Sustainable Development with Schumpeter Extended Endogenous Type of Innovation and Statistics in European Countries

Abstract

1. Introduction

2. Literature Review

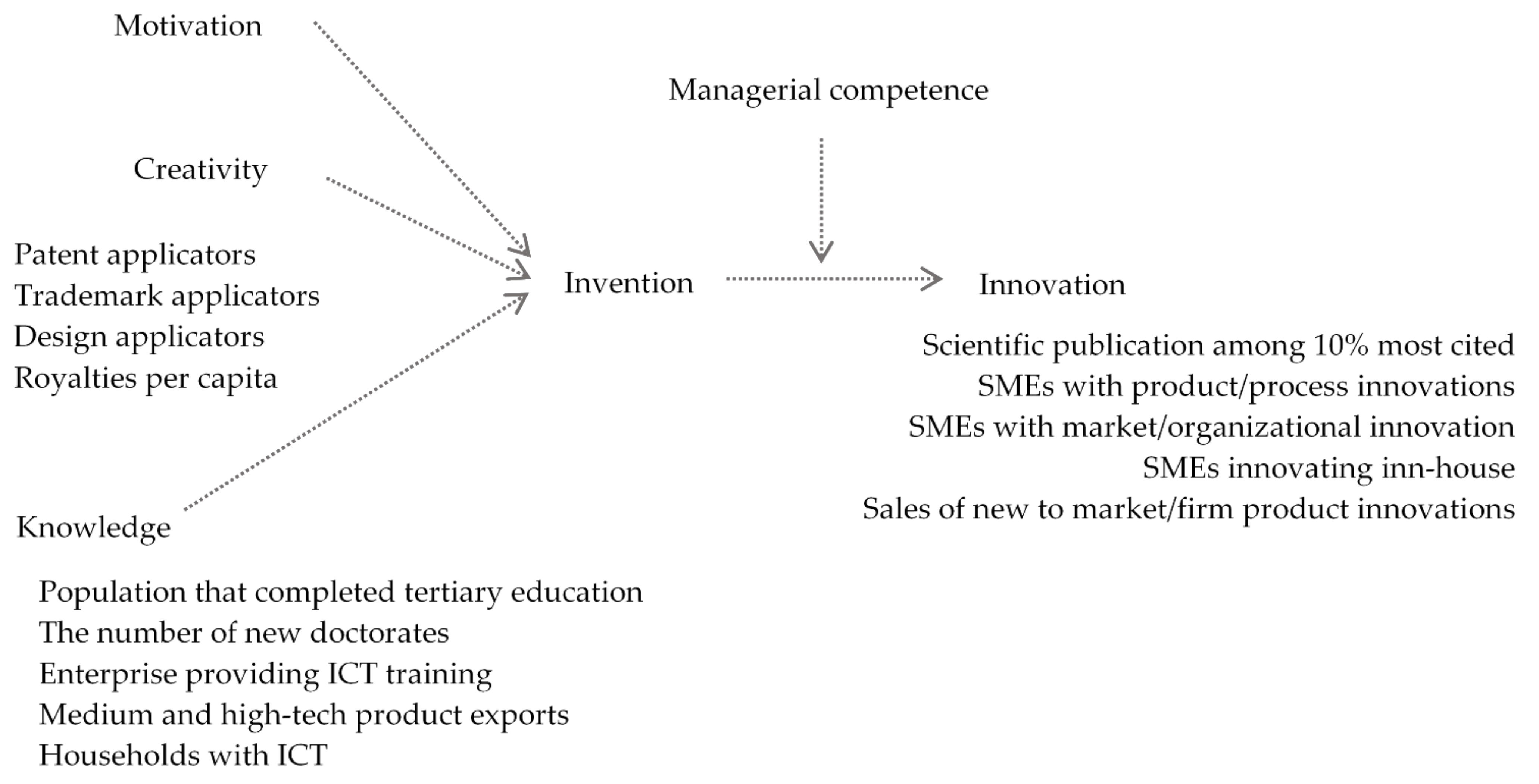

2.1. Framework

2.2. Creativity, Knowledge and Motivation in Innovation Theory

2.3. Aghion Howitt Basic Model of Growth through Creative Destruction

2.3.1. Basic Model

- (1)

- The inverse demand curve is pt = At F′(xt);

- (2)

- The monopolist chooses xt to max [At F′(xt) − wt] xt, knowing At and wt;

- (3)

- In the model, the “productivity-adjusted wage” is ωt ≡ wt/At, the “marginal-revenue function” is ῶ(x) ≡ F′(x) + x F″(x) and it is made the assumption that ῶ’(x) < 0 for all x > 0 (downward sloping) and respects the third and fourth of the Inada-type conditions.

- (4)

- The flow of monopoly profits is then: πt = At (ωt), where (ω) ≡ −((ω))2 F″((ω)) and the quantity of output is xt = (ω), where (ω) = ῶ(x)−1.

2.3.2. Equilibrium with Endogenous Size of Innovation

- (1)

- The expected present value of consumption:

- (2)

- Thus, independently of n, the social planner will choose γ to max

- (3)

- The socially-optimal value γ* is then defined by:

- (4)

- By the concavity of the γυ(γ), the stationary-equilibrium value γ` < γ* (socially optimal value). Innovation is smaller under laisses-faire. The difference comes from the internalization of the loss of the existing advantage of the present innovation (γ − 1), whereas the private research sector does not internalize it.

