The Impact of Fintech on Poverty Reduction: Evidence from China

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

2.1. Literature Review

2.2. Hypothesis Development

3. Methodology

3.1. Data

3.2. Empirical Model

4. Results and Discussion

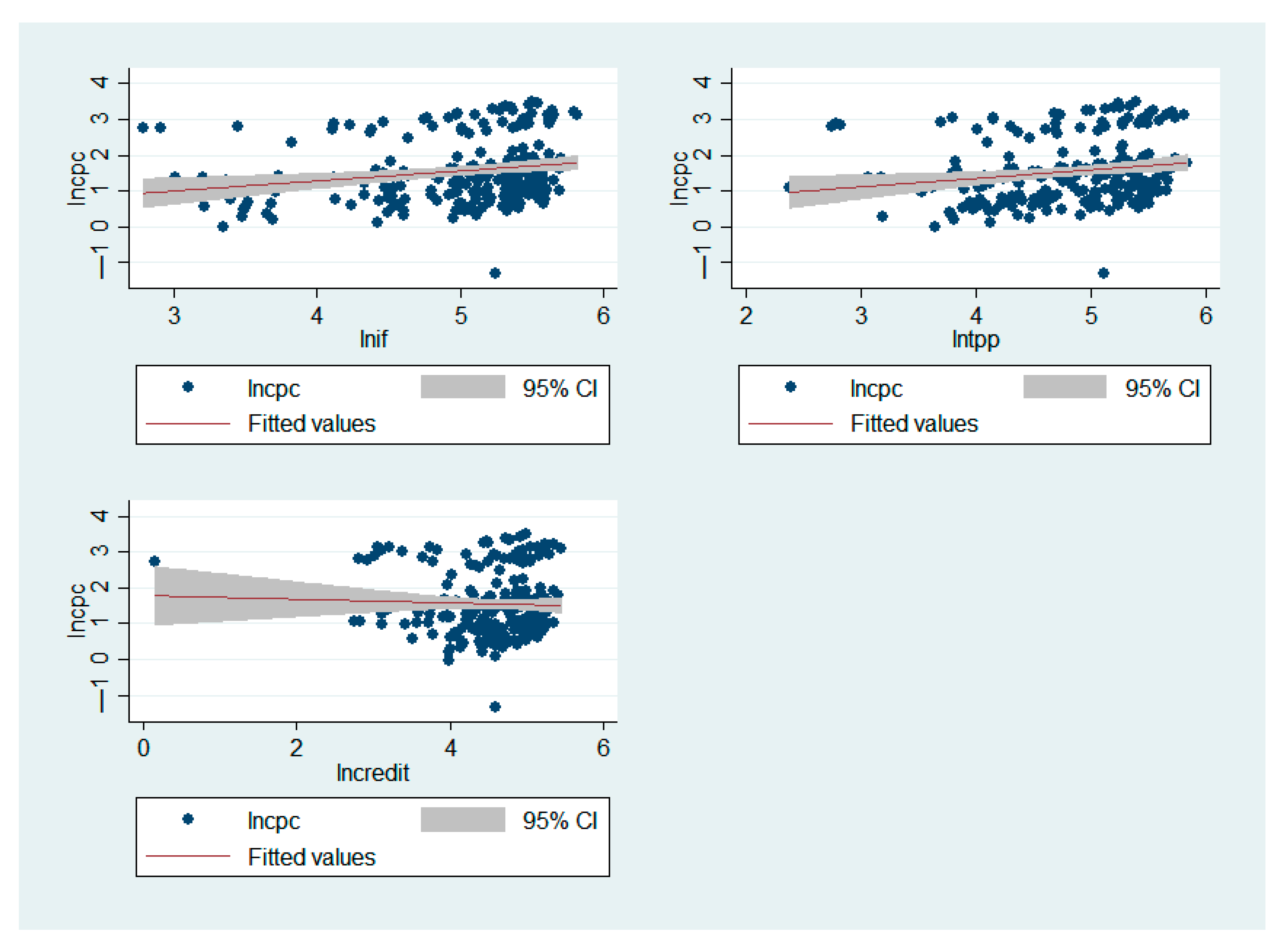

4.1. Direct Effect

4.2. Indirect Effect

4.3. Regional Analysis

4.4. Province-Specific Effect of Fintech on Household Per Capita Consumption

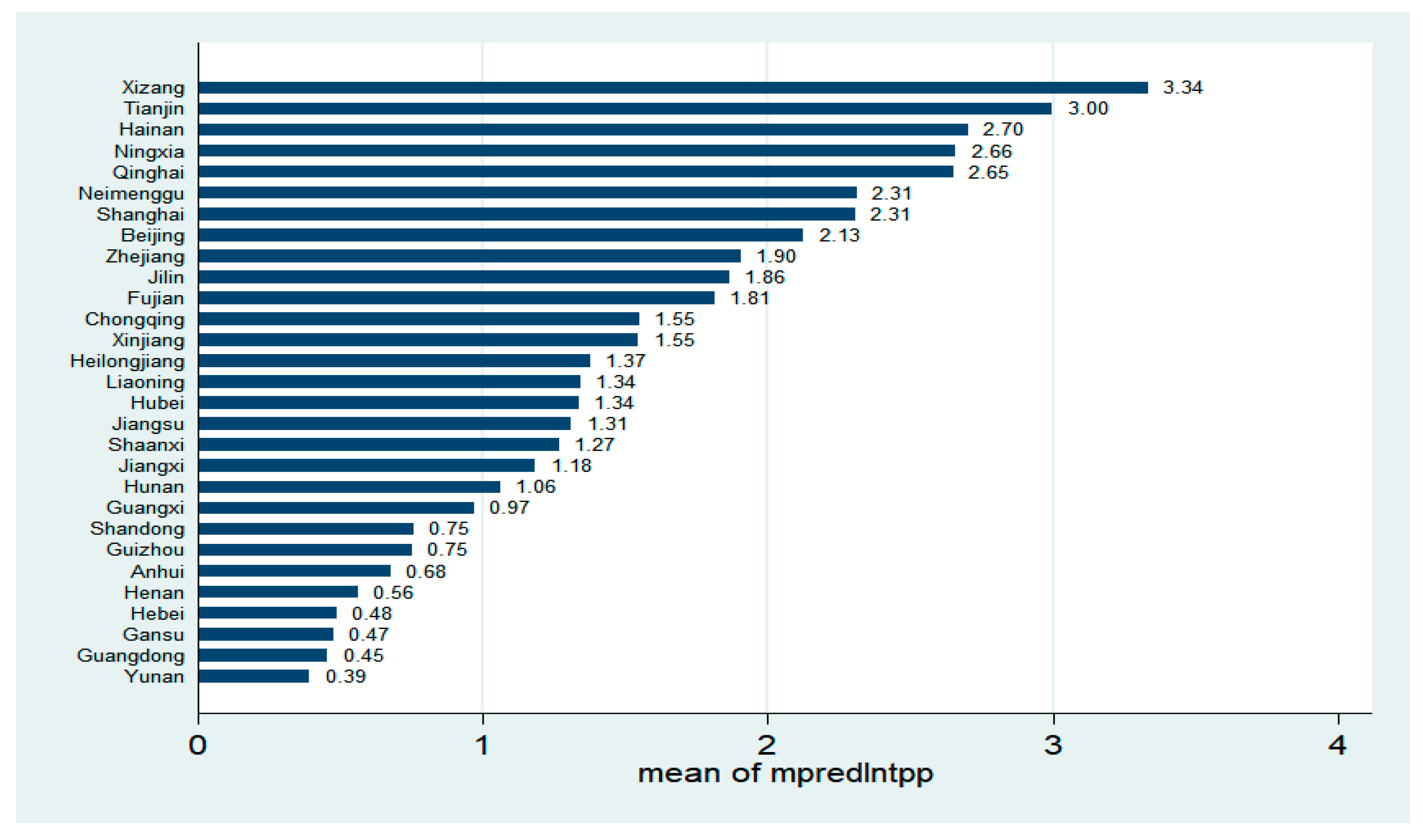

4.4.1. Province-Specific Effect of Third-Party Payment on Household Per Capita Consumption

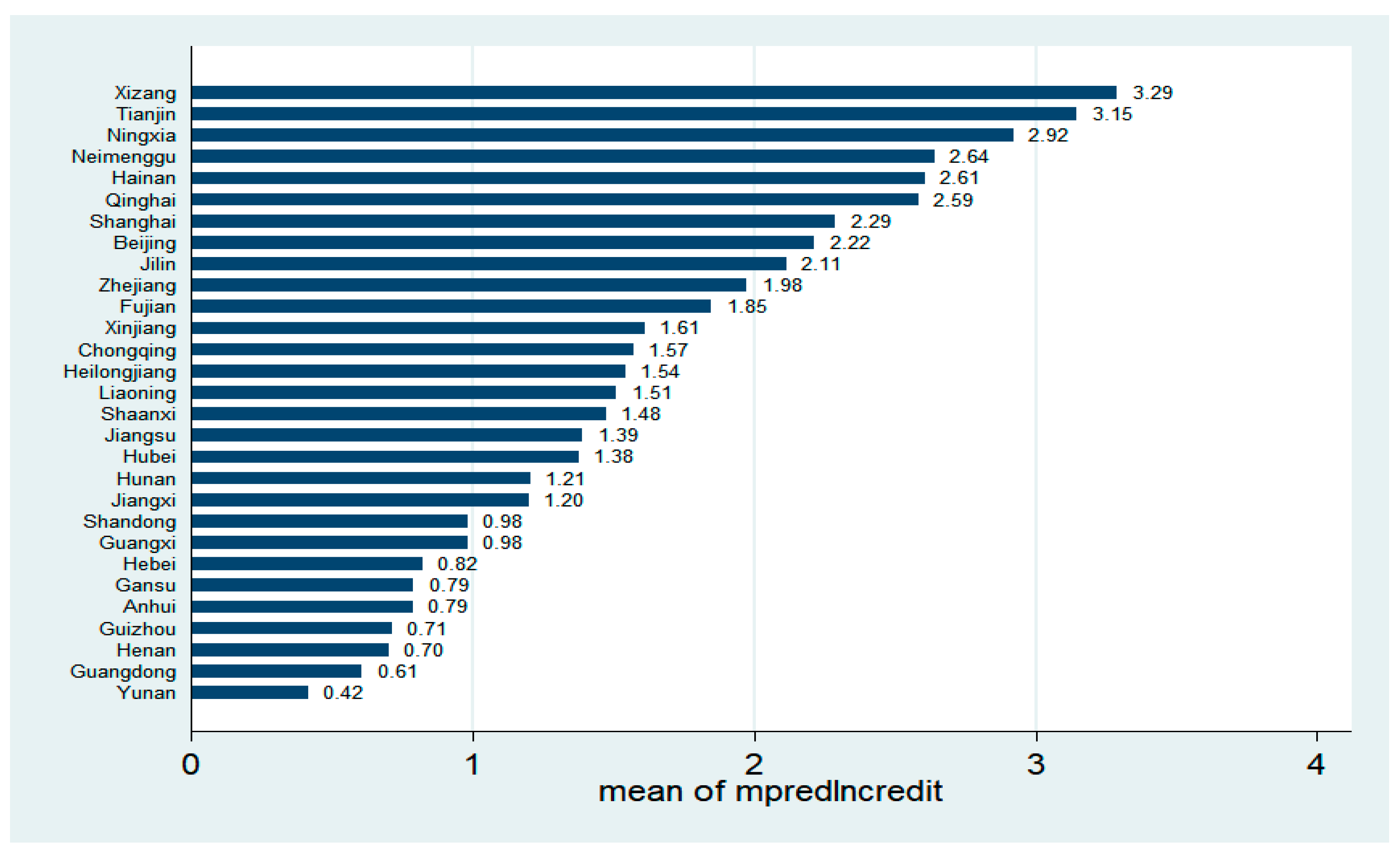

4.4.2. Province-Specific Effect of Credit on Household Per Capita Consumption

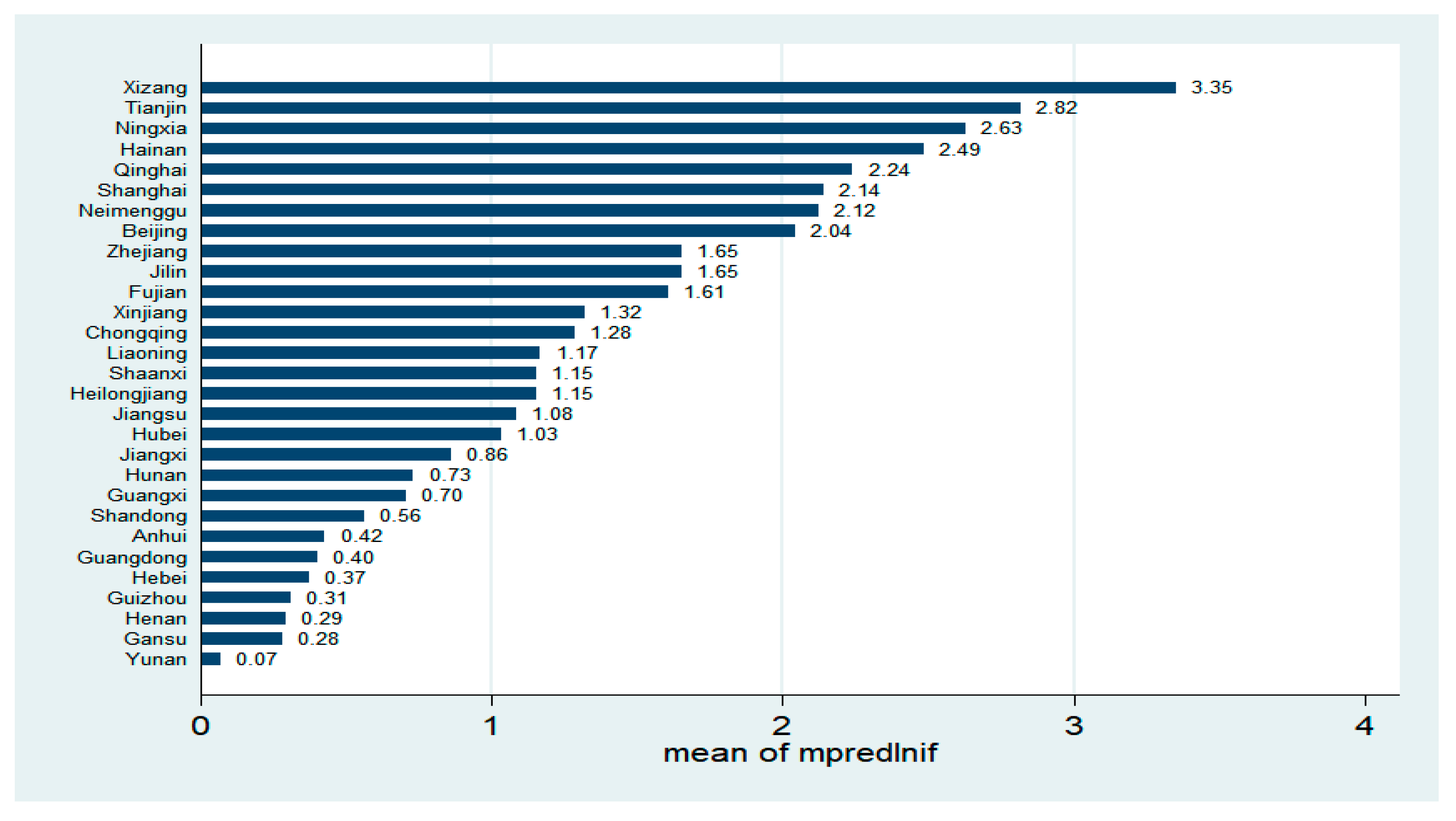

4.4.3. Province-Specific Effect of Fintech on Household Per Capita Consumption

5. Conclusions and Policy Implication

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Company | Product/Service | Brand Name | Description |

