4.1. Sample Selection and Descriptive Statistics

We select 19 systemically important commercial banks (SIBs) in China as our sample, including 5 state-owned commercial banks, 10 joint-stock commercial banks, and 4 city-based commercial banks: Ping An Bank, China Everbright Bank, Huaxia Bank, China Guangfa Bank, Ningbo Bank, Bank of Shanghai, Bank of Jiangsu, Bank of Beijing, Shanghai Pudong Development Bank, China CITIC Bank, Minsheng Bank, Postal Savings Bank, Bank of Communications, China Merchants Bank, Industrial Bank, Industrial and Commercial Bank of China, Bank of China, China Construction Bank, and Agricultural Bank. Their total assets account for 60% of the total assets of the entire Chinese banking industry. Relevant bank data are obtained from the Cathay Pacific database, the Financial Statistics Yearbook, and the annual reports of commercial banks. The descriptive statistics results are shown in

Table 3.

It can be seen from the above table that the standard deviation of the bankruptcy risk (Z value) of systemically important commercial banks is 0.19782, the maximum value is 2.38326, the minimum value is 1.44615, and the average value is 1.96874, because the Z value is a reverse indicator, indicating that the differences between systemically important banks’ risk pressure is not big and the probability of bankruptcy risk is low. For the non-performing loan ratio, the standard deviation of non-performing loan ratios of systemically important commercial banks is 0.39725, which is relatively small, indicating that the difference in non-performing loans of systemically important banks is not obvious, and it is considerably stable compared with other types of banks [

16,

17]. The maximum value of profitability is 0.46354 and the minimum value is 0.16526. The standard deviation is 0.06717, indicating that the asset returns of systemically important commercial banks are not significantly different, and the returns are stable with no significant loss. The maximum value of growth capability is 0.44096, the minimum value is −0.04271, and the standard deviation is 0.07945, indicating that there is a gap in growth capability among systemically important commercial banks.

The data of fintech advancement are from the Baidu Search Index. The research window of the sample is set for the past ten years from 2011 to 2020. This study uses STATA statistical software for analysis. The data of other control variables are from the China Statistical Yearbook. Descriptive statistics are as follows (please see

Table 4).

This study adopts the text mining method to construct the fintech index with the search frequency rate of 18 keywords from the four dimensions including basic technology, payment settlement, resource allocation, and information transmission. The standardized fintech index from the Baidu Search Index data for the past ten years (2011–2020) are shown in

Table 5.

The fintech index keyword data constructed from four dimensions need to pass the KMO and Bartlett spherical tests, and the test results are reported in

Table 6. For the fintech keyword test in

Table 6, the KMO value representing the basic technology dimension is 0.510, and the

p-value is 0.000; the KMO value representing the payment settlement dimension is 0.509, and the

p-value is 0.001; the KMO value representing the resource allocation dimension is 0.638, and the

p-value is 0.000; the KMO value representing the dimension of information transmission is 0.623, and the

p-value is 0.000. The KMO values of all four dimensions are greater than 0.5 and the

p-values are all significant at the 0.001 level. Therefore, the principal component analysis method can be used to process the data analysis method. After principal component factor analysis, the scores of each dimension are shown in

Table 7.

The scores of each dimension and each factor obtained in the above table are used as weights. The principal component analysis method in the factor analysis method is used to propose the common factors, and the load matrix is selected and rotated by the maximum variance method to obtain the score coefficient matrix to construct the factor score formula. Suppose

is each dimension (where

i = 1,2,3,4),

is the original keyword of each dimension, and

is the original keyword score, the formula is:

The formula for scoring the basic technology is:

Among them, represents the basic technology dimension, represents artificial intelligence, represents big data, represents cloud computing, represents the Internet of Things, and represents blockchain.

The formula for scoring payment and settlement is:

Among them, represents payment and settlement dimension, represents online payment, represents mobile payment, represents network payment, and represents third-party payment.

The formula for scoring resource allocation is:

Among them, represents the dimension of resource allocation, represents online loans, represents network security, represents online lending, represents Internet insurance, and represents online wealth management.

The formula for scoring information transmission is:

Among them,

represents the dimension of information transmission,

represents online banking,

represents mobile banking,

represents e-banking, and

represents online banking; the results obtained from these formulas are standardized to obtain the four-dimensional fintech index, as shown in

Table 8.

The standardized fintech composite indexes reflect the development trend of fintech in China from 2011 to 2020. The development of fintech in China was relatively slow from 2011 to 2013, while the development trend of fintech in China from 2013 to 2015 was fast. From 2015 to 2018, the development of fintech fluctuated slightly but showed an overall upward trend. There is a slight drop for 2019–2020, which is probably affected by other factors such as the curb of P2P loan platforms and then the epidemic occurred in 2020, but overall, fintech still attracts widespread attention and has been a growing trend for the past ten years.

