Appendix A.1. Proof of Section 4

We consider the asymmetrical case that both manufacturers offer different prices for their respective products, without loss of generality, we assume

. In other words, we investigate whether the manufacturers have the motivation to deviate the symmetrical equilibrium unilaterally. In this case, all consumers in spoke (

,

) will buy product T1. Thus, the demands are

and

. Both manufacturers solve the maximization problems as follows, respectively:

We firstly solve M1’s problem, given , which leads to the response functions (i) if and (ii) if , that is, this case degenerates to the symmetrical case. Then, we solve M2’s problem leading to (i) if and (ii) if , that is, this case degenerates to the symmetrical case. By combining the above cases, it yields that and should sustain simultaneously, which leads to and ; under which the constraints of and can never be satisfied, hence there is no asymmetrical equilibrium exists. That is, both manufacturers will not deviate from symmetrical equilibrium.

Appendix A.2. Proof of Lemma 1

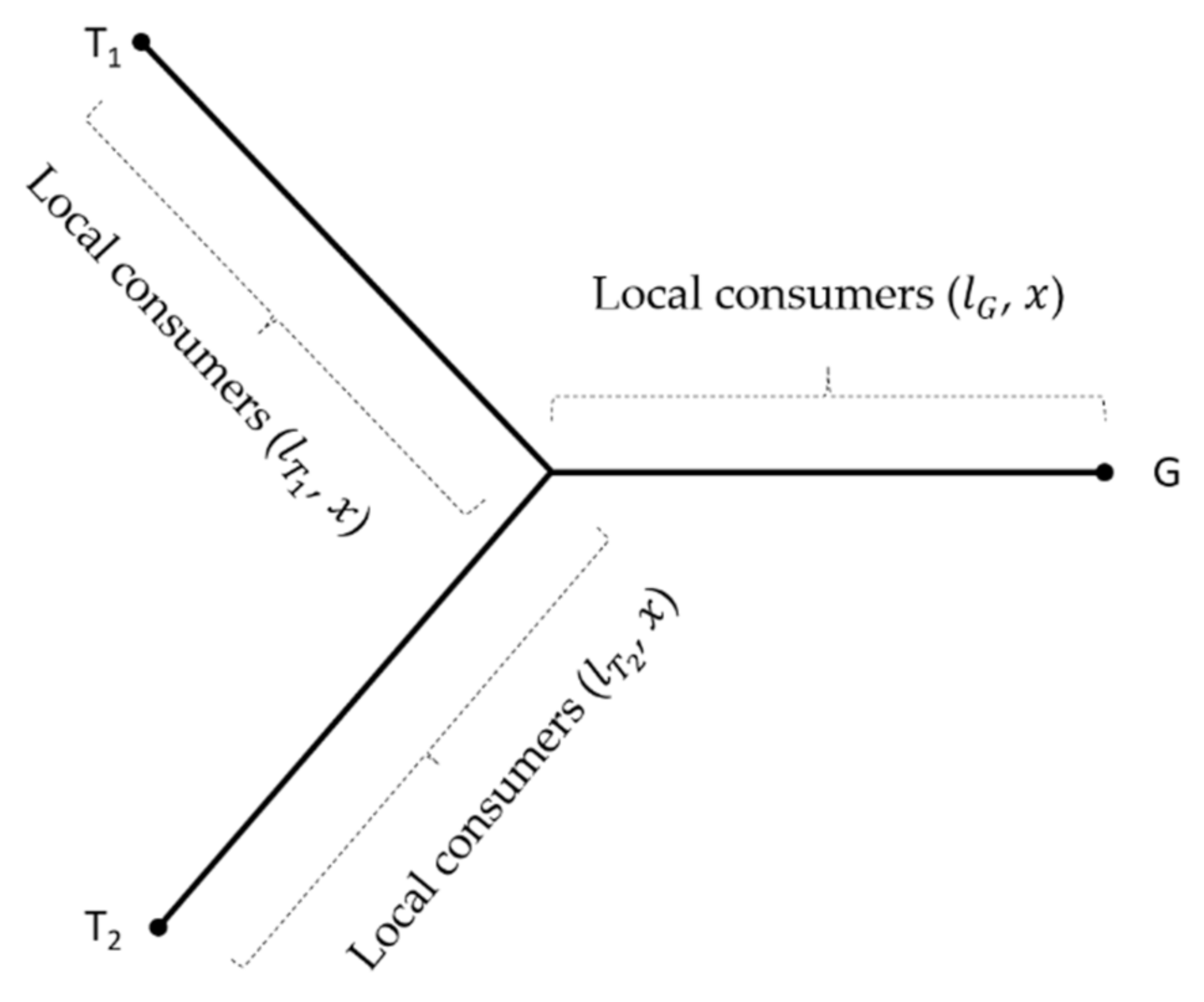

In this case, the platform sets a relatively low price so that all consumers in line (

,

) will buy their preferred green product. By contrast, some consumers who are adjacent to the center in line (

,

) will also buy the green product. Thus, the marginal consumer who is indifferent between the products

and G (i.e.,

) locates at the line (

,

). That is,

. Thus, for the consumers in line (

,

), those with

will buy the product

, while those with

will buy the product G. All the consumer in line (

,

) will buy their preferred product G. Therefore, in this case, the demand for green product

and traditional product

are as shown as Equations (1) and (2) respectively. The firms’ profit functions are

and

, where

. Next, we use backward induction to solve the equilibrium solution in this case. In the second stage of the game, the firms solve the profit maximization problems as below:

Subject to:

Notice that in this case consumers in (

,

) will consider products

and G only, hence each manufacturer will solve her profit maximization problem separately and simultaneously, while all consumers in (

,

) will consider product G only. Without loss of generality, we firstly solve M1 and platform’s problems with respect to

and

as below:

Subject to:

For ’s maximization problem, the first-order condition of yields . requires . Hence, we can obtain (1.a) if , and (1.b) If .

