1. Introduction

The concept of this paper was born as a result of many years of research conducted in the area of prudential regulations of banks, in which asset portfolios, along with intensively progressing globalization, are exposed to new types of financial risk. The beginning of the twenty-first century in the banking sector was a period of strong concentration of financial capital and domination of large capital groups, defined as the financialization process [

1,

2,

3,

4,

5,

6,

7,

8]. It turned out to be dangerous for the economic growth path because it was interrupted by the global financial crisis, which has undermined previous strong confidence in the too big to fail (TBTF)-financial institutions. As a consequence, these institutions were subjected to new regulations, limiting excessive leverage of their activities and obliging them to increase the volume and quality of their equity. Regarding this, two important documents, the Total Loss-Absorbing Capacity (TLAC) and Minimum Requirement for Own Funds and Eligible Liabilities (MREL) that build a new regulatory order of the European Union were implemented. TLAC was finally approved in October 2016, focusing on the top 30 G-SIBs (Global Systemically Important Banks) (As TLAC covers financial institutions all over the world, not only in the EU, it adopts a universal nomenclature and the word “bank” and G-SIB, while not “credit institution” and GSII as in the case of the EU.). The contained regulations increase the possibility of their recapitalization in the event of an orderly restructuring and liquidation (

resolution). The first regulations included in TLAC were implemented in January 2019. The second phase should take place in 2022. In general, TLAC is entirely composed of its own funds and subordinated liabilities that are credibly eligible for redemption or conversion of debt (bail-in) [

9]. MREL was developed by the European Banking Authority (EBA) for the EU financial institutions [

10]. MREL is a regulation that covers all European Union countries since 2017. EBA published the final report of MREL and implemented it into the Community legislation on 14 December 2016. MREL, like TLAC, specifies a minimum level of equity and eligible liabilities that, in the event of an orderly liquidation of a credit institution (resolution), are to be used to cover losses and ensure that losses are covered by the capital of shareholders and creditors, not by taxpayers’ funds. MREL is the EU standard for the bank’s bail-in capital, included in the BRRD/SRMR package of 2014, which will be implemented by 2023 [

11]. At the same time, since 1 January 2014, two important legal acts, called the CRD package (CRD IV/CRR), became applicable in the EU [

12,

13,

14]. They mainly change the requirements of capital adequacy in banks, although they also introduce new prudential regulations related to the financial leverage and liquidity requirements of credit institutions. In addition, it was the first time that financial intermediaries have been subjected to macroprudential requirements (see