|---|---|---|---|

| Alibaba | Payments, settlement, remittances | Alipay | Established in 2004 as a third-party payment platform to provide payment solutions to Alibaba’s Taobao C2C site. Can be used to pay utility and credit card bills and transfer funds to participating banks. Has also started to extend credit to consumers based on their repayment histories. |

| Lending | Ali Microfinance | Microfinance company that extends credit to merchants of Alibaba B2B site, Taobao C2C site, and Tmall B2C site. Also securitizes loans to microenterprises. | |

| Fund management | Yu’E Bao | See the development of Fintech | |

| Taobao Wealth Management | First online third-party fund sales platform (November 2013). Provides sales support to fund distributors. | ||

| Alibaba, China Ping An Insurance & Tencent | Insurance sales | Zhong An Online Property Insurance | Sells insurance and settles insurance claims without bricks-and-mortar branches (November 2013) |

| Tencent | Payments | Tenpay | Payment service similar to Alipay |

| Fund management | WeChat is a messaging app like Line. WeChat wealth management products were launched in January 2014. | ||

| Renrendai | P2P lending | Established in May 2010 | |

| Demohour | Crowdfunding | Established in May 2011 | |

| China Construction Bank | E-commerce, financial services | Shanrong | B2B and B2C e-commerce platform (June 2012). Industrial and Commercial Bank of China’s Rong-e-Guo (B2C) platform went live in January 2014. Bank of China, Bank of Communications et. al. also have similar platforms. |

References

- Ho, S.Y.; Iyke, B.N. Finance-growth-poverty nexus: A re-assessment of the trickle-down hypothesis in China. Econ. Change Restruct. 2018, 51, 221–247. [Google Scholar] [CrossRef]

- Jalilian, H.; Kirkpatrick, C. Financial development and poverty reduction in developing countries. Int. J. Financ. Econ. 2002, 7, 97–108. [Google Scholar] [CrossRef]

- Ben Naceur, S.; Zhang, R. Financial development, inequality and poverty: Some international evidence. Int. Rev. Econ. Financ. 2019, 61, 1–16. [Google Scholar] [CrossRef]

- Wang, X.; He, G. Digital financial inclusion and farmers’ vulnerability to poverty: Evidence from rural China. Sustainability 2020, 12, 1668. [Google Scholar] [CrossRef]

- Jingu, T. Internet finance growing rapidly in China. NRI 2014, 189, 1–6. [Google Scholar]

- Abbasi, K.; Alam, A.; Anna, M.; Luu, T.; Huynh, D. FinTech, SME efficiency and national culture: Evidence from OECD countries. Technol. Forecast. Soc. Chang. 2021, 163. [Google Scholar] [CrossRef]

- Guo, Y.; Zhou, W.; Luo, C.; Liu, C.; Xiong, H. Instance-based credit risk assessment for investment decisions in P2P lending. Eur. J. Oper. Res. 2016, 249, 417–426. [Google Scholar] [CrossRef]

