Abstract

Ending poverty in all its forms by 2030 remains the first agenda of Sustainable Development Goals set by the United Nations in 2015. Motivated by this agenda, this study examined the direct and indirect effect of financial technology (fintech) and its sub-measures of third-party payment and credit on poverty measured by household per capita consumption. We used a panel of 31 provinces in China from 2011 to 2017. The results indicated that fintech and these sub-measures reduce poverty in China. The results further showed that fintech complements economic growth and financial development to reduce poverty in China.

1. Introduction

Poverty remains one of the major challenges facing mankind in the 21st Century [1]. Poverty implies inadequate financial resources and it is linked to disease, the formation of dangerous social groups, absence of leisure activities, stigmatization, low standard of living, economic hardships, and poor diet, thus ending poverty in all its forms remains paramount to policymakers and international organizations such as the United Nations and the World Bank [1].

Undoubtedly, financial development plays an essential role in poverty alleviation. Financial development is argued to improve the chances of the poor accessing finance by solving the problems of financial market failures such as information asymmetry and the high lending cost to borrowers [2]. Financial development also helps the poor to spend their savings or to borrow money to start microenterprises, which in general promote broader financial services access, creates more jobs and improves incomes, and thus reduces poverty [3]. Finally, financial development is argued to boost economic growth which indirectly reduces poverty (trickle-down hypothesis) [1]. However, extending financial services to the poor by traditional financial institutions remains a challenge, especially in China [4].

Recently, fintech, also known as internet finance or digital financial inclusion, has emerged as an alternative source of finance for this neglected population and it is growing rapidly in China [5]. The rapid growth of the internet, information technology, mobile phones, and digital technologies in the financial sector has seen fintech spike in China. According to the data on fintech from the Wind database, China had 214 peer-to-peer (P2P) loan companies in 2011, but in 2014 China recorded 1544 P2P loan companies with over RMB 252.8 billion in outstanding loans. Moreover, the third-party payment market size stood at RMB 190.5 trillion in 2018. Finally, the data revealed that non-equity crowdfunding platforms raised RMB 2.9 billion in 2016. However, does fintech contribute to poverty reduction in China?

Fintech does not require banks to serve as an intermediary between lenders and borrowers [6]. P2P lending entails bringing lenders and borrowers together via the internet, where lenders examine the creditworthiness given the data supplied by borrowers and then make decisions regarding their loan choices [7]. Fintech magnifies the prospect of small and medium-sized enterprises (SMEs) getting loans at a cheap interest rate [8]. Additionally, fintech quickens the process of demanding credits thus helping borrowers attain loans faster, which might expand the ability of SMEs to use funds in a timely manner [6]. Similarly, investment management assistance to SMEs is made cheap by fintech [6]. This promotes efficiency [6] and is thus likely to reduce poverty. Zhang et al. [9] argued that fintech benefits the poor via the expansion of financial services access. These services encourage transactions, reduce the cost of sending money, and provide the opportunity to accumulate wealth and to smooth income flows. Wang and He [4] also argued that fintech reduces rural farmers’ vulnerability of falling into poverty by improving financial access, disseminating information and promoting social linkage, and promoting rural e-commerce. Fintech is further argued to boost income growth and financial development in China [9,10] with these indicators widely documented to influence poverty [11,12,13]. Conversely, the speedy rise of fintech has amplified risks [14,15,16,17]. For instance, 40 P2P platforms defaulted in July 2018 with over RMB 120 billion [18]. This impacts businesses, individuals, and industry growth [19], and hence are expected to prompt poverty in China; however, whether fintech actually impacts poverty in China is unknown.

It is important to note that existing study on fintech and poverty in China has focused on rural farmer’s vulnerability to poverty (ex-ante poverty measure) [4], whilst not much is known about the direct and indirect effect of fintech on poverty (ex-post welfare result) via economic growth and financial development. Thus, this study fills this knowledge gap by exploring both the direct and indirect effect of fintech on poverty via economic growth and financial development in China.

We contribute to the literature examining the links between fintech and poverty in the following ways. First, we examined the effect of fintech on poverty reduction in China. Since opening up in 1978, China has encountered fast economic and social development [20]. GDP growth has averaged nearly 10% a year and has lifted more than 800 million people out of poverty with the poverty headcount ratio dropping from 10.2% in 2012 to less than 4% in 2017 (World Bank, 2019). However, whether fintech has influenced poverty is not known. Thus, this study examined the impact of fintech on poverty. We also explored the indirect mechanisms via which fintech could influence poverty. Moreover, to reduce homogeneity in the dataset, we explored the regional impact of fintech. Furthermore, given the regional differences, we examined the individual provincial effect of fintech on poverty. Finally, to produce efficient results and to address endogeneity and the issue of omitted variables, we employed the instrumental variable generalized method of moments model.

2. Literature Review and Hypothesis Development

2.1. Literature Review

This section presents a brief review of fintech studies. Guo and Shen [21] explored the effect of fintech on bank risk-taking in China using data from 2003 to 2013 and found that fintech reduces banks’ risk and management costs at the early stages of fintech development; however, at the growth stage of fintech, banks’ risks and management cost increases. Huo et al. [22] found that fintech reduces the positive relationship between bank deposit growth and capitalization. They also found that the negative links between banks’ risky assets and deposit growth worsen with a rise in fintech development in China. Conversely, Ky et al. [23] discovered that fintech promotes bank deposits in Burkina Faso. Dong et al. [24] found that fintech spurs banks’ growth, profitability, and security; however, it impedes banks’ liquidity. Meifang et al. [10] found that third-party payment has promoted the development of the financial sector in China. Fu et al. [25] found that fintech promotes banking sector efficiency and size.

Zhang et al. [26] examined the effect of fintech on urbanization in China from 2010 to 2016 and found that fintech spurs urbanization. Li et al. [27] found that fintech improves household consumption in China. Liu et al. [28] also found that fintech improves urban household consumption. Riley [29] established that fintech adoption inhibits reduction in household consumption, given rainfall shocks. Zhang et al. [9] found that fintech increases household income with the effect being larger for rural households. They further found that the rich gain less than the poor from fintech development. Yin et al. [30] found that fintech improves household entrepreneurship by reducing risks, improving social connections, and providing liquidity. Dranev et al. [31] found that fintech drives firms’ average abnormal returns in the short-run, whilst the reverse exists in the long run. Sawadogo and Wandaogo [32] established that countries with fintech adoption tend to obtain greater benefits from trade as compared to non-adopters. Batista and Vicente [33] demonstrated that fintech stimulates domestic savings given the availability of interest. Munyegera and Matsumoto [34] found that fintech improves welfare in Uganda. Peprah et. al. [35] reached similar conclusions for three districts in Ghana. Wang and He [4] found that fintech reduces rural farmers’ vulnerability of falling into poverty by improving financial access, disseminating information and promoting social linkage, and promoting rural e-commerce; however, no study exists on the direct and indirect effect of fintech on poverty through economic growth and financial development in China, thus this study aims to fill these gaps.

