1. Introduction

The increased prominence of research on regional economic resilience may be prescribed to growing economic uncertainty [

1] at a time when globalization and increased interdependence among countries and regions have heightened risk associated with external economic shocks [

2,

3]. The GFC and perceptions of continued vulnerability have catalyzed interest in economic resilience, and that research on “regional development have recently broadened from a preoccupation with growth to one which captures the notion of resilience” [

3] (p. 650).

Related economic shocks are events in external regions that influence local economic growth, constituting a sudden disturbance and downturn to internal economic output. These shocks affect regional economic growth through reducing the size of markets and access to capital, affecting “sales, production, employment, and income” [

4] (p. 1719) for productive agents over a certain time period within an economy. While the effects of shocks may be temporary, the frequency of their occurrence may inhibit long-term socio-economic development as their impact lingers in the regional economy [

5]. Resilience to these economic shocks—i.e., the ability to recover from the initial impact and prolonged effects of these shocks—is influenced by the inherent vulnerability of regional economies to their impact. This vulnerability is particularly heightened in developing regions [

6,

7], due to the relatively smaller size of their economies and the related diversity of economic activities, reduced competitiveness (due to inadequate economies of scale) and limited access to external capital to catalyze productivity [

5,

8]. Developing economies, as the focus of this study, were significantly affected by the GFC [

9,

10], including the national economies of the SADC [

11] (see

Section 2.3).

The regional development policy of the SADC emphasizes the need for economic growth, rather than delineating explicit economic resilience objectives and related initiatives. Current regional policies, including the Regional Strategic Action Plan, have limited consideration for interventions specifically designed to support economic resilience in the region. The existing resilience objectives operate in the “environmental” rather than “economic” milieu, placing focus on climate change mitigation and related priorities that seek to ensure sustainable regional development [

12].

From the literature review (see

Section 2), it will become evident that there is a need to support the regional economic resilience of the SADC in order to reduce the effects of future external economic shocks on long-term regional economic growth and wider socio-economic development objectives [

13]. Inherent to this process is identifying appropriate regional policy interventions that may catalyze this resilience, while supporting existing initiatives towards regional economic growth in the SADC and enhancing their successful implementation. This paper seeks to contribute to research on regional economic resilience through delineating policy approaches that foster resilience in the unique context of SADC member countries, and the wider perspective of trading blocs among developing countries. Inherent to the aim of this research is to determine the primary factors that influence economic resilience in the face of external economic shocks. This is done through analyzing factors that relate to the endogenous and exogenous characteristics of the regional economy, including, inter alia, factors relating to regional integration and industrialization. The methodology includes an equilibrium and econometric analysis of data available on the UNCTADstat database for relevant dependent and independent variables. The period of the analysis is 2003–2018, with delineated pre-shock, shock, and post-shock stages (see

Section 3).

A central theme in this investigation is, therefore, to determine core components of regional policy conducive to economic resilience on this planning scale, with the objective of delineating related recommendations to shape regional policy in the SADC and to foster holistic implementation. Existing research highlights the elements inherent to external economic disturbances that perpetuate the impact on internal economic growth [

9,

10,

14]. Academic research has also explored the potential of regional integration and industrialization to support regional development and resilience [

15,

16] and to highlight the limitations in SADC policy creation and implementation in achieving regional development objectives [

13,

17,

18]. The research gap this paper seeks to fill is to determine the nature of nuanced regional policy implementation in the unique context of the SADC. This article has the specific objective of stimulating regional economic resilience on the back of delineating endogenous and exogenous economic factors that influence this resilience.

2. Literature Review

In order to address the research aim, the following interrelated concepts are discussed; namely, regional economic resilience, vulnerability in the regional economy, and SADC regional development policy.

2.1. Adaptation and Adaptability

Resilience research is diffused among a multitude of disciplines, contributing to a wide range of “discipline-specific” definitions and applications [

19] (p. 12). Prominent strands of resilience research are found in the paradigms of political and social sciences, ecology, biology, engineering, psychology, business studies, geography, economic studies and spatial planning [

18,

19,

20,

21]. Christopherson et al. [

1], referencing the resilience of ecological systems, transfers the concept of resilience to the framework of economic and spatial planning. In this context, the nature of regional economic resilience manifests in the ability of regional economic entities—centers of activity and production networks—to resist and recover from disturbances in their productivity and output [

1,

3,

22]). Hill et al. [

23] highlight the ability of the regional economy to withstand the impacts of sudden, short-term external economic shocks on networks of production and consumption. This is instrumental to economic resilience and to recovering possible reduced output that results from the shock in the post-shock period.

The concepts of adaptability and adaptation [

1,

3,

24] are central to regions’ ability to potentially change the social structure and catalyze the development of a new growth trajectory for regions; one that is more favorable for economic expansion and is resilient to external economic shocks [

25,

26,

27,

28]. Resistance to the initial effects of the economic shock highlights the long-term adaptation of the regional economy to changes in global trade and its inherent risks. Adaptability, meanwhile, enables regional production systems to react to the post-shock economic reality and adjust accordingly to recover pre-shock growth levels [

19,

23]. According to Pretorius et al. [

18] (p. 220), adaptation “is a continuous process a resilient region undertakes to ensure economic success in the long-term”. During this process the social structure is continuously reshaped to optimize the development trajectory and support the region’s resistance to economic disturbances. The notions of “adaptation” and “adaptability” are inherent to a systems approach [

23] (p. 2) to resilience analysis and can be transferred to the concepts of “resistance” and “recovery” as referenced in an equilibrium approach [

23,

29]. In such an approach, adaptation fosters resistance to the initial impact of the shock, and adaptability supports the timely recovery of the regional growth path in the face of external economic disturbances [

18].

2.2. Vulnerability in the Regional Economy

Several factors contribute to catalyzing growth in the regional economy, including local production factor availability and efficient utilization, as well as economic transformation through sustained industrialization. The neoclassical growth theory illustrates the importance of labor, capital and technology in stimulating output productivity and catalyzing regional economic growth [

30,

31,

32]. The Lewis two-sector model posits that industrialization is a central component of regional economic growth, identifying the role of excess labor transfer from the agricultural sector to the industrial manufacturing sector of the economy, increasing labor productivity and catalyzing increased industrial output [

33,

34,

35]. Endogenous factors, including industrialization and resource endowment, are important in stimulating regional economic growth in isolated developing regions. Nonetheless, the additional importance of exogenous growth factors such as interactions with external regions through inter-regional factor mobility (including FDI) and trade indicate that regions are part of complex systems of interaction and are interdependent with external regions [

36]. Through increased exports and capital inflows, increased investment is possible for local production, enabling the acquisition of technology and increased productivity in resource utilization, further stimulating export demand and economic output [

37].