- Odinet, C.K.; College, O. Consumer bitcredit and Fintech lending. Ala. Law Rev. 2018, 69, 781–858. [Google Scholar]

- Zhang, X.; Zhang, J.; Wan, G.; Luo, Z. Fintech, growth, and inequality: evidence from China’s household survey data. Singap. Econ. Rev. 2019. [Google Scholar] [CrossRef]

- Meifang, Y.; He, D.; Xianrong, Z.; Xiaobo, X. Impact of payment technology innovations on the traditional financial industry: A focus on China. Technol. Forecast. Soc. Chang. 2018, 135, 199–207. [Google Scholar]

- Perera, L.D.H.; Lee, G.H.Y. Have economic growth and institutional quality contributed to poverty and inequality reduction in Asia? J. Asian Econ. 2013, 27, 71–86. [Google Scholar] [CrossRef]

- Seven, U.; Coskun, Y. Does financial development reduce income inequality and poverty? Evidence from emerging countries. Emerg. Mark. Rev. 2016, 26, 34–63. [Google Scholar] [CrossRef]

- Quartey, P. Financial sector development, savings mobilization and poverty reduction in Ghana. In Financial Development, Institutions, Growth and Poverty; Research Paper No. 2005/71. 2005; Macmillan: London, UK, 2008; Volume 6. [Google Scholar]

- Wei, S. Internet lending in China: Status quo, potential risks and regulatory options. Comput. Law Secur. Rev. Int. J. Technol. Law Pract. 2015, 31, 793–809. [Google Scholar] [CrossRef]

- Duoqi, X.; Shiya, T.; Guttman, D. China’s campaign-style internet finance governance: Causes, effects, and lessons learned for new information-based approaches to governance. Comput. Law Secur. Rev. Int. J. Technol. Law Pract. 2019, 35, 3–14. [Google Scholar]

- Zhu, C.; Hua, G. The impact of China’s internet finance on the banking systemic risk–an empirical study based on the SCCA model and stepwise regression. Appl. Econ. Lett. 2020, 27, 267–274. [Google Scholar] [CrossRef]

- Qi, M.; Gu, Y.; Wang, Q. Internet financial risk management and control based on improved rough set algorithm. J. Comput. Appl. Math. 2021, 384, 113179. [Google Scholar] [CrossRef]

- Chen, R.; Yu, J.; Jin, C.; Bao, W. Internet finance investor sentiment and return comovement. Pac. Basin Financ. J. 2019, 56, 151–161. [Google Scholar] [CrossRef]

- Qi, S.; Jin, K.; Li, B.; Qian, Y. The exploration of internet finance by using neural network. J. Comput. Appl. Math. 2020, 369, 112630. [Google Scholar] [CrossRef]

- Sun, W.; Lin, X.; Liang, Y.; Li, L. Regional inequality in underdeveloped areas: A case study of Guizhou province in China. Sustainability 2016, 8, 1141. [Google Scholar] [CrossRef]

- Guo, P.; Shen, Y. The impact of Internet finance on commercial banks’ risk taking: Evidence from China. China Financ. Econ. Rev. 2016, 4. [Google Scholar] [CrossRef]

- Hou, X.; Gao, Z.; Wang, Q. Internet finance development and banking market discipline: Evidence from China. J. Financ. Stab. 2016, 22, 88–100. [Google Scholar] [CrossRef]

- Ky, S.S.; Rugemintwari, C.; Sauviat, A. Friends or foes? Mobile money interaction with formal and informal finance. Telecomm. Policy 2021, 45. [Google Scholar] [CrossRef]

- Dong, J.; Yin, L.; Liu, X.; Hu, M.; Li, X. Impact of internet finance on the performance of commercial banks in China. Int. Rev. Financ. Anal. 2020, 72. [Google Scholar] [CrossRef]

- Fu, J.; Liu, Y.; Chen, R.; Yu, X.; Tang, W. Trade openness, internet finance development and banking sector development in China. Econ. Model. 2019, 91. [Google Scholar] [CrossRef]

- Zhang, X.; Tan, Y.; Hu, Z.; Wang, C.; Wan, G. The Trickle-down effect of Fintech development: From the perspective of urbanization. China World Econ. 2020, 28, 23–40. [Google Scholar] [CrossRef]

- Li, J.; Wu, Y.; Xiao, J.J. The impact of digital finance on household consumption: Evidence from China. Econ. Model. 2020, 86, 317–326. [Google Scholar] [CrossRef]

- Liu, T.; Pan, B.; Yin, Z. Pandemic, mobile payment, and household consumption: Micro-evidence from China. Emerg. Mark. Financ. Trade 2020, 56, 2378–2389. [Google Scholar] [CrossRef]

- Riley, E. Mobile money and risk sharing against village shocks. J. Dev. Econ. 2018, 135, 43–58. [Google Scholar] [CrossRef]