2.2. Hypothesis Development

The impact of financial development measured by banks and stocks on poverty reduction has been extensively studied; however, an essential aspect of the financial system that has received less attention in the literature is fintech. Fintech drives financial inclusion, economic growth, and financial development [36] (See [36] for more advantages of fintech). Theoretically, financial inclusion, economic growth, and financial development are the three main channels via which fintech could impact poverty.

Fintech is acknowledged to promote financial inclusion [4,29,30,31]. It offers easier access to funds to SMEs which often experience enormous challenges in getting cash from state-owned banks mostly because of inadequate collateral security and also as a result of banks wishing to offer loans to better capitalized state-owned enterprises. This helps solve the problem of moral hazard and adverse selection associated with the traditional banking system [14]. By improving financial inclusion, fintech helps reduce inequalities and poverty [36].

Regarding the economic growth channel, fintech encourages e-commerce, improves the transmission of information, promotes social links, efficiency and easier access to loans, and reduces risks by households [4]. These improve household consumption, savings, investment, business growth, employment, and incomes [4,26,28], thus are to influence poverty. It is well acknowledged in the literature that economic growth influences poverty [11,37,38,39].

Fintech could also influence poverty via financial development. It is established that fintech influences the financial sector in China by promoting size, profitability, and security [10,21,22,24]. It is empirically shown that financial development influences poverty [12,13,40,41,42,43,44,45,46].

In a nutshell, we argue that since fintech drives financial inclusion, it can likewise reduce poverty. It is acknowledged that economic growth reduces poverty. Thus, provided that fintech influences economic growth, it can also influence poverty. Finally, provided that fintech drives financial development, it can similarly influence poverty. With these contentions, to our knowledge, no study has assessed the impact of fintech on poverty, thus we hypothesize:

Hypothesis 1 (H1).

Fintech increases poverty in China.

Hypothesis 2 (H2).

Fintech reduces poverty in China.

3. Methodology

3.1. Data

We used a panel of 31 provinces (Beijing, Tianjin, Hebei, Shanxi, Neimenggu, Liaoning, Jilin, Heilongjiang, Shanghai, Jiangsu, Zhejiang, Anhui, Fujian, Jiangxi, Shandong, Henan, Hubei, Hunan, Guangdong, Guangxi, Hainan, Chongqing, Sichuan, Guizhou, Yunan, Xizang, Shaanxi, Gansu, Qinghai, Ningxia and Xinjiang) from 2011 to 2017 covering 7 years. The period was driven by data availability. We used household per capita consumption as the proxy for poverty. Household per capita consumption (cpc) refers to the market value of all goods and services bought by households in a year averaged by the total population. Although this indicator might not be the best measure for poverty, there is not much data on the headcount ratio for China [1]. This indicator has also been used by Ho and Iyke [1], Odhiambo [46], and Quartey [13] and is acknowledged to be the best measure of poverty reduction given the regular and stable availability of data among the poor [1]. It also aligns with the World Bank’s definition of poverty as the failure to reach a minimum standard of living denoted in terms of basic consumption needs [1]. Fintech is represented by (if) and it is further disaggregated into third-party payment (tpp) and credit (credit). Fintech simply refers to the integration of technology and financial activities. It entails third-party payment, digital financing, and digital investments [4] and it is dominated by third-party payment and digital financing in China [15]. It offers easier access to credit, reduces transaction costs, promotes financial access, and reduces information asymmetry [4,29].

Following the literature on finance-poverty, we controlled for financial development measured by domestic credit to the private sector by banks (fd), per capita economic growth as a proxy for economic growth (gdp), inflation (inf) as a proxy for monetary policy and trade openness (to) (sum of export and import as a percentage of GDP). The data on fintech was obtained from [47] (See Feng et al. [47] for the construction of the fintech index). The data on poverty, economic growth, trade openness, and inflation was also obtained from the National Data (2020), National Bureau of Statistics. Finally, the data on financial development was obtained from the Wind database. We converted the variables into a natural logarithm form to present the results as elasticities. All the figures and analysis were conducted using STATA statistical software package. Appendix A (Table A1) shows examples of fintech in China.

Table 1 presents the variables, definition, and descriptive statistics. China has an average household per capita consumption rate of 1.556% with a maximum of 3.485%. Economic growth has an average rate of 10.740% with a maximum of 13.405%. Fintech has an average rate of 4.973% with a maximum of 5.819%. The standard deviations of all the variables are below the mean, indicating that the study does not suffer from outliers.

Table 1.

Descriptive statistics.

Table 2 presents the correlation matrix. We observed that there exists a positive linear correlation between economic growth, fintech, third-party payment and credit, and household per capita consumption, whilst there exists a negative relationship between trade openness, inflation, financial development, and household per capita consumption. Thus, an increase in economic growth, fintech, and the sub-measures will increase household per capita consumption, whilst an increase in trade openness, inflation, and financial development will reduce household per capita consumption. We also observed that there exists a strong positive linear relationship between trade openness, financial development, fintech, third-party payment, credit and economic growth, whilst there exists a strong negative relationship between inflation and economic growth. Thus, an increase in trade openness, financial development, fintech, third-party payment, and credit will increase economic growth. There exists a strong positive linear correlation between fintech, third-party payment, credit and financial development. This implies that an increase in fintech and the sub-measures will increase financial development.

Table 2.

Correlation matrix.

