Green Technology Investment in a Decentralized Supply Chain under Demand Uncertainty

Abstract

1. Introduction

2. Literature Review

2.1. Green Technology Investment and Supply-Chain Sustainability

2.2. Non-Cooperative Supply-Chain Operation

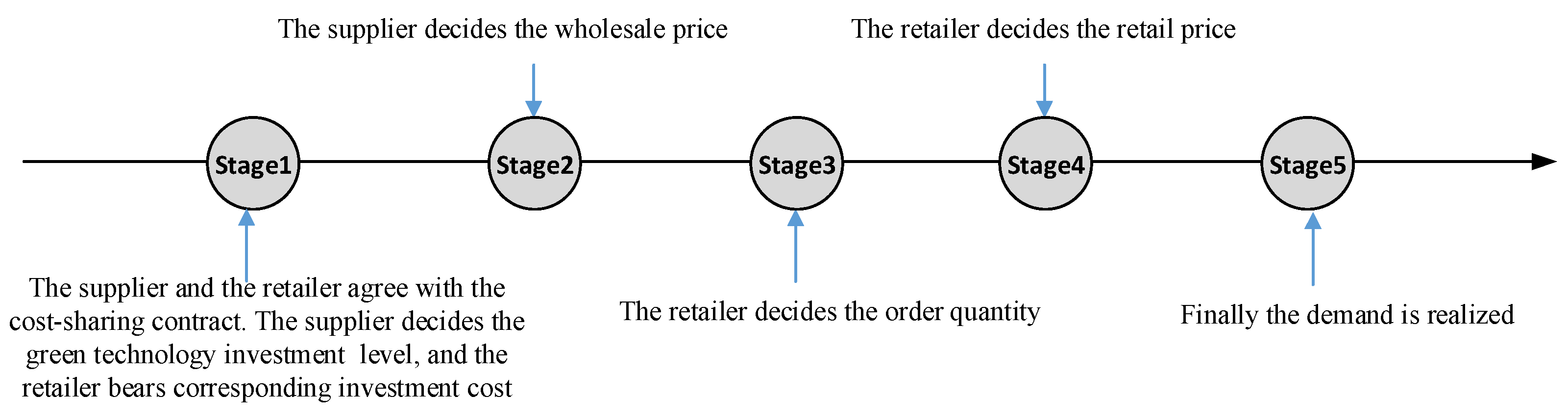

3. Model and Equilibrium Results

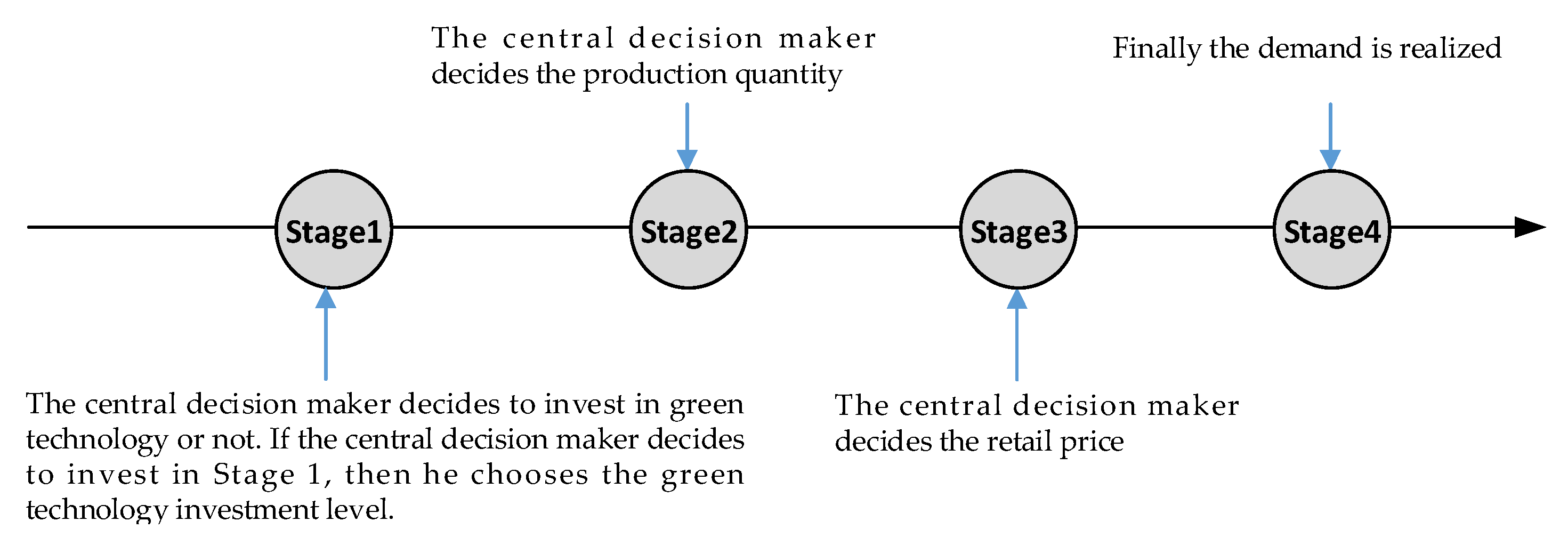