- (5)

- The socially optimal level of research employment, n*, satisfies the condition:

- (6)

- By comparing (17) with (12) it is seen, in the first place, that the social discount rate, appears in (12) in the right-hand side (the marginal benefit), in place of the “private discount rate” . The private rate is obviously greater due to the intertemporal spillover effect, that is, the social planner takes into account that the benefit will continue forever. In the right-hand side of the equation, profit , from (9), is replaced by the total output in (12), due to the appropriability effect [57]. Due to the “business-stealing” effect, (ɣ − 1) replace ɣ in (12), the social planner internalizing the previous monopolist’s loss. Additionally, in the marginal cost (the left-part of the equation), the wage from (9) is replaced by the marginal output , that is a “monopoly distortion” effect, as Aghion and Howitt called it. The cost of research in laisses faire is less than the cost of research in the socially optimal case, “because, in laissez-faire, the alternative use of skilled research labor is a monopolist”. Additionally, the fact that ɣ` < ɣ*, makes n` < n* (with respect to λ).

3. Materials and Methods

4. Results

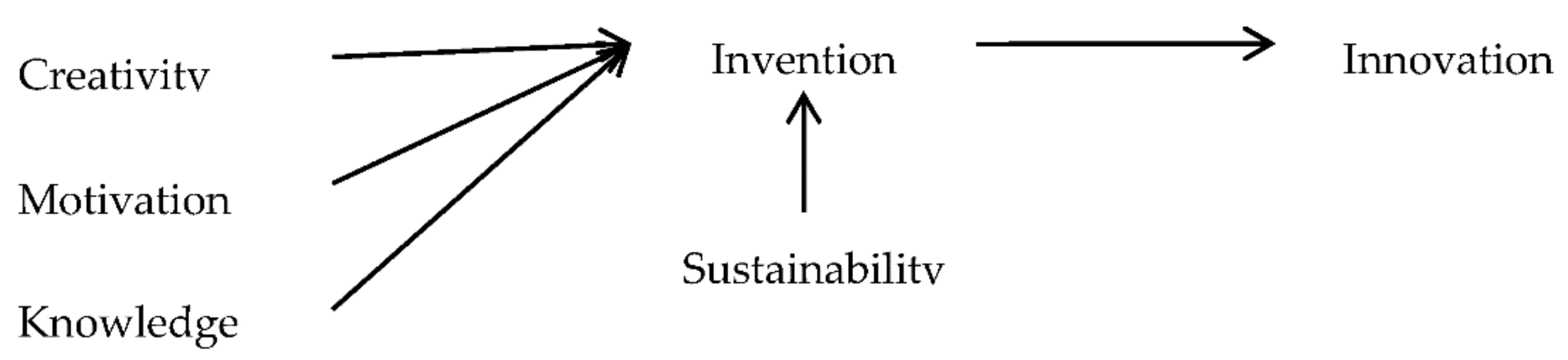

4.1. Extension of the Model by Including Creativity as Part of the Innovation Size Determinants

- (14)

- is a creativity function, dependent on many conditional factors, that are not the subject of the present paper;

- (15)

- M is the managerial competence level, which is a known constant, given by history and the countries political, educational and traditional specification;

- (16)

- is the knowledge level (the level of specialized knowledge), which is equal to the last innovation, from (13);

- (17)

- and are creativity and knowledge elasticities.