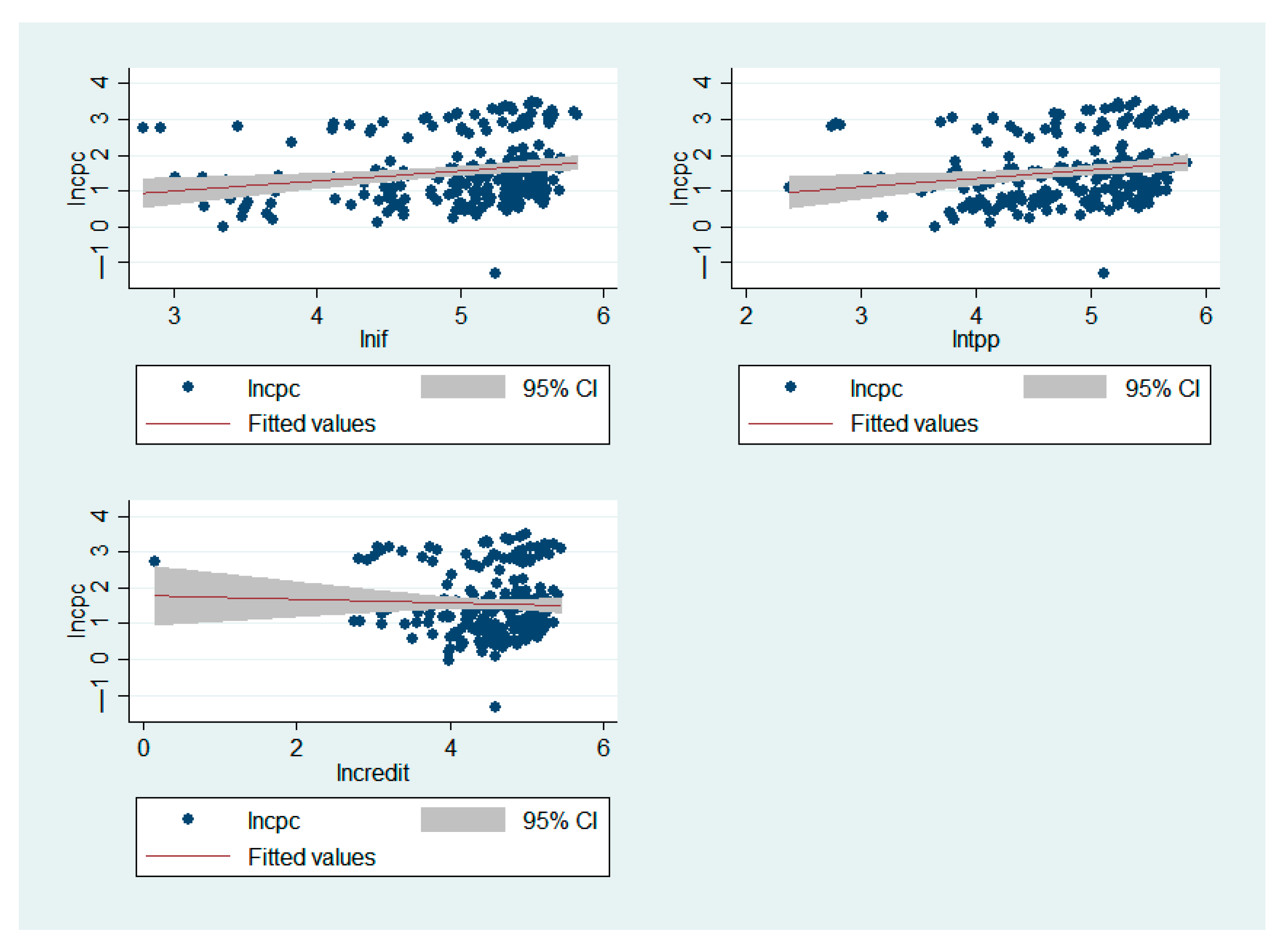

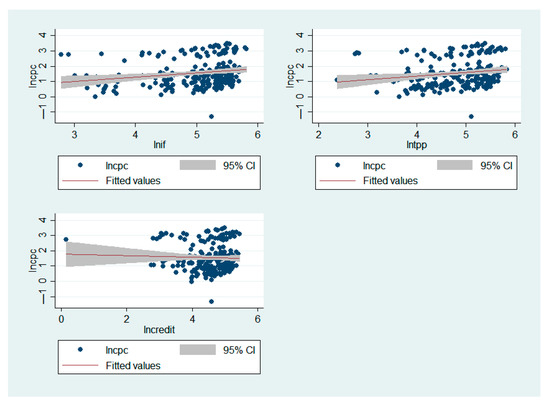

Figure 1 presents the bivariate relationship between fintech, third-party payment, credit, and household per capita consumption. The results indicate that there exists a positive relationship between fintech, third-party payment, and household per capita consumption, whilst there exists a weak positive relationship between credit and household per capita consumption.

Figure 1.

Bivariate relationship between fintech, third-party payment, credit and poverty (Full Sample).

3.2. Empirical Model

We estimated the effect of fintech on poverty reduction. Equation (1) presents the direct effect of fintech on poverty, whilst Equations (2) and (3) present the indirect channels via economic growth and financial development.

The subscript i and t represent provinces and time whilst ε represents the error term.

We expect fintech, third-party payment, and credit to have a statistically significant positive effect on household per capita consumption. That is, fintech improves the welfare and living standard of Chinese citizens. Given the financial repression of the Chinese banking system [48], we expect financial development to have a negative effect on household’s per capita consumption. We expect economic growth, trade openness, and inflation to have a positive effect on household per capita consumption.

We used the IV-GMM model for our analysis following Acheampong et al. [49] and Appiah-Otoo and Song [50]. This model produces efficient outcomes since it addresses endogeneity and the problem of omitted variables [49,50]. Following Acheampong et al. [49] and Appiah-Otoo and Song [50] we employed the robust option. This option shows the Hansen test [51] which tests the null hypothesis that instrument over-identification restriction should not be rejected in both models [51]. To solve endogeneity issues, we took the first and the second lags of the fintech proxies as instruments. For our robustness analysis, we used the ordinary least squares estimator (OLS), and the random effects (RE) model.

4. Results and Discussion

4.1. Direct Effect

Table 3 presents the results for the direct effect of fintech and the sub-measures on poverty. The results indicate that fintech, third-party payment, and credit have a positive and statistically significant effect on household per capita consumption in both models, specifically, a 1% increase in fintech, third-party payment, and credit increase household per capita consumption by 1.337%, 0.720%, and 0.368% by the IV-GMM model. These support our Hypothesis 2 (H2) that fintech reduces poverty. Fintech aids the poor through financial inclusion [36]. Fintech reduces transactions cost, provide easier financial access, reduces information asymmetry and household risk, provides rural e-commerce, provides social connections the opportunity to accumulate wealth and a smooth income [4,9], thus improving the living standards and welfare of Chinese citizens. These are novel outcomes. The results further indicate that economic growth increases household per capita consumption. That is, economic growth reduces poverty. This supports the findings of Perera and Lee [11] for nine Asian developing countries, Iniquez-Montiel [37] for Brazil, and Dollar and Kraay [38] for 92 developed and developing countries, who found that economic growth reduces poverty. The estimated coefficient of financial development was negative and significant in the IV-GMM model, OLS, and RE model 5. This implies that financial development worsens the poverty situation in China. This conflicts with the findings of Donou-Adonsou and Sylwester [41] for 71 developing countries, Boukhatem [42] for 67 low-and middle-income countries, and Uddin et al. [46] for Bangladesh, who found that financial development reduces poverty. These disparities could be ascribed to the differences in scope. Inflation was found to have a positive effect on household per capita consumption in Models 1, 2, 4, and 7. This implies that favourable monetary policies improve the living standard and the welfare of Chinese citizens, thus reducing poverty. Trade openness was found to have a statistically negative effect on household per consumption by the RE models.