3.1. Scenario CI—The Centralized Supply Chain

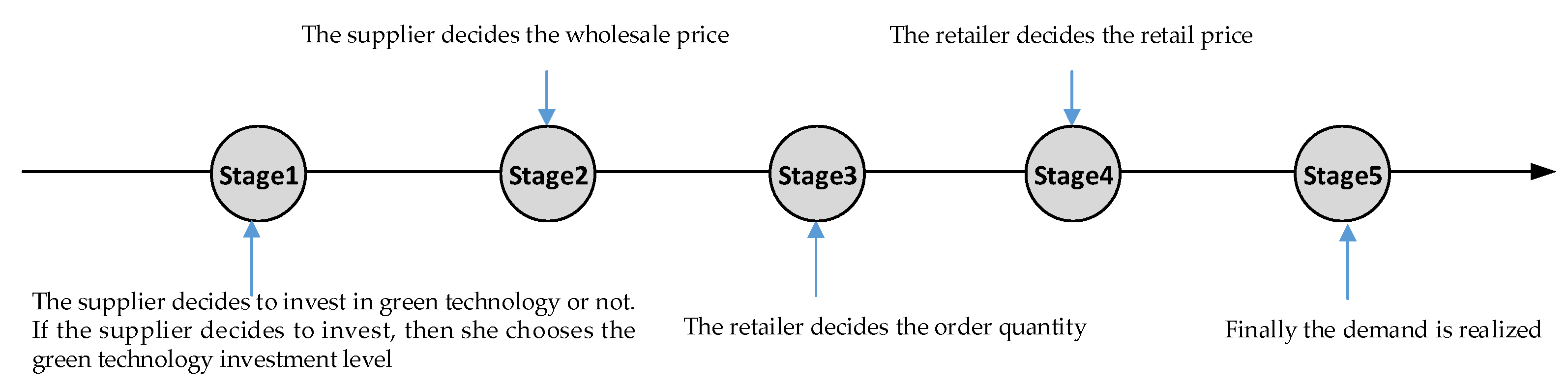

3.2. Scenario SI—The Supplier Investing in Green Technology

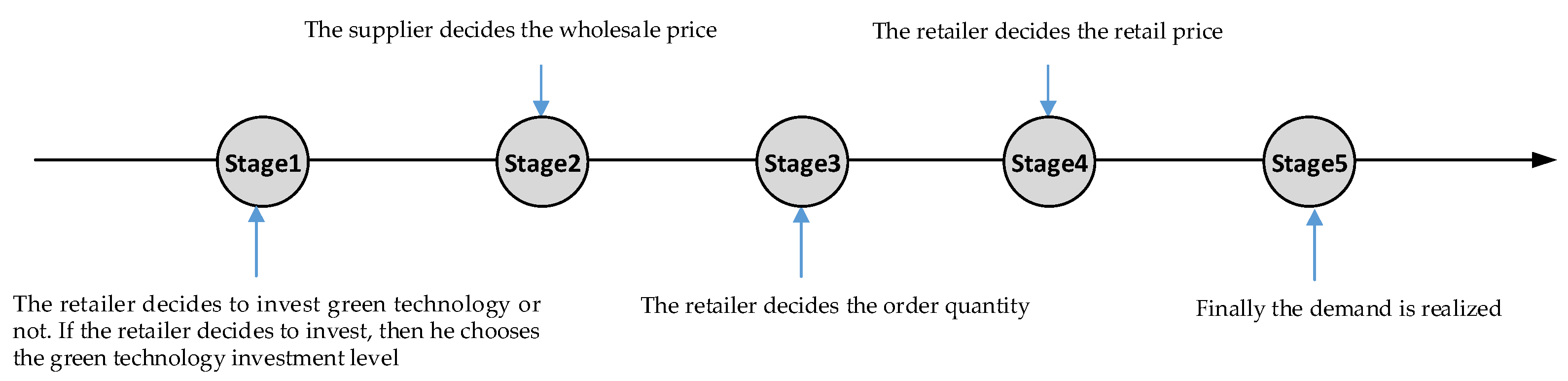

3.3. Scenario RI—The Retailer Investing in Green Technology

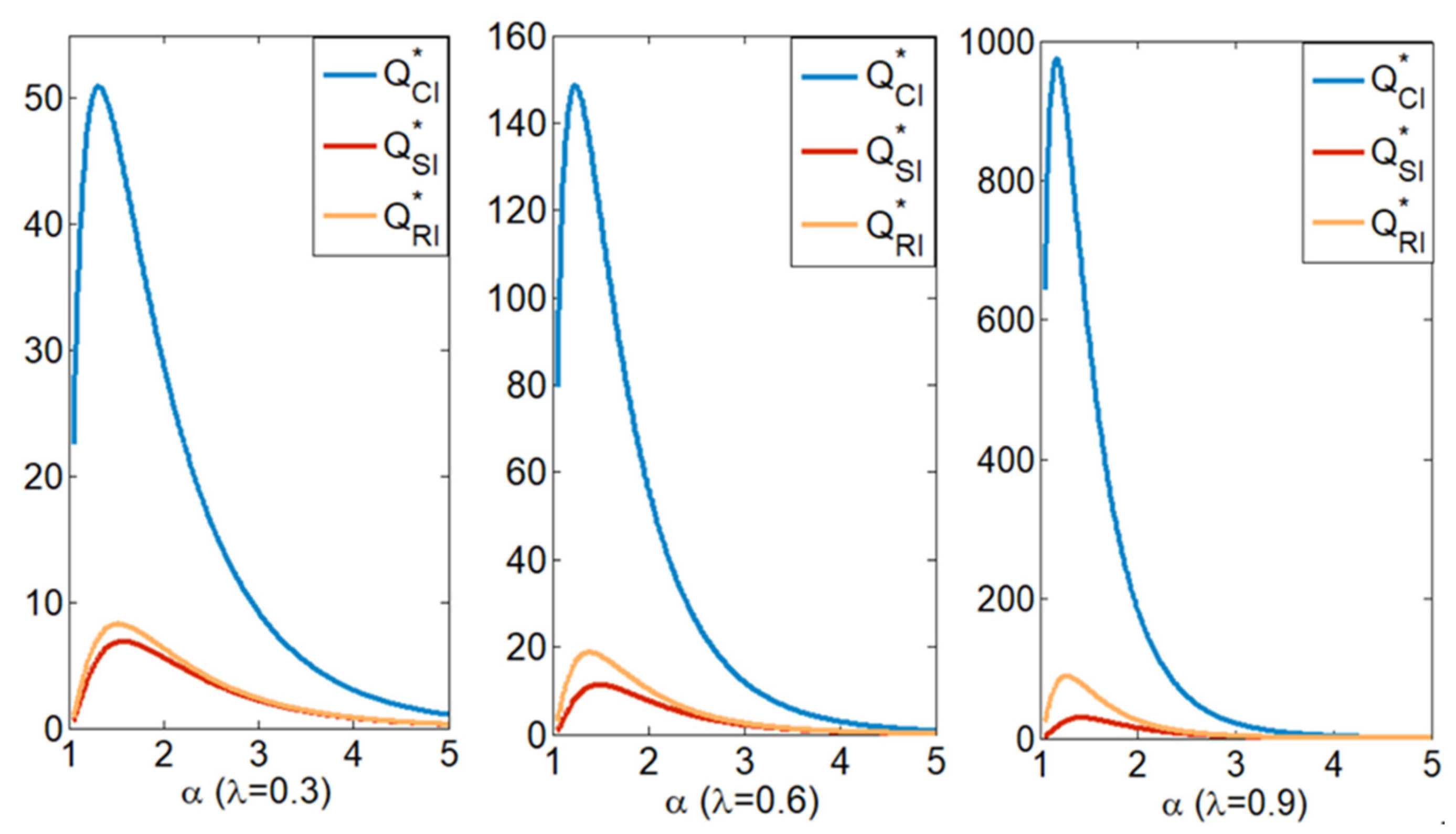

4. Operation Analysis

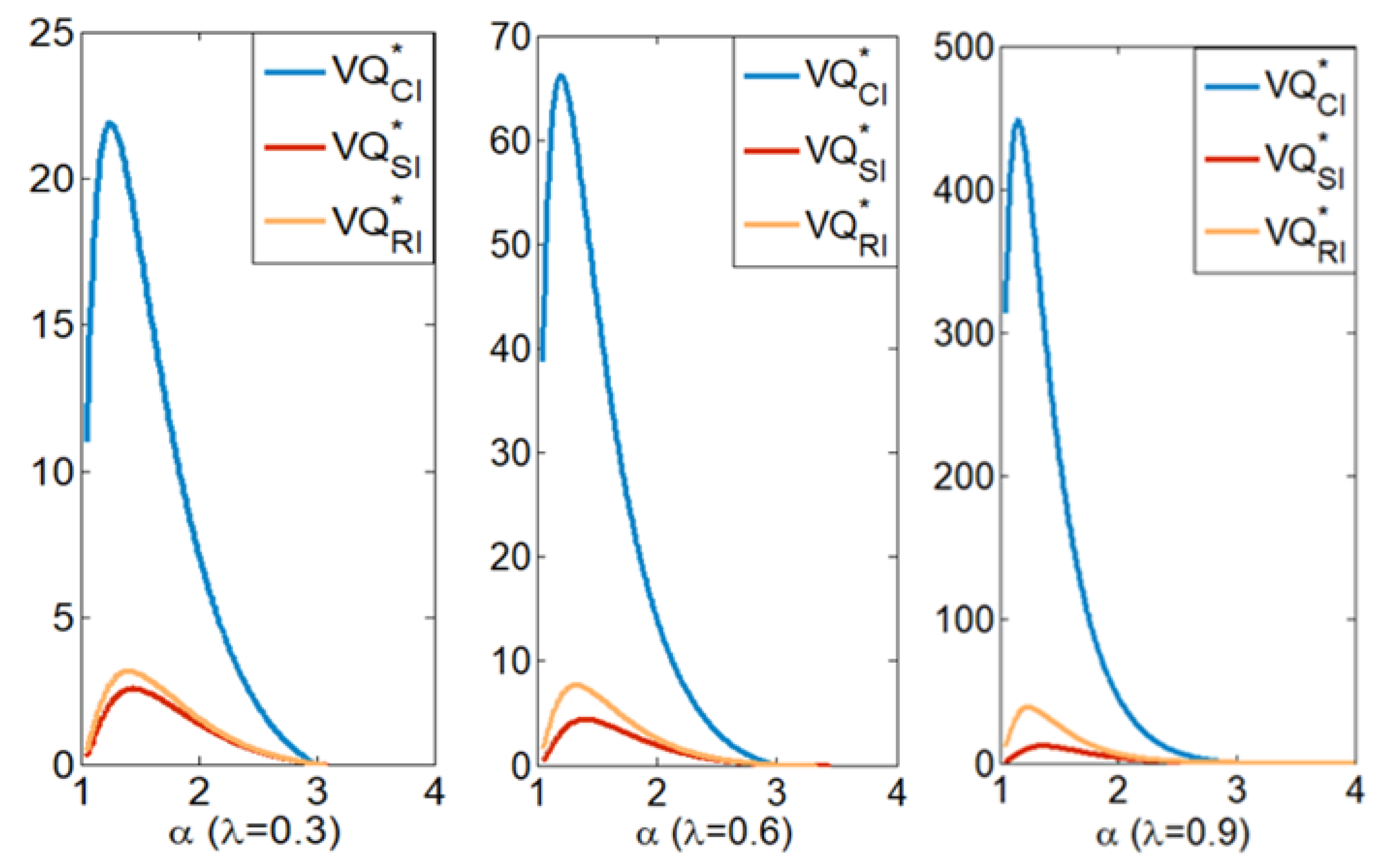