For ’s maximization problem, the first-order condition of yields ; requires . Hence, we can obtain (2.a) if , and (2.b) If . So, we have four possible combinations to consider. (1) Combination 1: Scenario (1.a) v.s. (2.a). By jointly solving and , we have ; both and requires . (2) Combination 2: Scenario (1.a) v.s. (2.b). By jointly solving and , we have and ; always sustains, while requires . (3) Combination 3: Scenario (1.b) v.s. (2.a). By jointly solving and , we have and ; requires , while always sustains. (4) Combination 4: Scenario (1.b) v.s. (2.b). In this combination, since both solutions are corner solution, it is clear that it dominated by the above respective case under all possible range of . So, this combination is infeasible. Per the property of symmetricity, we can obtain the same solution for M2 and E, so, for each combination above, we can obtain (i) and if ; (ii) and if ; and (iii) and if . When , for the above solution (ii), we have and ; for the above solution (iii), we have we have and . One can quickly obtain that and under , thus solution (iii) is not available.

Appendix A.3. Proof of Lemma 2

In this case, the demands

,

, and

are represented by Equations (3)–(5), respectively. The firms’ profit functions are

and

, where

. Depending on the relation between prices of products T1 and T2, that is,

and

, the firms face two formulations of the demand function. Next, we use backward induction to solve the equilibrium solution case by case. First, we use backward induction to seek the symmetrical equilibrium. In the second stage of the game, the firms solve the profit maximization problems as below:

Subject to:

Notice that in this case consumers in line (

,

) will consider product

only, while consumers in line (

,

) will consider both products G and

. Hence each manufacturer will solve her profit maximization problem separately and simultaneously. Without loss of generality, we firstly solve M1 and E’s problems with respect to

and

as below:

Subject to:

For ’s maximization problem, the first-order condition of yields . requires . Hence, we can obtain (1.a) if ; and (1.b) If . For ’s maximization problem, the first-order condition of yields ; requires . Hence, we can obtain (2.a) if , and (2.b) If . So, we have four possible combinations to consider: (1) Combination 1: Scenario (1.a) v.s. (2.a). By jointly solving and , we have and ; both and requires . (2) Combination 2: Scenario (1.a) v.s. (2.b). By jointly solving and , we have and ; always sustains, and requires . (3) Combination 3: Scenario (1.b) v.s. (2.a). By jointly solving and , we have and ; requires , and always sustains. (4) Combination 4: Scenario (1.b) v.s. (2.b). In this combination, since both solutions are corner solution, it is clear that it dominated by the above respective case under all possible range of . So, This combination is infeasible.