4.2. Multiple Linear Regression

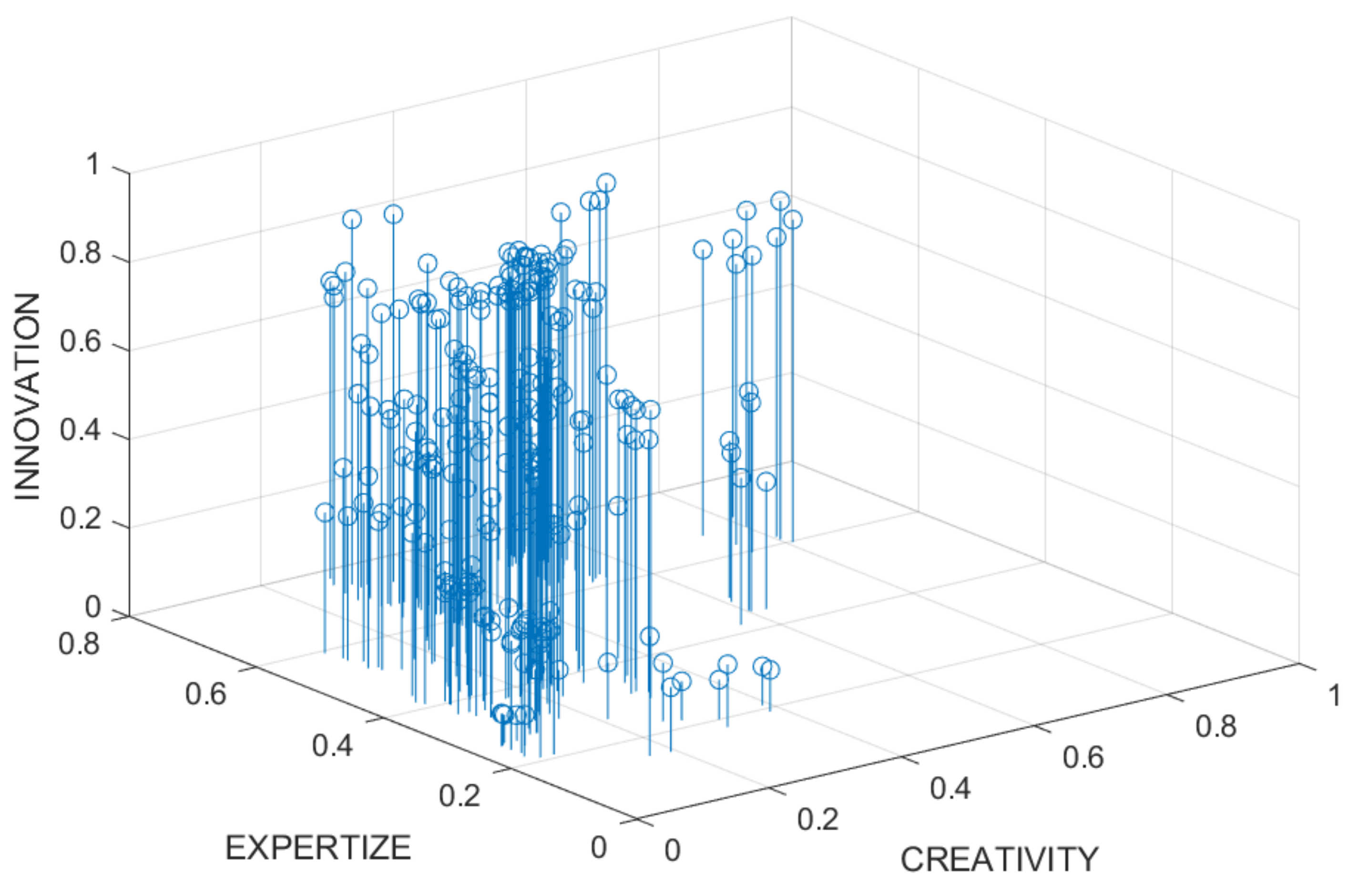

4.3. Mapping Innovation, Knowledge and Creativity

4.4. Correlation

4.5. Goodness of Fit and Hypothesis Testing

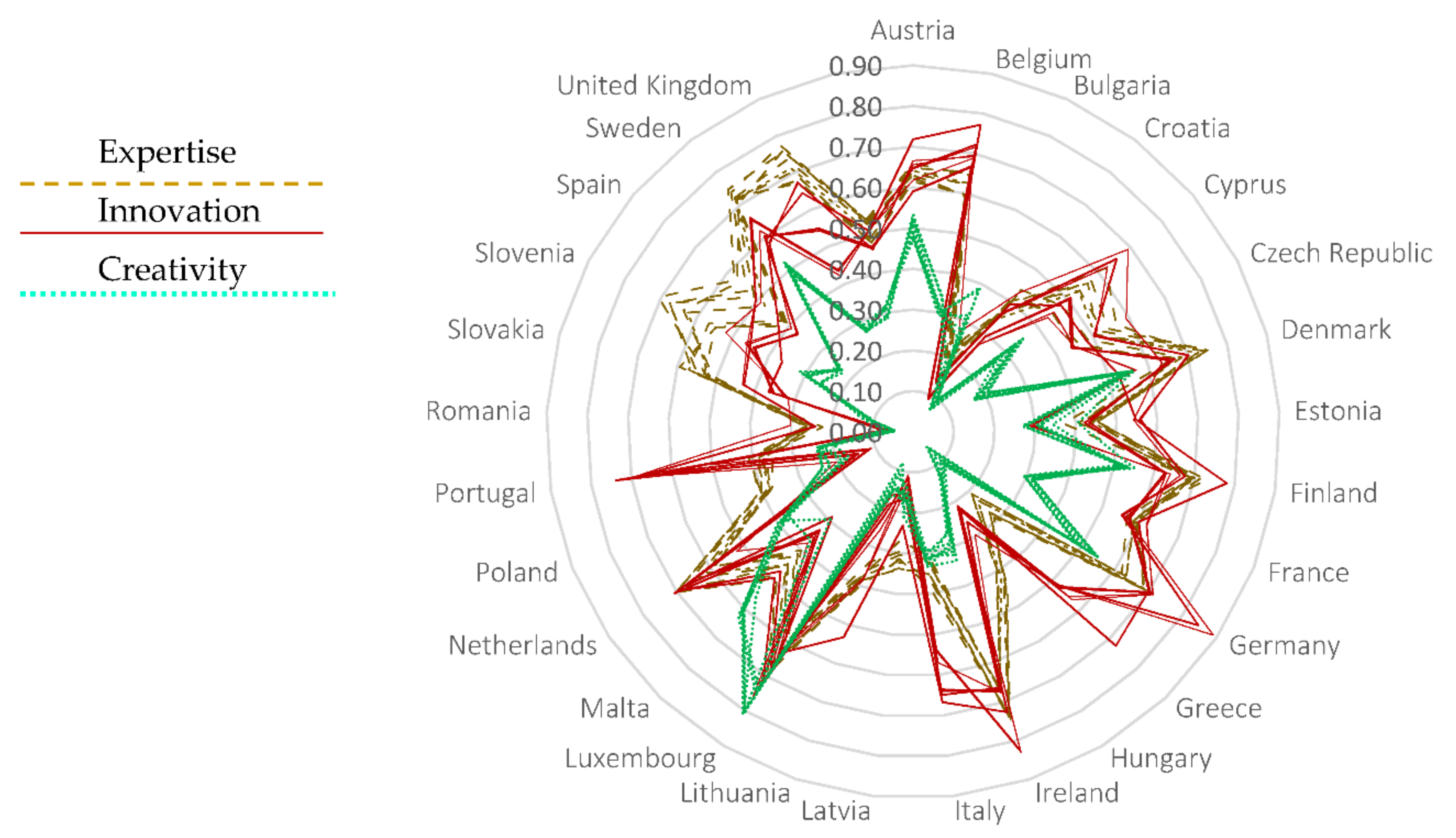

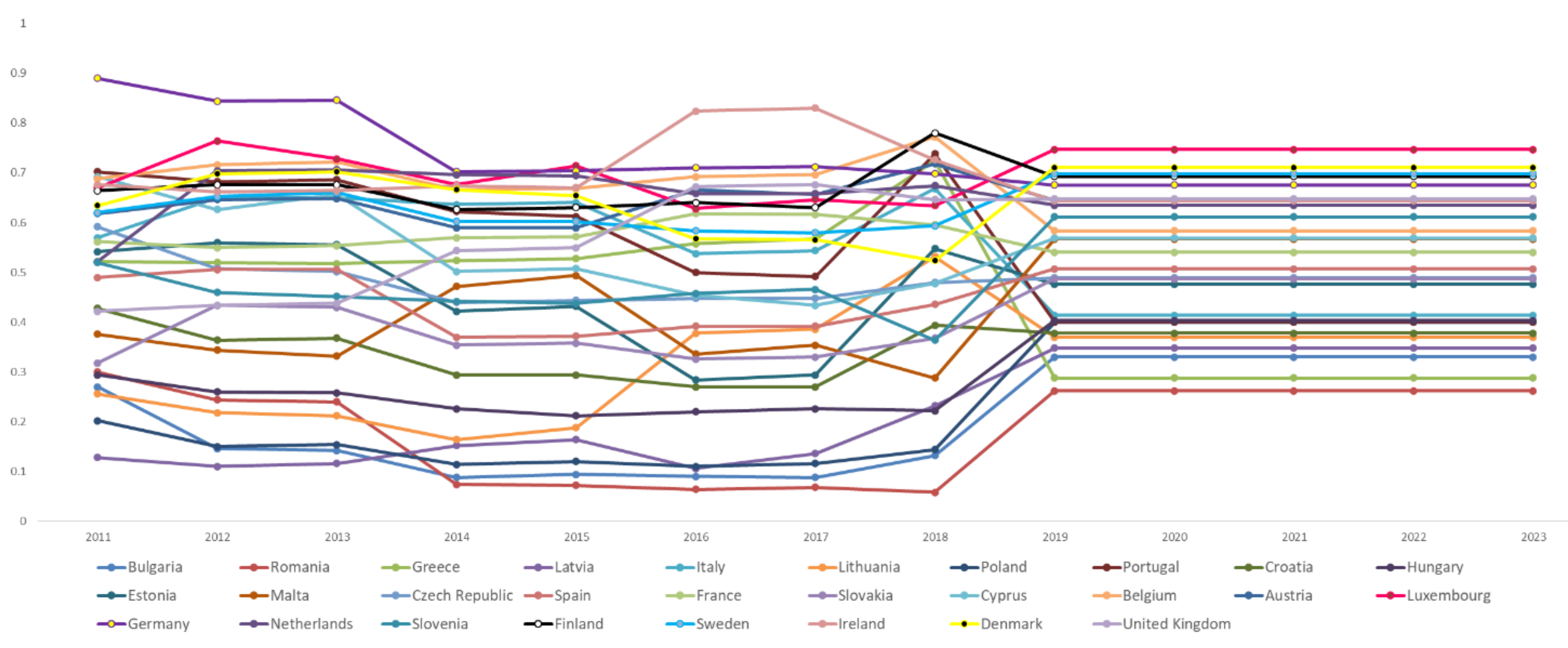

4.6. Innovation Trends in Europe

5. Discussion

- is a creativity function,

- M is the managerial competence level,

- is the knowledge level,

- and are creativity and knowledge elasticity.

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Swan, T. Economic Growth and Capital Accumulation. Econ. Rec. 1957, 33, 103–108. [Google Scholar] [CrossRef]

- Solow, R.M. A Contribution to the Theory of Economic Growth. Q. J. Econ. 1956, 70, 65–94. [Google Scholar] [CrossRef]

- Romer, P.M. Endogenous Technological Change. J. Polit. Econ. 1990, 98, S71–S102. [Google Scholar] [CrossRef]

- Lucas, R.E. On the Mechanics of Economic Development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Guarini, G. Innovation and Growth in the Grossman-Helpman’s 1991 Model with Increasing Returns. Econ. Bull. 2011, 31, 147–155. [Google Scholar]

- Arrow, K.J. The Economic Implications of Learning by Doing. Rev. Econ. Stud. 1962, 29, 155. [Google Scholar] [CrossRef]

- Aghion, P.; Howitt, P. A Model of Growth Through Creative Destruction. Econometrica 1992, 60, 323. [Google Scholar] [CrossRef]

- Howitt, P.; Aghion, P. Capital Accumulation and Innovation as Capital Accumulation in Long-Run Growth. J. Econ. Growth 1998, 3, 111–130. [Google Scholar] [CrossRef]

- Aghion, P.; García-Peñalosa, C.; Howitt, P. Knowledge and Development: A Schumpeterian Approach. Econ. Growth Macroecon. Dyn. Recent Dev. Econ. Theory 2004, 9780521835, 46–80. [Google Scholar] [CrossRef]