While exports are important components of economic growth, it is evident that the nature of trade and exports—including the type of goods being exported to different regions—may influence the nature of subsequent regional economic growth [

9,

10,

18]. The cumulative causation principle states that economic divergence takes place between developing and industrialized regions over the long-term due to resource transfer from the former to the latter through inter-regional trade [

38,

39,

40]. This transfer is perpetuated by developing regions’ continued dependence on the export of primary commodities to industrialized countries and regions. These primary commodities are vulnerable to price fluctuations over the long-term, as illustrated by the Prebisch–Singer hypothesis [

14].

In addition to unbalanced trade perpetuating the long-term transfer of resources from developing to industrialized regions, sudden economic downturns in external markets, i.e., “external shocks” [

41] (p. 32), may have an impact on economic growth in developing regions. While various factors contribute to economic downturns in export markets, the financial sector is often described as the source of economic uncertainty, catalyzing downturn in regional economic output, as well as decreasing the availability of capital for consumption and investment in these economies [

7,

42,

43]. This is reiterated by Hudson [

19] (p. 11), who states that volatility in the financial sector may be transferred to other sectors in the economy, amounting to “a generalized crisis of accumulation”. Economic downturns in export markets may negatively influence economic growth in developing and developed economies [

44], influencing the availability of capital for investment and consumption while the revenue and income of economic agents decline [

43].

Increasingly, developing countries are vulnerable to economic downturns originating in industrialized countries and regions [

18,

44]. This is evident from the impact of the GFC, which originated in the United States and spread to other industrialized and developing regions [

45]. While the impact of the shock and the recovery period was heterogeneous among SADC member countries, the cumulative initial impact of the shock manifested in regional GDP growth in the SADC falling from 6.5% in 2007 to 0.3% in 2009 [

46]. Factors attributed to the economic slowdown in the SADC, and in developing economies in general during this period, include reduced export demand in external markets and lower FDI [

47]. Although economic growth in the SADC rebounded to 4.2% in 2010 [

46], continued vulnerability of the regional economy to external shocks is harmful to the region achieving its development objectives over the long-term. This contributes to increased intra-regional economic divergence between member countries and threatens socio-economic advancement in southern Africa [

13]. This has contributed to research regarding the regional economic resilience of developing countries growing in prominence [

18]. When economic disturbances occur in developed regions, which may be due to imbalances in the financial, non-financial, asset market or public sectors [

43], economic growth is stunted as credit restrictions impede the availability of capital for consumption and investment by consumers and firms. As a consequence, imports of consumer goods and manufacturing inputs are lower as revenue declines and the economic downturn continues. Capital investment in the form of FDI, aid and tourism from developed regions to developing regions are reduced due to risk-averse investors seeking stable investment environments and consumers experiencing declined income [

45]. This may manifest as an external economic shock in developing regions, with decreased exports and FDI having an impact on domestic capital stock and the ability to acquire advanced technology to increase productivity and stimulate regional economic growth [

45].

Certain factors may be identified that increase the vulnerability of regional economies to cyclical sensitivity, induced by fluctuations in revenues from inter-regional exports. This includes the income elasticity of demand for the regional staple [

37,

48]. This means that demand in external regions for these export goods changes dramatically, based on income fluctuations in these regions. Accordingly, regions with single staples that are subject to low-income elasticity of demand are more vulnerable to fluctuations in external demand [

37]. This has also contributed to export diversification being identified as an important factor necessary in reducing vulnerability to external demand fluctuations [

37,

49]. This includes both increasing specialization in existing export sectors (horizontal diversification) and diversifying the sectors that contribute to exports (vertical diversification). For developing economies, vertical diversification entails extending the export base dominated by the primary sector to export of manufactured goods [

50].

2.3. Regional Development Policy

As a regional trading bloc, the SADC has grounded the pursuit of economic growth and development on policies of regional integration [

51,

52] and industrialization. Industrial policy seeks to catalyze industrial competitiveness and production in high value-adding industries [

53]. This seeks to overcome the current low to moderate participation of the region in global value chains [

54,

55]. These initiatives are supported by the Regional Indicative Strategic Development Plan (RISDP), which delineates development and investment priorities to maximize economic potential in the region [

56,

57].

Regional institutions guide the creation and implementation of development policies, including the SADC Secretariat, which oversees the strategic planning of SADC programmes [

58]. Industrial policy noted in the Action Plan for SADC Industrialization Strategy and Roadmap propagates the objectives of regional economic transformation through structural changes, increased economic growth and improved living standards, and the convergence in economic growth between member countries and external developed countries [

53]. The three strategic objectives include stimulating industrial production, increasing competitiveness and fostering regional integration. This is to be achieved by harnessing regional supply chains and developing intra-industry industrial linkages in order to drive region-wide industrialization. This industrial policy seeks to increase public and private sector investment in industrial production networks in member countries, especially in “high value-adding industries” [

53] (p. 4). In addition, the implementation of initiatives that do form part of existing policy, as well as having been identified as potentially fostering economic resilience (including regional integration [

8,

15,

59] and industrialization [

60,

61]) have been hindered by ineffective policy implementation [

17,

18].

Guided by the SADC Treaty and the Common Agenda, trade liberalization in the SADC equates to its function as a partial free trade agreement [

57], with tariffs eliminated for selected goods traded intra-regionally. In support of increased regional integration, the SADC propagates the development of regional connecting infrastructure, or development corridors, that ensure increased access between member countries for better trade and factor movements [

62,

63]. These corridors are prioritized in the Protocol on Trade, which notes the important role of targeted investment in infrastructure projects to enhance the function of the physical infrastructure [

56].

