1. Introduction

Income inequality is one of the most discussed topics at the global level. According to the European Commission, eight out of ten European citizens consider that unemployment, social inequalities, and migration are the main challenges that the European Union is currently facing [

1]. In this context, the European Commission has started to pay more attention to social developments at the EU level and has integrated the European Pillar of Social Rights into the European Semester to strengthen the social responsibility of Member States in the policy-making process.

The current situation in the EU on this topic is a delicate one, because on one hand, the EU promotes income growth in areas with relatively low labour efficiency (paradoxically measured precisely by the resulting effects, i.e., low wages, with vicious-circle arguments from a theoretical point of view in productivity models), and on the other hand, this promotes moral hazard effects on the efficiency of economic agents. However, studying the relationship between income inequality and economic growth is not a new initiative in this field, but in many cases, the evidence provided by the economic literature is limited, and there are still divergent views on the relationships between inequality and other social or economic indicators.

The main motivation for choosing this theme was the actuality of this phenomenon, as well as the strong academic interest in this topic in the current context of increased global inequalities and in the social dissatisfaction toward the developments of income inequality which, in some cases, may exert positive effects on economic growth since it reflects better human involvement in economic activity and higher risk taking. However, when national institutions do not promote equal and fair rights, inequality starts to reach excessive levels which harm the potential of human development and socioeconomic progress; thus, removing excessive inequalities is widely supported in the field of economics [

2]. In fact, this study is based on the hypothesis that the sign of the coefficient of inequality impact on growth is driven by the level of development. However, this should be validated after a thorough examination process, which explains the need to set our research questions. Therefore, through this paper, we decided to answer the following questions:

Q1: Which countries in the EU are developed and which are developing?

Q2: To what extent can the relationship between income inequality and growth be driven by a country’s level of development?

In this context, the objective of the paper was to assess the extent to which the relationship between income inequality and economic growth depends on each European Union Member State’s level of development. To reach this objective, we also set the following specific objectives: (i) clustering the European Union into two groups of countries (developing and developed Member States) using a proxy criterion for the level of development; (ii) estimating the impact of income inequality on growth in the case of both clusters and comparing the signs of the coefficients from each group; (iii) adding the relevant control variables for growth and estimating their specific effects; (iv) comparing the results obtained for each cluster; and (v) testing the accuracy of the models and their robustness.

We structured our paper into four sections. First, we provide a comprehensive overview of the main results of the economic literature in this field. Then, we describe the methods we used and the calculations performed to estimate the impact of income inequality on growth. Furthermore, we provided an economic interpretation of the obtained results, while checking whether the analysed relationship was driven by the country level of development.

2. Literature Review

In recent years, greater efforts have been made to reach a conclusion regarding the relationship between economic growth and income inequality [

2,

3,

4,

5,

6,

7,

8,

9,

10], however, the economic literature focusing on this topic does not provide clear evidence regarding the impact of income inequality on economic growth. However, most of the findings in the studied literature support the conclusion that the relationship between the analysed indicators depends on the size of income inequality or on the country’s level of development.

Many authors have proven the need to make a trade-off between social justice and economic efficiency [

11,

12,

13]. Okun showed that the process of redistribution of income through taxes and tax transfers marks a significant loss for national governments [

13]. This conclusion is also supported by Chletsos and Fatouros, who assessed the impact of income inequality on economic growth in 126 states during the 1968–2007 period [

14]. The resulting impact is positive, which highlights a potential trade-off between inequality and growth that national governments must take into account in the policy-making process. The authors argued their conclusion by examining the effect of taxation on income inequality and economic growth. They argued that an increase in tax rates leads to a reduction in economic growth, and thus, to a higher distribution of incomes. Of course, this effect is valid in the case of the existence of a system of progressive taxation or of a system of social transfers, which is oriented toward social inclusion. Moreover, Huang et al. concluded that an increase in the progressivity of labour income tax facilitates a rise in the economic growth rate and a fall in income disparities [

15]. The authors also assessed the consequences of increasing capital income tax progressivity and found that, usually, this is associated with a fall in both income inequality and economic growth. In fact, their study confirms that the progressivity of labour income tax is one of the main ways of reducing income inequality while boosting economic growth.