- Aghion, P.; Akcigit, U. Innovation and Growth: The Schumpeterian Perspective. Econ. Bord. 2017, 29–72. [Google Scholar] [CrossRef][Green Version]

- Zilibotti, F.; Aghion, P.; Howitt, P.; Garcia-Penalosa, C. Endogenous Growth Theory. Can. J. Econ. Rev. Canad. d’Econ. 1999, 1338. [Google Scholar] [CrossRef]

- Reinganum, J.F. Innovation and Industry Evolution. Q. J. Econ. 2014, 100, 81–99. [Google Scholar] [CrossRef]

- Nelson, R.R.; Winter, S.G. An Evolutionary Theory of Economic Change; Belknap Press: Harvard, MA, USA, 1982. [Google Scholar] [CrossRef]

- Dosi, G.; Nelson, R.R. An Introduction to Evolutionary Theories in Economics. J. Evol. Econ. 1994, 4, 153–172. [Google Scholar] [CrossRef]

- Sahal, D. Alternative Conceptions of Technology. Res. Policy 1981, 10, 2–24. [Google Scholar] [CrossRef]

- Conlisk, J. An Aggregate Model of Technical Change. Q. J. Econ. 1989, 104, 787. [Google Scholar] [CrossRef]

- Silverberg, G.; Lehnert, D. Long Waves and “evolutionary Chaos” in a Simple Schumpeterian Model of Embodied Technical Change. Struct. Chang. Econ. Dyn. 1993, 4, 9–37. [Google Scholar] [CrossRef]

- Verspagen, B. Uneven Growth Between Interdependent Economies: An Evolutionary View on Technology Gaps, Trade, and Growth; Aldershot and Brookfield: Avebury, UK, 1993. [Google Scholar]

- Hodgson, G.M.; Verspagen, B. Uneven Growth between Interdependent Economies: An Evolutionary View on Technology Gaps, Trade and Growth. Econ. J. 1994, 104, 1214. [Google Scholar] [CrossRef]

- Schumpeter, J.A. The Theory of Economic Development; Routledge: London, UK, 1934. [Google Scholar]

- Petrakis, P.E.; Kafka, K.I. Entrepreneurial Creativity and Growth. In Entrepreneurship—Practice-Oriented Perspectives Passion; InTech: Rijeka, Croatia, 2016. [Google Scholar] [CrossRef]

- Heunks, F.J. Innovation, Creativity and Success. Small Bus. Econ. 1998, 10, 263–272. [Google Scholar] [CrossRef]

- Ko, S.; Butler, J.E. Creativity: A Key Link to Entrepreneurial Behavior. Bus. Horiz. 2007, 50, 365–372. [Google Scholar] [CrossRef]

- Sternberg, R.J.; Lubart, T.I. An Investment Theory of Creativity and Its Development. Hum. Dev. 1991, 1–31. [Google Scholar] [CrossRef]

- Sternberg, R.J.; Lubart, T.I. Buy Low and Sell High: An Investment Approach to Creativity. Curr. Dir. Psychol. Sci. 1992, 1, 1–5. [Google Scholar] [CrossRef]

- Sternberg, R.J.; Lubart, T.I. Investing in Creativity. Am. Psychol. 1996, 51, 677–688. [Google Scholar] [CrossRef]

- Sternberg, R.J. The Assessment of Creativity: An Investment-Based Approach. Creat. Res. J. 2012, 24, 3–12. [Google Scholar] [CrossRef]

- Mulder, P.; De Groot, H.L.F.; Hofkes, M.W. Economic Growth and Technological Change: A Comparison of Insights from a Neo-Classical and an Evolutionary Perspective. Technol. Forecast. Soc. Chang. 2001, 68, 151–171. [Google Scholar] [CrossRef]

- Romer, P.M. Increasing Returns and Long-Run Growth. J. Polit. Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef]

- Grossman, G.M.; Helpman, E. The Review of Economic Studies, Ltd. Quality Ladders in the Theory of Growth Quality Ladders i n the Theory of Growth. Source Rev. Econ. Stud. Rev. Econ. Stud. 1991, 58, 43–61. [Google Scholar] [CrossRef]

- Veblen, T. Why Is Economics Not an Evolutionary Science? Q. J. Econ. 1898, 12, 373–397. [Google Scholar] [CrossRef]

- Cardon, M.S.; Wincent, J.; Singh, J.; Drnovsek, M. The Nature and Experience of Entrepreneurial Passion. Acad. Manag. Rev. 2009, 34, 511–532. [Google Scholar] [CrossRef]

- Chen, X.P.; Yao, X.; Kotha, S. Entrepreneur Passion and Preparedness in Business Plan Presentations: A Persuasion Analysis of Venture Capitalists’ Funding Decisions. Acad. Manag. J. 2009, 52, 199–214. [Google Scholar] [CrossRef]

- Davies, B.J.; Davies, B. Strategic Leadership. Sch. Leadersh. Manag. 2004, 24, 29–38. [Google Scholar] [CrossRef]

- Hirschi, G.; Jones, M. Affects of Strategic Leadership on Business Success—A Cross-Cultural Analysis from a Resource Based View. MIBES Trans. 2009, 3, 1–18. [Google Scholar]

- Smith, D. The Role of Entrepreneurship in Economic Development. Glob. Entrep. Dev. Index 2013, 53–71. [Google Scholar] [CrossRef]

- McMullan, W.E.; Kenworthy, T.P. Creativity and Entrepreneurial Performance: A General Scientific Theory; Springer International Publishing: Cham, Switzerland, 2015. [Google Scholar] [CrossRef]