In addition, the SADC seeks to implement various forms of non-physical infrastructure, including market access and operability between national markets. This supports increased access to national transport markets for regional partners to improve investment in regional transport infrastructure and trade facilitation [

56]. The Regional Indicative Strategic Development Plan (RISDP) describes development objectives and priorities in order to bring about regionally balanced economic growth [

56]. It seeks to support the enhancement of regional infrastructure linkages to enable the intra-regional mobility of traded goods [

56], to determine potential deficiencies in the integrated transport network and to develop targeted investment projects to improve infrastructure linkages [

57].

2.4. Economic Resilience

Central to the theme of this paper is the role of policy intervention in creating learning regions to potentially foster increased regional economic resilience [

64,

65]. Hudson [

19] (p. 17) states that “the capacity of regions to devise strategies for greater resilience will critically depend upon changes in modes of regulation and governing”, which will require “increased state involvement in the economy”. Explaining the nature of change regions required for increased economic resilience, Hudson [

19] (p. 17) also states that decision-makers and policy should reflect an increasingly proactive approach in “learning how to create” more resilient economies and subsequently implementing the regionally appropriate measures to counter the effects of external economic shocks on regional economic growth.

Policies toward regional integration and industrialization in the SADC are based on the motive that the synergy between these two policies will foster long-term regional economic growth. In developing countries, factors that include small domestic markets [

66] and a comparative disadvantage in producing manufactured goods [

67] may inhibit industrialization, and, therefore, sectoral and export diversification. An important motive for regional integration is decreasing developing regions’ dependency on unbalanced trade with developed regions by channeling trade among each other [

19]. The inherent elimination of tariff and non-tariff trade barriers may stimulate intra-regional trade, i.e., between members of the regional bloc [

52,

68], such as trade among member countries of the SADC. Regional integration is considered important in cultivating industrialization in the larger, integrated market of formerly isolated developing economies [

69]. The fusion of national markets increases the market size of productive agents and attracts capital inflow through FDI [

69,

70]. This, in turn, supports the development of economies of scale through technology acquisition and investment, and underlies productivity gains in the industrial sector [

69,

70,

71,

72,

73].

While the industrial sector is highlighted as important in stimulating regional economic growth, Ray et al. [

74] (p. 2) note that “goods-producing industries are generally less resilient to economic shock[s] than service industries”, given that “factories are closed rather than updated and reopened” subsequent to an economic shock. Furthermore, Eichengreen and O’Rourke [

75] highlight the sizeable decline in manufacturing production in the United States during the GFC, together with reduced exports, and its related impact on economic growth. In addition, Pretorius et al. [

18] (p. 226) state that regional integration, measured by increased intra-regional exports between member countries, “does not have a significant effect on alleviating the initial impact of the external shock on regional economic growth”. However, it does reduce the recovery period of the regional economy subsequent to the initial impact of the economic shock. Brixiová et al. [

15] note that regional integration may support economic resilience when it contributes to the diversification of trading partners and export markets, stressing the importance of reducing dependency on single export markets in order to support regional economic resilience. The positive relationship between endogenous economic diversity and regional economic resilience is also emphasized [

76,

77] because “the industry-mix of a region may be critical to its performance in recessions” [

74] (p. 2). Additional factors that may support regional resilience include prominent systems of innovation [

41,

78]; modern infrastructure [

79] that support adaptability and adaptation; a regional workforce that is highly skilled and innovative, with a strong entrepreneurial tradition [

80]; a financial system [

81] that provides steady access to capital for economic agents to spur continuous consumption, investment and innovation.

Evidently, both endogenous and exogenous economic factors may determine a region’s resilience to external economic shock. While adaptation and adaptability are identified as vital concepts in fostering resilience, the appropriate policy initiatives and effective implementation is central in optimizing a region’s capacity to resist and recover from economic disturbances [

82]. This resilience is based on sustained economic expansion on a single growth trajectory (through the effects of sufficient adaptation). At the same time, through the effects of adaptability, networks of interaction between socio-political, economic and institutional agents change and adjust this growth trajectory onto courses that support the resistance of the regional economy to external economic shocks [

83,

84]. The objective of this paper is to delineate policy approaches in order to support regional economic resilience in developing regions, with specific reference to the SADC. Inherent to this research aim is to determine the primary factors that influence economic resilience in the face of external economic shocks, through analyzing factors that relate to the endogenous and exogenous characteristics of the regional economy.

3. Materials and Methods

In order to achieve the research objectives of determining the factors that may support regional economic resilience in the context of developing countries, quantitative research approaches are utilized in the form of (i) an equilibrium analysis; (ii) an econometric analysis.

3.1. Equilibrium Analysis

Inherent to the equilibrium approach to resilience analysis is the notion that “resilience is the ability of a regional economy to maintain a pre-existing state” or an “equilibrium state” during an external economic disturbance [

23] (p. 1). Accordingly, the resilience of a region is determined by its ability to resist disturbances to the pre-shock growth equilibrium, and the subsequent recuperation of lost growth to regain this equilibrium in the post-shock period [

23,

29]. This approach therefore seeks to determine the ability of an economy to prevent a deviation from the pre-shock growth equilibrium, despite its production systems being subjected to external disturbances [

18]. In the context of this paper, an equilibrium analysis is applied to analyze economic growth trends [

15,

18] in developing economies. This is in an effort to determine (i) the initial impact of an external economic shock on economic growth; (ii) the period required to recover the pre-shock growth path. The following steps are inherent to the equilibrium analysis to determine (i) and (ii):

- 1.

Determining the pre-shock growth path: Analyzing the resilience of an economy necessitates establishing a pre-shock growth path, or equilibrium, to measure the deviation of economic growth due to the external economic shock.

- 2.

Measuring the resistance of economic growth: The initial impact of the external shock on economic growth is determined by the extent of the deviation of economic growth from the established pre-shock growth path.

- 3.

Determining the post-shock growth path and growth recovery: Once the post-shock growth rates are equal to or eclipse the pre-shock equilibrium, the economy is said to have recovered its pre-shock growth path.

The GFC is used as a proxy for the external economic shock in this analysis (also see Dąbrowski et al. [

85] and Filippetti et al. [

86]) due to its significant global impact on economic growth in developed and, specifically, developing regions [

45,

87]. An addition determinant is data availability considerations in utilizing the UNCTADstat database.