Other authors examined the relationship between inequality and growth and found that a Gini coefficient value between 0.25 and 0.40 promotes growth if the dynamics of income inequality is positive [

16]. According to the United Nations Development Program, increasing inequality leads to a reduction in economic growth when the Gini coefficient value exceeds 0.45 [

17]. In addition, Cho et al. analysed this relationship in 77 countries between 1980 and 2007 and demonstrated that the maximum threshold of the Gini coefficient which favours a positive relationship between the studied concepts is 0.245 [

18]. The determination of the Gini coefficient threshold depends on the country selection and the analysed period. This evidence was also confirmed by Petersen and Schoof, who found that increasing income inequality can lead to both an increase in the economic growth rate and a reduction in it, the effect depending on the dimension of the income gap [

19]. In addition to this, Henderson et al. stated that the negative relationship between inequality and economic growth becomes robust when the inequality drop is significantly large [

20]. However, their study and other research indicated a positive relationship in advanced countries (where inequality is constant or decreases) and a negative one in transitional economies (where inequality increases with high rates) [

21].

The positive linkage between income inequality and growth was also confirmed in the case of the US during the period between 1953 and 2008 [

22]. Nevertheless, when discussing the different effects of inequality on growth, we should also consider the structure of income inequality and the distinction between its forms. In this context, many authors showed that the inequality of effort is growth-friendly, while the inequality of opportunities is detrimental to growth [

23,

24,

25]. From another point of view, a significant determinant of the different effects of income inequality on growth consists in the intergenerational mobility [

26]. The authors stated that the negative impact of the income gap on economic growth is higher when the intergenerational mobility (used as a proxy for equality of opportunity) is lower, since the inequality of opportunity may affect the incomes obtained by poor households and, implicitly growth [