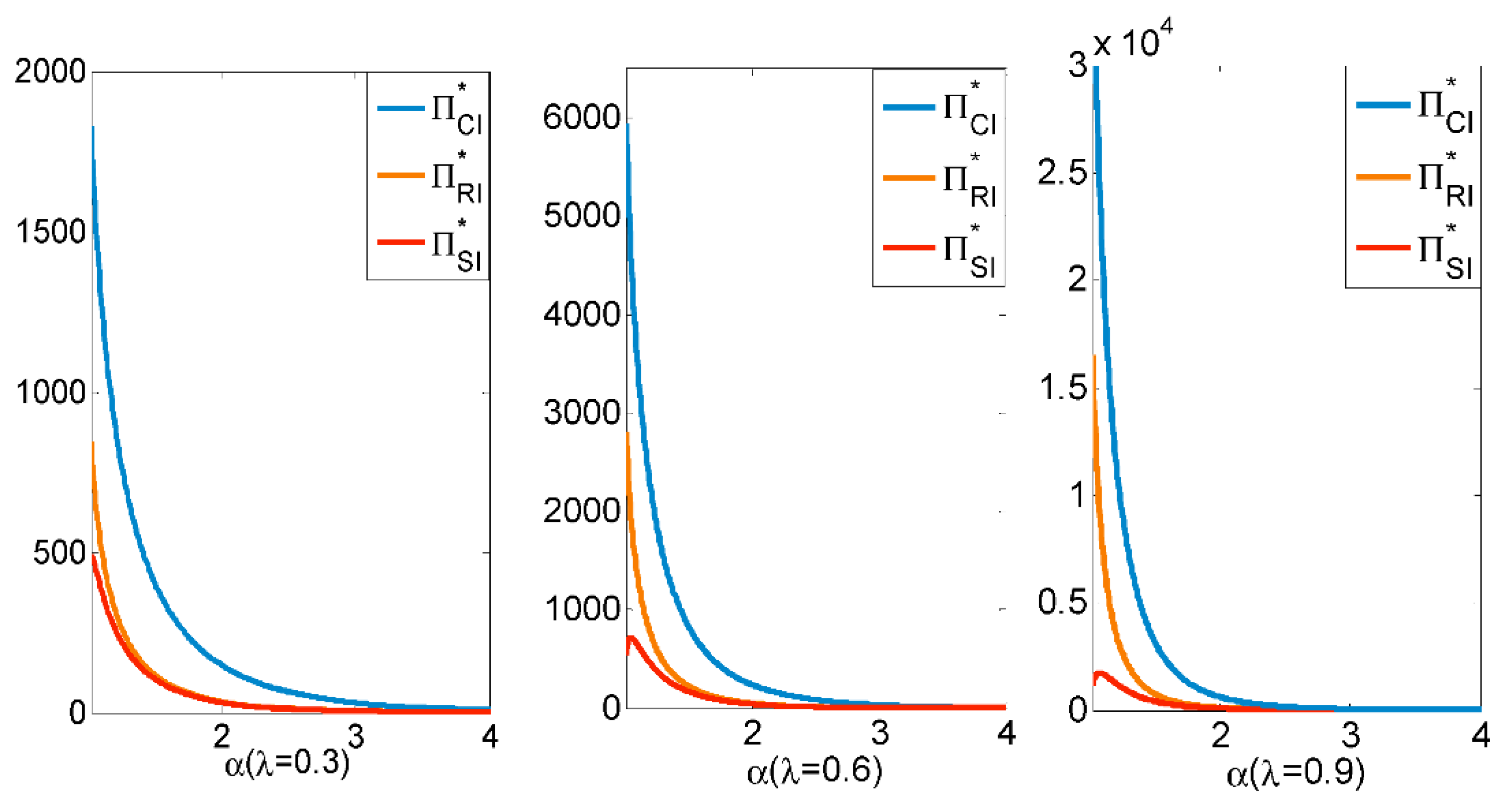

5. Supply Chain Sustainability Performance Analysis

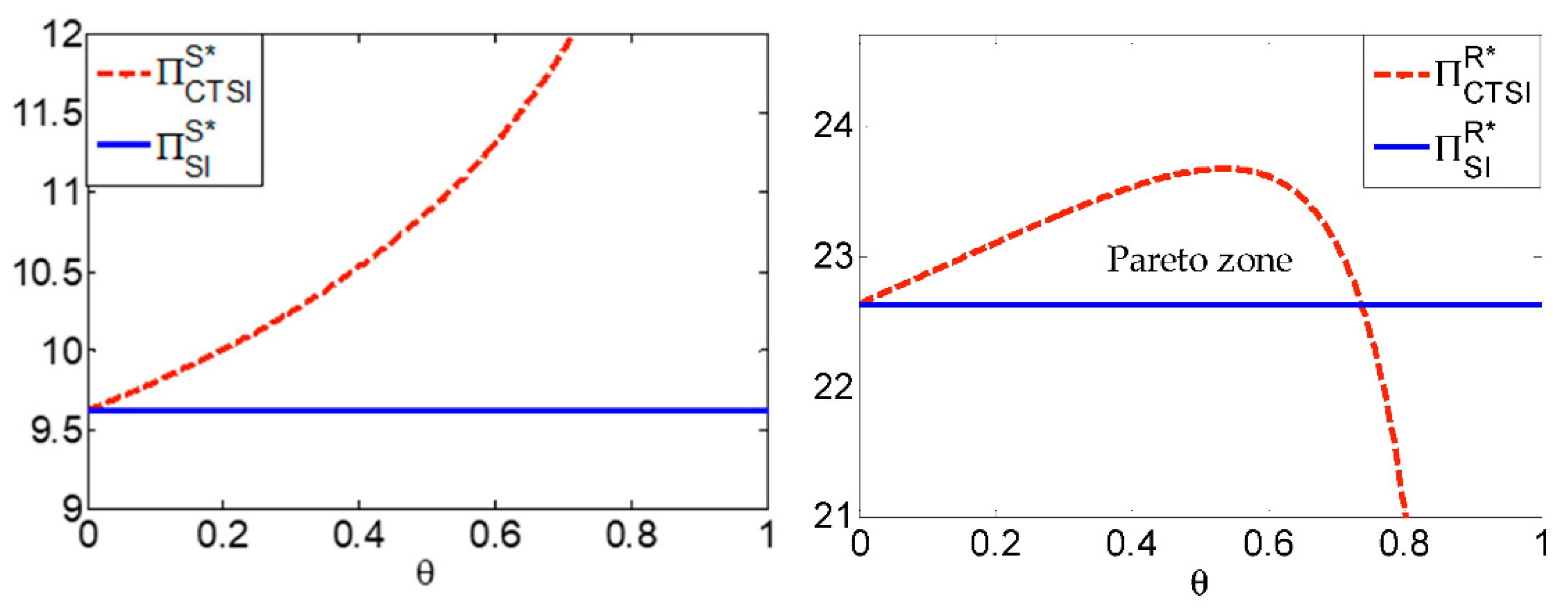

5.1. Economic Sustainability

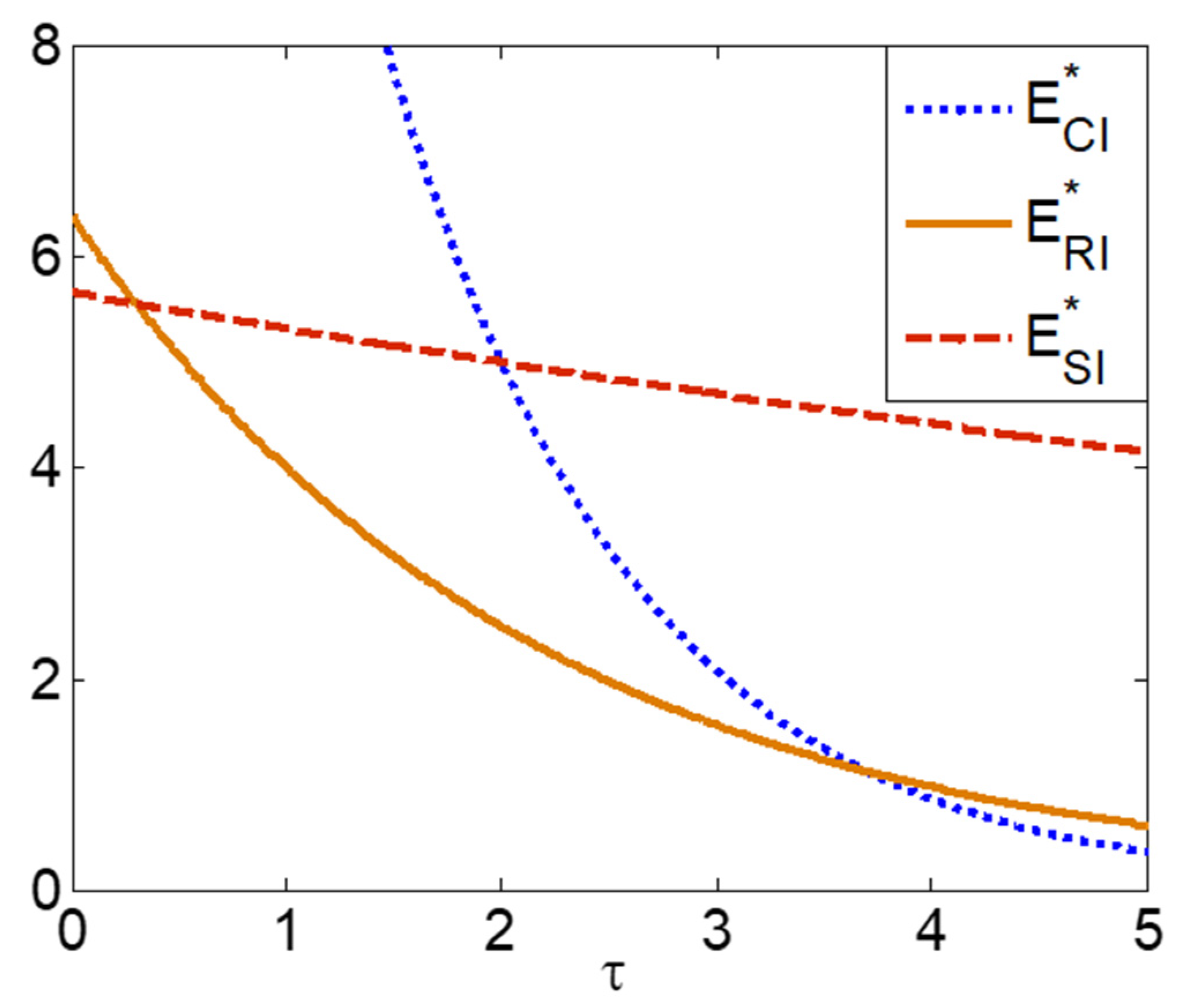

5.2. Environmental Sustainability

6. Extension-Joint Investment Mechanism

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

- (1).

- , ;

- (2).

- , ;

- (3).

- , . □

References

- Ahi, P.; Searcy, C. A comparative literature analysis of definitions for green and sustainable supply chain management. J. Clean. Prod. 2013, 52, 329–341. [Google Scholar] [CrossRef]

- Subramanian, N.; Gunasekaran, A. Cleaner supply-chain management practices for twenty-first-century organizational competitiveness: Practice-performance framework and research propositions. Int. J. Prod. Econ. 2015, 164, 216–233. [Google Scholar] [CrossRef]

- Martins, A. Most Consumers Want Sustainable Products and Packaging. Available online: https://www.businessnewsdaily.com/15087-consumers-want-sustainable-products.html (accessed on 5 June 2019).