Anchored in the context of this paper, the sample economies whose economic growth trends are analyzed are that of member countries of regional integration arrangements among developing countries. The economic growth trends of these regions are the product of the trends in their individual member countries. Consequently, the motive of this sampling approach is to increase the data points for the quantitative analysis, while still enabling findings to be conducive to determining factors that may influence economic resilience on a regional policy scale. In identifying the appropriate sample of regions and their member countries, the purposive sampling technique [

88] is applied with selection criteria. This includes, inter alia, regions consisting of developing countries that actively seek to increase regional integration and functional interdependence, and where regional development planning and policies are facilitated by regional institutions. As indicated in

Figure 1, the sample constitutes the member countries of the following regions: the Association of Southeast Asian Nations (ASEAN), the Central American Common Market (CACM), the Andean Community (CAN), the Caribbean Community (CARICOM), the Central African Economic and Monetary Union (CEMAC), the East African Community (EAC), Mercado Común del Sur (MERCOSUR), the South Asian Association for Regional Cooperation (SAARC), the West African Economic and Monetary Union (WAEMU), and specific focus on the SADC.

Accordingly, the equilibrium analysis enables the identification of two dependent variables to be applied in the subsequent econometric analysis, namely the initial impact of the GFC on economic growth (measured in GDP) (dependent variable 1) and the period (measured in years) required to recover the pre-shock growth path (dependent variable 2). These are determined for each country included in the sample.

3.2. Econometric Analysis

The objective of the econometric analysis is to further utilize the outcomes of the equilibrium analysis and to determine the relationship between the now quantified dependent variables and certain selected independent variables. The independent variables are selected factors that may influence economic growth, both of an endogenous and exogenous nature.

The econometric analysis seeks to contribute to identifying the factors that influence the immediate impact of and recovery period from an external economic shock, and therefore an economy’s economic resilience. Based on textual and narrative research, the following (

Table 1) are the independent variables utilized in this research:

Relevant data for the dependent and independent variables were collected and extracted from the UNCTADstat database. This data was curated using Microsoft Excel and prepared for further analysis on SAS Enterprise Guide 8.2.

The relationship between the dependent and independent variables are determined through the following approach inherent to the econometric analysis:

3.2.1. Step 1: Chi-Square Test of Homogeneity

This test shows whether potential errors in the data are homoscedastic or homogenous—whether the observed sample values differ significantly from the expected values specified in the null hypothesis (i.e., if the differences can be explained by just the sampling error) [

89].

Expected frequency counts: The expected values are calculated separately for each population at each level of the categorical variable, according to the following formula:

where

is the expected value for population

a at level

b of the categorical variable,

is the total number of observations from population a, is the total number of observations at treatment level b, and n is the total sample size;

Test statistic: For the test statistic, a chi-square random variable (

X2) is used, as defined by the below equation:

where

is the observed value in population

a for level

b of the categorical variable, and

is the expected frequency count in population

a for level

b of the categorical variable;

p-value: The p-value is the probability of observing a sample statistic as extreme as the test statistic. If a p-value of less than 0.05 is observed, then the null hypothesis would be rejected and concluded that the errors are not homoscedastic.

3.2.2. Step 2: Shapiro–Wilk Test for Normality

This test will show if the data is normally distributed. Combined with the chi-square test, this test will lead us to use parametric/non-parametric regression methods where applicable [

90].

The basic methodology of this test is the same as the chi-square test. The test statistic is calculated as follows:

where:

- -

xi shows the random ordered sample values

- -

ai shows the means of the data (size n) from a normally distributed sample

In this test, if a p-value of less than 0.05 is observed, the null hypothesis is rejected and concluded that the data is not normally distributed.

3.2.3. Step 3: Regression Analysis

The t-test for non-parametric regression and the F-test for parametric regression is subsequently used.

1. Non-Parametric Regression: t-test

The one-sample

t-test is used as only one independent variable is applied. The below formula is used:

where:

X is the sample mean from a sample X1, X2, …, Xn, of size n, s is the standard error of the mean, is the estimate of the standard deviation of the population, and μ is the population mean. The assumptions underlying a t-test in its simplest form are that:

- -

X follows a normal distribution, with mean μ and variance . This is achieved by transforming the data with a spline function in SAS;

- -

Z and s are independent.

2. Parametric Regression: F-test

X1, ..., Xn and Y1, ..., Ym is taken as the independent and identically distributed variables from two populations, each of which have a normal distribution. The expected values for the two populations can differ, and the null hypothesis is that the variances are equal.

Let = and = be the means of the sample.

Let and be the variances of the sample. Then the test statistic is: .

If the null hypothesis of equal variances is true, this statistic has an F-distribution with

n−1 and

m−1 degrees of freedom. If not true, it follows an F-distribution scaled by the ratio of true variances. The null hypothesis is rejected if

F is either too large or too small based on the desired significance level (i.e., statistical significance). This is why an absolute for

F is used in the test [

89]. The significance level is set at 0.1.

3.2.4. Step 4: Correlation and Testing the Association between Variables

The correlation between two variables measures the degree of linear relationship between two variables and will always be between −1 and 1 [

90];

The Spearman’s correlation to test for the association between variables is used. The null hypothesis is that there is no association between variables, with the alternative hypotheses being the inverse;

The correlation and the test for association between variables have a direct relationship, i.e., if there is a strong correlation between variables, the test for association will show that there is an association between the variables. The significance level is set at α = 0.05.

The results of the equilibrium and econometric analysis, and the relationship between certain economic variables and the resilience of regional economic growth, will inform recommendations regarding the policy objectives of the SADC in terms of endogenous and exogenous factors. These factors influence the economic resilience of economies to external economic shocks in the context of developing countries.

4. Results

The following section delineates the results of the equilibrium and econometric analysis conducted during the research.