4.3. Analysis Results

The panel data of 19 systemically important commercial banks in China were analyzed. After passing the stationarity test, the system generalized moment estimation is used to analyze the impact of fintech advancement on the financial risk of these systemically important banks. The results are reported in

Table 10.

Model 1 and Model 2 in

Table 10 are the empirical results of the regression Equation (1) and the regression Equation (2) developed in our model construction. The Z value is the measurement of the ability of systemically important banks to deal with the risk of bankruptcy with Ln(1 + Z) used in calculation. The AR(1) test results are 0.006 and 0.001, respectively, which are less than 0.1. The AR(2) test results are 0.189 and 0.214 respectively, which are greater than 0.1. The Hansen test results are 0.352 and 0.455, which are greater than 0.1. These results show that the models are valid, and the selected variables are reasonable with no phenomenon of second-order sequence autocorrelation or over-identification.

Model 1 and Model 2 both show that the coefficients of the lagged Z value (L.Z) are significantly positive at p < 0.01, indicating a positive relationship between commercial banks’ previous financial risks and current financial risks. This implies that there are persistent financial risks for commercial banks, and previously accumulated financial risks could increase current financial risk, leading to possible financial crises if not addressed.

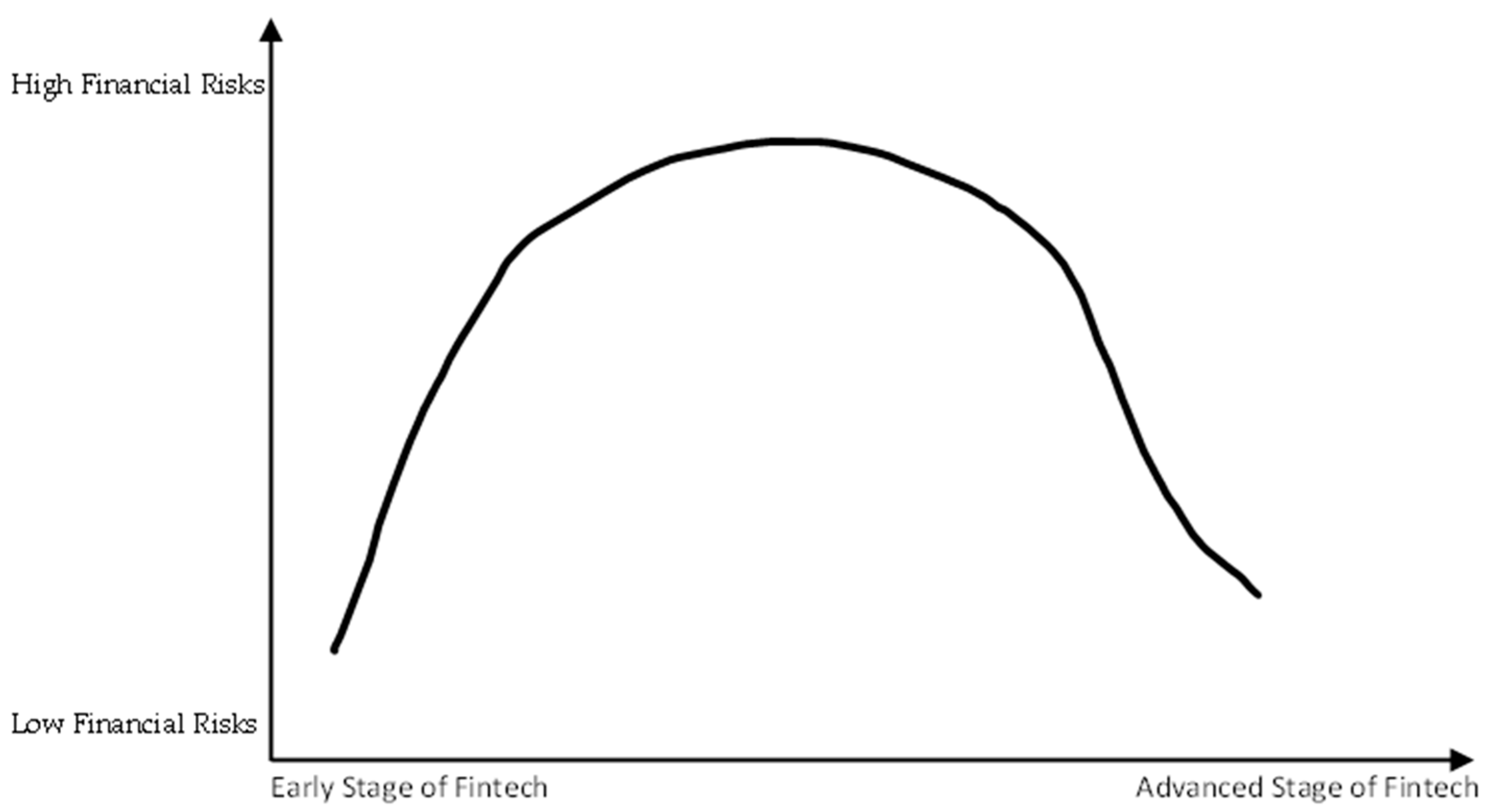

The coefficients of the fintech index are significantly negative in the primary regression (−0.058 and −0.0362), and significantly positive in the quadratic term (0.0397 and 0.0232). This shows that the development of fintech has an inverted U-shaped impact on systemically important banks’ financial risks. In the early stages of fintech, the advancement of fintech increases commercial banks’ financial risks (a negative relationship with the reversed probability of bankruptcy). However, alongside the further development of fintech to a late stage, the advancement of fintech can enable commercial banks to expand customer groups, improve operational efficiency, and achieve fintech innovations to effectively control financial risks and reduce possible bankruptcy risks for systemically important banks (a positive relationship with the reversed probability of bankruptcy for the quadratic term of fintech). These results support our proposed relationship in this study. In addition, the coefficient value of the fintech index is generally small. Therefore, when these selected systemically important banks are affected by fintech advancement, their responses tend to be stable and not very sensitive, which means that they are more conservative in the face of innovations and changes brought about by fintech.

The regression results of the control variables are also shown in the table. From the macroeconomic point of view, the coefficient for GDP growth rate is significantly positive at p < 0.01, indicating that as the overall economy gets better, it will reduce commercial banks’ financial risks with a low probability of bankruptcy. The coefficient for monetary policy (M2) growth rate is significantly negative at p < 0.01, indicating that systemically important banks will have higher financial risks under loose monetary policy. The coefficient for financial deepening index (FD) is also significantly positive, meaning that commercial banks’ financial risks as measured as probability of bankruptcy are reduced as financial markets expand and financial structures become mature.

