2.1. Global Trade Volume

Plastics are ubiquitous in the ocean. According to their sources, marine plastic garbage can be divided into land-sourced garbage and sea-sourced garbage [

23]. The distribution of land-based plastic waste will directly affect the flow of marine plastic waste, thereby affecting the treatment of marine plastic waste. The plastic waste trade directly changes a country’s plastic waste inventory, which in turn changes the distribution of marine plastic waste [

24]. International trade can only affect the distribution of waste in the short-term. In the long-term, the distribution of plastic waste will change with the action of ocean currents and winds that naturally occur in the oceans. According to the United Nations Comtrade Database (

http://comtrade.un.org/, accessed on 13 December 2020), code 3915 in the HS (International Convention Harmonized Commodity Description and Coding, Unified System) refers to plastic scrap, plastic leather scrap, and the database provides the volume, price and weight of the trade.

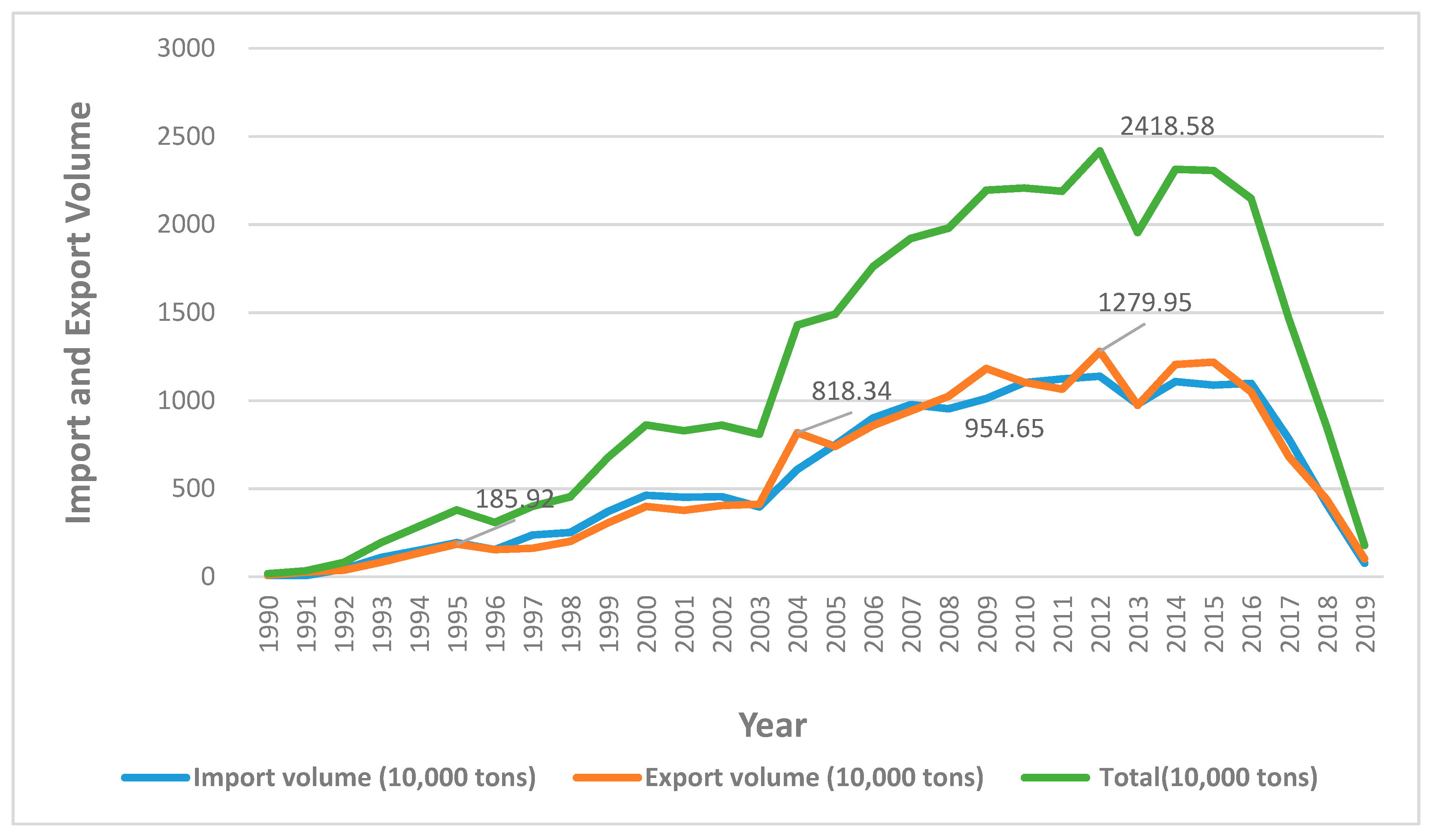

Figure 1 is plotted based on the volume of import and export trade, the global trade in plastic waste has undergone major changes in recent years:

From the perspective of global trade imports (

Figure 1), the global plastic waste trade volume rose rapidly from 1990, experienced a period of rapid development from 2006 to 2016, and fell sharply after 2016. Global imports rose from 84,500 tons in 1990 to 11,386,200 tons in 2012, and experienced a period of stable trade, from 7,823,200 tons in 2016 to 765,000 tons in 2019. It can be seen from the two curves of global total export volume and import volume that the trends are roughly similar, with the overall rising first and then falling. In 2013, the global export volume dropped significantly, an important reason was the Green Fence Campaign, which resulted in the reduction of acceptable plastic waste in China and the transport of plastic waste back to the original exporting countries. In addition, there was no infrastructure for waste management in other regions, so both the global import and export volume of plastics were affected, and the import and export volume declined at the same time. Of course, the impact of this movement is temporary, with exports and imports rising from 2014 to 2016. After China announced a ban on plastic waste in 2017, global imports and exports fell sharply. In general, plastic waste exports more than imports. There is a big import gap, it shows a lack of formal plastic waste management that countries can’t internally “digest” the waste. On the one hand, countries are seeking new solutions, to promote recycled plastics processing technology or to redesign of plastic packaging for recycling [

18]. On the other hand, they export waste to acceptable countries and reduce domestic waste through trade, but this trade has decreased as a large number of countries have enacted bans.

From the

Figure 1, the global plastic waste trade can be divided into three stages. The first stage (before 2000): The total import and export volume of the global plastic waste trade is low and the growth rate is slow, importing 84,500 tons from 1990, the export of 92,800 tons increased to 4,628,700 and 3,992,300 tons in 2000. In this stage, the European Union and North America dominated trade. The second stage (2001 to 2016): in this stage, the global trade volume increased sharply. The export volume increased from 4,521,000 tons in 2001 to 10,492,300 tons in 2016, and the import volume increased from 3,774,400 to 10,985,000 tons. The import volume and export volume increased by 142% and 147% respectively, and reached the maximum value of 11.39 million tons and 12.8 million tons in 2012. The third stage is (2017 to 2019): in this stage the total global import and export volume has shown a downward trend, from 782 million tons and 6.82 million tons in 2017 to 765,000 tons and 1.025 million tons, a drop of nearly 90% and 85%. Plastic trade can reduce manufacturing costs, as can be seen in the 1990s when China recycled plastic waste profitably by using it in the manufacturing industry. China’s demand for plastic is driving the global plastic trade, leading the country to accept more than 50% of the global plastic waste, and making it the world’s global plastic waste factory at the beginning of the 21st century. Along with the development of China’s manufacturing industry, the priority has also changed. Now the plastic recycling industry has a greater internal market, in order to protect the ecological environment domestically, China has implemented plastic import restrictions, following the “green fence” and “blue sky” initiatives launched by the Chinese government in 2017. The purpose was to crack down on smuggling solid waste “national sword action”, after which the global plastic trade went into chaos.