- Cromie, S.; O’Donaghue, J. Assessing Entrepreneurial Inclinations. Int. Small Bus. J. Res. Entrep. 1992, 10, 183–205. [Google Scholar] [CrossRef]

- Morris, J.L.; Fargher, K. Achievement Drive and Creativity as Correlates of Success in Small Business. Aust. J. Psychol. 1974, 26, 217–222. [Google Scholar] [CrossRef]

- Khan, A.M. Entrepreneur Characteristics and the Prediction of New Venture Success. Omega 1986, 14, 365–372. [Google Scholar] [CrossRef]

- Lim, S.B.; Ribeiro, D.; Lee, S.M. Factors Affecting the Performance of Entrepreneurial Service Firms. Serv. Ind. J. 2008, 28, 1003–1013. [Google Scholar] [CrossRef]

- Gielnik, M.M.; Frese, M.; Graf, J.M.; Kampschulte, A. Creativity in the Opportunity Identification Process and the Moderating Effect of Diversity of Information. J. Bus. Ventur. 2012, 27, 559–576. [Google Scholar] [CrossRef]

- Baron, R.A.; Tang, J. The Role of Entrepreneurs in Firm-Level Innovation: Joint Effects of Positive Affect, Creativity, and Environmental Dynamism. J. Bus. Ventur. 2011, 26, 49–60. [Google Scholar] [CrossRef]

- Ar, I.M.; Baki, B. Antecedents and Performance Impacts of Product versus Process Innovation: Empirical Evidence from SMEs Located in Turkish Science and Technology Parks. Eur. J. Innov. Manag. 2011, 14, 172–206. [Google Scholar] [CrossRef]

- Weede, E.; Kämpf, S. The Impact of Intelligence and Institutional Improvements on Economic Growth. Kyklos 2002, 55, 361–380. [Google Scholar] [CrossRef]

- Jones, G.; Schneider, W.J. Intelligence, Human Capital, and Economic Growth: A Bayesian Averaging of Classical Estimates (BACE) Approach. J. Econ. Growth 2006, 11, 71–93. [Google Scholar] [CrossRef]

- Squalli, J.; Wilson, K. Intelligence, Creativity, and Innovation. Intelligence 2014, 46, 250–257. [Google Scholar] [CrossRef]

- Nusbaum, E.C.; Silvia, P.J. Are Intelligence and Creativity Really so Different? Fluid Intelligence, Executive Processes, and Strategy Use in Divergent Thinking. Intelligence 2011, 39, 36–45. [Google Scholar] [CrossRef]

- Jacobs, J. The Economy of Cities; Random House: New York, NY, USA, 1969. [Google Scholar]

- Zucker, L.G.; Darby, M.R.; Armstrong, J. Geographically Localized Knowledge: Spillovers or Markets? Econ. Inq. 1998, 36, 65–86. [Google Scholar] [CrossRef]

- Lee, S.Y.; Florida, R.; Gates, G. Innovation, Human Capital, and Creativity. Int. Rev. Public Adm. 2010, 14, 13–24. [Google Scholar] [CrossRef]

- Knudsen, B.; Florida, R.R.; Stolarick, K. Beyond Spillovers: The Effects of Creative Density on Innovation; 2005. [Google Scholar]

- Aghion, P.; Akcigit, U.; Howitt, P. The Schumpeterian Growth Paradigm, Annu. Rev. Econom. 2015, 7, 557–575. [Google Scholar]

- Aghion, P.; Bloom, N.; Blundell, R.; Griffith, R.; Howitt, P. Competition and Innovation: An Inverted-U Relationship. Q. J. Econ. 2005, 120, 701–728. [Google Scholar] [CrossRef]

- Aghion, P.; Harris, C.; Howitt, P.; Vickers, J. Competition, Imitation and Growth with Step-by-Step Innovation. Rev. Econ. Stud. 2001, 68, 467–492. [Google Scholar] [CrossRef]

- Aghion, P.; Howitt, P. Model of Growth through Creative Destruction. NBER Work. Pap. Ser. 1990, 1–50. [Google Scholar]

- Lucas, B.; Sjak, S. Sustainable Resource Use and Economic Dynamics; Bretschger, L., Sjak, S., Eds.; Springer International Publishing: Cham, Switzerland, 2013; Volume 53. [Google Scholar] [CrossRef]

- Gault, F. Handbook of Innovation Indicators and Measurement; Edward Elgar Publishing: Cheltenham, UK, 2014. [Google Scholar] [CrossRef]

- UNTACD. Creative Economy Report 2010. English 2010, 392. [Google Scholar] [CrossRef]

- Poincaré, H. Mathematical Creation. Monist 1910. [Google Scholar] [CrossRef]

- Hadamard, J. An Essay on the Psychology of Invention in the Mathematical Field. J. Philos. 1945, 42, 333. [Google Scholar] [CrossRef]

- Sadler-Smith, E. Wallas’ Four-Stage Model of the Creative Process: More Than Meets the Eye? Creat. Res. J. 2015, 27, 342–352. [Google Scholar] [CrossRef]

- Hammershøj, L.G. Creativity in Education as a Question of Cultivating Sensuous Forces. Think. Ski. Creat. 2014, 13, 168–182. [Google Scholar] [CrossRef]

- Howell, J.M.; Higgins, C.A. Champions of Technological Innovation. Adm. Sci. Q. 1990, 35, 317–341. [Google Scholar] [CrossRef]