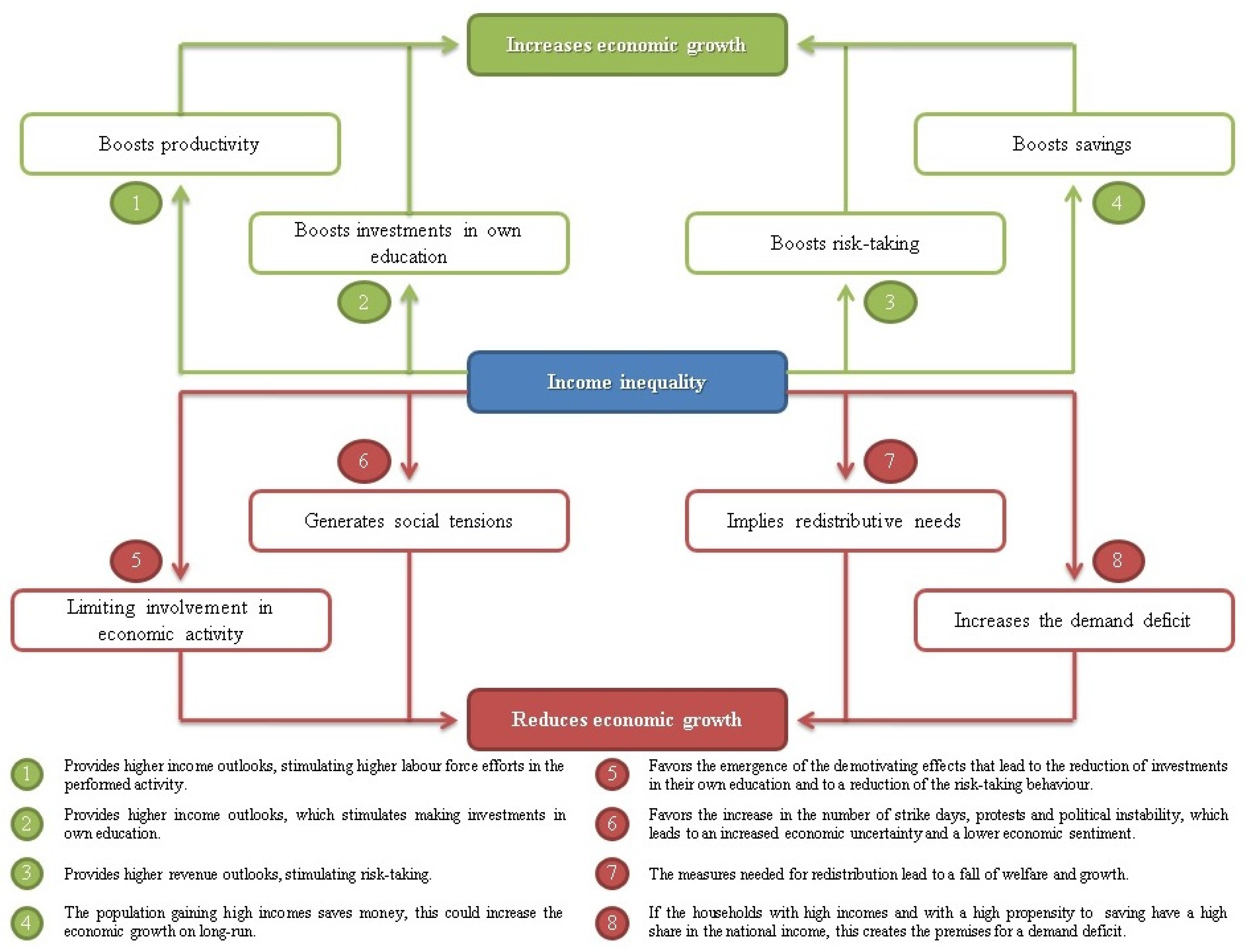

27]. The main reasons proving both the negative and positive relationship between income inequality and economic growth were highlighted in

Figure 1.

Other studies have shown the existence of a negative relationship between income inequality and economic growth. In this respect, Stiglitz concluded that income inequality slows down economic growth due to the reduced aggregate demand for low-income individuals [

28]. According to an OECD study, inequality diminishes people’s confidence in markets and free trade, which may jeopardize long-term economic growth and macroeconomic stability [

29]. The analysis shows that high levels of income inequality reduce confidence in national governments and institutions, and diminish the political space for implementing reforms, which undermines the economic growth potential. Of course, inequality may adversely impact growth through the channel of social or political instability [

5], but in most cases, its impact becomes visible in a couple of years [

30]. Generally, the studied literature supports the hypothesis that income inequality is harmful to economic growth, especially when it is perceived as unjust and insurmountable by the population [

31].

Shin confirmed the negative impact of inequality on growth in countries with low development levels and proved its positive effects in the case of countries in advanced development stages [

3]. The negative effect of income inequality on economic growth remained valid when Vo et al. examined the middle-income countries by applying a GMM model on 86 middle-income countries [

32], but also when Kim applied a GMM and a fixed effects model on 40 OECD countries during the period 2004–2011 [

33]. Other authors supported the conclusion that the effect of income inequality on economic growth varies according to the level of development, however, their findings were limited to the negative relationship between the mentioned variables [

34]. The study also shows that in high-income countries, there is no significant correlation between inequality and economic growth, given that opportunities are equally distributed, however, redistribution through taxes and social transfers is beneficial for growth in underdeveloped countries and unfavourable in developed countries. The same authors indicated (in another study) that increasing inequality is detrimental to growth since it affects investment and the share of the educated population but also increases the fertility rate [

35]. The literature in this field also confirms that high levels of income inequality are associated with periods of slowing economic growth [

36]. Other authors stated larger income gaps are associated with an increase in the short-term economic growth, and therefore with a long-term slowing down [

4].

Economic views are also divergent when studying the impact of economic growth on income inequality. Maintaining its consistency, Kuznets claimed the existence of a positive effect of economic growth on income inequality in low-income per capita states, and accordingly, a negative effect in the later stages of development [

11]. This conclusion has been also supported by other researchers [

37,

38,

39], however, it was rejected by Sayed and Ping, who confirmed an “N” shape of the long run relationship between income inequality and economic growth [

40], the Kuznets curve being the most important theory proving the existence of this effect.