Table 3.

Fintech and poverty (full sample).

The probability values of the Hansen statistics show that the instruments used are valid by the IV-GMM models.

The mean variance inflation factors of the OLS estimates are less than 10, signifying that the study does not suffer from multicollinearity issues.

4.2. Indirect Effect

Table 4 presents the indirect effect of fintech and the sub-measures on household per capita consumption via economic growth and financial development. The results show that the interaction effect of fintech and the sub-measures and economic growth on household per capita consumption is positive; however, only the interaction effect of fintech and economic growth was statistically significant. This implies that fintech complements economic growth to reduce poverty in China. The interaction effect of fintech and financial development, and credit and financial development on household per capita consumption, is positive and significant, whilst the interaction effect of third-party payment and financial development on household per capita consumption is negative and insignificant. This implies that fintech and credit mitigate the negative impact of financial development on household per capita consumption. That is, fintech expands the financial system in China which facilitates more credit to borrowers, thereby improving production, welfare, and the living standard of Chinese citizens. These are novel findings.

Table 4.

Indirect channels via economic growth and financial development.

The Hansen statistics probability values display that the instruments utilized are valid.

4.3. Regional Analysis

In this section, we used the IV-GMM model to explore the regional impact of fintech on household per capita consumption. The results are presented in Table 5. In line with our results in Table 3, fintech and the sub-measures maintained their statistically significant positive effect on household per capita consumption in both regions. Notably, increasing fintech, third-party payment, and credit by 1% increases household per capita consumption by: 1.524%, 0.756%, and 1.021% in the Eastern Region; 1.282%, 0.829%, and 0.977% in the Central Region; and 1.404%, 0.645%, and 0.371% in the Western Region. These affirm our Hypothesis 2 (H2) that fintech decreases poverty. These are also original discoveries. The results further show that economic growth drives household per capita consumption in both regions. Financial development impedes household per capita consumption in both regions, implying that financial development worsens the poverty situation in China.

Table 5.

Fintech and poverty (regional sample).

The study passes the instrument over-identification restriction, except for model 1. However, the Cragg-Donald Wald F test statistics show that the instruments used are not weak.