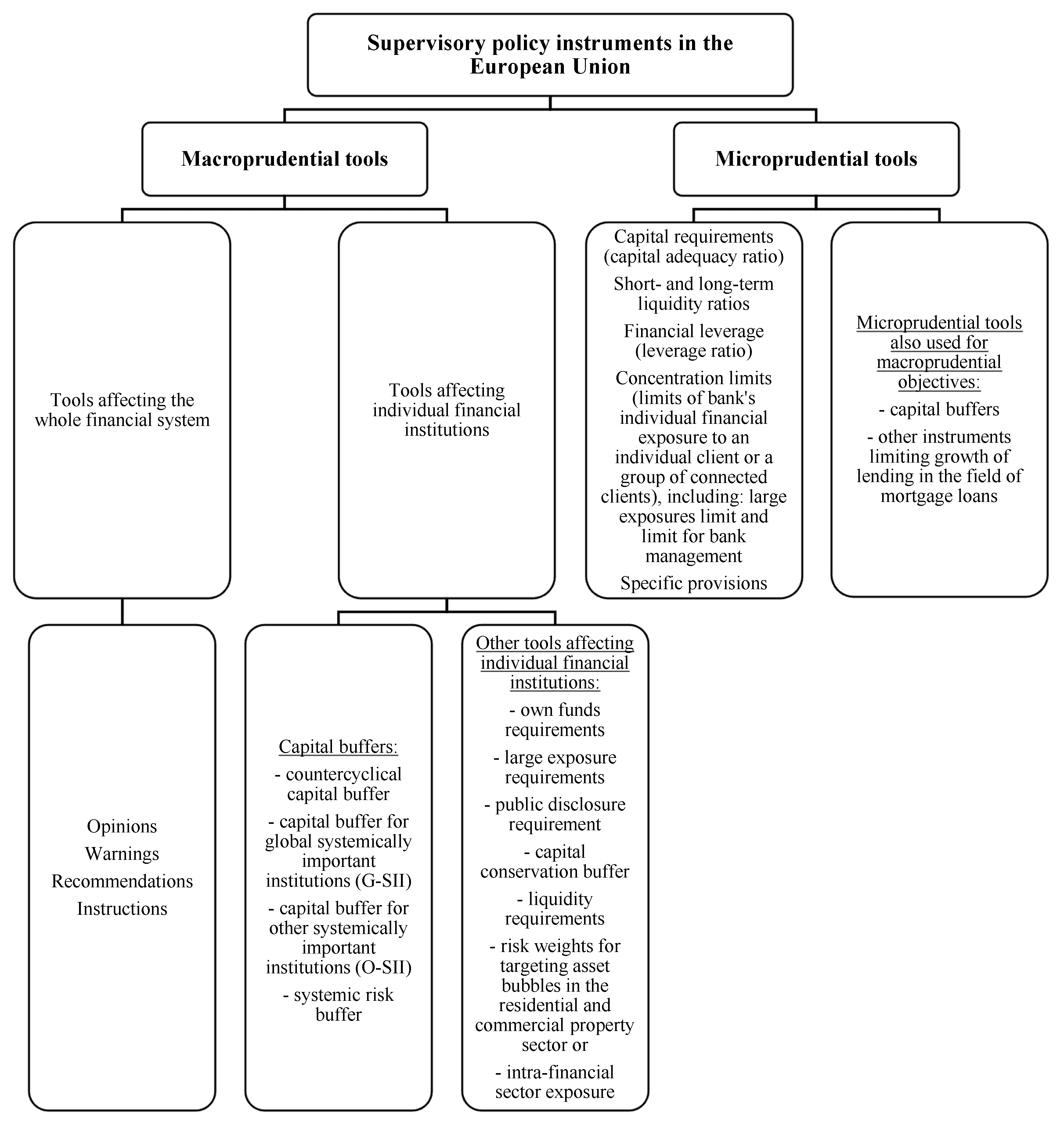

Scheme 1).

Therefore, after the global financial crisis, a new regulatory order has emerged in the banking system [

15]. While not all of the resulting prudential regulations—as it is not hard to see—took effect, in the space of the global economy another coronavirus-induced recession has appeared. Although, it first destabilized the real economy, but secondarily, it affected the financial stability of the world economy countries. Undoubtedly, financial markets are the major losers of this period [

16]. The wave of observed declines on markets may only be evidence of diminishing savings accumulated by economic entities, also causing serious problems in the banking market. Banks, after the global financial crisis, due to changes in prudential regulations, fell into the so-called “short-termism” [

17,

18]. It means that the average maturity of newly built assets is relatively short. Therefore, banks do not fulfill one of their most important functions, which is the maturity transformation. Thus, the effectiveness of their operating activities is declining, intensifying expectations for an extension of the financing period [

17,

18]. The COVID-19 pandemic is not conducive to changing the structure of banks’ financing. Undoubtedly, the negative effects of short-termism in banks are mitigated by expansionary (loose) monetary policy [

19,

20]. However, it is influenced in various ways by extensive government support [

21]. On the other hand, an important reason for recording government intervention support during the pandemic period is the expectations of financial market participants to their end. Then, it will turn out at what new level of economic equilibrium and in what financial market’s environment banks will operate. In connection with the COVID-19 pandemic, many regulators, including the Polish Financial Supervision Authority, the European Central Bank, EBA, ESMA, and even the European Commission, have taken initiatives to support banks in the continuation of financing business entities. The ECB enabled banks to operate below capital requirements resulting from Pillar 2 and the LCR ratio and postponed implementation of some of the requirements included in the CRD V under Pillar 2 that were due to apply from June 2021. The ECB also temporarily lowered a qualitative market risk multiplier in the face of exceptional market volatility. It also recommends banks suspend payments of dividends and refrain from repurchasing shares.

The Polish Financial Supervision Authority (PFSA) has an individual approach to a level of liquidity buffer, adjusting supervisory response if a bank’s LCR ratio is below the regulatory standards. The PFSA also implemented a reduced risk weight for secured loans by BGK (

National Economy Bank) guarantees [

22]. However, the regulatory support will cease along with the normalization of economic and financial conditions of the European economy affected by the COVID-19 pandemic. Nevertheless, it affects the efficient functioning of credit institutions, including their ability to hedge bank risk resulting from prudential norms. This issue was indicated by various representatives of the scientific community because the newly implemented regulations increase demand for bank capital while changing its quality and financing structure in banks, which significantly determines the capital effectiveness of global financial markets [

23,

24,

25,

26,

27,

28,

29,

30,

31,

32]. The main aim of this paper is an extrapolation of risks appearing in the unstable environment of credit institutions, which are increasingly boldly directing their expectations on their inclusion in the sustainable finance concept implementation. This concept already has its own history. Basically, it concerns the sustainable development of the global economy [

33,

34,

35,

36], which has also become an important objective of the European Union, enshrined in the Treaty of Lisbon. Article 3. pos. 3 obliges the EU Member States to contribute to sustainable development, which is based on sustainable economic growth and price stability, highly competitive social market economy, aiming at full employment and social progress, as well as a high level of protection and improvement of quality of the environment [

37]. The concept of sustainable development included in the documents constituting the European Union means in practice an imperative of its implementation by the EU bodies and structures, Member States, their citizens, as well as companies and institutions. In the EU environment, the concept of sustainable development turned out to be important to concretize, resulting from the Paris Agreement concluded in 2015 at the 21st Congress (COP21), where the climate policy goal was set, which is limiting global warming at a level “well below 2 °C” [

38]. However, by 2019, no comprehensive climate policy implementation program had been developed in any European country. For this reason, the European Commission has taken the initiative to accelerate and coordinate actions in the field of limiting climate change, assigned to the public policy [