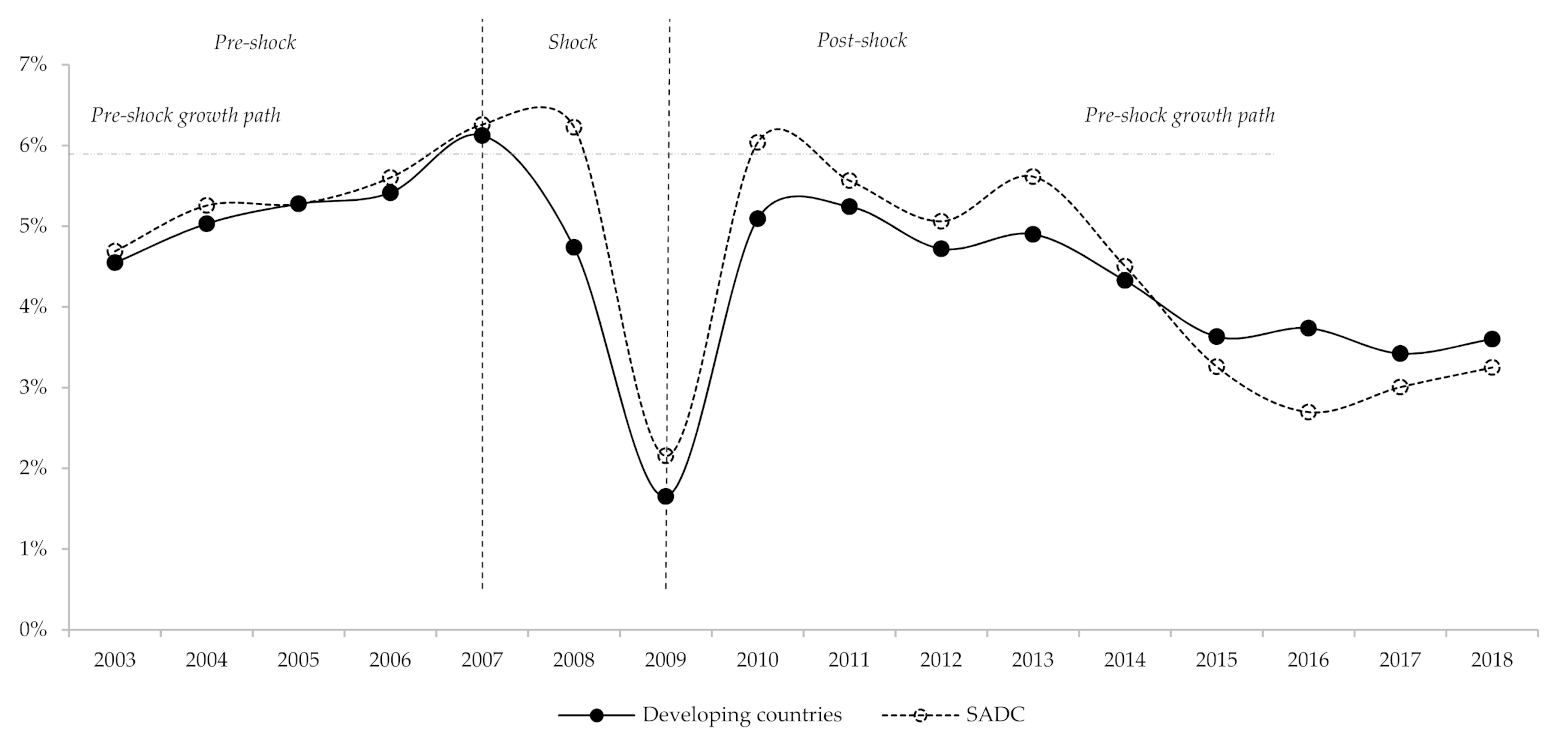

Figure 2 indicates the outcome of the equilibrium analysis, utilizing the economic growth trends of the developing country sample and the SADC region to identify a pre-shock, shock and post-shock period connected to the effects of the GFC.

The pre-shock period (2003–2007) indicates the economic growth for the sample in the period before the GFC. The cumulative pre-shock growth path (based on the median annual economic growth rate during this period) for the sample and SADC is 5.2% and is indicated in the figure above. The shock period (2008–2009) indicates the initial impact of the external shock on economic growth, quantified by calculating the deviation of economic growth from 2007 (pre-shock growth) to 2009 (apex of shock impact). Economic growth in developing countries and SADC members declined by 4.5% and 4.1%, respectively, indicating the impact of the GFC on output growth during this period. The post-shock period (2010–2018) indicates the recovery of economic growth rates subsequent to the initial effects of the shock. An economy is deemed to have recovered in the year the annual economic growth rate equals or exceeds the pre-shock growth path. Based on the equilibrium analysis, and as is evident from

Figure 2, the SADC regional economy recovered from the shock in 2010, while, cumulatively, the developing country sample is yet to recover the pre-shock growth path (as of 2018).