Per the property of symmetricity, we can obtain the same solution for M2 and E, so, for each combination above, we can obtain (i) and if ; (ii) and if ; and (iii) and if . When , for the above solution (ii), we have and ; for the above solution (iii), we have we have and . One can easily obtain that and under , thus solution (ii) is not available.

Next, we check the case of Asymmetrical pricing (

,

). In this case, without loss of generality, we let

. Notice that in this case consumers in line (

,

) will consider product

only, those in line (

,

) will consider both

and

, those in line (

,

) will consider products G and

.

Subject to:

By looking into , one can see that is independent in ; the first-order condition of yields which always holds for M2. We then solve M1 and E’s problems with respect to and as below. For ’s maximization problem, the first-order condition of yields . requires . Hence, we can obtain (1.a) if , and (1.b) If . For ’s maximization problem, the first-order condition of yields . requires . Hence, we can obtain (2.a) if , and (2.b) If . Since always holds, we first consider all combinations for and as below: (1) Combination 1: Scenario (1.a) v.s. (2.a). By jointly solving and , we have and ; both and require . (2) Combination 2: Scenario (1.a) v.s. (2.b). By jointly solving and , we have and ; always sustains, and requires . (3) Combination 3: Scenario (1.b) v.s. (2.a). By jointly solving and , we have and ; requires , and always sustains. (4) Combination 4: Scenario (1.b) v.s. (2.b). In this combination, since both solutions are corner solution, it is clear that it dominated by the above respective case under all possible range of . So, this combination is infeasible.

Plugging in each combination, we can obtain: (i) ; always sustains, and requires ; (ii) , can never sustain, thus this solution is infeasible; and (iii) , can never sustain, thus this solution is infeasible. When , for the above solution (i), we have and .

To compare M2’s solutions in the above symmetrical pricing case as below: (1) If , then . Since and under , we obtain . (2) If , then . Since , thus we obtain . In summary, M2 owns no incentive to increase the retail price, hence the asymmetrical pricing case is infeasible.