39]. In autumn 2019, the “European Green Deal” document was published [

40]. It is an action plan for a sustainable EU economy, taking into account the findings of the “2018 Katowice Climate Change Conference”, where positions on detailed solutions for the inclusion of sustainable finance in the investment decision-making processes were agreed upon. Therefore, sustainable finance is the main subject of this study. On 15 April 2020, the Council of the European Union implemented a common classification system for sustainable finance that should encourage private investors to invest in sustainable growth and contribute to the climate neutrality of an economy (Taxonomy for climate change mitigation and adaptation should have been adopted by the end of 2020, so that it could be fully applied by the end of 2021. For the remaining four objectives, the taxonomy is expected to be defined by the end of 2021 and apply by the end of 2022.). It should also facilitate assessment and help investors redirect investment towards more sustainable technologies and companies. The declaration of the “European Green Deal” implementation has been confirmed even in a pandemic. It was recognized that the post-pandemic economic recovery programs will also include initiatives leading to a zero GHG emission balance in Europe in 2050 [

41,

42]. However, activities undertaken in this area prove that a platform for financing sustainable development has been created outside the banking sector. Banks should be replaced by investment funds, pension funds, insurance companies, and, of course, a large stream of public funds, directed more and more abundantly at public-private partnerships. On the other hand, more and more banks are moving towards sustainable finance, perceiving a need for green assets, which is particularly satisfactory for their strategic partners. Banks also place their expectations in financial intermediation between EU funds to support green investments and their recipients. It should be expected that their role in the process of financing sustainable development will increase. However, banks will face serious financial challenges, resulting from both a need to hold adequate bank capital to secure their risk, as well as from limitations in access to financial capital caused by “green” competition. Therefore, this publication intends to verify a research hypothesis that after the global financial crisis banks meet the new prudential capital regulations, however by their inclusion in the concept of green finance, they will increase a share of mitigation in the bank risk management strategy.

This article consists of two parts: theoretical and empirical. The first part covers the introduction, along with a broad, international literature review, aimed at presenting the essence of new capital regulations of banks and credit institutions in the European Union, as well as origins of the concept of sustainable finance, which is an essential pillar of sustainable development of the global economy. The second part, the empirical one, includes the methodology used in the research, as well as the results obtained from the subsequent stages. The article is summarized by the “Discussion” and then “Conclusions” sections where the obtained results are interpreted in reference to the current literature, studies, and research. They also present final conclusions of the research, as well as main limitations, questions, and thoughts for further in-depth research. Additionally, they contain some recommendations for policymakers and researchers. The following research methods were used: descriptive and critical analysis, literature studies, review of empirical data, questionnaire survey, quantitative data analysis, cause and effect analysis, observation method, document analysis method, as well as a synthesis method. The questionnaire survey was conducted among managers of commercial banks operating in Poland, aimed at assessing the degree of restrictiveness of the prudential regulations implemented after the global financial crisis. Then, the results of the survey were compared with quantitative sector data to determine the adaptability of domestic banks to the new prudential regime.

The studies used a questionnaire survey as an inductive research method. The questionnaire survey allowed us to draw conclusions in the area of capital adequacy of commercial banks in Poland. At the same time, the use of the quantitative research method enabled verification of these conclusions, and in the process of deductive inference, their generalization for the whole banking sector. The adopted research methodology resulted from the lack of access to quantitative data of all commercial banks running a business in Poland.

The study also posed the following research questions:

- ▪

To what extent does the new regulatory order affect the level of capital adequacy of commercial banks in Poland in the process of implementing the concept of sustainable finance?

- ▪

Do the new capital requirements increase the level of financial security of credit institutions in Poland?

- ▪

What are the adaptation abilities of domestic banks in Poland to the new prudential regime?

- ▪

What is the current level of capital protection of credit institutions in Poland?

- ▪

To what extent are commercial banks in Poland involved in the implementation of the sustainable finance concept?

- ▪

Does the inclusion of commercial banks in Poland in the concept of green finance of investment change their bank risk management strategies?

2. Materials and Methods

The empirical research was carried out in two stages. The two-stage research concept enabled a comparative analysis of the results obtained at individual stages, and thus comprehensively investigating the undertaken issues and achieve the objective adopted in the study. In the first stage, a quantitative assessment of the impact of regulatory changes on a level of banks’ capital adequacy in the process of implementing the concept of sustainable finance (PLQIS: Polish banking sector Quantitative Impact Study) was performed. For this purpose, in the first quarter of 2020, the questionnaire survey was carried out. It was conducted using an electronic questionnaire. In the research, representatives of the top 10 largest commercial banks in Poland took part (The research covered the following commercial banks in Poland: PKO BP, Bank Pekao S.A., Santander Bank Polska, mBank, ING Bank Śląski, BNP Paribas, Bank Millenium, Alior Bank, Citi Handlowy, and Getin Bank.). The selection of the research sample was determined by the fact that the size of the total assets of the top 10 largest banks in Poland at the end of 2018 accounted for 73.5% of the total assets of the whole Polish banking sector. The balance sheet total of the banks included in the research was over 1609.2 bln PLN. The research sample included only commercial banks, none of the more than 500 cooperative banks operating in Poland participated in the study. As not all banks operating in Poland participated in the research, it can not be ruled out that including data from other banks in the sample might have influenced the final survey results.