- Yin, Z.; Gong, X.; Guo, P.; Wu, T. What drives entrepreneurship in digital economy? Evidence from China. Econ. Model. 2019, 82, 66–73. [Google Scholar] [CrossRef]

- Dranev, Y.; Frolova, K.; Ochirova, E. The impact of fintech M & A on stock returns. Res. Int. Bus. Financ. 2019, 48, 353–364. [Google Scholar]

- Sawadogo, F.; Wandaogo, A.A. Does mobile money services adoption foster intra-African goods trade? Econ. Lett. 2021, 199. [Google Scholar] [CrossRef]

- Batista, C.; Vicente, P.C. Improving access to savings through mobile money: Experimental evidence from African smallholder farmers. World Dev. 2020, 129. [Google Scholar] [CrossRef]

- Munyegera, G.K.; Matsumoto, T. Mobile money, remittances, and household welfare: Panel evidence from rural Uganda. World Dev. 2016, 79, 127–137. [Google Scholar] [CrossRef]

- Peprah, J.A.; Oteng, C.; Sebu, J. Mobile money, output and welfare among smallholder farmers in Ghana. SAGE Open 2020, 10. [Google Scholar] [CrossRef]

- Ozili, P.K. Impact of digital finance on financial inclusion and stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Iniguez-Montiel, A.J. Growth with equity for the development of Mexico: Poverty, inequality, and economic growth (1992–2008). World Dev. 2014, 59, 313–326. [Google Scholar] [CrossRef]

- Dollar, D.; Kraay, A. Growth is Good for the Poor. J. Econ. Growth 2002, 7, 195–225. [Google Scholar] [CrossRef]

- Begum, S.S.; Deng, Q.; Gustafsson, B. Economic growth and child poverty reduction in Bangladesh and China. J. Asian Econ. 2012, 23, 73–85. [Google Scholar] [CrossRef]

- Rewilak, J. The role of financial development in poverty reduction. J. Adv. Res. 2017, 7, 169–176. [Google Scholar] [CrossRef]

- Donou-adonsou, F.; Sylwester, K. Financial development and poverty reduction in developing countries: New evidence from banks and microfinance institutions. J. Adv. Res. 2016, 6, 82–90. [Google Scholar] [CrossRef]

- Boukhatem, J. Assessing the direct effect of financial development on poverty reduction in a panel of low- and middle-income countries. Res. Int. Bus. Financ. 2016, 37, 214–230. [Google Scholar] [CrossRef]

- Akhter, S.; Daly, K.J. Finance and poverty: Evidence from fixed effect vector decomposition. Emerg. Mark. Rev. 2009, 10, 191–206. [Google Scholar] [CrossRef]

- Beck, T.; Levine, R.; Demirguc-Kunt, A. Finance, inequality, and poverty: Cross-country evidence. NBER Work. Pap. 2004. [Google Scholar] [CrossRef]

- Odhiambo, N.M. Finance-growth-poverty nexus in South Africa: A dynamic causality linkage. J. Socio. Econ. 2009, 38, 320–325. [Google Scholar] [CrossRef]

- Uddin, G.S.; Shahbaz, M.; Arouri, M.; Teulon, F. Financial development and poverty reduction nexus: A cointegration and causality analysis in Bangladesh. Econ. Model. 2014, 36, 405–412. [Google Scholar] [CrossRef]

- Feng, G.; Jingyi, W.; Zhiyun, C.; Yongguo, L.; Fang, W.; Aiyong, W. The Peking university digital financial inclusion index of China (2011–2018). Inst. Digit. Financ. Peking Univ. 2019, 1–72. [Google Scholar]

- Allen, F.; Qian, J.; Qian, M. Law, finance, and economic growth in China. J. Financ. Econ. 2005, 77, 57–116. [Google Scholar] [CrossRef]

- Acheampong, A.O.; Adams, S.; Boateng, E. Do globalization and renewable energy contribute to carbon emissions mitigation in Sub-Saharan Africa? Sci. Total Environ. 2019, 677, 436–446. [Google Scholar] [CrossRef] [PubMed]

- Appiah-Otoo, I.; Song, N. The impact of ICT on economic growth—Comparing rich and poor countries. Telecomm. Policy 2021, 45. [Google Scholar] [CrossRef]

- Baum, C.F.; Schaffer, M.E.; Stillman, S. Instrumental variables and GMM: Estimation and testing. Stata J. Promot. Commun. Stat. Stata 2003, 3, 1–31. [Google Scholar] [CrossRef]

