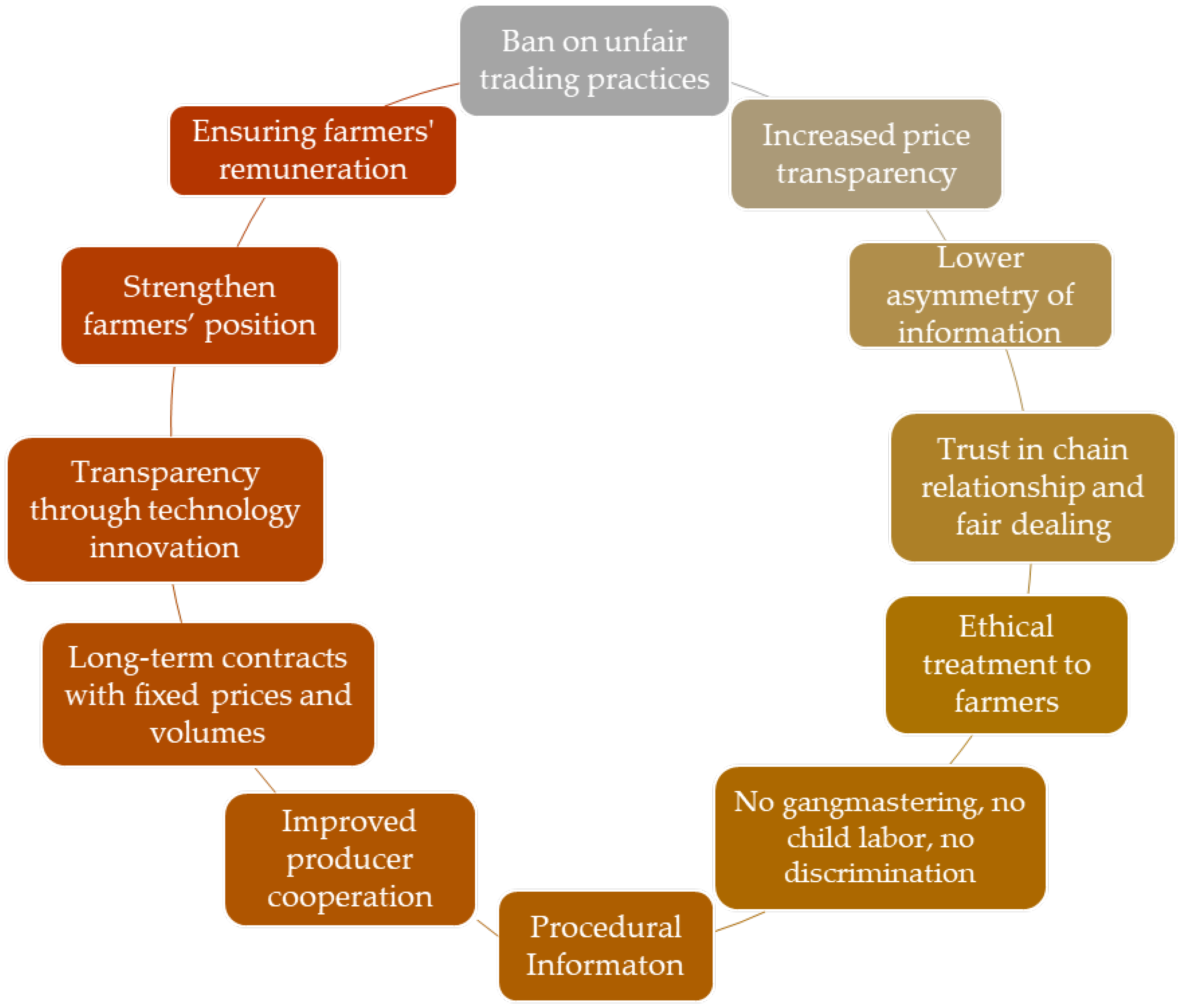

3.2. Upstream Fairness-Enabling Practices

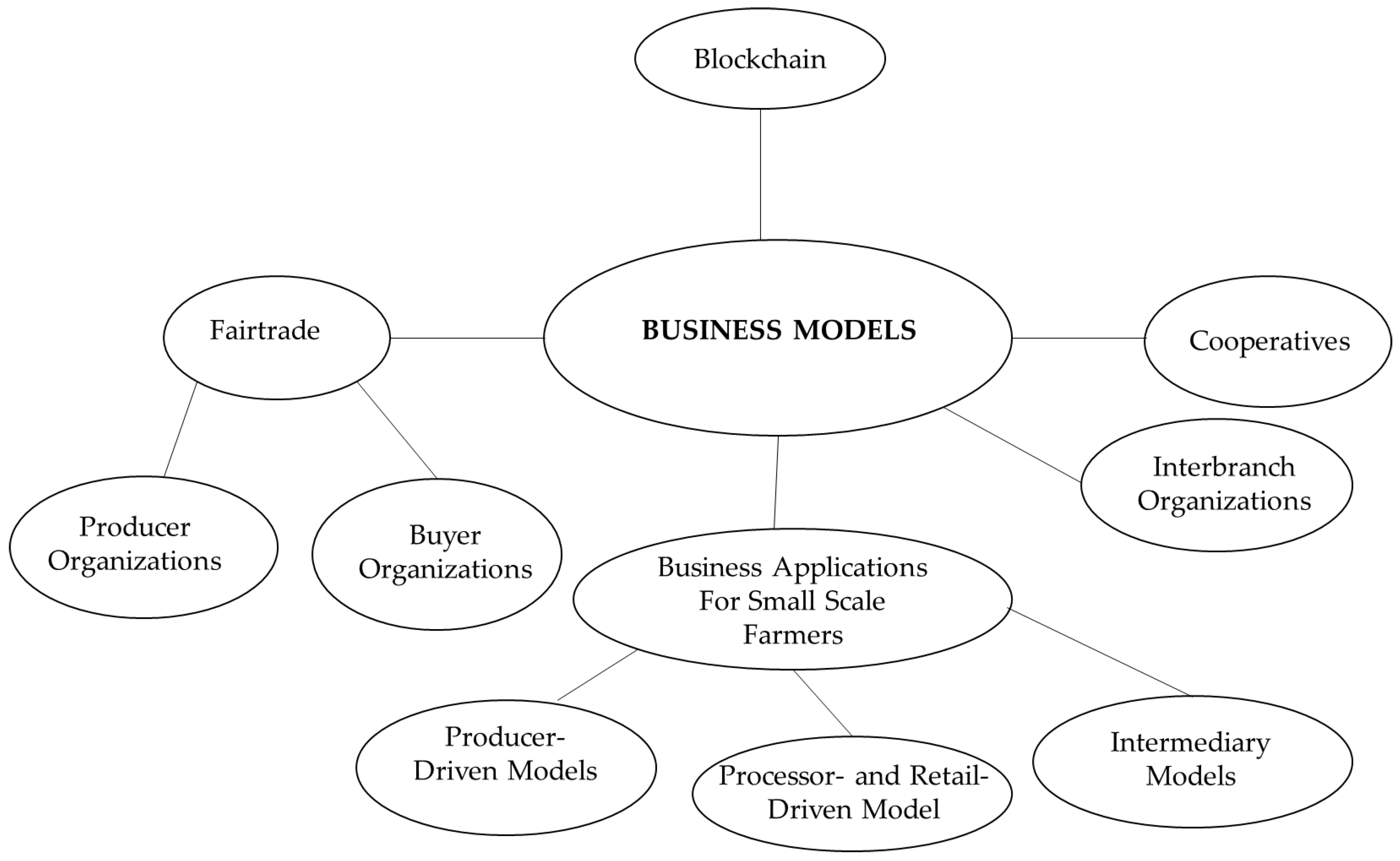

3.3. Upstream-Focused Business Applications

3.3.1. Blockchain

3.3.2. Cooperatives

3.3.3. Interbranch Organizations (IBO)

3.3.4. Business Applications for Small-Scale Farmers

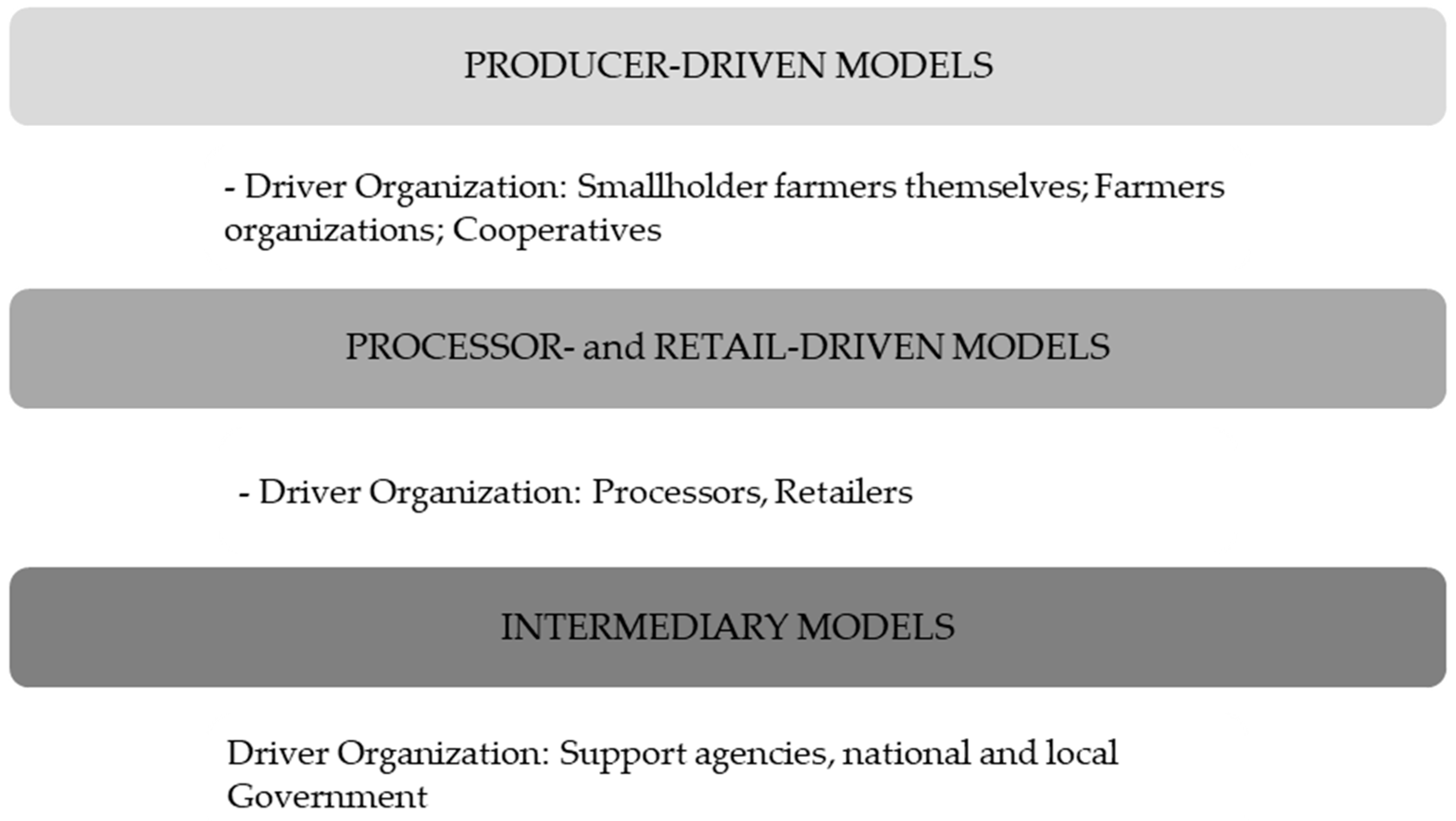

- Producer-Driven Models

- Processor- and Retail-Driven Models

- Intermediary Models

3.3.5. Fairtrade

- Producer Organizations

- Buyer Organizations

3.4. Downstream Enabling Practices

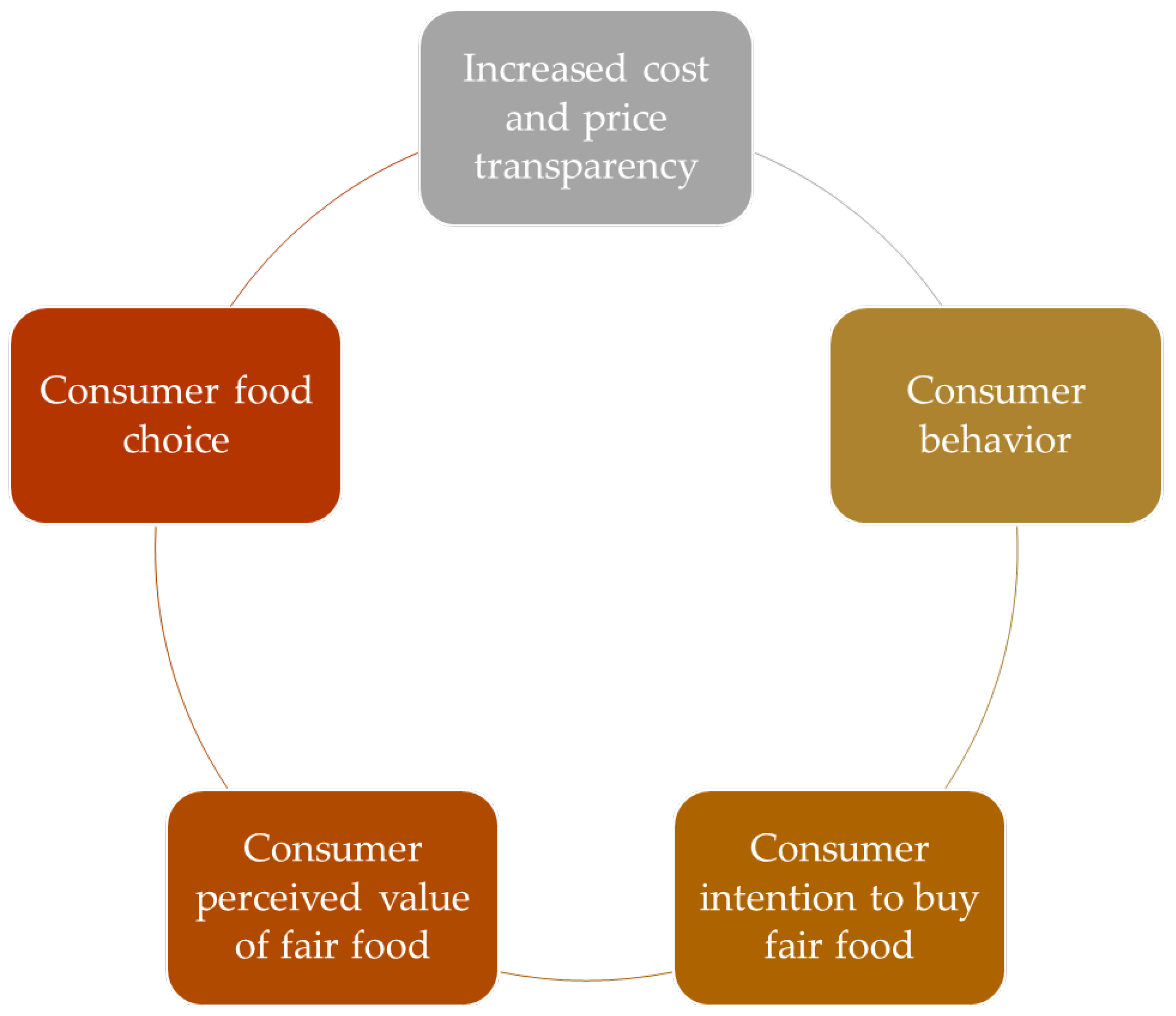

3.5. Consumer-Focused Business Approaches Related to Downstream Enabling Practices

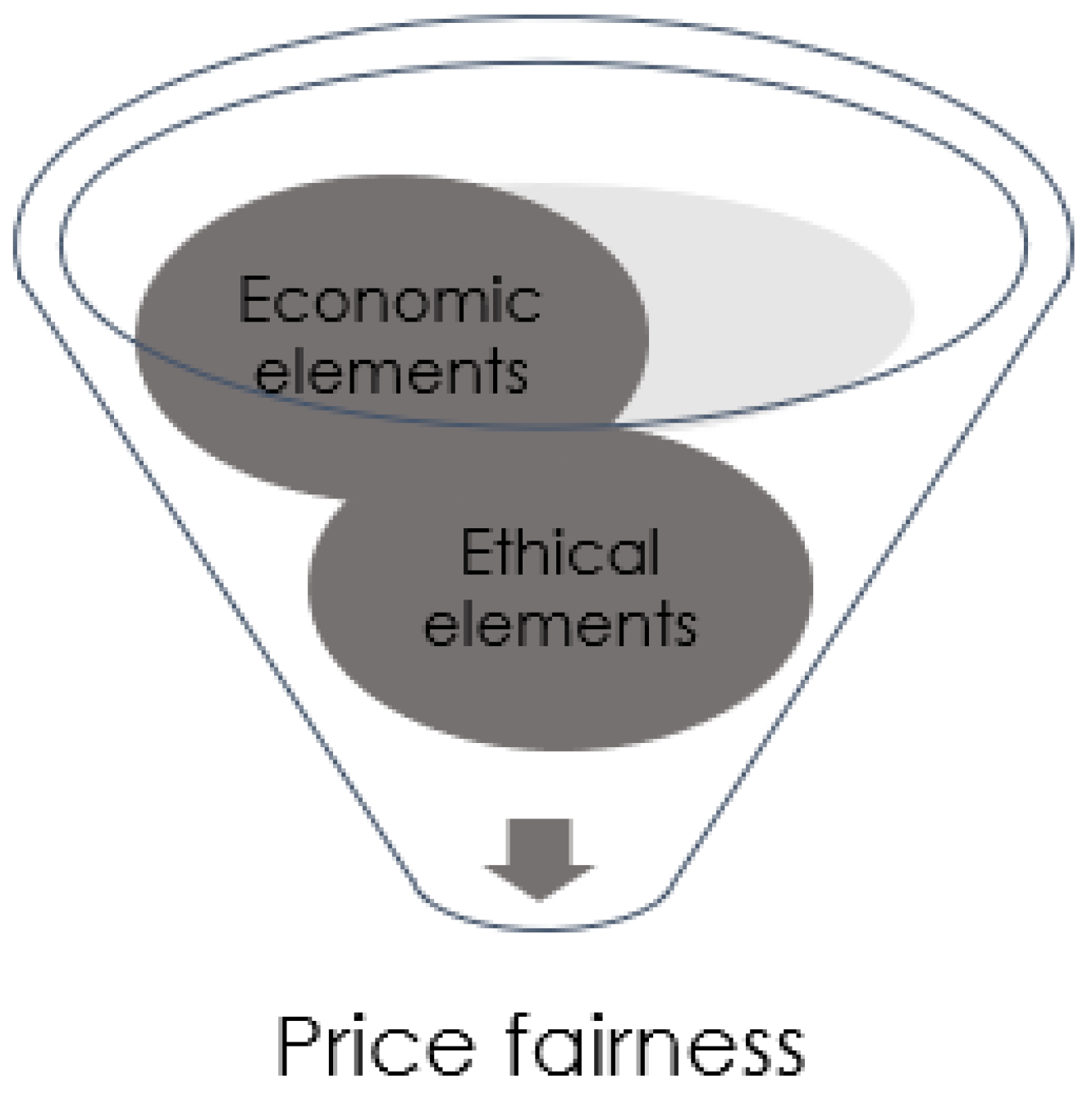

3.5.1. Fairness Conceptualization through Dual Entitlement

3.5.2. Fairness and Dynamic Pricing

3.6. Future Practices and Actions for a Sustainable and Fair Agro-Food Value Chain

4. Conclusions

Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Fairness in Business Models

| Building Blocks | Description | Fairness |

|---|---|---|