Bahmani-Oskooee and Gelan assessed the impact of economic growth on the distribution of income in the US economy and found that, in the short run, economic growth is associated with increased income inequality, while in the long run, the impact is negative [

41]. There were also other studies focused on assessing the long run growth effect on inequality in the US (covering the 1945–2004 period and using a PMG model) [

42], which confirmed that high growth volatility is positively linked with income inequality. In fact, they concluded that the impact of growth volatility on inequality is only significant when the economic growth rate is positive. However, other studies show that there is no well-defined relationship between economic growth and income inequality [

43,

44]. This finding was also supported by Thewissen, but the author demonstrated a positive effect of top income shares on economic growth [

45].

Following the examination of the economic literature, we found strong evidence proving that the relationship between income inequality and economic growth was positive in EU developed countries and negative in EU developing countries. Strong evidence from the economic literature confirming this hypothesis also implies that starting a discussion on the way forward, but this should be focused on the case of EU developing countries, since their situation is more challenging and vulnerable. The first recommendation consists of improving the quality of institutions [

46], but this is the most difficult one to implement as a consequence of the resistance to a change in the parties benefiting from the exclusive institutions. It is worth mentioning that this orientation is extremely wide and could imply many reforms in several fields, including the improvement of labour market institutions. Many authors stated that the engagement of countries to reduce inequality should start with the identification process of vulnerable groups in the labour market [

47], as well as with the human development process based on better educational systems [

48]. Remaining connected to the topic of this paper, we found that the minimum inclusion income or its reform is extremely used as a recommendation for developing countries by several international bodies, including the ones representing the EU (e.g., European Commission).

The idea of ensuring a minimum inclusion income, unique or not, at the European level, is a formula of real identity of the European model, an adaptive model in its evolution to global developments as regards economic and social needs. In fact, the concern to ensure a minimum inclusion income is both an expression of the relatively recent concerns of creating a harmonious economic space developed throughout the European Union and another formula that seeks to eliminate the effects of social injustice.

Arguments for standardizing the value of a minimum income are often political, and for this reason, discussing these issues becomes not only appropriate but also necessary. The targeted effects of a minimum income for inclusion are mainly of a social nature, ensuring a decent standard of living for all citizens of the European Union. The fact that the word “decent” is not a scientific term, but one that defines a social convention, makes it impossible to investigate the final impact of introducing a minimum inclusion income, unique for the whole geographical area of the EU. The economic effects of minimum income compared to social assistance measures are at least debatable [

49], while the beneficial effects in the field of labour are not contested by economic theory.

Regarding the literature gaps, an unexplored effect in the quantitative assessment of this paper is that exerted by the quality of institutions on the relationship between income inequality and economic growth. This may be good orientation for our further work. In addition, omitting other factors such as intergenerational mobility, inequality of opportunity may generate misspecification in the assessment process. However, including such factors in a model may raise additional issues as a consequence of the endogeneity risk or of the difficulty in measuring such indicators. Moreover, the literature focuses strictly on the Gini coefficient as a proxy for income inequality, and more emphasis should be placed on other measures of income inequality (such as the Theil index, the Atkinson index, the Palma ratio).

3. Materials and Methods

Through this section, we described the methodology framework used to assess the relationship between income inequality and growth. The statistical data were extracted from the Eurostat database covering the period 2010–2018 (yearly data) for EU-28 [

50]. The reason for using this time period was that we focused on the post-2009 economic shock period, since the integration of pre-crisis data in the dataset may be theoretically wrong and could facilitate spurious results of the regression as the crisis led to a structural change in the economy and society. Even if a distinct assessment of the pre-crisis period would have been beneficial, we limited our study to the post-2009 economic shock period taking into consideration the low availability of data for Croatia. Moreover, we used EU-28 data, since Brexit took effect in 2019, while the time period used in this study is 2010–2018.