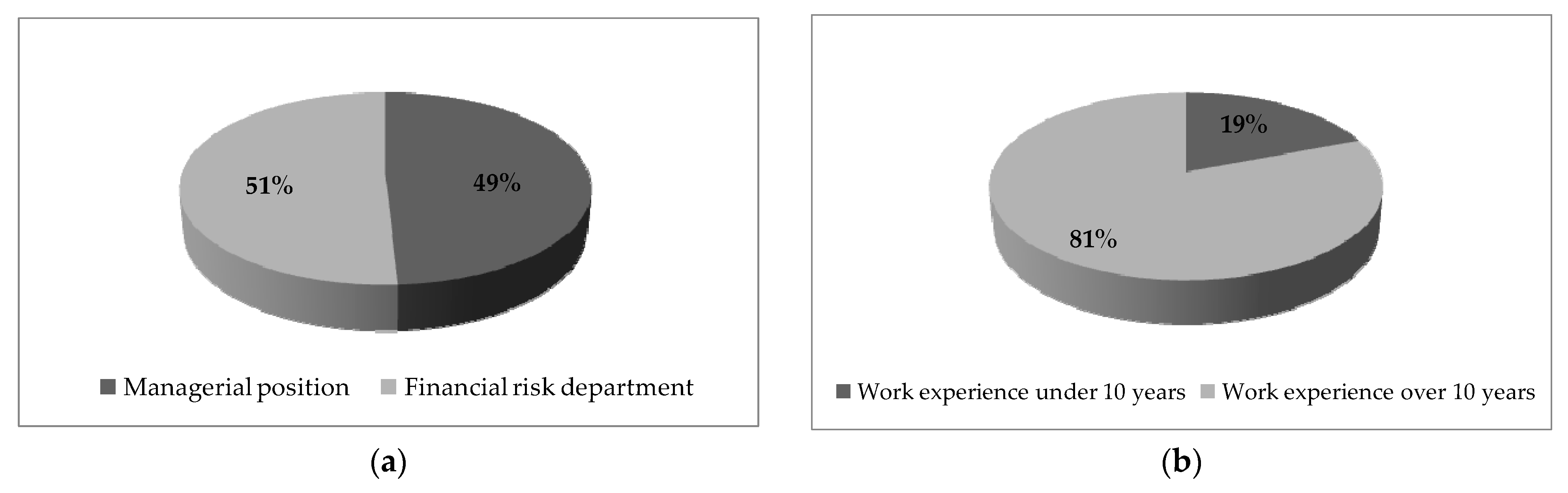

The questionnaire survey consisted of 29 questions, aimed at assessing relations between the new capital regulations and financial security of credit institutions in Poland. The survey questions were formulated using a 5-point Likert scale (1—definitely not; 2—rather not; 3—neither yes nor no; 4—rather yes; 5—definitely yes) in order to measure the degree of respondents’ acceptance of the studied phenomena. A total of 110 respondents (75 women and 35 men) took part in the research. The response rate in the survey research was 100%.

The questionnaire survey was addressed to representatives of credit institutions in Poland at a management level or representing the financial risk management department. The structure of respondents from the point of view of their position and experience is presented in

Figure 1. A limitation of the target group was dictated by the fact that respondents had to have specific knowledge in the field of risk management, as well as regulatory changes taking place after the global financial crisis. Other criteria for their selection were not taken into account. It was considered that in determining the representativeness of the sample, they are of secondary importance.

Results obtained from the survey were analyzed for the reliability of the measurement scale. For this purpose, the

α-Cronbach coefficient was used, measuring an internal consistency of a scale [

43]. An

α coefficient higher than 0.7 indicates the high reliability of the scale [

44]. The analyzed scale exceeds the required minimum level of reliability (see

Table 1), thus indicating its high internal compliance, and at the same time confirming the accuracy of the constructed questionnaire.

However, limitations of the conducted empirical research should also be taken into account. One limitation of our study is the online data collection approach. The sample may not be representative of the whole Polish banking sector. However, certain previous studies used the same approach. Lefever, Dal, and Matthíasdóttir (2007) note that whereas online surveys may access broad, geographically distributed populations, they nevertheless have limitations [

45]. One such shortcoming is accessing the population sample. However, this also applies to traditional data collection techniques. Despite this limitation, we feel our findings are robust, as evidenced by the obtained software results, and contribute to the body of knowledge.

The second stage of the research concerned a quantitative sector analysis, which aimed to compare the results obtained through the questionnaire survey with the data for the Polish banking sector. This stage was an attempt to determine the adaptability of domestic banks in Poland to the new prudential regulations. For this purpose, the main capital adequacy ratios and a level of the countercyclical capital buffer (CCyB) were used, determining a level of capital protection of credit institutions in Poland, which essentially covers the total amount of risk taken.