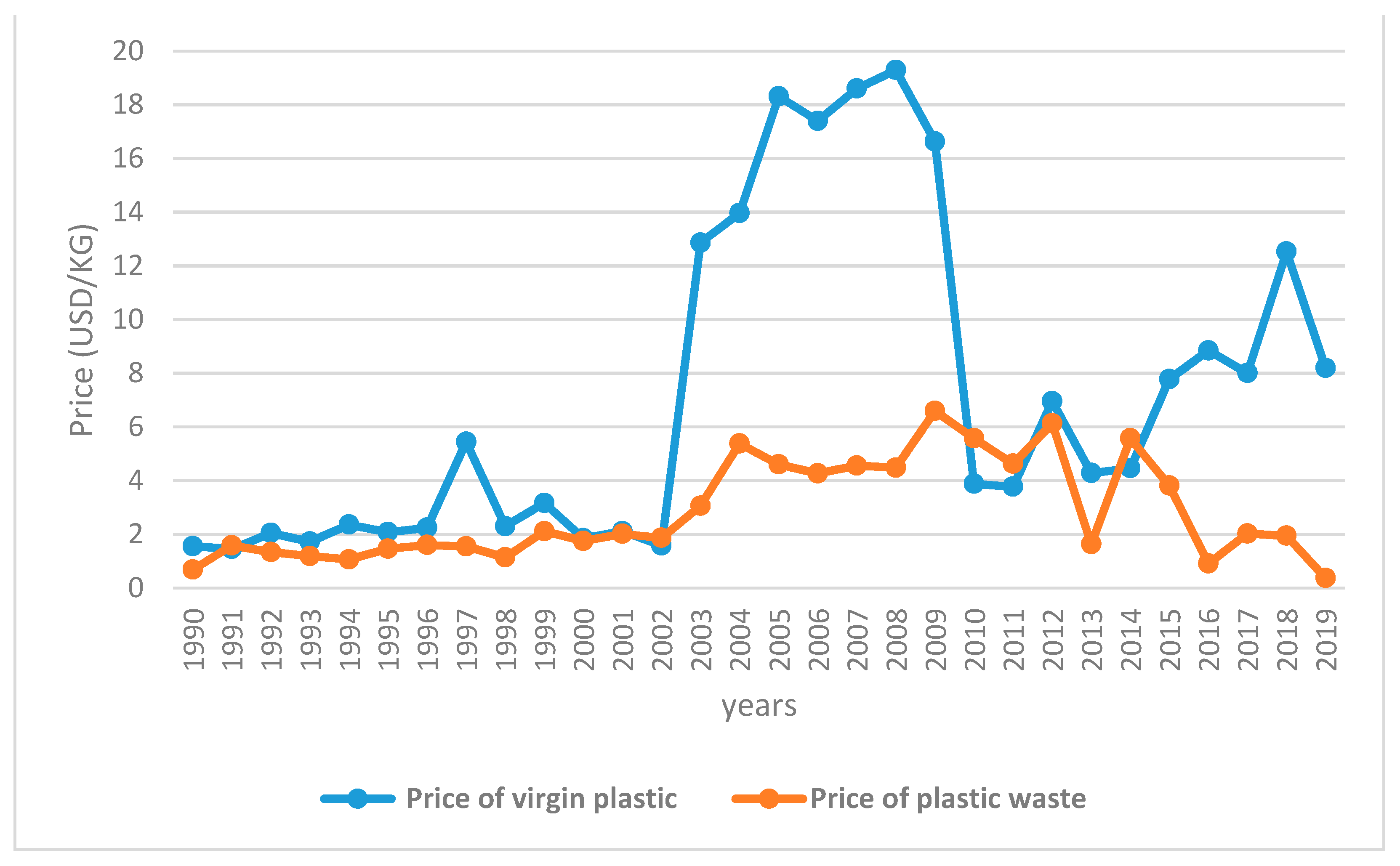

Global plastic waste trade is the cross-border transfer of plastic waste in which trade transaction price is an important factor affecting the volume of import and export trade. In order to explore the relationship between the price of plastic waste and the import and export volume (according to the UN Comtrade Database), the price of plastic waste imported and exported per unit and the price of virgin plastic finished products from 1990 to 2019 were calculated (

Figure 2). It can be seen from

Figure 2 that the price of plastic waste is generally follows the price of virgin plastic. During 1990 to 2000, the prices of the two curves were roughly the same; during 2000 to 2010, the price of virgin plastics was significantly higher than that of plastic waste; after 2010, the gap between the two curves gradually widened. Plastics are mostly formed by petroleum and other fossil fuels which are refined. Plastic flexible packaging materials are basically petroleum refined byproducts that are processed into the base material as raw materials. These would include, polypropylene (PP), ink, glue and other materials that are closely related to oil. In the value proportion of plastic flexible packaging products, the material cost accounts for 80% of its total cost, accounting for about 60% of sales. Therefore, the cost of plastic flexible packaging products and oil prices are positively correlated. The price of petroleum increased rapidly from 2005 to 2008, which led to a significant rise in the transaction price of plastics. After the financial crisis in 2008, the transaction price of virgin plastics dropped sharply, and the price of plastic waste also declined. In recent years, the fluctuation range of oil price has been smaller, and the price of plastic waste has been relatively stable. After 2014, the price showed a declining trend. One important reason is that China promulgated the “Green Fence Action” in 2013. As the largest importer, it has become more expensive to transport to China, so the plastic waste exporting countries turn to Africa, Southeast Asia and other regions with lower prices. The price of plastic waste is expected to rise in the future as the Basel Convention is gradually implemented and more and more countries sign up to agreements banning cross-border transfers of waste.