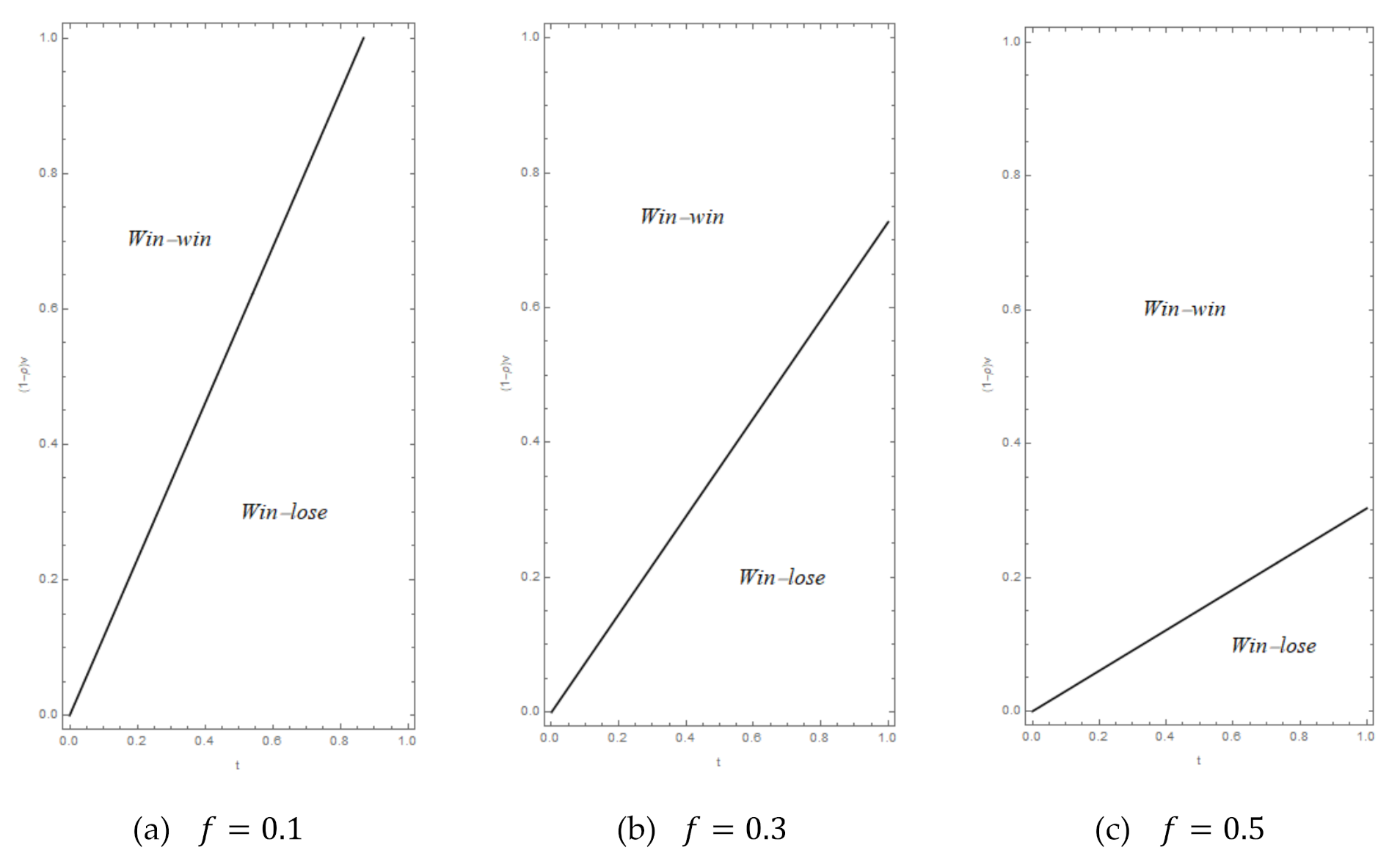

Appendix A.4. Proof of Proposition 1

Since under support , the following analysis has three cases. (1) When , we have . Since holds, we thus obtain . Furthermore, we have . Since holds, we thus obtain . Therefore, in this case, all firms prefer Case (2). (2) When , we have and . Since , we thus obtain and . Therefore, in this case, all firms prefer Case (2). (3) When , we have . Since , we thus obtain (i) if or ; (ii) if . Furthermore, we have . Since , we thus obtain (i) if or ; (ii) if . Since . To summarize the above outcomes and we obtain Proposition 1, where , , , and .