| Value proposition | Product/Service, customer segments, and relationships | Do the product/service, customer segments, and relationships enhance fairness? For example, do traceability for products and standards contribute to perceived fairness? |

| Value creation and delivery | Key activities, resources, channels, partners, and technologies | Do key activities, resources, channels, partners, and technologies focus on fairness aspects? Awareness of food-related ethics? Ethical consumption? For example, distributive fairness, procedural fairness, interactional fairness. |

| Value capture | Cost structure and revenue streams | Do cost structures and revenue streams include fairness considerations? For example, fair food systems based on distributive fairness, procedural fairness, interactional fairness. |

| Value intention | Mind-set of owner-manager | Is fairness a means, a goal, or something else? Is fairness enhancing or limiting the BM? |

References

- United Nations. The Sustainable Development Goals Report 2020; United Nations: New York, NY, USA, 2020; pp. 1–64. [Google Scholar]

- Ali, B.; Dahlhaus, P. The Role of fair data towards sustainable agricultural performance: A systematic literature review. Agriculture 2022, 12, 309. [Google Scholar] [CrossRef]

- European Commission. Fairness in the Food Supply Chain: Commission Proposes to Increase Price Transparency. 2019. Available online: https://ec.europa.eu/commission/presscorner/detail/hu/IP_19_2629 (accessed on 21 April 2022).

- Vorley, B.; Lundy, M.; Macgregor, J. Business models that are inclusive of small farmers. In Agro-Industries for Development; The Food and Agriculture Organization (FAO) of the United Nations: Rome, Italy; The United Nations Industrial Development Organization (UNIDO): Vienna, Austria; CAB International: Wallingford, UK, 2009. [Google Scholar] [CrossRef]

- Burch, D.; Lawrence, G. Supermarket own brands, supply chains and the transformation of the Agri-Food System. Int. J. Sociol. Agric. Food 2005, 13, 1–18. [Google Scholar]

- Brown, J.R.; Cobb, A.T.; Lusch, R.F. The roles played by interorganizational contracts and justice in marketing channel relationships. J. Bus. Res. 2006, 59, 166–175. [Google Scholar] [CrossRef]

- Duffy, R.; Fearne, A.; Hornibrook, S. Measuring Distributive and procedural justice: An exploratory investigation of the fairness of retailer-supplier relationships in the UK food industry. Br. Food J. 2003, 105, 682–694. [Google Scholar] [CrossRef]

- Xia, L.; Monroe, K.B.; Cox, J.L. The price is unfair! A conceptual framework of price fairness perceptions. J. Mark. 2004, 68, 1–15. [Google Scholar] [CrossRef]

- Maxwell, S. The Price is Wrong: Understanding What Makes a Price Seem Fair and the True Cost of Unfair Pricing; John Wiley & Sons: Hoboken, NJ, USA, 2008; Volume 1. [Google Scholar]

- Jongeneel, R.A.; Baltussen, W.H.M.; van Berkum, S.; Poppe, K.J. Proper and Fair Pricing; Wageningen Economic Research: The Hague, The Netherlands, 2020; pp. 1–13. [Google Scholar]

- Griffith, D.A.; Harvey, M.G.; Lusch, R.F. Social exchange in supply chain relationships: The resulting benefits of procedural and distributive justice. J. Oper. Manag. 2006, 24, 85–98. [Google Scholar] [CrossRef]