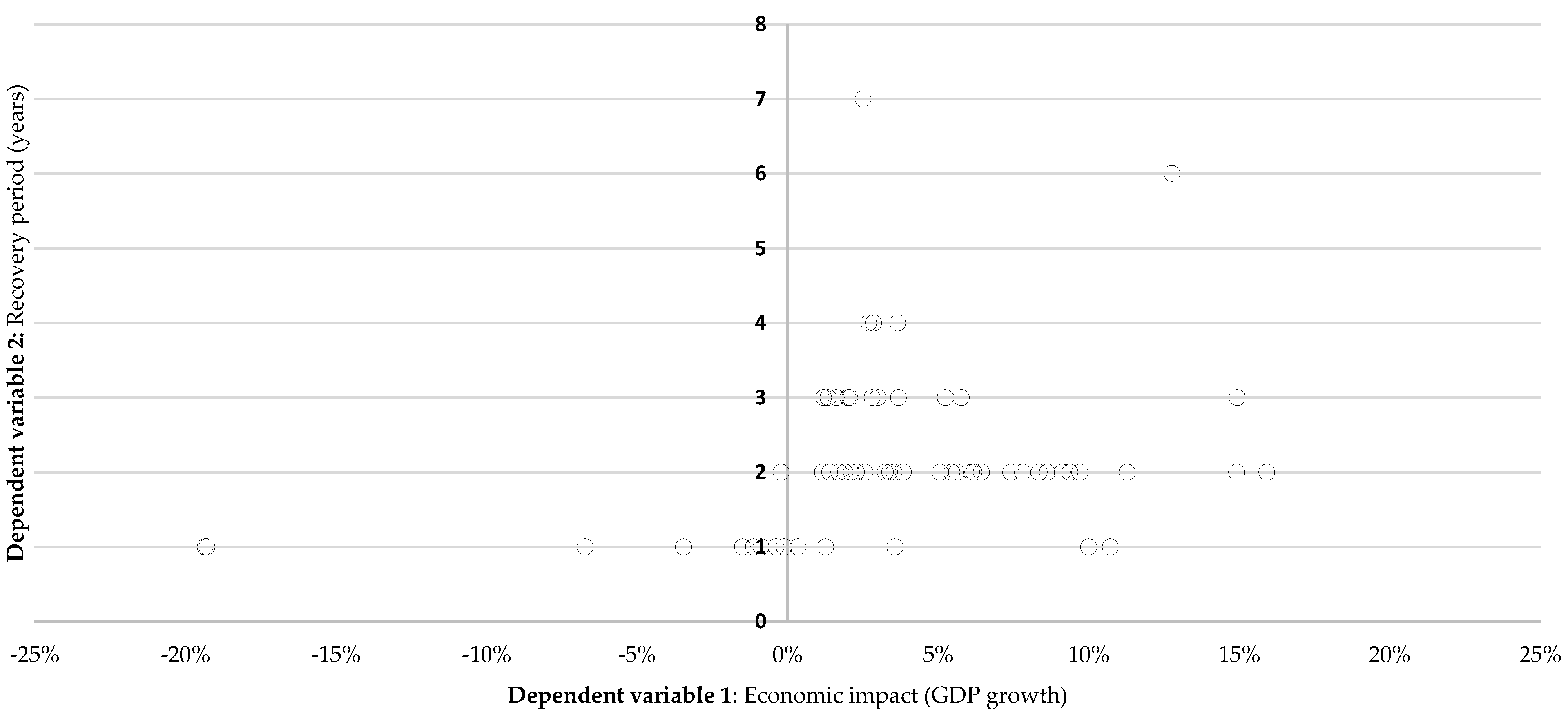

Figure 3 indicates the distribution of the economic impact of the shock and the subsequent recovery period for each country in the sample. The respective axes also constitute the dependent variables utilized in the econometric analysis. The figure excludes an outlier (Zimbabwe) and countries yet to recover their pre-shock growth path. A decline in economic growth is indicated as a positive in the figure.

As illustrated in the figure, the GFC had a heterogeneous impact on the economies of developing countries. For instance, economic growth in Antigua and Bermuda (a member country of CARICOM) and Botswana (SADC) declined by 21.4% and 15.9%, respectively, while the economies of Congo-Brazzaville (CEMAC) and Nepal (SAARC) increased by a respective 19.3% and 1.1% during the delineated shock period. While the median economic impact of the shock in developing countries was a 3.6% decline in economic growth, 45.7% of countries experienced an economic impact above 5%, 44.4% of countries lower than 5%, and 9.9% of countries illustrated positive economic growth during the shock period. Similar to the economic impact, the countries illustrate diverse pre-shock growth path recovery periods, ranging from countries recovering in the first year of the post-shock period (e.g., Afghanistan (SAARC), Mali (WAEMU) and Burundi (EAC)), with 25.9% of countries yet to recover. In addition, among sample countries, 53.1% recovered in two years or less, while 21% recovered in three years or more.

These results, indicating substantial differences among countries in terms of both economic impact and recovery period after the GFC, is illustrative of the divergence in their ability to resist the effects of an external economic shock, as well as the ability of their economies to recover from these effects over time. The aim of this paper is to determine the factors that may influence this divergence between developing countries, with the objective of delineating appropriate policies on a regional scale that support regional economic resilience. The econometric analysis investigates the differences between developing economies in this regard through analyzing the relationship between the dependent variables in the equilibrium analysis (economic impact [

1] and recovery period [

2]) and various endogenous and exogenous factors inherent to the economy of each developing country. This allows for the identification of important variables that may influence resistance and recovery in the face of a shock, which may inform nuanced regional policy recommendations in the SADC, seeking to support regional economic resilience.

Table 2 indicates the endogenous (independent variable 1 and 2) and exogenous factors (3–7) that have a significant relationship and association (as defined in

Section 3) with either one or both dependent variables. This is relevant to all sample countries. To inform the interpretation of these findings, the correlation between the relevant dependent and independent variables are illustrated.

The table indicates the relationship between the dependent variables and the three categories of independent variables. The endogenous factors include variables that are internal to each country’s economy, and relevant to local production and output (see

Section 2). The factors identified with high significance and association to the recovery period of developing economies are the economic contributions of the primary and tertiary sector, respectively. The correlation between this dependent and the first-mentioned independent variable may indicate that the higher the contribution of primary sector activities (including agriculture, forestry and fishing) to economic output, the lower the recovery period of the pre-shock growth path (ρ = −0.31343). However, the inverse is relevant with regard to the tertiary sector: the higher the portion of services and related activities to total economic output, the longer it would take for the country to regain the trajectory of the pre-shock growth path in the aftermath of the GFC (ρ = 0.39931).

In the analysis, the exogenous factors are grouped in two categories: economic openness and export market dynamics. The former includes export and FDI contributions, as well as import tariffs. As indicated in

Table 2, the higher the economic contribution (as a percentage of GDP) of FDI inflows (ρ = 0.30537) and the export of goods and services (ρ = 0.46676), the greater the initial impact of the GFC and related economic shock between 2007 and 2009. In addition, import tariffs on non-agricultural and non-fuel products have a high significance and association with the initial impact of the shock, with lower tariffs potentially increasing the impact (ρ = −0.27032).

In addition, export market dynamics may determine the impact of the shock, with exports to low- and high-income economies (as a percentage of total exports), respectively, inducing divergent effects on the aforementioned impact. The former may potentially reduce the short-term economic downturn (ρ = −0.30905), while the latter increases this economic impact (ρ = 0.22040).

5. Discussion

The findings of the equilibrium and econometric analysis indicates that the GFC had a divergent effect on economic growth in developing countries, both in terms of the initial impact and the recovery period of the pre-shock growth path. In line with research objectives, various economic factors are identified based on their potential influence on the dependent variables, as summarized in

Table 3.