- Genc, T.S.; De, G.P. Closed-loop supply chain games with innovation-led lean programs and sustainability. Int. J. Prod. Econ. 2020, 219, 440–456. [Google Scholar] [CrossRef]

- Ball, P.; Lunt, P. Lean eco-efficient innovation in operations through the maintenance organisation. Int. J. Prod. Econ. 2020, 219, 405–415. [Google Scholar] [CrossRef]

- Xu, X.; He, P.; Xu, H.; Zhang, Q. Supply chain coordination with green technology under cap-and-trade regulation. Int. J. Prod. Econ. 2017, 183, 433–442. [Google Scholar] [CrossRef]

- Lin, B.; Zhu, F.; Zhang, J.; Chen, J.; Chen, X.; Xiong, N.N.; Mauri, J.L. A Time-Driven Data Placement Strategy for a Scientific Workflow Combining Edge Computing and Cloud Computing. IEEE Trans. Ind. Inform. 2019, 15, 4254–4265. [Google Scholar] [CrossRef]

- Yi, B.; Shen, X.; Liu, H.; Zhang, Z.; Zhang, W.; Liu, S.; Xiong, N. Deep Matrix Factorization with Implicit Feedback Embedding for Recommendation System. IEEE Trans. Ind. Inform. 2019, 15, 4591–4601. [Google Scholar] [CrossRef]

- Qu, Y.; Xiong, N. RFH: A Resilient, Fault-Tolerant and High-Efficient Replication Algorithm for Distributed Cloud Storage. In Proceedings of the 2012 41st International Conference on Parallel Processing, Pittsburgh, PA, USA, 25 October 2012. [Google Scholar]

- Li, H.; Liu, J.; Liu, R.W.; Xiong, N.; Wu, K.; Kim, T.-H. A Dimensionality Reduction-Based Multi-Step Clustering Method for Robust Vessel Trajectory Analysis. Sensors 2017, 17, 1792. [Google Scholar] [CrossRef]

- Jabbour, C.J.C.; Neto, A.S.; Gobbo, J.A.; Ribeiro, M.D.S.; Jabbour, A.B.L.D.S. Eco-innovations in more sustainable supply chains for a low-carbon economy: A multiple case study of human critical success factors in Brazilian leading companies. Int. J. Prod. Econ. 2015, 164, 245–257. [Google Scholar] [CrossRef]

- Yu, Y.; Han, X.; Hu, P. Optimal production for manufacturers considering consumer environmental awareness and green subsidies. Int. J. Prod. Econ. 2016, 182, 397–408. [Google Scholar] [CrossRef]

- Gassmann, O.; Zeschky, M.; Wolff, T.; Stahl, M. Crossing the Industry-Line: Breakthrough Innovation through Cross-Industry Alliances with ‘Non-Suppliers’. Long Range Plan. 2010, 43, 639–654. [Google Scholar] [CrossRef]

- Laseter, T.M.; Ramdas, K. Product Types and Supplier Roles in Product Development: An Exploratory Analysis. SSRN Electron. J. 2001, 49, 107–118. [Google Scholar] [CrossRef]

- Flynn, B.B.; Koufteros, X.; Lu, G. On Theory in Supply Chain Uncertainty and its Implications for Supply Chain Integration. J. Supply Chain Manag. 2016, 52, 3–27. [Google Scholar] [CrossRef]

- Krause, D.R.; Vachon, S.; Klassen, R.D. Special topic forum on sustainable supply chain management: Introduction and reflections on the role of purchasing management. J. Supply Chain Manag. 2009, 45, 18–25. [Google Scholar] [CrossRef]

- Wu, Z.; Pagell, M. Balancing priorities: Decision-making in sustainable supply chain management. J. Oper. Manag. 2010, 29, 577–590. [Google Scholar] [CrossRef]

- Niu, B.; Chen, L.; Zhang, J. Punishing or subsidizing? Regulation analysis of sustainable fashion procurement strategies. Transp. Res. Part E Logist. Transp. Rev. 2017, 107, 81–96. [Google Scholar] [CrossRef]

- Ye, F.; Li, Y.; Yang, Q. Designing coordination contract for biofuel supply chain in China. Resour. Conserv. Recycl. 2018, 128, 306–314. [Google Scholar] [CrossRef]

- Ma, W.; Zhang, R.; Chai, S. What Drives Green Innovation? A Game Theoretic Analysis of Government Subsidy and Cooperation Contract. Sustainability 2019, 11, 5584. [Google Scholar] [CrossRef]

- Xue, J.; Gong, R.; Zhao, L.; Ji, X.; Xu, Y. A Green Supply-Chain Decision Model for Energy-Saving Products That Accounts for Government Subsidies. Sustainability 2019, 11, 2209. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int. J. Prod. Econ. 2015, 164, 319–329. [Google Scholar] [CrossRef]

- Saha, S.; Goyal, S. Supply chain coordination contracts with inventory level and retail price dependent demand. Int. J. Prod. Econ. 2015, 161, 140–152. [Google Scholar] [CrossRef]

- Yenipazarli, A. To collaborate or not to collaborate: Prompting upstream eco-efficient innovation in a supply chain. Eur. J. Oper. Res. 2017, 260, 571–587. [Google Scholar] [CrossRef]

- Choi, T.-M.; Chiu, C.-H. Mean-downside-risk and mean-variance newsvendor models: Implications for sustainable fashion retailing. Int. J. Prod. Econ. 2012, 135, 552–560. [Google Scholar] [CrossRef]

- Ma, W.; Cheng, Z.; Xu, S. A Game Theoretic Approach for Improving Environmental and Economic Performance in a Dual-Channel Green Supply Chain. Sustainability 2018, 10, 1918. [Google Scholar] [CrossRef]

- Krass, D.; Nedorezov, T.; Ovchinnikov, A. Environmental Taxes and the Choice of Green Technology. Prod. Oper. Manag. 2013, 22, 1035–1055. [Google Scholar] [CrossRef]