3. Results

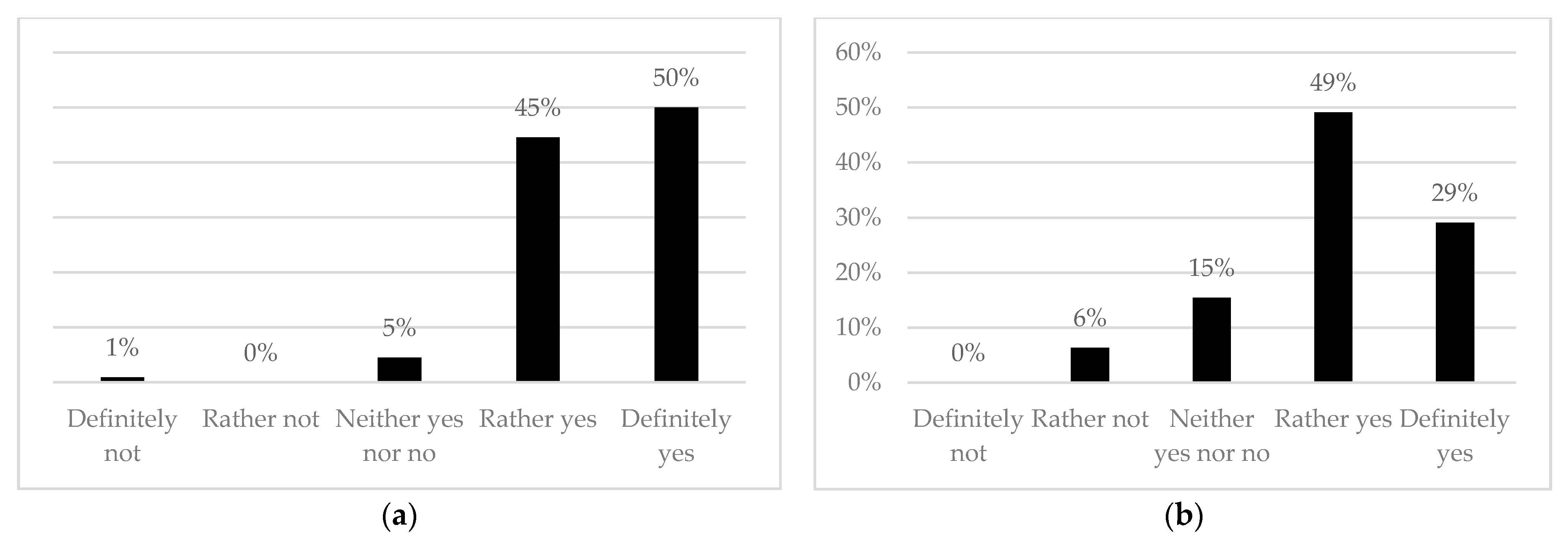

The conducted questionnaire survey allowed us to verify to what extent changes in the capital requirements of commercial banks in Poland take place in connection with the ongoing process of implementing the concept of sustainable finance. A total of 94.55% of all respondents noticed intensification of prudential regulations in the Polish banking sector after the global financial crisis (see

Figure 2a). These changes are the result of the new regulatory order, implemented in the financial system of the European Union, which is an attempt to block channels of the global crisis impact on the financial system and economy, and at the same time a part of the implemented concept of sustainable finance. The new prudential regulations, apart from the stricter scope of control and supervision, also changed the financial institutions’ approach to bank capital management (see

Figure 2b).

A total of 78.18% of the respondents representing commercial banks in Poland confirm this thesis, arguing it by a more in-depth focus on the process of increasing the capital base, optimizing its use, or overcoming capital restrictions. In modern banking, the process of bank capital management is as important as cost-income management, or bank risk management. It is an integral part of bank management and one of the priorities of bank management boards. The global financial crisis has shown that in banking institutions capital is a limited good and should be reasonably managed and optimally used. The results obtained from the questionnaire also indicate that the regulatory changes influenced the accumulation of bank capital, securing the risk. Changes in the approach to bank capital management are undoubtedly related to their greater emphasis on the need to implement the concept of sustainable finance as an inherent element of sustainable development. These changes take place in two areas—towards reducing bank risk and at the same time increasing a level of capital security (see

Figure 3). Therefore, the concept of sustainable finance prompts regulators to hedge bank risks by strong capital regulations.

More than half of the respondents (51.82%) believed that the new regulatory order favors a reduction of bank risk, through a more in-depth process of bank risk assessment, its modeling, and monitoring, which constitutes the overall bank risk management process. Moreover, 53.64% of the respondents indicated that, as a result, there is also an increase in the capital base, which makes a bank stronger and more resistant to potential loss absorption that may occur in the case of bank risk materialization. Consequently, the new prudential regulations also imply changes in the structure (quality) of banks’ own funds (see

Figure 4a). Of the respondents, 71.82% noticed these changes, indicating that they contribute to the improvement of their capital adequacy (see

Figure 4b). Banks have made significant progress in reinforcing their capital strength and security in response to the existing and still newly-implemented regulatory framework. Nevertheless, credit institutions choose different paths of change, because a scale of necessary adjustment activities to the new capital requirements varies depending on the institution-specific factors.