5.1. Factors in Economic Resilience

The findings of the analysis suggest that economic resilience in this context is determined by three components of an economy, namely (i) economic openness; (ii) export market dynamics; (iii) the sectoral composition of the economy. The openness of an economy, based on the contribution of exports and FDI, and reduced import tariffs, increases the vulnerability of the particular economy to the effects of an external economic shock. The inherent mechanism perpetuating this vulnerability is that a reduction in export demand and slowed foreign capital inflows increases the initial impact of the shock on economic output. This is additionally suggested by the findings of Lin [

45].

While exports influence economic resilience, the nature of export markets may alleviate the impact of the shock. The degree of economic vulnerability deviates with respect to exports to low- and high-income countries, with the former enhancing resistance to the shock. There is little difference between these markets in terms of risks associated with global trade (similar economic contribution of exports and FDI), or the goods categories exported there from developing countries (in terms of primary and manufactured goods). However, a divergence in the economic contribution of the tertiary sector as a percentage of GDP in these markets (45.3% in low-income and 72.3% in high-income countries) may illuminate the role of trading partners’ economic structure as an additional factor that influences the volatility of export demand and resilience to shocks.

Furthermore, the finding that endogenous tertiary activities may influence post-shock recovery points toward the acute impact of the GFC on this sector during the delineated period (see

Section 2.2). In line with existing literature [

91,

92],

Table 3 indicates that the primary sector may support economic resilience, with Giannakis and Bruggeman [

93] (p. 1209) noting the “positive effect of agriculture in the ability of both intermediate and rural regions to withstand and recover from the economic downturn impact”. This may be attributed to the inelasticity of demand for agricultural produce [

94].

5.2. Vulnerability of the SADC Member Countries

Table 4 provides a comparative overview of dependent and independent variables, the median performance of SADC countries and a select group of resilient countries in the sample. The latter grouping is selected through identifying the 10 leading countries in terms of resilience, measured using the dependent variables (lowest impact; timeous recovery). In addition to providing the pre-shock median for the various independent variables, the table indicates the latest available data (2018) for SADC countries in an effort to analyze trends of member countries.

As indicated in

Table 4, there is significant resilience divergence between SADC member countries and the resilient grouping, with the median impact of the economic shock being 3.01% in the former, while the economies of the latter expanded by 2.47% during the delineated period. In addition, differences are apparent in the post-shock recovery period.

In terms of economic openness, during the pre-shock period, the economic contribution of FDI and exports were higher in SADC countries compared to the identified resilient countries. The SADC countries also placed lower import tariffs on non-agricultural and non-fuel products. These factors may have contributed to the vulnerability of member countries, and by extension the regional economy. However, while potentially increasing the risk from external economic shocks, stimulating exports and attracting FDI is central to catalyzing economic growth in both developed and developing countries. Policies toward liberalization, through reduced import tariffs [

95] and market access, lowers transaction costs and increases returns [

68,

96,

97,

98], in addition to stimulating economic multiplier effects. As illustrated in

Table 4, the reliance on FDI and exports for economic growth in SADC member countries has declined since the GFC, as have import tariffs.

The motive for economic openness, while potentially increasing vulnerability, provides the initial evidence that policy towards economic resilience ought to balance the need for economic growth with interventions to support economic resilience. An example of this, while seeking to support exports, is to appropriately guide the nature of these exports to foster economic resilience while at the same time acknowledging the importance of exports for long-term regional economic growth and transformation. Based on the findings, what is especially relevant in this regard is appropriately guiding the nature of export markets. This references exports to low- and high-income economies, with the percentage of exports to the latter countries significantly lower among the resilient countries in the pre-shock period, as indicated in

Table 4. The SADC regional development policy, through the RISDP and Action Plan for SADC Industrialization Strategy, emphasize the interaction between regional integration and industrialization in stimulating regional economic growth, with the former implemented to expand national markets and enable the scale economies required for increased manufacturing output. While regional integration is not identified as a significant variable in economic resilience, increased intra-regional trade in the SADC may foster resilience due to member countries being characterized as lower-income export markets. In addition, decreased trade dependence on high-income, developed countries may, over the long-term, reduce resource transfers from developing countries, as illuminated by the Prebisch–Singer hypothesis (see

Section 2.2). Since the GFC, exports to high-income countries from SADC member countries have decreased to 45.82% from 73.79%.

The sectoral composition of the regional economy has influenced vulnerability in intra-regional export demand: tertiary activities constituted a median of 50.96% of GDP of SADC member countries during the pre-shock period, while contributing 48.61% in resilient countries. The economic contribution of manufacturing output—industrialization—is found not to be significant in supporting economic resilience, while several sources delineate the negative effect of this variable on resilience (see

Section 2.4). Accordingly, based on the findings, emphasis ought to be placed on stimulating primary sector output in the SADC and its member countries to reduce post-shock recovery periods and underline resilience. However, the median economic contribution of the primary sector in member countries has decreased to 9.03% in 2018, from 11.27% in the pre-shock period. Meanwhile, the tertiary sector has grown to represent 59.98% of member countries’ economies. The sectoral composition of the regional economy may potentially portray the continued vulnerability of the SADC to external economic shocks.

5.3. Consequences for SADC Regional Development Policy

The SADC resilience policy should focus on developing regional supply and value chains anchored in agricultural and related primary sector activities, with the additional objective of catalyzing intra-regional trade and interdependence among member countries. In terms of regional participation in global value chains, southern Africa is placed “relatively weakly […] either far upstream (commodity sales) or far downstream (end-market sales with limited value added)” [

55] (p. 5). However, due to regional members’ relative comparative advantage in primary activities [

99], the potential exists to develop and extend the regional competitiveness of the SADC through increased trade cooperation. The RISDP incorporates the Food Agriculture and Natural Resources (FANR) cluster as a central component of driving economic transformation in the region, with the objectives of promoting productivity in the sector, and enhancing food security and sustainable development. The cluster ought to catalyze “structural transformation of the region’s agriculture-dependent economies” through generating “domestic savings and foreign exchange” [

100] (p. 34). However, the current lack of regional framework to inform national policy and guide the holistic implementation of related interventions is a challenge in extracting the sector’s potential. While existing SADC policy earmarks growth in primary sector output as an instrument to catalyze structural change (with industrialization as the outcome), resilience policy would need to emphasize a balanced approach between agricultural and industrial strategy and growth objectives. This would support long-term restructuring and economic growth, while fostering continuity and resilience in this growth.