Appendix A.6. Proof of Proposition 3

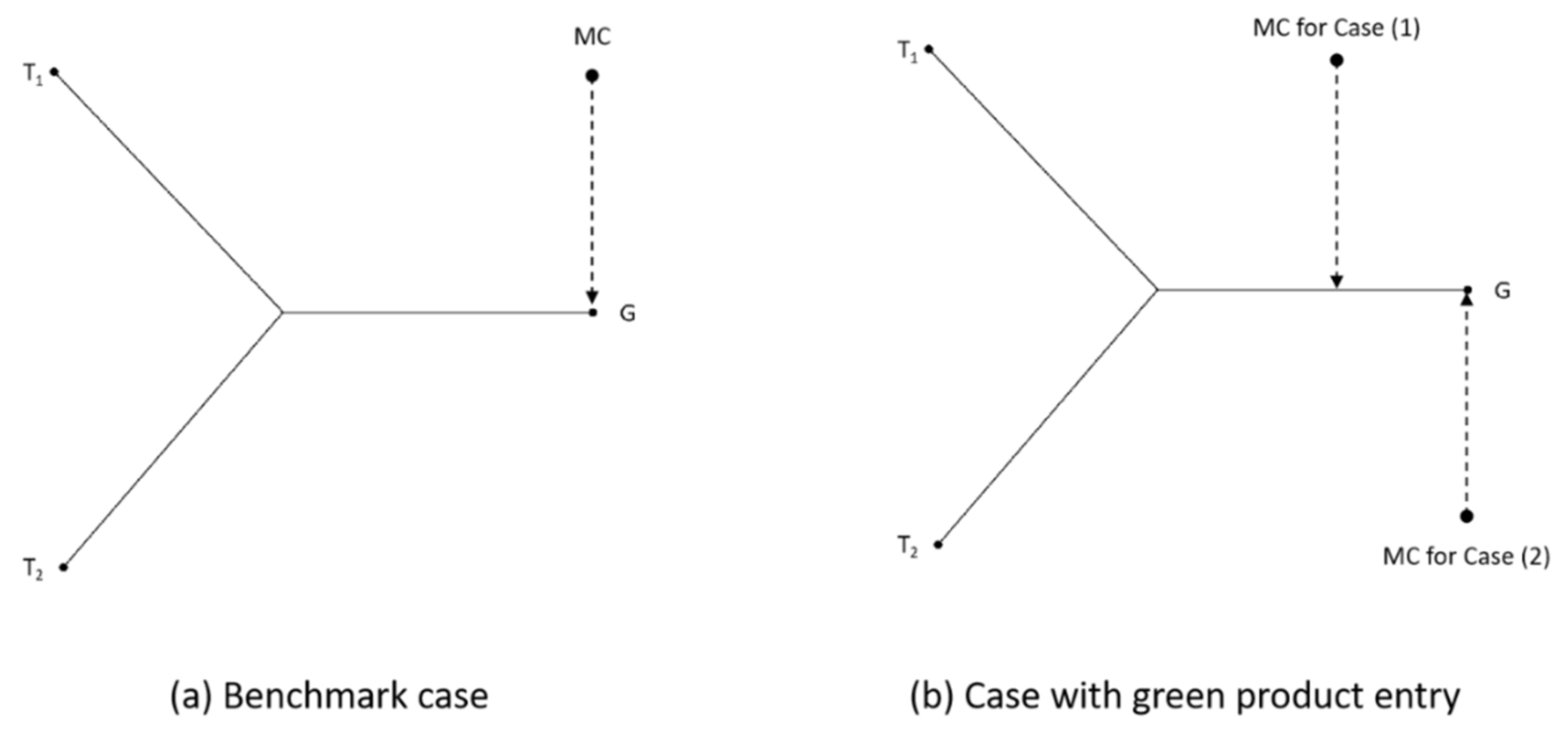

Follow the same process with the basic model, in this case the results are summarized in below Lemma for Case (1), i.e., .

Lemma A.1. For Case (1), there is a unique set of solutions for the firms’ optimal prices and profits: (i) if , such that , , , , , and ; (ii) if , such that , , , , .

For case (2), i.e., or , . First, given the symmetrical pricing for manufacturers, by following the same process with the basic model we can obtain (1) if such that , , , and ; (2) if , such that , , , and .

Second, given the asymmetrical pricing for manufacturers, by following the same process with the basic model we can obtain (1) if , such that , , , and ; (2) if , such that , , , and .

Next, given , we compare the equilibrium between symmetrical pricing and asymmetrical pricing as below: (1) When , we have , Since , we thus obtain ; (2) When , we have . Since , we thus obtain ; (3) When , we have . As a result, we can see that the subcase of asymmetrical pricing is dominated by that of symmetrical pricing. Thus, either manufacturer has no incentives to deviate symmetrical pricing. Thus, the optimal solutions under Case (2) are summarized in the following Lemma.

Lemma A.2. For Case (2), there is a unique set of solutions for the firms’ optimal prices and profits: (i) if , such that , , , , , and ; (ii) if , such that , , , , and .

Next, we will compare the outcomes stated in Lemma A.1 and Lemma A.2, and then find out firms’ optimal strategies under green product entry. Since under support , the following analysis has three cases. (1) When , we have . Since and , we thus obtain (i) if ; and (ii) if ; Since and , we thus obtain (i) if ; and (ii) if . As a result, since , we obtain that (i) and if ; (ii) and if ; and (ii) there exists no equilibrium if . (2) When , we have . Since , we have . Furthermore, since and , we have . (3) When , since and and , we have (i) if ; and (ii) if . Since and and , we have (i) if ; and (ii) if . As a result, since we have (i) and if ; (ii) and if ; and (iii) and if , thus these exist no equilibrium in this case.