- Gu, F.F.; Wang, D.T. The role of program fairness in asymmetrical channel relationships. Ind. Mark. Manag. 2011, 40, 1368–1376. [Google Scholar] [CrossRef]

- Kashyap, V.; Sivadas, E. An exploratory examination of shared values in channel relationships. J. Bus. Res. 2012, 65, 586–593. [Google Scholar] [CrossRef]

- Adams, J.S. Inequity in Social Exchange. In Advances in Experimental Social Psychology; Academic Press: Cambridge, MA, USA, 1965; Volume 2. [Google Scholar] [CrossRef]

- Toler, S.; Briggeman, B.C.; Lusk, J.L.; Adams, D.C. Fairness, farmers markets, and local production. Am. J. Agric. Econ. 2009, 91, 1272–1278. [Google Scholar] [CrossRef]

- Konovsky, M.; Folger, R.; Cropanzano, R. Relative effects of procedural and distributive justice on employee attitudes. Represent. Res. Soc. Psychol. 1987, 17, 15–24. [Google Scholar]

- Zitzmann, I.; Dobhan, A. Fairness in supply chains. In Mobility in a Globalised World 2018; University of Bamberg Press: Bamberg, Germany, 2019. [Google Scholar] [CrossRef]

- Cook, K.S.; Hegtvedt, K.A. Distributive justice, equity and equality. Annu. Rev. Sociol. 1983, 9, 217–241. [Google Scholar] [CrossRef]

- Lu, F.; Wang, L.; Bi, H.; Du, Z.; Wang, S. An improved revenue distribution model for logistics service supply chain considering fairness preference. Sustainability 2021, 13, 6711. [Google Scholar] [CrossRef]

- Cui, T.H.; Raju, J.S.; Zhang, Z.J. Fairness and channel coordination. Manag. Sci. 2007, 53, 1303–1314. [Google Scholar] [CrossRef]

- Diller, H. Price fairness. J. Prod. Brand Manag. 2008, 17, 353–355. [Google Scholar] [CrossRef]

- Yeoman, R.; Santos, M.M. Fairness and Organizational Performance: Insights for Supply Chain Management Mutuality in Business; Said Business School, Oxford University: Oxford, UK, 2016. [Google Scholar]

- Bolton, L.E.; Warlop, L.; Alba, J.W. Consumer perceptions of price (Un)Fairness. J. Consum. Res. 2003, 29, 474–491. [Google Scholar] [CrossRef]

- Hellberg-Bahr, A.; Spiller, A. How to treat farmers fairly? Results of a farmer survey. Int. Food Agribus. Manag. Rev. 2012, 15, 87–98. [Google Scholar]

- Briggeman, B.C.; Lusk, J.L. Preferences for fairness and equity in the food system. Eur. Rev. Agric. Econ. 2011, 38, 1–29. [Google Scholar] [CrossRef]

- Padel, S.; Röcklinsberg, H.; Schmid, O. The implementation of organic principles and values in the European Regulation for organic food. Food Policy 2009, 34, 245–251. [Google Scholar] [CrossRef]

- Andorfer, V.A.; Liebe, U. Consumer behavior in moral markets. On the relevance of identity, justice beliefs, social norms, status, and trust in ethical consumption. Eur. Sociol. Rev. 2013, 29, 1251–1265. [Google Scholar] [CrossRef]

- Chang, J.B.; Lusk, J.L. Fairness and food choice. Food Policy 2009, 34, 483–491. [Google Scholar] [CrossRef]

- Gielessen, R.; Graafland, J. Concepts of Price Fairness: Empirical Research into the Dutch Coffee Market. Bus. Ethics A Eur. Rev. 2009, 18, 165–178. [Google Scholar] [CrossRef]

- Busch, G.; Spiller, A. Farmer share and fair distribution in food chains from a consumer’s perspective. J. Econ. Psychol. 2016, 55, 149–158. [Google Scholar] [CrossRef]

- Swart, B. Fair pricing, and fair paradoxes. S. Afr. J. Econ. Manag. Sci. 2016, 19, 321–329. [Google Scholar] [CrossRef][Green Version]

- Rimal, A.; Moon, W. Perceived Risks of Agro-biotechnology and Organic Food Purchase in the United States. Consum. Econ. 2005, 1–26. [Google Scholar] [CrossRef]

- Zander, K.; Hamm, U. Consumer preferences for additional ethical attributes of organic food. Food Qual. Prefer. 2010, 21, 495–503. [Google Scholar] [CrossRef]

- Schneider, M.L.; Francis, C.A. Marketing locally produced foods: Consumer and farmer opinions in Washington County, Nebraska. Renew. Agric. Food Syst. 2005, 20, 252–260. [Google Scholar] [CrossRef]

- Thibaut, J.; Walker, L. A Theory of Procedure. Calif. Law Rev. 1978, 66, 541. [Google Scholar] [CrossRef]

- Narasimhan, R.; Narayanan, S.; Srinivasan, R. An Investigation of Justice in supply chain relationships and their performance impact. J. Oper. Manag. 2013, 31, 236–247. [Google Scholar] [CrossRef]

- Skarlicki, D.P.; Folger, R. Retaliation in the workplace: The roles of distributive, procedural, and interactional justice. J. Appl. Psychol. 1997, 82, 434–443. [Google Scholar] [CrossRef]

- Korsgaard, M.A.; Sapienza, H.J.; Schweiger, D.M. Beaten before begun: The role of procedural justice in planning change. J. Manag. 2002, 28, 497–516. [Google Scholar] [CrossRef]

- Druckman, D.; Wagner, L.M. Justice and negotiation. Annu. Rev. Psychol. 2016, 67, 387–413. [Google Scholar] [CrossRef] [PubMed]