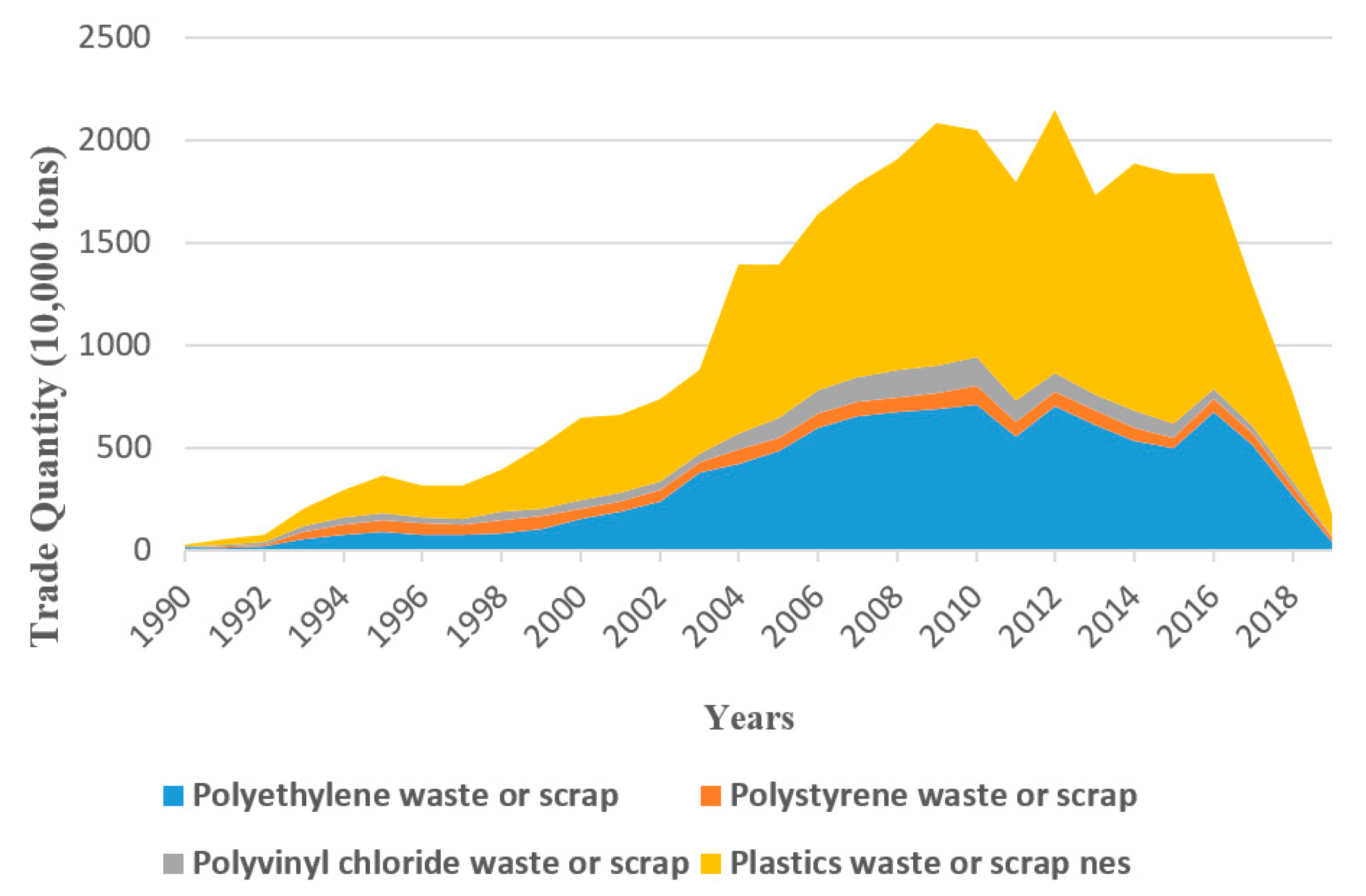

According to the UN Comtrade statistics list, plastic waste trade (HS 3915) can be divided into polyethylene waste (HS 391510), polystyrene waste (HS 391520), polyvinyl chloride (HS 391530), and others. The “other” plastics group includes plastic scrap polymers, which do not yet have an internationally agreed code for reporting. However, this includes trade in polymers such as polypropylene (PP) and polyethylene terephthalate (PET). Polyethylene (PE) waste is mainly used to make films and pipes. The recycling process is simple, however, the recycling value is relatively high [

25]. Polystyrene (PS) products are widely used in various capacities due to the small density, large volume, good thermal insulation performance and convenient installation. These capacities include, buildings and cold storage thermal insulation layers and disposable packaging materials, commonly found in a variety of household appliances, industrial accessories and product transportation packaging. In addition, a considerable part is used for disposable fast food lunch boxes, food packaging boxes, etc. The typical polystyrene waste is foam pads and various fast food boxes and drink cups, which are dirty and covered with dust and food debris, so it is difficult to recycle and of low value [

26]. Polyvinyl chloride (PVC) is mainly used for pipes, handbags, cables and so on. From the perspective of import and export categories (

Figure 3), the global plastic waste import and export trade was dominated by polyethylene and polystyrene waste in the early years. Polyethylene and polystyrene mixed with polypropylene are the most commonly used products by consumers [

27]. With the continuous development of trade, after entering the 21st century, polyethylene waste has become the main trading plastic waste which is easy to obtain and easy to recycle. Furthermore, polyethylene has a wide range of uses after recycling and processing, namely: further recycling, pelletizing, reusing, and making diesel.