First, we computed two clusters using the average GDP per capita expressed in the purchasing power, standard over the period 2010–2018, to derive the level of development. In this context, the EU-28 countries registering a GDP per capita (PPS) below the median of this criterion were categorized in the group of developing EU Member States, while the cluster of developed EU Member States was composed of the countries which registered higher values of this indicator than the median. To verify whether the level of development exercises an effect on the relationship between income inequality and growth, we estimated an econometric model using the same methodology for each cluster. The statistical data used were reported in

Table 1.

The structure of the model was decided according to the stationarity results we obtained with the summary technique, which provides a broader view of the main results of the relevant tests for stationarity, as (i) Levin, Lin and Chu t*; (ii) the Breitung t-stat; (iii) Im, Pesaran and Shin W-stat; (iv) ADF—Fisher Chi-square; and (v) the PP—Fisher Chi-square. The mentioned tests were performed using the Schwarz information criterion for selecting the appropriate lag. Since the variables used proved to be stationary at level and first difference, we decided to follow a classical approach by including in the model the first difference of the variables stationary at I(1) and the current data series for the variables stationary at level. We made these transformations to work with stationary variables since this approach provides better results and reduces the likelihood of encountering issues related to autocorrelation between residuals. In addition, we added some lags in the model, according to the economic theory, to better catch the effects that are usually transmitted over a period of 1 year.

Following the stationarity checking process, we used the redundant fixed effects–likelihood ratio test to check the compatibility with a fixed effects model (FEM) or a random effects model (REM), the results recommending the use of an FEM. In this context, we applied the estimated generalized least squares method with fixed effects in Eviews 9.0.0.0 software—which was also reinforced by the cross-section weights option and White cross-section covariance (tools used to increase the consistency of the estimators and to restrict the existence of heteroskedasticity to low dimensions—cross-section SUR, another option that addresses the heteroskedasticity issues, is not appropriate for models with a number of cross-sections which is higher than the number of observations per cross-section)—on Equation (1):

where:

is economic growth, represents the first difference of Gini coefficient lagged by one year, reflects the annual average rate of inflation lagged by one year, is the percentage change of gross capital formation to catch the impact of investments on growth, reflects the first difference of the high-tech exports share in total exports and refers to the first difference of the employment rate of people ending their tertiary education studies 1–3 years ago (20–34 age group). In addition, represents the residuals, while , ..., are the impact coefficients.

Then, in line with the fixed effects model (FEM) features, we added 13 dummy variables in the initial equation to enhance the estimation (FEM literature indicates adding a number of dummy variables equivalent to the number of cross-sections—1), as Equation (2):

where

, ...,

represents the intercepts of the dummies,

, ...,

are the new coefficients and

is the new residuals series.

Furthermore, we checked the Gauss–Markov hypotheses related to the maximum verisimilitude of the estimators. In this respect, we first verified the statistical validity of the model using the Fisher test. The next series of hypotheses we checked were related to the residuals. Initially, we analysed the distribution of the residuals using Jarque–Bera to check whether these were normally distributed. Afterward, we examined the possibility of cross-section dependence (which is not favourable to BLUE—best linear unbiased estimators) using Breusch-Pagan LM, Pesaran scaled LM, bias-corrected scaled LM, Pesaran CD and Friedman Chi-square tests. Then, we verified the absence of heteroskedasticity using the Breusch–Pagan–Godfrey test, but this has been performed in Microsoft Office Excel 2016, since this calculation is not available in Eviews 9.0—Panel window. In order to obtain the probability of the test which confirms the hypothesis of homoskedasticity—to the detriment of heteroskedasticity, we estimated Equation (3):

where

are the coefficients of the equation,

represents the residuals term, and

is the square of the residuals term obtained from Equation (2). Then, we used the R-squared value from Equation (3), as Equation (4):

where

= number of observations taken into consideration in Equation (3).

The probability of the test was calculated in Excel 2016, using Equation (5):

where df = degrees of freedom which is equivalent to the number of exogenous variables, excepting the constant = 5.