4.4. Province-Specific Effect of Fintech on Household Per Capita Consumption

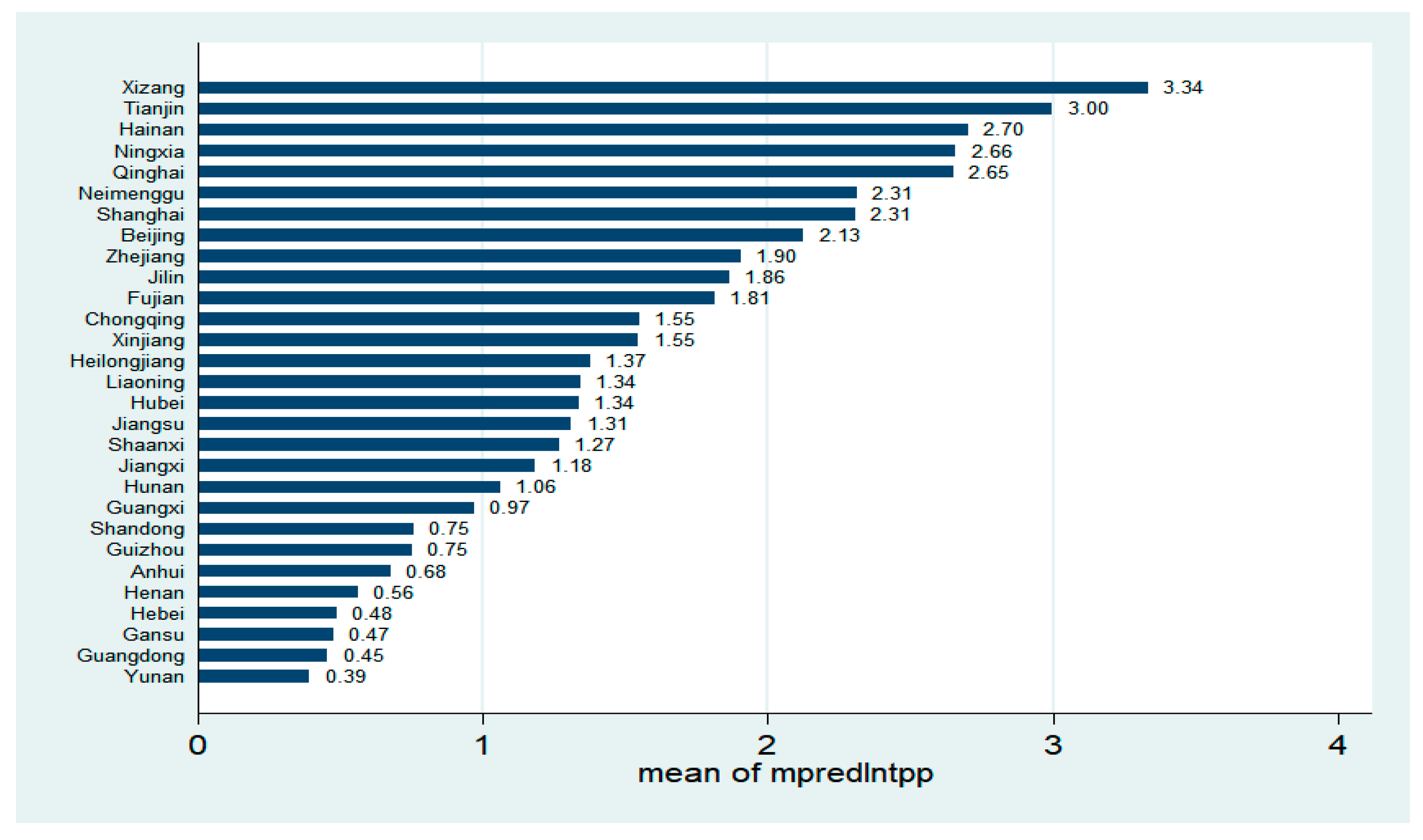

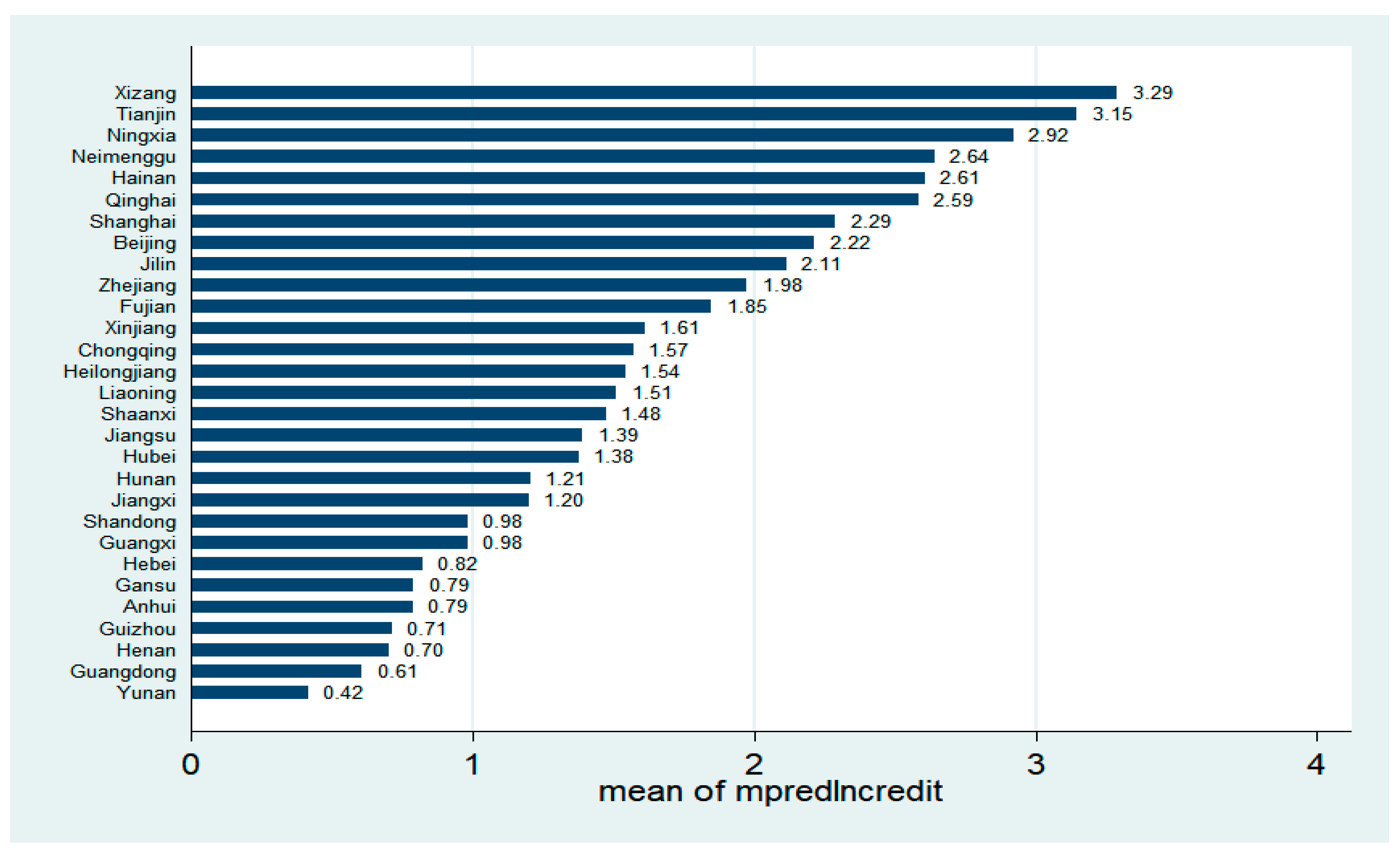

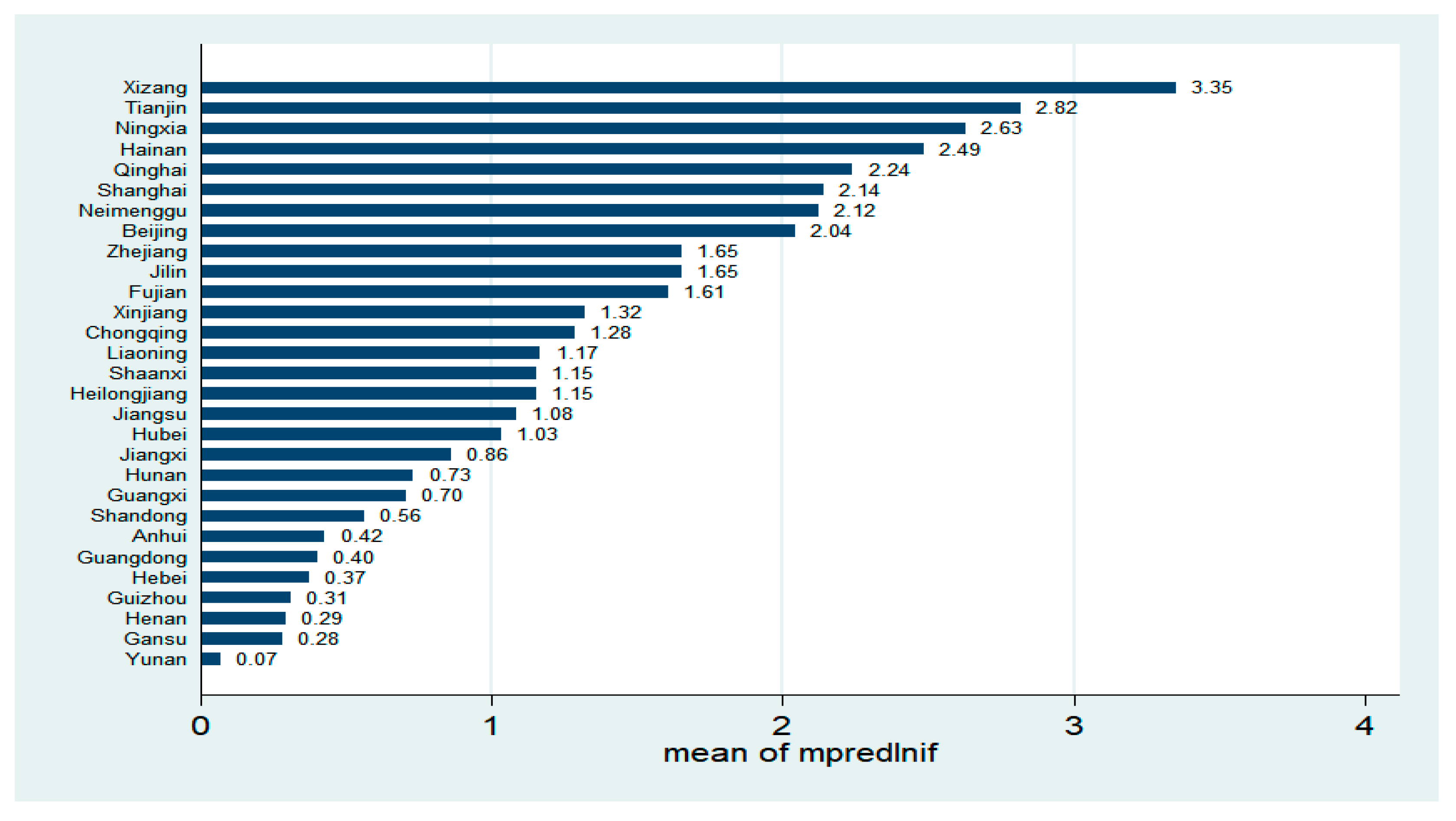

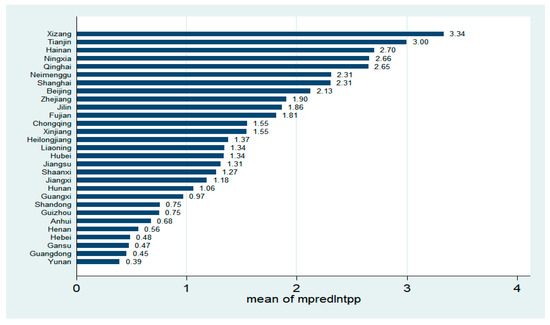

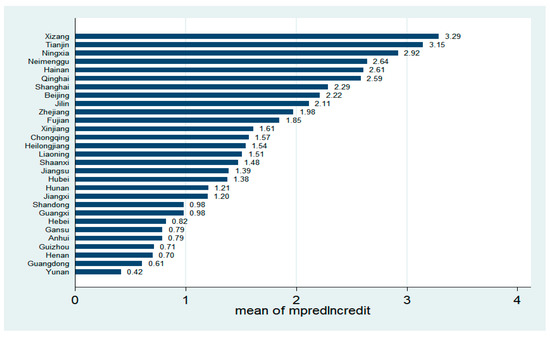

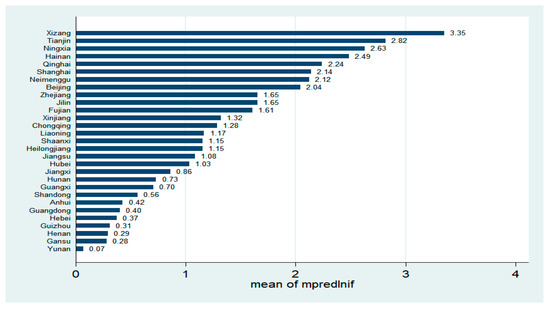

In this section, we used the IV-GMM results in Table 3 to present the provincial effect of fintech and the sub-measures on household per capita consumption given the variations in fintech development [47] and poverty in China [52]. Figure 2, Figure 3 and Figure 4 show the results.

Figure 2.

Effect of third-party payment on household per capita consumption.

Figure 3.

Effect of credit on household per capita consumption.

Figure 4.

Effect of fintech on household per capita consumption.

4.4.1. Province-Specific Effect of Third-Party Payment on Household Per Capita Consumption

Figure 2 shows the province-specific effect of third-party payment on household per capita consumption. The results show that the effect of third-party payment on household per capita consumption is positive for all the provinces. The results further show that Xizang (3.34), Tianjin (3.00), Hainan (2.70), Ningxia (2.66), and Qinghai (2.65) show a high effect of third-party payment on household per capita consumption as compared to Henan (0.56), Hebei (0.48), Gansu (0.47), Guangdong (0.45), and Yunan (0.39).

4.4.2. Province-Specific Effect of Credit on Household Per Capita Consumption

Figure 3 shows the province-specific effect of credit on household per capita consumption. The results show that this effect is positive for all the provinces. The results further show that Xizang (3.29), Tianjin (3.15), Ningxia (2.92), Neimenggu (2.64), and Hainan (2.61) have a high effect of credit on household per capita consumption as compared to Anhui (0.79), Guizhou (0.71), Henan (0.70), Guangdong (0.61), and Yunan (0.42).

4.4.3. Province-Specific Effect of Fintech on Household Per Capita Consumption

Figure 4 shows the province-specific effect of fintech on household per capita consumption. The results show that this effect is positive for all the provinces. The results further show that Xizang (3.35), Tianjin (2.82), Ningxia (2.63), Hainan (2.49), and Qinghai (2.24) have a high effect of fintech on household per capita consumption as compared to Hebei (0.37), Guizhou (0.31), Henan (0.29), Gansu (0.28), and Yunan (0.07). The reason why Xizang (Tibet) has the highest effect of fintech and the sub-measures on household per capita consumption could be attributed to the rapid adoption and use of fintech in this region. This region ranks first for the use of Alipay mobile financial services (http://english.qianlong.com/2017/0106/1287252.shtml (accessed on 15 January 2021).