- Folger, R.; Cropanzano, R.; Timmerman, T.A.; Howes, J.; Mitchell, D. Elaborating Procedural Fairness: Justice Becomes Both Simpler and More Complex. Personal. Soc. Psychol. Bull. 1996, 22, 435–441. [Google Scholar] [CrossRef]

- Thal, S.N. The inequality of bargaining power doctrine: The problem of defining contractual unfairness. Oxf. J. Leg. Stud. 1988, 8, 17–33. Available online: https://www.jstor.org/stable/764411 (accessed on 16 March 2022). [CrossRef]

- Lewicki, R.J.; Bunker, B.B. Trust in relationships: A model of development and decline. In Conflict, Cooperation, and Justice: Essays Inspired by the Work of Morton Deutsch; Jossey-Bass/Wiley: San Francisco, CA, USA, 1995; pp. 133–173. [Google Scholar]

- Bolton, G.; Brandts, J.; Ockenfels, A. Fair Procedures: Evidence from Games Involving Lotteries. Econ. J. 2005, 115, 1054–1076. [Google Scholar] [CrossRef]

- Bies, R.J.; Moag, J.S. Interactional Justice: Communication Criteria of Fairness. Res. Negot. Organ. 1986, 1, 43–55. [Google Scholar] [CrossRef]

- Rabin, M. Incorporating Fairness into Game Theory and Economics. Am. Econ. Assoc. 1993, 83, 1281–1302. [Google Scholar]

- Greenberg, J. Employee Theft as a Reaction to Underpayment Inequity: The Hidden Cost of Pay Cuts. J. Appl. Psychol. 1990, 75, 561–568. [Google Scholar] [CrossRef]

- Colquitt, J.A.; Conlon, D.E.; Wesson, M.J.; Porter, C.O.L.H.; Ng, K.Y. Justice at the millennium: A meta-analytic review of 25 years of organizational justice research. J. Appl. Psychol. 2001, 86, 425–445. [Google Scholar] [CrossRef]

- Liu, Y.; Huang, Y.; Luo, Y.; Zhao, Y. How does justice matter in achieving buyer-supplier relationship performance? J. Oper. Manag. 2012, 30, 355–367. [Google Scholar] [CrossRef]

- Gudbrandsdottir, I.Y.; Olafsdottir, G.; Oddsson, G.V.; Stefansson, H.; Bogason, S.G. Operationalization of interorganizational fairness in food systems: From a social construct to quantitative indicators. Agriculture 2021, 11, 36. [Google Scholar] [CrossRef]

- European Commission. Directive (EU) 2019/633 2019/633 of the European Parliament and of the Council of 17 April 2019 on Unfair Trading Practices in Business-to-Business Relationships in the Agricultural and Food Supply Chain; European Commission: Brussels, Belgium, 2019; Volume 111. [Google Scholar]

- Swinnen, J.; Olper, A.; Vandevelde, S. From Unfair Prices to Unfair Trading Practices: Political Economy, Value Chains and 21st Century Agri-Food Policy. Agric. Econ. 2021, 52, 771–788. [Google Scholar] [CrossRef]

- Bertazzoli, A.; Fiorini, A.; Ghelfi, R.; Rivaroli, S.; Samoggia, A.; Mazzotti, V. Food chains and value system: The case of potato, fruit, and cheese. J. Food Prod. Mark. 2011, 17, 303–326. [Google Scholar] [CrossRef]

- Fałkowski, J.; Ménard, C.; Sexton, J.; Swinnen, J.; Vandevelde, S. Unfair Trading Practices in the Food Supply Chain: A Literature Review on Methodologies, Impacts and Regulatory Aspects; KU Leuven, Faculty of Economics and Business (FEB), LICOS—Centre for Institutions and Economic Performance: Leuven, Belgium, 2017. [Google Scholar] [CrossRef]

- Velázquez, B.; Buffaria, B. About farmers’ bargaining power within the new CAP. Agric. Food Econ. 2017, 5, 16. [Google Scholar] [CrossRef]

- Dholakia, U.M. When Cost-Plus Pricing is a Good Idea. Harvard Business Review, 12 July 2018; 1–5. [Google Scholar]

- Busch, G.; Spiller, A. Real Farmer Share, Perceived Farmer Share and Fair Distribution in Food Chains from a Consumers’ Perspective. In Proceedings of the EAAE-AAEA Joint Seminar ‘Consumer Behavior in a Changing World: Food, Culture Society’, Naples, Italy, 25–27 March 2015. [Google Scholar]

- Associazione Terra. E(u)xploitation: Gangmastering: The Southern Question Italy, Spain, Greece; Associatione Terra: Rome, Italy, 2021. [Google Scholar]

- Landerbeit, I.F. Bericht. 2021. Available online: https://igbau.de/Binaries/Binary16991/2021-InitiativeFaireLandarbeit-Saisonarbeitsbericht.pdf (accessed on 14 March 2022).

- Druckman, D.; Wagner, L. Justice and fairness in negotiation. Group Decis. Negot. 2017, 26, 9–17. [Google Scholar] [CrossRef]

- Minot, N.; Ronchi, L. Contract Farming. In Viewpoint; No. 344; World Bank: Washington, DC, USA, 2014. [Google Scholar]

- Spina, D.; Vindigni, G.; Pecorino, B.; Pappalardo, G.; D’Amico, M.; Chinnici, G. Identifying themes and patterns on management of horticultural innovations with an automated text analysis. Agronomy 2021, 11, 1103. [Google Scholar] [CrossRef]

- Miatton, F.; Amado, L. Fairness, transparency and traceability in the coffee value chain through blockchain innovation. In Proceedings of the 2020 International Conference on Technology and Entrepreneurship—Virtual (ICTE-V), San Jose, CA, USA, 20–21 April 2020. [Google Scholar] [CrossRef]

- Stranieri, S.; Riccardi, F.; Meuwissen, M.P.M.; Soregaroli, C. Exploring the impact of blockchain on the performance of agri-food supply chains. Food Control 2021, 119, 107495. [Google Scholar] [CrossRef]

- Xiong, H.; Dalhaus, T.; Wang, P.; Huang, J. Blockchain Technology for Agriculture: Applications and Rationale. Front. Blockchain 2020, 3, 1–7. [Google Scholar] [CrossRef]

- Corner, S. How Blockchain Can Help Kiwi Farmers. 2016. Available online: https://www.computerworld.com/article/3479567/how-blockchain-can-help-kiwi-farmers.html (accessed on 17 May 2022).