- Tang, L.; Shi, J.; Yu, L.; Bao, Q. Economic and environmental influences of coal resource tax in China: A dynamic computable general equilibrium approach. Resour. Conserv. Recycl. 2017, 117, 34–44. [Google Scholar] [CrossRef]

- Hong, Z.; Guo, X. Green product supply chain contracts considering environmental responsibilities. Omega 2019, 83, 155–166. [Google Scholar] [CrossRef]

- Shen, B.; Li, Q. Impacts of Returning Unsold Products in Retail Outsourcing Fashion Supply Chain: A Sustainability Analysis. Sustainability 2015, 7, 1172–1185. [Google Scholar] [CrossRef]

- Leitão, J.; Pereira, D.; De Brito, S. Inbound and Outbound Practices of Open Innovation and Eco-Innovation: Contrasting Bioeconomy and Non-Bioeconomy Firms. J. Open Innov. Technol. Mark. Complex. 2020, 6, 145. [Google Scholar] [CrossRef]

- Li, Q.; Zhang, Z.; Rao, W.; Xu, W.; Jiang, L. Green Investment Decisions in Supply Chains: A Game Model with Complete Information. Information 2019, 10, 185. [Google Scholar] [CrossRef]

- Govindan, K.; Popiuc, M.N. Reverse supply chain coordination by revenue sharing contract: A case for the personal computers industry. Eur. J. Oper. Res. 2014, 233, 326–336. [Google Scholar] [CrossRef]

- Nesticò, A.; Galante, M. An estimate model for the equalisation of real estate tax: A case study. Int. J. Bus. Intell. Data Min. 2015, 10, 19–32. [Google Scholar] [CrossRef]

- Niu, B.; Liu, Y.; Luo, H.; Feng, B. Domestic sourcing vs. cross-border sourcing: Impact of the quality of the scrap metal and Government’s tariff policies. J. Clean. Prod. 2019, 208, 1281–1293. [Google Scholar] [CrossRef]

- Janeiro, L.; Patel, M.K. Choosing sustainable technologies. Implications of the underlying sustainability paradigm in the decision-making process. J. Clean. Prod. 2015, 105, 438–446. [Google Scholar] [CrossRef]

- Bai, C.; Satir, A.; Sarkis, J. Investing in lean manufacturing practices: An environmental and operational perspective. Int. J. Prod. Res. 2018, 57, 1037–1051. [Google Scholar] [CrossRef]

- Meng, Q.; Wang, Y.; Zhang, Z.; He, Y. Supply chain green innovation subsidy strategy considering consumer heterogeneity. J. Clean. Prod. 2021, 281, 125199. [Google Scholar] [CrossRef]

- Silvestre, B.S. Sustainable supply chain management in emerging economies: Environmental turbulence, institutional voids and sustainability trajectories. Int. J. Prod. Econ. 2015, 167, 156–169. [Google Scholar] [CrossRef]

- Xing, G.; Xia, B.; Guo, J. Sustainable Cooperation in the Green Supply Chain under Financial Constraints. Sustainability 2019, 11, 5977. [Google Scholar] [CrossRef]

- Shi, X.; Dong, C.; Zhang, C.; Zhang, X. Who should invest in clean technologies in a supply chain with competition? J. Clean. Prod. 2019, 215, 689–700. [Google Scholar] [CrossRef]

- Hall, J.; Matos, S.; Silvestre, B. Understanding why firms should invest in sustainable supply chains: A complexity approach. Int. J. Prod. Res. 2012, 50, 1332–1348. [Google Scholar] [CrossRef]

- Chan, H.K.; Yee, R.W.; Dai, J.; Lim, M.K. The moderating effect of environmental dynamism on green product innovation and performance. Int. J. Prod. Econ. 2016, 181, 384–391. [Google Scholar] [CrossRef]

- Ba, S.; Ling, L.; Liu, Q.; Stallaert, J. Stock Market Reaction to Green Vehicle Innovation. Prod. Oper. Manag. 2013, 22, 976–990. [Google Scholar] [CrossRef]

- Lin, R.-J.; Tan, K.-H.; Geng, Y. Market demand, green product innovation, and firm performance: Evidence from Vietnam motorcycle industry. J. Clean. Prod. 2013, 40, 101–107. [Google Scholar] [CrossRef]

- Niu, B.; Mu, Z.; Chen, L.; Lee, C.K. Coordinate the economic and environmental sustainability via procurement outsourcing in a co-opetitive supply chain. Resour. Conserv. Recycl. 2019, 146, 17–27. [Google Scholar] [CrossRef]

- Wang, Y.; Niu, B.; Guo, P. On the Advantage of Quantity Leadership When Outsourcing Production to a Competitive Contract Manufacturer. Prod. Oper. Manag. 2012, 22, 104–119. [Google Scholar] [CrossRef]

- Wu, J.; Fan, J.; He, Y. Pricing and horizontal information sharing in a supply chain with capacity constraint. Oper. Res. Lett. 2018, 46, 402–408. [Google Scholar] [CrossRef]

- Matsui, K. When should a manufacturer set its direct price and wholesale price in dual-channel supply chains? Eur. J. Oper. Res. 2017, 258, 501–511. [Google Scholar] [CrossRef]

- Zhao, J.; Wei, J.; Li, Y. Pricing decisions for substitutable products in a two-echelon supply chain with firms’ different channel powers. Int. J. Prod. Econ. 2014, 153, 243–252. [Google Scholar] [CrossRef]

- Chen, X.; Zhang, H.; Zhang, M.; Chen, J. Optimal decisions in a retailer Stackelberg supply chain. Int. J. Prod. Econ. 2017, 187, 260–270. [Google Scholar] [CrossRef]