In recent years, a strong growth trend of the highest quality capitals, with a slight decline in risk-weighted assets of the largest commercial banks in Poland has been observed. On the one hand, they result from adjustment activities to the new regulatory requirements, as well as due to a higher level of security in the event of bank risk materialization. Banking institutions in Poland are increasing the level of capital security, despite the fact that from the beginning of the Basel III implementation, they fully meet the formulated therein capital requirements (see

Figure 5).

The Common Equity Tier 1 (CET1) ratio, reflects the amount of the highest quality core capital to risk-weighted assets, since its estimation in the Polish banking sector, i.e., since 2014, is significantly above 4.5%—the minimum requirement specified in the Basel III (implemented in 2015) [

46]. Moreover, despite the changed definition of capital, credit institutions in Poland also increased their capital protection reflected in the Tier 1 ratio. Its level was comparable to the CET1 ratio (see

Figure 5). Therefore, capital used by banking institutions in Poland to absorb potential losses was covered almost entirely by the highest quality capital, arising from the issue of ordinary shares, retained profits, or the creation of bank reserves. They also fully met a solvency ratio, which should be—since the beginning of the Basel agreements—at a level of at least 8%. In 2018, the solvency ratio for the whole sector reached a maximum of 18.44%.

Basel III distinguished the following regulatory capital categories:

Tier 1 capital (going-concern capital): bank’s core capital, which is referred to as business continuity capital, used to cover losses and maintain bank’s solvency; it covers:

- ▪

Common Equity Tier 1 (CET1) also known as ordinary share capital Tier 1, it arises from the issue of ordinary shares, retained profits, and creation of reserves;

- ▪

Additional Tier 1 capital, which includes some types of hybrid instruments, such as: debt instruments, paid up and without a specified return date, issued by banks; by the agreement of a national supervisory authority, they may be redeemable, but after a period of at least five years;

Tier 2 capital (gone-concern capital): defined as a bank’s supplementary capital, including subordinated loans, as well as certain categories of reserves (general risk provisions and excess reserves over expected losses for the loan portfolio); capital significant in the event of insolvency or liquidation.

Therefore, the Polish banking sector has an adequate level of capital security, which at the same time does not put pressure on supervisory and regulatory authorities to increase the level of capital buffers. According to the “Recommendation of the European Systemic Risk Board” (ESRB/2014/1) [

47] and under Art. 23 of the “Act on Macroprudential Supervision” in Poland [

48], the Minister of Finance, by way of the regulation, is obliged every quarter to estimate a reference value of the countercyclical capital buffer rate (given as a percentage of risk-weighted assets, RWA). In the light of the Act and ESRB recommendations, a reference value should be a function of the credit gap and other variables that inform about systemic risk related to excessive lending. The level of the countercyclical capital buffer in Poland since its implementation, i.e., since February 2016, is maintained at 0% of risk-weighted assets (see

Table 2).

The analysis of a credit gap, as well as the early warning models, used by the National Bank of Poland and variables reflecting lending in Poland, indicate that there is no need to change the level of the countercyclical capital buffer [

49]. The sectoral data analysis illustrates that the Polish banking sector secures the risk to a large extent with capital held. This corresponds to the results obtained from the questionnaire survey, confirming that the new regulatory order translates into an increase in securing bank risk by bank capital. Considering that fulfillment of capital adequacy requirements is carried out not only by increasing a level of bank capital but also by changing the quality and structure of the capital base, towards greater coverage of potential losses by the highest quality capital, in the conditions of accelerated implementation of tasks, resulting from the concept of sustainable finance, many serious threats to the continuation of the outlined trend arise.

4. Discussion

The concept of sustainable finance, taking into account the chronology and nature of the tasks implemented within its framework, fundamentally changes the conditions and possibilities of hedging generated risk by bank capital. The economic recession, caused by the COVID-19 pandemic, is undoubtedly the cause of these problems. The lockdown, implemented at the beginning of the pandemic, exacerbated difficulties related to maintaining capital stability and financial security of banks. This mainly concerns the following issues:

- ▪

strong downward pressure on banks’ profitability, likely caused by the unconventional monetary policy of central banks, based on a low-interest margin resulting from low-interest-rate policy, as well as quantitative easing [

50,

51,

52,

53,

54,

55], determining a level of loan installments, continued or reimplemented during the economic lockdown,

- ▪

continuation of a downward trend in demand for bank loans of business entities varied depending on a type of loan and borrower,

- ▪

deterioration in the quality of banks’ loan portfolio, as well as their propensity to offer new loans as a result of the macroeconomic shock, following the global financial crisis and prolonged by the coronavirus recession,

- ▪

increased credit risk and write-offs for expected credit losses,

- ▪

an increase of bank risk, related to changes in the financial market environment (decline in the prices of financial assets, low valuation of investment fund portfolios, increase of debt level of the public finance sector).