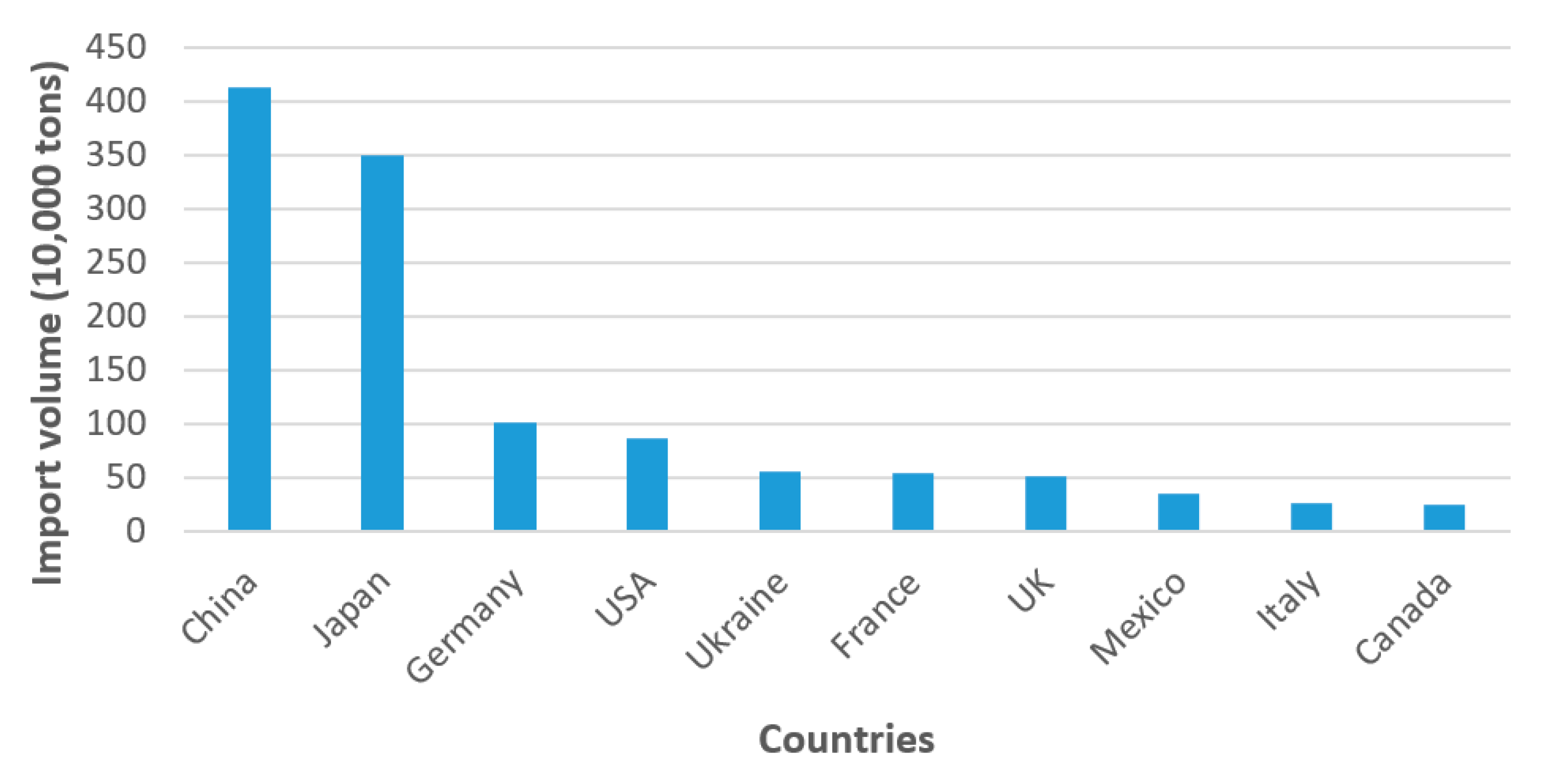

2.2. Main Country Trade Situation

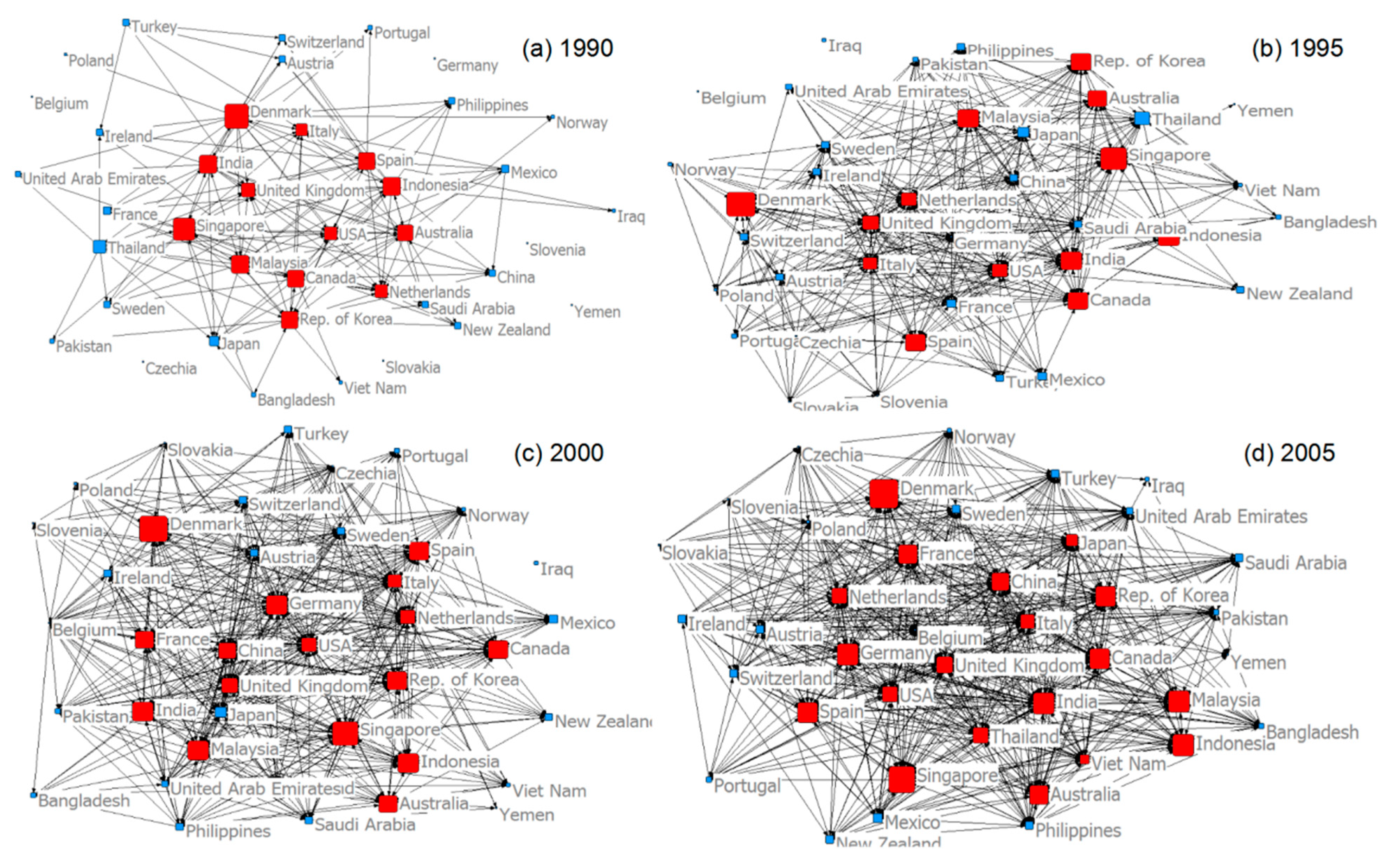

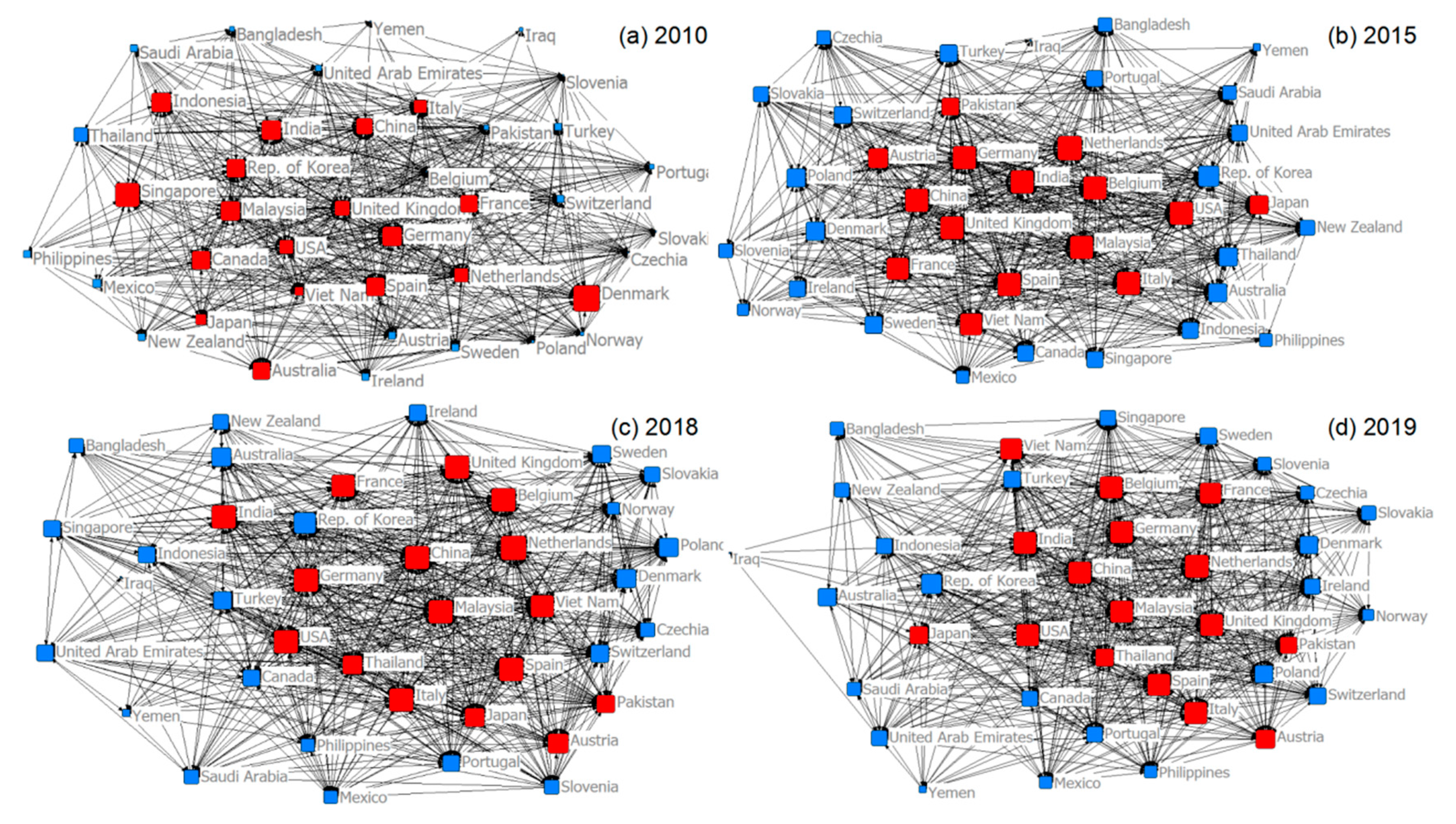

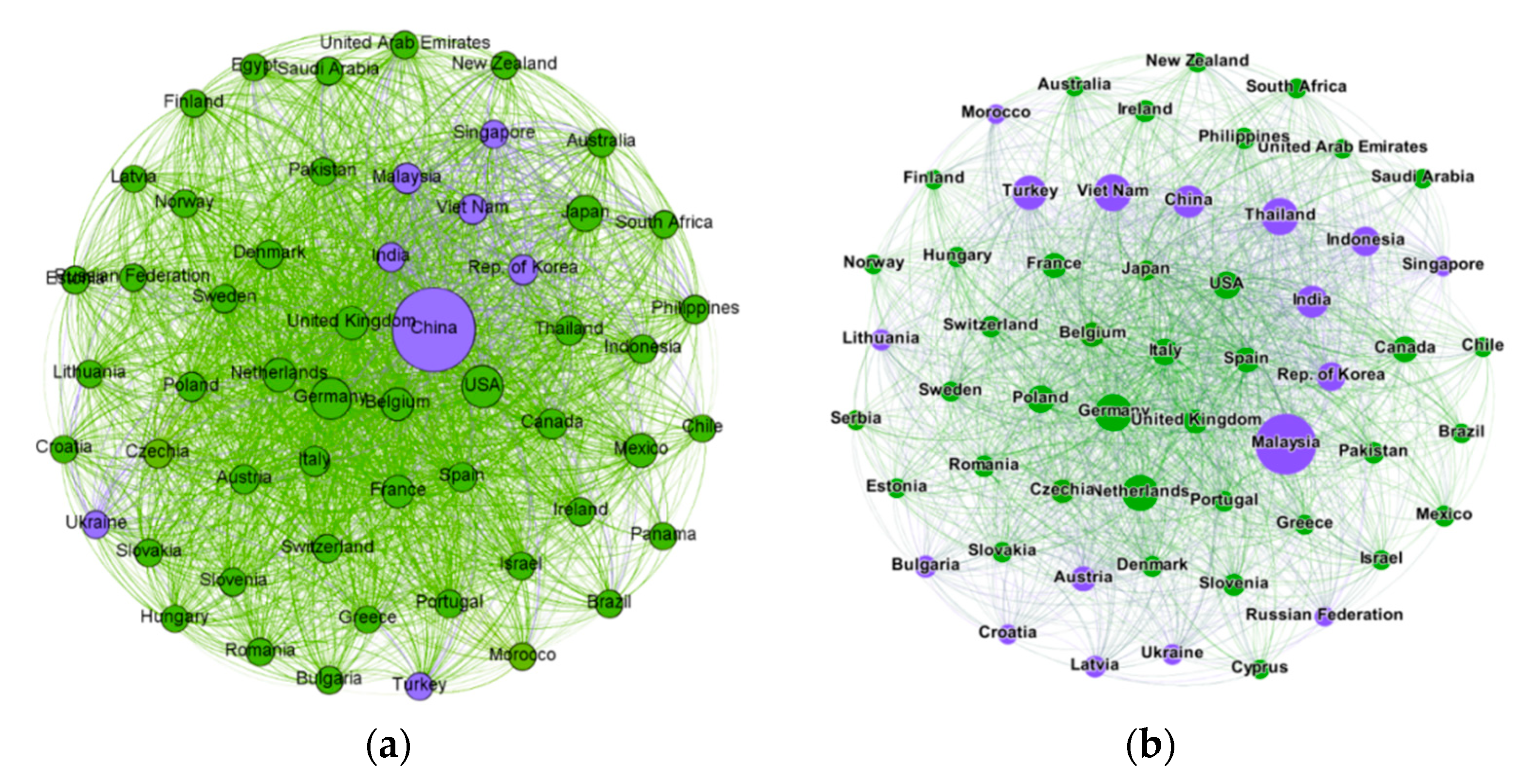

According to the UN Comtrade Database,

Figure 4 shows the top 10 countries in terms of global trade volume between 1990 and 2017. From 1990 to 2017, China (including Hong Kong, China) has been the world’s largest importer of plastic waste, followed by Japan and the European Union. That is, in the first two stages, China, Japan, the European Union, Germany, and the United States have always been the world’s largest plastic waste importers. The five countries (or regions) accounted for more than 65% of the total, which has a significant impact on the global plastic waste trade.

After China announced a ban on foreign waste imports in 2017, the global plastic waste trade has changed. The top 10 global plastic waste exports from 2015 to 2019 are listed in

Table 1 as follows:

From

Table 1, it can be concluded that Hong Kong has always been among the top three in global export volume (excluding the year 2018). From 2015 to 2017, Hong Kong, China has been ranked in first place. In 2018, its position declined and was subsequently ranked in fifth place. Hong Kong’s exports fell by 80% in 2018, and in 2019 it rose to second place