5. Conclusions and Policy Implication

Achieving zero poverty by 2030 remains the first goal set by the United Nations in 2015. Motivated by this goal, we assessed the impact of fintech and its sub-measures of third-party payment and credit on poverty for a panel of 31 provinces in China from 2011 to 2017. We found that fintech, third-party payment, and credit reduce poverty in China. We further found that fintech complements economic growth and financial development in order to reduce poverty in China. These results were robust at the regional level. Finally, Xizang tends to derive greater benefit from fintech adoption and use.

Consequently, we recommend the support of policymakers in developing fintech in China. Specifically, policymakers should promote investment in internet and mobile internet infrastructure given that fintech depends on these technologies. Policymakers should encourage partnerships between civil societies, the private and public sectors to stimulate investment in internet access in China. Policymakers should also strengthen the cybersecurity of the fintech platforms. Policymakers are also encouraged to ensure information disclosure, deposit insurance, screen investors, and protect consumer’s privacy. Moreover, policymakers should deepen fintech and ICT education. This will help bridge the digital divide and increase fintech adoption. Furthermore, Yunan province has the lowest effect of fintech on household per capita consumption, thus further development of fintech in this province will be essential to assist poverty eradication. Finally, we recommend reforms in the financial sector to be geared towards reducing constraints to credit.

This study has some shortcomings. First, the study was limited to China. However, fintech is a worldwide phenomenon. Thus, future investigations should utilize data from other countries to examine the fintech–poverty linkage. We investigated only the linear relationship of fintech and poverty. Thus, it is recommended that future investigations should analyze the non-linear impact of fintech on poverty. Furthermore, we concentrated on household per capita consumption as the only proxy for poverty. Consequently, future investigations should use a headcount ratio if the data becomes available. Finally, our data covered a short period (2011 to 2017) given data availability. Thus, future studies should use a current dataset to examine the fintech–poverty link.