- Williams, L.K.; McGuire, S.J. Economic Creativity and Innovation Implementation: The Entrepreneurial Drivers of Growth? Evidence from 63 Countries. Small Bus. Econ. 2008, 34, 391–412. [Google Scholar] [CrossRef]

- Amabile, T.M. Entrepreneurial Creativity through Motivational Synergy. J. Creat. Behav. 1997. [Google Scholar] [CrossRef]

- Amabile, T.M.; Pillemer, J. Perspectives on the Social Psychology of Creativity. J. Creat. Behav. 2012. [Google Scholar] [CrossRef]

- Altshuller, G. The Innovation Algorithm; Technical Innovation Center: Worcester, UK, 1999. [Google Scholar]

- Rossman, J. The Motives of Inventors. Q. J. Econ. 1931, 45, 522. [Google Scholar] [CrossRef]

- Hollanders, H.; Van Cruysen, A. Design, Creativity and Innovation: A Scoreboard Approach. In PRO INNO /INNO Metrics: Design, Creativity and Innovation; Springer: Cham, Switzerland, 2009; pp. 1–37. [Google Scholar] [CrossRef]

- Aghion, P.; Askenazy, P.; Bourlès, R.; Cette, G.; Dromel, N. Education, Market Rigidities and Growth. Econ. Lett. 2009, 102, 62–65. [Google Scholar] [CrossRef]

- Nathan, R. Perspectives on Technology; Cambridge University Press: Cambridge, UK, 1979; Volume 70. [Google Scholar] [CrossRef]

- Hall, C.M.; Williams, A.M.; Hall, C.M.; Williams, A.M. Knowledge, Creativity, and Innovation. Tour. Innov. 2019, 84–133. [Google Scholar] [CrossRef]

- Thomas, R.J. New Product Success Stories: Lessons from Leading Innovators; John Wiley and Sons: New York, NY, USA, 1996. [Google Scholar] [CrossRef]

- Drucker, P.F. The Coming of the New Organization. Harv. Bus. Rev. 1988, 45–53. [Google Scholar]

- Bevan-Roberts, E.M.; Csikszentmihalyi, M.; Rathunde, K.; Whalen, S. Talented Teenagers—The Roots of Success and Failure. Br. J. Educ. Stud. 1994, 42, 299. [Google Scholar] [CrossRef]

- Sternberg, R.J.; O’Hara, L.A.; Lubart, T.I. Creativity as Investment. Calif. Manag. Rev. 1997. [Google Scholar] [CrossRef]

- McClelland, D.C. The Achieving Society; D Van Nostrand Company: Princeton, NJ, USA, 1961. [Google Scholar]

- Romero, I.; Martínez-Román, J.A. Self-Employment and Innovation. Exploring the Determinants of Innovative Behavior in Small Businesses. Res. Policy 2012, 41, 178–189. [Google Scholar] [CrossRef]

- Martínez-Román, J.A.; Romero, I. About the Determinants of the Degree of Novelty in Small Businesses’ Product Innovations. Int. Entrep. Manag. J. 2013, 9, 655–677. [Google Scholar] [CrossRef]

- Vandenbussche, J.; Aghion, P.; Meghir, C. Growth, Distance to Frontier and Composition of Human Capital. J. Econ. Growth 2006, 11, 97–127. [Google Scholar] [CrossRef]

- Gryskiewicz, N. Entrepreneurs’ Problem-Solving Styles: An Empirical Study Using the Kirton Adaption/Innovation Theory. J. Small Bus. Manag. 1993, 31, 22–31. [Google Scholar]

- Allinson, C.W.; Chell, E.; Hayes, J. Intuition and Entrepreneurial Behaviour. Eur. J. Work Organ. Psychol. 2000, 9, 31–43. [Google Scholar] [CrossRef]

- Baron, R.A. Cognitive Mechanisms in Entrepreneurship: Why and When Enterpreneurs Think Differently than Other People. J. Bus. Ventur. 1998, 13, 275–294. [Google Scholar] [CrossRef]

- Levin, S.L.; Scherer, F.M. Innovation and Growth: Schumpeterian Perspectives. South. Econ. J. 1986, 52, 888. [Google Scholar] [CrossRef]

- Scherer, F.M. The Propensity to Patent. Int. J. Ind. Organ. 1983, 1, 107–128. [Google Scholar] [CrossRef]

- Scherer, F.M. Firm Size, Market Structure, Opportunity, and the Output of Patented Inventions. Am. Econ. Rev. 1965, 55, 1. [Google Scholar] [CrossRef]

- Braun, V. The Innovation War; Pearson Technology Group: London, UK, 1997; Volume 3. [Google Scholar] [CrossRef]

- Lynne, G.; Morone, J.; Paulson, A. Marketing and Discontinuous Innovation: The Probe and Learn Process. In Winning through Innovation; Tushman, M.L., O’Reilly, C.A., Eds.; Harvard Business School Press: Harvard, MA, USA, 1996; pp. 353–375. [Google Scholar]

- Ann, M. Innovative Genius: A Framework for Relating Individual and Organizational Intelligences to Innovation. Management 1996, 21, 1081–1111. [Google Scholar]

- Bleakley, A. ‘Your Creativity or Mine?’: A Typology of Creativities in Higher Education and the Value of a Pluralistic Approach. Teach. High. Educ. 2004, 9, 463–475. [Google Scholar] [CrossRef]

- Cook, P. The Creativity Advantage—Is Your Organization the Leader of the Pack? Ind. Commer. Train. 1998, 30, 179–184. [Google Scholar] [CrossRef]