To stimulate intra-regional trade, regional integration is dependent on both economic and spatial integration [

52,

101]. Exploiting the trade-stimulating benefits of trade liberalization depends on spatial linkages that eliminate barriers to accessibility among member countries [

52]. Various development corridors are identified for further development to facilitate physical linkages between member countries. The Regional Infrastructure Development Master Plan (RIDMP) coordinates further development and investment in regional corridors, with the objective of creating “well-maintained, operated infrastructure and the provision of seamless transport services” [

63] (p. 8). The plan emphasizes the importance of integrated regional transport networks, including surface transport, air transport, and intermodal development and delineates key corridor infrastructure projects to facilitate spatial integration in the region and enable the anticipated increase in intra-SADC trade.

In addition to their physical infrastructure, the effective functioning of the corridors is dependent on non-physical components. This includes interoperability, i.e., the ability of service providers to operate effectively across the region, which is dependent on harmonized infrastructure standards, vehicle regulations, infrastructure usage rates, and insurance and licensing requirements [

58,

102]. Market access is an additional non-physical component, which is determined by market access regimes, third country rules and cabotage. Despite progress made in fostering spatial integration [

102], “limitations in border facilities, excessive red tape, lengthy border procedures [and] vulnerability to corruption” still characterize the physical and non-physical infrastructure of certain development corridors in the SADC [

103] (p. 15). The creation of a free trade agreement, signifying deeper economic integration compared to the current preferential arrangement, may support further alignment and intra-regional trade. While objectives include the formation of a customs union and eventual single market [

51], such initiatives require substantial institutional capacity and political willpower from member countries over the long-term.

According to Christopherson et al. [

1] (p. 7), “regions make their own resilience, but they do not make it as they please”. The economic resilience of developing regions is therefore determined by economic decisions and subsequent policy implementation which influence their long-term path dependence [

41]. While growth paths of regions are substantially influenced by economic and policy decisions of the past, fostering resilience to external economic shocks necessitates proactive decision-making by economic agents and regional institutions [

19]. Therefore, an important factor in delineating appropriate regional policy to strengthen economic resilience, while overseeing regional integration and guiding sectoral development, is supranational institutions. The SADC institutions, including the SADC Secretariat, should contribute significantly to fostering resilience through administering a “processes to plan and implement change” [

104] (p. 140), and to utilize institutional and human capital to mitigate vulnerability in the regional economy and production systems of member countries [

58]. However, certain long-standing challenges inhibit institutions’ ability to fulfil their necessary functions. This includes a lack of capacity to oversee regional policy formulation and implementation, which affects policy harmonization and regional investment coordination inherent to effective economic and spatial integration [

105,

106]. Institutional capacity is stifled by insufficient funding from member countries and partners, in addition to the latter’s divergent commitment to regional integration and development initiatives [

105,

106]. Supranational institutions are central to enabling the adaptation and future adaptability of the regional economy to ensure it resists and recovers from potential external economic shocks.

6. Conclusions

Resistance and recovery are central components in conceptualizing economic resilience: An economy’s ability to resist the initial impact, as well as to recover the pre-shock growth path, underlines its resilience to an external economic shock. The impacts of the GFC were divergent among developing countries, some indicating a sharp decline in economic growth and an extended recovery period, while others experienced economic expansion during the apex of the global disturbance. Member countries of the SADC experienced a median economic downturn of 3.01% and required two years to recover the pre-shock growth path.

The equilibrium and econometric analysis determine the relationship between the various dependent and independent variables in the context of the developing country sample, and subsequently identify three broad factors that may influence regional economic resilience, including economic openness, export market dynamics and the sectoral composition of the economy. An economy’s dependence on exogenous growth factors, including FDI and exports (also manifesting in lower import tariffs), may underline national and regional vulnerability to external shocks. Negative multiplier effects induce the impact of the shock on local production systems through reduced export demand and capital inflows.

Export markets may also influence an economy’s resistance to shocks, with economic resilience potentially amplified as lower-income economies constitute an increased proportion of the export market. This may be attributed to the relatively reduced contribution of tertiary activities to the economic output of the mentioned countries—potentially illuminating the role of trading partners’ economic structure as an additional factor that influences the volatility of export demand and resilience to shocks. In addition, sectoral composition is a central endogenous factor that influences resilience through potentially reducing the post-shock recovery period. Echoing the unique impact of the GFC on the sector, tertiary activities may increase economic vulnerability, while the primary sector, including agriculture, may foster resilience.

The findings indicate the need for a balanced approach to formulating SADC resilience policy: one that is focused on catalyzing the needed structural transformation to stimulate industrialization and long-term economic growth, while incorporating elements to support economic resilience. Such elements include increased regional integration to stimulate intra-regional trade among SADC member countries and decreased dependence on external, higher-income export markets that may increase regional vulnerability. Economic and spatial integration initiatives, respectively seeking to liberalize trade and facilitate intra-SADC exports, ought to guide the development of regional supply and value chains anchored in primary sector activities, including agricultural output. The inelasticity of demand for primary products may support resilience to export demand fluctuations, thus highlighting the importance of incorporating sectoral composition in regional economic resilience policy consideration.

While the discussion is anchored in supranational regional planning and development policy, the findings related to economic openness, export market dynamics, and sectoral composition have implications for resilience analysis in other fields, particularly economic studies. Future economic research should investigate the specific dynamics of FDI as it relates to economic vulnerability. Relevant themes include the source and nature of investment, perceived risks for investors in the context of developing countries and regions, and the role of financial policy and interventions in the post-shock period in mitigating capital outflows. In addition, research should explore the agency of individual firms in considering inherent vulnerability of export demand and supply chains which may influence resilience across economic scales.

The limitations of the study relate to data availability considerations. In the equilibrium analysis of the present study, annual economic growth rates are available and utilized in determining an economy’s recovery of the pre-shock growth path. Future studies should consider quarterly changes to GDP, which would allow additional data points in investigating the aspect of recovery inherent to regional economic resilience. Additionally, the delineation of independent variables (including their definitions) is based on available datasets on the UNCTADstat database. Future studies should integrate datasets from multiple databases, as this may potentially allow the delineation of additional independent variables—and, thus, endogenous and exogenous factors—that may influence regional economic resilience. This is applicable to the econometric analysis inherent to the present study.