Author Contributions

Conceptualization, I.A.-O. and N.S.; methodology, I.A.-O.; software, I.A.-O.; validation, I.A.-O. and N.S.; formal analysis, I.A.-O.; investigation, I.A.-O.; resources, N.S.; data curation, I.A.-O.; writing—original draft preparation, I.A.-O. and N.S.; writing—review and editing, I.A.-O. and N.S.; visualization, I.A.-O.; supervision, N.S.; project administration, N.S.; funding acquisition, N.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Ministry of Education of Humanities and Social Science Grant of China (Grant Number: 17YJC790127).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data for this study are publicly available at Feng. et.al. [47], the National Bureau of Statistics, and the Wind database.

Acknowledgments

The authors gladly recognize important remarks from three reviewers, and the financial support of the Ministry of Education of Humanities and Social Science Grant of China.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Examples of fintech in China (Source:Jingu [5]).

Table A1.

Examples of fintech in China (Source:Jingu [5]).

| Company | Product/Service | Brand Name | Description |

|---|---|---|---|

| Alibaba | Payments, settlement, remittances | Alipay | Established in 2004 as a third-party payment platform to provide payment solutions to Alibaba’s Taobao C2C site. Can be used to pay utility and credit card bills and transfer funds to participating banks. Has also started to extend credit to consumers based on their repayment histories. |

| Lending | Ali Microfinance | Microfinance company that extends credit to merchants of Alibaba B2B site, Taobao C2C site, and Tmall B2C site. Also securitizes loans to microenterprises. | |

| Fund management | Yu’E Bao | See the development of Fintech | |

| Taobao Wealth Management | First online third-party fund sales platform (November 2013). Provides sales support to fund distributors. | ||

| Alibaba, China Ping An Insurance & Tencent | Insurance sales | Zhong An Online Property Insurance | Sells insurance and settles insurance claims without bricks-and-mortar branches (November 2013) |

| Tencent | Payments | Tenpay | Payment service similar to Alipay |

| Fund management | WeChat is a messaging app like Line. WeChat wealth management products were launched in January 2014. | ||

| Renrendai | P2P lending | Established in May 2010 | |

| Demohour | Crowdfunding | Established in May 2011 | |

| China Construction Bank | E-commerce, financial services | Shanrong | B2B and B2C e-commerce platform (June 2012). Industrial and Commercial Bank of China’s Rong-e-Guo (B2C) platform went live in January 2014. Bank of China, Bank of Communications et. al. also have similar platforms. |

References

- Ho, S.Y.; Iyke, B.N. Finance-growth-poverty nexus: A re-assessment of the trickle-down hypothesis in China. Econ. Change Restruct. 2018, 51, 221–247. [Google Scholar] [CrossRef]

- Jalilian, H.; Kirkpatrick, C. Financial development and poverty reduction in developing countries. Int. J. Financ. Econ. 2002, 7, 97–108. [Google Scholar] [CrossRef]

- Ben Naceur, S.; Zhang, R. Financial development, inequality and poverty: Some international evidence. Int. Rev. Econ. Financ. 2019, 61, 1–16. [Google Scholar] [CrossRef]

- Wang, X.; He, G. Digital financial inclusion and farmers’ vulnerability to poverty: Evidence from rural China. Sustainability 2020, 12, 1668. [Google Scholar] [CrossRef]

- Jingu, T. Internet finance growing rapidly in China. NRI 2014, 189, 1–6. [Google Scholar]

- Abbasi, K.; Alam, A.; Anna, M.; Luu, T.; Huynh, D. FinTech, SME efficiency and national culture: Evidence from OECD countries. Technol. Forecast. Soc. Chang. 2021, 163. [Google Scholar] [CrossRef]

- Guo, Y.; Zhou, W.; Luo, C.; Liu, C.; Xiong, H. Instance-based credit risk assessment for investment decisions in P2P lending. Eur. J. Oper. Res. 2016, 249, 417–426. [Google Scholar] [CrossRef]

- Odinet, C.K.; College, O. Consumer bitcredit and Fintech lending. Ala. Law Rev. 2018, 69, 781–858. [Google Scholar]

- Zhang, X.; Zhang, J.; Wan, G.; Luo, Z. Fintech, growth, and inequality: evidence from China’s household survey data. Singap. Econ. Rev. 2019. [Google Scholar] [CrossRef]

- Meifang, Y.; He, D.; Xianrong, Z.; Xiaobo, X. Impact of payment technology innovations on the traditional financial industry: A focus on China. Technol. Forecast. Soc. Chang. 2018, 135, 199–207. [Google Scholar]

- Perera, L.D.H.; Lee, G.H.Y. Have economic growth and institutional quality contributed to poverty and inequality reduction in Asia? J. Asian Econ. 2013, 27, 71–86. [Google Scholar] [CrossRef]

- Seven, U.; Coskun, Y. Does financial development reduce income inequality and poverty? Evidence from emerging countries. Emerg. Mark. Rev. 2016, 26, 34–63. [Google Scholar] [CrossRef]

- Quartey, P. Financial sector development, savings mobilization and poverty reduction in Ghana. In Financial Development, Institutions, Growth and Poverty; Research Paper No. 2005/71. 2005; Macmillan: London, UK, 2008; Volume 6. [Google Scholar]

- Wei, S. Internet lending in China: Status quo, potential risks and regulatory options. Comput. Law Secur. Rev. Int. J. Technol. Law Pract. 2015, 31, 793–809. [Google Scholar] [CrossRef]

- Duoqi, X.; Shiya, T.; Guttman, D. China’s campaign-style internet finance governance: Causes, effects, and lessons learned for new information-based approaches to governance. Comput. Law Secur. Rev. Int. J. Technol. Law Pract. 2019, 35, 3–14. [Google Scholar]

- Zhu, C.; Hua, G. The impact of China’s internet finance on the banking systemic risk–an empirical study based on the SCCA model and stepwise regression. Appl. Econ. Lett. 2020, 27, 267–274. [Google Scholar] [CrossRef]

- Qi, M.; Gu, Y.; Wang, Q. Internet financial risk management and control based on improved rough set algorithm. J. Comput. Appl. Math. 2021, 384, 113179. [Google Scholar] [CrossRef]

- Chen, R.; Yu, J.; Jin, C.; Bao, W. Internet finance investor sentiment and return comovement. Pac. Basin Financ. J. 2019, 56, 151–161. [Google Scholar] [CrossRef]

- Qi, S.; Jin, K.; Li, B.; Qian, Y. The exploration of internet finance by using neural network. J. Comput. Appl. Math. 2020, 369, 112630. [Google Scholar] [CrossRef]