- Pressman, S. Book Review: The Competitive Advantage of Nations. J. Manag. 1991, 17, 213–215. [Google Scholar] [CrossRef]

- Sternberg, R.J. The Theory of Successful Intelligence. Interam. J. Psychol. 2005, 39, 189–202. [Google Scholar] [CrossRef]

- Mihaly, C. Flow and the Psychology of Discovery and Invention; Cambridge University Press: Cambridge, UK, 1997. [Google Scholar] [CrossRef]

- Gardner, H. Frames of Mind; Basic Books: New York, NY, USA, 2011. [Google Scholar]

- Runco, M.A. Comments on Where the Creativity Research Has Been and Where Is It Going. J. Creat. Behav. 2017, 51, 308–313. [Google Scholar] [CrossRef]

| Coefficients | |||||

|---|---|---|---|---|---|

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | |

| B | Std. Error | Beta | |||

| (Constant) | 0.072 | 0.033 | 2.198 | 0.029 | |

| CREATIVITY | 0.29 | 0.071 | 0.25 | 4.075 | 0 |

| KNOWLEDGE | 0.633 | 0.077 | 0.505 | 8.216 | 0 |

| Share of Households with ITC at Home | Medium and High-Tech Product Exports | New Doctorate Graduates | Population Completed Tertiary Education | Enterprises Providing ICT Training | SMEs with Product or Process Innovations | SMEs with Marketing or Organizational Innovations | SMEs Innovating in-House | Scientific Publications among Top 10% Most Cited | Sales of New-to-Market/Firm Product Innovations | Patent Applications | Trademark Applications | Design Applications | Author’s Royalties Collected Euro/Capita | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Share of households with ITC at home | 1.00 | |||||||||||||

| Medium and high-tech product exports | 0.40 | 1.00 | ||||||||||||

| New doctorate graduates | 0.54 | 0.23 | 1.00 | |||||||||||

| Population completed tertiary education | 0.37 | −0.2 | 0.01 | 1.00 | ||||||||||

| Enterprises providing ICT training | 0.62 | 0.30 | 0.57 | 0.29 | 1.00 | |||||||||

| SMEs with product or process innovations | 0.60 | 0.06 | 0.48 | 0.31 | 0.70 | 1.00 | ||||||||

| SMEs with marketing or organizational innovations | 0.53 | 0.13 | 0.42 | 0.26 | 0.66 | 0.88 | 1.00 | |||||||

| SMEs innovating in-house | 0.55 | 0.09 | 0.40 | 0.32 | 0.66 | 0.97 | 0.87 | 1.00 | ||||||

| Scientific publications among top 10% most cited | 0.76 | 0.11 | 0.54 | 0.44 | 0.61 | 0.82 | 0.75 | 0.76 | 1.00 | |||||

| Sales of new-to-market and new-to-firm product innovations | 0.13 | 0.45 | 0.45 | −0.17 | 0.32 | 0.19 | 0.25 | 0.18 | 0.19 | 1.00 | ||||

| patent applications | 0.76 | 0.23 | 0.74 | 0.19 | 0.61 | 0.63 | 0.48 | 0.60 | 0.71 | 0.10 | 1.00 | |||

| Trademark applications | 0.37 | 0.10 | −0.2 | 0.36 | 0.37 | 0.37 | 0.35 | 0.39 | 0.36 | −0.24 | 0.16 | 1.00 | ||

| Design applications | 0.45 | 0.14 | 0.09 | −0.03 | 0.30 | 0.39 | 0.38 | 0.35 | 0.41 | −0.20 | 0.40 | 0.66 | 1.00 | |

| Author’s royalties collected euro / capita | 0.43 | 0.09 | −0.1 | 0.33 | 0.28 | 0.32 | 0.49 | 0.34 | 0.33 | −0.18 | 0.05 | 0.52 | 0.43 | 1.00 |

| Correlations | ||||||

|---|---|---|---|---|---|---|

| Control Variables | KNOWLEDGE | INNOVATION | CREATIVITY | |||

| GDP | KNOWLEDGE | Correlation | 1 | |||

| INNOVATION | Correlation | 0.676 * | 1 | |||

| CREATIVITY | Correlation | 0.611 ** | 0.588 ** | 1 | ||

| Model | 1 |

|---|---|

| R | 0.685 |

| R Square | 0.469 |

| Adjusted R Square | 0.465 |

| Std. Error of the Estimate | 0.1486003 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cristescu, M.P.; Nerișanu, R.A. Sustainable Development with Schumpeter Extended Endogenous Type of Innovation and Statistics in European Countries. Sustainability 2021, 13, 3848. https://doi.org/10.3390/su13073848

Cristescu MP, Nerișanu RA. Sustainable Development with Schumpeter Extended Endogenous Type of Innovation and Statistics in European Countries. Sustainability. 2021; 13(7):3848. https://doi.org/10.3390/su13073848

Chicago/Turabian StyleCristescu, Marian Pompiliu, and Raluca Andreea Nerișanu. 2021. "Sustainable Development with Schumpeter Extended Endogenous Type of Innovation and Statistics in European Countries" Sustainability 13, no. 7: 3848. https://doi.org/10.3390/su13073848

APA StyleCristescu, M. P., & Nerișanu, R. A. (2021). Sustainable Development with Schumpeter Extended Endogenous Type of Innovation and Statistics in European Countries. Sustainability, 13(7), 3848. https://doi.org/10.3390/su13073848