- Kang, P. A Framework of blockchain smart contract in fair trade agriculture. In Proceedings of the PIM 9th national and 2nd International Conference 2019 and 2nd Smart Logistics Conference, Nonthaburi, Thailand, 5 July 2019. [Google Scholar]

- Brookbanks, M.; Parry, G. The impact of a blockchain platform on trust in established relationships: A case study of wine supply chains. Supply Chain Manag. Int. J. 2022, 27, 128–146. [Google Scholar] [CrossRef]

- Fair Food. Available online: https://fairfood.org/en/about-us/ (accessed on 1 May 2022).

- Stoop, P.N. The consumer protection ACT 68 of 2008 and procedural fairness in consumer contracts. Potchefstroom Electron. Law J. 2015, 18, 1091–1124. [Google Scholar] [CrossRef]

- StartUs Insights. 8 Blockchain Startups Disrupting the Agricultural Industry; StartUs Insights: Wien, Austria, 2017. [Google Scholar]

- Ortmann, G.F.; King, R.P. Agricultural cooperatives II: Can they facilitate access of small-scale farmers in South Africa to input and product markets? Agrekon 2007, 46, 219–244. [Google Scholar] [CrossRef]

- Briscoe, R.; Ward, M. The Co-operatives of Ireland; Centre for Co-operative Studies: Cork, Ireland, 2000. [Google Scholar]

- Birchall, J.; Ketilson, L.H. Resilience of the Cooperative Business Model in Times of Crisis Sustainable Enterprise Programme; ILO: Geneva, Switzerland, 2009. [Google Scholar]

- Groot-Kormelinck, A.; Plaisier, C.; Muradian, R.; Ruben, R. Social capital and agricultural cooperatives: Experimental evidence from Ethiopia. In Cooperatives, Economic Democratization and Rural Development; Bijman, J., Muradian, R., Schuurman, J., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2016; Volume 49, pp. 1417–1426. [Google Scholar]

- Tefera, D.A.; Bijman, J.; Slingerland, M.A. Agricultural co-operatives in Ethiopia: Evolution, functions and impact. J. Int. Dev. 2017, 29, 431–453. [Google Scholar] [CrossRef]

- Sun, Y.; Liu, Z.; Yang, H. How does suppliers’ fairness affect the relationship quality of agricultural product supply chains? J. Food Qual. 2018, 2018, 9313068. [Google Scholar] [CrossRef]

- Samoggia, A.; Monticone, F.; Esposito, G. Governance in the Italian processed tomato value chain: The case for an interbranch organisation. Sustainability 2022, 14, 2749. [Google Scholar] [CrossRef]

- Roy, E.P. Contract Farming; Interstate Printers and Publishers Inc.: Danvill, IL, USA, 1963. [Google Scholar] [CrossRef]

- Hooks, T.; McCarthy, O.; Power, C.; Macken-Walsh, Á. A co-operative business approach in a values-based supply chain: A case study of a beef co-operative. J. Co-Oper. Organ. Manag. 2017, 5, 65–72. [Google Scholar] [CrossRef]

- European Commission. Producer and Interbranch Organisations. Available online: https://ec.europa.eu/info/food-farming-fisheries/key-policies/common-agricultural-policy/market-measures/agri-food-supply-chain/producer-and-interbranch-organisations (accessed on 5 January 2022).

- Kelly, S.; Vergara, N.; Bammann, H. Inclusive Business Models Guidelines for Improving Linkages between Producer Groups and Buyers of Agricultural Produce; Food and Agriculture Organization of the United Nations: Rome, Italy, 2015. [Google Scholar]

- Ertek, G.; Griffin, P.M. Supplier- and buyer-driven channels in a two-stage supply chain. IIE Trans. 2002, 34, 691–700. [Google Scholar] [CrossRef]

- Gereffi, G. The Organization of Buyer-Driven Global Commodity Chains: How US Retailers Shape Overseas Production Networks. In Commodity Chains and Global Capitalism; Praeger: Westport, CT, USA, 1994; pp. 95–122. [Google Scholar] [CrossRef]

- Lessmeister, R. Governance and organisational structure in the special tourism sector—Buyer-driven or producer-driven value chains? The case of trekking tourism in the Moroccan mountains. Erdkunde 2008, 62, 143–157. [Google Scholar] [CrossRef]

- IDH Report. Driving Innovations in Smallholder Engagement. No. Dec. 2017. Available online: https://www.idhsustainabletrade.com/uploaded/2017/12/Smallholder_Engagement_Report.pdf (accessed on 1 May 2022).

- Nuseva, D.; Uzelac, O. Fair Trade Business Model as a Function of Sustainable Development. 2020. Available online: https://www.researchgate.net/publication/344204754_Fair_Trade_Business_Model_As_a_Function_Of_Sustainable_Development (accessed on 17 April 2022).