The last hypothesis related to the residuals we have tested is the absence of autocorrelation between these. Eviews does not allow this calculation in the panel window. Therefore, we estimated Equation (6):

To compute the Breusch–Pagan–Godfrey probability, we followed the same method presented above, and in this context, we used the CHISQ.DIST.RT function with the following arguments: (i) the R-squared of the equation, multiplied by the number of observations used in this equation; (ii) df = the number of lagged residuals from Equation (6).

Furthermore, we used the Klein criterion to verify the existence of multicollinearity, which is rejected if the Pearson correlation between the exogenous variables is lower than the R-squared obtained in Equation (2). However, even if the maximum verisimilitude hypotheses are validated, there is also a need to check the robustness of the estimation. In this context, we tested the robustness hypothesis following an approach used in a study, which tried to identify whether the final results were influenced by the inclusion of one year or one country in the model [

51]. Therefore, in line with their methodology, we estimated one distinct model for each year that we excluded from the analysis covering the period 2010–2018 (9 models for each cluster and 18 models in total). As we mentioned above, we also followed the authors’ approach in estimating different models for each cross-section that we excluded from the analysis (14 models for each cluster and 28 in total). In sum, we performed the robustness test by estimating 46 additional models (using the same methodology we described above—estimated generalized least squares method with fixed effects reinforced by the cross-section weights option and the White cross-section covariance) to check whether the final estimators were influenced by some temporary or geographical features and developments.

4. Results

In this section, we provide the main results of our study. First, we used the GDP per capita expressed in the purchasing power standard to split the European Union into two groups of countries catching different stages of development. In this context, one group includes the developed EU Member States, while the other is formed by the developing EU Member States. As can be seen in

Table 2, ES, IT, MT, FR, UK, FI, BE, SE, DE, AT, DK, NL, IE, and LU forms the Developed EU Member States cluster, while the Developing EU Member States group is formed by the remaining EU countries.

Subsequently, we estimated the impact of income inequality on growth in the case of each cluster designed (

Table 3) using EGLS with fixed effects, since this is the most appropriate method according to the Redundant Fixed Effects—Likelihood ratio test, its corresponding probabilities being lower than 5% (

Table 4).

We found that income inequality has a positive impact on growth in developed EU countries, but it is also detrimental to growth in developing EU countries. According to the results, an increase in the first difference of the Gini coefficient lagged by one year with one deviation point leads to a hike in the economic growth equivalent to 0.21 percentage points in developed EU countries. Conversely, we estimated a negative effect on growth of −0.33 percentage points. At first sight, our results may seem strange, but these are in line with the literature review in this field, since in developed EU countries, income inequalities are mostly generated by risk-taking behaviour and the greater implication of some individuals in economic activity, which are also favourable to growth. On the other hand, in developing EU Member States, income inequality has a negative impact on economic growth, since these kinds of countries generally have low-quality institutions which promote welfare losses, providing benefits to the elite or to restrained interest groups.

In addition, the tax systems from developed EU countries have a high level of progressivity, which reduces the income gap between individuals while limiting economic growth, since the increase in tax rates slows down the economic growth rate. This argument confirms a positive effect of income inequality on economic growth. On the other hand, some developing EU countries still use the flat tax rate and are more open to modify the labour force or consumption taxes. As a consequence, the progressivity of tax systems may not neutralize the effect of some fiscal policies that generally affect the socially vulnerable groups, which increases the dimension of income inequality and lowers the economic growth rate.

We enhanced our estimation by adding some control variables, such as the inflation rate, the percentage change of gross capital formation, the share of high-tech exports in total exports and the employment rate of people ending their tertiary education studies 1–3 years ago (20–34).

Considering the impact of prices, we found that an increase in the inflation rate of the previous year by one percentage point has led to a fall in the current economic growth by −0.33 percentage points in developing EU Member States. The negative effect is in line with the economic theory since the increase in prices reduces the aggregate demand, which also is detrimental to growth. Even if, from the perspective of aggregate supply, the increase in prices may also generate additional revenues at the corporate level, the effect could be reversed at a different point in time since the low demand may affect the aggregate supply. In addition, inflation also affects economic growth through the uncertainty channel.