In the persistent pandemic environment, it is increasingly difficult for banks to battle to improve their operating conditions and compete for access to new “sources of capital” securing bank risk. Meanwhile, the concept of sustainable finance, implemented in the background of the analyzed problems, significantly modifies the banks’ business strategies, at the same time putting them in front of new challenges and requirements. In December 2017, on the initiative of the Bank of France, eight central banks established a

Network of Central Banks and Supervisors for Greening the Financial System (NGFS) [

56]. The NFSG indicates that the valuation of banking assets has not so far taken into account risks associated with climate change, recommending in this field appropriate prudential measures to be taken. In particular, it points to the need to identify the main channels of climate change transmission on financial risk, to adopt indicators to monitor these risks, to collect and analyze data for various scenarios, taking into account the pace and scope of climate change, to integrate climate change-related risks into the prudential supervision system, and ultimately also to estimate these risks and consider them in investment or management decisions.

Green finance, along with the progressive materialization of the concept, also changes banks’ attitude to implement it in their operation. Banks are not direct beneficiaries of green investments in the economy. Financing of the European Green Deal will be carried out mainly on capital markets through the issue of bonds, referred to as green bonds (The first green bonds appeared on the European financial market in 2013. In 2007–2012, green bonds supply on the global markets was almost exclusively represented by international development banks and other government-related institutions (European Investment Bank, World Bank). The green bond market continues to develop dynamically. In 2019, 257.7 bln USD of green bonds were issued, which indicates their growth on the financial market compared to the previous year by 51%.). In the group of debt securities of the capital market, they constitute a separate group [

57,

58], which—along with the development of a green financial market—is enriched with new, more complex structures [

59,

60,

61]. On the other hand, taking into account a spectrum of possible ecological initiatives, including a type of capital market label assigned to bonds—in addition to green bonds—blue and forest bonds are also identified [

62,

63]. Hence, the question arises whether the bond categorization procedure ends there. It is extremely difficult to give an unambiguous answer. The process of greening finance has a long-term nature and many institutions have been authorized to issue them. Green bonds can be issued by international financial institutions (

green supranational bonds), companies (

corporate green bonds), financial institutions (

green bonds of the financial system), local government units (

green municipal bonds), and the government (

green treasury bonds) [

64]. The burden of green finance is thus distributed among various public and private institutions (see

Scheme 2). Banks are also included among these institutions. However, bonds have not so far been the main source of their financing. Banks’ inclusion in the process of green finance means a serious revolution in the structure of their current financing sources.

Moreover, bonds issued to finance green investments compete with various financial market participants for capital resources. Increased demand for financial capital may result in higher costs of gaining new capital and inhibit banks’ interest in green investments. The effectiveness of green investment financing will also be a serious challenge for banks. It depends not only on the ability to collect green financial capital but also on the absorption of green investments by companies and consumers’ preferences (see

Scheme 2). For these reasons, green finance in banks may generate new types of bank risk. Due to the significant determination of green finance, the proposals for special treatment of regulatory standards with respect to ecological loans have so far been made. The European Union banking community recommends the EU authorities to change banking regulations, regarding capital requirements for financial institutions providing green loans in favor of a preference for their calculation. It should stimulate the development of green loans and make them cheaper for potential borrowers. Such preferences, although they are justified, redefine bank risk and methods of its protection. Consequently, they require a detailed analysis of the final effects, arising in this context in the banking sector.

The concept of green finance, as can be observed even in the relatively short period of its implementation, also seriously affects the current structure of bank loans and borrowers themselves. Banks, moving to green loans, verify their sectoral policy, including eliminating new financing for “high-emission” partners, e.g., coal companies. They also started financing the sustainable development of an economy, modifying their loan portfolios even earlier than the investment taxonomy was defined by green finance. This situation may increase banks’ exposure to investment risk and cause an increase of a level of bank capital as well as changes in its structure. Moreover, it should be noted that mortgage loans, which have not so far met the conditions of sustainable finance taxonomy, are very popular in banks. Therefore, there is a doubt whether banks will withdraw mortgage loans from their investment portfolio, so far equivalent to a highly profitable and long-term source of financing for business entities. Recently, one of the banks in Poland implemented its offer of the so-called green loans for businesses and consumers. Mortgage loans also appeared in this group. Furthermore, intensive preparations are also underway for banks to issue green financial instruments, intended for financing or refinancing real estate investments that meet the taxonomy criteria. However, in the new green lending procedure, it is necessary to identify a borrower of sustainable investments. In this process, an important role is played by investment advisers, who ensure that a borrower meets conditions of the taxonomy of sustainable finance. A borrower must identify and justify specific benefits for the natural environment. This description should include all accompanying risks and factors potentially disrupting the implementation of a financed project. A borrower should also present to banks all certificates and other documents related to the project. Therefore, banks will be forced to increase their access to data. However, borrowers often do not have such full documents, although expectations of green finance entities are increasingly directed towards documents characterizing the parameters of green investments. As a result, it will be difficult for banks to refer directly to such defined documentation requirements. In such circumstances, banks in the risk management process will implement numerous improvements in terms of control of a customer risk assessment process, defining risk appetite, or active customers’ involvement in providing data. Therefore, bank capital and its appropriate structure may not be sufficient to secure green investments. Thus, it confirms the adopted research hypothesis, stating that after the global financial crisis banks meet the new prudential capital regulations, however by their inclusion in the concept of green finance, they will increase a share of mitigation in the bank risk management strategy. On a horizon of the expected changes, there is a clear need for banks to increase the level of bank risk mitigation. This process, aimed at minimizing risk effects, will essentially concern changing the logic of bank customer financing based on a precisely specified choice of a bank’s investment plan. In a diverse green finance environment, this change will require high professionalism from bank risk management staff. The aim of mitigating bank risk management should be the absolute stabilization of the future value of cash flows from investments, at an assumed and acceptable level.