- Li, Y.; Wei, Y.H.D. The spatial-temporal hierarchy of regional inequality of China. Appl. Geogr. 2010, 30, 303–316. [Google Scholar] [CrossRef]

| Variables | Definition | Mean | Obs. | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|

| lncpc | Household per capita consumption | 1.556 | 217 | 0.898 | −1.315 | 3.485 |

| lngdp | Economic growth | 10.740 | 217 | 0.463 | 9.706 | 13.405 |

| lnto | Trade openness | 8.705 | 217 | 1.391 | 4.632 | 11.760 |

| lninf | Inflation | 0.816 | 217 | 0.486 | −0.511 | 1.841 |

| lnfd | Financial development | 9.931 | 193 | 0.833 | 7.710 | 11.744 |

| lnif | Fintech | 4.973 | 217 | 0.678 | 2.786 | 5.819 |

| lntpp | Third-party payment | 4.805 | 215 | 0.689 | 2.381 | 5.840 |

| lncredit | Credit | 4.547 | 217 | 0.662 | 0.148 | 5.446 |

| Variables | lncpc | lngdp | lnto | lninf | lnfd | lnif | lntpp | lncredit |

|---|---|---|---|---|---|---|---|---|

| lncpc | 1 | |||||||

| lngdp | 0.418 *** | 1 | ||||||

| lnto | −0.353 *** | 0.394 *** | 1 | |||||

| lninf | −0.0903 | −0.192 ** | 0.0864 | 1 | ||||

| lnfd | −0.242 *** | 0.632 *** | 0.816 *** | −0.254 *** | 1 | |||

| lnif | 0.279 *** | 0.466 *** | 0.0937 | −0.774 *** | 0.453 *** | 1 | ||

| lntpp | 0.209 ** | 0.460 *** | 0.191 ** | −0.709 *** | 0.545 *** | 0.906 *** | 1 | |

| lncredit | 0.0724 | 0.516 *** | 0.375 *** | −0.628 *** | 0.664 *** | 0.816 *** | 0.850 *** | 1 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 |

|---|---|---|---|---|---|---|---|---|---|

| OLS | RE | IV-GMM | |||||||

| lngdp | 1.576 *** | 1.664 *** | 1.734 *** | 0.177 | 0.250 | 0.145 | 1.930 *** | 2.057 *** | 2.166 *** |

| (0.321) | (0.298) | (0.330) | (0.301) | (0.267) | (0.303) | (0.125) | (0.118) | (0.124) | |

| lninf | 0.320 ** | 0.236 ** | −0.064 | 0.051 * | 0.051 | −0.062 | 0.200 * | 0.168 | 0.030 |

| (0.143) | (0.101) | (0.109) | (0.029) | (0.032) | (0.057) | (0.116) | (0.110) | (0.105) | |

| lnfd | −1.057 *** | −1.198 *** | −1.002 *** | −0.043 | −0.285 ** | 0.144 | −1.220 *** | −1.212 *** | −1.097 *** |

| (0.112) | (0.121) | (0.103) | (0.150) | (0.140) | (0.159) | (0.119) | (0.132) | (0.122) | |

| lnto | 0.035 | 0.070 | −0.017 | −0.170 *** | −0.088 * | −0.168 ** | 0.029 | 0.010 | −0.060 |

| (0.081) | (0.087) | (0.075) | (0.063) | (0.053) | (0.074) | (0.067) | (0.074) | (0.064) | |

| lnif | 0.600 *** | 0.261 *** | 1.337 *** | ||||||

| (0.176) | (0.062) | (0.224) | |||||||

| lntpp | 0.622 *** | 0.380 *** | 0.720 *** | ||||||

| (0.137) | (0.056) | (0.105) | |||||||

| lncredit | 0.252 ** | 0.129 ** | 0.368 *** | ||||||

| (0.121) | (0.060) | (0.133) | |||||||

| Constant | −8.512 *** | −8.301 *** | −8.145 *** | 0.246 | 0.614 | −0.466 | −14.534 *** | −12.374 *** | −12.067 *** |

| (2.475) | (2.577) | (3.047) | (2.448) | (2.204) | (2.411) | (0.966) | (0.904) | (1.015) | |

| R2 | 0.679 | 0.692 | 0.633 | 0.805 | 0.785 | 0.772 | |||

| R2_O | 0.370 | 0.431 | 0.167 | ||||||

| R2_B | 0.540 | 0.587 | 0.371 | ||||||

| RHO | 0.779 | 0.812 | 0.829 | ||||||

| RMSE | 0.505 | 0.493 | 0.540 | 0.242 | 0.228 | 0.236 | 0.389 | 0.406 | 0.420 |

| F | 101.791 | 131.705 | 51.296 | 195.198 | 165.545 | 131.558 | |||

| J | 2.615 | 0.537 | 0.327 | ||||||

| JP | 0.106 | 0.464 | 0.567 | ||||||

| VIF | 4.04 | 3.84 | 3.70 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 |