but with decreased volume. The United States ranks in the forefront of the world’s export volume, and has been in second place from 2015 to 2017, accounting for about 16% of the world’s exports. Japan is the country with the largest export volume (except Hong Kong, China and the USA), and its exports accounted for 14% of the world’s total exports. After China issued the ban, seven of the top ten export rankings were found to be developed countries. In general, the world’s plastic waste exports are dominated by developed countries.

From the statistical data in

Table 2, the top two imports of waste plastics from 2015 to 2017 were relatively stable. They have been China, Hong Kong (China). It is worth noting that China and Hong Kong (China) are calculated separately in the statistics. According to the statistics of import and export volume, Hong Kong is the largest export region and import region. Plastic waste flows from other countries to Hong Kong and then to mainland China, where Hong Kong is one of China’s most important transshipment ports for plastic waste, transferring 22% of world trade to China each year [

28]. In 2017, the pattern changed with the implementation of China’s ban on plastic imports, whereby plastic waste from other countries could no longer be exported to Hong Kong, which was also a major factor in exports’ decrease from the US, Japan and other countries. In 2018, for the first time in history, China was no longer the top importer of plastic waste, with Malaysia taking the top spot. However, the list changed in 2019 again. China (Hong Kong), Canada, and Poland have become the top three, and Malaysia has fallen out of the top ten. One of the reasons is that Southeast Asian countries such as Malaysia have followed China in enacting plastic waste import bans. Since China issued the ban, the export target countries have undergone dynamic changes and are now extremely unstable. The estimated global import trade of waste plastics will shift to Southeast Asian countries. The influx of a large amount of plastic waste will make it difficult for these countries to cope with it. Therefore, Southeast Asian countries are undergoing changes and refuse to become the “trash can” of plastic waste in the world [

29].

Based on the above findings, the global plastic waste trade is unevenly distributed. The trade is mainly concentrated in Europe, Southeast Asia and North America. With the promulgation of bans in China and other countries, the focus on global plastic waste trade has changed. Europe has gone from being a big exporter to being both a big importer and exporter, and some countries in Asia have seen a significant drop in imports.