5. Conclusions

The research conducted in the study was focused on new prudential regulations that require changes in the level and structure of capital securing bank risk. The conducted research allowed achieving the main aim of the paper which was an extrapolation of risks appearing in the unstable environment of credit institutions, which are increasingly boldly directing their expectations on their inclusion in the sustainable finance concept implementation. However, the issue of green investment financing, resulting from the progressive implementation of the concept of sustainable development of the world economy, became the main inspiration to prepare the article. Banks are increasingly interested in green financial instruments that require, as in any other case, hedging of bank risk generated from them. The research conducted in the Polish banking sector has shown that domestic banks meet all prudential requirements under the new capital standards. What is more, the risk department representatives notice the new regulatory order, implemented after the global financial crisis which is observed in the changes of value and quality of bank capital as well as in the risk management process. However, it should be noted that investment strategies, assuming composition of portfolio in accordance with the principles of sustainable finance and based on high rates of return in a long term, will change banks’ resilience to key risks from the perspective of sustainable development, i.e., environmental, social and corporate governance risks. At the same time, an international, critical literature review related to banks’ involvement in green finance indicates that a scale of their involvement in this process is and will remain highly diversified. The reasons for this situation vary, but one of them is a barrier to “overcome” bank risk. Furthermore, progress in green finance is decided on a micro-banking level. The reason for this situation is often a corset of capital and liquidity regulations. However, the chances of banks’ inclusion in the green finance process are significant. After the global financial crisis, the scale of investments in EU countries is substantially lower than in the years preceding it. At the same time, there is a space for green finance of investments in the banking sector that might be an important recommendation for banks and their management practice. The main limitation of the study is currently a limited knowledge of these issues and a need for further in-depth research. It is also necessary to increase empirical research in this area and prepare new recommendations regarding the direction of changes in the prudential standards for green investments. It may shed new light on the undertaken problems, indicating the appropriate path for banks in their risk management process during the implementation of the green finance concept. This paper organizes the existing knowledge about the concept of sustainable finance, emphasizing the increasing role of banks’ inclusion in the green finance of investments. At the same time, it presents the current possibilities of its implementation taking into account the pandemic circumstances, which undoubtedly contributes to the theory of sustainable development. Identification of stimuli or anti-stimuli for Environmental, Social and Corporate Governance (ESG) financing is also needed. A lack of reliable information about the course of green finance and its transparency towards financial market participants may contribute to the fact that increasing the share of banks in financing sustainable development, otherwise desirable and important, will be difficult and will not cause a radical change. However, this change is necessary, if a qualitative change in the financing of green sustainable development has to be achieved.

In the end, it should be noticed that the concept of sustainable development, disseminated in the world economy as a continuation of civilization changes, includes a number of thoughts and ideas related to the inclusion of the natural environment in the socio-economic development of a region, country or globally all over the world, finding widespread approval of the majority of scientific, economic and political communities. However, it is usually emphasized that their implementation is hampered nowadays by global unilateralism. In the European Union, the fundamental progress in its breaking is undoubtedly connected with taking actions on financing sustainable growth (EC: Action Plan on financing sustainable growth [

65]). In December 2016 the European Commission set up the High-Level Expert Group on sustainable finance to help develop a coherent EU strategy for sustainable finance, while in January 2018 the Group published a report containing eight key recommendations for sustainable finance. In the banking business environment, this fact became a basis for the intensification of efforts to include credit institutions in green financing. This paper recognizes a conflict between the existing banks’ stakeholders and a modified view of financial intermediaries’ business models. However, there are many problems that require the development of new research directions in economics, finance, and management science. In particular, they relate to a greater focus on assessing the utilitarian effects of financial institutions engaging in green finance. This study attempts to define the mechanism of the impact of green financing on bank risk management. After the global financial crisis, credit institutions were subjected to strong regulatory discipline, resulting in an increase in the level and quality of bank capital. The empirical research carried out in the study indicates that banks operating in Poland meet the capital adequacy ratios. However, the process of banks inclusion in green financing still remains in the initial phase, which encourages a need for further in-depth research in the fields of:

- ▪

the scale and method of linking bank risk with financial risk, resulting from climate change, environmental degradation, and problems of banking stakeholders,

- ▪

identifying an impact of green financing on bank risk management, changes in the management model and assessment methods of bank risk,

- ▪

changes taking place in the banking business environment as a result of the inclusion of government organizations and civil society, insurers, pension funds, and stock exchanges in green financing,

- ▪

transparency and changes in the financial activities of banks due to the long-term nature of green investments.

The above research requires a multidimensional approach combining the problems of banking, management, and the use of mathematical measurement tools. For this reason, the research process may face difficulties in completing a research team with such broad scientific competencies. Conducted research also requires the preparation of specific databases, which collection may prove problematic for various reasons.