|---|---|---|---|---|---|---|

| Economic Growth Channel | Financial Development Channel | |||||

| lnif × lngdp | 1.572 *** | |||||

| (0.585) | ||||||

| lntpp × lngdp | 0.111 | |||||

| (0.734) | ||||||

| lncredit × lngdp | 1.505 | |||||

| (1.069) | ||||||

| lnif × lnfd | 0.674 * | |||||

| (0.354) | ||||||

| lntpp × lnfd | −0.100 | |||||

| (0.200) | ||||||

| lncredit × lnfd | 0.355 * | |||||

| (0.212) | ||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 76.972 ** | −6.056 | 66.788 | 21.907 | −17.677 | 5.410 |

| (33.901) | (41.478) | (56.022) | (19.066) | (10.747) | (10.510) | |

| R2 | 0.819 | 0.790 | 0.801 | 0.810 | 0.781 | 0.797 |

| RMSE | 0.375 | 0.401 | 0.393 | 0.384 | 0.410 | 0.397 |

| F | 160.200 | 149.158 | 132.027 | 145.211 | 146.716 | 135.325 |

| J | 0.452 | 3.641 | 0.026 | 1.662 | 2.717 | 0.008 |

| JP | 0.501 | 0.056 | 0.872 | 0.197 | 0.099 | 0.928 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 |

|---|---|---|---|---|---|---|---|---|---|

| Eastern | Central | Western | |||||||

| lngdp | 2.148 *** | 2.261 *** | 2.313 *** | 0.513 | 0.799 | 1.299 *** | 1.100 *** | 1.364 *** | 1.366 *** |

| (0.134) | (0.139) | (0.138) | (0.533) | (0.510) | (0.497) | (0.136) | (0.122) | (0.123) | |

| lnto | 0.173 ** | 0.156 ** | 0.121 | −0.285 | −0.245 | −0.117 | −0.034 | −0.086 *** | −0.099 *** |

| (0.068) | (0.078) | (0.086) | (0.190) | (0.169) | (0.163) | (0.032) | (0.033) | (0.035) | |

| lninf | 0.282 ** | 0.264 * | 0.199 | −0.078 | −0.042 | −0.181 ** | 0.145 * | 0.096 | −0.054 |

| (0.143) | (0.157) | (0.146) | (0.065) | (0.061) | (0.073) | (0.081) | (0.072) | (0.099) | |

| lnfd | −1.376 *** | −1.348 *** | −1.422 *** | −1.069 *** | −1.250 *** | −1.354 *** | −1.206 *** | −1.132 *** | −1.130 *** |

| (0.113) | (0.127) | (0.152) | (0.149) | (0.175) | (0.213) | (0.078) | (0.079) | (0.094) | |

| lnif | 1.524 *** | 1.282 *** | 1.404 *** | ||||||

| (0.204) | (0.192) | (0.247) | |||||||

| lntpp | 0.756 *** | 0.829 *** | 0.645 *** | ||||||

| (0.095) | (0.188) | (0.124) | |||||||

| lncredit | 1.021 *** | 0.977 *** | 0.371 *** | ||||||

| (0.220) | (0.219) | (0.104) | |||||||

| Constant | −17.698 *** | −14.795 *** | −15.295 *** | 1.953 | 2.888 | −2.872 | −5.517 *** | −4.421 *** | −2.733 * |

| (0.909) | (0.941) | (1.069) | (6.429) | (6.420) | (5.770) | (1.375) | (1.336) | (1.564) | |

| R2 | 0.919 | 0.901 | 0.896 | 0.672 | 0.631 | 0.663 | 0.969 | 0.966 | 0.966 |

| RMSE | 0.255 | 0.282 | 0.289 | 0.371 | 0.394 | 0.376 | 0.147 | 0.153 | 0.153 |

| F | 210.143 | 177.264 | 139.526 | 92.674 | 55.342 | 28.930 | 331.349 | 224.591 | 323.055 |

| J | 5.216 | 0.196 | 1.386 | 0.122 | 0.902 | 0.177 | 0.037 | 0.026 | 1.644 |

| JP | 0.022 | 0.658 | 0.239 | 0.727 | 0.342 | 0.674 | 0.847 | 0.873 | 0.200 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Appiah-Otoo, I.; Song, N. The Impact of Fintech on Poverty Reduction: Evidence from China. Sustainability 2021, 13, 5225. https://doi.org/10.3390/su13095225

Appiah-Otoo I, Song N. The Impact of Fintech on Poverty Reduction: Evidence from China. Sustainability. 2021; 13(9):5225. https://doi.org/10.3390/su13095225

Chicago/Turabian StyleAppiah-Otoo, Isaac, and Na Song. 2021. "The Impact of Fintech on Poverty Reduction: Evidence from China" Sustainability 13, no. 9: 5225. https://doi.org/10.3390/su13095225

APA StyleAppiah-Otoo, I., & Song, N. (2021). The Impact of Fintech on Poverty Reduction: Evidence from China. Sustainability, 13(9), 5225. https://doi.org/10.3390/su13095225