In the case of developed EU Member States, we found a higher impact (−0.58 percentage points) than the one mentioned above. The main reason arguing this impact difference consists in the fact that the capacity of uncertainty to impact the economic sentiment is greater in developed EU countries, which stands at the core of the Economic and Monetary Union, these being more stable in terms of inflation. In addition, a shock in the evolution of inflation could increase the perception of risks, as linkages in the Euro Area are more prominent than the ones between the non-Euro Area Member States. Theoretically, non-Euro Area Member States need to prove their macroeconomic stability before accessing the Euro Area, but usually, these are the top of EU countries recording high inflation rates. It is worth mentioning that only four non-EA countries registered an annual inflation rate below 2% in 2019 (European Central Bank target), while 14 EA Member States were in line with the ECB target. In this context, the investors and consumers are expecting stable price developments, but this aspect increases the vulnerability of growth to price developments when a shock occurs. From another point of view, price changes at the level of the Eurozone generate more uncertainty which makes people act according to these risks.

Furthermore, we found that an increase in the percentage change of gross capital formation with one percentage point raises the economic growth by 0.11 percentage points in developed EU countries. However, the impact is a little higher in the case of developing EU Member States (0.14 percentage points), which indicates a greater multiplier effect of investments on growth in that group of countries.

On the other hand, we demonstrated that an increase in the first difference of the share of high-tech exports in total exports with one percentage point has a positive impact on growth of 0.16 percentage points in developing EU Member States, which is higher than the one we found in developed EU countries (0.15 percentage points). This effect is easy to argue since technological progress is one of the factors that enhances growth potential. However, the impact difference is quite low, but our results indicate an additional reason for Developing EU countries to engage in high-tech activities to support growth and resilience.

We also estimated the impact of the tertiary employment rate on economic growth. As

Table 3 indicates, we found that an increase in the first difference of employment rate of people ending their tertiary education studies 1–3 years ago (aged between 20–34) with one percentage point enhances the economic growth with 0.08 percentage points in developing EU Member States and 0.07 percentage points in developed EU countries. Tertiary education is more correlated with growth than other levels of education, such as primary or secondary education, whilst also being a significant driver of potential growth and human development. Nevertheless, there are no significant differences between the coefficients.

In sum, our results show that all coefficients are statistically significant at 1%, except the Gini coefficient which is significant at 5% in each model. The results also show that the selected independent variables explain 84.24% (developing EU Member States) and 88.21% (developed EU countries) of the evolution of the dependent variable, the high values of R-squared also proving that we properly selected the explanatory variables. Moreover, the models we estimated are statistically valid since the probabilities of the Fisher test are lower than the significance threshold (5%).

To verify the hypothesis of the maximum verisimilitude of the estimators, we performed additional tests related to the residuals (

Table 4). First, we confirmed the hypotheses of no serial correlation and homoskedasticity since their corresponding tests (Breusch–Pagan and Breusch–Pagan–Godfrey) indicate probabilities higher than 5% for both models.

We then used five tests (Breusch–Pagan LM, Pesaran scaled LM, bias-corrected scaled LM, Pesaran CD, and Friedman Chi-square) to check the dependence between cross-sections. According to the results obtained, four of the five tests confirmed the null hypothesis stating that there is no dependence between cross-sections in both cases; this result is supported to a greater extent.

Finally, in

Table 4, we provided the result of the Jarque–Bera test, which proves that residuals are normally distributed, this being the last required criterion for confirming the maximum verisimilitude hypothesis. This confirms that the estimators were properly selected and the results are robust, which supports high confidence in the obtained impact coefficients.