- Sun, W.; Lin, X.; Liang, Y.; Li, L. Regional inequality in underdeveloped areas: A case study of Guizhou province in China. Sustainability 2016, 8, 1141. [Google Scholar] [CrossRef]

- Guo, P.; Shen, Y. The impact of Internet finance on commercial banks’ risk taking: Evidence from China. China Financ. Econ. Rev. 2016, 4. [Google Scholar] [CrossRef]

- Hou, X.; Gao, Z.; Wang, Q. Internet finance development and banking market discipline: Evidence from China. J. Financ. Stab. 2016, 22, 88–100. [Google Scholar] [CrossRef]

- Ky, S.S.; Rugemintwari, C.; Sauviat, A. Friends or foes? Mobile money interaction with formal and informal finance. Telecomm. Policy 2021, 45. [Google Scholar] [CrossRef]

- Dong, J.; Yin, L.; Liu, X.; Hu, M.; Li, X. Impact of internet finance on the performance of commercial banks in China. Int. Rev. Financ. Anal. 2020, 72. [Google Scholar] [CrossRef]

- Fu, J.; Liu, Y.; Chen, R.; Yu, X.; Tang, W. Trade openness, internet finance development and banking sector development in China. Econ. Model. 2019, 91. [Google Scholar] [CrossRef]

- Zhang, X.; Tan, Y.; Hu, Z.; Wang, C.; Wan, G. The Trickle-down effect of Fintech development: From the perspective of urbanization. China World Econ. 2020, 28, 23–40. [Google Scholar] [CrossRef]

- Li, J.; Wu, Y.; Xiao, J.J. The impact of digital finance on household consumption: Evidence from China. Econ. Model. 2020, 86, 317–326. [Google Scholar] [CrossRef]

- Liu, T.; Pan, B.; Yin, Z. Pandemic, mobile payment, and household consumption: Micro-evidence from China. Emerg. Mark. Financ. Trade 2020, 56, 2378–2389. [Google Scholar] [CrossRef]

- Riley, E. Mobile money and risk sharing against village shocks. J. Dev. Econ. 2018, 135, 43–58. [Google Scholar] [CrossRef]

- Yin, Z.; Gong, X.; Guo, P.; Wu, T. What drives entrepreneurship in digital economy? Evidence from China. Econ. Model. 2019, 82, 66–73. [Google Scholar] [CrossRef]

- Dranev, Y.; Frolova, K.; Ochirova, E. The impact of fintech M & A on stock returns. Res. Int. Bus. Financ. 2019, 48, 353–364. [Google Scholar]

- Sawadogo, F.; Wandaogo, A.A. Does mobile money services adoption foster intra-African goods trade? Econ. Lett. 2021, 199. [Google Scholar] [CrossRef]

- Batista, C.; Vicente, P.C. Improving access to savings through mobile money: Experimental evidence from African smallholder farmers. World Dev. 2020, 129. [Google Scholar] [CrossRef]

- Munyegera, G.K.; Matsumoto, T. Mobile money, remittances, and household welfare: Panel evidence from rural Uganda. World Dev. 2016, 79, 127–137. [Google Scholar] [CrossRef]

- Peprah, J.A.; Oteng, C.; Sebu, J. Mobile money, output and welfare among smallholder farmers in Ghana. SAGE Open 2020, 10. [Google Scholar] [CrossRef]

- Ozili, P.K. Impact of digital finance on financial inclusion and stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Iniguez-Montiel, A.J. Growth with equity for the development of Mexico: Poverty, inequality, and economic growth (1992–2008). World Dev. 2014, 59, 313–326. [Google Scholar] [CrossRef]

- Dollar, D.; Kraay, A. Growth is Good for the Poor. J. Econ. Growth 2002, 7, 195–225. [Google Scholar] [CrossRef]

- Begum, S.S.; Deng, Q.; Gustafsson, B. Economic growth and child poverty reduction in Bangladesh and China. J. Asian Econ. 2012, 23, 73–85. [Google Scholar] [CrossRef]

- Rewilak, J. The role of financial development in poverty reduction. J. Adv. Res. 2017, 7, 169–176. [Google Scholar] [CrossRef]

- Donou-adonsou, F.; Sylwester, K. Financial development and poverty reduction in developing countries: New evidence from banks and microfinance institutions. J. Adv. Res. 2016, 6, 82–90. [Google Scholar] [CrossRef]

- Boukhatem, J. Assessing the direct effect of financial development on poverty reduction in a panel of low- and middle-income countries. Res. Int. Bus. Financ. 2016, 37, 214–230. [Google Scholar] [CrossRef]

- Akhter, S.; Daly, K.J. Finance and poverty: Evidence from fixed effect vector decomposition. Emerg. Mark. Rev. 2009, 10, 191–206. [Google Scholar] [CrossRef]

- Beck, T.; Levine, R.; Demirguc-Kunt, A. Finance, inequality, and poverty: Cross-country evidence. NBER Work. Pap. 2004. [Google Scholar] [CrossRef]

- Odhiambo, N.M. Finance-growth-poverty nexus in South Africa: A dynamic causality linkage. J. Socio. Econ. 2009, 38, 320–325. [Google Scholar] [CrossRef]

- Uddin, G.S.; Shahbaz, M.; Arouri, M.; Teulon, F. Financial development and poverty reduction nexus: A cointegration and causality analysis in Bangladesh. Econ. Model. 2014, 36, 405–412. [Google Scholar] [CrossRef]

- Feng, G.; Jingyi, W.; Zhiyun, C.; Yongguo, L.; Fang, W.; Aiyong, W. The Peking university digital financial inclusion index of China (2011–2018). Inst. Digit. Financ. Peking Univ. 2019, 1–72. [Google Scholar]

- Allen, F.; Qian, J.; Qian, M. Law, finance, and economic growth in China. J. Financ. Econ. 2005, 77, 57–116. [Google Scholar] [CrossRef]

- Acheampong, A.O.; Adams, S.; Boateng, E. Do globalization and renewable energy contribute to carbon emissions mitigation in Sub-Saharan Africa? Sci. Total Environ. 2019, 677, 436–446. [Google Scholar] [CrossRef] [PubMed]

- Appiah-Otoo, I.; Song, N. The impact of ICT on economic growth—Comparing rich and poor countries. Telecomm. Policy 2021, 45. [Google Scholar] [CrossRef]

- Baum, C.F.; Schaffer, M.E.; Stillman, S. Instrumental variables and GMM: Estimation and testing. Stata J. Promot. Commun. Stat. Stata 2003, 3, 1–31. [Google Scholar] [CrossRef]

- Li, Y.; Wei, Y.H.D. The spatial-temporal hierarchy of regional inequality of China. Appl. Geogr. 2010, 30, 303–316. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).