- Chernonog, T. Inventory and marketing policy in a supply chain of a perishable product. Int. J. Prod. Econ. 2020, 219, 259–274. [Google Scholar] [CrossRef]

- Albrecht, M. Determining near optimal base-stock levels in two-stage general inventory systems. Eur. J. Oper. Res. 2014, 232, 342–349. [Google Scholar] [CrossRef]

- Shafiq, M.; Savino, M.M. Supply chain coordination to optimize manufacturer’s capacity procurement decisions through a new commitment-based model with penalty and revenue-sharing. Int. J. Prod. Econ. 2019, 208, 512–528. [Google Scholar] [CrossRef]

- Bhaskaran, S.R.; Krishnan, V. Effort, Revenue, and Cost Sharing Mechanisms for Collaborative New Product Development. Manag. Sci. 2009, 55, 1152–1169. [Google Scholar] [CrossRef]

- Liu, X.; Lin, K.; Wang, L.; Ding, L. Pricing Decisions for a Sustainable Supply Chain in the Presence of Potential Strategic Customers. Sustainabillity 2020, 12, 1655. [Google Scholar] [CrossRef]

- Gong, B.; Xia, X.; Cheng, J. Supply-Chain Pricing and Coordination for New Energy Vehicles Considering Heterogeneity in Consumers’ Low Carbon Preference. Sustainability 2020, 12, 1306. [Google Scholar] [CrossRef]

- González, A.B.R.; Díaz, J.J.V.; Wilby, M.R. Dedicated tax/subsidy scheme for reducing emissions by promoting innovation in buildings: The EcoTax. Energy Policy 2012, 51, 417–424. [Google Scholar] [CrossRef]

- Liu, Z.; Li, X.; Peng, X.; Lee, S. Green or nongreen innovation? Different strategic preferences among subsidized enterprises with different ownership types. J. Clean. Prod. 2020, 245, 118786. [Google Scholar] [CrossRef]

- Kyparisis, G.J.; Koulamas, C. Resale price maintenance in supply chains with general multiplicatyive demand. Oper. Res. Lett. 2018. [Google Scholar] [CrossRef]

- Wang, Y.; Jiang, L.; Shen, Z. Channel Performance under Consignment Contract with Revenue Sharing. Manag. Sci. 2004, 50, 34–47. [Google Scholar] [CrossRef]

- Li, Y.; Xu, L.; Li, D. Examining relationships between the return policy, product quality, and pricing strategy in online direct selling. Int. J. Prod. Econ. 2013, 144, 451–460. [Google Scholar] [CrossRef]

- Dong, C.; Shen, B.; Chow, P.-S.; Yang, L.; Ng, C.T. Sustainability investment under cap-and-trade regulation. Ann. Oper. Res. 2016, 240, 509–531. [Google Scholar] [CrossRef]

- Wang, Y. Joint Pricing-Production Decisions in Supply Chains of Complementary Products with Uncertain Demand. Oper. Res. 2006, 54, 1110–1127. [Google Scholar] [CrossRef]

- Sun, J.; Wang, X.; Xiong, N.; Shao, J. Learning Sparse Representation with Variational Auto-Encoder for Anomaly Detection. IEEE Access 2018, 6, 33353–33361. [Google Scholar] [CrossRef]

- Fang, W.; Yao, X.; Zhao, X.; Yin, J.; Xiong, N. A Stochastic Control Approach to Maximize Profit on Service Provisioning for Mobile Cloudlet Platforms. IEEE Trans. Syst. Man Cybern. Syst. 2016, 48, 522–534. [Google Scholar] [CrossRef]

| Symbol | Definition |

|---|---|

| The price elasticity coefficient | |

| The green technology investment elasticity coefficient | |

| The production cost | |

| The green technology investment level | |

| The stocking factor of inventory | |

| The wholesale price | |

| The order quantity and the leftovers | |

| The demand stochastic variable which is uniformly distributed on | |

| The green technology investment cost coefficient | |

| The elasticity of products’ pollution reduction to green technology investment | |

| The supply chain’s environmental impacts | |

| // | The profit of the whole supply chain/supplier/retailer |

| CI/CI-N | The subscript represents the centralized supply chain with green technology investment/without green technology investment |

| SI/SI-N | The subscript represents the scenario in which the supplier invests in green technology/doesn’t invest in green technology |

| RI/RI-N | The subscript represents the scenario in which the retailer invests in green technology/doesn’t invest in green technology |

| CTSI | The subscript represents the scenario in which the supplier and the retailer joint invest in green technology and the supplier decides the investment level |

| / | The decentralized supply chain efficiency in Scenario SI and Scenario RI |

| Scenario CI | |

|---|---|

| Scenario SI | |

|---|---|

| Scenario RI | |

|---|---|

| Scenario CI | Scenario SI | Scenario RI | Scenario CTSI | |

|---|---|---|---|---|

| / | ||||

| / | ||||

| / | ||||

| / | ||||

| / |

| Scenario CTSI | |

|---|---|

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, C.; Zou, Z.; Geng, S. Green Technology Investment in a Decentralized Supply Chain under Demand Uncertainty. Sustainability 2021, 13, 3752. https://doi.org/10.3390/su13073752

Wang C, Zou Z, Geng S. Green Technology Investment in a Decentralized Supply Chain under Demand Uncertainty. Sustainability. 2021; 13(7):3752. https://doi.org/10.3390/su13073752

Chicago/Turabian StyleWang, Cong, Zongbao Zou, and Shidao Geng. 2021. "Green Technology Investment in a Decentralized Supply Chain under Demand Uncertainty" Sustainability 13, no. 7: 3752. https://doi.org/10.3390/su13073752

APA StyleWang, C., Zou, Z., & Geng, S. (2021). Green Technology Investment in a Decentralized Supply Chain under Demand Uncertainty. Sustainability, 13(7), 3752. https://doi.org/10.3390/su13073752