Regarding the robustness testing, we presented the results of the 44 models performed to check this hypothesis (

Appendix A and

Appendix B). Following this estimation, it is clear that there are no significant large-scale differences between the results obtained in the 28 models where we have run one separate model for each country excluded and the ones we obtain in the baseline model. This confirms that the relationships between variables from the baseline model were not placed on a different path as a consequence of some national specificities or developments. However, when we gradually removed one year from the analysis, in most cases, the results proved to be similar to the ones of the baseline model, but we found two exceptions, these being related to the years 2012 and 2015. In 2015, the coefficient of the share of high-tech exports in total exports (developed EU Member States cluster) had a different sign compared to the one from the baseline model, but this difference may be ignored as the coefficient became insignificant when this year was extracted. Nevertheless, when 2012 is removed, there are three coefficients that change their sign: the share of high-tech exports in total exports and inflation rate (developing EU Member States cluster), respectively, the employment rate of people ending their tertiary education studies 1–3 years ago (developed EU Member States).

Theoretically, this raises the possibility that the final results are influenced by the 2012 data. However, we took a look into the details of both clusters, and we found the presence of autocorrelation when we removed the 2012 data (Breusch–Pagan test: 0.038 prob.—developing EU Member States; 0.005 prob.—developed EU Member States), which confirms that we cannot trust these results, since the coefficients obtained in the model without 2012 data are spurious. In addition, removing one year in separate models until all years are removed may not be a useful approach in this case, as the estimated coefficient covariance matrix becomes of reduced rank. Taking into consideration all the arguments provided, we are confirming the robustness and verisimilitude of the results, the main finding being related to the justification of a negative relationship between inequality and growth in the case of developing EU Member States and a positive one in the case of developed EU Member States.

5. Conclusions

Our paper shows that income inequality impacts economic growth differently, depending on the country’s level of development. In this context, we found a positive impact of income inequality on growth in the developed EU Member States. On the other hand, the relationship between income inequality and economic growth proved to be negative in the case of developing EU Member States. This can be explained by the fact that income inequalities are mostly generated by risk-taking behaviour and the greater implication of some individuals in economic activity in developed EU countries (which is also favourable to growth) while developing EU countries are associated with low-quality institutions which extract wealth from the population and provide benefits to the elite or restrained interest groups. Low-quality institutions are detrimental to growth since these lower the economic expectations of individuals.

In addition, the tax systems of developed EU countries have a high level of progressivity, which reduces the income gap between individuals while limiting the economic growth since the increase in tax rates slows down the economic growth rate. This argument confirms a positive effect of income inequality on economic growth. On the other hand, some developing EU countries still use the flat tax rate and are more open to modify the labour force or consumption taxes. As a consequence, the progressivity of tax systems may not neutralize the effect of some fiscal policies that generally affect the socially vulnerable groups, which increases the dimension of income inequality and lowers the economic growth rate.

This provides important evidence for the need to promote an optimal level of income inequality, which shall be in line with its social supportability. The main policy recommendations are related to the improvement of institutions’ quality and the establishment of a minimum inclusion income, which may facilitate the achievement of the social inclusion objectives and increase the level of sustainable development. However, we did not test the relationship between income inequality and growth in the long run, our findings and results being limited to short run interpretation.

The analysis was enhanced by using other control variables for growth. Our results show that there are no differences between the signs of the impact coefficients of the independent variables (excepting the Gini coefficient) on growth obtained for each model. In this respect, we found a negative relationship between economic growth and the inflation rate lagged by one year, and a negative one between the dependent variable and the percentage change of gross capital formation, and thus also for the high-tech exports share in total exports. In addition, we also confirmed a positive relationship between the employment rate of people ending their tertiary education studies 1–3 years ago and economic growth in both models. Finally, following the methodology used, we confirmed the robustness of the results and the maximum verisimilitude of the estimators.

However, there are some limitations regarding the interpretation of the results since we estimated a unique impact of the income inequality on economic growth for each development cluster. In this context, the impact coefficients are valid only when the full country-group composition is examined. Identifying individual coefficients at the country level is not the subject of this study since our work attempted to determine whether the national level of development may change the sign of the relationship between income inequality and economic growth. Nevertheless, studying individual country effects may bring a value-added in our further work. Another limitation consists in the fact that there is too much focus on income inequality measured through the Gini coefficient, and more progress may be made in our further work by taking into consideration other indicators catching the level of income inequality (such as Theil index, Atkinson index, Palma ratio).