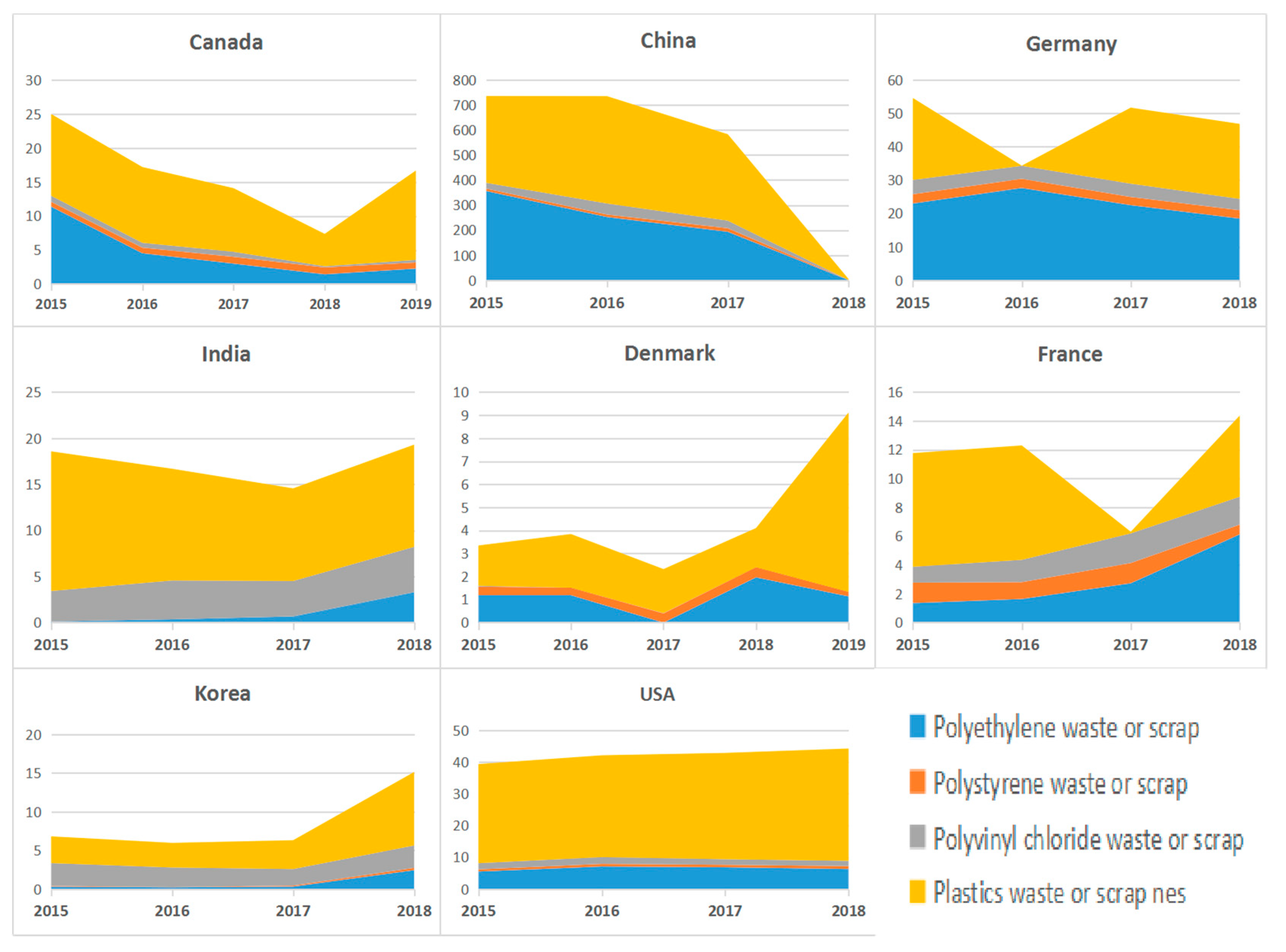

Figure 5 respectively reflects the imported plastic waste categories of major plastic waste trading countries from 2015 to 2018.

As shown in

Figure 5, imports of plastic waste in some countries, such as China and France, have declined significantly, but imports in most countries have increased, such as Japan and Denmark. The imports from the United States have remained stable. After the 2018 import ban took effect, China’s plastic waste imports continued to decline, from 3.4589 million tons in 2015 to 36,900 tons in 2018. Denmark’s imports in 2019 rose sharply, from 16,900 tons in 2018 to 78,000 tons. Japan also rose sharply, from 21,000 tons in 2018 to 16,800 tons, an increase of 6.7 times. In terms of total volume, the United States, Germany and Canada are important importing countries. The United States basically maintained around 350,000 tons in 2015–2018, and Germany basically remained at 220,000 tons. Canada’s imports in 2015–2018 have gradually declined, and imports in 2018 were 77,400 tons, but rose rapidly to 130,000 tons in 2019.

After the import ban took effect on 1 January 2018, China’s plastic waste imports continued to decline. With the exception of China and Japan, India experienced substantial growth in 2018 and fell back in 2019, while South Korea and Thailand jumped from net exporters to net importing countries. The United States plastic waste exports continued to decline in the period from 2018 to 2019. Imports also fell in 2019. Other net exporting countries also showed a decline in exports and an increase in imports in 2018. Among them, were the Netherlands and Belgium. In Spain and Canada, imports exceeded exports. This shows that the global plastic waste trade had some important changes under the influence of sudden factors. Next, this article will use complex network methods to predict the changing trend on global plastic waste.