- Simintiras, A.C.; Dwivedi, Y.K.; Kaushik, G.; Rana, N.P. Should consumers request cost transparency? Eur. J. Mark. 2015, 49, 1961–1979. [Google Scholar] [CrossRef]

- Lowe, B. Commentary: Should consumers request cost transparency? Cost transparency in consumer markets. Eur. J. Mark. 2015, 49, 1992–1998. [Google Scholar] [CrossRef]

- Beardon, H. The World Fair Trade Organization: Scaling Equitable Business Models; Oxfam: Nairobi, Kenya, 2020. [Google Scholar] [CrossRef]

- Ajzen, I. Nature and operation of attitudes. Annu. Rev. Psychol. 2001, 52, 27–58. [Google Scholar] [CrossRef]

- Cassia, F.; Ugolini, M.; Bonfanti, A.; Cappellari, C. The perceptions of italian farmers’ market shoppers and strategic directions for customer-company-territory interaction (CCTI). Procedia Soc. Behav. Sci. 2012, 58, 1008–1017. [Google Scholar] [CrossRef]

- Kumar, N.; Scheer, L.K.; Steenkamp, J.-B.E.M. The effects of supplier fairness on vulnerable resellers. J. Mark. Res. 1995, 32, 54. [Google Scholar] [CrossRef]

- Wölfel, J.; Grosse-Ruyken, P.T. Fairness of the NPD partnership’s financial distribution pie. J. Bus. Ind. Mark. 2019, 34, 1016–1029. [Google Scholar] [CrossRef]

- Samaha, S.A.; Palmatier, R.W.; Dant, R.P. Poisoning relationships: Perceived unfairness in channels of distribution. J. Mark. 2011, 75, 99–117. [Google Scholar] [CrossRef]

- Samoggia, A.; Grillini, G.; Del Prete, M. Price fairness of processed tomato agro-food chain: The italian consumers’ perception perspective. Foods 2021, 10, 984. [Google Scholar] [CrossRef]

- Novoseltsev, T.A.; Warlop, L. AP—Asia Pacific Advances in Consumer Research Volume 5|2002 Dual Entitlement Principle in Consumer Fair Price Judgments. 2002, Volume 5. Available online: https://www.acrwebsite.org/volumes/11795 (accessed on 17 April 2022).

- Martínez-Ruiz, M.P.; Gómez-Suárez, M.; Jiménez-Zarco, A.I.; Izquierdo-Yusta, A. Editorial: From consumer experience to affective loyalty: Challenges and prospects in the psychology of consumer behavior 3.0. Front. Psychol. 2017, 8, 2224. [Google Scholar] [CrossRef]

- Tversky, A.; Kahneman, D. Judgement under uncertainity: Heuristic and biases. Nonwovens Sophistic. Process Tech. 1987, 185, 1124–1131. [Google Scholar]

- Kalapurakal, R.; Dickson, P.R.; Urbany, J.E. Perceived price fairness and dual entitlement. Adv. Consum. Res. 1991, 18, 788–793. [Google Scholar]

- Goli, F.; Haghighinasab, M. Dynamic pricing: A bibliometric approach. Iran. J. Manag. Stud. 2022, 15, 111–132. [Google Scholar] [CrossRef]

- Narahari, Y.; Raju, C.V.L.; Ravikumar, K.; Shah, S. Dynamic pricing models for electronic business. Sadhana Acad. Proc. Eng. Sci. 2005, 30, 231–256. [Google Scholar] [CrossRef]

- Wamsler, J.; Natter, M.; Algesheimer, R. Transitioning to dynamic prices: Should pricing authority remain with the company or be delegated to the service employees instead? J. Bus. Res. 2022, 139, 1476–1488. [Google Scholar] [CrossRef]

- Elmaghraby, W.; Keskinocak, P. Dynamic pricing in the presence of inventory considerations: Research overview, current practices, and future directions. Manag. Sci. 2003, 49, 1287–1309. [Google Scholar] [CrossRef]

- Rodriguez-Anton, J.M.; Rubio-Andrada, L.; Celemín-Pedroche, M.S.; Alonso-Almeida, M.D.M. Analysis of the relations between circular economy and sustainable development goals. Int. J. Sustain. Dev. World Ecol. 2019, 26, 708–720. [Google Scholar] [CrossRef]

- EEB. Avoiding Blind Promoting Circular & Fair Business Models. 2020. Available online: https://eeb.org/library/avoiding-blind-posts-promoting-circular-and-fair-business-models/ (accessed on 15 March 2022).

- United Nations General Assembly. Circular Economy for the SDGs: From Concept to Practice General Assembly and ECOSOC Joint Meeting; United Nations General Assembly: New York, NY, USA, 2018; Volume 73, pp. 1–2. [Google Scholar]

- Wu, D. The Way from the Circular Economy to Venous Economy in China; Atlantis Press: Amsterdam, The Netherlands, 2011; pp. 200–207. [Google Scholar]

- van Eijk, F. Barriers & Drivers towards a Circular Economy. 2015. Available online: http://www.circulairondernemen.nl/uploads/e00e8643951aef8adde612123e824493.pdf (accessed on 20 March 2022).

- Barling, D.; Samoggia, A.; Olafsdottir, G. Dynamics of Food Value Chains: Resilience, Fairness and Sustainability. Agriculture 2022, 12, 720. [Google Scholar] [CrossRef]

| Steps 1 and 2 Academic and grey literature | Scopus WOS Google Scholar International institutions’ websites | 79 papers; 5 reports; 1 website | Keywords:

|

| Step 3 Business applications | Scopus WOS Google Scholar International institution reports and websites Researchers Experts Website search Consultancy reports | 36 papers; 10 reports; 4 websites | Keywords

|

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Samoggia, A.; Beyhan, Z. Fairness-Enabling Practices in Agro-Food Chain. Sustainability 2022, 14, 6391. https://doi.org/10.3390/su14116391

Samoggia A, Beyhan Z. Fairness-Enabling Practices in Agro-Food Chain. Sustainability. 2022; 14(11):6391. https://doi.org/10.3390/su14116391

Chicago/Turabian StyleSamoggia, Antonella, and Zeynep Beyhan. 2022. "Fairness-Enabling Practices in Agro-Food Chain" Sustainability 14, no. 11: 6391. https://doi.org/10.3390/su14116391

APA StyleSamoggia, A., & Beyhan, Z. (2022). Fairness-Enabling Practices in Agro-Food Chain. Sustainability, 14(11), 6391. https://doi.org/10.3390/su14116391