For microeconomic variables, the banks’ profitability impact is reflected in the regression coefficient of the return on assets, and it is significantly positive at p < 0.01, which shows that the banks will not pursue high risk businesses that may cause damage to these banks when their revenues are high. The liquidity level of commercial banks (LDR) is significantly and positively related to the Z value (p < 0.01), indicating that the banks’ ability to raise cash when in need could reduce the financial risks of banks. The impact of growth ability (AG) and operating efficiency (CT) on commercial banks’ financial risk is less clear, as no significant coefficients were found.

4.4. Robustness Test

In order to test whether the results were robust, we conducted a robustness test. Three robustness testing methods can be used to validate our model, such as replacing research variables, adjusting measurement methods, and replacing variable data. In this study, we use replacement of the key outcome variables to test the robustness. The bankruptcy probability (Z value) is replaced with the non-performing loan ratio (NPLR). Normally, commercial banks with higher non-performing loan ratios have a higher probability of bankruptcy, i.e., high financial risks, so using this indicator as the outcome variable is consistent with our analysis.

Since the Z value is a negative indicator, and the non-performing loan ratio is a positive indicator, the expected coefficients of explanatory variables in the regression should be opposite those in the Z value regression when the non-performing loan ratio is used as an outcome variable. The regression Equations (3) and (4) of the NPLR are designed as follows:

Using the same regression method and with the above equations, we obtain empirical results for the non-performing loan ration as the outcome variable (as in

Table 11). The AR(2) tests of the model are 0.496 and 0.877, and the Hansen tests are 0.555 and 0.734, all of which are greater than 0.1, indicating that there are no autocorrelation problems or over-identifying restrictions, and the models are acceptable. In the original model, as shown in

Table 10, the banks have a lower probability of bankruptcy as the Z value gets higher. The non-performing loan ratio as a replaced variable is opposite to the Z value. The higher the non-performing loan ratio, the greater the potential financial risk faced by these banks. The lag term of the non-performing loan ratio (L.NPLR) in

Table 11 is significantly positive, at

p < 0.01, which reveals the persistence of financial risks over the time. In the robust regression results, the coefficients of the first power of the key independent variable (Fintech) are significantly positive and the coefficients of the second power of the key independent variable are significantly negative, exactly the opposite to those in the Z-value models in

Table 10, which is also true for those control variables with significant coefficients, such as GDP, M2, ROA, and LDR. The result of this test is consistent with the conclusion of our original model, in support of the robustness of our research findings.